People still think “outsourcing” means call centres. However, the reality is far more structural, US & UK firms are outsourcing accounting to India because of deep shifts in talent, technology, and global economics.

Table of Contents

By 2025, a significant portion of US, UK, and EU finance and accounting operations is already executed from India. Yet this shift remains largely invisible to the public eye.

The real question is not whether outsourcing is happening, but why US & UK firms are accelerating it on such a scale.

The Reality of Global Accounting Outsourcing to India

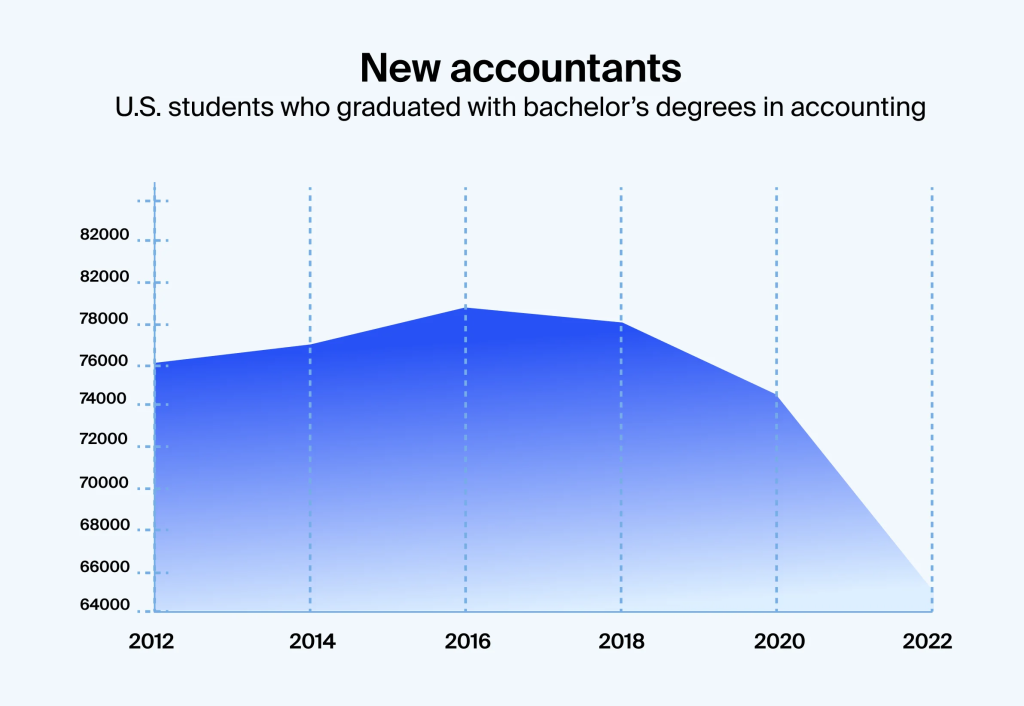

Let’s look at the numbers.

- Around 80% of the world’s top 500 companies outsource some finance or accounting work to India.

- India handles an estimated 40–50% of global outsourced finance & accounting (F&A) work.

- Over 1.4 million Indians work in finance, accounting, and analytics roles for overseas clients.

The Big 4 and global corporations operate massive India captives handling:

- General Ledger (GL) accounting

- Accounts Payable (AP)

- Accounts Receivable (AR)

- Payroll

- FP&A

- Audit support

- Tax & compliance

This is not “small back-office support.”

This is core financial infrastructure.

Understanding why US & UK firms are outsourcing accounting to India helps explain how deeply integrated India has become in global finance operations

How the US Accounting Industry Quietly Depends on India

For the United States alone:

- Tens of thousands of US CPA firms work with Indian teams, directly or through outsourcing vendors.

- A growing share of US tax preparation, bookkeeping, and audit support is completed overnight in India.

- Many “local US firms” already have 20–70% of their delivery based in India, even though clients never see it.

While the client believes their accounting is handled locally, large portions of execution happen in Indian finance teams.

India is already deeply embedded in the US accounting ecosystem.

The UK & Europe Are Following the Same Model

The UK currently faces one of the worst accountant shortages in Europe.

As a result:

- UK firms are aggressively building India teams.

- EU mid-market companies are routing shared services, AR/AP, reconciliations, and reporting to Indian centers.

- Global Capability Centres (GCCs) in Bangalore, Gurgaon, Pune, and Hyderabad now function as the financial back office of Western companies.

India has quietly become the operational engine behind Western finance.

Why This Shift Is Happening Now

Many assume the West outsources accounting to India because it’s cheaper.

That’s not the real reason.

The real reason is a talent shortage.

The Western Talent Crisis

- The average age of a US accountant is above 50.

- CPA enrollment has been falling for more than a decade.

- The US is projected to lose more than 300,000 accountants to retirement this decade.

- The UK has a severe accountant shortage.

- Europe is aging rapidly, and mid-sized finance teams are understaffed.

There is demand.

But there aren’t enough accountants.

That shortage is one of the primary drivers behind US and UK accounting outsourcing to India.

Meanwhile, India Has Talent But Limited Local Opportunities

Now look at India:

- India produces lakhs of commerce and accounting graduates every year.

- Nearly 1 crore students take commerce annually.

- Tier-2 and Tier-3 graduates often accept ₹12k–₹20k jobs or switch fields entirely.

- More than half of commerce graduates are underemployed or working in unrelated roles.

- Many graduates lack access to high-quality jobs in their cities.

India has a supply.

But limited demand locally.

The Historic Talent-Demand Gap

Here’s the contrast:

The West has demand but no talent.

India has talent, but insufficient high-paying local opportunities.

That gap is what makes this moment historic.

It also explains why more Western companies are outsourcing accounting functions to India instead of trying to rebuild shrinking local teams.

Global accounting, bookkeeping, FP&A, tax preparation, and e-commerce finance are no longer “outsourced back-office jobs.”

They are becoming a direct pathway for Indian professionals to bypass the broken local job market.

The New Global Accounting Opportunity for Indians

The real opportunities now include:

- US bookkeeping

- E-commerce accounting

- FP&A for SaaS companies

- UK contractor & SME accounting

- EU shared services

- Remote finance roles

Most of this work can be done from a laptop in India.

Meanwhile, many Indian accountants still compete for ₹35k/month local jobs, while Western firms pay $1,000–$3,000 per month for specialized remote work.

The opportunity gap is enormous.

Technology Has Made This Possible

Several shifts enabled this transition:

- Cloud accounting tools like QuickBooks, Xero, NetSuite, SAP, and Oracle

- Global payment platforms like Wise, Payoneer, Deel, and Remote

- Secure remote collaboration systems

- English-speaking, accounting-trained workforce in India

- Aging Western finance workforce

This is no longer experimental.

It is an operational reality.

How AI Will Reshape Global Finance Teams

As AI automates repetitive accounting tasks, global finance teams are reorganizing around a simple structure:

- Onshore strategy.

- Offshore execution.

India is not just participating in this shift.

It is becoming the operating system.

The West has already decided that India will power its finance and accounting execution layer.

What This Means for You

If you are an Indian accountant and only thinking in terms of:

- CA firm jobs

- Local industry roles

- City-based employment

You may be playing 1995 cricket in 2025.

The global market wants skilled Indian professionals more than the local market does.

This is especially true for graduates in Tier-2 and Tier-3 cities.

You are not late.

You are early.

The trend is structural, and the reasons why US & UK firms are outsourcing accounting to India are strengthening each year.

The real question is:

Will you remain confined to the local job market or plug into the global one?

India isn’t just a destination for outsourcing anymore.

It is becoming the execution engine of Western finance.

For those who recognize the shift early, the window is wide open.

What you are witnessing is a long-term restructuring of global finance. As Western talent shortages deepen and technology removes geographic barriers, India’s role in accounting and finance will only expand. The question is no longer whether outsourcing to India will continue, but how firms and professionals position themselves within it.

Allow notifications

Allow notifications