Complete guide to CPA course in India covering eligibility for B.Com, CA, and M.Com holders, exam structure under CPA Evolution, updated fees after June 2025 NASBA increase, and career opportunities.

Table of Contents

The Certified Public Accountant credential stands as the gold standard in global accounting, and Indian professionals are taking notice. With over 600 multinational corporations operating Global Capability Centers in India and Big 4 firms expanding their Indian operations, the demand for US CPA qualified professionals has surged dramatically.

If you are working in finance, audit, or accounting in India, you have likely seen job postings that list “CPA preferred” or colleagues who accelerated their careers after earning this credential.

Yet pursuing CPA from India comes with genuine confusion.

How do your Indian qualifications translate into US credit hours?

Which of the 55 US state boards should you apply to?

Why did exam fees jump significantly in June 2025?

What exactly changed with the CPA Evolution exam format?

These questions can feel overwhelming, especially when most online resources contain outdated information or generic advice that does not address India-specific challenges.

This guide cuts through the noise with verified data, including the recent NASBA fee revisions and the new Core plus Discipline exam structure.

Whether you hold a B.Com, M.Com, CA, CS, or CMA qualification, you will find clear eligibility pathways, realistic cost breakdowns in Indian Rupees, strategic state selection guidance, and actionable preparation strategies. Consider this your mentor-style roadmap to earning the CPA credential from India.

What Are the CPA Eligibility Requirements for Indian Candidates?

Understanding CPA eligibility is the critical first step for any Indian candidate, and this is where most aspirants face their first major hurdle. Unlike the Indian CA exam, which has uniform eligibility across the country, CPA requirements vary across 55 different US state boards, each with its own education, examination, and experience criteria. The good news is that most Indian commerce qualifications can meet these requirements with proper planning and the right state selection.

How Do Indian Degrees Translate into US CPA Credit Hours?

The US CPA system measures educational qualifications in semester credit hours rather than years of study. Most state boards require 120 credit hours to sit for the exam and 150 credit hours to obtain the license. As a general rule established by credential evaluation agencies, one year of Indian university education equals approximately 30 US semester credits, though graduates from NAAC A-accredited universities with first division may receive enhanced credit recognition.

Credit Hour Calculations for B.Com, M.Com, and MBA Graduates

A three-year Indian B.Com degree typically translates to 90 to 120 credit hours, depending on your university’s accreditation status and your academic performance. If you hold an M.Com or MBA in addition to your B.Com, you likely meet the 150 credit hour requirement for full licensure, as your postgraduate degree adds approximately 30 additional credits to your total.

Eligibility Pathways for Chartered Accountants and CMA Holders

Indian Chartered Accountants are in an advantageous position for CPA eligibility because the combination of the CA qualification plus an undergraduate degree like B.Com generally meets or exceeds the 150 credit hour requirement. Similarly, CMA India qualified professionals with a bachelor’s degree often satisfy the educational criteria, though the exact credit count depends on evaluation by agencies like NASBA International Evaluation Services.

Options for CS, ACCA, and Other Professional Qualification Holders

Company Secretary qualified professionals typically receive credit for business law components, but may need additional accounting coursework to meet subject-specific requirements. ACCA affiliates and members can pursue CPA, though they should note that ACCA credits may not fully transfer, and bridge courses focusing on US GAAP and taxation are often necessary to fill gaps in the curriculum.

Which US State Is Best for Indian Candidates to Pursue CPA?

State selection is arguably the most strategic decision you will make in your CPA journey, and getting this wrong can delay your certification by years. Not all states are equally accessible to international candidates, and requirements around Social Security Numbers, US residency, and supervised work experience vary dramatically across jurisdictions.

States Without SSN and Residency Requirements

For Indian candidates who plan to take the exam from India and may not have immediate plans to work in the US, states like Montana, Colorado, Alaska, and Guam offer the most accessible pathways. These jurisdictions do not require a Social Security Number for examination or initial licensing, and they have no US residency requirements. Montana’s Board of Public Accountants has become particularly popular among international candidates because of its straightforward application process.

Colorado offers another excellent option as it accepts international education and does not mandate US-based work experience for the CPA certificate. Alaska similarly welcomes international candidates with flexible requirements, though you should verify current rules directly with each state board, as policies can change.

Comparing Education and Experience Requirements Across Popular States

While education requirements hover around 150 credits for most states, experience requirements show significant variation. Some states require one year of supervised experience under a licensed CPA, while others, like Montana, require two years but accept experience gained under a CA or CPA in any country. This flexibility makes Montana attractive for Indian professionals whose supervisors hold Indian CA credentials rather than US CPA licenses.

Montana, Colorado, and Alaska: A Practical Comparison

Montana requires 150 credit hours, including specific accounting and business credits, plus two years of experience that can be verified by a licensed CPA or CA anywhere globally. The state charges moderate fees and processes applications efficiently, making it a top choice for Indian candidates based on data from multiple CPA coaching institutes.

Colorado requires 150 credit hours and one year of experience, but uniquely offers a CPA certificate to those who pass all exam sections before completing the experience requirement. This allows you to add “CPA candidate” or “CPA certificate holder” to your credentials while accumulating the necessary work experience, which can accelerate your career progression in India.

Alaska rounds out the popular choices with 150 credit hours requirements and flexible experience provisions. Each state has its own nuances regarding acceptable accounting and business credit distributions, so reviewing the specific requirements on NASBA’s state board directory before applying is essential.

How Does the CPA Credential Evaluation Process Work for Indians?

Before any US state board considers your application, you must have your Indian educational credentials evaluated by an approved agency. This evaluation converts your Indian degrees, marksheets, and professional qualifications into US credit hour equivalents that state boards can understand and verify.

NIES vs WES: Which Evaluation Agency Should You Choose?

NASBA International Evaluation Services, commonly called NIES, charges between $225 and $275 for evaluation and is directly operated by NASBA, making it accepted by over 50 state boards. World Education Services or WES offers slightly lower pricing at $160 to $225 and typically processes evaluations faster, within 7 to 10 business days after receiving your documents. Your choice should depend on which agencies your target state accepts, as some states specifically require NIES evaluations.

Document Requirements and Processing Timelines

You will need to submit official transcripts from each educational institution, degree certificates, and any professional qualification certificates, like CA or CMA. Documents not in English require certified translations. Plan for 4 to 8 weeks total processing time, including document collection, courier delivery, and evaluation completion, though expedited services are available for additional fees.

CPA Exam Structure and Format Under CPA Evolution

The CPA exam underwent its most significant transformation in decades when CPA Evolution launched in January 2024, replacing the traditional four-section format with a new Core plus Discipline model. Understanding this structure is essential because many online resources still reference the outdated format, including the now-retired BEC section. The current exam requires you to pass three mandatory Core sections plus one Discipline section of your choice.

What Are the Three Core Sections Every Candidate Must Pass?

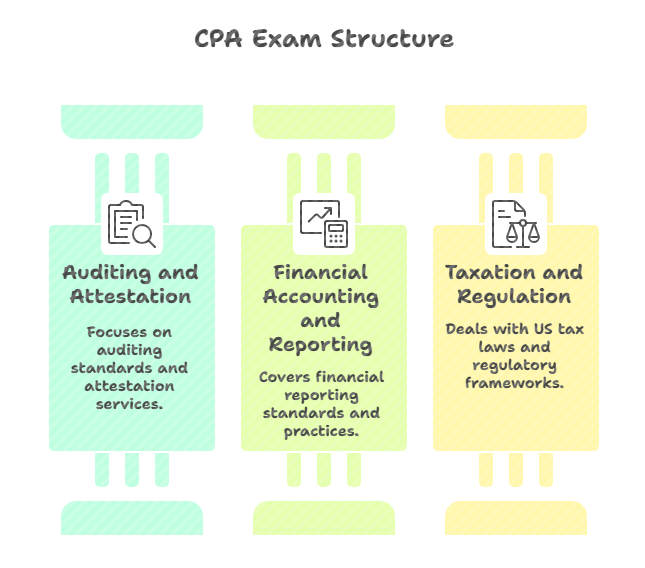

The three Core sections test foundational knowledge that every CPA must possess, regardless of their intended specialization. These sections are Auditing and Attestation, Financial Accounting and Reporting, and Taxation and Regulation. Each section is four hours long and must be passed with a minimum score of 75 on a scale of 0 to 99.

AUD (Auditing and Attestation): Content, Format, and Difficulty

AUD tests your understanding of audit procedures, attestation engagements, professional ethics, and internal controls. The section includes 78 multiple-choice questions and 7 task-based simulations, with the 2024 pass rate hovering around 46 to 48 percent according to AICPA data. Indian candidates with CA backgrounds often find AUD concepts familiar due to overlap with Indian auditing standards, though US-specific regulations require dedicated study.

FAR (Financial Accounting and Reporting): What Indian Candidates Should Know

FAR covers US GAAP, financial statement preparation, and accounting for various entity types, including government and not-for-profit organizations. With a pass rate of approximately 40 to 43 percent, FAR consistently ranks as the most challenging Core section, primarily due to its vast syllabus covering everything from basic accounting to complex consolidations and governmental accounting.

REG (Taxation and Regulation): US Tax Law Fundamentals

REG examines US federal taxation for individuals and entities, business law, and professional ethics related to tax practice. Despite covering the unfamiliar US tax code for Indian candidates, REG shows the highest Core section pass rate at 63 to 64 percent. The section includes 72 MCQs and 8 TBSs, and many candidates find that methodical study of tax rules and regulations leads to consistent scoring.

How to Choose Your Discipline Section: BAR vs ISC vs TCP

Beyond the three Core sections, you must select and pass one Discipline section that aligns with your career goals and strengths. Each Discipline focuses on specialized knowledge, and your choice should consider both your background and the statistical pass rates that reveal relative difficulty levels.

BAR (Business Analysis and Reporting): Ideal Candidate Profile

BAR focuses on advanced financial reporting, business analysis, and data-driven decision making, incorporating content that previously appeared in the retired BEC section. With a cumulative pass rate of only 40 to 41 percent, BAR is the most challenging Discipline option. This section suits candidates pursuing careers in financial analysis, corporate accounting, or roles requiring deep financial statement expertise.

ISC (Information Systems and Controls): For Technology-Oriented CPAs

ISC tests knowledge of IT systems, cybersecurity, data management, and technology controls relevant to audit and assurance services. The pass rate stands at approximately 52 to 56 percent, positioning it as moderately difficult. Indian candidates with IT backgrounds or those targeting roles in IT audit, systems consulting, or technology risk advisory find that ISC aligns well with their skill sets.

TCP (Tax Compliance and Planning): The Highest Pass Rate Discipline

TCP covers advanced individual and entity taxation, tax planning strategies, and compliance beyond what REG addresses. The section boasts the highest pass rate of any CPA exam section at 73 to 75 percent, making it statistically the most approachable Discipline. Candidates who performed well on REG or have tax experience often gravitate toward TCP, as the content closely aligns with Core REG material.

Exam Format, Scoring, and the 30-Month Testing Window

Understanding the exam mechanics helps you plan strategically and avoid costly mistakes. The testing format, scoring methodology, and time constraints all influence how you should approach your CPA journey.

Question Types: MCQs and Task-Based Simulations Explained

Each section combines multiple-choice questions and task-based simulations that test the practical application of concepts. MCQs account for 50 percent of your score in most sections, with the exception of ISC, where MCQs carry 60 percent weight. TBSs present realistic scenarios requiring you to analyze data, perform calculations, and apply professional judgment, simulating actual work a CPA would perform.

Understanding the 75-Point Passing Score

Your reported score ranges from 0 to 99, but this is not a percentage correct. The score results from a weighted combination of your MCQ and TBS performance, adjusted through psychometric scaling that accounts for question difficulty. A 75 represents the minimum competency threshold set by AICPA’s Board of Examiners, and scores are not curved, meaning exam difficulty remains consistent across testing windows.

Strategic Exam Sequencing for Indian Candidates

Most successful candidates recommend starting with FAR or your weakest Core section while your study momentum is highest. Core sections are now available through continuous testing year-round, while Discipline sections have specific testing windows in January, April, June, July, and October. Once you pass your first section, you have 30 months to pass all remaining sections, an extension from the previous 18-month window that provides more flexibility for working professionals.

CPA Application Process: From Decision to NTS

The application process involves multiple steps across different organizations, and understanding this sequence helps you avoid delays and unnecessary expenses. From your initial decision to receiving your Notice to Schedule, plan for approximately 8 to 12 weeks if your documents are in order.

Step-by-Step Application Guide for Indian Candidates

The application journey requires coordination between you, your educational institutions, evaluation agencies, and state boards. Each step builds on the previous one, so completing them in the correct order saves time and prevents rejected applications.

Creating Your NASBA Account and Selecting a State Board

Begin by creating an account on the NASBA candidate portal and selecting your target state board. Review the state’s specific requirements one final time before proceeding, as this decision affects your entire CPA journey. Pay the initial application fee, which ranges from $90 to $245 depending on your chosen state, to initiate your eligibility evaluation.

Submitting Documents for Credential Evaluation

Request official transcripts from each university you attended, ensuring they are sent directly from the institution to your chosen evaluation agency. Include degree certificates, professional qualification documents, and certified translations for any documents not in English. Track your submissions carefully and follow up if documents are not acknowledged within two weeks of expected delivery.

Receiving Your Notice to Schedule (NTS)

Once your evaluation is complete and your application is approved, the state board issues your NTS, which authorizes you to schedule exam sections. Your NTS is valid for a specific period, typically six months, so plan your study schedule accordingly before requesting it. The NTS lists the sections you paid for and includes your candidate identification number needed for scheduling.

Scheduling Your Exam at Prometric Centers in India

With your NTS in hand, you can schedule exams at Prometric testing centers, which administer the CPA exam globally. India has multiple testing locations, offering convenience for candidates across the country.

Eight Prometric Locations Across India

Prometric operates CPA testing centers in Ahmedabad, Bangalore, Chennai, Hyderabad, Kolkata, Mumbai, New Delhi, and Trivandrum. This geographic distribution means most Indian candidates can reach a testing center within a few hours of travel, eliminating the need for expensive international trips to take your exams.

Best Times to Schedule and Avoid Blackout Periods

Core sections are available for scheduling throughout the year under continuous testing, but Discipline sections only open during specific windows. Avoid scheduling during the last week of testing windows when centers are busiest, and stress levels run highest. Early morning slots often provide a calmer testing environment, and scheduling several weeks in advance ensures you get your preferred date and time.

What to Expect on Exam Day

Arrive at least 30 minutes before your scheduled time with a valid government-issued identification matching the name on your NTS. You will store personal belongings in a locker and receive scratch paper and a basic calculator from the testing center. The four-hour exam begins immediately after identity verification, with optional breaks that count against your testing time.

How Much Does the CPA Course Cost in India?

Cost planning is where many Indian candidates underestimate the investment required. The total expense includes fees paid to multiple organizations, optional but highly recommended review courses, and several hidden costs that surprise unprepared candidates. Using current exchange rates and updated fee structures, the complete CPA journey costs between ₹2.5 lakh and ₹5.5 lakh for Indian candidates.

What Is the Total Cost of CPA Certification in Indian Rupees?

Breaking down the costs into categories helps you plan your budget accurately and avoid financial surprises midway through your CPA journey. Some expenses are mandatory one-time payments, while others recur if you need to retake sections.

One-Time Costs: Evaluation, Application, and Licensing Fees

Credential evaluation through NIES costs $225 to $275 (approximately ₹19,000 to ₹23,000), while WES charges $160 to $225 (approximately ₹13,500 to ₹19,000). State board application fees range from $90 to $245 (₹7,500 to ₹21,000) depending on your chosen jurisdiction. Once you pass all sections and meet experience requirements, licensing fees add another $100 to $500 (₹8,500 to ₹42,500), depending on the state.

Ethics exam fees, required by most states for licensing, cost $150 to $250 (₹12,500 to ₹21,000). These one-time costs total approximately ₹60,000 to ₹1,05,000, forming the non-negotiable baseline of your CPA investment.

Exam Fees After the June 2025 NASBA Increase

In June 2025, NASBA increased examination fees for international candidates from $390 to $510 per section, representing a significant 31 percent increase. For the complete four-section exam, you now pay $2,040 (approximately ₹1,73,000) in examination fees alone. This fee covers both the domestic testing fee and the international administration surcharge for testing at Indian Prometric centers.

Hidden and Overlooked Costs Indian Candidates Face

Document courier fees for sending transcripts internationally can add ₹2,000 to ₹5,000 per institution. Attestation and apostille services, if required by your evaluation agency, cost ₹3,000 to ₹8,000. If you fail a section, retake fees of $510 plus any re-application fees quickly add up. Budget an additional ₹15,000 to ₹30,000 for these contingencies.

CPA Review Course Investment: Becker, UWorld, Surgent, Gleim, and SkillArbitrage Compared

Quality review courses significantly improve pass rates, with major providers reporting that students following structured study programs pass at rates well above the national average. Becker, available through Indian partners like Simandhar Education and Miles Education, offers comprehensive preparation with pricing ranging from ₹1,20,000 to ₹2,00,000 depending on the package and support level. Their adaptive learning technology and extensive question banks justify the premium pricing for many candidates.

UWorld Roger CPA Review provides lifetime access with strong visual explanations at approximately ₹80,000 to ₹1,20,000. Surgent offers adaptive learning at similar price points, while Gleim provides extensive practice questions at ₹70,000 to ₹1,00,000. SkillArbitrage offers comprehensive CPA preparation with competitive pricing and India-focused support, making it worth exploring alongside established providers. Most courses offer EMI options through Indian partners, easing the upfront financial burden.

Budget Planning: Three Cost Scenarios for Indian Candidates

Based on verified cost data and current exchange rates, here are realistic budget scenarios for your CPA journey.

Budget Path: ₹2.5-3.5 Lakh Approach

This path involves choosing affordable evaluation and state options, using a budget-friendly review course like Gleim or UWorld, and passing all sections on the first attempt. It requires disciplined self-study and assumes no retakes. The budget includes approximately ₹65,000 for mandatory fees, ₹1,73,000 for exam fees, and ₹70,000 to ₹80,000 for review materials.

Standard Path: ₹3.5-4.5 Lakh with Quality Coaching

The standard path adds a comprehensive review course from Becker or equivalent through an Indian partner, includes buffer funds for one possible retake, and provides structured coaching support. Most working professionals fall into this category, spending approximately ₹90,000 on mandatory fees, ₹1,73,000 on exam fees, ₹1,20,000 to ₹1,50,000 on review courses, and ₹30,000 as contingency.

Premium Path: ₹4.5-5.5 Lakh with Mentorship Support

The premium path includes top-tier coaching with live classes, personal mentorship from experienced CPAs, placement support, and comprehensive preparation without financial constraints. Candidates whose employers sponsor CPA preparation or those wanting maximum support often choose this route, which provides more structure and a higher pass probability.

How to Prepare for CPA While Working Full-Time in India

Balancing CPA preparation with a demanding Indian work schedule requires strategic planning and realistic expectations. Most successful candidates invest 300 to 400 total hours across all four sections, translating to approximately 15 to 20 hours of study per week over 12 to 18 months. The 30-month testing window provides more flexibility than ever before, but procrastination remains the biggest enemy of working professionals.

Creating a structured study routine that accounts for the Indian work culture is essential. Many successful candidates wake early to study before office hours, dedicating 5 AM to 7 AM for focused preparation when energy levels are high, and interruptions are minimal. Others prefer evening study from 8 PM to 11 PM after family responsibilities are handled. The key is consistency rather than marathon weekend sessions that lead to burnout.

Review course selection matters significantly for working professionals because self-paced options with mobile apps allow studying during commutes, lunch breaks, and travel. Becker, through partners like Simandhar and Miles, UWorld, and Surgent, all offer mobile-friendly platforms. Setting section-specific goals helps maintain momentum: aim to complete FAR preparation in 3 to 4 months, AUD in 2 to 3 months, REG in 2 to 3 months, and your chosen Discipline in 2 to 3 months, with buffer time for review and practice exams before each section attempt.

Career Opportunities and Salary After CPA in India

The career impact of CPA certification in India has grown substantially as multinational corporations, Big 4 firms, and Global Capability Centers expand their presence. The credential signals expertise in US GAAP, international financial reporting, and global accounting standards that Indian employers increasingly value for roles involving cross-border transactions, US subsidiary accounting, and international audit engagements.

What Jobs Can You Get with a CPA License in India?

CPA opens doors to diverse roles across multiple industries. Big 4 firms, including Deloitte, PwC, EY, and KPMG, actively recruit CPAs for their India practices, particularly for US-focused audit engagements and advisory services serving American clients. These firms handle substantial US GAAP reporting for Indian subsidiaries of American companies, creating consistent demand for CPA qualified professionals.

Beyond the Big 4, multinational corporations operating in India hire CPAs for financial controller positions, internal audit leadership, and finance management roles requiring US reporting expertise. Global Capability Centers of American companies like Amazon, Google, Microsoft, and major banks specifically seek CPAs for their India operations. Additionally, consulting firms, investment banks, and private equity firms value the analytical rigor and international standards knowledge that CPA certification represents.

CPA Salary Expectations in India: Freshers to Senior Professionals

Entry-level CPAs in India can expect salaries ranging from ₹6 to ₹10 lakh per annum at mid-sized firms and ₹10 to ₹15 lakh at Big 4 firms, representing a significant premium over non-CPA accountants at similar experience levels. The salary differential between CPA and non-CPA professionals ranges from 20 to 40 percent, with the gap widening at senior levels.

With 3 to 5 years of post-CPA experience, professionals typically earn ₹12 to ₹18 lakh per annum, rising to ₹18 to ₹25 lakh at manager levels. Senior managers and directors with CPA credentials in India command ₹25 to ₹35 lakh or more, particularly in Big 4 firms and large MNCs. Professionals who relocate to the US or UAE with their CPA credentials can earn significantly more, with US-based CPAs averaging $80,000 to $130,000 annually, depending on location and experience.

CPA vs CA: Which Credential Offers Better ROI for Your Goals?

Both CPA and CA are prestigious credentials, but they serve different career objectives. Understanding when each makes sense helps you invest your time and resources wisely.

When CPA Makes More Sense Than CA

CPA is the better choice if your career goals involve working for US companies, handling US GAAP reporting, or relocating internationally. The CPA exam takes 12 to 18 months to complete compared to CA’s 4 to 5 year journey, making it attractive for working professionals seeking faster credential completion. If you already hold a B.Com, M.Com, or MBA and want to add an internationally recognized accounting credential without starting from scratch, CPA provides that pathway.

Combining CA and CPA for Maximum Career Impact

Indian Chartered Accountants who add CPA to their credentials position themselves as uniquely qualified for roles bridging Indian and US accounting requirements. This combination is particularly valuable for transfer pricing, international tax, cross-border M&A advisory, and leadership roles in MNCs operating across both countries. The CA plus CPA combination often commands premium compensation, with professionals reporting ₹25 to ₹40 lakh packages at senior levels in Big 4 and top MNCs.

Conclusion

Pursuing a CPA from India represents a significant investment of time, money, and effort, but the returns in career growth, salary premium, and global opportunities justify the commitment for the right candidates. With updated fee structures requiring approximately ₹2.5 to ₹5.5 lakh total investment, the CPA credential remains accessible for Indian professionals while delivering substantial career ROI.

The key to success lies in strategic planning: choose your state wisely based on eligibility requirements, understand the new CPA Evolution exam structure, budget realistically, including the June 2025 fee increases, and commit to consistent preparation over 12 to 18 months. Whether you are a B.Com graduate exploring international accounting careers, a CA seeking global credentials, or a working professional targeting Big 4 opportunities, the CPA pathway is now more accessible from India than ever before.

To understand the overall CPA journey, you can also refer to this detailed guide on the Certified Public Accountant (CPA) Exam in USA.

Frequently Asked Questions

Can I pursue a CPA with a 3-year Indian B.Com degree?

Yes, you can pursue a CPA with a 3-year B.Com degree, but you will need additional credits to meet the 150-hour requirement for full licensure. Your B.Com typically provides 90 to 120 credits, so adding an M.Com, MBA, or bridge courses helps you reach the threshold. Some states allow you to sit for the exam with 120 credits and complete the remaining requirements for licensing.

Is CPA valid and recognized for jobs in India?

CPA is highly recognized in India, particularly by Big 4 firms, multinational corporations, and Global Capability Centers of US companies. While CPA does not authorize you to sign audit reports in India as that requires ICAI membership, employers value the US GAAP expertise and international standards knowledge the credential represents.

How long does it take to complete CPA from India?

Most Indian candidates complete CPA in 12 to 24 months, depending on their study schedule and exam performance. Working professionals studying 15 to 20 hours weekly typically finish in 18 months. You have a 30-month window to pass all four sections once you clear your first exam.

Which is the best state for Indian candidates to get CPA license?

Montana, Colorado, and Alaska are popular choices for Indian candidates because they do not require SSN or US residency. Montana accepts experience verified by a CA, making it ideal for Indian professionals. Colorado offers a certificate option before completing experience requirements. Your choice should depend on education requirements and experience provisions that match your situation.

Do I need work experience to sit for the CPA exam?

Most states allow you to sit for the CPA exam without work experience. However, you typically need one to two years of supervised accounting experience to obtain the actual CPA license after passing all sections. This experience can often be completed while working in India under a licensed CPA or CA.

Can Indian Chartered Accountants get exemptions in CPA?

Indian CAs do not receive direct exemptions from CPA exam sections, as all candidates must pass all four sections regardless of prior qualifications. However, CAs typically meet the 150 credit hour requirement easily and find significant content overlap in AUD and FAR sections, reducing study time needed.

How much does CPA cost in total for Indian candidates?

The total CPA cost for Indian candidates ranges from ₹2.5 lakh to ₹5.5 lakh, including evaluation fees of ₹15,000 to ₹25,000, exam fees of ₹1,73,000 after the June 2025 NASBA increase, review courses of ₹70,000 to ₹2,00,000, and application and licensing fees of ₹30,000 to ₹65,000.

Is CPA harder than CA?

CPA and CA are different in structure rather than directly comparable in difficulty. CPA has four sections completed over 12 to 18 months, with 40 to 75 percent pass rates depending on the section. CA spans 4 to 5 years with historically lower pass rates at final levels. Many find CPA more manageable because of the shorter timeline and section-based approach.

Can I take CPA exam in India or do I need to travel to the US?

You can take the CPA exam entirely in India at eight Prometric centers located in Ahmedabad, Bangalore, Chennai, Hyderabad, Kolkata, Mumbai, New Delhi, and Trivandrum. No US travel is required for examination, though you pay international testing fees included in the $510 per section cost.

What is the passing score for CPA exam sections?

You need a minimum score of 75 on each section to pass, with scores reported on a 0 to 99 scale. This score is not a percentage correct but a scaled score accounting for question difficulty. Scores are not curved, meaning the passing standard remains consistent across all testing windows.

How many attempts are allowed for CPA exam?

There is no limit on the number of attempts for any CPA exam section. If you fail, you can retake the section during the next available testing window after paying the exam fee again. However, you must pass all four sections within the 30-month window, or your earliest passed section expires.

Which CPA discipline section should Indian candidates choose?

Your discipline choice should align with your career goals and strengths. TCP has the highest pass rate at 73 to 75 percent and suits candidates targeting tax careers or those who performed well on REG. BAR suits financial analysis and reporting-focused careers despite its challenging 40 percent pass rate. ISC appeals to technology-oriented professionals pursuing IT audit or systems consulting.

What is the salary difference between CPA and non-CPA accountants in India?

CPA holders typically earn 20 to 40 percent more than non-CPA accountants at similar experience levels. Entry-level CPAs earn ₹6 to ₹15 lakh compared to ₹4 to ₹8 lakh for non-CPAs. At senior levels, CPAs in Big 4 and MNCs can earn ₹25 to ₹35 lakh or more, creating a significant lifetime earnings differential.

Do Big 4 firms in India hire CPA professionals?

Yes, all Big 4 firms in India actively recruit CPA professionals. Deloitte, PwC, EY, and KPMG hire CPAs for US GAAP audit engagements, advisory services for American clients, and international reporting roles. Entry-level CPA salaries at Big 4 India practices range from ₹10 to ₹15 lakh per annum.

Can I work in the US with an Indian CPA license?

Your CPA license allows you to practice in the US state where you are licensed, subject to visa requirements. Many Indian CPAs use their credential to secure H1B sponsorship from US employers, as accountants with CPA licenses qualify for specialty occupation visas. However, immigration depends on employer sponsorship and visa availability.

Allow notifications

Allow notifications