Complete CPA exam application process covering credential evaluation, state selection, NASBA portal, Prometric scheduling, and 2025 costs in INR.

Table of Contents

If you have ever tried to understand the CPA exam application process, you know exactly how overwhelming it can feel. There are multiple organizations involved, each with its own portals, fees, and timelines. You encounter unfamiliar acronyms like NTS, ATT, CPAES, and NIES. And just when you think you have figured it out, you discover that each US state has different requirements. For Indian candidates, this complexity is amplified because you are navigating a foreign examination system while managing full-time work, family responsibilities, and the challenge of converting everything into Indian Rupees.

This guide exists to cut through that confusion and give you a clear, actionable roadmap from start to finish. We have designed it specifically for Indian professionals, whether you are a B.Com graduate, a Chartered Accountant looking to add an international credential, or a finance professional working in an MNC. You will learn exactly how to get your Indian credentials evaluated, which US state to choose for your application, how to navigate the NASBA portal, and how to schedule your exam at one of the eight Prometric centers across India. With recent fee increases, understanding this process upfront is not just convenient; it directly impacts how much you spend and how efficiently you use your NTS validity window.

By the time you finish reading, you will have complete clarity on the four organizations you will work with during this journey. You will understand the step-by-step credential evaluation process and realistic timeline expectations for Indian candidates. We will walk through the entire NTS application process, from creating your NASBA account to receiving your Notice to Schedule. You will get a detailed cost breakdown in Indian Rupees, learn about common mistakes that cost candidates time and money, and find answers to the most frequently asked questions. Consider this your complete CPA application companion, built specifically for the Indian candidate experience.

The Four Key Organizations for CPA Exam

Before you fill out a single form or pay a single fee, you need to understand who does what in the CPA examination ecosystem. Four organizations will play critical roles in your journey, and knowing their responsibilities helps you direct your questions to the right place and avoid unnecessary confusion. Think of this as learning the rules of the game before you start playing.

NASBA and Its Role in Your CPA Journey

The National Association of State Boards of Accountancy is the central hub that connects candidates, state boards, and testing services. Understanding NASBA’s functions early will save you countless hours of confusion as you progress through your application. Most of your administrative interactions during the application phase will flow through NASBA’s systems and portals.

NASBA operates the CPA Examination Services (CPAES) system, which processes applications for the majority of US states. When you create your candidate account, pay your exam fees, and receive your Notice to Schedule, you are working within NASBA’s portal. They also operate NASBA International Evaluation Services (NIES), which evaluates foreign credentials for CPA exam eligibility. For Indian candidates, NASBA essentially becomes your one-stop shop for most application-related activities, from credential evaluation to fee payment to NTS issuance.

The NASBA CPA Portal is where you will spend significant time during your application journey. This portal allows you to check your eligibility status, view your NTS, track your scores after examination, and manage multiple exam sections. Familiarizing yourself with this portal early will save you considerable time and reduce anxiety as you progress through each step.

State Boards of Accountancy

Unlike many professional certifications that have uniform national requirements, the CPA license operates at the state level, with each jurisdiction setting its own rules. This decentralized structure creates both challenges and opportunities for Indian candidates. Your state selection decision will impact everything from your eligibility to your costs to your long-term career flexibility.

Here is something that surprises many Indian candidates: the CPA license is not issued by a national body. Instead, each of the 55 US states and territories has its own Board of Accountancy that sets eligibility requirements, processes applications, and ultimately issues your CPA license. This means your choice of state directly impacts your eligibility, costs, and long-term career flexibility.

Each state board has the authority to set its own education requirements, work experience requirements, and residency rules. Some states allow you to sit for the exam with 120 credit hours, while others require 150 credits. Some states require a Social Security Number, while others do not. Some states have specific accounting and business credit hour requirements that may or may not align with your Indian degree. This variation is precisely why state selection becomes one of the most important strategic decisions you will make.

For Indian candidates, state selection is particularly critical because not all states are equally accessible. States like Montana, Alaska, and Washington have become popular among international candidates because they do not require US residency or a Social Security Number. Your state choice also affects your evaluation agency options, as some states only accept evaluations from specific agencies like NIES. We will dive deeper into state selection criteria later in this guide, but for now, understand that this decision shapes your entire application experience.

AICPA’s Role in Exam Development and Scoring

The American Institute of Certified Public Accountants, or AICPA, is the organization responsible for creating and scoring the CPA exam itself. When you sit down at the Prometric center and begin answering questions, you are working through content that the AICPA developed based on its CPA Exam Blueprints. They determine what topics are tested, how questions are structured, and what constitutes a passing score.

After you complete each exam section, your responses are sent to AICPA for scoring. They use a sophisticated scoring methodology that includes both multiple-choice questions and task-based simulations. Once scores are finalized, AICPA sends advisory scores to NASBA, which then forwards them to your state board for official release. This process typically takes one to two weeks from your exam date, though exact timing depends on the score release schedule published by AICPA each year.

Prometric as Your Testing Partner

Prometric is where the theoretical becomes practical, where all your preparation and application efforts culminate in actually sitting for the exam. They manage the physical testing experience across hundreds of locations worldwide, including eight centers in India. Understanding Prometric’s role and policies helps you navigate scheduling, rescheduling, and exam day logistics smoothly.

Prometric is the company that actually administers the CPA exam at testing centers around the world. When you walk into a testing facility, show your identification, and sit down at a computer to take your exam, you are in a Prometric testing center. They handle everything related to the physical testing experience, from scheduling appointments to maintaining test center security to delivering exam content through their systems.

For Indian candidates, Prometric operates eight testing centers across the country: Ahmedabad, Bangalore, Kolkata, Chennai, Hyderabad, Mumbai, New Delhi, and Trivandrum. This domestic testing availability is a relatively recent development that has made the CPA journey significantly more accessible for Indian professionals. Previously, candidates had to travel to the Middle East or the United States to take their exams, adding substantial travel costs and logistical complexity.

Prometric also handles exam rescheduling and cancellation. If you need to change your exam date, you will do so through Prometric’s ProScheduler system. They have specific policies around rescheduling fees based on how close you are to your exam date, which we will cover in detail when we discuss scheduling. For now, know that Prometric is your partner for everything related to the actual testing experience.

Credential Evaluation for CPA Exam

Before you can apply to any US state board, you need to prove that your Indian education meets their requirements. This is where credential evaluation comes in. Since Indian universities follow a different credit system than American institutions, you need a third-party agency to translate your academic record into terms that US state boards can understand and evaluate. This step is mandatory for all international candidates and typically takes four to eight weeks to complete.

Why Indian Candidates Need Credential Evaluation

Credential evaluation bridges the gap between the Indian and American education systems, translating your academic achievements into a format that US state boards recognize. Without this translation, state boards have no standardized way to assess whether your education meets their requirements. This section explains why evaluation is necessary and helps you choose the right agency for your situation.

Understanding US Credit Hour Requirements

The US education system measures academic achievement in credit hours, with most bachelor’s degrees totaling around 120 semester credits and many CPA licensing requirements set at 150 credits. Indian degrees do not use this system, so there is no direct one-to-one conversion. A typical three-year Indian B.Com degree generally translates to approximately 90 to 120 US semester credits, depending on the evaluation agency and the specific courses you completed. This translation is not just about counting years; evaluators examine your actual coursework, credit loads per semester, and subject areas covered.

Most US states require 120 credit hours to sit for the CPA exam, with 150 credits needed for full licensure. This distinction is important because some states allow you to take the exam with 120 credits, but require 150 credits to actually receive your license. For Indian candidates with a three-year B.Com, you may qualify to sit for the exam in certain states, but you will likely need additional coursework for licensure. A four-year degree, M.Com, MBA, or CA qualification generally provides more credits and may meet the 150-credit threshold depending on your specific academic record.

Which Evaluation Agency Should You Choose?

Two primary agencies handle credential evaluation for CPA candidates: NASBA International Evaluation Services (NIES) and World Education Services (WES). Your choice between them depends largely on which state you plan to apply through, as some states mandate specific agencies, while others accept either.

NIES is operated by NASBA itself and is specifically designed for CPA exam candidates. Their evaluators understand exactly what state boards are looking for, and their reports are formatted to directly address CPA eligibility requirements. NIES fees range from $225 to $300, depending on the services you select, and processing typically takes four to six weeks after they receive all your documents. One significant advantage of NIES is its “Undecided Jurisdiction” option, which evaluates your credentials and recommends suitable states based on your academic background.

World Education Services (WES) is a broader credential evaluation agency that serves multiple purposes, including immigration, employment, and professional licensing. For CPA candidates, WES offers a CPA-specific evaluation package priced at approximately $305. WES is widely recognized and accepted by many state boards, though not all. Their processing time is generally similar to NIES, around four to eight weeks, depending on document verification requirements.

Before paying for any evaluation, verify which agencies your chosen state accepts. Some states, like Alaska, Arizona, Georgia, and several others, only accept NIES evaluations. If you pay for a WES evaluation and then discover your state only accepts NIES, you will need to pay for a second evaluation. This is one of the most common and costly mistakes Indian candidates make, so research your state’s requirements first.

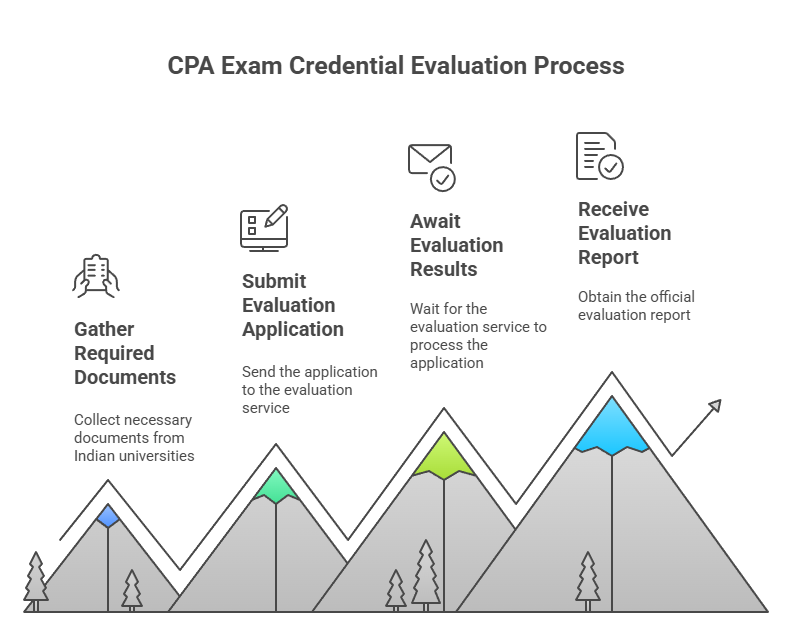

Step-by-Step Credential Evaluation Process for CPA Exam

Now that you understand why evaluation is necessary and which agencies are available, let us walk through the actual process of getting your Indian credentials evaluated. This process requires coordination between you, your Indian university, and the evaluation agency. Proper preparation and realistic timeline expectations will help you navigate this phase smoothly.

Documents Required from Indian Universities

Gathering the right documents in the correct format is crucial for a smooth evaluation. Most evaluation agencies require official transcripts that are either sent directly from your university in a sealed envelope or transmitted electronically through secure channels. Photocopies or student-held transcripts are generally not accepted because agencies need to verify authenticity.

You will typically need consolidated marksheets for all years of your degree, your degree certificate or provisional certificate, and sometimes course descriptions or syllabi. If your documents are not in English, you will need certified translations. Some agencies also require proof of your degree’s recognition by the University Grants Commission (UGC) or All India Council for Technical Education (AICTE). Contact your university’s examination section or registrar’s office well in advance, as processing transcript requests can take two to four weeks at Indian universities.

Submitting Your Evaluation Application

Once you have gathered your documents, create an account on your chosen evaluation agency’s portal and complete the application form. You will provide personal information, details about your educational institutions, and select which jurisdiction you want the evaluation sent to. Pay the evaluation fee online, and then either mail your documents or have your university send them directly to the agency. Track your application status through the agency’s portal and respond promptly to any requests for additional information.

Realistic Timeline Expectations for Indian Candidates

Indian candidates should budget three to five months for the complete evaluation process. This includes two to four weeks for your Indian university to process and send transcripts, four to eight weeks for the evaluation agency to receive, verify, and evaluate your credentials, and additional time for any follow-up documentation requests. Starting this process early gives you buffer time for unexpected delays and ensures you are not rushing when you are ready to begin studying.

CPA Exam Application Process: Choosing the Right US State

Your state selection is one of the most consequential decisions in your CPA journey. The wrong choice can result in eligibility problems, unnecessary expenses, or limitations on your future career flexibility. Take time to research and compare options before committing. This decision affects not just your exam eligibility but also your path to licensure and potential career mobility.

State Selection Criteria for Indian Candidates

Choosing the right state requires balancing multiple factors, including education requirements, identification requirements, fees, and long-term licensure considerations. Indian candidates face unique constraints that make some states more accessible than others. Understanding these criteria helps you make an informed decision that aligns with both your current situation and future goals.

Education Requirements: 120 vs 150 Credit Hours

States differ in how many credit hours they require to sit for the exam versus to obtain licensure. Some states, like Montana, Colorado, and Alaska, allow candidates to sit for the exam with 120 credits, making them accessible to Indian B.Com graduates who may not have 150 credits. Other states require 150 credits even to sit for the exam. Understanding this distinction helps you identify states where you can begin testing immediately versus states where you would need additional coursework first.

Residency and Social Security Number Requirements

Many Indian candidates worry about Social Security Number (SSN) requirements, but numerous states do not require an SSN for examination eligibility. States like Montana, Alaska, Washington, New Hampshire, and Maine are popular among international candidates specifically because they accommodate applicants without SSNs. Similarly, most states do not require US residency to sit for the exam, though some may have residency requirements for licensure. If you are based in India with no immediate plans to relocate to the US, prioritize states that accommodate your situation.

International-friendly states have become well-established pathways for Indian candidates. These states understand that professionals around the world seek US CPA credentials for career advancement in multinational companies, Big Four firms, and global finance roles. Your state choice does not limit where you can eventually work; CPA licenses can be transferred between states through reciprocity agreements once you are licensed.

Popular State Choices Among Indian CPA Candidates

Several states have emerged as favorites among Indian CPA candidates due to their combination of accessible requirements, reasonable fees, and international-friendly policies. Understanding what makes these states popular helps you evaluate whether they align with your specific circumstances. Let us examine the practical factors that differentiate these popular choices.

Comparing Application Fees and Processing Times

Application fees vary significantly across states. However, do not choose a state based solely on the lowest fees. Consider the total cost, including evaluation requirements, exam fees, and any additional documentation. Processing times also vary, with some states approving applications within two to three weeks while others may take six weeks or longer. Research current processing times on state board websites or CPA candidate forums to set realistic expectations.

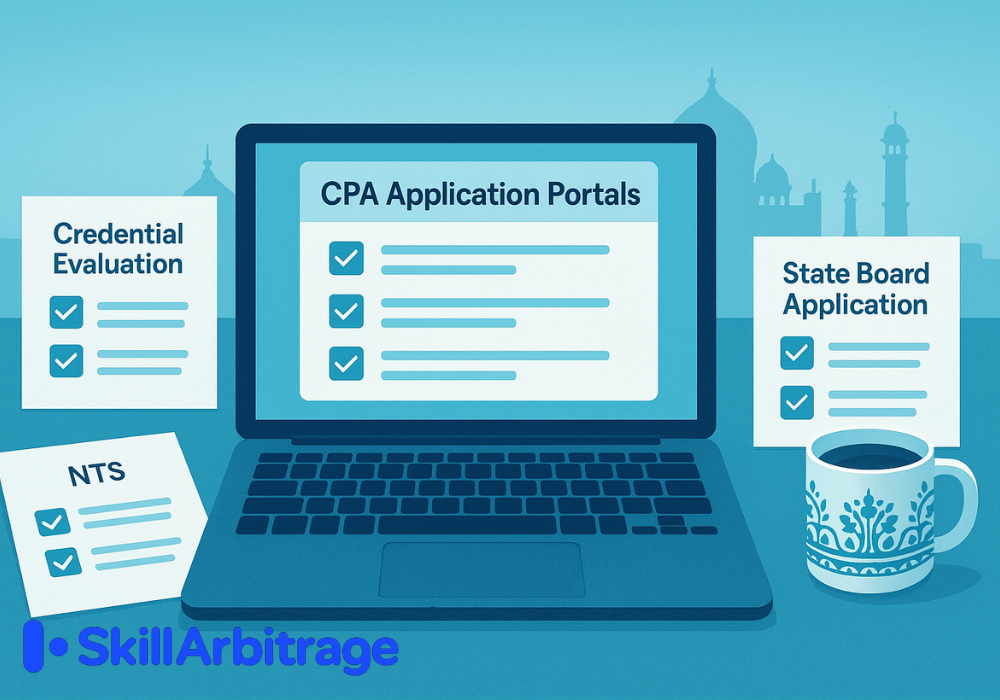

The Complete NTS Application Process: From Start to Scheduling

Now that you understand the ecosystem and have chosen your state, let us walk through the actual application process step by step. This section covers everything from creating your account to holding your Notice to Schedule in hand. Each step builds on the previous one, so following this sequence carefully ensures you do not miss critical requirements or deadlines.

Creating Your NASBA CPA Portal Account

Your NASBA CPA Portal account serves as your central command center throughout the CPA examination process. From this single portal, you will manage applications, pay fees, receive your NTS, and eventually check your scores. Setting up this account correctly from the start prevents complications later in your journey.

Registration and Profile Setup

Your journey begins at the NASBA CPA Portal, where you will create an Okta account using your email address. Choose a professional email that you check regularly, as all important communications will come to this address. During registration, you will provide personal information, including your legal name exactly as it appears on your passport. This is critical because your name must match across all documents: your passport, your NTS, and your test center identification.

Complete your profile with accurate educational history, contact information, and demographic details. Upload clear scans of required documents, such as your passport identification page. Take your time with this step because errors in your profile can cause delays later. Once your account is created, familiarize yourself with the portal’s layout and features before proceeding to the application phase.

Education Evaluation Application Through NASBA

If you are using NIES for credential evaluation, you can initiate the evaluation directly through the NASBA portal. Navigate to the Education Evaluation section and follow the prompts to submit your evaluation application. If you have already completed an evaluation through WES or another agency, you will instead submit proof of your evaluation along with your state board application. The portal guides you through each step, but having your evaluation completed beforehand streamlines this process significantly.

Understanding ATT and NTS: The Two Critical Documents for the CPA Exam

Two documents govern your ability to register for and take the CPA exam: the Authorization to Test (ATT) and the Notice to Schedule (NTS). Many candidates confuse these documents or do not understand their relationship, leading to missed deadlines and forfeited fees. Understanding the distinction between them is essential for managing your timeline and budget effectively.

Authorization to Test (ATT): What It Means

The Authorization to Test is a document from your state board confirming that you meet their eligibility requirements to sit for the CPA exam. Think of it as the green light that says “yes, you qualify to take this exam.” Once your application is approved and your eligibility is confirmed, you receive an ATT that is typically valid for 90 days in most states.

During this 90-day window, you must pay your exam section fees to convert your ATT into an NTS. If you let your ATT expire without paying exam fees, you may need to reapply and pay application fees again. This is why timing matters: do not submit your application until you are reasonably ready to begin paying for exam sections and scheduling tests.

The ATT period is essentially your decision window. Use this time to finalize which sections you want to register for first and ensure your study timeline aligns with NTS validity. Do not rush into paying for all four sections during your ATT period unless you are confident you can schedule and sit for all of them within your NTS validity window.

Notice to Schedule (NTS): Your Exam Ticket

The Notice to Schedule is your actual authorization to schedule and sit for specific CPA exam sections. After you pay exam fees for one or more sections, NASBA issues your NTS containing critical information: your candidate identification number, exam section IDs for each section you paid for, and the validity period during which you must schedule and take your exams.

Your NTS is valid for six months in most states, though some states offer extended validity of nine months (California, Hawaii, Louisiana, Utah) or even twelve months (North Dakota, South Dakota, Virginia). If your NTS expires before you take the exam, you forfeit the fees paid and must pay again to register. This is one of the most expensive mistakes candidates make, so plan your section registration carefully around your realistic study and testing timeline.

The NTS contains your Exam Section ID, which you will need when scheduling at Prometric. Guard this document carefully and save digital copies in multiple locations. You must bring either a printed or digital copy of your NTS to the test center on exam day; without it, you will not be permitted to test.

Paying Exam Fees and Receiving Your NTS

Once you have your ATT, the next step is paying for the exam sections you want to take. This payment triggers the issuance of your NTS and starts the clock on your validity window. Making strategic decisions about how many sections to pay for at once can significantly impact both your budget and your success rate.

Fee Payment Options and Process

Once you receive your ATT, log in to the NASBA portal to pay exam section fees. You can pay for one section at a time or multiple sections together. Payment is typically made by credit card through the secure portal. After successful payment, your NTS is usually generated within a few business days and becomes available in your portal account. You will also receive an email notification when your NTS is ready.

How Many Sections Should You Pay For at Once?

This is a strategic decision that depends on your study timeline and confidence level. Paying for all four sections at once locks you into completing them within your NTS validity period, typically six months. If you are working full-time in India with limited study hours, fitting four sections into six months may be unrealistic. A safer approach for most working professionals is to pay for one or two sections at a time, ensuring you can realistically prepare and test within the validity window. Yes, you will pay a small registration fee each time you request a new NTS, but this is far less expensive than forfeiting fees on expired sections.

Scheduling Your CPA Exam at Prometric India

With your NTS in hand, you are ready to schedule your actual exam appointment. This section walks you through the international testing registration and Prometric scheduling process. For Indian candidates, there are additional steps and fees compared to US-based candidates, but the process is straightforward once you understand the sequence.

International Testing Registration Requirements

Before you can schedule at a Prometric center in India, you must complete international testing registration through NASBA. This involves paying an additional administration fee and confirming your eligibility to test at international locations. These requirements exist because international testing involves additional coordination and costs beyond domestic US testing.

Paying the International Administration Fee

Before you can schedule at a Prometric center in India, you must pay an international administration fee of $390 per section (approximately ₹32,760 at current exchange rates). And for anyone outside the US and Canada, it is $510. This fee is in addition to your regular exam section fee. Log in to your NASBA CPA Candidate Account, select “International Administration,” and complete the payment for each section you want to schedule in India. After payment, you must wait at least 24 hours before you can schedule your appointment through Prometric.

Citizenship and Residency Requirements for India Testing

To test in India, you must be a citizen or long-term resident of India or one of the other eligible countries. You will need a valid passport for identification at the test center. Ensure your passport will remain valid through your exam date and that the name on your passport exactly matches the name on your NTS.

Step-by-Step Prometric Scheduling Process

Once you have paid your international administration fee and waited 24 hours, you can schedule your exam through Prometric’s online system. The scheduling process is intuitive, but requires you to have specific information from your NTS ready. Following these steps carefully ensures your appointment is booked correctly.

Accessing Prometric ProScheduler

Navigate to Prometric’s CPA scheduling page and select “Schedule” to begin the appointment booking process. Choose “Uniform CPA Exam” as your exam type. You will be asked to read and acknowledge identification policies and privacy disclosures. Then enter your Exam Section ID from your NTS along with the first four characters of your last name to access scheduling.

Selecting Your Test Center and Date

Enter your location and preferred date range to see available appointments at Prometric centers in India. The eight available cities are Ahmedabad, Bangalore, Kolkata, Chennai, Hyderabad, Mumbai, New Delhi, and Trivandrum. Choose a center convenient to your location and select from available time slots. Consider factors like travel time to the center, your personal peak performance hours, and score release dates when choosing your exam date.

Confirming Your Appointment

Review all details, including your name, exam section, date, time, and test center location. Confirm that everything is accurate, then complete your appointment booking. You will receive a confirmation email with your confirmation number. Save this email and note your confirmation number in multiple places. You will need this number if you ever need to reschedule or cancel.

Rescheduling and Cancellation Policies

Life is unpredictable, and sometimes circumstances require you to change your exam plans. Prometric has established policies for rescheduling and cancellation that balance flexibility with the need to manage testing center capacity. Understanding these policies helps you make informed decisions if you need to modify your appointment.

Fees and Deadlines for Changes

Life happens, and sometimes you need to change your exam date. Prometric’s rescheduling policy is based on how much notice you give. If you reschedule more than 61 days before your exam, there is no fee. Otherwise, you pay a $35 fee. Rescheduling between 24 hours and 5 days before your exam costs $84.84. If you are within 24 hours of your appointment or simply do not show up, you forfeit all fees and must pay again to register for that section.

These fees apply to changes made through Prometric. Plan your exam date carefully to avoid rescheduling costs. If you realize your preparation is not where it needs to be, reschedule early rather than waiting until the last minute.

Extreme Circumstances and NTS Extensions

NASBA recognizes that extreme circumstances sometimes prevent candidates from testing. Situations like serious illness, family emergencies, natural disasters, or military deployment may qualify for an NTS extension or partial refund. To request an exception, complete the Exception to Policy Form available on NASBA’s website. Provide documentation supporting your circumstances. Note that routine scheduling conflicts or inadequate preparation do not qualify as extreme circumstances. These exceptions are reserved for genuine hardships beyond your control.

Complete CPA Application Cost Breakdown for Indian Candidates (2025)

Understanding the full cost picture helps you budget effectively and avoid financial surprises. Let us break down every expense you will encounter from application to licensing. Having a comprehensive view of all costs allows you to plan your finances, explore payment options, and make informed decisions about timing your application.

Pre-Application and Evaluation Costs

Before you pay a single exam fee, you will incur costs for credential evaluation and state board application. These pre-application expenses represent your entry ticket into the CPA examination system. Planning for these costs ensures you are not caught off guard before you even begin the core examination process.

Your credential evaluation is your first major expense, ranging from $225 to $305 (approximately ₹18,900 to ₹25,600) depending on your chosen agency and service level. Add document courier costs if your university mails transcripts internationally, typically ₹2,000 to ₹5,000 depending on shipping speed. The state board application will be $100.

Plan for your pre-application and evaluation phase to cost approximately ₹30,000 to ₹50,000 in total, covering evaluation, document handling, application fees, and registration fees. This is before you pay for any exam sections.

Examination Fees for All Four Sections

The examination fees represent the largest portion of your CPA investment. These fees have increased in 2025, making it even more important to understand exactly what you will pay and plan your budget accordingly. For Indian candidates testing in India, the international testing fee doubles the effective cost per section.

Each CPA exam section now costs $390. For all four sections, your domestic exam fees total $2,040. But as an international candidate testing in India, you also pay the international administration fee, bringing the fee to $510.

Total Investment Summary and Budget Planning

Beyond the direct examination costs, most candidates invest in review courses and study materials to maximize their chances of passing. This section provides a complete picture of your total investment and offers guidance on managing these expenses across your CPA journey timeline.

Most Indian candidates should budget between ₹3,50,000 and ₹6,00,000 for their complete CPA journey when including a quality review course. Review courses from providers like Becker, Wiley, or Surgent range from ₹80,000 to ₹2,00,000, depending on the package and whether you access them through an Indian coaching institute. Some candidates also invest in supplementary materials, tutoring, or bridge courses if they need additional credits.

Build a financial buffer of 10-15% for currency fluctuations and unexpected expenses like retakes or rescheduling fees. Consider the payment timeline as well: you do not pay everything up front. Evaluation costs come first, followed by application fees, then section fees spread across your testing period. This natural spacing allows you to manage cash flow across several months rather than needing the entire amount immediately.

Common Application Mistakes and How to Avoid Them

Learning from others’ mistakes saves you time, money, and frustration. Here are the most common errors Indian candidates make and how to avoid them. Each of these mistakes has cost real candidates real money and delayed their CPA journeys, sometimes by months. A few minutes of careful attention at each stage can prevent these problems entirely.

Document and Evaluation Errors

Document-related mistakes are among the most common and frustrating problems Indian candidates face. These errors often result from unfamiliarity with US documentation standards or assumptions that Indian university practices will align with evaluation agency requirements. Avoiding these pitfalls requires attention to detail and verification at each step.

Transcript and Document Issues

Sending transcripts in unsealed envelopes or providing photocopies instead of official documents leads to evaluation rejection. Indian universities sometimes seal transcripts, but the envelope gets damaged in transit. Request your university to send transcripts directly to the evaluation agency when possible, or use tracked international courier services with proper packaging. Also, ensure all documents are in English or accompanied by certified translations.

Choosing the Wrong Evaluation Agency

Paying for a WES evaluation when your target state only accepts NIES is a costly error that requires starting over with a new evaluation. Before paying any evaluation fee, confirm your chosen state’s accepted agencies by checking the state board website directly. This five-minute verification can save you $225 or more and several weeks of delay.

Strategic and Timing Mistakes

Beyond document issues, strategic errors in timing and planning can derail your CPA journey. These mistakes often stem from enthusiasm without adequate research or from assumptions about how the process works. Taking time to understand the implications of each decision prevents costly missteps.

Paying for All Four Sections Too Early

Enthusiasm often leads candidates to pay for all four sections immediately upon receiving their ATT, only to discover they cannot realistically prepare for four exams within the six-month NTS validity. Assess your realistic study capacity, consider your work schedule and personal commitments, and register for sections in batches you can confidently complete.

Ignoring State Selection Implications

Choosing a state based solely on the lowest application fee without considering SSN requirements, evaluation agency restrictions, or licensure requirements causes problems later. Some candidates discover they cannot complete licensing in their chosen state because of experience requirements they cannot meet from India. Research comprehensively before applying, considering your long-term goals and not just immediate costs.

Scheduling and Logistical Errors

Even after successfully navigating evaluation and application, candidates can stumble during the scheduling phase. These logistical errors often occur when candidates are focused on exam preparation and overlook administrative details. Staying organized and verifying information prevents last-minute problems.

Last-Minute Scheduling Problems

Waiting until close to your NTS expiry to schedule often means your preferred test center or date is unavailable. Popular testing dates around score release windows and quarter-ends fill up quickly at Indian Prometric centers. Schedule your appointment as soon as you have a confident study timeline, even if it means booking several weeks in advance.

NTS Information Verification

Your name on the NTS must exactly match your passport. If your NTS shows “Rajesh Kumar Singh” but your passport shows “Rajesh K. Singh,” you may face problems at the test center. Verify all information on your NTS immediately upon receipt and contact your state board immediately if corrections are needed. Addressing this early avoids exam-day disasters.

Conclusion

The CPA exam application process for Indian candidates involves multiple organizations, several fee payments, and careful strategic decisions. From credential evaluation through NIES or WES, to state selection based on your specific circumstances, to navigating the NASBA portal for your ATT and NTS, to finally scheduling at one of eight Prometric centers across India, each step requires attention and planning. The journey from deciding to pursue the CPA to sitting for your first exam section typically takes three to six months when you factor in evaluation processing, application approvals, and NTS issuance.

While this process can feel overwhelming initially, thousands of Indian candidates successfully navigate it every year. They secure positions in Big Four firms, advance in multinational corporations, and build rewarding careers in global finance. The key is approaching each step methodically, maintaining realistic timeline expectations, and avoiding the common mistakes that cost others time and money. Your investment of approximately ₹3,50,000 to ₹6,00,000 and several months of effort opens doors to career opportunities that pay dividends throughout your professional life.

Begin your journey by researching state requirements and starting your credential evaluation. These two decisions, made early and wisely, shape everything that follows. Bookmark this guide to reference as you progress through each phase, and remember that complexity becomes manageable when broken into clear, sequential steps. Your CPA journey starts now.

Frequently Asked Questions

How long does the entire CPA application process take for Indian candidates?

The complete application process from starting credential evaluation to receiving your NTS typically takes three to six months. This includes two to four weeks for Indian universities to process transcript requests, four to eight weeks for credential evaluation, three to six weeks for application processing and ATT issuance, and up to a week for NTS generation after fee payment. Starting early gives you buffer time for unexpected delays.

Can I apply for the CPA exam with a 3-year Indian B.Com degree?

Yes, you can apply for the CPA exam with a three-year B.Com degree, but your state choice matters. Some states, like Montana and Alaska, allow candidates to sit for the exam with 120 credit hours, which most B.Com degrees meet after evaluation. However, you will likely need additional credits to reach 150 hours for full licensure. Consult your credential evaluation report for your specific credit total.

What is the difference between ATT and NTS?

The Authorization to Test (ATT) confirms your eligibility to take the CPA exam and is typically valid for 90 days. The Notice to Schedule (NTS) is issued after you pay exam section fees and actually allows you to schedule your exam at Prometric. Think of ATT as eligibility confirmation and NTS as your exam ticket. You cannot schedule without an NTS.

Which US state is best for Indian candidates to apply to?

States like Colorado, Montana, Alaska, and Washington are popular among Indian candidates because they do not require a Social Security Number or US residency. The “best” state depends on your specific credentials, credit hours, and long-term goals. Consider education requirements, evaluation agency acceptance, application fees, NTS validity periods, and licensure requirements when choosing.

How much does the CPA exam cost in Indian Rupees in 2025?

For Indian candidates testing in India, the total exam-related cost for all four sections is approximately ₹2,90,000 to ₹3,20,000. This includes credential evaluation (₹19,000-₹26,000), application and registration fees (₹10,000-₹30,000), exam section fees (₹1,31,000), and international testing fees (₹1,31,000). Adding a review course brings the total investment to ₹3,50,000 to ₹6,00,000.

Do I need a Social Security Number to apply for the CPA exam?

No, many states do not require a Social Security Number for exam eligibility. Colorado, Montana, Alaska, Washington, Maine, and New Hampshire are among the states that accommodate international candidates without SSNs. Research your chosen state’s specific requirements before applying.

Can I take the CPA exam at any Prometric center in India?

Yes, once you complete international testing registration and pay the administration fee, you can schedule at any of the eight Prometric centers in India: Ahmedabad, Bangalore, Kolkata, Chennai, Hyderabad, Mumbai, New Delhi, and Trivandrum. Choose the location most convenient for you based on availability.

What happens if my NTS expires before I take the exam?

If your NTS expires, you forfeit the exam fees paid for that section. You will need to pay all section fees again to receive a new NTS. This is why aligning your section registration with your realistic study timeline is crucial. Only pay for sections you can confidently prepare for and schedule within the validity period.

Should I apply for all four CPA exam sections at once?

For most working professionals in India, registering for one or two sections at a time is advisable. This approach ensures you can realistically prepare and test within your NTS validity period, typically six months. Paying for all four sections only makes sense if you have dedicated study time and confidence that you can complete all exams within the window.

How do I choose between NIES and WES for credential evaluation?

First, verify which agencies your chosen state accepts. Some states only accept NIES evaluations. If your state accepts both, consider processing times, fees, and your specific needs. NIES offers CPA-specific evaluations and an “Undecided Jurisdiction” option, while WES has broader recognition. Both typically take four to eight weeks to process.

What documents do I need from my Indian university for evaluation?

You typically need official sealed transcripts for all years of your degree, your degree certificate or provisional certificate, and sometimes course descriptions or syllabi. Documents must be sent directly from your university or in sealed envelopes. If documents are not in English, certified translations are required. Contact your university registrar two to four weeks before you need documents processed.

Can I reschedule my CPA exam after booking at Prometric?

Yes, you can reschedule through Prometric’s system. If you reschedule more than 30 days before your exam, there is no fee. Rescheduling 6-29 days before costs $35, and 24 hours to 5 days before costs $84.84. Within 24 hours, or no-shows result in complete fee forfeiture. Reschedule early if needed.

How long is the NTS valid for the CPA exam?

NTS validity varies by state. Most states provide a six-month validity period from the date of issue. Some states offer extended validity: California, Hawaii, Louisiana, and Utah offer nine months, while North Dakota, South Dakota, and Virginia offer twelve months. Check your specific state’s NTS validity before planning your exam schedule.

When should I start the CPA application process?

Start your application process three to six months before you want to begin testing. This allows time for credential evaluation (two to three months), application processing (one to two months), and scheduling. If you are still completing study materials, begin the evaluation and application process while studying so you have your NTS ready when your preparation is complete.

Allow notifications

Allow notifications