Discover CPA exam eligibility pathways for Indian professionals without CA. Complete guide covering M.Com, MBA, CS, CMA India routes, bridge courses, state selection, and step-by-step application process.

Table of Contents

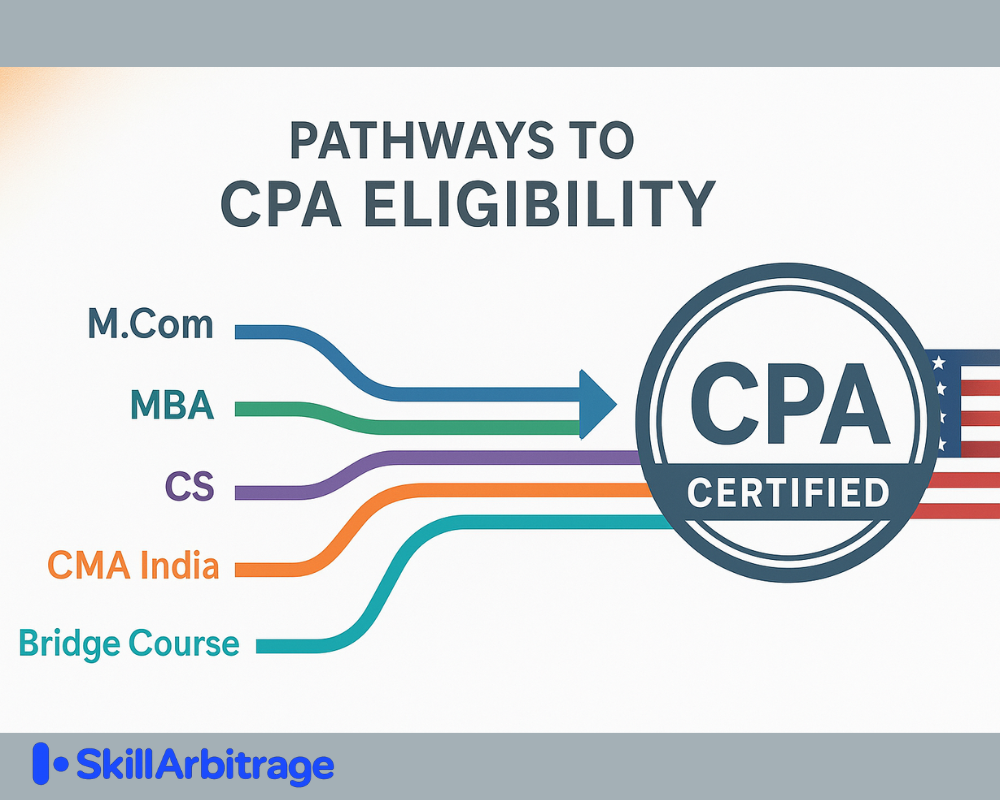

If you have ever felt that becoming a US CPA is only for Chartered Accountants, you are not alone. This is one of the most common misconceptions among Indian commerce and finance professionals. The truth is that CA is just one of many pathways to CPA eligibility. Whether you hold an M.Com, MBA in Finance, Company Secretary qualification, or CMA India credential, you have legitimate routes to pursue the prestigious US CPA certification.

This comprehensive guide is written specifically for you, the professional who chose a different path. We will walk through the credit hour system that determines your eligibility, explore each alternative pathway in detail, help you select the right US state board, and guide you through the credential evaluation process. By the time you finish reading, you will have complete clarity on how your qualification translates to CPA eligibility.

According to the National Association of State Boards of Accountancy (NASBA), most U.S. jurisdictions require candidates to complete 120 credit-hours of post-secondary education to sit for the CPA exam, and 150 credit-hours to obtain the CPA license.

For Indian students, this creates a common challenge. A standard three-year B.Com degree is typically evaluated at around 90 U.S. credits (roughly 30 credits per year), which means a standalone B.Com usually does not meet the exam-eligibility requirement for many state boards. Candidates generally bridge this gap by completing additional education, such as an M.Com, MBA, or professional qualifications like CA, CMA (India), or CS, to reach the 120- or 150-credit benchmarks.

In recent years, interest in the US CPA qualification among Indian candidates has grown dramatically. India is now the second-largest international market for the CPA exam, with enrollments increasing by nearly 60% since the exam became more accessible within India. This surge is supported by global industry trends: as the supply of U.S. accounting graduates declines and a significant portion of the American accounting workforce approaches retirement, U.S. and multinational firms are actively recruiting skilled Indian finance professionals to fill these roles.

Your journey to becoming a US CPA starts with understanding where you stand today. We will help you calculate your credits, identify any gaps, and create a clear action plan. Whether you need a bridge course or already qualify based on your current credentials, this guide will show you exactly what to do next. Let us begin by understanding what actually makes Indian professionals eligible for the US CPA exam.

US CPA Eligibility in India: Do You Need to Be a CA?

The US CPA credential is governed by a framework that focuses on education, examination, and experience. Understanding this framework is your first step toward determining your eligibility. Many Indian professionals assume the requirements are rigid and favor only CA holders, but that is simply not accurate. The system is designed to evaluate your educational background against US standards, and multiple Indian qualifications meet these standards effectively.

What is the 3E Framework for CPA Qualification?

The American Institute of Certified Public Accountants (AICPA) and the 55 US state boards of accountancy use what is commonly called the 3E framework to determine CPA eligibility. These three Es stand for Education, Examination, and Experience. Each component must be fulfilled, though the specific requirements vary by state. Understanding this framework helps you see exactly where your Indian qualification fits into the picture.

Education Requirements and Credit Hour System

The education requirement is where most of your focus should be as an Indian candidate. US state boards require candidates to have completed a certain number of credit hours in higher education, with specific credits in accounting and business subjects. The magic numbers you will hear repeatedly are 120 credits to sit for the exam and 150 credits to obtain your license. Your Indian degree and any additional qualifications you hold will be evaluated against these benchmarks.

The credit hour system measures educational attainment in a standardized way. One year of full-time university education in the US typically equals 30 credit hours. This means a standard four-year US bachelor’s degree equals 120 credits, and a bachelor’s plus master’s combination reaches the 150 credit threshold. Indian degrees follow a different structure, but they can be converted to US credit equivalents through a formal evaluation process.

Examination Component and What It Involves

The CPA Exam itself is uniform across all 55 jurisdictions. You must pass four sections within a rolling 30-month window. The core sections include

- Auditing and Attestation (AUD),

- Financial Accounting and

- Reporting (FAR), and Taxation and Regulation (REG).

Additionally, you choose one discipline section from –

- Business Analysis and Reporting (BAR),

- Information Systems and Control (ISC), or

- Tax Compliance and Planning (TCP).

Each section is four hours long and includes multiple-choice questions along with task-based simulations. The passing score is 75 on a scale of 0 to 99. Indian candidates can take the exam at Prometric centers located in eight Indian cities, including Mumbai, Delhi, Bangalore, Chennai, Hyderabad, Kolkata, Ahmedabad, and Trivandrum. This means you do not need to travel to the US to complete your examination.

Experience Requirements for Licensing

Beyond passing the exam, you need qualifying work experience to obtain your CPA license. Most states require one to two years of experience in accounting, auditing, or related fields. The tricky part for Indian candidates is that this experience typically must be verified by an actively licensed US CPA. We will address practical solutions for this challenge later in this guide.

The experience requirement is separate from the exam eligibility requirement. You can sit for and pass the exam before completing your experience. Many candidates choose to start accumulating experience while preparing for or taking the exam. This parallel approach can significantly reduce your total timeline to licensure.

How the US Credit Hour System Works for Indian Qualifications

Understanding credit hour conversion is essential for every Indian CPA aspirant. The US education system measures academic work differently from India, but your qualifications can be translated into equivalent credits through recognized evaluation agencies.

Converting Indian Degrees to US Credit Hours

Indian degrees are typically evaluated at 30 credit hours per year of study. A three-year B.Com degree equals approximately 90 US credit hours. A two-year M.Com or MBA adds another 60 credits. Professional qualifications like CA, CS, and CMA India are evaluated separately and can add significant credits to your total.

Some evaluation agencies provide bonus credits for academic excellence.

The 120 Credit Rule for Exam Eligibility

To sit for the CPA exam, you need at least 120 credit hours with a specified number of accounting and business credits. This is the threshold for exam eligibility, not licensure. If your B.Com plus additional qualification reaches 120 credits, you can register for the exam in states that accept your credential combination.

The 150 Credit Rule for Licensing

Obtaining your actual CPA license requires 150 credit hours. This is 30 credits more than the exam eligibility threshold. If you qualify to sit for the exam with 120 credits, you will need to earn additional credits before or after passing to get licensed. Many candidates complete bridge courses or additional certifications to bridge this gap.

Why CA Is Not Mandatory for CPA

The CA qualification is undoubtedly valuable and provides a strong foundation for the CPA. However, it is not the only path, and in some ways, alternative qualifications offer their own advantages.

Common Misconceptions About CA and CPA

Many people believe that the CPA exam content overlaps significantly with CA, making CA holders better prepared. While there is some overlap in foundational accounting concepts, the CPA exam focuses heavily on US GAAP, US taxation, and US business law. A CA holder still needs to learn these US-specific topics from scratch. An M.Com or MBA holder faces the same learning curve, putting them on relatively equal footing for exam preparation.

Another misconception is that US state boards prefer CA holders. In reality, state boards evaluate credentials based on credit hours and subject coverage, not the prestige of the qualification. An M.Com holder with 150 credits in accounting and business subjects is just as eligible as a CA holder with the same credits.

How Alternative Qualifications Meet CPA Requirements

M.Com, MBA Finance, CS, and CMA India qualifications all contribute credit hours toward CPA eligibility. When combined with a bachelor’s degree, these credentials often meet or exceed the 120 or 150-credit thresholds. The key is understanding exactly how many credits your specific combination provides and which states accept your credential mix.

Professional qualifications from recognized Indian bodies like ICSI and ICMAI are evaluated by US credential agencies. These agencies assess the curriculum, examination rigor, and practical training components to determine US credit equivalency. Many Indian professionals have successfully obtained CPA licenses using these alternative pathways.

CPA Exam Eligibility Without CA: Complete CPA Eligibility Pathways

Now, let us explore each alternative pathway in detail. Understanding the specifics of your qualification’s CPA eligibility will help you plan your journey more effectively.

The M.Com Pathway to CPA Eligibility

The Master of Commerce degree is one of the most straightforward paths to CPA eligibility for Indian professionals. It combines well with a B.Com foundation and provides substantial credit hours in accounting and business subjects.

Credit Hour Calculation for B.Com Plus M.Com

A three-year B.Com provides approximately 90 credit hours, and a two-year M.Com adds 60 more, bringing your total to 150 credits. This combination meets the licensing requirement in most states, not just the exam eligibility threshold. You are essentially ready for both the exam and eventual licensure from an education standpoint.

Which M.Com Specializations Work Best for CPA

M.Com in Accounting, Finance, or Taxation aligns most closely with CPA requirements. These specializations include coursework in financial accounting, cost accounting, auditing, and taxation, which are directly relevant to the CPA exam content areas. If your M.Com is in a less related specialization, you may need additional accounting coursework.

Timeline and Cost Considerations for M.Com Holders

If you already hold a B.Com plus an M.Com, you can begin the CPA application process immediately. The credential evaluation takes six to eight weeks, and you could be sitting for your first exam section within three to four months of starting. Your primary investment will be evaluation fees, exam fees, and review course costs, typically totaling INR 3.5 to 4.5 lakhs.

The MBA Finance Pathway to CPA Eligibility

An MBA with a finance or accounting concentration provides another excellent pathway to CPA eligibility. The degree is widely recognized and valued in the corporate world, adding career benefits beyond the CPA qualification.

Credit Hour Calculation for B.Com Plus MBA

Similar to M.Com, a two-year MBA program adds approximately 60 credit hours to your B.Com foundation. This brings your total to around 150 credits, meeting the licensing threshold. Even a B.Com plus one year PGDM can provide 120 credits, meeting the exam eligibility requirement in many states.

Accounting Course Requirements and How to Address Gaps

MBA programs vary significantly in their accounting content. Some MBA Finance programs include multiple accounting courses, while others focus more on corporate finance and investments. If your MBA transcript shows fewer than 24 credits in accounting subjects, some states may require additional accounting coursework. A pre-evaluation from NASBA International Evaluation Services (NIES) can identify any gaps before you formally apply.

Distance MBA vs Regular MBA for CPA Eligibility

Both distance and regular MBA programs can qualify for CPA eligibility, provided the granting institution is recognized. The key factor is whether the US evaluation agency accepts the university’s credentials. MBA degrees from UGC recognized universities, whether completed through distance or regular mode, are generally evaluated favorably. However, some lesser-known distance education providers may face scrutiny during evaluation.

The Company Secretary Pathway to CPA Eligibility

The Company Secretary qualification from ICSI offers another viable path to CPA eligibility. CS professionals have strong foundations in corporate law and governance, which partially overlaps with CPA exam content.

How CS Qualification Translates to US Credits

The CS qualification is typically evaluated as equivalent to 60 credit hours of US education. When combined with a three-year B.Com (90 credits), you reach 150 credits total. However, the subject distribution matters significantly. CS coursework is heavy on corporate law and secretarial practice but lighter on financial accounting and auditing compared to what CPA requires.

Some evaluation agencies and state boards may require additional accounting coursework to ensure you meet the subject-specific credit requirements. Getting a preliminary evaluation before committing to a state board application is advisable for CS professionals.

State Boards That Recognize CS Credentials

States like Alaska, Montana, and Guam have historically been more accepting of diverse international credentials, including CS. These states evaluate candidates holistically rather than rigidly requiring specific credential types. Working with an experienced CPA coaching provider can help you identify the best state for your CS plus B.Com combination.

Combining CS with Other Qualifications for Maximum Credits

If your CS plus B.Com combination falls short on accounting credits, you can supplement with additional coursework or certifications. Some professionals pursue a few accounting courses from recognized universities, while others complete bridge course modules specifically designed to fill accounting credit gaps.

The CMA India Pathway to CPA Eligibility

Cost and Management Accountants from ICMAI have strong analytical and accounting foundations that translate well to CPA preparation. The CMA India qualification provides substantial credit hours and relevant subject knowledge.

Credit Value of CMA India for US CPA

CMA India is typically evaluated as equivalent to approximately 60 credit hours. Combined with a B.Com, this brings your total to around 150 credits. The CMA curriculum covers cost accounting, financial management, and management accounting extensively, providing solid preparation for the FAR and potentially the BAR discipline sections of the CPA exam.

Unlike CMA USA (which is a separate certification from the Institute of Management Accountants), CMA India is a comprehensive program with multiple levels of examination. The depth and rigor of CMA India are generally well regarded by US evaluation agencies.

Differences Between CMA India and CMA USA for CPA Eligibility

CMA India and CMA USA are entirely different credentials from different professional bodies. CMA India from ICMAI provides credit hours toward CPA education requirements. CMA USA from IMA is a separate management accounting certification that does not directly contribute credit hours for CPA eligibility, but is valuable as an additional credential after becoming a CPA.

If you hold CMA India, your focus should be on credit hour evaluation and state board selection. If you are considering CMA USA, understand that it complements CPA rather than substituting for education credits.

Practical Considerations for CMA India Holders

CMA India professionals should ensure their ICMAI membership and qualification certificates are current and properly documented. Evaluation agencies will request official transcripts and certificates directly from ICMAI. Starting the document collection process early can prevent delays during evaluation. Many CMA India holders have successfully obtained CPA licenses in states like Alaska, Montana, etc.

CPA Exam Eligibility Without CA: Bridge Courses for CPA Eligibility When You Fall Short on Credits

Not everyone has 120 or 150 credits based on their existing qualifications. If you fall short, bridge courses offer a practical solution to fill the gap and achieve CPA eligibility.

What Are CPA Bridge Courses and How Do They Work

Bridge courses are educational programs specifically designed to help candidates meet CPA credit hour requirements. They provide academic credits in accounting and business subjects that count toward your eligibility total.

Understanding the Purpose of Bridge Courses

Bridge courses exist because the Indian education system does not perfectly align with US credit hour requirements. A three-year B.Com provides only 90 credits against the 120 needed for exam eligibility. Bridge courses fill this 30 credit gap efficiently, allowing B.Com graduates to qualify for the CPA exam.

These courses are offered by universities and educational institutions recognized by US evaluation agencies. Upon completion, you receive transcripts that can be included in your credential evaluation, adding the necessary credits to your total.

Credit Hours Provided by Bridge Course Programs

Most bridge course programs in India provide 30 to 60 credit hours, depending on the program structure. A one-year program typically provides 30 to 40 credits, while more comprehensive programs can provide 60 credits. The exact credit value depends on the course structure, contact hours, and recognition by evaluation agencies.

Bridge courses cover subjects relevant to the CPA exam content, including financial accounting, managerial accounting, auditing, taxation, and business law. This dual benefit of adding credits while building exam-relevant knowledge makes bridge courses particularly valuable.

Top Bridge Course Providers for Indian Candidates

Several reputable providers offer bridge courses specifically designed for Indian CPA aspirants. Choosing a recognized provider ensures your credits will be accepted during evaluation.

Simandhar Education Bridge Course Overview

Simandhar Education offers a popular bridge course program. The program covers accounting, law, financial management, and economics. It is designed to integrate with CPA preparation, meaning you learn content relevant to the exam while earning eligibility credits. The program fee is approximately INR 35,000, making it an affordable option for most candidates.

Simandhar’s bridge course is offered through partnerships with accredited US universities, ensuring the credits are recognized by NASBA and state boards. The course can be completed online, allowing working professionals to study at their own pace.

Miles Education Bridge Course Overview

Miles Education provides bridge course options through its NAAC-accredited university partnerships. Their programs are designed to complement various Indian qualifications and fill specific credit gaps. Miles offers flexibility in course selection, allowing candidates to choose modules based on their existing credit profile and deficiencies.

The Miles Bridge course integrates with their CPA coaching program, providing a streamlined experience from eligibility to exam preparation. Their counselors help assess your current credits and recommend the appropriate bridge course modules.

Other Recognized Bridge Course Options

Beyond Simandhar and Miles, several other providers offer recognized bridge courses. Becker, in partnership with Indian coaching institutes, provides bridge course options. Some Indian universities with NAAC A+ accreditation offer postgraduate diploma programs that can serve as bridge courses. The key is ensuring that whatever program you choose is recognized by NIES or other approved evaluation agencies.

How to Integrate Bridge Courses with Your Existing Qualification

Your bridge course strategy depends on your current educational background. Different starting points require different approaches.

Bridge Course Strategy for B.Com Only Holders

If you hold only a three-year B.Com, you have 90 credits against the 120 needed for exam eligibility. A bridge course providing 30 or more credits will make you exam-eligible. However, for licensing (150 credits), you will need either a more comprehensive bridge program or additional education, such as pursuing an M.Com alongside or after your CPA journey.

Many B.Com holders choose to complete a 40-credit bridge course, take the CPA exam, and then pursue additional credits for licensing later. This approach allows you to start the exam process quickly while planning for the remaining credits.

Bridge Course Strategy for Partial Postgraduation

If you have completed one year of postgraduation (such as an M.Com first year or a one-year PGDM), you may have around 120 credits already. A shorter bridge course or even individual course modules may be sufficient to reach 150 credits for licensing. Getting a pre-evaluation helps identify exactly how many additional credits you need.

Timeline and Cost Planning for Bridge Courses

Most bridge courses can be completed in six to twelve months, depending on the program structure and your pace of study. Costs range from INR 30,000 to INR 80,00,0, depending on the provider and credit hours. Factor this into your total CPA investment calculation.

The ideal timeline is to start bridge course enrollment while preparing for the CPA exam. By the time you complete your exam sections, you will also have your bridge course credits ready for licensing.

Choosing the Right US State Board for Non-CA Indian Candidates

State selection is one of the most critical decisions in your CPA journey. Each of the 55 US jurisdictions has different requirements, and choosing wisely can significantly impact your path to licensure.

States That Accept Indian Qualifications Without Social Security Number

Indian candidates typically do not have a US Social Security Number (SSN), which some states require. The good news is that several states have removed this requirement for examination, making them accessible to international candidates.

The states most commonly recommended for Indian candidates include Alaska, Guam, Montana, Washington, etc. These jurisdictions accept international applicants without SSN requirements for the exam. They also have relatively flexible education and experience verification policies.

Guam Board of Accountancy is particularly popular among Indian candidates due to its straightforward application process and acceptance of diverse international credentials. Montana and Alaska are also known for their favorable policies toward international candidates.

State-by-State Comparison for Different Qualifications

Your specific qualification influences which state is the best fit. Different states have different approaches to evaluating international credentials.

Best States for M.Com Holders

M.Com holders with 150 credits generally have the widest choice of states. Alaska, Colorado, and Washington are excellent options. These states accept international postgraduate credentials and have reasonable experience verification requirements.

Best States for MBA Finance Holders

MBA Finance holders should consider states that recognize business degrees with accounting concentrations. If your MBA has limited accounting coursework, states with more flexible subject requirements, like Guam and Alaska, may be more suitable. Montana also evaluates MBA credentials favorably when combined with adequate accounting courses.

Best States for CS and CMA India Holders

CS and CMA India holders should focus on states that evaluate professional qualifications holistically. Alaska and Montana have track records of accepting these credentials. Guam’s flexible evaluation process also makes it a good option. Getting a pre-evaluation from NIES specifically for your credential combination is highly recommended before committing to a state.

Factors to Consider When Selecting Your State Board

Beyond basic eligibility, several practical factors should influence your state selection.

Experience Verification Requirements by State

Different states have different approaches to experience verification. Some require experience under a US CPA specifically, while others accept verification from equivalent professionals or use third-party verification services. NASBA’s Experience Verification Service helps candidates in states that participate in this program.

For Indian candidates working in India, states that accept non-CPA supervisor verification or participate in NASBA’s verification service are more practical. Guam and Montana are known for their flexible verification approaches.

Residency and Citizenship Considerations

Most CPA friendly states for international candidates do not require US residency or citizenship for examination. However, some states require residency for licensure. If you plan to work primarily in India, this may not be a concern. If you plan to eventually work in a specific US state, consider that state’s residency requirements for license holders.

License Mobility and Reciprocity Between States

CPA licenses can often be transferred between states through a process called reciprocity or endorsement. If you obtain your initial license in Guam but later want to practice in California, you may be able to transfer your license. The NASBA website provides information on state-by-state reciprocity agreements. Choosing an initial state with good reciprocity options gives you flexibility for the future.

Credential Evaluation Process for Non-CA Indian Candidates

Your Indian qualifications must be formally evaluated and converted to US credit equivalents before you can apply for the CPA exam. This evaluation is a mandatory step for all international candidates.

Understanding NASBA International Evaluation Services

NASBA International Evaluation Services (NIES) is the primary evaluation agency for CPA candidates. It is the only approved provider for many state boards and is widely recognized across all jurisdictions.

What NIES Evaluates and How the Process Works

NIES evaluates your educational credentials to determine their US equivalency. They assess the institutions you attended, the credentials you earned, and the courses you completed. The evaluation report shows your total credit hours and breaks down credits by subject area (accounting, business, general education).

The NIES evaluation process begins with an online application. You select your destination state and pay the evaluation fee. NIES then contacts your institutions directly to obtain official documents. Once all documents are received, the evaluation typically takes six to eight weeks.

Documents Required for Indian Qualification Evaluation

For Indian university degrees, NIES requires official transcripts (mark sheets) for all years of study, degree certificates, and sometimes course syllabi. Documents must be sent directly from your university to NIES in sealed envelopes. For professional qualifications like CS or CMA India, official certificates and examination records from ICSI or ICMAI are required.

Some universities require you to request transcript dispatch through their examination controller’s office. Start this process early as Indian universities can sometimes be slow in processing such requests.

Timeline and Fees for NIES Evaluation

The standard NIES evaluation fee is $250 for a full international credential evaluation. Additional fees apply for expedited processing or additional jurisdictions. Once NIES receives all required documents, the evaluation is typically completed within six to eight weeks.

Plan for a total of three to four months from starting your document collection to receiving your evaluation report. This timeline accounts for university processing, international document transit, and NIES evaluation time.

Alternative Evaluation Agencies and When to Use Them

While NIES is the most widely accepted, some states also accept evaluations from other approved agencies.

How to Choose the Right Evaluation Agency

Your state board determines which evaluation agencies are accepted. Before paying for an evaluation, check your chosen state’s list of approved agencies. If you are unsure about your state selection, using NIES is the safest choice as it is accepted by the most jurisdictions.

World Education Services (WES) is another reputable agency that some states accept. Foreign Academic Credentials Service (FACS) is a cost-effective option accepted by certain states. Always verify acceptance before using any agency other than NIES.

Preparing Your Documents for Evaluation Success

Proper document preparation prevents delays and ensures a smooth evaluation process.

University Transcript Requirements for Indian Institutions

Your university transcripts must be official documents sent directly from the university to the evaluation agency. Photocopies or documents in your possession are not accepted. Contact your university’s examination section or controller of examinations to request the official transcript dispatch. Provide them with the evaluation agency’s address and any specific instructions.

Some universities charge fees for issuing and dispatching transcripts. Budget INR 2,000 to INR 5,000 for university documentation costs, depending on the number of transcripts needed.

Professional Qualification Certificate Requirements

For CS, CMA India, or CA qualifications, you need official documentation from the respective professional body. ICSI, ICMAI, and ICAI have processes for issuing credential verification letters for international evaluation purposes. Contact these bodies directly to understand their requirements and processing times.

Common Document Issues and How to Resolve Them

Common issues include name mismatches across documents, missing consolidated mark sheets, and delays in university dispatch. Ensure your name appears consistently across all documents. If there are variations, include a notarized affidavit explaining the discrepancy. If your university is slow, persistent follow-up and escalation to senior officials often helps.

Meeting Experience Requirements Without Working Under a CA

The experience requirement is often the most challenging aspect for Indian candidates. Unlike education and examination, experience verification requires practical solutions.

Understanding CPA Experience Verification Challenges

The standard requirement is one to two years of accounting experience verified by an actively licensed US CPA. For Indian professionals working in India, finding a US CPA supervisor is not always straightforward.

Why Experience Verification Is Difficult for Indian Candidates

Most Indian companies do not have US CPAs in supervisory positions. Even in multinational companies, the Indian offices may not have licensed CPAs on staff. This creates a verification gap where you have relevant experience but lack a qualified verifier.

This challenge affects candidates regardless of their educational background. CA, M.Com, MBA, CS, and CMA India holders all face the same verification hurdle if they work in India without US CPA supervision.

States with Flexible Experience Requirements

Some states have more flexible experience policies. Guam allows experience verification through NASBA’s experience verification service. Colorado accepts experience in diverse accounting roles. Alaska and Montana have provisions for alternative verification. Choosing a state with flexible experience policies is essential for Indian candidates working in India.

Practical Solutions for Experience Verification

Several practical solutions exist for the experience verification challenge.

Working at Big Four Firms in India

The Big Four accounting firms (Deloitte, PwC, EY, and KPMG) have US CPAs among their senior staff, including in India offices. If you work at a Big Four firm or can transition to one, you may find a US CPA who can verify your experience. This is one of the most straightforward solutions for experience verification.

Using the NASBA Experience Verification Service

NASBA offers an experience verification service for candidates in participating states. This service helps candidates who do not have direct access to a US CPA supervisor. NASBA evaluates your experience based on documentation and employer verification, then provides the necessary certification to the state board.

States participating in this service include Guam, Montana, and several others. Using this service involves additional fees but provides a legitimate path to a license for candidates working in India.

States That Allow Non-CPA Supervisor Verification

Some states allow experience verification by supervisors who hold equivalent credentials, such as a Canadian CA or Australian CA. Others accept verification by any qualified accounting professional in a supervisory role. Research your chosen state’s specific policies on alternative verifiers.

Strategic Planning for Experience Accumulation

Planning your experience strategically can simplify the verification process.

Building Qualifying Experience Before and During the CPA Exam

You do not need to wait until after passing the exam to accumulate experience. Many candidates work in qualifying roles while preparing for and taking the exam. This parallel approach means your experience requirement may be fulfilled shortly after passing your final exam section.

Focus on roles that clearly fall within accounting, auditing, taxation, or financial reporting. Document your responsibilities and achievements carefully as you will need detailed descriptions for verification.

Experience Categories That Count Toward CPA License

Qualifying experience typically includes public accounting (audit, tax, consulting), corporate accounting, governmental accounting, and academic teaching of accounting subjects. The experience must involve applying accounting principles, preparing financial statements, auditing, tax planning, or similar professional activities.

Experience in tangentially related fields like banking operations or general finance may not qualify unless it specifically involves accounting functions. When in doubt, check your state board’s experience guidelines or consult with a CPA advisor.

Cost and Timeline Comparison Across All Non-CA Pathways

Understanding the financial and time investment helps you plan realistically. Different pathways have different costs and timeline profiles.

Total Investment Breakdown by Qualification Pathway

The total cost of becoming a CPA includes evaluation fees, exam fees, review course costs, license application fees, and any additional education expenses.

Cost Analysis for M.Com Plus CPA Route

M.Com holders who already have 150 credits face the lowest additional investment. Your primary costs are credential evaluation (approximately INR 20,000), exam fees for all sections (approximately INR 1,20,000), CPA review course (INR 80,000 to INR 1,50,000), and license application (approximately INR 15,000). Total investment ranges from INR 2.5 to 4 lakhs.

Cost Analysis for MBA Plus CPA Route

MBA holders face similar costs to M.Com holders if they already have 150 credits with adequate accounting coursework. If additional accounting courses are needed, add INR 30,000 to INR 60,000 for supplementary coursework. Total investment ranges from INR 3 to 4.5 lakhs.

Cost Analysis for Bridge Course Plus CPA Route

B.Com holders requiring bridge courses face a higher total investment. Bridge course costs (INR 35,000 to INR 80,000) add to the standard CPA costs. Total investment ranges from INR 3.5 to 5 lakhs, depending on the bridge course provider and review course chosen.

Realistic Timeline Expectations for Each Pathway

Your timeline depends on your starting point and how quickly you can complete each phase.

Timeline for Already Qualified Professionals

If you already meet the 120 or 150 credit requirement, you can potentially complete the entire journey in 12 to 18 months. This includes evaluation (2-3 months), exam preparation and completion (9-12 months), and license application (1-2 months). Aggressive timelines of 9 to 12 months are possible for highly motivated candidates.

Timeline for Those Needing Additional Education

If you need bridge courses or additional credentials, add 6 to 12 months to the timeline. A B.Com holder starting from scratch might take 18 to 24 months to become fully licensed. This includes bridge course completion, evaluation, exam preparation and completion, and experience accumulation.

Factors That Can Speed Up or Delay Your Journey

Several factors impact your timeline. Document procurement delays from universities can add months. Choosing a state with faster processing helps. Your study commitment directly affects exam completion speed. Work schedule constraints may require a longer preparation period. Having a clear plan and staying organized throughout the process prevents unnecessary delays.

Conclusion

Becoming a US CPA without a CA qualification is not just possible but a well-established path that thousands of Indian professionals have successfully navigated. Whether you hold an M.Com, an MBA in Finance, a Company Secretary credential, a CMA India qualification, or even just a B.Com with the willingness to complete bridge courses, there is a clear pathway waiting for you.

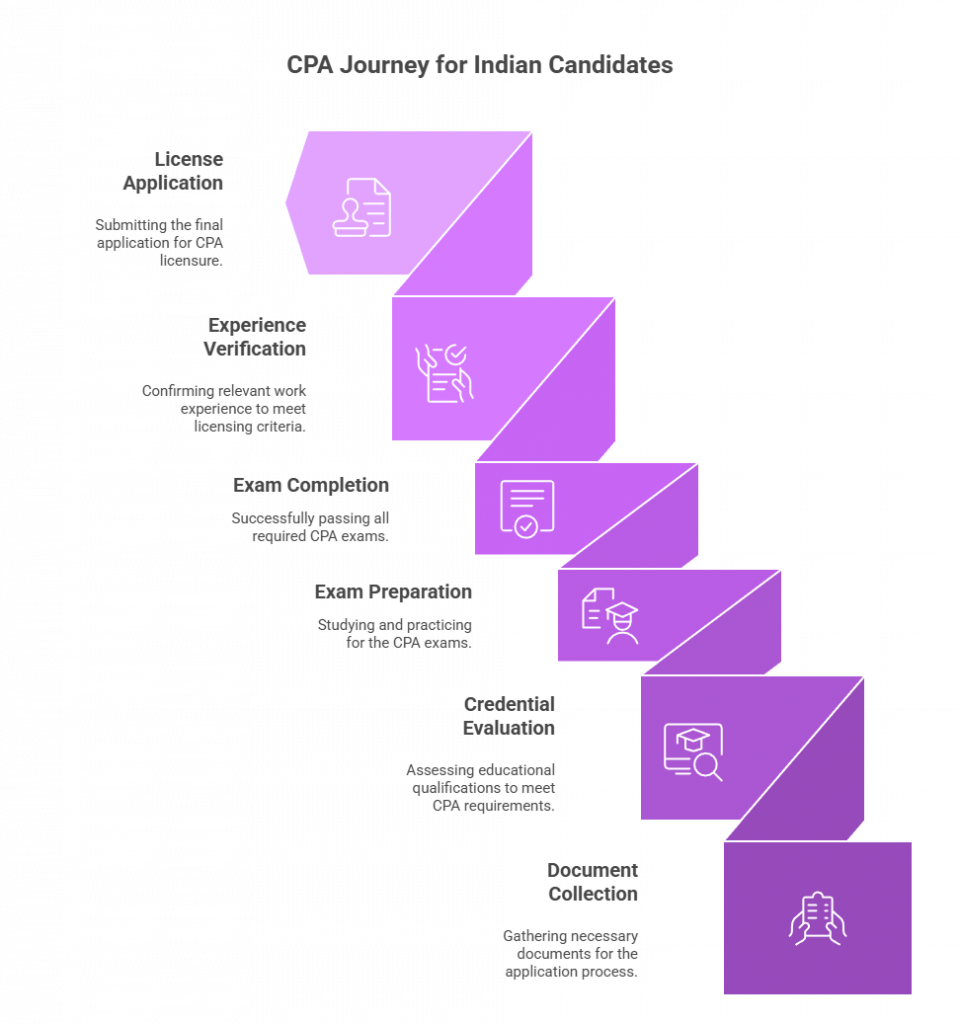

The key steps in your journey are straightforward. First, assess your current qualification and calculate your credit hours. Second, identify any credit gaps and determine whether you need bridge courses or additional education. Third, select the right US state board based on your credential profile and experience verification situation. Fourth, complete the credential evaluation through NIES or another approved agency. Finally, prepare for and pass the four sections of the CPA exam, accumulate your required experience, and apply for your license.

Your investment of time and money in CPA certification will pay dividends throughout your career. The credential opens doors to multinational companies, global accounting roles, and significantly higher earning potential. Start by getting your credentials evaluated today. The sooner you begin, the sooner you will join the growing community of Indian professionals who proudly hold the US CPA designation.

Frequently Asked Questions

Can I pursue CPA with only a B.Com degree from India?

A standalone three-year B.Com provides only 90 credit hours against the 120 needed for exam eligibility. You will need to complete a bridge course or additional qualification to make up the shortfall. Many B.Com holders complete 30 to 40 credit bridge courses to become exam-eligible.

Is M.Com better than MBA for CPA eligibility?

Both M.Com and MBA provide approximately 60 credit hours when combined with B.Com. M.Com typically has more accounting-focused coursework, which aligns better with CPA subject requirements. However, an MBA provides broader career benefits beyond a CPA. Choose based on your overall career goals rather than just CPA eligibility.

How many credits does a CS qualification provide for CPA?

The Company Secretary qualification from ICSI is typically evaluated as equivalent to 60 credit hours. Combined with a three-year B.Com, this provides 150 credits. However, you may need additional accounting coursework as the CS curriculum is heavier on corporate law than financial accounting.

Can CMA India holders directly apply for the CPA exam?

Yes, CMA India holders can apply for the CPA exam. The qualification provides approximately 60 credit hours. Combined with a B.Com, this reaches 150 credits. You will need to go through the credential evaluation process and select a state that accepts your credential combination.

Which US state is easiest for Indian candidates without CA?

Guam, Alaska, and Montana are generally considered the most accessible states for Indian candidates without CA. These states accept diverse international credentials, do not require an SSN for examination, and have flexible experience verification options.

Do I need to be a member of ICAI to pursue a CPA?

No, ICAI membership (for Chartered Accountants) is not required for CPA eligibility. CPA eligibility is based on your educational credentials and credit hours, not on Indian professional body memberships. M.Com, MBA, CS, and CMA India holders are equally eligible without any ICAI affiliation.

How long does the credential evaluation process take?

The NIES credential evaluation typically takes six to eight weeks after all documents are received. However, collecting and dispatching documents from Indian universities can take an additional four to eight weeks. Plan for a total of three to four months from start to finish.

Can distance learning degrees qualify for CPA eligibility?

Yes, distance learning degrees from UGC recognized universities are generally accepted for CPA evaluation. The degree must be from an accredited institution with proper recognition. Degrees from unrecognized or non accredited institutions may face challenges during evaluation.

What happens if my evaluation shows I am short on credits?

If your evaluation shows a credit shortfall, you have options. You can complete bridge courses to add the necessary credits. Alternatively, you can pursue additional recognized education. Some candidates complete individual accounting courses from accredited universities to fill specific gaps.

Can I work in India with a US CPA license?

Absolutely. The US CPA credential is highly valued by multinational companies operating in India, Big Four firms, and Indian companies with US business interests. Many CPAs work in India in senior finance, audit, and consulting roles, often commanding salary premiums of 30 to 50 percent over non CPA peers.

Is CPA recognition valid in India for career growth?

Yes, CPA is widely recognized and respected in India, particularly in the corporate sector. Companies following US GAAP, those listed on US stock exchanges, and multinationals with US parent companies specifically seek CPA qualified professionals. The credential demonstrates expertise in international accounting standards.

How do I verify my experience without a CPA supervisor?

Several solutions exist. You can work at Big Four firms where US CPAs are available. You can use NASBA’s experience verification service if your state participates. Some states accept verification from equivalent credential holders or general supervisors. Choosing a state with flexible verification policies is essential.

What is the pass rate for Indian candidates in the CPA exam?

The CPA exam has an overall pass rate of approximately 50 percent across all candidates globally. Indian candidates who prepare thoroughly with quality review courses typically perform at or above this average. Section-wise pass rates vary, with the FAR generally considered the most challenging section.

Can I take the CPA exam in India without traveling to the US?

Yes, you can take the CPA exam at Prometric testing centers located in eight Indian cities: Mumbai, Delhi, Bangalore, Chennai, Hyderabad, Kolkata, Ahmedabad, and Trivandrum. You do not need to travel to the US for the examination. However, note that candidates testing at international locations must complete experience requirements within three years of passing.

Allow notifications

Allow notifications