The CPA exam cost in India isn’t a fixed number. It varies based on your state board, preparation strategy, and attempt planning—and many candidates underestimate the real expenses. Here’s what you need to know.

Table of Contents

If you have ever tried to figure out exactly how much the CPA exam costs for Indian candidates, you know how frustrating the search can be. The fees are scattered across multiple organizations, quoted in US dollars, and seem to change depending on which website you visit. Some sources mention ₹3 lakhs, others say ₹5 lakhs, and a few even quote ₹7 lakhs.

The confusion is real, and it can make financial planning feel like guesswork.

This guide cuts through that noise and gives you a complete, verified breakdown of every rupee you will spend on your CPA journey.

Here is something most online resources have not updated yet: NASBA increased the international testing fee for Indian candidates in June 2025.

The cost per exam section for candidates testing in India jumped from $390 to $510. That is an increase of ₹10,800 per section, or ₹43,200 extra for all four sections.

If you are reading outdated articles that still quote the old fees, your budget calculations could be off by a significant margin.

Over the next several sections, we will walk through every cost category:

- one-time evaluation and application fees,

- exam section fees,

- review course investments,

- state-wise cost variations,

- hidden expenses most candidates overlook, and

- realistic total investment ranges.

By the end, you will have a clear picture of what the CPA certification actually costs from India and practical strategies to manage that investment smartly. Whether you are a working professional budgeting your savings or exploring employer sponsorship options, this guide has you covered.

One-Time CPA Fees to Pay Before Applying

Before you can even register for your first CPA exam section, there are essential one-time fees you need to pay. These include getting your Indian educational credentials evaluated to meet US standards and submitting your application to a state board of accountancy.

Think of these as entry fees that open the door to the CPA examination process. While they represent a smaller portion of your total investment, understanding them helps you plan your initial cash outflow accurately.

What is Credential Evaluation and Why Do Indian Candidates Need It?

Every US state board of accountancy needs to verify that your Indian education meets their requirements for CPA eligibility. Since Indian universities follow a different credit system than American institutions, your transcripts need to be evaluated and converted into US credit hour equivalents. This process is called credential evaluation, and it is mandatory for all international candidates, including those from India.

The evaluation determines how many accounting credits, business credits, and total credit hours your Indian qualifications provide.

Most state boards require 120 credit hours to sit for the exam and 150 credit hours for licensure. A typical Indian B.Com degree translates to roughly 90 US credit hours, while an M.Com or MBA adds more. The evaluation report tells you exactly where you stand and whether you need additional credits. For a detailed guide on credit evaluation and the CPA exam, you must read my article on CPA Exam: Complete Guide.

Without a credential evaluation, no state board will process your CPA application. The evaluation agency sends an official report directly to your chosen state board, confirming your educational eligibility.

This report typically remains valid for five years, so you do not need to repeat the process unless you change states or let significant time pass before applying.

Comparing Evaluation Agencies: NIES vs WES vs FACS

Indian CPA candidates primarily use three evaluation agencies:

- NIES (NASBA International Evaluation Services),

- WES (World Education Services), and

- FACS (Foreign Academic Credential Service).

Each agency has different fee structures, processing times, and state board acceptance rates. Choosing the right one can save you both money and time, so understanding the differences matters.

NIES (NASBA International Evaluation Services) Fees and Process

NIES is operated by NASBA itself, which means it has direct relationships with all participating state boards. The evaluation fee ranges from $225 to $275 (approximately ₹20,250 to ₹24,750), depending on the type of evaluation you need.

For most Indian candidates seeking CPA exam eligibility, the standard evaluation at $250 works well. You can apply online through the NIES portal on NASBA’s website.

The processing time for NIES typically runs between 8 to 12 weeks once all your documents are received. You will need to send official transcripts directly from your university, along with degree certificates and mark sheets. One advantage of NIES is that over 50 state boards accept their evaluations, and for some states, NIES is the only approved evaluation agency for international candidates.

WES (World Education Services) Fees and Process

WES is one of the most recognized credential evaluation services globally and is accepted by many US state boards for CPA applications. The course-by-course evaluation, which most CPA candidates need, costs between $160 and $225 (approximately ₹14,400 to ₹20,250). This makes WES slightly more affordable than NIES in most cases. You can start your application at the official WES website.

WES processing time is generally faster, averaging 7 to 10 business days after all documents are received and verified. However, getting your documents to WES can take longer since Indian universities need to send transcripts directly. WES has partnerships with several Indian universities that can send documents electronically, which speeds up the process. Check if your university is on their verified sender list before applying.

Which Evaluation Agency Should You Choose?

Your choice between NIES and WES often depends on which state you plan to apply to. Some states only accept NIES evaluations, while others accept both. Before paying any evaluation fee, check your target state board’s requirements on the NASBA state board directory. If your state accepts both agencies, WES might save you ₹4,000 to ₹5,000 and process faster.

If you are undecided about which state to choose, NIES offers an “Undecided Jurisdiction” option where they evaluate your credentials and recommend states where you would be eligible. This advisory service costs extra but can be valuable if you want guidance on state selection. For candidates who have already chosen a state that accepts WES, the cost savings and faster processing often make WES the better choice.

How Much Do CPA State Board Application Fees Cost?

Once your credentials are evaluated, you need to apply to a specific state board of accountancy. Each state charges its own application fee, and these fees vary dramatically. Some states charge as little as $15, while others charge over $200. Since you will pay this fee only once (unless you switch states), it is worth considering alongside other state-specific factors when making your choice.

Low-Fee States: Colorado, Montana, and Alaska

Colorado is a popular choice among Indian candidates, partly due to its reasonable fees (with an application fee of roughly $160) and flexible requirements. Colorado does not require U.S. residency or citizenship to be eligible for the CPA exam, making it accessible for many international candidates, though a Social Security Number (or an affidavit) is required. You can verify current fees on the Colorado State Board of Accountancy website.

Montana’s initial CPA application fee is relatively affordable (often cited at around $100–$150), making it one of the more economical choices among U.S. jurisdictions.

Alaska’s application fees are also similar, typically around $100–$125. Both states are popular among Indian candidates because they do not require U.S. citizenship, state residency, or a Social Security Number to sit for the CPA exam. However, application fees are just one part of the total cost, with exam fees and other fees adding significantly to the overall expense.

Mid-to-High Fee States: New York, California, and Texas

New York charges approximately $135 for the education evaluation application through their board, but the total application process can cost more due to additional verification requirements. New York is popular because of its strong CPA job market, but the application process is more complex for international candidates. California’s application fee is around $100, but California has stricter educational requirements that many Indian candidates struggle to meet.

In Texas, the CPA process begins with a modest application fee (around $20) and a non-refundable eligibility fee of $15 per exam section charged by the Texas State Board of Public Accountancy. After eligibility, candidates must pay NASBA exam section fees of approximately $260–$265 per section, which constitute the bulk of the cost. In addition, a $50 fee is payable for the issuance of the CPA certificate after passing the exam.

How Much Does the CPA Exam Cost for Indian Candidates?

The exam fees represent the largest single expense category in your CPA journey. As an Indian candidate testing at Prometric centers in India, you pay more than domestic US candidates because of international testing surcharges.

Understanding exactly how these fees break down helps you budget accurately and avoid unpleasant surprises when payment time comes.

What Is the Total Cost to Take All Four CPA Exam Sections?

The CPA exam consists of three Core sections (FAR, AUD, and REG) and one Discipline section (you choose from BAR, ISC, or TCP). Each section costs the same amount to take. For Indian candidates testing in India, the current fee is $510 per section as of June 2025. This means your total exam fees for all four sections will be $2,040, which translates to approximately ₹1,83,600 at current exchange rates.

Core Sections: FAR, AUD, and REG Costs

Financial Accounting and Reporting (FAR), Auditing and Attestation (AUD), and Regulation (REG) are the three mandatory Core sections every CPA candidate must pass. Each section costs $510 (approximately ₹45,900) for Indian candidates testing in India. This fee includes the NASBA examination fee, AICPA fee, Prometric testing fee, and the international administration surcharge. You pay this fee when scheduling each exam through NASBA’s candidate portal.

The total cost for all three Core sections is $1,530 (approximately ₹1,37,700). These fees are non-refundable once you schedule your exam. If you need to reschedule, there may be additional fees depending on how close to your exam date you make the change. Planning your exam schedule carefully can help you avoid these extra costs.

Discipline Section: BAR, ISC, or TCP Costs

You must choose one Discipline section from three options: Business Analysis and Reporting (BAR), Information Systems and Controls (ISC), or Tax Compliance and Planning (TCP). Whichever discipline you select, the exam fee remains the same at $510 (approximately ₹45,900). The discipline you choose should align with your career interests rather than cost considerations, since the fees are identical.

Your total Discipline section cost adds another ₹45,900 to your exam expenses. Combined with the Core sections, your complete exam fees come to $2,040 (approximately ₹1,83,600). Remember, this is assuming you pass all sections on your first attempt. Retakes add to this total, which we will cover in the hidden costs section.

What Additional Registration and NTS Fees Should You Expect?

Beyond the exam fees themselves, you will encounter registration fees and Notice to Schedule (NTS) related costs. The NTS is your authorization to schedule and take the CPA exam sections. These fees vary by state and add to your overall exam-related expenses. Understanding them prevents budget shortfalls during the examination phase.

State-Wise Registration Fee Variations

Registration fees are charged by state boards when you apply to take the exam. NASBA recommends a registration fee of approximately $93 per section for states that follow their fee schedule. However, many states set their own registration fees. For example, Massachusetts charges $185 per section, while West Virginia charges only $40 per section as an “intent to sit” fee.

For most Indian candidates using popular states like Colorado or Washington, you can expect registration fees between $80 and $150 per section. Over four sections, this adds $320 to $600 (approximately ₹28,800 to ₹54,000) to your total costs. Always check your specific state board’s current fee schedule before budgeting, as these fees can change.

NTS Validity Period and Extension Costs

Your NTS has a validity period during which you must schedule and take your exam sections. This period varies by state but typically ranges from 6 to 9 months. If your NTS expires before you take the exam, you lose the exam fees paid for that section and must reapply. There is no refund for expired NTS, making this a costly mistake to avoid.

Some states offer NTS extensions under specific circumstances, such as medical emergencies or military deployment. Extension fees, where available, typically range from $50 to $100. However, not all states grant extensions, and the process requires documentation. Your best protection against NTS expiration is realistic scheduling based on your actual preparation timeline.

How Much Do CPA Review Courses Cost in India?

While not technically mandatory, a CPA review course is practically essential for most candidates. The CPA exam has notoriously low pass rates, and comprehensive review courses significantly improve your chances of passing on the first attempt. In India, several coaching providers offer CPA preparation programs, often bundled with internationally recognized study materials from providers like Becker or Gleim. The investment in a quality review course often pays for itself by reducing retake costs.

Major CPA Review Course Providers and Their India Pricing

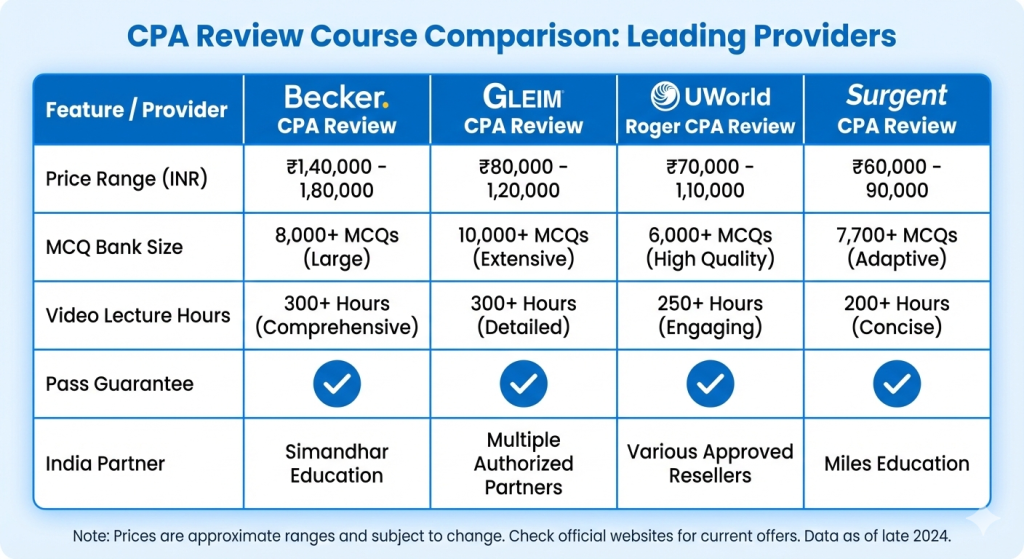

The Indian CPA coaching market is dominated by a few key players who partner with international review course providers. These partnerships give Indian candidates access to world-class study materials along with local support, live classes, and mentorship. Prices vary significantly based on the study materials included, the level of coaching support, and additional services like placement assistance.

Becker CPA Review: Fees Through Simandhar and Miles Education

Becker is the most recognized name in CPA exam preparation globally, with a reputation built over decades of helping candidates pass. In India, Becker courses are available through authorized partners like Simandhar Education and Miles Education. The cost of Becker CPA Review through these partners ranges from ₹1,40,000 to ₹1,80,000, depending on the package you choose.

Simandhar Education is Becker’s exclusive partner in India and offers comprehensive packages that include Becker’s Learning Management System (LMS), live classes with Indian faculty, physical textbooks, and placement support. Miles Education also offers Becker materials with their own coaching layer. The premium pricing reflects Becker’s extensive question bank (over 9,000 MCQs), adaptive learning technology, and high pass rates among users.

Gleim CPA Review: Fees Through Concorde Academics

Gleim CPA Review offers a more affordable alternative to Becker while still providing comprehensive preparation materials. Through partners like Concorde Academics in India, Gleim courses typically cost between ₹80,000 and ₹1,20,000. Gleim is known for having one of the largest test banks in the industry, which is excellent for candidates who learn best through extensive practice.

The Gleim course includes video lectures, a massive question bank, study planners, and access to their online platform. Concorde Academics adds live virtual classes and faculty support to the Gleim materials. For budget-conscious candidates who are disciplined self-studiers, Gleim offers strong value for money. The trade-off is less adaptive technology and fewer bells and whistles compared to Becker.

UWorld Roger, Surgent, and Other Options

UWorld Roger CPA Review has gained popularity for its engaging video lectures and high-quality practice questions. Pricing in India typically ranges from ₹70,000 to ₹1,10,000 through various distributors. Roger Philipp’s teaching style resonates with many candidates, making complex topics easier to understand. The course includes adaptive study tools and a solid question bank.

Surgent CPA Review is another affordable option, with prices ranging from ₹60,000 to ₹90,000 in India. Surgent’s adaptive learning technology claims to reduce study time by identifying your weak areas and focusing your efforts there. For candidates on tight budgets, Surgent offers good value. Other options like NINJA CPA Review can supplement your primary course at lower costs, typically under ₹30,000 for access to additional practice questions.

Emerging Strong Player

Alongside these partnerships, a major ed tech company—SkillArbitrage’s CPA Prep & Global Finance Career Acceleration Program—has emerged with a distinctive model. Instead of partnering with a U.S. course provider, SkillArbitrage delivers its own structured, NSDC-recognized training program that integrates live instructor-led classes, assignments, practical finance tools, and career-focused training. The program follows a 6-month, 8–10 hours/week schedule and includes two live classes every week, weekly practical assignments, LMS and mobile app access, mock tests, article writing training, freelancing templates, and two mock client interviews. Candidates receive a co-branded NSDC & Skill India certificate upon completion.

SkillArbitrage prices its standard plan at ₹120,000 (all-inclusive), positioning itself competitively against more established partnerships. Although the program does not bundle U.S. publisher materials like Becker, Wiley, or Gleim, it compensates with extensive skill-building modules in Excel, automation, AI-based financial workflows, and industry-style projects—making it particularly suitable for candidates who want both exam preparation support and real-world finance exposure. The institute also manages pre-exam guidance, exam strategy planning, and licensing orientation, while offering a 30-day participation-based refund window. Enrollment is currently waitlist-based due to limited seats in each cohort.

State-Wise Cost Comparison: Which State Saves Indian Candidates Money?

The state you choose for your CPA license affects more than just your application fee. Different states have varying fee structures throughout the examination and licensing process, and these differences can add up to significant amounts over your CPA journey. Understanding these state-wise variations helps you make a financially informed decision, especially if you have flexibility in state selection.

Why Does Your Choice of State Affect Your Total CPA Cost?

Your state board determines multiple fee categories: application fees, registration fees per exam section, license fees, and ongoing renewal costs. A state with a $50 application fee but $150 per section registration fees might end up costing more than a state with a $150 application fee but $80 per section registration fees. Looking at the complete picture across all fee categories reveals the true cost of each state choice.

Application Fees Vary Significantly by State

Application fees range from approximately $50 to over $200 across different state boards. Texas has one of the lowest at around $50, while Montana charges about $200 for initial applications. However, application fees are one-time costs, so their impact on your total investment is relatively limited compared to recurring fees. A $150 difference in application fees is meaningful but should not be the sole factor in your decision.

Some states charge additional fees for international candidates or require supplementary evaluations beyond the standard credential evaluation. These extras can add $50 to $200 to your initial costs. Always review your target state’s complete fee schedule for international applicants before making your choice.

Experience and Licensing Requirements Impact Long-Term Costs

States differ in their experience requirements for licensure. Some require one year of supervised experience under a licensed CPA, while others require two years. If you need to extend your experience period, you may face additional costs such as license application delays or the need to maintain exam section credits (which could expire and require retakes).

Licensing fees also vary significantly. Some states charge $100 for initial licensure, while others charge $400 or more. Annual or biennial renewal fees range from $50 to $500, depending on the state. If you plan to hold your CPA license long-term, these recurring costs add up over decades. California, for instance, has relatively high renewal fees compared to states like Colorado.

Cost Breakdown for the Top 5 States Popular Among Indians

Let us examine the total costs for the five states most commonly chosen by Indian CPA candidates. This comparison includes application fees, typical registration fees, licensing fees, and renewal costs to give you a comprehensive view of your financial commitment to each state.

Colorado: Complete Fee Structure

Colorado is arguably the most popular state among Indian CPA candidates due to its accessible requirements and reasonable fees. The application fee is approximately $140, and registration fees follow NASBA’s standard schedule. Colorado does not require US residency or citizenship for exam eligibility, and you can complete your experience requirement under a non-US CPA in some circumstances.

The initial license fee in Colorado is around $100, with biennial renewal fees of approximately $100. Over a 10-year period (including initial fees and five renewal cycles), your Colorado-specific costs would total roughly $740 (approximately ₹66,600). Combined with the universal exam fees, Colorado offers a balanced combination of accessibility and affordability.

Montana, Washington, and Alaska: Fee Comparison

Montana has slightly higher initial fees with an application cost of around $200, but competitive registration and licensing fees. Montana is known for being an international candidate-friendly state with no residency requirements. Washington state has similar characteristics, with application fees around $150 and straightforward international candidate processes.

Alaska offers another option for Indian candidates, with application fees around $125 and no residency requirements. All three states have relatively reasonable ongoing costs for license maintenance. The key advantage of these states is their acceptance of international candidates without complex additional requirements, making the overall process smoother despite modest fee differences.

New York and California: Higher Costs, Different Benefits

New York has significant appeal for candidates planning careers in the US financial hub. Application fees are around $125, but New York’s stringent verification process for international candidates can add costs and time. The benefit is holding a license from a prestigious jurisdiction with strong reciprocity with other states. Licensing fees are approximately $400 initially, with triennial renewals around $300.

California has specific educational requirements that many Indian candidates struggle to meet without additional coursework. If you need to take extra courses to qualify, factor in thousands of rupees for those credits. California’s application fee is around $100, but the total cost of meeting their requirements often makes it more expensive overall. Choose California only if you specifically plan to practice there or its requirements align with your existing qualifications.

How to Choose the Right State Based on Budget and Goals

If your primary goal is minimizing costs and you have no specific US state preference, Colorado or Washington often provides the best value for Indian candidates. These states combine reasonable fees with accessible requirements and good license portability. Run the complete numbers for your top two or three state choices before deciding.

Consider your career plans when choosing a state. If you plan to work for a US firm that will help with license transfer later, starting with a low-cost, accessible state makes sense. If you have specific geographic career goals, starting with that state (even if costlier) might save you transfer fees and complications later.

Finally, factor in the intangible costs of complexity. A state with a confusing application process or slow response times costs you time and stress, even if the dollar fees are lower. Read reviews from other Indian candidates about their experiences with different state boards. Sometimes paying slightly more for a smoother process is worth the premium.

Hidden Costs Most Indian CPA Candidates Miss

Beyond the obvious fees we have discussed, several hidden costs catch Indian candidates by surprise. These expenses do not appear in most CPA cost calculators but can add tens of thousands of rupees to your total investment. Being aware of them upfront helps you budget realistically and avoid financial stress during your CPA journey.

Document and Transcript Related Expenses

Getting your educational documents to evaluation agencies and state boards involves real costs that add up quickly. Your university likely charges for official transcripts, and you may need multiple copies for different purposes. Transcript fees in India typically range from ₹500 to ₹2,000 per copy, and you might need three to five copies throughout your CPA process.

Courier charges for sending documents internationally represent another significant expense. Sending a document package to the US via services like DHL or FedEx costs between ₹2,000 and ₹4,000 per shipment. If you need multiple shipments for different documents or corrections, these costs multiply. Some candidates spend ₹10,000 to ₹15,000 on courier services alone.

Document attestation and notarization may also be required, depending on your state board’s requirements. Notary fees in India are relatively modest (₹100 to ₹500 per document), but apostille services for international document authentication can cost ₹2,000 to ₹5,000. Check your specific state’s requirements to know which authentication services you need.

Currency Conversion and Bank Charges

Almost all CPA-related fees must be paid in US dollars via credit card. Indian banks typically charge foreign transaction fees of 2% to 3.5% on international credit card payments. On a $2,000 payment, that is an extra ₹3,600 to ₹6,300 you are paying to your bank, not toward your CPA.

Exchange rate fluctuations add unpredictability to your budgeting. The USD to INR rate has ranged from ₹84 to ₹90 during 2025, meaning the same dollar amount could cost you significantly different rupee amounts depending on when you pay. A $2,000 payment could cost ₹1,68,000 at ₹84 per dollar or ₹1,80,000 at ₹90 per dollar.

To minimize these costs, consider using credit cards with lower foreign transaction fees or forex cards that lock in exchange rates. Some candidates time their larger payments to favorable exchange rate periods, though this requires flexibility in your payment schedule. Budgeting at a slightly higher exchange rate (₹92 to ₹95) gives you a buffer against unfavorable fluctuations.

Retake Fees: The Cost of Not Passing First Time

If you do not pass a CPA exam section on your first attempt, you will need to pay the full exam fee again to retake it. At $510 per section for Indian candidates, each retake costs approximately ₹45,900. Given that CPA exam pass rates hover around 50% for most sections, many candidates face at least one retake during their journey.

Beyond the exam fee itself, retakes may require additional registration fees depending on your state and NTS status. If your NTS has expired, you need to pay for a new one. If your 18-month testing window is running out, failed sections can create a cascade of problems where passed sections expire before you can clear the failed ones.

The real cost of retakes extends beyond money. Each retake typically requires two to four additional weeks of study time, delaying your certification and potentially your career advancement. This is why investing in quality review materials and adequate preparation time often provides better ROI than trying to save money on study resources.

Post-Exam Costs: Ethics Exam and Licensing Fees

After passing all four CPA exam sections, you are not quite done spending money. Most states require you to pass an ethics exam before granting your license. The AICPA Professional Ethics examination costs between $250 and $320 (approximately ₹22,500 to ₹28,800), depending on whether you are an AICPA member.

State licensing fees vary from $50 to $500 for initial licensure. Some states have additional requirements like background checks ($25 to $50) or fingerprinting fees.

Once licensed, you face ongoing costs for license renewal (every one to three years) and Continuing Professional Education (CPE) requirements. CPE courses can cost ₹1,700 to ₹4,300 per credit hour, and you typically need 40 hours per year.

These post-exam costs total ₹40,000 to ₹80,000 in the first year after passing, and ongoing annual costs of ₹15,000 to ₹30,000 for CPE and renewals. When calculating your total CPA investment, include at least the first year of post-exam costs in your budget.

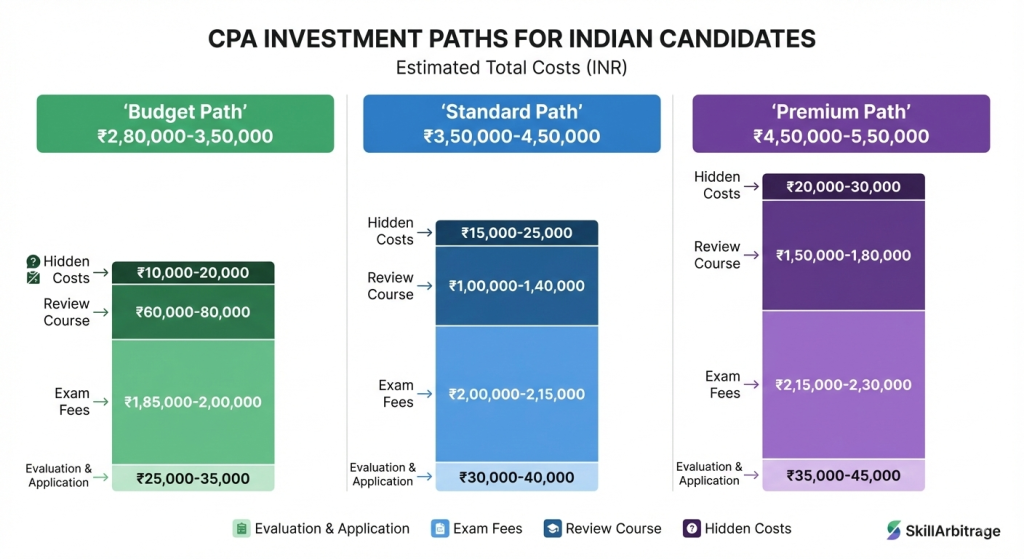

What Is the Total Investment Required to Become a CPA From India?

Now that we have covered all the individual cost categories, let us bring everything together into realistic total investment figures. Your actual spending will depend on your choices regarding review courses, state selection, and whether you pass all sections on the first attempt. We will look at three scenarios: minimum investment, typical investment, and maximum investment.

Please note that exchange rate fluctuations can affect these figures. The table uses an approximate rate of ₹90 per USD. Budget with a small buffer above these numbers to account for rate variations.

Minimum Investment to Become a CPA

The budget path is possible if you choose affordable options at every stage, pass all sections on your first attempt, and avoid unnecessary expenses. This path typically totals between ₹2,80,000 and ₹3,50,000. You would choose a lower-cost evaluation agency (WES at around ₹15,000), a state with reasonable fees, and an affordable review course like Surgent or Gleim (₹60,000 to ₹90,000).

The budget path requires discipline and carries a higher risk. Cheaper review courses may have fewer features, meaning you need strong self-study skills. Any retakes would quickly push you into the standard investment range. If you are a highly motivated self-studier with strong accounting fundamentals, the budget path is achievable.

This approach works best for candidates with relevant work experience who need less foundational teaching and more practice questions. It also suits those who can dedicate significant study time and do not need the structure of live classes or mentorship programs.

Typical Investment for Most Indian Candidates

The standard path represents what most Indian candidates actually spend. This range falls between ₹3,50,000 and ₹4,50,000 and includes a mid-tier to premium review course (Becker through a partner at ₹1,40,000 to ₹1,60,000), standard evaluation and application fees, one possible retake, and typical hidden costs.

This investment level provides comfortable preparation with quality materials, some level of coaching support, and a buffer for unexpected expenses. Most candidates who complete their CPA through Indian coaching institutes fall into this range. The return on investment remains excellent given the career and salary benefits of CPA certification.

If you are a working professional in India studying part-time, budgeting at the standard level is prudent. You have enough cushion to handle a retake if needed without financial stress, and you are investing in resources that improve your pass probability.

Maximum Preparation Investment

The premium path ranges from ₹4,50,000 to ₹5,50,000 and includes every advantage: Becker’s premium package through an authorized partner, personal mentorship, live classes, placement support, and a comfortable buffer for any retakes or unexpected expenses. Some candidates also invest in additional practice materials or supplementary courses.

This level of investment makes sense for candidates who want maximum support and have the financial means to afford it. The premium coaching packages often include career services, resume building, and interview preparation that can accelerate your post-CPA job search. If your employer is sponsoring your CPA, the premium path may be fully covered.

The premium path does not guarantee you will pass faster or score higher, but it does provide more support structure and resources. For candidates who struggle with self-study or need accountability systems, the extra investment in coaching and mentorship can be worthwhile.

Smart Budgeting Strategies for Indian CPA Candidates

Knowing the costs is only half the battle. The other half is managing cash flow and timing your payments strategically. Most working professionals cannot pay ₹3 to ₹5 lakhs upfront, so spreading the investment over time is essential. This section provides practical strategies for budgeting your CPA journey without financial strain.

When to Pay Each Fee: Creating Your Payment Timeline

Understanding when each fee is due helps you plan savings and manage cash flow. The CPA journey typically spans 12 to 24 months, and your payments are spread across this period. Rather than needing everything up front, you can phase your spending strategically.

Phase 1: Evaluation and Application (Months 1-2)

Your first payments are for credential evaluation and state board application.

Budget approximately ₹25,000 to ₹45,000 for this phase. The evaluation fee (₹15,000 to ₹25,000) is due when you submit your evaluation application. You will also need to pay for transcripts and courier services (₹5,000 to ₹10,000) to get your documents to the evaluation agency.

The state board application fee (₹5,000 to ₹18,000) comes after your evaluation is complete, typically one to two months later. Some candidates start their review course during this waiting period, so you might have overlapping payments. Having ₹50,000 saved before starting your CPA process gives you comfortable coverage for Phase 1.

Phase 2: Review Course and Exam Scheduling (Months 2-6)

Your review course investment is the largest single payment, ranging from ₹60,000 to ₹1,80,000 depending on your choice. Many Indian coaching institutes offer EMI options, allowing you to spread this cost over 6 to 12 months. If you use EMI, your monthly payment might be ₹10,000 to ₹20,000 rather than a lump sum.

Once your state board approves your application, you can begin scheduling exams. Most candidates schedule their first exam three to four months after starting their review course.

At scheduling time, you pay the exam fee for that section (₹45,900). You do not need to pay for all four sections upfront, allowing you to spread exam fees across your testing period.

Phase 3: Exam Fees and Testing (Months 6-18)

During your active testing phase, you will pay exam fees as you schedule each section. If you test one section every two to three months, your exam fee payments are naturally spread over 8 to 12 months. This phased payment reduces the strain compared to paying all ₹1,83,600 at once.

After passing all four sections, budget for the ethics exam (₹22,500 to ₹28,800) and licensing fees (₹10,000 to ₹45,000).

These come at the end of your journey, typically 12 to 18 months after starting. By this point, you have already spent most of your budget, so these final payments are manageable for most candidates.

Cost-Saving Strategies That Actually Work

While you cannot eliminate CPA costs, several strategies can reduce your total investment meaningfully. These are not shortcuts that compromise your preparation but rather smart choices that optimize your spending.

Review Course Discounts and EMI Options

Most CPA coaching institutes in India offer seasonal discounts, typically during Diwali, New Year, or exam result periods. These discounts range from 10% to 30% off regular prices. Waiting for a discount period can save ₹15,000 to ₹50,000 on your review course. Follow your target coaching institute on social media to catch their promotional offers.

EMI options do not reduce your total cost but make it more manageable. Many institutes offer 0% or low-interest EMI through partnerships with banks or NBFCs. Spreading a ₹1,50,000 course fee over 12 months means paying ₹12,500 per month instead of a lump sum. This improves cash flow significantly for working professionals.

State Selection for Lower Overall Costs

As discussed earlier, your state choice affects multiple fee categories. Choosing a state like Colorado or Washington over California or New York can save ₹20,000 to ₹50,000 over your CPA journey, including application, registration, and licensing fees. This saving comes without compromising your preparation or certification value.

Research state requirements thoroughly before applying. Switching states after starting costs money (new evaluation, new application fees) and time. Make an informed choice upfront based on your eligibility, career plans, and total cost analysis.

Passing First Time: The Biggest Money Saver

The single biggest cost-saving strategy is passing all your exam sections on the first attempt. Each retake costs ₹45,900 in exam fees alone, plus additional registration costs and the time value of extended preparation. Two retakes add nearly ₹1,00,000 to your total investment.

Investing more in quality preparation often produces net savings. A ₹50,000 premium on a better review course is worth it if it helps you avoid two retakes. Give yourself adequate study time for each section, use your review course materials fully, and do not schedule exams until you are consistently scoring well on practice tests.

If you want a detailed guide on CPA pass rate then read my article on CPA Exam Pass Rates.

Employer Sponsorship and Reimbursement Options

Many employers, especially Big 4 accounting firms and multinational corporations, offer CPA sponsorship or reimbursement programs. These programs can cover a significant portion of your CPA costs, making the certification financially accessible even at the premium investment level.

Big 4 and MNC CPA Sponsorship Programs

The Big 4 firms (Deloitte, PwC, EY, and KPMG) in India actively encourage their employees to pursue CPA certification. Most offer partial to full reimbursement of CPA exam fees and review course costs upon passing. Some firms provide upfront sponsorship, paying for your review course before you take the exams.

Large multinational corporations in India, particularly those with US parent companies, also offer CPA support as part of professional development programs. The coverage varies by company, ranging from partial reimbursement to full sponsorship. Check with your HR department about available professional certification benefits.

Negotiating CPA Support with Your Employer

If your employer does not have a formal CPA sponsorship program, you can still negotiate support. Prepare a business case showing how your CPA certification benefits the organization through improved skills, client service capability, or compliance expertise. Many managers have discretionary budgets for employee development.

Consider proposing a partial sponsorship arrangement where your employer covers the review course cost, and you pay the exam fees. Alternatively, ask for reimbursement upon passing, which reduces your employer’s risk. Even a ₹50,000 to ₹1,00,000 employer contribution significantly eases your financial burden.

Conclusion

The total cost of becoming a CPA from India ranges from approximately ₹2,80,000 for the budget-conscious candidate to ₹5,50,000 for those investing in premium preparation and support. Most candidates spend between ₹3,50,000 and ₹4,50,000 when accounting for a quality review course, standard fees, and a realistic buffer for unexpected expenses.

The CPA certification delivers an exceptional return on this investment. CPAs in India earn significant salary premiums, with roles at Big 4 firms and multinational corporations commanding ₹12 to ₹25 lakhs annually for experienced professionals. The global recognition of the CPA credential opens doors to international opportunities that multiply your earning potential. When viewed over a 10 to 20 year career, the ₹3 to ₹5 lakh investment generates returns many times over.

Plan your finances before starting your CPA journey. Create a detailed budget using the figures in this guide, identify your payment timeline, explore EMI options for the review course, and investigate employer sponsorship possibilities. With smart planning, the CPA investment becomes manageable for most working professionals. Take that first step by getting your credentials evaluated, and you will be on your way to one of the most valuable certifications in the global accounting profession.

To understand the overall CPA journey, you can also refer to this detailed guide on the Certified Public Accountant (CPA) Exam in USA.

Frequently Asked Questions

What is the total cost of CPA exam from India?

The total cost ranges from ₹2,80,000 to ₹5,50,000 depending on your choices. This includes credential evaluation (₹15,000-25,000), state application fees (₹5,000-18,000), exam fees for all four sections (₹1,83,600), review course (₹60,000-1,80,000), and additional costs like ethics exam and licensing. Most candidates spend ₹3,50,000 to ₹4,50,000.

How much is the CPA international testing fee for Indian candidates?

From June 2025 onwards, the CPA exam fee for candidates testing in India is $510 per section, which is approximately ₹45,900. This includes the international administration surcharge. For all four sections, the total exam fee is $2,040 (approximately ₹1,83,600). This fee increased from $390 per section in mid-2025.

Which is cheaper for evaluation: WES or NIES?

WES is generally cheaper, with course-by-course evaluation costing $160-225 (₹14,400-20,250) compared to NIES at $225-275 (₹20,250-24,750). However, check if your target state accepts WES evaluations. Some states require NIES specifically. If both are accepted, WES typically saves you ₹4,000 to ₹8,000.

Do I need to pay separately for each CPA exam section?

Yes, you pay the exam fee when scheduling each section. You do not need to pay for all four sections upfront. This allows you to spread your ₹1,83,600 exam cost over your testing period (typically 6-18 months). You schedule and pay for each section as you are ready to take it.

What are the hidden costs of CPA exam that candidates often miss?

Commonly overlooked costs include transcript and document fees (₹5,000-15,000), international courier charges (₹8,000-15,000), credit card foreign transaction fees (2-3.5% of payments), currency exchange rate fluctuations, retake fees (₹45,900 per section), and post-exam costs like ethics exam (₹25,000) and licensing (₹10,000-45,000).

How much does Becker CPA course cost in India?

Becker CPA Review through Indian partners like Simandhar Education or Miles Education costs between ₹1,40,000 and ₹1,80,000, depending on the package. This includes access to Becker’s LMS, video lectures, practice questions, and typically adds local faculty support, live classes, and placement assistance.

Which US state has the lowest CPA exam fees for Indians?

Texas has one of the lowest application fees at approximately $50 (₹4,500), but has strict educational requirements. For accessible states popular among Indians, Colorado and Washington offer reasonable fees with straightforward processes. Colorado’s application fee is around $140 (₹12,600) with no residency requirements.

How much does it cost to retake a failed CPA exam section?

Retaking a failed section costs the full exam fee of $510 (approximately ₹45,900) for Indian candidates. You may also need to pay additional registration fees depending on your state and NTS status. Each retake significantly increases your total CPA investment, making first-attempt preparation crucial.

Can I pay CPA exam fees in Indian Rupees?

No, all CPA-related fees (evaluation, application, exam, licensing) must be paid in US dollars via credit card. Your bank will convert the payment from your INR account at the prevailing exchange rate plus foreign transaction fees (typically 2-3.5%). Consider using forex cards or cards with lower international transaction fees.

What is the cost of CPA ethics exam?

The AICPA Professional Ethics examination costs between $250 and $320 (approximately ₹22,500 to ₹28,800), with AICPA members receiving a discount. This is a self-study course with an exam that most states require before granting your CPA license. Some states have their own ethics requirements with different fees.

How much should I budget for CPA if I am a working professional in India?

Working professionals should budget ₹3,50,000 to ₹4,50,000 for a realistic CPA journey, including a quality review course, standard fees, and a buffer for one possible retake. Plan to spend this over 12-18 months. Consider EMI options for the review course to manage monthly cash flow at ₹10,000-20,000 per month.

Are there EMI options available for CPA course fees in India?

Yes, most Indian CPA coaching institutes offer EMI options for their review courses. Simandhar Education, Miles Education, and others partner with banks and NBFCs to offer 0% or low-interest EMI plans ranging from 3 to 12 months. A ₹1,50,000 course can be converted to ₹12,500 monthly payments over 12 months.

What is the NTS fee and how long is it valid?

The NTS (Notice to Schedule) fee is part of your registration fee, which varies by state from $80 to $185 per section. The NTS is valid for 6 to 9 months, depending on your state, during which you must schedule and take your exam. If it expires unused, you lose the fees paid and must reapply.

How much do Big 4 firms reimburse for CPA exam costs?

Big 4 reimbursement policies vary but typically cover 50% to 100% of exam fees and review course costs upon passing. Some firms offer upfront sponsorship for review courses. Total reimbursement can range from ₹1,00,000 to the full investment amount. Check with your specific firm’s HR policy for exact coverage.

What is the annual license renewal cost after becoming a CPA?

CPA license renewal costs vary by state, typically ranging from $50 to $500 every one to three years. Additionally, you must complete Continuing Professional Education (CPE) requirements, usually 40 hours per year. CPE courses cost ₹1,700 to ₹4,300 per credit hour. Budget ₹15,000 to ₹30,000 annually for ongoing license maintenance.

Allow notifications

Allow notifications