Discover why the IRS conducts Enrolled Agent exams in Hyderabad, Bangalore, and Gurgaon. This article explains the U.S. tax talent shortage, India’s unique advantage, and how you can build an international career through the EA pathway.

Let me ask you a simple question.

If the U.S. Internal Revenue Service that is responsible for all Federal income tax matters, is conducting its professional exams in Hyderabad, Bangalore and Gurgaon, doesn’t that sound unusual?

Why would the IRS come all the way to India?

Why only these three cities?

And why now?

Before I explain why these cities, let’s look at what’s happening in your career in India, because that’s the real reason this exam even matters.

If you are an accountant or bookkeeper in India you already know the ground reality.

- Salaries are low, and entry-level pay is often not enough to survive.

- Even CAs and CMAs who worked hard to qualify are struggling to grow their income, and less than one percent make it into Big Four firms or top MNCs.

- For everyone else, the market is crowded, and clients mostly push for the cheapest option.

- Online filing companies have driven prices even lower, squeezing margins further.

- To make things worse, AI is now taking over many of the easy, voluminous but repetitive administrative tasks that accountants relied on.

You are competing with too many people for too little opportunity.

This is the crisis.

Every accountant I speak to feels stuck. They want growth, but the local market and job prospects feels like a dead end even if you keep pursuing new qualifications.

That’s not surprising, given that India graduates 1 cr commerce grads per year, who usually default to accounting, tax, finance and compliance. The supply grows way faster than the demand, keeping prices very, very low.

Now look at the other side of the world.

The U.S. is facing an accounting, bookkeeping and tax professional shortage like never before.

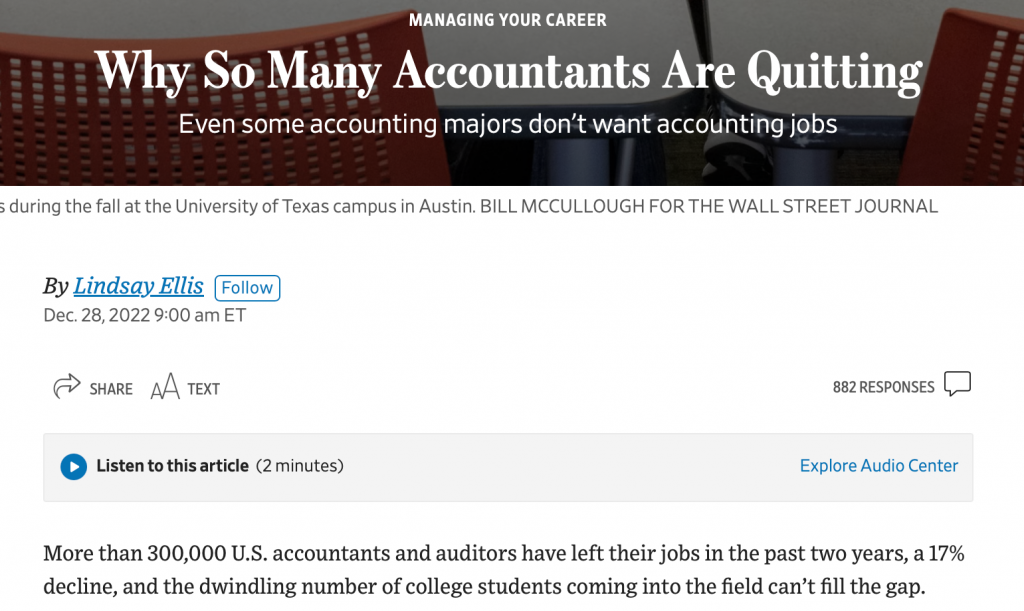

The Wall Street Journal reported in late 2022 that over 300,000 accountants quit in just two years. That’s a 17% decline in the workforce.

Older CPAs are retiring. Gen Z in the USA apparently hates accounting.

This is not my opinion. The IRS itself acknowledges a shortage of professionals. Things are so bad, people can’t find accountants and tax preparers to hire. CPA firms are struggling to find skilled professionals. Big 4 is struggling too.

They are already forced to outsource nearly 60% of all accounting work to India. And still, they can’t just outsource everything to KPOs. They still need skilled professionals for certain tasks – like representing clients during IRS audits.

This is where the opportunity lies.

The U.S. needs qualified tax talent. And Indians are perfectly positioned. Why?

India already has an overcrowded pool of accountants and finance professionals, with too many people chasing too few local opportunities. This makes Indian talent both abundant and available for global work.

Even if their English is not always perfect, even if US based clients often struggle to understand our accents, Indian accountants and tax professionals are adaptable, used to working in diverse teams, and can upgrade communication skills quickly when needed.

We have a long and proven record of handling outsourced tax, compliance, finance, IT, and back-office work for U.S. and global companies.

Our cost advantage is unmatched. But what is even harder to match is Indian talent in volume that simply does not exist in any other country.

An Indian professional charging $15–$20 per hour is still around 70% cheaper than a U.S. counterpart, while delivering consistent quality and reliability.

This is why the IRS sees India as the ideal place to find the next generation of enrolled agents who can support the U.S. tax system.

So what is the Enrolled Agent exam?

The IRS created a federal credential called the Enrolled Agent (EA).

An EA is the highest credential given by the IRS.

They have unlimited rights to represent taxpayers before the IRS. Audits, collections, appeals. Same authority as a CPA or tax attorney.

While it takes years to become a CA or CPA, you can prepare for the EA exam in just 6 months at about 1.5 hrs per day.

Pass all three parts, which you can do within 6 to 9 months, and you are licensed by the IRS itself.

Now the original question. Why is the exam conducted only in three cities: Hyderabad, Bangalore and Gurgaon?

Hyderabad, Bangalore and Gurgaon are the largest hubs for outsourced U.S. tax and compliance work.

Big 4 global delivery centres and hundreds of BPO/KPO firms operate here.

Thousands of Indian accountants already prepare U.S. tax returns from these cities. So the talent density for EA exams is highest here.

The IRS needs help, and Indian talent is the most logical solution.

That’s where the Enrolled Agent credential comes in. And the earnings?

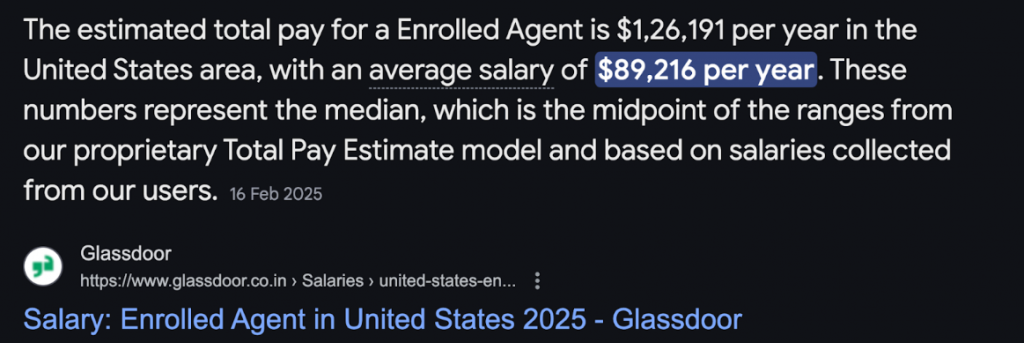

According to the U.S. Bureau of Labor Statistics, tax preparers earn a median of $58,000 annually, with top EAs earning $90,000–$180,000, which is as much as CPAs!

Big 4 firms in India’s Global Delivery Centres are already hiring EAs, offering ₹1–2 lakh per month to entry-level professionals.

That’s right, even a commerce fresher can get this credential and then start earning over 1 lakh per month working for big 4 or a CPA firm’s back office in India.

Independent Indian EAs serving U.S. clients remotely are billing $20–$50/hr, often more than what even Big 4 pays in early careers.

You don’t have to take my word for it.

Here’s an example of someone who is doing this (not our student):

Vimal Anilkumar from Bangalore.

A simple B.Com graduate, no CA, no CPA. He became an EA and today prepares U.S. tax returns (Forms 1040, 1065, 1120) and consults U.S. clients remotely from India.

His story proves that Indian professionals can leapfrog into international work without traditional qualifications.

So now you know why the IRS set up exams in Hyderabad, Bangalore and Gurgaon.

It’s not just about convenience.

It’s a signal. The U.S. wants more Indians trained, licensed, and ready to take on its massive tax workload.

EVen CAs are doing this. Many CA aspirants while preparing for CA are appearing for EA and cracking it.

And yet most Indian accountants have no clue this door exists.

But if you’ve read this far, you do.

Are you excited to know more about this?

I’m inviting you to join our free, 3-day bootcamp this weekend, where we’ll dive into how you can use the IRS Enrolled Agent pathway and other U.S. accounting and tax opportunities to build your international finance career.

We’ll cover:

- Why the IRS is holding Enrolled Agent exams in Indian cities and what it means for you

- How Indian accountants are building successful U.S. tax practices without a CPA or CA

- What opportunities open up once you clear the EA exam

- Step-by-step strategies to build your track record, land your first U.S. client, and start earning in dollars

It’s all live, and you can attend from anywhere. But remember, no recordings will be available, so don’t miss this chance!

Thousands of professionals have already discovered global opportunities with us, don’t be left out.

Set a reminder – your path to unlocking these opportunities starts this weekend.

See you there!

(P.S. Even if you’re unsure, I recommend you join the first session at least. It’ll open your eyes to options you didn’t know existed. Knowledge is power – especially in this rapidly changing world.)

Allow notifications

Allow notifications