CPA exam requirements: Learn eligibility criteria, credit hour calculations, state selection, costs in INR, and step-by-step application process.

Table of Contents

The US CPA certification has become one of the most sought-after credentials among Indian accounting and finance professionals. Whether you are a B.Com graduate exploring international opportunities, a Chartered Accountant looking to add a global qualification, or an M.Com holder planning a career with multinational corporations, understanding CPA exam requirements is your essential first step.

Yet navigating these requirements from India can feel overwhelming, with scattered information across dozens of websites, outdated guidance, and confusing state-by-state variations.

Here is the reality that most Indian candidates face: the US uses a credit-based education system that does not directly match Indian degree structures. You need to figure out how your B.Com or CA qualification translates to American semester hours.

You must select a US state board that will accept your application without requiring a Social Security Number. You have to budget for evaluation fees, exam costs, international testing charges, and review courses, all in Indian rupees. And you need to accomplish all of this while managing a demanding job and personal commitments.

This guide addresses every aspect of CPA exam requirements specifically for Indian professionals. You will learn exactly how your qualifications map to US credit requirements, which states offer the smoothest pathway for Indian candidates, how to get your credentials evaluated, what the CPA Evolution exam structure means for your preparation strategy, and what the complete journey will cost. By the end, you will have a clear roadmap from where you are today to holding that CPA license.

If you are also deciding whether CPA is the right path compared to traditional Indian qualifications, our detailed CPA Exam vs CA Exam comparison breaks down differences in eligibility, duration, cost, and global career outcomes.

What Are the CPA Exam Requirements for Indian Candidates?

Before you invest your time, energy, and money into pursuing the US CPA, you need to understand exactly what the eligibility requirements are and whether you qualify.

The good news is that CPA requirements, while they vary by state, follow predictable patterns. Most states require a combination of education credentials measured in semester credit hours, relevant work experience verified by a licensed CPA, and successful completion of the Uniform CPA Examination.

Understanding these requirements upfront will save you from costly surprises and help you plan your journey strategically.

Education Requirements and the 150 Credit Hour Rule

The foundation of CPA eligibility rests on your educational qualifications, measured through a system that may be unfamiliar to Indian candidates. US state boards evaluate education using semester credit hours, a standardized unit that allows them to assess degrees from around the world on a common scale.

For Indian professionals, grasping this credit hour system is not just helpful; it is absolutely essential for determining your eligibility and planning any additional coursework you might need.

Understanding the US Credit Hour System

The United States measures higher education in semester credit hours, where one credit hour typically represents one hour of classroom instruction per week over a 15-week semester. A standard US bachelor’s degree comprises 120 semester hours, while a master’s degree adds another 30 to 60 hours. For Indian candidates, the general conversion accepted by most evaluation agencies is that one year of full-time Indian university education equals approximately 30 US semester credit hours, though this can vary based on the specific institution and program intensity.

120 Credits to Sit for the Exam vs 150 Credits for Licensure

Here is a distinction that confuses many Indian candidates: the credit requirements to sit for the CPA exam are different from the requirements to obtain your CPA license. Most states allow you to take the exam with 120 semester hours of education, but require 150 semester hours for full licensure. This means you can begin your CPA exam journey with a bachelor’s degree equivalent, but you will need additional credits before you can actually call yourself a licensed CPA. Planning for this gap early prevents frustration later in your journey.

How Indian Qualifications Qualify for CPA Eligibility

Your Indian degree does not automatically translate to a specific credit count. Instead, it must go through a formal evaluation process where agencies assess your transcripts, course content, and institution accreditation to determine the US credit equivalent. Different qualifications receive different credit allocations, and understanding these mappings helps you identify exactly where you stand and what additional steps you might need to take.

B.Com Graduate Credit Calculation (3-Year Degree)

A standard three-year Bachelor of Commerce degree from an Indian university typically evaluates to approximately 90 US semester credit hours. This falls short of both the 120-credit exam requirement and the 150-credit licensure requirement in most states. If you hold only a B.Com, you will need to bridge this gap through additional coursework, which can include pursuing an M.Com, completing online bridge courses from accredited providers, or earning professional certifications that carry credit equivalence.

M.Com and Postgraduate Qualification Credits

A two-year Master of Commerce degree adds approximately 60 US semester credit hours to your profile, bringing a B.Com plus M.Com holder to around 150 total credits. This combination meets the full licensure requirements in most states, making it one of the most straightforward pathways for Indian candidates.

If you are currently a B.Com graduate considering CPA, pursuing an M.Com may be worth the investment purely from a credit accumulation perspective, even before considering the additional knowledge you will gain.

CA, CS, and CMA Qualification Recognition

Professional qualifications like Chartered Accountancy, Company Secretary, and Cost and Management Accountancy receive varying recognition across US state boards. Most evaluation agencies assign CA qualifications an additional 30 to 60 credit hours beyond underlying degrees, recognizing the rigorous examination and articleship requirements. However, recognition varies significantly by state, so CA holders should verify their specific state board’s policies.

The combination of B.Com plus CA typically meets or exceeds the 150-credit threshold in states that fully recognize Indian professional qualifications.

Work Experience Requirements for CPA Licensure

Passing the CPA exam alone does not make you a licensed CPA. Every US state requires candidates to complete a period of relevant work experience, typically ranging from one to two years, before granting licensure. This experience must generally be in accounting, auditing, taxation, or related fields, and crucially, it must be verified by a licensed CPA. For Indian candidates, this verification requirement presents unique challenges that require careful planning.

The experience requirement varies by state, with most requiring one year of full-time work, equivalent to approximately 2,000 hours.

Some states accept only public accounting experience, while others recognize industry, government, or academic experience. The key challenge for Indian professionals is finding a licensed US CPA to verify their experience. Working for Big 4 firms or multinational corporations with US operations often provides access to CPAs who can serve as verifiers. Alternatively, some candidates gain their experience after relocating to the United States or through remote work arrangements with US-based firms.

Which US States Allow Indian Candidates to Apply Without SSN?

Selecting the right US state board is one of the most critical decisions you will make in your CPA journey. Unlike many other professional certifications, the CPA license is issued at the state level, and each of the 55 US jurisdictions sets its own eligibility requirements. For Indian candidates, the most important consideration is often whether the state requires a Social Security Number, a nine-digit identification number issued only to US citizens and authorized workers. Choosing a state that accepts international candidates without an SSN opens the door to pursuing your CPA from India.

States That Do Not Require Social Security Number

Five US states have emerged as popular choices for Indian CPA candidates because they do not require applicants to possess a Social Security Number. These states are Washington, Montana, Alaska and Guam.

Each participates in the international administration of the CPA exam, meaning they will evaluate your foreign credentials, process your application, and allow you to take the exam at international testing centers including those in India. While all five states are viable options, they differ in their specific education requirements, fees, processing times, and experience requirements, making careful comparison essential.

Washington State has become the most popular choice among Indian candidates due to its relatively straightforward requirements and efficient processing. The state requires 150 semester hours including specific accounting and business credits, with a one-year experience requirement for licensure. Montana offers another accessible option with similar credit requirements but potentially faster processing times. Alaska and Guam provide alternatives for candidates whose credit profiles may not align perfectly with Washington or Montana requirements. Pennsylvania rounds out the options, though its requirements tend to be somewhat more complex for international candidates.

How to Choose the Right State Based on Your Qualification Profile

Choosing between these five states should not be random. Your selection should align with your specific educational background, career goals, and practical considerations like processing times and fees. Taking a systematic approach to this decision ensures you select a state where you clearly meet requirements and can process your application efficiently.

Factors to Consider: Fees, Processing Time, and Future Mobility

Application fees vary significantly across states, ranging from approximately $15 to $245 for initial applications. Processing times can range from four weeks to several months depending on the state board’s workload and your application completeness. Perhaps most importantly, consider license mobility: once licensed in one state, you can often practice in other states through reciprocity agreements, but some states have additional requirements for out-of-state CPAs. If you plan to eventually work in a specific US state, research whether your initial licensing state has favorable reciprocity arrangements.

Which State is Best for Your Qualification Profile?

For B.Com plus M.Com holders with 150 credits, Washington typically offers the smoothest pathway with its clear requirements and efficient international candidate processing. CA holders often find Montana accommodating, as it tends to recognize professional qualifications favorably. If you hold only a B.Com and plan to complete bridge courses, verify that your chosen courses will be accepted by your target state before enrolling. Candidates with non-traditional backgrounds or unusual credit profiles should consider consulting with evaluation agencies before selecting a state, as some states may be more flexible than others in interpreting foreign credentials.

How to Get Your Indian Credentials Evaluated for CPA Eligibility

Before any US state board will consider your CPA application, you must have your Indian educational credentials formally evaluated by an approved agency. This evaluation process converts your Indian degrees, transcripts, and professional qualifications into terms that American regulators can understand and assess. The evaluation determines how many US semester credit hours your education represents and whether you meet the specific accounting and business course requirements of your chosen state. Skipping this step or choosing the wrong evaluation service can delay your entire CPA journey by months.

Credential Evaluation Agencies Accepted for CPA

Several credential evaluation agencies are authorized to assess foreign education for CPA eligibility purposes. The two most commonly used by Indian candidates are NASBA International Evaluation Services and World Education Services. Each agency has its own process, fee structure, and timeline, and not all state boards accept evaluations from all agencies. Confirming that your chosen state accepts your evaluation agency before beginning the process prevents wasted time and money.

NASBA International Evaluation Services (NIES)

NASBA International Evaluation Services offers credential evaluation specifically designed for CPA candidates. NIES evaluations are accepted by the majority of state boards that participate in international CPA exam administration. Fees typically range from $200 to $300 depending on the evaluation type and processing speed selected. Standard processing takes six to eight weeks, though rush options are available for additional fees. NIES requires official transcripts sent directly from your Indian institutions, mark sheets, and degree certificates, all with certified English translations if originals are in other languages.

World Education Services (WES) Evaluation

World Education Services is another widely accepted evaluation agency, particularly popular among candidates who may use their evaluation for multiple purposes such as immigration or graduate school applications. WES fees are comparable to NIES, typically $200 to $350 including required document verification. For Indian candidates, WES requires transcripts to be verified through their designated verification service in India. CA holders must have their qualification verified through the Institute of Chartered Accountants of India before WES will include it in the evaluation. Processing times average six to eight weeks for standard service.

Other Accepted Evaluation Services

Beyond NIES and WES, several other agencies provide credential evaluations accepted by various state boards, including FACS (Foreign Academic Credential Service) and ECE (Educational Credential Evaluators). These alternatives may offer advantages for specific states or qualification types. Before selecting any evaluation agency, verify directly with your chosen state board that they accept evaluations from that specific agency. Some states maintain restricted lists of approved evaluators, and using an unapproved agency means starting the process over with an accepted one.

Document Requirements and Preparation

Gathering the required documents for credential evaluation often takes longer than candidates expect. You will need official transcripts from every post-secondary institution you attended, degree certificates, mark sheets, and potentially course syllabi or descriptions. Documents must typically come directly from institutions to the evaluation agency in sealed envelopes, or through authorized electronic verification systems. Start this document gathering process early, as obtaining official transcripts from Indian universities can sometimes take weeks, especially during examination periods or administrative backlogs.

Evaluation Timeline and What to Expect

Plan for the entire credential evaluation process to take two to three months from when you begin gathering documents to when you receive your final evaluation report. Document collection from Indian institutions typically requires two to four weeks, especially if you attended multiple colleges or universities. Once the evaluation agency receives all required documents, processing takes another six to eight weeks for standard service. You will receive a detailed report showing your total US credit hour equivalent, breakdown by subject area, and how your credentials compare to US degree standards. This report becomes a permanent document you can use for CPA applications and potentially other purposes.

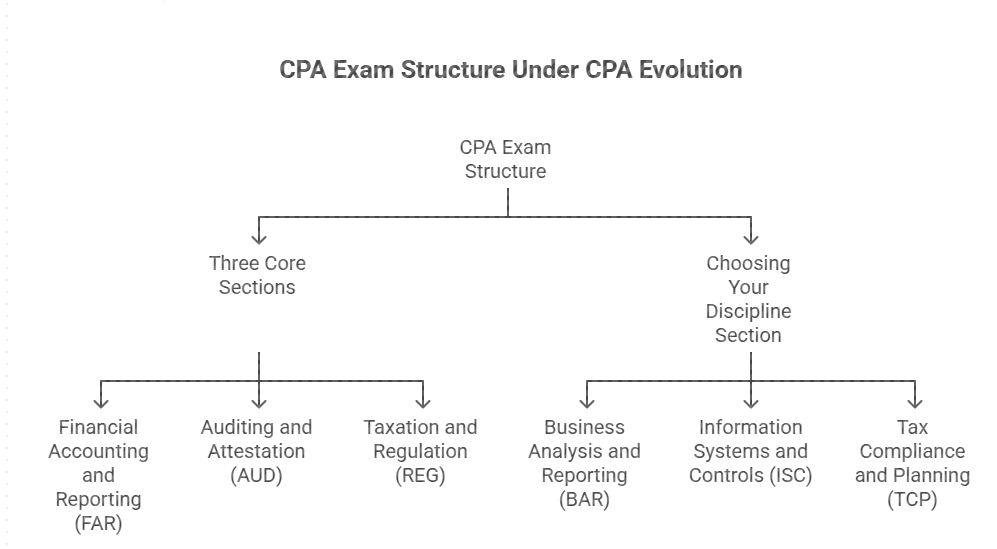

What Is the CPA Exam Structure Under CPA Evolution?

The CPA exam underwent its most significant transformation in decades when CPA Evolution launched in January 2024. This restructuring replaced the traditional four-section exam with a new Core plus Discipline model designed to reflect the evolving skills needed by modern CPAs. Understanding this new structure is essential for planning your exam preparation strategy, selecting review materials, and deciding which discipline section aligns with your career goals. Indian candidates should note that while the exam content has changed significantly, the fundamental requirements around passing scores and credit retention remain largely the same.

Three Core Sections Every Candidate Must Pass

Under CPA Evolution, every candidate must pass three Core sections that assess the foundational knowledge and skills all CPAs need regardless of their practice area. These Core sections are Financial Accounting and Reporting, Auditing and Attestation, and Taxation and Regulation. Each section is four hours long and tests both technical knowledge and the ability to apply that knowledge to realistic scenarios. The Core sections are now available through continuous testing, meaning you can schedule them throughout the year rather than within specific testing windows.

Financial Accounting and Reporting (FAR)

FAR tests your knowledge of financial accounting standards, reporting frameworks, and the preparation of financial statements for various entity types including businesses, governments, and nonprofits. According to AICPA’s published pass rate data, FAR consistently has one of the lower pass rates among Core sections, hovering between 40% and 43% in 2024 and 2025. For Indian candidates with strong accounting fundamentals from B.Com or CA backgrounds, FAR content may feel relatively familiar, though US GAAP differs significantly from Indian Accounting Standards in many areas.

Auditing and Attestation (AUD)

AUD covers auditing procedures, attestation engagements, professional responsibilities, and ethics for CPAs performing audit services. Pass rates for AUD typically range from 46% to 48%, making it moderately challenging compared to other sections. Indian CA holders often find significant overlap between AUD content and their articleship experience, though US auditing standards and regulatory frameworks differ from Indian standards. The conceptual nature of many AUD questions requires understanding the “why” behind audit procedures, not just memorizing steps.

Taxation and Regulation (REG)

REG focuses on US federal taxation for individuals, entities, and transactions, along with business law concepts including contracts, agency, and business structures. Pass rates have been relatively strong at 59% to 64% in recent testing periods, reflecting perhaps that the content, while extensive, is more rule-based and memorizable than other sections. For Indian candidates, REG presents the steepest learning curve because US tax law has virtually no overlap with Indian taxation. You will be learning an entirely new tax system from scratch, which requires dedicated study time regardless of your background.

Choosing Your Discipline Section

Beyond the three Core sections, you must select and pass one of three Discipline sections that assess deeper knowledge in a specialized area. Your discipline choice should reflect your career interests, existing strengths, and the type of CPA work you plan to pursue. Unlike Core sections, you have flexibility in this choice, and selecting strategically can make your exam journey smoother.

Business Analysis and Reporting (BAR)

BAR extends FAR content into more complex financial reporting topics including business combinations, derivatives, governmental accounting, and analytical procedures. According to AICPA data, BAR has recorded the lowest pass rates among all sections since CPA Evolution launched, ranging from 34% to 41%. This section suits candidates with strong financial accounting foundations who plan careers in financial reporting, technical accounting, or corporate finance roles. If you struggled with FAR, BAR may compound those challenges since it builds directly on FAR concepts.

Information Systems and Controls (ISC)

ISC covers information technology governance, system controls, cybersecurity, and data management relevant to accounting systems and audit procedures. Pass rates for ISC have been moderate at 56% to 59%, reflecting its unique content that differs significantly from traditional accounting. This section is ideal for candidates interested in IT audit, systems consulting, or cybersecurity roles within accounting firms. Indian candidates with technology backgrounds or IT experience may find ISC plays to their strengths, though it requires learning specific frameworks and control standards that may be unfamiliar.

Tax Compliance and Planning (TCP)

TCP extends REG content into advanced tax planning, compliance for complex entities, and specialized tax situations. This discipline has recorded the highest pass rates among all CPA exam sections, ranging from 72% to 82% since CPA Evolution began. The AICPA has noted that TCP candidates tend to be better prepared, likely because those choosing tax specialization often work in tax roles and study REG intensively before attempting TCP. For Indian candidates committed to tax careers, TCP offers both career alignment and statistically favorable pass rates.

For candidates who want a deeper breakdown of how CPA pass rates vary across FAR, AUD, REG, and discipline sections, a detailed analysis of CPA exam pass rates by section explains the quarterly trends and what they mean for preparation strategy.

Exam Format, Duration, and Scoring

Understanding the mechanics of how the CPA exam works helps you prepare effectively and manage your time on exam day. Each section follows a structured format with specific question types, time allocations, and scoring methodologies that have been refined over decades of administration.

Question Types: MCQs and Task-Based Simulations

Every CPA exam section contains two question types: multiple-choice questions and task-based simulations. MCQs test your knowledge of concepts and rules through traditional four-option questions. Task-based simulations present realistic scenarios requiring you to perform calculations, complete forms, conduct research, or analyze documents. The weighting between MCQs and simulations varies by section, but both contribute significantly to your final score. Simulations tend to be more challenging and time-consuming, so practicing with exam-format simulations is essential for success.

Passing Score and 30-Month Testing Window

You must score at least 75 on each section to pass, with scores reported on a scale from 0 to 99. This score is not a percentage; it is a scaled score that accounts for question difficulty and ensures consistent passing standards across different exam forms. Once you pass your first section, you have 30 months to pass the remaining three sections and retain credit for all passed sections. If you do not complete all four sections within this window, your earliest passed section expires and you must retake it. This rolling window creates strategic pressure to maintain steady progress through your exam journey.

CPA Exam Cost Breakdown for Indian Candidates

Cost is often the deciding factor for Indian professionals evaluating whether to pursue the CPA certification. Unlike some certifications with simple fee structures, the CPA involves multiple cost components spread across different stages of the journey.

Understanding the complete cost picture in Indian rupees helps you budget realistically and avoid financial surprises that derail your progress. The total investment varies based on your state choice, evaluation agency, review course selection, and whether you pass sections on your first attempt.

The complete CPA journey for an Indian candidate typically costs between ₹3,00,000 and ₹4,50,000 when accounting for all components.

The examination fees represent the largest single cost component. According to NASBA’s international exam fee schedule, Indian candidates testing at Prometric centres in India pay an international testing fee of approximately $510 per exam section. This amount includes both the standard exam section fee and the international administration surcharge. At current exchange rates, this works out to roughly ₹42,000 to ₹45,000 per section. For all four sections, examination fees alone total approximately ₹1,70,000 to ₹1,80,000.

CPA review courses represent another significant investment, with comprehensive courses from major providers like Becker, Wiley, Surgent, and Gleim ranging from $1,500 to $3,500, or approximately ₹80,000 to ₹1,50,000.

Candidates who want a line-by-line cost analysis can explore our dedicated CPA exam cost article for updated fee structures and planning examples.

Can Indian Candidates Take the CPA Exam in India?

One of the most significant developments for Indian CPA aspirants in recent years has been the availability of CPA exam testing within India. Prior to 2020, Indian candidates had to travel to the United States, Middle East, or other international locations to sit for their exams, adding thousands of dollars in travel costs and logistical complexity. Today, NASBA and Prometric administer the CPA exam at eight testing centers across India, allowing you to complete your entire CPA examination journey without leaving the country.

Prometric Test Center Locations Across India

Prometric operates CPA exam testing centers in eight major Indian cities, providing geographic accessibility for candidates across the country. These centers follow the same security protocols, exam delivery systems, and testing conditions as Prometric centers worldwide, ensuring your exam experience is identical to what candidates experience in the United States.

City-Wise Testing Center Directory

The eight Prometric testing centers in India are located in Ahmedabad, Bangalore, Calcutta, Chennai, Hyderabad, Mumbai, New Delhi, and Trivandrum. Each center serves candidates from surrounding regions, with Mumbai, Delhi, and Bangalore typically having the highest appointment availability due to multiple testing stations. Candidates from smaller cities may need to travel to the nearest metropolitan center, but this is far more convenient and affordable than international travel.

Scheduling Your Exam Appointment

Once you receive your Notice to Schedule from NASBA, you can book your exam appointment through the Prometric website. Appointments are available throughout the year for Core sections, with specific windows for Discipline sections. Popular testing times fill quickly, especially during morning slots and weekends, so booking four to six weeks in advance is advisable. If you need to reschedule, Prometric allows changes up to 30 days before your appointment without penalty, with fees applying for closer changes.

CPA Exam Scheduling Rules for Core and Discipline Sections

The scheduling rules differ between Core and Discipline sections, reflecting changes implemented under CPA Evolution. Understanding these rules helps you plan your exam sequence and avoid scheduling conflicts.

Year-Round Testing for AUD, FAR, and REG

Beginning in 2025, the three Core sections are available through continuous testing, meaning you can schedule them on any available date throughout the year except during brief maintenance blackout periods. This flexibility allows you to pace your preparation according to your study schedule rather than racing to meet testing window deadlines. You can also receive your scores faster, typically within one to two weeks of testing, compared to the batched score releases of previous years.

Discipline Section Testing Windows

Discipline sections follow a different model with quarterly testing windows. BAR, ISC, and TCP are available during the first month of each calendar quarter, with score releases following approximately one to two months later. This means if you miss a discipline testing window, you may wait several months for the next opportunity. Plan your discipline section timing carefully, especially if you are approaching the end of your 30-month credit window, to ensure you have multiple attempts available if needed.

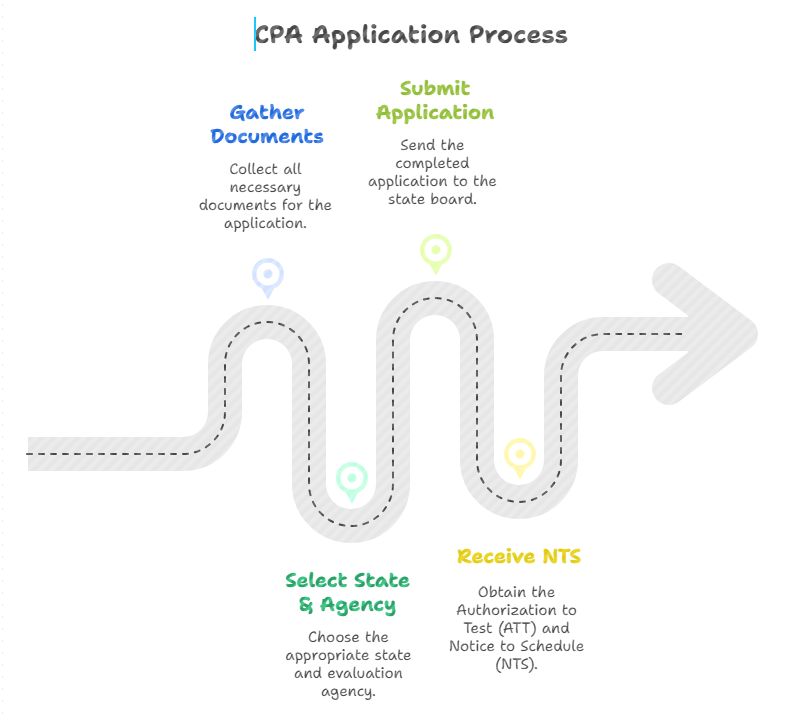

Step-by-Step CPA Application Process for Indian Candidates

With all the requirements, fees, and procedures involved, the CPA application process can feel overwhelming. Breaking it down into sequential steps makes the journey manageable and helps ensure you do not miss critical deadlines or requirements. The process from initial document gathering to sitting for your first exam typically takes three to six months, so starting early gives you the best chance of staying on schedule.

Pre-Application Preparation

Before submitting any applications or paying any fees, invest time in thorough preparation. This upfront effort prevents costly mistakes and ensures your application moves through the system efficiently without delays from missing documents or incorrect information.

Gathering Required Documents

Create a comprehensive checklist of required documents before contacting any institutions. You will need official transcripts from every college and university you attended, degree certificates, mark sheets for all years, and potentially course descriptions or syllabi. For CA, CS, or CMA holders, gather your qualification certificates and membership documentation. Ensure you have a valid passport, as this serves as your primary identification throughout the process. Start requesting documents early, as Indian universities often have processing delays, especially during examination seasons.

Selecting Your State and Evaluation Agency

With documents in hand, finalize your state board selection based on your qualification profile and the factors discussed earlier. Then select your evaluation agency, confirming that your chosen state accepts evaluations from that agency. Make these decisions before spending money on evaluations or applications, as changing course later wastes both time and fees. Consider reaching out to Indian CPA coaching institutes for guidance, as they have extensive experience helping candidates navigate these choices.

Application Submission and NTS Receipt

Once your credential evaluation is complete and you have your evaluation report showing your US credit equivalency, you can proceed with the formal application to your chosen state board. This application initiates your candidacy and eventually results in your authorization to schedule exam appointments.

Submitting Your Application to the State Board

Most state boards process applications through the NASBA candidate portal, where you create an account, submit your application, upload required documents, and pay fees. Some states require additional forms or documentation beyond the standard NASBA application. Application processing typically takes four to eight weeks, during which the state board verifies your credentials and confirms your eligibility. You will receive notification when your application is approved and you can proceed to the next step.

Authorization to Test (ATT) and Notice to Schedule (NTS)

Upon application approval, you receive an Authorization to Test, confirming your eligibility to sit for specific exam sections. After paying examination fees, you receive your Notice to Schedule, the document that allows you to book appointments at Prometric. Your NTS is valid for a limited period, typically six to nine months depending on your state. Schedule your exams within this window, as expired NTS documents mean forfeited fees and the need to reapply. Plan realistically about how many sections you can prepare for within your NTS validity period rather than paying for sections you will not be ready to take.

How Long Does It Take to Complete the CPA Exam from India?

Indian CPA candidates are almost universally working professionals balancing exam preparation with demanding jobs and personal responsibilities. Setting realistic timeline expectations prevents frustration and helps you plan sustainable study schedules. While some candidates complete the entire CPA journey in twelve months, a more typical timeline for working professionals is eighteen to twenty-four months from starting the credential evaluation process to receiving your license.

Credential Evaluation to First Exam: 3-6 Months

The pre-exam phase involves document gathering, credential evaluation, state board application, and initial study preparation. This phase cannot be rushed significantly because processing times are largely outside your control.

Document Gathering and Evaluation Processing

Allow two to four weeks for gathering official documents from your Indian institutions, longer if you attended multiple colleges or need documents from institutions with slow administrative processes. Credential evaluation takes another six to eight weeks for standard processing. State board application processing adds four to eight more weeks. In total, plan for three to four months minimum from when you start gathering documents to when you receive your NTS and can schedule your first exam.

Building Your Study Foundation

Use the waiting time during application processing productively by selecting and enrolling in a CPA review course, understanding the exam format through free resources and practice questions, and building foundational knowledge in areas where you are weakest. If you know REG will be challenging because you have never studied US taxation, begin familiarizing yourself with basic concepts even before your formal preparation begins. This head start pays dividends when you begin intensive section-specific preparation.

Completing All Four Sections: 12-18 Months

Once you can begin scheduling exams, the pace of completion depends on your study intensity, section order strategy, and whether you pass sections on the first attempt. Most working professionals complete all four sections in twelve to eighteen months of active testing.

Recommended Section Order Strategy

Common strategies include starting with FAR because it provides foundational knowledge useful for other sections and because its extensive content is best tackled while your study habits are freshest. Others prefer starting with their strongest section to build confidence and momentum. Whatever your approach, consider the 30-month credit retention window and plan to maintain steady progress rather than taking extended breaks between sections. For discipline selection, many candidates take REG and TCP back-to-back to leverage the content overlap while the material is fresh.

Balancing Work, Study, and Personal Life

Successful working candidates typically commit fifteen to twenty hours per week to CPA study, spread across weekday evenings and weekends. At this pace, preparing for a single section takes eight to twelve weeks. This is a marathon, not a sprint, and sustainable pacing prevents burnout that derails many candidates. Communicate with your employer about your CPA goals, as many firms provide study leave, exam fee reimbursement, or flexible scheduling to support your efforts. Build in rest weeks between sections to recover and avoid accumulating fatigue over the eighteen-month journey.

Conclusion

Pursuing the US CPA certification from India is absolutely achievable with proper planning, realistic expectations, and consistent effort. The requirements, while complex, follow logical patterns once you understand the credit hour system, state selection criteria, and exam structure. Your Indian qualifications, whether B.Com, M.Com, CA, or other credentials, can meet CPA eligibility requirements through the proper evaluation and state selection process.

The investment of ₹3,00,000 to ₹4,50,000 and eighteen to twenty-four months of dedicated effort yields a credential recognized globally and valued highly by Indian employers, especially Big 4 firms, multinational corporations, and companies with US operations.

If you have read this far and determined you meet the requirements, the next concrete step is beginning your credential evaluation. Contact NIES or WES, start gathering your documents, and set your CPA journey in motion. The path is clear; now it is time to walk it.

To understand the overall CPA journey, you can also refer to this detailed guide on the Certified Public Accountant (CPA) Exam in USA.

Frequently Asked Questions

Can I pursue CPA with only a 3-year Indian B.Com degree?

A three-year B.Com typically evaluates to approximately 90 US semester credit hours, falling short of the 120 credits required to sit for the exam in most states. You can bridge this gap by completing an M.Com, professional qualifications like CA or CMA, or accredited bridge courses specifically designed for CPA candidates.

Do I need to be a CA to take the CPA exam from India?

No, Chartered Accountancy is not required for CPA eligibility. B.Com plus M.Com holders with 150 credits meet the requirements in most states. However, CA does provide advantages in terms of credit recognition and content familiarity, particularly for the AUD section.

Which US state is best for Indian CPA candidates without SSN?

Washington and Montana are the most popular choices due to their straightforward requirements and efficient processing. The best state depends on your specific qualification profile, with Washington often preferred for B.Com plus M.Com holders and Montana offering flexibility for various educational backgrounds.

How much does the complete CPA journey cost in Indian rupees?

The total investment typically ranges from ₹3,00,000 to ₹4,50,000, including credential evaluation (₹15,000-25,000), application fees (₹7,500-20,000), exam fees with international testing (₹1,70,000-2,00,000), review courses (₹80,000-1,50,000), and licensing fees (₹10,000-25,000).

Can I take the CPA exam in India?

Yes, NASBA administers the CPA exam at eight Prometric testing centers in India: Ahmedabad, Bangalore, Calcutta, Chennai, Hyderabad, Mumbai, New Delhi, and Trivandrum. You can complete all four sections without leaving the country.

How long is the CPA exam valid after passing?

Once you pass your first section, you have 30 months to pass the remaining three sections. If you do not complete all four within this window, your earliest passed section expires and must be retaken. Strategic pacing is essential to avoid losing credits.

What is the CPA exam pass rate for Indian candidates?

AICPA does not publish country-specific pass rates. Overall section pass rates for 2024-2025 are: FAR 40-43%, AUD 46-48%, REG 59-64%, BAR 34-41%, ISC 56-59%, and TCP 72-82%. Pass rates reflect preparation quality regardless of nationality.

Is work experience required before taking the CPA exam?

Work experience is required for licensure, not for sitting for the exam. You can take all four exam sections before completing your experience requirement. Most states require one to two years of relevant experience verified by a licensed CPA.

How is WES evaluation different from NIES for CPA?

Both agencies are widely accepted, with NIES being NASBA’s own service specifically designed for CPA candidates. WES evaluations can be used for multiple purposes beyond CPA. Fees are comparable at $200-$350, and processing takes six to eight weeks for both.

Can I use my Indian CA experience for CPA work requirement?

Indian work experience can qualify, but it must be verified by a US-licensed CPA. Working for Big 4 firms or MNCs with US operations often provides access to CPA verifiers. Some candidates fulfill this requirement through remote work with US firms or after relocating.

What is CPA Evolution and how does it affect Indian candidates?

CPA Evolution, launched in January 2024, restructured the exam into three Core sections (FAR, AUD, REG) that all candidates must pass, plus one Discipline section (BAR, ISC, or TCP) of your choice. This allows specialization while ensuring foundational competency.

How many hours should I study for the CPA exam while working?

Working professionals typically commit fifteen to twenty hours weekly, requiring eight to twelve weeks per section. Total study time across all four sections ranges from 300 to 400 hours. Consistent pacing prevents burnout over the eighteen-month journey.

Is the CPA recognized by Indian employers?

CPA is highly valued by Indian employers, especially Big 4 accounting firms, multinational corporations, and companies with US operations. CPAs typically command salary premiums of 30-50% over non-certified peers and access senior roles in finance and accounting.

Can I switch states after passing the CPA exam?

Yes, through license mobility and reciprocity agreements. Most states allow CPAs licensed elsewhere to practice through interstate agreements. If you plan to practice in a specific US state eventually, research reciprocity requirements when selecting your initial licensing state.

What happens if I fail a CPA exam section?

You can retake failed sections after waiting for your score release, typically one to two weeks for Core sections. You must pay examination fees again for each retake, approximately $510 per section in India. There is no limit on retake attempts within your 30-month window.

Allow notifications

Allow notifications