Comprehensive guide to the role of independent directors under Companies Act 2013 and SEBI regulations—covering ethical standards, board oversight, committee functions, duties, and practical challenges in corporate governance.

Table of Contents

Independent directors serve as the cornerstone of corporate governance by bringing objective oversight and independent judgment to the boardroom. As outlined in Schedule IV of the Companies Act, 2013, their role extends beyond advisory participation — they evaluate management performance, scrutinise financial integrity, and ensure that risk management and internal controls function effectively. They are expected to safeguard stakeholder interests, promote transparency, and uphold ethical conduct in the company’s operations.

Under Regulation 25 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, independent directors are assigned defined obligations — including participation in at least one exclusive meeting of independent directors each year, undergoing familiarisation programmes, and ensuring that board decisions align with shareholder interests. Regulation 25 also anchors their involvement in key board committees such as the audit, nomination and remuneration, and stakeholder relationship committees, reinforcing their monitoring and governance role.

Together, the Companies Act and SEBI’s regulatory framework position independent directors as the guardians of board independence — professionals who ensure that management actions remain ethical, transparent, and accountable to shareholders and society at large.

To understand the eligibility, registration process, and practical roadmap to join a board, read our detailed guide on How to Become an Independent Director.

What is the role of independent directors in corporate governance?

Independent directors serve as the critical bridge between company management and shareholders, particularly protecting minority shareholders who lack the power to influence board decisions directly.

Their importance stems from their ability to provide unbiased oversight of management performance, challenge executive decisions constructively, and ensure that corporate strategies serve long-term stakeholder interests rather than short-term management gains. In the Indian corporate landscape, where promoter-dominated boards are common, independent directors act as watchdogs who prevent conflicts of interest, curb excessive risk-taking, and maintain checks on executive power.

The significance of independent directors became particularly evident after major corporate scandals like Satyam Computer Services (2009) and IL&FS crisis (2018), where inadequate board oversight led to massive governance failures affecting thousands of stakeholders.

These instances reinforced that independent directors are not merely statutory requirements but essential governance pillars who safeguard financial integrity, ensure ethical conduct, and provide strategic guidance grounded in broader industry experience.

Their role extends beyond compliance monitoring to active participation in shaping corporate vision, evaluating management effectiveness, and ensuring that companies operate with the trust and confidence of investors, regulators, and the public at large.

Role of independent director: based on ethical and professional standards

How should independent directors maintain integrity and objectivity in their role?

Schedule IV of the Companies Act, 2013, mandates that independent directors must uphold ethical standards of integrity and probity in all board dealings, which means consistently demonstrating honesty, moral soundness, and adherence to the highest professional principles. This requires independent directors to base their decisions solely on facts, analysis, and company interest rather than personal relationships, external pressures, or individual financial gains. Maintaining integrity involves refusing to compromise on ethical standards even when facing pressure from promoters, executive directors, or influential shareholders who may seek favorable board decisions.

Objectivity in the independent director’s role means evaluating every proposal, transaction, and strategic decision through an impartial lens that considers all stakeholder perspectives without bias. According to Part I of Schedule IV, independent directors must act constructively and objectively while exercising their duties, which translates to making informed judgments based on merit rather than predetermined positions or loyalty to management. This objectivity is particularly crucial when reviewing related party transactions, executive compensation proposals, or strategic decisions where management may have conflicts of interest, ensuring that board deliberations reflect balanced assessment rather than rubber-stamping executive recommendations.

How can independent directors avoid conflicts of interest?

Independent directors must proactively identify and disclose any situation where their personal, financial, or professional interests could potentially conflict with their fiduciary duty to the company (which includes consideration of shareholder interests). Section 149(6) of the Companies Act establishes stringent criteria to prevent pecuniary relationships exceeding specified thresholds, family connections with promoters or management, and professional associations that could compromise independence. Beyond statutory disqualifications, directors should voluntarily recuse themselves from board discussions and decisions where they have even indirect interests, such as transactions with companies where they serve in advisory capacities or have familial relationships with key decision-makers.

The practical implementation of conflict avoidance requires independent directors to maintain transparent communication with the board regarding their external affiliations, investments, and relationships that could create real or perceived conflicts. Schedule IV specifically prohibits independent directors from abusing their position to gain direct or indirect personal advantage or advantage for any associated person. This means declining opportunities to leverage board information for personal investments, avoiding business dealings with company suppliers or customers where they could benefit disproportionately, and ensuring that their independence remains unquestionable both in substance and perception throughout their tenure on the board.

What actions can compromise an independent director’s independence?

Several actions can fundamentally undermine an independent director’s independence, with financial relationships topping the list—accepting consulting fees, advisory payments, or any remuneration beyond sitting fees and commission approved by shareholders creates financial dependency that clouds judgment. Developing close personal relationships with promoters, executive directors, or key management personnel can subtly shift loyalties from shareholders to management, particularly when these relationships involve social obligations, reciprocal favors, or emotional attachments that make objective criticism difficult. Additionally, taking on excessive directorships in group companies or related entities creates complex webs of relationships where independent judgment becomes compromised by overlapping interests.

As provided in Part I(8) of Schedule IV, an independent director must immediately inform the Board if circumstances arise which affect his independence status, such as accepting a business contract from the company, family members joining company management, or acquiring shareholding exceeding prescribed limits.

Other compromising actions include participating in decisions where they lack adequate information or expertise, failing to question management assertions critically, consistently siding with management in board votes without substantive reasoning, or allowing extraneous considerations—such as fear of non-reappointment or desire to maintain cordial relations—to influence their independent judgment. Schedule IV explicitly requires independent directors to refrain from any action that would lead to loss of independence, making it their personal responsibility to guard their impartiality vigilantly.

How should independent directors exercise independent judgment?

Exercising independent judgment requires independent directors to develop informed opinions based on comprehensive analysis of information provided, supplemented by their own research, industry knowledge, and professional expertise rather than simply accepting management recommendations at face value. Schedule IV provides that independent directors not allow any extraneous considerations to vitiate their exercise of objective independent judgment in the paramount interest of the company, which means systematically questioning assumptions, demanding data to support proposals, and evaluating decisions against multiple criteria including legal compliance, financial prudence, strategic alignment, and stakeholder impact. This involves actively participating in board discussions by raising alternative perspectives, playing devil’s advocate when necessary, and ensuring that critical decisions receive thorough deliberation rather than rushed approval.

Independent judgment manifests in the willingness to dissent from collective board decisions when an independent director genuinely believes a proposal is not in the company’s best interest, with Schedule IV explicitly provides that directors should ensure their dissent is recorded in the minutes. This doesn’t mean being contrarian for its own sake, but rather exercising professional skepticism—particularly regarding aggressive accounting policies, ambitious revenue projections, related party transactions, or strategic moves that carry disproportionate risks. Independent directors must balance constructive support for management initiatives with vigilant oversight, asking probing questions about implementation plans, downside scenarios, competitive responses, and contingency measures while ensuring their judgment remains grounded in the company’s long-term sustainable success rather than short-term performance metrics that may pressure management to take excessive risks.

For a detailed explanation of statutory provisions defining their appointment, independence criteria, and tenure, refer to our article on Independent Director under the Companies Act.

What is the role of Independent director under Regulation 25 of SEBI LODR

Regulation 25 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, gives operational form to the ethical and professional expectations laid down in Schedule IV of the Companies Act, 2013.

It defines how independent directors must function in listed entities—how they meet, assess, question, report, and protect. These obligations ensure that independence is not a passive title but an active governance discipline rooted in accountability, diligence, and continuous learning.

Where Schedule IV articulates the spirit of independence, Regulation 25 prescribes its practice: periodic meetings without management presence, evaluation of information flow and board performance, self-declaration of independence, participation in familiarisation programmes, and coverage through D&O insurance. Collectively, these duties create a measurable, enforceable standard of board conduct.

Exclusive meetings and board evaluation

Regulation 25(3)–(4) institutionalises a forum where independent directors meet at least once every financial year without management or non-independent directors.

Within these sessions they evaluate the performance of the chairperson, review the functioning of the board, and assess whether information from management is adequate, timely, and reliable.This mechanism converts independence into structured oversight.

It gives directors the space to exchange candid views, identify governance lapses, and recalibrate the board’s strategic and ethical focus—strengthening their collective role as the conscience of the company rather than silent observers.

Duty of diligence and liability standard

Regulation 25(5) clarifies that independent directors are liable only for acts or omissions that occur with their knowledge, consent, or connivance, or where they fail to act diligently. This provision mirrors Section 149(12) of the Companies Act while adapting it to the securities-market context.

It emphasises that diligence is not optional—it is the threshold for protection. Independent directors must ask questions, insist on evidence, and record dissent when required.

As long as their oversight is informed and documented, the regulation shields them from liability for management decisions beyond their control.

Continuous familiarisation and competence

Under Regulation 25(7), listed entities must familiarise independent directors with the company’s industry, business model, and governance framework. This obligation transforms competence into a continuous process rather than a one-time induction.

Through periodic briefings, site visits, and industry updates, independent directors maintain the contextual knowledge needed to exercise meaningful oversight. It ensures that their independence is reinforced by understanding—so they can challenge management from a position of insight, not distance.

Annual declarations and verification of independence

Regulation 25(8)–(9) requires every independent director to declare, at the first board meeting of each financial year or upon any change of circumstances, that they continue to meet independence criteria and remain free from external influence. The board must then verify and record the authenticity of such declarations.

This two-step mechanism keeps independence under active supervision. It prevents complacency and ensures that both the director and the board remain alert to evolving conflicts, preserving the integrity of governance throughout the director’s tenure.

Protection through D&O Insurance

Regulation 25(10) mandates that the top 1,000 listed entities and all high-value debt-listed entities obtain Directors and Officers insurance for their independent directors. This safeguard acknowledges that diligent directors can still face exposure in complex corporate disputes.

D&O insurance provides financial security that encourages capable professionals to serve without fear of personal loss, thereby enhancing board diversity and quality. It complements the duty-based framework of Regulation 25 by offering practical protection for those who discharge their responsibilities in good faith.

How does the role of independent director strengthen board oversight and performance?

What is the role of independent director in strategic and risk oversight?

Independent directors bring external perspectives and cross-industry experience that enriches strategic discussions, helping boards evaluate whether proposed strategies are realistic, aligned with market trends, and supported by adequate resources and capabilities. Under Schedule IV, Part II(1), independent directors must help bring independent judgment to bear on board deliberations especially on issues of strategy, ensuring that strategic plans undergo rigorous scrutiny regarding assumptions, competitive positioning, execution feasibility, and alignment with stakeholder expectations. They challenge management to think beyond incremental approaches, question whether strategies adequately address emerging disruptions, and ensure that strategic choices reflect balanced consideration of growth opportunities against risk exposures.

In risk oversight, independent directors play a crucial role in ensuring companies maintain robust risk management frameworks that identify, assess, and mitigate material risks across operational, financial, regulatory, reputational, and strategic domains. Their role extends beyond reviewing risk reports to questioning whether risk assessment methodologies are comprehensive, risk appetites are appropriately calibrated, and risk mitigation measures are effectively implemented. Independent directors must satisfy themselves that risk management systems are defensible under Schedule IV, Part II(4), which requires active engagement with chief risk officers, internal audit teams, and management to understand the full spectrum of risks facing the company and ensuring that board-level risk committees receive complete, accurate information to make informed oversight decisions.

How do independent directors safeguard financial integrity?

Independent directors safeguard financial integrity by scrutinizing financial statements, accounting policies, and internal control systems to ensure they provide accurate, complete, and timely representation of the company’s financial position and performance. Schedule IV, Part II(4) explicitly requires independent directors to satisfy themselves on the integrity of financial information presented to the board, which means going beyond accepting audited financials at face value to understanding the accounting judgments underlying revenue recognition, asset valuations, provisioning policies, and contingent liability disclosures. This involves reviewing quarterly financial results before board approval, questioning deviations from previous accounting treatments, and ensuring that financial reporting reflects economic substance rather than legal form manipulation.

The role extends to ensuring that financial controls and systems of risk management are robust and defensible, requiring independent directors to evaluate the effectiveness of internal audit functions, statutory audit processes, and compliance monitoring mechanisms. Through their mandatory participation in audit committees under Section 177 of the Companies Act, independent directors directly oversee the appointment of statutory auditors, review audit plans and findings, assess management responses to audit observations, and ensure that material weaknesses in internal controls receive prompt remedial action. They must maintain ongoing dialogue with auditors regarding significant accounting matters, going concern assumptions, related party transactions, and any attempts by management to influence audit opinions, thereby creating a check on potential financial misrepresentation or fraud.

What is the role of independent directors in evaluating executive performance and remuneration?

Independent directors bear primary responsibility for objectively evaluating the performance of executive directors and key management personnel against pre-defined goals, key performance indicators, and strategic milestones agreed at the beginning of each financial year. Under Schedule IV, Part II(3), they must scrutinize the performance of management in meeting agreed goals and objectives, monitoring whether executives deliver on commitments regarding revenue targets, profitability metrics, operational efficiency improvements, strategic initiative implementation, and governance compliance. This evaluation must be evidence-based rather than subjective, requiring independent directors to review management dashboards, operational reports, customer feedback, employee engagement scores, and competitive benchmarking data to form comprehensive assessments.

The role in executive remuneration stems from Schedule IV, Part II(7), which assigns independent directors the prime role in determining appropriate levels of remuneration for executive directors, key managerial personnel, and senior management through their leadership of nomination and remuneration committees. Independent directors ensure that compensation structures align with company performance, industry benchmarks, and long-term value creation rather than rewarding short-term results achieved through excessive risk-taking or accounting manipulation. They design pay-for-performance frameworks that balance fixed and variable compensation, incorporate clawback provisions, link equity grants to sustained performance metrics, and ensure that executive pay remains reasonable relative to median employee compensation, thereby preventing excessive payouts that don’t correlate with genuine value creation for shareholders.

How do independent directors protect stakeholder interests?

Independent directors serve as guardians of stakeholder interests, particularly minority shareholders who lack direct representation or influence over board decisions, by ensuring that corporate actions serve the collective interest rather than benefiting controlling shareholders or management at the expense of smaller investors. Schedule IV, Part II(5) explicitly mandates that independent directors safeguard the interests of all stakeholders, particularly minority shareholders, which requires vigilance against oppression of minority rights through dilutive equity issuances, related party transactions at unfavorable terms, dividend policies that prioritize promoter interests, or corporate restructurings that transfer value from minority to controlling shareholders. They must scrutinize every board proposal through the lens of its impact on different stakeholder groups, questioning whether decisions are equitable and transparent.

Beyond shareholders, independent directors consider the legitimate interests of employees, creditors, customers, suppliers, communities, and other stakeholders whose welfare depends on sound corporate governance and sustainable business practices. Under Schedule IV, Part II(6), they must balance conflicting interests of stakeholders, which requires making nuanced judgments when different groups have competing claims—such as balancing employee job security concerns against efficiency measures needed to maintain competitiveness, or weighing creditor protection requirements against shareholder return expectations. Independent directors ensure that boards adopt stakeholder-inclusive decision-making approaches that consider long-term sustainability over short-term gains, promote ethical business conduct that maintains stakeholder trust, and create governance mechanisms where stakeholder concerns receive fair hearing and appropriate consideration in corporate strategy.

What role do independent directors play in executive remuneration?

Independent directors exercise decisive influence over executive remuneration policies and individual compensation packages through their constitutionally mandated majority in nomination and remuneration committees established under Section 178 of the Companies Act.

Their role encompasses designing comprehensive remuneration policies that establish clear linkages between pay and performance, defining appropriate peer groups for benchmarking compensation levels, determining the mix of fixed salary, performance bonuses, long-term incentives, and benefits, and ensuring that remuneration structures incentivize behaviors aligned with company values and strategic objectives. This responsibility requires independent directors to stay informed about industry compensation trends, regulatory requirements, shareholder expectations, and emerging best practices in executive pay design.

In practical terms, independent directors review and approve annual compensation proposals for managing directors, whole-time directors, and key managerial personnel, ensuring that variable pay outcomes genuinely reflect performance achievement against predetermined objectives rather than discretionary awards disconnected from results.

Schedule IV, Part II(7) assigns them the prime role in appointing and, where necessary, recommending removal of executive directors and key management personnel based on performance evaluations, which creates accountability for executives to deliver on commitments. Independent directors must also ensure compensation disclosures meet regulatory requirements under the Companies Act and SEBI LODR Regulations, maintaining transparency with shareholders about pay ratios, performance metrics, and the rationale behind significant compensation decisions or changes in remuneration policies.

How do independent directors moderate board conflicts?

Independent directors serve as neutral arbiters when conflicts arise between different board factions, between management and shareholders, or among various stakeholder groups with competing interests, using their impartial position to facilitate constructive dialogue and find solutions that serve the company’s overall best interest. Schedule IV, Part II(8) specifically requires independent directors to moderate and arbitrate in the interest of the company as a whole in situations of conflict between management and shareholder interests, which may arise when shareholders seek higher dividends while management wants to retain profits for reinvestment, or when shareholders demand management changes while the board supports executive continuity. Their mediation role requires deep understanding of both perspectives, ability to identify common ground, and credibility to propose compromises that different parties will accept.

The moderation function becomes particularly critical during board crises such as disputes between promoter groups, disagreements over succession planning, or conflicts regarding strategic direction where directors align with different camps.

Independent directors must navigate these situations by facilitating evidence-based discussions, ensuring all viewpoints receive fair hearing, preventing personal animosities from derailing governance, and building consensus around decisions that advance long-term corporate interests regardless of whose preferred option prevails. They may need to convene separate meetings of independent directors under Schedule IV, Part VII to assess situations without management presence, provide confidential counsel to conflicting parties, or in extreme cases, recommend governance interventions including leadership changes when conflicts become irreconcilable and threaten company stability.

Duties and responsibilities of independent directors?

Independent directors are entrusted with a wide range of duties and responsibilities that ensure ethical governance, transparency, and accountability in corporate affairs. Their conduct is guided by Schedule IV of the Companies Act, 2013, which outlines how they must perform their functions with integrity, diligence, and independence.

What training and development obligations do independent directors have?

Independent directors carry an ongoing responsibility under Schedule IV, Part III(1) to undertake appropriate induction when joining a board and regularly update and refresh their skills, knowledge, and familiarity with the company throughout their tenure. Effective induction involves comprehensive orientation to the company’s business model, competitive landscape, financial position, key operational processes, regulatory environment, major risks, governance framework, and introduction to senior management beyond board members.

This induction should extend beyond formal presentations to include facility visits, interactions with business unit heads, review of historical board minutes, understanding of past strategic decisions and their outcomes, and immersion in the company’s culture and values that shape decision-making.

Ongoing development requires independent directors to continuously enhance their understanding of evolving industry dynamics, emerging regulatory requirements, technological disruptions affecting the business, and governance best practices that could strengthen board effectiveness.

They should participate in specialized director development programs covering areas like financial reporting standards, risk management frameworks, digital transformation, cybersecurity governance, ESG reporting, and board evaluation processes. Additionally, independent directors must invest time in company-specific learning by reviewing management information packs thoroughly before meetings, staying informed about competitor actions and industry trends, engaging with external stakeholders including customers and suppliers when possible, and seeking deep dives into specific business areas through management presentations scheduled between formal board meetings.

Those preparing for board positions can also explore the Independent Director Exam, which assesses proficiency under the IICA framework and is a key step toward inclusion in the official databank.

How should independent directors seek information and advice?

Schedule IV, Part III(2) explicitly empowers independent directors to seek appropriate clarification or amplification of information presented to the board and, where necessary, take and follow appropriate professional advice and opinion of outside experts at company expense. This means independent directors should never hesitate to ask management detailed questions about proposals, request additional data or analysis to support decision-making, challenge assumptions underlying financial projections or business cases, and demand clarification when presentations contain technical jargon or incomplete information. The right to seek clarification extends to requesting one-on-one sessions with functional heads, commissioning detailed reports on specific topics, or scheduling special presentations that provide deeper context than time-constrained board meetings allow.

When board matters involve complex technical, legal, financial, or industry-specific issues beyond directors’ expertise, they have both the right and responsibility to engage independent external advisors who can provide objective expert opinions that inform board judgment.

This could include retaining independent valuers for merger transactions, engaging legal counsel for regulatory compliance matters, commissioning technical experts for evaluation of capital projects, or appointing special auditors when financial irregularities are suspected. Independent directors should exercise this authority particularly when they have concerns about management recommendations, when proposals involve conflicts of interest, or when they need to verify information provided by management against independent sources, ensuring their decisions rest on the most reliable, comprehensive information available rather than solely depending on management presentations.

How many meetings are expected from independent directors?

Independent directors must demonstrate strong commitment to their responsibilities through consistent attendance at board meetings, committee meetings where they serve, and general meetings of shareholders, recognizing that physical presence and active participation are fundamental to effective governance. Schedule IV, Part III(3) requires independent directors to strive to attend all meetings of the Board of Directors and board committees of which they are members, reflecting the expectation that directorship is not a passive role but requires regular engagement with company affairs.

The Companies Act mandates that independent directors attend at least one board meeting in person during each financial year, though best practice suggests attending most meetings physically rather than relying predominantly on video conferencing, as in-person interactions facilitate richer discussions, stronger board relationships, and better understanding of management dynamics.

Beyond formal meeting attendance, independent directors should allocate sufficient time for pre-meeting preparation, which involves reviewing board packs thoroughly, analyzing supporting documents, consulting external sources for context, and preparing questions or concerns to raise during discussions. Schedule IV, Part III(5) similarly encourages independent directors to strive to attend general meetings of the company, where their presence signals board accountability to shareholders, provides opportunities to understand shareholder perspectives directly, and allows them to address shareholder concerns regarding governance matters.

Consistent attendance patterns also build credibility with fellow directors and management, demonstrating that independent directors take their fiduciary responsibilities seriously and are genuinely invested in the company’s success rather than treating directorships as nominal positions that deliver fees for minimal effort.

How should independent directors participate in board committees?

Independent directors must engage actively and constructively in board committee deliberations, recognizing that committees perform detailed work on specialized governance areas that the full board relies upon for informed decision-making. Schedule IV, Part III(4) mandates that independent directors participate constructively and actively in committees of the board in which they are chairpersons or members, which means coming prepared with thorough review of committee papers, contributing substantive insights based on expertise, asking probing questions that uncover risks or gaps in proposals, and ensuring committee recommendations to the full board are comprehensive and well-reasoned. Active participation requires more than attendance—it demands intellectual engagement, willingness to challenge conventional thinking, and commitment to ensuring committees fulfill their mandates effectively.

When serving as committee chairpersons, independent directors bear enhanced responsibilities for setting committee agendas in consultation with management, ensuring meetings are scheduled with adequate frequency, facilitating inclusive discussions that leverage diverse member perspectives, monitoring that committee decisions are implemented, and reporting committee activities comprehensively to the full board. The Companies Act mandates independent director chairpersonship for certain committees like audit and nomination-remuneration committees, reflecting their crucial governance role. Committee chairs must balance efficiency with thoroughness, create environments where all members feel comfortable raising concerns, manage potential conflicts among committee members diplomatically, and ensure committee work products meet high standards of rigor that the full board and external stakeholders can rely upon.

How should independent directors handle concerns about company operations?

Independent directors must proactively voice concerns about any aspect of company operations, proposed actions, or governance practices that they believe could harm the company, stakeholders, or violate legal or ethical standards, rather than remaining silent for fear of being perceived as difficult or contrarian. Schedule IV, Part III(6) requires independent directors, where they have concerns about the running of the company or a proposed action, to ensure that these concerns are addressed by the board and, to the extent they are not resolved, insist that their concerns are recorded in the minutes of the board meeting. This procedural requirement creates an important accountability mechanism—concerns documented in minutes become part of the corporate record, protecting independent directors from later allegations that they failed to raise red flags while simultaneously pressuring the board to take concerns seriously.

When concerns arise, independent directors should first raise them during board discussions, providing specific reasoning, evidence, and alternative recommendations rather than vague objections that can be easily dismissed.

If the board proceeds despite unresolved concerns, independent directors have several escalation options depending on severity:

- requesting that dissenting views be recorded in minutes,

- calling for special board meetings to discuss matters in greater depth,

- convening independent director meetings without management presence to assess whether collective action is needed, or

- in extreme cases where concerns relate to fraud, legal violations, or fundamental governance breakdowns, considering resignation along with detailed explanation submitted to the company and regulatory authorities under Section 168(2) of the Companies Act that flags the issues prompting departure.

What due diligence is required for related party transactions?

Independent directors must exercise heightened scrutiny of related party transactions (RPTs) given their potential to transfer value from the company to related parties at minority shareholders’ expense, treating each RPT as requiring proof of fairness rather than presuming management’s good faith. Schedule IV, Part III(9) mandates that independent directors pay sufficient attention and ensure adequate deliberations are held before approving related party transactions, and assure themselves that the transactions are in the company’s interest. This requires independent directors to obtain comprehensive information about each proposed RPT including transaction terms, commercial rationale, valuation basis, comparison with market terms for similar transactions, evaluation of alternatives, and analysis of why transacting with a related party serves the company better than dealing with independent third parties.

The due diligence process should include obtaining independent valuations for material RPTs, engaging external advisors when transactions involve complex assets or specialized businesses, reviewing comparable transaction data to verify that pricing and terms are at arm’s length, and ensuring that audit committees specifically approve or reject RPTs based on detailed assessments rather than perfunctory reviews. Under Section 188 of the Companies Act and Regulation 23 of SEBI LODR Regulations, independent directors must ensure that related parties abstain from voting on RPT approvals, that material RPTs receive shareholder approval with disinterested shareholder voting, and that RPT disclosures in financial statements and board reports provide complete transparency about the nature, value, and justification for such transactions, maintaining vigilance against RPTs becoming channels for siphoning company resources to benefit related parties.

What reporting obligations do independent directors have?

Independent directors carry explicit reporting obligations under Schedule IV, Part III(11) to report concerns about unethical behavior, actual or suspected fraud, or violations of the company’s code of conduct or ethics policy through appropriate channels including audit committees, vigil mechanisms, or directly to regulatory authorities when warranted. This whistleblowing responsibility extends beyond personal knowledge to include situations where they receive credible complaints from employees or other stakeholders, observe red flags suggesting financial irregularities, or detect patterns of conduct that violate regulatory requirements or governance standards. Independent directors should not wait for conclusive proof before reporting concerns—reasonable suspicions based on circumstantial evidence, anonymous complaints that appear credible, or audit findings that suggest deeper problems all trigger the reporting obligation.

The reporting framework operates at multiple levels: routine reporting through committee structures like audit committees that review internal audit findings, compliance reports, and legal proceedings; escalated reporting when initial concerns don’t receive adequate management response, potentially triggering special investigations or engagement of forensic auditors; and regulatory reporting in extreme circumstances where independent directors determine that fraud or serious misconduct is occurring and company management or the board is complicit or unresponsive.

While Section 143(12) imposes a reporting duty on auditors, independent directors may, where appropriate, cause the matter to be examined by the audit committee or bring it to the attention of regulators.

How should independent directors protect confidential information?

Independent directors must maintain strict confidentiality regarding all information acquired through board service, recognizing that access to strategic plans, financial data, competitive intelligence, and operational details creates both fiduciary obligations and legal liabilities regarding information protection. Schedule IV, Part III(13) prohibits independent directors from disclosing confidential information, including commercial secrets, technologies, advertising and sales promotion plans, and unpublished price-sensitive information, unless such disclosure is expressly approved by the board or required by law. This confidentiality obligation continues beyond board tenure—former independent directors remain bound not to disclose or misuse confidential information learned during their directorship even after resignation or completion of their term.

Practical implementation of confidentiality requires independent directors to secure board materials, avoid discussing company matters in public settings where conversations could be overheard, refrain from sharing strategic information with advisors or other directors serving on competitor boards, and ensure family members don’t gain access to price-sensitive information through household conversations. Independent directors must be particularly vigilant about insider trading regulations under SEBI (Prohibition of Insider Trading) Regulations, 2015, which prohibit trading in company securities while possessing unpublished price-sensitive information and require maintenance of structured digital databases of persons with access to such information. When legal proceedings, regulatory inquiries, or shareholder requests require disclosure of board information, independent directors should seek board approval and legal advice before responding, ensuring disclosures comply with legal obligations while protecting information that legitimately remains confidential.

What are the boundaries of independent director authority?

Independent directors must recognize that their authority flows from their board membership rather than from individual positions of executive power, meaning they act collectively through board decisions rather than issuing directives to management in their personal capacity. Schedule IV, Part III(12) requires independent directors to act within their authority while assisting in protecting the legitimate interests of the company, shareholders, and employees, which means understanding that their role is oversight and guidance rather than operational management. Independent directors cannot unilaterally commit the company to transactions, make hiring or firing decisions, direct operational activities, or bind the company to contracts—these executive functions remain management’s domain subject to board policy and oversight.

The boundaries of authority become particularly important in managing relationships with management: independent directors should avoid bypassing the CEO to give instructions to subordinate managers, refrain from demanding information or reports in ways that create parallel reporting lines outside formal board processes, and resist temptations to involve themselves in operational decisions even when they have relevant expertise. Their authority legitimately extends to: asking questions and seeking information during board processes, approving or rejecting management proposals through board votes, setting policies and strategic direction that management must implement, evaluating management performance through established committees, and escalating concerns through appropriate governance channels. When independent directors step beyond these boundaries into operational roles, they not only create management confusion and governance dysfunction but also potentially expand their personal liability by assuming executive responsibilities that expose them to claims they should have prevented operational failures they directly involved themselves in managing.

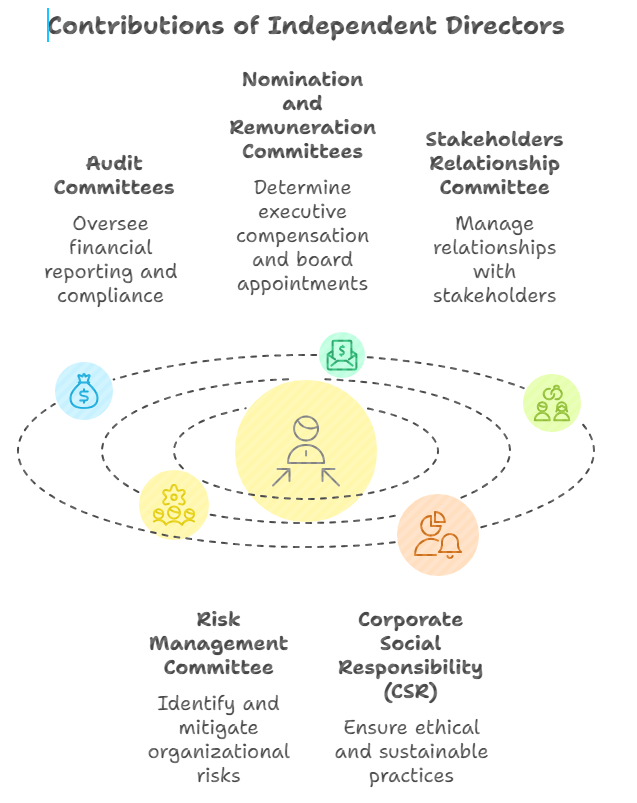

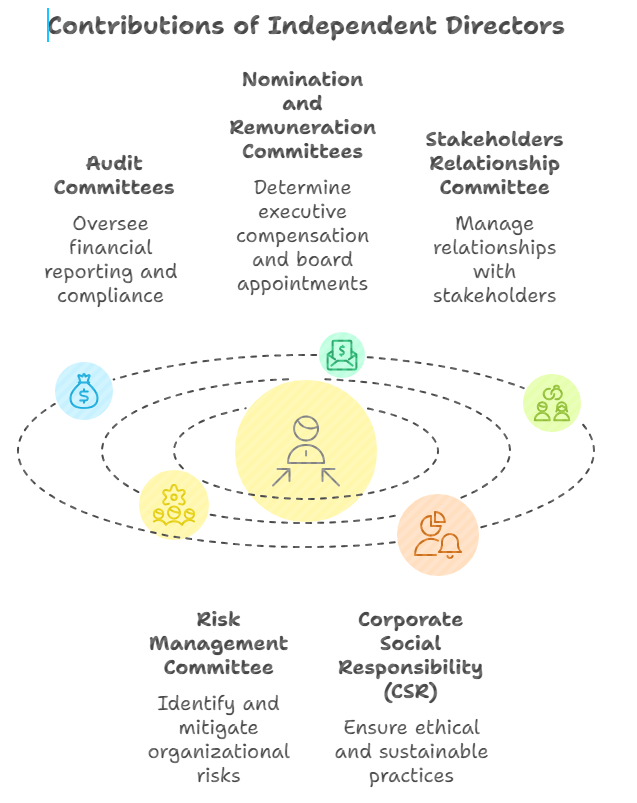

How do independent directors contribute through board committees?

What is the role of independent directors on audit committees?

Independent directors play a central role in ensuring the integrity, transparency, and effectiveness of a company’s financial oversight through their leadership on the Audit Committee. Under Section 177(2) of the Companies Act, 2013, every listed public company must constitute an Audit Committee comprising at least three directors, with independent directors forming a majority. For listed entities, Regulation 18(1)(b) of the SEBI (LODR) Regulations, 2015 goes a step further by requiring that at least two-thirds of the members be independent directors, and that the chairperson of the committee must be an independent director.

Within this framework, independent directors act as the principal guardians of financial integrity. They review and monitor the financial reporting process, examine quarterly and annual financial statements before board approval, and ensure that the statements present a true and fair view of the company’s affairs. They are expected to question accounting policies and judgments, challenge management assumptions where necessary, and satisfy themselves that accounting treatments reflect economic substance rather than convenience or form.

Independent directors also oversee the appointment, remuneration, and performance of statutory auditors, assess the effectiveness of the audit process, and ensure the auditor’s independence. They review inter-corporate loans and investments, valuation of assets or undertakings, and the end use of public issue proceeds, as prescribed under Section 177(4). In doing so, they provide an independent check on how financial resources are managed and reported.

A critical part of their role is to evaluate internal financial controls and risk management systems, ensuring that mechanisms for identifying and mitigating risks are robust and defensible. They review internal audit reports, assess management’s responsiveness to audit findings, and verify that corrective actions are implemented without delay.

Independent directors also supervise the functioning of the vigil mechanism (whistle-blower system) mandated under Section 177(9)–(10), ensuring adequate safeguards against victimisation and enabling direct access to the committee chairperson in exceptional cases. Through this role, they foster a culture of ethical conduct and accountability.

In addition, under Regulation 18(3) read with Part C of Schedule II of SEBI LODR, independent directors on the Audit Committee review related party transactions, management discussion and analysis, internal control weaknesses, and compliance with legal and regulatory requirements. Their independent judgment ensures that financial disclosures are reliable and that governance practices meet the highest standards of fairness and transparency.

Through these responsibilities, independent directors serve as the core of the Audit Committee’s effectiveness, providing objective oversight that strengthens investor confidence and safeguards stakeholder interests.

What functions do independent directors perform on nomination and remuneration committees?

Independent directors play a defining role in ensuring fairness, meritocracy, and transparency in board appointments and executive pay decisions through their leadership on the Nomination and Remuneration Committee (NRC).

Under Section 178(1) of the Companies Act, 2013, every listed public company must constitute an NRC comprising three or more non-executive directors, of which not less than one-half must be independent directors.

For listed entities, Regulation 19(1)(c) of the SEBI (LODR) Regulations, 2015 strengthens this requirement by mandating that at least two-thirds of NRC members be independent directors, with an independent director serving as the chairperson.

This composition ensures that decisions on board appointments and executive remuneration remain objective and insulated from management influence. In their nominating function, independent directors identify and recommend individuals qualified to become directors or members of senior management in accordance with criteria laid down by the committee.

They evaluate prospective candidates based on skills, experience, diversity, integrity, and independence, ensuring that the board collectively possesses the right balance of expertise and perspective. They also oversee the process of board and director performance evaluation as mandated under Section 178(2), specifying how such evaluations are to be conducted and reviewing their implementation.

In their remuneration function, independent directors formulate and recommend to the board the company’s policy on remuneration for directors, key managerial personnel, and senior management under Section 178(3). They ensure that remuneration policies attract and retain talent, establish a clear relationship between pay and performance, and maintain a balance between fixed and variable pay in line with Section 178(4). Independent directors scrutinize compensation proposals to ensure that incentive structures promote sustainable, long-term value creation and do not encourage excessive risk-taking.

Through their majority presence and chairpersonship, independent directors ensure that NRC deliberations reflect independence of judgment, adherence to governance principles, and responsiveness to shareholder concerns. Their oversight helps align board composition, succession planning, and executive compensation with the company’s strategic objectives and ethical standards — ensuring that governance decisions serve the company’s long-term interests rather than short-term managerial preferences.

What is the role of independent directors on the Stakeholders Relationship Committee?

Independent directors are instrumental in protecting investor confidence and ensuring transparent, fair, and timely redressal of shareholder and security-holder grievances through their participation in the Stakeholders Relationship Committee (SRC).

As required under Regulation 20 of the SEBI (LODR) Regulations, 2015, every listed entity must establish an SRC comprising at least three directors, including at least one independent director. In companies with superior right (SR) equity shares, at least two-thirds of SRC members must be independent directors. The Chairperson must be a non-executive director, and is expected to attend the Annual General Meeting to address shareholder queries.

Independent directors serving on this committee act as neutral custodians of shareholder interests. Their oversight ensures that the company maintains efficient systems for handling investor grievances related to transfer or transmission of shares, dividend payments, dematerialisation, duplicate share certificates, and general communication of shareholder rights.

They review periodic reports from the company’s registrar and share transfer agents, assess the timeliness and quality of complaint resolution, and ensure that grievances are redressed within prescribed SEBI timelines. Independent directors also examine trends in investor feedback to identify systemic issues — such as recurring service delays, disclosure gaps, or lapses in shareholder communication — and make recommendations for process improvement.

Through Part D of Schedule II, the SRC’s functions extend beyond grievance handling to encompass protection of the rights and interests of all security holders, including debenture holders and bond investors. Independent directors ensure that such stakeholders receive equal and fair treatment and that their concerns are duly considered in board-level deliberations.

By maintaining direct engagement with shareholders at AGMs and ensuring transparent reporting of investor grievance statistics in annual disclosures, independent directors reinforce the company’s accountability and responsiveness. Their presence on the SRC reassures investors that governance systems are designed to protect minority interests and that the company values open, equitable dialogue with all its security holders.

What is the role of independent directors on the Risk Management Committee?

Independent directors play a critical role in strengthening a company’s ability to identify, assess, and mitigate strategic, operational, financial, and compliance risks through their leadership on the Risk Management Committee (RMC).

Under Regulation 21 of the SEBI (LODR) Regulations, 2015, every top 1,000 listed company and every high-value debt-listed entity must constitute an RMC comprising at least three members, with a majority drawn from the Board and at least one independent director. In companies with outstanding SR equity shares, at least two-thirds of the RMC must be independent directors, ensuring that risk oversight remains objective and insulated from executive influence.

Independent directors bring external perspective and independence of judgment to risk deliberations. They oversee the design and implementation of the company’s risk management framework, ensuring that risk appetite and tolerance levels are clearly defined, approved by the board, and consistently applied across business units. They evaluate whether management has established robust systems for identifying emerging risks — including strategic, financial, operational, regulatory, and cybersecurity risks — and verify that these are monitored through measurable indicators and controls.

Through their participation in committee meetings (which must convene at least twice annually, with not more than 210 days between meetings), independent directors review risk reports, control matrices, and mitigation progress. They question underlying assumptions in management’s risk assessments, challenge optimistic projections, and ensure that contingency plans are realistic and adequately resourced.

Independent directors also ensure that cybersecurity risk receives explicit board-level attention as mandated by Regulation 21(4). Their oversight extends to ensuring that internal audit findings relating to risk controls are acted upon promptly and that key risk exposures are escalated to the full board.

Critically, the RMC chaired by or comprising independent directors acts as the board’s primary defense against excessive risk-taking. By ensuring transparency in risk disclosures and consistency between internal reporting and public statements, they protect investor confidence and strengthen overall corporate resilience.

What is the role of independent directors in Corporate Social Responsibility (CSR)?

Independent directors play a key role in guiding and supervising a company’s Corporate Social Responsibility (CSR) framework under Section 135 of the Companies Act, 2013. Every company that meets the prescribed financial thresholds—net worth of ₹ 500 crore, turnover of ₹ 1,000 crore, or net profit of ₹ 5 crore or more—must constitute a CSR Committee comprising three or more directors, including at least one independent director [Section 135(1)].

Within this committee, independent directors bring external judgment and ethical oversight to CSR planning and implementation. Their statutory role includes assisting the committee in formulating and recommending a CSR Policy to the Board that:

- specifies the activities to be undertaken in the areas listed in Schedule VII,

- recommends the amount of CSR expenditure, and

- monitors the implementation of the CSR Policy from time to time [Section 135(3)].

By virtue of their independence, these directors help ensure that CSR priorities are aligned with genuine community needs and the company’s long-term sustainability objectives rather than being treated as routine compliance. They encourage the integration of CSR into the company’s broader purpose and values, promoting initiatives that deliver measurable social and environmental impact.

In their oversight role, independent directors review management reports on CSR execution and spending, ensure that at least 2 % of the average net profits of the preceding three financial years is spent in accordance with the approved CSR Policy [Section 135(5)], and verify that any unspent or excess amounts are handled as required under sub-sections (6) and (7). They also ensure that the reasons for any shortfall in spending are properly disclosed in the Board’s report and that the company gives preference to local areas where it operates.

Through these responsibilities, independent directors reinforce accountability and transparency in CSR governance. Their involvement ensures that CSR moves beyond charitable contributions to become a strategic and values-driven board priority, demonstrating the company’s commitment to responsible and sustainable growth.

What challenges do independent directors face in exercising their role?

While independent directors play a vital role in ensuring ethical governance and board accountability, their effectiveness is often tested by structural and practical constraints. From information gaps to liability risks, these challenges shape how independently they can truly function.

How do independent directors overcome information asymmetry?

Information asymmetry represents a fundamental challenge for independent directors who must make informed oversight decisions despite possessing far less detailed knowledge about company operations, market dynamics, and organizational capabilities than executive management who work with the business daily.

This knowledge gap creates risks that independent directors might approve flawed strategies because they lack information to recognize weaknesses, miss early warning signs of operational problems, or fail to challenge optimistic management projections that insiders know are unrealistic. Overcoming information asymmetry requires independent directors to develop multiple information channels beyond formal board papers, including scheduling one-on-one sessions with business unit heads, conducting informal conversations with senior managers during facility visits, reviewing external analyst reports and media coverage about the company and competitors, and staying current with industry developments through professional networks and specialized publications.

Independent directors should systematically build their knowledge by requesting management to provide deep-dive presentations on specific business areas during board meetings, asking for historical data that shows performance trends over multiple years, demanding scenario analyses that explore downside cases rather than just base-case projections, and comparing management assertions against external benchmarks to verify their reasonableness.

Leveraging the right to seek external advice under Schedule IV, Part III(2) becomes crucial when evaluating complex transactions, technology investments, or strategic pivots where directors need independent expert validation of management recommendations. Building trust relationships with key managers below CEO level, understanding informal organizational dynamics through observation, and developing internal networks that provide unfiltered information helps independent directors triangulate official management presentations with ground reality, enabling more effective oversight despite inherent knowledge limitations.

How can independent directors maintain true independence?

Maintaining true independence requires constant vigilance against subtle pressures and relationship dynamics that can compromise objectivity, starting with recognition that independence is both a legal status defined by Section 149(6) criteria and a practical mindset that must be consciously cultivated despite natural human tendencies toward conformity and relationship preservation. Independent directors face multiple threats to their independence including financial dependency when director fees represent significant personal income, social pressure from developing friendships with management or controlling shareholders, professional considerations when directorship enhances their reputation or business prospects, and fear of non-reappointment when they consistently challenge management. Maintaining independence means accepting that directors might not be reappointed if they ask too many uncomfortable questions or oppose management positions, yet prioritizing fiduciary duty over personal convenience.

Practical strategies for preserving independence include limiting tenure on any single board to avoid becoming too comfortable with management, maintaining multiple income sources so no single directorship becomes financially essential, participating actively in separate meetings of independent directors under Schedule IV, Part VII where they can candidly assess board dynamics without management presence, and building peer relationships with other independent directors who provide support for principled stands.

Independent directors should question their own objectivity regularly, particularly when finding themselves consistently aligned with management without substantive disagreement, when feeling reluctant to raise concerns for fear of being labeled difficult, or when personal relationships with executives make critical evaluation uncomfortable.

The moment independent directors find themselves thinking more about maintaining good relationships than about whether decisions truly serve shareholder interests, they should recognize their independence is compromised and take corrective action, potentially including self-removal from situations where conflicts make objective judgment impossible.

What are the time and resource constraints?

Independent directors often struggle with insufficient time to fulfill their responsibilities effectively, particularly when serving on multiple boards simultaneously as Section 165 permits holding up to seven listed company independent directorships—a load that can make deep engagement with any single company impossible.

Each board membership demands substantial time commitment including pre-meeting preparation (4-6 hours per board meeting reviewing extensive board packs), meeting attendance (quarterly board meetings plus committee meetings totaling 15-20 meeting days annually), facility visits and management interactions, continuing education on industry and governance topics, and crisis response when issues arise requiring emergency meetings or special investigations. When directors spread themselves across multiple boards, the practical reality becomes superficial engagement—skimming board papers rather than deep analysis, relying on management assertions without independent verification, and missing nuances that deeper involvement would reveal.

Resource constraints also manifest in independent directors’ limited access to support systems that executives enjoy—they lack research staff to analyze proposals, data analytics capabilities to verify management reports, or administrative assistance to coordinate information gathering across management layers. This resource disadvantage, combined with episodic involvement through quarterly meetings versus management’s continuous engagement, creates real limitations on oversight effectiveness. Addressing these constraints requires independent directors to be selective about board commitments, limiting memberships to numbers allowing genuine engagement with each company’s affairs, negotiating adequate compensation that reflects time commitment expectations and allows directors to decline other opportunities, and establishing efficient practices like maintaining detailed board notes, using technology tools to organize information between meetings, and coordinating among independent directors to divide oversight responsibilities based on individual expertise areas.

How do independent directors manage liability concerns?

Independent directors face potential personal liability under multiple provisions of the Companies Act including Section 447 (fraud), Section 448 (punishment for false statements), and various SEBI regulations, creating legitimate concerns about legal exposure that could result in criminal prosecution, civil damages, regulatory penalties, and reputational harm.

Section 149(12) provides limited protection by specifying that independent directors shall be liable only for acts of omission or commission that occurred with their knowledge, attributable through board processes, and with their consent or connivance, or where they failed to act diligently with respect to such acts. This liability limitation acknowledges that independent directors have information constraints and cannot be held responsible for operational failures they couldn’t reasonably detect, but it doesn’t provide blanket immunity—directors who rubber-stamp decisions without adequate deliberation, ignore red flags suggesting problems, or fail to seek necessary information face liability exposure.

Managing liability concerns requires independent directors to maintain meticulous records proving their diligence, including ensuring their questions, concerns, and dissents are recorded in board minutes, maintaining personal notes documenting their review processes and reasoning for decisions, and insisting on receiving comprehensive information before approving major proposals rather than acting on incomplete data.

Directors should ensure companies maintain Directors and Officers (D&O) insurance covering legal costs and potential liabilities with adequate policy limits, understanding policy exclusions and ensuring coverage extends beyond their tenure to protect against claims filed after departure.

When situations arise that create significant liability exposure—such as evidence of fraud that management refuses to investigate, related party transactions that appear abusive, or financial reporting that seems manipulated—independent directors must take protective action including documented objections, calling for independent investigations, and in extreme cases, resignation with detailed explanation to regulatory authorities that creates record of their attempts to address problems before they escalated.

Conclusion

The role of independent director under the Companies Act, 2013, extends far beyond statutory compliance to encompass being the conscience of corporate India, balancing multiple stakeholder interests while ensuring companies operate with integrity, transparency, and long-term vision. Through their multifaceted responsibilities spanning strategic oversight, financial integrity protection, executive evaluation, risk management, and stakeholder safeguarding, independent directors serve as crucial counterweights to management power and controlling shareholder dominance. Schedule IV’s comprehensive code establishes not just rules but a philosophy of governance where independence means more than absence of relationships—it means possessing the moral courage to speak truth to power, the wisdom to distinguish short-term gains from sustainable value creation, and the commitment to serve the company’s best interests even when inconvenient.

The challenges independent directors face including information asymmetry, time constraints, liability concerns, and pressures threatening their independence make effective performance demanding, requiring exceptional individuals who bring not just expertise and experience but also integrity, diligence, and genuine commitment to governance excellence. As corporate governance continues evolving in response to global best practices, technological disruption, and stakeholder capitalism expectations, the independent director’s role will only grow in significance, demanding continuous learning, adaptation, and unwavering dedication to the principles that make them true guardians of corporate accountability and enablers of businesses that create value for all stakeholders while maintaining the trust that capital markets and society place in corporate India.

Frequently Asked Questions

Can an independent director be held personally liable for company decisions?

Yes, but only in limited cases. Under Section 149(12) of the Companies Act, 2013, an independent director is liable only for acts done with their knowledge, consent, or connivance, or where they fail to exercise due diligence. Those who actively participate, question decisions, and record dissent are largely protected. Liability arises mainly when directors ignore red flags or approve actions without proper review, which can lead to civil, criminal, or regulatory penalties.

How many board meetings must an independent director attend annually?

Independent directors must attend at least one board meeting in person each year if they usually join via video conferencing, as per the Companies Act, 2013.

Though, Schedule IV, Part III Duties (3) establishes a higher expectation that independent directors should “strive to attend all meetings of the Board of Directors and of the Board committees of which they are members.”

Most companies hold 4–6 board meetings a year, and good governance standards recommend at least 75% attendance. Poor attendance can weaken their effectiveness and increase liability risk, as active participation is key to demonstrating due diligence.

What is the difference between a role and a duty of an independent director?

Roles (Part II, Schedule IV) define what independent directors contribute—bringing independent judgment, overseeing strategy and management, protecting stakeholder interests, and ensuring financial integrity.

Duties (Part III, Schedule IV) define how they perform those roles—by attending meetings, seeking information, raising concerns, reporting misconduct, and maintaining confidentiality.

In short, roles explain purpose, while duties set out the actions needed to fulfil that purpose.

Can an independent director serve on multiple committees simultaneously?

Yes. Independent directors can serve on multiple board committees at the same time—commonly on the audit, nomination and remuneration, stakeholders relationship, risk management, or CSR committees.

The Companies Act, 2013 and listing regulations encourage this to ensure independent oversight across key functions.

However, directors must ensure they have enough time to discharge each committee’s duties effectively, as overboarding can weaken oversight and performance.

How should an independent director respond to suspected financial irregularities?

If financial irregularities are suspected, an independent director should immediately raise the issue with the Audit Committee Chairperson and request a formal investigation. Under Schedule IV, Part III(11), they must report concerns about actual or suspected fraud in writing, ensure the matter is properly examined, and monitor management’s cooperation.

If the board fails to act, the director should record dissent in the minutes, seek independent legal advice, and, in serious cases, report to statutory auditors or regulators such as MCA or SEBI.

What happens if an independent director loses their independence during their term?

Under Schedule IV, Part I(8), an independent director who loses independence must immediately inform the Board and resign from that position. They may continue as a non-independent director if reappointed accordingly. Loss of independence can occur due to pecuniary relationships, business dealings, relatives joining company management, or excess shareholding that breaches Section 149(6). The company must appoint a replacement independent director within three months, as per Schedule IV, Part VI(2).

Are independent directors entitled to remuneration beyond sitting fees?

Independent directors can receive sitting fees under Section 197(5) and Rule 4 of the Companies (Appointment and Remuneration of Managerial Personnel) Rules, 2014 up to ₹1 lakh per meeting. They may also earn profit-related commission with shareholder approval in terms of Section 197. They are entitled to expense reimbursements, but Section 149(9) bars them from stock options, preserving their independence from short-term share price incentives.

How much time should an independent director dedicate to company matters?

There’s no fixed legal requirement, but effective independent directors typically devote 15–25 days per year per board, covering meeting preparation, attendance, site visits, and ongoing learning. Time demands rise during M&A, leadership changes, or governance investigations. Before joining a board, directors should ensure they can commit adequate time, as overboarding reduces effectiveness and oversight quality.

Can an independent director access company documents freely?

Yes. Under Schedule IV, Part III(2), independent directors have the right to seek information, clarification, and professional advice at company expense. They may access records, reports, and documents needed for informed decision-making—typically through the Board or Company Secretary. However, access must be reasonable, limited to governance purposes, and all information must be kept confidential under Schedule IV, Part III(13).

What is the role of independent directors in succession planning?

Independent directors, through the Nomination and Remuneration Committee, oversee CEO and senior leadership succession. They review and update succession plans, assess internal and external candidates, and ensure emergency plans are in place for unexpected departures. Their objectivity helps ensure leadership selections are based on merit, support continuity, and protect long-term shareholder value.

How do independent directors evaluate executive director performance?

Independent directors evaluate executive directors through the Nomination and Remuneration Committee’s annual review process, as required under Schedule IV, Part II(3) of the Companies Act, 2013 and Regulation 25(4) of SEBI (LODR). They assess performance against financial, strategic, operational, and governance targets, using quantitative results, board feedback, and leadership effectiveness reviews. These evaluations inform remuneration, reappointment, or removal decisions, ensuring accountability and alignment with long-term shareholder and stakeholder interests.

Can independent directors communicate directly with minority shareholders?

Yes. Under Schedule IV, Part II(5) of the Companies Act, 2013 and Regulation 25(4) of SEBI (LODR), independent directors are responsible for protecting minority shareholder interests and may interact with them through AGMs, investor meetings, or formal correspondence. Such communication must remain transparent, governance-focused, and within confidentiality limits, avoiding interference with management functions or business decisions.

What expertise should independent directors bring to board deliberations?

Under Section 149(6) of the Companies Act, 2013 and Regulation 25(1) of SEBI (LODR), independent directors must have relevant expertise and experience in the board’s opinion. They should bring financial literacy, industry knowledge, and functional skills in areas like risk, law, technology, or strategy. Boards benefit from directors with diverse backgrounds, global or ESG experience, and independent judgment that strengthens decision-making and prevents groupthink.

How do independent directors coordinate with statutory auditors?

If the board disregards their concerns, independent directors should record their dissent in board minutes under Schedule IV, Part III(6) to protect themselves legally. They may also convene separate meetings of independent directors under Schedule IV, Part VII to collectively assess and escalate issues. For serious governance failures or suspected fraud, they can resign under Section 168(2) of the Companies Act, 2013, citing reasons—creating an official record and limiting future liability.

Allow notifications

Allow notifications