Complete guide to passing the CPA exam on first attempt for Indian candidates. Learn section order strategy, study hours, review courses, and proven techniques from successful Indian CPAs.

Table of Contents

Only about 20% of CPA candidates manage to pass all four sections on their first attempt. That statistic might seem discouraging at first glance, but here’s what most people don’t tell you: Indian professionals are uniquely positioned to beat these odds. Your rigorous academic training through B.Com, M.Com, or CA programs has already equipped you with analytical thinking, disciplined study habits, and a strong foundation in accounting principles. The challenge isn’t whether you can pass; it’s about channeling your existing strengths into a strategic approach designed specifically for the CPA exam’s structure.

The journey from an Indian accounting professional to a US CPA comes with specific challenges that generic American study guides simply don’t address. You’ll need to transition from Indian GAAP to US GAAP, master an entirely unfamiliar US tax code from scratch, and somehow fit 300 to 500 hours of study time around a demanding job that often exceeds 50 hours per week. Add to this the significant investment of ₹3 to 4 lakhs in exam fees and review courses, and it becomes clear why so many Indian candidates feel overwhelmed before they even begin. But these challenges aren’t insurmountable; they just require a different approach than what works for American candidates.

This guide delivers exactly the framework you need. We’ll cover the strategic section order that leverages your Indian accounting background, realistic study hour planning for working professionals, review course selection with India-specific pricing, proven study techniques from successful candidates, and practical exam day strategies. Every recommendation comes from analyzing what actually works for Indian professionals, not generic advice designed for fresh American graduates with unlimited study time. By the time you finish reading, you’ll have a clear roadmap to becoming part of that successful 20% who pass on their first attempt.

CPA Exam Challenges for Indian Candidates

The CPA exam presents a distinct set of challenges for Indian professionals that differ significantly from what American candidates face. Understanding these challenges upfront allows you to build a preparation strategy that addresses them directly rather than discovering gaps in your knowledge during the actual exam.

Current Pass Rates for CPA Exam

Pass rates provide crucial intelligence for strategic planning, helping you understand which sections demand more preparation time and where your background might give you an advantage. The overall CPA exam pass rate hovers around 50%, but this average masks significant variation across sections that Indian candidates must understand.

Section-Wise Pass Rate Analysis (2024-2025 Data)

The three Core sections show distinctly different pass rates that should influence your preparation priorities. Financial Accounting and Reporting (FAR) consistently records the lowest pass rates at approximately 43%, reflecting its massive content volume covering US GAAP, governmental accounting, and nonprofit accounting. Auditing and Attestation (AUD) shows moderate difficulty with pass rates around 48%, while Taxation and Regulation (REG) demonstrates the highest Core section pass rate at approximately 64%.

The Discipline sections present even more dramatic variation in candidate performance. Tax Compliance and Planning (TCP) leads with an impressive 78% pass rate, largely because candidates who choose TCP typically have tax backgrounds, and the content builds directly on REG knowledge they’ve already mastered. Information Systems and Controls (ISC) shows steady pass rates around 68%, while Business Analysis and Reporting (BAR) records the lowest pass rates at approximately 42%, making it the most challenging Discipline option for most candidates.

Why First-Attempt Success Rates Are Lower Than You Think

While individual section pass rates hover around 50%, the probability of passing all four sections on first attempt drops dramatically to approximately 20%. This mathematical reality reflects the compounding effect of multiple exam attempts. If you have a 50% chance of passing each section, your probability of passing all four consecutively drops to about 6.25% without any strategic preparation advantage.

The key insight here is that first-attempt success requires more than just studying hard; it demands strategic planning that accounts for section interdependencies, optimal ordering, and realistic timeline management. Candidates who approach the CPA exam as four separate tests rather than an integrated certification journey significantly reduce their chances of first-attempt success.

The CPA Exam Structure

The CPA Evolution initiative, launched in January 2024, transformed the exam from four fixed sections into a more flexible Core plus Discipline model. This new structure offers strategic opportunities for Indian candidates to play to their strengths while minimizing exposure to their weakest areas.

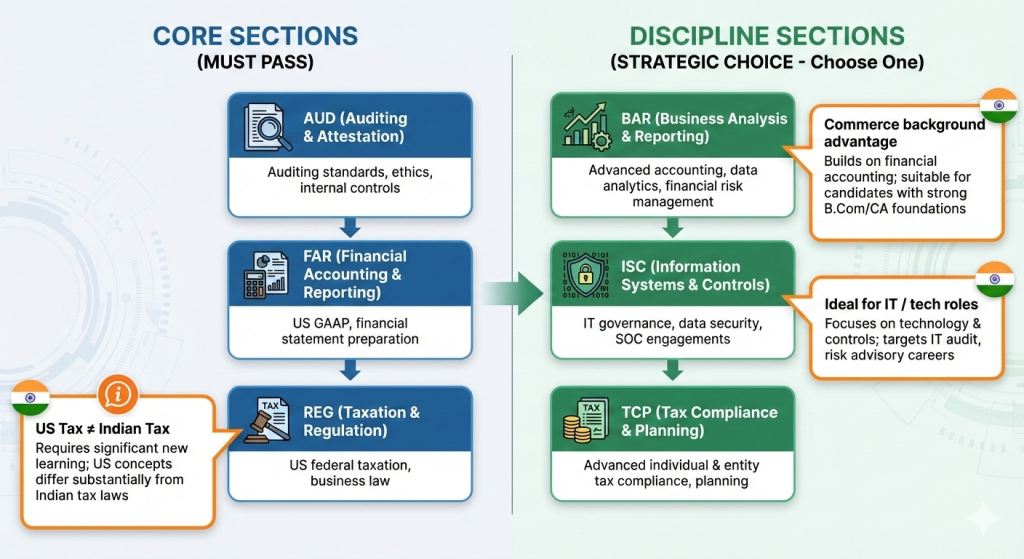

Core Sections: FAR, AUD, and REG Fundamentals

Every CPA candidate must pass three mandatory Core sections regardless of their intended career path. Financial Accounting and Reporting (FAR) covers the conceptual framework of US GAAP, financial statement preparation and presentation, and specialized accounting for governmental and nonprofit entities. This section typically requires 100 to 120 hours of study time due to its extensive content volume.

Auditing and Attestation (AUD) examines the complete audit engagement lifecycle from client acceptance through opinion issuance. The section tests conceptual understanding and professional judgment rather than calculations, covering audit risk assessment, evidence gathering, internal controls evaluation, and various engagement types, including audits, reviews, and attestation services. Taxation and Regulation (REG) covers federal taxation for individuals and entities, business law fundamentals, and ethics requirements. For Indian candidates, REG presents a unique challenge since US tax law bears little resemblance to Indian taxation principles.

Discipline Sections: Choosing Between BAR, ISC, and TCP

The fourth section allows you to specialize based on career goals and existing strengths. Business Analysis and Reporting (BAR) extends FAR content into advanced technical accounting, including derivatives, consolidations, and governmental accounting depth. This section also incorporates managerial accounting concepts like cost accounting and performance measurement that may be familiar from your Indian commerce education.

Information Systems and Controls (ISC) focuses on IT audit, cybersecurity, and System and Organization Controls (SOC) engagements. This section suits candidates with technology backgrounds or those targeting IT audit careers. Tax Compliance and Planning (TCP) builds directly on REG content, covering advanced individual and entity taxation, property transactions, and personal financial planning. Given its 78% pass rate and strong alignment with REG content, TCP represents the most popular choice among candidates prioritizing exam completion efficiency.

Strategy Planning for CPA: The 30-Month Clock

The 30-month rolling credit window means you have exactly two and a half years from passing your first section to complete all remaining sections. Once you pass FAR, AUD, or REG, the clock starts ticking. Any section not completed within this window expires, forcing you to retake it while continuing to chase the remaining sections.

This timeline creates strategic pressure that Indian candidates must plan around carefully. If you’re working full-time with limited weekly study hours, an aggressive section sequence that starts the clock prematurely could put you in a race you can’t win. The wisest approach involves ensuring you’re genuinely ready before attempting your first section, then maintaining consistent momentum to complete all four sections within 18 to 24 months of starting.

Which CPA Exam Section Should Indian Candidates Take First?

Your choice of the first section significantly impacts your overall success probability. The right starting point builds confidence, establishes momentum, and allows you to leverage knowledge across related sections. The wrong choice can create early discouragement and waste precious months of your 30-month window.

Leveraging Your Indian Accounting Background

Indian accounting education provides certain advantages that translate directly to CPA exam preparation, but these advantages apply differently across sections. Understanding where your background helps and where you’ll need to build knowledge from scratch is essential for strategic planning.

How Indian GAAP Knowledge Translates to FAR Preparation

Your training in Indian accounting standards provides a conceptual foundation that partially transfers to US GAAP learning. Core principles like accrual accounting, matching concepts, and financial statement presentation follow similar logic across both frameworks. However, you’ll encounter significant differences in specific areas.

The transition challenge isn’t learning accounting from scratch; it’s unlearning certain Indian GAAP treatments and replacing them with US GAAP approaches. Indian candidates typically find that their background accelerates FAR preparation compared to candidates with no accounting education, but they still need dedicated time to master US-specific standards that have no Indian equivalent, particularly governmental and nonprofit accounting.

Why CA and B.Com Holders Have Different Starting Advantages

Chartered Accountants bring rigorous audit training that provides substantial advantages in the AUD section. Your CA articleship experience with audit procedures, internal controls, and professional skepticism translates directly to AUD concepts. CAs often complete AUD preparation in less time than other Indian candidates because the conceptual framework feels familiar even when specific US standards differ.

B.Com and M.Com holders typically find stronger alignment with FAR content due to their extensive financial accounting coursework. However, B.Com candidates may need additional time for AUD since Indian undergraduate programs provide less audit exposure than CA training. Both qualification types face similar challenges with REG since neither Indian CAs nor commerce graduates have meaningful exposure to US federal taxation.

The Strategic Section Order Framework for CPA Exam

Section order strategy directly impacts your probability of first-attempt success. The optimal sequence varies based on your background, available study time, and career goals. Here are the three most common approaches and when each makes sense.

Option 1: FAR First Approach

Starting with FAR makes strategic sense for candidates with strong financial accounting foundations who want to tackle the most content-heavy section while motivation is highest. This approach front-loads the hardest section, providing psychological momentum when you pass. FAR knowledge also provides a foundational understanding that helps with portions of BAR if you choose that Discipline later.

The FAR-first approach works best for B.Com and M.Com holders whose recent coursework covered financial accounting extensively. It also suits candidates who have more study time available initially but expect increasing work demands later in their CPA journey. The primary risk is that failing the FAR first can create significant discouragement, given the section’s notorious difficulty and low pass rate.

Option 2: AUD First Approach

Chartered Accountants and working professionals with audit experience often benefit from starting with AUD. Your practical audit knowledge provides context that makes theoretical concepts easier to absorb and retain. Success on AUD builds confidence without requiring the massive content memorization that FAR demands.

The AUD-first approach also leaves FAR for later when you’ve developed CPA exam familiarity through a slightly more manageable section. Many successful Indian CAs report that passing AUD first validated their decision to pursue CPA and motivated them through the harder sections that followed. This approach works particularly well for candidates currently working in audit roles who can reinforce study content through daily work.

Option 3: REG First Approach

Starting with REG is generally not recommended for Indian candidates despite its relatively high pass rate. The section covers US federal taxation from scratch with no transferable knowledge from Indian tax training. Beginning your CPA journey by learning an entirely new subject area without any foundational advantage creates unnecessary difficulty.

The exception might be candidates specifically working in US tax for Indian subsidiaries of American multinationals who have developed practical exposure to US tax concepts. For everyone else, REG makes more sense as a second or third section when you’ve already built CPA exam confidence and study rhythm through sections that leverage your existing knowledge.

Planning Your CPA Discipline Section Strategically

Your Discipline choice should balance career alignment with exam completion efficiency. TCP offers the highest pass rate at 78% and builds directly on REG knowledge, making it the most efficient path to CPA completion for candidates without strong preferences. The content overlap means studying REG essentially prepares you for substantial portions of TCP.

ISC suits candidates targeting IT audit, cybersecurity consulting, or systems advisory roles. The 68% pass rate reflects reasonable difficulty for candidates with some technology background. BAR demands the most preparation time and shows the lowest pass rate at 42%, but provides deep expertise in advanced financial reporting that benefits controllers, CFOs, and financial reporting specialists. Your Discipline choice should reflect where you want to build your career, not just which section seems easiest.

How Many Hours Do You Really Need to Pass Each Section?

Generic study hour recommendations from American review courses assume backgrounds and circumstances that don’t match Indian professionals. Your actual study time requirements depend on your qualification background, work schedule, and learning efficiency. This section provides realistic estimates calibrated specifically for Indian candidates.

Realistic Study Hour Estimates for Indian Professionals

Industry standards suggest 300 to 500 total hours across all four sections, but this range is too broad to be useful for planning purposes. Indian professionals need section-specific estimates that account for their unique starting points. For a detailed breakdown of study hours by section and candidate profile, refer to SkillArbitrage’s comprehensive CPA Exam Section-Wise Study Plan.

FAR Study Hours: The Most Content-Heavy Section

FAR typically requires 120 to 150 hours for Indian candidates, making it the most time-intensive section by a significant margin. The section covers an enormous range of topics, including the US GAAP conceptual framework, all major asset and liability categories, equity transactions, revenue recognition, leases, income taxes, pensions, and specialized accounting for governmental and nonprofit entities.

Indian candidates with recent financial accounting coursework or active roles in financial reporting may manage closer to 100 hours. Those with weaker accounting foundations or significant time since their last formal accounting education should budget the full 120 hours to ensure comprehensive coverage of the vast FAR blueprint.

AUD Study Hours: Conceptual Understanding vs Memorization

AUD requires approximately 110 to 140 hours for most Indian candidates. Unlike FAR, AUD tests conceptual understanding and professional judgment rather than extensive memorization. The challenge lies in understanding the “why” behind audit procedures and developing the ability to evaluate audit scenarios rather than simply knowing what standards require.

Chartered Accountants with substantial audit experience often complete AUD preparation in closer to 80 hours since their practical background provides context for theoretical concepts. Candidates without audit experience should budget the full 100 hours to develop the judgment framework that AUD questions demand.

REG Study Hours: Learning US Tax Law from Scratch

REG requires 80 to 110 hours for Indian candidates, with most needing the higher end of this range. US federal taxation represents entirely new content regardless of your Indian tax knowledge. The Internal Revenue Code operates on fundamentally different principles than Indian taxation, covering individual taxation, corporate taxation, partnership taxation, S corporations, estates and trusts, and business law.

Budget at least 100 hours if you have no prior exposure to US tax concepts. Candidates working for US multinationals with some practical US tax exposure might manage with 80 to 90 hours. Don’t underestimate REG; many Indian candidates report being surprised by how much new learning the section requires despite their overall accounting expertise.

Discipline Section Study Hours: Targeted Preparation

Discipline sections typically require 60 to 80 hours depending on your choice and background. TCP candidates who performed strongly on REG often complete TCP in 60 to 90 hours since the content builds directly on taxation fundamentals they’ve already mastered. Taking TCP shortly after passing REG maximizes this efficiency.

ISC requires 60 to 90 hours for candidates without IT backgrounds, with technology professionals potentially managing in less time. BAR demands the full 120 – 150 hours and often more due to its combination of advanced financial reporting topics and managerial accounting concepts that may be less familiar to candidates focused primarily on financial accounting.

Creating a Study Timeline That Works Around Your Job

Your weekly available study hours determine your realistic timeline more than any other factor. Indian professionals working demanding jobs need to build plans around their actual availability rather than aspirational schedules they can’t sustain.

The 12-Month Aggressive Timeline

The 12-month timeline requires 20 to 25 hours of weekly study, translating to roughly three hours daily plus intensive weekend sessions. This pace suits candidates with employer support, flexible work arrangements, or temporary reductions in professional responsibilities. At this intensity, you’ll complete each section in approximately 10 to 12 weeks, including final review time.

The 18-Month Balanced Timeline

The 18-month timeline requires 15 to 18 hours weekly, representing the sweet spot for most Indian working professionals. You’ll study approximately two hours on weekdays plus six to eight hours across weekends. This sustainable pace allows for occasional missed sessions without derailing your schedule and provides buffer time for work emergencies or family obligations.

The 24-Month Conservative Timeline

The 24-month timeline requires 10 to 12 hours weekly and suits candidates with particularly demanding careers, family obligations, or preferences for thorough preparation. While longer, this approach remains comfortably within the 30-month window. The primary challenge is maintaining motivation and momentum across a two-year journey; build in milestone celebrations and accountability structures to stay on track.

Weekly Study Schedules for Working Professionals

Translating total study hours into practical weekly schedules requires honesty about your actual availability and recognition of your energy patterns throughout the week.

The 15-Hour Week Plan (Minimum Viable Preparation)

At 15 hours weekly, distribute your time as two hours on weekday evenings and five hours across the weekend. This minimum viable approach works for the 24-month timeline and represents the floor below which preparation efficiency drops significantly. Consistency matters most at this pace; missing even one week creates gaps that compound quickly.

The 20-Hour Week Plan (Optimal Balance)

The 20-hour week represents an optimal balance for most Indian professionals, supporting an 18-month timeline. Study two hours on four weekdays, take one weekday off for recovery, and dedicate six hours each weekend day. This structure provides enough intensity for real progress while allowing sustainable work-life integration.

The 25-Hour Week Plan (Accelerated Path)

At 25 hours weekly, you’re studying three hours on weekdays and five hours each weekend day. This accelerated pace supports a 12-month timeline but requires significant sacrifices in social activities and leisure time. Consider this approach only if you have strong family support, employer understanding, and a genuine ability to maintain intensity without burning out.

Choosing the Right CPA Review Course for Your Learning Style

Your review course choice significantly impacts both study efficiency and exam success probability. The right course can reduce total study hours through effective teaching, while the wrong choice wastes time and money without improving your pass likelihood.

Review Course Options and India-Specific Pricing

Review course pricing for Indian candidates ranges from approximately ₹80,000 to ₹3,50,000, depending on the provider and package selected. This substantial investment deserves careful evaluation of features, teaching style, and support offerings.

Course Offered by SkillArbitrage

SkillArbitrage offers a comprehensive CPA Prep and Global Finance Career Acceleration Program priced at ₹1,20,000. This six-month program provides 2 online live classes per week covering all four CPA exam sections, including FAR, REG, AUD, and the Discipline paper of your choice. The curriculum specifically addresses the needs of Indian candidates, including state board selection guidance for Indian degrees, NTS process walkthroughs, and study planning for working professionals.

The program includes practical assignments, instructor feedback, doubt-clearing sessions within 24 hours, and digital access to complete study materials. A key differentiator is the integration of career acceleration components, including freelancing and networking mentoring, LinkedIn profile optimization, and mock client interviews. The course is recognized by the National Skill Development Corporation under the Ministry of Skill Development and Entrepreneurship.

Becker CPA Review: Features, Pricing, and India Availability

Becker CPA Review represents the premium option with pricing ranging from ₹2,50,000 to ₹3,50,000 for comprehensive packages. Becker reports that their Exam Day Ready students achieve pass rates approximately 64% higher than the national average. The platform offers structured learning paths, extensive practice questions, and simulated exams that closely mirror actual CPA exam conditions.

Becker’s strengths include brand recognition, comprehensive content coverage, and strong pass rate data. However, the high price point makes it less accessible for many Indian candidates, and the content is designed primarily for American candidates without India-specific considerations. Consider Becker if budget isn’t a primary constraint and you prefer premium, structured learning experiences.

UWorld Roger CPA Review: Strengths and Considerations

UWorld Roger CPA Review offers engaging video lectures known for clear explanations and memorable teaching approaches. Pricing ranges from approximately ₹1,50,000 to ₹2,50,000 depending on package selection.

The platform excels at making complex concepts understandable through quality instruction. UWorld’s question explanations are particularly detailed, helping candidates understand not just correct answers but why incorrect options fail. Consider UWorld if you learn best from video instruction and detailed answer explanations.

Gleim CPA Review: The Question Bank Powerhouse

Gleim CPA Review is renowned for having the largest question bank in the industry with over 10,000 practice questions. Pricing ranges from approximately ₹1,25,000 to ₹2,00,000. The extensive question database provides comprehensive coverage of potential exam topics and multiple practice opportunities for every concept.

Gleim’s strength lies in the breadth of practice material rather than engaging instruction. The platform suits self-motivated learners who prefer learning through extensive practice rather than passive video consumption. If you plan to drill questions relentlessly as your primary study method, Gleim’s question bank depth provides exceptional value.

Surgent CPA Review: Adaptive Learning Technology

Surgent CPA Review differentiates through adaptive learning technology that customizes study paths based on your demonstrated strengths and weaknesses. Pricing ranges from approximately ₹1,00,000 to ₹1,75,000. The platform’s A.S.A.P. technology identifies your knowledge gaps and focuses study time on areas needing the most improvement.

Surgent works particularly well for candidates with inconsistent backgrounds who have strong knowledge in some areas but significant gaps in others. The adaptive approach can reduce total study hours by avoiding unnecessary review of mastered topics. Consider Surgent if you want technology-driven study optimization and prefer efficient targeting over a comprehensive review.

Self-Study vs Coaching Institute: Making the Right Choice

Indian coaching institutes like Simandhar Education, Miles Education, and Zell Education offer structured classroom or virtual instruction with India-specific support. These institutes provide scheduled classes, peer interaction, doubt-clearing sessions, and guidance through the complex application and scheduling process.

Self-study with a review course suits disciplined candidates who prefer flexibility and have strong independent study skills. Coaching institutes suit candidates who benefit from external structure, instructor access for doubt clearing, and peer motivation. Many successful Indian CPAs combine approaches, using coaching institute classes for foundational learning and self-study review courses for practice and reinforcement.

Study Techniques That Actually Work for CPA Exam Success

Study technique selection impacts your preparation efficiency as much as total hours invested. The wrong approach wastes time on low-value activities while effective techniques accelerate learning and improve retention.

The Active Learning Approach vs Passive Study

Passive studying, like watching video lectures without engagement, consumes hours without building exam-ready knowledge. Active learning techniques force you to apply concepts, identify gaps, and reinforce retention through practice.

The Multiple Choice Question Strategy

Start each new topic by attempting practice questions before watching lectures or reading explanations. This test-enhanced learning approach identifies your specific knowledge gaps immediately, allowing you to focus subsequent study time on filling those gaps rather than reviewing material you already understand. When reviewing incorrect answers, spend more time understanding why wrong answers fail than why correct answers succeed.

Track your accuracy rates by topic area using your review course analytics or a simple spreadsheet. Target 75% to 80% accuracy before considering yourself exam-ready for any topic. Below this threshold, you’re leaving points on the table that proper preparation would capture. Above 85%, you’re likely ready to move forward rather than over-preparing areas you’ve already mastered.

Task-Based Simulation Practice Methods

Simulations comprise 50% of your exam score on most sections, yet many candidates under-invest in simulation practice. Start practicing simulations early in your preparation, not just during final review. Build familiarity with the simulation interface, research tool, and various simulation types, including document review simulations and written communication tasks.

Time yourself during simulation practice and develop consistent approaches for each simulation type. Many candidates struggle with simulations not because they lack knowledge, but because they mismanage time or fail to extract relevant information from provided exhibits efficiently. Practice the mechanical aspects of simulation completion alongside the conceptual knowledge that the simulations test.

The Final Review Study Funnel (14-Day Framework)

The two weeks before your exam determine whether months of preparation translate into a passing score. Top-performing candidates follow structured final review frameworks rather than randomly cramming.

Phase 1: Comprehensive Review (Days 14-4)

During days 14 through 4 before your exam, focus on a systematic review of all major topic areas. Take at least two full-length practice exams under test conditions to identify remaining weak areas. Review your performance analytics to identify topics where accuracy remains below 75% and allocate additional practice time to these specific gaps.

This phase should feel intense but not desperate. You’re reinforcing and polishing knowledge you’ve already built, not learning new material for the first time. If you discover major topic areas where you lack foundational understanding during this phase, consider whether you’re genuinely ready to sit for the exam or whether postponing would improve your pass probability.

Phase 2: Simulated Exam Practice (Days 3-2)

Days 3 and 2 before your exam focus exclusively on full exam simulations under strict test conditions. Take complete practice exams matching actual exam timing, breaks, and environment. Turn off your phone, use only an approved calculator, and simulate the Prometric testing experience as closely as possible.

Review your simulation performance immediately after completion, but don’t get lost in detailed content review at this stage. Focus on identifying any remaining time management issues or simulation types that create difficulty. Your goal is to arrive at the actual exam with complete confidence in your ability to execute the mechanics of test-taking effectively.

Phase 3: Rest and Light Review (Day 1)

The day before your exam should prioritize rest and mental preparation over cramming. Light flashcard review or a brief skim of summary notes is acceptable, but avoid intensive study that creates stress or exhausts you before the exam. Review logistics like your Prometric center location, required documents, and arrival time requirements.

Get adequate sleep, even if nerves make this difficult. Research consistently shows that sleep-deprived test performance declines significantly regardless of preparation level. Trust that you’ve prepared adequately and focus on arriving at the exam physically rested and mentally calm.

Common Mistakes during CPA Exam Preparation

Understanding common mistakes helps you avoid them proactively rather than learning expensive lessons through failed attempts. These patterns emerge consistently from candidate experiences and represent predictable failure points.

Study Strategy Mistakes

The most damaging study strategy mistake is treating the CPA exam like college exams, where memorization and last-minute cramming can succeed. The CPA exam tests application and judgment, not recall. Candidates who memorize formulas without understanding when to apply them consistently underperform. Build conceptual understanding through practice problems rather than passive review.

Another critical mistake is linear studying without review loops. Studying chapters 1 through 10 sequentially without returning to earlier material guarantees you’ll forget chapter 1 content by the time you reach chapter 10. Implement spaced repetition by reviewing previous topics every few days while progressing through new material. This technique significantly improves long-term retention and exam-day recall.

Planning and Timeline Mistakes

Timeline mistakes often prove more costly than study technique errors because they can invalidate months of preparation effort.

Starting the 30-Month Clock Before You Are Ready

Your 30-month window begins when you pass your first section. Attempting sections before you’re genuinely prepared risks starting this clock with failed attempts that don’t count toward completion. Ensure you’re scoring consistently above 75% on practice exams before scheduling your first real exam, rather than hoping for luck to bridge preparation gaps.

Scheduling Exams Too Close Together

Scheduling sections too close together leaves insufficient recovery and study time between exams. Allow at least 2 to 3 weeks between section attempts, even if you feel confident. This buffer accommodates score release timing, mental recovery, and targeted preparation for the next section’s distinct content. Back-to-back scheduling often results in burnout and declining performance on later sections.

Ignoring the Discipline Section Testing Windows

Unlike Core sections that offer continuous testing, Discipline sections are only available during the first month of each quarter, plus an additional June window in 2025. Many candidates fail to plan around these windows and find themselves unable to schedule their Discipline section when they’re ready to take it. Map your timeline backward from your intended Discipline test window to ensure proper sequencing.

Exam Day Mistakes

Exam day mistakes can undermine months of preparation in four hours. The most common error is poor time management on simulations, spending too long on difficult simulations while leaving easier ones incomplete. Establish time limits per simulation and move on when you exceed them, returning to incomplete work only if time remains.

Another critical mistake is second-guessing multiple choice answers. Statistical analysis consistently shows that initial instincts are more often correct than changed answers. Unless you identify a specific reason why your first answer was wrong, resist the urge to change responses. Similarly, don’t let one difficult testlet derail your confidence for subsequent sections. The exam’s adaptive design means encountering hard questions often indicates you’re performing well, not poorly.

Conclusion

First-attempt CPA exam success is achievable for Indian professionals who approach the certification strategically rather than simply studying hard without direction. The framework outlined in this guide provides your roadmap: choose your section order based on your specific background with FAR first for financial reporting strength or AUD first for audit experience, allocate realistic study hours of 300 to 500 total with proper section weighting, select a review course that matches your learning style and budget, implement active learning techniques emphasizing practice over passive review, and execute a structured final review framework in the 14 days before each exam.

Your Indian accounting background provides genuine advantages in financial reporting foundations and analytical discipline. The challenges you face in learning US GAAP differences, mastering unfamiliar US tax law, and studying around demanding work schedules are significant but surmountable with proper planning. The approximately 20% of candidates who pass all four sections on the first attempt aren’t inherently smarter or luckier; they’re simply better prepared with more strategic approaches.

Your next step is immediate: evaluate your background honestly, select your first section based on the frameworks discussed, choose a review course that fits your learning style, and set a realistic target date for your first exam. The 30-month clock doesn’t start until you pass a section, giving you time to prepare properly before beginning. Every day you delay starting is a day further from the career opportunities that CPA certification unlocks. Begin your journey today.

Frequently Asked Questions

Can I pass the CPA exam on my first attempt while working full-time in India?

Yes, thousands of Indian professionals pass the CPA exam while working full-time. Success requires realistic timeline planning, typically 18 to 24 months, and consistent commitment of 15 to 20 study hours weekly. Many successful candidates study during early mornings, late evenings, and weekends while maintaining their regular work responsibilities.

Which CPA exam section should I take first as an Indian CA?

Indian CAs typically benefit from starting with AUD, given their extensive audit training during articleship. Your practical audit experience provides context for AUD’s conceptual content and creates early confidence. However, candidates with particularly strong financial accounting foundations might consider FAR first to tackle the most content-heavy section while motivation is highest.

How many months does it take to pass all four CPA exam sections?

Most Indian working professionals complete all four sections in 18 to 24 months with consistent effort. Aggressive candidates with significant available study time might complete in 12 months, while those with limited weekly hours might need 24 months. All these timelines fit comfortably within the 30-month credit window.

Is 15 hours per week enough study time to pass the CPA exam?

Fifteen hours weekly is sufficient but requires a longer 24-month timeline. At this pace, consistency becomes critical because missed weeks compound quickly. If your schedule only permits 15 hours weekly, commit to this pace deliberately and build accountability systems to maintain consistency across the extended preparation period.

Should I take FAR or AUD first if I have an Indian B.Com background?

B.Com holders typically have stronger alignment with FAR content due to extensive financial accounting coursework. Starting with FAR leverages this foundation and tackles the most content-heavy section while your academic knowledge remains fresh. However, if significant time has passed since your B.Com completion, AUD’s smaller content scope might build confidence more effectively.

What happens if I fail a CPA exam section?

Failing a section is disappointing but manageable with proper planning. You can retake any section after receiving your score, typically within 2 to 4 weeks of testing, depending on score release timing. Most candidates who eventually pass experience at least one failed attempt; the key is analyzing why you failed and addressing those gaps before retaking.

Can I pass the CPA exam without a coaching institute?

Yes, self-study with a quality review course is sufficient for disciplined candidates with strong independent study skills. Coaching institutes add value through structured schedules, instructor access, and peer motivation, but aren’t mandatory for success. Evaluate your personal learning preferences honestly; some candidates thrive with external structure while others prefer self-directed flexibility.

What is the best time of year to start CPA exam preparation in India?

January and July represent optimal starting points, aligning with quarterly Discipline windows while avoiding the Q4 busy season when work demands typically peak. Starting in January positions you for a potential Discipline attempt by October. However, the best time to start is whenever you can commit consistent effort; don’t delay simply waiting for an “ideal” starting date.

What score do I need to pass the CPA exam?

You need a scaled score of 75 on each section to pass. Scores range from 0 to 99 on a scaled basis that accounts for question difficulty. A score of 75 represents minimum competency, and a 75 is equally passing as a 95. Only you see your actual score; employers and licensing boards see only a pass or fail status.

Should I take multiple CPA exam sections in the same month?

Taking multiple sections in the same month is generally not recommended unless you have exceptional available study time. Each section requires focused preparation, and splitting attention typically reduces performance on both sections. The exception might be taking REG and TCP close together, given their content overlap, but even then, separate testing months provide better focus.

Allow notifications

Allow notifications