GAAP full form is Generally Accepted Accounting Principles, the US accounting framework set by FASB. Learn the 10 core principles, ASC Codification navigation, and career pathways for Indian professionals.

Table of Contents

If you work in finance at a US multinational’s India office, handle accounting for a shared services center, or support US-listed companies from an Indian subsidiary, you have almost certainly encountered US GAAP.

For thousands of Indian accountants and finance professionals, understanding Generally Accepted Accounting Principles is no longer optional; it is a core competency that directly impacts career growth.

India’s finance outsourcing industry has expanded dramatically, with US firms increasingly tapping the country’s talent pool for accounting, audit, and financial reporting roles that require GAAP expertise.

GAAP serves as the foundation of financial reporting for publicly traded companies in the United States. Every balance sheet, income statement, and cash flow statement prepared by a US public company must comply with these standards.

For Indian professionals, this means that whether you are reconciling intercompany transactions, preparing consolidated reports for a US parent, or advising clients on cross-border compliance, a solid grasp of GAAP principles will set you apart. This guide provides practical, India-relevant insights that go beyond textbook definitions to help you apply GAAP knowledge in your daily work.

In the sections that follow, you will learn the full form and core purpose of GAAP, trace its evolution from the 1929 market crash to the modern ASC Codification, and master the 10 foundational principles that govern all GAAP-compliant reporting.

You will also discover how to navigate the ASC Codification like a seasoned professional, understand the key differences between GAAP, IFRS, and Ind AS, and explore career pathways and certification options available to Indian professionals seeking to build GAAP expertise.

What is the Full Form of GAAP

GAAP stands for Generally Accepted Accounting Principles, and you will often hear it pronounced simply as “gap.”

This framework represents the comprehensive set of accounting rules, standards, and procedures that govern financial reporting in the United States. Published and maintained by the Financial Accounting Standards Board (FASB), GAAP provides the authoritative guidance that publicly traded US companies must follow when preparing their financial statements.

For Indian professionals working with US entities, understanding GAAP is essential because it forms the basis of every financial report you will encounter from American companies, whether you are processing transactions in a shared services center or preparing management reports for a US parent company.

What Is the Core Purpose of GAAP in Financial Reporting?

The core purpose of GAAP is straightforward yet profound: to ensure that financial statements are prepared consistently, transparently, and comparably across all organizations.

Before standardized accounting principles existed, companies could present their financial information in whatever format suited their needs, making it nearly impossible for investors to compare one company’s performance against another. GAAP eliminates this problem by establishing uniform rules for recognizing revenue, valuing assets, recording liabilities, and disclosing material information. When you review financial statements prepared under GAAP, you can trust that the same rules were applied as those used by any other GAAP-compliant company, enabling meaningful analysis and informed decision-making.

Investor Protection, Transparency, and Comparability

GAAP exists primarily to protect investors and other stakeholders by ensuring that financial reports accurately reflect an organization’s true financial position. The standards require full disclosure of material information, prevent companies from hiding liabilities or inflating revenues, and mandate that all significant accounting policies be clearly explained. This transparency allows investors to make informed decisions, creditors to assess creditworthiness accurately, and analysts to perform reliable company-to-company comparisons across industries and time periods.

Who Must Follow GAAP and When Adoption Is Voluntary

All publicly traded companies in the United States are legally required to follow GAAP when preparing financial statements filed with the Securities and Exchange Commission (SEC). Additionally, many private companies, non-profit organizations, and government entities voluntarily adopt GAAP because lenders, investors, and other stakeholders often require GAAP-compliant statements as a condition of financing or partnership. For Indian subsidiaries of US parent companies, GAAP compliance is typically mandatory for consolidation purposes, even though the Indian entity may also prepare local statutory accounts under Ind AS.

How GAAP Differs from Pro Forma and Non-GAAP Reporting

While GAAP provides standardized, audited financial information, some companies also present “pro forma” or “non-GAAP” financial measures alongside their official reports. These alternative presentations can include adjustments that exclude certain expenses, restructuring costs, or one-time charges to present what management believes is a clearer picture of ongoing operations. However, pro forma statements are not audited, may contain unspecified assumptions, and lack the inherent comparability that GAAP provides.

The SEC requires that any non-GAAP measures presented by public companies be accompanied by a reconciliation to the nearest GAAP measure, precisely because pro forma figures can be misleading if viewed in isolation. As an Indian professional working with US financial data, you should always prioritize GAAP figures for analysis and decision-making while understanding that non-GAAP metrics may provide supplementary insights into management’s perspective on company performance.

How GAAP Evolved from the 1929 Market Crash to Modern Standards

Understanding how GAAP developed helps you appreciate why certain rules exist and how the standard-setting process works today. The accounting profession did not always have a unified set of standards; the current framework emerged from regulatory responses to financial crises and evolved through decades of refinement. Knowing this history equips you to understand ongoing debates about accounting standards and anticipate how GAAP may continue to change in the future.

The Securities Acts That Created the Foundation for GAAP

The Great Depression of the 1930s fundamentally changed how Americans thought about financial regulation and corporate accountability. Before this period, there was no federal requirement for companies to follow consistent accounting practices, and the lack of standards contributed to the market conditions that led to catastrophe. The regulatory framework established in response to this crisis laid the groundwork for what we now know as GAAP.

Why Did the 1929 Stock Market Crash Lead to Accounting Reforms?

The Stock Market Crash of 1929 was partially attributed to misleading and manipulative financial reporting practices by publicly traded companies. Without standardized accounting rules, businesses could present their financial positions in whatever light suited their interests, and investors had no reliable way to evaluate the accuracy of reported earnings or asset values. When the market collapsed, millions of Americans lost their savings, and the resulting Great Depression created years of economic hardship.

In response to this catastrophe, the federal government recognized that investor confidence required transparent, standardized financial reporting. According to accounting historian Stephen Zeff, the term “GAAP” was first used in 1936 by the American Institute of Accountants, marking the beginning of a formal effort to establish consistent accounting practices. This historical context explains why GAAP places such heavy emphasis on conservatism, full disclosure, and the accurate representation of financial position.

How Did the Securities Acts of 1933 and 1934 Shape GAAP?

The Securities Act of 1933 required companies issuing new securities to provide investors with accurate financial information, establishing the principle that transparency should govern capital markets.

The following year, the Securities Exchange Act of 1934 created the SEC and gave it authority to regulate publicly traded companies, including the power to establish accounting standards. These two pieces of legislation fundamentally transformed corporate financial reporting in the United States.

Rather than developing accounting standards itself, the SEC encouraged the private sector to establish standard-setting bodies, believing that professional accountants possessed the technical knowledge necessary for this task.

This decision established the model that continues today, where private organizations like FASB develop the standards and the SEC provides oversight and enforcement authority. For Indian professionals, understanding this regulatory structure helps explain why GAAP compliance is taken so seriously by US companies and their auditors.

The Establishment of FASB and the Modern GAAP Framework

The journey from the original accounting committees to today’s FASB involved several organizational transitions, each aimed at improving the quality and consistency of accounting standards. Understanding this evolution helps you appreciate the current structure and the authority behind the standards you apply daily.

From CAP and APB to FASB

In 1939, the SEC encouraged the American Institute of Certified Public Accountants (AICPA) to establish the Committee on Accounting Procedure (CAP), which issued 51 Accounting Research Bulletins between 1939 and 1959. However, CAP’s problem-by-problem approach failed to create a cohesive conceptual framework, leading to its replacement by the Accounting Principles Board (APB) in 1959. The APB made significant progress but faced criticism for being too closely tied to the accounting profession and lacking independence.

In 1973, the Financial Accounting Foundation established FASB as an independent, private-sector body responsible for setting accounting standards. Unlike its predecessors, FASB operates with full-time board members, a dedicated research staff, and an open due process that includes public comment periods on proposed standards. This independence and rigor have made FASB the authoritative voice in US accounting standards for over five decades.

Fun Fact: – In 1939, the professional body was technically called the American Institute of Accountants (AIA), which later became the American Institute of Certified Public Accountants in 1957.

Launch of the ASC Codification in 2009

By the early 2000s, US GAAP had grown into a complex web of thousands of pronouncements from multiple sources, making research time-consuming and increasing the risk of overlooking relevant guidance. In response, FASB launched the Accounting Standards Codification (ASC) on July 1, 2009, reorganizing all authoritative GAAP into approximately 90 topics with a consistent structure. FASB Statement No. 168 established the Codification as the single source of authoritative nongovernmental GAAP, superseding all previous standards documents.

For Indian professionals, the ASC Codification represents a significant improvement in accessibility. Instead of searching through decades of pronouncements, you can now find all relevant guidance organized by topic in one searchable database. The Codification is available online with both free basic access and paid professional subscriptions, making it easier than ever for Indian accountants to reference authoritative GAAP guidance directly.

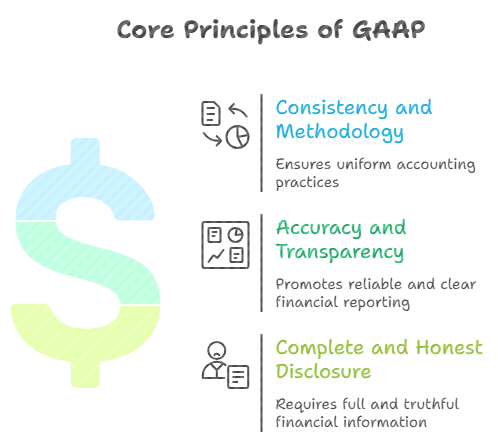

The 10 Core Principles of GAAP Every Accountant Must Know

At the heart of GAAP lie ten foundational principles that guide all compliant financial reporting. These principles work together to ensure that financial statements are prepared consistently, honestly, and in a manner that stakeholders can trust.

Whether you are recording a simple transaction or making complex judgments about revenue recognition, these principles provide the ethical and methodological framework for your work. Mastering these concepts will strengthen your ability to apply GAAP correctly and explain your accounting decisions to colleagues, auditors, and management.

Please be advised that these principles reflect the traditional conceptual foundations underlying GAAP, as commonly taught and applied in practice, rather than a single codified list issued by the standard setter.

Principles Governing Consistency and Methodology

The first group of GAAP principles focuses on maintaining uniform accounting practices over time and across reporting periods. These principles ensure that financial statements can be meaningfully compared from one period to another and that changes in reported results reflect genuine business developments rather than arbitrary methodology shifts.

Principle of Regularity

The principle of regularity requires that accountants adhere strictly to GAAP rules and regulations in all their work. You cannot pick and choose which standards to follow based on convenience or desired outcomes. This principle establishes GAAP as a non-negotiable framework; once you commit to GAAP-compliant reporting, you must apply all applicable standards consistently and completely.

Principle of Consistency

Consistency mandates that organizations use the same accounting methods and standards throughout each reporting period and from one period to the next. If your company uses straight-line depreciation for fixed assets, you must continue using that method unless there is a justifiable reason to change, and any such change must be disclosed with an explanation. This principle enables stakeholders to track trends and compare performance over time with confidence.

Principle of Permanence of Methods

Closely related to consistency, the principle of permanence of methods requires that the specific procedures and practices used in financial reporting remain constant over time. This includes everything from how you classify accounts to how you calculate estimates. Permanence allows for meaningful comparison of financial statements across multiple periods, helping analysts identify genuine changes in business performance rather than artifacts of methodology changes.

Principles Ensuring Accuracy and Transparency

The second group of principles addresses the quality and reliability of the information presented in financial statements. These principles guard against bias, speculation, and manipulation, ensuring that financial reports reflect genuine business conditions rather than wishful thinking or deliberate misrepresentation.

Principle of Sincerity

The principle of sincerity requires accountants to provide an accurate, impartial depiction of an organization’s financial position. Your financial statements should reflect the true state of the business, not a version designed to please management or present an artificially favorable picture. Sincerity demands professional objectivity and a commitment to truthful reporting, even when the numbers are not what stakeholders might hope to see.

Principle of Prudence

Prudence requires that financial reporting be grounded in facts and reasonable estimates rather than speculation or optimism. When uncertainty exists, GAAP directs you toward conservative assumptions that do not overstate assets or income or understate liabilities and expenses. This principle explains why GAAP requires recognizing potential losses when they become probable but delays recognition of potential gains until they are realized.

Principle of Non-Compensation

Non-compensation prohibits offsetting assets against liabilities or revenues against expenses unless specifically permitted by GAAP. You cannot net a debt owed to you against a debt you owe to make your balance sheet look stronger. All positive and negative aspects of an organization’s financial position must be reported separately and completely, ensuring that stakeholders see the full picture rather than artificially simplified figures.

Principles Supporting Complete and Honest Disclosure

The final group of principles ensures that financial statements provide all material information that stakeholders need to make informed decisions. These principles mandate transparency about significant matters and establish the ethical expectations for everyone involved in financial reporting.

Principle of Materiality

Materiality requires that financial reports disclose all information significant enough to influence the decisions of users. If a piece of information could affect how an investor, creditor, or other stakeholder evaluates the company, it must be disclosed. The concept of materiality involves both quantitative thresholds (is the amount significant relative to total assets or income?) and qualitative considerations (could this information change someone’s decision regardless of dollar amount?).

Principle of Continuity (Going Concern)

The principle of continuity, also known as the going concern assumption, requires that financial statements be prepared with the assumption that the business will continue operating into the foreseeable future. Asset valuations and liability measurements are based on this assumption. If there is substantial doubt about an entity’s ability to continue as a going concern, GAAP requires specific disclosures to alert stakeholders to this uncertainty.

Principle of Periodicity

Periodicity requires that financial reporting be divided into regular, standard accounting periods such as fiscal quarters or years. This principle ensures that stakeholders receive timely information about an organization’s performance and can compare results across consistent time frames. Annual and quarterly reporting cycles exist because of this principle, providing regular checkpoints for evaluating financial health.

Principle of Utmost Good Faith/ Ethical Financial Reporting

The principle of utmost good faith requires that all parties involved in preparing and using financial statements act honestly and with integrity. Accountants, auditors, management, and other stakeholders are expected to behave ethically and not knowingly mislead others. This principle underlies the entire GAAP framework, establishing that financial reporting is fundamentally an exercise in honest communication.

How Do Professionals Navigate the ASC Codification in Practice?

The FASB Accounting Standards Codification is the single authoritative source of US GAAP for nongovernmental entities. Before its launch in 2009, finding the correct accounting guidance required searching through thousands of documents from multiple sources. Today, the Codification organizes all authoritative GAAP into a logical, searchable structure that significantly reduces research time and improves accuracy. For Indian professionals working with US GAAP, learning to navigate the ASC is a practical skill that will serve you throughout your career.

Understanding the ASC Reference System

The Codification uses a systematic reference structure that allows you to locate specific guidance quickly and cite it correctly in your work. Once you understand this system, you can efficiently research any accounting question and communicate your findings clearly to colleagues and auditors.

Topics, Subtopics, Sections, and Paragraphs Explained

The ASC reference system follows a four-part structure: XXX-YY-ZZ-PP, where XXX represents the three-digit Topic, YY the two-digit Subtopic, ZZ the two-digit Section, and PP the paragraph number. Topics represent broad subject areas (such as Topic 606 for Revenue), Subtopics provide further classification by type or scope, and Sections contain the actual guidance organized under consistent headings like Scope, Recognition, Measurement, and Disclosure. This hierarchical structure means you can drill down from general principles to specific application guidance.

How to Read and Cite ASC References Correctly

When citing ASC guidance, you should reference the specific paragraph that supports your accounting treatment. For example, “ASC 606-10-25-1” refers to Topic 606 (Revenue from Contracts with Customers), Subtopic 10 (Overall), Section 25 (Recognition), Paragraph 1. In professional communications, you might write “FASB ASC 606-10-25, Revenue from Contracts with Customers, Overall, Recognition” to provide both the reference code and descriptive title. Consistent, accurate citations demonstrate your professionalism and make it easy for reviewers to verify your conclusions.

Key ASC Topics Every Finance Professional Should Know

While the Codification contains approximately 90 topics, certain areas come up frequently in practice, especially for Indian professionals supporting US entities. Familiarity with these key topics will prepare you for the most common accounting questions you will encounter.

ASC 606: Revenue from Contracts with Customers

ASC 606 establishes the comprehensive framework for revenue recognition, requiring companies to recognize revenue when control of goods or services transfers to customers in an amount reflecting expected consideration. The standard uses a five-step model: identify the contract, identify performance obligations, determine the transaction price, allocate the price to performance obligations, and recognize revenue as obligations are satisfied. This topic is essential for anyone involved in sales accounting or financial statement preparation.

ASC 842: Leases

ASC 842 requires lessees to recognize most leases on the balance sheet as right-of-use assets and corresponding lease liabilities. This standard significantly changed lease accounting by eliminating the previous distinction between capital and operating leases for balance sheet purposes. If your company leases office space, equipment, or vehicles, you will encounter ASC 842 requirements in your regular work.

ASC 326: Credit Losses (CECL)

ASC 326 introduced the Current Expected Credit Losses (CECL) model, requiring companies to estimate and recognize expected lifetime credit losses on financial instruments at origination rather than waiting until losses are probable. This standard affects banks, financial institutions, and any company with significant receivables or debt investments. Understanding CECL is increasingly important as more companies implement this forward-looking approach to credit loss accounting.

ASC 805: Business Combinations

ASC 805 governs the accounting for business combinations, requiring acquirers to recognize and measure identifiable assets acquired, liabilities assumed, and any noncontrolling interest at fair value on the acquisition date. If your company engages in mergers, acquisitions, or corporate restructuring, ASC 805 provides the guidance for recording these complex transactions.

Who Sets, Interprets, and Enforces US GAAP?

Understanding who develops and enforces GAAP helps you appreciate the authority behind the standards and navigate the regulatory landscape effectively. Multiple organizations play distinct roles in this ecosystem, from establishing new standards to ensuring companies comply with existing requirements. For Indian professionals, knowing these bodies and their functions is valuable when you need to research authoritative guidance or understand regulatory expectations.

The Financial Accounting Standards Board (FASB)

FASB serves as the primary standard-setter for US GAAP applicable to nongovernmental entities. Established in 1973 and operating under the oversight of the Financial Accounting Foundation, FASB is an independent, private-sector organization with a seven-member board appointed to five-year terms. The board’s independence from the accounting profession and corporate interests is considered essential to maintaining the integrity of US accounting standards.

How FASB Develops and Updates Accounting Standards

FASB follows a rigorous due process when developing new standards or amending existing guidance. This process typically includes research, a discussion paper, an exposure draft open for public comment, deliberation of feedback, and final issuance of an Accounting Standards Update (ASU). The process ensures that diverse perspectives are considered and that standards reflect both technical soundness and practical applicability.

Recent FASB Projects: Cryptocurrency, Income Tax Disclosures, and More

FASB continues to address emerging issues and improve existing standards. In December 2023, FASB finalized new requirements for cryptocurrency accounting, establishing standardized guidance for measuring crypto assets at fair value with changes recognized in income. The same month saw updates to income tax disclosure requirements, providing investors with greater transparency about tax reconciliations and payment timing. In 2024, FASB addressed measurement concepts and updated guidance on induced conversions of convertible debt instruments.

These ongoing projects demonstrate that GAAP is a living framework that evolves with business practices and stakeholder needs. As an Indian professional, staying current with ASUs helps you anticipate changes that may affect your company’s reporting requirements.

The Governmental Accounting Standards Board (GASB)

While FASB sets standards for businesses and non-profits, GASB establishes accounting and financial reporting standards for US state and local governments. Also operating under the Financial Accounting Foundation, GASB addresses the unique accountability and transparency needs of public-sector entities.

How GASB Differs from FASB in Scope and Application

GASB standards apply to state and local government financial reporting, including public universities, municipal utilities, and other governmental entities. The standards reflect the distinct nature of government operations, where accountability to taxpayers and compliance with budgetary requirements take precedence over profitability metrics. GASB estimates that approximately half of the US states require local governments to follow GAAP as established by GASB.

For Indian professionals, GASB is less directly relevant unless you work with US government entities or public-sector organizations. However, understanding that governmental GAAP differs from corporate GAAP helps you avoid confusion when encountering financial statements from different types of US entities.

The Role of the SEC in GAAP Enforcement

The SEC holds statutory authority to establish accounting standards for publicly traded companies, but has historically relied on private-sector bodies like FASB to develop the standards. The SEC’s role is primarily one of oversight and enforcement, ensuring that public companies comply with GAAP and that investors receive accurate financial information.

SEC Reporting Requirements for US-Listed Companies

Publicly traded companies must file regular reports with the SEC, including annual 10-K filings, quarterly 10-Q reports, and current 8-K reports for material events. These filings must comply with GAAP and SEC regulations, and they are subject to review by the SEC staff. The SEC can take enforcement action against companies that fail to comply with accounting standards, including requiring restatements, imposing fines, and pursuing fraud charges in serious cases.

For Indian professionals, understanding SEC reporting requirements is essential if you support a US-listed company or one preparing for a US listing. The regulatory expectations are rigorous, and the consequences of non-compliance can be severe.

How Indian Companies Listed on US Exchanges Must Comply

Indian companies listed on US stock exchanges through American Depositary Receipts (ADRs) or direct listings must file annual reports with the SEC and reconcile their financial statements to US GAAP or present them in accordance with GAAP. Companies like Infosys, HDFC Bank, and ICICI Bank that trade on US exchanges must meet these requirements, creating demand for professionals who understand both Ind AS and US GAAP. If you work with such a company, your GAAP knowledge directly contributes to regulatory compliance and investor relations.

The dual-reporting requirements for cross-listed entities create complexity but also opportunity. Professionals who can navigate both frameworks and explain the differences are valuable assets to their organizations.

GAAP vs IFRS vs Ind AS: Key Differences for Indian Professionals

For Indian accountants and finance professionals, understanding the differences between US GAAP, IFRS, and Ind AS is crucial for effective cross-border work. While all three frameworks aim to produce transparent and comparable financial statements, they differ in their approaches and specific requirements. Your ability to explain these differences and apply the correct standards in different contexts will distinguish you as a knowledgeable professional.

Rules-Based vs Principles-Based: The Fundamental Divide

The most fundamental difference between US GAAP and IFRS/Ind AS lies in their philosophical approach to standard-setting. US GAAP is characterized as “rules-based,” meaning it provides detailed, specific guidance for many types of transactions. The standards often include bright-line thresholds, explicit criteria, and extensive implementation guidance. This approach offers clarity and reduces judgment calls but can create complexity and sometimes allows for technical compliance that defeats the spirit of the rule.

IFRS and Ind AS, by contrast, are considered “principles-based,” meaning they establish broad principles and objectives while leaving more room for professional judgment in application. Ind AS are notified by the Ministry of Corporate Affairs (‘MCA’), based on recommendations of ICAI.

Ind AS closely aligns with IFRS while incorporating India-specific modifications. A principles-based approach offers flexibility and can better accommodate unusual transactions, but it requires accountants to exercise more judgment and document their reasoning carefully.

For Indian professionals, this philosophical difference has practical implications. When you prepare US GAAP financial statements, you may need to apply specific rules that do not exist under Ind AS, or you may need to reach different conclusions about the same transaction depending on which framework applies. Understanding when and why the frameworks diverge helps you anticipate conversion adjustments and explain differences to stakeholders.

If you are an Indian finance professional struggling with the mindset shift from principles-based Ind AS or IFRS to the rules-driven structure of US GAAP, you may want to read my article “Bridging the Gap: Transitioning from IFRS/Ind AS to US GAAP for Indian Finance Professionals.”

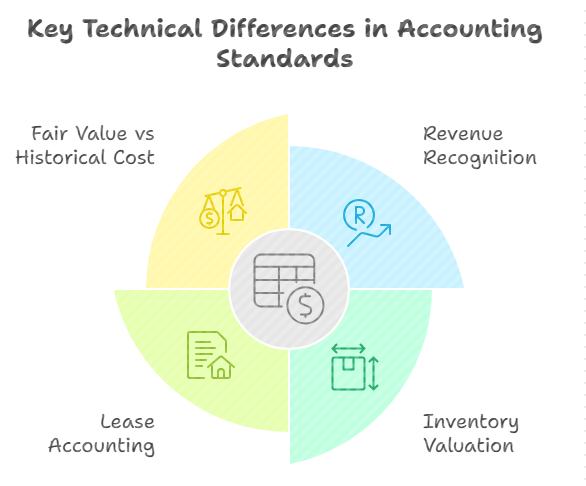

What Are the Key Technical Differences Between GAAP, IFRS, and Ind AS?

Beyond the philosophical divide, specific technical differences affect how transactions are recorded and reported under each framework. The following areas represent some of the most significant divergences that Indian professionals commonly encounter.

Revenue Recognition

While US GAAP and IFRS/Ind AS have converged significantly on revenue recognition through the five-step model (ASC 606 and IFRS 15/Ind AS 115), differences remain in specific application guidance. US GAAP provides more detailed, industry-specific guidance and includes extensive implementation examples. Ind AS follows the IFRS principles-based approach, which may require more judgment in applying the framework to specific transactions.

Inventory Valuation Methods (LIFO vs FIFO)

One of the most notable differences is that US GAAP permits the Last-In, First-Out (LIFO) inventory method, while both IFRS and Ind AS prohibit it. US companies using LIFO may report lower taxable income during inflationary periods, but their inventory values will differ significantly from companies following Ind AS or IFRS. If you are converting from US GAAP to Ind AS, inventory valuation is often a major adjustment area.

Lease Classification and Accounting

Under ASC 842, US GAAP uses a five-criterion test to classify leases as finance or operating for lessees, though both types now appear on the balance sheet. IFRS 16 and Ind AS 116 take a simpler approach, treating virtually all leases as finance leases for lessees (with limited exceptions). The classification differences can affect reported lease expenses, operating metrics, and financial ratios.

Fair Value vs Historical Cost Treatment

IFRS and Ind AS generally permit more extensive use of fair value measurement, particularly for property, plant, and equipment through the revaluation model. US GAAP typically requires historical cost measurement for these assets, with fair value reserved primarily for certain financial instruments and specific transactions. This difference can lead to significant divergence in asset values and equity positions between frameworks.

Why Indian Companies Need GAAP Knowledge Despite Following Ind AS

Even though Indian companies prepare statutory financial statements under Ind AS, many situations require US GAAP knowledge. The practical reality for Indian finance professionals is that GAAP expertise opens doors and solves problems that Ind AS knowledge alone cannot address.

Reporting to US Parent Companies

Indian subsidiaries of US corporations must typically prepare GAAP-compliant reporting packages for consolidation into the parent company’s financial statements. This means your Ind AS books need to be adjusted to GAAP, and you need to understand both frameworks to identify and quantify the differences. Monthly, quarterly, and annual reporting cycles often require GAAP adjustments, making this a routine rather than occasional need.

Dual Reporting Requirements for Cross-Listed Entities

Major Indian companies listed on US exchanges must reconcile their financials to US GAAP or prepare full GAAP-compliant statements. Finance teams at these companies need professionals who can navigate both frameworks, prepare reconciliations, and explain differences to auditors and regulators. The complexity of dual reporting creates a strong demand for professionals with genuine competence in both Ind AS and US GAAP.

If you are actively involved in converting Ind AS financials into US GAAP reporting packages, or planning to move into a US-facing finance role, you may find it helpful to read my detailed guide on “Transitioning from Indian Accounting Standards to US GAAP”.

Career Opportunities and Certification Pathways for GAAP Expertise in India

GAAP knowledge translates directly into career opportunities and higher earning potential for Indian finance professionals. As US companies continue to expand their operations and outsourcing relationships in India, demand for GAAP-skilled professionals has grown substantially. Understanding where these opportunities exist and how to build recognized credentials will help you position yourself for advancement.

Where GAAP Skills Are in High Demand in India

The demand for US GAAP expertise in India spans multiple sectors and organization types. US MNC subsidiaries require GAAP knowledge for parent company reporting and consolidation. Global Capability Centers (GCCs) and shared services operations handle accounting and finance functions for US entities, requiring staff who understand American accounting standards. The Big 4 firms and mid-sized accounting practices serve US clients and need professionals who can audit or advise on GAAP matters.

Major US corporations like Amazon, Google, Microsoft, and Apple operate substantial finance functions in India. Additionally, mid-sized US accounting firms, including RSM, BDO, and Grant Thornton have significantly expanded their India recruiting, with RSM US reportedly conducting dedicated hiring drives offering 50+ positions in a single quarter. Financial services companies, KPOs, and consulting firms also seek GAAP-skilled professionals for client service and internal finance roles.

The US CPA Certification Pathway for Indian Professionals

The Certified Public Accountant (CPA) credential is the most recognized qualification for demonstrating US GAAP expertise. Administered by the American Institute of Certified Public Accountants (AICPA), the CPA exam covers financial accounting and reporting (including extensive GAAP content), auditing, regulation, and a discipline-specific elective. The exam is challenging, with only about 20% of candidates passing all four sections on their first attempt.

For Indian professionals, the CPA pathway involves meeting educational requirements (typically 120 credits for exam eligibility and 150 credits for licensure), passing the four-part exam, and gaining relevant work experience. The total investment, including registration, study materials, and coaching, typically runs approximately ₹3,45,000 or more. However, the return on investment can be substantial: CPAs in India earn significantly more than non-certified peers, with entry-level salaries around ₹7-10 LPA and experienced professionals commanding ₹15-20 LPA or higher, particularly at Big 4 firms and MNCs.

Alternative Certifications and Learning Paths

Not everyone needs or wants to pursue the full CPA credential. Several alternative pathways can help you build GAAP expertise more quickly or at lower cost. EY India offers a Certificate in US GAAP covering key ASC topics, including revenue recognition, leases, and credit losses. Other Big 4 firms and training providers offer similar programs focused on specific GAAP topics or general US accounting knowledge.

Online resources including the FASB’s Codification (available with basic free access) allow self-directed learning. CPA review course materials from providers like Becker, Wiley, and UWorld can be valuable even if you are not planning to take the exam. For Indian professionals seeking to build GAAP knowledge progressively, combining on-the-job learning with structured coursework and eventually certification offers a practical path to expertise.

Conclusion

Understanding US GAAP is increasingly essential for Indian finance professionals working in a globalized economy. From the full form of Generally Accepted Accounting Principles to the practical application of ASC Codification topics, from the historical evolution of accounting standards to the current differences between GAAP, IFRS, and Ind AS, this knowledge base enables you to contribute more effectively to your organization and advance your career.

The 10 core GAAP principles provide the ethical and methodological foundation for all compliant financial reporting. The ASC Codification gives you a structured, searchable resource for finding authoritative guidance. Understanding who sets and enforces GAAP helps you navigate the regulatory landscape. And knowing the differences between accounting frameworks positions you to handle cross-border reporting challenges confidently.

Your next steps should match your career goals. If you work regularly with US GAAP, consider pursuing a CPA certification or a targeted certificate program to formalize your expertise. Bookmark the FASB Codification and practice navigating its structure. Follow FASB updates to stay current with new standards.

And look for opportunities in your current role to apply GAAP knowledge, whether that means preparing reporting packages, supporting audits, or explaining accounting treatment to stakeholders. The investment you make in GAAP expertise today will pay dividends throughout your career.

Frequently Asked Questions

What is the full form of GAAP in accounting?

GAAP stands for Generally Accepted Accounting Principles. It represents the comprehensive framework of accounting standards, rules, and procedures that govern financial reporting in the United States. Pronounced “gap,” this framework is maintained by the Financial Accounting Standards Board and serves as the authoritative guide for preparing financial statements of publicly traded US companies.

What are the 10 basic principles of GAAP?

The 10 core GAAP principles are: Regularity (following GAAP rules consistently), Consistency (using the same methods across periods), Permanence of Methods (maintaining stable procedures), Sincerity (providing accurate, unbiased information), Prudence (avoiding speculation), Non-Compensation (not offsetting assets and liabilities inappropriately), Materiality (disclosing significant information), Continuity (assuming ongoing operations), Periodicity (reporting in regular time periods), and Utmost Good Faith (acting honestly).

Who is responsible for setting GAAP standards?

The Financial Accounting Standards Board (FASB) is responsible for setting US GAAP standards for nongovernmental entities. FASB operates independently under the oversight of the Financial Accounting Foundation. For governmental entities, the Governmental Accounting Standards Board (GASB) sets applicable standards. The Securities and Exchange Commission has statutory authority to set standards but has historically delegated this role to FASB.

Is GAAP mandatory for all companies in the US?

GAAP is mandatory for all publicly traded companies in the United States and for any company that publicly releases financial statements. Private companies are not legally required to follow GAAP, but many choose to adopt these standards because lenders, investors, and other stakeholders often require GAAP-compliant financial statements as a condition of financing or partnership.

What is the difference between GAAP and IFRS?

The primary difference is that GAAP is rules-based with detailed, specific guidance, while IFRS is principles-based with broader standards requiring more professional judgment. GAAP applies primarily in the United States, while IFRS is used in over 140 countries. Specific technical differences include GAAP allowing LIFO inventory valuation (prohibited under IFRS), different lease classification criteria, and different approaches to asset revaluation.

How does US GAAP differ from Ind AS?

Ind AS closely follows IFRS, so the GAAP vs Ind AS differences largely mirror GAAP vs IFRS differences. Key divergences include inventory methods (LIFO allowed under GAAP but not Ind AS), asset revaluation (permitted under Ind AS but generally not under GAAP), and the overall rules-based versus principles-based approach. Indian subsidiaries of US companies often must prepare both Ind AS statutory statements and GAAP reporting packages.

What is the ASC Codification and how do I use it?

The FASB Accounting Standards Codification is the single authoritative source of US GAAP for nongovernmental entities. It organizes all GAAP guidance into approximately 90 topics using a reference system (XXX-YY-ZZ-PP for Topic, Subtopic, Section, and Paragraph). You can access it at asc.fasb.org with either free basic access or a paid professional subscription for enhanced features.

Do Indian companies need to follow US GAAP?

Indian companies must follow US GAAP if they are listed on US stock exchanges, are subsidiaries of US parent companies requiring GAAP-compliant reporting packages for consolidation, or have contractual obligations requiring GAAP compliance. Otherwise, Indian companies follow Ind AS for statutory reporting purposes.

What is the salary of a GAAP-skilled professional in India?

GAAP-skilled professionals in India typically earn ₹7-10 LPA at entry level, with mid-level professionals commanding ₹12-18 LPA and senior roles exceeding ₹20 LPA. Professionals with CPA certification often earn 20-40% more than non-certified peers. Salaries are generally highest in metropolitan areas like Mumbai, Bangalore, and Delhi NCR, and at Big 4 firms, MNCs, and financial services companies.

How can I get certified in US GAAP from India?

The primary certification is the US CPA, administered by the AICPA. Indian candidates must meet educational requirements (typically a commerce degree with additional credits), pass the four-part CPA exam, and complete work experience requirements. Alternative options include certificate programs from Big 4 firms like EY’s Certificate in US GAAP, which provide focused training without the full CPA commitment.

What are the most important ASC topics to learn first?

For most Indian professionals, the most valuable ASC topics to learn first are ASC 606 (Revenue from Contracts with Customers), ASC 842 (Leases), ASC 326 (Credit Losses), and ASC 805 (Business Combinations). These topics appear frequently in practice and represent areas where GAAP may differ significantly from Ind AS. The General Principles topic (ASC 105) provides useful foundational context.

Is CPA certification worth it for Indian accountants?

CPA certification is worth considering if you plan to work extensively with US GAAP, seek roles at Big 4 firms or US MNCs, or want to maximize your earning potential in accounting and finance. The investment of approximately ₹3,45,000 and 12-18 months of study typically pays off through higher salaries and access to senior roles. However, if your work is primarily Ind AS-focused, Indian qualifications like CA may be more directly relevant.

What jobs require US GAAP knowledge in India?

Jobs requiring US GAAP knowledge include positions at US MNC subsidiaries (financial analysts, accountants, controllers), Big 4 audit and advisory roles serving US clients, shared services and GCC positions supporting US entities, finance roles at Indian companies listed on US exchanges, and KPO/consulting positions focused on US accounting and reporting.

How long does it take to learn US GAAP?

Developing working knowledge of US GAAP fundamentals typically takes 3-6 months of focused study. Preparing for and passing the CPA exam usually requires 12-18 months. Developing deep expertise in specific areas like revenue recognition or lease accounting may take additional time and practical experience. Continuous learning is necessary as FASB regularly issues new standards and updates.

What is the difference between GAAP and non-GAAP reporting?

GAAP reporting follows standardized rules that all public companies must use, producing audited, comparable financial statements. Non-GAAP or “pro forma” reporting includes adjusted metrics that exclude certain items management considers non-recurring or unrepresentative of ongoing operations. The SEC requires companies to reconcile any non-GAAP measures to the nearest GAAP measure and prohibits presenting non-GAAP figures more prominently than GAAP figures.

Allow notifications

Allow notifications