Complete Certified Public Accountant Course Details for Indian professionals covering exam structure, eligibility, fees in INR, review courses, salary expectations, and preparation strategies.

Table of Contents

The Certified Public Accountant credential stands as the gold standard in global accounting qualifications, and for Indian professionals eyeing international career opportunities, it has never been more accessible. As multinational corporations continue expanding their operations across India and Big 4 firms actively recruit CPA-qualified professionals for their global delivery centers, the demand for this prestigious credential has surged dramatically among Indian commerce graduates and working accountants.

If you are reading this, you are likely a B.Com, M.Com, CA, or MBA professional exploring international credentials that can transform your career trajectory. Perhaps you have heard conflicting information about eligibility requirements, been confused by credit hour calculations, or been uncertain about the actual investment required. This comprehensive guide cuts through the noise to deliver verified 2025 data on every aspect of the CPA journey, from exam structure and eligibility mapping to costs in Indian Rupees and career outcomes.

This guide addresses the specific challenges Indian candidates face: understanding how their Indian qualifications translate to US credit requirements, navigating the education evaluation process, selecting the right state board, managing costs effectively, and preparing for the exam while working full-time in India. We will cover the complete CPA course details with current 2025 fee structures, pass rates from official AICPA data, and practical strategies tailored for Indian professionals taking the exam at Prometric centers across eight Indian cities.

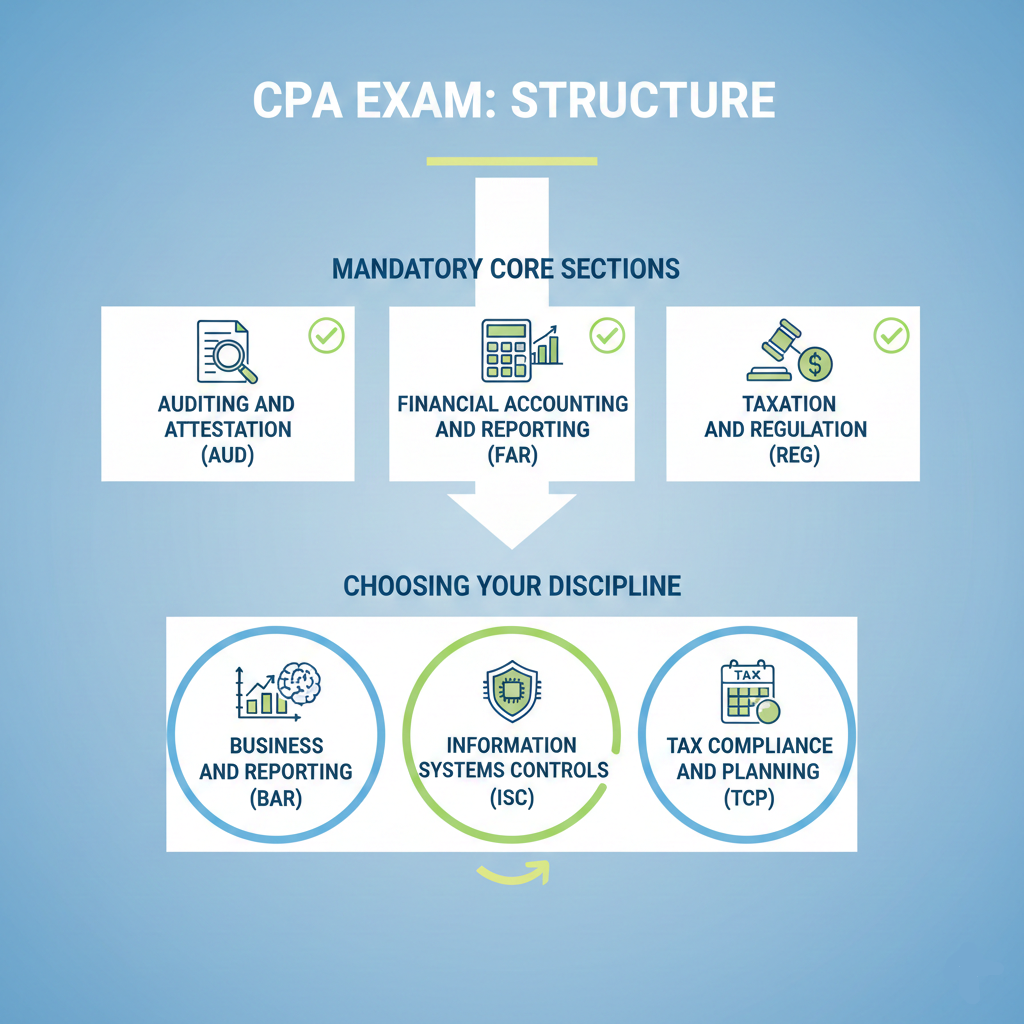

CPA Exam Structure: Core Sections and Discipline Options

The CPA exam underwent a fundamental transformation in January 2024 when AICPA and NASBA launched CPA Evolution, restructuring the examination to reflect the modern demands placed on accounting professionals. This overhaul recognized that today’s CPAs need competencies beyond traditional accounting, including technology skills, data analytics capabilities, and specialization in emerging practice areas. Understanding this new structure is essential before you begin your preparation journey.

Under the current CPA Evolution model, candidates must pass three mandatory Core sections that every CPA needs, regardless of career specialization, plus one Discipline section chosen based on career interests. The Core sections cover foundational competencies in auditing, financial reporting, and taxation, while the Discipline sections allow you to demonstrate deeper expertise in either business analysis, information systems, or tax planning. This structure ensures all CPAs share common foundational knowledge while developing specialized skills aligned with their career paths.

Three Mandatory Core Sections Every Candidate Must Pass

Regardless of whether you plan to specialize in audit, tax, or advisory services, every CPA candidate must demonstrate competency in the three Core examination sections. These sections test the fundamental knowledge that defines a qualified CPA and forms the backbone of professional practice. The Core sections can be taken in any order and are available for scheduling throughout the year on a continuous testing basis at Prometric centers.

Auditing and Attestation (AUD) Section Overview

The AUD section evaluates your understanding of the entire audit engagement process, from planning and risk assessment through evidence gathering and report issuance. You will face questions on professional responsibilities, ethics, independence requirements, and the application of professional skepticism throughout audit engagements. This section consists of 78 multiple-choice questions and seven task-based simulations, with a four-hour time limit.

According to AICPA’s 2024-2025 data, the AUD section maintains a pass rate of approximately 46% to 48%, making it moderately challenging. Many candidates with practical auditing experience find that the theoretical approach of the exam differs from real-world practice, so focused preparation on the conceptual frameworks is essential regardless of your professional background.

Financial Accounting and Reporting (FAR) Section Overview

FAR tests your comprehensive knowledge of financial reporting frameworks, primarily US GAAP, along with reporting requirements for governmental and not-for-profit entities. This section demands a deep understanding of recognition, measurement, and disclosure requirements for various transactions and account balances. The exam includes 50 multiple-choice questions and seven task-based simulations.

FAR consistently records the lowest pass rates among all CPA sections, hovering around 40% to 43% according to recent AICPA reports. The breadth of content coverage, from complex transactions like leases and pensions to specialized reporting for governmental entities, requires extensive preparation time. Most successful candidates dedicate 120 to 150 hours specifically to FAR preparation.

Taxation and Regulation (REG) Section Overview

REG examines your knowledge of US federal taxation for individuals and entities, business law concepts, and ethical responsibilities in tax practice. The section covers individual income tax, corporate taxation, partnership taxation, estate and gift taxes, and professional responsibilities. You will encounter 72 multiple-choice questions and eight task-based simulations within the four-hour timeframe.

REG shows the strongest Core section performance, with pass rates reaching 60% to 64% in recent quarters. Indian candidates often find REG challenging initially because US tax law differs significantly from Indian taxation concepts, but the structured nature of tax rules makes this section highly learnable with dedicated study.

Choosing Your Discipline Section: BAR, ISC, or TCP

The Discipline section represents your opportunity to specialize and demonstrate deeper expertise in an area aligned with your career interests. You must choose and pass exactly one of the three available Discipline sections. Unlike Core sections, which follow continuous testing, Discipline sections are available only during specific testing windows, typically the first month of each calendar quarter. Strategic selection based on your background and career goals can significantly impact both your preparation experience and professional trajectory.

Business Analysis and Reporting (BAR) for Finance-Focused Roles

BAR extends the financial reporting concepts from FAR into more complex technical areas, including advanced financial statement analysis, business valuation, and the strategic role of CPAs in business decision-making. This section suits candidates interested in financial planning and analysis roles, CFO tracks, or positions requiring sophisticated financial reporting expertise.

The BAR has proven the most challenging Discipline section, with pass rates ranging from 34% to 41%. The technical depth and overlap with advanced FAR concepts mean candidates should allocate significant preparation time, typically 120 to 150 hours, for this section.

Information Systems and Controls (ISC) for Tech and Audit Specialization

ISC focuses on information technology governance, IT audit procedures, SOC engagements, and data management controls. This section appeals to candidates interested in IT audit, cybersecurity consulting, or technology-focused advisory roles. The content covers IT control frameworks, business continuity planning, and system implementation controls.

ISC shows moderate pass rates around 68%. Candidates with technology backgrounds or those working in IT audit functions typically find ISC content more intuitive, while others may need additional preparation on technical concepts.

Tax Compliance and Planning (TCP) for Tax Career Paths

TCP delves deeper into tax practice, covering advanced individual taxation, entity tax planning, property transactions, and personal financial planning. This section is ideal for candidates pursuing tax advisory careers, planning to work extensively with high-net-worth individuals, or seeking partnership roles in tax-focused firms.

TCP demonstrates the highest pass rates of any section, showing around 78% in recent quarters. This strong performance reflects both the focused content scope and the fact that candidates choosing TCP often have substantial tax backgrounds. However, AICPA cautions that high pass rates do not indicate the section is easy for everyone, rather that candidates selecting TCP tend to be well-prepared for its content.

CPA Course Details: Exam Format, Duration, and Question Types

Each CPA section follows a standardized four-hour format with specific question distributions designed to test both knowledge recall and practical application. Understanding this format helps you develop appropriate time management strategies and set realistic expectations for exam day. The exam uses computer-based testing with an adaptive component in the multiple-choice sections.

Multiple Choice Questions and Testlet Structure

The multiple-choice portion of each section is delivered in two testlets, with the second testlet’s difficulty potentially adjusting based on your performance on the first. For Core sections, you will face between 50 and 78 MCQs, depending on the specific section. MCQs count for 50% of your total section score in most sections, with ISC weighting MCQs at 60%.

The adaptive nature means strong performance on the first testlet may result in more difficult questions in the second testlet. However, more difficult questions carry higher point values, so encountering harder questions often indicates positive performance. Each MCQ requires careful reading as answer choices frequently include plausible distractors designed to test the depth of understanding.

Task-Based Simulations and What to Expect

Task-based simulations, or TBSs, test your ability to apply knowledge to realistic work scenarios requiring analysis, judgment, and professional documentation. Each section includes seven to eight TBSs spread across three testlets following the MCQ portion. TBSs count for 50% of your score in most sections, making simulation performance critical to passing.

TBS formats include document review, spreadsheet completion, research tasks, and written responses. The research component requires you to search authoritative literature databases to locate relevant guidance, a skill that requires practice before exam day. Simulations can be time-intensive, so effective time allocation between MCQs and TBSs is essential for success.

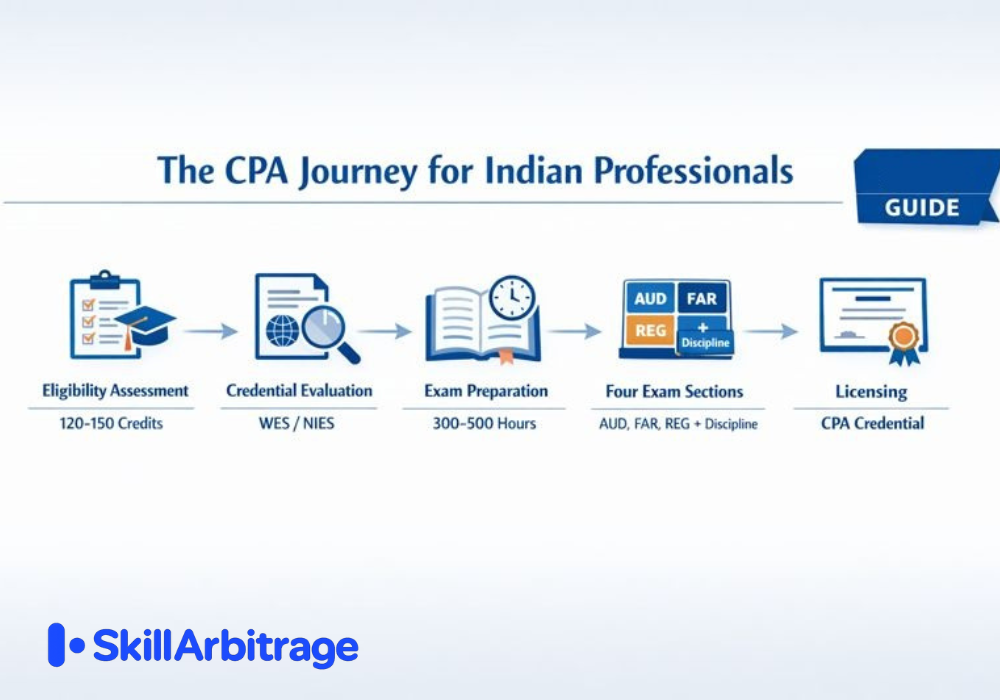

CPA Eligibility Requirements for Indian Candidates

Understanding CPA eligibility is often the most confusing aspect for Indian candidates, primarily because the US education system uses credit hours rather than years of study. The distinction between exam eligibility, which typically requires 120 credits, and licensure eligibility, which requires 150 credits, adds another layer of complexity. Getting clarity on these requirements early saves significant time and prevents costly mistakes in state selection or course planning.

Credit Hour Requirements for the CPA Exam

The US higher education system measures coursework in semester credit hours, where one credit hour typically represents one hour of classroom instruction per week over a semester. A standard four-year US bachelor’s degree equals 120 credit hours, while a master’s degree adds approximately 30 additional credits. Most state boards require 120 credits for exam eligibility and 150 credits for full CPA licensure, though some states allow you to begin testing at 120 credits while completing additional requirements for licensure.

B.Com Graduates: Credit Calculation and Gap Analysis

A standard three-year Indian Bachelor of Commerce degree typically converts to approximately 90 US semester credit hours when evaluated by credential agencies. This falls short of both the 120-credit exam threshold and the 150-credit licensure requirement. The credit shortfall means B.Com graduates must pursue additional education or qualifications to reach eligibility.

The gap between 90 credits and the required thresholds can be bridged through several pathways. Adding a two-year M.Com brings your total to approximately 150 credits, meeting full licensure requirements in most states. Alternatively, some candidates pursue shorter bridge courses or leverage professional qualifications to reach the necessary credit count.

M.Com, MBA, and Postgraduate Qualification Credits

Postgraduate degrees significantly strengthen your eligibility position. A two-year M.Com or MBA typically adds 60 credit hours, bringing a B.Com plus master’s combination to approximately 150 credits total. This combination satisfies full licensure requirements in most international-friendly states without additional coursework.

An MBA with a finance or accounting specialization not only provides the necessary credits but also includes coursework directly relevant to the CPA exam content. However, candidates should verify that their postgraduate program includes sufficient accounting-specific courses to meet state requirements for accounting credit distribution.

CA, CS, and CMA Qualified Professionals: Your Credit Advantage

Professional qualifications like Chartered Accountancy, Company Secretary, or Cost Management Accountancy can contribute additional credits toward your eligibility. The credit value assigned varies by evaluation agency and state board. Indian CA qualification, while historically credited as an academic qualification, is now primarily recognized as an experience qualification by most state boards since policy changes in 2012.

Despite these changes, CA holders typically find that their practical knowledge provides significant advantages in CPA exam preparation, particularly for audit and taxation content. The combination of a degree plus a professional qualification often provides sufficient total credits while also demonstrating the depth of knowledge state boards value.

Accounting and Business Credit Distribution Requirements for CPA Exam

Beyond total credit hours, most state boards impose specific requirements for accounting credits, usually 24 to 30 semester hours, and business credits, typically 24 semester hours. These distribution requirements ensure candidates have substantive exposure to core accounting and business disciplines regardless of their total credit count.

Accounting credits typically include coursework in financial accounting, managerial accounting, auditing, taxation, and accounting information systems. Business credits encompass subjects like business law, economics, finance, management, and statistics. Indian commerce degrees generally include strong coverage in these areas, but the specific credit distribution depends on your university’s curriculum and how evaluation agencies categorize your coursework.

Candidates should obtain a credential evaluation early in their journey to understand exactly how their coursework maps to these requirements. Some candidates discover they need additional accounting-specific courses even when their total credit count appears sufficient. Addressing these gaps before the application prevents delays and additional expenses later.

Bridge Courses and Additional Credit Options for CPA Exam

Candidates who fall short of credit requirements have several options to bridge the gap without pursuing full degree programs. These bridge courses provide focused education at a lower cost and time investment compared to traditional degrees.

US University Bridge Programs for Indian Candidates

Several US universities offer online bridge programs specifically designed for international CPA candidates. These programs allow you to complete accounting and business courses remotely, earning credits that count toward CPA eligibility. Programs from accredited institutions provide recognized credits that state boards accept for eligibility determination.

NASBA Approved Coursework and Credit Supplements

NASBA maintains relationships with approved educational providers offering supplementary coursework for CPA candidates. These courses focus specifically on areas where candidates commonly need additional credits, such as advanced accounting, taxation, or auditing. Completing approved coursework provides a direct pathway to meeting credit requirements while reinforcing exam-relevant knowledge.

Education Evaluation Process CPA Exam

Before any US state board considers your CPA application, they require verification that your international education meets their requirements. This verification comes through credential evaluation agencies that analyze your transcripts, convert your credentials to US equivalents, and provide official reports to state boards. The evaluation process typically takes four to eight weeks and represents an essential early step in your CPA journey.

Choosing Between WES, NIES, and Other Evaluation Agencies

Several credential evaluation agencies serve CPA candidates, each with different processes, costs, and turnaround times. The two most commonly used services for Indian candidates are World Education Services (WES) and NASBA International Evaluation Services (NIES). Your choice may depend on state board preferences, processing time requirements, and whether you need evaluation for purposes beyond CPA.

WES provides a comprehensive credential evaluation accepted by multiple state boards and useful for immigration or employment purposes beyond the CPA. The WES process requires transcript verification through their designated partners in India and separate verification for professional qualifications like CA through ICAI.

NIES offers a CPA-specific evaluation directly integrated with the NASBA candidate portal, streamlining the application process for some candidates. NIES evaluations focus specifically on CPA eligibility determination and may process faster for straightforward credential profiles. Evaluation fees range from $200 to $300, depending on service level and processing speed. Both agencies are accepted by the major international-friendly states, so your choice may come down to convenience, timeline, and multi-purpose needs.

Document Requirements and Preparation Checklist

Gathering and preparing documents for credential evaluation requires attention to detail and coordination with your educational institutions. Understanding exactly what documents you need prevents delays and rejected applications.

Academic transcripts must be official documents sent directly from your institution to the evaluation agency, not copies you provide yourself. For Indian universities, this typically requires submitting a transcript request form and paying applicable fees to your registrar’s office. Some agencies accept electronic transmission, while others require physical mailing in sealed envelopes.

Degree certificates proving completion of your qualification must accompany transcripts. These should be attested copies or originals, depending on agency requirements. For professional qualifications like CA, you will need membership verification from ICAI sent directly to the evaluation agency. Plan for at least four to six weeks for Indian institutions to process and send documents, building this timeline into your overall planning.

State Selection Strategy: Which US State Should Indian Candidates Choose

State selection represents one of the most consequential decisions in your CPA journey, yet many candidates underestimate its importance. Each of the 55 US jurisdictions sets its own eligibility criteria, experience requirements, and application procedures. Choosing a state aligned with your qualifications simplifies the process, while a mismatched selection can result in rejected applications and wasted fees.

International-Friendly States Without SSN Requirements for CPA Candidates

Most Indian candidates lack a US Social Security Number, immediately disqualifying them from many state boards. However, several states explicitly welcome international candidates and do not require an SSN for examination or licensure. The primary options include Montana, Alaska, Guam, and Pennsylvania, each participating in the international administration of the CPA exam through NASBA.

Washington has emerged as the most popular choice among Indian candidates, combining clear requirements with efficient processing and strong recognition. The state requires 150 semester hours with specific accounting and business credit distribution, plus one year of verified experience for licensure. Montana offers a streamlined alternative with comparable requirements and potentially faster turnaround times for some applicants.

Experience Requirements and Supervision Policies by State for the CPA Exam Candidates

Experience requirements for CPA licensure vary significantly by state, ranging from no experience to two years of supervised work. Understanding these requirements before selecting your state prevents surprises after passing all exam sections. Most internationally friendly states accept experience gained outside the US, but verification procedures differ.

Washington and Montana require one year of experience that can be verified through NASBA’s international experience verification program, eliminating the need for a U.S.-based CPA supervisor. This flexibility makes these states particularly attractive for candidates planning to remain in India. The experience must be in accounting-related functions under appropriate supervision, though the supervisor need not hold a US CPA license in most cases.

Making Your State Selection Decision

Your state selection should consider multiple factors: your current credit count, experience status, long-term career plans, and processing efficiency. If you have 150 credits already, states like Washington offer full licensure pathways. If you have only 120 credits, some states allow you to sit for the exam while accumulating additional credits before licensure.

For most Indian candidates without specific US practice requirements, choosing an international-friendly state with straightforward verification processes represents the optimal strategy. You can always transfer your license to another state later through reciprocity agreements if your career requires practice rights in a specific jurisdiction.

Complete CPA Course Fees and Costs in Indian Rupees (2025)

Understanding the total investment required for CPA certification helps you plan financially and avoid surprises during your journey. The costs span multiple categories, including credential evaluation, exam fees, review course investment, and licensing expenses. As of 2025, Indian candidates should budget between ₹2.8 lakhs and ₹5.5 lakhs for the complete CPA journey, depending on choices regarding review courses, state selection, and first-attempt success.

Credential Evaluation and Application Fees

Credential evaluation typically costs $150 to $300, depending on the agency, service level, and processing speed selected. At current exchange rates at $90 per dollar, this translates to approximately ₹17,000 to ₹34,000. State board application fees add another $90 to $245, depending on your chosen jurisdiction, representing an additional ₹7,500 to ₹21,000.

Some states bundle application and registration fees, while others charge separately for each component. Always verify the complete fee structure with your chosen state board before applying to avoid unexpected charges that delay your Notice to Schedule.

CPA Exam Section Fees for International Candidates

In June 2025, NASBA implemented significant fee increases for international candidates, making exam costs a substantial portion of your total investment. Indian candidates testing at domestic Prometric centers now pay $510 per section, increased from $390 previously. This $120 per-section increase represents a 31% jump that adds approximately ₹43,200 to your total exam costs compared to 2024 rates.

For all four sections, your total exam fees now reach $2,040, approximately ₹1,83,600 at current exchange rates. This amount covers only the examination itself; you must also pay NTS registration fees of approximately $93 per application. Failed sections require full repayment of exam fees for retakes, making first-attempt success increasingly important financially.

CPA Review Course Investment and Study Material Costs

Quality review course investment significantly impacts your probability of passing, making this a critical area where cost-cutting often proves counterproductive. Major review course providers charge between $800 and $4,000 for comprehensive packages, translating to approximately ₹68,000 to ₹3,40,000. Indian coaching institutes offering bundled packages with Becker materials typically charge between ₹80,000 and ₹1,50,000.

The difference between passing on first attempt versus requiring retakes often exceeds the price difference between basic and premium review courses. Candidates should evaluate review courses based on learning style fit, pass rate claims, and support features rather than price alone.

Total Investment Summary and Payment Planning

Summing all components, most Indian candidates invest between ₹2,80,000 and ₹5,50,000 for complete CPA certification. This range accounts for evaluation fees around ₹25,000, exam fees of ₹1,75,000, review courses between ₹80,000 and ₹1,50,000, and licensing costs of ₹15,000 to ₹40,000. Candidates requiring additional credits or experiencing retakes will incur costs toward the higher end.

Many review course providers offer EMI options and no-cost financing to spread the investment over time. Planning your payment schedule alongside your exam timeline helps manage cash flow while maintaining momentum in your preparation.

Best CPA Review Courses for Indian Candidates

Choosing the right review course significantly impacts your preparation experience and exam performance. The CPA exam tests both knowledge breadth and application depth, requiring structured study materials, practice questions matching exam difficulty, and simulation practice that mirrors the actual testing experience. For Indian candidates, additional considerations include timezone compatibility for live sessions, local support availability, and pricing in accessible ranges.

Indian CPA Review Courses

SkillArbitrage offers a CPA Prep and Global Finance Career Acceleration Program designed specifically for Indian professionals navigating the CPA journey. The program combines comprehensive exam preparation with practical career skills development, covering all four exam sections along with finance tools, automation skills, and freelancing guidance. The program spans six months with an 8 to 10 hours per week commitment, priced at ₹1,20,000. The curriculum includes state board selection guidance, document preparation support, and structured study planning alongside core exam content.

Indian coaching institutes provide localized support, live instruction in convenient time zones, and often bundle international review materials with personalized guidance. Simandhar Education, as Becker’s official partner in India, offers Becker content with additional live coaching, doubt-clearing sessions, and placement assistance. Their programs combine world-class Becker materials with instructor support from qualified CPAs who understand Indian candidates’ specific challenges.

Miles Education has established strong reputation for CPA coaching in India, offering comprehensive preparation support from evaluation through licensing. Miles provides live classes, recorded sessions, and continuous support throughout the exam journey. Their programs emphasize practical career outcomes, including placement connections with Big 4 firms and major MNCs. Pricing for Indian coaching institutes typically ranges from ₹80,000 to ₹1,50,000, depending on included features and support levels.

CPA Review Courses

Becker CPA Review maintains an industry-leading reputation, with the Big 4 firms frequently sponsoring their employees through Becker programs. Becker’s comprehensive packages include video lectures, extensive practice question banks, and task-based simulations with detailed explanations.

UWorld Roger CPA Review, which acquired Wiley CPA content, combines engaging video instruction with extensive practice materials. UWorld courses range from $3,499 to $4,099, positioning them at the premium end of the market. The integration of Roger Philipp’s engaging teaching style with Wiley’s content library creates a comprehensive learning experience valued by visual learners.

Surgent CPA Review differentiates through adaptive learning technology that customizes study plans based on your demonstrated knowledge levels. Their A.S.A.P. Technology assesses your starting point and continuously adapts content delivery to focus on weak areas. Surgent packages range from $799 for Essentials to $1,699 for Ultimate Pass, offering strong value for self-motivated learners comfortable with technology-driven study.

Gleim CPA Review provides the largest practice question bank in the industry with over 11,500 MCQs and 1,300 task-based simulations, making it ideal for candidates who learn best through extensive practice.

CPA Career Opportunities and Salary in India

The growing presence of multinational corporations in India, expansion of Big 4 operations, and increasing adoption of US GAAP reporting have created robust demand for CPA-qualified professionals. Organizations value CPAs for their understanding of international accounting standards, rigorous examination process, and demonstrated technical competence. This demand translates to attractive compensation packages and accelerated career progression.

CPA Salary Ranges for Freshers and Experienced Professionals

Entry-level CPAs in India typically earn between ₹6 lakhs and ₹9 lakhs per annum, with Big 4 firms and major MNCs offering packages at the higher end of this range.

Mid-level CPAs with five to ten years of experience command salaries between ₹15 lakhs and ₹25 lakhs per annum, particularly those working with US clients or on international engagements. Senior CPAs in leadership roles, especially within Big 4 firms or multinational corporations, often earn ₹20 lakhs to ₹30 lakhs annually.

Career Roles and Growth Paths for CPAs

The CPA qualification opens diverse career paths across public accounting, corporate finance, consulting, and specialized practice areas. The credential is particularly valued for roles requiring US accounting standards expertise, international audit experience, or cross-border financial reporting responsibilities.

Audit, Tax, and Advisory Career Tracks

In public accounting, CPAs advance through staff, senior, manager, and senior manager roles toward partnership tracks. Tax-focused CPAs build expertise in international taxation, transfer pricing, and cross-border structuring. Advisory track CPAs engage in transaction support, forensic accounting, and management consulting. Each track offers distinct progression paths with compensation increasing significantly at each level.

Transitioning to CFO and Leadership Positions

The CPA credential provides a strong foundation for executive finance roles, including CFO positions in multinational companies. The combination of technical expertise, ethical grounding, and comprehensive business understanding positions CPAs well for strategic leadership responsibilities. Many CFOs at India-based subsidiaries of US companies hold a CPA qualification alongside other credentials.

CPA Exam Preparation Timeline and Study Strategies

Realistic timeline planning distinguishes successful candidates from those who struggle with the CPA journey. The exam covers substantial content requiring consistent, sustained effort over months rather than weeks. Working professionals face additional challenges balancing preparation with career responsibilities, making efficient study strategies essential.

Realistic Study Hours and Timeline for Indian Professionals

The AICPA indicates candidates spend between 300 and 500 hours preparing for all four CPA sections, translating to approximately 75 to 125 hours per section. However, individual study time varies significantly based on educational background, work experience, and familiarity with US accounting concepts. Indian candidates transitioning from Indian GAAP to US GAAP often require additional time, particularly for FAR and REG sections.

12 to 18 Month Timeline for Working Professionals

Working professionals studying 15 to 20 hours weekly should plan for 12 to 18 months to complete all four sections. This timeline allows adequate preparation for each section while maintaining work-life balance and preventing burnout. Attempting to compress the timeline significantly often leads to failed sections and an extended overall duration.

A realistic schedule might allocate three to four months per section, with one to two weeks between sections for exam scheduling and mental recovery. Building buffer time into your schedule accommodates unexpected work demands, illness, or the need for additional review in challenging areas.

CPA Exam Pass Rates

Understanding pass rate data helps you calibrate expectations and develop appropriate preparation strategies. Pass rates reflect aggregate candidate performance and should inform your study planning without causing undue anxiety. The exam is designed to assess competence, not curve performance against other candidates, meaning adequate preparation leads to passing regardless of others’ results.

Section-Wise Pass Rates Under CPA Evolution

Since CPA Evolution launched in January 2024, pass rates have established new patterns across the restructured sections. According to AICPA’s official data, Core section pass rates in 2024-2025 show FAR at approximately 40% to 43%, AUD at 46% to 48%, and REG at 60% to 64%. Discipline sections demonstrate wider variation: BAR at 34% to 41%, ISC at around 68%, and TCP at 72% to 82%.

These rates represent all candidates who sat for each section, including those who were inadequately prepared. Candidates using quality review courses and completing full study plans consistently outperform these averages. Becker reports their Exam Day Ready students achieve pass rates 64% higher than other candidates, demonstrating the impact of thorough preparation.

What Pass Rates Mean for Your Preparation Strategy

Pass rate data should inform strategic decisions rather than cause discouragement. Lower pass rates on FAR and BAR indicate these sections require more intensive preparation, not that passing is unlikely for well-prepared candidates.

Why FAR and BAR Have Lower Pass Rates

FAR’s lower pass rates reflect the section’s extensive content coverage spanning financial reporting for multiple entity types, complex transactions, and governmental accounting standards. The sheer volume of material tests candidates’ ability to retain and apply broad knowledge bases. BAR extends FAR’s complexity with advanced technical topics, explaining its similarly challenging pass rates.

Both sections reward methodical preparation over cramming. Candidates who build strong conceptual foundations through consistent study typically perform well, while those attempting shortcuts struggle with the application-oriented simulations.

How to Position Yourself Above the Average

Positioning yourself above average pass rates requires comprehensive preparation using quality materials, consistent study habits, and strategic practice. Complete your review course fully rather than skipping sections that seem familiar. Practice extensively with actual exam-format questions and simulations. Take full-length practice exams under timed conditions to build stamina and time management skills.

Review your wrong answers carefully to understand why you missed each question, not just what the correct answer was. This analytical approach to practice builds the deeper understanding that simulations require. Candidates who approach preparation systematically and complete their study plans thoroughly pass at rates far exceeding published averages.

Conclusion

The CPA journey represents a significant investment of time, money, and effort, but the returns for Indian professionals are substantial and lasting. With Big 4 firms actively recruiting CPA-qualified professionals, multinational corporations expanding their India operations, and global finance roles increasingly requiring international credentials, the CPA opens doors that remain closed to those with only domestic qualifications.

Your path forward starts with obtaining a credential evaluation to understand your exact credit position and eligibility options. From there, select an international-friendly state aligned with your qualifications, choose a review course matching your learning style and budget, and develop a realistic study timeline accommodating your work and life responsibilities. The eight Prometric testing centers across India, located in Ahmedabad, Bangalore, Calcutta, Chennai, Hyderabad, Mumbai, New Delhi, and Trivandrum, make exam access convenient without international travel.

Thousands of Indian professionals successfully earn their CPA licenses each year. With the right preparation approach, verified information guiding your decisions, and persistent effort through the examination process, you can join them. The investment pays dividends throughout your career in the form of enhanced opportunities, accelerated progression, and compensation that reflects your internationally recognized expertise.

Frequently Asked Questions

Can I pursue CPA after B.Com in India?

Yes, B.Com graduates can pursue CPA, though you will likely need additional credits to meet eligibility requirements. A three-year B.Com typically provides approximately 90 credits, while most states require 120 credits for exam eligibility and 150 for licensure. Adding an M.Com, professional qualification, or bridge courses can fill the gap.

How many credits does an Indian B.Com degree provide for CPA?

A standard three-year Indian B.Com degree typically converts to approximately 90 US semester credit hours when evaluated by credential agencies. The exact count depends on your specific university curriculum and how the evaluation agency categorizes your coursework.

What is the total cost of CPA in Indian Rupees?

The total CPA investment for Indian candidates ranges from approximately ₹2.8 lakhs to ₹5.5 lakhs, covering credential evaluation (₹17,000 to ₹34,000), exam fees (₹1,73,400 for all four sections at current 2025 rates), review courses (₹80,000 to ₹1,50,000), and licensing costs (₹15,000 to ₹40,000).

How long does it take to complete CPA from India?

Most working professionals complete the CPA within 12 to 18 months, studying 15 to 20 hours weekly. This timeline allows three to four months of focused preparation per section. Candidates with more study time available may complete faster, while those with demanding work schedules may require longer.

Which US state is best for Indian CPA candidates?

Montana, Guam, and Alaska are popular choices for Indian candidates because they do not require a Social Security Number and accept international experience verification. Washington is the most commonly chosen state, combining clear requirements with efficient processing and strong recognition.

Is CPA recognized in India for jobs?

Yes, CPA is highly recognized by Big 4 firms, multinational corporations, and companies with US operations or reporting requirements. Major employers including Deloitte, PwC, EY, KPMG, Accenture, and numerous MNCs actively recruit CPA-qualified professionals for their India offices.

Can I take the CPA exam from India?

Yes, the CPA exam is available at eight Prometric testing centers across India: Ahmedabad, Bangalore, Calcutta, Chennai, Hyderabad, Mumbai, New Delhi, and Trivandrum. Core sections follow continuous testing while Discipline sections are available during specific testing windows.

What is the CPA exam pass rate in 2025?

Pass rates vary by section. According to AICPA data for 2024-2025: FAR approximately 40% to 43%, AUD 46% to 48%, REG 60% to 64%, BAR 34% to 41%, ISC 51% to 59%, and TCP 72% to 82%. Well-prepared candidates using quality review courses significantly exceed these averages.

Do I need work experience to become a CPA?

Work experience is required for CPA licensure but not for taking the exam in most states. Most international-friendly states require one year of verified experience in accounting functions. You can complete experience requirements after passing all exam sections.

Is CPA harder than CA?

CPA and CA differ in structure and focus rather than being directly comparable in difficulty. CA involves longer duration (three to four years) and multiple levels, while CPA requires passing four sections within 30 months. Many CA holders find CPA exam preparation manageable given their strong accounting foundation.

Which CPA discipline section should I choose?

Choose based on career goals and background alignment: TCP for tax-focused careers (highest pass rates at 72% to 82%), ISC for IT audit or technology roles (51% to 59% pass rates), or BAR for advanced financial analysis positions (34% to 41% pass rates). Strong background alignment improves both preparation efficiency and career relevance.

What is the validity period for passing CPA sections?

You must pass all four CPA sections within 30 months of passing your first section. This 30-month rolling window replaced the previous 18-month requirement under CPA Evolution, providing additional flexibility for working candidates.

Can CA holders get exemptions in CPA?

Indian CA holders do not receive exam exemptions for CPA. You must pass all four CPA sections regardless of prior qualifications. However, your CA knowledge provides strong preparation foundation, and your qualification may contribute credits toward eligibility requirements depending on the state and evaluation agency.

Allow notifications

Allow notifications