Is the CPA exam hard for Indian professionals? Complete difficulty analysis with Q3 pass rates (FAR 43%, TCP 75%), study hours, CPA vs CA comparison, and preparation strategies.

Table of Contents

“Is the CPA exam hard?” This is the question that keeps Indian accounting professionals awake at night before they commit to this credential.

You have heard the stories about grueling four-hour exam sections, complex US GAAP standards, and pass rates that hover around 50%. The fear is real, and so is the uncertainty about whether your Indian qualifications have prepared you adequately for what lies ahead.

Here is what the data actually tells us. According to AICPA’s Q3 2025 Candidate Performance Report, the overall CPA exam pass rate sits at approximately 50% across all sections.

However, this number masks significant variation. FAR (Financial Accounting and Reporting) recorded a 43.07% pass rate, while TCP (Tax Compliance and Planning) achieved an impressive 75% or higher. The CPA Evolution changes that launched in January 2024 introduced a new Core plus Discipline model that has shifted how candidates experience exam difficulty. For Indian professionals specifically, these numbers take on different meaning because you are learning US-centric content that may be entirely unfamiliar.

This guide cuts through generic advice to give you an India-specific difficulty analysis backed by current data. You will understand exactly why each section poses particular challenges for Indian candidates, how CPA difficulty compares to the CA exam you may already know, and what realistic preparation looks like when you are balancing exam study with a full-time job in India. We will cover section-wise pass rates, study hour requirements verified by AICPA and major review providers, and actionable strategies that successful Indian CPAs have used to clear this exam.

CPA Exam Pass Rates in Recent Times

Pass rate data from AICPA provides the most objective measure of CPA exam difficulty. These figures represent actual candidate performance across hundreds of thousands of exam attempts, giving you a realistic picture of what to expect. The rates have fluctuated over the years, but certain patterns remain consistent, particularly around which sections prove most challenging.

Core Sections Pass Rate vs Discipline Sections Pass Rate

The three Core sections that every CPA candidate must pass show meaningful variation in difficulty. According to Q3 2025 data from AICPA, AUD (Auditing and Attestation) achieved a 50.03% pass rate, showing slight improvement from the previous quarter’s 49.05%. FAR continues as the most challenging Core section with a 43.07% pass rate, down marginally from 43.52% in Q2 2025. REG (Regulation) stands out as the strongest performer among Core sections, consistently achieving pass rates around 64% throughout 2025.

The Discipline sections introduced under CPA Evolution in 2024 show even wider variation. TCP leads with pass rates consistently above 75%, making it the most approachable section across the entire exam. ISC (Information Systems and Controls) showed strong performance in mid-2025, peaking near 72% in Q2 before moderating in Q3 as testing volumes increased. BAR (Business Analysis and Reporting) presents the greatest challenge among Discipline sections, hovering around the low-40% range, placing it alongside FAR as the toughest sections overall.

First-Time Pass Rate vs Overall Pass Rate

The ‘around 50%’ pass rate often quoted refers to section-level results and includes repeat attempts by candidates. When viewed at a candidate level, the picture is tougher. While AICPA and NASBA do not publish official first-attempt completion statistics, analysis by CPA review providers consistently shows that only a minority of candidates pass all four sections on their first attempt. In practice, this means most candidates will need more than one attempt to clear at least one section.

This reality is reflected in the CPA Exam’s structure itself. The credit window—extended from 18 months to 30 months under CPA Evolution—recognises that passing all sections in one continuous stretch is not the norm. Many successful CPAs, including those now working at Big 4 firms in India and abroad, required multiple attempts before qualifying. Preparation strategies should therefore be built around persistence, not the assumption of a single-cycle clearance.

These numbers only tell part of the story, and a closer look at historical trends, section-wise performance, and first-time versus repeat attempts provides deeper clarity. You can explore a detailed breakdown of CPA pass rates across sections and testing windows here.

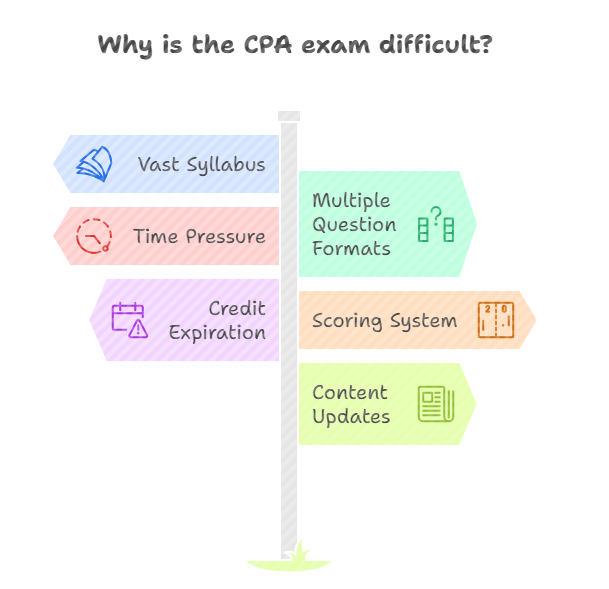

Challenges the Candidates might face while preparing for the CPA Exam

Understanding what makes the CPA exam challenging helps you target your preparation effectively. The difficulty does not come from any single factor but rather from a combination of elements that compound each other. Candidates who recognize these factors early can develop strategies to address each one systematically.

Vast Syllabus Across Accounting, Audit, Tax, and Business

The CPA exam covers an enormous breadth of material across four distinct knowledge domains. FAR alone encompasses financial accounting standards under US GAAP, governmental accounting, not-for-profit accounting, and international financial reporting standards. This single section tests content that would typically span multiple semesters of graduate-level coursework in American universities.

For Indian candidates, this volume becomes even more daunting because much of the content requires learning new frameworks rather than applying existing knowledge. While a Chartered Accountant may have deep expertise in Indian Accounting Standards, the US GAAP treatment of topics like revenue recognition, leases, and stock compensation differs significantly.

You are essentially learning substantial portions of the material from scratch, which adds hundreds of hours to what an American candidate with US accounting education might require.

Multiple Question Formats (MCQs and Task-Based Simulations)

The CPA exam tests candidates through two distinct question formats that require different skills. Multiple-choice questions (MCQs) assess your ability to recognize correct answers and apply concepts quickly. The exam uses adaptive testing for MCQs, meaning if you perform well on initial questions, subsequent testlets become more difficult. This mechanism ensures the exam accurately measures competency but also creates psychological pressure as questions seem to get harder.

Task-based simulations (TBSs) present real-world scenarios that require candidates to apply knowledge in practical contexts. Under AICPA’s CPA Exam scoring framework applicable in 2025, TBSs account for 50% of the score in most sections, with the exception of ISC, where they carry a 40% weight. These simulations may involve completing journal entries, analyzing financial data, researching authoritative literature, or preparing tax calculations. Indian candidates often find TBSs particularly challenging because they require application of US-specific rules in formats that differ significantly from Indian professional examinations.

Four-Hour Exam Structure and Time Pressure

Each CPA Exam section provides four hours of testing time, with an optional 15-minute break that does not reduce the exam clock. Question volume varies significantly by section. FAR includes 50 multiple-choice questions (MCQs) and 7 task-based simulations (TBSs), while ISC features a much higher MCQ count—typically around 78 MCQs—along with 6 TBSs.

Because of this variation, time-management strategies must differ by section. ISC, in particular, places greater pressure during the MCQ testlets due to the higher question density. Time pressure compounds the challenge because unanswered questions receive no credit. Many candidates report feeling rushed on their first attempt, especially in sections with heavier MCQ loads. Beyond content difficulty, the four-hour duration itself tests mental stamina—maintaining focus and accuracy for 240 minutes is something most candidates underestimate until they experience it under exam conditions.

Understanding the CPA Scoring System

The CPA exam uses a scaled scoring system that confuses many candidates. Your reported score ranges from 0 to 99, with 75 required to pass. However, this 75 does not mean you answered 75% of questions correctly. The AICPA uses a weighted formula that considers question difficulty, with harder questions contributing more to your score than easier ones.

This scoring methodology means you cannot calculate your likely score during or after the exam based on how many questions you think you answered correctly. Candidates often leave the testing center uncertain about their performance, adding to exam stress. Additionally, scores are not curved. The 75 threshold represents a fixed standard of competency, meaning pass rates can fluctuate based on how well-prepared the candidate population is during any given testing period.

30-Month Testing Window and Credit Expiration Pressure

Once you pass your first CPA exam section, a clock starts ticking. You have 30 months (in most jurisdictions) to pass the remaining three sections. If you fail to complete all sections within this window, your earliest passed section expires, and you must retake it. This rolling deadline creates ongoing pressure throughout your CPA journey.

The 30-month window replaced the previous 18-month requirement, providing welcome relief for candidates.

However, credit expiration remains a real risk, particularly for Indian candidates balancing demanding jobs with exam preparation. Planning your exam sequence strategically becomes essential. Many candidates recommend passing your most challenging section first so that if credits begin expiring, you are retaking easier sections rather than your hardest ones.

Continuous Updates to Exam Content and Standards

The CPA Exam is not static. The AICPA regularly updates the CPA Exam Blueprint and underlying exam content to reflect changes in accounting standards, tax law, and professional practice. The most significant recent change—CPA Evolution—fundamentally restructured the exam in January 2024. Since then, incremental refinements have continued, with the 2025 Blueprint introducing targeted adjustments across all sections.

For candidates relying on older study materials or delaying their exams after completing coursework, these changes create real challenges. New accounting standards or tax law updates can quickly make prior preparation outdated. Staying current with exam content and using a review course aligned with the latest Blueprint is therefore essential throughout the preparation period.

CPA Exam Sections

Different sections pose different challenges, and your personal difficulty experience will depend heavily on your educational background and work experience. However, pass rate data combined with content analysis reveals clear patterns about which sections challenge Indian candidates most. Understanding these patterns helps you allocate preparation time strategically.

FAR: Syllabus Volume, US GAAP Depth, and Lowest Pass Rates

FAR consistently records the lowest pass rates among Core sections, with Q3 2025 showing a 43.07% pass rate. The section covers financial accounting and reporting frameworks including US GAAP, IFRS fundamentals, governmental accounting, and not-for-profit accounting. This breadth alone makes FAR daunting, and the depth required within each topic area compounds the challenge.

For Indian candidates, FAR difficulty intensifies because US GAAP differs substantially from Indian Accounting Standards in several key areas. Revenue recognition under ASC 606, lease accounting under ASC 842, and stock-based compensation treatment often require learning new frameworks from the ground up. Indian CAs may find that prior familiarity with Indian standards can initially cause confusion where US GAAP takes a different approach. As a result, FAR typically demands the highest preparation time—often 150 to 200 hours or more, with Indian candidates frequently needing the upper end of this range.

AUD: Professional Judgment and US Auditing Standards

AUD achieved a 50.03% pass rate in Q3 2025, placing it in the middle difficulty range among Core sections. The section tests auditing and attestation services, professional responsibilities, and ethical requirements under US standards. Unlike FAR, which has many objective calculations, AUD requires significant professional judgment in evaluating scenarios.

Indian candidates with audit experience may find some concepts familiar, but US auditing standards (GAAS, PCAOB standards) differ meaningfully from Indian Standards on Auditing. The emphasis on professional skepticism, audit documentation requirements, and internal control evaluation follows American regulatory frameworks. Many candidates describe AUD questions as conceptual and occasionally ambiguous, requiring you to select the “best” answer among several that seem partially correct.

REG: US Taxation Unfamiliarity vs Relatively Higher Pass Rates

REG stands out with consistently strong pass rates around 64%, making it the easiest Core section statistically. However, this statistic can mislead Indian candidates. REG covers US federal taxation for individuals, businesses, and entities, along with business law and ethics. For American candidates with undergraduate tax courses, much of this content is review. For Indian candidates, US taxation represents an entirely new subject area.

The relative ease reflected in pass rates comes partly from candidates who already understand US tax fundamentals. Indian candidates approaching REG without any US tax background often find it more challenging than the pass rates suggest. Topics like individual income tax calculations, corporate taxation, partnership taxation, and estate and gift tax follow rules completely different from Indian tax law. Budget additional preparation time for REG despite its favorable pass rates.

Discipline Sections: Choosing Based on Your Background

The CPA Evolution model requires you to choose one Discipline section in addition to the three Core sections. Your choice significantly impacts overall exam difficulty based on your background and career goals. Each Discipline section has distinct content focus and markedly different pass rates.

BAR (Business Analysis and Reporting): Best for Accounting Backgrounds

BAR extends FAR content into business analysis, financial statement analysis, and technical accounting topics. With pass rates around 43%, BAR matches FAR as the most challenging section overall. Indian candidates with strong accounting backgrounds, particularly CAs, often choose BAR because the content aligns with their existing expertise. However, the analytical depth required exceeds what most candidates expect from the section name alone.

ISC (Information Systems and Controls): IT and Audit Focus

ISC covers information technology governance, security, and system controls. Pass rates have climbed to approximately 72% as preparation resources mature. Candidates with IT audit experience or interest in technology-focused roles find ISC approachable. The section uniquely weights MCQs at 60% compared to 40% for TBSs, differing from other sections. Indian candidates working in IT audit or targeting Big 4 technology advisory roles should seriously consider ISC.

TCP (Tax Compliance and Planning): Highest Pass Rate at 75%

TCP consistently achieves the highest pass rates across all six sections, regularly exceeding 75%. The section extends REG content into advanced tax planning for individuals and entities. Candidates who perform well on REG often find TCP manageable because of content overlap. The strong pass rates partly reflect self-selection, as candidates confident in tax content choose this Discipline. For Indian candidates, TCP requires the same US tax foundation as REG, meaning you must master unfamiliar content, but the consistency between sections allows efficient preparation.

Which Discipline Should Indian CA, B.Com, or MBA Graduates Choose?

Your Indian qualification should guide your Discipline selection, though career goals matter equally. Indian CAs typically have the strongest accounting foundation, making BAR a natural choice despite its lower pass rates. The technical accounting content aligns with CA training, and many Indian CAs pursuing CPA target financial reporting roles where BAR knowledge adds value.

B.Com graduates without additional professional qualifications may find TCP or ISC more approachable than BAR. TCP requires learning US taxation from scratch regardless of background, so the playing field is more level. ISC suits candidates interested in technology or those who found REG challenging and want to avoid additional tax content. MBA Finance graduates should evaluate their specific coursework and career targets, but often ISC or TCP provides a smoother path than BAR given less intensive accounting training.

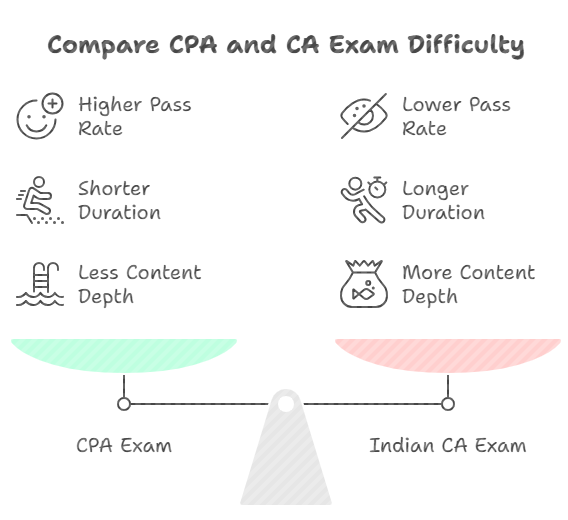

CPA Exam vs Indian CA Exam

Indian professionals often frame CPA difficulty relative to the CA exam they know well. This comparison helps contextualize the CPA challenge and informs realistic expectations. Both credentials demand significant commitment, but they test different competencies through different structures over vastly different timeframes.

Pass Rate Comparison: CPA 50% vs CA 5-15%

The statistical comparison is striking. CPA exam sections achieve pass rates around 45% to 55% (with TCP reaching 75%), while Indian CA exam pass rates at Intermediate and Final levels typically range from 5% to 15% per attempt. The May 2025 CA Final results recorded an overall pass rate of approximately 19%, with Group I and Group II pass percentages ranging between about 22% and 26%, reinforcing the long-standing pattern of CA Final being one of the most statistically challenging professional examinations in India.

However, these numbers require context. CA’s lower pass rates reflect a different examination philosophy. ICAI designs exams to maintain rigorous standards, and the three-level structure means many candidates are filtered out before reaching Final. CPA pass rates reflect a single-level exam where candidates have already met education requirements before sitting. The comparison suggests CA is statistically harder to complete, but this does not mean CPA is easy.

Duration and Structure: Sprint vs Marathon

The time commitment difference is dramatic. CPA can realistically be completed in 12 to 18 months for focused candidates, though many take 24 months while working full-time. The four-section structure allows concentrated preparation on one area at a time. CA requires 4 to 5 years minimum, including mandatory three-year articleship, multiple exam levels, and practical training requirements.

This difference leads to the common characterization: CA is a marathon, CPA is a sprint. Both are exhausting, but the exhaustion type differs. CA tests your ability to sustain commitment across years of preparation and training. CPA tests your ability to intensively master content and perform under pressure across a compressed timeline. Indian professionals who have completed CA demonstrate the persistence needed for CPA, but must adapt to the faster pace required.

Content Depth and Examination Style

CA examinations test deep knowledge of Indian accounting, taxation, company law, and auditing across 19 papers spanning three levels. The examination style includes lengthy written answers, case studies, and extensive calculations. Memory, analysis, and writing speed all contribute to success. The syllabus covers approximately 5,000 pages of study material across all levels.

CPA tests application of US standards through MCQs and task-based simulations. The depth required is narrower but highly specific to US frameworks. Where CA might ask you to explain a concept comprehensively, CPA asks you to apply a specific rule to a given scenario and select the correct answer. Indian candidates often find the shift from explanatory writing to multiple-choice selection challenging initially, requiring different preparation techniques.

Which Exam is Actually Harder for Indian Professionals?

The honest answer: they are hard in different ways. CA is harder to complete due to lower pass rates, longer duration, and the mandatory articleship requirement. Many CA aspirants take 6 to 7 years rather than the minimum 4 to 5 years because of repeated exam attempts. The sheer persistence required to clear CA exceeds what CPA demands.

CPA is harder for Indian professionals in terms of content unfamiliarity. Every section contains US-specific material that Indian qualifications do not cover. US GAAP, US taxation, US auditing standards, and US business law require learning new frameworks rather than applying existing knowledge. An Indian CA attempting CPA faces more content learning than an American accounting graduate attempting the same exam. Both exams demand respect, and neither should be underestimated

India-Specific Challenges That Increase CPA Difficulty

Beyond the inherent exam difficulty that all candidates face, Indian professionals encounter additional challenges that compound the CPA journey. Recognizing these India-specific factors helps you plan realistically and avoid underestimating the preparation required. These challenges do not make CPA impossible, but they do require acknowledgment and strategic response.

US GAAP Learning Curve for Indian Accounting Professionals

Indian accounting education and professional training emphasize Indian Accounting Standards (Ind AS), which converged significantly with IFRS but differ meaningfully from US GAAP. When you approach FAR, you discover that familiar concepts like revenue recognition, leases, and consolidation follow different rules under ASC standards. This requires not just learning new material but sometimes unlearning existing frameworks.

The US GAAP learning curve hits hardest for experienced Indian accountants who have internalized Indian standards through years of practice. Your existing knowledge can actually create confusion when US GAAP rules contradict what you know. Topics like LIFO inventory valuation (permitted under US GAAP but prohibited under IFRS and Ind AS), development cost capitalization differences, and pension accounting variations all require careful relearning. Budget additional study time specifically for areas where your existing knowledge may interfere with US GAAP mastery.

US Federal Taxation: A Completely New Subject Area

REG and TCP sections require understanding US federal taxation at a level that Indian qualifications simply do not provide. US individual income tax with its brackets, deductions, and credits follows a completely different structure than Indian income tax. Corporate taxation concepts like S-corporations, partnerships, and estate taxation have no direct Indian equivalents that would help you relate new learning to existing knowledge.

Indian candidates often underestimate REG difficulty because the section has relatively high pass rates. Those pass rates reflect American candidates who studied US taxation in college. For you, REG represents learning an entirely new tax system from fundamentals upward. Topics like basis calculations, at-risk limitations, passive activity rules, and alternative minimum tax require starting from zero. Consider REG your most unfamiliar section regardless of what pass rates suggest, and prepare accordingly.

Studying While Working Full-Time in India

Most Indian CPA candidates are working professionals, often in demanding roles at Big 4 firms, MNCs, or Indian corporations. Indian work culture frequently involves long hours, weekend commitments during busy seasons, and expectations of availability that leave limited time for structured study. Finding 15 to 20 hours weekly for CPA preparation while managing professional responsibilities requires intentional scheduling and often personal sacrifices.

The challenge intensifies because CPA study cannot be passive. You need focused attention to learn unfamiliar concepts, practice MCQs actively, and work through complex simulations. Squeezing study into late-night hours after exhausting workdays yields diminishing returns. Successful Indian CPA candidates often negotiate reduced workloads during preparation periods, utilize leave strategically around exam dates, or extend their overall timeline to maintain sustainable study habits.

Timezone and Testing Logistics Challenges

The CPA exam is administered in India at eight Prometric testing centers located in Ahmedabad, Bangalore, Calcutta, Chennai, Hyderabad, Mumbai, New Delhi, and Trivandrum. While having domestic testing centers eliminates the need to travel abroad, seat availability can be limited, particularly during popular testing months. Securing your preferred exam date and location requires booking well in advance.

Discipline sections present additional scheduling complexity because they are offered only during specific quarterly windows in 2025 (primarily January, April, July, and October). Unlike Core sections available throughout the year under continuous testing, Discipline scheduling requires aligning your preparation timeline with these limited windows. Missing a testing window means waiting months for your next opportunity, potentially affecting your credit expiration timeline.

English Language Considerations for Non-Native Speakers

While most Indian professionals possess strong English proficiency, the CPA exam uses technical American English with specific terminology that may be unfamiliar. Terms like “check the box election,” “stepped-up basis,” and “boot” in tax contexts have meanings that standard English vocabulary does not prepare you for. Reading speed also matters when you have approximately 1.5 minutes per MCQ.

Task-based simulations often include lengthy scenarios requiring careful reading comprehension. Misunderstanding a key detail in a complex TBS scenario can lead to completely incorrect answers despite knowing the underlying concepts. Indian candidates sometimes benefit from reading exam questions aloud during practice to improve processing speed, and building vocabulary specifically around CPA technical terminology beyond standard accounting terms.

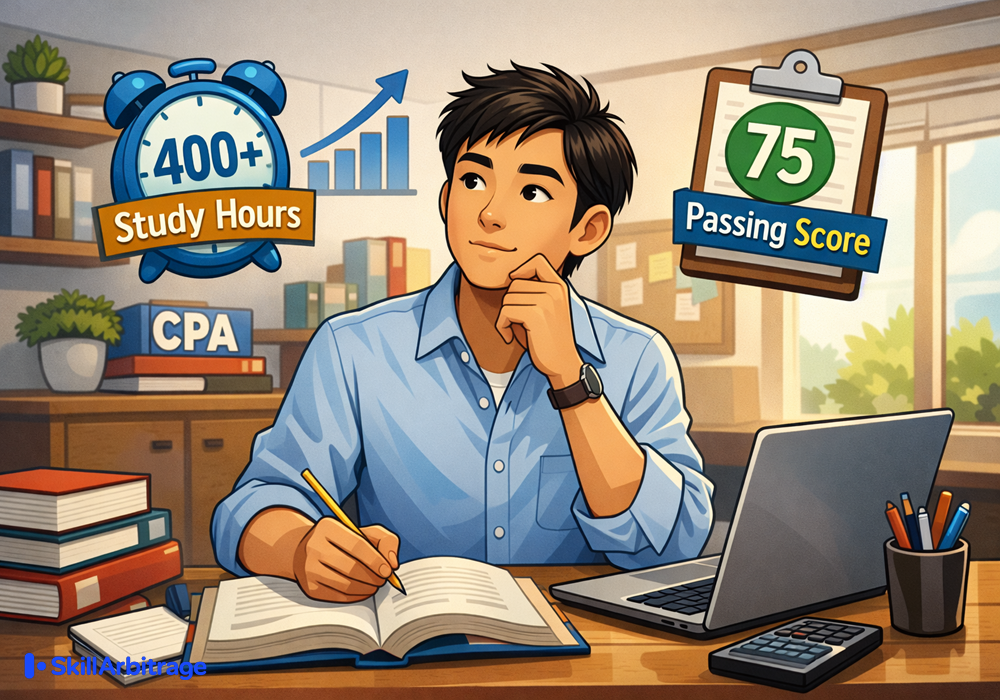

Study Hours Required to Pass Each CPA Section

Understanding time requirements helps you build realistic preparation schedules and set appropriate expectations. The hours needed vary based on your background, but industry consensus from AICPA, review course providers, and successful candidate data provides reliable benchmarks. For Indian candidates facing additional content learning, planning toward the higher end of these ranges makes sense.

According to AICPA guidance, candidates typically need 330 to 500 total hours across all four sections. Major review providers like Becker recommend 400 to 600 hours, translating to 100 to 150 hours per section. UWorld’s analysis suggests approximately 550 hours total for comprehensive preparation. The variation reflects different candidate backgrounds and study efficiency.

For Indian professionals, planning 400 to 500 hours total provides a realistic target. FAR typically demands the most time at 100 to 150 hours due to sheer content volume and US GAAP learning requirements. AUD and REG each require 90 to 120 hours, with REG potentially needing more for Indian candidates mastering US taxation from scratch. Discipline sections generally need 80 to 100 hours, with BAR requiring more time than TCP or ISC for most candidates.

Translating total hours into weekly schedules, most working professionals target 15 to 20 hours per week. At 15 hours weekly, a 120-hour section takes 8 weeks to prepare. Four sections at this pace require 8 to 10 months of concentrated study, not counting breaks between sections or retake time. Many Indian candidates realistically complete the CPA exam in 18 to 24 months while working full-time, though faster timelines are achievable with greater weekly hour commitments.

Many Indian candidates underestimate difficulty because they focus only on preparation, without first aligning their background with the CPA exam requirements, which play a crucial role in state selection and overall timelines.

Strategies to Prepare for the CPA Exam

Knowing the CPA exam is hard provides limited value without actionable strategies to address that difficulty. Successful candidates follow structured approaches that maximize study efficiency and build exam-day confidence. These strategies apply regardless of which review course you choose or what background you bring to the exam.

Section-Wise Preparation Strategy

Your preparation approach should differ by section based on content type and your existing knowledge. For FAR, focus heavily on understanding US GAAP conceptually before drilling practice questions. Many Indian candidates make the mistake of jumping into MCQs before building foundational understanding, leading to memorization without comprehension. Take time to understand why US GAAP rules exist, not just what they are.

For REG, build a structured framework of US tax concepts before tackling detailed calculations. The section tests tax law application, so understanding the logic of US taxation helps you reason through unfamiliar scenarios. For AUD, focus on professional judgment questions and practice identifying what auditors should do in various situations. The section requires thinking like a US auditor, which takes time to develop. Your Discipline section preparation should leverage your Core section knowledge, particularly TCP building on REG or BAR building on FAR.

Time-Management Frameworks for Working Candidates

Successful working candidates treat CPA study as a non-negotiable appointment rather than something to fit in when convenient. Block specific hours on your calendar for study and protect that time as you would protect an important meeting. Morning study before work often proves more effective than evening study after mental exhaustion from the workday.

Consider organizing your week with different focus areas: weekday sessions for new content learning and weekend sessions for practice questions and simulations. This rhythm allows deeper focus during longer weekend blocks while maintaining momentum through shorter weekday sessions. Track your actual study hours honestly. Many candidates overestimate their time investment, leading to false confidence about preparation progress.

Importance of Mock Exams and Task-Based Simulations

Mock exams serve multiple critical functions beyond content review. They build stamina for four-hour testing sessions, reveal time management weaknesses, and identify content areas needing additional work. Schedule at least two full-length mock exams per section in your final weeks before testing. Treat these mock exams as actual test conditions: timed, no breaks beyond the allowed 15 minutes, and no reference materials.

Task-based simulations deserve dedicated practice time separate from MCQs. Many candidates focus disproportionately on MCQs because they are faster to complete, but TBSs account for 50% of your score (40% in ISC). Practice simulations teach you to navigate the exam software, extract relevant information from lengthy scenarios, and manage time across different TBS types. The authoritative literature research simulations particularly benefit from practice since using the research tool efficiently requires familiarity you can only build through repetition.

Choosing the Right CPA Review Course

Your review course choice significantly impacts preparation effectiveness. Different courses suit different learning styles, and choosing poorly wastes both money and time. Evaluate courses based on how you learn best: video lectures for auditory learners, textbooks for readers, adaptive practice for those who learn through doing.

Comparing Becker, UWorld, Surgent, and Gleim for Indian Candidates

Becker remains the market leader with comprehensive content and strong brand recognition among employers. Their Exam Day Ready program claims 64% higher pass rates for students meeting specific study milestones. The investment is substantial at approximately $3,000 to $5,000 for full packages, but many employers offer reimbursement. UWorld (formerly Roger CPA Review) emphasizes engaging instruction and strong pass rate data, with their SmartPath technology claiming 90% pass rates for students hitting all targets.

Surgent differentiates through adaptive learning technology that customizes your study path based on performance, potentially reducing overall study time. Gleim offers comprehensive content at lower price points than Becker, making it attractive for cost-conscious candidates. For Indian candidates, evaluate whether courses offer content relevant to your starting point. Some courses assume US accounting education background that you may lack, requiring supplementary resources for foundational concepts.

Indian Coaching Institutes: SkillArbitrage, Miles, Simandhar

Indian coaching institutes provide localized support that American review courses cannot match. Miles Education offers comprehensive programs with India-based faculty understanding the specific challenges Indian candidates face. Simandhar Education provides coaching with placement support for candidates targeting roles after CPA completion. These institutes often combine American review course content with additional India-specific guidance.

SkillArbitrage offers CPA preparation designed specifically for Indian professionals, addressing the US GAAP transition challenges and providing mentorship from successful Indian CPAs. The advantage of Indian coaching institutes includes timezone-appropriate live sessions, peer groups facing similar challenges, and guidance on state selection and application processes specific to Indian candidate situations. Many successful Indian CPAs credit localized support alongside comprehensive review materials for their exam success.

Conclusion

The CPA Exam is genuinely difficult, and pretending otherwise does Indian candidates no favors. With section pass rates ranging from the low-40% range for FAR and BAR to around 75% for TCP, roughly half of all candidates fail a given section attempt. At a candidate level, the picture is even tougher. While the AICPA does not publish official first-attempt completion statistics, analysis based on section pass rates shows that only a minority of candidates pass all four sections without any retakes—meaning most successful CPAs needed multiple attempts somewhere in their journey. These numbers deserve respect as you plan your preparation.

However, difficulty does not mean impossibility. Thousands of Indian professionals earn their CPA credentials each year, many while working demanding full-time jobs. The keys to success include realistic expectations, strategic preparation, and sustained commitment across 12 to 24 months. Understanding the specific challenges you face as an Indian candidate—from US GAAP learning curves to unfamiliar taxation content—allows you to address them directly rather than being surprised mid-preparation.

Your next step is honest self-assessment. Evaluate your current knowledge gaps, available study time, and timeline flexibility. Choose your Discipline section based on background and career goals rather than perceived ease. Select a review course aligned with your learning style and budget, and then commit to the preparation required, knowing that the CPA credential opens doors that justify the investment of time and effort.

To understand the overall CPA journey, you can also refer to this detailed guide on the Certified Public Accountant (CPA) Exam in USA.

Frequently Asked Questions

Is the CPA exam harder than the CA exam in India?

They are difficult in different ways. CA has dramatically lower pass rates (5-15%) and requires 4-5 years including mandatory articleship, making it statistically harder to complete. CPA presents concentrated difficulty across 12-18 months with unfamiliar US-specific content. Indian CAs often find CPA content challenging because it requires learning new frameworks rather than applying existing knowledge, but the shorter timeline and higher pass rates make completion more predictable.

What is the hardest section of the CPA exam?

FAR (Financial Accounting and Reporting) and BAR (Business Analysis and Reporting) share the lowest pass rates at approximately 43% as of Q3 2025. Most candidates and review providers identify FAR as the hardest section due to its vast syllabus covering US GAAP, governmental accounting, and not-for-profit accounting. For Indian candidates specifically, FAR difficulty intensifies because US GAAP differs significantly from Indian Accounting Standards in several key areas.

How many hours should I study for the CPA exam?

Plan for 400 to 500 total hours across all four sections. This breaks down to approximately 100-150 hours for FAR, 90-120 hours each for AUD and REG, and 80-100 hours for your chosen Discipline section. Indian candidates often need hours toward the higher end of these ranges due to unfamiliarity with US-specific content. At 15-20 hours weekly, expect 8-10 months of active preparation.

Can I pass the CPA exam while working full-time in India?

Yes, thousands of Indian professionals pass the CPA exam while working full-time, but it requires intentional time management and often personal sacrifices. Most successful working candidates commit 15-20 hours weekly to study, often using early mornings, late evenings, and weekends. Consider negotiating reduced workloads during intensive preparation periods or using leave strategically around exam dates.

What is the first-time pass rate for the CPA exam?

The first-time pass rate for all four sections combined is approximately 25-30%. This means roughly three out of four candidates fail at least one section on their initial attempt. Individual section first-time pass rates vary, with TCP achieving higher rates and FAR achieving lower rates. This statistic reflects exam difficulty and reinforces why the 30-month testing window exists.

Is the CPA exam harder after CPA Evolution changes in 2024?

The CPA Evolution changes that launched in January 2024 restructured the exam from four fixed sections to three Core sections plus one Discipline choice. Early data shows pass rate variation across the new Discipline sections, with TCP performing strongest and BAR performing weakest. Whether the exam is “harder” depends on your Discipline choice and background. The extended 30-month testing window actually provides more flexibility than the previous 18-month window.

Which discipline section is easiest for Indian candidates?

TCP (Tax Compliance and Planning) has the highest pass rates at approximately 75%, making it statistically the easiest section. However, TCP requires understanding US federal taxation, which is entirely unfamiliar to Indian candidates. ISC (Information Systems and Controls) at 72% may be more approachable for Indian candidates with IT audit experience since technology concepts translate better across borders than tax law.

How many attempts do most candidates need to pass all CPA sections?

Most candidates need multiple attempts across their CPA journey, with 2-3 total attempts being common. The 25-30% first-time pass rate for all sections means failing at least one section is the norm rather than the exception. Many successful CPAs, including those at top firms, needed 2-4 attempts on their most challenging section. Your preparation should account for this possibility in timeline planning.

Is CPA exam difficulty the same throughout the year?

The exam itself does not become easier or harder at different times. AICPA explicitly states that scores are scaled to maintain consistent standards across testing periods. However, pass rates do fluctuate quarterly based on candidate preparedness. Q4 typically shows lower pass rates, likely due to holiday distractions and year-end work pressures. Q2 and Q3 often show slightly higher rates.

Can Indian CA holders pass CPA exam faster due to their background?

Indian CAs have strong accounting foundations that help with conceptual understanding but still face significant US-specific content learning. CA training provides advantages in understanding complex accounting concepts but does not directly prepare you for US GAAP differences, US taxation, or US auditing standards. CAs may complete CPA faster than candidates without professional accounting qualifications but should not expect dramatically reduced preparation time compared to other graduate-level candidates.

What happens if I fail a CPA exam section?

You can retake failed sections after receiving your score, subject to state board retake policies and scheduling availability. Failing does not affect your passed section credits within the 30-month window. You will need to pay exam fees again for the retake (approximately $200-250 per section). Many candidates use the waiting period between test date and score release to begin studying for their next section.

Is the CPA exam harder for non-native English speakers?

The exam is conducted entirely in English with no accommodations for non-native speakers. Technical terminology specific to US accounting and taxation adds vocabulary challenges beyond standard English proficiency. Reading speed matters when you have limited time per question. However, most Indian professionals with graduate-level English education handle exam language adequately. Focus on building CPA-specific vocabulary during preparation.

How long do I have to pass all four CPA exam sections?

You have 30 months from passing your first section to pass all remaining sections. This timeline replaced the previous 18-month window under CPA Evolution policies. If you do not complete all sections within 30 months, your earliest passed section expires, requiring you to retake it. Some states allow 36 months, so verify your specific jurisdiction’s requirements through NASBA’s state board directory.

What is the minimum passing score for the CPA exam?

You need a score of 75 to pass each section. This score is on a 0-99 scale and does not represent a percentage of correct answers. The AICPA uses weighted scoring that considers question difficulty, with harder questions contributing more to your score. Scores are not curved, meaning the 75 threshold represents a fixed competency standard regardless of how other candidates perform.

Allow notifications

Allow notifications