Compare top independent director courses in India – IICA, ICSI, IIM Bangalore, KPMG, LawSikho & more. Find fees, duration, eligibility & choose the right program for your career stage.

Table of Contents

You have built a successful career, led teams, driven growth — and now comes the question: what next?

For many seasoned and mid-level professionals, the answer lies in the boardroom. Many of you must have heard of Independent Directorships — prestigious boardroom roles that blend influence, flexibility, and continued professional relevance — yet the pathway to those seats often feels uncertain and closed.

While you may have the experience for the position, however getting that first independent directorship might feel like a far-fetched idea. You need to be visible, eligible, and board-ready.

And that’s where most professionals stumble.

You might not know that India’s demand for qualified independent directors has never been higher. SEBI and MCA regulations now require listed and large unlisted companies to appoint independent directors who understand governance, risk, and compliance.

Compensation too has grown rapidly — compensation for independent directors at India’s top companies soared to around ₹72 lakh in FY23, up from ~₹35.5 lakh five years ago as per a news article published on Economic Times in 2023. The compensations have even gone higher as you read this.

Nevertheless, even as the demand has surged, the supply lagged — not because professionals lack expertise, but because they lack direction.

Bridging that gap is what a well-designed Independent Director Course does.

It helps you translate decades of leadership experience into governance credibility, pass the IICA proficiency test with confidence, and make yourself discoverable to companies actively searching for qualified directors.

If you have ever wondered which course to choose, how to start, or whether it’s even worth it — this article will guide you step-by-step to make the right decision for your career stage.

So, read on to discover which Independent Director Course is best suited for you.

Who needs independent director course and why?

First we will answer the Why Independent Course?

Every person who want to become an independent director must register with Independent Director Databank and then pass the Independent Director Online Proficiency Self-Assessment Test. (Click here to learn how to register on Independent Director Databank and here to learn everything about the exam).

The test is a statutory gateway to India’s corporate boardrooms. Mandated under Rule 6(4) of the Companies (Appointment and Qualification of Directors) Rules, 2014, the exam determines who can legally serve as an independent director.

Conducted by the Indian Institute of Corporate Affairs (IICA) under the Ministry of Corporate Affairs, this proctored online test assesses one’s grasp of company law, SEBI regulations, accounting fundamentals, and corporate governance principles.

It’s designed not merely to evaluate knowledge but to ensure that those influencing corporate decisions truly understand the legal, ethical, and financial framework guiding India’s listed entities.

Passing the exam is mandatory for board eligibility (with limited exemptions), reflecting the growing emphasis on accountability and competence in governance.

Now that you know Why?, let’s talk about the ‘Who’

Understanding who needs an independent director course depends on career stage, professional background, and aspirations for board roles.

Aspiring professionals

If you’re looking to transition into board roles for the first time, an independent director course becomes your gateway to this specialized career path.

The Companies Act, 2013 under Section 149 requires listed companies to appoint at least one-third of their board as independent directors, creating substantial demand for qualified candidates.

However, the regulatory framework introduced in 2019 through the Companies (Appointment and Qualification of Directors) Fifth Amendment Rules makes it mandatory for aspiring directors to register with the IICA Independent Directors Databank and pass the online proficiency self-assessment test.

For professionals who have never served on a board, courses provide structured learning on corporate governance principles, board dynamics, fiduciary duties, and regulatory compliance.

You need to understand not just the Companies Act provisions but also SEBI’s Listing Obligations and Disclosure Requirements (LODR), financial statement analysis, risk management frameworks, and the nuanced role of board committees. Without prior exposure to boardroom operations, self-study through free resources may leave critical knowledge gaps that might leave you unable to pass the mandatory proficiency test.

Most aspiring independent directors come from operations and consulting in diverse industries. Some of the courses such as KPMG, LawSikho, inter alia, addresses the critical question of how to position yourself in the market and secure your first board appointment, which free resources rarely cover.

Existing executive directors

Executive directors currently serving on boards who wish to transition into independent director roles face a unique challenge.

While you have boardroom experience, the role of an independent director differs fundamentally from that of an executive director.

Executive directors are involved in day-to-day management and implementation, whereas independent directors provide strategic oversight, monitor management performance, and protect stakeholder interests while maintaining arm’s-length independence.

Executive directors transitioning to independent roles also benefit from courses that cover conflict of interest management, the delicate balance between supporting management and exercising independent judgment, and understanding when to blow the whistle on governance failures.

The shift from operational involvement to governance oversight requires a mindset change that structured learning facilitates more effectively than independent study.

Retired professionals and senior advisors

Retirement from corporate careers doesn’t mean the end of professional contribution.

Many retired CEOs, CFOs, CXOs, and senior executives pursue independent directorships as a portfolio career that leverages decades of industry experience while offering flexibility, intellectual engagement, and meaningful income.

Independent director positions allow you to contribute strategic wisdom without the operational demands of full-time executive roles.

For retired professionals, independent director courses serve multiple purposes beyond test preparation.

You gain updated knowledge on recent regulatory changes, evolving governance standards, emerging risks like cybersecurity and ESG compliance, and contemporary board practices that may have evolved since your active corporate years. The business environment and regulatory framework change rapidly, and what was acceptable governance practice even five years ago may no longer meet current standards.

Furthermore, courses provide networking opportunities with other aspiring and practicing directors, creating connections that often lead to board introductions and recommendations.

Courses offered by institutions like IIM Bangalore, KPMG and LawSikho include access to executive search firms and board placement networks, which are particularly valuable for retired professionals who may no longer have active corporate networks. Course like LawSiko

If you’ve served for ten years or more as a director or key managerial personnel in qualifying companies, you’re exempt from the IICA proficiency test.

However, even exempt professionals often choose to take structured courses to refresh their knowledge, understand current best practices, and signal their commitment to professional development to companies seeking independent directors.

In a competitive market where boards seek not just experience but also contemporary expertise, demonstrating recent training can differentiate you from other candidates with similar backgrounds.

Should you choose a free or paid independent director course?

One of the most common dilemmas while deciding which course to choose is, whether to invest in paid courses/programs or rely on free resources. The answer depends on your learning style, existing knowledge base, career urgency, and networking needs.

IICA: Free e-modules for Independent Director’s proficiency test

The Indian Institute of Corporate Affairs (IICA), operating under the Ministry of Corporate Affairs, offers comprehensive free e-learning modules through the Independent Directors Databank platform at independentdirectorsdatabank.in. These courses represent the official curriculum designed specifically to prepare candidates for the mandatory online proficiency self-assessment test.

Once you register in the IICA databank (with subscription fees of ₹1,000 for one year, ₹15,000 for five years, or ₹25,000 for lifetime enrollment), you gain immediate access to the entire course library.

The free IICA courses are organized into three categories covering over 40 distinct modules.

- Board Essentials Courses cover statutory provisions from the Companies Act, 2013, including incorporation of companies, share capital, board meetings, general meetings, accounts of companies, duties and liabilities of directors, board committees, audit and auditors, corporate social responsibility, and SEBI LODR regulations. These modules explain the legal framework that governs corporate India and the specific obligations that fall on independent directors.

- Board Practice Courses focus on practical governance skills such as board effectiveness and culture, governance of committees, board evaluation methodologies, managing through financial ratios, engaging stakeholders, building resilient companies, and understanding the board’s role in strategy governance. These modules translate legal requirements into practical board behaviors and decision-making frameworks.

- Case Studies, the platform also offers detailed case studies on major corporate governance failures both in India and globally, including Satyam Computer Services, Yes Bank, IL&FS, PMC Bank, Enron Corporation, WorldCom, Volkswagen, and Olympus. These real-world examples illustrate how governance failures occur and what independent directors should watch for.

Each module is designed as bite-sized learning content with post-assessment quizzes to check retention.

The content is accessible anytime, anywhere, from any device, allowing you to study at your own pace. The courses are continuously updated by IICA to reflect regulatory amendments and evolving governance practices. All content is available in English, and the platform provides a mock test environment that simulates the actual proficiency test, allowing you to familiarize yourself with the question format and test interface before attempting the real assessment.

The IICA proficiency test itself consists of multiple-choice questions covering all topics from the e-learning modules. You have 75 minutes to complete the test, and you need to score at least 50% to pass. There’s no limit on the number of attempts, though you must maintain a one-day gap between consecutive attempts. You have two years from your databank registration date to pass the test, failing which your name will be removed from the databank (though restoration is possible by paying ₹1,000 and passing the test within the restoration period). Click here to learn more about Independent Director’s Proficency Test

When free e-modules are sufficient

Free IICA e-modules are sufficient if you are an experienced professional with a strong foundation in corporate law, finance, and governance.

If you’re a practicing Chartered Accountant, Company Secretary, or corporate lawyer, you already possess deep knowledge of the Companies Act, financial statements, and regulatory compliance. For such professionals, the IICA e-learning modules serve primarily as a refresher and help you focus specifically on independent director responsibilities rather than general corporate law.

Free e-modules are also appropriate if your primary goal is simply to pass the IICA proficiency test and obtain the mandatory certification without immediate plans for active board seeking. If you’re registering in the databank as a compliance requirement because you’ve already been offered a board position, or if you’re approaching the two-year deadline and need to pass the test urgently, investing in an expensive paid course may not be necessary.

Budget-conscious professionals, particularly those in the early stages of their careers without significant disposable income for premium programs, should start with free IICA courses. You can always supplement with paid courses later if you find the free content insufficient or if you need the networking and placement support that premium programs offer. The free content is genuinely comprehensive and of good quality, representing the official curriculum designed by governance experts at IICA.

When to invest in paid Courses

Paid courses become valuable when you need

- structured learning,

- expert guidance,

- peer interaction, and

- career support beyond just test preparation.

If you’re transitioning from a non-governance background, such as operations, technology, or marketing, without prior exposure to corporate law or financial analysis, self-study through free modules can be overwhelming.

Paid courses offer sequential curriculum design, live faculty interaction, doubt-clearing sessions, and contextualized explanations that make complex legal and financial concepts more accessible.

The networking dimension of paid courses often justifies the investment for professionals serious about building board careers. Programs like IIM Bangalore’s IDCP, LawSikho’s Independent Director’s Professional Development Program, KPMG’s Board Leadership Centre Programme, and similar offerings attract senior professionals, existing directors, and CXO-level candidates.

The peer group you interact with during the course becomes a valuable professional network. Many board appointments happen through recommendations and introductions rather than formal applications, and the connections you build during premium courses can lead to opportunities years later.

Several paid programs offer connections to executive search firms and board placement services. KPMG, for instance, explicitly mentions partnerships with executive search firms who help place certified candidates in board roles. While there’s no guarantee of placement, these connections significantly increase your visibility in the market. If you’re a retired professional without an active corporate network or a mid-career professional looking to break into board roles, this placement support can accelerate your journey to your first appointment.

Premium courses also provide credentials beyond the mandatory IICA certification. A certificate from IIM Bangalore carries significant brand value and signals to companies that you’ve invested seriously in governance education. Similarly, CPD-accredited programs like those offered by Directors Institute provide international recognition in over 50 countries, valuable if you’re targeting board roles in multinational companies or overseas entities. The certificate itself becomes a differentiator in a competitive market where multiple candidates may have similar experience levels.

If you’re targeting high-value board positions in large listed companies, PSUs, or MNC subsidiaries, the depth of knowledge provided by paid courses such as LawSikho’s exceeds basic test preparation.

These programs cover advanced topics like ESG governance, cyber risk oversight, digital transformation at the board level, M&A evaluation, family business governance, and crisis management that IICA’s free modules address only superficially. The case study discussions, simulations, and interactive sessions in paid courses build the judgment and confidence needed for effective board participation.

Time-constrained professionals also benefit from paid courses’ structured approach. If you have limited time due to demanding work schedules, a guided program with clear milestones, scheduled sessions, and faculty support ensures disciplined progress. Self-study requires significant self-discipline and time management, which busy professionals often struggle to maintain. The investment in a paid course creates accountability and structure that increases your likelihood of completion.

Top independent director courses and programs in India

The Indian market offers diverse independent director training options, from free government programs to premium executive education. Each caters to different audience segments, learning objectives, and budget levels.

IICA Certification Course for Independent Directors

Program Overview: IICA Certification Course for Independent Directors is IICA’s own optional certification program—separate from the mandatory databank registration and proficiency test.

Duration and Format: The Director’s Certification Program in Corporate Governance runs 4 months with 21 online sessions delivered via a sophisticated Learning Management System. Sessions are live, conducted on Thursdays & Fridays from 4:30 PM to 6:00 PM, and accessible through the sophisticated LMS platform.

Target Audience: Designed for operational-level executives in Central Public Sector Enterprises (CPSEs), government companies, and professionals seeking foundational board governance knowledge.

Curriculum Highlights: The program covers company law compliance basics, board committee structures, SEBI LODR requirements, financial statement interpretation, and case studies on corporate governance failures and successes.

Faculty: Program is taught by faculty of national and international repute with extensive experience in policy-making, academia, and corporate practice.

Fees: ₹50,000 + 18% GST = ₹59,000 (total ₹59,000). Corporate discount of 10% on basic fee available when organizations nominate 3 or more delegates. No discount for individual nominations.

Certificate: Upon completion, you receive an IICA certificate co-branded with the Ministry of Corporate Affairs, which carries official government recognition.

Unique Advantage: Since IICA administers the proficiency test, their training aligns perfectly with test requirements. If you complete this certification, you are reasonably well-prepared for the mandatory proficiency exam.

Best Suited For: Government officers, PSU employees, and first-time board aspirants with limited private sector governance exposure who want foundational training from the regulatory authority itself.

Please note that the above details are based on Batch 17 (commencing June 2025). For updated information on the latest batch including current fees, schedule, and curriculum modifications, please check IICA’s official website or contact the course lead directly.

ICSI Certificate Course on Independent Directors

Program overview: The Institute of Company Secretaries of India (ICSI) offers a certificate course on Independent Directors specifically designed for company secretaries, ICSI members, students, and professionals seeking structured board training with strong compliance and secretarial focus.

Duration and format: Approximately 3-month program (July to September) with 15-20 hours of training delivered through weekly live webinar sessions. Sessions are conducted every Friday from 3 PM to 5 PM (approximately 2 hours each). While live attendance is encouraged for interactive learning, all session recordings, reference materials, and PPTs are made available on ICSI-LMS platform for one year, allowing participants to review content at their convenience.

Target audience: Primarily targets ICSI members, ICSI Executive Programme students, and graduates from any stream recognized universities.

Curriculum highlights: Covers Companies Act provisions relevant to independent directors, board committee roles (audit, nomination and remuneration, stakeholder relationship), corporate social responsibility, related party transactions, and insider trading regulations.

Fees: ₹7,500 + GST for ICSI members and students; ₹15,000 + GST for non-members. This makes it one of the most affordable structured programs available.

Certificate: ICSI Certificate of Completion awarded to candidates upon successful completion of both the MCQ-based assessment test and qualifying project report.

Assessment: Two-component evaluation system:

- MCQ Based Test – 50% weightage

- Project Report – 50% weightage

Both components must be successfully completed to receive the certificate.

Unique advantage: Strong focus on statutory compliance, board meeting procedures, and secretarial practices that company secretaries excel at. If you are a CS professional, this leverages your existing knowledge base.

Best suited for: Company secretaries, legal professionals, and compliance managers with 5-10 years experience seeking affordable, compliance-focused board training.

Please note: – the above details are based on Batch 9 (Registration: 10 July 2025 to 14 September 2025; Commencement: 19 September 2025). For updated information on the latest batch including current fees, schedule, and curriculum modifications, please visit www.icsi.edu or contact [email protected] / call 0120-4522089/79. Registration once done cannot be cancelled or transferred and is non-refundable.

LawSikho Independent Directors’ Professional Development Program

Program overview: LawSikho offers a comprehensive NSDC-certified program designed for aspiring board members, corporate leaders eyeing board transitions, legal professionals, entrepreneurs, and seasoned professionals approaching retirement who want not just certification but actual board appointment strategy.

Duration and format: The program runs approximately 6 months with 48 live interactive classes (2 classes per week), typically held on Sundays or after 8 PM on weekdays to accommodate working professionals. The course combines live sessions, 400+ pre-recorded video lectures, comprehensive case study discussions, and practical application exercises. All content is delivered through a sophisticated learning platform accessible on any device, with 3 years of online access to updated materials.

Target audience:Specifically designed for retired professionals and professionals with 10+ years of experience in corporate sectors, including CEOs, CFOs, COOs, C-suite executives, lawyers, accountants, company secretaries with a decade or more of experience, HR professionals, entrepreneurs, and anyone approaching retirement seeking lucrative post-retirement board opportunities.

Curriculum Highlights: The program provides extensive coverage including:

- 1500+ MCQs for practice and assessment

- 200+ comprehensive notes

- 7 major case studies (WorldCom, Enron, Volkswagen, Olympus, Hydro One, Satyam, Maruti Suzuki)

- Independent director eligibility criteria under Section 149(6) of Companies Act 2013

- Comprehensive coverage of Companies Act 2013 provisions (incorporation, share capital, debentures, deposits, management, accounts, CSR, audits, director appointment and qualifications, related party transactions, director liabilities, board committees, meetings, mergers, oppression and mismanagement)

- SEBI (LODR) Regulations 2015

- Board committee operations and governance

- Financial statement analysis and basic accountancy

- Corporate governance best practices and regulatory compliance framework

- Secretarial Standard 2 and Schedule IV (Code for Independent Directors)

- Professional ethics for independent directors

- Most importantly: How to find your first clients, position your profile, and secure independent director appointments

Faculty: Program instructors include:

- Qualified Independent Directors who have successfully cleared the IICA proficiency test

- Experienced corporate law practitioners with 7+ years of litigation and advisory experience before High Courts

- Teaching professionals with 23+ years of experience in CA, ACCA, IFRS, CPA-USA, and CMA-USA courses

- Senior associates with extensive expertise in company law, corporate affairs, governance, and regulatory compliance

- Practicing professionals with decades of industry experience as company secretaries and legal advisors

Fees: ₹63,000 for the complete program (inclusive of all charges). EMI plans are available in collaboration with financing partners, making the investment more manageable for working professionals..

Certificate: The program is recognized by the National Skill Development Corporation (NSDC), a public-private partnership under the Ministry of Skill Development and Entrepreneurship, Government of India. You receive a co-branded NSDC and Skill India certificate upon successful completion, which carries official government recognition.

Refund policy: 100% money-back guarantee available after 30 days of full participation if you don’t find the course beneficial. The only condition is that you must pursue it diligently for a month, complete the exercises, but still not find value in it.

Unique advantages:

- Post-certification placement strategy: Unlike other programs that end with certification, LawSikho explicitly teaches you how to find clients, position your profile, leverage networking, and secure actual appointments. This addresses the biggest gap most certified professionals face—getting from certified to appointed.

- Live mentorship: The program includes live sessions where you can ask questions about your specific situation—whether that’s transitioning from a corporate role, building your personal brand, or navigating your first board appointment.

- IICA Test Preparation: The curriculum specifically prepares you for the mandatory IICA proficiency test with mock assessments that mirror the actual test format.

Success stories: LawSikho’s program has enabled Rangaraj Ravindran (CEO of VST Group India), Vivek Suman (Investment Banker), Dilip Sharma (Chartered Accountant) and many more to clear the IICA proficiency test within just three months of joining the course and subsequently enrolled in their Personal Branding program to position themselves for appointments.

Best suited for: Mid-career to senior professionals (10-25 years experience) in law, finance, management, sales, marketing, research, or related fields who want comprehensive training that doesn’t stop at certification but extends to actual appointment strategy and career placement. The higher fee is justified by the extensive content (1500+ MCQs, 400+ videos, 48 live classes, 7 case studies), long-term access, placement support, and most critically—the post-certification roadmap to securing actual board positions, which is where most other programs leave a gap.

Please note: – Course content, fees, and program structure are subject to updates. For the most current information including batch schedules, enrollment deadlines, and any program modifications, please visit lawsikho.com or click here or search for “ LawSikho’s Independent Director’s professional Development Program” or schedule a counseling call at +91 80474 86192. Registration is non-refundable except under the 30-day money-back guarantee terms.

IOD Directors Orientation Programme

Program overview: The Institute of Directors (IOD), established in 1990, offers a comprehensive Orientation Programme (Online) to help participants prepare for and pass the IICA online proficiency self-assessment test.

Duration and format: The program covers 6 comprehensive modules delivered through intensive sessions. Available in both virtual and physical formats, with virtual sessions offering synchronous learning, in-depth knowledge delivery, and one-to-one communication through online query redressal.

Curriculum highlights: The program covers all topics relevant for independent directors qualifying the online test in the first attempt. It includes discussion on mock test papers for the independent directors’ proficiency test.

Faculty: Sessions are conducted by renowned speakers with systematic, synchronous learning approaches. The program provides in-depth knowledge beyond geographical barriers through virtual delivery.

Fees: Program fees is divided in two parts:

- Virtual Programme: Rs. 2.50 Lakh + GST 18% = Rs. 2,95,000 total

- Physical Programme: Rs. 2 Lakh + GST 18% = Rs. 2,36,000 total

Additional benefits: Participants receive one year complimentary membership of the Institute of Directors (for non-members).

Certificate: IOD certificate confirming program completion and comprehensive test preparation for the IICA proficiency examination.

Flexibility: IOD reserves the right to change course syllabus, content, faculty, locations, and fees. If a registered participant cannot attend, registration is cancelled with no refund. This strict policy reflects the program’s intensive, time-bound nature.

Unique advantage: Established track record with 430+ batches and 10,000+ executives trained. Comprehensive curriculum designed specifically to align with IICA proficiency test requirements. The program offers systematic coverage of all regulatory, governance, and financial topics tested in the IICA examination, with practical mock test experience and discussion to build test-taking confidence.

Best suited for: Given the premium pricing (Rs. 2.36-2.95 Lakh), this is best suited for senior executives and professionals for whom board positions represent significant career value and who want expert-guided preparation from India’s established Institute of Directors.

For more information, visit their website by clicking here.

IIM Bangalore Independent Directors Certificate Programme (IDCP)

Program overview: IIM Bangalore’s Executive Education Programmes Office offers a prestigious Independent Directors Certificate Programme (IDCP) designed to provide comprehensive knowledge about how the real world of corporate governance works and the current and emerging role of Independent Directors.

Duration and format: The program is a 21-day certificate programme spread over 6 months (November 2025 to April 2026), comprising 35 sessions conducted in hybrid mode. Hybrid delivery means participants can choose to be physically present in the IIM Bangalore classroom or participate virtually via Zoom. The program offers flexibility for working professionals with sessions scheduled on:

- Fridays: 18:00-20:45 (evening sessions to accommodate work schedules)

- Saturdays: 10:00-12:45 & 14:15-17:00 (full-day weekend sessions)

Target audience: Designed for directors, non-executive directors, professionals looking to leverage ‘IIM’ brand name.

Curriculum highlights: The program informs participants how the real world of corporate governance works and the current and emerging role of independent directors. It offers a clear perspective on corporate governance with conceptual models for investigating independent director roles and behavior based on both practical insights and academic understanding.

Faculty: Program Directors include Professor S. Raghunath from the Strategy area and Professor Anil B. Suraj from the Centre for Public Policy at IIM Bangalore. Faculty bring both academic rigor and practical board experience.

Fees: IIM Bangalore programs typically command premium pricing. While specific fees aren’t publicly disclosed, the fee for non-residential is INR 4,50,000 + 18% GST = INR 5,31,000 total.

Certificate: IIM Bangalore Executive Education Programme Certificate of Completion awarded to participants at the end of the programme upon successful completion of programme requirements. This carries the prestige and credibility of India’s top ranked business school (QS 2025 Global Full-Time MBA Ranking).

Unique advantages:

- IIM Brand Equity: An IIM Bangalore certificate carries significant credibility with corporate boards, particularly for those targeting blue-chip company appointments.

- Hybrid Learning Experience: Unlike purely online programs, you experience IIM Bangalore’s campus environment, interact face-to-face with faculty and peers, and build stronger networking relationships.

- Academic Rigor: The program is described as a “unique offering from IIM Bangalore” that combines theoretical frameworks with practical governance challenges.

- Networking: Your cohort comprises practicing directors and senior executives—connections that often lead to board referrals and co-directorship opportunities.

Best suited For: Senior executives and CXO-level professionals (20+ years experience, current compensation ₹50 lakh+) who want the IIM brand on their credentials and can justify the premium investment through future board portfolio earnings. If you’re targeting blue chips indian companies and PSU boards, the IIM certificate opens doors.

Please note: The above details are specific to Batch 7 (November 2025 – April 2026). For updated information on subsequent batches including schedules, curriculum modifications, and any changes in program structure or fees, please visit https://eep.iimb.ac.in/ or contact the Executive Education Programmes office directly or click here for Brochure.

KPMG Board Leadership Centre Programme

Program overview: KPMG India’s Board Leadership Centre has designed the Independent Director Certification Programme to help participants gain comprehensive knowledge on all aspects of board membership and prepare them to effectively carry out their roles and responsibilities as independent directors.

Duration and format: 10-week program delivered through virtual classroom format with 50+ learning hours (also referenced as 45+ hours in program materials). Weekend classes scheduled over 10 weeks with live virtual instructor-led sessions, allowing working professionals to participate without disrupting their careers.

Target audience: The program is best suited for professionals who aspire to join blue chips listed companies.

Curriculum structure: The program covers 18 comprehensive modules:

- Module 1: Introduction to being a board member

- Module 2: Governance frameworks and Independent Director’s position

- Module 3: Finding your place in a board committee

- Module 4: Professional discipline, compliance, and ethics

- Module 5: Interpreting financial statements

- Module 6: Basics of risk and governance

- Module 7: Select regulatory focus areas

- Module 8: Stakeholder management and investor relations

- Module 9: Human capital and diversity

- Module 10: Board effectiveness and evaluation

- Module 11: Anti-bribery, fraud, and corruption

- Module 12: Family business governance

- Module 13: Mergers and acquisitions

- Module 14: ESG (Environmental, Social, Governance)

- Module 15: Cyber security

- Module 16: Digital strategy and transformation using emerging technologies

- Module 17: Getting your first directorship

- Module 18: Continuous professional development

Faculty: Program faculty includes KPMG partners and industry leaders with expertise in corporate governance, board matters, forensics, risk advisory, finance, investor relations, ESG, cybersecurity, accounting, digital transformation, and people management.

Special feature—module 17: KPMG uniquely includes a dedicated module on “Getting your first directorship”—addressing the post-certification placement challenge that most programs ignore.

Additional benefits: Executive search partnerships: KPMG connects participants with executive search firms specializing in board placements. (Note: Executive search partners may change without prior notice).

Important caveat: Participants must register and undergo the mandatory IICA assessment separately. The KPMG program prepares you for board service but does not directly prepare you for the IICA proficiency test. You’ll need additional IICA test-specific preparation.

Fees: ₹2.75 lakh per participant plus GST approximately INR 3.245 lakh (₹2.75 lakh + 18% GST)

Certificate: Certificate from KPMG India upon program completion.

Unique advantages:

- Big 4 credibility: KPMG’s brand carries weight with audit committees and CFOs who value the financial rigor and governance focus of Big 4 firms.

- Executive search connections: Access to KPMG’s executive search network could accelerate your first appointment—assuming you meet their client companies’ experience requirements.

- Contemporary topics: Modules on ESG, cyber security, and digital transformation reflect current board priorities, making you relevant for 2025-2030 governance challenges.

- Peer network: Your cohort comprises CXO-level professionals who can potentially refer you to board openings in their networks.

Limitations: Unlike other courses, the premium pricing and senior experience requirement exclude mid-career professionals.

- Additionally, the program doesn’t directly prepare you for the IICA test, necessitating separate preparation.

- Non-refundable fee policy means once you pay, there are no refunds regardless of circumstances.

- Selection process includes resume screening, interview, and SOP requirement—not everyone who applies will be accepted.

Best suited For: Professionals who want Big 4 brand credibility, executive search connections, and are targeting blue chip listed companies. The investment makes sense if your professional profile commands ₹1+ lakh sitting fees per board meeting.

Directors Institute Independent Directors Program (IDP)

Program overview: Directors Institute offers the Independent Directors Program (IDP) to prepare non-executive directors for their crucial role in overseeing corporate governance and preventing mismanagement.

Format: Self-paced online courses accessible anytime, anywhere, designed to allow participants to progress at their own speed without fixed schedules. The program offers 200+ hours of course content that participants can complete according to their availability and learning pace.

Target audience: Professionals across various backgrounds seeking to develop integrated governance thinking and skills.

Curriculum highlights: The program incorporates key elements from the Companies Act 2013, SEBI’s Listing Obligations and Disclosure Requirements (LODR), and various case studies. It includes more than 24 well-researched modules designed as per industry requirements (referred to as “9 Well Designed 200+ Hours Courses” in their achievements).

Sample modules cover:

- Introduction to board membership roles, responsibilities, and legal obligations

- Principles and practices essential for effective board operation

- Different provisions of Companies Act 2013

- SEBI LODR compliance

- Global best practices in corporate governance

Learning resources: Different provisions and sections of the Companies Act 2013, SEBI LODR, case studies, and other resources are consolidated in one place for participants’ convenience. Case studies on major corporations provide concentrated reference points for independent directors.

Credibility: Completion of the program enhances professional credibility, setting you apart as a qualified and competent leader. The courses are backed by government and non-government bodies for contributions to economic development.

Fees: Program fees and structure require direct inquiry with Directors Institute.

Certificate: Directors Institute certificate upon program completion.

Unique advantages:

- Self-paced flexibility: No fixed schedules—access courses at your convenience and progress at your own speed.

- Comprehensive resource consolidation: Instead of hunting across multiple sources, you get Companies Act provisions, SEBI regulations, and case studies consolidated in a single platform.

- Focus on crisis management: The program teaches independent directors the proper approach during conflicts or crises—practical skills often overlooked in academic programs.

Limitations:

- No live instruction or interactive sessions with faculty

- Requires strong self-motivation and discipline to complete

- No specified cohort-based learning or peer networking during the program

- Fees not transparent—requires inquiry

- No information about faculty credentials or backgrounds

- Limited details on assessment methods or program completion requirements

Best suited for: Professionals seeking self-paced training who don’t need live instruction or campus experiences. Ideal for those with strong self-discipline and time management skills who can complete online modules independently.

Important Note: For updated information on program fees, detailed module breakdown, faculty credentials, assessment methods, and enrollment procedures, please contact Directors Institute directly through their website or offices. The information above is based on publicly available content on their website and may be subject to change.

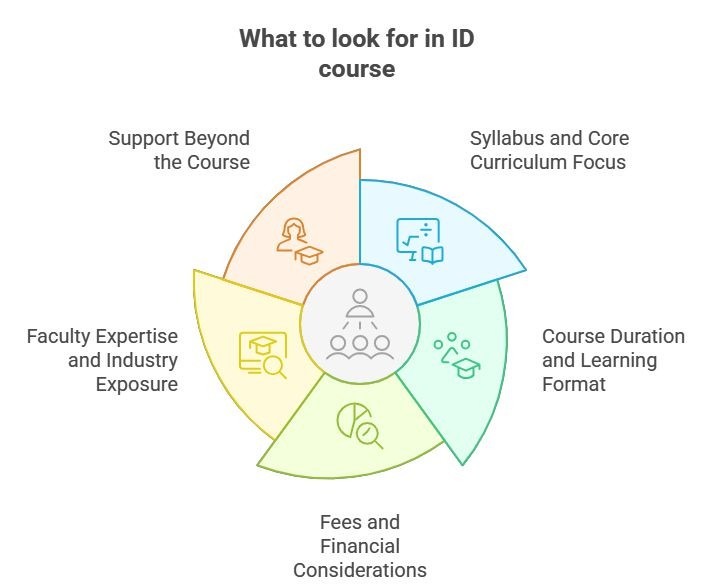

What should you look for in an independent director course?

Choosing the right independent director course requires evaluating multiple dimensions beyond just fees and duration. Here’s what matters most.

Syllabus and core curriculum focus

The first criterion is whether the course curriculum aligns with your learning objectives.

If your primary goal is passing the IICA proficiency test, ensure the program covers the complete test syllabus including Companies Act 2013 provisions on incorporation, board meetings, directors’ duties, CSR, related party transactions, accounts and audit, and SEBI LODR regulations on board composition, disclosure requirements, and committee functions.

Many programs go beyond IICA test requirements to cover advanced governance topics, which adds value for long-term career development but may not be necessary if you’re focused purely on certification.

For professionals from non-finance backgrounds, ensure the program provides sufficient depth on financial literacy. Independent directors must understand balance sheets, P&L statements, cash flow statements, key financial ratios, and warning signs of financial distress. If you’re an engineer, operations professional, or marketing expert transitioning to board roles, financial literacy becomes a critical learning priority that should receive substantial curriculum time.

Red flags to avoid:

- Generic “corporate governance overview” without specific module breakdowns

- Heavy theory without practical case studies

- Curricula that haven’t been updated since 2019 (ignoring recent Companies Act amendments and SEBI updates)

Green flags to seek:

- Specific modules on contemporary issues like ESG, cybersecurity, digital transformation, and family business governance

- Balance between regulatory compliance (Companies Act, SEBI LODR) and board effectiveness skills

- Case studies from major corporations that provide practical reference points

- Coverage of board committee operations (audit, nomination and remuneration, CSR, risk management)

How to assess: Request the detailed curriculum before enrolling. Ask for sample module content or preview materials. If a program won’t share its syllabus upfront, that’s a warning sign.

Course duration and learning format

Course duration impacts both your time commitment and the depth of learning possible.

Short-duration programs provide focused test preparation but limited depth on governance nuances. Three-month programs like ICSI’s offer balanced coverage with manageable time commitment for working professionals. Six-month programs like IIM Bangalore, LawSikho and KPMG allow extensive exploration of topics, multiple case studies, and time for reflection and application.

Consider your availability and learning preference.

If you’re employed full-time with demanding travel and meeting schedules, self-paced online programs offer maximum flexibility.

You can study during early mornings, evenings, or weekends without blocking out specific dates. However, self-paced learning requires strong discipline and self-motivation. Many professionals enroll in such programs but don’t complete them due to competing priorities.

Virtual classroom programs with scheduled sessions create accountability and structure. When you know there’s a Saturday afternoon session with faculty and peers, you’re more likely to prioritize attendance. The real-time interaction allows immediate doubt clarification and dynamic discussions that deepen understanding. However, scheduled sessions may conflict with work commitments or personal obligations, causing stress.

Hybrid programs combining on-campus and online components offer the best of both worlds. The campus experience, while requiring travel, creates immersive learning and stronger networking than purely virtual formats. If you’re targeting board roles where relationships and referrals matter significantly, the networking advantage of in-person sessions can justify the travel and time commitment.

To sum up, these are the options to pick from: –

Duration options:

- Short programs (3 months): ICSI’s part-time certificate course balances work and study

- Medium programs (4 months): IICA programs provide comprehensive learning without excessive time commitment

- Extended programs (6+ months): IIM B, LawSikho’s and KPMG’s program are spread over 6 months.

Format considerations:

- Fully online/self-paced: Offers maximum flexibility but requires strong self-discipline. You miss networking opportunities.

- Live virtual sessions: Virtual classroom and live format provides instructor interaction and peer engagement while maintaining location flexibility

- Hybrid (campus + online): IIM Bangalore’s model offers the best of both—convenience plus networking through on-campus sessions

Questions to ask yourself:

- Can you commit to fixed weekly sessions, or do you need self-paced flexibility?

- Do you value networking opportunities, or is knowledge acquisition your sole priority?

- Will your employer allow study time during work hours, or must you complete training evenings/weekends?

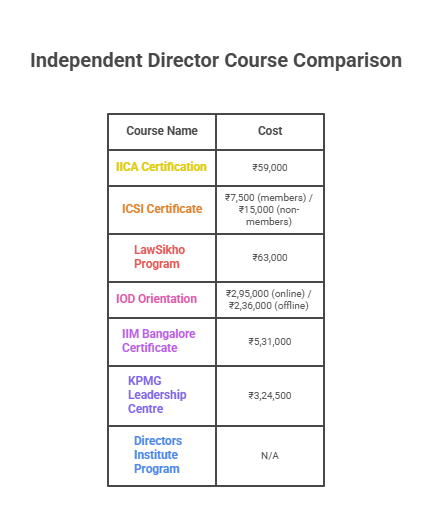

Fees and financial considerations

The fee structure of all seven programs as available in the public domain are as illustrated in the table below:

Price spectrum analysis:

- Budget-friendly: ICSI (₹7,500 for members, ₹15,000 + GST for non-members),

- High Value: IICA (₹59,000) and LawSikho (₹63,000)

- Premium : IOD (₹2.36 lakh for physical, ₹2.95 lakh for virtual), KPMG (₹3.24 lakh), and IIM Bangalore (₹5.31 lakh) KPMG and IIM Bangalore programs

Hidden costs to factor in:

- ₹25,000 for IICA lifetime databank registration (required regardless of training program)

- Travel and accommodation for hybrid programs with campus components

- Opportunity cost of time away from work

Financial aid options: LawSikho and KPMG offers EMI plans in collaboration with financing partners, and some employers reimburse executive education expenses. Check your organization’s professional development policy.

Faculty expertise and industry exposure

Faculty credentials significantly impact learning quality. Check whether faculty members are practicing independent directors with current board experience, academics with research expertise in governance, or consultants who advise boards.

What matters in faculty credentials:

Academic Credentials Alone Aren’t Enough: A PhD in corporate governance doesn’t necessarily equip someone to teach practical board dynamics. Prioritize faculty with:

- Active or former board experience as independent directors who’ve cleared the proficiency test

- Expertise in specialized areas like forensics, risk advisory, ESG, cybersecurity, and digital transformation

- Combined academic and practical experience (like IIM Bangalore’s professors who also advise corporate boards)

Warning sign: Programs listing faculty as “industry experts” without naming them or providing credentials. Legitimate programs showcase faculty profiles prominently.

Questions to ask:

- How many faculty members currently serve or have served as independent directors?

- What percentage of instructors come from academia vs. practicing professionals?

- Will you have access to faculty after course completion for mentorship?

Support beyond the course: networking, placement, and visibility

The course’s value extends beyond curriculum content to the networks and opportunities it creates. This is where most programs fail—and where your evaluation should focus heavily.

Networking opportunities:

- Does the program create peer cohorts where you interact with 20-30 other professionals pursuing similar goals?

- Are alumni networks active, or do participants disappear after the program or course?

- Does the platform facilitate ongoing discussions, forums, and community engagement among registered independent directors?

Placement support:

- Does the program offer executive search partnerships that can connect you with board opportunities?

- Is there a dedicated placement support or a curriculum on “getting your first directorship”—teaching you how to find companies, position your profile, and navigate the appointment process?

- Post-course, do instructors make themselves available for career advice?

Profile visibility boost:

- Does completing the program result in certificates co-branded by recognized bodies like NSDC, Skill India, or Ministry of Corporate Affairs?

- Can you feature program completion on LinkedIn and other professional platforms?

- Do companies recognize the certificate when evaluating director candidates?

The Make-or-break question: “What happens on Day 1 after I complete your program and want to secure my first independent director appointment?”

If the answer is “you’ll have the knowledge you need,” that’s insufficient. The right answer should include specific strategies: optimizing your IICA databank profile, leveraging program alumni networks, approaching executive search firms, targeting companies in your industry, and using LinkedIn effectively.

LawSikho has a specialized placement support and KPMG addresses this through dedicated curriculum on roadmap to securing appointments, while most other programs end at knowledge transfer.

Which course is right for your experience level?

Your professional experience level significantly influences which program will serve you best. Here’s how to match courses to career stages.

Programs for fresh graduates and early-career professionals

If you are a recent graduate or professional with less than 5 years of experience, managing expectations is critical.

Independent director positions are typically offered to professionals with substantial experience, industry expertise, and demonstrated leadership. Fresh graduates rarely qualify for independent director roles in established companies. However, building governance knowledge early in your career creates a foundation for future board opportunities and can open doors to governance-adjacent roles like board secretarial work, corporate governance consulting, or compliance advisory.

For early-career professionals, IICA’s free e-learning courses represent the best starting point. You can register in the IICA databank, complete the free modules at your pace, and pass the proficiency test without significant financial investment. This certification validates your interest in governance and provides foundational knowledge. Given that you won’t be actively seeking board positions for next 10 years, investing heavily in premium programs now offers limited return.

ICSI’s Certificate Course on Independent Directors is also well-suited for early-career professionals, particularly if you’re a Company Secretary, CA, or law graduate.

The ₹7,500-15,000 fee (excluding GST) is manageable early in your career, the three-month duration fits your learning capacity without overwhelming you, and the ICSI certificate adds credibility to your resume. The program provides structured learning superior to self-study while remaining affordable.

Consider LawSikho’s program if you’re from a legal or compliance background and want to build specialized expertise in governance. The practical focus on drafting, documentation, and compliance makes you immediately useful in governance-related roles even if you’re not yet ready for independent directorships.

Many graduates of such programs start careers in corporate secretarial roles, compliance departments, or governance advisory firms, gaining experience that eventually positions them for board roles.

Recommended Programs:

- ICSI Certificate Course (₹7,500-₹15,000): Cost-effective, compliance-focused training that leverages your existing statutory knowledge

- LawSikho Program (₹63,000): If you’re serious about board career trajectory and value the post-certification appointment strategy that other programs lack

- Avoid (₹2.5 to 5 Lacs+): KPMG, IOD and IIM Bangalore programs explicitly target 20+ years experience —you’d be the junior participant in the room.

Mid-career professionals (10 to 20 years experience)

If you have 10–20 years of professional experience in finance, legal, operations, technology, or marketing, this is your optimal certification window. You’ve built enough credibility for companies to take you seriously, yet you may not have the personal boardroom network that makes formal training unnecessary. Now is the time to get certified and strategically position yourself for future board opportunities.

If you have 10-20 years of professional experience with growing functional expertise in finance, legal, operations, technology, or marketing, you’re building the foundation for potential board roles in the future. This stage is ideal for investing in comprehensive governance education that complements your functional skills. However, you still need to be strategic about timing and investment level.

ICSI’s Certificate Course remains an excellent option for mid-career professionals. You now have sufficient business experience to appreciate governance nuances better than fresh graduates. The case discussions and interactive sessions will resonate more deeply with your work experience. The certification enhances your profile if you’re targeting senior management roles, as many companies value governance awareness even in executive positions.

LawSikho’s program is particularly suitable if you’re a practicing advocate, in-house counsel, or compliance professional looking to transition into board advisory or independent director roles in 5-7 years. The legal focus aligns with your expertise while expanding your governance perspective. Mid-career is the right time to start positioning yourself as a governance expert within your functional domain.

Avoid IIM Bangalore and KPMG programs unless you’re at the very senior end of this experience range (18-20 years) and targeting early board positions. The premium investment makes sense only when you’re 2-3 years away from actively seeking directorships and have the financial capacity to invest ₹2.5 – 5 lakhs in career development. For most mid-career professionals, these programs are premature both in terms of ROI and experiential readiness to absorb the content.

Recommended programs:

Option 1—Budget-Conscious Path:

ICSI Certificate Course (₹7,500-₹15,000) + Self-study for IICA proficiency test + ₹25,000 IICA lifetime registration = Total ₹32,500-₹40,000

This works if you are self-motivated and have strong regulatory knowledge from your CA/CS/legal background.

Option 2—Comprehensive Training:

LawSikho Program (₹63,000) + ₹25,000 IICA lifetime registration = Total ₹88,000

Choose this if:

- You lack board-specific training and want structured learning

- You value the post-certification appointment coaching that addresses “what happens after I’m certified”

- You’re willing to invest for comprehensive preparation

Option 3—Premium:

KPMG Program (~₹3.24 lakh) + ₹25,000 IICA registration = Total ₹3.49 lakh

This makes sense only if:

- Your current compensation exceeds ₹40 lakh and you can justify the investment

- You are targeting audit committee positions where Big 4 credentials help

- Your employer reimburses executive education costs

Senior executives and CXO-level candidates (20+ years)

Senior executives with 20+ years of experience, particularly those at CXO level or equivalent positions, are prime candidates for independent director roles. At this career stage, investing in premium governance education makes strategic sense as you prepare for portfolio careers that include multiple board positions.

Option 1: IIM Bangalore IDCP (~₹5.31 lakh) + ₹25,000 IICA registration = Total ₹5.56 lakh

Choose IIM Bangalore if:

- You’re targeting blue-chip Indian companies and Nifty 50 boards

- You want IIM brand equity on your profile

- You value hybrid learning with on-campus immersion for networking

- Your professional background is general management, strategy, or operations

OR

Option 2: KPMG Board Leadership Centre (~₹3.24 lakh) + ₹25,000 IICA registration = Total ₹3.49 lakh

Choose KPMG if:

- You are a CFO, CA, or financial executive targeting audit committee positions

- You want Big 4 brand credibility with finance and risk committees

- You value executive search partnerships that can connect you with board opportunities

- Your expertise is in finance, risk, compliance, or forensics

OR

Option 3: LawSikho’s High Value Program for Strategic CXOs

While premium programs offer brand equity, LawSikho (₹63,000 + ₹25,000 IICA = ₹88,000) provides exceptional value at the lower end of the pricing spectrum with unique advantages that premium programs often lack:

- Dedicated placement support and profile building services: Unlike programs that end at certification, LawSikho explicitly teaches you how to find clients, position your profile, leverage networking, and secure actual appointments—addressing the biggest gap most certified professionals face

- Post-certification roadmap: Comprehensive guidance on optimizing your IICA databank profile, approaching executive search firms, targeting companies in your industry, and using LinkedIn effectively

- Live mentorship for career strategy: Interactive sessions where you can discuss your specific situation—whether transitioning from corporate roles or building your personal brand

- Extended access: 3 years of online access to updated materials (400+ video lectures, 1500+ MCQs, 200+ notes, 7 major case studies)

- IICA test-specific preparation: Curriculum specifically designed to prepare you for the mandatory IICA proficiency test with mock assessments

Best suited for: CXO-level professionals who prioritize practical appointment strategy over institutional brand equity, or those who want to maximize ROI by investing in placement support rather than credential prestige alone.

How to get appointed as independent director after the course

Completing a course and passing the IICA proficiency test makes you eligible for independent director roles, but securing actual appointments requires proactive effort and strategic positioning.

How do companies find independent directors?

Companies use multiple channels to identify independent director candidates. Understanding these pathways helps you position yourself effectively.

The most common route is personal networks and recommendations. Existing board members, promoters, and senior management reach out to their professional networks when board positions open up. This is why networking during premium courses proves so valuable; your course peers may recommend you when their companies need independent directors.

Executive search firms play an increasingly important role in director recruitment, particularly for listed companies and large private companies. Firms like EMA Partners, ABC Consultants, Korn Ferry, Spencer Stuart, and Russell Reynolds specialize in board searches. Register your profile with these firms, ensuring your CV highlights governance credentials, industry expertise, functional strengths, and board-readiness indicators like course certifications and understanding of fiduciary duties.

The IICA Independent Directors Databank serves as a searchable database for companies seeking candidates. Ensure your profile is complete, updated, and highlights your unique value proposition. Many smaller companies and startups use this database for initial candidate identification. While elite listed companies may not rely primarily on the database, maintaining an updated profile increases visibility.

Professional networks and industry associations offer board opportunity postings. LinkedIn has become a critical platform for board recruitment. Optimize your LinkedIn profile with governance keywords, showcase your IICA certification and any premium course credentials, join LinkedIn groups focused on corporate governance and independent directors, and engage with content on governance topics to build thought leadership visibility.

Some boards actively recruit for diversity and specialized expertise. If you bring unique skills like cyber security expertise, ESG experience, international market knowledge, or sector-specific technical knowledge, highlight these specializations. Companies increasingly seek directors who offer specific expertise rather than just general business wisdom. You can also click here to learn more about Independent Director appointment.

What is the typical timeline from course completion to first appointment?

Managing expectations around the timeline prevents frustration.

For senior executives and retiring CXOs with strong professional networks, the timeline from certification to first appointment can be 3-6 months. Your existing reputation, network reach, and visible track record create demand even before you actively market yourself as available for board roles.

For mid-career professionals without existing board networks, the timeline extends to 6-18 months or longer. You need time to build visibility, develop relationships with search firms, get recommended into searches, and compete against more experienced candidates. Your first board role may come in a smaller private company, unlisted entity, or startup rather than a prestigious listed company. View these early roles as learning experiences and credibility builders that position you for better opportunities.

Professionals from specialized functional backgrounds like technology, legal, or operations may find opportunities faster than generalists if their expertise addresses specific board needs. For example, a cyber security expert may be sought after as companies strengthen their technology oversight. A senior lawyer specializing in M&A may be recruited to boards of companies planning acquisitions. Identify and emphasize your differentiated expertise rather than positioning yourself as a general management director.

Geography significantly impacts timelines.

Professionals based in metro cities like Mumbai, Delhi, or Bangalore have advantages due to concentration of corporate headquarters and easier meeting attendance. If you’re based in smaller cities, be prepared for longer timelines or consider targeting boards of companies headquartered in your region, where local presence becomes an advantage rather than a disadvantage.

Persistence and patience are essential.

Treat board appointment as a long-term career objective rather than an immediate outcome. Continue building your professional reputation, expanding networks, staying updated on governance developments, and remaining visible in relevant circles. Many directors report that their first appointment came unexpectedly through a casual conversation or a recommendation from someone they’d met years earlier, illustrating the unpredictable nature of board opportunities.

What is the ROI of independent director course?

Evaluating the return on investment for independent director courses requires considering both financial and non-financial returns.

Financial ROI (Sitting fees, profit linked commission, timeline to recover investment)

Sitting fees structure for board meetings

The Companies (Appointment and Remuneration of Managerial Personnel) Rules, 2014 specify that sitting fees payable to any director for attending a board or committee meeting cannot exceed ₹1 lakh per meeting.

Here’s the current market reality:

Fee distribution across Nifty 100 Companies (FY24):

As per an article published on Business Standards, In FY24, 29 Nifty 100 companies paid sitting fees of ₹1 lakh or more per board meeting, up from 21 in FY21 and 26 in FY23. Conversely, 36 companies paid ₹50,000 or less, down from 42 in FY21 and 40 in FY23.

This reveals an upward trend—a 5.4% compound annual growth rate in sitting fees over three years, largely aligned with retail inflation rates.

Typical fee ranges by company type:

Small Public Companies (₹10-50 crore paid-up capital):

- Sitting fees: ₹10,000-₹25,000 per meeting

- Board meetings: 4-5 per year

- Committee meetings: 3-4 per year (if you’re on a committee)

- Annual potential: ₹70,000-₹2.25 lakh

Mid-Cap Listed Companies (₹50-500 crore market cap):

- Sitting fees: ₹25,000-₹50,000 per meeting

- Board meetings: 4-6 per year

- Committee meetings: 4-6 per year

- Annual potential: ₹2-6 lakh

Large-Cap Listed Companies (₹500+ crore market cap):

- Sitting fees: ₹50,000-₹1 lakh per meeting

- Board meetings: 4-8 per year

- Committee meetings: 5-10 per year (multiple committee memberships common)

- Annual potential: ₹4.5-18 lakh

PSUs and Government Companies: Some PSUs like NTPC pay ₹20,000 per meeting as sitting fees for independent directors, though rates vary significantly across different public sector enterprises.

Regional Variation: Metropolitan boards (Mumbai, Bangalore, Delhi) typically pay 20-40% higher sitting fees than regional company boards.

Annual retainer compensation ranges

Beyond per-meeting sitting fees, independent directors can receive profit-linked commission not exceeding 1% of the company’s net profits.

How Profit-Linked Compensation Works: According to the Companies Act 2013, companies can distribute up to 1% of net profits as profit-linked compensation (PLC) to non-executive directors. However, the 2024 survey found most Nifty 100 companies use only part of that amount for compensating independent directors.

In FY24, 53 companies paid 51-100% of distributable profits as PLC to independent directors (down from 57 in FY22), while 22 companies distributed less than 50% of distributable profits (up from 13 in FY22).

For example, A company with ₹100 crore net profit could distribute ₹1 crore to non-executive directors. If split among 5 independent directors, each receives ₹20 lakh annual profit commission—in addition to sitting fees.

The real ROI question: It’s not “how long to recover certification costs?” but “how long from certification to first appointment?”

Realistic timeline expectations:

- If you have 20+ years experience + strong network: 3-9 months from certification to first appointment

- If you have 10-15 years experience + moderate network: 9-18 months

- If you have less than 10 years experience + limited network: 18-36 months (or may need to build more experience first)

Non-financial ROI (networking, credibility, influence)

Financial returns are only part of the value proposition.

Non-financial ROI often proves more significant for professionals at senior career stages. The credibility enhancement from a recognized certification creates differentiation in a competitive market.

Networking represents immeasurable ROI.

The relationships you build during courses can lead to board introductions, business partnerships, advisory opportunities, and collaborations that extend far beyond the specific course objective. A fellow participant may recommend you for a board position three years after the course ends. Another may invite you to join an advisory board for their startup. These secondary benefits compound over time and often exceed the direct benefit of course content.

For professionals who view board service as social contribution rather than purely income generation, particularly those targeting nonprofit boards, public sector undertakings, or social enterprises, the non-financial ROI justifies course investment even when direct financial returns are modest. The knowledge gained enables more effective service in these roles, creating value for stakeholders and communities.

Conclusion

Choosing an independent director course requires aligning your career stage, learning needs, financial capacity, and board aspirations with the diverse programs available. Free IICA e-learning provides the mandatory foundation for all aspiring directors, offering comprehensive content for professionals with strong self-learning capabilities and prior knowledge of corporate law and governance. For those needing structured guidance, affordable programs like ICSI and IOD bridge the gap without significant financial burden.

Programs from IIM Bangalore, KPMG and LawSikho justify their fees for senior executives and CXO-level professionals who are within 2-3 years of actively seeking board positions.

The credibility, networking, and placement support these programs offer accelerate your path to well-compensated board roles.

Ultimately, your course choice should reflect where you are in your governance journey. If you’re building foundational knowledge early in your career, start with free or low-cost options. If you’re a senior executive preparing for portfolio board careers, invest in premium credentials that match your professional stature. If you’re a retired professional with extensive networks, even basic certification may suffice while you leverage your reputation for board opportunities.

Beyond course selection, remember that certification is the beginning, not the end.

Securing board appointments requires proactive networking, strategic positioning, patience, and persistence. The knowledge you gain through courses must be complemented by relationship building, personal branding, and continuous professional development. Approach board careers as a long-term endeavor where credentials open doors, but your expertise, integrity, and value addition keep you in the boardroom for years to come.

Frequently Asked Questions

Is IICA registration mandatory to become an independent director?

Yes, IICA registration is mandatory if you wish to be appointed as an independent director in any company after December 2019. The Companies (Appointment and Qualification of Directors) Fifth Amendment Rules, 2019 require all aspiring and existing independent directors to register with the IICA Independent Directors Databank and pass the proficiency test within two years, unless you qualify for exemption based on 3+ or 10+ years of prior qualifying experience.

Can I become an independent director without taking any course?

Technically yes, you can become an independent director by simply registering with IICA, passing the proficiency test, and securing a board appointment without taking any formal course. The IICA test is the only mandatory requirement, and many experienced professionals pass it through self-study using free IICA e-learning modules. However, courses enhance your governance knowledge, build credibility, and provide networking opportunities that improve your chances of securing appointments.

What is the difference between IICA proficiency test and ID courses?

The IICA proficiency test is a mandatory regulatory requirement conducted by the Indian Institute of Corporate Affairs that you must pass to be eligible for independent director appointments. It’s a 75-minute online test requiring 50% marks. Independent director courses are training programs offered by various institutes like ICSI, LawSikho IIM Bangalore, KPMG, and others that prepare you for the test and provide broader governance education, but they are not mandatory unless you want structured learning and certification from those institutes.

Do I need a paid course to pass the IICA test?

No, you don’t necessarily need a paid course to pass the IICA test. The free IICA e-learning modules available after databank registration cover the complete test syllabus and are sufficient for many candidates, especially those with backgrounds in CA, CS, law, or corporate management. Paid courses add value through structured learning, faculty guidance, mock tests, and peer interaction, but self-study using free resources can also lead to successful test completion.

Which course is best for IICA test preparation?

For focused IICA test preparation, LawSikho’s Indepednent Director Professional Development Program and ICSI’s Certificate Course are specifically designed with test syllabus alignment and include mock tests and preparation strategies. If cost is a constraint, the free IICA e-learning modules themselves are the most directly relevant resource. Premium programs like IIM Bangalore and KPMG go well beyond test preparation to cover broader governance topics, making them better for overall career development rather than just test clearing.

How much does it cost to become a certified independent director?

The minimum cost is ₹1,000 for one-year IICA databank registration plus self-study using free resources.

What is the total time from registration to certification?

The fastest path is 4-6 weeks: register in IICA databank (1 week), study using free IICA modules (2-4 weeks for focused preparation), book and pass the proficiency test (5th weeks to schedule and receive results). Realistically, most working professionals take 2-3 months. If you enroll in structured courses, the timeline extends to 3-6 months depending on course duration. You have a maximum of 2 years from registration to pass the test.

Is IIM Bangalore or KPMG or LawSikho course better?

IIM Bangalore offers premier academic credentials, prestigious alumni network, and comprehensive six-month curriculum, best suited for senior executives targeting high-profile board positions willing to invest ₹5,00,000. KPMG provides practical contemporary content, ten-week duration, executive search connections, and is ideal for finance/risk professionals targeting mid-to-large company boards at an estimated ₹2-3 lakhs investment. LawSikho focuses on offering practical legal-governance skills, and provides the best placement support services to make sure the candidates get appointed.

Do companies prefer paid course over IICA-only?

Honestly, no. Companies primarily value your professional experience, industry expertise, and functional skills over certifications. The mandatory IICA certification is baseline eligibility. For many board positions, especially in smaller companies or startups, your track record matters more than certifications. The networking and visibility that courses provide often matter more than the certificate itself.

How long is the IICA certificate valid?

The IICA proficiency test certificate doesn’t expire once you pass it. However, your IICA databank registration has the validity period you selected during enrollment: 1 year, 5 years, or lifetime. You must renew your databank registration within 30 days of expiry if you chose the 1-year or 5-year option. Your proficiency test results remain valid and you don’t need to retake the test upon renewal, but maintaining active databank registration is necessary if you want companies to find you through the database.

Can I take the course and test in Hindi?

Currently, the IICA proficiency test and most independent director courses are available only in English. The IICA databank portal, e-learning modules, and proficiency test are all conducted in English.

What happens if I don’t renew my databank registration?

If you don’t renew your IICA databank registration within 30 days of expiry, your name will be removed from the active database and you won’t appear in search results when companies look for independent director candidates. However, your proficiency test results remain valid.

Allow notifications

Allow notifications