Complete guide to CPA exam study hours for Indian professionals. Section-wise breakdown of FAR, AUD, REG, BAR, ISC, TCP with realistic 12, 18, and 24-month timelines.

Table of Contents

If you’re an Indian professional considering the US CPA certification, you’ve probably searched “how many hours to study for the CPA exam” and found answers that don’t quite fit your reality. The generic advice floating around suggests 300 to 400 hours of total study time. But that recommendation comes from American review courses designed for candidates who studied US GAAP in college, work standard 8-hour days, and have weekends completely free. That’s not your situation. You’re working 10-hour days in Mumbai or Bangalore, managing family responsibilities, and learning an entirely new accounting framework from scratch.

Getting your study hour estimates wrong can completely derail your CPA journey. Underestimate the time needed, and you’ll walk into your Prometric exam feeling underprepared, likely joining the 50% of candidates who fail each section. Overestimate, and you might delay starting altogether, convincing yourself that you simply don’t have enough time to pursue this credential. Neither outcome serves your career goals. What you need is a realistic, India-specific breakdown of study hours that accounts for your educational background, work schedule, and the genuine learning curve involved in mastering US accounting standards.

This guide delivers exactly that. We’ll break down the study hours required for each of the six CPA exam sections, explain how your Indian qualifications might reduce preparation time for certain areas, and provide three complete timeline frameworks designed specifically for Indian working professionals. Whether you’re a Chartered Accountant adding international credentials, a B.Com graduate building your qualifications, or a finance professional balancing career demands with exam preparation, you’ll finish this guide with a clear, actionable study plan tailored to your specific situation.

CPA Exam Structure

Before diving into study hours, you need to understand exactly what you’re preparing for. The CPA exam underwent significant changes in January 2024 with the launch of CPA Evolution, transforming the traditional four-section format into a more flexible Core plus Discipline model. This new structure affects how you should allocate your study time and plan your exam sequence.

Core Plus Discipline Model

The modern CPA exam consists of four sections total, but you now have choices that didn’t exist before. Three sections are mandatory for everyone, while the fourth allows you to specialize based on your career interests and strengths. Understanding this structure is essential for creating an efficient study plan.

The Three Core Sections Every Candidate Must Pass

Every CPA candidate, regardless of their intended career path, must pass three Core sections. These include Financial Accounting and Reporting (FAR), which tests your knowledge of US GAAP and financial statement preparation. Auditing and Attestation (AUD) covers the entire audit process, from planning through reporting. Taxation and Regulation (REG) examines federal taxation and business law fundamentals.

These Core sections form the foundation of CPA competency that every licensed accountant needs. The good news for Indian candidates is that you can take these sections year-round at Prometric testing centers, giving you flexibility in scheduling. According to NASBA’s candidate portal, Core sections follow continuous testing, meaning you’re not restricted to specific testing windows.

Choosing Your Discipline Section (BAR, ISC, or TCP)

The fourth section is where you get to choose. You’ll select one Discipline from three options: Business Analysis and Reporting (BAR), Information Systems and Controls (ISC), or Tax Compliance and Planning (TCP). Each Discipline builds on knowledge from a related Core section and allows you to demonstrate deeper expertise in a specific area.

Your choice should align with your career goals and existing strengths. If you’re planning a career in financial reporting or controllership, BAR makes sense. If you’re interested in IT audit or systems consulting, ISC is your path. For those focused on tax practice, TCP provides advanced tax planning knowledge.

Section-Wise Study Hours: Core Sections Breakdown

Now let’s get into the numbers that matter most. The following study hour recommendations come from analyzing data from major review providers like Becker, industry research, and feedback from Indian candidates who’ve successfully passed. These aren’t arbitrary figures; they’re calibrated for the actual difficulty level and content volume of each section.

Financial Accounting and Reporting (FAR): 80-100 Hours

FAR consistently ranks as the most demanding section of the CPA exam, and the study hours reflect this reality. Most Indian candidates should budget between 80 and 100 hours for FAR preparation, with the exact number depending on your accounting background and familiarity with US GAAP.

Why FAR Demands the Most Study Time

FAR covers the broadest range of accounting topics and requires you to master complex calculations across multiple entity types. The section includes governmental accounting, nonprofit accounting, and consolidated financial statements, areas where most Indian professionals have limited exposure, regardless of their qualifications.

FAR Content Areas and Hour Allocation

The FAR blueprint from AICPA divides content into three main areas: financial reporting, select balance sheet accounts, and select transactions. Financial reporting covers the conceptual framework, financial statement presentation, and public company reporting requirements. You should allocate roughly 40% of your FAR study time to this area.

Select balance sheet accounts to examine cash, receivables, inventory, fixed assets, and investments in detail. Select transactions cover revenue recognition, leases, income taxes, and business combinations. These transaction-based topics often involve complex calculations that require extensive practice. Plan to spend significant time working through simulations in these areas, as they frequently appear in the task-based simulation portion of the exam.

Auditing and Attestation (AUD): 80-100 Hours

AUD requires fewer total hours than FAR, but don’t mistake shorter study time for easier content. This section tests conceptual understanding and professional judgment rather than calculations, which creates its own challenges for candidates accustomed to number-focused exams.

Understanding AUD’s Conceptual Nature

AUD is fundamentally different from other CPA sections because it emphasizes evaluation and judgment over computation. You’ll need to understand the “why” behind audit procedures, not just the “what.” This conceptual focus means that even candidates with audit work experience sometimes struggle, as the exam tests theoretical knowledge that may differ from day-to-day practice.

The section covers the complete audit engagement lifecycle, from client acceptance through opinion issuance. You’ll need to understand different types of audit reports, when each is appropriate, and how various circumstances affect the auditor’s conclusions. Indian candidates often find AUD challenging because Indian auditing standards, while similar in principle, have different specific requirements than US standards.

AUD Content Areas and Time Investment

AUD content spans four areas: ethics and professional responsibilities, risk assessment and planning, performing procedures and gathering evidence, and forming conclusions and reporting. The risk assessment and evidence-gathering sections carry the heaviest weight, accounting for roughly 65% of the exam content.

Plan to spend substantial time understanding internal controls, as this concept underlies much of the AUD content. You’ll also need to master the differences between various types of engagements, including audits, reviews, compilations, and attestation services. Allocate at least 25-30 hours specifically for practicing AUD simulations, as these often present complex scenarios requiring judgment calls.

Taxation and Regulation (REG): 80-100 Hours

REG presents a unique challenge for Indian candidates because US federal taxation is entirely new material, regardless of your background. Even Chartered Accountants with extensive Indian tax experience need to approach this section as beginners in many respects.

The US Tax Code Challenge for Indian Professionals

The US tax system operates on fundamentally different principles from Indian taxation, with different entity classifications, deduction rules, and compliance requirements. Indian candidates cannot rely on prior knowledge here; you’re essentially learning a new subject from scratch, which affects how you should allocate study time.

REG Content Areas and Hour Breakdown

REG covers five content areas: ethics and professional responsibilities, business law, property transactions, individual taxation, and entity taxation. Individual and entity taxation together comprise roughly 70% of the exam, so these areas deserve the majority of your attention. Business law concepts, while important, carry less weight and can be covered more quickly. Plan to spend extra time on basis calculations and property transactions, as these topics frequently appear in simulations.

Section-Wise Study Hours: Discipline Sections Breakdown

Your Discipline choice significantly impacts your total study hours and timeline. Each Discipline varies in content volume, difficulty level, and how well it connects to the knowledge you’ve already built from the Core sections. Let’s examine what each option requires.

Business Analysis and Reporting (BAR): 100-120 Hours

BAR demands the most study time among Discipline sections and has consistently shown the lowest pass rates since CPA Evolution launched. This section isn’t for candidates looking for an easy path to completion.

Why BAR Requires More Hours Than Other Disciplines

BAR covers advanced technical accounting topics that build significantly on FAR content. You’ll encounter complex areas like business combinations, derivatives, and governmental accounting at deeper levels than FAR requires. The section also incorporates managerial accounting concepts, including cost accounting and performance measurement, which may be new territory for some candidates.

BAR Content Areas and Advanced Topics

BAR content divides into three areas: business analysis, technical accounting and reporting, and state and local governments. Business analysis covers financial statement analysis, cost management, and budgeting concepts. This area connects accounting knowledge to business decision-making, requiring you to interpret data rather than just calculate it.

Technical accounting and reporting examines complex transactions, including consolidations, derivatives, and foreign currency matters. These topics often involve multi-step calculations and require strong foundational knowledge from FAR. State and local government accounting extends the governmental concepts introduced in FAR, adding detail on fund accounting and government-wide reporting.

Information Systems and Controls (ISC): 80-100 Hours

ISC offers a different path for candidates interested in IT audit, cybersecurity, or systems consulting. The study hours are lower than BAR, but the content requires comfort with technology concepts that accounting curricula don’t typically emphasize.

ISC Content Overview and Technology Focus

ISC examines information systems from an audit and control perspective. You’ll study data management, system security, IT governance, and the specific requirements for System and Organization Controls (SOC) engagements. The section builds on AUD concepts, applying audit thinking to technology environments.

Content areas include information systems and data management, security and privacy, and SOC engagement considerations. If you’ve worked in IT audit or have a technology background, you’ll find familiar concepts here. However, candidates from purely financial backgrounds should budget additional time to build foundational IT knowledge.

Study Hour Requirements for Non-IT Backgrounds

Candidates without IT experience should plan for the higher end of the 80-100 hour range. You’ll need to learn technology vocabulary and concepts before you can effectively study ISC content. Consider spending initial study time on IT fundamentals before diving into exam-specific material.

However, don’t let unfamiliarity with IT deter you if ISC aligns with your career goals. The section tests conceptual understanding rather than deep technical expertise. You don’t need to be a programmer or systems administrator; you need to understand how controls work in IT environments and how auditors evaluate those controls.

Tax Compliance and Planning (TCP): 80-100 Hours

TCP has consistently shown the highest pass rates among all CPA sections since CPA Evolution began, making it an attractive choice for candidates prioritizing exam completion. The section builds directly on REG knowledge, creating natural study efficiencies.

TCP Content Areas Building on REG Knowledge

TCP extends REG taxation concepts into planning and compliance for complex situations. Content includes advanced individual taxation, entity tax planning, property transactions, and personal financial planning. Because TCP builds so directly on REG, candidates who’ve recently passed REG often find TCP content familiar.

Recommended Study Hours for Tax-Focused Candidates

Candidates with tax experience or strong REG performance can often prepare for TCP in 80 hours or less. The key is timing; if you take TCP shortly after passing REG, you’ll retain knowledge that directly applies. Waiting too long between REG and TCP means relearning material, which increases required study hours. For Indian candidates working in tax roles, TCP represents the most efficient path to completing the CPA exam.

CPA Exam Study Hours: How Many Total Hours Do You Need to Pass?

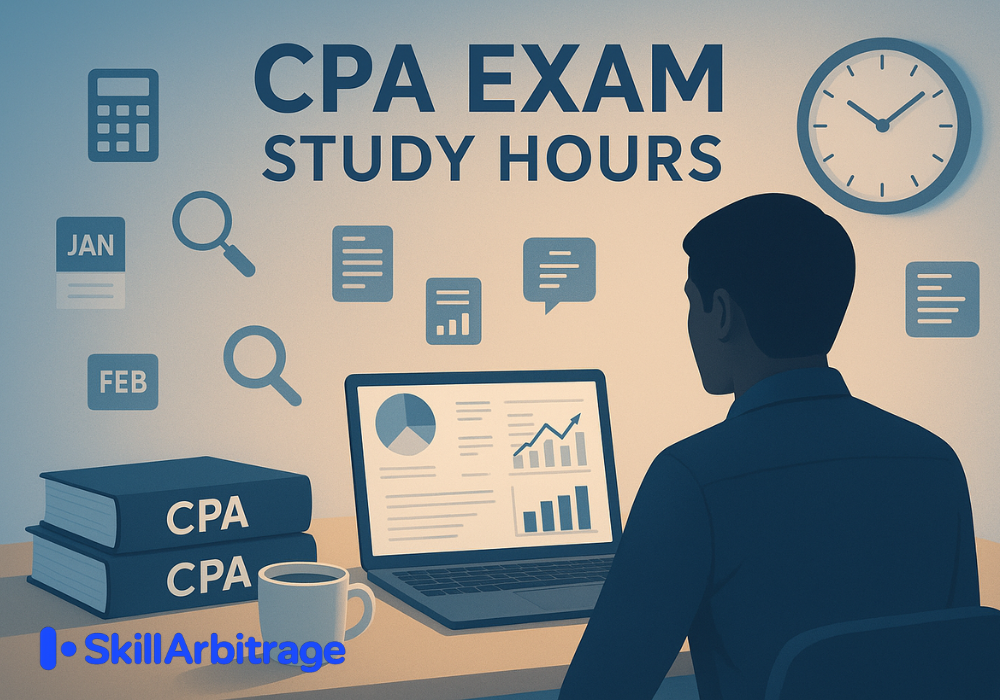

With section-specific hours established, let’s address the total picture. How many hours should you budget for completing all four CPA sections? The answer depends on your background, but we can establish useful ranges based on industry data and candidate experiences.

Industry Standard Recommendations from Major Review Providers

Major CPA review providers have analyzed thousands of successful candidates to develop study hour recommendations. These benchmarks provide useful starting points, though Indian candidates should expect to adjust based on their specific circumstances.

Becker’s 320-420 Hour Framework

Becker CPA Review, one of the largest review providers globally, recommends 320 to 420 total hours, depending on your Discipline choice. This breaks down to 80-100 hours per Core section and 80-120 hours for your Discipline. Becker’s estimates assume candidates have a US accounting education background and can study 10-20 hours weekly.

AICPA Guidelines and What They Mean for Candidates

The AICPA doesn’t publish official study hour recommendations, but its exam blueprints indicate content volume and complexity. Based on blueprint analysis and pass rate data, industry consensus suggests 300-500 total hours for most candidates. The wide range reflects significant variation based on educational background, work experience, and study efficiency.

Why Indian Professionals May Need Different Hour Allocations

Standard American recommendations don’t account for the unique challenges Indian candidates face. Several factors may increase your required study hours compared to US-based candidates.

The US GAAP Learning Curve for Indian-Trained Accountants

Indian accounting education focuses on Indian GAAP and Ind AS, which differ from US GAAP in significant ways. Revenue recognition, lease accounting, and financial instruments have different treatment under each framework. Plan to add 20-40 hours specifically for understanding US GAAP differences.

Adjustments Based on Your Qualification Background

Your existing qualifications affect how much new learning each section requires. CA-qualified candidates have strong accounting foundations but still face new material in taxation and US-specific regulations. B.Com graduates may need more foundational work across all sections.

English Language Considerations for Non-Native Speakers

While most Indian professionals have strong English skills, the CPA exam uses American English with specific technical terminology. Reading speed and comprehension matter when you’re facing hundreds of multiple-choice questions and complex simulations under time pressure. Budget extra time if English isn’t your first language.

Total Hour Ranges Based on Your Profile

Based on analysis of Indian candidate experiences and industry data, here are realistic total hour estimates by candidate profile.

Fresh Graduates: 400-500 Hours

If you’re a recent B.Com or M.Com graduate without significant work experience, budget 400-500 total hours. You’ll need time to build a practical understanding of concepts that working professionals learn through job experience. The advantage is that your study skills are sharp and academic concepts are fresh.

Fresh graduates should consider a longer timeline to spread these hours appropriately. Attempting to compress 500 hours into six months while job hunting or starting a new role is unrealistic. An 18-month timeline allows sustainable weekly study loads.

Working Professionals: 350-450 Hours

If you’re currently working in accounting or finance, you bring practical knowledge that can reduce study time in certain areas. However, limited study hours per week mean your timeline extends. Budget 350-450 total hours, recognizing that efficiency matters more than raw hours when study time is scarce.

Working professionals benefit from focusing on weak areas rather than a comprehensive review of familiar topics. Use diagnostic assessments to identify where your work experience provides an advantage and where you need concentrated study.

CA-Qualified Candidates: 300-380 Hours

Chartered Accountants have the strongest foundation among Indian candidates. Your rigorous CA training provides advantages in accounting and auditing concepts, potentially reducing FAR and AUD study time. However, US taxation and business law require full attention since your CA knowledge doesn’t transfer.

CA candidates can realistically target the lower end of study hour ranges for FAR and AUD while budgeting full hours for REG and their chosen Discipline. The 30-month window provides ample time even for busy CA professionals.

Realistic Timeline Frameworks for Indian Professionals

Study hours only matter when translated into a workable timeline. The following frameworks account for Indian professional realities: demanding work schedules, family obligations, and the need for sustainable study habits over many months.

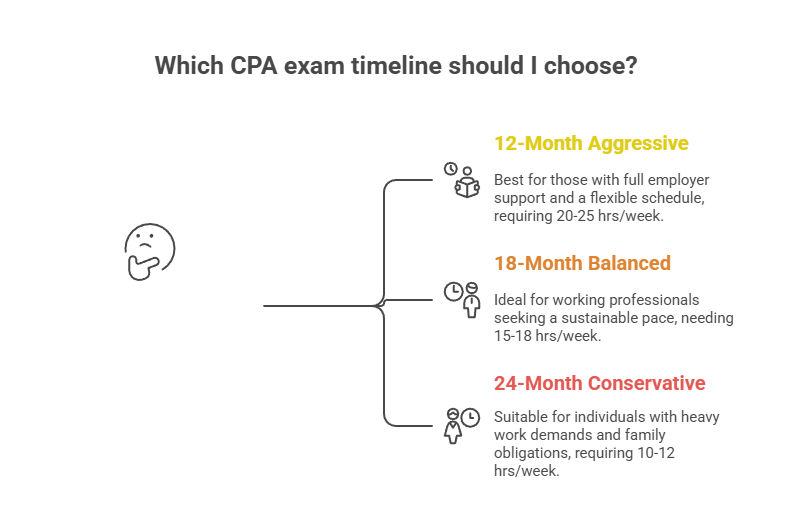

CPA Exam Study Hours: The 12-Month Aggressive Timeline

The 12-month timeline is aggressive but achievable for candidates who can commit significant weekly hours and maintain intensity throughout. This path requires discipline and usually works best for candidates with employer support or flexible work arrangements.

Weekly Hour Commitment (20-25 Hours)

Completing the CPA exam in 12 months requires 20-25 hours of weekly study, which translates to roughly three hours daily plus intensive weekend sessions. For Indian working professionals, this typically means studying before work, during lunch, after work, and most of both weekend days.

This commitment level is difficult to sustain while managing a demanding job. Before committing to a 12-month timeline, honestly assess whether you can maintain this intensity for an entire year. Burnout halfway through is worse than choosing a more sustainable pace from the start.

Month-by-Month Section Sequence

A typical 12-month sequence dedicates three months to each section. Start with FAR since it provides foundational knowledge for other sections, then move to AUD or REG based on your background. Complete your Discipline last, timing it to coincide with available testing windows.

Build one to two weeks of buffer between each section for final review and unexpected delays. If you pass each section on your first attempt, you’ll complete the exam in about 10 months, leaving buffer time within the 30-month window.

CPA Exam Study Hours: The 18-Month Balanced Timeline

The 18-month timeline represents the sweet spot for most Indian working professionals. It allows sustainable weekly hours while maintaining momentum and staying well within the 30-month window.

Weekly Hour Commitment (15-18 Hours)

At 15-18 hours weekly, you’re studying roughly two hours on weekdays plus six to eight hours across the weekend. This commitment is demanding but sustainable for professionals with supportive families and manageable work schedules.

This pace allows for occasional missed study sessions without derailing your timeline. Life happens, and the 18-month framework builds in flexibility for work emergencies, family events, and the occasional need for rest.

Quarter-by-Quarter Planning Framework

Structure your 18 months as six quarters, with each quarter dedicated to one section plus buffer time. Spend 10-12 weeks studying for each section and two to four weeks for final review and the exam itself.

This framework aligns well with Discipline testing windows, which occur quarterly. Plan backward from your intended Discipline test date and schedule Core sections accordingly. Leave your most challenging section for a period when work demands are lighter, if possible.

The 24-Month Conservative Timeline for CPA Exam

The 24-month timeline suits candidates with demanding careers, significant family obligations, or preferences for thorough, unhurried preparation. While longer, this path can still succeed within the 30-month window.

When This Timeline Makes Sense

Choose the 24-month path if your work regularly exceeds 50 hours weekly, if you have young children or elderly parents requiring care, or if you prefer a comprehensive understanding over rapid completion. This timeline also works well for candidates paying exam costs themselves and spacing expenses over time.

The risk with longer timelines is maintaining motivation and momentum. Two years is a long commitment, and life circumstances can change significantly. If you choose this path, break it into smaller milestones and celebrate progress along the way.

Weekly Hour Commitment (10-12 Hours)

At 10-12 hours weekly, you’re studying roughly 90 minutes daily or concentrating hours on weekends. This pace is sustainable for nearly any professional but requires patience with slower progress.

Consistency matters more than intensity at this pace. Missing a week of study when you’re only investing 10 hours weekly creates gaps that compound quickly. Build study habits that you can maintain regardless of work pressure or personal demands.

Creating Your Personalized Timeline for CPA Exam

The frameworks above provide starting points, but your optimal timeline depends on personal factors. Take time to honestly assess your situation before committing to a specific path.

Assessing Your Available Weekly Hours Honestly

Track your actual time for one or two weeks before deciding on a timeline. Most people overestimate available study hours. Account for commute time, household responsibilities, social obligations, and the simple need for rest. Choose a timeline based on hours you can realistically commit, not hours you wish you had.

Mapping Your Timeline to Exam Windows

Remember that the Discipline sections are only available during the first month of each quarter. Work backward from your intended Discipline test date when planning your timeline. Also consider Prometric center availability in your city, as popular testing dates fill quickly.

Weekly and Daily Study Planning for Working Professionals

Having a timeline means nothing without a practical system for fitting study hours into your actual week. Indian working professionals face specific scheduling challenges that generic study advice doesn’t address. Let’s build practical structures that work within your constraints.

Effective Weekly Study Structures

Different work patterns and personal preferences call for different weekly study structures. Choose an approach that matches your energy patterns and life circumstances.

The Weekday Evening Model (2 Hours Daily)

The weekday evening model spreads study time across Monday through Friday, with two hours of focused study each evening after work. This approach works well for candidates who have predictable evening availability and can maintain daily habits. The key is protecting your study time from work spillover and social demands.

The Weekend Intensive Model (8-10 Hours Weekend)

The weekend intensive model concentrates study time on Saturday and Sunday, with minimal weekday studying. This works for professionals with unpredictable weekday schedules or demanding jobs that leave little evening energy. Plan for four to five hours on both weekend days, with breaks to prevent burnout.

Daily Study Session Optimization

How you use your study hours matters as much as how many hours you log. Optimize your daily sessions for maximum learning efficiency.

Morning Study Before Work: Pros and Cons

Morning study sessions, typically 5 AM to 7 AM, offer distraction-free time before work demands begin. Your mind is fresh, and no meetings or emails compete for attention. However, this approach requires earlier bedtimes and consistent sleep schedules, which can be challenging for Indian professionals whose social lives often extend into late evening.

Evening Study After Work: Making It Effective

Evening study, typically 8 PM to 10 PM after dinner, is more common among Indian professionals. The challenge is maintaining focus after a draining workday. Combat fatigue by starting with active learning, like practice questions, rather than passive video watching. Take a short break between arriving home and starting study to mentally transition from work mode.

Maximizing Study Efficiency to Reduce Total Hours

Smart study techniques can significantly reduce total hours needed while improving retention and exam performance. Efficiency matters especially for time-strapped Indian professionals.

Choosing the Right CPA Review Course

Your review course choice directly impacts study efficiency. Quality courses provide structured learning paths, comprehensive practice questions, and performance analytics that help you focus on weak areas. Leading options available to Indian candidates include Becker, Wiley, Surgent, and Gleim, each with different strengths in content delivery and pricing.

Consider courses with adaptive learning technology, which adjusts content based on your performance. This prevents wasting time reviewing material you’ve already mastered while ensuring adequate practice on challenging topics. Miles Education and other India-based providers offer localized support and payment options that may simplify your preparation.

Active Learning Techniques That Save Time

Passive studying, like watching videos without engagement, consumes hours without building exam-ready knowledge. Instead, prioritize active learning techniques that force you to apply concepts.

Start each topic with practice questions before watching lectures. This approach, called test-enhanced learning, helps you identify knowledge gaps immediately. When you then review the content, you’re focused on filling specific gaps rather than absorbing everything equally.

Practice simulations from early in your preparation, not just during final review. Simulations test application of knowledge in realistic scenarios, and comfort with the format reduces exam-day anxiety. Many candidates spend too many hours on multiple-choice questions and not enough on simulations, leading to poor simulation performance on the actual exam.

Tracking Progress and Adjusting Hours

Regularly assess your readiness and adjust study hours accordingly. Review courses provide progress metrics, but you should also track your own performance on practice exams.

Target 75-80% accuracy on practice questions before considering yourself exam-ready for a section. If you’re not reaching this threshold after your planned study hours, add more time rather than testing unprepared. Retaking a failed section costs more in money, time, and motivation than investing additional preparation hours upfront.

Conversely, if you’re consistently scoring above 85% on practice exams, you may be ready to test earlier than planned. Don’t study beyond readiness out of anxiety; move forward while knowledge is fresh.

Conclusion

The CPA exam requires significant time investment, but with realistic planning, thousands of Indian professionals successfully earn this credential each year while managing demanding careers and personal responsibilities. The key is matching your study plan to your actual circumstances rather than following generic advice designed for different situations.

Start by honestly assessing your available weekly hours, then select the timeline framework that matches. From there, work backward to create your section sequence and map it to exam testing windows. The planning you do now determines whether your CPA journey ends in success or frustration.

Your next step is evaluating your eligibility and choosing the right state for your CPA license. Understanding CPA exam eligibility requirements for Indian candidates ensures you’re building your study plan on solid ground. The credential waiting at the end of this journey opens doors to global opportunities that make every study hour worthwhile.

Frequently Asked Questions

How many total hours do I need to pass all four CPA exam sections?

Most Indian candidates need between 300 and 500 total hours to pass all four CPA sections. The exact number depends on your educational background, with CA-qualified candidates typically needing 300-380 hours while fresh graduates may require 400-500 hours. Choose your Discipline strategically, as TCP requires fewer hours than BAR for most candidates.

Can I pass the CPA exam while working full-time in India?

Yes, thousands of Indian professionals pass the CPA exam while working full-time. The key is choosing a realistic timeline, typically 18-24 months, and committing to 10-18 hours of weekly study. Many successful candidates study during early mornings, late evenings, and weekends while maintaining their regular work schedules.

How do I adjust study hours if I’m already a Chartered Accountant?

CA-qualified candidates can often reduce FAR study hours by 20-30% due to strong accounting foundations. However, don’t reduce REG hours, as US taxation is entirely new material regardless of Indian tax expertise. Focus your saved hours on mastering US GAAP differences and the US tax code.

Is 10 hours per week enough to pass the CPA exam?

Ten hours weekly is sufficient but requires a longer timeline of 20-24 months to complete all four sections. At this pace, consistency becomes critical because missed weeks compound quickly. If you can only commit 10 hours weekly, choose this pace deliberately rather than attempting an unrealistic faster timeline.

How long does it take to prepare for one CPA exam section?

Individual section preparation typically takes 8-12 weeks, depending on the section and your weekly study hours. FAR and BAR may require 10-12 weeks, while REG, AUD, ISC, and TCP can often be completed in 8-10 weeks. Add one to two weeks for final review before your exam date.

Should I study for multiple CPA sections simultaneously?

Studying for multiple sections simultaneously is generally not recommended. Each section covers distinct content, and splitting attention reduces retention and increases confusion. The exception is studying for a Discipline section while waiting for Core section scores, since Discipline content builds on related Core material.

How many hours should I study per day for the CPA exam?

Most successful candidates study two to three hours daily on weekdays and four to five hours on weekend days. Avoid marathon eight-hour study sessions, as retention drops significantly after three to four hours of focused study. Quality matters more than quantity in daily study time.

What is the best time of day to study for CPA exam in India?

The best study time depends on your personal energy patterns and schedule. Early morning study (5-7 AM) offers distraction-free focus before work, while evening study (8-10 PM) is more practical for many professionals. Experiment with both and choose what produces your best retention and consistency.

Can I reduce study hours by choosing an easier discipline section?

Yes, choosing TCP can reduce total study hours compared to BAR. TCP has the highest pass rates and builds directly on REG knowledge, creating study efficiencies. However, choose your Discipline based on career alignment, not just study hour reduction, since you’ll use this knowledge throughout your career.

How do I know if I’ve studied enough hours for a section?

Your readiness indicators include scoring consistently above 75-80% on practice exams, completing all review course material, and feeling confident with simulation formats. Don’t rely on logged hours alone; some candidates need more time to reach readiness, while others achieve it faster.

What happens if I run out of time in the 30-month window?

If you don’t pass all four sections within 30 months of passing your first section, your earliest passed section expires. You’ll need to retake that section while continuing to pass the remaining sections, all within rolling 30-month windows. Proper timeline planning prevents this stressful situation.

How many hours do successful CPA candidates typically study?

Research from review providers suggests successful candidates average 350-400 hours total, with significant variation based on background. More important than total hours is study quality and consistency. Candidates who study efficiently with quality materials often pass with fewer hours than those who use passive study techniques.

Should I take time off work to study for the CPA exam?

Taking time off can help during final review weeks before each exam, but extended leave is usually unnecessary. Most Indian professionals successfully pass while working full-time by using evenings and weekends effectively. If your employer offers study leave or reduced hours during exam preparation, take advantage of this support.

How do study hours compare between CPA and CA exams?

The CA qualification requires more total study hours than the CPA due to its three-level structure and broader scope. However, CPA study hours are more concentrated, typically spread over 12-24 months, versus CA’s four to five years. CA-qualified candidates find CPA preparation manageable precisely because they’ve already developed rigorous study habits.

Allow notifications

Allow notifications