Complete guide on how to prepare for CPA exam while working full-time in India. Covers study hours, weekly schedules, review course pricing in INR, and proven strategies .

Table of Contents

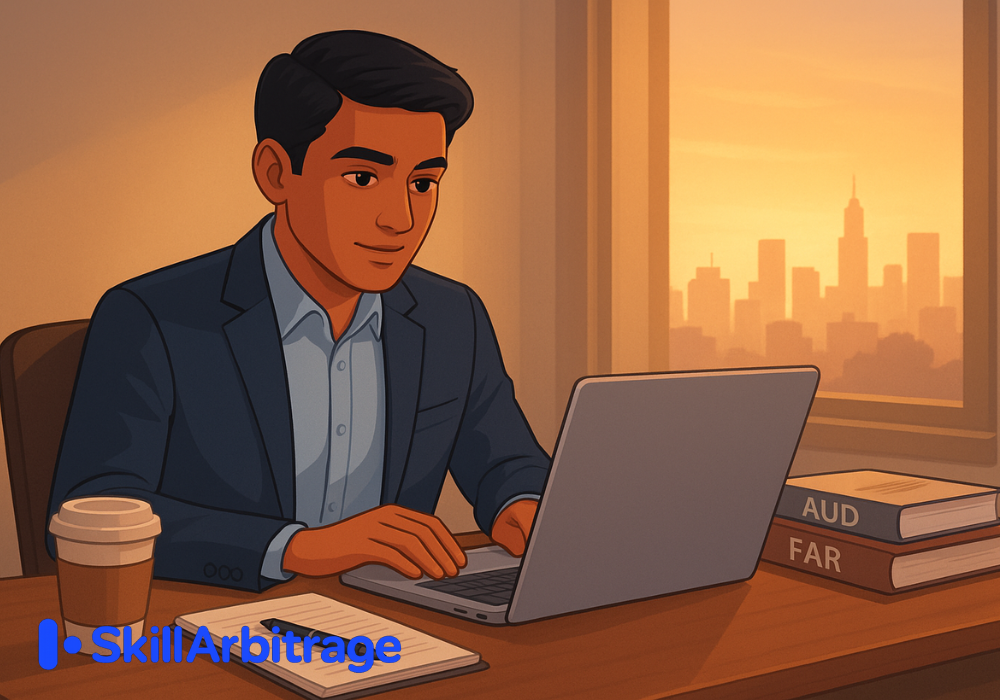

Let me be honest with you about something most CPA guides won’t admit upfront. Preparing for the US CPA exam while holding down a full-time job in India is genuinely difficult. You’re looking at 9 to 10-hour workdays, lengthy commutes in cities like Mumbai or Bangalore, family responsibilities that don’t pause for your career ambitions, and an exam that demands 300 to 450 hours of focused study time. It sounds overwhelming because, well, it is. But here’s what I want you to understand before you read any further: thousands of Indian professionals pass all four CPA sections every year while working full-time, and you can absolutely join them.

The difference between candidates who succeed and those who abandon their CPA journey halfway through isn’t intelligence or talent. It’s having a realistic, sustainable study plan that accounts for the unique challenges Indian working professionals face. This guide exists because most CPA preparation advice comes from a US perspective, where work culture, commute patterns, and support systems look very different from what you experience in India. You deserve guidance that speaks directly to your situation, whether you’re a CA looking to add an international credential, an M.Com graduate building your finance career, or a Big 4 associate eyeing global opportunities.

Over the next several sections, you’ll learn exactly how many hours you need to invest in each CPA section, how to build a study schedule around your demanding job, which review courses offer the best value for Indian candidates with pricing in Indian Rupees, and how to maintain your motivation across 12 to 18 months of preparation. This isn’t about studying harder or sacrificing your health and relationships. It’s about studying smarter with a framework designed specifically for professionals like you.

What Makes CPA Preparation Challenging for Working Professionals in India?

Before diving into study strategies, let’s acknowledge the specific obstacles you’re facing. Understanding these challenges isn’t about making excuses; it’s about building a plan that actually works for your life. Indian working professionals deal with constraints that generic CPA advice simply doesn’t address, and pretending otherwise sets you up for frustration and failure.

Balancing Indian Work Culture with CPA Studies

The Indian corporate environment presents unique challenges for CPA candidates. Unlike many Western countries, where leaving the office at 5 or 6 PM is standard, Indian professionals often face extended work hours, last-minute project demands, and a culture where staying late signals commitment. Add to this the expectations around availability for calls and emails outside office hours, and you’re already starting with less discretionary time than your counterparts in other countries.

Understanding Typical Work Hours and Commute Constraints

Most Indian professionals work 9 to 10 hours daily, with commutes in major cities averaging 1 to 2 hours each way. This means your “workday” often consumes 11 to 14 hours, leaving limited windows for focused study. The physical and mental exhaustion from long commutes further reduces your effective study capacity during weekday evenings.

Managing Festival Seasons, Family Expectations, and Social Obligations

Indian family structures often involve greater participation in extended family events, festival celebrations, and social obligations compared to Western norms. Wedding seasons, religious festivals, and family gatherings can disrupt study schedules significantly. Successful candidates learn to plan around these periods rather than fighting against cultural expectations that aren’t going away.

Unique Time Zone and Scheduling Challenges

The 9.5 to 12.5 hour time difference between India and the US creates practical complications that affect everything from exam scheduling to accessing live support from review course providers. Understanding these timezone realities helps you plan more effectively.

Coordinating with US-Based Exam Systems from IST

The CPA exam is administered by AICPA and managed through NASBA’s candidate portal, both operating primarily on US business hours. When you need to contact state boards about application issues or resolve NTS problems, you’re often limited to late evening or early morning IST windows. Score releases typically happen during US business hours, which means checking results often falls in Indian late evening or nighttime.

Prometric Scheduling and Availability in Indian Test Centers

India has eight Prometric testing centers located in Ahmedabad, Bangalore, Kolkata, Chennai, Hyderabad, Mumbai, New Delhi, and Trivandrum. While this is a significant improvement from when Indian candidates had to travel abroad for testing, appointment availability during convenient dates can be limited. Popular testing windows fill up quickly, so you’ll need to schedule your exam date 45 to 60 days in advance, especially if you have specific date preferences around work commitments or leave availability.

How to Prepare for the CPA Exam While Working Full-Time in India: Number of Hours of Study

One of the most common questions I hear from working professionals is simply: “How many hours do I actually need to study?” The answer varies based on your background, but having realistic expectations about the time investment prevents both overconfidence and unnecessary panic. Let me break down what the data and successful candidates tell us about study hour requirements.

Section-by-Section Study Hour Requirements

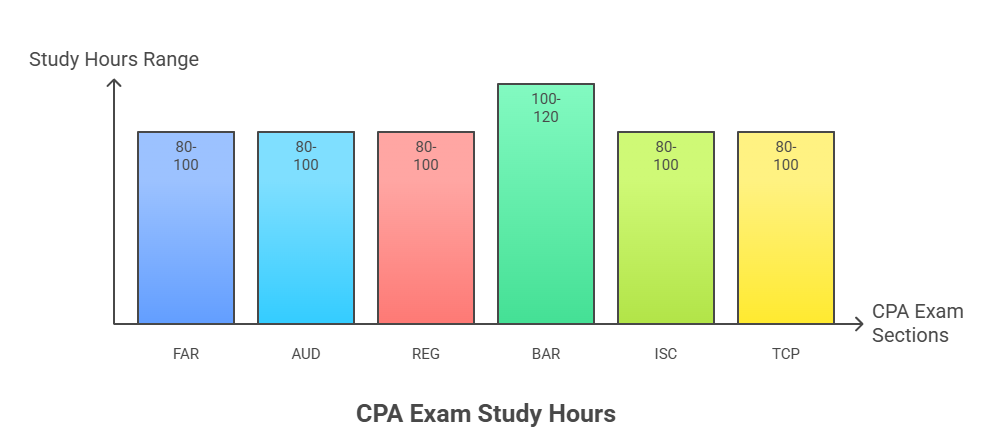

The CPA exam under the current CPA Evolution format consists of three Core sections that everyone must pass (FAR, AUD, and REG) plus one Discipline section of your choice (BAR, ISC, or TCP). Each section demands different amounts of preparation time based on content volume and complexity.

FAR: The Most Time-Intensive Core Section (80-100 Hours)

Financial Accounting and Reporting is universally considered the most demanding CPA section, and for good reason. FAR covers an enormous range of topics, including financial statement preparation, governmental accounting, not-for-profit accounting, and detailed GAAP requirements. According to Becker’s study recommendations, candidates should allocate 80 to 100 hours.

The 2024-2025 pass rates for FAR hover around 40 to 43 percent, making it one of the more challenging sections statistically. If you’re coming from an Indian CA background, you’ll find some concepts familiar, but the US-specific accounting standards require dedicated study time. Don’t underestimate this section or rush through it; FAR forms the foundation for understanding BAR if you choose that discipline later.

AUD and REG: Building on Your Existing Knowledge (80-100 Hours Each)

The Auditing and Attestation section tests your understanding of audit procedures, professional responsibilities, and reporting requirements. Most review providers recommend 80 to 100 hours for AUD, though candidates with practical audit experience often manage with slightly less. The 2024-2025 AUD pass rates sit around 46 to 48 percent, reflecting moderate difficulty.

REG, covering federal taxation and business law, typically requires 80 to 110 hours of study. Here’s some encouraging news: REG consistently shows the highest pass rates among Core sections, reaching 60 to 64 percent in recent testing periods. If you’ve worked in tax or studied Indian taxation extensively, some concepts around tax planning and compliance will feel familiar, though US tax law specifics require careful attention.

Discipline Sections: BAR, ISC, and TCP Hour Requirements (80-120 Hours)

Your choice of the Discipline section significantly impacts both your study time and your pass probability. Business Analysis and Reporting (BAR) extends FAR concepts into advanced accounting topics, requiring approximately 100 to 120 hours.

Information Systems and Controls (ISC) focuses on IT audit and data management, typically needing 80 to 100 hours. Tax Compliance and Planning (TCP) builds on REG foundations and usually requires 80 to 100 hours.

How Should You Calculate Your Total Study Timeline as a Working Professional?

Converting total study hours into a realistic timeline requires an honest assessment of how many hours you can genuinely commit each week. Working professionals face time constraints that full-time students don’t, making timeline planning essential for success.

The 15-20 Hours Per Week Framework for Full-Time Employees

Most successful working professionals dedicate 15 to 20 hours weekly to CPA preparation. This typically breaks down to 1.5 to 2 hours on weekday mornings or evenings, plus 4 to 6 hours spread across weekend sessions. Attempting to study 25 or 30 hours weekly while working full-time usually leads to burnout within weeks, so be realistic about sustainable commitments.

Realistic Completion Timelines: 12-18 Months vs. Aggressive 9-Month Plans

At 15 to 20 hours weekly, completing all four sections takes 12 to 18 months for most working professionals. Aggressive 9-month plans require either significantly more weekly hours or a lighter work schedule. Remember that NASBA provides a 30-month rolling window to pass all four sections after your first passed exam, so you have the flexibility to pace yourself appropriately.

What Are The Factors That Affect Your Personal Study Hour Requirements?

Your individual background significantly influences how much time you’ll need for each section. Recognizing your strengths helps you allocate study time more efficiently across the exam.

Leveraging Your CA, M.Com, or B.Com Background

Indian Chartered Accountants often find FAR and AUD sections more manageable due to overlapping concepts from the CA curriculum. The financial reporting frameworks, audit procedures, and professional ethics covered in CA studies provide a foundation that can reduce FAR preparation time. M.Com graduates with specializations in accounting benefit similarly, though the US GAAP specifics still require dedicated attention.

B.Com graduates without CA or additional certifications typically need the full recommended study hours for each section. However, don’t view this as a disadvantage; it simply means your study plan should account for building foundational knowledge that CA holders may already possess.

How Current Work Experience Reduces Study Time for Certain Sections

Your job function directly impacts how quickly you’ll grasp certain CPA concepts. Professionals working in audit roles find AUD content more intuitive, often reducing study time. Those in tax departments or advisory roles similarly benefit when preparing for REG and TCP. If you work in financial reporting or controllership functions, FAR concepts will feel more familiar.

The key insight here is matching your first section choice to your work experience. Starting with a section where your job provides daily reinforcement builds confidence and momentum for tackling less familiar content later.

How to Prepare for CPA Exam While Working Full-Time in India: Building a Personalized CPA Study Plan

Generic study schedules rarely survive contact with real life, especially when your real life includes demanding Indian work hours and family responsibilities. The key to successful CPA preparation lies in building a personalized plan that accounts for your specific constraints, energy patterns, and priorities. Let me walk you through how to create a schedule you’ll actually follow.

Identifying Your Peak Productivity Hours for Maximum Retention

Not all study hours are created equal. An hour of focused study when you’re mentally sharp produces far better results than two hours of distracted reading when you’re exhausted. Understanding your personal energy patterns helps you position high-intensity study activities during your peak performance windows.

Morning Study Sessions: The 5 AM to 7 AM Advantage

Early morning study sessions before work begin offer significant advantages for many candidates. Your mind is fresh, interruptions are minimal, and you complete your study commitment before the day’s demands can derail your plans. The tradeoff involves earlier bedtimes and disciplined sleep schedules, which may require family coordination.

Evening Sessions: Making Post-Work Hours Productive

If mornings don’t work for your schedule or energy patterns, evening sessions between 8 PM and 10 PM can be effective. The key is allowing adequate decompression time after work before studying. Jumping straight from office stress into CPA preparation rarely yields quality study time. A 30 to 60 minute buffer for dinner and relaxation helps your brain shift into learning mode.

Weekend Power Blocks: Structuring 4-6 Hour Deep Study Sessions

Weekends provide opportunities for longer, uninterrupted study blocks that weekdays simply can’t match. These sessions are ideal for working through complex topics, completing full practice exam sections, and tackling task-based simulations that require extended focus. Protect at least one 4 to 6-hour block each weekend for intensive study, treating it as a non-negotiable appointment.

Creating Your Weekly Study Schedule Template

A written schedule transforms vague intentions into concrete commitments. Your weekly template should specify exactly when you’ll study, for how long, and ideally what content you’ll cover during each session.

Sample Weekday Schedule for 9-to-6 Office Workers

For professionals with standard office hours, a typical weekday schedule might include 5:30 AM to 7:00 AM study sessions before your commute, or alternatively, 8:30 PM to 10:00 PM sessions after dinner. Attempting both morning and evening sessions daily leads to burnout; choose one approach and maintain consistency.

Sample Schedule for Professionals with Flexible or Remote Work

Remote or hybrid workers can leverage midday flexibility more effectively. Consider blocking 12:30 PM to 1:30 PM for study during lunch breaks, supplemented by 60 to 90-minute evening sessions. The elimination of commute time provides additional hours that office-bound colleagues don’t enjoy; use this advantage wisely.

Adjusting Your Plan During Busy Periods and Deadlines

Work demands fluctuate, and your study schedule must accommodate busy periods without completely derailing progress. During intense work weeks, reduce daily targets to 30 to 45 minutes of review rather than abandoning the study entirely. Maintaining any level of contact with the material prevents the regression that comes from complete breaks.

Strategic Use of Leave Days and Extended Weekends

Strategic time off can dramatically accelerate your preparation, particularly in the final weeks before each exam section. Planning your leave around CPA preparation shows professional commitment to your career development and often receives employer support.

Planning Study Vacations Before Each Exam Section

Taking 2 to 3 consecutive leave days before your exam date creates a focused final review period. Use this time for full-length practice exams, weak area review, and mental preparation. Many successful candidates report that these pre-exam study breaks significantly improve their confidence and performance.

Maximizing Long Weekends and Festival Holidays

Indian calendar holidays create natural extended weekend opportunities. Diwali breaks, Independence Day weekends, and regional festivals provide 3 to 4-day windows for intensive study. Planning your exam schedule around these holidays lets you leverage time off without using your leave balance.

Which CPA Review Course Should Indian Working Professionals Choose?

Your choice of review course significantly impacts both your preparation quality and your budget. With options ranging from ₹80,000 to over ₹4 lakhs, understanding what each provider offers helps you make an informed investment decision. Let me break down the major options with pricing relevant to Indian candidates.

Comprehensive Review Course Comparison with Indian Pricing

The international CPA review course market is dominated by a few major players, each with distinct strengths and price points. All pricing below reflects current rates converted to Indian Rupees at approximately ₹84 per USD.

Becker CPA Review: Features, Pricing in INR, and Suitability

Becker holds the largest market share in CPA preparation, trusted by all Big 4 accounting firms globally. Their course includes comprehensive video lectures, over 8,000 multiple-choice questions, 500+ task-based simulations, and adaptive learning technology. The Becker Pro package costs approximately ₹2,60,000 to ₹3,20,000, making it the premium option in the market.

For Indian candidates, Becker’s primary advantage lies in its proven methodology and extensive support resources, including live online classes and one-on-one tutoring options. If your employer offers Becker reimbursement or you’re targeting Big 4 employment, the investment often makes sense. However, self-funding candidates should carefully evaluate whether the premium price delivers proportionally better results for their situation.

Gleim CPA Review: Value Proposition for Budget-Conscious Candidates

Gleim CPA Review offers the largest test bank in the industry. Their Premium package costs approximately ₹2,80,000 to ₹3,20,000, providing significant savings compared to Becker while maintaining comprehensive coverage.

Gleim’s strength lies in practice question volume and detailed answer explanations. For candidates who learn best through extensive problem practice rather than video lectures, Gleim often proves more effective. The “access until you pass” guarantee also provides peace of mind for working professionals whose preparation timeline may extend beyond initial estimates.

Surgent CPA Review: Adaptive Learning for Time-Strapped Professionals

Surgent differentiates itself through A.S.A.P. adaptive learning technology that claims to reduce study time by identifying and focusing on your weak areas. Their packages range from approximately ₹1,50,000 to ₹2,00,000, depending on the features selected.

For working professionals with severe time constraints, Surgent’s efficiency-focused approach holds appeal. The software continuously adapts to your performance, theoretically eliminating time spent reviewing material you’ve already mastered. Their READYscore feature predicts your likely exam score, helping you determine when you’re genuinely prepared to sit for each section.

UWorld Roger CPA Review: Engaging Content for Visual Learners

UWorld Roger CPA Review combines engaging video lectures with comprehensive practice materials. Formerly separate companies, the merged entity offers packages ranging from approximately ₹2,95,000 to ₹3,45,000.

Roger’s lectures are known for high engagement and memorable explanations, which help candidates who struggle with dry, textbook-style presentations. The UWorld question bank brings medical and nursing exam expertise to CPA preparation, with detailed explanations designed to teach concepts through practice questions.

Indian CPA Coaching Institutes: Miles, Simandhar, and Zell Education

Beyond international review courses, Indian coaching institutes offer localized support that can significantly benefit candidates who prefer structured guidance and in-person or live online interaction.

What Indian Coaching Institutes Offer Beyond Self-Study Materials

Institutes like Miles Education, Simandhar Education, and Zell Education provide comprehensive packages that bundle Becker or other review course access with live classes, doubt-clearing sessions, exam application support, and placement assistance. This end-to-end approach addresses challenges that self-study candidates often struggle with alone.

The mentorship component proves particularly valuable for first-generation CPA candidates who lack guidance from family or colleagues who’ve completed the exam. Having instructors who understand Indian educational backgrounds and can explain US concepts in relatable terms accelerates comprehension for many candidates.

When evaluating total investment, consider that coaching institute fees often include services that self-study candidates must handle independently: credential evaluation guidance, state board application assistance, and exam scheduling support. For candidates who value this comprehensive approach, the additional cost frequently proves worthwhile.

How Should Working Professionals Approach Each CPA Section?

Strategic section ordering and targeted preparation approaches can significantly improve your efficiency and success probability. Working professionals benefit from sequencing sections to build momentum while leveraging their professional experience.

FAR Section Strategy: Tackling the Largest Content Area

FAR demands the most study time and covers the broadest content range, making it a logical first section for many candidates. Starting with FAR while your study habits are fresh and motivation is high helps you tackle the biggest challenge before fatigue sets in. The content spans financial statement preparation, revenue recognition, leases, governmental accounting, and not-for-profit reporting.

For working professionals, focus your FAR preparation on high-weight topics identified in the AICPA exam blueprints. The financial reporting and select transactions content area carries 45 to 55 percent of the exam weight, making it your highest priority. Governmental and not-for-profit accounting represents another 20 to 30 percent, and these topics often feel unfamiliar to candidates without public sector experience.

Task-based simulations in FAR frequently test journal entries, financial statement preparation, and research within the FASB Codification. Practicing with authentic TBS formats prepares you for the substantial weight these simulations carry in your final score.

AUD Section Strategy: Leveraging Practical Audit Knowledge

AUD tests your understanding of audit procedures, professional responsibilities, and reporting requirements. Candidates with audit work experience hold natural advantages here, as many concepts map directly to daily responsibilities. Even without audit backgrounds, the logical flow of audit engagements from planning through reporting provides a framework for organizing your study.

The exam emphasizes risk assessment, audit evidence evaluation, and report writing. Internal control testing and documentation requirements also feature prominently. Unlike FAR’s calculation-heavy content, AUD requires understanding conceptual frameworks and applying professional judgment to scenarios.

For working professionals, connecting AUD concepts to real-world audit situations accelerates learning. Even if you don’t work in audit, relating content to your company’s external audit process or internal control environment makes abstract concepts concrete.

REG Section Strategy: Mastering US Federal Taxation

REG combines federal taxation with business law topics, testing both calculation skills and regulatory knowledge. The taxation content focuses on individual and entity tax compliance, including basis calculations, property transactions, and entity selection considerations.

Despite covering material less familiar to Indian candidates, REG consistently shows the highest Core section pass rates. The content, while voluminous, follows logical patterns that respond well to systematic study. Business law topics, including contracts, agency relationships, and business entity formation, round out the section.

Working professionals in tax advisory or compliance roles find REG content most directly applicable to their work. Even without tax backgrounds, the structured nature of tax rules makes them learnable through consistent practice with tax scenarios and calculations.

Choosing Your Discipline Section: BAR, ISC, or TCP

Your Discipline section choice should align with both your career goals and your comfort with the content area. This decision deserves careful consideration since it affects both your study investment and your professional positioning.

Which Discipline Aligns with Your Career Goals?

BAR suits candidates pursuing careers in financial reporting, controllership, or CFO tracks where advanced accounting knowledge proves valuable. The content extends FAR into complex areas, including business combinations, derivatives, and governmental financial reporting.

ISC aligns with IT audit, risk advisory, and technology-focused accounting careers. If you’re interested in SOC engagements, cybersecurity advisory, or data analytics roles, ISC content directly supports these paths.

TCP targets candidates building tax advisory careers. The advanced individual and entity tax planning content prepares you for complex tax consulting engagements and complements the foundational REG content.

Pass Rate Considerations and Study Hour Investment

The significant pass rate differences between Disciplines warrant attention in your decision. TCP’s 72 to 78 percent pass rates compare favorably to BAR’s 34 to 41 percent and ISC’s 61 to 68 percent. However, these statistics reflect candidate self-selection; those choosing TCP typically have stronger tax backgrounds.

If your goal is simply to complete the CPA credential efficiently, TCP’s higher pass rates and lower study hour requirements present an attractive option. If your career specifically requires BAR or ISC knowledge, the additional study investment and potentially multiple attempts remain worthwhile for your long-term trajectory.

Conclusion

Preparing for the CPA exam while working full-time in India is demanding, but it’s a challenge that thousands of your peers have successfully navigated. The strategies outlined in this guide work because they’re built around the realities of Indian professional life: long work hours, family responsibilities, timezone challenges, and budget considerations that generic CPA advice ignores.

Your path to CPA success starts with an honest assessment of your available time, typically 15 to 20 hours weekly for most working professionals. From there, building a personalized study schedule that protects your peak productivity hours and leverages weekends for intensive sessions creates sustainable momentum. Choosing the right review course based on your budget, learning style, and support needs sets you up with appropriate tools. And approaching each section strategically, leveraging your professional experience and educational background, maximizes your efficiency.

Your CPA credential opens doors that few other qualifications can match: global career mobility, Big 4 opportunities, premium compensation in multinational corporations, and professional recognition that transcends borders. The investment you’re making in yourself over the next year to eighteen months will pay dividends throughout your career.

Start today by selecting your first section based on your background and work experience. Download or create your weekly study schedule template. Choose a review course that fits your budget and learning preferences. Then commit to your first week of consistent study, building the habits that will carry you through to exam day and beyond.

Frequently Asked Questions

Can I pass the CPA exam while working full-time in India?

Yes, thousands of Indian professionals pass all four CPA sections annually while maintaining full-time employment. Success requires realistic planning, typically allocating 15 to 20 hours weekly across 12 to 18 months. The key is building sustainable study habits rather than attempting intensive preparation that leads to burnout.

How many hours per week should I study for the CPA exam while working?

Most successful working professionals dedicate 15 to 20 hours weekly to CPA preparation. This typically breaks down to 1.5 to 2 hours on weekday mornings or evenings, plus 4 to 6 hours across weekend sessions. Attempting more than 20 hours weekly while working full-time often proves unsustainable.

What is the best time to study for the CPA when working a 9-to-6 job?

Early morning sessions between 5 AM and 7 AM work well for many candidates because the mind is fresh and interruptions are minimal. Alternatively, evening sessions from 8:30 PM to 10 PM, after adequate decompression time from work, can be effective. Choose the approach that aligns with your natural energy patterns.

How long does it take to pass all four CPA sections while working full-time?

At 15 to 20 hours of weekly study, completing all four sections typically takes 12 to 18 months. More aggressive timelines of 9 to 12 months require either increased weekly hours or reduced work commitments. NASBA provides a 30-month rolling window after your first passed section.

Should I take leave from work to prepare for the CPA exam?

Strategic leave usage accelerates preparation, particularly before exam dates. Taking 2 to 3 consecutive days off before each section allows intensive final review and mental preparation. Many successful candidates also leverage long weekends and festival holidays for extended study periods.

Which CPA section should working professionals attempt first?

Most candidates benefit from starting with either FAR or the section most aligned with their work experience. FAR, despite being the largest section, makes a logical first choice because it builds foundational knowledge and is best tackled while motivation is highest. Alternatively, starting with a section related to your job function builds early confidence.

Is Becker worth the investment for Indian candidates?

Becker’s value depends on your specific situation. If your employer offers reimbursement or you’re targeting Big 4 employment where Becker is standard, the premium price often proves worthwhile. Self-funding candidates should compare Becker’s offerings with alternatives like Gleim or Surgent that deliver quality preparation at lower price points.

Can I prepare for the CPA without joining a coaching institute in India?

Yes, self-study using international review courses like Becker, Gleim, or Surgent is entirely viable. However, coaching institutes provide valuable support, including application assistance, live doubt-clearing, and structured schedules that benefit candidates who prefer guided preparation. Evaluate whether the additional cost provides value for your learning style.

What if I fail a CPA section while working full-time?

Section failures are common and don’t indicate you should abandon your CPA journey. Analyze your exam performance using the diagnostic report, identify weak areas, and adjust your preparation approach. Many successful CPAs failed one or more sections initially. The 30-month rolling window provides time to retake failed sections.

How do Indian CA holders benefit when preparing for CPA while working?

CAs often find FAR and AUD content more manageable due to curriculum overlap with CA studies. Financial reporting frameworks, audit procedures, and professional ethics concepts transfer well. This background can reduce FAR study time by 15 to 20 percent, though US GAAP specifics still require dedicated attention.

Can I study for two CPA sections simultaneously while working?

Studying two sections simultaneously while working full-time is generally not recommended. The increased cognitive load and split focus typically reduce retention and performance on both sections. Complete one section before beginning intensive preparation for the next, though light preview reading for upcoming sections is acceptable.

How do I stay motivated during 12-18 months of CPA preparation?

Break the journey into smaller milestones: completing each section represents a major achievement worth celebrating. Connect with fellow CPA candidates through online communities or study groups for accountability. Remind yourself regularly why you started this journey and the career rewards awaiting completion.

Allow notifications

Allow notifications