Enrolled Agent exam pass rates 2024-2025: Part 1 at 58%, Part 2 at 71%, Part 3 at 70%. Learn difficulty factors, common mistakes, and preparation strategies for Indian candidates.

Table of Contents

The Enrolled Agent exam carries a reputation for being more accessible than the CPA exam, but recent pass rate data reveal a more complex picture. With Part 1 pass rates hovering at just 58% and significant variation across all three sections, Indian professionals pursuing this credential need a clear understanding of what lies ahead. The notion that this exam is straightforward has led many candidates to underestimate their preparation needs, resulting in failed attempts and wasted examination fees.

The Special Enrollment Examination consists of three distinct parts, each testing different aspects of US federal taxation. Pass rates differ dramatically between these sections, ranging from 58% to 71% depending on the part. Understanding why these variations exist and what causes candidates to struggle can mean the difference between passing on your first attempt and spending months preparing for costly retakes.

This guide provides current pass rate statistics from Prometric, detailed difficulty analysis for each exam part, frequently tested topics that appear repeatedly, common mistakes both in preparation and on exam day, and strategic approaches tailored for Indian professionals. Whether you are a commerce graduate exploring international credentials or a working professional seeking US tax expertise, this comprehensive resource will help you approach the EA exam with realistic expectations and effective preparation strategies.

What Are the Current Enrolled Agent Exam Pass Rates?

Enrolled Agent Exam: Official 2024-2025 Pass Rate Statistics from Prometric

Part 1, covering Individuals, currently has a 58% pass rate, making it the most challenging section statistically. Part 2, focusing on Businesses, shows a 71% pass rate, while Part 3, addressing Representation, Practices and Procedures, maintains a 70% pass rate.

The overall average across all parts stands at approximately 66%, which remains considerably higher than professional certifications like the CPA exam at 45-50% or the CMA exam at 35-50%.

Why Do Pass Rates Differ So Much Between Parts?

Candidate populations vary substantially between exam parts because not everyone who takes Part 1 continues to Parts 2 and 3. Nearly double the number of candidates attempt Part 1 compared to the other sections, which naturally includes more first-time test takers who may be underprepared.

Part sequencing creates a filtering effect where candidates who pass Part 1 have already demonstrated their ability to succeed on the EA exam format. By the time they reach Parts 2 and 3, these candidates typically have refined study strategies and better understand what the examination requires.

Prometric explicitly warns against drawing direct comparisons between pass rates for different parts. The testing organization notes that variations in candidate backgrounds, preparation levels, and testing order make meaningful comparison difficult without additional context.

Content complexity differs meaningfully across sections. Part 1 covers the broadest range of individual tax situations that candidates encounter daily, creating a false sense of familiarity. Part 2 requires mastery of multiple business entity types, while Part 3 focuses on procedural knowledge that many find easier to memorize systematically.

What the Pass Rates Really Mean for Your Preparation

Higher overall pass rates compared to the CPA exam do not indicate that the EA exam is easy. The exam tests US federal tax law in considerable depth, and candidates must demonstrate genuine competence rather than surface-level familiarity with concepts.

First-time pass rates typically fall between 65-70% for well-prepared candidates, while repeat test takers often see success rates drop to 45-55%. This gap suggests that inadequate initial preparation is difficult to overcome simply by retaking the examination without substantial additional study.

A strong correlation exists between preparation quality and examination success. Candidates using comprehensive review courses with AI-adaptive learning technology report pass rates exceeding 90%, demonstrating that proper preparation dramatically improves outcomes regardless of the overall statistics.

How Difficult Is Each Part of the Enrolled Agent Exam?

EA Exam Part 1 (Individuals): Why It Has the Lowest Pass Rate

The 58% pass rate for Part 1 makes it statistically the most difficult section despite covering individual taxation that many candidates believe they understand intuitively. This paradox stems from the gap between everyday familiarity with personal taxes and the detailed technical knowledge the examination requires.

Many candidates underestimate Part 1 because they file their own tax returns or have prepared individual returns professionally. However, the exam tests complex scenarios involving multiple income sources, unusual deductions, and specialized situations that rarely appear in routine tax preparation work.

Why Indian Candidates Struggle with Part 1

Indian professionals typically lack exposure to US individual tax concepts that American candidates absorb through years of personal tax filing experience. Concepts like filing status determination, dependency exemptions, and the standard deduction versus itemized deduction decision require building knowledge from the ground up.

The US retirement system structure differs fundamentally from the Indian provident fund and pension frameworks. Estate and gift tax frameworks in the US operate under unified credit systems and generation-skipping provisions that have no direct equivalent in Indian tax law.

Indian candidates must invest additional time in understanding concepts like the annual gift exclusion, applicable exclusion amount, and portability between spouses.

EA Exam Part 2 (Businesses): The Most Complex Content

The 71% pass rate for Part 2 appears encouraging but masks an important selection effect. Candidates reaching Part 2 have typically already passed at least one other section, demonstrating both their commitment and their ability to succeed on the EA exam format.

Survivor bias significantly influences Part 2 statistics because many candidates who struggled with Part 1 never attempt Part 2. The remaining candidate pool is more experienced with the exam format, better prepared through refined study strategies, and more likely to complete the full EA credential.

Part 2 covers sole proprietorships, partnerships, C corporations, S corporations, limited liability companies, estates, trusts, tax-exempt organizations, and specialized business situations. This breadth requires candidates to master fundamentally different taxation frameworks for each entity type.

Why Part 2 Requires the Most Study Time

Business taxation involves inherently more complex rules than individual taxation because businesses operate as separate legal and tax entities with their own income recognition, deduction timing, and reporting requirements. Each entity type follows different provisions that candidates must keep distinct.

Multiple entity types demand mastery of formation rules, operational taxation, distributions, and liquidation for partnerships, C corporations, S corporations, and LLCs taxed under various elections. The cognitive load of maintaining these parallel frameworks exceeds what Part 1 requires.

Computational intensity in Part 2 exceeds other sections because business tax questions frequently require multi-step calculations involving depreciation schedules, basis adjustments, and income allocations. Practice with calculations proves essential for building speed and accuracy.

EA Exam Part 3 (Representation, Practices & Procedures): The “Easiest” Part?

The 70% pass rate for Part 3 reflects its reputation as the most straightforward section, though this characterization oversimplifies the preparation required. The content differs fundamentally from Parts 1 and 2 because it focuses on procedural knowledge rather than tax computation.

Part 3 earns its easier reputation because it tests memorizable rules, deadlines, and procedures rather than requiring complex calculations. Candidates with strong memory skills often find this section more manageable than the computation-heavy earlier parts.

The trap of underpreparation catches candidates who dismiss Part 3 as merely procedural. Circular 230 contains detailed ethical requirements, and IRS procedures involve specific deadlines and processes that require systematic study rather than assumptions based on general knowledge.

How Part 3 Builds on Parts 1 and 2

Content overlap benefits candidates who take Part 3 last because representation scenarios often involve individual or business tax issues. Understanding the underlying tax law from Parts 1 and 2 provides context for the procedural questions in Part 3.

Strategic sequencing suggests taking Part 3 after the other sections because the representation concepts make more sense when candidates understand what types of tax issues they would be representing clients on. Additionally, the study discipline developed in earlier parts carries forward to Part 3 preparation.

What Are the Most Frequently Tested Topics on the EA Exam?

Enrolled Agent Exam: Part 1 High-Yield Topics (Individuals)

Income and Assets questions comprise about 25% of Part 1 and test recognition of various income types, including wages, self-employment income, interest, dividends, rental income, and capital gains. Candidates must understand the differences between ordinary income and capital gain treatment, as well as exclusions and exemptions that apply to specific income categories.

Deductions and Credits also represent about 25% of Part 1 questions, covering both above-the-line adjustments and itemized deductions. The distinction between deductions for adjusted gross income and deductions from adjusted gross income appears repeatedly, as do questions about credit eligibility and calculation, including the Child Tax Credit, Earned Income Credit, and education credits.

Taxation questions of Part 1 test candidates on tax computation, including regular tax, self-employment tax, and alternative minimum tax. Understanding tax brackets, filing status impacts on tax liability, and the interaction between various tax calculations proves essential for this section.

Enrolled Agent Exam: Part 2 High-Yield Topics (Businesses)

Business Financial Informational dominates Part 2 at 40% of questions, covering income recognition, deduction timing, accounting methods, and specific deduction limitations. Candidates must understand cash versus accrual accounting implications, the economic performance requirement, and limitations on deductions like the 50% meal limitation.

Business Entities and Considerations represent 28% of Part 2, testing entity selection, formation, and operational differences. Questions frequently compare tax treatment across entity types or ask candidates to identify the most advantageous structure for specific scenarios.

Specialized Returns and Taxpayers comprise covering estates, trusts, tax-exempt organizations, and specialized business situations. While these areas receive less emphasis than general business taxation, candidates cannot ignore them entirely without risking failure.

Business Topics You Cannot Skip

Entity classification elections under the check-the-box regulations determine how businesses are taxed and frequently appear in Part 2 questions. Understanding default classifications and election options for partnerships, corporations, and disregarded entities proves essential.

Partner and shareholder basis tracking questions test candidates on complex calculations involving contributions, distributions, allocated income, and debt. These calculations form the foundation for determining gain on distributions and loss limitation rules.

Depreciation methods, including MACRS recovery periods, Section 179 expensing, and bonus depreciation, generate substantial question volume. Candidates must understand the interaction between these provisions and the limitations that apply based on business type and asset usage.

Enrolled Agent Exam: Part 3 High-Yield Topics (Representation)

Practices and Procedures comprise 33% of Part 3 questions, testing knowledge of IRS organizational structure, examination procedures, and practitioner responsibilities. Understanding the audit selection process, examination methods, and taxpayer rights during examination proves essential.

Representation before the IRS is also at 33% covers power of attorney requirements, practitioner conduct standards, and the scope of representation authority. Questions test both the procedural requirements for establishing representation and the ethical obligations practitioners bear. Filing and Payment Procedures is at 34% and it covers deadlines, penalties, payment methods, and collection procedures.

Circular 230 Rules You Must Memorize

Due diligence requirements obligate practitioners to verify information provided by clients and not ignore the implications of information received. Questions test specific scenarios where practitioners must take action based on knowledge or information suggesting errors.

Conflicts of interest provisions restrict practitioners from representing clients with conflicting interests unless specific conditions are met and all affected parties consent in writing. Questions often present scenarios requiring the identification of conflicts.

Fee structure rules prohibit contingent fees except in specific circumstances, including original return preparation and claims for refund. Understanding when contingent fees are permitted versus prohibited regularly appears on examinations.

Advertising restrictions limit claims practitioners can make about their services and require specific disclosures in certain communications. Questions test knowledge of what representations are permitted and what disclosures are required.

Return preparation standards impose requirements for positions taken on returns and disclosures required for uncertain positions. Understanding the realistic possibility standard and disclosure requirements proves essential for Part 3 success.

What Are the Most Common Mistakes Candidates Make on the EA Exam?

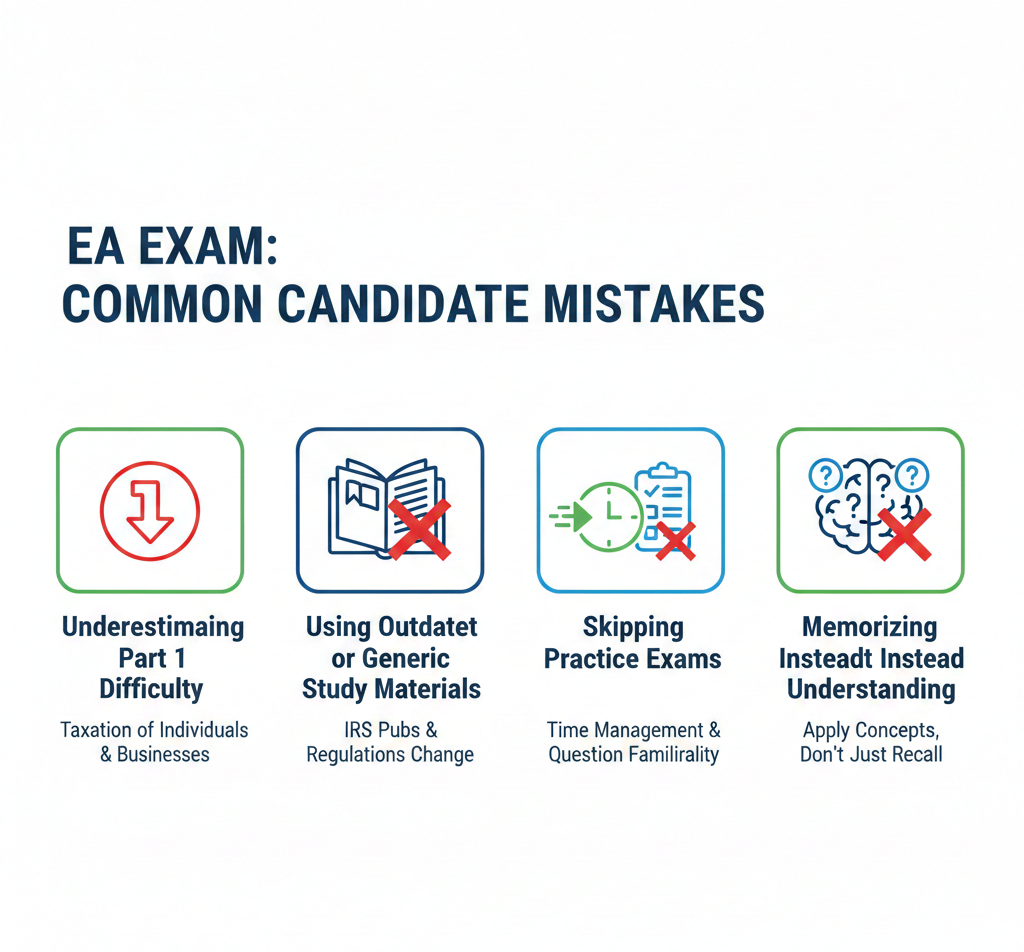

Enrolled Agent Exam: Preparation Mistakes That Lead to Failure

Underestimating Part 1 Difficulty

Many candidates assume their experience with individual taxation from personal filing or professional practice adequately prepares them for Part 1. This assumption leads to insufficient study time and superficial preparation that fails to address the depth of knowledge the exam requires.

Using Outdated or Generic Study Materials

Tax law changes annually, and the EA exam tests on Internal Revenue Code, forms, and publications current through December 31 of the prior year. Using materials from previous testing cycles means studying obsolete rules that no longer appear on the exam while missing new provisions that do.

Skipping Practice Exams

Practice examinations serve multiple purposes beyond knowledge assessment. They build familiarity with question formats, develop time management skills, and identify weak areas requiring additional study. Candidates who skip practice exams often struggle with pacing and question interpretation on exam day.

Trying to Memorize Everything Instead of Understanding Concepts

The tax code contains thousands of rules, exceptions, and exceptions to exceptions that cannot be memorized comprehensively. Candidates who focus on memorization without understanding underlying principles struggle to apply their knowledge to unfamiliar scenarios that the exam presents.

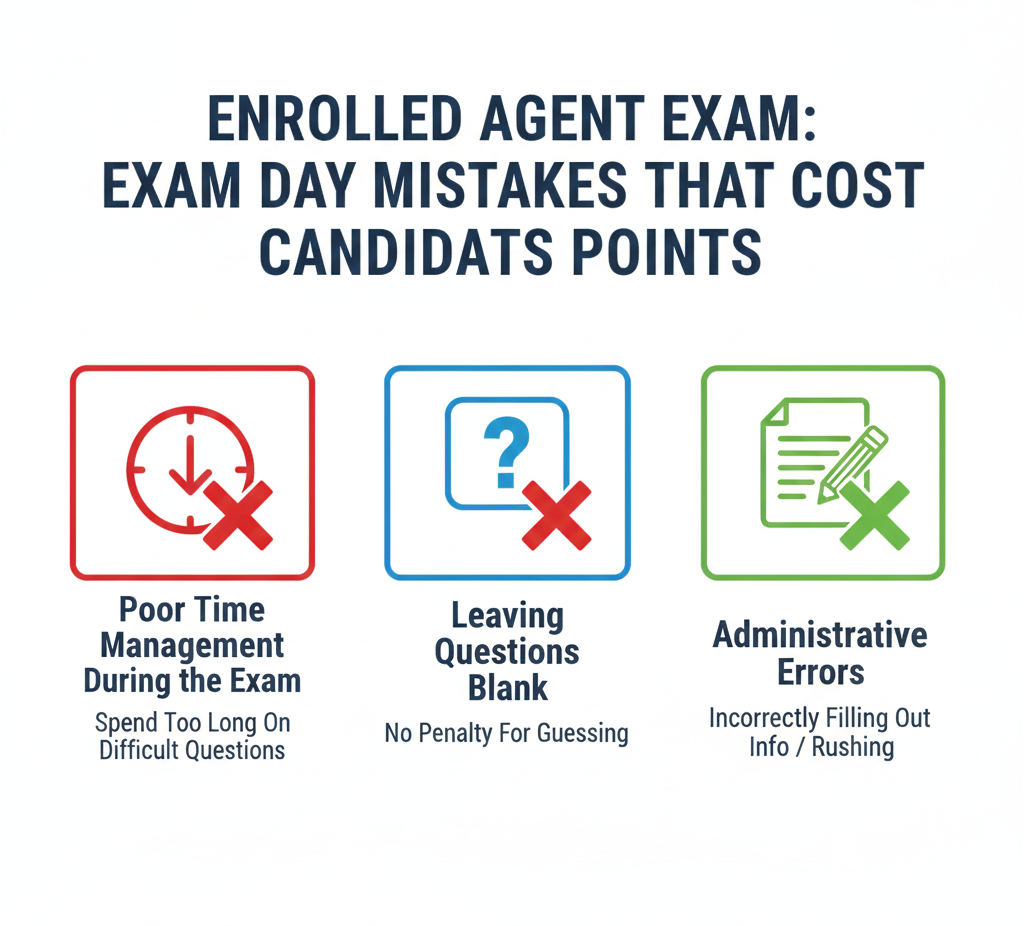

Enrolled Agent Exam: Exam Day Mistakes That Cost Candidates Points

Poor Time Management During the Exam

With 100 questions in 3.5 hours, candidates should spend approximately 1.5 to 2 minutes per question on their first pass. Spending excessive time on difficult questions early in the exam leaves insufficient time for questions that the candidate could answer correctly with adequate attention.

Leaving Questions Blank

The EA exam imposes no penalty for incorrect answers, meaning random guesses have a 25% chance of being correct while blank answers have zero chance. Candidates should answer every question, flagging difficult ones for review if time permits, but never leaving responses blank.

Administrative Errors

Name mismatches between Prometric registration and identification documents prevent candidates from testing, forfeiting examination fees. Late arrival at testing centers can result in denied entry and lost fees. Unfamiliarity with the testing interface wastes valuable time that should be spent answering questions.

Common Mistakes Indian Candidates Specifically Make

Approaching US Tax Like Indian Tax

Indian tax concepts do not translate directly to US taxation, and candidates who assume similarity often misapply their existing knowledge. The US system uses different income recognition rules, deduction timing principles, and entity classification frameworks that require learning fresh rather than adapting existing knowledge.

Underestimating the Role of IRS Publications

IRS Publication 17 and other official publications provide detailed guidance that often appears verbatim in examination questions. Candidates who rely solely on review course materials without consulting primary IRS sources miss language and concepts that the exam specifically tests.

How Should You Prepare for the EA Exam to Maximize Pass Rate?

Recommended Study Hours by Part

Part 1 requires 70-100 hours of dedicated study time to cover the breadth of individual taxation topics adequately. Part 2 demands 80-100 hours due to the complexity of business entity taxation and the computational practice required. Part 3 needs 60-80 hours for thorough coverage of Circular 230 and IRS procedures. The total investment ranges from 210-280 hours, depending on prior knowledge and learning efficiency.

Creating a Realistic Study Schedule for Working Professionals

Dedicating 10-15 hours weekly allows working professionals to complete preparation over 6-9 months while maintaining career and personal obligations. Consistent daily study of 1-2 hours proves more effective than irregular marathon sessions because it improves retention and builds lasting understanding.

Balancing work and study requires treating EA preparation as a priority commitment rather than something to fit around other activities. Setting specific study times, communicating boundaries to family and colleagues, and tracking progress against milestones help maintain momentum throughout the extended preparation period.

Which Part Should You Take First?

Background and experience should guide part sequencing decisions. Tax professionals who primarily prepare individual returns often find Part 1 content more familiar and may benefit from starting there to build confidence. Those with business accounting backgrounds might prefer beginning with Part 2, where their existing knowledge provides advantages.

Starting with Part 3 can help build confidence for candidates who feel intimidated by the computational content in Parts 1 and 2. Success on Part 3 demonstrates the ability to pass EA examinations and may reduce anxiety about subsequent parts.

Strategic Part Sequencing for Indian Candidates

Beginning with Part 1 establishes foundational US tax concepts that inform later study. Individual taxation principles like basis calculation, income recognition, and deduction timing recur in business contexts, making Part 1 knowledge valuable for Part 2 preparation.

Taking Part 2 before allowing Part 1 knowledge to fade maximizes the benefit of conceptual connections between individual and business taxation. Scheduling Parts 1 and 2 within a few months of each other preserves knowledge while it remains fresh.

Completing Part 3 leverages understanding from earlier parts because representation scenarios involve individual and business tax issues. The procedural focus of Part 3 also provides a change of pace after the computational intensity of earlier sections.

Surgent recommends completing Part 1 and then Part 3, and Saving Part 2 for last. This is because Part 2 needs the most time to study and you might already have an idea of topics and content covered in Part 1 & 2.

Essential Resources for EA Exam Preparation

Review Courses Worth Considering

Major review course providers include Gleim, Surgent, Becker, and PassKey, each offering comprehensive study materials with different approaches. Gleim provides extensive question banks and detailed textbooks. Surgent uses adaptive learning technology that adjusts to candidate performance. Becker offers a structured curriculum from a recognized accounting education provider. PassKey provides cost-effective materials popular among self-study candidates.

Costs for review courses range from approximately ₹40,000 to ₹1,00,000, + depending on the provider and package selected. While the investment may seem substantial, candidates using comprehensive review courses report significantly higher pass rates than those relying on free materials alone.

Free IRS Resources You Should Use

The IRS website provides essential free resources, including sample examination questions, the Candidate Information Bulletin, Publication 17 for individual taxation, Publication 535 for business expenses, and Circular 230 for practice standards. These primary sources often contain language that appears directly in examination questions.

Practice Exam Strategy

Completing 5-8 full practice examinations per part under simulated testing conditions builds time management skills and identifies remaining weak areas. Working through 1,000-1,500 practice questions per part provides exposure to the variety of scenarios the exam presents and builds pattern recognition for common question types.

Understanding the EA Exam Scoring System

How Your Score Is Calculated

Each EA exam part contains 100 questions, with 85 contributing to the score and 15 serving as experimental questions that the IRS uses to evaluate potential future examination items. Candidates cannot identify which questions are experimental and should treat all questions as scored.

The raw score converts to a scaled score ranging from 40 to 130, with 105 established as the passing threshold. This scaling process adjusts for variation in difficulty between different examination versions to ensure consistent passing standards regardless of which specific questions a candidate receives.

What Happens If You Pass vs. Fail

Candidates who achieve 105 or higher receive notification that they passed without learning their specific score. This approach prevents distinctions between candidates who barely passed and those who scored well above the threshold.

Candidates who score below 105 receive their actual scaled score along with a diagnostic report indicating performance levels across content domains. This feedback helps focus subsequent study on areas requiring the most improvement before retaking the examination.

Retake Policies and Strategies

Candidates may attempt each exam part up to four times during the testing window running from May 1 through February 28. A waiting period applies between attempts, and each retake requires payment of the full examination fee.

Using the diagnostic report from failed attempts to target weak areas proves essential for retake success. Simply repeating the same preparation that led to failure rarely produces different results. Candidates should analyze their performance, identify specific knowledge gaps, and adjust their study approach accordingly.

Conclusion

The Enrolled Agent exam presents genuine challenges that the overall 66% pass rate obscures. Part 1’s 58% pass rate demonstrates that individual taxation tests knowledge beyond everyday familiarity, while Part 2’s complexity requires mastery of multiple business entity frameworks. Part 3’s procedural focus demands memorization of Circular 230 rules and IRS processes. Indian candidates face additional challenges from unfamiliarity with the US tax systems, but strategic preparation can overcome these obstacles.

Success on the EA exam requires a realistic assessment of the difficulty, adequate study time investment of 210-280 hours, quality review materials, and systematic practice examination completion. Understanding common mistakes, both in preparation and on exam day, allows candidates to avoid pitfalls that derail many attempts. With proper preparation and a strategic approach, Indian professionals can achieve first-time pass success on all three parts and earn this valuable credential for the US tax practice.

Frequently Asked Questions

What is the overall pass rate for the Enrolled Agent exam?

The overall pass rate averages approximately 66% across all three parts, though this figure varies significantly by section. Part 1 has the lowest rate at 58%, while Parts 2 and 3 hover around 70-71%.

Which part of the EA exam has the lowest pass rate?

Part 1 covering Individuals has the lowest pass rate at 58%, despite testing content, many candidates assume they understand from personal tax filing experience. The breadth and depth of individual taxation topics catch underprepared candidates off guard.

Is Part 2 of the EA exam really the hardest?

Part 2 contains the most complex content with multiple business entity types to master, but its 71% pass rate exceeds Part 1’s 58%. The higher rate reflects survivor bias because candidates reaching Part 2 have typically already demonstrated success on EA examinations.

How many hours should I study for the EA exam?

Total preparation time ranges from 210-280 hours, split across the three parts. Part 1 requires 70-100 hours, Part 2 needs 80-100 hours, and Part 3 demands 60-80 hour,s depending on prior knowledge and study efficiency.

Is the EA exam harder than the CPA exam?

The EA exam has higher pass rates at 66% average versus 45-50% for the CPA exam, and covers narrower subject matter focused solely on taxation. However, the EA exam tests tax law in greater depth than the CPA REG section, making direct comparison difficult.

What happens if I fail one part of the EA exam?

Candidates can retake failed parts up to four times per testing window. After failing, you receive a diagnostic report showing performance across content areas to guide additional study before your next attempt.

Can I take the EA exam from India?

Yes, Prometric operates testing centers in major Indian cities, including Bangalore, Hyderabad, and Delhi.. The examination content and format remain identical regardless of testing location.

What is the passing score for the EA exam?

The passing score is 105 on a scaled score ranging from 40 to 130. This threshold remains consistent across all three parts and all testing administrations, regardless of specific question difficulty.

How long do I have to pass all three parts?

Once you pass any part, you have two years to pass the remaining parts. If you fail to complete all three parts within this window, the credit for the part you passed expires and must be retaken.

What are the most common reasons candidates fail the EA exam?

Inadequate preparation time, poor time management during the exam, underestimating difficulty, using outdated study materials, and skipping practice examinations represent the most frequent causes of failure.

Should I take a review course for the EA exam?

Review courses significantly improve pass rates, with candidates using comprehensive courses reporting success rates above 90% compared to the 66% overall average. The structured curriculum, practice questions, and adaptive learning features justify the investment for most candidates.

What is the best order to take the EA exam parts?

The optimal sequence depends on your background. Most candidates start with Part 1 to establish foundational concepts, proceed to Part 2 while knowledge remains fresh, and conclude with Part 3, which builds on both earlier sections.

How does the EA exam difficulty compare to CA in India?

The CA examination covers broader subject matter across financial accounting, auditing, law, and taxation over a longer examination period. The EA exam focuses narrowly on US federal taxation but requires deep mastery of this specific domain. Both credentials demand substantial preparation but serve different career paths.

How long should I wait before retaking a failed EA exam part?

While minimum waiting periods apply between attempts, 2-4 weeks of focused additional study typically proves more effective than immediate retakes. Use the diagnostic report to identify weak areas and address them systematically before scheduling your next attempt.

Allow notifications

Allow notifications