Complete guide to CPA exam FAR section for Indian candidates. Learn the syllabus, pass rates, difficulty analysis, preparation strategies, and costs in INR to pass FAR on your first attempt.

Table of Contents

If you have been researching the US CPA exam, you have probably heard people call FAR the “beast” of the CPA journey. And honestly, that reputation is well earned.

The Financial Accounting and Reporting section consistently records the lowest pass rate among all three Core sections, hovering around 40 to 42% percent in recent years according to AICPA’s official pass rate data. For Indian candidates preparing for this exam while managing demanding jobs in finance, audit, or accounting roles, FAR can feel like climbing a mountain without a clear map.

Here is the good news, though.

As an Indian commerce graduate, Chartered Accountant, or M.Com holder, you are not starting from scratch. Your foundation in financial accounting, your familiarity with accounting standards, and your comfort with complex calculations give you a significant head start over many international candidates. The challenge lies in the areas where your Indian education did not prepare you, particularly US GAAP nuances, governmental accounting under GASB standards, and not-for-profit reporting. These topics require fresh learning, and this is where many Indian candidates stumble.

This guide is designed specifically for you. We will walk through the complete FAR syllabus, break down exactly what you need to know, analyze why certain topics trip up Indian candidates, and give you a realistic preparation strategy that works alongside your full-time job. Whether you are a CA looking to add the CPA credential to your profile or a B.Com graduate exploring international opportunities, this comprehensive resource will help you approach FAR with confidence and a clear game plan.

How Does FAR Fit Into the CPA Evolution Framework?

When the AICPA and NASBA launched CPA Evolution in January 2024, they restructured the entire CPA exam into a Core plus Discipline model. Under this framework, every CPA candidate must pass three Core sections that test foundational knowledge universal to all accountants. These Core sections are Financial Accounting and Reporting (FAR), Auditing and Attestation (AUD), and Taxation and Regulation (REG). After completing the Core sections, you choose one Discipline section based on your career interests.

FAR serves as the accounting foundation of this entire structure. The knowledge you build in FAR directly feeds into the Business Analysis and Reporting (BAR) Discipline section, which covers more advanced technical accounting topics. Think of FAR as the base layer that supports everything else you will learn and apply throughout your CPA journey. If your foundation is shaky, the entire structure becomes unstable.

What Does FAR Test

FAR evaluates your understanding of financial accounting and reporting frameworks used by businesses, not-for-profit organizations, and governmental entities.

The section tests your knowledge of standards issued by the

- Financial Accounting Standards Board (FASB),

- the Governmental Accounting Standards Board (GASB),

- the US Securities and Exchange Commission (SEC), and

- the American Institute of Certified Public Accountants (AICPA).

You need to demonstrate that you can prepare, review, and analyze financial statements while understanding the conceptual framework behind accounting decisions.

What makes FAR foundational is that every CPA, regardless of specialization, needs to understand financial statements and reporting. Whether you end up in tax, audit, advisory, or corporate finance, the ability to read, interpret, and prepare accurate financial statements is non-negotiable. This is why FAR tests such a broad range of topics and why mastering this section is critical for your career as a licensed CPA.

Why Do Indian Candidates Find FAR Particularly Challenging?

The primary challenge for Indian candidates is not the difficulty of individual concepts but the sheer volume of content FAR covers.

Indian commerce education provides excellent preparation for corporate accounting topics like financial statements, inventory valuation, and equity transactions. However, US GAAP has specific treatments that differ from Indian Accounting Standards (Ind AS), and these differences can catch you off guard during the exam if you are not prepared.

The bigger hurdle is governmental and not-for-profit accounting. Indian education rarely covers fund accounting, modified accrual basis, or GASB standards because these frameworks are specific to US government entities.

For most Indian candidates, this content is completely new territory requiring dedicated study time. The good news is that governmental accounting represents a defined portion of the exam, so with focused preparation, you can master these topics even without any prior exposure.

Complete FAR Syllabus Breakdown for CPA Exam

Area I: Financial Reporting (30-40% of Exam)

General Purpose Financial Reporting for For-Profit Entities

This content area covers the preparation and analysis of financial statements for business enterprises under US GAAP.

You will need to understand the conceptual framework established by FASB, including the objectives of financial reporting, qualitative characteristics of useful information, and the elements of financial statements.

The exam tests your ability to prepare balance sheets, income statements, statements of comprehensive income, statements of stockholders’ equity, and cash flow statements.

For Indian candidates, this area should feel relatively comfortable because it aligns closely with what you studied in B.Com, M.Com, or CA coursework. However, pay attention to US-specific disclosure requirements and the presentation formats mandated by SEC regulations for public companies. The exam may ask you to identify proper classifications, calculate financial ratios, or analyze performance metrics based on financial statement data.

Not-for-Profit Financial Reporting Requirements

Not-for-profit (NFP) accounting introduces concepts that most Indian candidates have not encountered before. NFP entities follow different reporting requirements than for-profit businesses, including the use of net asset classifications (without donor restrictions and with donor restrictions) instead of traditional equity accounts.

You need to understand how contributions are recorded, how conditional versus unconditional promises work, and how to prepare statements of activities and statements of functional expenses.

The key to mastering NFP accounting is recognizing the fundamental differences in how these organizations measure success. Unlike for-profit entities focused on net income, NFPs track changes in net assets and must demonstrate proper stewardship of donor funds.

Spend dedicated time on this topic because questions can appear in both MCQs and task-based simulations, and many Indian candidates lose easy points by neglecting this area.

State and Local Government Concepts

Governmental accounting is the topic that causes the most anxiety among Indian CPA candidates, and for good reason. This content requires understanding fund accounting, where government activities are segregated into different funds based on their purpose and restrictions. You need to know the difference between governmental funds (like the general fund and special revenue funds), proprietary funds, and fiduciary funds.

Additionally, you must understand government-wide financial statements prepared on the accrual basis versus fund financial statements prepared on the modified accrual basis.

The reconciliation between fund-based statements and government-wide statements is frequently tested and requires careful study. Indian candidates should allocate extra time to this topic because it has no equivalent in Indian accounting education.

The good news is that governmental accounting follows logical patterns once you understand the underlying concepts. Many successful Indian CPAs recommend studying this section early in your FAR preparation so you have time to let the concepts sink in.

Area II: Select Balance Sheet Accounts (30-40% of Exam)

Current Assets: Cash, Receivables, and Inventory

This content area covers the recognition, measurement, and presentation of current assets on the balance sheet.

You need to understand bank reconciliations, the allowance method for uncollectible accounts, and various inventory costing methods including FIFO, LIFO, and weighted average. The exam tests your ability to calculate ending inventory, cost of goods sold, and the effects of inventory errors on financial statements.

Indian candidates typically find this area manageable because inventory and receivables accounting is covered extensively in Indian commerce curricula. However, LIFO (Last-In, First-Out) requires special attention because it is not permitted under Ind AS but is commonly used under US GAAP. Make sure you can calculate LIFO reserve, understand LIFO liquidation, and convert between LIFO and FIFO when required.

Long-Term Assets: Property, Plant, Equipment, and Intangibles

Property, plant, and equipment (PPE) accounting covers acquisition costs, depreciation methods, impairment testing, and disposal of long-term assets.

You need to know how to capitalize versus expense costs, calculate depreciation using straight-line, declining balance, and units of production methods, and determine when assets should be tested for impairment. Intangible assets add another layer, including the treatment of goodwill, research and development costs, and internally developed software.

The differences between Ind AS and US GAAP in asset impairment testing deserve your attention. Under US GAAP, impairment of long-lived assets follows a two-step process (recoverability test followed by measurement), while Ind AS follows a single-step approach aligned with IFRS.

Investment accounting also falls under this area, covering equity method investments, fair value through net income, and available-for-sale securities under the current expected credit loss (CECL) model.

Liabilities and Equity Transactions

Liabilities testing covers both current and long-term obligations, including accounts payable, accrued expenses, bonds payable, and lease liabilities.

Bond accounting is heavily tested on FAR, so you need to master the calculations for bond issuance at premium, discount, and par value, as well as effective interest method amortization. Lease accounting under ASC 842 is another frequently tested topic requiring you to classify leases and calculate right-of-use assets and lease liabilities.

Equity transactions include stock issuances, treasury stock, dividends, and stock splits.

You should understand the difference between par value and no-par stock, how to account for stock dividends versus cash dividends, and the proper treatment of stock compensation under ASC 718. This area generally aligns well with Indian accounting education, but the specific US GAAP guidance has nuances you must learn.

Area III: Select Transactions (25-35% of Exam)

Revenue Recognition and Lease Accounting

Revenue recognition under ASC 606 follows a five-step model that applies across all industries. You need to identify the contract, identify performance obligations, determine the transaction price, allocate the price to performance obligations, and recognize revenue when obligations are satisfied.

The exam frequently tests scenarios involving variable consideration, contract modifications, and principal versus agent considerations.

Lease accounting underwent major changes with ASC 842, which requires lessees to recognize most leases on the balance sheet.

You must be able to classify leases as finance or operating, calculate the initial lease liability and right-of-use asset, and understand the subsequent measurement and amortization patterns. Given the complexity of lease calculations, practice plenty of problems to build speed and accuracy.

Income Taxes and Fair Value Measurements

Income tax accounting under ASC 740 is one of the more challenging FAR topics for many candidates.

You need to understand the difference between current tax expense and deferred tax expense, identify temporary differences that create deferred tax assets and liabilities, and apply the appropriate tax rates. Valuation allowances for deferred tax assets and the treatment of uncertain tax positions also appear on the exam.

Fair value measurements under ASC 820 establish a framework for measuring fair value and require disclosures about fair value measurements.

You should understand the fair value hierarchy (Level 1, 2, and 3 inputs) and when fair value measurement is required versus permitted. This topic intersects with many other areas, including investments, business combinations, and impairment testing.

Accounting Changes, Error Corrections, and Subsequent Events

Accounting changes include changes in accounting principle, changes in accounting estimate, and changes in reporting entities. Each type requires different treatment, with changes in principle generally requiring retrospective application while changes in estimate are applied prospectively. Error corrections require restatement of prior period financial statements, and you need to understand when errors are material enough to require restatement.

Subsequent events are events occurring after the balance sheet date but before the financial statements are issued or available to be issued.

You must distinguish between recognized subsequent events (which require adjustment to the financial statements) and non-recognized subsequent events (which require disclosure only). This topic often appears in task-based simulations where you must evaluate a scenario and determine the appropriate accounting treatment.

How Does the FAR Syllabus Map to an Indian Commerce or CA Background?

Topics Familiar to Indian Students

If you completed B.Com, M.Com, or the CA program in India, you already have solid preparation for significant portions of FAR.

Financial statement preparation, including balance sheets, income statements, and cash flow statements, follows similar logic under both Ind AS and US GAAP. Inventory accounting, receivables management, and basic depreciation concepts will feel familiar, giving you a foundation to build upon rather than starting from zero.

The CA curriculum, in particular, provides excellent preparation for topics like consolidations, investments, and complex transactions.

If you cleared CA Final, you have already tackled challenging accounting problems that rival the difficulty of FAR questions. Your calculation skills and ability to work through multi-step problems are significant advantages that many international candidates lack.

Topics Requiring Fresh Learning (US GAAP Specific)

Despite your strong foundation, several FAR topics will require dedicated study because they follow US-specific standards. LIFO inventory accounting does not exist under Ind AS, so you need to learn this method thoroughly.

The impairment testing approach under US GAAP differs from IFRS-aligned Ind AS, particularly for indefinite-lived intangibles and goodwill. Bond accounting terminology and the effective interest method calculations, while conceptually similar, have presentation differences you must master.

Revenue recognition under ASC 606, while converged with IFRS 15, has specific US interpretations and examples you should study.

The same applies to lease accounting under ASC 842, which has some differences from IFRS 16 regarding presentation and classification criteria. Dedicate focused study time to these areas and work through plenty of US GAAP-specific practice problems.

Why Governmental Accounting is Difficult for Indian Candidates

Governmental accounting represents the biggest learning curve for Indian CPA candidates because there is simply no equivalent in Indian education or professional practice. The concept of fund accounting, where a government entity maintains separate self-balancing sets of accounts for different purposes, is unique to the public sector in the United States. Understanding modified accrual accounting, measurement focus, and the differences between governmental fund statements and government-wide statements requires building entirely new mental models.

The good news is that governmental accounting, while initially confusing, follows consistent rules once you understand the framework. Many successful Indian CPAs recommend treating governmental accounting as a completely separate subject, almost like learning a new module from scratch. Start early, be patient with yourself, and use plenty of practice questions to reinforce concepts. The investment of time pays off because governmental accounting questions often appear in predictable patterns.

FAR Exam Format, Structure, and Scoring Explained

The Four-Hour Exam Structure

Understanding the Five Testlets

The FAR exam is a four-hour test divided into five testlets.

The first two testlets contain multiple-choice questions (MCQs), with 25 questions in each testlet for a total of 50 MCQs.

The remaining three testlets contain task-based simulations (TBSs), distributed as 2 TBSs in testlet three, 3 TBSs in testlet four, and 2 TBSs in testlet five, giving you 7 TBSs total. Before starting the exam, you will complete a welcome screen and confidentiality agreement that takes approximately 10 minutes.

After completing testlet three (your first TBS testlet), you receive a mandatory 15-minute break that does not count against your exam time. This break is strategically placed to give you a mental reset before tackling the remaining simulations. You can also take optional breaks after other testlets, but the timer continues running during these breaks, so use them wisely.

Multiple Choice Questions: Format and Strategy

FAR MCQs follow a standard format with a question stem and four answer choices, where only one answer is correct.

The questions test three skill levels:

- remembering and understanding (5-15% of exam),

- application (45-55% of exam), and

- analysis (35-45% of exam).

This means most questions require you to apply concepts to scenarios or analyze situations rather than simply recall facts.

Each MCQ testlet includes some pretest questions that do not count toward your score. These questions help AICPA gather data for future exams, and you cannot identify which questions are pretests. Treat every question as if it counts because you have no way of knowing which ones are scored. Focus on accuracy over speed, but monitor your time to ensure you complete all questions.

Task-Based Simulations: What to Expect

Task-based simulations are mini case studies requiring you to demonstrate practical accounting skills. TBS formats include journal entries, form completion, research questions, document review simulations, and reconciliations. You might need to prepare financial statements, calculate depreciation schedules, record bond transactions, or research authoritative literature to answer questions. Each TBS contains multiple parts, and you can earn partial credit for correct portions even if you do not complete everything perfectly.

The authoritative literature for FAR TBSs includes the FASB Accounting Standards Codification, which you can search during the exam. Familiarize yourself with the codification structure and practice using the search function before exam day. Research questions typically ask you to identify the specific ASC reference for a given accounting treatment, so knowing how to navigate the codification efficiently saves valuable time.

How FAR Exam is Scored?

The 75 Passing Score and What It Really Means

To pass FAR, you need a scaled score of 75 or higher on a scale of 0 to 99. This score is not a percentage of questions answered correctly. Instead, the AICPA uses a complex scoring methodology that weights questions based on difficulty.

A harder question answered correctly contributes more to your score than an easier question. This means two candidates could answer the same number of questions correctly but receive different scores based on which questions they got right.

The exam is not curved, meaning your score depends solely on your performance against a fixed standard, not how you compare to other candidates.

The AICPA Board of Examiners sets the passing standard based on the minimum competency expected of a newly licensed CPA. This standard remains consistent across testing windows, so the exam is neither harder nor easier to pass at different times of the year.

MCQ and TBS Weighting (50-50 Split)

Your FAR score combines MCQ and TBS performance, with each component contributing 50% of your total score. Within the MCQ portion, questions are weighted by difficulty using item response theory, meaning harder questions you answer correctly have greater positive impact on your score. The TBS portion uses similar difficulty weighting, and you can earn partial credit on simulations with multiple response items.

Understanding this weighting helps you allocate preparation time appropriately. Some candidates focus heavily on MCQs because they seem easier to practice, but neglecting TBS preparation can hurt your score significantly. Aim for balanced preparation that builds both MCQ speed and accuracy along with TBS problem-solving skills.

Time Management Strategies for FAR

Recommended Time Allocation Per Testlet

Effective time management is critical for FAR success because the exam includes substantial calculations that can eat into your time if you are not careful. A commonly recommended allocation gives you approximately 50 to 55 minutes for each MCQ testlet (roughly 2 minutes per question) and uses the remaining time for TBSs. For the three TBS testlets, allocate around 35 minutes for testlet three (2 TBSs), 50 minutes for testlet four (3 TBSs), and 35 minutes for testlet five (2 TBSs).

This allocation leaves you approximately 15 to 20 minutes of buffer time to review flagged questions or spend extra time on challenging TBSs. Practice with timed exams during your preparation to develop a personal rhythm and adjust these allocations based on your strengths. If MCQs come easily to you, shift more time to TBSs where you can maximize partial credit opportunities.

Managing Calculations Without Losing Time

FAR involves more calculations than any other Core section, including bond amortization, lease present value calculations, depreciation schedules, and inventory costing. The on-screen calculator provided during the exam is basic, so practice using a similar calculator during your preparation.

Develop shortcuts and estimation techniques that help you quickly eliminate wrong answers on MCQs without performing full calculations.

For TBSs involving complex calculations, set up your work systematically even if you are not sure of the final answer. Graders award partial credit for correct methodology even if your final number is wrong due to a minor arithmetic error. Show your work clearly in the spreadsheet tools provided, and if time runs short, focus on the calculation steps you know rather than leaving items blank.

When to Use the 15-Minute Break Strategically

The 15-minute break after testlet three is your opportunity to rest, reset, and prepare mentally for the remaining simulations.

Use this time wisely by stepping away from the computer, stretching, using the restroom, and having a quick snack if permitted at your testing center. Do not use this break to stress about questions you found difficult in earlier testlets because you cannot change those answers.

Some candidates wonder whether to skip the break to maintain momentum. Generally, taking the full break is advisable because TBSs require sustained concentration, and mental fatigue leads to careless mistakes. The break does not count against your exam time, so there is no penalty for using it.

Return to the exam refreshed and ready to tackle the simulations with full focus.

FAR Difficulty Analysis and Pass Rate Reality

What Are the FAR Pass Rates for Recent Years?

According to AICPA data, FAR consistently has the lowest pass rate among the three Core sections of the CPA exam.

In 2024, the cumulative FAR pass rate was approximately 39.59%, with quarterly rates ranging from 39.82% in Q3 to 41.92% in Q1. The fourth quarter of 2024 saw the lowest pass rate at around 36.80%, likely due to end-of-year candidate fatigue and holiday distractions. These numbers highlight that more than half of candidates who sit for FAR do not pass on their first attempt.

For context, the overall CPA exam pass rate across all sections hovers around 50%, and only about 20% of candidates pass all four sections on their first attempt. These statistics should motivate rather than discourage you.

With proper preparation, you can absolutely be among the candidates who pass FAR on the first try. The key is understanding why so many candidates struggle and addressing those challenges directly in your study plan.

Which Areas of FAR Are Considered the Most Difficult?

Surveys of CPA candidates and review course providers consistently identify governmental accounting as the most challenging FAR topic.

The concepts are unfamiliar to most candidates, including Indian professionals who have no exposure to US government accounting standards. Fund accounting, modified accrual basis, and the reconciliation between fund statements and government-wide statements require significant study time to master. Many candidates report that governmental accounting questions feel like a completely different exam.

Bonds and debt instruments also rank among the most difficult FAR topics.

While the concepts are straightforward, the calculations for bond issuance at premium or discount, effective interest amortization, and bond retirement require precision and practice. Candidates who do not master the timing of interest payments and amortization entries often lose points on otherwise manageable questions.

Lease accounting under ASC 842 presents similar calculation challenges with the added complexity of classification criteria.

Other frequently cited difficult areas include pension accounting, which involves complex actuarial concepts and multiple account balances, and not-for-profit accounting, which uses unfamiliar terminology and reporting requirements. Consolidations and business combinations round out the list, particularly when variable interest entities or intercompany eliminations are involved.

The common thread is that these topics require deep understanding rather than surface memorization, and they all involve multi-step problems where errors compound.

Why Indian Candidates Find Certain Topics Challenging

Indian candidates face a unique challenge because the topics that are difficult for everyone (governmental accounting, pensions, consolidations) are compounded by unfamiliar US GAAP treatments.

When an American accounting graduate studies governmental accounting, they are learning new content with a foundation of US-centric education. When you study the same topic, you are learning new content while also unlearning some Ind AS habits and adjusting to US presentation styles.

The psychological challenge should not be underestimated either. After completing rigorous Indian qualifications like CA, facing a 40% pass rate exam can feel frustrating.

You might expect that your strong foundation will guarantee success, but FAR requires specific US GAAP knowledge that must be learned regardless of prior credentials. Indian candidates who approach FAR with humility and dedication to learning the US-specific content perform better than those who assume prior knowledge will carry them through.

Time zone and work schedule challenges also contribute to difficulty for Indian candidates. Most live online classes and study resources are designed around US schedules, requiring you to study early mornings or late nights if you want live instruction.

Balancing FAR preparation with demanding Indian work culture, particularly if you work in Big 4 GCCs or MNCs with tight deadlines, requires exceptional discipline and planning.

What Is the Best FAR Preparation Strategy for Indian Working Professionals?

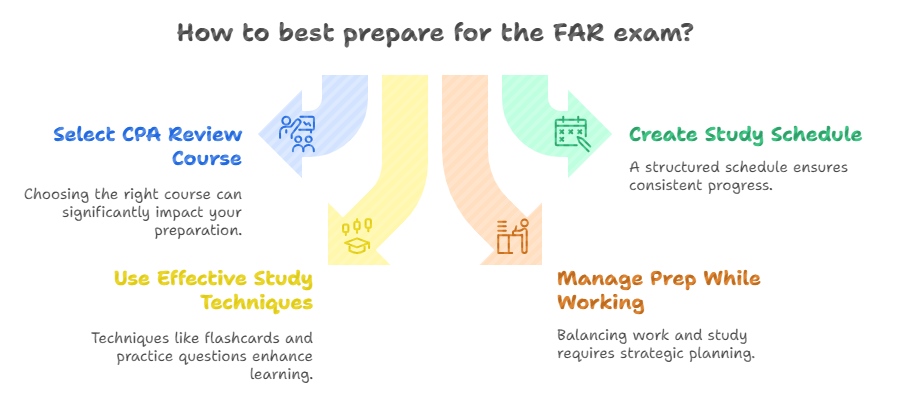

Choosing the Right CPA Review Course

Selecting the right CPA review course is one of the most important decisions in your FAR preparation.

The major providers include Becker, Wiley, Surgent, and Gleim, each with different teaching styles, pricing, and features. Becker is known for comprehensive content and strong pass rates but comes with premium pricing. Wiley offers unlimited access until you pass and features bite-sized lessons suitable for busy professionals.

Surgent uses adaptive technology to customize your study plan based on performance, while Gleim provides extensive practice questions at a more affordable price point.

For Indian candidates, cost is often a significant factor. Review course prices range from approximately ₹80,000 to ₹2,00,000 depending on the provider and package selected.

Many Indian CPA coaching institutes like Miles Education, Simandhar Education, and Zell Education partner with US review providers to offer localized pricing and support.

Consider factors like access duration (some courses expire after 12-18 months), quality of video lectures, number of practice questions, and availability of live instruction when making your decision.

Creating Your FAR Study Schedule

The AICPA recommends spending 300 to 400 hours studying for the entire CPA exam, which translates to roughly 80 to 100 hours per section.

However, FAR typically requires more study time than other sections due to its content volume, with many successful candidates reporting 120 to 160 hours of preparation.

If you are working full-time in India, plan for 10 to 12 weeks of dedicated study, allocating 12 to 15 hours per week through a combination of weekday evenings and weekend sessions.

Structure your study plan in phases: spend the first 60 to 70 percent of your time learning content through videos and textbook readings, then dedicate the final 30 to 40 percent to intensive review and practice questions.

Start with topics you find most challenging, like governmental accounting, so you have time to revisit them later. Many Indian candidates benefit from studying early morning before work (5 AM to 7 AM) when distractions are minimal and energy levels are fresh.

Study Techniques That Work for FAR

Active learning beats passive reading for FAR preparation. After watching a lecture or reading a chapter, immediately work through related practice questions to reinforce concepts. The exam tests application and analysis skills, so you need practice applying knowledge to scenarios rather than just memorizing rules.

Aim to complete at least 1,500 to 2,000 MCQs and 50 to 70 TBSs during your FAR preparation, reviewing explanations for both correct and incorrect answers.

Create summary notes for complex topics, particularly governmental accounting and pensions, that you can review in the final weeks before your exam. Flashcards work well for memorizing key ratios, journal entry formats, and disclosure requirements.

Join online CPA candidate communities where you can ask questions, share experiences, and stay motivated. Many Indian CPAs credit study groups with keeping them accountable throughout their preparation journey.

Managing FAR Prep While Working in India

Balancing FAR preparation with a demanding Indian job requires intentional scheduling and boundary setting. Block specific study times in your calendar and protect them as you would important meetings.

Communicate with your manager about your CPA goal so they understand if you need to decline optional overtime during your exam preparation period. Many Indian employers, particularly Big 4 firms and MNCs, support CPA pursuits and may offer study leave or flexible hours during exam weeks.

Leverage weekends effectively since they provide your largest blocks of uninterrupted study time. Consider taking a week of leave immediately before your exam date for final intensive review. If your work involves US GAAP reporting, use it as an opportunity to reinforce FAR concepts through practical application.

And remember to take care of your health because sleep deprivation and stress undermine learning. Short, focused study sessions beat long, exhausted ones every time.

How Much Does the FAR CPA Exam Cost for Indian Candidates?

Complete Fee Breakdown in Indian Rupees

The costs associated with FAR and the overall CPA exam include multiple components that Indian candidates should budget for carefully.

The exam application fee varies by state but typically ranges from $100 to $200 (approximately ₹8,500 to ₹17,000).

Each section of the CPA exam costs between $200 and $250 to sit (approximately ₹17,000 to ₹21,000 per section), so FAR alone will cost around ₹17,000 to ₹21,000 in exam fees. Additionally, you will pay for credential evaluation through agencies like WES or NIES, which costs between $150 and $350 (₹12,750 to ₹30,000).

Prometric testing center fees are included in the section fees for testing in India.

However, if you need to reschedule your exam, fees apply depending on how close to your exam date you make changes. Budget for potential retakes as well because the 40% pass rate means many candidates need more than one attempt. A single FAR retake adds another ₹17,000 to ₹21,000 to your total investment.

Total FAR Preparation Investment

Beyond exam fees, your largest expense will be the CPA review course.

Comprehensive courses from major providers range from ₹80,000 to ₹2,00,000 for full access to all four sections. If you purchase section-specific access for FAR only, expect to pay ₹25,000 to ₹50,000 depending on the provider.

Additional study materials like supplementary textbooks, flashcards, or extra question banks add another ₹5,000 to ₹15,000 if needed.

When you combine evaluation fees, exam fees, review courses, and potential retakes, the total investment for clearing FAR typically ranges from ₹1,00,000 to ₹2,50,000. While this represents a significant investment, consider the return on investment.

CPA holders in India command significantly higher salaries than non-certified professionals, with experienced CPAs in Big 4 firms and MNCs earning ₹20 lakh to ₹50 lakh or more annually. The credential pays for itself many times over throughout your career.

When Should You Take FAR in Your CPA Exam Journey?

Should You Take FAR as Your First CPA Exam Section?

Most CPA exam experts recommend taking FAR as your first section, and this advice applies equally to Indian candidates. The primary reason is that FAR requires the most study time due to its extensive content coverage.

By tackling FAR first, you can study for as long as you need without worrying about the 30-month clock that starts ticking once you pass your first section. If FAR is your first pass, you have 30 months to complete the remaining three sections.

Taking FAR first also builds confidence and establishes strong study habits. Once you conquer the section with the lowest pass rate, the remaining sections feel more manageable.

Additionally, if you do not pass FAR on your first attempt, you can retake it without losing credit for other sections. Many Indian CPAs who cleared all four sections on their first attempts credit their success to starting with FAR and establishing momentum early.

What Are the Best Strategies for Sequencing CPA Exams?

The most common sequence recommended by successful candidates is FAR, then AUD, then REG, followed by your chosen Discipline section. This order works well because AUD content connects naturally to FAR knowledge (auditors verify financial statements), and completing the Core sections first gives you flexibility in choosing your Discipline.

If you select BAR as your Discipline, the FAR-first approach makes even more sense because BAR builds directly on FAR content.

Alternative sequences may work better depending on your background. If you have extensive tax experience from working in Indian tax compliance or US tax preparation for MNCs, starting with REG might leverage your existing knowledge.

Similarly, if you work in audit, AUD might feel more comfortable as a first section. However, the advantage of starting with FAR outweighs background considerations for most candidates because it removes the most time-intensive section before your clock starts.

How Do You Schedule the FAR Exam at Prometric India?

After receiving your Notice to Schedule (NTS) from NASBA, you can book your FAR exam through the Prometric website. India has multiple Prometric testing centers in cities including Mumbai, Delhi, Bangalore, Hyderabad, Chennai, Kolkata, and others. Select a testing center convenient to your location and choose an available date within your NTS validity period, which is typically six months from issuance.

Book your exam date at least 4 to 6 weeks in advance to secure your preferred time slot, especially during peak testing periods. Morning slots are popular among Indian candidates who want to test while mentally fresh.

Confirm your appointment details, understand the testing center rules regarding permitted items, and plan your travel to arrive at least 30 minutes before your scheduled time. Familiarize yourself with the Prometric check-in process to avoid any surprises on exam day.

Conclusion

FAR may have a reputation as the most challenging CPA exam section, but Indian candidates are well-positioned to succeed with the right preparation strategy. Your background in Indian commerce education or CA qualification provides a solid foundation in financial accounting fundamentals that many international candidates lack.

The key is approaching US-specific content, particularly governmental accounting and US GAAP nuances, with the same dedication you brought to your Indian qualifications.

Start your FAR preparation early, invest in a quality review course, and create a study schedule that realistically fits your work commitments. Focus extra attention on unfamiliar topics like governmental and not-for-profit accounting while reinforcing your strengths in areas like financial statements and inventory.

With 100 to 150 hours of focused preparation, strategic use of practice questions, and proper time management on exam day, you can join the thousands of Indian professionals who have successfully cleared FAR and moved forward in their CPA journey. Your US CPA credential awaits, and FAR is simply the first step on that path.

To understand the overall CPA journey, you can also refer to this detailed guide on the Certified Public Accountant (CPA) Exam in USA.

Frequently Asked Questions

How many hours should I study for the FAR CPA exam?

Most successful candidates study between 100 to 160 hours for FAR, depending on their background and familiarity with US GAAP. Indian CA holders may need closer to 100 hours if they are comfortable with financial accounting, while B.Com graduates without work experience might need 150 hours or more. Plan for 10 to 12 weeks of preparation if studying part-time while working.

Is FAR the hardest section of the CPA exam?

FAR consistently has the lowest pass rate among Core sections, hovering around 42 to 43 percent. However, “hardest” is subjective because difficulty depends on your background. FAR covers the most content and requires significant memorization, but candidates with strong financial accounting foundations often find AUD or REG more challenging due to their conceptual nature.

Can I pass FAR on my first attempt as an Indian candidate?

Absolutely. Thousands of Indian candidates pass FAR on their first attempt each year. Success requires respecting the exam’s difficulty, dedicating sufficient study time, and not assuming your Indian qualifications alone will guarantee a pass. Focus on US-specific content and practice extensively with MCQs and TBSs designed for the CPA exam format.

How is Indian CA knowledge helpful for FAR preparation?

CA preparation provides strong foundations in financial statements, consolidations, investments, and complex transactions that transfer well to FAR. Your calculation skills and ability to work through multi-step problems give you advantages over candidates from non-rigorous backgrounds. However, you must still learn US GAAP specifics, governmental accounting, and not-for-profit reporting from scratch.

Which FAR topics are most heavily tested?

Based on the AICPA blueprint, Financial Reporting and Select Balance Sheet Accounts each comprise 30 to 40 percent of the exam, while Select Transactions covers 25 to 35 percent. Within these areas, frequently tested topics include financial statement preparation, inventory, bonds, leases, revenue recognition, governmental accounting, and not-for-profit reporting.

How do I prepare for governmental accounting in FAR?

Treat governmental accounting as a completely separate subject requiring dedicated study time. Start early in your preparation to allow concepts to sink in through repeated exposure. Focus on understanding fund types, modified accrual accounting, and the reconciliation between fund statements and government-wide statements. Practice many questions specifically on governmental topics.

What is the best CPA review course for FAR in India?

The best course depends on your learning style and budget. Becker offers comprehensive content with strong pass rates but premium pricing. Wiley provides unlimited access and bite-sized lessons ideal for busy professionals. Surgent uses adaptive technology for efficient studying, while Gleim offers extensive practice questions at lower cost. Indian coaching institutes often provide localized support with these courses.

How long does it take to prepare for FAR while working full-time?

Working professionals in India typically need 10 to 12 weeks to prepare for FAR, studying 12 to 15 hours per week. This timeline allows for content learning, practice questions, and review. Candidates with stronger backgrounds or more study time available may finish in 8 weeks, while those with limited availability might need 14 to 16 weeks.

Should I take FAR as my first CPA exam section?

Yes, most experts recommend taking FAR first. This approach lets you study as long as needed before starting your 30-month clock, eliminates the most content-heavy section early, and builds confidence for remaining sections. If you have extensive specialized experience in tax or audit, alternative sequences might work, but FAR-first is the safest approach.

What is the difference between US GAAP and Ind AS for FAR?

Key differences include LIFO inventory (allowed under US GAAP, prohibited under Ind AS), impairment testing methodology, and specific disclosure requirements. While Ind AS converges with IFRS, US GAAP has unique standards like ASC 606 for revenue and ASC 842 for leases that have subtle differences from international standards. FAR tests US GAAP exclusively.

How much does FAR exam preparation cost in Indian Rupees?

Total FAR preparation costs range from approximately ₹85,000 to ₹1,54,000 including credential evaluation (₹12,750 to ₹30,000), application and section fees (₹25,000 to ₹38,000), review course FAR portion (₹25,000 to ₹50,000), and buffer for potential retakes. Investing in quality preparation materials increases your chances of passing on the first attempt.

What happens if I fail FAR on my first attempt?

If you fail FAR, you can retake the exam after receiving your score and paying the section fee again (approximately ₹17,000 to ₹21,000). There is no waiting period beyond score release, and you can schedule a retake as soon as the next testing window. Analyze your score report to identify weak areas and adjust your study plan before retaking.

Can I use a calculator during the FAR exam?

Yes, an on-screen calculator is provided during the FAR exam, but you cannot bring your own calculator. The provided calculator is basic with standard arithmetic functions. Practice using a similar on-screen calculator during your preparation to build familiarity. You may also access spreadsheet tools for certain TBSs that require extensive calculations.

How do I manage time during the FAR exam?

Allocate approximately 50 to 55 minutes for each MCQ testlet (about 2 minutes per question) and distribute remaining time across TBS testlets based on complexity. Take the full 15-minute break after testlet three to refresh mentally. Use the flag feature to mark uncertain questions for review, but do not spend excessive time on any single question. Practice timed exams during preparation to develop your personal pacing strategy.

Allow notifications

Allow notifications