Complete guide to becoming a US CPA from India. Learn eligibility requirements, state selection, exam structure, costs in INR, and career opportunities for Indian professionals.

Table of Contents

If you’re reading this, you’ve probably been researching the US CPA credential for weeks, maybe months. You’ve seen the salary figures, noticed the job postings demanding CPA qualifications, and wondered if this globally recognized certification is within your reach as an Indian professional. The good news is that it absolutely is. Thousands of Indian candidates successfully earn their CPA licenses every year, and with the right roadmap, you can join them.

The Certified Public Accountant credential, issued by the American Institute of Certified Public Accountants (AICPA), stands as one of the most respected accounting qualifications worldwide. For Indian professionals, it opens doors that domestic certifications alone cannot. Whether you’re a B.Com graduate exploring international opportunities, a Chartered Accountant seeking global recognition, or a working professional in an MNC wanting to advance your career, the CPA offers a proven pathway to higher salaries, leadership roles, and international mobility.

This guide will walk you through every step of the CPA journey, from assessing your eligibility based on Indian qualifications to obtaining your license. You’ll find specific credit mappings for Indian degrees, current 2025 fee structures in Indian Rupees, state selection frameworks tailored to candidates without US Social Security Numbers, and preparation strategies designed for professionals balancing full-time work in India. By the end, you’ll have a clear, actionable roadmap to becoming a US CPA.

Certified Public Accountant

The Certified Public Accountant designation represents the highest standard of competence in the accounting profession within the United States. Administered by the AICPA, this credential has evolved over more than a century to become a globally recognized mark of accounting expertise. For Indian professionals, understanding what a CPA does and where this license holds value is the essential first step in deciding whether to pursue this qualification.

The Role of a CPA: What the Profession Actually Involves

A CPA is a licensed accounting professional authorized to perform services that regular accountants cannot. These exclusive responsibilities include signing audit reports, representing clients before the IRS, and certifying financial statements for publicly traded companies. CPAs work across diverse areas, including financial reporting, tax advisory, internal and external auditing, forensic accounting, and management consulting.

The scope of a CPA’s work extends far beyond basic bookkeeping. In practice, CPAs analyze complex financial data, ensure regulatory compliance, advise on mergers and acquisitions, and help organizations make strategic financial decisions. This breadth of responsibility explains why employers, particularly multinational corporations and Big 4 firms, specifically seek CPA-qualified professionals for senior finance roles.

Is the CPA License Recognized Worldwide?

The US CPA license enjoys recognition across more than 100 countries through various mutual recognition agreements. Beyond the United States, CPAs can practice or leverage their credentials in Canada, Australia, New Zealand, Hong Kong, Ireland, and several other jurisdictions. This global portability makes the CPA particularly valuable for Indian professionals seeking international career mobility.

Within India itself, the CPA credential carries significant weight among multinational corporations, Big 4 accounting firms, and companies with US reporting requirements. While the CPA does not replace the Indian CA for statutory compliance work within India, it complements domestic qualifications by adding expertise in US GAAP, international financial reporting standards, and American tax regulations.

Why are Indian Accounting Professionals Pursuing CPA?

The demand for CPA-qualified professionals in India has grown substantially over the past decade, driven by the expansion of US companies operating in India and Indian companies seeking US listings. According to industry data, the Big 4 firms alone employ thousands of CPAs in their Indian offices to serve global clients requiring US GAAP expertise.

The Growing Demand for US GAAP Expertise in India

Multinational corporations operating shared service centers in India require professionals who understand US accounting standards. Companies like Amazon, Google, Microsoft, and hundreds of others maintain significant finance operations in Indian cities, all requiring staff proficient in US GAAP reporting. This demand has created a consistent job market for CPA holders in metros like Bangalore, Mumbai, Hyderabad, and Delhi NCR.

The Big 4 accounting firms, Deloitte, PwC, EY, and KPMG, actively recruit CPA-qualified professionals for their US-focused audit and advisory practices based in India. These roles often involve working with American clients during US business hours, providing a pathway to international exposure without relocating abroad.

Career Advantages of Holding Both CA and CPA

For Indian Chartered Accountants, adding the CPA credential creates a powerful combination that opens doors domestically and internationally. The CA provides deep expertise in Indian taxation, company law, and statutory compliance, while the CPA adds US GAAP knowledge, international tax understanding, and global recognition.

Professionals holding both qualifications often find themselves fast-tracked into leadership positions. They become natural choices for roles requiring coordination between Indian and American accounting requirements, such as transfer pricing, cross-border tax planning, and consolidated financial reporting for multinational groups.

CPA Eligibility Requirements for Indian Candidates

Understanding CPA eligibility is arguably the most critical step in your journey, and it’s where many candidates face confusion. Unlike Indian professional exams, where eligibility is straightforward, the US CPA system evaluates candidates through a credit-based framework that requires your Indian qualifications to be translated into American educational terms. Getting clarity on this upfront saves you from investing in a path you cannot complete and helps identify any gaps you need to address.

How the US Credit System Works for Indian Qualifications

The US measures higher education in semester credit hours, a unit that doesn’t directly correspond to Indian degree structures. Your Indian transcripts will be evaluated by authorized agencies that convert your academic records into US credit equivalents based on course content, duration, and institutional accreditation. This conversion determines whether you meet the threshold for exam eligibility and eventual licensure.

Credit Hour Requirements (120 for Exam, 150 for License)

Most US state boards require 120 credit hours to sit for the CPA exam and 150 credit hours for full licensure. This two-tier system means you can begin taking exams at 120 credits while working toward the additional 30 credits needed for your license. Some states, like Guam, allow candidates to complete all four exam sections with just 120 credits, making the initial qualification process more accessible for Indian candidates.

The 150-credit requirement for licensure typically equals a bachelor’s degree plus a master’s degree or equivalent additional coursework. For Indian candidates, this usually means combining your undergraduate degree with either a postgraduate qualification or professional certifications that carry credit value.

How do Indian Degrees Convert to US Credits?

The conversion of Indian qualifications to US credits follows patterns that credential evaluation agencies have established over the years of assessing thousands of applications. While exact credits vary based on your specific institution and coursework, the following ranges represent typical evaluations.

B.Com Credit Equivalency

A three-year Indian B.Com degree typically evaluates to approximately 90 semester credit hours. This falls short of the 120-credit exam requirement, meaning B.Com holders need additional qualifications to become eligible. However, candidates who completed a four-year B.Com (Honors) program may receive evaluations closer to 120 credits depending on their coursework.

M.Com, MBA, and Postgraduate Credit Values

An M.Com degree adds approximately 60 credits to your total, bringing a B.Com plus M.Com combination to around 150 credits, meeting the full licensure requirement. Similarly, an MBA in Finance or Accounting adds 60 credits. These postgraduate qualifications not only satisfy credit requirements but also typically include advanced accounting and business coursework that strengthens your exam preparation.

CA, CS, and CMA Credit Recognition

The Indian Chartered Accountant qualification adds between 30 and 60 credits, depending on the evaluating agency and state board. When combined with a B.Com, a CA typically brings total credits to 120-150, making most CAs eligible for the CPA exam. Company Secretary (CS) and Cost and Management Accountant (CMA) certifications also receive credit recognition, though typically in lower ranges than the CA.

Which Indian Qualifications Meet CPA Eligibility?

The pathway to CPA eligibility varies significantly based on your starting qualifications. B.Com graduates typically need additional credentials to reach 120 credits, while postgraduate degree holders and professional qualification holders often meet requirements without additional coursework.

For B.Com graduates, the most common pathway involves completing a postgraduate degree such as M.Com or MBA. Alternatively, pursuing the Indian CA or CMA alongside your B.Com can bring your credits to the required threshold. Some candidates opt for bridge courses offered by Indian universities or online platforms to make up specific credit deficiencies in accounting or business subjects.

Chartered Accountants generally find themselves well-positioned for CPA eligibility. The CA qualification, combined with the underlying B.Com degree, typically evaluates to 120-150 credits depending on the evaluation agency. Many CAs can begin the CPA exam process immediately after their credential evaluation, making the CA plus CPA combination an efficient pathway to global recognition.

M.Com and MBA holders with a B.Com foundation typically meet the 150-credit threshold for full licensure. These candidates can proceed directly to credential evaluation and state board application without additional coursework. The accounting content in these degrees also provides a strong foundation for CPA exam preparation.

Bridging the Credit Gap: Options for Candidates Who Fall Short

If your credential evaluation reveals a shortfall in total credits or specific subject areas, several options exist to bridge the gap. Understanding these options early allows you to plan your pathway efficiently.

Additional Coursework Options

Many US universities offer individual courses that international candidates can complete online to satisfy credit deficiencies. These courses typically focus on specific areas like US taxation, business law, or advanced accounting topics that may not have been covered in your Indian curriculum. Completing these courses adds both credits and subject-specific knowledge that benefits your exam preparation.

Indian Universities and Online Platforms Offering Bridge Courses

Several Indian institutions have developed programs specifically designed to help CPA aspirants meet credit requirements. Universities offering distance learning commerce programs provide coursework that evaluation agencies recognize. Additionally, there are bridge courses that are offered by coaching institutes that can contribute to your credit total while being completed alongside your work schedule.

How to Choose the Right US State for Your CPA Application

State selection is one of the most consequential decisions in your CPA journey, yet many candidates treat it as an afterthought. Each of the 55 US jurisdictions sets its own requirements for exam eligibility, experience verification, and licensure. Choosing wisely based on your specific circumstances can mean the difference between a smooth application process and years of complications.

Understanding the 55 Jurisdictions System

The United States has 55 CPA licensing jurisdictions, including all 50 states plus Washington D.C., Guam, Puerto Rico, the US Virgin Islands, and the Commonwealth of the Northern Mariana Islands. Each jurisdiction operates independently through its State Board of Accountancy, setting requirements for education, examination, experience, and ethics. This decentralized system creates opportunities for international candidates because some jurisdictions maintain more accommodating policies than others.

Key Differences That Affect Indian Candidates

The variations between states that matter most to Indian candidates include Social Security Number requirements, credit hour thresholds for exam eligibility, experience verification policies, and residency rules. Some states require an SSN for exam application, immediately disqualifying most Indian candidates. Others accept 120 credits for the exam, while some demand 150 credits upfront.

Experience verification presents another critical difference. Some states require your work experience to be verified by a US-licensed CPA, which creates challenges for candidates working in India under CA supervision. However, certain states participate in NASBA’s experience verification service, accepting verification from equivalent international professionals.

Best US States for Indian CPA Candidates in 2025

Based on current policies and the experience of thousands of Indian candidates, certain states have emerged as preferred choices. These jurisdictions combine favorable eligibility rules with practical application processes.

Guam: The Most Popular Choice for Indians

Guam consistently ranks as the most popular jurisdiction for Indian CPA candidates, and for good reason. This US territory does not require a Social Security Number, accepts 120 credits for exam eligibility, and participates in NASBA’s experience verification service. The application process is straightforward, and the board responds relatively quickly to international applicants. If you’re uncertain where to apply, Guam represents the safest and most practical starting point.

Montana, Illinois, and Alaska: Strong Alternatives

Montana offers similar flexibility to Guam, with no SSN requirement and acceptance of international credentials. The state has historically been friendly toward CA holders and provides alternative pathways for experience verification. Illinois appeals to candidates seeking a more traditionally recognized state, offering no SSN requirement and increasing acceptance of online degrees from accredited institutions.

Alaska works well for candidates who haven’t yet completed their education, as the state allows you to sit for the exam before graduation if you’ve fulfilled sufficient accounting credit hours. This flexibility benefits candidates currently pursuing M.Com or MBA programs who want to begin their CPA exams early.

States to Avoid If You Don’t Have an SSN

Several states require a Social Security Number for exam application, making them impractical for most Indian candidates. California, while attractive due to its recognition, requires an SSN for licensure even though you can sit for the exam without one. Texas, New York, and Florida also have SSN requirements at various stages. Before applying to any state, verify current SSN policies directly with the state board or through NASBA’s website.

State Selection Decision Framework

Rather than simply picking the most popular state, consider how different factors apply to your specific situation. This framework helps you make an informed choice.

Choosing Based on Your Credit Count, Experience Verification Needs, and Long-Term Career Goals

If you have exactly 120 credits, prioritize states like Guam that allow exam completion at this threshold. For 150-credit candidates, more options become available. Consider where you plan to eventually practice or seek employment, as some employers prefer licenses from specific states.

Your experience verification situation matters significantly. If you work under a CA in India without access to a US CPA supervisor, choose states like Montana or Guam that offer alternative verification pathways through NASBA. If you work for a Big 4 firm with US CPA partners who can verify your experience, more states become viable options.

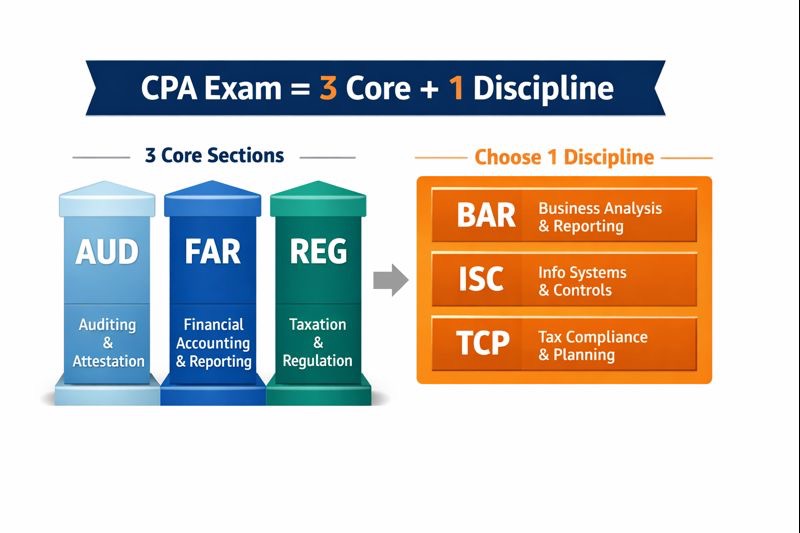

CPA Exam Structure: Core Sections and Discipline Choices

The CPA exam underwent significant changes in January 2024 with the implementation of CPA Evolution, restructuring the traditional four-section format into a new model. Understanding this current structure is essential for planning your preparation strategy and selecting the discipline that aligns with your career goals.

Three Core Sections Every Candidate Must Pass

Under the CPA Evolution model, all candidates must pass three Core sections:

- Auditing and Attestation (AUD),

- Financial Accounting and Reporting (FAR), and

- Taxation and Regulation (REG).

These sections test foundational knowledge that every CPA needs, regardless of their eventual specialization. Each Core section is a four-hour exam combining multiple-choice questions and task-based simulations, weighted 50% each in your final score.

The Core sections are available for testing year-round at Prometric testing centers, giving you flexibility in scheduling. You can take these sections in any order, though many candidates start with FAR due to its foundational content that supports understanding in other sections.

Choosing Your Discipline Section: BAR vs ISC vs TCP

In addition to the three Core sections, you must pass one Discipline section of your choice:

- Business Analysis and Reporting (BAR),

- Information Systems and Controls (ISC), or

- Tax Compliance and Planning (TCP).

This choice should reflect your career interests and strengths rather than perceived difficulty.

BAR suits candidates interested in financial analysis, management accounting, and advisory roles. ISC aligns with careers in IT audit, cybersecurity, and technology consulting. TCP fits those planning to specialize in tax advisory and compliance work. According to AICPA guidance, the Discipline sections are designed to be equally rigorous, and higher pass rates in some sections reflect candidate self-selection rather than easier content.

Deep Dive into Each CPA Exam Section

Understanding what each section covers helps you plan your preparation and set realistic expectations for the time and effort required.

Financial Accounting and Reporting (FAR)

FAR covers US GAAP, IFRS, and governmental accounting, testing your ability to prepare and analyze financial statements. The section includes complex topics like business combinations, derivatives, and pension accounting. For Indian candidates familiar with Indian AS, FAR requires learning US-specific treatments that differ from Indian standards.

According to AICPA’s Q3 2025 data, FAR maintains a pass rate of around 43%, making it one of the more challenging sections. The breadth of content, spanning corporate, governmental, and not-for-profit accounting, requires significant study time.

Auditing and Attestation (AUD)

AUD tests your knowledge of audit procedures, professional responsibilities, and attestation engagements. The section emphasizes understanding the flow of an audit engagement, from planning through reporting, and requires familiarity with AICPA auditing standards. For candidates with audit experience, much of this content will feel familiar.

AUD pass rates hover around 48% according to recent AICPA data. The section is conceptually challenging, requiring you to apply judgment rather than simply recall facts. Candidates working in audit roles often find this section more intuitive, while those from industry backgrounds may need additional preparation time.

Taxation and Regulation (REG)

REG covers US federal taxation for individuals, corporations, and pass-through entities, along with business law topics. This section requires learning an entirely new tax system for Indian candidates, as US tax concepts differ substantially from Indian taxation. Topics include individual income tax, corporate tax, estate and gift tax, and professional ethics.

REG shows the strongest Core section pass rate at approximately 64% in 2025. The section rewards methodical study of tax rules and their application. While the content is new for Indian candidates, its rule-based nature means consistent preparation typically yields good results.

Business Analysis and Reporting (BAR)

BAR builds on FAR content, diving deeper into financial statement analysis, management accounting, and business decision-making. The section includes technical accounting topics that were previously tested in the now-retired BEC section, such as variance analysis, budgeting, and performance measurement.

As a Discipline section, BAR shows pass rates around 43%, similar to FAR. Candidates choosing BAR typically have strong financial accounting backgrounds and an interest in analytical roles. The section suits those targeting positions in financial planning and analysis, controller roles, or advisory services.

Information Systems and Controls (ISC)

ISC focuses on IT governance, cybersecurity, and system controls relevant to financial reporting. The section tests understanding of IT general controls, system development processes, and technology risk assessment. For candidates comfortable with technology concepts, ISC offers an alternative to the heavily accounting-focused BAR.

ISC pass rates reach approximately 68%, the highest among Discipline sections. This rate reflects both the specialized nature of candidates choosing this path and growing familiarity with the content as educators adapt to CPA Evolution. Candidates interested in IT audit or technology consulting careers often select ISC.

Tax Compliance and Planning (TCP)

TCP extends REG content into more complex tax scenarios, including advanced individual taxation, entity tax planning, and multistate taxation. This section suits candidates planning careers in tax advisory, where deep technical knowledge drives client value.

TCP consistently shows the highest pass rates at approximately 78% in 2025. However, AICPA emphasizes that high pass rates reflect candidate selection rather than easier content. Those choosing TCP typically have already demonstrated strength in taxation by passing REG, creating a self-selected group predisposed to success.

Why Some Sections Have Higher Pass Rates

Several factors explain the variation in pass rates across sections. REG’s relatively high Core section rate reflects its rule-based content that rewards consistent study. TCP and ISC, as Discipline choices, attract self-selected candidates who have already demonstrated strength in related Core content.

FAR and BAR’s lower rates stem from their comprehensive content breadth and analytical demands. These sections require understanding and applying numerous accounting standards across various entity types and scenarios. Success requires both memorization and the ability to synthesize complex information.

The CPA Application and Registration Process: From Evaluation to NTS

The administrative process of becoming CPA-eligible involves multiple steps, each with its own timeline and requirements. Understanding this process in detail helps you avoid common delays and budget appropriately for each stage.

Step 1: Getting Your Indian Credentials Evaluated

Before any US state board considers your CPA application, they need verification that your Indian education meets their requirements. This evaluation translates your Indian academic records into US credit equivalents and confirms your eligibility for the exam.

NASBA International Evaluation Services (NIES) vs World Education Services (WES)

Two agencies dominate credential evaluation for CPA candidates: NASBA International Evaluation Services (NIES) and World Education Services (WES). NIES operates as NASBA’s own evaluation service, designed specifically for CPA candidates. This direct connection to the CPA licensing system means evaluations align precisely with what state boards need. Fees typically run $200 to $300, depending on service level.

WES offers a more general credential evaluation that can serve multiple purposes beyond CPA licensing, such as immigration applications or graduate school admissions. Fees are comparable at $150-$200. For CA holders, WES requires ICAI verification before including the qualification in your evaluation. Both agencies are accepted by major no-SSN states, so your choice may depend on whether you need the evaluation for purposes beyond CPA licensing.

Documents Required from Indian Institutions

The evaluation process requires official academic documents sent directly from your Indian institutions. You’ll need original transcripts, degree certificates, and mark sheets from each college or university you attended. For professional qualifications, you’ll need membership certificates and examination records from bodies like ICAI, ICMAI, or ICSI.

Obtaining these documents often takes longer than candidates expect. Indian universities may require weeks to process transcript requests, and you’ll need documents sent in sealed envelopes directly to the evaluation agency. Start this process early, ideally three to four months before you plan to apply to a state board.

Evaluation Timeline and What to Expect

Standard evaluation processing takes six to eight weeks once the agency receives all required documents. Rush services are available for additional fees, reducing processing to two to three weeks. However, delays frequently occur when documents are incomplete or require verification from Indian institutions.

Your evaluation report will specify total credit hours, breakdown by subject area, and degree equivalency. Review this report carefully, as it determines your eligibility for your chosen state. If the evaluation reveals credit deficiencies, you’ll know exactly what additional coursework to pursue.

Step 2: Applying to Your Chosen State Board

With your credential evaluation complete, you can apply to your chosen state board or through NASBA’s centralized application system. This step involves submitting your application, paying fees, and receiving confirmation of your eligibility.

Creating Your NASBA CPA Candidate Account

Most state boards process applications through NASBA’s CPA Central portal. Creating your account is straightforward, requiring basic personal information and contact details. Through this portal, you’ll submit applications, pay fees, track your status, and eventually receive your Notice to Schedule.

Keep your login credentials secure, as you’ll return to this account throughout your CPA journey. The portal maintains records of your applications, exam history, and credit status across sections.

Submitting Your Application and Paying Fees

Your application requires your credential evaluation report, proof of education, and payment of application fees. Application fees vary by state, ranging from $50 to $200 for initial applications. Some states also charge per-section registration fees at this stage, while others bill these separately when you receive your NTS.

Submit complete applications to avoid processing delays. Missing documents or incorrect information can add weeks to your timeline. Double-check all entries before submission, particularly your name spelling, which must exactly match your passport for exam day identification.

Understanding the Authorization to Test (ATT)

After the state board reviews your application, you’ll receive an Authorization to Test (ATT) confirming your eligibility for specific exam sections. The ATT precedes your Notice to Schedule and confirms that you’ve met the state’s educational requirements for the sections you’ve applied to take.

Some states issue ATTs quickly, within two to three weeks, while others take six to eight weeks. This timeline varies by state workload and the completeness of your application. The ATT itself doesn’t allow you to schedule exams; you’ll need to proceed to the NTS stage first.

Step 3: Receiving Your Notice to Schedule (NTS)

The Notice to Schedule is your ticket to actually sit for the CPA exam sections. Understanding the NTS process, including international administration fees for testing in India, helps you plan your exam timeline effectively.

What the NTS Contains and Its Validity Period

Your NTS contains your candidate identification number, the exam sections you’re authorized to take, and the validity period during which you must schedule and complete these exams. NTS validity varies by state, typically ranging from six to nine months. Some states allow extensions under certain circumstances.

Plan your exam schedule around your NTS validity carefully. If your NTS expires before you’ve taken all listed sections, you’ll need to reapply and pay fees again for those sections. Most candidates request NTS for one or two sections at a time rather than all four, maintaining flexibility in their preparation timeline.

Paying International Administration Fees

Indian candidates testing at Prometric centers in India must pay international administration fees in addition to regular exam fees. Following NASBA’s June 2025 fee update, the international administration fee increased significantly. The total fee per section for candidates testing in India now stands at $510, up from $390 previously. This $120 per-section increase adds approximately ₹43,200 to the total cost for all four sections at current exchange rates.

You’ll pay international fees through the NASBA candidate portal after receiving your NTS. This payment converts your domestic NTS to an international NTS, enabling you to schedule at Prometric locations outside the United States.

Scheduling Your Exam at Prometric Centers in India

Once your international administration fees are processed, which takes 24 to 48 hours, you can schedule your exam through Prometric’s website. India has eight Prometric test centers located in Ahmedabad, Bangalore, Kolkata, Chennai, Hyderabad, Mumbai, New Delhi, and Trivandrum. The Bangalore and Mumbai centers are particularly popular and fill quickly, so book early.

When scheduling, consider your preparation timeline, work commitments, and preferred testing conditions. Core sections are available year-round, while Discipline sections follow quarterly testing windows. Arrive at least 30 minutes early on exam day with your NTS and passport for identification.

CPA Exam Preparation: Review Courses, Study Hours, and Strategies

Passing the CPA exam requires structured preparation over several months, balancing comprehensive content review with practice questions and simulations. For Indian professionals managing full-time work alongside exam preparation, efficient study strategies become essential.

Recommended Study Hours by Section

Total preparation for all four CPA exam sections typically requires 300 to 400 hours of study, distributed based on each section’s content breadth and your background knowledge.

Discipline section preparation adds another 80 to 120 hours, depending on your choice. BAR, with its analytical depth, requires time similar to FAR preparation. ISC and TCP may require less time if you have a relevant background in technology or taxation, respectively. These estimates assume a consistent, focused study rather than passive reading.

Creating a Realistic Study Plan While Working Full-Time in India

Most Indian CPA candidates prepare while working full-time, requiring careful time management. A realistic plan dedicates 15 to 20 hours weekly to CPA preparation, allowing completion of all four sections in 12 to 18 months. Some candidates accelerate this timeline by studying more intensively, while others extend it to manage work and personal commitments.

Structure your study around consistent daily sessions rather than irregular weekend marathons. Early morning or late evening sessions, when work interruptions are minimal, often prove most productive. Use weekends for practice exams and simulation work that requires extended focus. Track your progress against your review course’s recommended schedule, adjusting as needed based on actual results.

Best CPA Review Courses for Indian Candidates

Investing in a quality review course significantly improves your chances of passing each section on the first attempt. The upfront cost, while substantial, typically saves money compared to retaking failed sections and pays dividends in accelerated career progression.

Becker CPA Review remains the market leader, trusted by Big 4 firms and used by over two million candidates globally. Their comprehensive materials, expert instructors, and proven methodology justify premium pricing of $2,000 to $4,000, depending on the package. Becker’s partnership with Simandhar Education brings their content to Indian candidates with local support and instruction.

Wiley CPAexcel offers bite-sized lessons ideal for busy professionals, with unlimited access until you pass. Surgent CPA Review uses adaptive learning technology to customize your study path based on performance, potentially reducing total study time. UWorld Roger CPA Review, known for engaging video lectures, appeals to candidates who prefer instructor-led learning.

Indian coaching institutes including Simandhar Education, Miles Education, and SkillArbitrage provide localized support, live instruction in Indian time zones, and assistance with the application process. These options typically cost ₹1,20,000 to ₹2,00,000 and include international review materials from providers like Becker or Gleim. The combination of global content with local mentorship helps many Indian candidates navigate both exam preparation and administrative requirements.

Complete CPA Exam Cost Breakdown for Indian Candidates in 2025

Understanding the full financial investment required helps you budget appropriately and avoid surprises. CPA costs for Indian candidates include credential evaluation, exam fees, international administration fees, review course investment, and post-exam licensing expenses. At current exchange rates of approximately ₹90 per USD, the total investment ranges from ₹3,00,000 to ₹4,50,000.

Credential Evaluation Costs

The evaluation process represents your first significant expense, typically ranging from ₹18,000 to ₹35,000 depending on the agency and service level selected.

NIES and WES Fee Comparison

NIES standard evaluation costs approximately $200 to $200, translating to ₹20,000 to ₹25,000. Rush processing adds $50 to $100. WES charges similar rates, with their course-by-course evaluation needed for CPA purposes costing $150 to $200, approximately ₹20,000 to ₹27,000. Both agencies charge additional fees for authentication of certain documents.

Document Courier and Authentication Costs

Sending official documents from Indian institutions to US evaluation agencies involves courier charges of ₹2,000 to ₹5,000 more sometimes more, depending on the service used. Some documents may require an authentication, adding ₹3,000 to ₹8,000. Budget approximately ₹10,000 total for document-related expenses beyond evaluation agency fees.

Exam Application and Section Fees

Exam-related fees constitute the largest portion of your CPA investment, particularly after the June 2025 fee increase for international candidates.

State Application Fees

Initial application fees vary by state, ranging from $50 to $200. New York charges $150, California charges about $100, but they have stricter educational requirements. Budget approximately ₹15,000 to ₹25,000 for state application and registration fees.

Exam Section Fees (Updated 2025) and International Administration Fees for India

Following NASBA’s June 2025 update, Indian candidates now pay $510 per exam section, comprising the base examination fee plus the international administration fee. For all four sections, this totals $2,040, approximately ₹1,83,600 at current exchange rates. This represents a significant increase from the previous $390 per section, adding nearly ₹43,000 to total exam costs.

CPA Review Course Investment

Quality review materials represent a significant but worthwhile investment that dramatically improves pass rates and reduces costly retakes.

Premium vs Budget Review Course Options

Premium review courses from Becker, Wiley, and Roger range from $2,000 to $4,000, translating to ₹1,80,000 to ₹3,60,000. These comprehensive packages include all four sections, practice questions, simulations, and varying levels of instructor support.

Budget-conscious candidates can explore options like Gleim or Surgent, which cost $1,000 to $2,000, or Indian coaching institute programs that bundle international content with local instruction for ₹1,20,000 to ₹2,00,000. While saving money upfront, ensure any budget option provides current, comprehensive content aligned with CPA Evolution requirements.

Post-Exam and Licensing Costs

After passing all four sections, additional costs arise before you hold your CPA license.

Ethics Exam Fees & License Application Fees

Most states require passing an ethics exam before licensure. The AICPA ethics course and exam costs approximately $200, around ₹18,000. Some states accept alternative ethics courses at similar price points. License application fees range from $100 to $400 depending on your state, translating to ₹9,000 to ₹36,000. Some states also require background checks adding $50 to $100.

Continuing Professional Education (CPE) Costs

After licensure, maintaining your CPA requires ongoing continuing professional education. Annual CPE requirements vary by state but typically mandate 40 hours yearly. CPE costs range from ₹20,000 to ₹50,000 annually, depending on course providers and delivery format.

Total Investment Summary in Indian Rupees

Combining all costs, the complete CPA investment for Indian candidates in 2025 ranges from approximately ₹3,00,000 to ₹4,50,000. This includes evaluation, application, and exam fees, review course, and licensing costs. While substantial, this investment typically delivers strong returns through increased earning potential and career advancement.

Career Opportunities and Salary After Becoming a CPA in India

The investment in CPA certification pays dividends through expanded job opportunities, higher salaries, and accelerated career progression. Understanding the Indian job market for CPAs helps you set realistic expectations and target appropriate roles.

Job Roles Open to US CPAs in India

CPAs in India work across diverse roles spanning financial reporting, audit, taxation, and consulting. Financial reporting positions include roles preparing consolidated financial statements under US GAAP, managing statutory audits for US-listed companies, and overseeing internal controls documentation for Sarbanes-Oxley compliance.

Audit and assurance roles represent a significant employer of CPAs in India, particularly within Big 4 firms serving US-headquartered clients. These positions involve planning and executing audits of subsidiaries and shared service operations, requiring both technical expertise and client relationship management.

Tax advisory and consulting roles leverage CPA expertise in US taxation for transfer pricing analysis, international tax planning, and cross-border transaction structuring. Management consulting positions utilize the broad business knowledge CPAs develop, applying financial analysis skills to strategic advisory engagements.

CPA Salary Ranges in India for 2025

CPA salaries in India vary based on experience, employer type, location, and additional qualifications. According to industry surveys and recruitment data, entry-level CPAs with zero to two years of experience typically earn between ₹6 and ₹9 lakhs per annum. Candidates entering Big 4 firms may start at ₹10 to ₹12 lakhs depending on their background and the specific service line.

Mid-level professionals with five to ten years of experience and CPA certification commonly earn ₹15 to ₹25 lakhs per annum. Those in Big 4 manager roles or senior positions in multinational corporations reach the higher end of this range.

Conclusion

Becoming a US CPA from India is an achievable goal that thousands of professionals accomplish every year. The pathway, while requiring significant investment of time and money, offers substantial returns through global career opportunities, higher earning potential, and professional recognition that extends across borders.

Your journey begins with assessing your eligibility, getting your credentials evaluated, and choosing the right state for your circumstances. From there, disciplined exam preparation using quality review materials, strategic scheduling around your work commitments, and persistence through the four-section exam process will carry you to your goal. The CPA credential, once earned, opens doors that remain closed to those without it, making the investment worthwhile for motivated accounting professionals.

Frequently Asked Questions

Can I pursue a CPA with just a 3-year Indian B.Com degree?

Yes, you can pursue CPA with a B.Com degree, but you’ll need additional credentials to meet the 120-credit requirement for exam eligibility. A B.Com typically evaluates to approximately 90 credits. Options include completing an M.Com or MBA, pursuing the CA certification, or taking bridge courses to make up the credit deficit.

Do I need to be a Chartered Accountant to become a CPA?

No, CA is not a prerequisite for CPA eligibility. While CA holders often find the CPA pathway efficient because their qualification adds 30 to 60 credits, candidates with other backgrounds, including M.Com, MBA, or B.Com with additional coursework, can also qualify.

Which US state should I choose if I don’t have a Social Security Number?

Guam is the most popular choice for Indian candidates without an SSN due to its straightforward application process and flexible experience verification. Montana, Alaska, and Illinois also accept candidates without an SSN and offer accommodating policies for international applicants.

How long does it take to become a CPA from India?

Most working professionals complete the CPA journey in 18 to 24 months, including credential evaluation, exam preparation, and all four exam sections. Candidates studying full-time or with lighter work commitments may finish in 12 to 15 months, while those managing significant responsibilities may take longer.

What is the total cost of becoming a CPA in Indian Rupees?

The complete investment ranges from ₹3,00,000 to ₹5,50,000, including credential evaluation, exam fees, international administration fees, review course materials, and licensing costs. The June 2025 fee increase raised exam costs significantly for Indian candidates.

Can I take the CPA exam in India, or do I need to travel to the US?

You can take all CPA exam sections in India at Prometric test centers located in eight cities: Ahmedabad, Bangalore, Kolkata, Chennai, Hyderabad, Mumbai, New Delhi, and Trivandrum. There is no requirement to travel to the US for the exam.

What is the difference between the CPA exam and the CA exam?

The CPA exam consists of four sections taken over 12 to 18 months with objective testing formats, while the Indian CA exam involves multiple levels over three to five years with varied examination formats. CPA focuses on US accounting standards and taxation, while CA covers Indian regulatory requirements.

How many times can I attempt the CPA exam if I fail?

There is no limit on the number of attempts for CPA exam sections. However, you must retake failed sections before credit for passed sections expires. Under current rules, credit for passed sections remains valid for 30 to 36 months depending on your state.

Is the CPA license valid in India?

The CPA license is recognized by Indian employers, particularly Big 4 firms and multinational corporations, but it does not authorize statutory audit or compliance work within India that requires CA certification. The CPA is valued for US GAAP expertise, international reporting, and global career mobility.

Which CPA exam section should I take first?

Many candidates start with FAR because its foundational accounting content supports understanding in other sections. However, the optimal sequence depends on your background and preparation timeline. Some candidates prefer starting with their strongest subject to build confidence.

How do I get my work experience verified if I work under a CA in India?

States like Guam and Montana participate in NASBA’s experience verification service, which accepts verification from qualified professionals, including Indian CAs. Verify your state’s specific requirements, as some states require US CPA verification while others offer alternative pathways.

What happens if I don’t pass all sections within the validity period?

If you don’t complete all four sections before your earliest passed section expires, that section’s credit is lost and must be retaken. The validity period is currently 30 to 36 months from your first passed section, depending on your state’s rules.

Can I work in the US with a CPA license obtained from India?

Your CPA license itself doesn’t provide work authorization in the US; you would need appropriate visa status. However, holding an active CPA license strengthens visa applications for accounting positions and demonstrates professional qualification recognized by US employers.

Which discipline section (BAR, ISC, or TCP) should Indian candidates choose?

Choose based on career goals rather than perceived difficulty. BAR suits those targeting financial analysis and advisory roles. ISC aligns with IT audit and technology consulting careers. TCP fits candidates planning to specialize in tax advisory. All three are designed to be equally rigorous.

Is CPA worth it for someone already holding an Indian CA?

Yes, the CA plus CPA combination creates powerful career opportunities. The CA provides Indian regulatory expertise, while the CPA adds US GAAP knowledge and global recognition. This dual qualification positions you for leadership roles in multinational corporations and Big 4 firms serving global clients.

Allow notifications

Allow notifications