CPA exam is the four-part Uniform CPA Examination conducted by AICPA that tests accounting professionals in auditing, financial reporting, taxation, and a specialized discipline. Indian candidates can take this exam at Prometric centers across 8 Indian cities to earn the globally recognized US CPA credential.

Table of Contents

If you’re an Indian accounting or finance professional looking to elevate your career on the global stage, you’ve probably come across the term “CPA” more than once. The Certified Public Accountant credential is one of the most prestigious accounting qualifications worldwide, and the CPA exam is your gateway to earning it.

Whether you’re a B.Com graduate wondering about your options or a Chartered Accountant exploring international credentials, understanding what the CPA exam involves is your essential first step.

The good news for Indian professionals is that you no longer need to travel abroad to take this exam. The CPA exam has been available at Prometric testing centers across eight Indian cities, making it significantly more accessible for candidates in our country.

With multinational corporations expanding their presence in India and Indian companies increasingly adopting US GAAP standards, the demand for CPA-qualified professionals has never been higher. This credential can open doors to Big 4 firms, US-based MNCs, and global finance roles that were previously out of reach.

This comprehensive guide will walk you through everything you need to know about the CPA exam.

We’ll cover the exam structure under the new CPA Evolution model that launched in 2024, eligibility requirements for Indian candidates, the complete cost breakdown in Indian rupees, and the application process from start to finish. Whether you hold a B.Com, M.Com, CA, or other commerce degree, you’ll find specific guidance tailored to your situation.

CPA Exam Meaning

The CPA examination serves as the standardized assessment that determines whether accounting professionals possess the knowledge and skills necessary to protect the public interest. Developed and maintained by the American Institute of Certified Public Accountants (AICPA), this rigorous exam tests candidates across multiple domains of accounting practice. For Indian professionals, understanding what this exam represents and how it differs from our domestic qualifications is crucial before embarking on this journey.

CPA Full Form and Meaning

CPA stands for Certified Public Accountant, which is the professional designation granted to accountants who pass the Uniform CPA Examination and meet additional state-specific requirements in the United States. Think of it as the American equivalent of the Chartered Accountant designation, though there are important differences in scope and recognition.

The “Certified” part indicates that the professional has demonstrated competency through examination and experience. The “Public” aspect means these accountants are licensed to offer their services to the general public, not just private employers. This distinction matters because CPAs can sign audit reports, represent clients before the IRS, and perform other functions that non-certified accountants cannot legally do in the United States.

CPA Exam test

The CPA exam evaluates candidates across four critical areas of accounting practice: auditing procedures, financial accounting standards, taxation and business law, and one specialized discipline of your choice. According to the AICPA’s official exam blueprints, the exam assesses not just your knowledge of accounting rules but also your ability to apply them to real-world scenarios.

The exam specifically tests competencies in US Generally Accepted Accounting Principles (US GAAP), auditing standards issued by the PCAOB and AICPA, federal taxation regulations, and business law concepts. For Indian candidates familiar with Indian Accounting Standards, this means you’ll need to learn a different framework. The exam also emphasizes professional ethics, analytical thinking, and the practical application of concepts through task-based simulations that mimic actual work situations.

CPA Exam vs CA Exam

The most fundamental difference lies in the exam structure and timeline. While the Indian CA requires clearing three levels of exams (Foundation, Intermediate, and Final) along with articleship spanning several years, the CPA exam consists of four sections that most candidates complete within 12 to 18 months. According to recent NASBA data, candidates have a 30-month window to pass all four sections once they clear their first one.

Another significant difference is the regulatory framework tested. The CA exam focuses on Indian Accounting Standards, the Companies Act 2013, and Indian tax laws. In contrast, the CPA exam tests US GAAP, FASB standards, SEC regulations, and US federal taxation. The pass rates also differ considerably. The CA Final pass rate often hovers around 10 to 15 percent, while the average CPA exam pass rate across all sections is approximately 50 percent based on AICPA’s 2024-2025 performance data. However, this doesn’t mean the CPA is easier; it simply has a different testing philosophy and candidate pool.

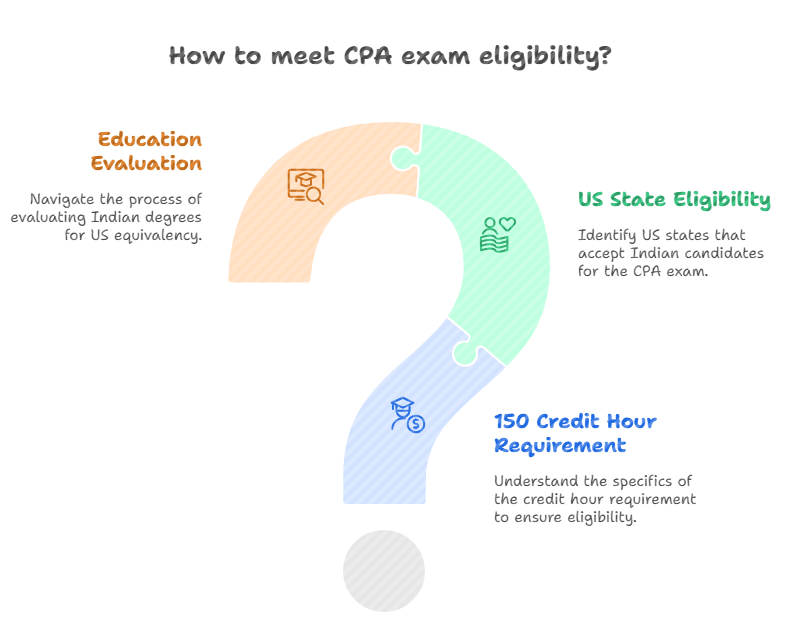

CPA Exam Eligibility Requirements

Before you start preparing for the CPA exam, you need to understand whether you qualify to sit for it in the first place. The eligibility requirements are set by individual US state boards of accountancy, and they vary significantly from state to state. For Indian candidates, navigating these requirements involves understanding the credit hour system, identifying states that accept international candidates, and getting your Indian credentials properly evaluated.

Before getting into credit hours and state-wise rules, it’s important to understand the CPA exam eligibility requirements for Indian candidates, which vary based on education, state board selection, and evaluation agency.

How Does the 150 Credit Hour Requirement Work?

The credit hour system is how American universities measure academic coursework, and it forms the foundation of CPA eligibility requirements. Most state boards require 150 semester credit hours for CPA licensure, though some allow you to sit for the exam with 120 credits and complete the remaining 30 before obtaining your license. Understanding how your Indian qualifications translate to this system is essential for planning your CPA journey.

Converting Indian Qualifications to US Credits

The general conversion formula used by credential evaluation agencies assigns approximately 30 semester credits for each year of university education in India. This means a three-year bachelor’s degree typically translates to around 90 semester credits, while a two-year master’s program adds another 60 credits. However, the exact conversion depends on your university’s accreditation status, the specific courses you completed, and the evaluation agency you choose.

Your credentials will be evaluated based on whether your institution is recognized by bodies like NAAC or UGC, and whether your coursework includes sufficient accounting and business credits. Most state boards require a specific number of credits in accounting subjects (typically 24 to 30) and business subjects (typically 24) in addition to the overall credit requirement. This is why a pure science graduate would face more challenges than a commerce graduate in meeting eligibility.

Credit Mapping for B.Com, M.Com, and CA

A three-year B.Com degree from an Indian university typically converts to approximately 90 semester credits, leaving you 30 credits short of the 120 needed to sit for the exam in most states and 60 credits short of the 150 needed for licensure. If you’ve completed both B.Com and M.Com, you’re looking at approximately 150 credits, which meets the full licensure requirement in most states. Indian Chartered Accountants often receive credit for their CA qualification, with evaluation agencies typically assigning 30 to 40 additional credits for the CA designation.

Which US States Allow Indian Candidates to Apply?

Not all US states are equally accessible to Indian CPA candidates. Some states require a Social Security Number, US residency, or US citizenship, which creates barriers for international applicants. However, several states have more flexible requirements that make them popular choices for candidates sitting for the exam from India. Choosing the right state is one of the most important early decisions in your CPA journey.

States Without Social Security Number Requirements

Several U.S. state boards of accountancy allow international candidates to apply for the CPA examination without a Social Security Number (SSN), making them accessible to Indian professionals. States such as Montana, Colorado, Alaska, Washington, and Guam permit candidates to sit for the CPA exam without an SSN at the examination or evaluation stage. In most of these jurisdictions, the SSN requirement is either waived entirely or deferred until the licensing stage. Importantly, an Individual Taxpayer Identification Number (ITIN) is not a substitute for an SSN for employment purposes, but may be accepted for limited tax or administrative filings where applicable.

Montana is particularly popular among Indian candidates because it has relatively straightforward education requirements and doesn’t mandate US residency. Colorado offers similar flexibility and has a reputation for efficient processing of international applications. Washington state is another common choice, though its requirements have evolved over time. Before applying to any state, verify the current requirements directly with the state board, as these can change periodically.

Popular State Choices for Indian CPA Candidates

Among Indian candidates, Montana is frequently chosen for CPA applications due to its relatively accessible eligibility requirements, reasonable fees, and the absence of a U.S. residency requirement. The state accepts international academic credentials through NASBA evaluation and follows a relatively streamlined application process.

Colorado, Alaska, and Guam are also commonly selected by Indian candidates. Guam, in particular, has historically been favoured by international applicants due to its clear eligibility framework and flexibility at the exam application stage.

When selecting a state board, candidates should consider not only initial exam eligibility but also licensure requirements, including experience criteria, SSN requirements at the licensing stage, CPE obligations, and license mobility or reciprocity provisions. The choice of jurisdiction should align with long-term career objectives rather than being based solely on ease of exam entry.

To know in detail about which US state to choose as per your career profile, read my article on Choosing the best US state for CPA exam registration.

Education Evaluation Process for Indian Degrees

Before any US state board will consider your application, you’ll need to have your Indian credentials evaluated by an approved foreign credential evaluation agency. This process involves submitting your original transcripts and degree certificates to an agency that will assess them against US educational standards and provide a report that state boards can understand and accept.

WES vs NIES vs FACS Evaluation Services

Three evaluation agencies handle the majority of Indian CPA candidate evaluations: World Education Services (WES), NASBA International Evaluation Services (NIES), and the Foreign Academic Credentials Service (FACS). Each has different processing times, fee structures, and relationships with state boards. WES is the most widely recognized and accepts applications from candidates worldwide, with fees ranging from $200 to $300 depending on the services selected. NIES is NASBA’s own evaluation service and has the advantage of seamless integration with the CPA application process, typically charging $225 to $275. FACS is often the most affordable option at around $150 to $200 but may have longer processing times.

Documents Required for Credential Evaluation

The evaluation process requires several key documents, and missing or incorrect documentation can delay your application significantly. You’ll need official transcripts from all universities you attended, sent directly from the institution to the evaluation agency in sealed envelopes. Your degree certificates or provisional certificates must also be submitted, along with mark sheets showing individual course grades and credit hours.

Additionally, you’ll need a valid passport copy for identity verification and, in some cases, course descriptions or syllabi to help the evaluator understand the content of your coursework. If you’re a Chartered Accountant, you’ll also need documentation from ICAI confirming your membership status. Start gathering these documents early, as obtaining official transcripts from Indian universities can sometimes take several weeks, and any delays at this stage push back your entire timeline.

CPA Exam Structure

The CPA exam underwent a significant transformation in January 2024 with the implementation of CPA Evolution, a major restructuring designed to better reflect the modern accounting profession. Under this new model, candidates must pass three core sections that all CPAs need to master, plus one discipline section that allows for specialization. Understanding this structure is essential for planning your study strategy and choosing the right path for your career goals.

What are the Three Core Sections of the CPA Exam?

The three core sections of the CPA exam represent the foundational knowledge that every CPA must demonstrate, regardless of their eventual specialization. These sections are Auditing and Attestation (AUD), Financial Accounting and Reporting (FAR), and Taxation and Regulation (REG). Every candidate must pass all three core sections, and they test competencies that the AICPA considers essential for protecting the public interest.

Auditing and Attestation (AUD) Overview

The AUD section tests your understanding of the entire audit process, from planning and risk assessment through evidence gathering and report issuance. According to the AICPA exam blueprints, this section covers ethics and professional responsibilities, audit planning and risk assessment procedures, audit evidence and procedures, and forming conclusions and reporting. The content is heavily focused on US auditing standards issued by the PCAOB for public company audits and AICPA standards for other engagements.

For Indian candidates familiar with Indian Standards on Auditing, you’ll find many similar concepts, though the specific standards and documentation requirements differ. The AUD section is four hours long and contains 78 multiple-choice questions across two testlets and seven task-based simulations across three testlets. Based on AICPA’s Q3 2025 data, the pass rate for AUD hovers around 46 to 48 percent, making it one of the more challenging sections. Strong conceptual understanding of the audit process flow is more important here than memorizing specific rules.

Financial Accounting and Reporting (FAR) Overview

FAR is widely considered the most content-heavy section of the CPA exam, covering financial accounting and reporting frameworks for business entities, government entities, and not-for-profit organizations. This section tests your knowledge of US GAAP as codified by FASB, SEC reporting requirements for public companies, and the unique accounting standards that apply to governmental and nonprofit entities under GASB and FASB ASC 958.

The FAR section has historically had the lowest pass rate among the core sections, ranging from 40 to 43 percent according to recent AICPA data. The exam format includes 50 multiple-choice questions and seven task-based simulations, all to be completed within four hours. Indian candidates often find FAR challenging because the US GAAP framework differs significantly from Indian Accounting Standards in areas like revenue recognition, lease accounting, and consolidation procedures. However, if you’ve worked with IFRS, you’ll find US GAAP somewhat more familiar since the two frameworks have been converging in recent years.

Taxation and Regulation (REG) Overview

The REG section covers US federal taxation for individuals and entities, business law concepts, and professional ethics related to tax practice. This section tests your understanding of the Internal Revenue Code, tax compliance procedures, and the legal framework within which businesses operate. Topics include individual taxation, corporate taxation, partnership taxation, property transactions, and ethics and professional responsibilities in tax practice.

For Indian candidates, REG often presents the steepest learning curve because US tax law is entirely different from Indian taxation. You’ll need to learn concepts like the alternative minimum tax, qualified business income deductions, and the intricate rules governing pass-through entities that have no direct equivalent in Indian tax law. The section includes 72 multiple-choice questions and eight task-based simulations. On the positive side, REG has one of the higher pass rates among core sections, with recent data showing approximately 63 to 64 percent of candidates passing. This suggests that with proper preparation, the material is very learnable despite being unfamiliar.

What are the Discipline Sections and How Do You Choose?

Under CPA Evolution, candidates choose one discipline section to complete in addition to the three core sections. This choice allows you to demonstrate deeper expertise in an area aligned with your career interests. The three discipline options are Business Analysis and Reporting (BAR), Information Systems and Controls (ISC), and Tax Compliance and Planning (TCP). Your choice should reflect both your career goals and your existing strengths.

Business Analysis and Reporting (BAR)

BAR is designed for candidates interested in financial analysis, management accounting, and business advisory roles. This section covers technical accounting and reporting topics that go beyond the core FAR content, including advanced topics like business combinations, derivatives, and foreign currency transactions. It also incorporates managerial accounting concepts like cost management, performance measurement, and financial statement analysis that were previously tested in the now-retired BEC section.

The BAR section has proven to be one of the more challenging discipline options, with pass rates around 40 to 41 percent based on 2024 data. This lower pass rate reflects the breadth and complexity of the material, which draws from both advanced financial accounting and managerial accounting domains. Indian candidates with strong financial accounting backgrounds or those targeting controller, financial analyst, or CFO-track positions often find BAR to be the natural choice. The section contains 50 multiple-choice questions and seven task-based simulations.

Information Systems and Controls (ISC)

ISC focuses on the intersection of accounting and technology, covering IT governance, cybersecurity, data management, and system controls. This section is ideal for candidates interested in IT audit, internal audit, risk management, or technology consulting roles within accounting. Topics include system development lifecycle, IT infrastructure, data governance, and the design and testing of IT controls.

With a pass rate around 56 to 57 percent, ISC falls in the middle of the discipline sections in terms of difficulty. The section contains 82 multiple-choice questions, the highest among the disciplines, but only six task-based simulations. Notably, ISC has a different weighting than other sections, with MCQs counting for 60 percent and TBSs for 40 percent, compared to the standard 50-50 split. Indian candidates with IT backgrounds or those working in technology-driven audit roles may find ISC aligns well with their experience and career trajectory.

Tax Compliance and Planning (TCP)

TCP is the discipline section for candidates who want to specialize in taxation. It covers advanced individual and entity tax planning, complex property transactions, and tax compliance for specialized situations. This section builds directly on the foundation established in REG, diving deeper into areas like international taxation, personal financial planning from a tax perspective, and advanced entity planning strategies.

TCP has shown remarkably high pass rates since CPA Evolution launched, with data showing rates between 72 and 78 percent through 2024-2025. According to AICPA analysis, this high pass rate likely reflects that TCP candidates have already passed REG and are familiar with the tax framework, plus many are active tax practitioners who can leverage their work experience. The section includes 68 multiple-choice questions and six task-based simulations. For Indian candidates targeting careers in international tax, transfer pricing, or tax advisory with US MNCs, TCP provides relevant specialization.

Which Discipline Section Should Indian Candidates Choose?

Your discipline choice should align with your career goals, existing knowledge base, and the roles available in your target job market. If you’re aiming for positions in Big 4 audit practices or corporate controllership, BAR’s emphasis on advanced financial reporting makes sense. If you’re interested in technology-focused roles or see yourself moving into IT audit or cybersecurity consulting, ISC provides relevant credentials. For those targeting tax advisory roles, particularly with firms serving US clients from India, TCP is the clear choice.

Consider your existing strengths as well. If you struggled with FAR concepts, BAR will likely be challenging since it builds on that foundation. If you found REG manageable and have an interest in taxation, TCP leverages that knowledge effectively. Many Indian candidates choose TCP because of the relatively high pass rate and the strong demand for tax professionals in India’s GCC (Global Capability Centers) serving US parent companies. However, don’t choose based solely on pass rates; choose based on where you want your career to go.

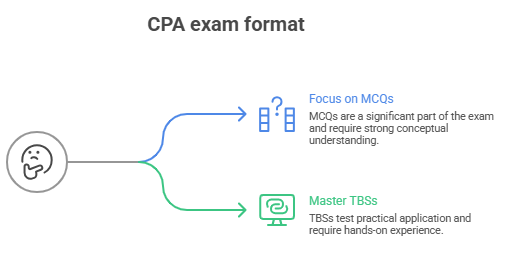

CPA Exam Format

Each section of the CPA exam follows a standardized format consisting of five testlets delivered within a four-hour testing window. Understanding this format is crucial for effective preparation because the exam tests not just your knowledge but also your ability to perform under timed conditions with specific question types that may be unfamiliar to candidates from the Indian examination system.

Multiple Choice Questions (MCQs) and Testlet Structure

The CPA exam organizes questions into testlets, which are groups of questions presented together. For most sections, the first two testlets contain multiple-choice questions, while testlets three through five contain task-based simulations. The number of MCQs varies by section: AUD has 78 MCQs, REG has 72, FAR has 50, and the discipline sections range from 50 (BAR) to 82 (ISC). Each MCQ has four answer choices, and there’s no negative marking for wrong answers.

An important feature of the CPA exam’s MCQ testlets is adaptive difficulty. Your performance on the first MCQ testlet influences the difficulty level of the second testlet. If you perform well on testlet one, testlet two will contain more difficult questions, which actually contribute to a higher score. This means that finding the second testlet harder than the first is often a good sign. For time management, plan to spend approximately one to one and a half minutes per MCQ, leaving adequate time for the more time-intensive simulations.

Task-Based Simulations (TBSs) Explained

Task-based simulations (TBSs) are practical, scenario-based questions designed to test a candidate’s ability to apply knowledge to realistic work situations. Unlike MCQs, TBSs require candidates to perform tasks such as analysing documents, completing journal entries, reconciling accounts, interpreting data, or drafting written responses. Each simulation typically consists of multiple components and requires the use of information from exhibits such as financial statements, emails, invoices, or research databases.

TBSs carry significant weight in the CPA exam scoring, accounting for 50 percent of the total score in most sections and 40 percent in the ISC discipline. The number of TBSs varies by section—AUD and FAR include 7 TBSs, REG includes 8, while each discipline section (BAR, TCP, ISC) includes 6 TBSs.

Many Indian candidates initially find TBSs challenging due to the exam’s computer-based, exhibit-driven format, which differs from traditional written or numerical problem-solving formats. Effective preparation involves practising on exam-like software, learning to navigate multiple exhibits efficiently, and developing strategies to maximise partial credit across multi-step simulations.

CPA Exam Pass Rates

Understanding how the CPA exam is scored helps you set realistic expectations and develop an effective study strategy. The scoring methodology is more complex than a simple percentage-correct calculation, and knowing how it works can actually help you approach the exam more strategically. Additionally, examining pass rate trends provides valuable insight into which sections present the greatest challenges and how you should allocate your preparation time.

How is the CPA Exam Scored?

The CPA exam uses a sophisticated scoring methodology that goes beyond simply counting correct answers. The AICPA employs psychometric scaling to ensure that scores are comparable across different test forms and testing windows, meaning a score of 75 represents the same level of competency regardless of when or where you took the exam. This approach ensures fairness while maintaining consistent professional standards.

Understanding the 0-99 Scoring Scale

Your CPA exam score is reported on a scale from 0 to 99, with 75 being the minimum passing score. It’s crucial to understand that this is not a percentage score. A score of 75 doesn’t mean you answered 75 percent of questions correctly; rather, it indicates you demonstrated the minimum competency level required for entry-level CPAs. The scaled scoring methodology adjusts for question difficulty, meaning getting harder questions correct contributes more to your score than getting easier questions correct.

The AICPA does not release the exact formula used for scoring, but we know that both MCQs and TBSs contribute to the final score based on predetermined weights. For most sections, MCQs and TBSs are weighted equally at 50 percent each, though ISC differs with a 60-40 split favoring MCQs. Importantly, there is no curve applied to scores; the exam is criterion-referenced, meaning your performance is measured against a fixed standard rather than compared to other candidates.

How MCQs and TBSs are Weighted

The weighting between MCQs and TBSs has significant implications for your study strategy. In sections like AUD, FAR, and REG, where the split is 50-50, strong performance on simulations is just as important as mastering multiple-choice content. This means you cannot rely solely on memorization; you must develop the ability to apply concepts in practical scenarios. The simulations often test higher-order skills like analysis, evaluation, and application.

Within the MCQ testlets, the adaptive difficulty feature means that your performance on the first testlet affects the questions you receive in the second testlet. Performing well leads to more difficult questions, which have higher scoring potential. This is why many successful candidates report finding the second testlet noticeably harder than the first. For TBSs, partial credit is available on many questions, so even if you can’t complete every aspect of a simulation perfectly, demonstrating competency on portions of the question contributes to your score.

Score Release Dates and Results Timeline

The anticipation of waiting for CPA exam scores can be stressful, but understanding the score release process helps set appropriate expectations. The AICPA releases scores according to a predetermined schedule that varies depending on when you took your exam and which section you completed. Planning your exam dates around score releases can help you maintain momentum in your CPA journey.

When to Expect Your CPA Exam Results

Starting in 2025, the core sections (AUD, FAR, REG) moved to continuous testing with rolling score releases, meaning you can typically expect your score within one to two weeks of testing rather than waiting for quarterly release windows. This is a significant improvement over the previous system and allows candidates to move more quickly through their exams. For discipline sections (BAR, ISC, TCP), testing is available during specific months of each quarter, and score releases follow a scheduled timeline.

Scores are released to your NASBA candidate portal, and you’ll receive an email notification when your score is available. The AICPA publishes the official score release schedule on their website, which you should reference when planning your exam dates. If you’re targeting multiple exams in sequence, consider the score release timing so you know whether you passed before your NTS expires or before you sit for your next section.

What Happens If You Fail a Section

Receiving a failing score is disappointing but not uncommon. Remember that average pass rates hover around 50 percent, meaning roughly half of all candidates fail on any given attempt. If you fail, you can retake the section, but you’ll need to pay the examination fees again and obtain a new NTS. There’s no limit to how many times you can retake a section, but you must pass all four sections within the rolling 30-month window that begins when you pass your first section.

When you fail a section, you’ll receive a Candidate Performance Report along with your score. This report provides feedback on your performance across different content areas, showing which areas were stronger or weaker. Use this information to guide your restudy efforts, focusing more time on areas marked as “weaker.” Many candidates pass on their second attempt after targeted review, so a failing score should be viewed as specific feedback rather than a final verdict. The key is analyzing what went wrong, adjusting your study approach, and trying again with better preparation.

You can read a detailed article on the CPA exam pass rate by clicking here.

CPA Exam Application and Scheduling Process

Navigating the CPA exam application process can feel overwhelming, especially for international candidates who must coordinate between multiple organizations: your chosen state board, NASBA, credential evaluation agencies, and Prometric testing centers. Breaking this process into clear steps helps ensure you don’t miss any requirements and can schedule your exam in a timely manner. For Indian candidates, understanding this process is particularly important because you’ll be dealing with US-based systems while sitting in India.

Step-by-Step Application Guide for Indian Candidates

The application process begins with choosing your state board and understanding its specific requirements. Most Indian candidates apply through states that don’t require a Social Security Number, such as Montana, Colorado, or Washington. Your first step is verifying that your educational qualifications meet the state’s requirements, which typically means having your credentials evaluated by an approved agency before submitting your application.

Once you’ve chosen your state and completed credential evaluation, you’ll create an account in the NASBA CPA Central portal, which serves as the central hub for most state board applications. Through this portal, you’ll submit your application, upload required documents, and pay application fees. The application typically asks for personal information, educational background, and which exam sections you wish to take. You can apply for one, two, three, or all four sections at once, though most candidates apply for one or two at a time.

After submitting your application, the state board reviews your credentials to confirm eligibility. This review process can take anywhere from two to eight weeks depending on the state and time of year. Once approved, you’ll receive notification that you’re eligible to proceed to the next step. Be prepared for possible requests for additional documentation during this review period, especially regarding your educational credentials or professional qualifications.

Understanding ATT and NTS

Two key documents in the CPA exam process are the Authorization to Test (ATT) and the Notice to Schedule (NTS). Understanding what each document represents and its validity periods is crucial for planning your exam timeline and avoiding unnecessary fees. Many candidates lose money by obtaining an NTS before they’re truly ready to take the exam.

The ATT is issued by your state board after approving your application. It confirms that you’ve met the eligibility requirements and are authorized to proceed with scheduling. The ATT typically has a validity period of 90 days to six months, depending on the state. During this time, you must pay your examination fees to NASBA to receive your NTS. If your ATT expires before you pay, you may need to reapply and pay the application fees again.

The NTS is your permission slip to actually schedule and sit for the exam. Once you receive your NTS, you can visit Prometric’s website to select your testing date, time, and location. The NTS includes your personal information, the sections you’re approved to take, and the expiration date by which you must complete testing. NTS validity periods vary by state, typically ranging from three to nine months. If you don’t take your scheduled exam before the NTS expires, you forfeit the examination fees and must pay again. This is why many experts recommend only applying for sections you’re confident you can prepare for within the NTS validity window.

Scheduling Your Exam at Prometric Centers in India

With your NTS in hand, you’re ready to schedule your exam at a Prometric testing center. India has eight Prometric centers offering CPA exam testing, located in Ahmedabad, Bangalore, Chennai, Hyderabad, Kolkata, Mumbai, New Delhi, and Trivandrum. Scheduling is done through the Prometric website using your NTS identification number.

When scheduling, you’ll see available dates and times at your preferred location. Peak periods like quarter-ends and months following score releases tend to have higher demand, so booking well in advance is advisable. You can schedule your exam up to one year in advance, though most candidates book two to four weeks out. Consider factors like your work schedule, your preparation timeline, and the score release dates when choosing your exam date. Some candidates prefer morning slots when they’re mentally fresh, while others perform better later in the day.

On exam day, arrive at the testing center at least 30 minutes before your appointment time. Bring two forms of identification, one of which must be government-issued with your photograph (a passport is ideal for international candidates). The name on your IDs must match exactly with the name on your NTS. Late arrivals may not be admitted, and failure to bring proper identification will prevent you from testing. Prometric centers provide lockers for personal belongings, and you’ll be prohibited from bringing any items into the testing room except the locker key provided by the center.

CPA Exam Cost in India: Complete Fee Breakdown

Understanding the full cost of pursuing CPA certification helps you plan your finances and avoid surprises along the way. For Indian candidates, the costs include several components: credential evaluation fees, exam application fees, examination fees for each section, international testing surcharges, review course investments, and eventual licensing fees. The total investment ranges significantly depending on your chosen state, review course, and how many attempts you need to pass each section.

What are the CPA Exam Fees for Each Section?

The examination fees for the CPA exam recently increased, with NASBA implementing new fee structures in 2025. For domestic candidates, the standard examination fee is approximately $262.64 per section based on NASBA’s recommended fee schedule. However, as an international candidate testing in India, you’ll pay an additional international testing surcharge on top of this base fee. The international administration fee is currently $390 per section, bringing your total examination fee to approximately $510 to $520 per section.

At current exchange rates (approximately ₹90 per USD), this translates to roughly ₹45,000 to ₹47,000 per section for the examination fee alone. If you’re testing all four sections, your total examination fees will be approximately ₹1,80,000 to ₹1,88,000. These fees are paid to NASBA through the CPA Central portal after your application is approved and before you can schedule with Prometric. It’s important to note that these fees are non-refundable if you fail to appear for your exam or let your NTS expire.

The fee increase announced by NASBA in 2025 represented a significant jump for international candidates. Previously, the international surcharge was lower, but it increased to $390 per section. According to recent updates, this fee structure reflects the costs of administering examinations at international locations. Plan your budget accordingly and consider this fee increase when timing your exam applications.

Additional Costs Beyond Exam Fees

Beyond the examination fees, several other costs add to your total CPA investment. Application fees vary by state and typically range from $100 to $200 for your initial application. Some states charge this as a one-time fee, while others require a portion to be paid each time you apply for new sections. Registration fees, which some states charge separately from application fees, can add another $50 to $150, depending on how many sections you’re registering for at once.

Credential evaluation is a mandatory expense for international candidates. WES charges approximately $200 to $300 for a full evaluation, NIES charges $225 to $275, and FACS is typically $150 to $200. You may also need to pay your universities in India for official transcript services, which can cost ₹500 to ₹2,000 depending on the institution. Additionally, if your state requires it, you’ll need to pay for an ethics exam (typically $150 to $200) as part of the licensing process.

The highest additional cost for most candidates is a CPA review course. Quality review courses from providers like Becker, Wiley, Surgent, and Gleim range from $1,000 to $4,000 (approximately ₹84,000 to ₹3,36,000). Indian coaching institutes offering CPA preparation typically charge ₹80,000 to ₹1,50,000 for comprehensive programs. While you can theoretically self-study, the complexity of the CPA exam and the unfamiliarity of US accounting standards for Indian candidates make a structured review course highly advisable. Many candidates consider this an investment rather than an expense, given the salary premium CPAs command.

Total CPA Investment for Indian Candidates

Adding up all the components, Indian candidates should budget for a total investment ranging from approximately ₹2,50,000 to ₹4,00,000 (roughly $3,000 to $4,800) to complete their CPA certification. This estimate assumes passing all four sections on the first attempt. If you need to retake sections, add approximately ₹43,000 to ₹45,000 per retake for the examination fee alone.

Here’s a typical cost breakdown for Indian candidates choosing a state like Montana:

| Cost Component | USD | INR (Approximate) |

| Credential Evaluation | $200-300 | ₹17,000-25,000 |

| Application Fee | $100-200 | ₹8,500-17,000 |

| Exam Fees (4 sections) | $2,040-2,080 | ₹1,71,000-1,75,000 |

| Review Course | $1,000-3,000 | ₹84,000-2,52,000 |

| Ethics Exam | $150-200 | ₹12,600-17,000 |

| License Fee | $150-400 | ₹12,600-33,600 |

| Total | $3,640-6,180 | ₹3,06,000-5,20,000 |

Compared to the Indian CA, which costs significantly less in fees but requires much more time (often 4 to 5 years), the CPA’s higher upfront cost is offset by the shorter timeline and potentially faster career advancement. Many candidates finance their CPA through employer sponsorship, especially if working at Big 4 firms or MNCs that value the credential. Some review course providers also offer payment plans to spread the cost over several months.

Conclusion

The CPA exam represents a significant but achievable milestone for Indian accounting professionals seeking global recognition. Through this guide, you’ve learned that the exam consists of three core sections (AUD, FAR, REG) plus one discipline of your choice (BAR, ISC, or TCP), all administered at Prometric centers across eight Indian cities. With pass rates averaging around 50 percent and a 30-month window to complete all sections, the CPA offers a realistic pathway to international certification that’s far more accessible than it was even a few years ago.

Your next steps should begin with assessing your eligibility based on your educational credentials. If you have a B.Com and M.Com, you likely meet the 150 credit requirement for most states. Choose a state like Montana, Colorado, or Washington that doesn’t require a Social Security Number, get your credentials evaluated through WES or NIES, and start your application process. Budget approximately ₹3 to ₹5 lakhs for the complete journey, and consider investing in a quality review course to maximize your chances of first-attempt success. The CPA credential can transform your career, opening doors to Big 4 firms, multinational corporations, and global opportunities that recognize and reward this prestigious qualification.

To understand the overall CPA journey, you can also refer to this detailed guide on the Certified Public Accountant (CPA) Exam in USA.

Frequently Asked Questions

Can I take the CPA exam with a 3-year Indian B.Com degree?

Yes, you can take the CPA exam with a 3-year B.Com degree, but you’ll need additional credits to meet most states’ requirements. A 3-year B.Com typically converts to approximately 90 US semester credits, while most states require 120 credits to sit for the exam and 150 credits for licensure. You can bridge this gap through additional coursework, professional certifications, or choosing states with lower credit thresholds.

Is the CPA exam harder than the Indian CA exam?

The CPA and CA exams are difficult in different ways, making direct comparison challenging. The CA exam has significantly lower pass rates (10-15 percent for finals) and requires articleship, making the total journey 4-5 years. The CPA exam has higher pass rates (around 50 percent) but tests entirely unfamiliar content like US GAAP and US tax law. Most Indian candidates complete CPA within 12-18 months.

How long does it take to complete all four CPA exam sections?

Most candidates complete all four CPA exam sections within 12 to 18 months, though this varies based on your study schedule and work commitments. You have a 30-month window from passing your first section to complete all four. Working professionals studying part-time typically need 300-400 total study hours spread across this period.

Can I work while preparing for the CPA exam in India?

Absolutely. Most Indian CPA candidates are working professionals who study alongside their jobs. The key is creating a consistent study schedule, typically 15-20 hours per week, and choosing exam dates strategically around work commitments. Many candidates take one section every 3-4 months while working full-time.

Which CPA exam section should I take first?

Most experts recommend starting with FAR or AUD because they contain foundational concepts used in other sections. FAR is content-heavy, so tackling it first while your study momentum is high makes sense. Others prefer starting with REG if they have tax experience. There’s no single correct order; choose based on your background and preferences.

What is the passing score for the CPA exam?

The minimum passing score for each CPA exam section is 75 on a scale of 0 to 99. This is not a percentage score; rather, it represents the competency level the AICPA considers necessary for entry-level CPAs. Scores are scaled based on question difficulty, so getting harder questions correct contributes more to your final score.

How many times can I retake the CPA exam if I fail?

There’s no limit to how many times you can retake a CPA exam section. However, you must pass all four sections within the 30-month rolling window that begins when you pass your first section. Each retake requires paying the full examination fee again, so first-attempt success saves significant money.

Is CPA certification recognized by Indian employers?

Yes, CPA certification is highly valued by Indian employers, particularly Big 4 accounting firms, US-based MNCs operating in India, and companies with US reporting requirements. CPAs in India typically earn a salary premium of 20-40 percent over non-CPA accountants and have access to more senior roles, especially in US GAAP reporting, international tax, and global finance functions.

Do I need a Social Security Number to take the CPA exam?

No, you don’t need a Social Security Number to take the CPA exam if you choose the right state. Several states, including Montana, Colorado, Washington, and Alaska, allow international candidates to apply without an SSN. These states either waive the requirement entirely or accept an Individual Taxpayer Identification Number (ITIN) as an alternative.

What is the validity period for passed CPA exam sections?

Passed CPA exam sections are valid for 30 months under the current NASBA guidelines adopted by most states. This rolling window begins when you pass your first section. If you don’t pass all four sections within 30 months, your earliest passed section expires, and you must retake it. Some states may have different periods, so verify with your specific state board.

Can Indian Chartered Accountants get exemptions in the CPA exam?

No, there are no exemptions from CPA exam sections for Indian Chartered Accountants. However, the CA qualification does help with CPA eligibility by providing additional credits during the credential evaluation process. Some evaluation agencies assign 30-40 semester credits for the CA designation, which can help meet the 150 credit requirement for licensure.

How much does the CPA exam cost in Indian rupees?

The total CPA exam cost for Indian candidates typically ranges from ₹3,00,000 to ₹5,00,000, including credential evaluation (₹17,000-25,000), application fees (₹8,500-25,000), examination fees for all four sections (₹1,71,000-1,75,000), review course (₹84,000-2,52,000), and licensing fees (₹25,000-50,000). Additional costs apply if you need to retake any section.

Where can I take the CPA exam in India?

The CPA exam is available at eight Prometric testing centers across India: Ahmedabad, Bangalore, Chennai, Hyderabad, Kolkata, Mumbai, New Delhi, and Trivandrum. You can schedule your preferred location through the Prometric website once you receive your Notice to Schedule (NTS). Choose a center convenient to your location to minimize travel stress on exam day.

What is the difference between CPA exam and CPA license?

The CPA exam is the four-part assessment you must pass to demonstrate competency. The CPA license is the credential you receive from a state board after passing the exam AND meeting additional requirements like education (150 credits), experience (typically 1-2 years under CPA supervision), and ethics (exam or course). Passing the exam is necessary but not sufficient for licensure.

Is online CPA exam preparation sufficient for Indian candidates?

Yes, online CPA exam preparation can be sufficient, and most Indian candidates use some combination of online courses, video lectures, and digital question banks. Quality online review providers like Becker, Wiley, and Surgent offer comprehensive programs with the same content as their US offerings. Many Indian coaching institutes also provide hybrid programs combining online resources with in-person guidance.

Allow notifications

Allow notifications