Complete Enrolled Agent exam study plan guide: part-wise hours, sequencing strategy, daily schedules for working professionals. Pass all 3 parts with these preparation tips.

Table of Contents

If you’re a commerce graduate, accounting professional, or CA dropout looking to break into the lucrative US tax market, the Enrolled Agent credential offers one of the most accessible pathways to represent taxpayers before the IRS. Unlike the CPA, which demands 150 credit hours and state-specific licensing, the EA designation has no educational prerequisites, making it particularly attractive for Indian professionals seeking remote work opportunities with US tax firms.

But here’s what most candidates discover the hard way: passing the three-part Special Enrollment Examination requires more than just knowledge of US tax law. It demands a strategic study plan that accounts for your background, available time, and the varying difficulty levels across exam parts. Without a structured approach, many candidates find themselves burning out midway or running out of their credit carryover period before completing all three parts.

There has been substantial global growth in recent years. As of September 2024, there were approximately 66,794 active Enrolled Agents, up from about 64,489 a year earlier, a growth of roughly 3.6%. In India specifically, the number of EAs is 2,683 as of September 2024, representing a nearly 19% jump in just one year. In 2025, there are approximately 3500 active enrolled agents in India. That indicates that there is demand for qualified EA-credentialed professionals is clearly expanding outside the U.S., and that more Indian accounting graduates and professionals are successfully obtaining EA status, widening the pool of remote, globally oriented tax experts.

In this comprehensive guide, I’ll walk you through everything you need to create an effective EA exam study plan, from understanding how many hours each part truly requires, to deciding which part to tackle first, to building daily schedules that work around your job. Whether you’re targeting an aggressive 3-month timeline or a relaxed 12-month journey, you’ll find actionable strategies backed by data from thousands of successful candidates.

Understanding the Enrolled Agent Exam Structure Before Creating Your Study Plan

Before diving into study schedules and hour allocations, you need a clear picture of what you’re preparing for. The Special Enrollment Examination (SEE) consists of three distinct parts, each testing different aspects of US tax law and IRS representation. Understanding the structure, scoring methodology, and relative difficulty of each part will help you allocate your study time strategically rather than spreading yourself thin across all topics equally.

Many candidates make the mistake of treating all three parts identically, the same study hours, and, same preparation intensity. Let me break down exactly what each part covers and how the scoring works so you can plan accordingly.

What Are the Three Parts of the EA Exam and How Do They Differ?

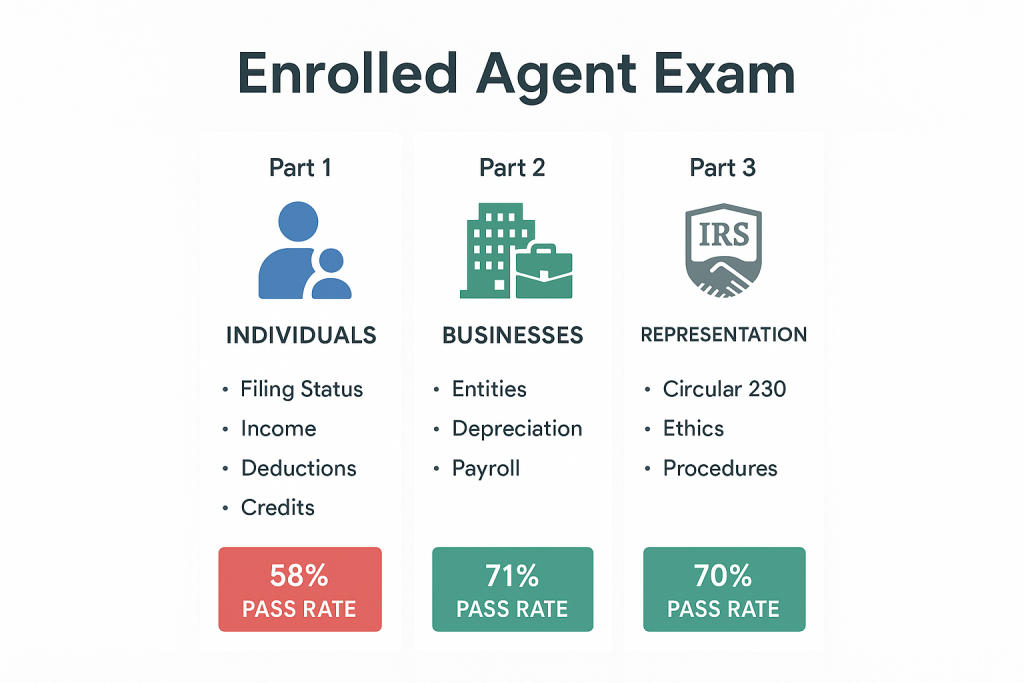

The EA exam tests your competence across three domains:

- individual taxation,

- business taxation, and

- representation practices before the IRS.

Each part contains 100 multiple-choice questions to be completed in 3.5 hours, but the similarity ends there. The content complexity, topic breadth, and historical pass rates vary significantly across parts, and your study plan should reflect these differences.

Part 1 – Individuals: Scope, Topics, and Question Distribution

Part 1 covers everything related to individual tax returns, including filing statuses, income types, deductions, credits, and Form 1040 preparation. If you’ve worked on personal tax returns or have familiarity with individual taxation concepts, you’ll find much of this content intuitive.

The pass rate for Part 1 typically hovers around 58%. Topics like adjusted gross income calculations, itemized deductions, and retirement account distributions form the core of this section.

Part 2 – Businesses: Why This Part Requires the Most Preparation

Part 2 examines business entity taxation, sole proprietorships, partnerships, C corporations, and S corporations, along with complex topics like depreciation methods, payroll taxes, and business deductions. This part has a pass rate of approximately 70%.

The breadth of business taxation topics and the intricate rules governing different entity types make Part 2 the most challenging section. Most EA review providers recommend allocating nearly 50% of your total study time to this part alone.

Part 3 – Representation, Practices, and Procedures: The Highest Pass Rate Section

Part 3 focuses on IRS procedures, taxpayer representation rights, ethics under Circular 230, and practice requirements. With pass rates of 70%, this is generally considered the most manageable part of the exam, along with Paper 2.

The content here is more about understanding rules and procedures rather than complex calculations. Many candidates find that knowledge gained from studying Parts 1 and 2 naturally supports their Part 3 preparation.

How Is the EA Exam Scored and What Does 105 Out of 130 Mean?

The EA exam uses a scaled scoring system that can confuse first-time candidates. Your raw score (questions answered correctly) gets converted to a scale ranging from 40 to 130, with 105 set as the passing threshold. This scaling methodology ensures consistent passing standards across different exam versions and testing dates.

Understanding the Scaled Scoring System

The IRS uses scaled scoring to account for slight variations in difficulty between different exam versions administered on different days. A scaled score of 105 doesn’t mean you answered exactly 105 questions correctly; it represents achieving the minimum competency level established by a panel of Enrolled Agents and IRS representatives.

How Many Questions Can You Afford to Miss and Still Pass?

Of the 100 questions on each part, only 85 are actually scored; the remaining 15 are experimental questions being tested for future exams. Based on the scaling methodology, most estimates suggest you need approximately 70-75% correct answers on the scored questions to achieve a passing scaled score of 105.

How Many Hours Should You Study for Each Part of the EA Exam?

One of the most common questions I hear from EA candidates is: “How many hours do I actually need to study?” The honest answer is that it depends on your background, but I can give you data-backed ranges that have helped thousands of candidates pass. Leading EA review providers have tracked completion times across their student populations, and these numbers provide reliable benchmarks for planning your study schedule.

The key insight here is that not all parts require equal preparation time. Part 2 consistently demands the most hours due to its complexity and breadth, while Part 3 typically requires the least. Let me walk you through what the major providers recommend and how to adjust these numbers based on your specific situation.

What Do Leading EA Review Providers Recommend for Study Hours?

Different EA review providers offer varying recommendations based on their course structures and student data. Understanding these ranges helps you set realistic expectations and avoid both over-preparation (burnout) and under-preparation (failing and retaking).

Gleim’s Data-Backed Study Hour Recommendations

Gleim, the most widely used EA review course and preferred provider of the National Association of Enrolled Agents (NAEA), has analyzed completion times from thousands of successful candidates. Their data suggests Part 1 requires approximately 85 hours, Part 2 needs around 120 hours, and Part 3 takes about 55 hours, totaling roughly 265 hours for all three parts.

These numbers come from actual candidate performance data rather than theoretical estimates, making them particularly reliable. Gleim’s breakdown clearly shows Part 2 requiring nearly 50% more time than Part 1 and more than double the time needed for Part 3. If you’re creating a study schedule, these figures give you a solid foundation to work from.

Becker, Surgent, and Brainscape Study Time Comparisons

Becker recommends 70-90 hours for Part 1, 80-100 hours for Part 2, and 60-80 hours for Part 3, totaling 210-270 hours. Their slightly lower estimates reflect their comprehensive course structure designed to cover fundamentals efficiently. Surgent claims their adaptive technology can reduce study time significantly, with students achieving exam readiness in under 50 hours per part, though this assumes their AI-driven approach effectively targets your weak areas.

Brainscape suggests 80-120 hours per part without distinguishing between parts, which is less precise but accounts for varying candidate backgrounds. The consensus across providers points to a total preparation time of 200-300 hours, with Part 2 consistently requiring the most attention, regardless of which course you choose.

Enrolled Agent Exam: How Does Your Background Affect the Study Hours You Need?

The study hour recommendations above represent averages, but your actual needs may differ significantly based on your prior experience with taxation concepts. A tax professional with years of US tax experience will move through the material much faster than a commerce graduate encountering these concepts for the first time.

Study Time Adjustments for Tax Professionals with US Tax Experience

If you’ve been preparing US tax returns professionally, you likely already understand core concepts like filing statuses, income recognition, and basic deductions. You might reduce Part 1 study time by 20-30% and focus primarily on filling knowledge gaps rather than learning from scratch.

Study Hour Estimates for Commerce Graduates New to US Taxation

Commerce graduates from India entering US taxation for the first time should plan for the higher end of the study hour range, potentially 100+ hours for Part 1 and 130-150 hours for Part 2. The US tax code differs significantly from Indian taxation, and you’ll need time to build a foundational understanding before tackling exam-specific preparation.

CA, CMA, and Accounting Professionals: Leveraging Your Existing Knowledge

If you’re a CA, CMA, or have strong accounting fundamentals, your analytical skills and familiarity with tax concepts will accelerate your learning curve. While you’ll still need to learn US-specific rules, your ability to understand complex calculations and entity structures means you can likely target the middle of recommended hour ranges.

EA Exam: What Is the Minimum Study Time to Pass Each Part?

While I’ve shared recommended study hours, many candidates want to know the absolute minimum they can get away with. The reality is that minimum viable preparation depends entirely on your background and risk tolerance, but cutting corners significantly increases your chances of failing and having to pay the $267 exam fee again.

Risks of Under-Preparing and How to Avoid Them

Under-preparation is one of the primary reasons candidates fail the EA exam, particularly Part 2. Beyond the financial cost of retaking exams, failing disrupts your study momentum and can lead to discouragement. The 2-year (now extended to 3-year) credit carryover period might seem generous, but it passes quickly when you’re balancing work and study.

To avoid under-preparation, use practice exam scores as your guide rather than study hours alone. Most EA review courses recommend scoring consistently above 75% on practice exams before scheduling your actual test. If you’re not hitting these benchmarks, you need more study time regardless of how many hours you’ve already invested.

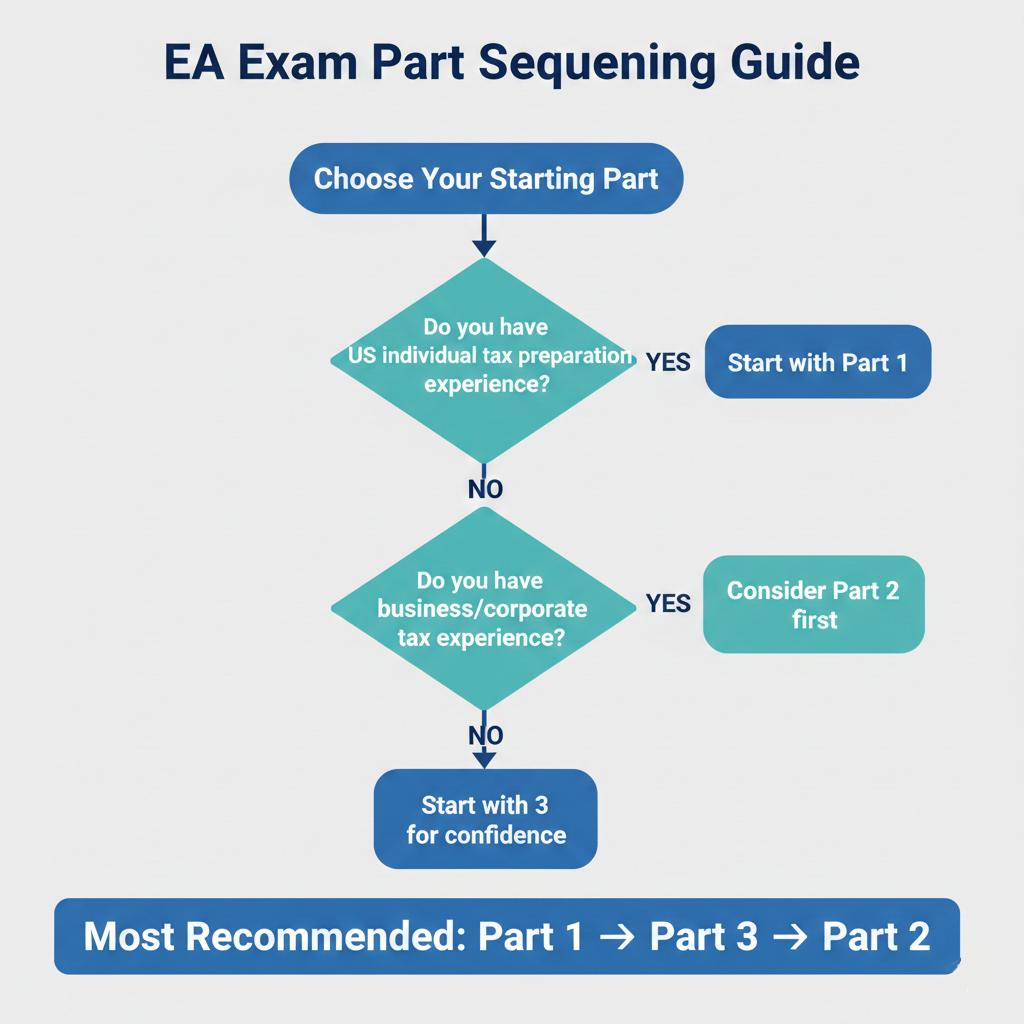

Which Part of the EA Exam Should You Attempt First?

One advantage of the EA exam is flexibility; you can take the three parts in any order you choose. This freedom is valuable, but it also creates a decision point that many candidates overthink. The sequence you choose can impact your momentum, confidence, and overall success probability. Based on pass rate data and topic overlap considerations, there’s a strategic approach that works well for most candidates.

What Is the Recommended Sequence for Taking the EA Exam Parts?

The sequencing decision should balance building confidence early with managing your most challenging content strategically. You want to establish momentum without leaving your hardest part for when you’re potentially fatigued from months of studying.

The Part 1 → Part 3 → Part 2 Strategy and Why It Works

Most EA review providers, including Surgent, recommend starting with Part 1 (Individuals) because it directly relates to individual tax return preparation, work most tax preparers have done. After passing Part 1, tackle Part 3 (Representation) next, since it has the highest pass rate and builds confidence before your final challenge. Save Part 2 (Businesses) for last, giving yourself maximum time and focus for the most difficult section.

This sequence also makes practical sense because Part 2’s business taxation concepts are more complex, and you’ll be a more experienced exam-taker by the time you reach it. The confidence from two passing scores helps you push through Part 2’s demanding material.

Alternative Sequencing Approaches Based on Your Background

If you have extensive business taxation experience, perhaps from working on corporate returns or business entity consulting, you might consider tackling Part 2 earlier while that knowledge is fresh. Similarly, if you’re completely new to US taxation, starting with Part 3 (the highest pass rate section) could build confidence before diving into more technical content.

The key is matching your sequence to your strengths. If individual taxation feels intuitive because of your background, start there. If you’re already familiar with Circular 230 and IRS procedures from professional experience, Part 3 might be your confidence-builder.

Should Working Professionals Take All Parts in the Same Testing Window?

The EA exam testing window runs from May 1 through February 28, with March and April reserved for exam updates. You can take each part up to four times within a single testing window, giving you flexibility to retake if needed without waiting months.

Benefits of Completing All Three Parts Within One Year

Completing all three parts within one testing window (or one calendar year) offers significant advantages. Tax law tested on the exam remains consistent throughout the testing window, so you won’t need to relearn changed provisions. Additionally, maintaining study momentum is easier when you’re continuously engaged rather than taking extended breaks between parts.

Managing the 2-Year (Now 3-Year) Credit Carryover Period

Once you pass any part, that credit remains valid for three years from the passing date (extended from the previous two-year period). However, the clock starts ticking immediately after your first passed part. If you pass Part 1 in May 2025, you must pass Parts 2 and 3 by May 2028, or you’ll lose credit for Part 1 and need to retake it.

Creating a Realistic EA Exam Study Timeline for Working Professionals

Now that you understand the exam structure, study hour requirements, and sequencing strategy, it’s time to build an actual timeline. The approach you take depends on whether you have a firm deadline (like wanting to complete before tax season) or limited weekly hours (like only having 10 hours per week available). Both constraints are valid starting points for building your study plan.

How to Build a Deadline-Based Study Plan?

If you have a specific date by which you need to become an Enrolled Agent, perhaps to qualify for a promotion, start a new job, or complete before tax season intensifies, your deadline becomes the anchor for your entire plan.

Working Backward from Your Target Exam Date

Start by marking your target completion date, then work backward. If you want all three parts done by December 31, and you’re starting in July, you have roughly 6 months. Allocate time proportionally: approximately 2 months for Part 1, 1 month for Part 3, and 3 months for Part 2 (the heaviest section). Build in buffer weeks for life events, holidays, and potential exam retakes.

Sample 6-Month Study Timeline with Milestones

A 6-month timeline starting in May might look like this: Part 1 study from May to mid-July (exam in late July), Part 3 study from late July to late August (exam in early September), and Part 2 study from September through November (exam in early December). This leaves December as buffer time if any retakes are needed before the testing window closes in February.

Enrolled Agent Exam: How to Build an Hours-Based Study Plan When Time Is Limited?

If your constraint is available study time rather than a deadline, you’ll build your plan around weekly hour capacity. This approach is more common for working professionals who can’t predict exactly when they’ll be ready but know they can commit to a certain number of hours weekly.

Calculating Your Weekly Study Capacity

Be honest about how many hours you can realistically study each week. Factor in work commitments, family responsibilities, commute time, and rest needs. If you can genuinely commit to 10 hours weekly, that’s your number; don’t inflate it hoping you’ll find extra time. Using Gleim’s recommended 265 total hours divided by 10 hours weekly equals approximately 27 weeks, or about 7 months.

Sample 9-Month Study Timeline for Busy Professionals

For professionals limited to 8-10 hours weekly, a 9-month timeline provides comfortable pacing. Months 1-3 focus on Part 1 (approximately 85-90 hours), months 4-5 cover Part 3 (55-60 hours), and months 6-9 tackle Part 2 (120-130 hours). This extended timeline reduces daily pressure and accommodates busy periods without derailing your progress.

Building buffer time into a 9-month plan is essential. Tax season, major work projects, or personal commitments will inevitably disrupt some weeks. Planning for 9 months when 7 months of pure study would theoretically suffice gives you breathing room.

What Are the Best Study Timelines for Different Situations for the EA Exam?

Different life situations call for different approaches. Here are three common timeline scenarios with the daily commitment each requires.

The 3-Month Aggressive Timeline (2+ Hours Daily)

The 3-month aggressive approach requires 2-3 hours of daily study, seven days a week. This timeline suits candidates with significant schedule flexibility, strong tax backgrounds, or urgent deadlines. It’s intense but achievable. Surgent specifically markets their adaptive course as enabling 3-month completion for motivated candidates.

The 6-Month Balanced Timeline (1-1.5 Hours Daily)

The 6-month balanced timeline is the sweet spot for most working professionals. Studying 1-1.5 hours daily (or equivalent weekly distribution) provides steady progress without overwhelming your life. This pace allows for proper absorption of complex material and adequate practice question exposure.

The 12-Month Relaxed Timeline (30-45 Minutes Daily)

The 12-month relaxed approach works for candidates with demanding jobs, family obligations, or those who learn best with lower daily intensity. Studying 30-45 minutes daily keeps material fresh without creating burnout. The trade-off is maintaining motivation over a full year and ensuring early material doesn’t fade from memory by exam time.

Enrolled Agent Exam: Structuring Your Daily and Weekly Study Schedule

Having a total hour target and timeline is essential, but execution happens at the daily and weekly level. How you distribute your study hours across the week significantly impacts retention, consistency, and long-term sustainability. Let me share practical scheduling approaches that have worked for working professionals.

What Is the Ideal Weekly Study Schedule for Working Professionals?

The “ideal” schedule is one you’ll actually follow consistently. That said, certain distribution patterns tend to work better than others for knowledge retention and avoiding burnout.

Sample Weekly Schedule: 10 Hours Per Week

A 10-hour weekly schedule might include 1.5 hours on weekday evenings (Monday through Thursday = 6 hours) plus 2 hours each on Saturday and Sunday mornings. This distribution maintains daily contact with material while concentrating heavier sessions on weekends when you’re fresher.

Sample Weekly Schedule: 15 Hours Per Week

For 15 hours weekly, consider 1.5 hours on weekday evenings (7.5 hours) plus 3-4 hours each weekend day. Alternatively, some professionals prefer longer weekend sessions (5 hours Saturday, 5 hours Sunday) with lighter weekday touch-points (1 hour, three evenings). Find what matches your energy patterns.

How Should Indian Professionals Structure Study Around Work Hours?

Indian professionals targeting remote US tax careers often work evening or night shifts to align with US business hours. This creates unique scheduling challenges but also opportunities; your “morning” might be the perfect fresh study time before your US-hours shift begins.

If you’re working US evening hours (roughly 6 PM to 3 AM IST), your optimal study window might be late morning to early afternoon (10 AM to 1 PM IST) after adequate sleep. Weekend study sessions become even more valuable since you’re likely off from US-hours work. Additionally, Indian testing centers in Bangalore, Hyderabad, and New Delhi offer flexibility in scheduling your exam appointments, with testing available from May through February.

The Three-Phase Study Approach for EA Exam Success

Effective EA exam preparation isn’t just about logging hours. It’s about structuring those hours purposefully. I recommend dividing your study time into three distinct phases: initial learning (60%), practice questions (30%), and final review (10%). This framework ensures you’re building knowledge, testing understanding, and consolidating retention before exam day.

Phase 1: Initial Learning (60% of Your Study Time)

The first phase is about acquiring knowledge. Reading study materials, watching video lectures, and understanding concepts. For Part 2 with its 125-hour recommendation, this means approximately 75 hours of initial learning before heavy practice begins.

How to Work Through Study Materials Systematically

Work through your EA review course materials in the sequence provided, resisting the urge to skip around. Each topic builds on previous concepts, and random jumping creates knowledge gaps. Complete all readings and lectures for a topic before moving to its associated practice questions.

Note-Taking Strategies and Setting Topic Completion Milestones

Take notes in your own words rather than copying text verbatim; paraphrasing forces active engagement with the material. Set clear milestones like “complete all Part 1 individual income topics by the end of week 3” to maintain accountability and track progress against your timeline.

Phase 2: Practice Questions and Application (30% of Your Study Time)

After building foundational knowledge, shift focus to applying that knowledge through practice questions. This phase reveals gaps in your understanding and builds the pattern recognition needed for exam success.

How Many Practice Questions Should You Complete Per Part?

Quality EA review courses include 1,500-2,000+ practice questions per part. Aim to complete at least 500-700 questions per part during your preparation, with particular focus on questions you initially answer incorrectly. Gleim’s extensive test bank and Surgent’s adaptive questioning both excel at providing sufficient practice volume.

The key isn’t just answering questions; it’s learning from the answer explanations. When you miss a question, spend time understanding why the correct answer is correct and why your choice was wrong. This analysis process is where deep learning happens.

Identifying and Strengthening Your Weak Areas

Most EA review courses include performance tracking that identifies your weak content areas. If your practice scores show you’re struggling with partnership taxation or depreciation methods, allocate additional study time to those specific topics. Don’t waste hours reviewing material you’ve already mastered when weak areas need attention.

Use the diagnostic feedback strategically. If you’re consistently scoring 85%+ on individual income topics but only 60% on deductions, redirect your Part 1 study time accordingly. The goal is raising your floor, not your ceiling.

Phase 3: Final Review and Exam Readiness (10% of Your Study Time)

The final phase consolidates everything you’ve learned and ensures you’re ready for exam conditions. This typically covers the last 1-2 weeks before your scheduled exam date.

The Two-Week Final Review Strategy

In your final two weeks, stop learning new material and focus entirely on review. Revisit your notes, re-do questions you previously missed, and take full-length practice exams. Your goal is to reinforce existing knowledge and build confidence, not to cram new concepts.

Create a condensed summary of key formulas, thresholds, and frequently-tested rules. Review this summary daily during your final week. The act of creating the summary is itself a valuable review, and having it for quick reference builds exam-day confidence.

Taking Full-Length Practice Exams Under Timed Conditions

Take at least 2-3 full-length practice exams (100 questions, 3.5 hours) under realistic conditions. Find a quiet space, set a timer, and don’t allow yourself breaks beyond what you’d have on exam day. This builds stamina and reveals whether your pacing allows you to complete all questions with time for review.

Practice exams also expose time management issues. If you’re consistently running out of time, you need to practice moving through questions faster. If you’re finishing with an hour to spare, you might be rushing and making careless errors.

Signs You Are Ready to Schedule Your Exam

Schedule your exam when you’re consistently scoring 75%+ on full-length practice exams and feeling confident with all major topic areas. You don’t need to feel 100% ready. Exam-day adrenaline often helps performance. But if practice scores are below 70%, invest more preparation time before scheduling.

Other readiness indicators include being able to explain key concepts without looking at notes, recognizing question patterns from your practice sessions, and feeling that additional study is yielding diminishing returns. Trust the preparation process and your practice exam data.

Maintaining Consistency and Avoiding Burnout During EA Preparation

The EA exam journey spans months, not weeks. Whether you’re on a 3-month sprint or a 12-month marathon, maintaining consistent effort over time is more important than any single study session. Burnout is a real risk that derails many candidates; let me share strategies for sustaining your momentum throughout the journey.

Why Is Daily Consistency More Important Than Study Hours?

Research on learning and retention consistently shows that distributed practice (studying regularly over time) beats massed practice (cramming) for long-term retention. Studying 1 hour daily for 7 days creates stronger memory than studying 7 hours in one marathon session. Your brain needs time between sessions to consolidate information into long-term memory.

Daily consistency also builds habit formation. When studying becomes as automatic as brushing your teeth, you spend less mental energy deciding whether to study and more energy actually learning. Protect your study time like a non-negotiable appointment, and the habit will carry you through motivation dips.

How Do You Prevent Burnout During a 6-12 Month Study Journey?

Burnout manifests as declining motivation, difficulty concentrating, and dreading study sessions. If you notice these signs, don’t push through; you’ll waste study time and potentially create negative associations with the material. Instead, take a strategic 2-3 day complete break from studying.

After your break, evaluate whether your study schedule is sustainable. Burnout often signals that you’ve set unrealistic daily targets. It’s better to study 45 minutes daily for 9 months than to burn out attempting 2 hours daily and quit after 3 months. Adjust your timeline if needed; passing eventually beats giving up entirely.

What Motivation Strategies Work for Long-Term EA Preparation?

Connect your daily studying to your larger career goals. When motivation wanes, remind yourself why you started: the career advancement, income potential, remote work opportunities, or professional recognition that the EA designation provides. Keep your “why” visible, perhaps a note on your desk or phone background.

Set milestone rewards for completing each part’s preparation or passing each exam. These don’t need to be expensive; a nice dinner, a day trip, or simply a guilt-free weekend off. Celebrating progress reinforces positive associations with your study journey and provides psychological breaks between intensive preparation phases.

Conclusion

Creating an effective EA exam study plan requires understanding the exam’s structure, honestly assessing your background and available time, and building a sustainable daily routine. The data is clear: Part 2 requires the most preparation, the Part 1 → Part 3 → Part 2 sequence works best for most candidates, and consistent daily study beats sporadic marathon sessions.

Your path to becoming an Enrolled Agent is achievable with strategic planning. Whether you choose a 3-month sprint or a 12-month marathon, the key is matching your approach to your reality, then executing consistently until you’ve passed all three parts and earned your EA credential.

For more insights on this this please visit our iPleaders blog by clicking here.

Frequently Asked Questions

How long does it take to study for the EA exam while working full-time?

Most working professionals complete all three parts in 6-12 months, depending on weekly study hours available. With 10-15 hours weekly, expect approximately 6-9 months total preparation time across all parts.

Can I pass the EA exam in 3 months with aggressive studying?

Yes, passing all three parts in 3 months is achievable with 2-3 hours daily study and a strong tax background. Surgent specifically markets their adaptive course for this aggressive timeline.

Should I study for one EA part at a time or all three together?

Study for one part at a time. This allows focused preparation and prevents confusion between different content areas. Complete and pass one part before beginning serious study for the next.

What is the best order to take the EA exam parts for someone new to US tax?

Start with Part 1 (Individuals), then Part 3 (Representation), and finish with Part 2 (Businesses). This builds confidence with easier sections before tackling the most challenging part.

How many hours a day should I study for the Enrolled Agent exam?

Most successful candidates study 1-2 hours daily on weekdays with longer weekend sessions. The specific amount depends on your timeline; shorter timelines require more daily hours.

Can I prepare for the EA exam without a review course?

While technically possible using free IRS publications, review courses significantly improve pass rates and efficiency. The structured approach, practice questions, and performance tracking justify the investment.

What happens if I don’t pass all three parts within the carryover period?

Credits for passed parts expire after 3 years from the passing date. You would need to retake any expired parts, paying the exam fee again, and restudying that content.

How should Indian working professionals schedule their EA exam preparation?

Study during morning hours before US shift work begins or on weekends. Test at Prometric centers in Bangalore, Hyderabad, or New Delhi during the May-February testing window.

Is it better to study in the morning or evening for the EA exam?

Study when your mind is freshest, typically mornings for most people. However, evening study works well if that’s when you have uninterrupted time and mental clarity.

How many practice questions should I complete before taking an EA exam part?

Complete at least 500-700 practice questions per part, focusing especially on questions you answer incorrectly. Quality courses offer 1,500+ questions per part.

What is the minimum study time needed to pass each EA exam part?

Minimums vary by background, but plan for at least 50-60 hours for Part 1, 80-100 hours for Part 2, and 40-50 hours for Part 3. Below these thresholds, failure risk significantly increases.

Can commerce graduates with no US tax background pass the EA exam?

Absolutely. The EA exam has no educational prerequisites, and thousands of Indian commerce graduates have passed. Plan for higher-end study hours and choose a comprehensive review course.

How do I know when I am ready to schedule my EA exam?

Schedule when you’re consistently scoring 75%+ on full-length practice exams under timed conditions and feel confident with major topic areas. Don’t wait for perfection; reasonable readiness is sufficient.

Allow notifications

Allow notifications