From metros to smaller cities, discover how India’s finance BPO industry is creating global career growth for skilled accounting professionals.

Introduction

Something remarkable is happening in finance and accounting services across India.

The old BPO model, where you had to relocate to Bangalore, Mumbai or Pune for decent opportunities, is being completely disrupted.

We all know, Knowledge Process Outsourcing (KPO) companies handle back-office operations like accounting, bookkeeping, payroll, and financial analysis for international clients, essentially becoming their remote finance departments.

Traditionally, these high-paying opportunities were concentrated only in metros like Bangalore, Gurgaon, Mumbai, and Pune, forcing talented professionals to relocate for career growth.

But now, they are spreading beyond traditional metros, to smaller cities as well.

What’s driving this shift?

1. Cost arbitrage finally benefiting Tier 2/3 professionals

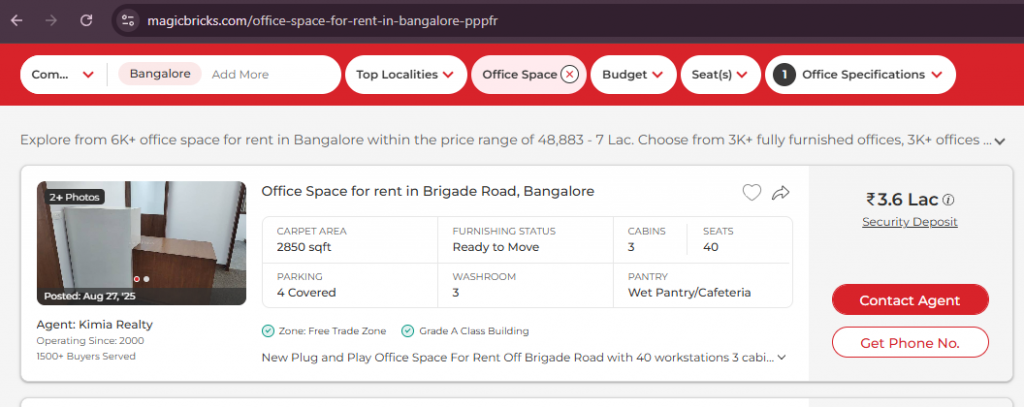

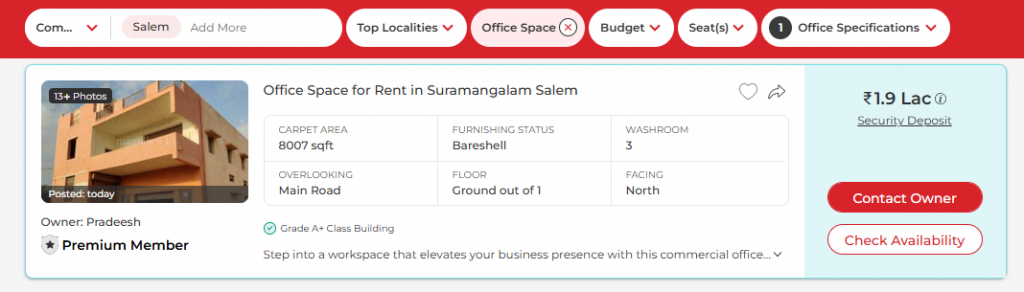

The economics are stark and undeniable. Metro office spaces in Bangalore and Mumbai command ₹120-150 per square foot, while tier 2 cities offer similar quality office infrastructure at ₹20-50 per square foot – that’s a minimum 60% cost reduction on real estate alone.

Tier 1 city rate:

Tier 3 city rate:

Professional salaries in metros carry a 40-60% premium over tier 2 cities, not because of skill differences, but purely due to location-based cost of living adjustments.

However, technology costs remain identical everywhere – the same QuickBooks license, internet connectivity, and software subscriptions cost exactly the same whether you’re in Mumbai or Mysore.

2. Talent shortage in traditional BPO hubs

Bangalore and Mumbai are facing talent saturation. High attrition rates, expensive living costs, and competition from tech companies make it difficult to retain good finance professionals.

Meanwhile, tier 2 and 3 cities have abundant, stable, qualified talent looking for growth opportunities.

3. Client comfort with remote service delivery

Post-COVID, global clients are comfortable with distributed teams. They care about deliverable quality, not where the team sits.

The professionals landing these opportunities aren’t necessarily more qualified. They’ve simply adapted their skills to meet the new market demand.

The skills that are actually opening doors are:

International accounting systems:

The foundation of modern BPO work lies in mastering cloud-based accounting platforms that international clients actually use, like QuickBooks, Xero, and Wave which has become the standard software across US and UK businesses. Understanding US GAAP fundamentals & multi-currency accounting capabilities becomes crucial since most international clients operate under these accounting principles rather than Indian standards.

Process automation:

Modern finance BPOs demand efficiency through technology, making Excel VBA and advanced functions non-negotiable skills. Financial reporting automation & dashboard creation has become a key differentiator, allowing professionals to generate client reports automatically rather than manually compiling data each month.

Communication & client management:

Written English proficiency goes beyond basic grammar to include professional communication standards expected in international business correspondence and client reporting. Video conference presentation skills have become essential as most client interactions happen virtually. Time zone flexibility for international clients shows commitment to seamless service delivery.

Compliance knowledge:

A basic understanding of international tax structures helps BPO professionals navigate the complexities of cross-border business operations and advise clients on tax-efficient structuring. Anti-money laundering basics have become mandatory knowledge as financial institutions and businesses worldwide implement stricter compliance protocols that BPO teams must understand and implement.

Once you’ve mastered US accounting fundamentals, multiple high-paying career paths become available to you, in fast paced economies like the US, UK, middle east and even in Tier 1 cities in India.

These opportunities span from traditional accounting firms to emerging fintech companies, each offering different advantages based on your career goals and preferred work style.

Most accounting professionals don’t even know that such opportunities now exist.

Some of the possible roles you can land in big cities like Bangalore, Mumbai, Delhi, Chennai, and Hyderabad are as follows:

1. Big 4 & Mid-Tier Accounting Firms’ US Tax Divisions

Firms like Deloitte, EY, PwC, KPMG, Grant Thornton, BDO, and RSM are desperately seeking professionals who understand both Indian tax systems and US compliance.

Have you ever wondered what kind of work accounts professionals would be performing in these big firms?

Let me give you a sneak peak:

- Prepare individual tax returns (Form 1040) for US taxpayers – this includes calculating income, deductions, and determining tax liability

- Handle business tax returns (Form 1120 for corporations, Form 1065 for partnerships)

- Assist with IRS correspondence and representation when clients receive notices

- Review supporting documents like W2s, 1099s, bank statements, and investment records

- Use professional tax software like ProConnect, Lacerte, or Drake to process returns

- Communicate with clients via email and phone to gather missing information

To do this, you need to know certain skills. They are:

- Understanding of US tax brackets, standard deductions, and common tax credits

- Proficiency in tax preparation software (we teach you ProConnect and others)

- Basic knowledge of different business entity types and their tax implications

- Communication skills for client interaction

- Attention to detail for reviewing financial documents

Companies like Deloitte, EY, PwC, and KPMG have dedicated hiring programs for US tax roles in India. They struggle to find people with both technical knowledge and practical skills.

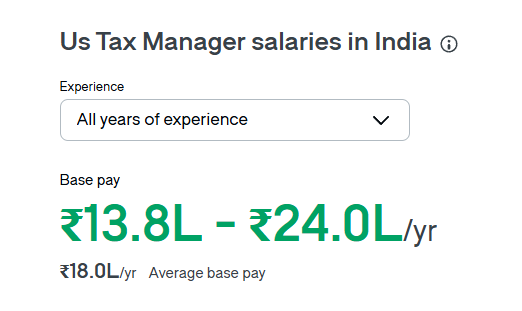

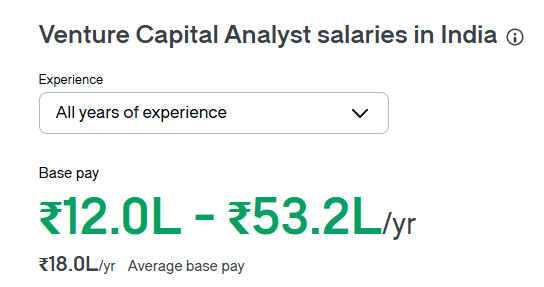

Take a look at the what your salary is going to look like when you land a role like this:

Our placement team has direct connections with recruiters from these firms. In fact, Animesh Goyal from our February 2023 batch secured an Associate 2 position at PwC within 8 months, and Tanu Priya got placed at EY as an Assurance Consultant.

2. Global Capability Centers Beyond Traditional BPO

Fortune 500 companies have moved beyond basic bookkeeping to sophisticated finance operations in India.

Cities like Bangalore, Hyderabad, and Chennai host specialized roles as US GAAP Accountants, Tax Analysts, and Compliance Specialists for companies like JP Morgan, Morgan Stanley, Goldman Sachs, Citi, Wells Fargo, and Bank of America.

These aren’t data entry roles, they’re strategic finance positions requiring deep US accounting expertise, like:

- Maintain books of accounts for US subsidiary companies using QuickBooks or Xero

- Prepare monthly financial statements following US GAAP principles

- Handle accounts payable and receivable processes

- Reconcile bank statements and credit card accounts

- Assist with monthly closing activities and journal entries

- Support treasury functions like cash flow management and foreign exchange accounting

Again, to perform these strategic tasks, you will need to know come specific skills, such as:

- US GAAP knowledge for revenue recognition, expense classification, and asset valuation

- Proficiency in cloud accounting software (QuickBooks Online, Xero, NetSuite)

- Excel skills for financial analysis and reporting

- Understanding of US banking systems and payment methods

- Basic knowledge of inter-company transactions

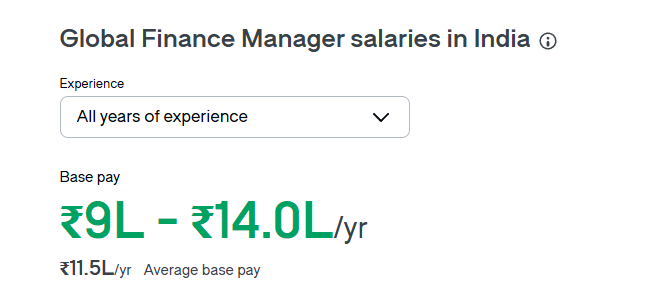

Want to know how much they will pay you?

These are among the most straightforward opportunities to secure. GCCs in Bangalore, Hyderabad, and Chennai actively recruit accounting professionals. Since you’ll be working on actual US company books, they value practical software skills over just theoretical knowledge.

3. Fintech & SaaS Product Leadership

Indian companies like Zoho Books, RazorpayX, ClearTax, Cred, and Groww are scaling into US markets and need domain experts for product design, customer success, and market expansion.

They will require you to:

- Help design user-friendly accounting features for software products

- Test new financial software features before they’re released to customers

- Provide customer support to US businesses using the software

- Create educational content and tutorials about US accounting practices

- Assist with customer onboarding and software implementation

- Work with development teams to ensure compliance with US accounting standards

Roles include Product Manager for Finance domains, Customer Success Head for US markets, and Implementation Specialists for QuickBooks/Xero integrations.

Here are some of the skill boxes you might want to check before entering such roles:

- Deep understanding of how US businesses actually use accounting software

- Ability to explain complex accounting concepts in simple terms

- Problem-solving skills for troubleshooting software issues

- Project management basics for coordinating with multiple teams

- Understanding of integration between different business software tools

These positions combine technology with finance expertise, commanding premium salaries.

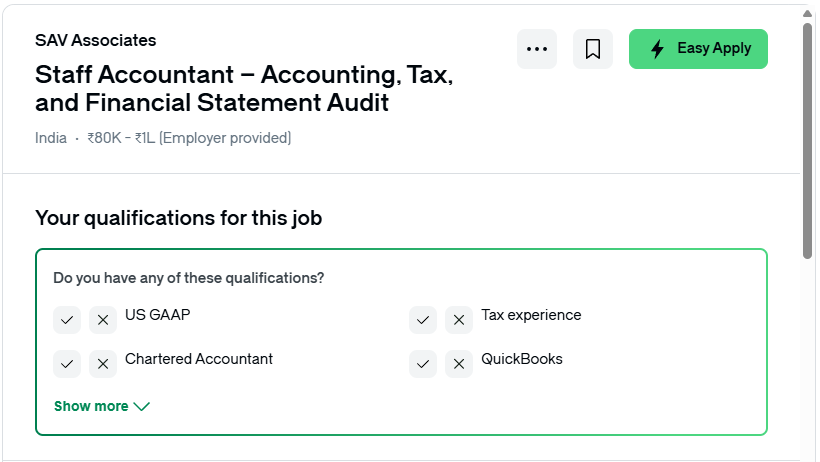

Take a look at what Grant Thornton offers its finance team:

4. Startup & VC Ecosystem Opportunities

Every startup raising money now sets up Delaware C-Corps or Cayman structures, creating demand for Finance Managers specializing in international structuring, Tax & Compliance Leads for US-India cross-border operations, and Virtual CFOs for US-facing startups.

Some of the roles you will be seeing yourself in are:

1. Delaware C-Corp & International Structuring:

- Set up financial systems for newly incorporated Delaware C-Corps and Cayman entities

- Create proper chart of accounts following US GAAP standards for venture-backed companies

- Handle cross-border accounting between Indian parent companies and US subsidiaries

- Prepare monthly financials that meet investor reporting requirements

- Manage equity accounting including cap table maintenance and stock option expense calculations

2. Virtual CFO for Startups:

- Prepare monthly board packages with key metrics like burn rate, runway, and unit economics

- Create financial models for fundraising including 3-year projections and sensitivity analysis

- Build investor dashboards showing CAC (Customer Acquisition Cost), ARPU (Average Revenue Per User), and EBITDA

- Handle use-of-funds reporting to show VCs how their investment is being utilized

- Support due diligence processes during funding rounds

3. VC Portfolio Support:

- Work across 5-10 portfolio companies of the same VC firm

- Standardize financial reporting across all portfolio companies for easier VC review

- Create comparative analysis reports showing performance metrics across the portfolio

- Handle special projects like M&A financial modeling or IPO readiness assessments

VC firms like Accel, Sequoia, and Peak XV place finance experts across their portfolio companies, creating multiple career advancement opportunities within the startup ecosystem.

If this interests you, be sure to fiddle with the following skills:

- Advanced US GAAP knowledge, especially for revenue recognition and equity accounting

- Financial modeling expertise including DCF, comparable company analysis, and scenario planning

- Understanding of startup metrics like LTV/CAC ratios, monthly recurring revenue, and churn rates

- Proficiency in financial planning tools beyond basic accounting software

- Communication skills for presenting complex financial information to investors and board members

This is a moderate to challenging entry point, but the rewards are substantial.

You can start by working with individual startups and gradually build relationships with their investors.

4. Remote US roles while based in India

Many US CPA firms are hiring directly in India, bypassing outsourcing intermediaries entirely for roles such as:

- Complete bookkeeping for small US businesses – this means entering daily transactions, categorizing expenses, and maintaining accurate records

- Process payroll for US employees using systems like ADP or Paychex

- Prepare sales tax returns for various US states

- Handle basic client communication via email and client portals

- Assist with year-end procedures like issuing 1099s to contractors

- Support US CPAs with data entry and document organization

Platforms like Upwork, LinkedIn, and FlexJobs list Controller positions for US SMBs, Tax Advisory roles for small businesses, and Fractional CFO positions.

To efficiently handle all these tasks, you need to have :

- Solid understanding of basic accounting principles and the US chart of accounts

- Familiarity with US business transactions like credit card processing, loan payments, and depreciation

- Proficiency in multiple accounting software platforms

- Understanding of US sales tax concepts and multi-state compliance

- Client service skills for professional communication

This is probably the easiest entry point into US accounting work.

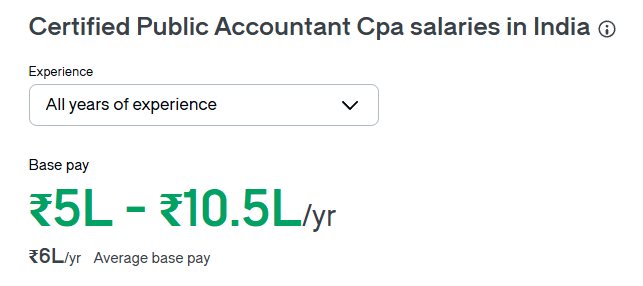

The pay is quite substantial too :

With over 1,000 firms in India providing these services, there’s constant demand for trained professionals. Many of our students start here and quickly move up to more complex work.

5. High-end consulting & advisory

Consulting firms like EY-Parthenon, Deloitte Consulting, and Bain Capability Network differentiate by offering cross-border expertise.

The roles you will see here are not just interesting but also diverse, such as:

1. Cross-border tax structuring:

- Design optimal tax structures for Indian companies expanding to the US market

- Handle transfer pricing documentation for US-India intercompany transactions

- Advise on tax-efficient ways to repatriate profits from US subsidiaries to Indian parent companies

- Support M&A transactions involving cross-border elements

2. Financial due diligence:

- Review target company financials during acquisition processes

- Identify accounting irregularities, revenue recognition issues, and hidden liabilities

- Prepare detailed reports highlighting financial risks and opportunities

- Work alongside legal teams to ensure complete transaction due diligence

3. Strategic financial advisory:

- Help companies optimize their US operations for profitability and growth

- Design financial control systems to prevent fraud and improve efficiency

- Advise on financing strategies including debt restructuring and equity raises

- Support IPO readiness projects for companies planning US public listings

And yes, the pay is GREAT :

These positions leverage US accounting knowledge for strategic consulting rather than operational work.

This isn’t just about getting a better job in the same field but rather about positioning yourself at the intersection of India’s growing economy and America’s massive market demand.

Here’s what makes this opportunity particularly powerful for professionals in smaller cities:

1. Lower cost base means higher profit sharing. When a Coimbatore-based finance team delivers the same results as a Mumbai team at 60% of the operational cost, companies can share savings with talented professionals through better incentives and growth opportunities.

2. Metro BPOs face 40-50% annual personnel attrition. Tier 2/3 city professionals, once they find good opportunities locally, tend to be more stable and committed.

3. A ₹60,000 salary in Indore provides better quality of life than ₹1,00,000 in Bangalore. Lower commute stress, family proximity, and cost advantages make professionals more productive and satisfied.

This transition is happening right now..

Early movers in tier 2 and 3 cities who upgrade their skills to meet international KPO requirements will have first-mover advantages in their local markets.

The window won’t stay open forever. As more professionals in these cities upskill, competition will increase.

If you’re currently stuck in the traditional accounting career path in a smaller city with limited local opportunities, periodic travel to metros for better roles, or considering complete relocation, this presents a different path.

Instead of moving to where opportunities were, you can position yourself for opportunities that are coming to you.

Professionals who are succeeding in this new model share common traits:

- They learned international accounting systems proactively

- They developed strong written and verbal English communication

- They understood client service delivery standards

- They stayed current with global finance technology trends

The finance BPO revolution is redistributing opportunities across India. The question isn’t whether this will impact your career – it’s whether you’ll position yourself to benefit from it.

The professionals who will benefit most from this shift are those who act while it’s still emerging. Once the trend is obvious to everyone, the early-mover advantage disappears.

If you want to get the exact roadmap that will position you for success, join our free 3 day LIVE only bootcamp, happening this weekend (20th – 22nd September 2025, 7-10 pm IST).

No recordings will be available, so set your reminders & I’ll see you there.

Allow notifications

Allow notifications