Complete CPA vs CA exam comparison for Indian candidates covering difficulty, pass rates, costs in INR, duration, salary, and career paths. Make the right choice with our data-driven guide.

Table of Contents

If you’re a commerce graduate, CA aspirant, or working professional in India exploring your options in accounting, you’ve probably found yourself asking one question repeatedly: should I pursue CPA or CA?

This isn’t just an academic debate. It’s one of the most consequential career decisions you’ll make, and the answer depends entirely on where you want your career to take you.

Both the US CPA (Certified Public Accountant) and Indian CA (Chartered Accountant) credentials command respect in the accounting world.

They open doors to Big 4 firms, multinational corporations, and leadership roles in finance.

But here’s the reality: these two qualifications serve fundamentally different purposes, require vastly different time commitments, and lead to distinct career trajectories. Choosing the wrong one for your goals could cost you years of effort and lakhs of rupees.

In this comprehensive guide, we’ll break down everything you need to know about CPA vs CA for Indian candidates.

You’ll find current pass rates from AICPA and ICAI, complete cost breakdowns in Indian rupees, realistic timelines for working professionals, salary comparisons across career stages, and a decision framework to help you choose the right path.

Whether you’re a B.Com graduate weighing your options or a CA considering adding CPA to your credentials, this guide will give you the clarity you need to move forward confidently.

How Do CPA and CA Exam Structures Compare?

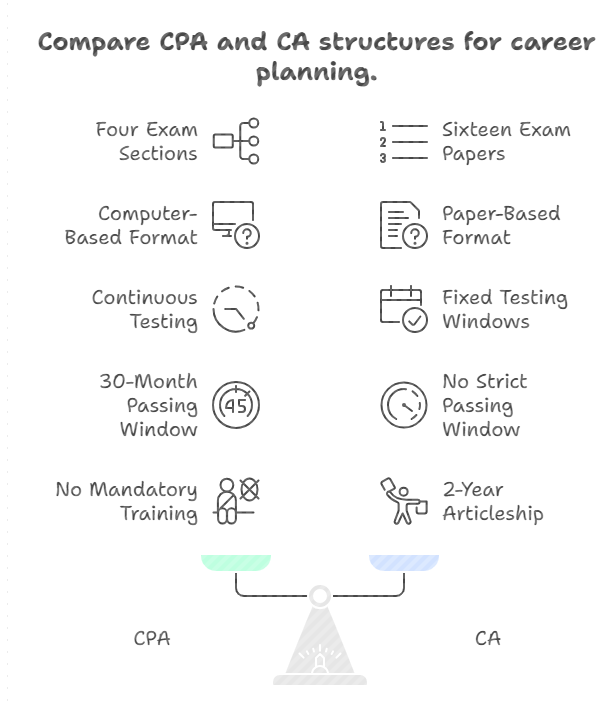

Before diving into difficulty levels and costs, you need to understand what you’re actually signing up for with each credential. The structural differences between CPA and CA exams explain why one takes 18 months while the other takes 5 years, and why preparation strategies differ so dramatically between the two.

The CPA exam follows a streamlined, focused format designed for candidates who already hold accounting degrees. The CA exam, in contrast, is a comprehensive professional education program that takes you from foundational concepts to advanced practice, with mandatory practical training built into the journey. Understanding these structural differences will help you appreciate every comparison that follows.

CPA Exam Format Under CPA Evolution

The CPA exam underwent significant changes in January 2024 with the launch of CPA Evolution, transforming the traditional four-section format into a more specialized structure. Under this new model, you’ll take three mandatory core sections plus one discipline section of your choice, giving you some control over your exam experience based on your career interests. You can learn more about the current exam structure on the AICPA’s official CPA exam page.

Each CPA exam section is four hours long and delivered entirely on computer at Prometric testing centers. The format combines multiple-choice questions (MCQs) with Task-Based Simulations (TBS), which are case-study style problems requiring you to apply concepts to realistic scenarios. Unlike CA’s subjective papers, CPA exams are graded objectively, meaning there’s no ambiguity in how your answers are evaluated. This standardized approach ensures that your score reflects your actual knowledge rather than an examiner’s interpretation of your written responses.

Core Sections: AUD, FAR, REG

Every CPA candidate must pass three core sections regardless of their chosen discipline. Auditing and Attestation (AUD) covers audit procedures, professional responsibilities, and attestation engagements, testing your understanding of how auditors gather evidence and form opinions on financial statements. Financial Accounting and Reporting (FAR) is widely considered the most challenging section, testing your knowledge of US GAAP, IFRS, and financial statement preparation across various entity types including governmental and not-for-profit organizations.

Regulation (REG) focuses on federal taxation for individuals and entities, business law, and professional ethics. For Indian candidates, REG presents unique challenges because US federal tax law differs significantly from Indian tax regulations. According to AICPA’s 2024 data, REG actually has one of the higher pass rates among core sections at approximately 63%, suggesting that candidates who study thoroughly can master this content despite its unfamiliarity.

Discipline Choices: BAR, ISC, TCP

Under CPA Evolution, you select one discipline section based on your career interests and strengths. Business Analysis and Reporting (BAR) focuses on management accounting, data analytics, and financial statement analysis, making it suitable for those targeting corporate finance or FP&A roles. Information Systems and Controls (ISC) covers IT governance, cybersecurity, and system controls, appealing to candidates interested in IT audit or SOX compliance work. Tax Compliance and Planning (TCP) dives deeper into individual and entity taxation beyond what REG covers, ideal for those pursuing tax advisory careers.

The pass rate differences between discipline sections have been striking since CPA Evolution launched. TCP consistently leads with pass rates between 75% and 82% throughout 2024, while BAR has struggled around 33% to 40% and ISC has performed moderately at 56% to 58%. The AICPA has explained that TCP’s higher rates reflect that candidates choosing this discipline typically have strong tax backgrounds from their REG preparation and often work in tax roles already. This doesn’t mean TCP is easier; it means candidates self-select based on their strengths.

CA Exam Structure Under ICAI

The Chartered Accountancy course administered by the Institute of Chartered Accountants of India (ICAI) follows a three-tier structure designed to build competence progressively. Unlike CPA, which assumes you already have accounting education, CA takes you from foundational concepts through advanced professional practice over a minimum of 4-5 years. This comprehensive approach ensures thorough preparation but requires significant time commitment.

The CA journey includes Foundation, Intermediate, and Final levels, with mandatory practical training (articleship) integrated between Intermediate and Final. ICAI implemented a new education and training scheme that modernizes the curriculum while maintaining the rigorous standards that have made CA one of India’s most respected professional qualifications. By the time you qualify as a CA, you possess both theoretical knowledge and hands-on experience across taxation, auditing, accounting, and business advisory.

Overview of CA Foundation, Intermediate & Final

CA Foundation serves as the entry point, testing basic concepts in accounting, business laws, quantitative aptitude, and economics across four papers. You can register after passing 10th standard but can only appear for the exam after completing 12th. Foundation exams are now conducted three times a year in January, May, and September, giving you multiple opportunities to clear this level within a year of starting your CA journey.

CA Intermediate comprises two groups with three papers each, covering advanced accounting, corporate law, taxation (both direct and indirect), auditing, and financial management. You can appear for single or both groups simultaneously, and passing either group allows you to begin articleship. Many candidates choose to attempt both groups together, though some prefer focusing on one group at a time. CA Final, the most challenging level, also has two groups with three papers each, focusing on advanced financial reporting, strategic financial management, direct and indirect tax laws, and advanced auditing. The breadth of subjects across these three levels totals over 20 papers, compared to CPA’s focused four-section approach.

Mandatory Articleship Training Requirements

What truly sets CA apart from CPA is the mandatory 3-year articleship (2 years in new scheme), a practical training period where you work under a practicing Chartered Accountant. This isn’t optional; you cannot qualify as a CA without completing this training regardless of how quickly you pass your exams. Articleship can begin after passing either group of Intermediate, meaning it runs parallel to your Final exam preparation for most candidates.

During articleship, you gain hands-on experience in auditing, taxation, accounting, and compliance work at CA firms or corporate settings. ICAI prescribes minimum monthly stipends that vary by city size, ranging from ₹3,000 to ₹6,000 for the first year and increasing slightly in subsequent years.

Many reputable firms pay significantly above these minimums, with some offering ₹15,000 to ₹25,000 monthly. While articleship provides invaluable practical exposure that makes CAs job-ready upon qualification, it also represents an opportunity cost for those who could otherwise be earning full professional salaries during those three years.

Side-by-Side Comparison of Test Format, Papers & Frequency

When you put CPA and CA structures next to each other, the differences become stark. CPA involves just four exam sections that you can complete in 12-18 months, while CA spans over 16 papers (as per the new scheme) across three levels requiring 4-5 years minimum. CPA uses a fully computer-based format with MCQs and simulations, while CA has traditionally been paper-based with subjective questions, though ICAI is gradually transitioning to computer-based testing.

Testing frequency also differs significantly. CPA now offers continuous testing for core sections as of 2025, meaning you can schedule exams year-round whenever you’re ready, subject to Prometric availability. CA exams are conducted three times annually in January, May, and September, creating fixed windows that require you to plan your preparation around specific dates.

The CPA’s 30-month passing window (starting from your first passed section) creates some time pressure, while CA has no strict overall window though registration validity periods apply at each level.

Perhaps the most significant structural difference is the practical training requirement. CPA candidates don’t need to complete any mandatory training to sit for exams, though some states require work experience for licensure after passing.

CA mandates 2-year articleship integrated into the qualification journey, making it impossible to fast-track completion even if you pass all exams quickly. For working professionals considering a career credential, this distinction often tips the decision toward CPA.

Which Exam is More Difficult: CPA or CA?

This is the question every Indian candidate asks first, and honestly, there’s no simple answer. Difficulty is subjective and depends on your background, preparation quality, and how you define “hard.” However, we can analyze objective data points like pass rates, scoring requirements, and syllabus complexity to give you a nuanced understanding that goes beyond surface-level comparisons.

What the data tells us is that CA has significantly lower pass rates and requires much longer commitment, making it statistically harder to complete. CPA, while having higher pass rates, demands a 75/99 score with no room for weakness in any content area. Both exams are challenging in different ways, and understanding these differences will help you prepare appropriately for whichever path you choose.

Pass Rate Analysis for CPA and CA

Pass rates are the most objective measure of exam difficulty, though they don’t tell the complete story. When you compare CPA section pass rates ranging from 40% to 82% with CA level pass rates hovering between 10% and 20%, the statistical difference is undeniable. However, these numbers reflect not just exam difficulty but also candidate preparation levels, exam frequency, and scoring methodologies.

It’s important to understand what these percentages represent. CPA pass rates show performance on individual sections, where candidates typically prepare for months focusing on one subject area. CA pass rates, particularly the “both groups” figures, reflect candidates attempting to pass multiple papers simultaneously across diverse subjects. A candidate might pass one CA group while failing the other, which affects how pass rates are calculated and reported.

CPA Pass Rates by Section (Past Data)

Based on AICPA’s official data for 2024, FAR (Financial Accounting and Reporting) consistently presents the biggest challenge with pass rates around 40%, dropping to just 36.80% in Q4 2024. This makes FAR the section that fails the most candidates, partly due to its massive syllabus covering governmental accounting, not-for-profit accounting, and complex consolidation topics alongside regular financial reporting. Industry commentators have raised concerns about FAR’s declining pass rates, with some suggesting the exam needs rebalancing.

AUD (Auditing and Attestation) performs slightly better but remains challenging at approximately 46% cumulative pass rate for 2024, with Q4 showing 43.50%. REG (Regulation) is the strongest-performing core section at around 63%, suggesting that candidates who dedicate time to learning US federal tax law can master it despite the content being unfamiliar to those trained in Indian taxation.

Among discipline sections, TCP (Tax Compliance and Planning) stands out dramatically with pass rates between 72% and 82% throughout 2024, while BAR (Business Analysis and Reporting) struggles at 33% to 40% and ISC (Information Systems and Controls) falls in the middle at 56% to 58%.

CA Pass Rates Across Foundation, Intermediate, and Final

ICAI’s results paint a picture of an extraordinarily selective examination system.

The November 2024 CA Final results showed a both-groups pass rate of just 13.44%, with Group 1 at 16.8% and Group 2 at 21.36%. This means roughly 86 out of every 100 candidates attempting both Final groups together did not succeed.

Even at the Foundation level, only about 1 in 5 candidates pass, with September 2024 showing a 19.67% pass rate.

CA Intermediate presents perhaps the starkest numbers. The September 2024 results showed a both-groups pass rate of just 5.66%, though individual group pass rates were higher at 14.67% for Group 1 and 21.51% for Group 2.

These low percentages reflect the challenging nature of attempting six diverse papers simultaneously while many candidates are also beginning their articleship. The consistently low pass rates across all CA levels explain why completing the qualification in the minimum 4-5 years is genuinely an achievement, and why many candidates require additional attempts at one or more levels.

For candidates who want a deeper breakdown of how CPA pass rates vary across FAR, AUD, REG, and discipline sections, a detailed analysis of CPA exam pass rates by section explains the quarterly trends and what they mean for preparation strategy.

Exam Format and Question Types

Beyond pass rates, the exam format significantly influences difficulty perception and preparation strategy. CPA’s objective format provides certainty in grading, while CA’s subjective papers introduce variability that can work for or against you depending on your presentation skills and how examiners interpret your responses.

The CPA exam uses MCQs and Task-Based Simulations with predetermined correct answers. Your score depends entirely on selecting the right options and completing simulations correctly, with no partial credit for “almost right” answers in most cases.

CA exams, particularly at Intermediate and Final levels, require detailed written answers that examiners evaluate based on content, presentation, and completeness. This means two candidates with similar knowledge might receive different scores based on how effectively they communicate their understanding.

Understanding the CPA 75/99 Passing Requirement

To pass any CPA section, you need a scaled score of 75 out of 99. This isn’t simply 75%; it’s a scaled score calculated using Item Response Theory (IRT), which weights questions based on difficulty. The scoring system ensures that passing reflects consistent competence rather than lucky guessing, but it also means the 75 threshold is demanding with minimal room for weak areas.

Here’s what makes this challenging for candidates: you can’t compensate for poor performance in one content area with excellence in another the way you might hope. If your MCQ performance is strong but you struggle with simulations (or vice versa), you might still fail despite feeling confident during the exam.

The 75/99 requirement essentially demands that you demonstrate solid understanding across all tested areas, not just high average performance. This is why CPA review courses emphasize covering every topic rather than focusing only on high-weight areas.

Understanding CA’s 40% Per Paper and 50% Aggregate Rule

CA’s passing requirements appear more lenient on paper:

- you need a minimum 40% in each individual paper and

- 50% aggregate across the group.

However, the subjective nature of evaluation and the breadth of topics make achieving these thresholds surprisingly difficult in practice. The pass rate data confirms that despite seemingly modest percentage requirements, most candidates struggle to meet them consistently across all papers.

Consider what CA Final actually requires: you need 40% in each of six papers (three per group) covering topics from advanced financial reporting to international taxation to strategic financial management.

With examiner subjectivity in evaluating your written responses, your score partly depends on how clearly you present answers, not just whether your content is technically accurate. Additionally, the 50% aggregate requirement means you can’t have too many papers near the 40% minimum.

The combination of breadth, depth, and subjective evaluation creates a challenge that the pass rates clearly reflect.

Syllabus Breadth, Depth & Conceptual Complexity

CPA covers four focused areas in depth, while CA spans over 20 papers across three levels, building from foundational concepts to advanced professional practice. The question of which syllabus is “harder” depends significantly on whether you find concentrated depth or extensive breadth more challenging to master.

CPA’s syllabus assumes you already understand accounting fundamentals and focuses specifically on US regulations, GAAP, federal taxation, and auditing standards.

The content is deep but narrow, allowing you to develop expertise in specific domains. CA’s syllabus builds from scratch, covering Indian accounting standards, GST, income tax, company law, cost accounting, financial management, economics, and information technology comprehensively. By Final level, CAs possess broad knowledge spanning multiple domains of business and finance.

For Indian candidates, CPA presents the additional challenge of learning US-centric content that differs significantly from familiar Indian standards.

Federal tax law bears little resemblance to Indian income tax, and US GAAP has important differences from Indian AS. CA, while broader, covers Indian regulations that candidates encounter in their daily environment. Your educational background and career focus influence which syllabus feels more manageable and relevant.

Overall Difficulty Verdict for Indian Candidates

Based on a comprehensive analysis of pass rates, duration requirements, and syllabus scope, CA is statistically the harder credential to obtain. With pass rates below 15% at the Final level for both groups attempts and a minimum 4-5 year commitment that many candidates exceed, fewer people complete CA than those who start the journey. The combination of subjective evaluation, extraordinarily broad syllabus, and mandatory 3-year articleship (2 years in the new scheme) creates multiple hurdles that filter out a large majority of aspirants.

CPA, while having higher pass rates, isn’t “easy” by any meaningful standard.

The 75/99 requirement is unforgiving, the content is unfamiliar to candidates trained entirely in Indian standards, and the 30-month window creates time pressure that forces consistent performance. However, with focused preparation using quality review courses, candidates with solid accounting backgrounds can realistically complete CPA in 12-18 months. The pass rates between 40% and 82% across sections confirm that success is achievable for well-prepared candidates.

If you’re choosing based purely on probability of completion, CPA offers better odds in significantly less time. But difficulty shouldn’t be your only consideration; career goals, practice rights, recognition, and your specific circumstances matter equally in making this decision.

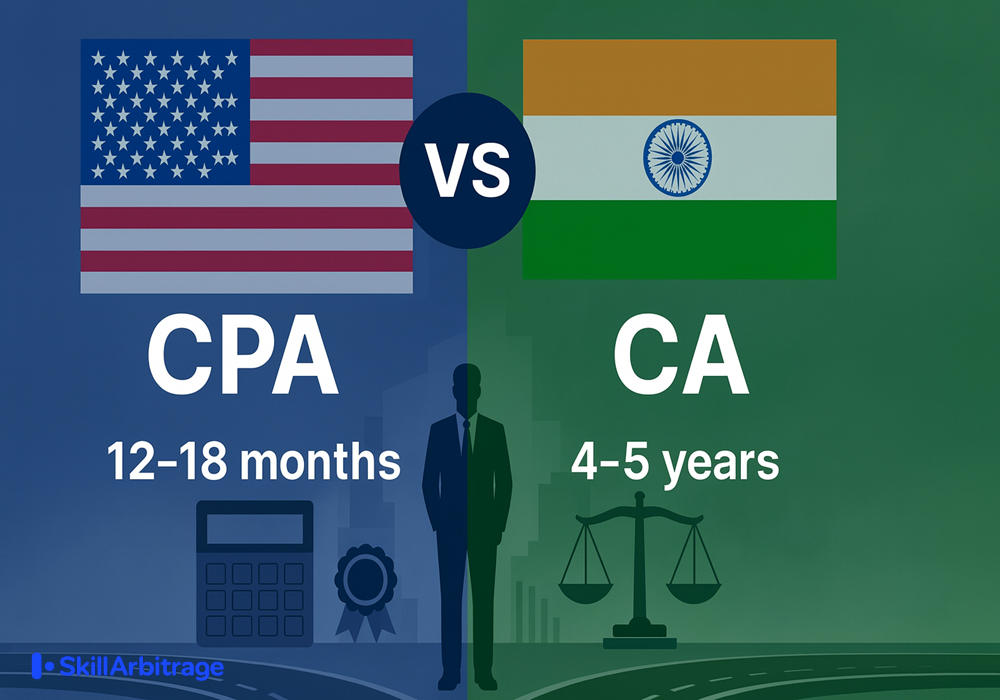

How Long Does It Take to Complete CPA vs CA?

Time is often the deciding factor for working professionals and those eager to start their careers. The duration difference between CPA and CA is dramatic: 12-18 months versus 4-5 years minimum. This isn’t a minor distinction; it represents years of your professional life and potentially lakhs of rupees in opportunity cost.

For those already holding degrees or professional qualifications, CPA offers a faster path to an internationally recognised credential that can immediately impact your career options.

For students starting after the 12th standard who want a comprehensive accounting education with practical training built in, CA provides thorough preparation despite the longer journey. Your current situation determines which timeline makes practical sense for your goals.

CPA Completion Timeline for Indian Candidates

Most Indian candidates complete their CPA journey in 12-18 months, though motivated individuals with strong accounting backgrounds can finish in as little as 9-12 months. This timeline includes credential evaluation, state board application, receiving your Notice to Schedule (NTS), and passing all four exam sections. The compressed timeframe is possible because CPA doesn’t require mandatory practical training before or during the exam process.

The CPA timeline is largely self-directed, giving you control over your pace. Unlike CA with fixed exam dates three times a year, CPA core sections now offer continuous testing as of 2025, meaning you can schedule exams at Prometric testing centers whenever you feel ready.

This flexibility allows you to accelerate when your preparation is strong or slow down during busy periods at work or personal commitments. You can explore state-specific requirements and application processes through NASBA’s official website.

Evaluation and Application Process Duration

Before you can sit for the CPA exams, your educational credentials must be evaluated by agencies recognised by your chosen state board. For most Indian candidates, this means using NASBA International Evaluation Services (NIES), WES (World Education Services), or similar agencies.

The evaluation process typically takes 6-10 weeks, depending on how quickly your Indian universities provide transcripts and the evaluation agency’s current processing times. Planning ahead and requesting transcripts early can prevent delays at this stage.

After the evaluation confirms you meet the 150 credit hour requirement, you apply to your chosen state board of accountancy.

Most Indian candidates select states like Colorado, Montana, Alaska, or Guam because these jurisdictions don’t require US residency or Social Security Numbers, making them accessible for international candidates. State board processing takes another 4-6 weeks typically. Once approved, you receive your NTS, which remains valid for a specified period (usually 6 months) and authorizes you to schedule your first exam sections. Our guide on the Best US states for Indian CPA candidates explains these differences in detail.

Section-by-Section Exam Timeline

With your NTS in hand, you can schedule exams at Prometric testing centers in Indian cities, including Mumbai, Delhi, Bangalore, Hyderabad, Chennai, and Kolkata. Most candidates take 3-4 months to prepare for and pass their first section, then maintain momentum by scheduling subsequent sections every 2-3 months. The key is building and maintaining study habits rather than taking extended breaks between sections.

A typical 12-month completion timeline looks like this: the first two months handle evaluation and application, while you begin studying. Months three through six focus on your first two sections, often FAR and AUD, since FAR’s content can fade if studied too early. Months seven through ten tackle REG and your chosen discipline section.

Months eleven and twelve provide a buffer for any needed retakes or scheduling delays. The 30-month window starting from your first passed section provides a cushion for unexpected challenges, but maintaining momentum is crucial because restudying forgotten content wastes valuable time.

CA Journey from Foundation to Final (4–5 Years)

The CA journey spans a minimum of 4-5 years, with many candidates taking longer due to exam challenges or articleship scheduling. Unlike CPA’s self-directed timeline, CA follows a structured progression dictated by ICAI’s exam schedules, registration requirements, and the non-negotiable 3-year articleship (2-years in the new scheme) that cannot be compressed or skipped.

Starting after the 12th standard, the fastest theoretically possible CA completion would be: Foundation clearance in 6-8 months, Intermediate clearance in 1-1.5 years, beginning articleship immediately after passing one Intermediate group, and completing Final exams in the last year of articleship.

In reality, most candidates require additional attempts at one or more levels, and coordinating articleship with Final preparation extends the total duration to 5-7 years for many aspirants.

Academic Progression Through Three Levels

CA Foundation requires a minimum of 4 months of study after registration before you can appear for exams. With exams conducted thrice yearly in January, May, and September, you have regular opportunities to attempt Foundation. After passing Foundation, you register for Intermediate, which requires another 8-9 months of preparation before your first attempt can realistically succeed.

Intermediate consists of two groups that can be attempted together or separately, giving you strategic choices about your approach. Many candidates pass one group at a time, which extends their timeline but allows focused preparation on three papers rather than six.

This approach works well for those who struggle with the breadth of simultaneous subjects. After passing at least one Intermediate group, you register for articleship training while continuing to prepare for any remaining papers. Final exams are typically attempted in the last year of articleship or shortly after completion.

How Articleship Extends CA Timelines

The 3-year articleship (2-years in the new scheme) requirement is non-negotiable and significantly impacts CA timelines regardless of exam performance. Even if you pass all exams with exceptional speed, you cannot qualify as a CA until articleship is complete.

This means someone who clears Foundation and both Intermediate groups in the minimum possible time still needs 3+ years before they can call themselves a Chartered Accountant.

Articleship can begin after passing either group of Intermediate, allowing parallel progression with Final exam preparation. However, balancing full-time training commitments (typically 9 hours daily at most firms) with Final exam study is genuinely demanding. Many article clerks take study leaves during exam periods, and firm culture varies significantly in how accommodating employers are about preparation time. Some candidates strategically complete articleship first before seriously attempting the Final, while others prefer clearing exams during articleship to minimise total duration.

Time Investment Comparison for Working Professionals

For working professionals, CPA’s flexibility represents a significant advantage. You can study during evenings and weekends without disrupting your career, schedule exams when your preparation is complete, and earn the credential without resigning from your current role.

Many Indian CPAs continue full-time employment throughout their 12-18 month exam journey, making CPA a career enhancement rather than a career interruption.

CA presents substantial challenges for established working professionals due to articleship requirements. If you’re already employed and earning a professional salary, taking a 3-year articleship (2 years in the new scheme) means either leaving your job entirely or finding the rare firm willing to accommodate part-time or evening arrangements.

Direct entry routes exist for commerce graduates, but articleship remains mandatory regardless of your prior work experience. You cannot substitute professional experience for articleship under the current ICAI regulations.

The financial math is straightforward: a working professional earning ₹8-10 LPA can add CPA to their resume in 12-18 months while continuing to earn, potentially recovering the entire CPA investment through salary increases within a year of passing.

The same professional pursuing CA would need 4-5 years minimum, with 3 years spent in articleship earning stipends of ₹3,000-15,000 monthly rather than full professional salaries. For established professionals weighing credential options, this opportunity cost often tips the decision toward CPA.

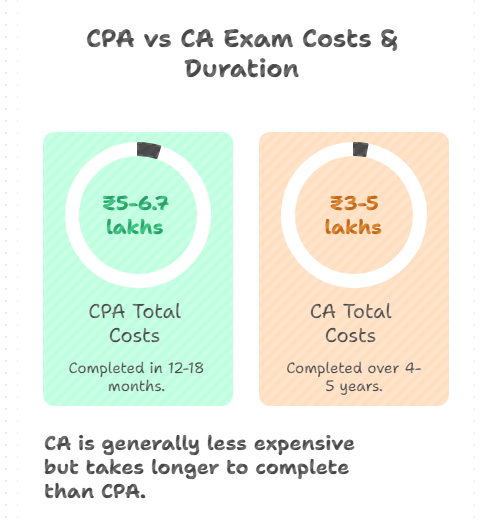

What Is the Total Cost of CPA vs CA in Indian Rupees?

Cost is a practical consideration that influences when and how you pursue professional credentials. Both CPA and CA require significant investment, but the breakdown differs substantially in timing and structure. CPA has higher upfront costs compressed into 12-18 months, while CA costs are spread across 4-5 years with lower annual outlay but longer total commitment.

Understanding the complete cost picture, including expenses that candidates often overlook, like document courier charges, retake fees, and opportunity costs, helps you budget accurately and avoid financial stress mid-journey.

Many candidates underestimate CPA costs or forget to factor in CA coaching expenses, leading to difficult decisions when funds run short before completion.

CPA Costs: Evaluation, Exam Fees & Study Materials

The total CPA investment for Indian candidates ranges from approximately ₹3.5 lakhs to ₹7 lakhs, depending on your review course selection, number of exam attempts needed, and which state board you choose. This covers credential evaluation, application fees, exam section fees, international testing surcharges at Prometric centers, and study materials or coaching programs. The higher end of this range typically includes premium review courses like Becker through Indian coaching partners.

CPA costs are front-loaded, meaning you pay most expenses within your 12-18 month exam window rather than spreading them across years.

Unlike CA where costs distribute over a longer period, CPA requires financial readiness upfront or access to EMI options that many Indian coaching institutes now offer. Planning your budget before starting ensures you can complete the journey without interruption.

Evaluation and Application Fees

Before sitting for any CPA exam, you must get your Indian educational credentials evaluated to confirm you meet the 150 credit hour requirement. Evaluation agencies charge between $200 and $350, which translates to approximately ₹17,000 to ₹30,000 at current exchange rates. NIES (NASBA International Evaluation Services) and WES (World Education Services) are popular choices for Indian candidates, with processing times varying based on how quickly your universities respond to transcript requests.

State board application fees vary by jurisdiction but typically range from $150 to $200, adding another ₹12,500 to ₹17,000 to your costs.

Don’t forget the smaller expenses that add up: document courier charges for sending transcripts internationally, notarization fees if required, and transcript request fees from your Indian universities can collectively add ₹5,000 to ₹10,000. Budget approximately ₹40,000 to ₹50,000 total for the entire evaluation and application process before you even schedule your first exam.

Exam Fees and International Testing Charges

This is where CPA costs accumulate quickly for Indian candidates. Each exam section costs $390 approximately, which comes to approximately ₹33,000 at current exchange rates. Please be advised that each state in the US has a different application and exam fee.

Since you’re taking exams outside the United States, you also pay an international testing fee of approximately $510 per section, adding roughly ₹43,000 per exam for the privilege of testing at Indian Prometric centers rather than travelling to the US.

When you calculate total exam costs for all four sections, the numbers are significant. Exam fees alone total approximately ₹1,32,000 for four sections, and international testing adds another ₹1,72,000 or so.

Together, you’re looking at roughly ₹3,00,000 to ₹3,25,000 just in exam-related costs assuming you pass each section on your first attempt.

If you need to retake any section, these fees apply again in full. Each failed attempt costs over ₹75,000, which is why thorough preparation before scheduling is both strategically and financially crucial.

Review Course and Study Material Investment

Quality review materials significantly impact your pass probability, and this is not an area where cutting corners pays off. Becker CPA Review, the market leader, costs between ₹1,20,000 and ₹2,00,000 when accessed through Indian coaching partners. Becker reports that their Exam Day Ready students achieve pass rates 64% higher than average test-takers, which can translate to significant savings by reducing retake expenses.

Other reputable options include Wiley/UWorld at ₹80,000 to ₹1,50,000, Surgent with its AI-powered adaptive learning at ₹70,000 to ₹1,20,000, and Gleim offering comprehensive content at ₹60,000 to ₹1,00,000.

Indian coaching institutes like Simandhar Education, Miles Education, and Zell Education bundle these review materials with live classes, doubt-clearing sessions, mock exams, and placement support, typically charging ₹1,50,000 to ₹2,50,000 for complete packages. The investment in quality preparation materials almost always pays for itself through higher first-attempt pass rates.

CA Costs: ICAI Fees, Coaching & Articleship Considerations

The total CA investment ranges from approximately ₹3 lakhs to ₹4 lakhs spread across 4-5 years. This includes ICAI registration and exam fees at each level, private coaching for Foundation through Final, study materials, test series subscriptions, and miscellaneous expenses. While nominally lower than CPA in absolute terms, the opportunity cost of 3-year articleship (2 years in the new scheme) should factor into any honest financial comparison.

CA costs distribute over years rather than concentrating in a short window, making annual outlay more manageable for families budgeting for a student’s professional education. ICAI’s statutory fees themselves are remarkably affordable; private coaching constitutes the bulk of expenses and is technically optional, though most successful candidates invest in quality instruction.

ICAI Registration and Exam Fees Across All Levels

ICAI’s official fees for the complete CA journey are surprisingly modest compared to other professional qualifications.

Foundation registration costs ₹9,000 with exam forms at ₹1,500 per attempt. Intermediate registration for both groups is ₹18,000, with exam forms costing ₹2,700 when attempting both groups or ₹1,500 for a single group. You’ll also pay ₹13,500 for ICITSS (Information Technology and Soft Skills training) before beginning articleship.

Articleship registration adds ₹2,000, and Final registration for both groups costs ₹22,000 with exam forms at ₹2,700 for both groups per attempt.

Advanced ICITSS training required before Final costs, approximately ₹14,500. When you add everything together, the total ICAI statutory fees across all levels come to approximately ₹85,000 to ₹1,10,000, assuming you pass each level on your first attempt. Each additional exam attempt adds the relevant exam form fee, which can accumulate significantly for candidates requiring multiple tries.

Coaching and Study Material Costs

While ICAI provides official study materials included with registration, most serious candidates invest in private coaching to supplement their preparation. Coaching fees vary substantially based on city, institute reputation, and delivery mode (physical classroom, live online, or recorded lectures). Foundation coaching typically costs ₹40,000 to ₹60,000 at reputable institutes.

Intermediate coaching for both groups ranges from ₹70,000 to ₹1,20,000, while Final coaching commands ₹80,000 to ₹1,50,000 given the advanced content and higher stakes.

Beyond coaching fees, candidates spend on test series subscriptions (₹5,000 to ₹15,000 per level), additional reference books and question banks (₹5,000 to ₹10,000 per level), and mock exam packages.

Premium institutes in metros like Mumbai, Delhi, and Bangalore charge at the higher end of ranges, while online options and institutes in tier-2 cities offer more affordable alternatives. Total coaching investment across all three CA levels typically falls between ₹1,90,000 and ₹3,30,000.

The Articleship Factor: Stipend vs Opportunity Cost

Articleship provides monthly stipends that partially offset living costs during your three years of practical training. ICAI’s mandated minimum stipends for 2024-25 depend on city population: candidates in cities above 20 lakh population receive a minimum ₹5,000 monthly in the first year, increasing to ₹6,000 in the second year, while smaller cities have proportionally lower minimums. Many reputable firms pay well above these minimums, with some Big 4 and large corporate articleships offering ₹15,000 to ₹25,000 monthly.

However, even the most generous articleship stipend represents a fraction of what the same individual might earn in regular employment. A working professional earning ₹8 LPA who leaves their job for CA articleship essentially forgoes ₹24 lakhs in salary over three years, receiving perhaps ₹5-7 lakhs in stipends during the same period.

This opportunity cost of ₹17-19 lakhs doesn’t appear in direct cost comparisons but represents real financial sacrifice. For students starting CA after 12th or graduation with no established earning power to sacrifice, this opportunity cost is minimal. For working professionals, it’s a major consideration that often makes CPA’s faster timeline more financially rational.

Total Investment Comparison

When comparing total direct costs, CPA requires approximately ₹5,00,000 to ₹6,70,000 assuming you choose a quality review course and pass all sections without retakes. CA requires approximately ₹3,10,000 to ₹5,10,000 in direct costs across all levels including coaching. CPA costs more in absolute terms but delivers the credential in 12-18 months versus CA’s 4-5 years.

The annual cost perspective tells a different story.

CPA concentrates ₹3,50,000 to ₹5,50,000 of spending into a single year, requiring either savings or financing arrangements. CA spreads ₹70,000 to ₹1,00,000 across each year, making it more accessible for families funding a student’s education gradually. Your financial situation, access to education loans or EMI options, and earning capacity should influence which cost structure works better for your circumstances.

What Career and Salary Opportunities Does CPA or CA Qualification Offer?

Ultimately, professional credentials matter because of the doors they open and the careers they enable. Both CPA and CA lead to rewarding opportunities in accounting, finance, audit, and business advisory, but the specific roles, employers, and career trajectories differ based on each credential’s recognition and the skills it certifies.

CPA holders find strongest demand in multinational corporations, Big 4 firms (particularly in US-facing practices), and Global Capability Centers serving American companies. CAs have the broadest career options within India, including exclusive practice rights that CPA doesn’t provide, statutory audit signing authority, and diverse roles spanning industry, practice, and consulting. Understanding these distinctions helps you align your credential choice with realistic career aspirations.

CPA Roles in India: Big 4, GCCs & US-Facing Teams

The demand for US CPAs in India has grown substantially as more American companies establish Global Capability Centers and outsource finance, accounting, and compliance functions to Indian operations.

CPAs are specifically valued for their expertise in US GAAP financial reporting, SOX (Sarbanes-Oxley) compliance testing, federal taxation knowledge, and ability to communicate effectively with US-based teams and clients who expect familiarity with American accounting standards.

CPA holders in India typically work in roles that specifically require US accounting knowledge, distinguishing them from general accounting professionals who may be equally qualified in Indian standards.

This specialization creates salary premiums in organizations with significant US business exposure, though it also means CPA demand concentrates in certain company types rather than spanning the entire employment market.

Big 4 Opportunities for US CPAs

All Big 4 firms actively recruit CPAs in India for specific practice areas where US accounting expertise is essential. While CAs dominate statutory audit engagements (which require CA signing authority under Indian law), CPAs are preferred for US GAAP advisory work helping Indian subsidiaries of American companies with financial reporting.

SOX compliance testing and internal control documentation is another major CPA employment area, as is international tax advisory involving cross-border transactions between Indian and US entities.

Transaction advisory services, particularly due diligence for US-India M&A deals, frequently require CPA expertise in understanding US accounting implications.

Forensic accounting investigations involving US regulations and securities law also favor CPA credentials. Entry packages for CPAs at Big 4 firms in India typically range from ₹12 lakhs to ₹20 lakhs annually, positioning CPA holders significantly above general accounting hires. With 5-7 years of experience, CPAs in senior manager positions at Big 4 can command ₹25 lakhs to ₹35 lakhs or more.

MNC Finance Roles and Global Capability Centers

India hosts hundreds of Global Capability Centers (GCCs, formerly called captive centers or shared services centers) for American corporations, creating substantial and growing CPA demand. Technology giants, financial services firms, manufacturing companies, and retailers have established significant finance operations in Indian cities. Companies like Amazon, Google, Microsoft, Goldman Sachs, JP Morgan, Walmart, and many others employ thousands of finance professionals in India, with CPA holders filling specialized roles.

CPAs in GCC environments typically work in US GAAP financial reporting, ensuring Indian subsidiary results consolidate correctly into parent company statements. Internal audit functions with SOX compliance focus represent another major employment category, as does tax compliance and planning for US-India operations.

Business controllership roles overseeing financial operations and FP&A (Financial Planning & Analysis) positions supporting US-based management also favour CPA credentials.

These roles often offer competitive compensation, international exposure through collaboration with US teams, and opportunities for international assignments or eventual relocation.

CPA Salary Progression in India

CPA salary progression in India varies based on employer type, location, and individual performance, but general patterns are observable.

Entry-level CPAs with 0-2 years of experience typically earn ₹6 lakhs to ₹10 lakhs annually in industry roles, with Big 4 and premium GCCs offering the higher end starting at ₹12 lakhs to ₹20 lakhs. The credential commands a meaningful premium over non-credentialed accounting graduates from the start.

As CPAs gain experience, salaries progress accordingly. Professionals with 2-5 years of experience typically earn ₹10 lakhs to ₹18 lakhs in roles like Senior Analyst or Consultant. Mid-career CPAs with 5-8 years reach ₹18 lakhs to ₹28 lakhs in Manager and Senior Manager positions.

Senior professionals with 8-12 years command ₹28 lakhs to ₹40 lakhs as Associate Directors or Directors. CPAs reaching leadership levels after 12+ years can earn ₹40 lakhs to ₹60 lakhs or more as VP Finance, Controller, or similar positions. Those combining CPA with CA or MBA credentials often progress faster and reach the higher end of these ranges.

CA Roles: Practice, Industry, Audit & Compliance

Chartered Accountants enjoy the widest career options within India among accounting credentials. The CA qualification grants exclusive rights that no other credential provides in the Indian context, including authority to sign statutory audit reports, certify various regulatory filings, appear before income tax appellate authorities, and conduct certain attestation engagements. These exclusive rights make CAs indispensable in the Indian business ecosystem.

CAs are absorbed across virtually every industry in India, from manufacturing to banking to technology to government. ICAI’s placement data consistently shows strong demand across sectors, reflecting the versatility of CA training that covers Indian taxation, company law, auditing standards, cost accounting, and financial management comprehensively. This breadth allows CAs to pivot between different career paths throughout their professional lives.

Practice, Industry, and Big 4 Options for CAs

CAs can pursue three broad career paths, each with distinct characteristics and earning potential. Public practice allows CAs to establish their own firms, sign audit reports, appear before tax authorities on behalf of clients, and provide attestation and certification services that other professionals cannot offer. This entrepreneurial path has unlimited income potential but requires building client relationships and managing a business alongside technical work.

Industry or corporate roles employ CAs as CFOs, Finance Directors, Financial Controllers, Tax Heads, Internal Audit Heads, and similar positions across sectors. Every company of significant size in India needs qualified CAs for compliance functions, statutory reporting, and financial management. The Big 4 and other professional services firms employ CAs extensively in statutory audit practices where they dominate due to signing authority requirements. CAs also work in tax advisory, risk consulting, transaction advisory, and management consulting at these firms. Big 4 entry packages for qualified CAs typically range from ₹8 lakhs to ₹12 lakhs through campus placements, with partnership tracks available for exceptional performers willing to commit long-term.

CA Salary Progression: Campus Placements to Senior Roles

ICAI conducts campus placements for newly qualified CAs, providing useful benchmarks for fresher salaries. The 60th Campus Placement Drive in 2024 reported an average package of ₹12.49 lakhs per annum, with the highest domestic offer reaching ₹26.7 lakhs. These campus placement figures represent the top tier of CA fresher hiring; many qualified CAs secure positions through direct applications, networking, or placement agencies at different salary levels.

Off-campus CA freshers typically start in the ₹4.5 lakhs to ₹7 lakhs range depending on firm size, location, and role. Early career CAs with 2-5 years of experience progress to ₹8 lakhs to ₹18 lakhs as Senior Associates or Managers. Mid-career professionals with 5-10 years reach ₹15 lakhs to ₹30 lakhs in Senior Manager or AVP positions.

Senior CAs with 10-15 years command ₹30 lakhs to ₹50 lakhs as VPs or CFOs at mid-size companies. Leadership positions after 15+ years can exceed ₹50 lakhs to ₹1 crore or more, particularly in Big 4 partnership tracks or CFO roles at large corporations.

The ceiling for CA earnings is exceptionally high for those who reach senior partnership or corporate leadership positions.

Head-to-Head Salary Comparison

Comparing CPA and CA salaries requires nuance because the credentials serve somewhat different market segments and career paths.

At the entry level, CPAs typically start higher, particularly in Big 4 and MNC roles requiring US accounting expertise. A CPA joining a Big 4 US GAAP practice might start at ₹15 lakhs, while a CA joining a statutory audit at the same firm starts at ₹10 lakhs. However, the CA has signing authority and a clearer partnership track in audit.

At mid-career levels around 5-7 years of experience, salaries largely converge as individual performance, specialization, and role matter more than the original credential. Both CPAs and CAs in this range earn ₹15 lakhs to ₹25 lakhs in comparable positions.

At senior levels, CAs may have higher ceiling potential due to CFO positions at Indian companies (which traditionally prefer CA qualification) and Big 4 partnership tracks in statutory audit. Top CPAs also reach executive levels, particularly in MNCs where the credential carries more weight than CA.

For MNC careers and US-facing roles, CPA provides clearer salary premiums throughout the career span.

For India-centric careers with aspirations toward CFO positions, audit practice, or Big 4 partnership, CA offers broader opportunities and potentially higher senior-level compensation. Many ambitious professionals pursue both credentials to maximise options across all employer types.

Global Mobility: Which Qualification Opens More Doors?

One of CPA’s strongest advantages is international recognition and portability. The US CPA license is valued and often required across North America, is recognized throughout Europe for American company subsidiaries, carries weight in the Middle East where many American firms operate, and is understood throughout Asia-Pacific in international business contexts.

Several countries have Mutual Recognition Agreements (MRAs) with US state boards, simplifying credential conversion for CPAs seeking to practice elsewhere.

CA, while deeply respected in India, has more limited direct recognition abroad. Indian CAs seeking to work in the US must typically pass the CPA exam and meet state-specific requirements; there is no automatic recognition or reciprocity.

However, the UK (through ICAEW), Australia (through CA ANZ), and some other accounting bodies have arrangements allowing Indian CAs to qualify with reduced requirements, providing pathways for those targeting specific international destinations.

For candidates with firm international career ambitions, whether relocating abroad or working with global clients from India, CPA provides smoother mobility and clearer recognition.

Those committed to building careers primarily within India may find CA’s domestic dominance more valuable than CPA’s international portability. The optimal choice depends on your genuine geographic career intentions.

How Do You Decide Between CPA and CA?

After examining structure, difficulty, cost, duration, and career outcomes across multiple dimensions, the decision ultimately comes down to your specific circumstances and professional goals. Neither credential is universally “better” in any absolute sense; each serves different purposes for different people at different career stages.

This section provides a decision framework to help you match your individual situation with the right credential choice. Consider honestly your current qualifications, career stage, geographic aspirations, time availability, and financial capacity. Getting this decision right saves years of effort and significant financial investment; getting it wrong means either switching paths midway or accepting suboptimal career outcomes.

Choose CPA If Your Goals Align With These Factors

CPA is the better choice when several specific conditions apply to your situation. If you already hold a degree that meets the 150 credit hour requirement, want credentials quickly without a multi-year commitment, prefer MNC environments over traditional Indian companies, have international career aspirations, or are an established working professional who cannot sacrifice income for a 2-year articleship, CPA deserves serious consideration as your primary or additional credential.

The CPA path works best for those who want recognized credentials faster, prefer the flexibility of self-paced preparation alongside existing work commitments, and target employers who specifically value US accounting expertise. CPA’s focused curriculum suits those with existing accounting backgrounds who want specialization over comprehensive ground-up training.

Ideal Candidate Profile for CPA

You’re an ideal CPA candidate if you already hold a degree meeting credit requirements, such as B.Com + M.Com, B.Com + MBA, or an existing CA qualification. These educational backgrounds typically fulfill the 150 credit hours needed for CPA licensure. You’re also well-suited for CPA if you’re targeting MNC careers at companies like Amazon, Google, Goldman Sachs, or similar organizations with significant US business where CPA expertise is specifically valued.

CPA fits well if you want international mobility with plans to work in the USA, Canada, Middle East, or extensively with US clients. Working professionals who need flexible study schedules and cannot leave employment for articleship find CPA’s self-paced approach practical.

Those who prefer focused curriculum covering specific areas deeply rather than broad coverage across Indian regulations may find CPA’s four-section format more manageable. And if timeline matters because you want credentials within 12-18 months rather than 4-5 years, CPA is the only realistic option.

CPA After CA: Is the Dual Credential Worth It?

For existing CAs considering adding CPA, the dual qualification creates a powerful combination that commands premium positioning in the job market.

CA + CPA holders are among the highest-paid accounting professionals in India because they offer employers the best of both worlds: CA’s Indian practice rights, statutory audit capability, and deep knowledge of Indian regulations combined with CPA’s US GAAP expertise, SOX competence, and international recognition.

The CPA journey is also easier for CAs than for other candidates.

Your CA qualification typically satisfies the 150 credit hour requirement, your accounting foundation accelerates CPA preparation, and your exam-taking experience helps you navigate the CPA testing process.

Many CAs complete CPA in 9-12 months rather than the typical 12-18 months. The additional investment of ₹5-7 lakhs and less than a year of effort can yield salary increases of ₹3-5 lakhs or more annually, making the ROI compelling for CAs targeting Big 4 advisory practices, MNC finance roles, or eventual US opportunities.

Choose CA If Your Goals Align With These Factors

CA is the better choice when different conditions apply.

If you’re starting early in your educational journey after 12th or during graduation, have 4-5 years available to invest in comprehensive professional training, want the broadest possible career options within India including exclusive practice rights, or aspire to roles like CFO at Indian companies or Big 4 audit partner where CA is essentially required, then CA is your appropriate path.

The CA journey suits those committed to careers primarily within the Indian business ecosystem, those who value the depth of training that articleship provides, and those who see the longer journey as an investment in thorough preparation rather than an obstacle to overcome.

Ideal Candidate Profile for CA

You’re an ideal CA candidate if you’re starting young, whether after 12th standard or during undergraduate studies, with 4-5 years available before you need to establish yourself professionally. This timing allows you to complete CA before peers finish postgraduate degrees, entering the job market with a highly respected credential. CA also fits if you’re committed to India-centric careers and don’t have firm plans for international relocation or extensive work with US clients.

Those aspiring to independent practice with their own CA firm, statutory audit signing authority, or representation before Indian tax authorities must pursue CA; no other credential provides these exclusive rights.

If you’re attracted to CFO tracks at major Indian companies or partnership tracks at Big 4 audit practices, CA is the credential employers expect and require. Students from families where cost needs to spread across years rather than concentrating upfront also find CA’s financial structure more manageable.

CPA After CA: When Dual Qualification Adds Value

CA creates excellent pathways to additional credentials including CPA, ACCA, CMA, and others. For CAs who discover international career interests after qualifying, or who find themselves in roles where US accounting expertise would accelerate progression, adding CPA makes strategic sense. The CA foundation significantly eases CPA preparation, and the combined credentials open doors that neither qualification alone provides.

Dual qualification adds particular value when you’re targeting Big 4 advisory practices serving US companies from India, MNC finance roles where both Indian compliance and US reporting fall under your scope, or eventual relocation to the US where CPA is required for accounting practice. CAs who add CPA typically see faster career progression and higher compensation than those with either credential alone, though the additional time and investment must be weighed against alternative uses of those resources.

Decision Matrix Based on Career Intent, Budget & Time

To systematize your decision, consider these factors and how they apply to your specific situation. If your primary career intent is MNC finance, international roles, or US-facing work, CPA aligns better. If your intent is Indian corporate leadership, audit practice, or independent CA firm, choose CA. For those wanting maximum flexibility across all employer types, the CA + CPA combination is optimal but requires 5-6 years and ₹8-11 lakhs total investment.

Budget constraints influence the decision practically. If you have ₹5-7 lakhs available now or access to education financing, CPA is feasible within 12-18 months. If funds must spread across years with annual outlay under ₹1 lakh, CA’s structure accommodates this better. Time availability is equally crucial: working professionals with limited time for 3-year articleship (2-years in new scheme) realistically can only pursue CPA, while students with years ahead can commit to CA’s comprehensive journey.

Your current qualifications also matter. B.Com graduates need additional education (M.Com or equivalent) to meet CPA requirements unless their B.Com program was unusually credit-heavy. CA qualification itself meets CPA eligibility requirements.

Those already holding CA can add CPA efficiently, while those without accounting credentials would need to start CA from Foundation. Assess your starting point honestly to determine which path is practically accessible.

Conclusion

Both CPA and CA are valuable credentials that lead to successful, well-compensated careers in accounting and finance. They are not competitors in the sense of one being universally superior; rather, they serve different purposes, different markets, and different career aspirations. The right choice depends entirely on your individual circumstances, goals, and constraints.

If you want international recognition, faster completion, and premium positioning in MNC and US-facing roles, CPA offers clear advantages. You can complete it in 12-18 months while continuing to work, and the credential opens doors globally. If you want the broadest career options within India, including exclusive practice rights, statutory audit authority, and pathways to Big 4 partnership or CFO positions at Indian companies, CA provides unmatched domestic value despite the 4-5 year commitment.

The most successful accounting professionals often recognize that credentials are tools for career building, not ends in themselves. Many CAs add CPA later to access international opportunities. Some CPAs pursue additional Indian qualifications when their careers evolve toward India-centric roles.

Your first credential choice starts your journey, but doesn’t limit your ultimate destination. Choose the path that makes sense for where you are today and where you genuinely want to be in 5-10 years, then pursue it with full commitment. Whichever path you choose, consistent effort and continuous learning will determine your ultimate success far more than the letters after your name.

To understand the overall CPA journey, you can also refer to this detailed guide on the Certified Public Accountant (CPA) Exam in USA.

Frequently Asked Questions

Is CPA easier than CA for Indian candidates?

CPA has significantly higher pass rates, ranging from 40% to 82% across sections, compared to CA’s 10% to 20% across levels, suggesting CPA is statistically easier to pass. However, direct difficulty comparison is complex because CPA requires a 75/99 scaled score with no compensation across content areas, while CA needs 40% per paper with 50% aggregate. CPA content is also unfamiliar to candidates trained in Indian standards. Most importantly, CPA takes 12-18 months versus CA’s 4-5 years, making CPA faster to complete regardless of relative difficulty per exam.

Can I pursue CPA without being a CA first?

Yes, CPA doesn’t require CA qualification as a prerequisite. You need 150 credit hours of education in accounting and business subjects, which B.Com + M.Com or B.Com + MBA graduates typically fulfill. Some states allow sitting for exams with 120 credits, with the remaining 30 required for licensure. Your educational credentials are evaluated by agencies like NIES or WES to confirm eligibility before you can apply to a state board and receive your Notice to Schedule.

How much does CPA cost in India compared to CA?

CPA costs approximately ₹5 lakhs to ₹7 lakhs total including evaluation, exam fees, international testing charges, and quality review courses, all concentrated in 12-18 months. CA costs approximately ₹3 lakhs to ₹5 lakhs total including ICAI fees and private coaching spread across 4-5 years. CPA has higher absolute cost but delivers the credential much faster. CA has lower direct costs but includes 3-year articleship (2-years in new scheme) with stipends rather than full salaries, representing significant opportunity cost for working professionals.

Which credential offers higher salary in India?

Entry-level salaries show CPA advantage in specific contexts: CPAs at Big 4 US-facing practices start at ₹12 lakhs to ₹20 lakhs, while CA campus placements average ₹12.49 lakhs. At mid-career levels around 5-7 years, salaries converge at ₹15 lakhs to ₹25 lakhs for both credentials. At senior levels, CAs may have higher ceilings in CFO roles and Big 4 partnership tracks, while CPAs excel in MNC leadership positions. For maximum earning potential, the CA + CPA combination commands premium compensation across employer types.

How long does CPA take compared to CA?

CPA can be completed in 12-18 months for most candidates, including evaluation, application, and passing all four exam sections. Motivated candidates with strong backgrounds sometimes finish in 9-12 months. CA takes 4-5 years minimum due to three exam levels plus mandatory 3-year articleship (2-years in new scheme) that cannot be compressed. Many CA candidates require additional time due to exam retakes. For working professionals, CPA’s timeline advantage is particularly significant since you can earn the credential without career interruption.

Is CPA valid in India for practicing as an accountant?

CPA doesn’t grant signing authority for statutory audits in India; that right belongs exclusively to Chartered Accountants under Indian law. However, CPA is highly valued in India for roles that don’t require Indian practice rights. MNCs, Big 4 advisory practices, Global Capability Centers, and companies with US operations actively seek CPAs for US GAAP reporting, SOX compliance, international tax, and client-facing roles involving American stakeholders. CPA is valid and valuable in India for corporate employment; it’s not valid for Indian public practice.

Can I do CPA while working full-time in India?

Yes, CPA is particularly popular among working professionals precisely because of this flexibility. You can study during evenings and weekends, schedule exams when your preparation is complete rather than on fixed dates, and maintain full employment throughout the 12-18 month journey. Many Indian CPAs pass all four sections without taking significant leave from work. Review courses offer recorded lectures and self-paced study materials that accommodate varying schedules. This flexibility contrasts sharply with CA’s structured timeline and full-time articleship requirement.

Which Big 4 firms hire more CPAs vs CAs in India?

All Big 4 firms (Deloitte, PwC, EY, KPMG) hire both credentials in significant numbers for different practice areas. CAs dominate statutory audit engagements because Indian law requires CA signing authority for audit reports. CPAs are preferred for US GAAP advisory, SOX compliance, international tax, transaction advisory involving US entities, and roles serving American clients. Neither credential has absolute advantage across all Big 4 practices; your target service line determines which credential is more relevant for your specific career aspirations.

What is the pass rate for CPA vs CA in 2024?

CPA 2024 pass rates vary by section: FAR at approximately 40%, AUD at 46%, REG at 63%, TCP at 75-82%, ISC at 56%, and BAR at 33-40%. CA November 2024 results show: Foundation at approximately 20%, Intermediate both groups at 5.66% (individual groups 14-21%), and Final both groups at 13.44% (individual groups 17-21%). These numbers confirm CA has substantially lower pass rates across all levels, though the exams test different content and use different formats.

Should I do CA first and then CPA?

This depends on your timeline, current status, and career goals. If you’re starting after 12th and have 5-6 years before needing full employment, pursuing CA first then adding CPA creates the most powerful credential combination. If you’re a working professional or graduate who wants credentials quickly, pursuing CPA directly makes more sense since CA’s articleship would interrupt your earning career. If you’re already a CA and discover international career interests, adding CPA is straightforward and valuable. There’s no single right answer; your specific circumstances determine the optimal sequence.

Which states are best for Indian candidates to register for CPA?

Colorado, Montana, Alaska, Guam, and Washington are popular among Indian candidates because they don’t require US Social Security Numbers or US residency for CPA licensure. These states allow international candidates to complete the entire process from India. Your choice among these should consider specific education requirements (credit hour breakdowns between accounting and business courses vary), experience requirements for licensure after passing exams, and any additional ethics exam requirements. Research current requirements on NASBA’s website as they can change.

Does CPA help in getting a job in the USA?

CPA is essentially required for most professional accounting roles in the USA, so the credential definitely helps. However, CPA alone doesn’t provide work authorization; you still need appropriate visa status (H-1B, L-1, green card, or citizenship) to work legally in the US. Many Indian CPAs work for US companies remotely from India, leveraging the credential without relocating. Others use CPA as part of their profile when seeking employer sponsorship for US work visas. CPA helps significantly with job opportunities but doesn’t solve immigration requirements separately.

Can a CA practice in the USA?

No, Indian CA is not recognized for public practice in the United States. To practice as a CPA in any US state, CAs must pass the US CPA exam (all four sections), meet that state’s education requirements (which CA typically satisfies), fulfill any experience requirements, and obtain licensure from the state board. There is no automatic recognition or reciprocity agreement between ICAI and US state boards. However, CAs find the CPA exam more manageable than candidates without accounting backgrounds, and many successfully add CPA to their credentials.

What is the ROI comparison between CPA and CA?

CPA offers faster ROI due to its compressed timeline. Investing ₹5-7 lakhs over 12-18 months, you can potentially see salary increases of ₹3-5 lakhs annually in CPA-preferring roles, recovering your investment within 1-2 years. CA requires ₹3-5 lakhs over 4-5 years plus opportunity cost of articleship stipends versus full salaries. However, CA’s long-term ROI can exceed CPA’s due to higher ceiling potential in partnership tracks and CFO roles. The optimal ROI calculation depends on your career trajectory and how quickly you can leverage each credential for advancement.

Is the CPA exam getting harder after CPA Evolution 2024?

CPA Evolution changed the exam structure but not necessarily overall difficulty. The three core sections (AUD, FAR, REG) remain similar to their pre-2024 versions, testing the same fundamental competencies with updated content. The discipline sections (BAR, ISC, TCP) are new, with pass rates varying significantly. TCP has shown remarkably high pass rates (75-82%) while BAR has struggled (33-40%). AICPA maintains that disciplined candidates selecting sections aligned with their backgrounds should not find the new exam harder than the old format. Early data suggest overall difficulty is comparable to previous years.

Allow notifications

Allow notifications