Complete guide to CPA exam pattern for Indian candidates. Learn exam structure, MCQ and TBS counts, scoring, pass rates, time management, and discipline selection strategy.

Table of Contents

The pattern for the CPA exam can feel overwhelming when you first look at it. Four sections, multiple question types, different testing windows, and a discipline choice you need to make before you even begin. If you’re an Indian professional trying to understand exactly what you’re signing up for, you need clarity, not confusion.

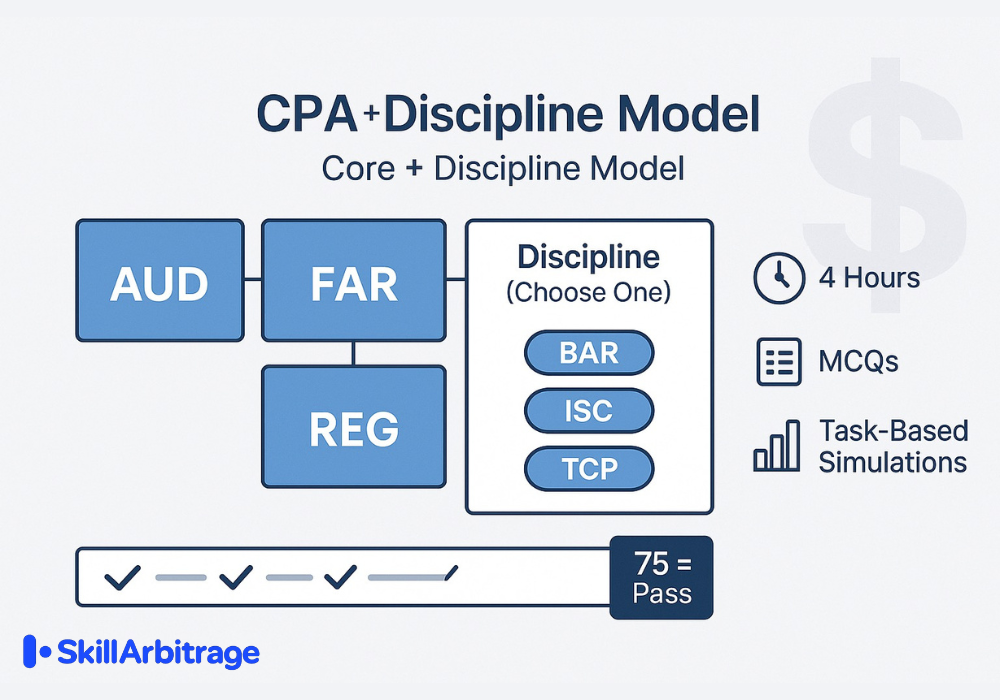

Here’s the good news: the CPA exam structure is actually quite logical once you understand how the pieces fit together. Since January 2024, the exam follows a “Core + Discipline” model where you complete three mandatory core sections and choose one specialized discipline section. This structure gives you flexibility while ensuring you master the foundational knowledge every CPA needs.

This guide breaks down every aspect of the CPA exam pattern specifically for Indian candidates. You’ll understand exactly how many questions you’ll face, how much time you have, how scoring works, and most importantly, how to approach each section strategically. Whether you’re a CA holder, B.Com graduate, or working professional in finance, this comprehensive breakdown will help you plan your CPA journey with confidence.

CPA Exam Pattern: The Core + Discipline Model

The CPA exam underwent a significant transformation in January 2024 with the launch of CPA Evolution, replacing the traditional four-section format that had been in place for decades. Under this new model, you’ll complete three mandatory core sections that test foundational accounting knowledge, plus one discipline section of your choice that allows you to specialize. This structure was designed by AICPA and NASBA to address growing demands for skills in technology, data analytics, and cybersecurity while giving candidates flexibility to align their exam with career goals.

The old BEC (Business Environment and Concepts) section has been eliminated entirely. Its content has been redistributed across the core sections and the new discipline options. For Indian candidates, this change actually works in your favor because you can now choose a specialization that matches your background, whether that’s advanced financial reporting, IT audit, or tax planning.

CPA Exam Pattern: Three Core Sections Every Candidate Must Pass

Every CPA candidate, regardless of their chosen discipline, must pass these three core sections. According to the AICPA CPA Exam Blueprints, these sections assess the knowledge and skills that all newly licensed CPAs need to protect the public interest. The core sections are available for continuous testing throughout 2025, meaning you can schedule them any day a Prometric center is open, giving you maximum flexibility.

Each core section is four hours long and tests both theoretical knowledge and practical application through a combination of multiple-choice questions and task-based simulations. The content focuses on US GAAP, US auditing standards, and US federal taxation, so Indian candidates need to invest time in understanding these frameworks even if they have strong backgrounds in Indian accounting standards.

Auditing and Attestation (AUD) Overview

The AUD section evaluates your ability to perform audit engagements, attestation engagements, and accounting and review service engagements. You’ll face 78 multiple-choice questions and 7 task-based simulations, making it the section with the highest MCQ count among the core exams. Content areas include

- ethics and professional responsibilities (15-25%),

- risk assessment and planned response (25-35%),

- performing procedures and obtaining evidence (30-40%), and

- forming conclusions and reporting (10-20%).

For Indian CA holders, this section may feel somewhat familiar because auditing principles share common foundations globally. The Q3 2025 pass rate for AUD is approximately 48%

Financial Accounting and Reporting (FAR) Overview

FAR tests your knowledge of financial reporting frameworks, with heavy emphasis on US GAAP under the FASB Accounting Standards Codification. This section contains 50 multiple-choice questions and 7 task-based simulations.

The content is organized into three main areas:

- financial reporting (30-40%),

- select balance sheet accounts (30-40%), and

- select transactions (25-35%).

This is widely considered the most challenging section of the CPA exam, with a Q3 2025 pass rate of only 43%. The difficulty comes from the sheer volume of technical accounting standards you need to master. Indian candidates with CA or M.Com backgrounds will find some overlap with concepts they’ve studied, but the US GAAP specifics require dedicated preparation.

Taxation and Regulation (REG) Overview

REG covers federal taxation for individuals and entities, business law, and ethics. You’ll encounter 72 multiple-choice questions and 8 task-based simulations in this four-hour exam.

Content areas include:

- ethics and federal tax procedures (10-20%),

- business law (15-25%),

- property transactions (5-15%),

- individual taxation (22-32%), and

- entity taxation (23-33%).

The good news for Indian candidates is that REG has the highest pass rate among core sections at approximately 65% as of Q3 2025. The section is manageable if you approach it systematically, though the US federal tax code will be entirely new territory for most Indian professionals. Business law concepts like contracts, agency, and bankruptcy are tested at a foundational level.

Choosing Your Discipline Section: BAR, ISC, or TCP

After passing the three core sections, you must pass one discipline section to complete your CPA exam. This is where you have a choice, and your decision should align with your career goals and professional background. Each discipline is an extension of one of the core sections, diving deeper into specialized knowledge areas. According to AICPA guidance, you should select based on your education, experience, interests, and career aspirations rather than perceived difficulty or pass rates.

Discipline sections are offered during specific quarterly testing windows in 2025, unlike the continuous testing available for core sections. The windows fall in January, April, June, July, and October, so you’ll need to plan your preparation timeline accordingly.

Business Analysis and Reporting (BAR)

BAR is an extension of the FAR core section, testing more complex technical accounting topics and financial analysis skills. This discipline contains 50 multiple-choice questions and 7 task-based simulations.

Content areas include:

- business analysis (40-50%),

- technical accounting and reporting (35-45%), and

- state and local government accounting (10-20%).

Topics covered include advanced revenue recognition, business combinations, derivatives, hedge accounting, and financial statement analysis using data analytics.

The Q3 2025 pass rate for BAR is approximately 41%, making it the most challenging discipline section. This difficulty reflects the advanced nature of the technical accounting content. BAR is ideal for candidates planning careers in corporate financial reporting, Big 4 audit practice, or financial analysis roles.

Information Systems and Controls (ISC)

ISC is an extension of the AUD core section, focusing on IT audit, cybersecurity, and system controls. This discipline has 82 multiple-choice questions and only 6 task-based simulations, with a unique scoring weight of 60% for MCQs and 40% for TBSs (unlike the 50/50 split in other sections). Content areas include:

- information systems and data management (35-45%),

- security, confidentiality, and privacy (35-45%), and

- SOC engagement considerations (15-25%).

The Q3 2025 pass rate for ISC is approximately 66%. This section suits candidates interested in IT audit, cybersecurity consulting, or technology risk advisory roles. With the growing emphasis on digital transformation in Indian businesses and Big 4 firms expanding their technology consulting practices, ISC-qualified CPAs are increasingly in demand.

Tax Compliance and Planning (TCP)

TCP is an extension of the REG core section, covering advanced individual and entity tax compliance, tax planning, and personal financial planning. You’ll face 68 multiple-choice questions and 7 task-based simulations. Content areas include:

- individual tax compliance and personal financial planning (30-40%),

- entity tax compliance (30-40%),

- entity tax planning (10-20%), and

- property transactions (10-20%).

TCP has the highest pass rate of any CPA exam section at approximately 78% as of Q3 2025. This isn’t because the content is easy; rather, candidates who choose TCP typically have strong tax backgrounds from their REG preparation and often work in tax-related roles. For Indian CPAs planning to work in US-India cross-border taxation or international tax practices, TCP provides excellent specialization.

CPA Exam Pattern: Question Types and Testlet Structure

Understanding the CPA exam question format is essential for effective preparation. Unlike the CA exam, which relies heavily on descriptive answers, the CPA exam is entirely computer-based with objective question types. Every section combines multiple-choice questions with task-based simulations, and as of 2024, written communication tasks have been completely removed from the exam. This change means you no longer need to write essays; instead, your analytical and application skills are tested through simulations.

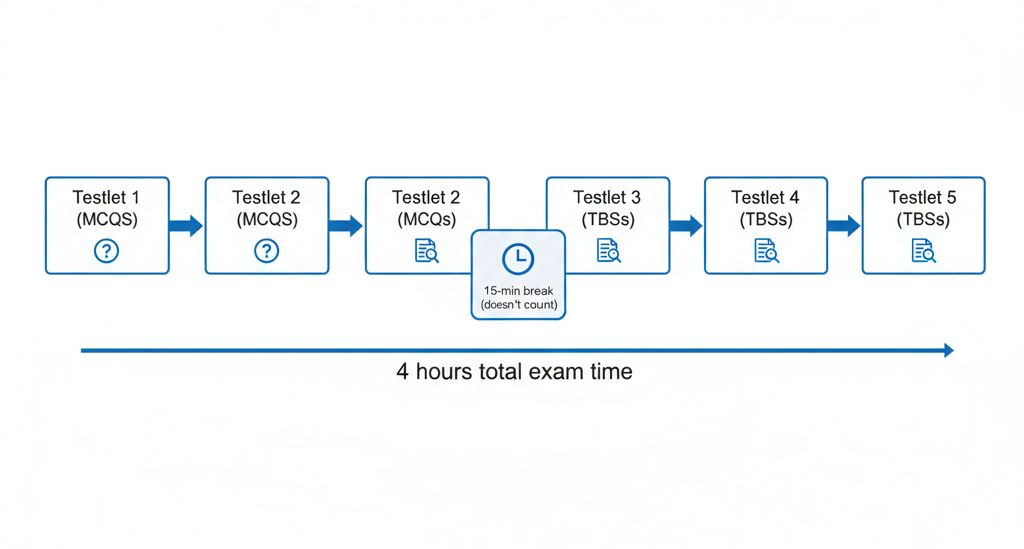

The exam uses a testlet-based structure where questions are grouped into sets. Each section contains five testlets delivered in a specific sequence, with a mandatory break opportunity after the third testlet. Your performance on earlier testlets can influence the difficulty of subsequent MCQ testlets through adaptive testing.

Multiple Choice Questions (MCQs) Format and Scoring Weight

MCQs form 50% of your total score in most CPA exam sections (60% in ISC). These questions test your ability to recall information, understand concepts, and apply knowledge to specific scenarios. Each MCQ presents four answer choices, and you must select the single best answer. There is no negative marking, so you should answer every question, even if you need to make an educated guess.

The MCQ portion is delivered in the first two testlets of each exam section. The number of questions varies significantly by section, ranging from 50 MCQs in FAR and BAR to 82 MCQs in ISC. This variation directly impacts your time management strategy.

How MCQ Testlets Work and Adaptive Testing Explained

The CPA exam uses multi-stage adaptive testing for MCQs. Your first MCQ testlet contains questions of medium difficulty. Based on your performance on this testlet, the exam algorithm determines whether your second MCQ testlet will be of medium or higher difficulty. If you perform well on Testlet 1, you’ll receive a harder Testlet 2; if you struggle, you’ll receive another medium-difficulty testlet.

Here’s the important part: receiving a harder second testlet is actually a good sign. The scoring algorithm accounts for difficulty, so correctly answering harder questions contributes more to your score than getting easier questions right. Don’t panic if Testlet 2 feels more challenging; it likely means you performed well initially.

MCQ Counts by Section (AUD, FAR, REG, BAR, ISC, TCP)

The number of MCQs varies significantly across sections, which directly impacts how much time you can spend per question. Here’s the exact breakdown from the 2025 CPA Exam Blueprint:

| Section | Total MCQs | Testlet 1 | Testlet 2 |

| AUD | 78 | 39 | 39 |

| FAR | 50 | 25 | 25 |

| REG | 72 | 36 | 36 |

| BAR | 50 | 25 | 25 |

| ISC | 82 | 41 | 41 |

| TCP | 68 | 34 | 34 |

Notice that FAR and BAR have the fewest MCQs at 50 each, while ISC has the most at 82. This means you have more time per MCQ in FAR and BAR, but those sections compensate with more complex technical content. ISC requires faster MCQ pacing but tests more discrete IT and systems concepts.

Task-Based Simulations (TBS) Format and Scoring Weight

Task-based simulations test your ability to apply accounting knowledge to realistic work scenarios. Unlike MCQs that test discrete knowledge points, TBSs require you to analyze information, perform calculations, complete forms, and demonstrate professional judgment. TBSs contribute 50% of your total score in most sections, making them equally important as MCQs.

Each TBS presents a scenario with multiple requirements, and you’ll use various response formats, including filling in spreadsheets, selecting from dropdown menus, completing journal entries, and performing research tasks. The exam provides a SpreadJS tool (which replaced Excel in 2024) for calculations and an authoritative literature database for research tasks.

Types of TBS You Will Encounter

The CPA exam includes several TBS formats. Document Review Simulations present emails, memos, and financial documents that you must analyze to answer questions. Research Simulations require you to search authoritative literature (like the FASB Codification or IRS Code) to find answers to specific questions. Calculation-based Simulations ask you to complete financial statements, reconciliations, or tax forms using provided data.

Form-based Simulations require completing standardized forms like tax returns or audit documentation. The most challenging TBSs often combine multiple requirements, asking you to analyze data, perform calculations, and make professional judgments within a single simulation. Practice with authentic TBS formats is essential; simply knowing the content isn’t enough if you’re unfamiliar with how questions are presented.

Complete Testlet Breakdown: What to Expect in Each 4-Hour Exam

Each CPA exam section follows an identical five-testlet structure, regardless of whether it’s a core or discipline section. Understanding this structure helps you mentally prepare for the exam experience and plan your time allocation effectively. The first two testlets contain all MCQs, followed by a break, then three testlets of TBSs.

The exam interface allows you to flag questions for review within each testlet, but once you submit a testlet, you cannot return to it. This means you should complete all questions within a testlet before moving on, even if you need to guess on some items.

Testlet Sequence and the 15-Minute Break

Here’s exactly what happens during your four-hour CPA exam:

Testlet 1 (MCQs): First half of your multiple choice questions. Time varies by section based on MCQ count.

Testlet 2 (MCQs): Second half of MCQs. Difficulty may increase based on Testlet 1 performance.

Mandatory Break: After completing Testlet 2, you receive a 15-minute break that does not count against your exam time. Use this break to step away from the computer, stretch, use the restroom, and mentally reset before tackling simulations.

Testlet 3 (TBSs): First set of task-based simulations.

Testlet 4 (TBSs): Second set of TBSs.

Testlet 5 (TBSs): Final set of TBSs.

The 15-minute break is optional, but only does not count against exam time if taken immediately after Testlet 2. Experienced candidates recommend actually taking the full break to refresh your focus before the mentally demanding simulation section.

Section-Wise MCQ and TBS Distribution Table

Here’s a comprehensive view of the exam structure from the official AICPA blueprint:

| Section | Duration | MCQs | TBSs | MCQ Weight | TBS Weight |

| AUD | 4 hours | 78 | 7 | 50% | 50% |

| FAR | 4 hours | 50 | 7 | 50% | 50% |

| REG | 4 hours | 72 | 8 | 50% | 50% |

| BAR | 4 hours | 50 | 7 | 50% | 50% |

| ISC | 4 hours | 82 | 6 | 60% | 40% |

| TCP | 4 hours | 68 | 7 | 50% | 50% |

The ISC section is the only one with different weighting, giving 60% to MCQs and 40% to TBSs. This reflects the nature of IT and systems content, which lends itself well to discrete knowledge testing through multiple-choice questions.

CPA Exam Scoring System: How is Your Score Calculated?

The CPA exam scoring system differs significantly from the percentage-based grading you may be familiar with from Indian exams. Your score is reported on a scale from 0 to 99, but this number does not represent the percentage of questions you answered correctly. Instead, it’s a scaled score derived from a complex statistical process that accounts for question difficulty, weighting, and the specific mix of items you received.

Understanding how scoring works helps you set realistic expectations and interpret your results correctly. It also explains why the 75 passing score is more meaningful than it might initially appear.

Understanding the 0-99 Scaled Score and 75 Pass Mark in the CPA Exam

To pass any CPA exam section, you must achieve a minimum scaled score of 75. This threshold is set by the AICPA Board of Examiners and represents the minimum level of competence required of newly licensed CPAs. The scoring process involves several steps: your raw performance is first converted based on question difficulty, then weighted according to the MCQ/TBS proportions, and finally scaled to the 0-99 range.

A score of 75 does not mean you answered 75% of the questions correctly. Because of difficulty weighting, you might answer 65% correctly and pass, or answer 70% correctly and fail, depending on which questions you got right. Harder questions contribute more to your score than easier ones. This is why guessing on difficult questions is always better than leaving them blank.

Score Weighting by Section: The ISC Exception

In most CPA exam sections, MCQs and TBSs each contribute exactly 50% to your final score. This equal weighting means you need to perform well on both question types to pass. However, the Information Systems and Controls (ISC) section uses different weighting: MCQs contribute 60% and TBSs contribute 40%.

This ISC exception exists because the IT and systems content tested in that discipline lends itself to discrete knowledge assessment through multiple-choice questions. For ISC candidates, strong MCQ performance is even more critical than in other sections. If you’re choosing ISC as your discipline, focus extra attention on mastering the MCQ content areas.

Current CPA Exam Pass Rates and What They Mean for Indian Candidates

Pass rates provide insight into section difficulty and candidate preparedness, but they should be interpreted carefully. The AICPA publishes pass rates quarterly, and the data since CPA Evolution launched in January 2024 show interesting patterns. Remember that pass rates reflect the aggregate performance of all candidates, including those who were underprepared.

For Indian candidates, these rates offer benchmarks but shouldn’t determine your section order or discipline choice. Your individual preparation, background, and study time matter far more than aggregate statistics.

Core Section Pass Rates (AUD, FAR, REG)

AUD (Auditing and Attestation): The cumulative pass rate for AUD in 2025 is 48%.. This section has remained moderately difficult, with pass rates relatively stable over the past several years. The conceptual nature of auditing standards and the judgment-based questions contribute to this difficulty level.

FAR (Financial Accounting and Reporting): FAR consistently has the lowest pass rate among core sections, sitting at approximately 43% in 2025. This reflects the extensive technical content covering US GAAP that candidates must master. The section improved slightly from 40% in early 2024 as candidates adapted to the CPA Evolution format. For Indian CA holders, FAR may feel somewhat familiar but requires dedicated study of US-specific standards.

REG (Taxation and Regulation): REG has the highest core section pass rate at approximately 64% in 2025, up from 62% in 2024. This improvement suggests candidates are adapting well to the focused tax content. The section covers material that’s entirely new to most Indian candidates, but its structured nature makes it manageable with systematic preparation.

Discipline Section Pass Rates (BAR, ISC, TCP)

BAR (Business Analysis and Reporting): BAR has the lowest pass rate of any discipline section at approximately 42% in 2025. If you choose BAR, allocate extra study time for the complex technical topics.

ISC (Information Systems and Controls): ISC pass rates have steadily improved from 51% in Q1 2024 to approximately 66% in Q3 2025. This suggests growing familiarity with the IT and cybersecurity content among candidates. ISC attracts fewer test-takers than other disciplines, so the candidate pool may be more specialized in technology backgrounds.

TCP (Tax Compliance and Planning): TCP has the highest pass rate of any CPA exam section at approximately 78% 2025. The AICPA attributes this to several factors: TCP candidates typically already passed REG (which covers foundational tax content), many TCP candidates work in tax roles, and the content closely aligns with REG. For Indian candidates interested in US tax practice, TCP offers strong pass rate prospects.

What is the Time Management Strategy for Each CPA Exam Section?

Time management can make or break your CPA exam performance. You have exactly four hours (240 minutes) for each section, but the number of questions varies significantly. Without a deliberate pacing strategy, many candidates find themselves rushing through simulations or, worse, running out of time entirely. The key is allocating specific time budgets for MCQs and TBSs, then sticking to those budgets during the exam.

Your time strategy should account for the 15-minute break (which doesn’t count against your time), the varying MCQ counts per section, and the typically higher time demands of task-based simulations.

CPA Exam: Recommended Time Allocation Per MCQ and TBS

As a general framework, plan to spend approximately 50% of your exam time on MCQs (minus the first few minutes for reading instructions) and 50% on TBSs. However, this split needs adjustment based on your section because the MCQ counts vary from 50 to 82 questions. The goal is to complete MCQs with enough time remaining to thoughtfully work through each simulation.

For TBSs, budget approximately 15-25 minutes per simulation, depending on complexity. Some simulations involve straightforward calculations you can complete in 12-15 minutes, while others require extensive analysis and may need 25-30 minutes. Build in buffer time to avoid the stress of watching the clock on your final TBS.

Time Per MCQ by Section (Factoring Question Counts)

Your time per MCQ depends on your section’s question count. Here’s a practical breakdown assuming you allocate roughly 45-50% of total time to MCQs.

| Section | MCQs | Recommended MCQ Time | Time Per MCQ |

| AUD | 78 | ~100 minutes | ~1.3 minutes |

| FAR | 50 | ~90 minutes | ~1.8 minutes |

| REG | 72 | ~95 minutes | ~1.3 minutes |

| BAR | 50 | ~90 minutes | ~1.8 minutes |

| ISC | 82 | ~105 minutes | ~1.3 minutes |

| TCP | 68 | ~90 minutes | ~1.3 minutes |

FAR and BAR give you the most time per MCQ because they have fewer questions. Use this extra time for the complex technical calculations these sections require. AUD, ISC, and REG require faster pacing; don’t get stuck on any single MCQ.

Time Per TBS and Simulation Strategy

After completing MCQs and taking your 15-minute break, you’ll have roughly 120-140 minutes for simulations (depending on how quickly you completed MCQs). With 6-8 TBS per section, this gives you approximately 17-23 minutes per simulation on average.

However, not all TBSs require equal time. Research tasks where you search authoritative literature can often be completed in 10-15 minutes if you’re familiar with the database. Calculation-heavy simulations involving financial statements or tax returns typically need 20-25 minutes. Plan to complete easier simulations quickly to bank extra time for complex ones.

CPA Exam: Section-Specific Time Management Frameworks

Generic time advice only takes you so far. Let’s break down specific strategies for each section based on their unique question distributions and content demands.

AUD Time Strategy (78 MCQs + 7 TBSs)

For AUD’s 78 MCQs, aim to complete Testlet 1 (39 questions) in approximately 50 minutes and Testlet 2 in another 50 minutes. This gives you roughly 1.3 minutes per question. AUD MCQs often require reading detailed scenarios, so resist the urge to skim; misreading a fact pattern leads to wrong answers.

After your break, you’ll have roughly 125 minutes for 7 TBSs, averaging about 18 minutes each. AUD simulations frequently involve audit documentation, planning procedures, and risk assessment. These require careful reading but not extensive calculations. Flag any simulation that’s taking too long and return to it after completing others.

FAR Time Strategy (50 MCQs + 7 TBSs)

FAR’s 50 MCQs give you the luxury of approximately 1.8 minutes per question. Use this time wisely because FAR MCQs often involve calculations or require applying complex accounting standards. Complete Testlet 1 in about 45 minutes and Testlet 2 in another 45 minutes.

This leaves approximately 135 minutes for 7 TBSs (about 19 minutes each). FAR simulations are calculation-intensive, involving journal entries, financial statement preparation, and consolidation exercises. Make full use of the SpreadJS tool for calculations. Don’t waste time on mental math when the spreadsheet function is available.

REG Time Strategy (72 MCQs + 8 TBSs)

REG has 72 MCQs and 8 TBSs, the highest TBS count of any section. Plan approximately 45 minutes per MCQ testlet (36 questions each), giving you about 1.3 minutes per question. REG MCQs test discrete tax rules that you either know or don’t, so avoid spending too long on questions where you’re uncertain.

With 8 TBS, you’ll need efficient simulation work. Budget roughly 15-17 minutes per TBS, totaling about 130 minutes. REG simulations often involve completing tax forms or analyzing tax implications of transactions. Familiarity with US tax forms from your study materials helps tremendously here.

Discipline Section Time Strategies

BAR (50 MCQs + 7 TBSs): Similar to FAR, use your 1.8 minutes per MCQ for the technical calculations involved. BAR simulations are complex, involving financial analysis and advanced accounting topics. Budget 19-20 minutes per TBS.

ISC (82 MCQs + 6 TBSs): ISC has the most MCQs at 82, so pace yourself at 1.3 minutes each. The trade-off is only 6 TBSs, giving you about 20 minutes per simulation. ISC questions test discrete IT concepts, so you can often answer quickly if you know the material.

TCP (68 MCQs + 7 TBSs): Budget 1.3 minutes per MCQ across your 68 questions. TCP simulations involve tax calculations and planning scenarios. With 7 TBSs and roughly 130 minutes, you have about 18-19 minutes each.

What to Do If You Run Out of Time

Despite the best planning, you might find yourself short on time. First, don’t panic; stress only slows you down further. If you’re running out of time on MCQs, answer every remaining question with your best educated guess. Remember, there’s no penalty for wrong answers, and leaving questions blank guarantees zero points.

For TBSs, prioritize completing as much as possible on each simulation rather than leaving entire simulations blank. Partial credit exists for TBSs, so entering some correct data or completing some tabs earns points even if you can’t finish everything. If you have two simulations left and only 15 minutes, split your time and attempt both rather than perfectly completing one.

Which Discipline Section Should Indian Candidates Choose?

Choosing your discipline section is one of the most important decisions in your CPA journey. Unlike the core sections, where you have no choice, the discipline selection lets you align your certification with your career aspirations. The AICPA advises choosing based on education, experience, interests, and career goals rather than pass rates alone. A section with a higher pass rate isn’t necessarily easier for you individually.

For Indian candidates, this decision should factor in your current qualifications (CA, B.Com, MBA), your work experience, and whether you plan to build your career in India, the US, or in cross-border roles. Let’s examine each discipline through an India-focused lens.

BAR for Financial Analysis and Reporting Careers

Business Analysis and Reporting (BAR) is the natural choice for candidates pursuing corporate finance, Big 4 audit, or financial reporting roles. This discipline builds on FAR by testing advanced technical accounting topics and financial analysis skills. If you enjoyed FAR content and want to deepen your expertise in complex accounting standards, BAR aligns with that path.

The 41% pass rate shouldn’t discourage you if this discipline matches your goals. The candidates struggling with BAR are often those who chose it for the wrong reasons, not those genuinely interested in advanced financial reporting.

Ideal Candidate Profile for BAR

You’re well-suited for BAR if you have a strong foundation in financial accounting, whether from CA Intermediate/Final, M.Com, or professional experience in audit or accounting roles. Candidates who excelled at FAR typically find BAR content challenging but manageable because it builds on familiar frameworks. Interest in data analytics and financial statement analysis is also valuable since BAR incorporates these elements.

Working professionals in Big 4 audit practice, corporate accounting departments, or financial planning and analysis (FP&A) roles will find BAR content directly applicable to their jobs. The investment in learning advanced accounting standards pays dividends in career credibility and practical skill development.

BAR Content Areas and Career Opportunities in India

BAR covers three main areas: business analysis (40-50%), technical accounting and reporting (35-45%), and state and local government accounting (10-20%). The business analysis portion emphasizes financial statement analysis, forecasting, and data interpretation. Technical accounting includes revenue recognition complexities, business combinations, derivatives, and hedge accounting.

In India, BAR-qualified CPAs are valued in Big 4 firms’ audit and assurance practices, multinational corporate accounting departments, investment banking, and equity research roles. The advanced US GAAP knowledge positions you for US-India cross-border reporting projects and IPO advisory work involving US market listings.

ISC for IT Audit and Systems Control Careers

Information Systems and Controls (ISC) focuses on IT governance, cybersecurity, data management, and SOC (System and Organization Controls) engagements. This discipline suits candidates interested in the technology side of accounting and auditing. With digital transformation accelerating across industries, ISC-qualified professionals are increasingly valuable.

The 56% pass rate reflects strong candidate preparation among those who choose this technical specialization. If technology interests you and you’re comfortable with IT concepts, ISC offers excellent career differentiation.

Ideal Candidate Profile for ISC

ISC suits candidates with IT backgrounds, those working in IT audit roles, or professionals interested in technology risk and cybersecurity. You don’t need to be a software engineer, but comfort with technology concepts is essential. Candidates with CA backgrounds who have worked on systems audits or IT controls will find familiar territory here.

If you find topics like data governance, access controls, encryption, and SOC reporting interesting, ISC provides structured knowledge in these areas. The discipline also suits candidates who want to differentiate themselves in the accounting profession through technology expertise.

ISC Content Areas and Growing Demand in Indian Big 4 Firms

ISC covers information systems and data management (35-45%), security, confidentiality, and privacy (35-45%), and SOC engagement considerations (15-25%). Topics include IT governance frameworks, database management, cybersecurity controls, privacy regulations, and the SOC 1, SOC 2, and SOC 3 reporting frameworks.

Indian Big 4 firms have significantly expanded their technology consulting and IT audit practices in recent years. ISC-qualified CPAs are sought for technology risk advisory, cybersecurity consulting, and SOC attestation engagements. Global capability centers of US companies in India also need ISC expertise for internal audit and IT compliance functions.

TCP for Tax Specialization and Planning Careers

Tax Compliance and Planning (TCP) is the discipline of choice for candidates pursuing tax careers. This section extends REG content into advanced individual and entity tax topics, tax planning strategies, and personal financial planning. The 75% pass rate reflects the strong alignment between REG preparation and TCP content.

If you’re interested in US taxation, cross-border tax planning, or personal financial advisory services, TCP provides the specialized knowledge to excel in these roles.

Ideal Candidate Profile for TCP

TCP suits candidates who performed well in REG and want to deepen their tax expertise. Those already working in tax roles, whether in Big 4 tax practices, corporate tax departments, or tax consulting firms, will find TCP content directly relevant. Interest in individual taxation, estate planning, and entity structuring is valuable.

For Indian CAs with backgrounds in Indian direct taxes, TCP offers an opportunity to build parallel expertise in US federal taxation. The structured nature of tax rules (unlike the judgment-heavy aspects of audit) appeals to candidates who prefer clear frameworks and definitive answers.

TCP Content Areas and US-India Tax Practice Opportunities

TCP covers individual tax compliance and personal financial planning (30-40%), entity tax compliance (30-40%), entity tax planning (10-20%), and property transactions including asset dispositions (10-20%). Advanced topics include partnership taxation, S corporation planning, estate and gift taxes, and cross-border tax considerations.

The US-India tax treaty, transfer pricing regulations, and cross-border structuring create significant demand for professionals with dual expertise. TCP-qualified CPAs in India work on inbound US investment structures, outbound Indian investment tax planning, and individual tax compliance for NRIs and US citizens in India.

CPA Exam Scheduling and Testing in India

Indian candidates can take the CPA exam at Prometric testing centers within India, eliminating the need for international travel. This accessibility, which became permanent after initially launching during the COVID-19 pandemic, has made the CPA significantly more attainable for Indian professionals. However, testing in India involves additional fees and specific registration processes.

Understanding the scheduling logistics helps you plan your exam timeline effectively, especially when coordinating study schedules with work commitments common among Indian working professionals.

Prometric Test Centers in India for CPA Exam

NASBA administers the CPA exam in India at eight Prometric testing centers located in major cities: Ahmedabad, Bangalore, Chennai, Hyderabad, Kolkata, Mumbai, New Delhi, and Trivandrum. This geographic distribution means most candidates can find a center within reasonable travel distance. Each center operates on standard Prometric hours and is closed on Sundays and Indian public holidays.

Seat availability varies by location and time period. Mumbai, Bangalore, and Delhi centers tend to fill up faster due to higher candidate concentrations in these cities. Book your exam at least 30-45 days in advance to secure your preferred date and location. You can check seat availability using Prometric’s online scheduling tool before paying exam fees.

Core Sections: Continuous Testing Year-Round in 2025

Starting in 2025, the three core sections (AUD, FAR, REG) are available through continuous testing. This means you can schedule these exams any day a Prometric center is open, subject to seat availability. You’re no longer restricted to specific quarterly testing windows for core sections, providing maximum flexibility for your study and exam schedule.

Continuous testing also means faster score release. Instead of waiting for batch score releases tied to testing windows, you’ll receive core section scores within 1-2 weeks of testing. This allows you to quickly move to your next section or plan retakes if needed.

Discipline Sections: Quarterly Testing Windows

Unlike core sections, discipline sections (BAR, ISC, TCP) are offered only during specific testing windows in 2025. This requires more careful planning because you can’t test whenever you’re ready; you must align your preparation with the available windows.

The quarterly structure means you have multiple opportunities throughout the year, but missing a window delays your discipline test by several weeks. Plan your core section schedule to complete those exams before your target discipline window.

The 30-Month Completion Window for CPA Exam: Strategic Planning for Working Professionals

Most US jurisdictions have extended the exam completion window from 18 months to 30 months. This means once you pass your first CPA exam section, you have 30 months to pass the remaining three sections before your first passing score expires. This extended window is particularly valuable for Indian working professionals balancing exam preparation with demanding jobs.

With 30 months, you can reasonably plan to pass one section every 6-8 months while maintaining your work commitments. This pace allows approximately 200-300 study hours per section, which aligns with industry recommendations for working candidates. Don’t interpret the extended window as permission to procrastinate; rather, use it to build a sustainable study pace.

International Administration Fee and Registration Process for CPA Exam

Testing at international locations, including India, requires paying an International Administration Fee on top of standard exam fees. This fee compensates for the additional logistics of international testing. To pay this fee, log into your NASBA CPA Candidate Account portal and select “International Administration” after receiving your Notice to Schedule (NTS).

The international administration fee is paid separately from exam section fees and must be processed before you can schedule at Indian Prometric centers. Without completing this step, you won’t see Indian testing locations when trying to schedule. Allow several business days for fee processing before attempting to book your exam date.

Conclusion

The CPA exam pattern, while initially complex, follows a logical structure that Indian candidates can master with proper understanding and preparation. You’ll complete three core sections (AUD, FAR, REG) testing foundational accounting, auditing, and taxation knowledge, plus one discipline section of your choice that allows specialization in financial analysis, IT controls, or tax planning.

Each section presents 50-82 multiple-choice questions and 6-8 task-based simulations over four hours, with the 15-minute break providing a crucial mental reset between question types. The 75 scaled score requirement, current pass rates ranging from 41% (BAR) to 75% (TCP), and the 30-month completion window provide the benchmarks and flexibility you need for planning. With eight Prometric centers across India and continuous testing for core sections, the logistics of taking this exam have never been more accessible for Indian professionals pursuing a US CPA certification.

Frequently Asked Questions

How many sections are there in the CPA exam?

The CPA exam has four sections total: three mandatory core sections (AUD, FAR, REG) and one discipline section of your choice from three options (BAR, ISC, TCP). You must pass all four sections to complete the exam.

What is the duration of each CPA exam section?

Each CPA exam section is exactly four hours (240 minutes) long. This includes time for both multiple-choice questions and task-based simulations. A 15-minute break is provided after the MCQ testlets, and this break does not count against your exam time.

How many MCQs and TBSs are in each CPA exam section?

MCQ counts vary by section: AUD has 78, FAR has 50, REG has 72, BAR has 50, ISC has 82, and TCP has 68. TBS counts are more consistent: AUD, FAR, BAR, and TCP each have 7 TBSs, REG has 8 TBSs, and ISC has 6 TBSs.

What is the passing score for the CPA exam?

You need a minimum scaled score of 75 to pass any CPA exam section. Scores are reported on a 0-99 scale, but this is not a percentage. The score is calculated through a weighted combination of MCQ and TBS performance, adjusted for question difficulty.

Which CPA exam section is the hardest?

Based on Q3 2025 pass rates, FAR (43%) and BAR (41%) are the most challenging sections. However, difficulty is subjective and depends on your background. An IT professional might find ISC easier than someone without technology experience, regardless of aggregate pass rates.

Can I take all four CPA exam sections in one day?

Technically, you could schedule multiple sections on the same day at a testing center, but this is not recommended. Each section is four hours long, making it physically and mentally exhausting to attempt more than one section daily. Most candidates take sections weeks or months apart.

What is the difference between core and discipline sections?

Core sections (AUD, FAR, REG) are mandatory for all candidates and test the foundational knowledge every CPA needs. Discipline sections (BAR, ISC, TCP) are elective, and you choose one based on your career interests. Core sections have continuous testing, while disciplines have quarterly testing windows.

Which discipline section should I choose as an Indian CA?

Indian CAs often choose BAR if pursuing audit careers (leveraging their FAR knowledge), TCP if interested in tax (building on REG content), or ISC if working in IT audit. Your choice should align with your career goals rather than pass rates alone.

How is the CPA exam different from the CA exam in India?

The CPA exam is computer-based with objective questions (MCQs and simulations), while CA exams include descriptive answers. CPA has four sections versus CA’s multiple levels with 16+ papers. CPA requires a 75 scaled score to pass each section, tested against US accounting standards.

Where can I take the CPA exam in India?

You can take the CPA exam at eight Prometric testing centers in India: Ahmedabad, Bangalore, Chennai, Hyderabad, Kolkata, Mumbai, New Delhi, and Trivandrum. Testing in India requires paying an International Administration Fee through your NASBA account.

How long do I have to pass all four CPA exam sections?

Most jurisdictions now allow 30 months to pass all four sections after your first passing score. Your 30-month clock starts when you pass your first section, not when you first attempt the exam. Verify the specific timeline with your state board.

Are there any written communication questions in the CPA exam?

No. Written communication tasks were removed from the CPA exam as part of the January 2024 CPA Evolution changes. All sections now contain only multiple-choice questions and task-based simulations.

What happens if I fail a CPA exam section?

You can retake a failed section after receiving your score, with no limit on attempt numbers. You must wait for the score release before rescheduling the same section. For core sections with continuous testing, this wait is typically 1-2 weeks; for disciplines, you may need to wait for the next testing window.

Can I change my discipline section after starting the exam?

You choose your discipline section before beginning your first exam, and this choice is not permanent. You can switch disciplines at any point before passing a discipline section. However, switching after significant preparation wastes study time, so choose thoughtfully upfront.

What is continuous testing for CPA core sections?

Continuous testing means core sections (AUD, FAR, REG) are available year-round at Prometric centers, not restricted to specific testing windows. You can schedule these exams on any day the center is open, subject to seat availability. This was implemented for core sections starting in 2025.

Allow notifications

Allow notifications