CPA exam pass rates: section-wise analysis for Indian candidates. Understand FAR, AUD, REG, BAR, ISC, TCP difficulty, scoring system, and proven strategies to pass.

Table of Contents

Let me be honest with you.

The CPA exam is tough, and the pass rates prove it.

With an overall average hovering around 50%, roughly half of all candidates who sit for any given section walk away without a passing score.

For Indian professionals investing lakhs of rupees in exam fees, review courses, and credential evaluation, understanding these numbers is not optional. It is essential for planning a realistic path to certification.

The CPA exam underwent its most significant transformation in decades when CPA Evolution launched in January 2024.

The old four-section structure of AUD, BEC, FAR, and REG gave way to a new Core plus Discipline model.

BEC was retired entirely, and three new discipline sections emerged:

- Business Analysis and Reporting (BAR),

- Information Systems and Controls (ISC), and

- Tax Compliance and Planning (TCP).

This restructuring has dramatically shifted pass rate patterns, creating both challenges and opportunities for candidates who understand the data.

This comprehensive guide breaks down everything Indian CPA aspirants need to know about 2024 and 2025 pass rates.

You will learn which sections candidates find most difficult, how the scoring system actually works, what unique challenges Indian professionals face, how to choose your discipline section strategically, and proven strategies to beat the average pass rate.

Whether you are a Chartered Accountant adding an international credential, a B.Com graduate exploring global opportunities, or a working professional in Big 4 or industry, this analysis will help you plan your CPA journey with confidence.

CPA Exam Pass Rates: Why They Matter for Your Journey

Understanding CPA exam pass rates goes far beyond satisfying curiosity about how hard the exam is.

These numbers provide actionable intelligence that can shape your entire preparation strategy, from which section to tackle first to how many study hours you should budget for each part. Smart candidates use pass rate data to make informed decisions rather than stumbling through the process blindly.

What Do Pass Rates Reveal About the Difficulty of the CPA Exam?

Pass rates serve as the most objective measure of how challenging each CPA exam section actually is in practice. While review course providers and coaching institutes may describe sections as “manageable” or “straightforward,” the numbers tell the real story. When FAR shows a cumulative pass rate of 42% and TCP shows 78%, you are looking at concrete evidence of vastly different difficulty levels that should influence your preparation approach.

The AICPA publishes pass rates quarterly, providing transparency about candidate performance across all sections. These figures represent actual results from thousands of candidates worldwide, including those testing at Indian Prometric centers. Unlike subjective opinions about difficulty, pass rates reflect real-world outcomes that you can use to calibrate your expectations and effort.

Pass rates also reveal trends over time that indicate whether sections are becoming easier or harder.

The introduction of CPA Evolution in 2024 disrupted historical patterns significantly. BAR inherited complex content from FAR and initially showed pass rates below 40%, while TCP benefited from alignment with REG content and soared above 75%. Tracking these trends helps you anticipate what to expect and prepare accordingly.

Why Indian Candidates Should Pay Attention to the Pass Rates Numbers

Indian candidates face the identical exam as their American counterparts, meaning pass rate data applies directly to your situation.

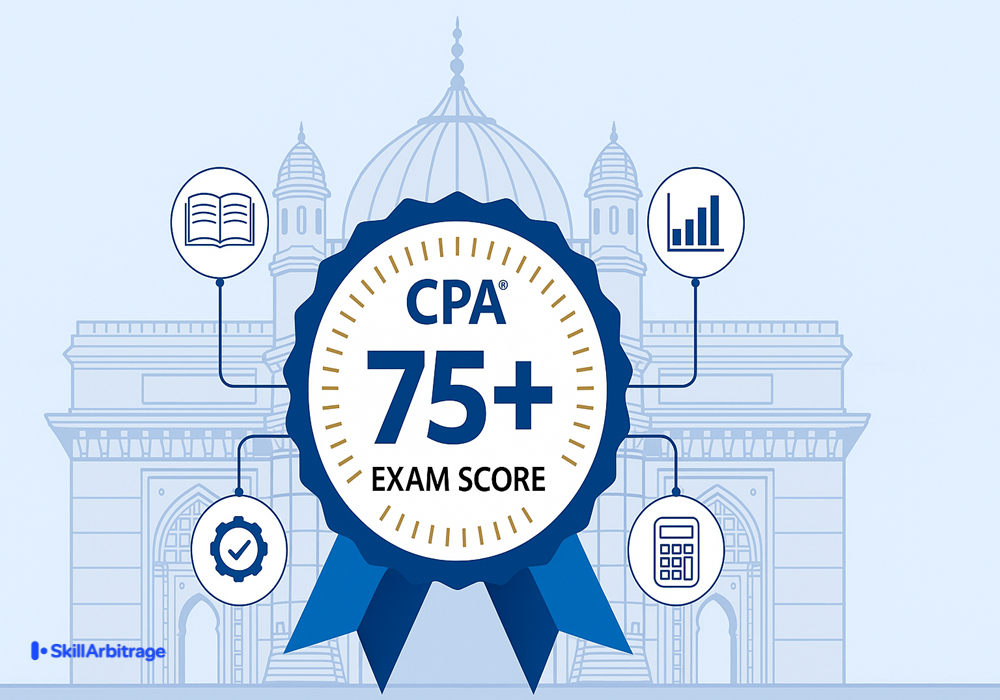

The questions, scoring standards, and passing threshold of 75 remain constant whether you test in Mumbai, Delhi, or New York. Understanding how candidates globally perform on each section helps you benchmark your preparation and identify where you might need extra focus.

Pass rates become even more valuable when you consider the significant financial investment Indian candidates make. Between credential evaluation fees, exam application costs, section fees, review course subscriptions, and potential retake expenses, pursuing CPA certification can cost between ₹2,50,000 to ₹4,00,000 or more.

Every failed section adds approximately ₹25,000 to ₹35,000 in retake costs. By studying pass rate patterns and preparing strategically, you protect this investment and minimize the risk of expensive setbacks.

What Are the Recent Trends in CPA Exam Pass Rates for Each Section?

The CPA Evolution restructuring in 2024 fundamentally changed how candidates experience and perform on the exam. Understanding current pass rate trends for each section helps you prioritize your preparation efforts and set realistic timelines.

Let us examine each section individually, starting with the three core sections that every candidate must pass.

Core Sections Pass Rate Analysis (AUD, FAR, REG)

The three core sections form the foundation of your CPA journey, and their pass rates reveal important patterns about where candidates struggle and succeed. These sections test fundamental competencies in auditing, financial reporting, and regulation that every CPA must master regardless of their chosen specialization.

Auditing and Attestation (AUD): Quarterly Trends and Insights

AUD occupies the middle ground in terms of difficulty, with 2025 cumulative pass rates around 48%. Quarterly figures have shown gradual improvement, rising from 44.30% in Q1 2025 to 50.03% in Q3 2025.

This upward trend suggests that candidates and review providers are adapting well to the section’s requirements under the CPA Evolution format.

The section tests your understanding of audit procedures, professional responsibilities, ethics, and attestation engagements. Many candidates find AUD challenging because questions often require judgment calls between multiple seemingly correct answers. Success in AUD typically comes from extensive practice with multiple-choice questions that train you to identify the subtle distinctions the exam tests.

Financial Accounting and Reporting (FAR): Why It Remains the Toughest

FAR consistently records the lowest pass rates among core sections, with 2025 cumulative figures at approximately 42.80%. The quarterly pattern shows remarkable consistency, ranging from 41.67% in Q1 to 43.52% in Q2 and 43.07% in Q3. This stability at low levels confirms FAR’s reputation as the most challenging core section that candidates face.

The difficulty stems from FAR’s enormous scope and technical depth. The section covers financial accounting and reporting for commercial entities, government organizations, and not-for-profit entities under US GAAP.

For Indian candidates trained primarily in Ind AS or IFRS frameworks, the adjustment to US GAAP principles adds complexity. Topics like governmental accounting, which have no equivalent in Indian practice, require learning entirely new conceptual frameworks from scratch.

Regulation (REG): The Most Consistent Performer

REG stands out as the strongest performer among core sections, with 2025 cumulative pass rates exceeding 63%. The section showed steady improvement through the year, rising from 62.03% in Q1 to 66.05% in Q3. This consistent performance above 60% makes REG one of the more reliable sections for candidates seeking early wins in their CPA journey.

The section covers federal taxation for individuals, businesses, and property transactions, along with business law and professional ethics.

While Indian candidates must learn US tax law from scratch, the structured and rule-based nature of taxation content rewards systematic study. Many candidates find that dedicated preparation yields predictable results in REG, unlike the judgment-intensive nature of AUD or the vast scope of FAR.

Discipline Sections Pass Rate Analysis (BAR, ISC, TCP)

The three discipline sections introduced under CPA Evolution have shown dramatically different performance patterns.

Your choice among BAR, ISC, and TCP significantly impacts your overall CPA journey, and pass rate data should inform this decision. Each section attracts candidates with different backgrounds and career goals, which partly explains the variation in results.

Business Analysis and Reporting (BAR): The Challenging New Section

BAR presents the greatest challenge among discipline sections, with 2025 cumulative pass rates around 42.55%. The section experienced significant volatility, dropping to just 33.68% in Q4 2024 before recovering to 47.26% in Q2 2025 and settling at 39.46% in Q3 2025. This inconsistency suggests that candidates are still adapting to BAR’s demanding content.

The difficulty arises because BAR absorbed much of the advanced financial reporting content previously tested in FAR. Topics include business combinations, consolidations, derivatives, hedging, and foreign currency transactions.

These areas require strong technical accounting knowledge and analytical skills. Candidates without graduate-level exposure to advanced accounting often find BAR overwhelming, explaining why many opt for TCP or ISC instead.

Information Systems and Controls (ISC): Rising Pass Rates Explained

ISC has shown the most dramatic improvement among discipline sections, climbing from 50.93% in Q1 2024 to 68.21% cumulatively in 2025.

The Q2 2025 pass rate reached an impressive 71.96%, indicating that candidates and educators have successfully adapted to this newer section. This upward trajectory makes ISC an increasingly attractive option for candidates with relevant backgrounds.

The section covers information systems, data management, cybersecurity concepts, and SOC reports.

Candidates with IT audit experience, systems implementation backgrounds, or data analytics exposure find ISC content more intuitive. The section appeals particularly to those pursuing careers in IT audit, internal audit, or consulting roles where technology governance matters. If your background includes any exposure to information systems or controls, ISC deserves serious consideration.

Tax Compliance and Planning (TCP): Why It Has the Highest Pass Rate

TCP leads all CPA exam sections with the highest pass rates by a substantial margin. The 2025 cumulative pass rate exceeds 78%, with Q2 2025 reaching 80.63%. According to AICPA analysis, TCP’s strong performance reflects the close alignment between TCP content and the REG core section that all candidates complete before taking their discipline.

The section covers advanced taxation topics, including complex individual taxation, entity tax planning, property transactions, and personal financial planning.

Candidates who perform well in REG often carry that momentum into TCP, especially if they work in tax or have a genuine interest in the subject. For Indian CAs with taxation experience, TCP frequently feels like a natural extension of familiar concepts, just applied to the US tax code.

Recent Pass Rate Comparison: What Changed Under CPA Evolution

The transition to CPA Evolution in January 2024 reshuffled the difficulty hierarchy significantly. Under the old exam, BEC typically had the highest pass rates, often exceeding 60%, while FAR consistently struggled around 45%. The new structure eliminated BEC and redistributed its content, creating an entirely new landscape.

The most notable change involves the discipline sections, which did not exist before 2024. TCP emerged as the clear winner in terms of passability, while BAR became the new challenging section. ISC occupies an improving middle ground. For candidates who began their CPA journey before 2024, comparing old pass rates to new ones requires caution since the sections now test different content and attract different candidate pools.

The core sections (AUD, FAR, REG) maintained relative stability in their difficulty rankings. FAR remains the toughest, REG remains the most passable, and AUD stays in between. However, some content shifted from FAR to BAR, which theoretically should have made FAR easier. The data shows only modest improvement in FAR pass rates, suggesting the section remains demanding despite the reduced scope.

How does the CPA Exam Scoring System work?

Understanding how the CPA exam calculates your score helps you prepare more strategically and interpret your results accurately. The scoring system is more complex than simply counting correct answers, and this complexity works in your favor if you understand how to leverage it.

Understanding the 0-99 Scoring Scale

The CPA exam reports scores on a scale from 0 to 99, with 75 as the minimum passing score. However, this scale does not represent a simple percentage of questions answered correctly. Many candidates mistakenly believe they need to answer 75% of questions correctly to pass, but the relationship between raw performance and scaled scores is more nuanced.

Why a Score of 75 Does Not Mean 75% Correct

The passing score of 75 represents a performance standard established by the AICPA Board of Examiners, not a percentage threshold. The Board determines this standard based on what knowledge, skills, and abilities a minimally competent CPA should possess. Your scaled score reflects how your performance compares to this standard, adjusted for the difficulty of the specific questions you encountered.

In practical terms, you might pass the exam while answering fewer than 75% of questions correctly if your exam contained particularly difficult questions.

Conversely, answering 75% correctly on an easier form might not guarantee passing. The scaling process ensures fairness across different exam forms and testing dates, so your score truly reflects your competence rather than the luck of which questions appeared on your exam.

How Does Scaling Adjust for Question Difficulty?

The AICPA uses statistical methods called Item Response Theory to calibrate question difficulty and calculate scaled scores. Each question carries a difficulty rating based on historical performance data. When you answer a difficult question correctly, it contributes more to your scaled score than answering an easy question correctly. This approach rewards candidates who demonstrate mastery of challenging concepts.

The practical implication for your preparation is that you should not panic if you encounter difficult questions during the exam. Those questions offer opportunities to demonstrate high-level competence. Focus on answering every question to the best of your ability, knowing that the scoring system accounts for difficulty. Guessing on questions you cannot answer carries no penalty, so never leave questions blank.

How Are MCQs and Task-Based Simulations Weighted?

Your total score combines performance on multiple choice questions (MCQs) and task-based simulations (TBSs). Understanding the weighting helps you allocate study time appropriately and manage your time during the exam itself.

Standard Weighting for Core Sections

For the core sections (AUD, FAR, and REG) and most discipline sections (BAR and TCP), the weighting splits evenly: 50% from MCQs and 50% from TBSs. This equal distribution means you cannot afford to neglect either question type. Candidates who excel at MCQs but struggle with simulations, or vice versa, often find themselves just below the passing threshold.

Each core section contains multiple testlets of MCQs followed by TBS testlets. The first MCQ testlet contains questions of medium difficulty. If you perform well, the second testlet increases in difficulty, which actually benefits your score since harder questions carry more weight. The TBSs test your ability to apply knowledge in realistic scenarios, often requiring you to work with spreadsheets, research authoritative literature, or analyze complex fact patterns.

ISC Exception: 60% MCQ, 40% TBS

ISC differs from other sections with a weighting of 60% MCQs and 40% TBSs. This higher MCQ weighting reflects the nature of ISC content, which includes many testable concepts related to information systems, data management, and cybersecurity that lend themselves well to multiple-choice testing.

For candidates choosing ISC, this weighting means strong MCQ performance can significantly boost your overall score. Spend more time proportionally practicing ISC multiple choice questions compared to other sections. The TBSs remain important, but the math favors candidates who master the MCQ content thoroughly.

What Happens When You Fail: The Candidate Performance Report

When you score below 75 on any section, you receive a Candidate Performance Report along with your score. This report provides valuable diagnostic information that helps you prepare more effectively for your retake. Understanding how to interpret and use this report can mean the difference between repeating failure and passing on your next attempt.

The report breaks down your performance across content areas within the section, indicating whether you performed Stronger, Comparable, or Weaker relative to the passing standard in each area. Rather than showing specific scores or percentages, these qualitative indicators highlight where your knowledge gaps exist. A “Weaker” rating signals that you need substantial additional study in that content area before retaking.

Smart candidates treat the Candidate Performance Report as a personalized study guide for their retake. Instead of reviewing all content equally, focus intensively on areas rated “Weaker” while maintaining your knowledge in “Stronger” areas. This targeted approach maximizes the value of your study time and addresses the specific deficiencies that caused you to fall short initially.

What Indian Candidates Need to Know About CPA Pass Rates

While the CPA exam is identical worldwide, Indian candidates navigate unique circumstances that affect their preparation and performance. Understanding these factors helps you develop strategies tailored to your situation rather than blindly following advice designed for American candidates.

Do Indian Candidates Perform Differently Than US Candidates?

The AICPA does not publish pass rates segmented by candidate nationality or testing location, so we cannot make precise comparisons between Indian and US candidate performance. However, available evidence suggests that Indian candidates perform comparably to the global average, achieving pass rates in the 45% to 55% range across most sections.

Indian CPA coaching institutes report that their students achieve results consistent with or slightly above national averages when they follow structured preparation programs. The strong academic foundations that Indian commerce graduates and Chartered Accountants bring to the exam often compensate for challenges like unfamiliarity with US GAAP. Candidates who leverage quality review courses and dedicate adequate study time generally perform well regardless of their geographic location.

The key differentiator is not nationality but preparation quality. Indian candidates who treat CPA preparation seriously, invest in proper review materials, and allocate sufficient study hours perform just as well as their American counterparts. Those who underestimate the exam’s difficulty or attempt to shortcut preparation struggle regardless of their background.

What Unique Challenges Do Indian Candidates Face?

Indian candidates encounter several obstacles that American candidates do not face, and acknowledging these challenges helps you prepare realistically. The first major challenge involves accounting framework differences. Indian accounting education focuses on Ind AS and IFRS, while the CPA exam tests US GAAP extensively. Concepts like LIFO inventory valuation, certain lease accounting treatments, and governmental accounting require learning new frameworks rather than applying existing knowledge.

The second challenge involves working while studying. Most Indian CPA candidates are working professionals, often in demanding roles at Big 4 firms, multinational corporations, or Indian companies with US operations. Balancing 50 to 60-hour work weeks with CPA preparation requires exceptional discipline and time management. American candidates who take the exam immediately after graduation often have more time flexibility.

The third challenge involves logistics and costs. Testing at Indian Prometric centers requires advance scheduling, and the limited number of centers can create availability constraints during peak periods. All exam fees are denominated in US dollars, meaning exchange rate fluctuations affect your total investment. Additionally, accessing some study resources designed for US candidates may involve timing challenges due to timezone differences for live classes or support sessions.

What Strategies Help Indian Working Professionals Overcome These Challenges?

Successful Indian candidates develop specific strategies to address these unique challenges. For the accounting framework gap, dedicate extra study time to US GAAP differences rather than assuming your Ind AS knowledge transfers directly. Pay particular attention to governmental accounting, which has no Indian equivalent, and review lease accounting and revenue recognition differences carefully.

For the work-life study balance, create a realistic schedule that accounts for your actual availability. Many successful candidates study early mornings before work, during lunch breaks, and on weekends. Communicate your CPA goals with your employer if possible, as many firms support employee certification efforts with study leave or flexible scheduling. Consider timing your exam attempts during slower work periods to maximize your preparation capacity.

For logistics challenges, book your Prometric appointments well in advance, especially if targeting popular testing windows. Build buffer time into your preparation schedule to accommodate potential rescheduling needs.

When selecting review courses, consider providers like Becker, Wiley, or Gleim that offer robust self-paced options and recorded content accessible anytime, rather than relying solely on live sessions that may occur at inconvenient hours.

How Should Indian Candidates Choose Their CPA Discipline Section?

Selecting your discipline section is one of the most consequential decisions in your CPA journey. This choice affects your study workload, career trajectory, and ultimate success in completing the certification. While pass rates provide useful guidance, your decision should integrate multiple factors, including your educational background, professional experience, and career aspirations.

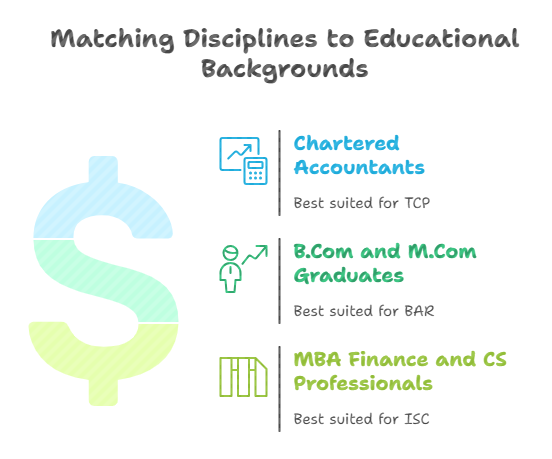

Which Discipline (TCP, ISC, BAR) Matches Your Educational Background?

Your existing knowledge base significantly influences how difficult each discipline section will feel during preparation. Choosing a section that leverages your strengths reduces study time and improves your probability of passing on the first attempt.

Best Discipline Choice for Chartered Accountants (CA)

Indian Chartered Accountants typically find TCP most accessible among the three discipline options. Your CA curriculum included extensive taxation coverage, and while US tax law differs from Indian law, the analytical approach and conceptual frameworks transfer well. The structured nature of tax rules means you can systematically learn the differences without starting from zero.

TCP’s content covering individual taxation, entity tax planning, and property transactions aligns well with the tax knowledge CAs develop during articleship and professional practice. Many Indian CAs report that TCP felt manageable after completing REG, as the sections share conceptual foundations and reinforce each other. If you enjoyed the taxation portions of your CA studies, TCP likely represents your smoothest path to completing the discipline requirement.

Best Discipline Choice for B.Com and M.Com Graduates

B.Com and M.Com graduates without CA should evaluate their specific coursework and interests when selecting a discipline. If your degree program included strong exposure to advanced accounting topics like consolidations, mergers, and complex financial instruments, BAR might not feel as overwhelming as pass rates suggest. Your familiarity with these concepts provides a foundation to build upon.

However, if your accounting education focused primarily on fundamentals without deep dives into advanced topics, TCP or ISC likely offer smoother paths. TCP works well if you have an interest in taxation and are willing to learn the US tax rules systematically.

ISC suits candidates whose studies or work experience include exposure to information systems, internal controls, or data analytics. Honestly assess your strengths and interests rather than defaulting to what seems easiest on paper.

Best Discipline Choice for MBA Finance and CS Professionals

MBA Finance graduates and Company Secretaries often gravitate toward ISC, especially if their roles involve governance, internal controls, risk management, or information systems. The section covers SOC reports, IT general controls, cybersecurity concepts, and data management, topics that align well with corporate governance responsibilities and strategic finance roles.

If you have worked on systems implementations, IT audits, or compliance projects involving technology controls, ISC leverages that experience directly. The section’s rising pass rates suggest that candidates with relevant backgrounds perform well. However, if your MBA or CS work focused purely on financial analysis or corporate law without technology exposure, TCP might still offer a more predictable path given its consistently high pass rates.

Should You Choose Based on Pass Rates Alone?

While TCP’s 78% pass rate looks attractive compared to BAR’s 42%, choosing solely based on these numbers can lead you astray. The AICPA explicitly states that higher pass rates do not mean a section is easier for every candidate. These aggregate figures reflect self-selection, where candidates tend to choose sections aligned with their backgrounds and interests.

TCP’s strong numbers partly reflect that candidates choosing it often have tax backgrounds or have just completed REG with strong performance. They enter TCP with relevant preparation and momentum. BAR attracts candidates pursuing financial reporting careers who accept the challenge despite knowing it is difficult. Comparing their pass rates without considering these selection effects overstates the difficulty difference between sections.

What is the Most Strategic Way to Select a CPA Discipline?

The most strategic approach balances three factors: your background fit, your career goals, and the pass rate data. Start by honestly evaluating which section aligns best with your existing knowledge and experience. A section that leverages your strengths reduces study time and increases first attempt pass probability.

Next, consider your career aspirations. If you plan to specialize in tax, TCP provides directly relevant knowledge you will use throughout your career. If you aim for CFO track roles or financial reporting leadership, BAR’s challenging content builds valuable expertise despite its lower pass rate. If technology governance, IT audit, or consulting interests you, ISC develops applicable skills.

Finally, use pass rate data as a tiebreaker when multiple sections seem equally suitable, or as a warning flag when considering sections far outside your experience area.

Strategies to Beat the Average Pass Rate

Knowing pass rates and understanding section difficulty only helps if you translate that knowledge into effective preparation habits. The strategies below have consistently helped candidates outperform averages and complete their CPA certification efficiently.

What is the Best Exam Order for Most Candidates?

Exam sequencing significantly impacts your overall journey, and several proven approaches exist depending on your circumstances and preferences. The most commonly recommended strategy involves taking FAR first while your motivation is highest and your study habits are sharpest. Since FAR has the lowest pass rate and the most extensive content, conquering it early prevents the section from becoming a psychological barrier that grows more intimidating over time.

An alternative approach builds confidence by starting with REG or your chosen discipline section if you have relevant background knowledge.

Passing your first section validates your preparation methods and proves you can succeed on this exam. This psychological boost carries forward into subsequent sections, and you enter FAR with confidence rather than anxiety. Neither approach is universally correct, but your decision should be intentional rather than arbitrary.

When Should You Schedule Each Exam for Maximum Success?

Strategic timing can meaningfully improve your chances of joining the successful candidate pool. The data consistently shows lower pass rates in Q1 and Q4 compared to Q2 and Q3. January through March coincides with the busy season for accountants, reducing available study time. October through December involves holiday commitments and year-end work pressures that distract from preparation.

If your schedule allows flexibility, targeting Q2 (April through June) or Q3 (July through September) for your most challenging sections optimizes your odds.

Recent graduates often perform best in Q3 after using the summer months for intensive preparation. Working professionals should align exam attempts with slower periods in their work cycles. The 2025 shift to continuous testing for core sections provides additional flexibility, allowing you to schedule when truly ready rather than rushing to meet testing window deadlines.

What Study Habits Do High-Scoring Candidates Follow?

High-performing candidates share several common habits that separate them from those who struggle. First, they invest in quality review courses from established providers like Becker, Wiley, Gleim, or Surgent. These courses structure vast content into manageable modules, provide practice questions aligned with exam format, and offer simulated exams that build familiarity with the testing interface.

Second, successful candidates prioritize active practice over passive review. They work through hundreds or thousands of multiple-choice questions and task-based simulations rather than simply reading textbooks or watching lectures.

The CPA exam tests application, not memorization, and pattern recognition develops only through extensive practice. Many top performers follow an 80/20 rule, spending 80% of study time on active practice and only 20% on content review.

What is the Real Cost of Failing a CPA Exam Section?

Understanding the true cost of failing helps you appreciate why thorough preparation matters. The expenses extend beyond just retake fees to include opportunity costs, emotional toll, and potential career impacts that accumulate with each unsuccessful attempt.

How Much Does a Retake Cost for Indian Candidates (in INR)?

Each failed section requires paying the exam fee again, which currently ranges from approximately $200 to $250 per section, depending on your jurisdiction, translating to roughly ₹17,000 to ₹21,000 at current exchange rates.

If your Notice to Schedule expires, you may also need to pay re-registration fees of $85 to $170 (approximately ₹7,000 to ₹14,000). Additionally, extending your review course access or purchasing additional study materials adds to the financial burden. A single retake can easily cost ₹25,000 to ₹40,000, and multiple failures across sections can push total additional costs above ₹1,00,000.

Emotional and Mental Toll of Multiple Attempts

Beyond financial costs, repeated failures take a psychological toll that affects your confidence, motivation, and even performance on subsequent attempts. Each failed section requires revisiting material you already studied, which feels demoralizing compared to learning new content. The pressure increases as your 18-month window shrinks, adding stress that can impair your performance. Some candidates enter a negative spiral where anxiety about failing causes the very underperformance they fear.

How Can Better Preparation Help You Avoid Retakes?

The most effective way to avoid retake costs is to invest adequately in your first attempt at each section. Candidates who try to minimize upfront spending by using outdated materials, skipping review courses, or rushing through preparation often spend far more in retakes than they saved initially. Budget sufficient study hours for each section, typically 80 to 120 hours, and do not schedule your exam until you consistently score above 75% on practice exams and simulated tests. Passing on your first attempt is always cheaper than passing on your second or third.

Conclusion

CPA exam pass rates tell a clear and actionable story for Indian candidates planning their certification journey. FAR and BAR demand the most preparation with pass rates hovering around 42% to 43%, while REG and TCP reward systematic study with success rates above 60% and 78% respectively. AUD and ISC occupy the middle ground, challenging but manageable with proper preparation. These patterns have remained consistent through the CPA Evolution transition, giving you reliable data to inform your strategy.

Your path to CPA success involves leveraging this data rather than being intimidated by it. Choose your discipline section based on your background, career goals, and only then on pass rates. Sequence your exams strategically, targeting challenging sections when your motivation and available time peak.

Invest in quality review materials and prioritize practice over passive study. Most importantly, prepare thoroughly for each section before scheduling your exam. The roughly 50% overall pass rate means half of all candidates prove it is possible. With the right preparation and strategy, you absolutely can join them.

To understand the overall CPA journey, you can also refer to this detailed guide on the Certified Public Accountant (CPA) Exam in USA.

Frequently Asked Questions

What is the overall CPA exam pass rate in 2025?

The overall CPA exam pass rate in 2025 hovers around 50% across all sections combined. However, individual section rates vary dramatically from 42% for FAR to 78% for TCP. According to AICPA data through Q3 2025, approximately one in five candidates passes all four sections on their first attempt.

Which CPA exam section has the highest pass rate?

TCP (Tax Compliance and Planning) has the highest pass rate among all CPA exam sections, with 2025 cumulative rates exceeding 78%. This strong performance reflects TCP’s alignment with REG content and the tendency for candidates with tax backgrounds to select this discipline section.

Which CPA exam section is the hardest to pass?

FAR (Financial Accounting and Reporting) and BAR (Business Analysis and Reporting) tie for the hardest sections, with pass rates around 42% to 43%. FAR’s difficulty stems from its vast scope covering US GAAP, governmental accounting, and not-for-profit entities. BAR challenges candidates with advanced financial reporting topics like consolidations and derivatives.

Do Indian candidates have lower pass rates than US candidates?

The AICPA does not publish pass rates by nationality, so direct comparison is not possible. However, evidence from Indian CPA coaching institutes suggests that Indian candidates perform comparably to global averages when they follow structured preparation programs. The exam is identical worldwide, and preparation quality matters more than geography.

How many times can I retake a failed CPA exam section?

There is no limit on how many times you can retake a failed section. However, you must pass all four sections within an 18 to 30-month rolling window, depending on your jurisdiction. Each retake requires paying the section fee again, currently approximately ₹17,000 to ₹21,000.

What score do I need to pass the CPA exam?

You need a minimum scaled score of 75 on each section to pass the CPA exam. This score is not a percentage but rather a performance standard on a 0 to 99 scale. The passing threshold applies equally to all sections regardless of their individual difficulty levels.

Is the CPA exam curved?

No, the CPA exam is not curved. Your score reflects your performance against a fixed competency standard, not your ranking relative to other candidates. The exam uses scaling to adjust for question difficulty, ensuring fairness across different exam forms, but this is different from curving.

How long do I have to pass all four CPA exam sections?

Most jurisdictions require you to pass all four sections within an 18-month rolling window, though some states allow 30 or 36 months. Check with your specific state board through NASBA for exact requirements. The clock starts when you pass your first section.

Which discipline section should Indian CA candidates choose?

Most Indian Chartered Accountants find TCP (Tax Compliance and Planning) most accessible because it leverages their existing taxation knowledge. The structured nature of tax rules means CAs can systematically learn US tax differences. However, if your career goals involve IT audit or financial reporting, consider ISC or BAR, respectively.

What percentage of candidates pass the CPA exam on their first attempt?

Approximately 20% of candidates pass all four CPA exam sections on their first attempt. This means roughly one in five candidates complete the exam without any retakes. The remaining 80% require at least one retake across their four sections before achieving full certification.

Are pass rates different at Indian Prometric centers?

No, pass rates do not vary by testing location. The CPA exam is standardized globally, and candidates at Indian Prometric centers face identical questions and scoring standards as candidates anywhere else. Your performance depends entirely on your preparation, not your testing location.

How do CPA pass rates compare to Indian CA pass rates?

The CPA exam pass rate of approximately 50% per section is significantly higher than Indian CA pass rates, which typically range from 10% to 15% at intermediate and final levels. However, this comparison is imperfect because the exams test different content, serve different regulatory purposes, and attract different candidate pools.

When does AICPA release quarterly pass rate data?

The AICPA typically releases quarterly pass rate data within two to three weeks after each quarter ends. Q1 data (January through March) releases in April, Q2 data in July, Q3 data in October, and Q4 data in January of the following year. You can find official releases on the AICPA website.

Does using a review course improve my chances of passing?

Yes, candidates who use structured review courses consistently outperform those who self-study. Major providers like Becker report that their prepared students achieve pass rates 50% to 80% higher than national averages. The investment in a quality review course typically pays for itself by reducing retake costs and accelerating your path to certification.

What happens if my 18-month window expires before I pass all sections?

If your testing window expires before passing all sections, you lose credit for any sections you previously passed and must start over from scratch. This makes strategic planning and consistent preparation essential. Monitor your timeline carefully, especially after passing your first section, to ensure you complete all remaining sections before your window closes.

Allow notifications

Allow notifications