Indian CAs can take the US CPA exam with significant advantages. Learn credit calculations, best states, fast-track preparation strategies, and complete costs for CA holders pursuing CPA certification.

Table of Contents

You have worked incredibly hard to earn your Chartered Accountancy qualification.

The grueling exams, the three years of articleship, and the countless hours of study have made you one of the most rigorously trained accounting professionals in the world.

Now you are wondering: can I leverage this hard-earned CA qualification to pursue the prestigious US CPA certification?

The answer is a resounding yes.

Indian Chartered Accountants can absolutely take the CPA exam, and in many ways, you have a significant advantage over other candidates.

With Big 4 firms, multinational corporations, and global finance roles increasingly seeking professionals who understand both Indian and US accounting standards, the CA plus CPA combination has become one of the most powerful credential pairs in the accounting profession.

We understand the confusion that surrounds credit requirements, state selection, and evaluation processes. Many qualified CAs hesitate to pursue CPA simply because the pathway seems complicated and the information available online is often contradictory or outdated.

Some sources claim you need a master’s degree, others suggest certain states no longer accept CA credentials, and the credit hour calculations can feel like solving a puzzle with missing pieces. This guide is designed to cut through that complexity with clear, actionable guidance specifically created for CA holders like you.

In the sections that follow, we will cover everything you need to know: confirming your eligibility, understanding exactly how your credits translate, selecting the right US state for your application, leveraging your CA knowledge to fast-track exam preparation, navigating the experience verification process, and calculating your total investment in Indian Rupees.

This is not a generic CPA guide.

This is specifically written for Indian Chartered Accountants who want to add the US CPA credential to their professional profile and unlock global career opportunities.

Can Indian Chartered Accountants Take the US CPA Exam?

The direct answer: yes, indian CAs are eligible

Let us start with the question that brought you here. Yes, Indian Chartered Accountants are eligible to take the US CPA exam.

The American Institute of Certified Public Accountants (AICPA) and the National Association of State Boards of Accountancy (NASBA) have established pathways that allow international candidates, including Indian CAs, to pursue CPA certification. Your CA qualification, combined with your undergraduate degree, positions you well to meet the educational requirements that US state boards demand.

However, eligibility is not automatic.

You must understand the specific requirements, choose the right state board, and ensure your credentials are properly evaluated. The good news is that the process, while detailed, is entirely manageable when you know what to expect.

Understanding why CAs make strong CPA candidates

The Indian CA curriculum is one of the most comprehensive accounting programs in the world. You have studied financial reporting, auditing, taxation, corporate law, and strategic management at a depth that rivals or exceeds many international qualifications. This rigorous training means you already possess substantial knowledge that overlaps with the CPA exam syllabus.

US state boards recognize this rigor.

When credential evaluators assess your CA qualification, they see a professional certification that required passing multiple levels of examinations and completing three years of practical training. This is precisely the kind of academic and professional preparation that the CPA licensing process values.

The three requirements every ca must meet

To become a licensed CPA, you must satisfy what the profession calls the “3 Es”: Education, Examination, and Experience.

Education: You need a minimum of 120 semester credit hours to sit for the CPA exam in most states, and 150 credit hours to obtain your license. Your B.Com degree plus CA qualification typically provides enough credits to meet these thresholds, though the exact count depends on your specific educational background and the state you choose.

Examination: You must pass all four sections of the Uniform CPA Examination within a rolling 30-month window. The exam is administered by the AICPA and can be taken at Prometric testing centers, including locations in India.

Experience: Most states require one to two years of relevant accounting experience verified by a licensed CPA or, in some cases, an equivalent professional. Your articleship and post-qualification work experience can often satisfy this requirement.

For a detailed breakdown of exam structure, format, and administration, you can also refer to this guide on the Certified Public Accountant Exam in the US.

How the CA Qualification Strengthens Your CPA Application

Academic rigor that US state boards recognize

Your CA qualification represents years of intensive study and examination. When credential evaluation agencies assess your transcripts, they translate your Indian education into US semester credit hours.

The CA qualification itself is typically recognized as equivalent to 30 to 60 additional credits beyond your undergraduate degree, depending on the state and evaluator.

This recognition is not arbitrary.

The CA Final examinations cover advanced topics in financial reporting, auditing, taxation, and strategic management that align closely with CPA exam content. State boards understand that a candidate who has passed the CA examinations has demonstrated competency in core accounting areas.

Professional experience that counts toward licensing

The three-year articleship required for CA qualification is a significant advantage.

This practical training, completed under the supervision of a practicing Chartered Accountant, provides exactly the kind of hands-on experience that CPA licensing requires. You have audited financial statements, prepared tax returns, advised clients on compliance matters, and worked with real-world accounting challenges.

Many states accept this articleship experience toward the CPA experience requirement, particularly when it involves auditing, attestation, or financial reporting work. Some states also accept post-qualification experience gained at Big 4 firms or multinational corporations, even if your supervisor was not a US-licensed CPA.

Common Misconceptions About CA Eligibility for CPA

Myth vs Reality: What state boards actually accept

Myth: You need a master’s degree to be eligible for the CPA exam. Reality: While some states require 150 credit hours for licensing, many allow you to sit for the exam with 120 credits. Your B.Com plus CA combination often meets or exceeds these thresholds without requiring additional degrees.

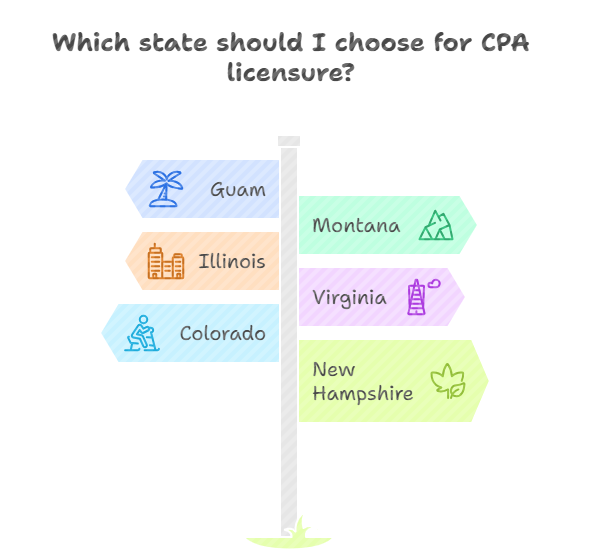

Myth: The CA qualification is no longer recognized by US state boards. Reality: While some states have changed their rules over the years, several states continue to recognize CA credentials favorably. States like Guam, Montana, Illinois, and Virginia remain popular choices for Indian CA candidates.

Myth: You must have a US Social Security Number to take the CPA exam. Reality: Many states do not require an SSN for exam eligibility. You can obtain an alternative identifier and proceed with your application.

Why some CAs face rejection (and how to avoid it)

Some CA candidates do face challenges in the application process. The most common reasons include applying to states with strict requirements that do not favor international credentials, submitting incomplete documentation, or choosing evaluation agencies that the state board does not accept.

To avoid rejection, research your target state’s requirements thoroughly before applying. Ensure your credential evaluation is completed by an approved agency, and prepare all required documents from both your university and the Institute of Chartered Accountants of India (ICAI). When in doubt, contact the state board directly or consult with CPA coaching institutes that specialize in helping Indian candidates.

How Many CPA Credit Hours Does a B.Com + CA Provide for US CPA Eligibility?

What Are CPA Credit Hours and How Do They Work?

The US higher education system measures academic achievement in semester credit hours. One year of full-time study at a US university typically equals 30 semester hours. To sit for the CPA exam, most states require 120 credit hours, which is equivalent to a four-year bachelor’s degree. To obtain your CPA license, you typically need 150 credit hours, equivalent to five years of higher education.

For Indian candidates, this creates an initial challenge. The standard B.Com degree in India is three years, which translates to approximately 90 credit hours. This leaves a gap that must be filled through additional qualifications, postgraduate education, or professional certifications like the CA.

Credit Allocation for B.Com + CA

B.Com credits: what your degree provides

Many Indian B.Com degrees are evaluated by U.S. credential-evaluators as yielding fewer credit hours than a standard 4-year U.S. bachelor’s — often in the ballpark of 80–100 semester credits.

In some cases, depending on the detail and strength of the academic record (course load, transcripts showing course-wise marks, institutional standing, etc.), evaluators may award additional credit hours. Some applicants report that under favorable evaluation results their B.Com has been treated more closely to a U.S. 4-year degree. However, this outcome is not guaranteed and varies case-by-case depending on the evaluator and state board reviewing the credentials.

CA qualification credits: State-by-state recognition

The Indian Chartered Accountant (CA) qualification is evaluated for U.S. CPA eligibility on a state-by-state basis, as each state board sets its own education rules. Because there is no mutual recognition agreement between ICAI and any U.S. accounting body, Indian CAs must complete the full Uniform CPA Examination and meet the applicable experience requirements.

Credential evaluation services—most commonly NASBA’s International Evaluation Services (NIES)—review the CA’s academic components, examinations, and articleship to determine their U.S. semester-hour equivalency toward the 120–150 credit-hour education requirements. Historically, evaluators have awarded roughly 20–30 semester hours for the CA qualification, depending on documentation and curriculum structure. Articleship may, in some cases, contribute limited additional value toward either education or experience, but this is not guaranteed and varies by evaluator and state rules.

Some states, such as Guam, Montana, and Alaska, are popular among international candidates because they allow non-residents to apply and accept NIES evaluations without requiring a U.S. SSN for exam eligibility. Colorado also accepts foreign evaluations but imposes stricter academic requirements, including higher total credit hours and specific accounting coursework. Because state policies evolve, applicants should always verify current requirements directly through NASBA or the relevant state board before applying.

Additional qualifications that boost your credits

If your B.Com plus CA combination falls short of 150 credits, additional qualifications can bridge the gap:

M.Com: A two-year Master of Commerce degree adds approximately 60 credits, easily taking you to 150+ total credits.

MBA: Similarly, a two-year MBA provides around 60 additional credits. If your MBA is in Finance or Accounting, it may also help satisfy accounting-specific credit requirements some states impose.

CS or CMA: The Company Secretary qualification or Cost and Management Accountant certification can add 20 to 30 credits, depending on how the evaluator assesses these credentials.

B.Com (3 years) + CA: Complete credit analysis

The most common pathway for Indian CAs is the B.Com plus CA combination without additional postgraduate degrees. This pathway typically yields between 120 and 150 credit hours, depending on how your credentials are evaluated.

If your B.Com is recognized at 90 credits and your CA at 30 credits, you have 120 total credits. This is sufficient to sit for the CPA exam in many states but may fall short of the 150-credit licensing requirement. In this scenario, you can take additional coursework through US-based programs or bridge courses to reach 150 credits after passing the exam.

If your evaluator recognizes your B.Com at 120 credits (for NAAC A-grade universities with first division) and your CA at 30 credits, you have 150 total credits and meet both exam and licensing thresholds.

B.Com + CA + M.Com: The 150 Credit Pathway

Adding an M.Com to your qualifications eliminates any uncertainty about meeting the 150-credit requirement. Your credit calculation would look like this:

B.Com: 90 credits CA: 30 credits M.Com: 60 credits Total: 180 credits

With 180 credits, you comfortably exceed both the exam and licensing requirements. This pathway is particularly straightforward because evaluators have clear academic credentials to assess, and state boards have no room to question your eligibility.

B.Com + CA + MBA: Alternative route to full eligibility

An MBA provides the same credit boost as an M.Com, giving you approximately 180 total credits. The added advantage of an MBA is the business coursework, which can help satisfy the business credit requirements that some states impose alongside accounting credits.

If your MBA includes finance, accounting, or related concentrations, the coursework may also strengthen your preparation for the REG and BAR sections of the CPA exam.

Which US States Are Best for Indian CA Holders to Apply?

Choosing the right state is one of the most important decisions you will make in your CPA journey. Each of the 55 US jurisdictions (50 states plus 5 territories) has its own requirements for education, examination, and experience. Some states are significantly more favorable for Indian CA candidates than others.

Top 6 States for Indian CAs Seeking CPA Licensure

Guam

Guam remains a popular jurisdiction for international CPA candidates because of its straightforward application process and lack of U.S. residency requirements.

- Requires 150 credit hours for full licensure.

- Candidates with a qualifying 120-hour degree may sit for the exam and can obtain an inactive license until they complete 150 credits.

- Foreign education is evaluated through approved agencies such as NASBA’s NIES.

- Guam participates in NASBA’s international exam administration structure, and many candidates later transfer scores or credentials to other jurisdictions where permitted.

Montana

Montana is generally considered accessible for foreign-educated candidates and offers flexible pathways for those without a U.S. SSN.

- Accepts foreign academic credentials through board-approved evaluation agencies (e.g., FACS, NIES—confirm the current list).

- Provides an SSN affidavit option for applicants who do not yet have a U.S. Social Security Number.

- Experience may be verified by a licensed CPA or through NASBA’s Experience Verification Service, which assists candidates whose supervisors were not U.S. CPAs.

Illinois

Illinois is widely used by international candidates because it does not require an SSN solely to apply for the CPA exam.

- Foreign academic credentials are evaluated through NIES or other evaluators approved by the Illinois Board.

- Specific coursework requirements (e.g., accounting research/research & analysis) may require an additional course for some candidates.

- Note: An SSN or board-approved alternative may be required at the licensure stage.

Virginia

Virginia offers a clear exam and licensure process and makes effective use of NASBA’s Experience Verification Service.

- Accepts foreign academic evaluations through NIES/NASBA.

- Requires one year of relevant experience for licensure.

- Experience typically must be verified by a CPA. Candidates without CPA supervision may—in many cases—use NASBA’s Experience Verification Service, subject to Virginia Board requirements.

Colorado

Colorado remains friendly to foreign-educated applicants and provides pathways for verifying international work experience.

- Accepts foreign credential evaluations through recognized agencies.

- Allows certain international experience if it meets Colorado’s rules and is properly verified.

- May accept verification from supervisors with certain foreign designations under NASBA/IQAB reciprocity arrangements, subject to Colorado Board approval.

- Offers an affidavit option for candidates without a U.S. SSN at initial stages.

New Hampshire

New Hampshire offers a straightforward 120/150 credit-hour structure and uses recognized international credential evaluation services.

- Generally uses NIES for foreign credential evaluation.

- Requires 120 credit hours to sit for the exam and 150 hours for licensure.

- Experience must be verified by a CPA; international applicants may use NASBA’s Experience Verification Service.

- Important: New Hampshire requires a U.S. Social Security Number for licensure, which applicants should factor into their long-term planning.

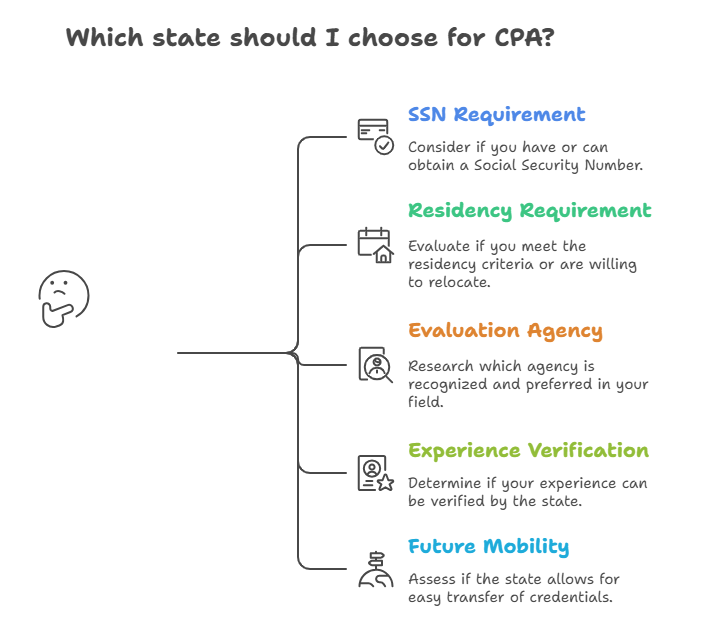

How to Choose Your State: SSN, Residency, Evaluation Rules

When selecting your state, consider these key factors:

SSN Requirement: If you do not have a US Social Security Number, eliminate states that require one. Guam, Montana, Illinois, and several others do not require an SSN for exam eligibility.

Residency Requirement: Most international-friendly states do not require US residency or citizenship. Verify this before applying.

Evaluation Agency: Some states only accept evaluations from NASBA International Evaluation Services (NIES), while others accept World Education Services (WES) or multiple agencies. Confirm which evaluator your target state accepts before paying for an evaluation.

Experience Verification: If your work experience was supervised by a non-CPA, choose a state that accepts alternative verification methods or participates in NASBA’s experience verification service.

Future Mobility: Consider where you might want to practice or work in the future. CPA licenses can often be transferred between states through reciprocity, but starting with a flexible state makes the initial process easier.

Which states reject or limit CA credits?

Some states have become stricter regarding international credentials over the years. Michigan and New Hampshire previously recognized Indian CA certificates more favorably but have since changed their policies. Delaware, which once accepted three-year degrees, now requires a standard four-year bachelor’s equivalent.

States with strict requirements for accounting-specific credit hours may also pose challenges for CA holders whose coursework is categorized differently by evaluators. California, for example, requires 48 accounting credit hours, which can be difficult to satisfy depending on how your CA curriculum is evaluated.

Before applying to any state, research current requirements thoroughly and consider contacting the state board directly to confirm your eligibility.

How should Indian CAs get their credentials evaluated for the US CPA exam?

Credential evaluation is a mandatory step for any Indian candidate seeking CPA certification. Your Indian transcripts and CA qualification must be assessed by an approved evaluation agency that translates your credentials into US-equivalent semester credit hours.

WES vs NIES: Which evaluation service is better for CA holders?

Two evaluation agencies dominate the CPA credential evaluation space: World Education Services (WES) and NASBA International Evaluation Services (NIES).

NIES (NASBA International Evaluation Services): NIES is operated directly by NASBA, the organization that coordinates CPA examination services. Many state boards prefer or exclusively accept NIES evaluations because of this direct relationship. NIES offers a CPA-specific evaluation package designed for accounting board requirements.

If you are uncertain which state to apply to, NIES offers an “Undecided Jurisdiction Evaluation” that assesses your credentials against multiple states’ requirements, helping you identify the best fit.

WES (World Education Services): WES is a well-established credential evaluation agency with extensive experience evaluating Indian qualifications. WES offers a CPA Supplemental Report specifically designed for state accounting boards, and their CPA International Credential Advantage Package (ICAP) stores your verified transcripts for easy sending to multiple boards.

Not all states accept WES evaluations. Before choosing WES, confirm that your target state’s board accepts their reports.

Recommendation for CA Holders: Given that some states exclusively require NIES evaluations and NIES is directly connected to NASBA, we recommend starting with NIES unless you have a specific reason to choose WES. This approach maximizes your flexibility if you decide to change states during the application process.

Required documentation from ICAI and the university

Preparing your documents properly is essential for a smooth evaluation process. You will need:

From Your University: Official transcripts or mark sheets for your B.Com degree. These must be issued on official university letterhead with the registrar’s signature and seal. Some evaluators require transcripts to be sent directly from the university in a sealed envelope.

Degree certificate or provisional certificate confirming the award of your degree.

If you have an M.Com, MBA, or other postgraduate qualification, you need official transcripts and degree certificates for those as well.

From ICAI: Membership certificate confirming your CA qualification. Mark sheets for CA Foundation, Intermediate, and Final examinations. Articleship completion certificate showing your three years of practical training.

Translations: If any documents are in languages other than English, you must provide word-for-word translations by a certified translator alongside the original language documents.

Evaluation Processing Times and Costs

Processing times

NIES (NASBA International Evaluation Services): Expect around four to six weeks after all required documents are received and verified. Actual processing can be somewhat faster or slower depending on volume.

WES (World Education Services): WES generally begins evaluation after document verification, and processing commonly takes about 7–10 business days once all materials are accepted. International candidates may experience extra time during verification if institutions are slow to respond.

Practical Guidance for International Candidates: To be safe, plan for a total timeline of four to six weeks, especially if university verification or postal delays occur.

| Evaluation Service | Typical Fee (USD) | Approx. INR Range (2025) | Notes |

| NIES – CPA Evaluation | USD 200–250 | ₹17,000–₹23,000 | Higher fees may apply for rush/expedited services. |

| WES – CPA Board Evaluation (ICAP recommended) | USD 345 | ₹25,000–₹30,000 | Delivery charges are additional. |

| Delivery / Courier Fees (NIES & WES) | USD 10–60+ | ₹800–₹6,000 | Varies by destination, number of copies, and courier option. |

These costs are approximate and subject to exchange rate fluctuations. Check current fees directly with the evaluation agency before applying.

What Is the Fastest Preparation Plan for Indian CAs Taking the CPA Exam?

Here is where your CA qualification becomes a genuine advantage. Unlike candidates starting from scratch, you have already mastered many of the concepts tested on the CPA exam. With the right strategy, you can pass all four sections faster than the typical candidate.

Key Syllabus Overlap Between CA and CPA

The CPA exam consists of three Core sections and one Discipline section of your choice. Let us examine how your CA knowledge maps to each section:

Financial Accounting and Reporting (FAR): This section covers financial reporting frameworks, including US GAAP for businesses, government entities, and nonprofits. Your CA Final Paper 1 (Financial Reporting) provides an excellent foundation. The conceptual frameworks, revenue recognition principles, and financial statement preparation you studied align closely with FAR content. You will need to learn US GAAP-specific rules, but the underlying principles are familiar.

Auditing and Attestation (AUD): Your CA training in auditing, covered extensively in CA Final Paper 3 (Advanced Auditing) and your articleship experience, directly applies here. Audit planning, risk assessment, internal controls, and audit evidence concepts are similar between Indian and US standards. The main adjustment is learning US auditing standards (PCAOB and AICPA) rather than Indian standards.

Taxation and Regulation (REG): This is where you will face the most new material. REG covers US federal taxation, business law, and ethics. While you studied Indian taxation extensively, US tax law is entirely different. Plan to spend more time on this section, but your analytical skills and understanding of tax concepts will help you learn faster.

Discipline Sections: You must choose one of three Discipline sections:

- Business Analysis and Reporting (BAR): Extends FAR concepts; good choice for CAs strong in financial reporting

- Information Systems and Controls (ISC): Focuses on IT auditing and controls; suitable if you worked on systems audits during articleship

- Tax Compliance and Planning (TCP): Extends REG concepts; choose only if you want to deepen US tax expertise

For most Indian CAs, BAR is the recommended Discipline choice because it builds on the financial reporting knowledge you already have.

How to Choose the Right CPA Review Course as a CA

A quality CPA review course is essential for exam success. The major providers include Becker, Wiley, Surgent, and Gleim. Each has strengths depending on your learning style and budget.

Becker: The most widely used CPA review course, known for comprehensive content and high pass rates. Becker’s structured approach works well for candidates who prefer following a set curriculum. Premium pricing, but often available through employer sponsorship at Big 4 firms.

Wiley: Offers unlimited access until you pass, making it ideal for candidates who may take longer or want ongoing access. Strong question bank and adaptive learning technology. More affordable than Becker.

Surgent: Uses adaptive learning to identify your weak areas and focus study time efficiently. Good choice for CAs who want to leverage existing knowledge and not waste time on topics they already know. Mid-range pricing.

Gleim: Known for its extensive question bank and detailed explanations. Self-study focused with less video content. Most affordable option among major providers.

Recommendation for CAs: If you want to maximize study efficiency and leverage your existing knowledge, Surgent’s adaptive platform is particularly well-suited for CA holders. It identifies what you already know and focuses your time on new material. If budget is a concern, Gleim provides excellent value. If your employer offers Becker, take advantage of it.

Does CA Articleship and Work Experience Count Toward CPA Licensing Requirements?

Meeting the experience requirement is often the final hurdle for international candidates. Let us clarify how your CA articleship and subsequent work experience can satisfy CPA licensing requirements.

Understanding CPA Experience Rules

Most states require one to two years of relevant accounting experience for CPA licensing. The experience must typically be verified by an actively licensed CPA who supervised your work. The type of experience that qualifies usually includes:

Public accounting work such as auditing, attestation, and tax services. Private industry accounting work in financial reporting, internal audit, or tax departments. Government accounting and audit work.

The key challenge for Indian candidates is the verification requirement. If you worked in India under a CA supervisor rather than a US CPA, some states will not accept that experience without alternative verification.

When CA Articleship Is Accepted vs Not Accepted

Accepted: States that participate in NASBA’s Experience Verification Service can help you verify articleship experience even if your supervising CA was not a US CPA. Guam, Montana, and Michigan participate in this service.

States with flexible experience requirements may accept articleship if the work involved auditing, attestation, or other qualifying activities. Virginia, for example, does not require your supervisor to be a CPA.

Not Accepted: States that strictly require supervision by an actively licensed US CPA will not accept articleship supervised by an Indian CA. In these states, you would need to gain experience after qualification under a US CPA’s supervision.

How to Verify Big 4 or MNC Work Experience for CPA Licensing

If you work at a Big 4 firm (Deloitte, PwC, EY, KPMG) in India, there is a good chance you have US CPA colleagues in your office or within your practice area. These CPAs can verify your experience for licensing purposes, even if they were not your direct supervisor during every engagement.

Similarly, if you work at a multinational corporation with US-based finance leadership, a US CPA within your organization may be able to verify your experience.

When seeking verification:

- Identify US-licensed CPAs within your organization or network

- Confirm they are actively licensed and in good standing

- Discuss your work responsibilities to ensure they can accurately describe your experience

- Complete the state board’s verification form together

How Much Does It Cost for an Indian CA to Become a CPA?

Understanding the full financial investment helps you plan effectively. Here is a comprehensive breakdown of costs in Indian Rupees, based on current 2025 rates (approximate, as fees and exchange rates fluctuate).

| Phase / Cost Component | Typical USD Amount (2025) | Estimated INR Equivalent (2025) | Comments / Notes |

| Education Evaluation (credential evaluation) | $200–$250 (NASBA NIES) | ₹18,000–₹22,500 | Required for foreign degrees like Indian CA; NIES standard. Indian CAs meet education equivalence (no extra hours needed). |

| Courier / Delivery (evaluation documents, shipping, etc.) | $10–$60+ | ₹900–₹5,400+ | Varies; often ₹2,000–₹4,000 India-U.S. |

| One-time application / registration (state board / NTS / first-time fees) | $50–$200 (varies by state) | ₹4,500–₹18,000 | E.g., $20 TX, $133 MA; low-fee states like AK/CO for Indians. |

| Exam section fee (domestic portion, per section) | $265–$390 (state-set) | ₹23,900–₹35,200 per section | Varies by board (e.g., $265.57 VA, up to $390 post-2025 adjustments); paid to NASBA. Total for 4: $1,060–$1,560 (₹95,600–₹1.41 lakh). |

| International Testing Fee (for Indian / overseas test-center, per section) | $510 (full surcharge) | ₹46,000 per section | Mandatory for India (Prometric in 8 cities); x4 = $2,040 (₹1.84 lakh). Effective June 1, 2025. |

| Total exam fees (per section, India/international) | $775–$900 | ₹69,900–₹81,200 per section | Domestic + surcharge; Indian CAs take full 4 (no waivers). |

| Total exam fees (all 4 sections) | $3,150–$3,800 (first attempt) | ₹2.84–₹3.43 lakh | Includes app/registration; retakes +$50–$300/section. Continuous testing available. |

| Review / Prep Course (optional but common among Indian candidates) | Varies; $700–$3,100 full | ₹63,000–₹2,80,000+ | Becker: $2,700 (₹2.43 lakh direct; ₹1.4–1.8 lakh via Indian partners). Bundles: ₹80,000–₹2 lakh. |

| Post-Exam Steps (Licensing / Ethics / Miscellaneous, if applicable) | |||

| – Ethics exam | $250–$320 (AICPA) | ₹22,500–₹28,800 | Required in ~35 states; discounts for members. |

| – State Board Licensing / Registration Fee (if seeking U.S. license) | $50–$500 (varies by state) | ₹4,500–₹45,000 | E.g., $50 TX, $590 CA; plus $100–$800 experience verification if needed. |

Your actual cost will fall within this range depending on your choice of review course, state, and whether you pass each section on the first attempt.

Career Benefits of Holding Both CA and US CPA

The investment of time and money in CPA certification delivers substantial returns for CA holders. Let us examine why the CA plus CPA combination is so powerful.

Why the CA + CPA Combination is Powerful

Holding both qualifications gives you dual expertise in Indian and US accounting standards. You understand Indian GAAP, Ind AS, and IFRS from your CA training, while your CPA credential demonstrates proficiency in US GAAP, US auditing standards, and federal taxation. This combination is rare and highly valued.

Multinational corporations operating in India need professionals who can bridge both accounting frameworks. US-listed Indian companies require expertise in SEC reporting and US GAAP reconciliation. Big 4 firms serving international clients need team members who understand cross-border accounting issues.

Salary Impact: What CA + CPA Professionals Earn

While individual salaries vary based on experience, location, and employer, dual-qualified professionals consistently earn premiums over those with single credentials.

Entry to Mid-Level (0-5 years post-CA): CA only: ₹8-15 LPA CA + CPA: ₹12-22 LPA

Senior Level (5-10 years): CA only: ₹18-30 LPA CA + CPA: ₹28-45 LPA

Leadership Level (10+ years): CA only: ₹35-60 LPA CA + CPA: ₹50-80+ LPA

At Big 4 firms specifically, the CPA credential often accelerates promotion timelines and opens doors to international secondments and global roles. Partners and senior directors in US GAAP-focused practices typically hold CPA certification.

Career Paths Open to CA + CPA Holders

The dual qualification opens several career paths:

Big 4 and Global Accounting Firms: Leadership roles in audit, tax, and advisory practices serving international clients. Opportunities for international transfers to US, UK, or other global offices.

Multinational Corporations: CFO and senior finance leadership roles at US-headquartered companies with Indian operations. Controller positions requiring both local and US GAAP expertise.

US-Based Opportunities: The CPA license enables you to work in the US if you obtain appropriate work authorization. H-1B visas are commonly sponsored for CPAs in accounting roles.

Independent Practice: Dual qualification allows you to serve clients with cross-border operations, providing compliance, advisory, and tax services across jurisdictions.

Conclusion

Indian Chartered Accountants are not just eligible for the US CPA exam; you are exceptionally well-prepared for it. Your rigorous CA training has given you deep knowledge in accounting, auditing, and financial reporting that directly applies to CPA exam content. With strategic state selection, proper credential evaluation, and an efficient study plan, you can add the CPA credential to your profile in 12 to 18 months.

The pathway is clear: confirm your credit calculation, choose a state that welcomes international candidates, get your credentials evaluated through NIES or WES, and leverage a quality review course to fill knowledge gaps in US-specific topics. Your articleship and work experience can satisfy licensing requirements, especially if you choose states with flexible verification options.

The investment of ₹4 to ₹6.5 lakh is significant but delivers strong returns through salary premiums, career acceleration, and access to global opportunities. The CA plus CPA combination positions you among the most versatile and valuable accounting professionals in the market.

Take the first step today. Request your official transcripts, gather your ICAI documents, and begin the credential evaluation process. Within 18 months, you could join the elite group of professionals who hold both the CA and CPA credentials.

Frequently Asked Questions

Can I take the CPA exam with just B.Com and CA, without a master’s degree?

Yes. The B.Com plus CA combination typically provides 120 to 150 credit hours depending on how your credentials are evaluated. Many states allow you to sit for the exam with 120 credits, and you can complete additional credits for licensing after passing the exam.

How many credits does the CA qualification give me for CPA?

The CA qualification is typically evaluated at 30 to 60 semester credit hours, depending on the state and evaluation agency. Combined with your B.Com degree, this usually meets or approaches the 150-credit licensing requirement.

Which is the easiest state for Indian CA holders to get a CPA license?

Guam is the most popular choice due to flexible requirements: no SSN needed, no residency requirement, 120 credits for exam eligibility, and NASBA experience verification service. Montana and Illinois are also favorable for Indian candidates.

Do I need a Social Security Number (SSN) to take the CPA exam?

No. Several states, including Guam, Montana, Illinois, and Virginia, do not require an SSN for exam eligibility. You can obtain an alternative identifier and proceed with your application.

Can I take the CPA exam in India, or do I need to travel to the US?

You can take the CPA exam in India. Prometric testing centers are available in eight Indian cities: Ahmedabad, Bangalore, Calcutta, Chennai, Hyderabad, Mumbai, New Delhi, and Trivandrum.

How long does it take for a CA to pass all four CPA sections?

Most CAs can pass all four sections within 9 to 15 months with focused preparation. Your existing knowledge in accounting and auditing reduces the learning curve compared to candidates without professional qualifications.

Is the CPA exam difficult for Indian Chartered Accountants?

The CPA exam is challenging but manageable for CAs. Your familiarity with accounting and auditing concepts provides a strong foundation. The main challenges are learning US-specific tax law and adapting to the computerized exam format.

What is the total cost of CPA for an Indian CA in 2025?

The total investment ranges from approximately ₹3.9 lakh to ₹6.5 lakh, including evaluation fees, exam fees, review course, and licensing costs. Your actual cost depends on your choice of review course and whether you pass sections on the first attempt.

Can my CA articleship experience count toward CPA experience requirements?

Yes, in states with flexible verification options. States like Guam and Montana participate in NASBA’s experience verification service, which can help verify articleship experience. Virginia allows non-CPA supervisors to verify experience.

Do I need to work under a US CPA to get my license?

Not in all states. Some states accept experience verified by non-CPA supervisors or through NASBA’s experience verification service. If you work at a Big 4 firm or MNC, US CPAs within your organization can often verify your experience.

Which CPA exam section is easiest for CA holders?

Most CAs find the AUD (Auditing and Attestation) section most familiar due to extensive audit training during CA. FAR (Financial Accounting and Reporting) also leverages your financial reporting knowledge, though you must learn US GAAP specifics.

Is CPA worth it if I plan to stay and work in India?

Yes. The growing presence of US-based multinationals, US-listed Indian companies, and global service delivery centers in India creates strong demand for CPAs. Dual-qualified professionals earn significant salary premiums even when working in India.

Can I use my CA experience gained in India for CPA licensing?

Yes, if you choose the right state. Experience gained under a CA supervisor can be verified through NASBA’s experience verification service in participating states. If you work under a US CPA in India, that experience typically qualifies in all states.

What documents do I need from ICAI for CPA evaluation?

You need your ICAI membership certificate, mark sheets for all CA examination levels (Foundation, Intermediate, Final), and your articleship completion certificate. Ensure all documents are official copies with appropriate signatures and seals.

How is the CA to CPA pathway different from B.Com to CPA pathway?

CA holders have significant advantages: more credits toward the 150-hour requirement, overlapping subject knowledge that reduces study time, and articleship experience that can count toward licensing. B.Com-only candidates must complete additional education and start from scratch on all exam content.

Allow notifications

Allow notifications