Complete guide to choosing the best CPA review course for Indian candidates. Compare Becker vs Surgent vs Gleim vs Wiley with INR pricing, Indian coaching partnerships, and profile-based recommendations.

Table of Contents

Choosing the right CPA review course from India can feel like navigating a maze blindfolded. You are investing somewhere between ₹2 lakh to ₹4 lakh, committing 12 to 18 months of your life, and making a decision that will shape your entire accounting career.

Yet most of the information available online is written for American candidates, with pricing in dollars and no understanding of the unique challenges Indian professionals face.

The stakes could not be higher.

Pick the wrong course, and you might waste months studying with materials that do not match your learning style. Choose wisely, and you could be celebrating your CPA license in under a year.

The difference often comes down to understanding which course aligns with your background, whether you are a CA looking to add international credentials or a B.Com graduate building your foundation from scratch.

This guide cuts through the marketing noise and gives you exactly what you need to make an informed decision. We will break down the four major CPA review courses, compare their features side by side, show you all the pricing in Indian Rupees, and explain how course offered by Skill Arbitrage fits into this picture.

By the end, you will know precisely which course matches your profile, budget, and career goals.

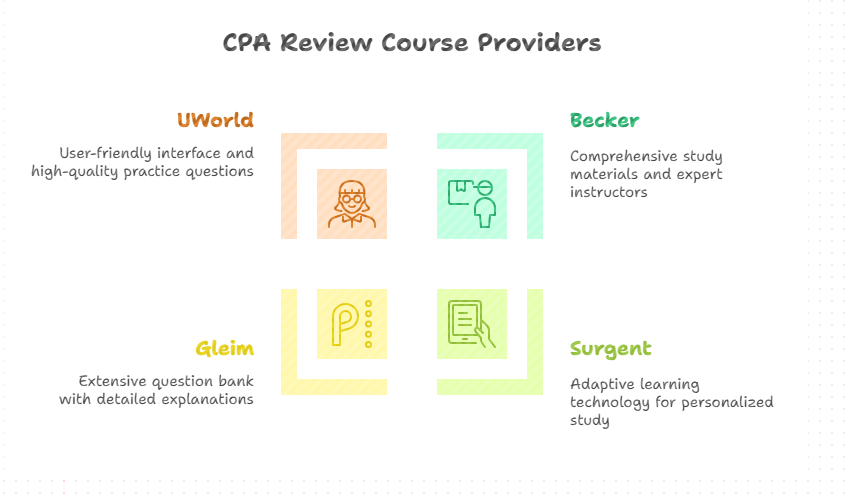

The Four Major CPA Review Course Providers

The CPA review course market is dominated by four major players, each with distinct strengths and positioning. Understanding these differences is your first step toward making the right choice for your CPA journey from India.

Becker CPA Review stands as the undisputed industry leader with over 60 years of experience helping candidates pass the CPA exam. The company has trained nearly two million candidates and enjoys endorsements from all Big 4 accounting firms. Becker’s premium positioning means higher prices, but also comes with the most comprehensive suite of features, including AI-powered learning tools and extensive live class options.

Surgent CPA Review has carved out a reputation as the technology innovator in the space. Founded by CPA exam veterans, including Liz Kolar, Surgent built its entire approach around adaptive learning technology called A.S.A.P. that claims to reduce study time by up to 400 hours. For time-pressed Indian professionals juggling work and study, this efficiency promise makes Surgent particularly attractive.

Gleim CPA Review takes pride in offering the most exhaustive preparation materials in the industry. With over 10,000 multiple-choice questions and 1,300 task-based simulations, Gleim provides more practice opportunities than any competitor. The company was founded by Dr. Irvin Gleim in 1974 and has been a trusted name in accounting education for five decades, particularly popular among universities and academic institutions.

UWorld CPA Review represents the consolidated powerhouse formed from two beloved brands. UWorld acquired Roger CPA Review in 2019 and Wiley CPA Review in 2023, combining Roger Philipp’s legendary teaching style with Wiley’s comprehensive question banks. The merged platform now features Peter Olinto, who spent 25 years at Becker before joining UWorld, creating a formidable instructor lineup.

Each provider occupies a distinct position in the market. Becker targets candidates willing to pay premium prices for premium results and Big 4 credibility. Surgent appeals to efficiency-focused professionals who want to minimize study time through technology. Gleim attracts detail-oriented learners who want to leave no stone unturned in their preparation. UWorld positions itself as the engaging middle ground with charismatic instructors and solid question banks.

The competitive landscape has shifted dramatically in recent years. The Wiley and Roger mergers under UWorld created uncertainty that some candidates find concerning. Meanwhile, Becker has responded by enhancing its technology offerings with AI features like the Newt assistant. Surgent and Gleim have maintained their core strengths while adding modern conveniences like mobile apps and adaptive learning.

Key Indian Coaching Partnerships You Should Know About

Understanding the Indian coaching ecosystem is crucial because it can dramatically change your CPA preparation experience and costs. Several US course providers have established partnerships with Indian institutions that bundle their materials with local support, live classes, and mentorship.

Becker has partnered with Simandhar Education as their exclusive authorized training partner in India. This partnership means Indian candidates can access Becker’s world-class materials while receiving live instruction from Indian CPAs who understand the local context. Simandhar adds value through doubt-clearing sessions, structured study schedules, and placement assistance with Big 4 firms. The Simandhar and Becker bundle typically costs between ₹1,40,000 to ₹1,80,000, which includes the complete Becker course access, live classes conducted by Sripal Jain and other qualified CPAs, mock exams, and end-to-end support from evaluation to licensing. For candidates who prefer guided learning with local support, this partnership offers significant value beyond what you would get by purchasing Becker directly.

UWorld’s Wiley content has found a home with Miles Education, one of India’s most recognized CPA coaching institutes. Miles has built a reputation for comprehensive support that extends from eligibility evaluation through job placement. Their partnership with Wiley provides access to the course materials along with Miles’ proprietary study methodology and analytics. Miles Education charges approximately ₹1,08,900 and above for their CPA program, which bundles Wiley study materials with live sessions, weekend and weekday batch options, and their signature LMS platform. The institute boasts strong placement records with Big 4 firms and multinational corporations, making it attractive for candidates prioritizing career outcomes alongside exam success.

Gleim has partnered with Concorde Academics to serve the Indian market. This partnership offers the Gleim Premium CPA Review bundled with virtual classroom sessions conducted three times weekly. The program includes over 300 hours of interactive training from faculty who hold both CA and CPA qualifications. The Concorde and Gleim bundle is priced at approximately ₹1,20,000, making it one of the more affordable coaching options. The partnership handles all the complex formalities, including CPA evaluation, exam registration processes, and licensing procedures. For candidates intimidated by the administrative complexity of pursuing a CPA from India, this hand-holding approach provides peace of mind.

Alongside these major partnerships, a major ed tech company—SkillArbitrage’s CPA Prep & Global Finance Career Acceleration Program—has emerged with a distinctive model. Instead of partnering with a U.S. course provider, SkillArbitrage delivers its own structured, NSDC-recognized training program that integrates live instructor-led classes, assignments, practical finance tools, and career-focused training. The program follows a 6-month, 8–10 hours/week schedule and includes two live classes every week, weekly practical assignments, LMS and mobile app access, mock tests, article writing training, freelancing templates, and two mock client interviews. Candidates receive a co-branded NSDC & Skill India certificate upon completion.

SkillArbitrage prices its standard plan at ₹120,000 (all-inclusive), positioning itself competitively against more established partnerships. Although the program does not bundle U.S. publisher materials like Becker, Wiley, or Gleim, it compensates with extensive skill-building modules in Excel, automation, AI-based financial workflows, and industry-style projects—making it particularly suitable for candidates who want both exam preparation support and real-world finance exposure. The institute also manages pre-exam guidance, exam strategy planning, and licensing orientation, while offering a 30-day participation-based refund window. Enrollment is currently waitlist-based due to limited seats in each cohort.

Self-Study vs Indian Coaching Institute Partnerships

The decision between purchasing directly from US providers or going through an Indian coaching institute fundamentally shapes your CPA preparation experience. Both paths can lead to success, but they suit different types of candidates.

Self-study through direct purchase gives you complete flexibility and often lower costs. You can access the course immediately after payment, study at your own pace, and skip any content you already know. This path works well for disciplined learners who have strong time management skills and do not need external accountability to stay on track.

The direct purchase approach also means you interact directly with the US provider’s support systems. Response times may not align with Indian business hours, and support staff may not understand India-specific questions about evaluation agencies or state selection. You will need to figure out eligibility requirements, document submission, and exam scheduling largely on your own.

The coached path through Indian partners adds a layer of structure and support that many candidates find invaluable. You get scheduled classes that create accountability, instructors who can explain concepts in familiar contexts, and administrative support for the complex CPA process. Doubt-clearing sessions mean you never stay stuck on a concept for days.

Indian coaching institutes also provide peer communities where you can connect with fellow candidates facing similar challenges. The motivation boost from studying alongside others, sharing tips, and celebrating milestones together should not be underestimated during a demanding 12 to 18-month journey. Many institutes also facilitate study groups and WhatsApp communities for ongoing support.

The pros of self-study include lower costs in many cases, complete schedule flexibility, and the ability to accelerate through topics you already understand. You avoid the overhead of institute fees and can choose exactly which course package suits your needs. Self-study also builds self-reliance skills that serve you well throughout your career.

The cons of self-study include isolation, lack of accountability, and no local support for administrative challenges. If you get stuck on a concept at 11 PM, you cannot quickly message an instructor for help. You must research and navigate evaluation agencies, state board requirements, and exam scheduling entirely on your own.

Becker CPA Review

What Makes Becker the Most Popular CPA Review Course

Becker’s dominance in the CPA review market stems from six decades of proven results and institutional trust. When all Big 4 accounting firms recommend Becker to their employees, that endorsement carries enormous weight. The company has helped nearly two million candidates pass the CPA exam, creating a track record that no competitor can match.

The Big 4 endorsement matters beyond just reputation. It means Becker’s curriculum is developed with input from practicing professionals at the highest levels of the accounting industry. The content reflects what top firms expect their CPAs to know, not just what appears on the exam. This alignment between Becker preparation and Big 4 expectations creates a seamless transition from candidate to professional.

Becker’s “Exam Day Ready” methodology represents their comprehensive approach to preparation. The system combines structured content coverage, adaptive practice, and simulated exam experiences to ensure candidates feel confident walking into Prometric centers. Every element of the course, from video lectures to practice questions, is designed to build toward that readiness moment.

The methodology emphasizes understanding over memorization. Becker instructors focus on teaching the “why” behind accounting concepts, not just the “what.” This deeper understanding helps candidates handle the application-based questions that increasingly dominate the CPA exam. When you understand principles rather than just memorize rules, you can reason through unfamiliar scenarios.

Becker claims that Exam Day Ready students achieve a 64% higher pass rate on the CPA exam compared to all other test takers. This statistic comes from Becker’s analysis of candidates who complete their recommended study activities and achieve readiness milestones before sitting for the exam.

Understanding this claim requires nuance.

The 64% higher pass rate applies specifically to candidates who become “Exam Day Ready” by completing Becker’s prescribed activities. Self-reported data and selection bias mean highly motivated candidates are more likely to both complete the program and pass the exam. Still, the correlation between Becker completion and exam success is compelling for many candidates.

Becker Course Packages and What Each Includes

The Advantage package at $2,499 (approximately ₹2,10,000) provides entry-level access to Becker’s core materials. You get 24 months of access to over 900 video lectures, 8,000+ multiple-choice questions, 400+ task-based simulations, digital textbooks, and the Adapt2U technology for personalized practice tests. This package suits budget-conscious candidates who need foundational materials without premium add-ons.

The Premium package at $3,099 (approximately ₹2,60,000) adds unlimited access that never expires, printed textbooks, and success coach support. The unlimited access is crucial for candidates who may need more than 24 months due to work commitments or life circumstances. Premium represents Becker’s standard recommendation for most candidates seeking comprehensive preparation.

The Pro package at $3,799 (approximately ₹3,20,000) includes everything in Premium plus LiveOnline classes, the Final Review cram course, flashcards, and five hours of one-on-one tutoring with a CPA expert. The live classes add accountability and real-time instruction that self-study lacks. Pro is Becker’s flagship offering and frequently goes on sale, sometimes at prices lower than Premium.

The Concierge package at $5,999 (approximately ₹5,05,000) delivers the ultimate guided experience with 50 hours of one-on-one tutoring, dedicated success coaching, personalized study plans, and comprehensive hand-holding throughout your journey. This premium tier suits candidates who want maximum support and can invest accordingly in their career transformation.

Becker’s Key Features Evaluated

The Newt AI Assistant represents Becker’s embrace of artificial intelligence for learning support. When you are stuck on a concept or confused by a practice question, you can type your question and receive an instant, detailed explanation. Newt draws from Becker’s trusted content library to ensure accuracy while providing personalized clarification that adapts to your specific confusion.

Adapt2U Technology powers Becker’s personalized practice test system. The algorithm analyzes your performance across topics and question types, then generates unlimited practice tests weighted toward your weak areas. This ensures your study time targets the concepts you most need to reinforce rather than repeatedly practicing what you already know.

SkillBuilder Videos provide step-by-step walkthroughs of every task-based simulation in the Becker course. These videos show exactly how expert instructors approach complex simulations, demonstrating thought processes and techniques you can apply on exam day. Given that TBS questions can make or break your score, this visual guidance proves invaluable for many candidates.

The mobile app and study planner capabilities allow seamless study across devices. You can start a video lecture on your laptop at home, continue on your phone during your commute, and the app remembers exactly where you left off. The customizable study planner tells you what to study each day based on your exam date, available hours, and learning pace.

Becker Pricing for Indian Candidates in INR

Direct purchase from Becker’s website requires payment in US dollars, with current exchange rates around ₹84 per dollar. The Advantage package at $2,499 translates to approximately ₹2,10,000, while the Pro at $3,799 comes to roughly ₹3,20,000. International shipping for printed materials adds additional costs, and you may face currency conversion fees from your bank.

Through Simandhar Education’s partnership, Indian candidates can access Becker materials bundled with local coaching for ₹1,40,000 to ₹1,80,000, depending on the package selected and any ongoing promotions. This pricing often represents better value than direct purchase when you factor in the additional live classes, mentorship, and administrative support included.

The Indian coaching bundle through Simandhar includes complete Becker LMS access for all four exam sections, live weekend or weekday classes conducted by qualified CPAs, doubt-clearing sessions, mock exams with detailed feedback, resume preparation, and placement assistance with Big 4 and multinational companies. The bundle also provides guidance through the evaluation, application, and licensing processes.

Becker offers interest-free financing through FlexPay with 6, 12, or 24-month payment plans. This means you can start with the Pro package for as low as $158 per month (approximately ₹13,300) without paying the full amount upfront. For Indian candidates managing tight budgets, this financing option makes Becker more accessible than the sticker price suggests.

Is Becker Worth the Premium Price for Indians?

The value proposition depends entirely on your profile and priorities. If you are targeting Big 4 firms and want the credentials that hiring managers recognize and respect, Becker’s industry standing delivers intangible benefits beyond just exam preparation. The “I studied with Becker” statement carries weight in interview conversations and networking situations.

For CA-qualified professionals who already have strong accounting foundations, Becker’s premium price may be harder to justify since you need less foundational content. However, for B.Com graduates who need a comprehensive grounding in US GAAP and American business concepts, Becker’s thorough curriculum and extensive support infrastructure provide genuine value.

Consider your learning style honestly. If you thrive with structured guidance, live classes, and available tutoring, Becker’s premium packages deliver features you will actually use. If you are a disciplined self-studier who just needs good materials, the Advantage package or even a competitor’s course may serve you equally well at a lower cost.

Surgent CPA Review

Surgent’s A.S.A.P. Technology: How It Reduces Study Time

Surgent’s Adaptive Study Algorithm Platform, known as A.S.A.P., fundamentally differs from traditional CPA review approaches. Instead of working through content linearly from start to finish, the system assesses your existing knowledge through initial diagnostics and creates a personalized study plan that skips what you already know. The algorithm continuously adapts based on your performance, always directing you toward your weakest areas.

The ReadySCORE feature provides a real-time prediction of how you would perform if you took the actual CPA exam today. This score updates after every study session based on your demonstrated mastery across all content areas, topics, and question types. When your ReadySCORE reaches 75 or above across all areas, Surgent claims you are ready to sit for the exam with confidence.

The ReadySCORE removes the guesswork that plagues many CPA candidates. Instead of wondering whether you have studied enough, you have an objective metric tracking your progress. This visibility helps you make data-driven decisions about when to schedule your exam rather than relying on gut feeling or arbitrary timeframes.

Surgent’s marketing prominently features the claim that candidates save up to 400 hours compared to traditional study methods. This figure assumes you would otherwise spend significant time reviewing material you already understand and practicing questions targeting your strengths. For candidates with solid accounting backgrounds, the time savings can be substantial.

However, realistic expectations matter. The 400-hour figure represents an upper bound for ideal candidates, not a guarantee for everyone. If you are starting with weak accounting foundations, you will need to cover more material regardless of adaptive technology. Still, even modest time savings of 100 to 200 hours translate to real value for busy professionals balancing work and study.

Surgent Course Packages Explained

The Essentials Pass at $999 to $2,499 (approximately ₹84,000 to ₹2,10,000) delivers the core Surgent experience. You get access to the A.S.A.P. adaptive technology, over 8,800 multiple-choice questions, 450+ task-based simulations, video lectures, digital textbooks, and the ReadySCORE tracking. This package provides unlimited access until you pass, making it a strong value for disciplined self-studiers.

The Premier Pass at $1,599 to $3,099 (approximately ₹1,35,000 to ₹2,60,000) adds printed textbooks, physical flashcards, and three 30-minute sessions with a CPA exam success coach. The coaching sessions provide personalized guidance on study strategies, time management, and addressing specific challenges you face in your preparation.

The Ultimate Pass at $1,999 to $3,799 (approximately ₹1,68,000 to ₹3,20,000) includes everything plus an integrated test bank with 1,000 additional MCQs, audio lectures for studying during commutes, an Excel training course, and 12 coaching sessions with a CPA expert. The Ultimate Pass also provides “Ultimate Customer Support” with guaranteed responses within one business day.

Surgent’s Question Bank and Practice Materials

The main test bank contains over 8,800 multiple-choice questions spanning all six CPA exam sections. Each question comes with detailed explanations for both correct and incorrect answers, helping you understand the underlying concepts rather than just memorizing the right answers. Questions are tagged by topic and difficulty, enabling targeted practice.

The integrated test bank exclusive to higher-tier packages adds 1,000 additional MCQs not found in the main bank. These extra questions provide fresh material for candidates who have exhausted the primary bank and want additional practice without seeing repeated questions. The combination gives Ultimate Pass students nearly 10,000 unique practice questions.

The Daily Surge feature presents personalized study recommendations each time you log in. Based on your ReadySCORE analysis, the system suggests whether you should watch video lectures, read study materials, answer multiple-choice questions, or practice task-based simulations. This guidance removes decision fatigue and ensures every study session targets your actual needs.

Surgent Pricing and Value for Indian Candidates

Direct purchase from Surgent’s website requires a US dollar payment. At current exchange rates, the Essentials Pass translates to approximately ₹84,000 to ₹2,10,000, the Premier Pass to ₹1,35,000 to ₹2,60,000, and the Ultimate Pass to ₹1,68,000 to ₹3,20,000. Surgent frequently offers promotional discounts that can reduce these prices significantly.

Unlike Becker and Gleim, Surgent does not have a major dedicated Indian coaching partnership. This means most Indian candidates purchase directly from Surgent and study independently. The trade-off is lower total cost, but no local support infrastructure for doubt-clearing or administrative guidance through the CPA process.

Surgent offers financing through Affirm with rates ranging from 0% to 30% AP, depending on your credit profile. Monthly payments can be as low as $255 for the Ultimate Pass, spreading the investment over manageable installments. The unlimited access guarantee means you never lose your materials, regardless of how long passing takes.

Surgent Pros and Cons for Indian Professionals

The biggest advantage for Indian working professionals is study time efficiency. If you are managing a demanding job with 10 to 12-hour days, every saved hour matters enormously. Surgent’s adaptive technology genuinely delivers value by eliminating redundant study and focusing your limited time on what moves the needle.

The ReadySCORE provides confidence that you are not over-preparing or under-preparing. Many candidates either delay their exam out of unnecessary fear or rush unprepared due to overconfidence. Having an objective readiness metric removes this uncertainty and helps you schedule your exam at the optimal time.

The main disadvantage is limited personal support compared to coached options. Without an Indian coaching partner, you handle eligibility evaluation, state selection, application submission, and exam scheduling yourself. If you encounter challenges at 10 PM India time, Surgent’s US-based support may not respond until the next day.

Video lectures, while comprehensive, feature less dynamic presentation than competitors like Becker or UWorld. Candidates who need engaging instruction to stay focused may find Surgent’s lecture style less compelling. The strength lies in the adaptive question bank rather than the video content.

Gleim CPA Review

Why Gleim Has the Largest Test Bank in the Industry

Gleim’s commitment to comprehensive preparation shows most clearly in its question bank size. With over 10,000 multiple-choice questions across all exam sections, Gleim provides more practice opportunities than any competitor. For candidates who believe that practice makes perfect, this volume ensures you never run out of fresh material.

The sheer quantity matters because the CPA exam draws from an enormous pool of potential questions. The more unique scenarios you encounter during preparation, the better equipped you are to handle whatever appears on exam day. Gleim’s 10,000+ questions expose you to edge cases and unusual applications that smaller question banks might miss.

The task-based simulation bank containing 1,300+ simulations further demonstrates Gleim’s exhaustive approach. Simulations test your ability to apply knowledge in realistic scenarios, and Gleim offers nearly three times as many TBS practice opportunities as most competitors. Given that simulations comprise 50% of your exam score, this extensive practice proves invaluable.

Gleim’s answer explanations go beyond simply stating the correct choice. Each explanation addresses why every answer option is correct or incorrect, helping you understand the reasoning behind accounting concepts. This thorough approach transforms each practice question into a learning opportunity rather than just an assessment.

Gleim Course Packages and Features

The Traditional package at $2,499 (approximately ₹2,10,000) provides the foundational Gleim experience with access to the complete question bank, digital textbooks, study planner, and personal counselor support. This package excludes video lectures, making it suitable for candidates who prefer text-based learning or plan to supplement with other video resources.

The Premium package at $2,999 (approximately ₹2,52,000) adds over 100 hours of video lectures, digital flashcards, mock exams, and comprehensive final review materials. This package represents Gleim’s standard recommendation for candidates wanting a complete, well-rounded preparation experience with both reading and video learning modalities.

The Premium Pro package at $3,499 (approximately ₹2,95,000) includes live webinars with Gleim instructors and access to an additional simulation question bank. The live component adds accountability and the opportunity to ask questions in real-time, addressing one of the main drawbacks of self-study approaches.

Gleim’s SmartAdapt Technology and Study Methodology

SmartAdapt technology powers Gleim’s personalized learning experience. The system begins with diagnostic assessments that establish your baseline knowledge in each content area. Based on this baseline and your ongoing performance, SmartAdapt creates a customized study plan that allocates more time to weak areas while maintaining awareness of your strengths.

The Interactive Study Planner integrates SmartAdapt intelligence into a day-by-day schedule. You input your exam date and available study hours, and the planner generates a detailed calendar showing exactly what to study each day. As you progress and your mastery levels change, the planner automatically adjusts to keep you on track.

Personal counselor access distinguishes Gleim from purely self-study options. Every Gleim student can reach out to their assigned counselor for guidance on study strategies, motivation during difficult stretches, and accountability check-ins. While not as intensive as one-on-one tutoring, this human touch adds valuable support to the self-study journey.

Gleim Pricing Options for Indian Candidates

Direct purchase from Gleim requires a US dollar payment. The Traditional package at $2,499 translates to approximately ₹2,10,000, Premium at $2,999 comes to roughly ₹2,52,000, and Premium Pro at $3,499 equals about ₹2,95,000 at current exchange rates. Gleim periodically offers promotional discounts that can reduce these prices by several hundred dollars.

Through the Concorde Academics partnership, Indian candidates can access Gleim Premium bundled with local coaching for approximately ₹1,20,000. This bundle includes 300+ hours of virtual classroom training, assistance with evaluation and registration formalities, and support through licensing. For candidates wanting Gleim’s materials with Indian coaching support, this partnership offers compelling value.

The Mega Test Bank at $999 (approximately ₹84,000) provides a budget option for candidates who primarily need practice questions. This standalone product includes the complete 10,000+ question bank and 1,300+ simulations without video lectures or other course materials. It works well as either a primary study tool for experienced accountants or a supplement to other courses.

Several universities partner with Gleim to offer discounted institutional pricing for their students and alumni. If you completed your degree at a university with a Gleim partnership, you may qualify for reduced rates. Check with your alma mater’s accounting department to explore this possibility.

Is Gleim Right for Detail-Oriented Indian Learners?

Gleim excels for candidates who want to leave absolutely nothing to chance. If your study philosophy involves covering every possible topic in exhaustive detail, Gleim’s comprehensive approach matches that mindset. The massive question bank ensures you have seen variations of virtually every concept that could appear on exam day.

Candidates with strong reading comprehension skills particularly benefit from Gleim’s text-heavy approach. The digital textbooks are thorough and well-organized, presenting information in a structured format that rewards careful reading. If you learn better from reading than watching videos, Gleim aligns with your natural preference.

The potential downside is information overload. Gleim’s thoroughness can feel overwhelming for candidates who prefer streamlined, focused preparation. The sheer volume of content requires discipline to work through systematically. Some candidates find themselves lost in details when they would benefit more from mastering core concepts.

Video lecture quality, while improved in recent years, remains less engaging than competitors like Becker or UWorld. Gleim’s instructors are knowledgeable academics, but the presentation style tends toward traditional lecture format rather than dynamic teaching. Candidates who need entertainment value to stay focused may find Gleim lectures dry.

UWorld CPA Review: The Merged Powerhouse (Formerly Wiley and Roger)?

UWorld Course Packages

The Premier package at $3,499 (approximately ₹2,95,000) provides entry-level access to UWorld’s combined platform. You get the complete four-section course mapped to AICPA blueprints, over 8,500 MCQs and 500 TBSs, video lectures from Roger Philipp and Peter Olinto, digital study guides, and SmartPath performance tracking. Access duration varies based on the specific package terms.

The Elite package at $3,799 (approximately ₹3,20,000) adds printed textbooks, ReadyDecks flashcards with spaced repetition technology, TBS Mastery Videos, and a cram course for final review. The printed materials appeal to candidates who prefer physical resources alongside digital access, and the cram course helps consolidate learning before exam day.

The Elite Unlimited+ package at $4,099 (approximately ₹3,45,000) includes everything plus StudyPass unlimited access until you pass and enhanced support. The unlimited access guarantee protects you if life circumstances extend your preparation timeline beyond the standard access period. This package also includes a money-back guarantee with specific completion requirements.

UWorld’s Star Instructors: Roger Philipp and Peter Olinto

The instructor lineup represents UWorld’s greatest competitive advantage. Roger Philipp founded Roger CPA Review and built a devoted following through his high-energy teaching style. His lectures feature constant movement, whiteboard demonstrations, memorable mnemonics, and an enthusiasm that keeps candidates engaged through complex material.

Peter Olinto spent 25 years at Becker, where he became one of the most beloved CPA instructors in the industry. His decision to join UWorld in 2023 brought credibility and name recognition to the merged platform. Together, Philipp and Olinto create a dynamic instructional duo that few competitors can match.

The combination of teaching styles provides variety during long study sessions. Philipp’s animated approach works well for candidates who need entertainment to stay focused, while Olinto’s more measured style appeals to those preferring structured explanation. Having both instructors gives candidates options based on their mood and the topic at hand.

UWorld Features and Technology

SmartPath Predictive Technology tracks your progress and compares it against students who previously passed the CPA exam. This data-driven tool shows how your preparation compares to successful candidates at similar points in their journey. Students who meet SmartPath targets report a 90% average pass rate according to UWorld’s data.

The question bank quality reflects UWorld’s broader test prep expertise. The company has helped over four million candidates across medical, legal, and professional exams develop a deep understanding through high-quality practice questions. Each CPA question includes thorough explanations addressing every answer choice, not just the correct one.

ReadyDecks flashcards use spaced repetition technology to optimize memorization. The system tracks which cards you know well and which need more review, automatically adjusting frequency to maximize retention. For candidates drilling accounting terms, standards, and formulas, this intelligent flashcard approach accelerates memorization.

UWorld Pricing and Indian Market Presence

Direct purchase from UWorld’s accounting platform requires a US dollar payment. The Premier package at $3,499 translates to approximately ₹2,95,000, Elite at $3,799 to roughly ₹3,20,000, and Elite Unlimited+ at $4,099 to about ₹3,45,000. UWorld frequently runs promotional discounts that can provide significant savings.

Miles Education’s partnership with Wiley content provides an Indian coaching option, though the merger transition has created some uncertainty about materials and platform access. Miles charges approximately ₹1,08,900 and above for programs that historically included Wiley content, though candidates should confirm current arrangements directly.

The merger transition creates legitimate concerns for candidates. Consolidating three platforms (Roger, Wiley, and UWorld) into one unified experience takes time, and some candidates have reported inconsistencies or confusion during the transition. If platform stability matters to you, carefully evaluate UWorld’s current state before committing.

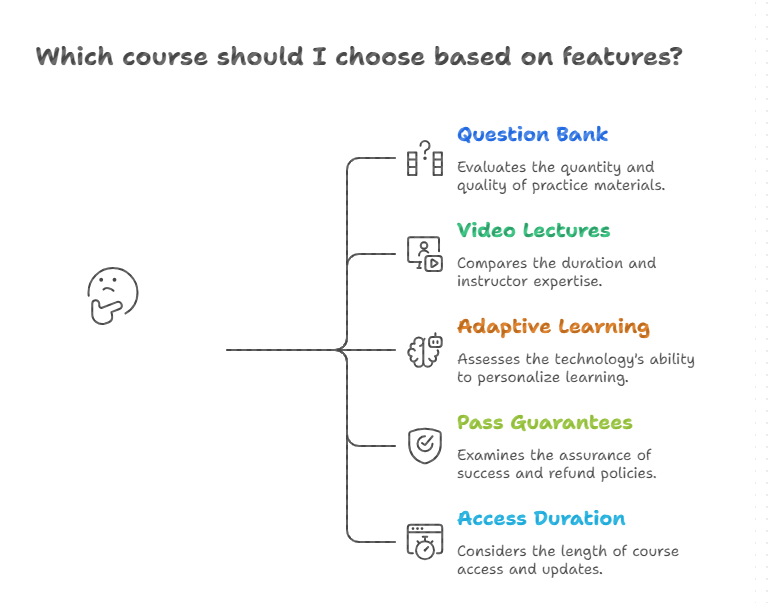

Complete Feature – by – Feature Comparison of All Four Courses

Before comparing the major CPA review providers, it’s important to understand how each course differentiates. The sections below break down these features so you can see which course aligns best with your study style and exam strategy.

Question Bank and Practice Materials Comparison

MCQ Quantity and Quality Analysis

Becker’s question bank contains over 9,200 multiple-choice questions developed by their team of CPA experts. Each question aligns with current AICPA blueprints and includes detailed explanations linking back to relevant textbook sections. The questions are challenging enough to prepare you for exam difficulty without being unrealistically hard.

Surgent provides 8,800+ MCQs in their main bank, plus an additional 1,000 integrated questions in higher-tier packages. The adaptive algorithm ensures you see questions matched to your current level, gradually increasing difficulty as your mastery improves. Questions tagged by topic and difficulty enable targeted drilling of weak areas.

Gleim offers the industry’s largest bank of 10,000+ multiple-choice questions. The sheer volume ensures you encounter diverse question formulations and edge case scenarios. Explanations address all answer choices, transforming each question into a comprehensive learning experience that reinforces both correct reasoning and common misconceptions.

UWorld’s bank contains 8,500+ MCQs drawing from the combined Roger and Wiley question pools. The company’s expertise in medical and legal test prep translates into particularly strong answer explanations. Questions focus on testing understanding rather than rote memorization, preparing you for the application-based approach of modern CPA exams.

Task-Based Simulation Comparison

Becker includes 580+ task-based simulations with accompanying SkillBuilder videos that demonstrate solution approaches. These videos show expert instructors working through each simulation step by step, revealing thought processes and techniques you can apply on exam day. The combination of practice simulations and instructional videos addresses both testing and learning needs.

Surgent offers 450+ TBS across all exam sections, integrated into their adaptive learning platform. The system tracks your simulation performance and recommends additional practice when needed. While the quantity is smaller than some competitors, the quality and integration with adaptive technology provide focused preparation.

Gleim dominates with 1,300+ task-based simulations, nearly three times what most competitors offer. This extensive bank includes simulations with exhibits that closely mirror the actual exam format. For candidates who believe simulation practice is the key to success, Gleim provides unmatched volume.

UWorld includes 500+ TBS with Mastery Videos that teach strategies for approaching different simulation types. The videos help you develop systematic approaches rather than just practicing individual problems. This strategic focus prepares you to handle unfamiliar simulations by applying general principles.

Video Lecture Hours and Instructor Quality

Becker delivers over 250 hours of video lectures featuring their team of experienced instructors. The lectures break down complex topics into manageable segments, with clear explanations and practical examples. Production quality is professional, with good pacing and visual aids that enhance understanding.

Surgent provides approximately 350 hours of video content led by Liz Kolar and other CPA experts. The lectures tend toward shorter, focused segments that integrate with the adaptive learning approach. While less dynamic than some competitors, the content is accurate and comprehensive.

Gleim offers 100+ hours of video lectures from their team of accounting professors and subject matter experts. The academic approach appeals to candidates who prefer structured, traditional teaching. Recent updates have improved production quality, though the style remains more educational than entertaining.

UWorld features 100+ hours of lectures from Roger Philipp and Peter Olinto, two of the most popular instructors in CPA review history. The engaging presentation style helps candidates maintain focus during long study sessions. If instructor personality influences your learning motivation, UWorld has a clear advantage.

Adaptive Learning Technology Comparison

All four providers now offer some form of adaptive learning, though implementations differ significantly. Becker’s Adapt2U focuses on personalizing practice tests, analyzing your performance to create unlimited customized quizzes targeting weak areas. The technology adapts test composition but does not fundamentally restructure your study path.

Surgent’s A.S.A.P. represents the most aggressive adaptive approach. The entire course experience, from initial diagnostics through study recommendations to ReadySCORE tracking, centers on personalization. The algorithm truly adapts your curriculum rather than just your practice tests, potentially saving significant time.

Gleim’s SmartAdapt integrates personalization into the study planning process. The Interactive Study Planner adjusts based on your performance, allocating more time to weak areas while maintaining coverage of all required topics. The approach balances personalization with ensuring comprehensive preparation.

UWorld’s SmartPath tracks progress against benchmarks from successful candidates. The technology shows where you stand relative to past passers, helping you gauge readiness. While less aggressive about restructuring your study than Surgent, SmartPath provides useful comparative insights.

Pass Guarantees and Money-Back Policies

Pass guarantees sound compelling, but require careful examination of terms and conditions. Each provider structures their guarantee differently, with varying requirements for eligibility and different forms of fulfillment.

Becker offers the “Becker Promise” which provides continued access and discounted course renewal if you fail after meeting certain study milestones. The Concierge package includes a more robust pass guarantee, but eligibility requires completing substantial portions of the course and meeting activity thresholds.

Surgent provides a full purchase price money-back guarantee for candidates who meet all requirements. You must complete the course, achieve certain ReadySCORE thresholds, and follow the prescribed study plan. Meeting all criteria entitles you to a refund if you fail.

Gleim offers a satisfaction guarantee with refund options within specific timeframes. Their Access Until You Pass guarantee ensures you never lose course access regardless of how long passing takes. This approach focuses on continued access rather than money back.

UWorld’s guarantee varies by package, with the Elite Unlimited+ offering a $1,000 money-back guarantee. Eligibility requirements include completing significant course portions and meeting performance benchmarks. Read the fine print carefully before relying on any guarantee.

Access Duration and Course Updates

Access duration varies significantly across providers and packages. Becker’s Advantage package provides 24-month access, while Premium, Pro, and Concierge include unlimited access. Surgent and Gleim both offer unlimited access until you pass across all their packages. UWorld’s standard packages have time limits, while Elite Unlimited+ provides unlimited access.

All providers update their courses when the AICPA changes exam content or blueprints. Becker, Surgent, Gleim, and UWorld all commit to keeping materials current with exam changes. The key difference is whether you continue receiving updates throughout your access period or only for a fixed time.

If you need more time than initially anticipated, your options depend on your chosen provider and package. Unlimited access packages protect you from losing materials if life circumstances extend your timeline. Time-limited packages may require additional purchases or upgrades to continue studying.

Complete Pricing Comparison in Indian Rupees (INR)

Understanding how much each CPA review provider costs in Indian Rupees is essential for making an informed decision. Currency fluctuations, shipping charges, and country-specific coaching bundles all influence the actual investment. The comparison below breaks down every component so you can evaluate the true cost of each option.

Direct Purchase Pricing from US Providers

Becker Complete Pricing in INR

At current exchange rates around ₹84 per dollar, Becker packages translate to: Advantage at ₹2,10,000, Premium at ₹2,60,000, Pro at ₹3,20,000, and Concierge at ₹5,05,000. International shipping for printed materials adds approximately $145 (₹12,200) for express delivery. Payment processing may incur additional currency conversion fees from your bank.

Surgent Complete Pricing in INR

Surgent’s packages convert to: Essentials Pass at ₹84,000 to ₹2,10,000, Premier Pass at ₹1,35,000 to ₹2,60,000, and Ultimate Pass at ₹1,68,000 to ₹3,20,000. The price ranges reflect different retail prices and promotional discounts frequently available on the Surgent website. Individual section courses cost $599 each (approximately ₹50,400).

Gleim Complete Pricing in INR

Gleim packages translate to: Traditional at ₹2,10,000, Premium at ₹2,52,000, and Premium Pro at ₹2,95,000. The Mega Test Bank alone costs ₹84,000, offering a budget-friendly option for candidates who primarily need practice questions. Individual section courses are available at $599 to $699 per section.

UWorld Complete Pricing in INR

UWorld packages convert to: Premier at ₹2,95,000, Elite at ₹3,20,000, and Elite Unlimited+ at ₹3,45,000. Individual section courses range from approximately ₹50,000 to ₹65,000, depending on the section and access duration. UWorld frequently runs promotional sales that can reduce these prices substantially.

Indian Coaching Partnership Pricing

Simandhar Education bundles Becker materials with Indian coaching for ₹1,40,000 to ₹1,80,000. Miles Education offers programs, including Wiley content starting at ₹1,08,900. Concorde Academics bundles Gleim Premium with coaching for approximately ₹1,20,000.

SkillArbitrage, though not partnered with a U.S. publisher, offers its own NSDC-recognised CPA Prep & Global Finance Career Acceleration Program at ₹1,20,000, which includes instructor-led classes, weekly assignments, mock tests, LMS access, and extensive skill-building modules in Excel, automation, AI tools, and industry workflows. These partnerships and independent coaching models often represent better total value than direct purchase when you factor in the added support.

The coaching bundles include benefits beyond course materials: live classes, doubt-clearing sessions, study scheduling, mock exams, administrative support for evaluation and application, and often placement assistance. SkillArbitrage adds further differentiation through project-based learning, freelancing templates, article-writing training, and two mock client interviews—features designed to build both exam readiness and workplace skills. For candidates who value these services, the bundled pricing delivers significant value over purchasing components separately.

Total Cost of CPA Including Review Course

The review course represents only part of your total CPA investment from India. Add evaluation fees of $200 to $350 (₹17,000 to ₹30,000) through agencies like WES or NIES. Exam application fees range from $50 to $200, depending on the state. Exam section fees total approximately $800 to $1,000 (₹67,000 to ₹84,000) for all four sections.

International testing administration fees add approximately $390-$500 per section for candidates testing in India. State licensing fees after passing range from $150 to $500, depending on jurisdiction. All told, expect total CPA costs of ₹3,50,000 to ₹6,00,000, including a mid-tier review course.

Which CPA Review Course Should You Choose? Recommendations by Profile

Best Course for Indian Chartered Accountants (CAs)

CA-qualified professionals bring significant advantages to CPA preparation. Your foundation in accounting principles, auditing standards, and financial reporting translates well despite differences between Indian and US GAAP. You already understand how to think like an accountant, which accelerates learning US-specific rules and regulations.

Given your existing knowledge base, study time efficiency should be your priority. Surgent’s adaptive technology identifies what you already know and skips redundant content, potentially saving hundreds of hours. The ReadySCORE lets you validate your existing knowledge quickly and focus preparation where it actually matters.

For CAs who prefer structured coaching with local support, the Simandhar-Becker partnership delivers excellent value. The Becker materials are comprehensive, and Simandhar instructors understand the CA perspective. They can highlight key differences between Indian and US standards rather than explaining basics you already know.

Gleim also works well for CAs who want exhaustive practice. Your accounting foundation means the detailed content will not overwhelm you, and the massive question bank ensures thorough familiarity with US-specific scenarios. The lower price point compared to Becker makes Gleim attractive for self-disciplined CA candidates.

Best Course for B.Com and M.Com Graduates

B.Com and M.Com graduates typically need more foundational support than CA-qualified candidates. Your commerce education provides conceptual understanding, but you may lack depth in US GAAP, American tax law, and audit standards specific to the CPA exam. Choosing a course with strong instructional content is essential.

Becker’s comprehensive approach suits B.Com graduates well. The structured curriculum builds knowledge systematically, and features like Newt AI help when you encounter unfamiliar concepts. The extensive video lectures explain topics thoroughly rather than assuming prior knowledge. If the budget allows, Becker provides the safest path to success.

For budget-conscious commerce graduates, Gleim Premium offers comprehensive content at a lower cost than Becker. The detailed textbooks and massive question bank ensure you cover all the required material. The Traditional package at ₹2,10,000 through direct purchase provides excellent value if you prefer text-based learning.

UWorld appeals to commerce graduates who learn best from engaging instruction. Roger Philipp’s dynamic teaching style makes complex topics accessible, and Peter Olinto’s explanations break down difficult concepts clearly. If maintaining motivation is your challenge, UWorld’s instructors may keep you more engaged than competitors.

Best Course for Working Professionals in India

Indian working professionals face unique challenges: long work hours, commute time, family responsibilities, and preparation squeezed into evenings and weekends. Every hour of study time must count, making efficiency your paramount concern.

Surgent’s adaptive technology directly addresses time constraints. By eliminating redundant study and focusing on weak areas, you maximize the impact of limited study hours. The Daily Surge recommendations ensure every session targets the highest-value activities. For professionals managing 10 to 15 hours weekly, Surgent offers the clearest path to success.

Mobile accessibility matters enormously for busy professionals. All four providers offer mobile apps, but evaluate how well each integrates with your routine. Can you complete a meaningful study during commutes? Does the app work offline in airplane mode during travel? These practical considerations affect your ability to maintain consistent progress.

If you need accountability to maintain momentum despite work demands, consider Indian coaching partnerships. Scheduled classes create commitment. Knowing you will face questions from an instructor motivates preparation. The structure compensates for the self-discipline challenges that busy schedules create.

Best Budget-Friendly Option for Indian Candidates

When budget constraints limit your options, prioritize courses that deliver the most essential features at lower price points. The goal is passing the exam, and effective preparation does not require the most expensive option.

Gleim’s Mega Test Bank at ₹84,000 provides practice questions comparable to full courses at a fraction of the cost. For candidates with strong accounting backgrounds who primarily need practice rather than instruction, this standalone product offers exceptional value. Supplement with free resources like AICPA sample questions and YouTube videos.

Surgent Essentials Pass at the lower end of its price range (around ₹84,000 during promotions) delivers the core adaptive technology and complete question bank. You miss printed materials and coaching sessions, but the fundamental study system remains intact. For disciplined self-studiers, Essentials provides a strong foundation.

The Concorde-Gleim partnership at approximately ₹1,20,000 offers the best value in coached preparation. You get Gleim Premium materials plus live instruction and support at a price below most direct purchase options. If you want coaching without premium pricing, this partnership deserves serious consideration.

Best Course for First-Time Exam Takers vs Retakers

First-time candidates benefit from comprehensive courses that build knowledge systematically. You need instruction that assumes no prior familiarity with CPA content and structures learning progressively. Becker’s curriculum design specifically supports first-time candidates with foundational content before advancing to complex topics.

First-timers should also value pass guarantees and unlimited access. You cannot predict exactly how long preparation will take, and life circumstances may extend your timeline. Choosing a course with unlimited access protects against losing materials if your first attempt timeline stretches longer than expected.

Retakers need targeted preparation rather than a comprehensive review. If you failed one section, you likely do not need to redo your entire course. Surgent’s adaptive technology works particularly well for retakers because it identifies exactly where your knowledge gaps exist and focuses preparation there.

Consider supplemental resources if your initial course did not work for you. NINJA CPA Review at $67 monthly provides affordable supplementation with practice questions and audio content. Sometimes a different perspective on challenging topics makes the difference between failing and passing.

Why Choosing the Right CPA Review Course Matters for Indian Candidates

The Unique Challenges Indian Professionals Face When Selecting a Review Course

Most CPA review courses offer free trials, but accessing them from India can be complicated. Some providers require US payment methods, phone numbers, or addresses that Indian candidates do not have. Others restrict trial access to US IP addresses. You may be asked to make purchasing decisions without the trial experience American candidates enjoy.

The difficulty in accessing trials means you rely more heavily on reviews, recommendations, and secondhand information. This guide aims to fill that gap, but nothing replaces direct experience with a platform. When possible, explore partnerships with Indian coaching institutes that may provide trial access as part of their enrollment process.

Currency conversion creates pricing opacity that US candidates never experience. Published prices in dollars require mental conversion, and exchange rates fluctuate. Payment processing fees, international transaction charges, and potential customs duties on shipped materials add costs not reflected in advertised prices.

Building accurate budget expectations requires adding these hidden costs to the listed prices. Plan for 5% to 10% above converted USD prices to account for transaction fees and currency fluctuation risk. When comparing courses, evaluate the total cost to you in INR rather than just converting list prices.

Live online classes and support services operate on US time zones. A 2 PM class in Eastern Time means 11:30 PM or 12:30 AM in India, depending on daylight saving time. Support responses submitted in your evening may not arrive until your next morning. This timezone mismatch affects how much value you extract from live features.

Evaluate whether you can realistically attend live classes at the offered times before weighting them heavily in your decision. Recorded options that you watch at your convenience may prove more valuable than live classes you cannot attend. Support via email or forums that accommodates asynchronous communication serves Indian candidates better than phone support.

CPA review courses are designed for American candidates who grew up learning US business terminology and concepts. Explanations assume familiarity with American corporate structures, tax situations, and regulatory frameworks that Indian candidates may lack. You may encounter references that require additional context to understand fully.

This gap is where Indian coaching partnerships add genuine value. Instructors who understand both Indian and American contexts can bridge cultural and terminological differences. They explain concepts using familiar reference points and highlight where your existing knowledge transfers versus where you need to learn something genuinely new.

How This Guide Will Help You Make an Informed Decision

This guide provides comprehensive coverage of features, pricing in INR, Indian coaching partnerships, and profile-based recommendations. You now have information equivalent to what American candidates access through free trials and peer recommendations. Use this foundation to narrow your options before committing a significant investment.

We evaluated each course across multiple dimensions: question bank size and quality, video lecture hours and instructor engagement, adaptive technology effectiveness, pricing and value, pass guarantees and access duration, and suitability for different candidate profiles. The goal was a balanced assessment rather than promoting any single provider.

Our methodology combined official source verification for features and pricing, review aggregation from multiple third-party evaluators, candidate testimonials, and community feedback, and expert analysis of how course strengths match different learning needs. We prioritized accuracy and acknowledged uncertainty where information was unclear or conflicting.

This guide serves CA-qualified professionals seeking efficient preparation, B.Com and M.Com graduates building CPA foundations, working professionals balancing career and study, budget-conscious candidates maximizing value, and anyone pursuing CPA from India, regardless of background. While no single recommendation fits everyone, the profile-based analysis helps you identify which courses best match your specific situation.

Conclusion

Selecting the right CPA review course from India requires balancing multiple factors: your budget, educational background, available study time, learning preferences, and support needs. There is no universally best course, only the best course for your specific situation.

Becker delivers premium preparation with an industry-leading reputation and comprehensive support, ideal for candidates prioritizing Big 4 credibility and willing to invest accordingly. Surgent offers technology-driven efficiency that maximizes impact from limited study time, particularly valuable for working professionals.

Gleim provides exhaustive preparation materials at competitive prices, perfect for detail-oriented learners who want comprehensive coverage. UWorld combines engaging instruction with solid content, appealing to candidates motivated by dynamic teaching.

Your next step is narrowing to two or three finalists based on your profile analysis, then researching each more deeply. Explore Indian coaching partnerships if you value local support. Take advantage of free trials where accessible. Connect with candidates who have completed courses you are considering. The investment of time in research pays dividends in avoided regret and wasted resources.

To understand the overall CPA journey, you can also refer to this detailed guide on the Certified Public Accountant (CPA) Exam in USA.

Frequently Asked Questions

Which CPA review course has the highest pass rate?

Becker claims that Exam Day Ready students achieve 64% higher pass rates than other candidates. Surgent reports 88% pass rates for students achieving a ReadySCORE of 75 or above. These figures represent students who complete prescribed activities, not all purchasers. Choose based on course fit rather than marketed pass rates.

Can I access CPA review courses from India without any issues?

Yes, all major providers accept international students and deliver digital content globally. Challenges include payment processing with Indian cards, timezone differences for live support, and shipping costs for physical materials. Indian coaching partnerships simplify access by handling payment and providing local support.

Is Becker worth the extra cost for Indian candidates?

Becker’s premium pricing delivers value for candidates targeting Big 4 firms, those needing comprehensive instruction from scratch, and learners who benefit from live classes and tutoring. CA-qualified professionals with strong foundations may find the premium unnecessary when more affordable options provide sufficient preparation.

What is the cheapest CPA review course that is still effective?

Gleim’s Mega Test Bank at approximately ₹84,000 provides comprehensive practice materials. Surgent Essentials during promotional periods reaches similar price points with adaptive technology included. The Concorde-Gleim coaching bundle at ₹1,20,000 offers the best value in coached preparation.

Should I buy directly from US providers or through Indian coaching institutes?

Direct purchase offers lower base costs and complete flexibility but requires self-managing all logistics. Indian coaching partnerships add cost but provide live instruction, doubt-clearing, administrative support, and peer community. Working professionals and first-time international candidates typically benefit more from coached options.

How long do I get access to my CPA review course?

Access duration varies by provider and package. Surgent and Gleim offer unlimited access until you pass across all packages. Becker’s Advantage provides 24 months while Premium, Pro, and Concierge include unlimited access. UWorld varies by package with Elite Unlimited+ providing unlimited access.

Which course is best for working professionals in India?

Surgent’s adaptive technology maximizes impact from limited study hours, making it ideal for professionals managing 10 to 15 weekly study hours. The ReadySCORE provides objective readiness measurement, and the platform works well for self-paced study around demanding work schedules.

Does Surgent really reduce study time by 400 hours?

The 400-hour figure represents maximum savings for candidates with strong existing knowledge who would otherwise study redundant material. Realistic savings vary based on your starting point. Even modest time savings of 100 to 200 hours provide genuine value for time-constrained candidates.

What happened to Wiley CPA Review?

UWorld acquired Wiley’s Efficient Learning test prep portfolio in 2023, following its earlier acquisition of Roger CPA Review. The Wiley brand has been consolidated under UWorld Accounting. Current course offerings combine content and features from both predecessor companies.

Can I switch to a different course if I am not satisfied?

Most providers offer 10 to 30 day return windows for dissatisfied customers. Some providers, like Surgent, offer switching discounts for candidates coming from competitor courses. Evaluate return policies before purchasing and test courses thoroughly during any return window.

Which course has the best mobile app for studying on the go?

All four major providers offer functional mobile apps. Becker’s app synchronizes seamlessly between devices. UWorld’s app offers full offline access. Surgent and Gleim apps integrate with their adaptive systems. Test each app during free trials to evaluate which best fits your mobile study habits.

Are there any discounts available for Indian students?

All providers run periodic promotions, particularly during major sale events. Becker offers partner pricing through certain employers and universities. Indian coaching partnerships often provide better total value than discounted direct purchases when factoring in added services.

What if I fail the exam after using a review course?

Providers with unlimited access let you continue studying with updated materials. Becker’s Promise provides discounted renewal options. Surgent’s money-back guarantee refunds full tuition if you meet eligibility requirements. Review guarantee terms carefully before relying on them.

How do Indian coaching partnerships work with US course providers?

US providers license their content to authorized Indian training partners. Partners bundle this content with live instruction from local faculty, doubt-clearing support, mock exams, and administrative assistance. You typically access the US provider’s LMS while receiving instruction from the Indian partner.

Which CPA review course is best for CA-qualified professionals?

CA professionals benefit most from efficiency-focused options like Surgent that leverage existing knowledge and skip redundant content. Gleim’s exhaustive practice materials also work well for drilling US-specific applications of concepts you already understand. Avoid paying premium prices for foundational instruction you do not need.

Allow notifications

Allow notifications