Complete guide to CPA exam discipline sections BAR, ISC, and TCP for Indian candidates. Compare pass rates, exam formats, and career paths with India-specific decision framework.

Table of Contents

The CPA Evolution changed everything for aspiring CPAs in January 2024. Gone are the days when every candidate took the same four exam sections. Now, you must pass three Core sections and choose one Discipline section from BAR, ISC, or TCP. For Indian candidates preparing for the US CPA exam, this discipline choice has quickly become one of the most debated decisions in study groups, coaching centers, and online forums across the country.

If you are an Indian professional considering a CPA, you have probably asked yourself these questions already. Does choosing TCP mean I can only work in tax? Will BAR’s low pass rate make my journey harder? How does my CA or B.Com background influence this decision? These concerns are completely valid, and the good news is that understanding the discipline sections thoroughly will help you make a confident choice that aligns with your strengths and career goals.

This comprehensive guide breaks down everything Indian candidates need to know about the CPA discipline sections. We will explore what each discipline tests, compare exam formats and pass rates, and most importantly, provide an India-specific framework for making your decision. By the end of this guide, you will have the clarity you need to choose your discipline and move forward with your CPA preparation.

CPA Exam Discipline Sections: Importance

Understanding the CPA Evolution and Core + Discipline Model

How has the CPA Exam Changed since 2024?

The CPA Evolution initiative transformed the Uniform CPA Examination starting January 2024. The previous four-section exam structure, which required all candidates to pass AUD, BEC, FAR, and REG, was replaced with a Core + Discipline model. Under this new structure, candidates must pass three Core sections along with one Discipline section of their choice.

The elimination of the BEC (Business Environment and Concepts) section was the most significant change. BEC content was redistributed across the Core sections and the new Discipline sections. Technology, data analytics, and digital acumen are now tested throughout all exam sections, reflecting the evolving demands of the accounting profession.

What Does the Discipline Choice Actually Mean for Your CPA License?

Here is the most important thing you need to understand about discipline sections: your choice does not restrict your future practice areas. Whether you pass BAR, ISC, or TCP, you receive the same CPA license. Your license certificate does not mention which discipline you chose, and you can work in any area of accounting regardless of your discipline specialization.

Think of the discipline choice as an opportunity to demonstrate deeper expertise in one area during the exam. It does not lock you into a specific career path. A CPA who passed TCP can work in audit, and a CPA who passed BAR can work in tax. The accounting profession values the credential itself, and employers care far more about your overall competence than which discipline you selected.

CPA Exam Discipline Sections: Overview of the Three Discipline Options

Business Analysis and Reporting (BAR)

BAR is the discipline that builds directly on the Financial Accounting and Reporting (FAR) Core section. If you enjoyed FAR and found yourself gravitating toward advanced financial analysis, technical accounting standards, and business advisory work, BAR extends that knowledge into more sophisticated territory. The section covers advanced financial statement analysis, technical accounting requirements under FASB and SEC standards, and state and local government accounting.

This discipline is designed for candidates who want to deepen their expertise in financial reporting, data analytics for business decisions, and performance management. BAR tests your ability to analyze financial information, make projections, and understand complex accounting treatments like derivatives, consolidations, and revenue recognition at an advanced level.

Information Systems and Controls (ISC)

ISC takes a completely different direction by focusing on technology, data management, and business controls. This discipline builds on the Auditing and Attestation (AUD) Core section and is tailored for candidates interested in IT audit, cybersecurity, data governance, and systems risk management. If you find yourself curious about how technology intersects with accounting and assurance services, ISC is worth serious consideration.

The section covers information systems architecture, data management throughout its lifecycle, security and privacy controls, and SOC (System and Organization Controls) engagements. ISC recognizes that modern CPAs increasingly work at the intersection of accounting and technology, whether auditing IT systems, advising on cybersecurity risks, or managing data governance frameworks.

Tax Compliance and Planning (TCP)

TCP extends the Regulation (REG) Core section into advanced taxation territory. If you performed well on REG and want to specialize in tax compliance and planning, TCP allows you to demonstrate expertise in individual and entity taxation, personal financial planning, and complex property transactions. This discipline is the most closely aligned with its corresponding Core section.

The section tests advanced individual tax concepts like gift taxation and passive activity limitations, along with sophisticated entity tax compliance for C corporations, S corporations, partnerships, and trusts. TCP also covers entity tax planning strategies, including formation, liquidation, and transactions between entities and their owners.

Complete Breakdown of BAR: Business Analysis and Reporting

What Does the BAR Exam Test?

Content Areas and Weightings

The BAR exam is divided into three major content areas with specific allocation ranges. Business Analysis accounts for 40 to 50 percent of the exam and focuses on financial statement analysis, prospective analysis, and data-driven decision making. Technical Accounting and Reporting represents 35 to 45 percent and covers complex accounting standards and treatments.

State and Local Governments make up 10 to 20 percent of the BAR exam. This governmental accounting component is often the most unfamiliar territory for Indian candidates, as Indian accounting education typically does not cover US governmental accounting standards. However, the relatively small allocation means this area, while important, will not dominate your exam experience.

Specific Topics Covered in BAR

Within Business Analysis, you will encounter topics like financial ratio analysis, trend analysis, variance analysis, and prospective financial information, including forecasts and projections. The section also tests data analytics skills, asking you to interpret data visualizations and draw business conclusions from financial data. Risk management concepts and financial planning techniques round out this content area.

Technical Accounting and Reporting dives deep into complex accounting treatments that build on FAR foundations. Expect questions on revenue recognition nuances, lease accounting complexities, stock compensation, business combinations, consolidated financial statements, derivatives and hedge accounting, and internally developed software. The governmental accounting portion covers the financial section of comprehensive annual financial reports, fund accounting, and government-wide financial statement preparation.

BAR Exam Format and Scoring

Question Types and Time Allocation

The BAR exam consists of 50 multiple-choice questions and 7 task-based simulations, giving you 4 hours to complete the entire section. The exam is organized into five testlets. Testlets 1 and 2 contain 25 MCQs each, while Testlets 3, 4, and 5 contain the simulations distributed as 2, 3, and 2 TBSs, respectively.

For time management, plan approximately 37 minutes each for the two MCQ testlets. Allocate around 40 minutes for Testlet 3, 60 minutes for Testlet 4, and 40 minutes for Testlet 5. You will receive a 15-minute break between Testlets 2 and 3 that does not count against your exam time. This leaves approximately 26 minutes of buffer time to use as needed.

Who Should Choose BAR?

Ideal Candidate Profile for BAR

BAR is ideal for candidates who performed strongly on the FAR Core section and want to build on that foundation. If you found financial accounting concepts intuitive and enjoyed working through complex accounting treatments, BAR extends that momentum into advanced territory. Candidates with financial reporting backgrounds, those working in corporate accounting, or professionals interested in FP&A and advisory services often find that BAR aligns with their existing knowledge.

Career Paths After Passing BAR

CPAs who choose BAR often pursue careers in external audit at public accounting firms, corporate accounting and financial reporting roles, controller positions, and eventually CFO tracks. The discipline also supports careers in financial advisory, valuation services, and business consulting, where advanced financial analysis skills are essential.

Complete Breakdown of ISC: Information Systems and Controls

What Does the ISC Exam Test?

Content Areas and Weightings

ISC is structured around three content areas that reflect the intersection of technology and accounting. Information Systems and Data Management accounts for 35 to 45 percent of the exam and covers how organizations collect, store, process, and use data throughout their lifecycle. Security, Confidentiality, and Privacy also represent 35 to 45 percent, focusing on protecting organizational information assets.

Considerations for System and Organization Controls (SOC) Engagements make up 15 to 25 percent of the ISC exam. This area tests your understanding of SOC 1 and SOC 2 engagements, which are specialized attestation services that have become increasingly important as organizations rely on third-party service providers for critical business functions.

Specific Topics Covered in ISC

The Information Systems and Data Management area covers database concepts, data governance frameworks, IT general controls, application controls, and the data lifecycle from collection through archival or disposal. You will need to understand how information flows through organizations and the controls that ensure data integrity, availability, and reliability.

Security, Confidentiality, and Privacy topics include cybersecurity frameworks, access controls, network security, encryption, incident response procedures, and privacy regulations. The SOC Engagements content covers planning and performing SOC engagements, understanding the different SOC report types, and reporting considerations. This combination makes ISC particularly relevant as organizations face increasing cybersecurity threats and regulatory scrutiny.

ISC Exam Format and Scoring

Question Types and Time Allocation

ISC has a unique exam format compared to BAR and TCP. The section includes 82 multiple-choice questions and 6 task-based simulations, the highest MCQ count and lowest TBS count among the three disciplines. You still have 4 hours to complete the exam, organized into five testlets with 41 MCQs in each of the first two testlets.

Time allocation for ISC should account for the heavier MCQ load. Plan approximately 51 minutes for each MCQ testlet. Testlet 3 contains 1 TBS with roughly 20 minutes allocated, Testlet 4 has 3 TBSs with 60 minutes, and Testlet 5 has 2 TBSs with 40 minutes. The 15-minute break comes between Testlets 2 and 3, leaving approximately 18 minutes of buffer time.

Who Should Choose ISC?

Ideal Candidate Profile for ISC

ISC suits candidates who performed well on the AUD Core section and have an interest in technology, data management, or systems auditing. If you have a background in information technology, have taken IT audit courses, or currently work in roles involving systems controls, risk management, or cybersecurity, ISC builds on that foundation.

Career Paths After Passing ISC

CPAs specializing in ISC often pursue careers as IT auditors at public accounting firms, internal audit roles focused on technology controls, risk advisory positions, data governance managers, and eventually CIO or CTO tracks in organizations that value the combination of accounting and technology expertise. The growing importance of cybersecurity and data privacy has made ISC skills increasingly valuable.

Complete Breakdown of TCP: Tax Compliance and Planning

What Does the TCP Exam Test?

Content Areas and Weightings

TCP is divided into four content areas that comprehensively cover advanced taxation topics. Tax Compliance and Planning for Individuals and Personal Financial Planning accounts for 30 to 40 percent, focusing on sophisticated individual tax scenarios and wealth management concepts. Entity Tax Compliance also represents 30 to 40 percent, covering compliance requirements for various business entity types.

Entity Tax Planning makes up 10 to 20 percent and tests your understanding of tax-advantaged strategies for business entities. Property Transactions, covering the disposition of assets, accounts for another 10 to 20 percent. This distribution means individual and entity compliance together dominate the exam, while planning and property transactions provide important supporting content.

Specific Topics Covered in TCP

Individual tax topics include advanced gross income inclusions and exclusions, gift taxation compliance and planning, passive activity and at-risk loss limitations, and personal financial planning concepts like retirement planning and estate considerations. These topics extend beyond what REG covers, requiring deeper expertise in individual tax scenarios.

Entity tax compliance covers C corporations, S corporations, partnerships, trusts, and tax-exempt organizations at an advanced level. Entity planning topics include formation and liquidation of business entities, consolidated returns, and multijurisdictional tax issues. Property transactions content covers like-kind exchanges, involuntary conversions, related party transactions, and the calculation of gains and losses on asset dispositions.

TCP Exam Format and Scoring

Question Types and Time Allocation

TCP includes 68 multiple-choice questions and 7 task-based simulations, completed within 4 hours. The exam uses five testlets with 34 MCQs in each of the first two testlets. This MCQ count falls between BAR’s 50 and ISC’s 82, representing a moderate volume of multiple-choice questions.

Plan approximately 42 minutes for each MCQ testlet in TCP. Testlet 3 contains 2 TBSs with roughly 40 minutes allocated, Testlet 4 has 3 TBSs with 60 minutes, and Testlet 5 has 2 TBSs with 40 minutes. After the 15-minute break between Testlets 2 and 3, you will have approximately 16 minutes of buffer time to distribute as needed.

Who Should Choose TCP?

Ideal Candidate Profile for TCP

TCP is the natural choice for candidates who excelled on the REG Core section and have a genuine interest in taxation. If you found tax concepts logical and enjoyed working through compliance and planning scenarios, TCP allows you to demonstrate advanced expertise in this area. Candidates with tax backgrounds, those working in tax compliance roles, or professionals planning tax-focused careers often gravitate toward TCP.

Career Paths After Passing TCP

CPAs who choose TCP frequently pursue careers as tax analysts, tax managers, corporate tax directors, and partners in tax practices at public accounting firms. The discipline also supports careers in personal financial planning, estate planning, and entrepreneurship through starting your own tax practice. Big 4 tax practices and mid-size firm tax departments actively recruit CPAs with strong tax credentials.

CPA Exam Discipline Sections: CPA Discipline Pass Rates

Current Pass Rate Data for 2024-2025

Understanding pass rates helps you set realistic expectations, though they should not be the primary factor in your discipline decision. According to AICPA’s official pass rate data, the 2025 cumulative pass rates through Q3 show significant variation across disciplines. TCP leads with a 78.06% pass rate, followed by ISC at 68.21%, and BAR at 42.55%.

Why TCP Has the Highest Pass Rate (And What That Means for You)

TCP’s significantly higher pass rate is not an accident, and understanding the reasons helps you interpret this data correctly. The most important factor is content alignment. TCP and REG have the highest overlap of any Core-Discipline pairing, meaning candidates who just passed REG are very well prepared for TCP content. Many candidates take TCP immediately after REG while tax concepts are fresh.

Additionally, TCP attracts a self-selected population of candidates who are either already working in tax or have a strong tax background. Tax professionals who took REG and then TCP were exceptionally well prepared compared to general candidate populations. AICPA analysis confirms that TCP candidates in early quarters were disproportionately experienced tax professionals.

Should You Choose TCP Just Because of the Pass Rate?

Choosing TCP solely because of its high pass rate is a strategy that may backfire. Pass rates are expected to normalize over time as the initial wave of highly prepared tax professionals is replaced by a broader candidate pool. The AICPA has indicated that TCP’s pass rate will likely decrease as more diverse candidates attempt the section.

More importantly, your personal strengths matter more than aggregate pass rates. If you struggled with REG and tax concepts that do not come naturally to you, TCP may actually be harder for you despite its high pass rate. A candidate who excelled at FAR and finds financial analysis intuitive might achieve a higher score on BAR despite its lower overall pass rate. Choose based on your strengths and goals, not perceived ease.

Why BAR Has the Lowest Pass Rate

What Makes BAR Challenging

BAR’s lower pass rate reflects several challenging elements within the exam. First, BAR absorbed significant content from the eliminated BEC section, including cost accounting and managerial accounting topics that many candidates find difficult. The integration of this content with advanced financial reporting creates a broad and demanding syllabus.

Second, BAR includes governmental accounting, which is unfamiliar to most candidates, especially those from India, where governmental accounting follows entirely different standards. The Application-heavy skill weighting means candidates cannot rely on memorization and must demonstrate the ability to analyze complex scenarios. Finally, BAR tests advanced accounting treatments like derivatives, hedge accounting, and consolidations at a sophisticated level that goes beyond FAR foundations.

When BAR is Still the Right Choice Despite Lower Pass Rates

Despite the statistics, BAR is absolutely the right choice for many candidates. If FAR was your strongest Core section and you genuinely understand financial accounting concepts, BAR builds naturally on that foundation. Candidates pursuing corporate finance careers, controller positions, or CFO tracks benefit from demonstrating BAR expertise.

If you found yourself energized by FAR content rather than drained by it, that is a strong signal that BAR aligns with your strengths. The discipline’s lower pass rate partially reflects candidates who chose it without strong FAR foundations. Candidates who are well prepared and genuinely suited to BAR content pass at much higher rates than the aggregate data suggests.

CPA Exam Discipline Sections: How Indian Candidates Should Choose Their CPA Discipline

Mapping Your Indian Qualifications to Discipline Strengths

If You Are a Chartered Accountant (CA)

Your CA background provides excellent preparation for both BAR and TCP. The rigorous financial reporting training in the CA curriculum aligns well with BAR’s advanced accounting content, while your taxation studies support TCP preparation. ISC may require additional learning if your CA experience did not include significant IT audit or systems work, though many CAs working in Big 4 audit practices have relevant exposure.

If You Have a B.Com or M.Com Background

Your discipline choice depends heavily on your specialization and work experience. If your commerce degree emphasized financial accounting and you have worked in financial reporting roles, BAR is a natural fit. If your studies or career leaned toward taxation, TCP aligns with that background. Consider your strongest subjects during your degree and the work you have done since graduation when making this decision.

If You Are a CMA or CS

CMA holders often find BAR appealing because of the cost accounting and managerial accounting content that transferred from BEC. Your CMA training in performance management and financial analysis provides a foundation for BAR’s business analysis content. Company Secretaries may find ISC’s governance and compliance topics familiar, as CS training covers corporate governance frameworks that relate to ISC’s control environment concepts.

Career Goals and Discipline Alignment

Planning to Work in India

All three disciplines offer strong career prospects within India. TCP is particularly valuable if you are targeting US tax compliance roles at captive centers, KPOs, or consulting firms serving US clients. Major accounting firms in India have substantial US tax practices that actively recruit CPAs with TCP expertise. BAR supports financial reporting and advisory roles at MNCs operating in India, while ISC aligns with the growing demand for IT audit and risk advisory services.

Planning to Work in the US or Internationally

If relocation to the US is your goal, all three disciplines are valued in the American job market. TCP may offer slight advantages for direct tax roles, but employers primarily value your CPA credential and overall competence. The discipline on your transcript matters far less than your ability to demonstrate relevant skills during interviews and on the job.

Already Working at Big 4 or MNC in India

Align your discipline with your current service line or your target service line for promotion. If you work in audit and want to continue that path, BAR or ISC both make sense, depending on whether your interest leans toward financial statement audit or IT audit. Tax professionals should strongly consider TCP, as it demonstrates a commitment to their specialization. Risk advisory professionals might find ISC most relevant to their work.

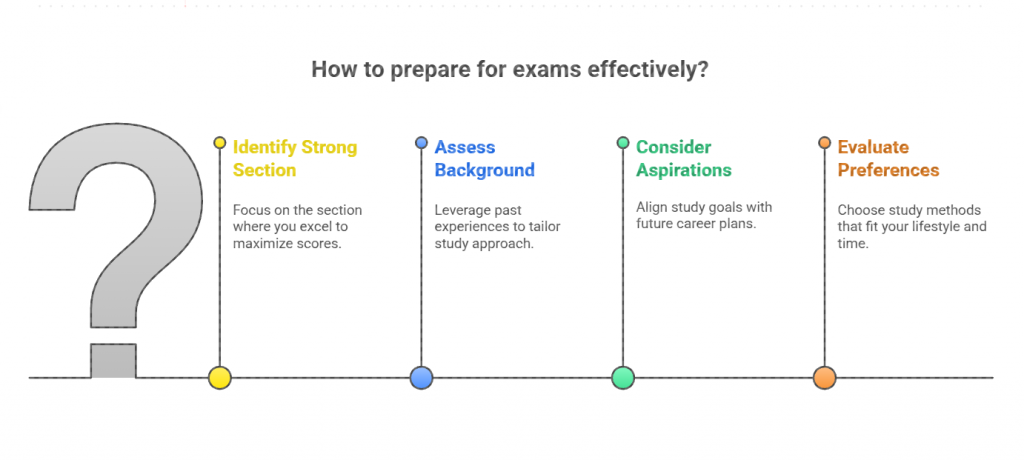

A Practical Decision Framework for Candidates

Step 1: Identify Your Strongest Core Section

Start with an honest assessment of your Core section performance. If FAR was your highest score or felt most intuitive, BAR is your natural discipline. If AUD resonated with you and you enjoyed the conceptual nature of auditing, consider ISC. If REG was your strongest section and tax concepts clicked for you, TCP is the logical choice. This alignment leverages your existing strengths.

Step 2: Assess Your Background and Experience

Reflect on your educational background and work experience. What subjects did you enjoy most during your B.Com, M.Com, or CA studies? What type of work energizes you in your current role? Candidates with financial reporting backgrounds often succeed in BAR, those with IT or systems exposure thrive in ISC, and tax practitioners find TCP most comfortable.

Step 3: Consider Your Career Aspirations

Think beyond passing the exam to your long-term career goals. Where do you see yourself in five or ten years? If you aspire to CFO or controller roles, BAR’s financial analysis expertise supports that trajectory. If you want to lead IT audit or risk functions, ISC positions you well. If building a career in tax advisory or starting your own practice appeals to you, TCP makes strategic sense.

Step 4: Evaluate Your Study Preferences and Available Time

Consider practical factors like study time and content preferences. BAR and TCP require approximately 150 to 200 study hours for most candidates. ISC, with its larger MCQ count and unique content, may require similar or slightly more time if IT concepts are new to you. If you are working full-time in India and have limited study hours, choosing a discipline aligned with your existing knowledge reduces preparation burden.

Preparing for Your Chosen Discipline: Strategies for Candidates

When to Take Your Discipline Section

The Strategic Sequencing Recommendation

The most effective strategy is to take your discipline immediately after passing the related Core section. Take the BAR right after passing the FAR, while the advanced accounting concepts are fresh. Schedule ISC after passing AUD when audit frameworks and control concepts are top of mind. Plan TCP immediately after REG when tax rules and calculations are still readily accessible in your memory.

This sequencing maximizes content overlap and minimizes relearning. Candidates who wait several months between the related Core and Discipline sections often report needing extensive review to recall concepts that would have been automatic if tested sooner. The continuous testing model allows you to schedule sections close together without waiting for testing windows.

Managing the Discipline Exam Timeline While Working in India

Working professionals in India face unique scheduling challenges. Prometric testing centers in major Indian cities like Mumbai, Delhi, Bangalore, Chennai, Hyderabad, and Kolkata offer CPA exam appointments, but popular time slots fill quickly. Plan your discipline exam at least six to eight weeks in advance to secure your preferred date and location.

Consider taking a leave around your exam date to allow for a focused final review. Many Indian candidates find that scheduling exams for early morning slots minimizes work disruption and allows afternoon recovery. Remember that discipline sections are typically offered in the first month of each quarter, so plan your study schedule around these testing windows.

Study Resources and Review Course Considerations for CPA

How CPA Review Courses Cover Discipline Sections

Major CPA review courses like Becker, Wiley, Surgent, and Gleim include discipline content as part of their comprehensive packages. When purchasing a review course, confirm that your chosen discipline is included or available as an add-on. Some providers offer discipline-specific modules that can be purchased separately if you already have Core section materials.

Pricing for comprehensive CPA review courses ranges from approximately ₹80,000 to ₹1,50,000, depending on the provider and package level. Indian coaching institutes often bundle review course access with their programs, which may offer cost savings. Compare features like adaptive learning, video lectures, practice questions, and simulations when evaluating options.

Study Hour Estimates by Discipline

Plan for approximately 150 to 200 hours of study time for your discipline section. BAR candidates should allocate time for governmental accounting if this is an unfamiliar area. ISC candidates without IT backgrounds may need additional hours to learn technology concepts. TCP candidates with strong REG performance and tax experience often report needing fewer hours due to content familiarity.

For Indian working professionals, this typically translates to 8 to 12 weeks of preparation if studying 15 to 20 hours per week. Create a study schedule that accounts for your work commitments, and build buffer time for unexpected disruptions. Consistency matters more than intensity, so sustainable daily study habits outperform weekend cramming sessions.

Common Mistakes Candidates Make When Choosing a Discipline

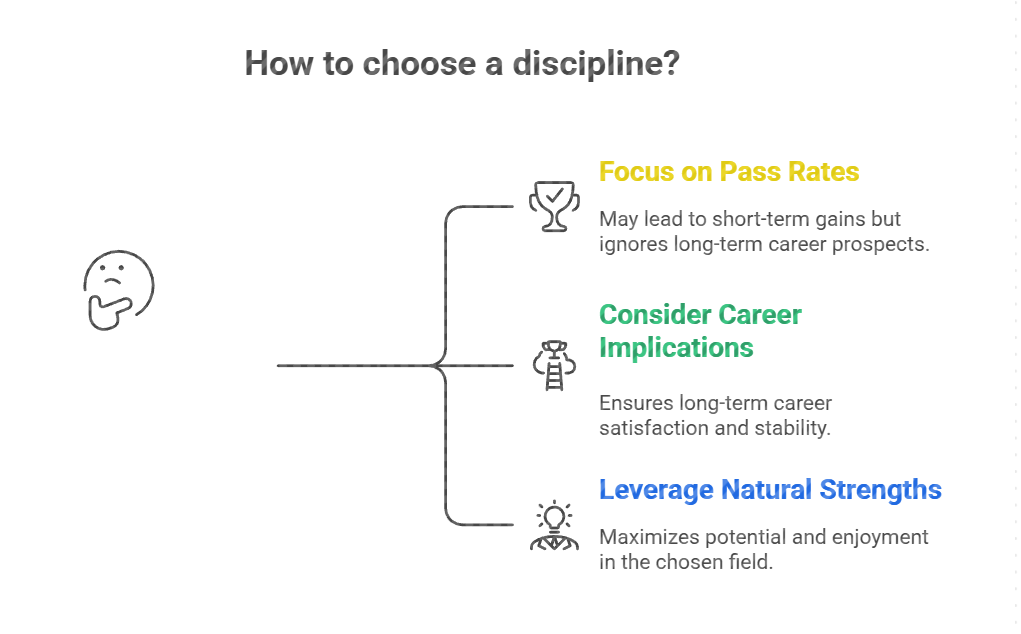

Choosing Based Only on Pass Rates

The most common mistake is selecting TCP simply because it has the highest pass rate. This approach ignores your personal strengths and assumes the aggregate experience applies to you individually. TCP’s pass rate will normalize over time, and a candidate poorly suited to tax content may struggle regardless of overall statistics. Choose the discipline where your specific background gives you the best chance of success.

Not Considering Long-Term Career Implications

While your discipline does not restrict your practice rights, demonstrating expertise in a specific area can support your career trajectory. Some candidates choose disciplines randomly without considering how the knowledge might benefit their long-term goals. If you have a clear career direction, aligning your discipline with that path provides both immediate exam benefits and future career value.

Ignoring Your Natural Strengths

Playing to your strengths gives you the best chance of passing efficiently. Candidates who ignore their natural aptitudes and choose based on perceived job market trends often struggle more than necessary. If financial analysis comes naturally to you, BAR will feel more manageable than forcing yourself through tax content. Trust your experience and choose the discipline where your existing knowledge provides the strongest foundation.

Conclusion

Choosing your CPA discipline section is an important decision, but it is not one that should cause excessive stress. The key insight to remember is that your discipline does not define your career or limit your practice rights. Every CPA license is the same regardless of whether you passed the BAR, ISC, or TCP. Employers value your credentials and competence, not which specific discipline appears on your score report.

For Indian candidates, the best approach is to align your discipline with your genuine strengths and interests. If you excelled at FAR and enjoy financial analysis, BAR is likely your path. If AUD resonated with you and technology interests you, consider ISC. If REG was your strongest section and tax concepts feel intuitive, TCP is the natural choice. Do not let pass rates or perceived difficulty override your honest assessment of where you perform best.

Make your decision, commit fully to your preparation, and move forward with confidence. The discipline choice is one step in your broader CPA journey, not the entire journey itself. Thousands of Indian professionals have successfully earned their CPA credentials by choosing the discipline that suited their strengths and preparing thoroughly. You can do the same. Focus on building genuine expertise, trust your preparation, and approach your exam with the confidence that comes from thorough study.

Frequently Asked Questions

Which CPA discipline is the easiest to pass?

TCP currently has the highest pass rate at approximately 78%, but “easiest” depends entirely on your background. A strong tax professional will find TCP easier, while a financial reporting specialist may find BAR more intuitive despite its lower pass rate. Choose based on your strengths rather than perceived difficulty, as your individual experience will differ from aggregate statistics.

Can CA holders take any CPA discipline they want?

Yes, your CA qualification does not restrict your discipline choice in any way. However, your CA background in financial reporting and taxation may give you natural advantages in BAR or TCP, respectively. Evaluate your specific CA experience and which areas felt most comfortable during your CA studies when making your decision.

Does my CPA discipline appear on my license?

No, your CPA license is a general license that does not reference which discipline you passed. You receive the same credentials as every other CPA, and you can practice in any area of accounting regardless of your discipline choice. Employers generally do not ask about or care about your specific discipline.

Can I change my discipline if I fail?

Yes, if you fail a discipline section, you can switch to a different discipline when you retake the exam. This flexibility allows you to reconsider your choice if you discover that your initial discipline was not the right fit. However, once you pass a discipline, you cannot take another one, as you only need credit for one discipline to complete the CPA exam.

Should I take my discipline section before or after the Core sections?

You can take sections in any order, but the recommended strategy is to take your discipline immediately after the related Core section while the content is fresh. Take BAR after FAR, ISC after AUD, and TCP after REG. This sequencing maximizes content overlap and reduces the amount of review needed.

Which discipline is best for Indian candidates planning to stay in India?

All three disciplines have strong career prospects in India. TCP is in high demand for US tax compliance roles at captive centers and consulting firms serving American clients. BAR aligns with financial reporting and advisory roles at MNCs operating in India. ISC is growing rapidly with an increasing focus on IT audit and risk advisory work.

How much additional study time does the discipline section require?

Plan for approximately 150 to 200 hours for your discipline section. This varies based on your background and how recently you passed the related Core section. Candidates who take their discipline immediately after the corresponding Core section typically need less study time due to content familiarity.

Is BAR significantly harder than TCP and ISC?

BAR has the lowest pass rate at around 42%, partly because it covers challenging advanced accounting topics, including cost accounting and governmental accounting absorbed from the old BEC section. However, candidates with strong FAR scores and financial reporting backgrounds often perform well on BAR. The difficulty is relative to your personal strengths.

Which discipline do Big 4 firms in India prefer?

Big 4 firms do not restrict hiring based on your discipline choice. However, TCP may be advantageous for US tax practice roles, ISC for risk advisory and IT audit positions, and BAR for audit and financial advisory service lines. Choose based on your target service line rather than trying to guess employer preferences.

Can I work in tax even if I passed the BAR or ISC?

Absolutely. Your discipline does not restrict your practice areas in any way. Many CPAs work in areas different from their discipline specialization throughout their careers. The license grants you the same rights regardless of which discipline you passed, so career flexibility remains fully intact.

What if I’m interested in two disciplines equally?

If you cannot decide between two disciplines, default to the one aligned with your strongest Core section performance. If you still remain undecided, consider which career path excites you more or which content area you have more background knowledge in. You can also review sample questions from each discipline to see which feels more natural.

Should I worry about governmental accounting in BAR if I have no background in it?

Governmental accounting represents only 10 to 20 percent of BAR content, so while you should study it thoroughly, this area alone will not make or break your exam. Your strong FAR foundation will carry you through most of BAR. Dedicate appropriate study time to governmental accounting without letting anxiety about it dominate your preparation.

Which discipline offers the best long-term career growth in India?

All three disciplines offer strong growth potential in India. ISC may have the highest growth trajectory due to increasing organizational focus on technology, cybersecurity, and digital transformation. TCP remains stable with ongoing demand for US tax compliance expertise. BAR supports traditional career paths toward CFO and controller roles that continue to be valued.

Allow notifications

Allow notifications