Complete guide to independent directors under Companies Act 2013: eligibility criteria, appointment procedure, roles, duties, tenure limits, committee requirements, and compliance obligations for listed and unlisted companies.

Table of Contents

An independent director is a non-executive director defined under Section 149(6) of the Companies Act, 2013, who doesn’t hold any managerial position and maintains no material or pecuniary relationship with the company, its promoters, or management.

The director must be a person of integrity possessing relevant expertise and experience, as determined by the Board. This independent status ensures they can provide objective oversight without conflicts of interest that could compromise their judgment.

For listed companies, SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, impose additional requirements beyond the Companies Act. SEBI mandates that independent directors must be atleast 21 years of age and requires their appointment through special resolution in certain circumstances.

SEBI regulations also prescribe stricter disclosure norms and performance evaluation mechanisms to strengthen corporate governance standards in publicly traded entities.

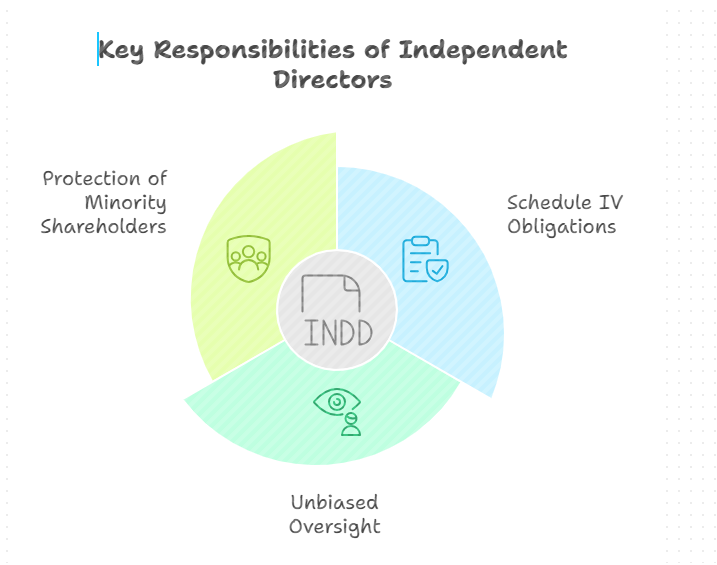

Independent directors serve as guardians of corporate governance by bringing unbiased judgment to board deliberations, particularly on strategy, performance evaluation, risk management, and executive appointments.

They act as a bridge between management and shareholders, ensuring minority shareholder interests are protected while maintaining accountability in financial reporting and compliance. Their presence creates a system of checks and balances that prevents concentration of decision-making power and promotes transparency, ultimately strengthening investor confidence and enhancing the company’s credibility in the market.

Which companies must appoint independent directors?

Listed public company requirements (One-Third Mandate)

Every listed public company in India must mandatorily appoint independent directors comprising at least one-third of its total board strength, as per Section 149(4) of the Companies Act, 2013. This requirement applies regardless of the company’s paid-up capital, turnover, or financial performance. Any fraction in calculating one-third is rounded off as one, meaning a company with 8 directors must have at least 3 independent directors.

The one-third mandate ensures that listed companies maintain higher governance standards due to their public interest implications and the presence of minority shareholders. Companies must maintain this ratio continuously, and any vacancy in independent director positions must be filled within three months from the date of such vacancy or before the next board meeting, whichever is later.

Unlisted public company thresholds

Unlisted public companies are required to appoint at least two independent directors if they meet any one of three financial thresholds specified in Rule 4 of the Companies (Appointment and Qualification of Directors) Rules, 2014.

The first threshold is paid-up share capital of Rs. 10 crore or more, calculated based on the amount as on the last date of the latest audited financial statements.

The second criterion is annual turnover of Rs. 100 crore or more, again determined from the latest audited financials.

The third threshold applies to companies having aggregate outstanding loans, debentures, and deposits exceeding Rs. 50 crore.

Once any of these thresholds is crossed, the company must appoint independent directors within the prescribed timeline. However, if a company ceases to meet all three conditions for three consecutive financial years, the requirement to maintain independent directors no longer applies, though they cannot be removed before their term expires.

Companies exempt from independent director requirements

Certain categories of unlisted public companies are exempt from appointing independent directors even if they meet the financial thresholds: wholly-owned subsidiaries, joint ventures, dormant companies as defined under the Act, and companies registered under Section 8 (not-for-profit companies).

Additionally, specified IFSC (International Financial Services Centre) public companies incorporated under the IFSC Authority regulations are also exempt from these provisions, recognizing their specialized regulatory framework and operational structure.

What are the eligibility and disqualification criteria?

Integrity, expertise & experience requirements

Section 149(6)(a) requires that an independent director must be a person of integrity and possess relevant expertise and experience in the opinion of the Board.

While the Act doesn’t define specific benchmarks for “integrity” or quantify “relevant expertise,” the Board must exercise due diligence in assessing the candidate’s professional background, educational qualifications, industry knowledge, and ethical standing. Independent directors typically bring specialized skills in finance, law, management, technology, or corporate governance that complement the company’s business operations and strategic needs.

Relationship-based restrictions (promoter, related parties)

An independent director cannot be or have been a promoter of the company or its holding, subsidiary, or associate company at any point in time.

This absolute prohibition ensures that individuals who founded or originally controlled the company cannot later claim independent status. The restriction extends to the entire corporate group to prevent circumvention through related entities.

The candidate must not be related to any promoter or any director in the company, its holding, subsidiary, or associate company. “Related” here means relationship as defined under Section 2(77) of the Act, covering relatives within specified degrees of consanguinity. This prevents family members of promoters or directors from occupying independent director positions, even if they have no direct shareholding or management role.

This relational independence ensures that independent directors are free from personal loyalties or family obligations that could influence their decision-making.

The restriction applies both to blood relations and certain in-law relationships, creating a clear separation between independent oversight and promoter/management control.

Companies must obtain declarations from proposed independent directors confirming they meet these relationship criteria before appointment.

Pecuniary, financial & shareholding limits (consolidated)

Section 149(6)(c) prohibits pecuniary relationships with the company, its group entities, or their promoters/directors during the two immediately preceding financial years or the current year.

However, the amended provision creates specific carve-outs: remuneration received as independent director is excluded, and transactions not exceeding 10% of the candidate’s total income or such prescribed amount are permitted. This 10% threshold allows independent directors to have limited professional or business dealings without compromising their independence status.

The independent director’s relatives cannot hold securities or interest in the company or its group entities beyond prescribed limits. The permitted threshold is face value of Rs. 50 lakh or 2% of paid-up capital, whichever is lower, during the two preceding years or current year.

Similarly, relatives cannot be indebted to the company or its group for amounts exceeding Rs. 50 lakh, nor can they provide guarantees or security for third-party indebtedness beyond this limit, as per Rule 5(2) of the Directors Rules, 2014.

Additionally, relatives cannot have other pecuniary transactions with the company amounting to 2% or more of its gross turnover or total income, whether singly or in combination with the security holding, indebtedness, or guarantee provisions.

These financial restrictions ensure that independent directors are not influenced by significant economic interests held by their family members, maintaining the objectivity essential for independent oversight and protecting the integrity of board deliberations from potential conflicts of interest.

Employment, professional service & voting restrictions

Independent directors cannot have held key managerial positions or been employees of the company or its group entities during the three financial years immediately preceding their proposed appointment.

A proviso clarifies that if a relative is an employee, this restriction doesn’t apply to that relative’s employment during the preceding three years, meaning the independent director candidate isn’t disqualified merely because their relative works for the company in a non-KMP role.

The candidate and their relatives cannot have been employees, proprietors, or partners in firms of auditors, company secretaries in practice, or cost auditors of the company or its group during the three preceding financial years.

Similarly, they cannot be associated with legal or consulting firms that had transactions with the company exceeding 10% or more of such firm’s gross turnover during this period. This prevents professional service providers from occupying independent positions while simultaneously benefiting from lucrative consulting relationships.

The independent director cannot hold, together with relatives, 2% or more of the total voting power of the company. They also cannot serve as Chief Executive or director of any non-profit organization that receives 25% or more of its receipts from the company, its promoters, directors, or group entities, or that holds 2% or more voting power in the company. These voting power restrictions ensure independent directors don’t have sufficient shareholding to influence company decisions through voting rights, and prevents potential conflicts arising from leadership roles in charities or NGOs substantially funded by the company.

Eligibility self-assessment checklist

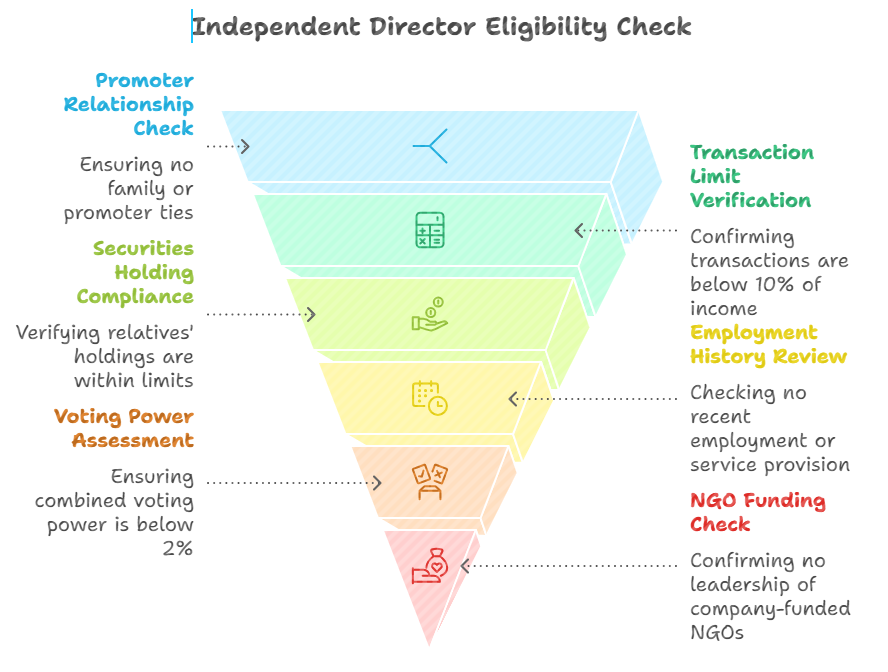

Before pursuing an independent director position, candidates should conduct a systematic self-assessment covering six key areas:

- confirm they have no promoter relationship or family connections with promoters/directors;

- verify that their total transactions with the company don’t exceed 10% of their annual income;

- ensure their relatives’ securities holdings stay below Rs. 50 lakh or 2% of capital;

- check they haven’t been employed by or provided professional services to the company in the past three years;

- confirm their combined voting power with relatives is below 2%; and

- verify they don’t lead NGOs receiving substantial funding from the company.

Any single disqualification under Section 149(6) makes the candidate ineligible, so thorough due diligence is essential before accepting nomination.

What are the pre-appointment requirements for independent director position?

DIN requirement

Every individual seeking appointment as an independent director must first obtain a Director Identification Number (DIN) from the Ministry of Corporate Affairs under Section 153 of the Companies Act, 2013. The DIN is a unique 8-digit identification number that remains valid for the individual’s lifetime and is mandatory regardless of how many companies they serve as director. Applications are filed electronically through Form DIR-3, and the MCA typically allots the DIN within 30 days of application with prescribed fees.

Databank registration

All existing independent directors and individuals aspiring to become independent directors must register in the Independent Directors Databank maintained by the Indian Institute of Corporate Affairs (IICA) at independentdirectorsdatabank.in, as mandated by Section 150 and the Companies (Creation and Maintenance of Databank of Independent Directors) Rules, 2019. Existing independent directors had to register within thirteen months from December 1, 2019, while aspiring independent directors must register before their appointment to any company.

The databank offers subscription plans for 1 year, 5 years, or lifetime registration, requiring payment of prescribed fees. Individuals must provide comprehensive information including DIN, PAN, educational and professional qualifications, directorship history, areas of expertise, and any pending criminal proceedings.

The registration must be renewed before expiry (within 30 days), failing which the name is removed from the databank, though companies retain the responsibility of conducting due diligence on candidates selected from the databank. A detailed walk-through of the enrolment steps, fees and renewal requirements is available in Independent Director Databank Registration.

Proficiency test & exemptions

Every individual registered in the databank must pass an online proficiency self-assessment test conducted by IICA within two years from the date of inclusion of their name in the databank.

The test covers company law, securities law, basic accountancy, and other areas relevant to independent director functioning, with passing marks set at 50% or more in aggregate. There is no limit on the number of attempts, and IICA provides online study material including video lessons and mock tests to help candidates prepare.

Individuals who have served for a period of not less than three years as directors or key managerial personnel in listed public companies or unlisted public companies with paid-up share capital of Rs. 10 crore or more are exempt from the proficiency test requirement. This exemption recognizes their substantial practical experience in corporate governance. However, if someone eligible for exemption has already passed the test, or if a candidate fails to pass within two years, their name is removed from the databank until they successfully complete the test. To understand the exam pattern, exemptions and preparation strategy in detail, refer to Independent Director Exam.

Mandatory declarations (DIR-2, DIR-8, MBP-1)

Before appointment, the proposed independent director must submit three critical declarations:

- Form DIR-2 providing written consent to act as director,

- Form DIR-8 declaring they are not disqualified under Section 164 of the Act, and

- Form MBP-1 declaring their interest in other entities to avoid conflicts.

Additionally, they must provide a specific declaration of independence in writing, confirming they meet all criteria specified under Section 149(6) and have no relationships or circumstances that would impair their independence.

These declarations form the foundation of the appointment process and must be filed with the company before the board considers the appointment proposal.

You may read my article for a step-by-step guide on How to become an independent director.

What is the appointment process step-by-step?

Nomination & remuneration committee recommendation

For companies required to constitute a Nomination and Remuneration Committee (NRC) under Section 178 of the Companies Act, 2013, the appointment process must begin with the NRC’s recommendation.

The committee evaluates potential candidates based on their qualifications, expertise, independence criteria, and the skills gap analysis conducted for the board. The NRC assesses whether the candidate’s background aligns with the company’s strategic needs and ensures appropriate balance of skills, experience, and knowledge on the board.

Once the NRC identifies a suitable candidate—either from the IICA databank or through other professional networks—it recommends the appointment to the full Board of Directors for consideration.

The recommendation should include justification for choosing the particular candidate, confirmation of their independence status, and proposed terms of appointment. For companies not required to have an NRC, the Board directly proceeds with identifying and evaluating candidates, though best practices suggest involving senior independent directors in the selection process.

Board meeting & approval

The Board of Directors must convene a meeting with proper notice (minimum seven days, unless shorter notice is justified) to consider the appointment of the independent director. During the meeting, directors discuss the NRC’s recommendation (if applicable), review the candidate’s declarations and credentials, and assess their fit with the company’s governance needs.

The Board must satisfy itself that the proposed appointee fulfills all conditions specified in Section 149(6) and possesses the integrity, expertise, and experience required for the role.

The Board then passes a resolution approving the appointment subject to shareholders’ approval in the general meeting. The resolution should specify the appointment term (up to five consecutive years), proposed remuneration structure, and committee memberships if already determined.

The appointment is formalized through a detailed letter of appointment that sets out the term, expectations, fiduciary duties, committee roles, code of conduct, remuneration details, and D&O insurance provisions as required by Schedule IV of the Act.

Shareholders’ approval in the general meeting

The appointment of an independent director must be approved by shareholders in a general meeting through an ordinary resolution as per Section 152(2) read with Section 150(2) of the Companies Act.

For listed companies, SEBI LODR Regulations may require a special resolution in certain circumstances, particularly for reappointment. The notice of the general meeting must include an explanatory statement under Section 102, indicating the justification for choosing the appointee and explicitly stating that in the Board’s opinion, the proposed director fulfills the independence conditions and is independent of management.

The explanatory statement should provide the director’s background, qualifications, expertise, other directorships held, and the specific value they would bring to the board. During the meeting, shareholders can raise questions about the appointment, and the proposed independent director may attend to provide additional information. Once the resolution is passed, the appointment becomes effective from the date specified in the resolution or the date of the general meeting, subject to filing of requisite forms with the Registrar of Companies.

ROC filings (DIR-12 and MGT-14)

Within 30 days of the appointment, the company must file Form DIR-12 with the Registrar of Companies, providing details of the newly appointed independent director including their DIN, address, date of appointment, and declaration of non-disqualification. Additionally, Form MGT-14 must be filed within 30 days of the general meeting, attaching a certified copy of the special resolution or ordinary resolution passed for the appointment, as applicable under Section 117 of the Act.

Letter of appointment essentials

Schedule IV of the Companies Act mandates that independent director appointments be formalized through a comprehensive letter of appointment issued by the company.

The letter must specify the tenure of appointment, expectations regarding Board and committee attendance, fiduciary duties and accompanying liabilities, Directors and Officers insurance provisions (if any), the company’s code of business ethics, prohibited actions while serving as independent director, and remuneration details including sitting fees, reimbursable expenses, and profit-related commission if approved.

This letter serves as the contractual foundation of the relationship and must be available for inspection by members at the registered office and posted on the company’s website as per Schedule IV requirements. For a complete explanation of NRC recommendation, board approval, shareholders’ resolution and ROC filings, see my article on Independent Director Appointment.

What are the tenure, reappointment, resignation & removal rules?

Initial term & second term

Under Section 149(10), an independent director can be appointed for an initial term of up to five consecutive years on the Board, with eligibility for reappointment for a second term of up to another five consecutive years upon passing a special resolution by shareholders and disclosure in the Board’s report.

MCA General Circular 14/2014 clarifies that even if appointed for less than five years, it still counts as one complete term. No independent director can hold office for more than two consecutive terms (maximum 10 years total), as mandated by Section 149(11), after which they must observe a cooling-off period before becoming eligible for reappointment.

Cooling-off period under Section 149(11)

After serving two consecutive terms totaling up to 10 years, an independent director becomes eligible for reappointment only after the expiration of three years from ceasing to be an independent director. During this three-year cooling-off period, the individual cannot be appointed in or associated with the company in any other capacity, whether directly or indirectly, ensuring a genuine break in the relationship. This cooling-off mechanism prevents indefinite tenure and maintains the freshness of independent oversight on the board.

Resignation procedure & vacancy filling

An independent director may resign from office by giving written notice to the company under Section 168 of the Act. Within 30 days of receiving the resignation, the Board must file Form DIR-12 with the Registrar of Companies intimating the resignation and must also disclose the fact of resignation in the Board’s Report at the subsequent general meeting. The resigning director may also forward a copy of the resignation letter along with detailed reasons for resignation to the Registrar in Form DIR-11 within 30 days from the date of resignation. Although not mandatory, but this Form DIR-11 is for those situations when the resigning director has reasons to believe that the company might default in informing the Registrar about resignation.

The resignation becomes effective from the date mentioned in the resignation letter or the date the company receives it, whichever is later. The resigning director should specify reasons for resignation, as this becomes part of the public record and may serve as evidence in any subsequent legal proceedings. Vague resignations citing only “personal reasons” are increasingly scrutinized, especially in contexts where governance concerns might exist.

Under Schedule IV, an independent director who resigns or is removed must be replaced by a new independent director within three months from the date of resignation or removal. However, if the company fulfills its independent director requirement even without filling the vacancy (for example, having more independent directors than the minimum required), the replacement requirement doesn’t apply. Companies should be strategic about maintaining buffer capacity in independent director numbers to avoid compliance gaps during transition periods.

Removal procedure & special notice

A company may remove an independent director before the expiry of their term only through an ordinary resolution passed by shareholders under Section 169 of the Act, provided the director is given a reasonable opportunity of being heard.

The process requires special notice of at least 14 days before the general meeting where the removal resolution is proposed, and this special notice must be sent to the company by shareholders representing not less than 1% of voting power or holding shares on which aggregate sum of not less than Rs. 5 lakh has been paid up.

The company must provide a copy of the special notice to the concerned independent director immediately upon receipt, giving them the right to make representations in writing and request these representations be circulated to members or read out at the meeting. The director may attend the meeting personally or through a representative to present their case. If the removal resolution is passed, it takes effect from the date specified in the resolution, and the company must file Form DIR-12 with ROC within 30 days.

Directors appointed through proportional representation cannot be removed through this ordinary resolution process, and removal of independent directors requires careful consideration as it may signal governance concerns to regulators and investors. Additionally, removal doesn’t extinguish any claim for damages or compensation the director may have under their appointment letter or for any breach of contract by the company. Companies should document valid grounds for removal and follow proper procedures to avoid potential legal challenges.

What are the roles, duties and governance expectations?

Schedule IV obligations

Schedule IV of the Companies Act, 2013, establishes a comprehensive Code for Independent Directors that serves as a guide to professional conduct. The code mandates that independent directors uphold ethical standards of integrity and probity, act objectively and constructively while exercising duties, and exercise responsibilities in bona fide manner in the company’s interest.

They must devote sufficient time and attention to their professional obligations for informed decision-making, refrain from actions that would vitiate objective independent judgment, and not abuse their position to the detriment of the company or shareholders.

The code further requires independent directors to refrain from any action leading to loss of independence, and where circumstances arise that make them lose independence, they must immediately inform the Board.

They must assist the company in implementing best corporate governance practices. Adherence to these standards promotes confidence among minority shareholders, regulators, and the investment community in the institution of independent directors, making Schedule IV compliance not merely a legal requirement but a cornerstone of effective corporate governance.

Key duties & responsibilities

Independent directors must help bring independent judgment to board deliberations, especially on issues of strategy, performance, risk management, resources, key appointments, and standards of conduct. They provide an objective view in evaluating board and management performance, scrutinizing whether agreed goals and objectives are met and monitoring the reporting of performance. This oversight function prevents group-think and ensures management accountability to the board.

They must satisfy themselves about the integrity of financial information and that financial controls and risk management systems are robust and defensible. Independent directors play a crucial role in audit committee oversight, examining quarterly and annual financial statements, reviewing internal audit reports, and questioning management on significant transactions or accounting policies. Their financial vigilance protects against fraudulent reporting and strengthens investor confidence.

Independent directors are responsible for determining appropriate remuneration levels for executive directors, key managerial personnel, and senior management, and have a prime role in appointing and, where necessary, recommending removal of executives. They must moderate and arbitrate in situations of conflict between management and shareholder interests, act constructively in committees where they serve as chairpersons or members, and ensure the company maintains an adequate vigil mechanism for reporting unethical behavior, fraud, or code of conduct violations without prejudice to whistleblowers.

Protection of minority shareholders

Independent directors serve as trustees for minority shareholders who lack the voting power to influence management decisions directly. They safeguard these stakeholders’ interests by ensuring fair treatment in related party transactions, opposing any actions that benefit promoters or majority shareholders at the expense of minorities, and balancing conflicting interests among different stakeholder groups. Their objective oversight prevents oppression and mismanagement, making the independent director institution critical for maintaining minority shareholder confidence and ensuring equitable corporate governance in Indian companies.

What committee requirements apply to independent directors?

Audit committee

The Audit Committee must consist of a minimum of three directors, with independent directors forming the majority, as mandated by Section 177 of the Companies Act.

For listed companies, the chairperson of the Audit Committee must be an independent director, ensuring independent oversight of financial reporting and internal controls.

The committee’s responsibilities include recommending appointment and remuneration of auditors, reviewing financial statements, examining related party transactions, overseeing internal audit function, and reviewing significant accounting policies.

Independent directors on the Audit Committee must possess financial literacy and at least one member should have accounting or related financial management expertise. They scrutinize the adequacy of internal financial controls, review audit findings with auditors, evaluate risk management systems, and approve policies for non-audit services by statutory auditors. Their independence is crucial for maintaining audit quality, preventing earnings manipulation, and ensuring transparent financial disclosure to investors and regulators.

Nomination & remuneration committee

The Nomination and Remuneration Committee must consist of three or more non-executive directors, with at least half being independent directors, under Section 178 of the Companies Act. Crucially, the chairperson of this committee must be an independent director, ensuring independence in critical decisions about board composition and executive compensation. The committee identifies qualified candidates for board positions, evaluates existing directors’ performance, and formulates remuneration policies for directors, KMPs, and senior management that align pay with performance while maintaining market competitiveness.

CSR committee

Companies meeting specified thresholds (net worth of Rs. 500 crore or more, turnover of Rs. 1,000 crore or more, or net profit of Rs. 5 crore or more) must constitute a Corporate Social Responsibility Committee under Section 135.

The committee must comprise three or more directors, with at least one being an independent director.

The independent director’s role is to ensure CSR spending aligns with Schedule VII activities, monitor implementation of CSR policy and projects, and verify that CSR expenditure meets the mandatory 2% of average net profits requirement while delivering genuine social impact rather than serving as disguised marketing expenses.

Stakeholders relationship committee (listed companies)

Listed companies must constitute a Stakeholders Relationship Committee to address shareholder and investor grievances, with SEBI LODR Regulations requiring at least one independent director as a member.

The committee oversees investor services covering share transfers, transmission, dematerialization, dividend payments, and redressal of complaints regarding non-receipt of declared dividends or annual reports.

Independent directors ensure the committee functions effectively, that investor grievances are resolved promptly, and that the company maintains high standards of shareholder servicing, thereby protecting retail investor interests and maintaining market confidence.

For a comprehensive breakdown of Schedule IV duties and governance expectations, you may read Roles and responsibilities of Independent Director.

What compensation and benefits can independent directors receive?

Sitting fees

Under Section 197(5) of the Companies Act read with rule 4 of Companies (Appointment and Remuneration of Managerial Personnel) Rules 2014, independent directors may receive sitting fees for attending Board meetings and committee meetings, with the maximum limit set at Rs. 1 lakh per meeting as decided by the Board of Directors.

Listed companies often pay differentiated fees based on the committee (Audit Committee meetings typically command higher fees than other committees) and meeting duration, though all payments must remain within statutory limits. Sitting fees compensate independent directors for time spent in meetings and preparation, recognizing their contribution without creating dependency that could compromise independence.

Profit-related commission

Independent directors may receive profit-related commission as approved by shareholders in general meeting, subject to the overall ceiling on managerial remuneration prescribed under Sections 197 and 198 of the Companies Act.

The commission can be calculated as a percentage of net profits and must be disclosed in the Board’s report. However, such commission arrangements should be carefully structured to avoid creating incentives that might compromise the independent director’s objectivity, particularly regarding short-term profit maximization decisions that could conflict with long-term sustainability or stakeholder interests.

Reimbursement of expenses

Independent directors are entitled to reimbursement of expenses incurred for participating in Board and committee meetings, including travel costs, accommodation, and other reasonable out-of-pocket expenses.

Reimbursement is not considered remuneration and doesn’t count toward sitting fee limits or profit commission calculations under the Act. Companies should have clear reimbursement policies specifying eligible expenses, approval processes, and documentation requirements to ensure transparency and prevent misuse while facilitating independent directors’ active participation in board processes.

Benefits they are not entitled to (e.g., ESOP prohibition)

Section 149(9) explicitly prohibits independent directors from being entitled to any stock options, ensuring they don’t benefit from short-term stock price movements that could compromise their long-term oversight role. This prohibition prevents independent directors from having financial interests aligned with promoters or management rather than all shareholders collectively. Independent directors also cannot receive any other form of remuneration beyond sitting fees, commission, and expense reimbursement as specified in the Act, maintaining clear separation between independent oversight and executive compensation structures.

Schedule V limits when profits are inadequate

If a company has no profits or inadequate profits, an independent director may receive remuneration in accordance with Schedule V of the Companies Act, exclusive of sitting fees payable under Section 197(5) read with rule 4 of Companies (Appointment and Remuneration of Managerial Personnel) Rules 2014.

Schedule V prescribes limits based on effective capital (defined as aggregate of paid-up share capital, securities premium, and reserves less accumulated losses and intangible assets), allowing remuneration ranging from Rs. 12 lakh to Rs. 24 lakhs+ per year depending on effective capital size.

However, this provision requires careful application as paying substantial fixed remuneration to independent directors in loss-making companies could create perceptions of independence compromise and should be used judiciously.

What is the liability of independent directors?

Statutory liability framework

Section 149(12) provides a special liability framework for independent directors and non-executive directors who are not promoters or key managerial personnel.

They shall be held liable only in respect of acts of omission or commission by a company which occurred with their knowledge, attributable through Board processes, and with their consent or connivance, or where they had not acted diligently. This limited liability provision recognizes that independent directors don’t participate in day-to-day management and shouldn’t bear the same liability as executive directors for operational matters beyond their knowledge or control.

Situations where liability may arise

Independent directors can be held liable when they knowingly participate in or approve decisions that violate law, such as approving fraudulent financial statements, sanctioning illegal transactions, or failing to prevent misappropriation of funds despite being aware through board papers or committee meetings. Liability also arises when they act with “willful blindness”—deliberately avoiding knowledge of wrongdoing by not attending meetings, not reading board papers, or not asking obvious questions that any diligent director should raise.

The “failure to act diligently” limb of Section 149(12) can be invoked when independent directors don’t exercise reasonable care and skill expected from persons of their knowledge and experience. For instance, Audit Committee members who approve questionable related party transactions without proper scrutiny, or independent directors who never question unusual patterns in financial statements, could face liability for breach of fiduciary duty. Courts examine whether the independent director’s conduct met the standard of a reasonably prudent person in similar circumstances.

Protection & safe harbour provisions

MCA Circular dated March 2, 2020, provides crucial clarification on initiating legal proceedings against independent directors, stating that authorities must ensure proceedings are not unnecessarily initiated unless sufficient evidence exists showing the acts occurred with their knowledge attributable through Board processes and with their consent, connivance, or where they failed to act diligently.

This circular creates a procedural safe harbor, requiring investigating agencies to examine board meeting minutes, attendance records, and documented dissent before prosecuting independent directors.

Directors and Officers (D&O) insurance, which should be mentioned in the letter of appointment as per Schedule IV, provides financial protection for independent directors against claims arising from their board service.

Many companies now secure comprehensive D&O policies covering legal defense costs and potential liability, though such insurance doesn’t cover willful misconduct or fraud. Independent directors should verify D&O coverage adequacy before accepting appointments and maintain detailed records of their participation, questions raised, and dissenting views to demonstrate diligence if later challenged.

What are the post-appointment compliance requirements?

Annual declaration of independence

Every independent director must give a declaration of independence at the first Board meeting in which they participate as a director and thereafter at the first meeting of the Board in every financial year, or whenever there is any change in circumstances that may affect their status as independent director, as per Section 149(7).

The declaration must explicitly confirm that the director continues to meet all criteria specified in Section 149(6), including absence of disqualifying relationships, pecuniary interests, and other independence criteria prescribed under the Act and rules.

Separate meetings of independent directors

Independent directors must hold at least one separate meeting in each financial year without the attendance of non-independent directors and members of management, as required by Schedule IV. During this exclusive meeting, independent directors review the performance of non-independent directors and the Board as a whole, evaluate the performance of the chairperson taking into account views of executive and non-executive directors, and assess the quality, quantity, and timeliness of information flow between company management and the Board necessary for effective and reasonable performance of duties.

Board evaluation requirements

The performance evaluation of independent directors must be done by the entire Board of Directors excluding the director being evaluated, as mandated by Schedule IV paragraph VIII. The evaluation should assess parameters such as attendance and participation in meetings, quality of contributions to board discussions, ability to bring independent judgment, understanding of company’s business and industry, expertise in specialized areas, relationship with fellow directors and management, and adherence to corporate governance principles and ethical standards.

On the basis of the performance evaluation report, the Board determines whether to extend or continue the term of appointment of the independent director for a second term or upon expiry of the first term. Listed companies under SEBI LODR must disclose the criteria for performance evaluation in their annual reports. The evaluation process should be structured, objective, and documented to ensure fairness and provide feedback for individual development while maintaining the quality of board composition.

Registers & disclosures

Companies must maintain a Register of Directors and Key Managerial Personnel as per Section 170, recording details of each independent director including name, DIN, date of birth, appointment date, resignation/removal date, and other prescribed particulars. Additionally, Form MBP-4 must be maintained as a Register of Contracts or Arrangements in which directors are interested. The terms and conditions of appointment of independent directors, as specified in the letter of appointment, must be available for inspection by members at the registered office during business hours and must be posted on the company’s website as required by Schedule IV, ensuring transparency in governance arrangements.

Practical questions and special situations

How many companies can you serve as independent director?

Section 165 of the Companies Act prescribes that a person cannot be a director in more than 20 companies, with a sub-limit of maximum 10 public companies. However, the Act doesn’t specify a separate limit for independent directorships. In practice, an individual serving as a whole-time director or managing director in a listed company can be an independent director in a maximum of three listed companies, while others can serve as independent directors in up to seven listed companies, as clarified through various circulars. These limits ensure independent directors can devote adequate time and attention to each company they serve.

Can a company secretary be an independent director?

A practicing company secretary (not employed by any company) can be appointed as an independent director in other companies, provided they meet all eligibility criteria under Section 149(6) and don’t have any professional relationship with the appointing company that would compromise independence. However, a company secretary employed full-time by a company cannot be appointed as an independent director of the same company because they hold a key managerial position and are part of management, violating the fundamental requirement that independent directors must be non-executive and separate from management.

What happens when you lose independence?

If circumstances arise that cause an independent director to lose independence—such as acquiring shares exceeding permitted limits, entering into material pecuniary relationships with the company, or accepting a managerial position—Schedule IV requires them to immediately inform the Board accordingly. The director must submit a fresh declaration disclosing the change in circumstances, and if the independence criteria are no longer met, they should resign from the position or convert to a non-independent non-executive director role, subject to shareholders’ approval.

The company must take immediate action upon being informed of loss of independence, removing the designation of “independent director” from the concerned person and filing necessary intimations with the stock exchange (for listed companies) and Registrar of Companies. Failure to act promptly can result in non-compliance penalties, as the company would be violating independent director requirements. If the loss of independence causes the company to fall below minimum independent director numbers, a replacement must be appointed within three months to restore compliance.

Difference between independent directors in listed vs. unlisted companies

Listed companies face stricter independent director requirements under SEBI LODR Regulations, 2015, including minimum one-third independent directors on the board (versus minimum two for unlisted companies meeting thresholds), mandatory appointment through special resolution in certain cases, stricter age limits of 21-75 years, and more rigorous disclosure requirements in annual reports and stock exchange filings. Listed companies must also ensure the chairperson of Audit Committee and Nomination & Remuneration Committee are independent directors, whereas unlisted companies only require majority independent directors in Audit Committee.

Performance evaluation of independent directors is more structured in listed companies, with SEBI mandating disclosure of evaluation criteria and process in the annual report. Listed companies must conduct familiarization programs for independent directors and disclose details of these programs on their websites.

The frequency of separate meetings of independent directors and the documentation requirements are more stringent for listed companies, reflecting higher governance standards expected from publicly traded entities with diverse shareholder bases and greater public interest implications compared to unlisted companies.

Conclusion

Independent directors under the Companies Act, 2013, represent a crucial institutional mechanism for balancing management power with stakeholder protection in Indian companies. The comprehensive framework covering eligibility criteria, appointment procedures, tenure limits, role definitions, and liability provisions creates robust corporate governance architecture.

From the mandatory one-third requirement for listed companies to specific committee composition rules and the innovative databank registration system, the law establishes clear standards ensuring only qualified, genuinely independent individuals occupy these positions.

For aspiring independent directors, success requires not just understanding statutory compliance but embracing the fiduciary responsibility these positions entail. Meeting the technical eligibility criteria under Section 149(6) is merely the starting point—effective independent directors bring industry expertise, strategic insight, and the courage to ask difficult questions while safeguarding minority shareholders’ interests. Companies benefit from this independent oversight through enhanced credibility, better risk management, and access to specialized expertise, making the investment in proper independent director appointment and engagement a cornerstone of sustainable business success in India’s evolving corporate landscape.

Frequently Asked Questions

What is the minimum age to become an independent director in India?

Under the Companies Act, 2013, the minimum age is 18 years; however, SEBI LODR Regulations 16 mandate minimum age to be 21 years for listed companies.

Can an independent director hold office in more than 7 companies?

You cannot be a director in more than 20 companies at a time, with a sub-limit of 10 public companies. However, for independent directors specifically, a more restrictive limit applies: you cannot be an independent director in more than 7 listed companies simultaneously in terms of Regulation 17A of SEBI (LODR). If you are already a whole-time director in any listed company, your independent directorship limit drops to 3 listed companies.

Is proficiency test mandatory for all independent directors?

Yes, except those with 3+ years’ experience as director or KMP in listed/large unlisted companies and also CA/CS/CWA/Advocate with 10+ years of practise are exempt from the test.

What happens if an independent director fails the proficiency test?

If an independent director fails to clear the IICA proficiency test within the prescribed two-year period from the date of registration in the databank, their name is removed from the IICA Independent Directors Databank, and they immediately lose eligibility to continue as an independent director. This means they cannot hold or be appointed to any independent directorship until they pass the test and get their name re-included in the databank.

There is no restriction on the number of attempts, so the individual may retake the test as many times as required. Re-eligibility is restored only after passing the test and getting re-entered into the databank.

Individuals who qualify for the statutory experience-based exemption (three years as a director or KMP in listed or specified large unlisted public companies) are not affected, as they are not required to take the test at all.

Can an independent director be removed before completing the term?

Yes, through ordinary resolution by shareholders under Section 169, provided special notice is given and the director is allowed to be heard.

What is the difference between an independent director and a nominee director?

Independent directors are impartial oversight providers, while nominee directors represent specific institutions (banks, financial institutions, government) who appointed them to protect their interests.

Are independent directors entitled to stock options?

No, Section 149(9) explicitly prohibits independent directors from receiving any stock options from the company.

How is sitting fee for independent directors determined?

The Board decides the sitting fee, subject to the statutory maximum of Rs. 1 lakh per meeting under Section 197(5) read with Rule 4 of Companies (Appointment and Remuneration of Managerial Personnel) Rules 2014.

Can an independent director serve on all board committees?

Yes, though they are typically required specifically for Audit Committee (majority), NRC (half), and CSR Committee (at least one) where applicable.

What is the cooling-off period for independent directors?

Three years after completing two consecutive terms (10 years), during which they cannot be associated with the company in any capacity.

Can relatives of an independent director hold shares in the company?

Yes, but limited to face value of Rs. 50 lakh or 2% of paid-up capital, whichever is lower, per Rule 5(2) of Companies (Appointment and Qualification of Directors) Rules,2014.

What forms must be filed when appointing an independent director?

Form DIR-12 (appointment notice to ROC) and Form MGT-14 (shareholders’ resolution filing), both within 30 days of appointment.

Is special resolution required for initial appointment of independent director?

Generally no—ordinary resolution suffices for initial appointment; special resolution is required for reappointment after the first five-year term.

What are the consequences of non-compliance with independent director requirements?

Penalties under Section 149 including fines up to Rs. 5 lakh, potential delisting concerns for listed companies, and governance red flags for investors.

Can an independent director participate in related party transactions?

Independent directors should scrutinize and ap prove related party transactions but generally shouldn’t be parties to such transactions themselves to avoid compromising independence.

Allow notifications

Allow notifications