Discover Enrolled Agent career opportunities and salary in the US and India. Explore EA job paths, Big 4 hiring, remote work options, and tips to maximize earnings.

Table of Contents

So you have passed the Enrolled Agent exam, and now you are wondering what comes next. Congratulations on earning one of the most respected credentials in the tax profession. The EA designation opens doors that many other certifications simply cannot, and the career possibilities are genuinely exciting.

Whether you are based in the United States or India, the Enrolled Agent credential positions you as a federally authorized tax expert with skills that employers actively seek. From working at Big 4 firms to launching your own practice, the paths ahead are varied and financially rewarding.

This guide walks you through everything you need to know about EA career opportunities and salary potential in both markets.

The demand for qualified tax professionals continues to grow as tax codes become more complex and IRS enforcement intensifies.

If you are ready to understand exactly what your EA credential can do for your career and earning potential, you are in the right place. Let us explore the opportunities waiting for you.

You can also read this step-by-step guide on how to become a US Enrolled Agent to understand the full pathway from eligibility to certification.

Career Opportunities After Becoming an Enrolled Agent

What Does the Enrolled Agent Credential Allow You to Do?

Unlimited IRS Representation Rights

The Enrolled Agent credential grants you something incredibly powerful: unlimited practice rights before the Internal Revenue Service. This means you can represent any taxpayer, on any tax matter, before any IRS office.

Whether your client is facing a routine audit, dealing with collections, or appealing an IRS decision, you have the authority to stand in their corner.

This is not a limited license tied to specific clients or tax matters.

Unlike tax preparers without credentials who can only represent clients whose returns they personally prepared, you can take on any case that walks through your door. This flexibility dramatically expands the services you can offer and the clients you can serve throughout your career.

Federal Credential vs State-Licensed Professionals

One of the most significant advantages of the EA credential is its federal nature.

While Certified Public Accountants are licensed at the state level and must meet different requirements in each state where they practice, your EA designation works everywhere in the United States. You earn it once, and you can practice in all 50 states without additional licensing requirements.

This portability gives you remarkable career flexibility. You can relocate for better opportunities, serve clients across multiple states, or even work remotely for clients anywhere in the country. For professionals considering a move or wanting to build a nationwide client base, this federal recognition removes barriers that other credentials create.

Why the EA Credential is in Demand (US and India)

In the United States, IRS audits and enforcement actions have increased significantly in recent years. Taxpayers facing complex tax situations need qualified representation, and EAs fill this need at a more accessible price point than tax attorneys. The combination of expertise and affordability makes Enrolled Agents valuable in a market where tax complexity keeps growing.

For Indian professionals, the EA credential has become a gateway to the global tax services industry. US companies increasingly outsource tax preparation and compliance work to India, creating strong demand for professionals who understand American tax law. The credential positions you for roles at Big 4 firms, tax outsourcing companies, and remote positions serving US clients directly.

Before exploring career opportunities, you can also learn about the exam format and structure in this detailed guide on the IRS Enrolled Agent Exam.

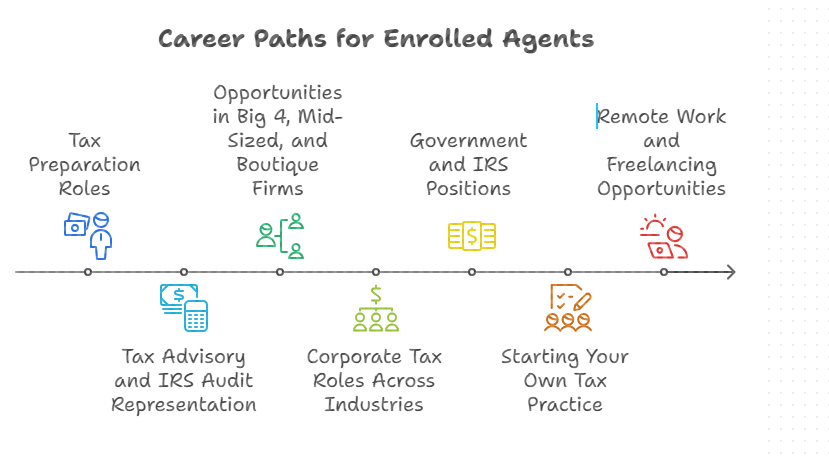

What Career Paths Can Enrolled Agents Pursue?

Tax Preparation Roles (Individual and Business)

Tax preparation is often the foundation of an EA career, and it offers more variety than you might expect. As an Enrolled Agent preparing individual returns, you handle everything from straightforward W-2 filings to complex returns involving investments, rental properties, and self-employment income. The depth of your training means you can confidently tackle situations that would overwhelm uncredentialed preparers.

Business tax preparation adds another dimension to your services.

You can prepare returns for

- sole proprietors,

- partnerships,

- S corporations, and

- C corporations.

Each entity type brings its own challenges and opportunities, from pass-through taxation rules to corporate tax strategies. Building expertise in business returns often leads to higher fees and longer client relationships.

The beauty of tax preparation work is its flexibility.

You can work seasonally during the busy January through April period, or you can build a year-round practice by adding planning and advisory services. Many EAs start with preparation work and gradually shift toward higher-value consulting as they gain experience and build their client base.

Tax Advisory and IRS Audit Representation

Beyond preparing returns, EAs provide valuable advisory services that help clients make smarter tax decisions throughout the year. Tax planning involves analyzing a client’s financial situation and recommending strategies to minimize their tax burden legally. This might include timing income and deductions, choosing optimal business structures, or planning for retirement contributions.

IRS audit representation is where your EA credential truly shines.

When clients receive that dreaded audit notice, they need someone who understands IRS procedures and can advocate effectively on their behalf. You can handle correspondence audits, attend in-person examinations, and negotiate with revenue agents. This service commands premium fees because clients understand the stakes involved.

The representation work extends beyond audits to collections, appeals, and penalty abatement requests. Clients facing IRS liens, levies, or significant tax debts need help navigating programs like Offers in Compromise and installment agreements. Developing expertise in IRS tax resolution creates a specialized niche that many EAs find both lucrative and personally rewarding.

Opportunities in Big 4, Mid-Sized, and Boutique Firms

The Big 4 accounting firms, including Deloitte, PwC, EY, and KPMG, all employ Enrolled Agents within their tax practices. While these firms are known for hiring CPAs, EAs bring specialized tax expertise that complements broader accounting teams. Working at a Big 4 firm offers structured training, exposure to complex engagements, and a prestigious name on your resume.

Mid-sized regional firms often provide an excellent balance between challenge and quality of life. These firms handle sophisticated tax work without the intense travel and long hours that Big 4 positions sometimes require. You get exposure to varied clients and tax situations while maintaining more control over your schedule and career development.

Boutique tax firms focus exclusively on taxation and often specialize in particular niches like international tax, estate planning, or IRS representation. Working at a specialized firm allows you to develop deep expertise quickly because you are surrounded by tax professionals all day. Many EAs find that boutique firms offer the most direct path to becoming a recognized expert in their chosen specialty.

Corporate Tax Roles Across Industries

Many large corporations maintain in-house tax departments rather than outsourcing all their tax work. As an EA in a corporate tax role, you might handle the company’s federal and state tax compliance, manage estimated payments, or support tax planning initiatives. Corporate positions often offer competitive salaries along with benefits that smaller firms cannot match.

The industry variety available to corporate tax professionals is impressive. Healthcare companies, technology firms, manufacturing businesses, and financial institutions all need tax expertise. If you have a passion for a particular industry, you can combine that interest with your tax skills. Understanding industry-specific tax issues makes you more valuable to employers in that sector.

Corporate roles also tend to offer more predictable schedules than public accounting positions. While busy periods still exist around quarterly estimates and annual filings, you generally avoid the extreme hours that public accounting demands during tax season. For professionals seeking work-life balance, corporate tax departments often provide a sustainable, long-term career path.

Government and IRS Positions

Working for the Internal Revenue Service itself is a career path many EAs do not initially consider. The IRS employs revenue agents, tax compliance officers, and other professionals who examine returns and ensure taxpayers meet their obligations. Your EA background demonstrates the tax knowledge these positions require.

State revenue departments also hire tax professionals for similar roles. These positions involve less travel than IRS jobs and keep you focused on a single state’s tax code. Government positions typically offer excellent job security, comprehensive benefits, and pension plans that private sector jobs rarely match.

The experience you gain working on the government side proves invaluable if you later transition to private practice. Understanding how the IRS or state agencies operate from the inside gives you insights that help you represent clients more effectively. Many successful tax resolution specialists started their careers in government roles.

Starting Your Own Tax Practice

The EA credential gives you everything you need to hang out your own shingle and start a tax practice. You can represent clients, prepare returns, and provide advisory services without any additional licensing. This entrepreneurial path offers unlimited income potential and complete control over your professional life.

Starting a practice requires more than technical skills. You need to develop marketing strategies to attract clients, implement systems for managing workflows, and handle the administrative aspects of running a business. Many EAs start by taking on clients while working another job, gradually building their practice until it can support them full-time.

The financial rewards of practice ownership can be substantial. Instead of earning a salary, you capture the full value of your services minus overhead costs. Successful practice owners often earn significantly more than their employed counterparts, though this success requires business development skills alongside tax expertise. Building a practice takes time, but the long-term rewards make the effort worthwhile.

Remote Work and Freelancing Opportunities

Platforms for Freelance EAs

The rise of remote work has created exciting opportunities for Enrolled Agents who want flexibility in how and where they work. Platforms like Upwork, Fiverr, and specialized tax marketplaces connect EAs with clients seeking tax services. You can build a profile showcasing your expertise and attract clients from across the country.

Freelancing allows you to set your own rates based on your experience and the complexity of work you handle. Hourly rates for freelance EAs typically range from $25 to $100 depending on the services provided and your reputation on the platform. As you accumulate positive reviews and build a client base, you can increase your rates and become more selective about the projects you accept.

Working for US Clients from India

For Indian professionals, the EA credential opens doors to serving US clients without relocating. Many US-based tax firms and outsourcing companies hire remote EAs in India to handle preparation, review, and compliance work. The time zone difference can actually be an advantage, allowing work to be completed overnight from the US client’s perspective.

Companies like QX Global, SurePrep, and Initor specifically recruit EAs in India for US tax work. The Big 4 firms also have substantial operations in Indian cities where EAs contribute to global tax engagements. This remote work model lets you earn competitive compensation while enjoying lower living costs than you would face in the United States.

Enrolled Agent Salary Guide (United States and India)

How Much Do Enrolled Agents Earn in the United States?

Entry-Level to Senior Salary Ranges

Entry-level Enrolled Agents in the United States typically earn between $45,000 and $55,000 annually in their first few years. This starting range varies based on location, employer type, and whether you have prior tax experience. Even at the entry level, credentialed EAs earn noticeably more than uncredentialed tax preparers, reflecting the value employers place on your expertise.

As you gain experience, your earning potential increases substantially. Mid-career EAs with three to seven years of experience commonly earn between $65,000 and $85,000, while senior EAs with a decade or more of experience often exceed $100,000 annually. According to Gleim, the average EA salary in the US is approximately $70,891, though top performers earn significantly more.

Industries and Firms Offering the Highest EA Compensation

The type of employer significantly impacts your earning potential as an EA.

Large accounting firms and specialized tax practices generally pay more than small local firms. Big 4 firms offer competitive salaries along with bonuses and benefits that can push total compensation well above base salary figures.

Corporate tax departments, particularly in industries like healthcare, technology, and financial services, often offer the highest salaries for EAs. These companies need in-house tax expertise and are willing to pay premium rates for qualified professionals. If maximizing income is your priority, targeting corporate positions in high-paying industries makes strategic sense.

Factors Influencing EA Pay in the US

Geographic location dramatically affects EA salaries across the country. States like Washington, New York, and California offer the highest average salaries, often exceeding $75,000 for mid-career professionals. However, you need to consider the cost of living in these areas when evaluating offers. A lower salary in a less expensive region might provide better actual purchasing power.

Your specialization also influences earning potential. EAs who develop expertise in complex areas like international taxation, IRS representation, or business tax planning command higher rates than generalists. Building a reputation in a lucrative niche takes time but pays dividends throughout your career in the form of higher fees and more interesting work.

How Much Do Enrolled Agents Earn in India?

Fresher Salary Ranges

Fresh Enrolled Agents entering the Indian job market can expect starting salaries ranging from INR 5 lakhs to INR 8 lakhs per annum. This range varies based on the employer, your educational background, and the city where you work. Big 4 firms and established US tax outsourcing companies tend to offer the higher end of this range.

While these starting figures might seem modest compared to US salaries, they are competitive within the Indian professional services market. The EA credential differentiates you from candidates with only local qualifications, giving you negotiating leverage that non-credentialed candidates lack. Starting strong sets the foundation for faster career progression.

Mid-Career and Senior Compensation

EAs with three to five years of experience in India typically earn between INR 10 lakhs and INR 15 lakhs annually. At this stage, your practical experience handling US tax matters makes you valuable to employers who need professionals who can work independently on complex assignments. Salary growth during these years often outpaces inflation significantly.

Senior EAs with more than five years of experience can earn INR 18 lakhs to INR 25 lakhs or more, especially at Big 4 firms or in leadership roles.

City-Wise Hotspots (Bangalore, Hyderabad, Mumbai, Pune)

Bangalore and Hyderabad have emerged as the primary hubs for US tax work in India. Both cities host substantial operations from Big 4 firms and major tax outsourcing companies. The concentration of employers in these cities creates competitive job markets where EAs can often negotiate better compensation packages.

Mumbai and Pune also offer strong opportunities, though the employer base differs somewhat. Mumbai tends to have more financial services companies with in-house tax needs, while Pune has grown its IT services sector with significant US client work. Delhi NCR rounds out the major markets, with Gurgaon and Noida hosting several US tax practices.

Top Companies Hiring EAs in India (Big 4 and US Tax Outsourcing)

The Big 4 firms maintain large US tax practices in India, making them natural employers for Enrolled Agents. Deloitte, PwC, EY, and KPMG all recruit EAs for their GDS (Global Delivery Services) centers. These positions offer structured career paths, training opportunities, and the prestige of working for globally recognized firms.

Beyond the Big 4, specialized US tax outsourcing companies actively recruit EAs.

Firms like QX Global, SurePrep, and Initor focus specifically on US tax services and value the EA credential highly. These companies often offer competitive salaries and the opportunity to work on a variety of US tax matters across individual and business clients.

Factors Affecting Enrolled Agents’ Salary in India

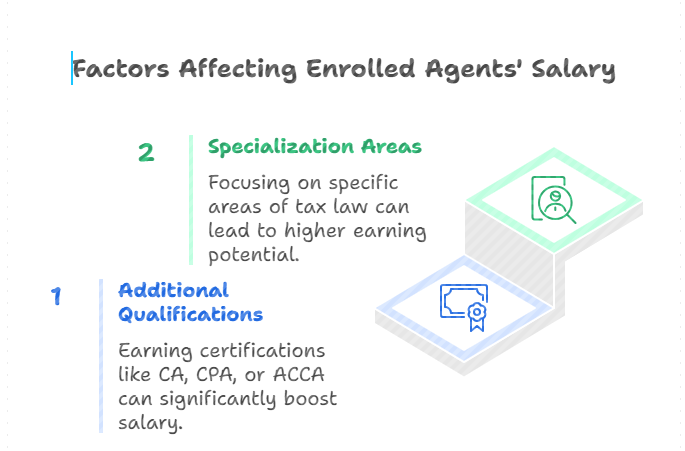

Additional Qualifications (CA, CPA, ACCA)

Holding additional qualifications alongside your EA significantly boosts your earning potential. Professionals with both EA and CA designations command premium salaries because they understand both US and Indian tax systems. This dual expertise is particularly valuable for firms serving multinational clients with operations in both countries.

The EA plus CPA combination is especially powerful for maximizing compensation. Professionals holding both credentials can earn 25 to 40 percent more than those with EA alone. ACCA credentials also pair well with EA for professionals interested in broader financial roles beyond pure taxation.

Specialization Areas

Developing expertise in high-demand specializations increases your market value substantially. International taxation, including FATCA and FBAR compliance, commands premium salaries because few professionals have deep knowledge in these areas. As cross-border transactions increase, specialists in international tax matters become increasingly valuable.

IRS representation and tax resolution is another lucrative specialization. Indian firms serving US clients occasionally need professionals who can handle audit support, collections matters, and penalty abatement requests. Building skills in these areas differentiates you from the larger pool of tax preparation specialists.

Enrolled Agent vs CPA: Which Offers Better Career Prospects?

How do the Salaries of Enrolled Agents and CPA Professionals Compare?

When comparing raw salary figures, CPAs generally earn more than Enrolled Agents at all career stages. According to Becker, the average CPA salary ranges from $60,000 to over $150,000, while EA salaries typically fall between $50,000 and $100,000. This difference reflects the broader scope of services CPAs can provide beyond taxation.

However, salary comparisons do not tell the complete story.

The time and financial investment required to become a CPA significantly exceeds what EA candidates spend. When you factor in the years of additional education and the opportunity cost of delayed career entry, the return on investment for the EA credential often looks more attractive.

Top-earning EAs who build successful practices or develop specialized expertise can match or exceed average CPA salaries. The EA path to high earnings typically involves entrepreneurship or niche specialization rather than climbing a corporate ladder. If you are willing to build a practice or become known as an expert in a particular area, your EA credential does not limit your income ceiling.

Which Credential Offers Better Career Scope and Flexibility?

CPAs undeniably have broader career scope because their credential covers auditing, financial accounting, and general business advisory in addition to taxation. If you want to keep your options open for non-tax accounting work, the CPA provides more flexibility. Many CFO positions and senior financial leadership roles require or strongly prefer CPA credentials.

EAs enjoy focused career scope within taxation, which can actually be an advantage. Your training concentrates entirely on tax matters, making you highly specialized from day one. For professionals certain they want tax careers, this focus means you develop expertise faster than CPAs who must split their attention across multiple disciplines.

The federal nature of the EA credential provides unique flexibility that CPAs lack. You can practice anywhere in the United States without additional state licensing, while CPAs must navigate different requirements in each state. For building a national client base or maintaining flexibility to relocate, the EA offers advantages CPAs do not share.

What Are the Time and Cost Differences for Obtaining Each Credential?

Becoming an EA typically takes three to six months if you study consistently. The three-part Special Enrollment Examination has no educational prerequisites, meaning you can pursue it immediately regardless of your academic background. Total costs, including exam fees, study materials, and enrollment, generally fall between $1,500 and $3,000, which is roughly 1.35 lacs to 2.7 lacs (assuming 1$= ₹89)

The CPA path requires substantially more investment. Most states require 150 semester hours of education, which often means completing a master’s degree or additional coursework beyond a bachelor’s. The four-part CPA exam covers material beyond taxation, requiring broader preparation. From start to finish, becoming a CPA typically takes two to four years and costs significantly more.

For professionals who want to start working in tax as quickly as possible, the EA offers a faster on-ramp to the profession. You can begin building experience and earning money while CPAs are still completing educational requirements. Some professionals start with the EA and later add the CPA, using their EA work experience to fund continued education.

How to Maximize Your Earning Potential as an Enrolled Agent

Skills That Command Higher Salaries

Tax Software Proficiency (Drake, Lacerte, ProSeries)

Mastering professional tax software makes you immediately more valuable to employers. Programs like Drake Tax, Lacerte, and ProSeries are industry standards that firms expect new hires to learn. Coming in with existing proficiency or quickly developing it positions you for faster advancement and better compensation.

Beyond basic return preparation, understanding software features for review, analysis, and workflow management sets you apart. Many firms struggle to find EAs who can leverage technology effectively. Demonstrating that you can improve efficiency through better software utilization makes the case for higher compensation.

International Tax Knowledge (FATCA, FBAR)

International tax has become increasingly important as more individuals and businesses operate across borders. The Foreign Account Tax Compliance Act (FATCA) and Foreign Bank Account Reporting (FBAR) requirements create compliance obligations that require specialized knowledge. EAs who understand these areas can command premium rates for their expertise.

Developing international tax expertise requires dedicated study beyond what the EA exam covers, but the investment pays dividends. Clients with foreign accounts, expatriates, and businesses with international operations all need advisors who understand cross-border taxation. This specialization remains undersupplied relative to demand, supporting higher fees.

Complementary Certifications to Boost Your EA Career

EA Plus CPA Dual Certification

Holding both EA and CPA credentials positions you as a versatile professional capable of handling both specialized tax work and broader accounting services. This combination is particularly valuable for professionals who want to serve business clients needing comprehensive financial services beyond tax compliance.

The dual credential path makes strategic sense for EAs who started their careers wanting quick entry but later decided to expand their scope. Your EA experience gives you practical tax knowledge that helps with the REG section of the CPA exam, making the additional certification somewhat easier to obtain than it would be starting from scratch.

EA Plus CMA Combination

The Certified Management Accountant credential focuses on financial planning, analysis, and strategic management. Pairing EA with CMA positions you for corporate roles where you can contribute to both tax strategy and broader financial decision-making. This combination is particularly valuable for professionals targeting senior roles in corporate finance departments.

Specialized Tax Credentials (ADIT, Estate Planning)

The Advanced Diploma in International Taxation (ADIT) from the Chartered Institute of Taxation provides globally recognized credentials in cross-border tax matters. For EAs building practices around international clients, ADIT demonstrates specialized expertise that commands premium fees.

Estate planning credentials open doors to serving high-net-worth individuals and families with complex wealth transfer needs. This specialization pairs naturally with tax expertise and typically involves higher fees than standard tax preparation. Building credentials in estate planning creates opportunities for ongoing advisory relationships rather than one-time tax preparation engagements.

Career Growth Strategies

Building a Niche Specialization

Generalist EAs compete primarily on price, while specialists compete on expertise. Identifying a niche where you can develop deep knowledge creates differentiation that supports higher fees and more interesting work. Potential niches include specific industries, particular tax situations like cryptocurrency, or specialized services like IRS representation.

Building a niche reputation takes time and deliberate effort. You need to invest in additional education, seek out relevant experience, and position yourself as an expert through content creation, speaking, or professional involvement. The investment pays off as referrals begin flowing from professionals who recognize your specialized expertise.

Networking and Professional Development

Joining the National Association of Enrolled Agents (NAEA) connects you with other tax professionals and provides continuing education opportunities. State and local EA associations offer networking events where you can build relationships that lead to referrals, job opportunities, and mentorship.

Continuous learning beyond required continuing education keeps your skills current and opens new service opportunities. Tax law changes frequently, and staying ahead of developments positions you to serve clients better than competitors who only do the minimum. Investing in your professional development is investing in your long-term earning potential.

Conclusion

The Enrolled Agent credential opens doors to diverse career paths and competitive compensation in both the United States and India. Whether you choose employment with established firms or entrepreneurship through your own practice, your EA designation provides the foundation for a rewarding professional journey. The key is understanding your options and making intentional choices about your career direction.

Salary potential varies significantly based on your decisions about specialization, employer type, and geographic location. Entry-level EAs can expect reasonable starting compensation that grows substantially with experience and expertise development. Those who invest in complementary skills and credentials position themselves for earnings that rival or exceed other financial professionals.

Your EA credential is a beginning, not an ending. The professionals who achieve the highest success combine their technical expertise with business development skills, continuous learning, and strategic career planning. Whether your goal is financial independence through practice ownership or advancement through corporate ranks, the EA provides a solid platform for achieving your professional aspirations.

If you want a breakdown of the exam topics and what you need to study for each part, this Enrolled Agent Syllabus Guide provides a complete, updated outline.

Frequently Asked Questions

What is the starting salary for an Enrolled Agent in the US?

Entry-level Enrolled Agents in the United States typically earn between $45,000 and $55,000 annually. Starting salaries vary based on location, employer type, and prior experience in tax preparation or related fields.

How much do Enrolled Agents earn in India?

Fresh EAs in India can expect starting salaries between INR 5 lakhs and INR 8 lakhs per annum. Experienced professionals with five or more years earn INR 15 lakhs to INR 25 lakhs or higher at top firms.

Do Big 4 companies hire Enrolled Agents?

Yes, all Big 4 firms hire Enrolled Agents for their tax practices. In India, Deloitte, PwC, EY, and KPMG maintain large US tax operations where EAs work on client engagements across various tax matters.

Can I work for US clients from India as an EA?

Absolutely. Many US tax firms and outsourcing companies hire EAs in India to handle preparation, review, and compliance work for American clients. Remote work arrangements have expanded these opportunities significantly.

Is EA salary higher than CPA salary?

Generally, CPAs earn more than EAs at comparable career stages. However, top-earning EAs with specialized expertise or successful practices can match or exceed average CPA compensation levels.

What is the highest salary an EA can earn?

There is no hard ceiling on EA earnings. Employed EAs in senior positions earn $100,000 to $175,000, while practice owners and highly specialized consultants can earn substantially more based on their client base and fee structures.

Are there remote job opportunities for Enrolled Agents?

Yes, remote work opportunities have expanded dramatically for EAs. Many firms hire remote preparers, and freelance platforms connect EAs with clients seeking virtual tax services across the country.

What skills help EAs earn more?

Tax software proficiency, international tax knowledge (FATCA, FBAR), IRS representation expertise, and business development skills all command higher compensation. Specialization in complex areas creates premium earning opportunities.

How long does it take to see salary growth as an EA?

Most EAs see meaningful salary increases within two to three years as they gain experience and demonstrate competence. Those who actively develop specializations or take on additional responsibilities typically advance faster.

Is the EA credential worth it for Indian professionals?

Yes, the EA credential provides Indian professionals access to the growing US tax services industry. It differentiates you from competitors and opens doors to roles at Big 4 firms and US tax outsourcing companies.

Can EAs start their own tax practice?

The EA credential fully authorizes you to operate an independent tax practice. You can prepare returns, provide advisory services, and represent clients before the IRS without any additional licensing requirements.

What industries pay EAs the most?

Financial services, healthcare, and technology industries typically offer the highest EA salaries in corporate settings. Specialized tax firms focusing on high-net-worth individuals or complex business taxation also pay premium rates.

Does location affect EA salary significantly?

Location substantially impacts EA compensation. States like Washington, New York, and California offer the highest salaries, though cost of living differences mean purchasing power varies less dramatically than raw salary figures suggest.

Should I get EA or CPA for a tax career?

If you are certain about a tax-focused career and want to start working quickly, the EA provides faster entry with lower investment. If you want broader accounting career options, the CPA offers more flexibility despite requiring more time and cost.

What additional certifications increase EA salary?

CPA and CA credentials significantly boost earning potential when combined with EA. Specialized certifications like ADIT for international tax, CMA for management accounting, and estate planning credentials also command higher compensation.

Allow notifications

Allow notifications