Complete guide to choosing the best US State for CPA exam registration from India. Compare Washington, Alaska, Guam, Illinois requirements, costs in INR, and decision framework for Indian B.Com, M.Com, and CA candidates.

Table of Contents

Here’s the thing about pursuing the US CPA from India. Chances are you’ll face a decision that can make or break your entire journey before you even start studying.

With 55 different US jurisdictions to choose from, each with its own set of rules around education requirements, SSN policies, and experience verification, picking the wrong state could mean rejected applications, wasted fees, or worse, passing all four exam sections only to discover you cannot get licensed.

For Indian candidates specifically, this challenge is amplified because most state requirements were designed with American students in mind, not professionals with B.Com degrees, CA qualifications, or work experience verified by Indian employers.

Most online guides treat all international candidates the same way, offering generic advice about “flexible states” without explaining how a 3-year B.Com degree translates to US credit hours, whether your CA qualification gives you any advantage, or which states will actually accept work experience signed off by your manager in Mumbai.

This gap in India-specific guidance leads thousands of Indian candidates to make uninformed decisions every year. Some choose states that have quietly changed their rules, while others pick jurisdictions where they will never meet the experience requirements, regardless of how many exams they pass.

This guide changes that by providing you with everything you need to make a confident, informed state selection decision.

We will walk through exactly how Indian qualifications convert to US credits, which states genuinely welcome Indian candidates, how much the entire process costs in Indian Rupees, and a practical decision framework based on your specific situation. Whether you have just a B.Com, hold the CA designation, or fall somewhere in between, you will find clear guidance tailored to your circumstances.

Why is choosing the right US CPA state important for Indian candidates?

Selecting your CPA state is not just an administrative formality. It is a strategic decision that affects your eligibility to sit for the exam, your ability to get licensed after passing, and even the total cost of your CPA journey. Unlike the uniform CPA exam itself, which is identical across all jurisdictions, state requirements vary dramatically in ways that specifically impact Indian candidates.

If you’re still building your foundation on how the exam works overall, you can read our detailed overview here: Certified Public Accountant Exam in US

What unique challenges do Indian CPA aspirants face?

SSN limitations

Most US states require a Social Security Number (SSN) at some point in the CPA process. Since Indian candidates typically do not have an SSN unless they have worked in the US on a valid visa, this single requirement eliminates many states from consideration. Some states require SSN just to sit for the exam, others need it only for licensure, and a few offer waivers or alternatives. Understanding this distinction early saves you from applying to a state where you will hit a wall before even scheduling your first exam.

Credit hour calculation differences

The US education system measures academic progress in credit hours, typically requiring 120 credits for exam eligibility and 150 credits for licensure. Indian degrees operate on a completely different system. A 3-year B.Com might yield around 90 semester credits when evaluated, while an M.Com adds another 30 credits. The problem is that different evaluation agencies and state boards interpret these conversions differently, meaning your qualification might meet requirements in one state but fall short in another.

International work experience verification

Even after passing all four CPA exam sections, you need verified work experience to obtain your license. Most states require this experience to be supervised and verified by an active US CPA. For Indian candidates working in India, finding a US CPA to verify your experience becomes a significant hurdle. Some states offer flexibility by accepting verification from non-CPA supervisors or recognizing international experience more broadly, making them far more practical choices for Indian professionals.

How the Wrong State Choice Can Derail Your CPA Journey

Selecting a CPA jurisdiction without matching its education and experience requirements can lead to avoidable delays and financial loss. Each state has its own rules: some allow candidates to sit for the exam with around 120 credit hours, while others require more extensive coursework before or during the licensure process.

If your international credential evaluation does not meet the minimum threshold of the state you applied to, your application may be denied — and because exam and application fees are generally non-refundable, that money is usually lost.

The problem does not end there. Many candidates pass all four CPA exam sections through one state, only to realise later that they cannot meet that state’s experience or licensure conditions. Moving to another jurisdiction is possible, but it involves extra steps and costs. NASBA charges for services such as transferring CPA exam scores and re-evaluating education for a different jurisdiction, because each state applies its own criteria. In some cases, candidates also discover that the second state has requirements they had not previously accounted for, causing further delays.

For international candidates — including those from India — the financial impact adds up quickly. Between credential evaluation fees, state application fees, and exam section fees, it is common to spend a substantial amount before even beginning the licensing stage. Since many of these payments are non-refundable, choosing a jurisdiction that you are not truly eligible for often means losing both money and time.

Taking the time upfront to understand state-specific requirements helps prevent these setbacks and ensures that the jurisdiction you choose aligns with your education, experience, and long-term licensure goals.

Which state-level policies make some US jurisdictions more welcoming to Indian candidates?

Several U.S. jurisdictions are considered more accessible for international candidates because their rules reduce common barriers faced by applicants educated outside the United States.

These jurisdictions often share certain features: they may not require a Social Security Number (or may waive it) at the exam stage; they allow candidates to sit for the exam with 120 credit hours even though 150 hours are required for licensure; they accept foreign-credential evaluations from agencies such as NASBA International Evaluation Services (NIES) or World Education Services (WES); and some offer flexibility in experience verification by allowing it to be completed by a CPA who is not a direct U.S.-based supervisor.

States and territories such as Guam, Alaska, Montana, and Washington are frequently recommended because they address several of these factors, though not all of them share every feature in the same way.

For example,

- Guam generally permits sitting with 120 credits and does not require an SSN to sit;

- Alaska allows early exam eligibility and uses NIES for evaluations;

- Montana recognises NIES and often waives SSN requirements at the exam stage; and

- Washington is known for flexible experience verification and NIES recognition, it typically requires 120 credits to sit for the exam.

Because each jurisdiction’s rules differ in important details, popularity alone should not drive your choice. The right state depends on your specific academic background, whether B.Com, M.Com, Chartered Accountancy, or a combination, along with your experience profile and long-term licensing goals. A jurisdiction that works well for one candidate may not be the most efficient or realistic pathway for another.

What CPA exam and licensure requirements do US states follow?

Before diving into specific state recommendations, you need to understand the framework that governs CPA requirements across all jurisdictions. This foundation helps you evaluate any state’s requirements against your own qualifications.

What are the “Three Es” every CPA candidate must meet?

Every US state structures its CPA requirements around three fundamental elements:

- Education,

- Examination, and

- Experience.

Education requirements typically mandate a bachelor’s degree with specific accounting and business coursework, measured in semester credit hours.

The examination requirement is straightforward, as all candidates must pass the four-section Uniform CPA Exam with a minimum score of 75 on each section.

Experience requirements specify how much supervised work in accounting-related roles you need before receiving your license.

While these three Es apply universally, states implement them with significant variation. Some states add a fourth E for Ethics, requiring candidates to pass the AICPA Ethics Exam before licensure. Others have specific coursework mandates, like requiring a dedicated US taxation course or a research methods class. Understanding your target state’s specific implementation of these requirements is essential before committing to that jurisdiction.

How do exam eligibility rules differ from licensure requirements?

This distinction trips up many Indian candidates. Exam eligibility refers to the minimum requirements to sit for the CPA exam, while licensure requirements are what you need to actually receive your CPA license after passing.

Most states allow candidates to sit for the exam with 120 credit hours but require 150 credit hours for licensure. This means you can start taking exam sections while still accumulating additional credits.

For Indian candidates, this two-tier approach offers strategic flexibility. If your current qualifications yield approximately 120 credits after evaluation, you can begin the exam process immediately while completing additional coursework to reach 150 credits. However, you must verify that your chosen state actually operates this way. A handful of states, including Kansas, Louisiana, and Rhode Island, require the full 150 credits before you can even schedule your first exam section.

How do one-tier and two-tier CPA states work for Indian candidates?

In one-tier states, passing the CPA exam and meeting all requirements results in both your CPA certificate and your license to practice being issued simultaneously. Two-tier states separate these credentials, first issuing a CPA certificate upon passing the exam and meeting education requirements, then requiring additional experience for the practice license. Two-tier states include Alabama, Connecticut, Hawaii, Illinois, Kansas, Nebraska, and Oklahoma.

For international candidates, two-tier states sometimes offer advantages. In Guam, for example, you can obtain an “inactive” CPA certificate after passing the exam and meeting education requirements, even without fulfilling the experience requirement. This inactive status acknowledges your exam success while you work toward completing experience requirements. Understanding whether your target state operates on a one-tier or two-tier system helps you plan realistic timelines for your CPA journey.

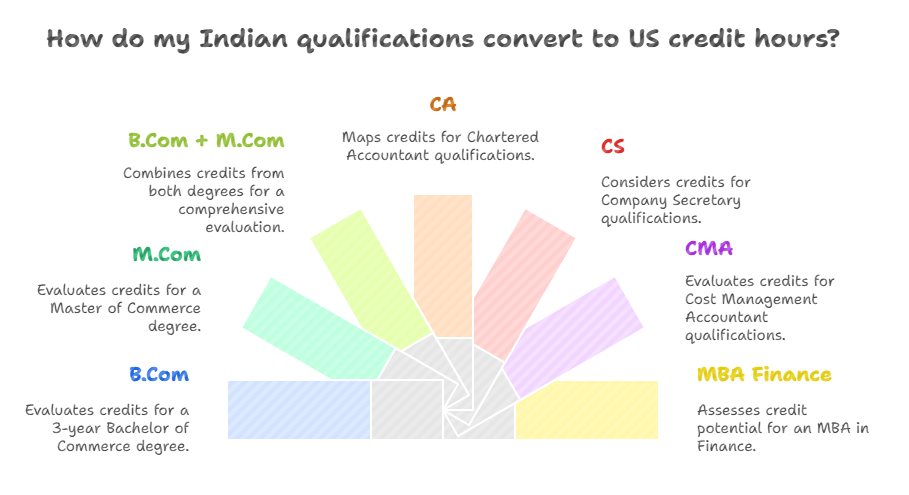

How Do Indian Qualifications Convert to US Credit Hours?

The credit hour conversion is where many Indian candidates feel most uncertain. Your entire eligibility hinges on how many US semester credits your Indian education translates to, yet this conversion involves judgment calls by evaluation agencies that can vary from case to case.

How are common Indian university degrees evaluated?

B.Com (3-year) Degree

A typical 3-year Bachelor of Commerce from India is generally evaluated as less than a U.S. four-year bachelor’s degree. Evaluation agencies such as NIES and WES review each program individually, taking into account contact hours, course content, accreditation status, and institutional reputation. Because of these variations, the exact U.S. semester-credit equivalency differs from candidate to candidate.

Most international advisors note that a standalone B.Com rarely meets the 120-credit threshold to sit for the CPA Exam and falls short of the 150-credit requirement for licensure.

If you’re a B.Com graduate trying to understand whether you meet the 120-credit requirement, this guide breaks it down clearly: CPA Exam Eligibility for Indian B.Com Graduates

M.Com (2-year) Degree

A Master of Commerce is often evaluated as comparable to a U.S. master’s degree. The number of U.S. semester credits awarded depends on program structure, level of specialization, and whether the coursework builds meaningfully on the undergraduate program. Programs with substantial, non-duplicative advanced coursework typically receive higher credit equivalency.

B.Com + M.Com Combination

When evaluated together, a B.Com followed by an M.Com frequently satisfies both the 120-credit exam requirement and the 150-credit licensure requirement in several jurisdictions, though outcomes vary based on the evaluator’s methodology and the specific programs completed. Candidates whose combined credit total falls short can usually bridge the gap through additional accredited coursework or online programs accepted by their chosen state board.

How do CA, CS, CMA, and MBA qualifications count toward credit hours?

CA (Chartered Accountant – ICAI)

The Chartered Accountant qualification represents rigorous professional training, but U.S. evaluation agencies do not award a fixed number of academic credits for the CA designation by itself. Instead, NIES, WES, and other evaluators review the underlying coursework, articleship documentation, and examination structure to determine whether portions of the program are equivalent to U.S. collegiate study.

Earlier state policies that directly recognized foreign professional designations have been discontinued, so CA holders are now evaluated only through the standard credential-evaluation process. In practice, a CA may contribute additional academic credits beyond a candidate’s bachelor’s degree—but the amount varies widely based on documentation and is not guaranteed.

CS (Company Secretary – ICSI)

The Company Secretary program is heavily oriented toward corporate law, governance, and compliance. U.S. evaluators typically recognize these subjects as business-related coursework rather than accounting coursework. As a result, the CS qualification can sometimes increase a candidate’s total semester-credit count, but it rarely satisfies the accounting-specific requirements imposed by most state boards. Candidates combining a B.Com and CS usually still need further accounting coursework to meet U.S. CPA academic rules.

CMA (Cost Management Accountant – ICMAI)

The CMA qualification includes advanced study in cost accounting, management accounting, and financial management. Because these areas overlap more closely with U.S. accounting curricula, evaluators may award graduate-level or upper-division accounting or business credits when sufficient documentation is provided. However, as with CA and CS, there is no standard number of credits associated with CMA. Each evaluation is conducted case-by-case, and credit recognition depends on the quality of transcripts, course descriptions, and program structure.

MBA (Finance or Related Specializations)

A U.S. equivalent MBA generally contributes a substantial number of graduate-level semester credits, but the exact amount depends on the length, rigor, and structure of the program. MBAs with significant coursework in financial accounting, auditing, taxation, or related subjects may help satisfy accounting-hour requirements. However, many MBA programs emphasize general management or finance without deep accounting content. An MBA alone—particularly when built on a non-accounting undergraduate degree—often does not meet the accounting-specific requirements set by many state boards, even though it may satisfy part of the total credit requirement.

Do NAAC ratings and first-division scores improve your credit evaluation?

University accreditation and academic performance can influence your evaluation, though not always in predictable ways. Degrees from NAAC A+ accredited institutions are generally viewed more favorably by evaluation agencies. Some evaluators use institutional reputation as a factor when interpreting coursework depth. However, there is no guaranteed “bonus” for attending a highly-rated institution.

First-division marks (60% or above) and distinction-level performance demonstrate academic rigor but do not directly translate to additional credit hours. What matters more is the breadth and depth of your coursework. A candidate with 55% marks but more accounting courses might receive more favorable credit evaluation than a first-division student with fewer relevant courses. Focus on documenting all relevant coursework comprehensively rather than assuming your percentage will speak for itself.

What factors should Indian candidates use to select the right CPA state?

State selection requires balancing multiple factors against your specific situation. No single state is universally “best” because candidate circumstances vary so dramatically. However, understanding the key decision variables helps you narrow your options systematically.

The most critical factor for most Indian candidates is SSN policy.

If you do not have an SSN and cannot obtain one, your choices immediately narrow to states that offer SSN waivers or do not require SSN at any stage.

Alaska, Montana, and Guam all accommodate candidates without SSN, though their specific policies differ. States like Virginia and California allow exam-sitting without SSN but require it for licensure, creating a pathway only if you expect to obtain SSN before licensing.

Washington allows candidates to sit for the CPA Exam without an SSN, but it requires a valid SSN for licensure. The state does not grant broad SSN waivers under its statute. Therefore, Washington is not a viable option for candidates who do not have an SSN and cannot obtain one. Only candidates who already possess an SSN should consider Washington.

Credit hour requirements form your second major filter. If your evaluated credentials yield approximately 120 credits, you need states that allow exam-sitting at that threshold.

If you fall below 120 credits, Alaska stands out for allowing candidates who are within 18 semester hours of completing their bachelor’s degree to begin the exam process. Experience verification policies matter most for your long-term licensing pathway.

Washington requires CPA experience to be verified by a U.S.-licensed CPA who has held an active license for at least five years. Virginia and Illinois also require experience verification by an active CPA from any U.S. jurisdiction, so they do not allow verification by non-CPA supervisors. While the specific conditions differ across states, all three require CPA-level verification rather than broader supervisory approval.

Complete Analysis of Best States for Indian CPA Candidates

Now let us examine specific states that work well for Indian candidates. We will cover their requirements in detail, highlight advantages and limitations, and help you understand which situations each state suits best.

Top Tier States (Highly Recommended for Indians)

Alaska

Alaska is frequently considered by international CPA candidates because of its comparatively flexible exam-eligibility rules and its openness to foreign applicants. The Alaska Board of Public Accountancy allows candidates to sit for the CPA Exam if they have completed a bachelor’s degree or are close to completing it, provided they meet the state’s minimum required accounting and business coursework. The exact number of remaining credits permitted depends on how the candidate’s education is evaluated; therefore, eligibility may vary after credential evaluation.

Alaska does not require U.S. citizenship or state residency to apply. It also accepts foreign education evaluations through approved agencies such as NIES. Licensure requires 150 semester hours of education and one year of qualifying experience verified by a licensed CPA. Alaska’s rules describe acceptable experience broadly, but experience must still fall within the Board’s defined accounting-related categories.

Education evaluation and exam fees follow NASBA’s standard schedules (e.g., approximately $121 for evaluation and $262.64 per exam section), though fees are subject to periodic updates.

Guam

Guam is widely known for being accessible to international CPA candidates, but several commonly repeated claims about its licensing pathways must be clarified.

Guam requires 120 semester hours and specified accounting coursework to sit for the CPA Exam. Foreign education must be evaluated by an approved credential-evaluation agency. Guam participates in NASBA’s international testing program, allowing candidates to sit for the exam at authorized locations outside the U.S.

For licensure, Guam requires 150 semester hours and one year of supervised experience verified by a licensed CPA.

Guam offers both active and inactive CPA license statuses. Under Guam’s regulations (§2102(f)), an ‘inactive license’ may be issued to an applicant who has completed the education and examination requirements but has not yet completed the experience requirement. An inactive licensee may not practice public accountancy and must use the title ‘CPA (Inactive).’ To convert to an active license, one year of CPA-supervised experience is required under §2105(b). Guam does not issue a separate exam-only certificate, but its inactive license functions as the experience-pending pathway for exam passers.

Exam and application fees follow NASBA and Board schedules and may change over time.

Montana

The Montana Board of Public Accountants switched to a one-tier system in 2015, eliminating the previous certificate-only option. Current requirements include 120 credit hours for sitting the exams and 150 for licensure, one year of experience verified by a licensed CPA, and an ethics exam.

Montana remains a suitable option for candidates whose foreign credentials already meet the 120-semester-hour requirement. Since adopting a one-tier system in 2015, Montana issues CPA licenses only — no exam-only certificates.

To sit for the CPA Exam and to obtain licensure, Montana requires:

- 120 semester hours of education

- One year of supervised experience verified by a licensed CPA

- Successful completion of the ethics requirement

Montana does not publish citizenship or residency restrictions for exam applicants. For Indian candidates whose B.Com + M.Com combination evaluates to 150 credits, Montana provides a straightforward path to both exam eligibility and licensure. Candidates evaluated below 120 credits must complete additional coursework before applying.

Strong Alternative States

Illinois

Illinois is a strong option for candidates whose foreign credentials meet the state’s academic requirements, but several common misconceptions must be clarified. Illinois requires 150 semester hours for licensure and collects an SSN as part of the licensing process; candidates without an SSN must complete the Board’s SSN Affidavit, which is permitted but not the same as an SSN waiver.

For experience, Illinois requires verification by a licensed CPA, not by a non-CPA supervisor.

The Illinois Board of Examiners also requires 3 semester hours in accounting research and analysis, a requirement that often necessitates one additional course for international candidates. While processing times may be longer than in some jurisdictions, Illinois offers a clear pathway for those who can meet its education and CPA-verified experience requirements.

New York

New York is one of the most widely recognized CPA jurisdictions worldwide, particularly for candidates seeking mobility in multinational firms. New York requires 150 semester hours, including 33 hours in accounting across required subject areas such as auditing, taxation, cost accounting, and financial accounting.

The New York State Education Department (NYSED) conducts its own foreign-credential evaluation and does not rely on external evaluators such as NIES as the final authority, which can add time and complexity to the process.

Experience may be gained in public accounting, industry, or government, but must ultimately be verified by a licensed CPA.

SSN requirements follow standard New York licensing laws, though accommodations exist for individuals legally unable to obtain one. For candidates prioritizing global brand recognition and long-term mobility, New York remains a prestigious and reliable option.

Virginia

The Virginia Board of Accountancy allows candidates to sit for the CPA Exam with 120 semester hours and the required distribution of accounting and business coursework.

Foreign candidates whose degrees are evaluated as equivalent to a U.S. bachelor’s degree such as certain B.Com + CA combinations may qualify for exam eligibility. However, Virginia requires a U.S. Social Security Number for both exam application and licensure, which means candidates without an SSN cannot proceed.

Licensure requires one year of supervised experience, verified by an active CPA; verification by non-CPA supervisors is not permitted under current rules. For candidates who already possess an SSN through U.S. work authorization, Virginia offers a straightforward and well-defined pathway, but it is not a viable option for most Indian candidates without U.S. employment-based credentials.

States That No Longer Work for Indian Candidates

Delaware (Rule Changes)

Delaware was once considered a flexible jurisdiction for international CPA candidates, but the basis for that perception has largely disappeared. Effective 1 August 2012, Delaware amended its regulations so that all CPA exam candidates must hold a baccalaureate (bachelor’s) degree and meet the standard 120-credit hour requirement with an accounting concentration. A total of 150 hours is still required for licensure. This means candidates can no longer sit with sub-bachelor qualifications, and older advice suggesting that Delaware is suitable for those with only a 3-year degree is now outdated.

Delaware does not require residency or in-state employment to sit for the CPA exam or to obtain a license. Official regulations and current requirement summaries make clear that there is no residency, citizenship, or Delaware-based work requirement, and experience may be gained anywhere so long as it is supervised by a CPA licensed in a U.S. jurisdiction.

Michigan (CA Recognition Removed)

Michigan does not offer any special recognition for foreign professional qualifications such as the Indian Chartered Accountant (CA) designation.

All international candidates, including CAs, must meet the same educational requirements as any other candidate and must undergo a standard foreign credential evaluation to determine degree equivalency and credit hours.

While older online discussions suggested Michigan was once more open to CA holders, there is no official rule or historical policy confirming an automatic pathway or exemption for ICAI members. Today, Michigan’s requirements align with the national norm: 150 semester hours for licensure, completion of required accounting and business coursework, and one year of CPA-verified experience.

As a result, Michigan no longer offers any unique advantage to Indian candidates.

New Hampshire (2014 Restrictions)

New Hampshire previously offered greater flexibility, but regulatory changes effective July 1, 2014 made the state significantly more stringent.

Under current rules, New Hampshire requires:

- 150 semester hours for licensure

- 30 semester hours in accounting

- 24 semester hours in business subjects

The older policy that allowed exam candidates to sit with 120 hours and only 12 accounting credits — which indirectly benefited some Indian B.Com + CA candidates — has been eliminated.

New Hampshire does not recognize foreign professional certifications (including CA from India) as substitutes for academic coursework, and all international degrees must undergo formal evaluation.

These changes mean that candidates whose education does not already meet the 150-hour and subject-area requirements must complete additional coursework before applying.

Complete Cost Breakdown in Indian Rupees (INR)

Understanding the full cost of your CPA journey helps you budget realistically and avoid surprises. Costs vary by state and change periodically, so these figures represent current estimates using an exchange rate of approximately ₹83-84 per USD.

State-by-State Fee Comparison

Application Fees

State board application fees vary widely across jurisdictions. Most states fall in the US $90–$200 range, though some may be slightly lower or higher. For example, Montana’s CPA Examination Services (CPAES) application typically ranges from US $96.00, while Texas charges US $20 for the Notice of Intent plus a separate exam application fee. Washington uses NASBA’s evaluation and processing system but does not charge a $90 application fee as sometimes assumed.

In INR terms, state application fees generally fall between ₹8,000 and ₹18,000. Because these fees are normally non-refundable, candidates should apply only after confirming eligibility.

Evaluation Fees (WES vs NIES)

International credential evaluation is billed separately from state application fees.

- NASBA NIES charges US $250 (≈ ₹22,500) for a full international credential evaluation.

- WES charges around US $305 (≈ ₹27,500) for its CPA-specific evaluation package.

Some states accept only NIES, while others allow either NIES or WES. Always confirm which evaluation agency your chosen board recognizes before paying.

Exam Fees (All Four Sections)

NASBA’s current exam fee structure places each CPA exam section at US $344.80 (≈ ₹31,000).

The total for all four sections comes to approximately:

- US $1,379.20 (≈ ₹1,24,000) assuming all sections are passed on the first attempt.

International Testing Surcharge

NASBA has discontinued the international testing surcharge under its global administration model. Candidates testing at Prometric centers in India (Delhi, Mumbai, Bangalore, Hyderabad, etc.) now pay the same exam fee as U.S. candidates, i.e., US $344.80 per section, with no additional surcharge. Total four-section cost remains approximately ₹1,24,000 when testing in India.

Licensing Fees

State license application fees typically range from US $100–$300 (≈ ₹9,000–₹27,000). Costs vary by jurisdiction:

- New York charges US $292 for initial licensure.

- California charges approximately US $250 for the initial application, with fingerprinting fees charged separately by the vendor.

- Washington’s initial licensing fee is approximately US $330, not US $100.

Annual or biennial renewal fees for individual CPAs generally fall between US $60–$200, though some states (such as California) charge higher biennial renewal amounts.

Total Cost Estimates for Top States

Alaska: Total Estimated Cost

Alaska’s total expense structure is straightforward and fully transparent. The main costs include:

- NIES evaluation: $250

- Exam application (CPAES): $115

- Four CPA exam sections (standard global rate): $1,379.20

- Initial CPA license fee: $200

Correct Total: $1,944.20

Approx. INR (~₹90/USD): ₹1,75,000

Alaska no longer has a separate “certificate fee,” and NASBA does not charge any international exam surcharge for India. This makes Alaska relatively cost-efficient despite requiring careful educational qualification review.

Guam: Total Estimated Cost

Guam’s total cost remains competitive for international candidates. The key components are:

- NIES evaluation: $250

- Exam application (CPAES): ~$90–$150 (mid-range used: $120)

- Four CPA exam sections: $1,379.20

- License application: $250

Correct Total: ~$1,999.20

Approx. INR (~₹90/USD): ₹1,80,000

Guam does not impose a separate “administration surcharge,” and exam fees in India follow the standard NASBA rate.

Montana: Total Estimated Cost

Montana offers a clean, traditional licensure pathway but requires full 120 semester hours before sitting for the exam. The total cost includes:

- NIES evaluation: $250

- Exam application (CPAES): ~$120–$150 (mid-range used: $135)

- Four CPA exam sections: $1,379.20

- Initial license fee: $150

Correct Total: $1,914.20

Approx. INR (~₹90/USD): ₹1,72,000

Montana’s costs are stable and predictable, though the 120-credit rule means many Indian candidates need additional coursework before applying.

Hidden Costs Indian Candidates Should Budget For

Additional Credit Courses if Needed

If your evaluation falls short of required credit hours, online courses from accredited institutions can fill gaps. Programs like those offered through UWorld or university extension programs charge $200 to $500 per course. Budget ₹15,000 to ₹40,000 if you need 2-3 additional courses, which is common for B.Com-only candidates.

Document Attestation and Courier

Getting transcripts sent directly from Indian universities to evaluation agencies involves attestation fees, courier charges, and sometimes notarization costs. Budget ₹5,000 to ₹15,000 for document preparation and international courier services. Universities sometimes charge additional fees for sealed transcript processing.

Ethics Exam Fees

Most states require passing the AICPA Professional Ethics Exam after completing your CPA exam sections. The self-study course and exam cost approximately $190 (₹16,000). While this is a small portion of total costs, forgetting to budget for it creates an unexpected expense at the final stage of your licensing journey.

State Selection Decision Framework for Indian Candidates

With all the information covered above, let us consolidate it into a practical decision framework you can apply to your specific situation.

Decision Tree Based on Your Qualification

If you hold only a B.Com (3-year), your evaluated credits will likely fall between 90 and 110 semester hours. This makes Alaska your strongest option because it allows exam-sitting when you are within 18 hours of degree completion. You will need to complete additional coursework regardless of which state you choose, so Alaska lets you start the exam process sooner. Washington and Illinois work if you complete bridge courses to reach 150 credits before applying.

If you have B.Com plus M.Com, your combined credentials typically yield 120 to 150 credits. This opens most international-friendly states. Washington, Illinois, and Montana all become viable options. Your choice then depends on secondary factors like experience verification preferences and cost sensitivity. If your evaluation reaches 150 credits, you have maximum flexibility across all these states.

Decision Tree Based on Your Situation

If you do not have an SSN and cannot obtain one in the foreseeable future, your viable options narrow to Alaska, Guam, Montana, and Illinois. Washington is not suitable because it requires an SSN for licensure. If you work in India and will need experience verified by a non-CPA supervisor, Illinois stands out because it does not require CPA verification.

If you have access to SSN through a US work visa or other means, Virginia becomes an excellent option due to its 120-credit exam threshold and flexible experience requirements. California also opens up, though it requires SSN for licensure specifically. Having SSN significantly expands your state choices, so factor this into your decision if your immigration status might change.

Quick Recommendation Matrix

For B.Com graduates working in India without SSN, Alaska or Illinois provide the best starting points. Alaska’s credit flexibility helps if you fall short of 120 credits, while Illinois’s experience verification flexibility helps when you reach the licensing stage. For B.Com plus M.Com holders without SSN, Illinois or Alaska provide the most balanced combination of reasonable requirements and processing efficiency.

For Chartered Accountants, the CA designation adds value to your credential evaluation but does not provide automatic recognition anywhere since Colorado and Michigan changed their policies. Evaluate your CA as an addition to your undergraduate degree and choose states accordingly. If your combined B.Com plus CA evaluation reaches 150 credits with strong accounting course distribution, Washington and Illinois are optimal choices.

Conclusion

Selecting the right US state for your CPA exam registration is one of the most consequential decisions in your entire CPA journey. For Indian candidates, this choice determines not just where you take your exams, but whether you can realistically complete the licensing process given your specific qualifications, SSN status, and work experience situation.

The states we have covered, particularly Washington, Alaska, Guam, Illinois, and Montana, have established themselves as viable options for Indian candidates because they address the unique challenges international professionals face. Washington offers balanced requirements with efficient processing.

Alaska provides flexibility for candidates with fewer credits. Guam offers an inactive license pathway when experience verification seems impossible. Illinois accommodates candidates whose supervisors are not US CPAs. Montana provides a straightforward pathway for those meeting the 120-credit threshold.

Your optimal choice depends on matching these state characteristics to your personal situation. Take time to get your credentials evaluated before finalizing your state selection. The evaluation report will clarify exactly how many credits you have and whether you meet accounting coursework requirements, eliminating guesswork from your decision. From there, apply the framework in this guide to identify states where you genuinely qualify and can complete the full journey from exam eligibility through licensure.

The CPA credential opens doors to career opportunities that justify the investment of time, effort, and money this process requires. By choosing your state strategically rather than arbitrarily, you set yourself up for a smoother journey with fewer obstacles and wasted resources. Start with credential evaluation, select your state based on the factors we have discussed, and begin your CPA exam preparation with confidence that your path to licensure is clear.

Frequently Asked Questions

Can I take the CPA exam from India with just a B.Com degree?

Yes, but you will likely need additional coursework. A 3-year B.Com typically evaluates to 90 credits, falling short of the 120-credit minimum most states require. Alaska allows candidates within 18 credits of their degree requirement to begin the exam, providing the most flexible option for B.Com holders willing to complete bridge courses simultaneously.

Which state is best if I am a Chartered Accountant from India?

Illinois works well for most CAs without an SSN. Washington is an option only for candidates who already have a valid SSN.. Your CA credential adds value to your education evaluation but does not provide automatic recognition. Have your B.Com plus CA combination evaluated through NIES, and if you reach 150 credits with strong accounting course coverage, both states offer accessible pathways without SSN requirements.

Do I need a Social Security Number to become a US CPA?

Not necessarily. Washington requires a Social Security Number (SSN) for licensure, and SSN waivers are granted only under narrow statutory exceptions. Therefore, Washington is not a suitable state for candidates who do not have an SSN and cannot obtain one. Alaska, Guam, Montana, and Illinois remain viable SSN-free pathways, but Washington does not.

What is the cheapest state for Indian candidates to register for CPA?

When comparing costs across international-friendly CPA jurisdictions, the largest cost component for Indian candidates is the international exam fee, which is currently $480 per exam section (total $1,920 for all four sections).

Using the updated fee structure, the realistic total cost for each major state is as follows:

| State | Realistic Breakdown | Total USD | Total INR (~₹90/USD) | Notes / Sources |

| Alaska | NIES $250 + Application $115 + International Exams $1,920 + License $500 | $2,785 | ~₹2,50,700 | NIES $250 (NASBA); App $115 (CPAES); NASBA $480/section; License $500 (AK Commerce Dept.) |

| Guam | NIES $250 + Application $130 + International Exams $1,920 + License $250 | $2,550 | ~₹2,29,500 | No separate Guam surcharge; App $130 (Guam BOA/CPAES); NASBA $480/section; License $250 (Guam BOA) |

| Montana | NIES $250 + Application $140 + International Exams $1,920 + License $150 | $2,460 | ~₹2,21,400 | App $140 (MT Board/CPAES); NASBA $480/section; License $150 (MT Board) |

Can my Indian employer verify my work experience for CPA license?

In most states, experience must be verified by a licensed US CPA, which creates challenges for Indian-based candidates. Illinois is the notable exception, accepting verification from any supervisor familiar with your work regardless of their credentials. This makes Illinois particularly attractive for candidates working in India without access to a US CPA verifier.

Is Washington or Alaska better for Indian CPA candidates?

It depends on your credits. Washington requires 150 credits to sit for the exam but has more established processes and competitive fees. Alaska allows exam-sitting with fewer credits (within 18 hours of degree completion) but has higher total licensing costs. If you have 150 credits, Washington is typically preferable. If you fall short, Alaska offers a faster start.

How long does credential evaluation take for Indian candidates?

NIES currently completes evaluations in approximately 6 weeks after receiving all required documents. However, the total timeline includes time for your Indian universities to process transcript requests and send sealed documents, which can add 4-8 weeks. Plan for a realistic total of 3-4 months from initiating the process to receiving your evaluation report.

Can I change my state after passing the CPA exam?

Yes, through a process called score transfer or interstate transfer. You will pay transfer fees (typically $25-$50) and may need your credentials re-evaluated for the new state’s requirements. Some states accept transfers more readily than others. If you anticipate potentially changing states, research transfer policies before your initial state selection.

What happens if my credits fall short of 120 hours?

You have several options: complete additional coursework through accredited online programs, apply to Alaska which allows exam-sitting when within 18 credits of completion, or pursue additional Indian qualifications like M.Com or professional certifications that add credits. Many candidates successfully bridge 10-30 credit gaps through targeted online courses.

Do I need to travel to the US to take the CPA exam?

No. Prometric operates CPA testing centers in India (Delhi, Mumbai, Bangalore, and other cities) as well as locations in the Middle East including Dubai, Bahrain, and Kuwait. International testing incurs additional fees ($390 per section surcharge) but eliminates travel requirements for candidates who cannot or prefer not to visit the US.

Which states have removed the 150 credit hour requirement?

Several states now offer alternative pathways that substitute additional experience for the 150-credit requirement. Alaska, Connecticut, Georgia, Hawaii, Illinois, Indiana, Iowa, Minnesota, and Montana have enacted or are implementing such pathways. These typically require 2-3 years of supervised experience instead of the additional 30 credits. Check specific state boards for current implementation status.

Can I get a CPA license without any work experience?

Guam offers an “inactive” CPA certificate to candidates who pass the exam and meet education requirements without completing experience requirements. This inactive status is not a full practice license but officially recognizes your exam achievement. You can later convert to active status by completing experience requirements or transferring to another jurisdiction.

Is the CPA license from Guam valid across the United States?

A Guam CPA license allows you to practice in Guam and can be transferred to other US states through reciprocity or endorsement processes. However, practicing in another state typically requires obtaining that state’s license through their specific transfer requirements. The CPA exam scores themselves are valid nationwide, making the credential portable even if the specific license requires transfer.

How do I verify work experience if my supervisor is not a CPA?

Choose Illinois, which does not require CPA verification, or find any US CPA who can attest to your experience even if they are not your direct supervisor. Washington requires that experience be verified by a CPA who holds an active Washington State license. Verification by CPAs licensed in other states is not accepted unless the verifier also holds Washington licensure. Some candidates connect with US CPAs through professional networks, CPA coaching institutes, or LinkedIn connections willing to review and verify their experience documentation.

What is the total cost of CPA from India including all fees?

Budget ₹2,00,000 to ₹2,60,000 for the complete process including credential evaluation (₹21,000-25,000), state application fees (₹7,500-20,000), four exam sections taken in India (₹1,70,000), ethics exam (₹16,000), and licensing fees (₹8,000-25,000). Add ₹15,000-40,000 if you need additional coursework, and ₹80,000-2,50,000 for a CPA review course, bringing comprehensive total investment to ₹3,00,000-5,50,000.

Allow notifications

Allow notifications