US GAAP stands for Generally Accepted Accounting Principles, the accounting framework for US companies. Learn GAAP principles, ASC Codification, differences from Ind AS, and career opportunities for Indian professionals.

Table of Contents

If you are working in finance or accounting in India today, chances are high that you have encountered US GAAP at some point in your career. With over 1,000 US-based multinational corporations operating in India and the rapid expansion of Global Capability Centers (GCC) across cities like Bangalore, Hyderabad, and Pune, American accounting standards have become an essential part of the Indian finance professional’s toolkit. Whether you are preparing consolidated financial statements for a US parent company, handling SOX compliance at a shared services centers, or simply aiming to advance your career at a Big 4 firm, understanding US GAAP is no longer optional.

This comprehensive guide will take you through everything you need to know about Generally Accepted Accounting Principles as they apply to the American financial reporting system. You will learn the foundational principles that govern all US accounting standards, understand how to navigate the ASC Codification system, and discover the key differences between US GAAP and the Ind AS framework you already know. More importantly, this guide is written specifically for Indian professionals, addressing the practical scenarios you face when working with US entities.

By the time you finish reading, you will have a clear understanding of GAAP’s 10 core principles, the structure of the ASC Codification, critical differences from Ind AS that affect your daily work, and the certification pathways that can accelerate your career. We will also cover salary expectations and career opportunities for GAAP-skilled professionals in India, giving you actionable insights to plan your next move.

What Does US GAAP Stand For

GAAP stands for Generally Accepted Accounting Principles, and it represents the standardised framework of accounting rules, conventions, and guidelines that companies in the United States must follow when preparing their financial statements.

The primary purpose of GAAP is to ensure that financial reporting across all public companies remains consistent, accurate, and transparent, allowing investors, regulators, and other stakeholders to make informed decisions based on comparable financial information. For Indian professionals working with US subsidiaries, MNCs, or companies listed on American stock exchanges, GAAP knowledge is essential because these entities must report their financials in accordance with these standards, regardless of where their operations are located.

The significance of GAAP extends beyond mere compliance. When you understand GAAP, you gain the ability to interpret financial statements prepared under American standards, identify potential issues in cross-border reporting, and communicate effectively with US-based colleagues and auditors. The Financial Accounting Standards Board (FASB) maintains and updates these standards, ensuring they evolve to address new business practices and economic realities. For Indian accountants and finance professionals, this knowledge opens doors to roles at multinational corporations, Big 4 accounting firms, and global capability centers where US GAAP expertise commands premium compensation.

How GAAP Evolved from Market Crisis to Modern Standards

The history of US GAAP is a story of how financial catastrophe led to systematic reform. Understanding this evolution helps you appreciate why certain principles exist and how the standard-setting process works today.

From the chaos of the 1929 market crash to the sophisticated framework managed by FASB, American accounting standards have undergone continuous refinement to protect investors and ensure market integrity.

The 1929 Stock Market Crash and the Push for Standardisation

Before 1929, American companies had significant freedom in how they reported their financial information, with no uniform standards governing what had to be disclosed or how figures should be calculated. The stock market crash of 1929 and the subsequent Great Depression exposed the dangers of this approach, as investors discovered that many companies had used manipulative or misleading accounting practices. This crisis created the political will for comprehensive reform, leading to the creation of the Securities and Exchange Commission in 1934 and the beginning of standardised financial reporting requirements for public companies.

Securities Acts, APB, and Early Accounting Reforms

The Securities Act of 1933 and the Securities Exchange Act of 1934 established the legal foundation for financial reporting standards in the United States, giving the SEC authority to set accounting rules for public companies. Rather than develop these standards itself, the SEC delegated this responsibility to private accounting bodies, first to the American Institute of Accountants’ Committee on Accounting Procedure and later to the Accounting Principles Board. The term “generally accepted accounting principles” was first used in 1936 by the American Institute of Accountants, marking the formal recognition of a standardised approach to financial reporting.

Creation of FASB in 1973 and Evolution of Modern GAAP

In 1973, the Financial Accounting Standards Board was established as an independent, private-sector organisation dedicated to developing and improving accounting standards for public and private companies. FASB replaced the Accounting Principles Board and brought greater structure, transparency, and stakeholder participation to the standard-setting process. The most significant recent development came in 2009 when FASB launched the Accounting Standards Codification, consolidating all authoritative US GAAP guidance into a single, searchable system organised into approximately 90 accounting topics.

Who Sets and Enforces US GAAP Today

The regulatory ecosystem governing US GAAP involves multiple organisations working together to develop, maintain, and enforce accounting standards. Understanding these roles helps you navigate the authoritative sources and stay current with changes that affect your work.

Role of the Financial Accounting Standards Board (FASB)

FASB is the primary body responsible for establishing and updating accounting standards for nongovernmental entities in the United States. The board consists of seven full-time members appointed by the Financial Accounting Foundation, and it follows a rigorous due process that includes research, public exposure drafts, and stakeholder feedback before issuing new standards. When you need authoritative guidance on any US GAAP topic, FASB’s Accounting Standards Codification is your definitive source.

SEC’s Oversight and Enforcement Authority

The Securities and Exchange Commission (SEC) retains ultimate authority over financial reporting standards for public companies, though it has historically deferred to FASB for standard-setting. The SEC enforces compliance with GAAP through its review of company filings, and it can bring enforcement actions against companies or individuals who violate reporting requirements. For Indian professionals working with US-listed companies or SEC registrants, understanding SEC requirements is crucial alongside GAAP knowledge.

Financial Accounting Foundation and Governance Structure

The Financial Accounting Foundation serves as the parent organisation overseeing both FASB and the Governmental Accounting Standards Board. FAF appoints board members, secures funding, and provides governance oversight while maintaining the independence of the standard-setting process. This structure ensures that accounting standards development remains free from undue influence while remaining accountable to the public interest.

The 10 Core Principles That Define US GAAP

At the foundation of all US GAAP standards lie ten core principles that guide how financial information should be recorded, processed, and reported. These principles are not arbitrary rules but rather fundamental concepts designed to ensure that financial statements provide useful, reliable, and comparable information. For Indian professionals accustomed to Ind AS, understanding these principles helps you interpret any GAAP guidance you encounter, even when dealing with topics you have not studied in detail.

Principles Governing Accuracy and Consistency

The first group of GAAP principles focuses on ensuring that financial information is accurate and that reporting methods remain consistent over time. These principles form the foundation for reliable financial statements that stakeholders can trust.

Regularity and Strict Adherence to Standards

The principle of regularity requires that accountants strictly adhere to established GAAP rules and regulations without exception. This means you cannot selectively apply standards based on convenience or desired outcomes. When preparing financial statements under US GAAP, every applicable standard must be followed as written, and any departures must be clearly disclosed with justification.

Consistency Across Reporting Periods

Consistency requires that companies apply the same accounting policies and methods from one reporting period to the next, enabling meaningful comparisons over time. If a company changes its accounting methods, US GAAP requires full disclosure of the change, the reason for it, and the impact on financial statements. This principle is particularly important when you are analysing trends in a company’s financial performance.

Sincerity and Impartiality in Reporting

The principle of sincerity demands that accountants approach their work with accuracy and impartiality, representing the company’s financial position honestly without bias toward any particular outcome. This means financial statements should reflect economic reality rather than management’s preferred narrative. For professionals preparing US GAAP financials, this principle underscores the ethical responsibility that comes with the role.

Principles Ensuring Transparency and Completeness

The second group of principles ensures that financial statements provide complete information and do not hide unfavourable details from stakeholders.

Permanence of Methods for Comparability

The principle of permanence of methods requires that consistent procedures be used in preparing all financial reports, making it easier for external observers to compare results across periods and between companies. This extends beyond accounting policies to include the format and presentation of financial statements. When you are reviewing US GAAP financials, you can generally expect consistency in how information is organised and presented.

Non-Compensation and Full Disclosure of Debts

Non-compensation means that all aspects of a company’s financial performance, whether positive or negative, must be fully reported without offsetting debts against assets or losses against gains unless specifically permitted by GAAP. This principle ensures transparency by preventing companies from hiding unfavourable items by netting them against favourable ones. You must report the full picture, allowing stakeholders to understand both the good and the challenging aspects of financial performance.

Materiality and Investor-Relevant Information

The principle of materiality requires that all financial information significant enough to influence an investor’s decision must be disclosed. Determining materiality involves professional judgment, considering both quantitative thresholds and qualitative factors. For Indian professionals preparing US GAAP financials, this means evaluating each item not just by its rupee or dollar amount but by whether a reasonable investor would consider it important.

Principles Guiding Measurement and Assumptions

The final group of principles addresses how financial items should be measured and what assumptions underlie financial reporting.

Prudence and Fact-Based Reporting

The principle of prudence, sometimes called conservatism, requires that accountants report only verified facts without speculative assumptions. When uncertainty exists, GAAP generally favours approaches that do not overstate assets or income. This does not mean being pessimistic, but rather being cautious and ensuring that reported figures can be supported by evidence.

Continuity and Going Concern Assumptions

The continuity principle states that asset valuations and other accounting treatments are based on the assumption that the company will continue operating for the foreseeable future. This going concern assumption affects how you value assets, recognise liabilities, and present financial information. If there is substantial doubt about a company’s ability to continue as a going concern, this must be disclosed prominently.

Periodicity and Regular Financial Reporting

Periodicity requires that companies divide their economic activities into regular reporting periods, such as fiscal quarters or years, and prepare financial statements for each period. This enables timely reporting and allows stakeholders to track performance over time. For US public companies, this means quarterly and annual reporting in accordance with SEC requirements.

Utmost Good Faith in All Transactions

The principle of utmost good faith assumes that all parties involved in financial transactions and reporting are acting honestly. This fundamental assumption underlies the entire financial reporting system, as stakeholders rely on the integrity of reported information. For professionals preparing or auditing US GAAP financials, this principle reinforces the ethical foundation of the accounting profession.

How Is US GAAP Organised Under the ASC Codification?

Since July 1, 2009, the FASB Accounting Standards Codification has served as the single authoritative source of US GAAP for nongovernmental entities. Before the Codification, practitioners had to navigate thousands of pronouncements from multiple standard-setters, including FASB Statements, EITF Issues, and AICPA guidance. The ASC reorganised all of this guidance into a unified, topical structure containing approximately 90 accounting topics, making research faster and reducing the risk of missing relevant guidance.

The Structure of ASC References and How to Read Them

Understanding the ASC’s structure is essential for efficient research and accurate application of US GAAP. The Codification uses a standardised numbering system that allows you to pinpoint specific guidance quickly.

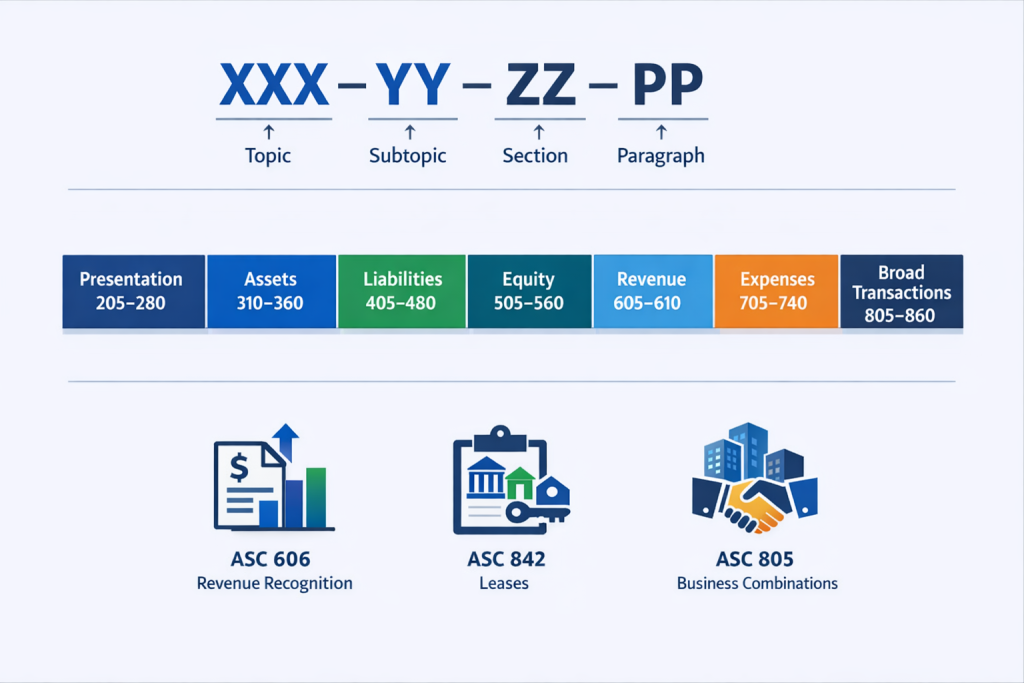

Topics, Subtopics, Sections, and Paragraphs Explained

Every ASC reference follows the format XXX-YY-ZZ-PP, where XXX represents the three-digit Topic number, YY is the two-digit Subtopic, ZZ is the two-digit Section, and PP is the Paragraph number. For example, ASC 606-10-25-1 refers to Topic 606 (Revenue from Contracts with Customers), Subtopic 10 (Overall), Section 25 (Recognition), Paragraph 1. When you encounter an ASC reference in audit documentation or technical memos, this structure tells you exactly where to find the authoritative guidance.

The Seven Major Categories of the Codification

The ASC organises its approximately 90 topics into seven major categories plus a General Principles section.

These categories are

- Presentation (Topics 205-280),

- Assets (Topics 310-360),

- Liabilities (Topics 405-480),

- Equity (Topics 505-560),

- Revenue (Topics 605-610),

- Expenses (Topics 705-740), and

- Broad Transactions (Topics 805-860), with Industry Topics (905-995) providing sector-specific guidance.

Understanding this structure helps you navigate directly to relevant guidance based on the type of transaction or account you are researching.

How to Navigate the ASC Research System

The ASC online research system offers multiple navigation options, including browsing by topic, using the “Go To” function for known references, and full-text searching. For efficient research, start with the topic most relevant to your question, then drill down through subtopics and sections. The system also includes cross-references to original standards, SEC guidance, and implementation examples that can help you understand how to apply the guidance in practice.

Key ASC Topics Every Indian Professional Should Know

While the Codification contains guidance on dozens of accounting topics, certain areas come up repeatedly in the work of Indian professionals supporting US entities. Mastering these key topics will address the majority of questions you encounter.

ASC 606 and Revenue Recognition Requirements

ASC 606 establishes the principles for recognising revenue from contracts with customers, replacing the previous industry-specific guidance with a single, comprehensive framework. The standard introduces a five-step model: identify the contract, identify performance obligations, determine the transaction price, allocate the price to performance obligations, and recognise revenue as obligations are satisfied. For Indian professionals, this topic is particularly important because revenue recognition differences between US GAAP and Ind AS 115 can significantly impact reported results.

The five-step model requires careful analysis of contract terms and significant judgment in areas like variable consideration, standalone selling prices, and performance obligation identification. Indian subsidiaries reporting to US parents must ensure their revenue recognition policies align with ASC 606 requirements, which may differ from how they recognise revenue under Ind AS. Understanding these nuances helps you prepare accurate US GAAP financials and explain differences to auditors.

ASC 842 and Lease Accounting Standards

ASC 842 fundamentally changed lease accounting by requiring lessees to recognise most leases on the balance sheet as right-of-use assets and corresponding lease liabilities. This standard affects virtually every company with significant lease arrangements, from office space to equipment to vehicles. The key distinction under ASC 842 is between finance leases and operating leases, which differ in how expense is recognised over the lease term.

For Indian professionals, the differences between ASC 842 and Ind AS 116 may seem subtle but can affect reported figures. While both standards require balance sheet recognition of leases, differences exist in areas like lease modification accounting, sale-leaseback transactions, and certain practical expedients. When preparing US GAAP reporting packages, you need to ensure that lease calculations follow ASC 842 requirements specifically.

ASC 805 and Business Combinations

ASC 805 provides guidance on accounting for business combinations using the acquisition method, requiring the acquirer to recognise identifiable assets acquired and liabilities assumed at fair value as of the acquisition date. This topic is crucial for Indian professionals involved in M&A transactions or the consolidation of acquired entities. The standard also addresses complex areas like contingent consideration, bargain purchases, and step acquisitions.

Understanding ASC 805 is essential when your company acquires businesses or when preparing consolidated financial statements that include acquired entities. The fair value measurements required by this standard often involve significant judgment and may require valuation specialists. Indian subsidiaries that are themselves acquired by US companies must also understand how their assets and liabilities will be remeasured under this guidance.

ASC 350 and Intangibles Including Goodwill

ASC 350 covers the recognition, measurement, and impairment of intangible assets, including goodwill arising from business combinations. Under US GAAP, goodwill is not amortised but instead tested for impairment at least annually. This differs from some other frameworks and represents a significant ongoing compliance requirement for companies with goodwill on their balance sheets.

The impairment testing requirements under ASC 350 require companies to compare the fair value of a reporting unit to its carrying amount, recognising an impairment loss if the carrying value exceeds the fair value. For Indian professionals preparing US GAAP financials, this means understanding how to identify reporting units, determine fair values, and properly document impairment analyses. Recent simplifications to the impairment test have made the process somewhat easier, but it remains an area requiring careful attention.

How Does US GAAP Differ from Ind AS and IFRS?

For Indian professionals who have trained under Indian Accounting Standards or worked with IFRS-based frameworks, understanding the differences with US GAAP is critical for accurate reporting and effective communication with US stakeholders. While the FASB and IASB have worked on convergence projects over the years, significant differences remain in both fundamental approach and specific technical requirements. These differences can materially impact reported financial results, making it essential to understand where the standards diverge.

Fundamental Approach Differences Between the Standards

Before examining specific technical differences, it is important to understand the philosophical distinction between US GAAP and IFRS-based standards like Ind AS.

Rules-Based GAAP vs Principles-Based IFRS and Ind AS

US GAAP is often characterised as a rules-based framework, providing detailed, prescriptive guidance for specific situations and transactions. This approach aims to reduce ambiguity and ensure consistent application across different companies and industries. In contrast, IFRS and Ind AS are considered principles-based frameworks, establishing broad principles and objectives while allowing more professional judgment in application. The IFRS Foundation has noted that principles-based standards focus on the economic substance of transactions rather than their legal form.

This distinction has practical implications for how you approach accounting issues under each framework. Under US GAAP, you will often find specific rules addressing narrow fact patterns, while under Ind AS, you may need to apply broader principles to determine the appropriate treatment. Neither approach is inherently superior; they simply represent different philosophies for achieving reliable financial reporting.

How These Approaches Affect Professional Judgment

The rules-based nature of US GAAP means that professionals often have less latitude in determining accounting treatments, but it also means more research may be required to find applicable guidance for specific situations. Under Ind AS, you may exercise more judgment but must be prepared to defend your conclusions with well-reasoned analysis. When working across both frameworks, you need to shift your mindset between these approaches and document your reasoning appropriately.

Specific Technical Differences That Impact Financial Statements

Beyond philosophical differences, specific technical requirements under US GAAP and Ind AS can lead to materially different reported results for the same economic transactions.

Revenue Recognition Timing and Criteria

While both US GAAP (ASC 606) and Ind AS 115 use a similar five-step revenue recognition model following convergence efforts, differences remain in certain detailed requirements and interpretive guidance. Areas where divergence may occur include the treatment of licensing arrangements, principal versus agent determinations, and certain industry-specific applications. When preparing US GAAP financials, you should not assume that Ind AS 115 conclusions automatically apply.

Inventory Valuation and the LIFO Question

One of the most significant differences between US GAAP and IFRS/Ind AS relates to inventory valuation methods. US GAAP permits the use of LIFO (Last-In, First-Out) inventory costing, while IFRS and Ind AS prohibit this method entirely. For companies using LIFO under US GAAP, this can result in significantly different inventory values and cost of goods sold figures compared to FIFO or weighted average methods required under Ind AS.

Lease Classification and Right-of-Use Assets

Although both ASC 842 and Ind AS 116 require lessees to recognise most leases on the balance sheet, differences exist in classification criteria, measurement of lease liabilities, and treatment of certain transactions. US GAAP maintains a distinction between finance leases and operating leases that affects expense recognition patterns, while Ind AS 116 treats most leases similarly from an expense perspective. These differences require careful attention when reconciling between frameworks.

Fair Value Measurement and Asset Revaluation

US GAAP generally prohibits upward revaluation of most long-lived assets to fair value, requiring them to remain at historical cost less depreciation and impairment. In contrast, Ind AS (following IFRS) permits revaluation of property, plant, and equipment and certain intangible assets to fair value. This difference can result in significantly different asset values on the balance sheet and affect depreciation expense in subsequent periods.

Development Costs and Intangible Asset Treatment

Under US GAAP, most research and development costs must be expensed as incurred, with limited exceptions for software development and certain other costs. Ind AS, following IFRS, allows capitalisation of development costs when specific criteria are met, including technical feasibility and intention to complete the asset. This difference affects both the balance sheet (capitalised assets) and income statement (timing of expense recognition) for companies with significant R&D activities.

Practical Implications for Indian Companies and Professionals

Understanding technical differences is important, but knowing how to apply this knowledge in practice is what distinguishes effective professionals.

Reporting for US Parent Companies from Indian Subsidiaries

Indian subsidiaries of US parent companies typically maintain their primary books under Ind AS for local statutory purposes while also preparing reporting packages under US GAAP for consolidation into the parent company’s financial statements.

This dual reporting requirement means you need to track differences between the two frameworks and prepare adjustment entries to convert Ind AS financials to US GAAP. Common adjustments include inventory valuation changes, lease classification differences, revenue recognition timing adjustments, and asset revaluation reversals.

The reconciliation process requires a systematic approach to identifying all differences, quantifying their impact, and documenting the adjustments clearly.

Many companies maintain parallel ledgers or use mapping tables to facilitate this process. As a professional involved in this work, you become the bridge between local accounting requirements and group reporting standards.

Dual Reporting Requirements and Reconciliation Challenges

Managing dual reporting requirements efficiently requires both technical knowledge and strong processes. You need to understand which differences are likely to be material for your entity, establish procedures for capturing necessary information, and develop reconciliation templates that facilitate accurate and timely reporting. The reconciliation workpapers become critical audit evidence, so documentation must be thorough and well-organised.

Technology can help manage dual reporting complexity, with many ERP systems offering capabilities to track transactions under multiple frameworks. However, system solutions alone are not sufficient; you need professionals who understand both frameworks deeply enough to configure systems correctly and review outputs critically. This expertise is precisely why GAAP-skilled professionals command premium compensation in the Indian market.

Career Opportunities and Salary Expectations for US GAAP-Skilled Professionals in India

The demand for US GAAP expertise in India has grown substantially over the past decade, driven by the expansion of multinational corporations, the establishment of Global Capability Centers, and the increasing complexity of cross-border financial reporting.

For Indian finance professionals, developing GAAP skills opens doors to premium roles that offer higher compensation, greater responsibility, and international career mobility. Understanding where these opportunities exist and what compensation to expect helps you make informed career decisions.

Where GAAP Skills Are Most Valued in India

US GAAP expertise is particularly valued in organisations that have direct connections to American companies or capital markets.

Big 4 accounting firms (Deloitte, PwC, EY, and KPMG) actively recruit professionals with US GAAP knowledge for their audit, advisory, and consulting practices serving multinational clients. These firms offer excellent training, exposure to complex transactions, and clear career progression paths.

Additionally, MNC subsidiaries, shared services centers, and Global Capability Centers of companies like Amazon, Microsoft, Google, and other Fortune 500 corporations represent significant employers of GAAP-skilled professionals in cities including Bangalore, Hyderabad, Pune, and Gurgaon.

Indian companies listed on US stock exchanges or those raising capital from American investors also require professionals who can ensure compliance with SEC reporting requirements and US GAAP.

The finance teams of these companies, along with their external auditors, need deep GAAP expertise to navigate complex accounting issues and regulatory requirements. As India’s integration with global capital markets continues to deepen, these opportunities are expected to grow further.

Salary Ranges by Experience Level and Location

Compensation for US GAAP-skilled professionals in India varies significantly based on experience, certifications, and location. Entry-level professionals with basic GAAP training can expect starting salaries in the range of INR 6 to 12 lakhs per annum, depending on the employer and city. With a few years of experience and demonstrated expertise, mid-career professionals typically earn between INR 12 and 20 lakhs annually. Those who combine GAAP knowledge with certifications like a US CPA often command 40 to 60 percent higher salaries than their non-certified counterparts.

Senior professionals with extensive GAAP experience and leadership responsibilities can earn upwards of INR 20 lakhs, with finance controllers, directors, and CFOs at multinational subsidiaries sometimes earning INR 40 to 50 lakhs or more. Metropolitan cities like Mumbai and Bangalore typically offer 10 to 20 percent higher compensation than other locations due to the concentration of MNCs and the higher cost of living. Professionals working directly for US companies or in roles with international exposure often receive additional benefits and may have opportunities for overseas assignments.

Career Progression Pathways for GAAP Professionals

Career progression for GAAP-skilled professionals typically follows a trajectory from analyst or accountant roles through senior positions to management and eventually leadership. In Big 4 firms, this means moving from associate to senior associate to manager to senior manager to director and potentially partner. In corporate finance, the path leads from financial analyst through accounting manager to controller to finance director and ultimately to CFO for those with the right combination of technical skills and leadership abilities.

What distinguishes GAAP-skilled professionals in their career progression is the ability to handle complex, high-value work that organisations are willing to pay premium rates for. Whether it is leading a conversion to US GAAP reporting, managing SOX compliance programs, or advising on the accounting implications of major transactions, these roles require specialised knowledge that is relatively scarce in the Indian market. Developing and demonstrating this expertise positions you for faster advancement and more interesting work throughout your career.

US GAAP Certification Options for Indian Professionals

While on-the-job experience is valuable for developing GAAP skills, formal certification provides external validation of your expertise and can significantly accelerate career advancement. Several certification options are available to Indian professionals seeking to demonstrate US GAAP proficiency, with the US CPA credential being the most recognised and comprehensive.

The US CPA Credential and Its Value in India

The Certified Public Accountant designation issued by US state boards of accountancy represents the gold standard for accounting credentials in the American context. For Indian professionals, earning a CPA license demonstrates mastery of US GAAP, audit standards, business law, and tax regulations, signalling to employers that you can handle complex accounting work with minimal supervision. The credential is increasingly valued in India as more companies seek professionals who can bridge Indian and American accounting requirements.

CPA Eligibility Requirements for Indian Candidates

To sit for the CPA exam, Indian candidates must meet education requirements that typically include 120 credit hours for exam eligibility and 150 credit hours for licensure, with specified amounts in accounting and business subjects. Indian qualifications like CA, B.Com, and M.Com can be evaluated for equivalency by credential evaluation services. Each US state has different requirements, so candidates should research states that recognise their educational background before beginning the process.

Exam Structure and Preparation Timeline

The CPA exam consists of four sections: Auditing and Attestation (AUD), Business Environment and Concepts (BEC), Financial Accounting and Reporting (FAR), and Regulation (REG). The FAR section is particularly relevant for GAAP knowledge, covering financial reporting frameworks, account-specific standards, and government accounting. Most candidates require 12 to 18 months of dedicated study to pass all four sections, though this varies based on individual circumstances and available study time.

Costs, Pass Rates, and Return on Investment

The total cost of pursuing the CPA credential from India, including application fees, exam fees, review course materials, and credential evaluation, typically ranges from INR 3 to 4 lakhs. Pass rates hover around 50 percent globally, with approximately 20 percent of candidates passing all four sections on their first attempt. Despite the significant investment of time and money, the return on investment is generally favourable, with certified professionals earning 40 to 60 percent more than non-certified counterparts and gaining access to senior roles that might otherwise be unavailable.

Conclusion

US GAAP has become an essential competency for Indian finance professionals working in today’s globalised business environment. From understanding the 10 core principles that govern all American accounting standards to navigating the ASC Codification’s organised structure, the knowledge you have gained from this guide provides a solid foundation for working with US entities and advancing your career. The differences between US GAAP and Ind AS, while manageable, require attention and expertise that employers increasingly value.

The career opportunities for GAAP-skilled professionals in India are substantial and growing, with premium compensation available for those who develop genuine expertise. Whether you choose to pursue formal certification through the CPA exam or build your skills through practical experience and self-study, investing in GAAP knowledge is an investment in your professional future. Take the next step by exploring the certification options discussed, seeking out roles that expose you to US GAAP reporting, or simply continuing to deepen your understanding of these important standards.

If you are actively involved in converting Ind AS financials into US GAAP reporting packages, or planning to move into a US-facing finance role, you may find it helpful to read my detailed guide on “Transitioning from Indian Accounting Standards to US GAAP”.

Frequently Asked Questions

What is the full form of GAAP and what does it stand for?

GAAP stands for Generally Accepted Accounting Principles. It represents the standardised framework of accounting rules and guidelines that companies in the United States must follow when preparing financial statements. GAAP ensures consistency, accuracy, and transparency in financial reporting.

Who is responsible for setting US GAAP standards?

The Financial Accounting Standards Board (FASB) is the primary body responsible for establishing and updating US GAAP for nongovernmental entities. The Securities and Exchange Commission has oversight authority and enforces compliance for public companies, while the Financial Accounting Foundation provides governance.

How is the ASC Codification structured and organized?

The ASC uses a hierarchical structure with references following the format XXX-YY-ZZ-PP, representing Topic, Subtopic, Section, and Paragraph. The Codification organises approximately 90 topics into seven major categories: Presentation, Assets, Liabilities, Equity, Revenue, Expenses, and Broad Transactions, plus Industry-specific guidance.

What are the main differences between US GAAP and Ind AS?

Key differences include US GAAP’s rules-based approach versus Ind AS’s principles-based approach, LIFO inventory costing permitted under GAAP but prohibited under Ind AS, prohibition of asset revaluation under GAAP, and different treatments for development costs and certain lease transactions.

Can Indian accountants work with US GAAP without a CPA license?

Yes, Indian accountants can work with US GAAP in roles like financial analyst, accountant, or controller without a CPA license. The CPA license is required primarily for signing audit opinions and certain attestation services. However, having CPA certification enhances career prospects and earning potential.

How much do GAAP-skilled professionals earn in India?

Entry-level GAAP professionals earn INR 6 to 12 lakhs annually, mid-career professionals earn INR 12 to 20 lakhs, and senior professionals can earn INR 20 lakhs or more. US CPA-certified professionals typically earn 40 to 60 percent more than non-certified counterparts in comparable roles.

Which certification is better for GAAP knowledge: CPA or CMA?

The US CPA is more comprehensive for GAAP knowledge as the FAR section extensively covers financial reporting standards. The CMA focuses more on management accounting and strategic planning. For roles primarily involving US GAAP reporting, the CPA is generally more relevant.

How long does it take to learn US GAAP basics?

Basic familiarity with US GAAP fundamentals can be developed in two to three months of focused study. However, developing practical proficiency for professional application typically requires six to twelve months of combined study and hands-on experience with real transactions.

What are the most important ASC topics to know?

The most frequently encountered topics include ASC 606 (Revenue Recognition), ASC 842 (Leases), ASC 805 (Business Combinations), ASC 350 (Intangibles and Goodwill), ASC 740 (Income Taxes), ASC 820 (Fair Value Measurement), and ASC 326 (Credit Losses).

Is GAAP certification worth it for Indian CA professionals?

Yes, GAAP certification complements the CA qualification by adding international credibility and opening doors to MNC roles, Big 4 international assignments, and positions requiring US reporting expertise. Many CAs find that adding CPA certification significantly enhances their career options.

How do Indian subsidiaries report under US GAAP to their US parent companies?

Indian subsidiaries typically maintain books under Ind AS for statutory purposes and prepare separate US GAAP reporting packages for group consolidation. This involves tracking differences between frameworks, calculating adjustments, and preparing reconciliation workpapers for auditor review.

What are the latest FASB updates Indian professionals should know about?

Recent significant updates include ASU 2024-01 on profit interest awards, ASU 2024-02 on codification improvements, and ASU 2024-03 on disaggregation of income statement expenses. Professionals should monitor the FASB website for new Accounting Standards Updates affecting their areas.

Which Indian cities have the highest demand for GAAP professionals?

Bangalore, Hyderabad, Mumbai, Pune, and Gurgaon/NCR have the highest concentrations of MNCs, GCCs, and Big 4 offices seeking GAAP-skilled professionals. These cities offer the most opportunities and typically the highest compensation for US GAAP expertise.

How does US GAAP handle lease accounting differently from Ind AS?

Under ASC 842, US GAAP maintains a distinction between finance leases and operating leases that affects expense recognition patterns. While both ASC 842 and Ind AS 116 require balance sheet recognition, differences exist in classification criteria, certain measurement aspects, and treatment of lease modifications.

What career roles specifically require US GAAP expertise in India?

Roles requiring US GAAP expertise include US GAAP accountants at MNC subsidiaries, financial analysts at shared services centers, audit seniors and managers at Big 4 firms serving US clients, finance controllers at American company offices, and compliance managers handling SOX and SEC requirements.

Allow notifications

Allow notifications