Complete guide to independent director in company law covering eligibility, appointment, IICA registration, roles, liabilities under Companies Act 2013 & SEBI LODR.

Table of Contents

Corporate India has learned, sometimes the hard way, that good governance is not just about growth—it’s about accountability.

And at the center of this accountability sits the Independent Director—a professional expected to question, guide, and ensure that companies act in the best interest of all stakeholders, not just the few in control.

Under the Companies Act, 2013 and SEBI (LODR) Regulations, the role of an independent director has evolved from being symbolic to strategic. They’re no longer mere board members but crucial gatekeepers of transparency, ethics, and financial prudence. Their presence reassures investors, regulators, and the market that decisions are taken objectively and that corporate conduct remains above reproach.

For professionals, the independent directorship has also become a sought-after opportunity—offering a chance to contribute expertise, gain boardroom experience, and play a meaningful role in shaping corporate behavior. Yet, many still ask: Who qualifies as an independent director? What are the legal requirements? How does one register or prepare for the IICA proficiency test?

This guide answers those questions in detail—explaining the eligibility, appointment process, responsibilities, and compliance obligations that define an independent director’s role in India today.

Whether you’re a compliance professional ensuring statutory adherence or an aspirant exploring board opportunities, this article serves as your complete, practical reference to Independent Directors in Company Law.

Who qualifies as independent director in Company Law

An independent director is not just another board member—they’re the voice of objectivity in corporate decision-making. To understand who truly qualifies, it’s essential to first look at how the law defines their role under the Companies Act and SEBI regulations.

What is the definition of an independent director in Company Law?

An independent director under Section 149(6) of the Companies Act, 2013 is defined as a non-executive director who does not have any material or pecuniary relationship with the company, its promoters, directors, or holding, subsidiary, or associate companies. The director must be a person of integrity possessing relevant expertise and experience as determined by the company’s board. This definition ensures that independent directors remain free from any influences that could compromise their objective judgment in board deliberations.

The statutory framework explicitly excludes managing directors, whole-time directors, and nominee directors from qualifying as independent directors. Section 149(6) establishes strict criteria including restrictions on promoter relationships, pecuniary transactions exceeding specified thresholds, and employment history with the company or its associates during the preceding three financial years. These comprehensive eligibility conditions are designed to preserve the independence and impartiality that are fundamental to the role’s effectiveness in corporate governance.

What is the definition of an independent director in SEBI LODR?

Regulation 16(1)(b) of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 supplements the Companies Act definition by adding specific criteria for listed entities.

Under SEBI LODR, an independent director must not be a promoter of the listed entity or its holding, subsidiary, or associate company, nor can they be members of the promoter group. The regulation emphasizes that the director should not have any material pecuniary relationship or transaction with the company that could affect their independence of judgment.

SEBI’s definition further restricts independent directors from being material suppliers, service providers, customers, lessors, or lessees of the listed entity. This broader interpretation ensures that even indirect business relationships that might create conflicts of interest are prohibited. The SEBI framework thus provides an additional layer of independence requirements specifically tailored for publicly traded companies where minority shareholder protection is paramount.

How Independent Directors Differ from Executive and Non-Executive Directors

Executive directors are actively involved in the day-to-day management and operations of the company, typically holding positions such as managing director, whole-time director, or CEO. They are employees of the company drawing regular salaries, bonuses, and benefits, and are responsible for implementing board decisions and executing business strategy. In contrast, independent directors are non-executive members who provide oversight and strategic guidance without participating in operational management or holding any executive position within the organization.

While all independent directors are non-executive directors, not all non-executive directors qualify as independent. Non-executive directors may have relationships with the company that disqualify them from independence—such as being representatives of significant shareholders, having business dealings with the company, or being related to promoters.

Independent directors must meet stringent criteria under Section 149(6) and Schedule IV of the Companies Act, 2013, ensuring they have no material relationship that could compromise their objective judgment. This distinction is crucial because independent directors serve as watchdogs protecting minority shareholders and ensuring board decisions are made in the best interest of all stakeholders rather than just promoters or management.

Which companies must appoint independent directors?

Applicability for listed public companies

Every listed public company in India must mandatorily appoint independent directors to constitute at least one-third of the total board strength under Section 149(4) of the Companies Act, 2013.

SEBI LODR Regulation 17 further refines this requirement based on the board’s composition—if the chairperson is a non-executive director, at least one-third of the board must be independent; however, if the chairperson is an executive director or a promoter-related person, at least half of the board must comprise independent directors. Additionally, the top 1,000 listed companies by market capitalization must have at least one woman independent director as per amended SEBI regulations effective from April 1, 2020.

Applicability for unlisted public companies

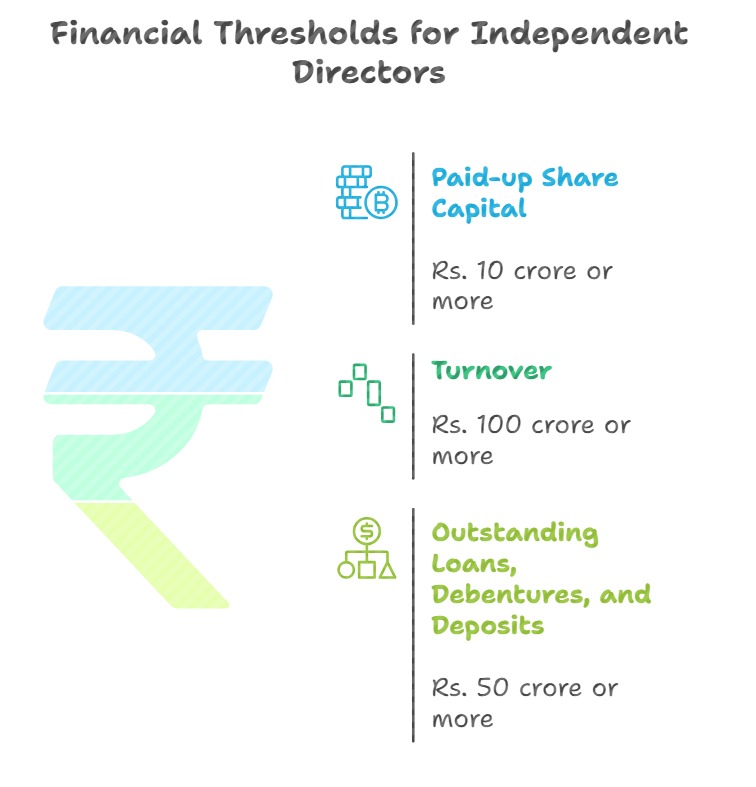

Unlisted public companies are required to appoint at least two independent directors if they meet any one of the following financial thresholds as per Rule 4 of the Companies (Appointment and Qualification of Directors) Rules, 2014:

(i) paid-up share capital of Rs. 10 crore or more,

(ii) turnover of Rs. 100 crore or more, or

(iii) outstanding loans, debentures, and deposits aggregating to Rs. 50 crore or more.

However, certain categories of companies are exempted from this requirement, including wholly owned subsidiaries, joint ventures, and dormant companies, even if they meet the financial criteria.

The financial parameters are calculated based on the amounts existing on the last date of the latest audited financial statements.

What are the laws governing an Independent Director in company law?

The framework governing independent directors in India is built on two pillars —

- the Companies Act, 2013 and

- the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015.

Together, they define governs the position of an independent director.

Key provisions of the Companies Act, 2013

Section 149 – appointment, qualifications, and tenure provisions

Section 149 of the Companies Act, 2013 is the primary statutory provision governing independent directors in India.

Sub-section (4) mandates the appointment of independent directors for listed companies and specified classes of public companies, establishing minimum board independence requirements.

Sub section (6) defines who qualifies as an independent director through detailed eligibility criteria covering integrity, expertise, absence of promoter relationships, restrictions on pecuniary dealings, and prohibitions on past employment or professional associations with the company.

The section also addresses practical aspects of independent directorship including tenure limits (sub-section 10), liability framework (sub-section 12), and exemption from retirement by rotation (sub-section 13).

Sub-section (10) restricts independent directors to two consecutive terms of up to five years each, with mandatory cooling-off periods thereafter.

Sub-section (11) requires special resolution for reappointment after the first term. Critically, sub-section (12) establishes limited liability, holding independent directors accountable only for acts occurring with their knowledge through board processes and with their consent, connivance, or where they failed to act diligently—providing crucial protection while maintaining accountability.

Section 150 complements Section 149 by creating the framework for an independent director data bank maintained by authorized institutes like the Indian Institute of Corporate Affairs (IICA). Companies can select independent directors from this centralized repository containing names, qualifications, and contact details of eligible individuals. The provision emphasizes that while companies may use the data bank, they retain responsibility for conducting due diligence before appointment.

Schedule IV – Code of conduct for independent directors

Schedule IV of the Companies Act, 2013 prescribes a comprehensive code for independent directors covering guidelines of professional conduct, roles and functions, duties, manner of appointment, re-appointment, resignation, and removal.

The code mandates that independent directors uphold ethical standards of integrity and probity, act objectively and constructively, exercise independent judgment, devote sufficient time to their duties, and not abuse their position for personal gain. It requires them to refrain from any action that would lead to loss of independence and immediately inform the board if circumstances arise that compromise their independent status, ensuring transparency and accountability throughout their tenure.

Key provisions of SEBI LODR Regulations 2015

Regulation 16

Regulation 16 of SEBI LODR establishes corporate governance requirements specific to boards of directors of listed entities. It defines “independent director” with reference to Section 149(6) of the Companies Act while adding SEBI-specific conditions such as prohibiting material supplier, service provider, or customer relationships. The regulation ensures that listed companies maintain higher governance standards by incorporating stricter independence criteria beyond statutory minimums, addressing the unique accountability requirements of publicly traded entities where diverse shareholder interests must be protected.

Regulation 17

From the perspective of an Independent Director, Regulation 17 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 lays down multiple provisions that directly define their composition, role, evaluation, and remuneration within the board of a listed entity.

Under Regulation 17(1)(a), every board must have an optimum combination of executive and non-executive directors, with at least 50% being non-executive and at least one woman director. Importantly, for the top 1000 listed entities, there must be at least one independent woman director.

Further, as per Regulation 17(1)(b), where the chairperson is a non-executive director, at least one-third of the board must comprise independent directors. However, if the chairperson is a promoter or related to the promoter or management, or if there is no regular non-executive chairperson, at least half the board must consist of independent directors.

In the case of listed entities with outstanding SR equity shares, Regulation 17(1)(d) mandates that at least half of the board should comprise independent directors — reinforcing their role in maintaining checks on differential voting rights.

Independent directors are also crucial to maintaining the board quorum in the top 2000 listed entities, as specified under Regulation 17(2A), which requires that every board meeting include at least one independent director among the minimum quorum.

As per Regulation 17(5)(b), the board’s code of conduct must “suitably incorporate the duties of independent directors” as laid down in the Companies Act, 2013 — emphasizing ethical responsibility, independence of judgment, and integrity.

In terms of remuneration, Regulation 17(6) provides a detailed framework. Under Regulation 17(6)(a), all fees or compensation to non-executive directors, including independent directors, must be approved by shareholders in a general meeting. As per Regulation 17(6)(d), independent directors shall not be entitled to any stock option, thereby ensuring their financial independence from the company. Moreover, under Regulation 17(6)(ca), if the annual remuneration payable to a single non-executive director exceeds 50% of the total annual remuneration payable to all non-executive directors, such payment must be approved by special resolution each financial year.

The evaluation of independent directors is specifically dealt with under Regulation 17(10), which mandates that their performance and continued fulfillment of independence criteria must be evaluated by the entire board, excluding the directors being evaluated. This ensures an objective and periodic review of their contribution and independence from management.

Regarding limits on holding directorships, Regulation 17A(1) stipulates that no person may serve as an independent director in more than seven listed entities, and under Regulation 17A(2), any person serving as a whole-time or managing director in a listed entity may serve as an independent director in not more than three listed entities.

Overall, these provisions under Regulations 17 and 17A collectively underscore the pivotal governance role of independent directors — ensuring balanced board composition, ethical conduct, transparent evaluation, and protection of minority shareholder interests. Independent directors serve as institutional safeguards of corporate integrity and accountability within India’s listed companies.

Regulation 25

From the perspective of an Independent Director, Regulation 25 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, outlines the key obligations, rights, and safeguards governing their appointment, functioning, and accountability within listed entities.

As per Regulation 25(1), no person can be appointed or continue as an alternate director for an independent director, thereby ensuring that the role of an independent director is personally exercised and not delegated. The maximum tenure of independent directors is governed by the Companies Act, 2013 under Regulation 25(2), which limits continuous service and encourages board refreshment.

Their appointment, re-appointment, or removal must receive shareholder approval by special resolution in accordance with Regulation 25(2A). Even if the special resolution fails to achieve the requisite majority, an appointment is deemed valid if public shareholders’ votes in favour exceed those against, thereby strengthening minority shareholder protection.

To preserve independence and enhance board effectiveness, Regulation 25(3) mandates that independent directors must hold at least one exclusive meeting every financial year, without the presence of non-independent directors or management. During this meeting, as stated in Regulation 25(4), they are expected to review the performance of non-independent directors, evaluate the chairperson’s performance, and assess the quality and timeliness of information flow between management and the board.

Regulation 25(5) restricts the liability of independent directors only to acts or omissions that occurred with their knowledge, consent, or connivance, or where they failed to act diligently, ensuring protection from undue liability for actions beyond their control.

To strengthen their understanding of the company and its environment, Regulation 25(7) obligates listed entities to familiarise independent directors with the industry, business model, and their roles, rights, and responsibilities through structured programmes.

Under Regulation 25(8), every independent director must annually declare that they meet the independence criteria under Regulation 16(1)(b) and are not subject to any circumstance impairing their objective judgment. The board, in turn, must take on record and assess the veracity of this declaration under Regulation 25(9).

Recognising their exposure to professional risks, Regulation 25(10) mandates that the top 1000 listed entities undertake Directors and Officers (D&O) insurance for all their independent directors. A similar requirement under Regulation 25(12) applies to high-value debt listed entities, ensuring coverage against potential liabilities arising from their professional role.

Finally, Regulation 25(11) imposes a cooling-off period of one year, prohibiting an independent director who resigns from joining the same listed entity, its holding, subsidiary, associate, or promoter group company as an executive or whole-time director within that time frame, thereby preserving post-tenure independence.

Collectively, Regulation 25 creates a robust governance framework for independent directors, ensuring their appointment through shareholder scrutiny, promoting autonomy and informed oversight, protecting them from undue risk, and reinforcing their accountability as impartial custodians of good corporate governance.

What are the qualifications and disqualifications for independent director in Company Law?

What are the positive qualifications?

Integrity, expertise, and experience in relevant fields

The foremost qualification for an independent director under Section 149(6) is that the person must be of integrity and possess relevant expertise and experience in the opinion of the board of directors. This subjective assessment allows boards to evaluate candidates based on their professional reputation, ethical track record, and demonstrated competence in areas beneficial to the company.

The integrity requirement ensures that individuals appointed as independent directors have maintained high ethical standards throughout their careers and can be trusted to act in the best interests of all stakeholders without succumbing to conflicts of interest or undue influence.

Skills in finance, law, management, or technical operations

Rule 5(1) of the Companies (Appointment and Qualification of Directors) Rules, 2014 mandates that independent directors must possess appropriate skills, experience, and knowledge in one or more fields including finance, law, management, sales, marketing, administration, research, corporate governance, technical operations, or other disciplines related to the company’s business. This requirement ensures that independent directors bring valuable domain expertise to board deliberations, enabling them to ask informed questions, challenge management assumptions, and provide strategic guidance based on their specialized knowledge rather than serving as mere rubber stamps for executive decisions.

What are the disqualifications and restrictions?

Section 149(6) sets out a series of disqualifications to ensure that only individuals with complete independence from the company’s management, promoters, and related entities can be appointed.

An individual is disqualified from being appointed as an independent director, if they are or have ever been a promoter of the company, its holding, subsidiary, or associate company, or if they are related to any promoter or director of these entities.

Under Section 149(6)(c), a person becomes ineligible if they have had any pecuniary relationship with the company, its holding, subsidiary, associate company, promoters, or directors — other than remuneration as a director or transactions not exceeding 10% of their total income — during the two preceding financial years or the current year.

The law further extends this disqualification to relatives of the proposed independent director. As per Section 149(6)(d), a person is disqualified if any of their relatives —

- hold securities or interests in the company or its group entities exceeding a face value of ₹50 lakh or 2% of paid-up capital, whichever is higher;

- are indebted to these entities beyond prescribed limits;

- have given any guarantee or security in connection with indebtedness to these entities; or

- have had pecuniary transactions or relationships amounting to 2% or more of the gross turnover or total income of such entities.

Disqualification also arises under Section 149(6)(e) if the individual or their relatives have, in the three immediately preceding financial years, been employees, key managerial personnel, or partners, proprietors, or employees of firms providing audit, company secretarial, cost audit, legal, or consulting services to the company or its group entities, where the transactions constituted 10% or more of the firm’s gross turnover.

Similarly, holding 2% or more of the voting power in the company or serving as a chief executive or director of a nonprofit organisation that either receives 25% or more of its receipts from the company or its group entities, or holds 2% or more of their voting power, also disqualifies a person.

Lastly, under Section 149(6)(f), a person may also be disqualified if they fail to meet any additional qualifications prescribed by the Central Government from time to time.

In essence, a person cannot be appointed as an independent director if they have financial, managerial, professional, or familial connections with the company or its related entities that could compromise their independence of judgment. These disqualifications are designed to ensure that independent directors remain truly impartial custodians of corporate governance.

What is the appointment process for Independent Directors?

Pre-appointment requirements

Registration on MCA/IICA Independent Director Data Bank

Every individual seeking appointment as an independent director must register with the Independent Directors’ Data Bank maintained by the Indian Institute of Corporate Affairs (IICA) as per the Companies (Creation and Maintenance of databank of Independent Directors) Rules, 2019.

The registration process begins on the MCA portal under “MCA Services” where candidates enter their Director Identification Number (DIN), PAN, or passport details for verification.

After OTP authentication, the system redirects to the IICA portal where applicants complete their profile with personal details, educational qualifications, professional experience, and undertakings.

Candidates must select a subscription plan—one year, five years, or lifetime—and pay the applicable registration fee online. Upon successful payment, IICA issues a registration certificate containing the individual’s name, registration number, and validity period. The data bank serves as a centralized repository that companies can access when seeking qualified independent directors, though companies retain full responsibility for conducting due diligence before appointment. Registration must be completed within three months of appointment for existing directors or before appointment for prospective directors.

Read my article on how to register on Independent Director Data bank for a detailed guide on registration.

Who must take the online proficiency test and exemptions

All individuals whose names are included in the independent directors’ data bank must pass an online proficiency self-assessment test conducted by IICA within two year from the date of registration.

The test assesses understanding of corporate laws, corporate governance, financial management, risk management, and other relevant topics through a multiple-choice format. Candidates must score at least 50% marks to pass, with no limit on the number of attempts. The test can be scheduled at the candidate’s convenience from available time slots and is conducted online with webcam monitoring and screen recording to ensure integrity.

However, certain categories of individuals are exempted from the proficiency test requirement under Rule 6(4) of the Companies (Appointment and Qualification of Director) 2014 Rules. Exemptions apply to those who have served for at least 3 years as directors or key managerial personnel in listed public companies or unlisted public companies with paid-up capital of Rs. 10 crore or more.

Additionally, individuals with at least three years of experience in senior positions (secretary level or equivalent) in government ministries, regulatory bodies like SEBI, RBI, IRDAI, or PFRDA, or international organizations dealing with securities, banking, or finance regulations are exempt. Despite exemptions, all individuals must register with the data bank to be eligible for appointment as independent directors. Also professionals such as Lawyers, Company Secretaries, Chartered Accountants and Cost Accountants with 10 years of experience are also eligible for exemption from the test.

Appointment procedure and tenure

Nomination, board approval, shareholder approval, and filing with MCA

The appointment process typically begins with the Nomination and Remuneration Committee identifying suitable candidates based on required skills, expertise, and independence criteria. The committee may select candidates from the IICA data bank or identify individuals through other channels.

The proposed appointment is then placed before the board of directors, which evaluates the candidate’s eligibility under Section 149(6), verifies independence status, and passes a resolution approving the appointment subject to shareholder approval. The board must prepare an explanatory statement attached to the general meeting notice stating that in their opinion, the proposed director fulfills independence conditions and is independent of management.

For listed companies, shareholder approval through special resolution is mandatory under Regulation 25 of SEBI LODR, requiring at least 75% of votes cast in favor. Unlisted companies require ordinary resolution in a general meeting.

After shareholder approval, the company must file Form DIR-12 with the Ministry of Corporate Affairs within 30 days, execute a formal letter of appointment outlining terms, expectations, committee assignments, fiduciary duties, and the code of conduct. The independent director must provide a declaration of independence at the first board meeting they attend as director and thereafter at the first board meeting of every financial year or whenever circumstances affecting independence arise.

For a detailed guide on appointment process, read my complete guide on how to appoint an Independent Director.

Tenure limits, reappointment, and cooling-off period

An independent director can hold office for a term of up to five consecutive years on the board of a company and is eligible for reappointment for another term of up to five consecutive years upon passing a special resolution by shareholders. However, no independent director can hold office for more than two consecutive terms of five years each, meaning the maximum continuous tenure is ten years. After completing two consecutive terms, the independent director cannot be reappointed in the same company or its holding, subsidiary, or associate companies until a cooling-off period of three years has elapsed from the date of cessation. Independent directors are exempt from retirement by rotation under Section 152, ensuring stability and continuity in their oversight role throughout their tenure.

What are the roles, responsibilities, and liabilities of independent directors in Company law?

Core responsibilities

Strategic oversight, performance monitoring, and risk management

Independent directors bring objective judgment to board deliberations, particularly on critical issues such as business strategy, performance evaluation, risk assessment, resource allocation, key appointments, and standards of conduct.

They are expected to leverage their expertise and external perspective to challenge management assumptions, question strategic decisions, and ensure that the company’s long-term interests are prioritized over short-term gains.

Their oversight function includes monitoring whether agreed goals and objectives are being met by management and examining the reporting mechanisms to ensure accuracy and transparency in performance disclosures.

Schedule IV of the Companies Act mandates that independent directors satisfy themselves about the integrity of financial information and ensure that financial controls and risk management systems are robust and defensible. This requires active engagement with internal and external auditors, review of audit committee reports, and periodic assessment of the company’s risk management framework.

Independent directors must bring specialized knowledge in areas such as finance, technology, legal compliance, or operations to identify emerging risks and guide the board in formulating appropriate mitigation strategies, thereby protecting the company from potential threats to its sustainability and reputation.

Protecting minority shareholder interests

One of the fundamental responsibilities of independent directors is safeguarding the interests of all stakeholders, particularly minority shareholders who lack direct control over company decisions. Independent directors serve as a voice for investors who hold smaller stakes and may not have representation on the board or influence over promoter-driven decisions.

They ensure that related party transactions, preferential allotments, mergers and acquisitions, and other significant corporate actions are fair, transparent, and conducted at arm’s length pricing rather than benefiting promoters or management at the expense of minority shareholders.

Committee participation and oversight duties

Mandatory role in audit, nomination, and CSR committees

Section 177 of the Companies Act mandates that the audit committee of every listed company and specified classes of companies must comprise at least three directors, with independent directors forming the majority. The audit committee oversees financial reporting processes, recommends appointment and remuneration of auditors, reviews internal financial controls and risk management systems, and scrutinizes related party transactions.

Similarly, the Nomination and Remuneration Committee established under Section 178 must consist of three or more non-executive directors with at least half being independent directors. This committee identifies persons qualified for board and senior management positions, formulates criteria for performance evaluation, and recommends remuneration policy for directors and key managerial personnel.

For companies meeting specific criteria under Section 135, a Corporate Social Responsibility (CSR) Committee must be constituted comprising three or more directors with at least one being an independent director.

This committee formulates the CSR policy, recommends CSR expenditure amounts, and monitors implementation of CSR activities. The mandatory participation of independent directors in these critical committees ensures that decisions on financial reporting, executive appointments, remuneration, and social responsibility spending are made objectively and transparently, free from undue influence by executive management or controlling shareholders.

Ensuring financial transparency and internal control systems

Independent directors bear responsibility for ensuring that the company maintains robust internal control systems covering financial reporting, operational efficiency, compliance with laws and regulations, and asset safeguarding. They must verify that adequate systems are in place for timely identification and disclosure of material financial information to the board, audit committee, and stakeholders. This involves regular review of internal audit reports, assessment of auditor independence and effectiveness, and ensuring that management addresses control deficiencies identified during audits.

Schedule IV requires independent directors to pay sufficient attention to ensure adequate deliberations are held before approving related party transactions and to satisfy themselves that such transactions are in the company’s best interest.

They must ascertain that the company has an adequate and functional vigil mechanism (whistle-blower policy) and ensure that individuals using such mechanisms are not prejudicially affected.

Additionally, independent directors must report concerns about unethical behavior, actual or suspected fraud, or violations of the company’s code of conduct or ethics policy. This oversight function requires continuous engagement, access to relevant information, and willingness to question management when financial disclosures or control systems appear inadequate. For detailed information on the role and responsibilities of an Independent Director, read the article here.

Legal liability and protection

Limited liability under Section 149(12)

Section 149(12) of the Companies Act, 2013 provides crucial legal protection to independent directors by establishing a limited liability framework.

Unlike executive directors who may be held liable for a broader range of company actions, independent directors are liable only for acts of omission or commission by the company that occurred with their knowledge attributable through board processes and with their consent, connivance, or where they have not acted diligently.

This means independent directors cannot be held responsible for decisions made in their absence, matters not brought to their attention, or operational failures occurring without their knowledge or involvement in the decision-making process.

Due diligence, documentation of dissent, and D&O Insurance

To effectively utilize the limited liability protection, independent directors must demonstrate active participation and due diligence in board deliberations.

This includes regular attendance at board and committee meetings, thorough review of agenda materials, asking pertinent questions, seeking clarifications from management and external experts when necessary, and ensuring that their concerns are adequately addressed.

When independent directors disagree with board decisions, it is critical that they formally document their dissent in the minutes of the meeting, providing clear reasoning for their objection. This documented dissent serves as evidence that they did not consent to or connive in questionable decisions and can protect them from liability if those decisions later prove problematic.

Many listed companies, particularly high-value debt listed entities (HVDLEs), are required or choose to provide Directors and Officers (D&O) insurance coverage for their independent directors under Regulation 25 of SEBI LODR. D&O insurance protects directors from personal financial liability arising from claims related to their board service, covering legal defense costs and potential damages.

This insurance provides an additional layer of protection beyond statutory limited liability, enabling independent directors to discharge their duties without fear of personal financial ruin from litigation.

However, D&O insurance typically does not cover willful misconduct, fraud, or deliberate violations of law, reinforcing that independent directors must maintain high ethical standards and act diligently to benefit from both statutory and insurance-based protections.

What are the remuneration rules and compliance obligations?

Remuneration framework

Sitting fees and profit-linked commission

Independent directors are entitled to receive sitting fees for attending meetings of the board or any committee thereof, subject to a maximum of Rs. 1 lakh per meeting as prescribed under Rule 4 of Companies (Appointment and Remuneration of Managerial Personnel) Rules, 2014 read with Section 197(5) of the Companies Act, 2013.

The actual sitting fee amount is determined by the board of directors based on factors such as the company’s net worth, financial performance, and industry practices, though it cannot exceed the statutory ceiling.

In addition to sitting fees, independent directors may receive reimbursement for expenses incurred in connection with attending meetings, such as travel, accommodation, and other reasonable costs, ensuring that financial constraints do not hinder their participation in board activities.

Restrictions on stock options

Section 149(9) of the Companies Act explicitly prohibits independent directors from receiving stock options from the company.

This restriction is fundamental to preserving independence, as equity ownership creates a direct financial interest that could align independent directors too closely with management or promoter objectives rather than maintaining their role as objective watchdogs for all stakeholders.

By prohibiting stock options, the law ensures that independent directors’ compensation is not tied to short-term stock price movements that management might manipulate, allowing them to focus on long-term sustainable value creation and protection of minority shareholder interests without conflicts of interest arising from personal equity stakes.

Ongoing compliance requirements

Annual declarations, board evaluations, and meetings

Independent directors must provide a fresh declaration of their independence at the first meeting of the board in every financial year or whenever circumstances arise that may affect their independence status. This annual reaffirmation ensures continuous monitoring of compliance with eligibility criteria under Section 149(6) and allows the board to assess whether any relationships or transactions have developed that could compromise independence.

Additionally, the performance of independent directors must be evaluated annually by the entire board of directors (excluding the director being evaluated) based on criteria specified under Schedule IV, including their contribution to board deliberations, domain expertise, integrity, and ability to provide objective judgment.

Independent directors are also required to hold at least one separate meeting annually without the attendance of non-independent directors or members of management to review the performance of non-independent directors, the chairperson, and the overall effectiveness of the board. This exclusive forum enables candid discussions about board dynamics, executive performance, and governance challenges without potential influence from executive directors or management.

Independent directors must strive to attend all board meetings (minimum four per year with maximum 120-day gaps for listed companies), committee meetings where they serve as members or chairpersons, and general meetings of shareholders, demonstrating their active engagement and commitment to their oversight responsibilities.

Common mistakes and how to maintain independence

One of the most common mistakes leading to inadvertent loss of independence is accepting additional roles, consultancy assignments, or professional services engagements from the company while serving as an independent director. Such arrangements create pecuniary relationships that may exceed the 10% of total income threshold specified in Section 149(6), automatically disqualifying the person from independent director status.

Similarly, independent directors must be vigilant about their relatives’ relationships with the company—if a relative joins as a key managerial personnel, accepts employment, or acquires shares exceeding 2% voting power, the independent director’s eligibility may be compromised and must be immediately disclosed to the board.

Another critical area requiring careful management is the directorship limit under SEBI Regulation 25, which caps independent directorships at seven listed entities (or three for individuals serving as whole-time directors in any listed company). Accepting additional board positions without tracking the cumulative count can lead to regulatory violations. Independent directors should also be cautious about board interlocks prohibited under Regulation 26—situations where a non-independent director of one company serves as an independent director on another company’s board where any non-independent director of the second company is an independent director of the first.

To maintain independence effectively, directors should maintain a detailed personal register of all directorships, relationships, and transactions; conduct periodic self-assessments against eligibility criteria; immediately inform the board if any circumstance affecting independence arises; and seek legal counsel when facing potential conflict of interest situations to ensure they can continue serving or must resign to preserve their reputation and the company’s governance standards.

Conclusion

The role of independent directors in Indian company law represents a cornerstone of modern corporate governance, balancing the need for professional management with accountability to diverse stakeholders.

Through the comprehensive framework established by the Companies Act, 2013 and SEBI LODR Regulations, independent directors serve as crucial gatekeepers ensuring that boards function transparently, decisions are made objectively, and minority shareholder interests receive adequate protection.

The stringent eligibility criteria, mandatory data bank registration with proficiency testing, and active participation requirements ensure that only qualified individuals with genuine independence serve in this capacity, strengthening investor confidence and corporate integrity.

Looking ahead, the regulatory landscape continues to evolve with increasing expectations on independent directors to demonstrate expertise, diligence, and ethical conduct. Post-Satyam reforms have established robust liability frameworks that protect diligent directors while holding negligent ones accountable.

For companies, appointing competent independent directors is not merely a compliance exercise but a strategic advantage that brings diverse perspectives, specialized expertise, and credibility to board decisions. For aspiring independent directors, understanding the legal framework, maintaining impeccable independence standards, and actively engaging in board responsibilities are essential to fulfilling this vital role effectively while managing personal liability exposure in an increasingly scrutinized corporate environment.

Frequently Asked Questions

Can a practicing Company Secretary be appointed as an Independent Director?

Yes. A practicing Company Secretary can serve as an independent director in companies where they or their firm have not provided professional services in the last three financial years. However, a full-time company secretary of a firm cannot be an independent director in the same company.

What is the minimum age to become an Independent Director under Indian law?

There’s no specific minimum age under the Companies Act, 2013. However, SEBI LODR Regulation 17(1A) requires directors in listed companies to be at least 21 years old. Practically, independent directors must be 21 or older to qualify for appointment.

Is the IICA proficiency test mandatory for all Independent Directors?

Yes, unless exempted. The IICA proficiency test is mandatory for those registered in the data bank, except individuals that are exempted in terms of Rule 6(4) of the Companies (Appointment and Qualification of Directors) Rules 2014. Exempt or not, everyone must register with the data bank.

Can an Independent Director receive consultancy fees from the company?

No. Independent directors cannot receive consultancy fees or any pecuniary benefits exceeding 10% of their total income, except for sitting fees, profit-linked commissions, and expense reimbursements. Accepting consultancy work would breach independence under Section 149(6).

What happens if an Independent Director’s relative joins the company as KMP?

The director immediately loses independence under Section 149(6)(e). They must inform the board and vacate office, as a relative holding a KMP role creates a conflict of interest, disqualifying the independent director from continuing.

Can a former employee become an Independent Director of the same company?

Not immediately. A former employee must wait at least three financial years after leaving the company or its group entities before qualifying as an independent director, ensuring sufficient distance for objective oversight.

How many listed companies can an Independent Director serve simultaneously?

An independent director can serve on up to seven listed entities. If they are a whole-time or managing director in any listed company, the cap reduces to three. This ensures directors can give adequate time to each board.

What is the cooling-off period after completing two consecutive terms?

After two five-year terms, a three-year cooling-off period applies before reappointment in the same company or its group. SEBI also mandates a one-year cooling-off if an independent director resigns before taking any executive role in that company.

Are Independent Directors subject to retirement by rotation?

No. Independent directors are exempt from retirement by rotation under Section 149(13). They serve fixed five-year terms, renewable once, and can only be removed through a special resolution after being given an opportunity to be heard.

What is the penalty for companies not appointing required Independent Directors?

If a company fails to appoint independent directors as required under Chapter XI of the Companies Act, 2013, it is liable to a penalty of ₹50,000, and for continuing failure, ₹500 per day, up to ₹3 lakh for the company and ₹1 lakh for each officer in default. Under SEBI LODR, listed entities may also face monetary penalties, trading suspension, or delisting for persistent non-compliance.

Can an Independent Director hold shares in the company?

No, an independent director cannot hold any shares in the company or its group entities. However, relatives may hold securities up to face value of Rs. 50 lakh or 2% of paid-up capital (whichever is lower) without disqualifying the director.

How is the performance of Independent Directors evaluated annually?

Schedule IV of the Companies Act, 2013 mandates that the performance evaluation of independent directors shall be done by the entire board of directors, excluding the director being evaluated. Additionally, Regulation 17(10) of SEBI LODR requires listed companies to disclose the evaluation criteria and process in their annual reports.

What is the timeline for filling a vacancy in an Independent Director position?

Vacancies must be filled at the earliest, but not later than the next board meeting or within three months of the vacancy—whichever is later. Timely replacement ensures continuous compliance with board independence norms.

Do Independent Directors need to attend Annual General Meetings?

Attendance isn’t mandatory but strongly recommended. Schedule IV encourages independent directors to attend AGMs to engage with shareholders and address governance-related queries, demonstrating accountability and transparency.

What was the impact of the Satyam scam on Independent Director regulations?

The 2009 Satyam scam led to sweeping reforms: detailed independence criteria under Section 149(6), limited liability under 149(12), mandatory data-bank registration, proficiency tests, and performance evaluations—transforming independent directors into active governance watchdogs.

Allow notifications

Allow notifications