Complete guide to CPA exam sections for Indian candidates. Covers AUD, FAR, REG, Discipline sections, pass rates, fees in INR, testing logistics, and strategic preparation tips.

Table of Contents

The CPA exam underwent its most significant transformation in decades when CPA Evolution launched in January 2024. If you’re an Indian professional planning to pursue this credential, understanding exactly how the exam works is your first strategic advantage. Gone are the days of four identical sections that every candidate had to clear. Today’s CPA exam offers you choices, and those choices can significantly impact your preparation journey and career trajectory.

Recent data shows a rapidly growing interest among Indian students in the US CPA pathway. India has become the second-largest market for US-CPA among international candidates as enrollment rose by about 60% after the exam became widely accessible in India, with thousands of Indian applicants every year. This surge is driven by demand from global firms: as U.S. accounting graduates dwindle and many accountants in the U.S. workforce near retirement, American firms are increasingly turning to Indian finance professionals to fill the gap

This guide breaks down everything you need to know about the CPA exam structure, from the three mandatory Core sections to the Discipline options that let you specialize based on your career goals. You’ll find current 2025 pass rates, updated fee structures in Indian Rupees, question formats, testing logistics at Indian Prometric centers, and strategic insights that most generic guides miss. Whether you’re a CA looking to add an international credential, a B.Com graduate exploring global opportunities, or a working professional in an MNC, this comprehensive resource will give you complete clarity on what lies ahead.

By the end of this guide, you’ll understand not just what each section tests, but how to approach the exam strategically as an Indian candidate. Let’s walk through everything the CPA exam entails.

CPA Core and Discipline Sections

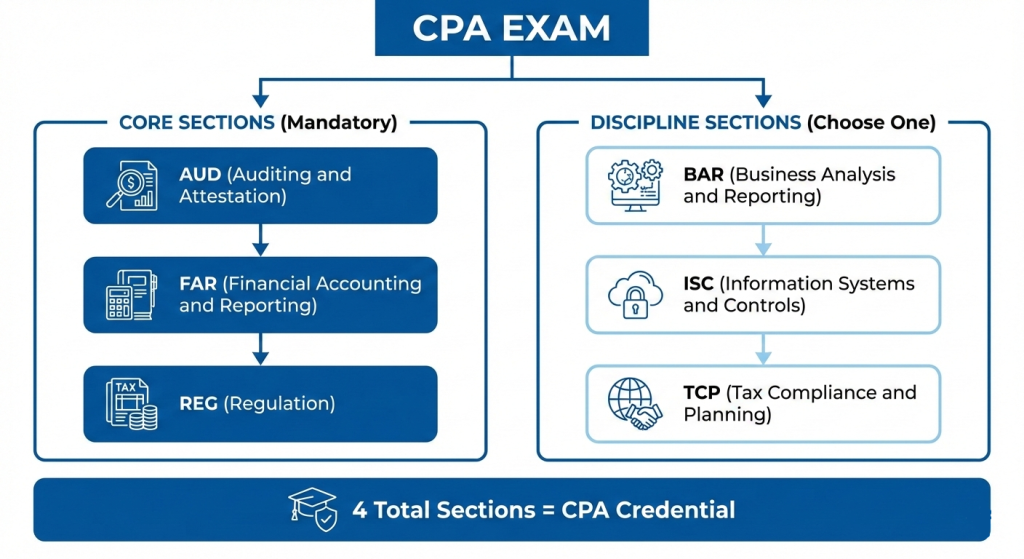

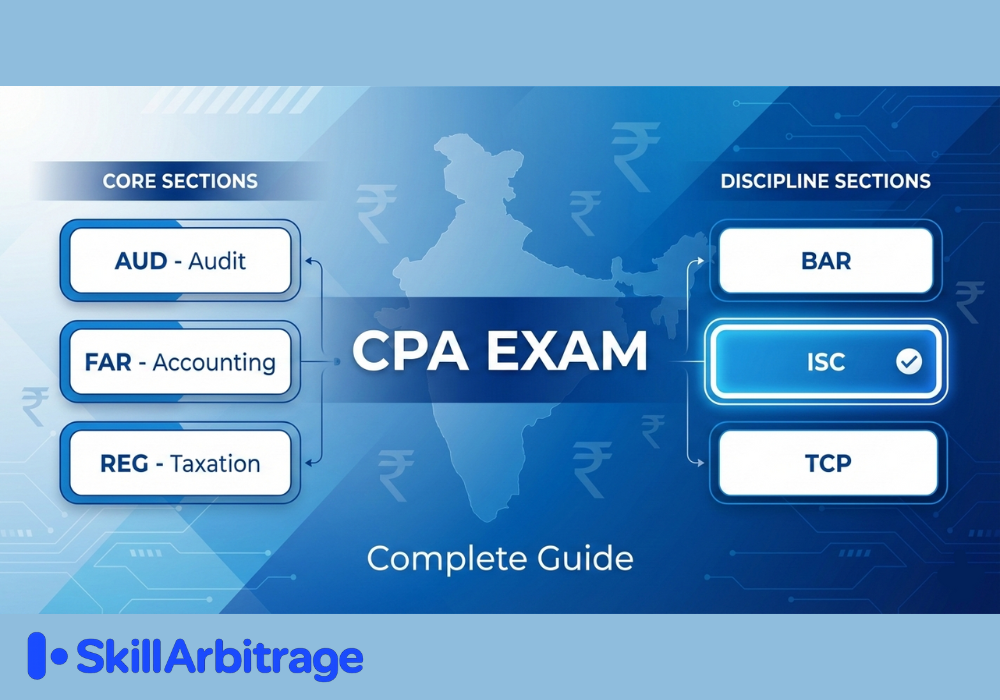

The CPA exam now operates on a “Core plus Discipline” framework that replaced the previous four-section model. Under this structure, you’ll complete three mandatory Core sections that test foundational accounting knowledge, plus one Discipline section of your choice that aligns with your career specialization. This framework, introduced through the CPA Evolution initiative by AICPA and NASBA, reflects the changing demands of the accounting profession and gives you more control over your certification path.

Three Mandatory Core Sections Every Candidate Must Pass

Every CPA candidate worldwide must pass the same three Core sections:

- Auditing and Attestation (AUD),

- Financial Accounting and Reporting (FAR), and

- Taxation and Regulation (REG).

These sections test the foundational knowledge that all CPAs need, regardless of their eventual specialization. AUD covers audit procedures and professional responsibilities, FAR focuses extensively on US GAAP and financial reporting, and REG addresses US federal taxation and business law fundamentals.

The Core sections are designed to ensure every licensed CPA possesses essential competencies in audit, accounting, and tax. For Indian candidates, this means you’ll encounter both familiar concepts and entirely new material. Your CA or accounting background will provide some advantages in FAR and AUD, but REG’s focus on US federal taxation will require dedicated study since Indian tax knowledge doesn’t transfer directly to US tax code requirements.

Choosing Your Discipline Section for Career Specialization

After completing the three Core sections, you’ll select one Discipline section from three options:

- Business Analysis and Reporting (BAR),

- Information Systems and Controls (ISC), or

- Tax Compliance and Planning (TCP).

Each Discipline extends one of the Core sections into advanced territory. BAR builds on FAR with complex accounting and financial analysis, ISC extends AUD into IT audit and cybersecurity, and TCP deepens REG content with advanced tax planning strategies.

Your Discipline choice should reflect your career aspirations rather than perceived difficulty. According to NASBA’s candidate guidance, candidates should select their Discipline based on education, work experience, and professional interests. The Q3 2025 pass rates vary significantly across Disciplines, with TCP at approximately 78%, ISC at 68%, and BAR at 41-43%, but these numbers reflect candidate self-selection rather than inherent difficulty.

Why This Structure Benefits Indian Candidates

The Core plus Discipline framework offers Indian professionals meaningful advantages over the previous exam structure. You can now tailor part of your certification to match your career trajectory, whether that’s Big 4 audit practice, technology risk consulting, or cross-border tax advisory work.

Flexibility to Align Exam with Career Goals

The ability to choose your Discipline section means your CPA credential can reflect your professional specialization. If you’re working in IT audit at a Big 4 firm in India, ISC provides directly relevant knowledge. If you’re building a career in transfer pricing or serving NRI clients, TCP offers essential expertise. This flexibility didn’t exist under the old four-section model, where everyone took identical exams regardless of career direction.

The 30-Month Completion Window

Most jurisdictions have extended the completion window from 18 months to 30 months, giving Indian candidates more time to balance exam preparation with demanding work schedules. Once you pass your first section, you have 30 months to pass the remaining three before that initial credit expires. This extension, confirmed across most state boards through NASBA, acknowledges the challenges working professionals face and provides breathing room for unexpected delays.

CPA Exam Sections Explained: Core Sections – AUD, FAR, and REG

The three Core sections form the foundation of CPA competence and represent the knowledge every licensed accountant must demonstrate. Each section runs four hours and combines multiple-choice questions with task-based simulations. Understanding what each section tests and how it relates to your existing knowledge will help you plan your preparation strategically.

Auditing and Attestation (AUD)

AUD tests your understanding of the complete audit process, from planning and risk assessment through evidence gathering and final reporting. The section covers US auditing standards, professional ethics, attestation engagements, and the auditor’s responsibilities. For Indian candidates with audit experience, many concepts will feel familiar, though the specific standards and regulatory framework differ from Indian audit practices.

AUD Content Areas and Weightings

The AUD section organizes content into four main areas with specific weightings that determine how many questions you’ll see from each topic.

- Ethics, Professional Responsibilities, and General Principles account for 15-25% of the exam.

- Assessing Risk and Developing a Planned Response represents 25-35%.

- Performing Further Procedures and Obtaining Evidence carries the heaviest weight at 30-40%.

- Forming Conclusions and Reporting rounds out the section at 10-20%.

The question format includes 78 multiple-choice questions and 7 task-based simulations, with each component contributing 50% to your final score. AUD’s Q3 2025 pass rate stands at approximately 48%, placing it in the middle difficulty range among Core sections.

How Indian Audit Experience Translates to AUD Preparation

If you’ve worked in audit roles in India or hold a CA qualification, you’ll recognize many AUD concepts at a foundational level. Risk assessment, internal controls evaluation, and evidence gathering follow similar logic regardless of the specific standards framework. However, the technical details differ significantly between Indian Standards on Auditing and US Generally Accepted Auditing Standards.

Your Indian experience provides a conceptual advantage, but shouldn’t lead to overconfidence. AUD questions test specific US auditing standards, SEC requirements for public company audits, and PCAOB regulations that have no Indian equivalent. Plan dedicated study time for these US-specific requirements rather than assuming your existing knowledge will carry you through.

Financial Accounting and Reporting (FAR)

FAR is widely considered the most content-heavy section of the CPA exam, covering extensive US GAAP requirements across virtually every area of financial accounting. The section tests your ability to prepare financial statements, apply accounting standards to complex transactions, and handle specialized topics like governmental and not-for-profit accounting. With a Q3 2025 pass rate of approximately 42-43%, FAR presents the greatest challenge among Core sections.

FAR Syllabus Breakdown and US GAAP Focus

FAR content divides into three major areas that span the full breadth of financial accounting knowledge.

- Financial Reporting accounts for 30-40% of the exam.

- Select Balance Sheet Accounts represent another 30-40%.

- Select Transactions covers the remaining 25-35%.

FAR includes 50 multiple-choice questions and 7 task-based simulations, the lowest MCQ count among all sections. This means each question carries more weight, and the simulations demand strong technical application skills. The four-hour time limit requires efficient pacing given the complexity of FAR topics.

Transitioning from Ind AS to US GAAP Concepts

Indian candidates trained in Ind AS or older Indian GAAP will find both similarities and significant differences in US GAAP. While many foundational concepts align, the specific recognition criteria, measurement approaches, and disclosure requirements often diverge.

Don’t assume that familiarity with IFRS through Ind AS convergence will fully prepare you for FAR. US GAAP maintains numerous differences from IFRS, and the exam tests US-specific requirements exclusively. Governmental accounting, which has no direct Indian equivalent, accounts for a meaningful portion of FAR content and requires learning entirely new frameworks.

Taxation and Regulation (REG)

REG covers US federal taxation for individuals, businesses, and property transactions, along with business law fundamentals and professional ethics. This section will likely require the most new learning for Indian candidates since US tax law has virtually no overlap with Indian taxation. The Q3 2025 pass rate of approximately 63-64% reflects REG’s relatively structured content that rewards systematic study.

REG Content Areas for Indian Candidates

REG content spans five areas with varying weights.

- Ethics, Professional Responsibilities, and Federal Tax Procedures account for 10-20%.

- Business Law represents 15-25%.

- Federal Taxation of Property Transactions covers 5-15%.

- Federal Taxation of Individuals represents 23-32%.

- Federal Taxation of Entities rounds out the section at 23-33%.

REG includes 72 multiple-choice questions and 8 task-based simulations, the highest TBS count among all sections. The 50/50 weighting means simulations carry substantial importance, often requiring multi-step tax calculations and form preparation.

Why REG Requires Dedicated Study Regardless of Indian Tax Experience

Your knowledge of Indian direct and indirect taxation provides essentially no advantage for REG preparation. US federal tax law operates under completely different code sections, rate structures, filing requirements, and compliance rules. Concepts like US basis calculations, depreciation methods under MACRS, S corporation taxation, and individual deduction limitations have no Indian equivalents you can draw upon.

Approach REG as entirely new material regardless of your Indian tax expertise. The silver lining is that REG content follows logical structures once you learn the foundational rules, and the section rewards systematic study and practice. Many Indian candidates who struggled with REG initially find it manageable after accepting that their existing tax knowledge won’t shortcut the learning process.

CPA Discipline Sections: BAR, ISC, and TCP Selection Guide

Your Discipline selection represents the most strategic decision in your CPA journey. Unlike Core sections, where everyone covers identical material, your Discipline choice signals your specialization and shapes the knowledge you’ll carry into your career. Each Discipline extends one Core section into advanced territory, so your performance in related Core sections can indicate which Discipline might suit you best.

Business Analysis and Reporting (BAR): For Financial Analysis Careers

BAR serves candidates pursuing careers in corporate financial reporting, audit practice, equity research, or investment banking. The section extends FAR content into advanced accounting topics, financial statement analysis, and data analytics applications. BAR’s Q3 2025 pass rate of approximately 41-43% makes it the most challenging Discipline, reflecting its technical complexity and the breadth of advanced topics covered.

BAR Content Areas and Connection to FAR

BAR organizes content into three areas that build directly on FAR foundations.

- Business Analysis accounts for 40-50% of the exam. This area tests your ability to interpret financial data and draw meaningful conclusions for decision-making purposes.

- Technical Accounting and Reporting represents 35-45%.

- State and Local Governments cover the remaining 10-20%.

Career Paths Where BAR Provides Maximum Value

BAR aligns best with careers requiring deep financial analysis and reporting expertise. Big 4 assurance practices value BAR-qualified CPAs for complex audit engagements involving technical accounting judgments. Corporate accounting departments in US multinationals operating in India benefit from BAR holders who can navigate intricate US GAAP requirements and financial statement preparation.

If you’re targeting financial advisory roles, equity research, or investment banking with a focus on US markets, BAR provides directly relevant credentials. The section’s emphasis on financial analysis and advanced accounting topics matches the daily requirements of these positions. Indian CAs moving into US GAAP reporting roles at MNCs often find BAR’s content immediately applicable to their work.

Information Systems and Controls (ISC): For IT Audit and Technology Roles

ISC targets candidates building careers in IT audit, technology risk advisory, cybersecurity consulting, or SOC attestation engagements. The section covers information systems governance, data management, security controls, and system audit procedures. ISC’s Q3 2025 pass rate of approximately 68% reflects growing candidate familiarity with technology content and strong performance among self-selected IT-oriented candidates.

ISC Content Focus on Cybersecurity and System Controls

ISC content is divided into three areas reflecting the technology landscape CPAs increasingly navigate.

- Information Systems and Data Management accounts for 35-45%. This area tests your understanding of how organizations manage technology environments and data resources.

- Security, Confidentiality, and Privacy represent another 35-45%.

- Considerations for System and Organization Controls Engagements covers 15-25%.

Why ISC Appeals to Indian IT and Audit Professionals

India’s prominence in IT services and the expansion of global capability centers create strong demand for ISC-qualified CPAs. Technology risk practices at Big 4 firms in India actively seek professionals who understand both accounting and technology controls. The combination of a CPA credential with an ISC specialization positions you for roles bridging finance and technology functions.

If you’re currently working in IT audit, technology consulting, or have a technology background alongside your accounting qualifications, ISC leverages your existing knowledge. The section’s 60/40 weighting toward MCQs (unique among all CPA sections) and 82 multiple choice questions suit candidates comfortable with technology concepts who can move quickly through question content.

Tax Compliance and Planning (TCP): For Tax Specialization

TCP serves candidates building careers in tax compliance, tax planning, or personal financial planning. The section extends REG content into advanced individual and entity tax planning, estate taxation, and sophisticated compliance scenarios. TCP’s Q3 2025 pass rate of approximately 75-78%, the highest among all CPA sections, reflects strong alignment with REG and candidate self-selection among tax practitioners.

TCP Syllabus and Alignment with REG Content

TCP organizes content into four areas that deepen REG foundations.

- Tax Compliance and Planning for Individuals and Personal Financial Planning accounts for 30-40%.

- Entity Tax Compliance represents 30-40%.

- Entity Tax Planning covers 10-20%.

- Property Transactions rounds out the section at 10-20%.

Cross-Border Tax Practice Opportunities for TCP Holders

TCP provides essential credentials for Indian CPAs pursuing cross-border tax practice between India and the United States. The growing population of NRIs, Indian businesses expanding to US markets, and US companies with Indian operations creates sustained demand for professionals understanding both tax systems. TCP’s advanced US tax knowledge complements your Indian tax expertise for comprehensive cross-border advisory.

Transfer pricing roles, international tax departments at Big 4 firms, and private wealth practices serving clients with US connections all value TCP specialization. If you’re already working in tax or have a strong interest in taxation, TCP offers the natural extension of your REG preparation and positions you for specialized roles commanding premium compensation.

CPA Exam: Question Types, Testlet Structure, and Time Management

Every CPA exam section uses the same two question formats: multiple choice questions and task-based simulations. Understanding how these formats work and how the exam delivers them through testlets helps you develop effective time management strategies. The four-hour duration requires disciplined pacing, and knowing what to expect reduces exam day anxiety.

Multiple Choice Questions (MCQs): Format and Adaptive Testing

MCQs test your ability to recall information, understand concepts, and apply knowledge to specific scenarios. Each question presents four answer choices, and you select the single best response. The CPA exam uses adaptive testing for MCQs, meaning your performance on the first testlet influences the difficulty of questions in your second testlet. This adaptive mechanism affects scoring but shouldn’t change your preparation approach.

MCQ Counts by Section and Scoring Weight

MCQ counts vary significantly across sections, directly impacting your available time per question. ISC has the highest count at 82 MCQs, followed by AUD at 78, REG at 72, TCP at 68, and both FAR and BAR at 50. These variations mean you’ll average about 1.1 minutes per MCQ in ISC versus nearly 1.8 minutes in FAR, requiring different pacing strategies.

Most sections weight MCQs at 50% of your total score, but ISC uniquely weights MCQs at 60%. This higher MCQ weighting in ISC benefits candidates who perform strongly on multiple-choice formats and can move efficiently through technology-focused questions. Regardless of the section, there’s no penalty for wrong answers, so you should answer every question, even if guessing.

How Adaptive Testing Affects Your Second MCQ Testlet

The CPA exam delivers MCQs in two testlets. Your first testlet contains medium-difficulty questions regardless of the section. Based on your performance, the exam algorithm assigns your second testlet as either medium or greater difficulty. Receiving harder questions in Testlet 2 actually signals strong Testlet 1 performance and doesn’t disadvantage your score.

The scoring mechanism accounts for question difficulty, so correctly answering harder questions contributes more to your score than easier ones. Don’t become discouraged if Testlet 2 questions seem more challenging; this likely means you performed well initially. Focus on each question independently without trying to gauge whether you’re receiving harder material.

Task-Based Simulations (TBSs): Practical Application Testing

TBSs test your ability to apply accounting knowledge to realistic work scenarios. These simulations present documents, financial data, or client situations requiring analysis, calculations, or professional judgments. TBSs contribute 50% of your score in most sections (40% in ISC) and often determine pass/fail outcomes for candidates scoring near the 75 threshold.

TBS Formats Including Research and Document Analysis

TBS formats include several types you’ll encounter across sections. Document review simulations present financial statements, contracts, or other business documents requiring analysis and interpretation. Calculation simulations require computing specific amounts using spreadsheet tools provided within the exam interface. Research simulations ask you to locate authoritative guidance within the FASB Codification, AICPA Professional Standards, or Internal Revenue Code.

Form-based simulations require completing portions of tax forms or financial statement templates. Judgment simulations present scenarios requiring professional conclusions with supporting rationale. Most sections include a mix of these formats, with research simulations appearing in nearly every section and calculation simulations particularly common in FAR, REG, and TCP.

Section-Wise TBS Counts and Weightings

TBS counts range from 6 to 8 across sections. REG has the highest count at 8 TBSs, while ISC has the lowest at 6. AUD, FAR, BAR, and TCP each include 7 TBSs. Given the 50% weighting (40% in ISC), each simulation carries a significant scoring impact, making thorough TBS practice essential to your preparation.

The exam delivers TBSs in three testlets following your MCQ testlets and a 15-minute break. Unlike MCQs, TBSs are not adaptive. You’ll receive the same simulation types regardless of MCQ performance. Budget 15-25 minutes per TBS, depending on complexity, recognizing that some simulations require extensive analysis while others involve straightforward calculations.

Time Allocation Strategy for Each Section

Effective time management requires planning before exam day and discipline during the exam. With four hours total and a 15-minute break that doesn’t count against your time, you have 240 minutes for actual testing. Allocating roughly 45-50% of your time to MCQs and 50-55% to TBSs provides a reasonable starting framework.

Managing the 15-Minute Break Effectively

The exam offers an optional 15-minute break after completing both MCQ testlets. This break doesn’t count against your four hours and provides a crucial mental reset before tackling simulations. Use this time to step away from the screen, use restroom facilities, have a small snack if permitted by your testing center, and clear your mind before the TBS section.

CPA Exam Scoring System and 2025 Pass Rates

Understanding how the CPA exam calculates your score helps set realistic expectations and interpret your results correctly. The scoring system differs fundamentally from percentage-based grading common in Indian examinations. Your pass rate awareness should inform strategic decisions about exam order and preparation intensity without creating undue anxiety about particular sections.

75 Pass Mark and Scaled Scoring

To pass any CPA exam section, you need a minimum scaled score of 75 on a 0-99 scale. This 75 is not a percentage correct; it’s a scaled score derived from your raw performance adjusted for question difficulty and the specific items you received. The AICPA’s scoring methodology ensures scores remain comparable across different test forms and testing dates, meaning the exam isn’t harder or easier at different times.

Your total score combines weighted scaled scores from MCQs and TBSs according to section-specific allocations. Harder questions contribute more to your score than easier ones, which is why adaptive testing that assigns harder MCQs to strong performers doesn’t disadvantage those candidates. If you fail a section, you’ll receive a Candidate Performance Report showing strengths and weaknesses across content areas to guide retake preparation.

Current Pass Rates by Section

Pass rates provide useful benchmarks for understanding where candidates typically succeed and struggle. The AICPA publishes aggregate pass rates quarterly, and the Q3 2025 data reveals meaningful patterns across Core and Discipline sections. These rates reflect candidate preparation levels rather than changes in exam difficulty, which remains consistent through the scaling process.

Core Section Pass Rates: FAR, AUD, and REG

Among Core sections, REG leads with the highest pass rate at approximately 63-64% in Q3 2025. This relatively strong performance reflects REG’s structured content that rewards systematic study and the logical organization of tax rules once foundational concepts are mastered. Indian candidates who approach REG as entirely new material and study thoroughly often perform well despite having no background in US taxation.

AUD falls in the middle at approximately 48%, reflecting the judgment-intensive nature of audit content. Understanding concepts isn’t sufficient for AUD; you must apply professional judgment to specific scenarios, which many candidates find challenging. The 48% rate has remained relatively stable since CPA Evolution launched.

FAR presents the greatest Core section challenge with a pass rate of approximately 42-43%. FAR’s extensive content, technical complexity, and the unfamiliarity of governmental accounting for Indian candidates contribute to this lower rate. The section’s concentration of advanced accounting topics since BEC’s elimination has maintained its reputation as the most difficult Core section.

Discipline Section Pass Rates: BAR, ISC, and TCP

TCP dominates Discipline pass rates at approximately 75-78%, the highest across all CPA sections. AICPA’s analysis attributes TCP’s strong performance to close alignment with REG content and candidate self-selection among tax practitioners who already demonstrate tax aptitude through their REG performance.

ISC shows great improvement at approximately 68%. This upward trend suggests candidates and review course providers have adapted well to ISC’s technology-focused content. The section’s unique 60/40 MCQ weighting may benefit candidates comfortable with technology concepts.

BAR matches FAR’s difficulty with a pass rate of approximately 41-43%, making it the most challenging Discipline. BAR absorbed some of FAR’s former content and requires deep technical accounting knowledge that challenges even well-prepared candidates. The combination of advanced accounting topics and financial analysis demands extensive preparation.

What Pass Rates Mean for Your Preparation Strategy

Pass rates should inform your strategic planning without dictating your choices. A 43% pass rate means more than half of the candidates fail, but you control your preparation intensity. Understanding pass rate patterns helps you allocate study time appropriately and set realistic expectations for each section.

Using Pass Rate Data to Plan Exam Order

Consider tackling FAR early while academic knowledge remains fresh, especially if you recently completed accounting coursework or CA studies. FAR’s low pass rate partly reflects candidates attempting it after extended gaps from formal education. Your recency with accounting concepts provides an advantage worth leveraging.

If you plan to take TCP as your Discipline, scheduling it shortly after passing REG maximizes content overlap while tax concepts remain fresh. The strong correlation between REG performance and TCP success suggests the sections share substantial foundational knowledge. Similarly, consider BAR shortly after FAR, and ISC shortly after AUD, to leverage related content connections.

Why Higher Pass Rates Do Not Mean Easier Sections

TCP’s 78% pass rate doesn’t mean the section is objectively easy. It means candidates choosing TCP tend to perform well, often because they have tax backgrounds, strong REG performance, and a genuine interest in taxation. If you lack these characteristics, TCP’s “easier” label won’t translate to an easier experience for you personally.

Select your Discipline based on career alignment, subject interest, and related Core section performance rather than chasing pass rates. A candidate who struggles with REG but excels at FAR would likely find BAR more manageable than TCP despite the pass rate differential. Your personal strengths and career goals matter more than aggregate statistics.

CPA Testing Windows, Score Release, and Scheduling

The CPA exam operates on different testing schedules for Core and Discipline sections, a distinction with significant planning implications for Indian candidates. Understanding when you can test, when scores are released, and how to schedule strategically around your professional commitments helps you build a realistic completion timeline. The AICPA’s published testing schedules provide the authoritative dates for planning.

Continuous Testing for Core Sections

Beginning in 2025, all three Core sections (AUD, FAR, REG) returned to continuous testing after the restricted windows during CPA Evolution’s initial rollout. This means you can schedule Core sections any day Prometric centers operate, excluding brief blackout periods for exam maintenance and scoring analyses.

Year-Round Availability and Faster Score Release

Continuous testing eliminates the frustration of waiting for specific testing windows to open. You can schedule your Core section exam whenever your preparation reaches exam-ready status, rather than aligning your readiness with arbitrary calendar dates. This flexibility particularly benefits working professionals whose schedules may shift unpredictably.

Score release for Core sections follows a rolling schedule tied to when the AICPA receives your exam data file. Under continuous testing, scores are typically released within 1-2 weeks of testing, dramatically faster than the multi-week waits during quarterly windows. The 2025 Core section score release schedule includes approximately 16 target release dates spread throughout the year.

How to Schedule Core Sections Strategically

With continuous testing, your scheduling decisions should align with preparation readiness rather than window availability. Schedule your exam when you’ve completed your review course, achieved target scores on practice exams, and feel genuinely prepared. Avoid scheduling too far in advance, which locks you into a date before confirming readiness, or too close to your target date, which risks unavailable seats.

Book your Prometric appointment 30-45 days before your target exam date to secure your preferred time and location. Popular Indian centers like Mumbai and Bangalore fill quickly, so earlier booking provides more options. Consider scheduling morning appointments when mental energy is highest, and testing center noise is typically lowest.

Quarterly Windows for Discipline Sections

Unlike Core sections, Discipline sections (BAR, ISC, TCP) operate on quarterly testing windows. In 2025, these windows fall in January, April, June, July, and October. The June window was added specifically to accommodate candidates with expiring credits through the CPA Evolution transition. Missing a window means waiting weeks or months for the next opportunity.

Planning Your Discipline Section Around Work Commitments

The quarterly window structure requires aligning your preparation timeline with fixed testing dates. If you want to take your Discipline in July, count backward to determine when you must begin preparation to be exam-ready by early July. Build buffer time for unexpected work demands that might derail your study schedule.

Consider Indian holiday periods when planning your Discipline attempt. The October window aligns with Diwali in many years, which could provide extended study time immediately before testing or could disrupt your preparation with family obligations. The January window falls during relatively calm periods for many Indian businesses after the year-end closes completely.

Score Release Timeline and What to Expect

Score release follows predictable patterns that help you plan subsequent exam attempts and manage the waiting period. Core section scores are released on rolling dates throughout the year based on when you tested, while Discipline scores are released in batches after each window closes. You’ll receive your score through your NASBA CPA Candidate Account and can also check directly with your state board.

If you pass, your score and credit expiration date appear immediately. If you fail, you’ll receive a scaled score and Candidate Performance Report within 24-48 hours of the target release date. Use this report to identify weak areas for retake preparation rather than dwelling on the overall score. Retake attempts require waiting for score release, meaning you cannot immediately reschedule a section you suspect you failed.

CPA Exam Fees for Indian Candidates: Complete Breakdown

Understanding the complete cost structure helps you budget effectively and avoid financial surprises during your CPA journey. Indian candidates face higher costs than US domestic candidates due to international testing fees, credential evaluation requirements, and currency conversion factors. The total investment ranges from approximately ₹2.8 lakhs to ₹5.5 lakhs, depending on your choices and whether you pass all sections on first attempts.

New International Exam Fees at $510 Per Section

In June 2025, NASBA implemented a significant fee increase for international candidates testing outside the United States. The exam fee per section jumped from $390 to $510, representing a 31% increase. This $120 per-section hike translates to approximately ₹10,200 additional cost per exam at current exchange rates. The increase affects all six exam sections equally, whether Core (FAR, AUD, REG) or Discipline (BAR, ISC, TCP).

For the complete four-section exam, your total exam fees increased from $1,560 to $2,040 under the new structure. At exchange rates of approximately ₹90 per dollar, this translates to roughly ₹1,83,600 in exam fees alone.

Complete Fee Structure in Indian Rupees

Your CPA costs extend well beyond exam fees to include evaluation, application, and various administrative charges. Understanding each component helps you plan cash flow across your 12-24 month journey rather than facing unexpected expenses.

Credential Evaluation Fees (NIES and WES)

Before any state board considers your application, your Indian credentials must be evaluated to determine US credit hour equivalents. NASBA International Evaluation Services (NIES) charges around $250 (approximately ₹22,500) and is accepted by most state boards. Some states specifically require NIES evaluation, so check your target state’s requirements before selecting an agency.

World Education Services (WES) offers an alternative at $160-225 with typically faster processing times of 7-10 business days. Your evaluation determines total credit hours, accounting credits, and business credits, which directly affect your eligibility for various states. Choose your evaluation agency based on your target state’s requirements rather than solely on cost.

Application, Exam, and International Testing Fees

State board application fees vary from $90-150 and are typically one-time charges when you first apply. Registration fees of approximately $93 per section apply each time you schedule an exam, totaling around $372 for all four sections on first attempts.

Total Investment Range for Indian Candidates

The complete CPA investment for Indian candidates breaks into ranges based on preparation choices and exam performance. The budget-conscious path runs approximately ₹2.8-3.5 lakhs, including self-study review materials, standard evaluation, and passing all sections on first attempts with minimal retakes.

The standard path costs approximately ₹3.5-4.5 lakhs with quality review courses like Becker through Indian partners, comprehensive support, and realistic buffers for one possible retake. The premium path reaches ₹4.5-5.5 lakhs with top-tier coaching, mentorship programs, and comfortable contingency buffers. Employer sponsorship significantly reduces your out-of-pocket costs if available.

Payment Timeline and Budgeting Strategy

Your CPA expenses don’t arrive as a single lump sum but rather are spread across your 12-24-month journey. Understanding when each payment becomes due helps you plan cash flow and avoid disrupting your exam schedule due to funding gaps.

When Each Fee Becomes Due

Evaluation fees come first, typically 3-6 months before you plan to take your first exam, as the credential evaluation must be completed before the state board application. Application fees follow once your evaluation confirms eligibility. Exam and registration fees become due when you schedule each section, typically 4-6 weeks before your test date. International administration fees are processed through your NASBA account after receiving your Notice to Schedule.

This timeline means you won’t pay all costs upfront. Spreading four exam attempts across 12-18 months distributes the ₹3.37 lakh in exam-related fees across multiple payment points. However, review course costs typically require upfront payment or EMI arrangements at the start of your preparation.

Managing Currency Fluctuations and Payment Planning

All CPA-related fees are denominated in US dollars, creating exposure to exchange rate movements during your multi-month journey. A ₹5 per dollar movement represents approximately ₹10,000 variance on total exam fees alone. Consider making larger payments when rates are favorable rather than spreading all payments across time.

Some Indian CPA coaching providers bundle various fees into rupee-denominated packages that provide exchange rate certainty. These bundles may cost slightly more than direct payment, but they eliminate currency risk from your budgeting. Evaluate whether the convenience and certainty justify any premium over self-managed direct payments.

Testing at Prometric Centers in India: Logistics and Preparation

The ability to take the CPA exam at Prometric centers within India eliminates the need for international travel that Indian candidates previously faced. Understanding the logistics of Indian testing, from center locations to booking procedures, helps you plan your exam attempts without unnecessary complications.

Eight Prometric Centers Across India

India hosts eight Prometric testing centers authorized for CPA exam administration: Ahmedabad, Bangalore, Chennai, Hyderabad, Kolkata, Mumbai, New Delhi, and Trivandrum. This geographic distribution means most candidates can find a center within reasonable travel distance, though seat availability varies by location and testing date.

Mumbai and Bangalore centers typically experience the highest demand given the concentration of finance professionals in these cities. Book these locations 6-8 weeks in advance during peak periods to secure your preferred date and time. Smaller centers like Trivandrum and Kolkata may offer better availability but require travel planning if you’re not based nearby. All centers operate similar schedules, typically Monday through Saturday, with morning and afternoon testing slots.

Strategic Approach to CPA Exam for Indian Professionals

Your success as an Indian CPA candidate depends not just on content mastery but on strategic decisions about exam order, Discipline selection, and preparation approach. The choices you make early in your journey significantly impact your completion timeline and overall experience.

Choosing the Right Discipline Based on Career Goals

Your Discipline selection deserves careful consideration since it shapes your credential’s specialization signal to employers. Match your choice to your career trajectory rather than optimizing for pass rates or perceived difficulty. A TCP specialist pursuing IT audit roles sends mixed signals; align your Discipline with your intended professional direction.

Big 4 audit practice and financial reporting roles favor BAR, which provides advanced accounting and analysis credentials directly relevant to complex engagements. Technology risk advisory, IT audit, and cybersecurity consulting roles benefit from ISC’s systems and controls focus. Cross-border tax practice, transfer pricing, and wealth management serving NRI clients align naturally with TCP’s advanced tax specialization.

Recommended Exam Order for Indian Candidates

Most successful Indian candidates begin with FAR while accounting concepts remain fresh from their CA, B.Com, or M.Com studies. FAR’s extensive content benefits from recent academic exposure, and passing the FAR first builds confidence for the remaining sections. Follow FAR with your related Discipline (BAR) if applicable, leveraging the content overlap while FAR material remains fresh.

Consider REG second if you’re planning TCP as your Discipline, allowing back-to-back tax sections that reinforce each other. AUD can slot effectively into middle positions since audit concepts require professional judgment that develops through practice rather than pure content memorization. Complete your Discipline within one quarter of finishing its related Core section to maximize synergies.

Balancing Exam Preparation with Full-Time Work

Indian professionals typically maintain full-time employment throughout their CPA journey, requiring realistic time management and employer awareness. Plan for 15-20 hours of weekly study time across 12-18 months rather than intensive cramming periods that prove unsustainable alongside demanding jobs.

Communicate your CPA goals to your manager and team, particularly regarding exam dates that may require leave or reduced availability. Many Indian employers, especially Big 4 firms and MNCs, support CPA pursuit through study leave, fee reimbursement, or flexible scheduling. Leverage Indian holidays strategically for intensive study periods, using Diwali breaks, extended weekends, and planned time off to accelerate preparation before section attempts.

Conclusion

The CPA exam’s Core plus Discipline structure offers Indian candidates a clear, flexible pathway to US CPA certification. You’ll complete three mandatory Core sections covering audit, accounting, and taxation fundamentals, plus one Discipline section aligned with your career specialization. Understanding the exam’s format, question types, scoring system, and testing logistics positions you to plan effectively and execute confidently.

Your preparation should account for the data we’ve covered: section-wise question counts ranging from 50-82 MCQs and 6-8 TBSs, pass rates varying from 42% for FAR to 78% for TCP, and total costs reaching ₹2.8-5.5 lakhs depending on your choices. With eight Prometric centers across India, continuous Core section testing, and a 30-month completion window, the CPA exam has never been more accessible to Indian professionals. Approach your journey strategically, prepare thoroughly, and join the growing community of Indian CPAs advancing their careers through this globally recognized credential.

Frequently Asked Questions

How many sections are there in the CPA exam?

The CPA exam consists of four sections total: three mandatory Core sections (AUD, FAR, REG) that every candidate must pass, plus one Discipline section (BAR, ISC, or TCP) of your choice. All four sections must be passed with a minimum score of 75 within your completion window to earn the CPA credential.

What is the passing score for the CPA exam sections?

You need a minimum scaled score of 75 on a 0-99 scale to pass each section. This is not a percentage correct but a scaled score that accounts for question difficulty. The scaling ensures consistent standards across different test forms and testing dates.

Can I take the CPA exam sections in any order?

Yes, you can take the four sections in any order you choose. Most candidates start with FAR while their accounting knowledge is fresh, but there’s no required sequence. Strategic ordering based on content relationships and your strengths can improve your overall success rate.

How long do I have to pass all four CPA exam sections?

Most jurisdictions allow 30 months to pass all four sections once you pass your first section. This extended window replaced the previous 18-month timeline in most states. Check your specific state board’s requirements, as some variations exist.

What is the difference betweenthe Core and the Discipline sections?

Core sections (AUD, FAR, REG) test foundational knowledge every CPA needs and are mandatory for all candidates. Discipline sections (BAR, ISC, TCP) test specialized knowledge in specific areas, and you choose one based on your career goals and interests.

Which CPA exam section has the highest pass rate?

TCP (Tax Compliance and Planning) has the highest pass rate at approximately 75-78% as of Q3 2025. This reflects strong alignment with REG content and self-selection among tax-oriented candidates rather than inherently easier content..

How much does the CPA exam cost for Indian candidates in 2025?

The total investment ranges from approximately ₹2.8 lakhs to ₹5.5 lakhs, including exam fees ($510/section), registration fees, international administration fees, credential evaluation, and review course costs. The exact amount depends on your choices and the number of retakes.

Can I take the CPA exam in India?

Yes, the CPA exam is offered at eight Prometric centers across India: Ahmedabad, Bangalore, Chennai, Hyderabad, Kolkata, Mumbai, New Delhi, and Trivandrum. You must pay the international administration fee through NASBA before booking at Indian locations.

How many times can I retake a failed CPA exam section?

There’s no limit on retake attempts. However, you must wait for the score release before rescheduling the same section, and each retake requires paying the exam and registration fees again. You cannot take the same section twice within the same testing window.

What happens if my NTS expires before I take the exam?

If your NTS expires before you test, you lose the fees paid and must reapply for a new NTS with fresh fees. NTS validity is typically six months. Plan your application timing carefully to avoid this costly situation.

How long should I study for each CPA exam section?

Most candidates require 300-400 total study hours across all four sections, averaging 75-100 hours per section. FAR typically requires the most time (100-120 hours) due to content volume, while your Discipline section may require less if closely aligned with a recently passed Core section.

Is there negative marking in the CPA exam?

No, there’s no penalty for wrong answers on either MCQs or TBSs. You should answer every question, even if guessing. Leaving questions blank guarantees zero points, while guessing provides at least a chance of earning credit.

When are CPA exam scores released?

Core section scores are released on rolling dates, typically 1-2 weeks after testing under continuous testing. Discipline scores are released 6-8 weeks after each quarterly window closes. Specific target release dates are published by AICPA at the start of each year.

Which Discipline section should I choose as an Indian CA?

Your choice should align with career goals rather than your CA background alone. If pursuing audit or financial reporting roles, consider BAR. For technology risk or IT audit careers, ISC provides relevant credentials. For cross-border tax practice or transfer pricing, TCP leverages your potential interest in international taxation.

Allow notifications

Allow notifications