US CPA Exam is a 16-hour, four-part certification examination administered by AICPA and NASBA that tests accounting professionals in auditing, financial reporting, taxation, and one specialized discipline. Indian candidates can take this exam at eight Prometric centers across India, with pass rates averaging 50% .

Table of Contents

The demand for US Certified Public Accountants in India has never been higher.

Big 4 firms are actively expanding their Global Capability Centers across Bangalore, Mumbai, Hyderabad, and Gurgaon, and they need professionals who understand US GAAP, SEC reporting, and American tax regulations.

Multinational corporations setting up finance shared services in India are offering premium salaries to CPAs, while the accounting talent shortage in the United States has opened doors for Indian professionals seeking international careers. If you have been considering the US CPA credential, this is the right time to understand what it takes and whether it aligns with your career goals.

However, pursuing a CPA from India comes with unique challenges that most generic guides fail to address. You need to navigate credit hour requirements that don’t align neatly with Indian degrees, choose from 55 different US state boards with varying rules, and figure out how to prepare for a demanding four-part exam while managing a full-time job in Indian Standard Time. The good news is that thousands of Indian professionals have successfully earned their CPA credentials, and with the right roadmap, you can too.

This guide covers everything you need to know about the US CPA exam as an Indian professional.

You will learn how your B.Com, M.Com, CA, or other Indian qualifications translate to US credit hours, which states offer the most favorable requirements for international candidates, how the new CPA Evolution exam structure works, what it costs in Indian Rupees, and how to create a realistic preparation plan that fits your work schedule.

By the end, you will have complete clarity on whether CPA is right for you and exactly how to proceed.

What Is the US CPA and Why Are Indian Professionals Choosing It?

The US CPA is more than just another accounting certification. It represents the gold standard for accounting professionals in the United States and carries significant weight in global finance markets.

For Indian professionals, this credential opens doors that remain closed to those with only domestic qualifications, particularly in multinational environments where US accounting standards govern financial reporting.

Understanding what the CPA credential represents and why it has become increasingly popular among Indian accountants will help you evaluate whether this investment of time and money makes sense for your specific career trajectory.

What Does the US CPA Credential Represent Globally?

The Certified Public Accountant designation is issued by US state boards of accountancy and regulated by the American Institute of Certified Public Accountants (AICPA) and the National Association of State Boards of Accountancy (NASBA). Unlike many professional certifications, a CPA license is legally required to sign audit reports, file certain tax returns, and perform specific attestation services in the United States. This regulatory backing gives the credential its authority and recognition.

Globally, the CPA is recognized in over 130 countries through mutual recognition agreements. Major financial centers, including London, Singapore, Hong Kong, and Dubai, value the CPA credential for roles involving US GAAP reporting, SEC compliance, and cross-border transactions.

For Indian professionals working with American clients or US-headquartered multinationals, the CPA signals competence in the accounting standards that govern their financial reporting.

Career Benefits of Becoming a US CPA from India

The career advantages of holding a CPA credential in India have become increasingly tangible. According to placement data from major Indian coaching institutes, CPA holders command starting salaries of ₹8-12 LPA at Big 4 firms, compared to ₹6-8 LPA for non-CPA hires in similar roles. Senior CPAs with 5-7 years of experience regularly earn ₹25-40 LPA in India, with those in leadership positions at MNC finance centers exceeding ₹50 LPA.

Beyond salary, the CPA opens specific career pathways. Big 4 Global Capability Centers in India actively recruit CPAs for US audit support, SOX compliance, and technical accounting advisory roles.

Companies like Amazon, Google, Microsoft, and other tech giants with significant India operations prefer CPAs for their finance and accounting leadership positions. Additionally, the CPA credential facilitates H1B visa sponsorship for those seeking to work in the United States, where the accounting talent shortage has made qualified professionals highly sought after.

Is the US CPA Right for Your Career Goals?

The CPA makes the most sense if your career involves or will involve US accounting standards. This includes professionals working in US-focused audit teams, those handling SEC reporting or US GAAP consolidation, tax professionals dealing with US federal and state taxation, and anyone targeting leadership roles in MNCs where American financial reporting standards apply. If your work is primarily governed by Indian Accounting Standards or IFRS with no US connection, the return on investment may be lower.

Consider your timeline and commitment level honestly. The CPA requires passing four rigorous exam sections within a 30-month window, accumulating 150 credit hours of education, and completing 1-2 years of relevant work experience. Most working professionals in India take 12-18 months to complete all four sections while managing their jobs. If you can dedicate 15-20 hours per week to preparation and have a clear career reason for pursuing the credential, the CPA is likely a worthwhile investment.

Who is Eligible to Pursue the US CPA Exam from India?

Eligibility for the US CPA exam depends on meeting education requirements set by individual state boards. Since India’s education system differs significantly from the American system, understanding how your qualifications translate is essential before you invest in exam preparation or credential evaluation.

The good news is that most Indian commerce graduates with postgraduate qualifications or professional certifications can find a pathway to CPA eligibility. The key lies in understanding the credit hour system and identifying which states offer the most favorable requirements for your specific educational background.

The 3E Requirements: Education, Examination, and Experience

Every US state board requires CPA candidates to fulfill three fundamental requirements, commonly called the 3Es. Education requirements typically mandate a bachelor’s degree equivalent to a US four-year degree, along with specific credit hours in accounting and business courses. The examination requirement involves passing all four sections of the Uniform CPA Examination. Experience requirements, which vary significantly by state, generally demand 1-2 years of accounting work under the supervision of a licensed CPA.

For Indian candidates, the education requirement creates the first hurdle because most Indian bachelor’s degrees span three years rather than four. However, candidates can overcome this through additional qualifications, and some states have more flexible interpretations of international credentials. According to NASBA’s international candidate guidelines, foreign-educated candidates must have their credentials evaluated by an approved agency before applying.

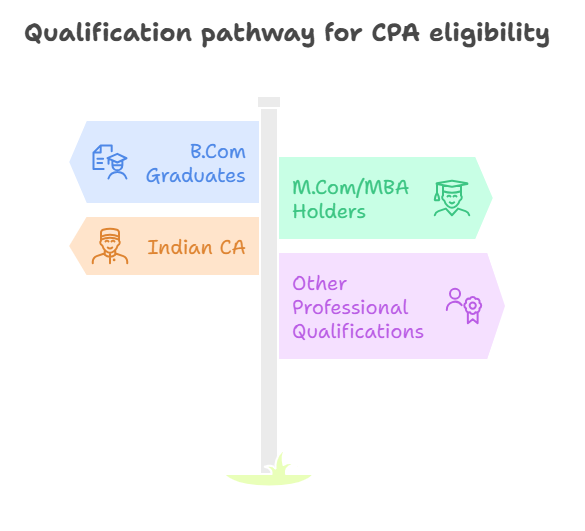

Eligibility Pathways for Different Indian Qualifications

Your specific Indian qualifications determine which pathway you will take to meet CPA eligibility requirements. Each qualification provides a different number of credit hours, and understanding this mapping helps you identify what additional education, if any, you need to pursue.

CPA Eligibility for B.Com Graduates (3-Year Degree Holders)

A three-year B.Com degree from an Indian university typically translates to 90 credit hours in the US system, calculated at 30 credits per academic year. Since most states require 120 credit hours just to sit for the exam and 150 credit hours for licensure, B.Com graduates alone do not meet eligibility requirements. You will need additional qualifications, such as an M.Com, MBA, CA, or other recognized credentials, to bridge this gap, or you can complete additional coursework through accredited US institutions offering online programs.

CPA Eligibility for M.Com and MBA Holders

If you hold a B.Com plus M.Com combination, your five years of academic education typically translates to 150 credit hours, meeting the licensure requirement in most states. Similarly, a B.Com plus MBA combination provides approximately 150 credit hours. The key consideration is whether your coursework includes sufficient accounting-specific credits, as many states require 24-30 credit hours specifically in accounting subjects. An MBA with a finance concentration may need supplemental accounting courses to meet these subject-specific requirements.

CPA Eligibility for Indian Chartered Accountants (CA)

Indian Chartered Accountants present a more complex evaluation scenario. The CA qualification itself is highly rigorous, but US state boards classify it as a professional certification rather than an academic education. Most states no longer grant direct credit hour equivalency for CA, though some states like Colorado and Guam may provide partial credit. If you hold a B.Com plus CA, your total credit hours depend on how the evaluating agency assesses your CA coursework. Many CA holders pursue an M.Com or additional US credits to ensure they comfortably meet the 150-hour requirement.

CPA Eligibility for CS, CMA, and Other Professional Qualifications

Company Secretaries (CS), Cost and Management Accountants (CMA India), and holders of other professional qualifications face similar evaluation considerations as CAs. These credentials demonstrate professional competence but may not translate directly to academic credit hours. If you hold a B.Com plus CS or CMA, you likely have around 90-100 credit hours and will need additional education. Combining multiple qualifications or pursuing an M.Com or MBA remains the most reliable path to meeting the 150-hour requirement.

How Are Credit Hours Calculated for Indian Degrees?

Credit hour calculation for Indian degrees follows a general formula based on years of study. Each academic year of full-time university education typically equals 30 US semester credit hours. Therefore, a three-year B.Com equals 90 credits, a two-year M.Com adds 60 credits for a total of 150, and so forth. However, credential evaluation agencies examine your actual transcripts and may adjust credits based on course content, contact hours, and comparability to US accounting curricula.

The critical distinction is between credits needed to sit for the exam versus credits needed for licensure. Some states allow candidates to take the exam with 120 credit hours while requiring 150 for final licensure. This flexibility helps candidates begin their exam journey while completing additional education. When your credentials are evaluated by agencies like World Education Services (WES) or NASBA International Evaluation Services (NIES), you receive a detailed report showing exactly how many credits you have and in which subject categories.

How to Choose the Right US State for Your CPA Application?

Choosing the right state board is one of the most consequential decisions you will make in your CPA journey. Since each of the 55 US jurisdictions sets its own requirements for education, examination eligibility, and experience verification, selecting a state that aligns with your qualifications and circumstances can mean the difference between a smooth licensing process and years of frustration.

For Indian candidates who may not have a Social Security Number, who need flexibility in experience verification, or whose credit hours fall in borderline territory, state selection requires careful analysis rather than defaulting to popular choices.

Why State Selection Matters for International Candidates

International candidates face considerations that domestic US candidates never encounter. The state you choose determines whether you need a Social Security Number to apply, how your foreign credentials are evaluated, whether your Indian work experience counts toward licensing, and what ongoing requirements you must meet to maintain your license.

SSN, Residency, and Experience Verification Differences

Several states require a valid US Social Security Number to apply for the CPA exam, effectively excluding international candidates who have never worked in the United States. Other states require residency or citizenship, though these are increasingly rare. Perhaps most critically for Indian candidates, experience verification rules vary dramatically. Some states require your work experience to be supervised directly by a licensed US CPA, which can be difficult to arrange in India. Others accept verification from a CPA equivalent or offer alternative verification pathways through NASBA’s experience verification service.

The Impact of State Choice on Your Licensing Journey

Your initial state choice affects your entire CPA career. While you can transfer your license to other states through reciprocity agreements once licensed, the initial licensing requirements must be met in your chosen state. If you select a state with requirements you cannot meet, such as US-based experience under a licensed CPA, you may pass all four exam sections but remain unable to obtain your license. This scenario has frustrated many international candidates who did not research state requirements thoroughly before applying.

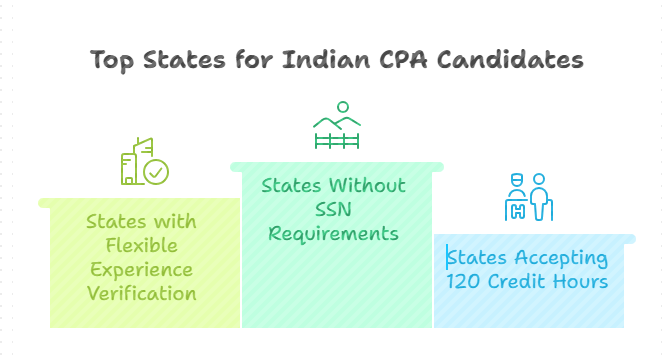

Best States for Indian CPA Candidates

Based on current requirements and feedback from Indian CPA candidates, several states consistently emerge as favorable options for international applicants. These states offer combinations of accessible requirements that align with the typical Indian candidate’s situation.

States Without SSN Requirements (Alaska, Montana, Guam)

Alaska, Montana, and Guam allow candidates to apply for the CPA exam without a US Social Security Number, making them accessible to Indian professionals who have never worked in the United States. Guam is particularly popular among international candidates because it also participates in NASBA’s experience verification service, which can help candidates whose work experience was not directly supervised by a US CPA. Montana offers similar flexibility and has historically been welcoming to international candidates.

States with Flexible Experience Verification Options

For candidates working in India under supervisors who are not US CPAs, states offering alternative experience verification pathways are essential. Guam, Montana, and Washington participate in NASBA’s Experience Verification Service, which evaluates international experience and can verify qualifying work even without direct CPA supervision. Colorado and certain other states accept verification from chartered accountants or equivalent professionals, though requirements change periodically and should be confirmed directly with state boards.

States Accepting 120 Credit Hours for Exam Eligibility

If your credit hours fall between 120 and 150, states that allow exam sitting with 120 credits while requiring 150 for licensure provide valuable flexibility. Colorado, Montana, and several other states offer this two-tier approach. This allows you to begin taking exam sections while completing additional coursework, spreading your education investment over time rather than front-loading all costs before you can even attempt the exam.

How Should You Decide the Right State for Your Profile?

Rather than following what others have chosen, evaluate states systematically based on your specific situation. Your educational credentials, work experience, circumstances, and long-term career plans should drive this decision.

Factors to Consider Based on Your Qualifications

Start by determining your exact credit hour count through a preliminary credential evaluation. If you have 150+ credits with adequate accounting courses, you have maximum flexibility in state choice. If you have between 120-150 credits, prioritize states allowing exam eligibility at 120 hours. Next, assess your experience situation. If you work for a Big 4 firm in India with US CPA partners, experience verification may be straightforward in most states. If your supervisor is not a CPA, you need to state with alternative verification options or NASBA verification service participation.

Long-term Licensing and Mobility Considerations

Consider where you might work in the future. If you plan to eventually practice in a specific US state, licensing there directly may be advantageous despite potentially stricter requirements. Most states have reciprocity agreements allowing licensed CPAs to practice across state lines, but initial licensing in a state with lenient requirements followed by transfer to a stricter state is a common strategy. However, some states have additional requirements for reciprocal licenses, so research your target state’s reciprocity rules before finalizing your initial state choice.

What is the CPA Exam Structure Under CPA Evolution 2024?

The CPA exam underwent its most significant transformation in decades when CPA Evolution launched in January 2024. Understanding the new exam structure is essential because preparation strategies, study timelines, and even your choice of which section to take first have all changed under the new format.

The redesigned exam moves away from the traditional four-section model toward a Core plus Discipline structure that allows candidates to demonstrate both foundational competency and specialized expertise aligned with their career interests.

The New Core Plus Discipline Model Explained

Under CPA Evolution, all candidates must pass three Core sections that test fundamental accounting and auditing knowledge. Additionally, each candidate selects one Discipline section from three options, allowing specialization in an area relevant to their intended career path. This structure acknowledges that modern CPAs often specialize rather than practice across all areas equally.

Core Sections: AUD, FAR, REG

The three Core sections test competencies that every CPA needs, regardless of specialization. Auditing and Attestation (AUD) covers audit procedures, attestation engagements, professional responsibilities, and ethics. Financial Accounting and Reporting (FAR) tests US GAAP, IFRS fundamentals, government accounting, and not-for-profit accounting. Regulation (REG) covers federal taxation, business law, and professional ethics. Each Core section is four hours long and includes multiple-choice questions and task-based simulations.

Discipline Options: BAR, ISC, TCP

The three Discipline options allow candidates to demonstrate deeper expertise in one area. Business Analysis and Reporting (BAR) focuses on technical accounting, financial statement analysis, and data analytics. Information Systems and Controls (ISC) covers IT governance, cybersecurity, system controls, and SOC engagements. Tax Compliance and Planning (TCP) tests advanced individual and entity taxation, tax planning strategies, and compliance. Each Discipline section is also four hours and includes MCQs, simulations, and in some cases, written communication tasks.

CPA Exam Format, Duration, and Scoring

Understanding the exam format helps you prepare effectively and manage your time during the actual test. Each section tests not just knowledge but also application and analysis skills through varied question types.

Question Types: MCQs, Task-Based Simulations, and Written Communication

Every exam section includes multiple-choice questions (MCQs) and task-based simulations (TBSs). MCQs test foundational knowledge and typically account for 50% of your score. TBSs present realistic work scenarios requiring you to analyze information, perform calculations, and make professional judgments, accounting for the remaining 50%. Certain sections include written communication tasks testing your ability to draft professional memos or letters.

The exam provides access to authoritative literature during TBS portions, so knowing how to research standards efficiently is a tested skill.

Passing Score Requirements and the 30-Month Testing Window

You must score 75 or higher on each section to pass, with scores ranging from 0 to 99. Importantly, this is not a percentage; the score represents your performance relative to the minimum competency standard set by the AICPA Board of Examiners.

Once you pass your first section, you have 30 months to pass the remaining three sections. If you fail to complete all sections within this window, your earliest passed section expires, and you must retake it. Some states offer a 36-month window, so verify your state’s specific rules.

Which Discipline Section Should Indian Candidates Choose?

Your discipline choice should align with your career goals and existing strengths. Since you only need to pass one discipline section, selecting strategically can improve both your pass probability and career positioning.

Aligning Discipline Choice with Career Goals

If you plan to work in tax, whether in compliance, planning, or advisory, TCP is the natural choice and builds directly on REG content.

If your career focuses on financial reporting, technical accounting, or data analytics roles common in Big 4 advisory practices, BAR aligns well. If you work in IT audit, SOC reporting, cybersecurity, or system implementation, ISC provides relevant specialization. Consider what you want to do after passing, not just what seems easiest.

Pass Rate Analysis and Preparation Considerations

The 2025 pass rate data from AICPA reveals significant differences across discipline sections. TCP has consistently shown the highest pass rates at approximately 78%, partly because candidates choosing TCP often have strong tax backgrounds from preparing for REG. ISC shows pass rates around 56%, while BAR has the lowest at approximately 41%. However, pass rates reflect the candidate pool as much as difficulty.

A candidate with a strong IT background may find ISC easier than TCP despite overall pass rate differences. Choose based on your strengths and career goals rather than chasing the highest pass rate.

What is the Complete Cost of Pursuing a CPA from India?

The total investment for CPA certification from India ranges from approximately ₹2,50,000 to ₹4,50,000, depending on your choices regarding evaluation agencies, state board, review courses, and whether you pass all sections on your first attempt. Understanding the complete cost breakdown helps you budget appropriately and avoid surprises during your CPA journey.

NASBA increased examination fees effective 2025, making current cost calculations essential for accurate budgeting. International candidates testing in India pay higher fees than domestic US candidates due to additional administration charges for operating international test centers. Here is the complete breakdown based on the current 2025 fee structures:

Credential Evaluation Fees: Evaluation agencies charge $115-$300 (₹10,000-₹27,000) depending on service level and processing speed. NIES, WES, and FACS are commonly used agencies with varying turnaround times and costs.

State Board Application Fees: Application fees vary by state from $90 to $245 (₹7,560-₹20,580). This one-time fee covers your initial eligibility determination.

Examination Fees (Per Section for India Testing): Candidates testing at Prometric centers in India pay approximately $510 per section, which includes both the standard examination fee and the international administration surcharge. Accordingly, the total examination fee for all four sections is about $2,040 (approximately ₹1.7–1.85 lakhs, depending on exchange rates). The commonly cited figure of $780 per section is incorrect, as it double-counts the international fee.

CPA Review Course: Quality review courses from providers like Becker, Wiley, Surgent, or Gleim range from $1,500 to $3,500 (₹1,26,000-₹2,94,000). Indian coaching institutes partnering with these providers may offer localized pricing and support.

Ethics Exam and Licensing Fees: Most states require an ethics exam costing $150-$320 (₹12,600-₹26,880) and charge licensing fees of $100-$500 (₹8,400-₹42,000).

Total Investment Range: Minimum scenario (passing all first attempt, budget review course): ₹2,50,000-₹3,00,000 Typical scenario (quality review course, some retakes): ₹3,50,000-₹4,00,000 Maximum scenario (premium review course, multiple retakes): ₹4,50,000+

How to Prepare for the CPA Exam While Working Full-Time in India?

Preparing for the CPA exam while managing a demanding job in India requires strategic planning rather than heroic effort. Most successful Indian CPAs complete their exams in 12-18 months while working full-time, but they do so by studying smart and maintaining consistency rather than cramming during random windows of availability.

The challenges specific to Indian professionals include managing IST timezone constraints for any live sessions, maintaining energy for evening study after long work days, and navigating busy seasons at Big 4 firms or month-end closes at corporate finance roles. Your preparation strategy must account for these realities.

Creating a Realistic Study Plan for Indian Professionals

Most CPA review courses recommend 300-400 total study hours across all four sections, translating to roughly 80-100 hours per section. For a working professional studying 15-20 hours per week, each section requires 5-7 weeks of dedicated preparation. Building in buffer time for unexpected work demands and review periods, a realistic timeline for all four sections is 12-18 months.

Structure your study schedule around your work patterns. If your job has predictable busy periods like quarter-ends or audit seasons, avoid scheduling exams during these windows. Many Indian candidates find that early morning study before work is more reliable than evening sessions when fatigue and unexpected work demands compete for attention. Whatever schedule you choose, consistency matters more than intensity. Studying 2 hours daily beats sporadic 8-hour weekend sessions.

Balancing CPA Preparation with Indian Work Schedules

Big 4 professionals in India face particular challenges during the busy season, which can stretch from January through March. Planning your exam schedule around these periods is essential. Consider targeting exam sections for April-December when workloads are more manageable, or front-load your studying during lighter periods so you can maintain minimal review during busy season without losing momentum.

Corporate finance professionals often face month-end and quarter-end crunches that temporarily consume all available time. Build your study calendar with these predictable busy periods blocked out. Some candidates negotiate with employers for study leave or flexible arrangements during the final weeks before an exam. If your employer values the CPA credential, they may accommodate reasonable requests, especially if you frame it as professional development benefiting the organization.

Choosing the Right CPA Review Course

Your review course is the most important investment after exam fees themselves. A good course provides structured learning, quality practice questions, simulated exam experience, and often the accountability that self-study lacks. With Indian candidates increasingly pursuing the CPA, several options cater specifically to this market.

Becker vs Wiley vs Surgent vs Gleim Comparison

Becker CPA Review is widely considered the gold standard, used by most Big 4 firms globally, and claiming that their prepared students achieve significantly higher pass rates than the national average. The premium pricing around $2,500-$3,500 reflects comprehensive content and a strong brand reputation. Wiley offers similarly comprehensive content at a lower price point with unlimited access until you pass. Surgent uses adaptive learning technology to customize study plans based on your performance, potentially reducing study time. Gleim provides extensive practice questions and detailed explanations at competitive pricing. Each course has strengths; your choice depends on learning style, budget, and whether your employer provides access to a specific platform.

Indian Coaching Institutes: Miles, Simandhar, and SkillArbitrage

Indian coaching institutes provide localized support, including live classes in IST, mentorship from CPAs who understand the Indian candidate journey, and assistance with the application process. Miles Education claims that 80% of licensed CPAs in India are their alumni, offering comprehensive programs including Becker materials with Indian faculty support. Simandhar Education partners officially with Becker and provides classroom coaching in multiple Indian cities.

SkillArbitrage offers the CPA Prep and Global Finance Career Acceleration Program, combining CPA preparation with career placement support and practical skills training designed specifically for Indian professionals targeting Big 4 and multinational finance roles. These institutes often provide value beyond just exam prep through application guidance, experience verification support, and job placement assistance.

Exam Sequencing Strategy and Scheduling Tips

The order in which you take exam sections can impact your momentum and success probability. There is no universally correct sequence, but strategic sequencing based on your background improves outcomes.

Which Section to Take First Based on Your Background

Many advisors recommend starting with FAR because it is content-heavy and foundational to other sections. Passing FAR first builds confidence and starts your 30-month clock with the most demanding section behind you. However, if you have a strong tax background from CA or prior tax work, starting with REG may be easier and build momentum through an early success. If you work in audit, AUD may feel most familiar. The key is not following generic advice but honestly assessing which section plays to your strengths while being substantial enough that passing it first gives you genuine confidence.

Strategic Use of Continuous Testing Windows

Under CPA Evolution, Core sections (AUD, FAR, REG) are available year-round through continuous testing, meaning you can schedule whenever Prometric has availability rather than waiting for specific testing windows. Discipline sections (BAR, ISC, TCP) are offered only during the first month of each quarter. Plan your exam sequence with this constraint in mind. Many candidates complete Core sections first with their flexible scheduling, then target a discipline section during its quarterly window. This approach maximizes scheduling flexibility while ensuring you don’t miss discipline testing opportunities.

What is the Step-by-Step CPA Application Process for Indian Candidates?

The CPA application process involves multiple organizations and sequential steps that must be completed correctly to avoid delays. Understanding the complete workflow helps you plan your timeline and avoid common mistakes that set candidates back by weeks or months.

The process begins with credential evaluation, proceeds through state board application, advances to NTS issuance and exam scheduling, and concludes with post-exam licensing requirements. Each stage has specific requirements and typical timelines that Indian candidates should anticipate.

Credential Evaluation: Getting Your Indian Degree Assessed

Before any state board will consider your application, you need an evaluation report from an approved credential evaluation agency assessing your Indian education against US standards. The three most commonly used agencies are NASBA International Evaluation Services (NIES), World Education Services (WES), and Foreign Academic Credentials Service (FACS). Your state board’s requirements determine which agencies are acceptable; some states only accept NIES, while others allow multiple options.

The evaluation process requires submitting official transcripts, degree certificates, and mark sheets directly from your Indian universities to the evaluation agency. Plan for 4-8 weeks processing time under standard service, though expedited options exist for additional fees. Ensure your name appears consistently across all documents, and follow agency instructions precisely regarding attested copies, sealed envelopes, and translation requirements for any documents not in English.

Applying to Your Chosen State Board

Once you have your credential evaluation report, you can apply to your chosen state board through NASBA CPA Central or directly through the state board’s application system, depending on the jurisdiction. Your application includes personal information, education details supported by your evaluation report, and payment of application fees. Some states require additional documentation, such as passport copies or background check authorization.

Review your application carefully before submission. Errors or incomplete information cause delays and may require resubmission with additional fees. The state board reviews your application against its eligibility requirements and determines which exam sections you are approved to take. Processing times vary by state from 2-8 weeks. Once approved, you receive authorization to proceed with exam registration.

From NTS to Prometric Scheduling

After state board approval, you pay examination fees through NASBA and receive your Notice to Schedule (NTS). This document authorizes you to schedule your approved exam sections at Prometric testing centers. Your NTS has a validity period, typically 6 months, during which you must take your scheduled sections or forfeit those fees.

For Indian candidates, you must also pay the international administration fee for each section you plan to take in India. Once fees are processed, you can schedule through Prometric’s website, selecting from the eight Indian testing centers: Ahmedabad, Bangalore, Calcutta, Chennai, Hyderabad, Mumbai, New Delhi, and Trivandrum.

Schedule early for preferred dates, as popular centers and times fill up quickly. Arrive at your exam with your NTS, valid passport, and your confirmation email.

Post-Exam Steps: Ethics Exam and Licensing

Passing all four exam sections is a major milestone, but not the final step. Most states require passing an ethics exam, typically the AICPA Professional Ethics exam, which is an open-book self-study course and examination costing $150-$320. This requirement ensures licensed CPAs understand professional responsibilities and ethical obligations.

The experience requirement must also be fulfilled for licensing. Depending on your state, you need 1-2 years of accounting experience verified by a licensed CPA or through alternative verification pathways.

For Indian candidates not working directly under a US CPA, states offering NASBA’s experience verification service provide a viable path. Once education, examination, ethics, and experience requirements are met, you submit your license application, pay licensing fees, and upon approval, become a licensed Certified Public Accountant.

Conclusion

The US CPA credential represents a significant but achievable goal for Indian professionals committed to advancing their careers in global finance and accounting. Throughout this guide, you have seen that eligibility pathways exist for most Indian qualifications, strategic state selection can simplify your licensing journey, and the new CPA Evolution exam structure offers flexibility in how you demonstrate competency.

The investment of ₹2.5-4.5 lakhs and 12-18 months of dedicated preparation yields returns through higher salaries, expanded career opportunities, and access to roles in Big 4 GCCs, multinational corporations, and potentially the US job market.

Your next step is to get your credentials evaluated, choose your state board strategically based on your specific situation, and begin preparation with a realistic study plan that accounts for your work schedule. The path is clear, and thousands of Indian professionals have walked it successfully. Your turn begins with the first step.

To understand the overall CPA journey, you can also refer to this detailed guide on the Certified Public Accountant (CPA) Exam in USA.

Frequently Asked Questions About US CPA Exam for Indian Professionals

Can I pursue US CPA with only a 3-year B.Com degree from India?

A 3-year B.Com alone typically provides only 90 credit hours, while most states require 120 hours to sit for the exam and 150 for licensure. You will need additional qualifications such as M.Com, MBA, CA, or supplementary coursework from accredited institutions to meet eligibility requirements.

Do I need to be an Indian CA before attempting the US CPA exam?

No, the CA qualification is not a prerequisite for CPA. While many Indian CPAs also hold CA, plenty of candidates qualify through M.Com, MBA, or other educational pathways. The CA can help bridge credit hour gaps but is neither required nor sufficient on its own for CPA eligibility.

Which US state is best for Indian candidates without an SSN?

Alaska, Montana, and Guam are popular choices for candidates without Social Security Numbers as they do not require SSN for exam application. Guam additionally offers flexible experience verification through NASBA’s service, making it particularly attractive for international candidates.

How many credit hours does an Indian B.Com degree provide?

A three-year Indian B.Com typically translates to 90 US semester credit hours, calculated at 30 credits per academic year. However, exact credit determination depends on your credential evaluation agency’s assessment of your specific transcripts and coursework.

What is the total cost of CPA in Indian Rupees?

Total CPA costs range from ₹2,50,000 to ₹4,50,000 depending on your choices. This includes credential evaluation (₹17,000-34,000), state application (₹7,500-20,500), exam fees for four sections tested in India (₹2,62,000), review course (₹1,26,000-2,94,000), and ethics plus licensing fees (₹21,000-69,000).

Can I take the CPA exam in India or do I need to travel to the US?

Yes, you can take the CPA exam in India at eight Prometric testing centers located in Ahmedabad, Bangalore, Calcutta, Chennai, Hyderabad, Mumbai, New Delhi, and Trivandrum. International testing requires additional administration fees but eliminates the need to travel to the United States.

How long does it take to complete the CPA from India while working?

Most working professionals in India complete all four CPA exam sections in 12-18 months while maintaining full-time employment. This timeline assumes 15-20 hours of weekly study and may extend during busy seasons or if retakes are needed.

What is the difference between CPA and CA in terms of difficulty?

Both are rigorous professional certifications with different focus areas. CA involves 18 papers across three levels over approximately 5 years with historically low pass rates. CPA involves 4 sections over 12-18 months with approximately 50% average pass rates. CPA focuses on US GAAP and US tax law while CA covers Indian standards. Direct difficulty comparison is subjective and depends on individual background.

Which CPA discipline section (BAR, ISC, or TCP) should I choose?

Choose based on career goals and existing strengths. TCP shows the highest pass rates (78%) and suits those pursuing tax careers. BAR aligns with financial reporting and advisory roles. ISC fits IT audit and cybersecurity career paths. Select what matches your intended specialization rather than chasing pass rates alone.

Do I need work experience under a US CPA to get licensed?

Most states require experience verification by a licensed CPA, but options exist for international candidates. Some states accept verification from CPA-equivalent professionals like CAs. States participating in NASBA’s experience verification service can evaluate and verify qualifying experience even without direct CPA supervision.

What happens if I fail a CPA exam section?

You can retake failed sections as soon as score release occurs, subject to paying examination fees again. Under continuous testing for Core sections, you can reschedule relatively quickly. There is no limit on retake attempts, but all sections must be passed within 30 months of your first passed section.

Is the US CPA license valid in India?

The US CPA license is recognized globally but does not grant signing authority for statutory audits in India, which requires Indian CA certification. However, the CPA credential is highly valued by multinational employers in India for roles involving US GAAP reporting, SEC compliance, and cross-border transactions.

Can I use my Indian CA articleship as CPA work experience?

CA articleship may count toward CPA experience requirements depending on your state board’s rules and how the experience is verified. States with flexible verification options or NASBA’s experience verification service may accept qualifying articleship experience. Confirm with your specific state board before relying on this pathway.

What are the CPA exam pass rates?

According to AICPA data for 2025, pass rates vary by section: AUD approximately 48%, FAR approximately 43%, REG approximately 64%, BAR approximately 41%, ISC approximately 56%, and TCP approximately 78%. The overall average across all sections is approximately 50%, with only about 20% of candidates passing all four sections on their first attempt.

How do I maintain my CPA license after passing the exam?

Licensed CPAs must complete Continuing Professional Education (CPE) credits to maintain their license, typically 40 hours annually or 80 hours biennially, depending on state requirements. CPE requirements ensure CPAs stay current with accounting standards, regulations, and professional developments throughout their careers.

Allow notifications

Allow notifications