Complete CPA Exam guide for Indian professionals covering eligibility, costs in INR, exam structure, application process, and career opportunities.

Table of Contents

The CPA (Certified Public Accountant) credential has become one of the most sought-after qualifications for Indian accounting and finance professionals looking to build global careers. Whether you’re a B.Com graduate exploring international opportunities, a Chartered Accountant wanting to add a US credential, or a working professional in a Big 4 firm eyeing leadership roles, understanding the CPA Exam is your first step toward this transformative career move. The demand for US CPAs in India has grown exponentially, with multinational corporations and Big 4 firms actively recruiting professionals who hold this prestigious designation.

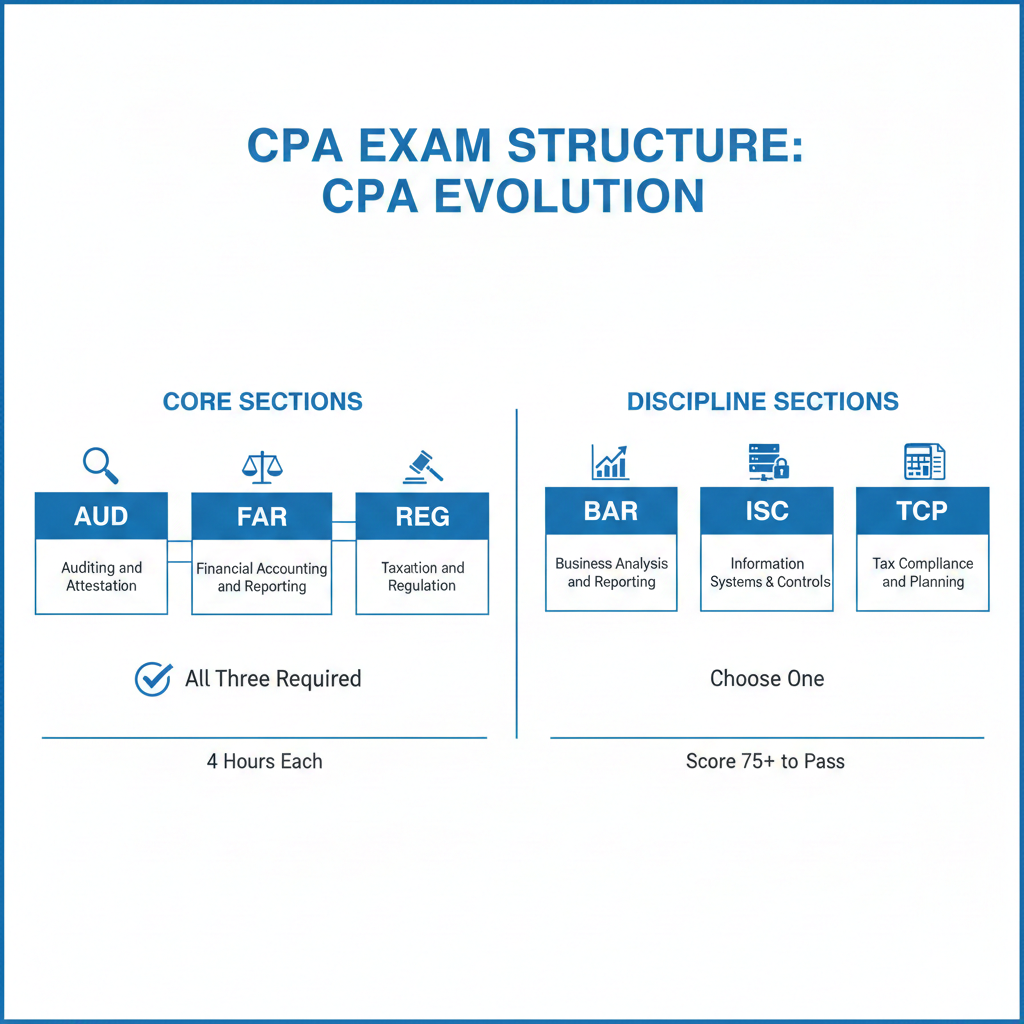

What makes the CPA Exam particularly attractive for Indians is its accessibility. Unlike the grueling multi-year CA journey, the CPA requires you to pass just four exam sections, and you can now take the exam right here in India at eight Prometric centers. The 2024 CPA Evolution brought significant changes to the exam structure, introducing a flexible Core plus Discipline model that lets you specialize based on your career goals. According to NASBA’s international testing information, thousands of Indian candidates now take the CPA Exam domestically each year, eliminating the need for expensive international travel.

This guide walks you through everything you need to know about the CPA Exam as an Indian candidate. From understanding eligibility requirements and mapping your Indian qualifications to US credit hours, to breaking down costs in Indian Rupees and creating a realistic preparation timeline, we’ve covered it all with verified data from official sources. Consider this your complete roadmap to CPA success.

CPA Exam Eligibility Requirements for Indian Candidates

Before you start preparing for the CPA Exam, you need to confirm that you meet the eligibility requirements set by the US state boards of accountancy. The good news is that most Indian professionals with commerce backgrounds can qualify, though you may need to take some additional steps depending on your educational qualifications.

Credit Hour System for CPA

The US education system measures academic work in credit hours or semester hours, which is quite different from the Indian system. Understanding this conversion is essential because CPA eligibility is primarily determined by how many credit hours you’ve accumulated through your education.

How do Indian Degrees Convert to US Credits?

In the US system, one year of full-time university education typically equals 30 semester credit hours. When your Indian degree is evaluated by a credential evaluation agency, they convert your academic work into US-equivalent credits. According to evaluation guidelines from NASBA International Evaluation Services (NIES), a standard three-year Indian B.Com degree translates to approximately 90 semester credits. If you’ve completed a two-year master’s degree like M.Com or MBA on top of your bachelor’s, that adds another 60 credits, bringing your total to around 150 credits.

The conversion process considers several factors beyond just duration. World Education Services (WES) notes that evaluation agencies examine the actual coursework, institutional accreditation, and academic performance. Graduates from NAAC A-grade universities and those with first division marks generally receive more favorable credit evaluations. A B.Com Honours degree might receive slightly more credits than a regular B.Com, while professional qualifications like CA, CS, or CMA can add significant credits to your total.

For candidates with combined qualifications, the picture improves substantially. A B.Com plus M.Com combination typically yields around 150 credits, meeting the licensure requirements for most states. Similarly, B.Com plus MBA in Finance provides approximately 150 credits. Indian Chartered Accountants combining their CA with a bachelor’s degree often exceed 150 credits comfortably, putting them in a strong position for CPA eligibility.

The 120 vs 150 Credit Hour Requirement for CPA

Here’s where things get nuanced, so pay close attention. Most US states have two different credit requirements: one for sitting for the exam and another for obtaining your CPA license. According to the AICPA’s CPA licensure requirements, most states require 120 credit hours with a bachelor’s degree to sit for the exam, but 150 credit hours to actually receive your CPA license after passing.

This distinction is crucial for Indian candidates. If you have a three-year B.Com providing approximately 90 credits, you won’t meet even the 120-credit exam eligibility requirement without additional education. However, some states offer more flexible pathways. For instance, certain states allow candidates with 120 credits to sit for the exam while they complete the remaining 30 credits before licensure. This approach lets you start your exam journey earlier while continuing your education in parallel.

Beyond total credits, most states require specific minimums in accounting and business subjects. The Colorado State Board of Accountancy requires 27 accounting credits and 21 business credits, while Montana requires 24 accounting credits. Your credential evaluation will break down your credits by category, so verify that your accounting-specific credits meet your chosen state’s requirements.

CPA Exam: Qualification Pathways for Different Indian Backgrounds

Your specific educational and professional background determines the easiest path to CPA eligibility. Let’s examine the most common scenarios for Indian candidates.

B.Com and M.Com Graduate Eligibility

If you’re a B.Com graduate from a recognized Indian university, you’ll typically have around 90 semester credits after evaluation, falling short of the 120-credit exam eligibility threshold. The most practical options include pursuing an M.Com or MBA, which adds approximately 60 credits and brings your total to around 150. Alternatively, you can complete a CPA bridge course offering 30 credits from a recognized US institution, bringing you to the 120-credit exam eligibility mark.

M.Com graduates are generally in a strong position for CPA eligibility. With undergraduate and postgraduate education combined, you’ll likely have 140 to 150 credits, meeting the requirements for most states. According to Miles Education’s eligibility guidance, the key consideration for M.Com holders is ensuring sufficient accounting-specific credits, as many states require 24 to 30 credits in accounting subjects specifically. If your M.Com included substantial accounting coursework, you’re likely covered. If it were more general in nature, you might need a few additional accounting courses.

Chartered Accountant (CA) Eligibility and Advantages

Indian Chartered Accountants have a significant advantage when pursuing the CPA. According to Simandhar Education’s CA eligibility analysis, the CA qualification, combined with your bachelor’s degree, typically provides well over 150 credit hours when evaluated. Your extensive accounting coursework through the CA Foundation, Intermediate, and Final levels easily satisfies the accounting credit requirements that trip up many other candidates.

That said, being a CA doesn’t exempt you from any CPA Exam sections. The AICPA doesn’t offer exemptions to any international candidates regardless of their qualifications. You’ll still need to pass all four parts of the exam just like everyone else. The advantage lies in your strong conceptual foundation, which makes preparing for sections like FAR (Financial Accounting and Reporting) and AUD (Auditing and Attestation) considerably faster. Many CAs report completing their CPA preparation in 9 to 12 months compared to the 15 to 18 months typical for non-CA candidates.

CS, CMA, and Other Professional Qualification Holders

Company Secretaries (CS) and Cost Management Accountants (CMA India) can also pursue the CPA, though eligibility depends on your complete educational profile. According to NIES evaluation guidelines, your professional qualification alone may not provide sufficient accounting credits, so you’ll likely need to combine it with your bachelor’s degree and potentially additional coursework. CS holders typically have strong business law credits but may need additional accounting courses. CMA India holders have solid cost accounting backgrounds but might need financial accounting supplements.

The evaluation process for these qualifications can be more complex, so it’s worth getting a preliminary evaluation done before committing to the CPA journey. NIES offers preliminary evaluations that assess your credentials and tell you exactly where you stand, helping you plan any additional coursework needed.

CPA Exam: Bridge Courses and Additional Credit Options

If your current qualifications don’t meet the credit requirements, don’t worry. There are several pathways to bridge the gap without spending years in additional education.

When You Need Bridge Courses

Bridge courses become necessary when you fall short of either the total credit requirement or the specific accounting and business credit requirements. For instance, if you have 110 credits but need 120 to sit for the exam, a bridge course offering 10 to 15 credits can close that gap. Similarly, if you have sufficient total credits but only 20 accounting credits when your state requires 24, targeted accounting courses can help.

Several institutions offer CPA bridge courses recognized by US state boards. Miles Education partners with US universities to offer a 30-credit bridge program specifically designed for Indian candidates, priced between ₹75,000 and ₹1,00,000 with completion timelines of 6 to 9 months. Simandhar Education offers similar programs through their university partnerships at comparable price points. When selecting a bridge course, verify that the credits will be accepted by your chosen state board before enrolling, as acceptance can vary.

How does the CPA Exam Structure Work Under CPA Evolution?

The CPA Exam underwent a major transformation in January 2024 with the implementation of CPA Evolution. According to the AICPA’s CPA Evolution overview, this change replaced the old four-section format with a new Core plus Discipline model that offers candidates more flexibility and specialization options.

CPA Exam: The Three Core Sections Every Candidate Must Pass

Under the new format, every CPA candidate must pass three Core sections that test foundational knowledge all CPAs need regardless of their eventual specialization. These sections are Auditing and Attestation (AUD), Financial Accounting and Reporting (FAR), and Taxation and Regulation (REG).

Auditing and Attestation (AUD) Overview

The AUD section tests your knowledge of the entire audit process, from planning and risk assessment to evidence gathering and reporting. According to Becker, the section covers:

- Area I – Ethics, Professional Responsibilities, and General Principles accounts for 15-25% of the exam and covers the AICPA Code of Professional Conduct, independence requirements, and professional skepticism.

- Area II – Assessing Risk and Developing a Planned Response makes up the largest portion at 25-35%, testing your ability to understand an entity’s environment and design appropriate audit procedures.

- Area III – Performing Further Procedures and Obtaining Evidence represents 30-40% of the exam, focusing on substantive procedures, tests of controls, and audit sampling.

- Area IV – Finally, Forming Conclusions and Reporting covers 10-20%, testing your knowledge of audit reports, modifications, and communication requirements.

The exam includes 72 multiple-choice questions across two testlets and 8 task-based simulations across three testlets, with a total time of four hours.

For Indian candidates familiar with Indian auditing standards, AUD requires some adjustment because it focuses exclusively on US auditing standards, PCAOB requirements, and AICPA professional standards. However, the conceptual framework of auditing is universal, so your existing knowledge provides a solid foundation. According to AICPA’s Q3 2025 pass rate data, AUD has maintained steady pass rates of 47-48%, indicating moderate difficulty.

Financial Accounting and Reporting (FAR) Overview

FAR is widely considered the most content-heavy section of the CPA Exam. FAR divides its content into three major areas with relatively balanced weightings.

- Area I – Financial Reporting accounts for 30-40% of the exam, covering financial statement preparation, presentation requirements, and disclosure rules for various entity types, including for-profit businesses, not-for-profit organizations, and government entities.

- Area II – Select Balance Sheet Accounts makes up another 30-40%, testing your knowledge of specific asset and liability accounts like receivables, inventory, fixed assets, and various liabilities.

- Area III – Select Transactions rounds out the section at 25-35%, focusing on how to account for specific types of transactions such as revenue recognition, leases, and equity transactions. Under CPA Evolution, several advanced topics moved from FAR to the BAR Discipline section, including business combinations, consolidated financial statements, derivatives, and government accounting. This shift made FAR more focused but didn’t necessarily make it easier, as the remaining content is tested more deeply.

Indian candidates, especially CAs, often find FAR challenging, not because the concepts are unfamiliar, but because of the sheer volume of US GAAP standards to memorize. According to AICPA’s pass rate reports, FAR consistently has the lowest pass rates among Core sections, hovering around 40-43% through 2024 and 2025. The Q1 2024 pass rate was 40.1%, improving slightly to 43.5% by Q3 2025 as candidates adapted to the CPA Evolution format. Plan for 120 to 150 study hours for FAR, more than any other section.

Taxation and Regulation (REG) Overview

The REG section spans five content areas with varying emphasis.

- Area I – Ethics, Professional Responsibilities, and Federal Tax Procedures covers 10-20%, testing your knowledge of Circular 230 regulations and practitioner responsibilities before the IRS.

- Area II – Business Law accounts for 15-25%, including contracts, agency relationships, business structures, and debtor-creditor relationships.

- Area III – Federal Taxation of Property Transactions makes up 5-15%, focusing on basis calculations, gains and losses, and like-kind exchanges.

- Area IV – Federal Taxation of Individuals is heavily weighted at 22-32%, covering everything from gross income to deductions to credits for individual taxpayers.

- Area V – Finally, Federal Taxation of Entities at 23-33% tests your knowledge of C corporations, S corporations, partnerships, and other business entity taxation. According to the AICPA’s REG blueprint, the section focuses on routine and recurring tax compliance tasks that newly licensed CPAs commonly perform.

The good news is that REG has shown strong pass rates since CPA Evolution launched. According to AICPA data, REG pass rates reached 62.8% in Q1 2024 and climbed to 64.1% by Q3 2025, making it the highest-performing Core section. While the US tax content is entirely new for Indian candidates, the logical structure of tax rules makes REG more learnable than the volume-heavy FAR section.

Choosing Your Discipline Section

In addition to the three Core sections, you must pass one Discipline section. This is where CPA Evolution gives you a choice based on your career interests and strengths. The three options are Business Analysis and Reporting (BAR), Information Systems and Controls (ISC), and Tax Compliance and Planning (TCP).

Business Analysis and Reporting (BAR) Explained

BAR focuses on advanced financial reporting topics, technical accounting, and data analytics. The section covers three main content areas:

- Area I – Business Analysis at 40-50%,

- Area II – Technical Accounting and Reporting at 35-45%, and

- Area III – State and Local Governments at 10-20%.

According to the AICPA Blueprints, content areas include financial statement analysis, technical accounting applications, governmental and not-for-profit reporting, and data analytics. BAR includes 50 MCQs and 7 TBSs, with 50% weightage each.

BAR builds heavily on FAR content, making it ideal for candidates interested in corporate finance, FP&A roles, or financial reporting positions. However, AICPA pass rate data shows BAR has the lowest Discipline pass rates, ranging from 34.1% in Q3 2024 to 43.5% by Q3 2025. The initial low rates reflected candidate unfamiliarity with the new content, but rates have improved as the study materials matured.

Information Systems and Controls (ISC) Explained

ISC is designed for candidates interested in technology, cybersecurity, and system controls.

- Area I – The section covers Information Systems and Data Management at 35-45%,

- Area II – Security, Confidentiality, and Privacy at 35-45%, and

- Area III – Considerations for SOC Engagements at 15-25%.

Notably, ISC has a different weighting structure: 60% MCQs and 40% TBSs, with 82 MCQs and only 6 simulations.

ISC aligns well with the growing demand for CPAs who understand technology risk and IT audit. According to AICPA data, ISC pass rates have been solid, reaching around 68%. If you have a background or interest in technology, or if you’re targeting Big 4 IT audit or SOC engagement roles, ISC is an excellent choice.

Tax Compliance and Planning (TCP) Explained

TCP goes deeper into taxation than REG, focusing on advanced tax planning strategies for individuals and entities. According to the AICPA Blueprints, TCP covers individual and entity taxation with emphasis on planning strategies, property transactions, and advanced compliance topics. TCP includes 68 MCQs and 7 TBSs.

TCP extends REG’s tax foundation into more complex compliance scenarios and tax planning strategies.

- Area I – The section covers Tax Compliance and Planning for Individuals and Personal Financial Planning at 30-40%.

- Area II – Entity Tax Compliance at 30-40%,

- Area III – Entity Tax Planning at 10-20%, and

- Area IV – Property Transactions at 10-20%.

Here’s an interesting pattern from AICPA pass rate reports: TCP consistently has the highest pass rate among all CPA Exam sections. Q1 2024 saw an impressive 82.4% pass rate, and while rates have normalized somewhat to 77-79% through 2025, TCP remains the top performer. This isn’t because TCP is easy; it’s because candidates who choose TCP have typically already demonstrated strong tax knowledge by passing REG. The content overlap between REG and TCP works in your favor if tax is your strength.

Which Discipline Should Indian Candidates Choose?

Your discipline choice should align with your career goals, not just pass rate statistics. If you’re targeting audit roles or Big 4 positions in assurance, ISC provides relevant technology and controls knowledge that’s increasingly essential in modern audits. If you’re interested in corporate finance, financial planning, or CFO-track roles, BAR deepens your technical expertise. For tax consulting or advisory careers, TCP is the clear choice.

Many Indian candidates choose TCP because the REG preparation gives them a running start, and the high pass rates provide confidence. However, make an informed decision based on where you want your career to go, not just which section seems easiest to pass.

Exam Format, Duration, and Question Types

Understanding the exam format helps you prepare more effectively. According to Prometric’s CPA exam information, each section is four hours long and uses a testlet-based structure. The first two testlets contain multiple-choice questions, while the remaining testlets contain task-based simulations.

The MCQs use adaptive testing, meaning the difficulty of your second MCQ testlet adjusts based on your performance in the first. Performing well on the first testlet means harder questions in the second, but those harder questions are worth more points. The simulations test higher-order skills and often require you to work with multiple documents, spreadsheets, and research tools to solve complex problems.

Each section’s MCQ and TBS weightage is typically 50-50, with the exception of ISC, which uses 60% MCQ and 40% TBS weightage. You’ll need a score of 75 out of 99 to pass each section. This isn’t a percentage of questions answered correctly; it’s a scaled score that accounts for question difficulty. According to the AICPA scoring methodology, your final score is a weighted combination of scaled scores from both MCQs and TBSs.

CPA Exam Pass Rates and What They Mean for Your Preparation

Understanding pass rates helps you set realistic expectations and allocate your study time wisely. The AICPA publishes quarterly pass rate data that provides valuable insights into how candidates are performing across sections.

Section-Wise Pass Rates for 2024-2025

Pass rates under CPA Evolution have shown interesting patterns as candidates adapt to the new exam structure.

- REG: Among the Core sections, REG has emerged as the strongest performer. According to AICPA’s official reports, REG pass rates started at 62.8% in Q1 2024 and climbed steadily to 64.1% by Q3 2025, representing an improvement from pre-Evolution years and suggesting that the restructured content resonates well with candidates.

- AUD: AUD has remained relatively stable throughout the CPA Evolution transition. Pass rates held steady at 46.2% in Q1 2024 and gradually improved to 48.2% by Q3 2025, showing consistency with historical patterns. The modest improvement indicates that while the exam format changed, the core auditing knowledge being tested remains similar to previous versions.

- FAR: This section continues to be the most challenging Core section, with pass rates starting at 40.1% in Q1 2024 and improving to 43.5% by Q3 2025. Analysis from UWorld Roger CPA Review suggests that FAR’s difficulty stems from its massive content volume covering US GAAP, governmental accounting, and not-for-profit reporting. If you’re planning your exam sequence, don’t underestimate the preparation required for FAR.

The Discipline sections have shown the most variation in pass rates, largely reflecting candidate selection patterns. TCP leads with impressive rates that started at 82.4% in Q1 2024, though they’ve normalized somewhat to 77-79% through 2025 as more candidates attempt the section. According to AICPA analysis, TCP’s high rates reflect that candidates choosing TCP have typically already passed REG and bring strong tax knowledge.

ISC pass rates are around 68%.. BAR started with the lowest Discipline pass rate at 38.2% in Q1 2024, dropped further to 34.1% in Q3 2024 during the adjustment period, but has since recovered to around 43% by Q3 2025 as study materials and candidate preparation strategies matured.

Complete CPA Exam Cost Breakdown in Indian Rupees

One of the most common questions Indian candidates have is about the total investment required for the CPA. This table provides a comprehensive breakdown of every cost component, verified against official sources as of December 2025. All conversions use an exchange rate of approximately ₹85 per dollar.

Complete Cost Breakdown Table

| Cost Component | Amount (USD) | Amount (INR) | Paid to | When | Notes |

| Credential Evaluation | |||||

| NIES Evaluation | $225 | ₹19,125 | NIES/NASBA | Month 1-2 | 6-8 weeks processing |

| WES Evaluation (alternative) | $200 | ₹17,425 | WES | Month 1-2 | 7 days after receipt |

| Document Courier & University fees | ₹5,000-10,000 | Universities/Couriers | Month 1 | Sealed transcripts required | |

| State Board Application | |||||

| Montana Application | $141 | ₹11,985 | Montana Board | Month 2-3 | Registration included |

| Colorado Application + Registration | $180 + $372 | ₹46,920 | Colorado Board | Month 2-3 | $93 per section registration |

| Washington Application + Registration | $100 + $372 | ₹40,120 | Washington Board | Month 2-3 | $93 per section registration |

| Exam fees (per section) | |||||

| Base Examination Fee | $390.76 | ₹33,215 | NASBA | Per section | US and Canada |

| International Administration Fee | $510.00 | ₹45,900 | NASBA | Per section | India testing surcharge |

| Total Per Section (India) | $780.76 | ₹66,365 | – | – | 2025 rates |

| Total 4 Sections (India) | $3,123 | ₹265,458 | – | – | No retakes assumed |

| Review Courses | |||||

| Becker (Premium) | $3,499 | ₹2,97,415 | Becker | Upfront/EMI | 24-month access |

| UWorld Roger | $2,999 | ₹2,54,915 | UWorld | Upfront/EMI | Unlimited access |

| Surgent | $2,199 | ₹1,86,915 | Surgent | Upfront/EMI | Unlimited access |

| Miles Education (India) | – | ₹1,50,000-2,50,000 | Miles | EMI available | Includes Becker + support |

| Simandhar Education (India) | – | ₹1,40,000-2,20,000 | Simandhar | EMI available | Includes Becker + support |

| Post-Exam Costs | |||||

| Ethics Exam | $150-200 | ₹12,750-17,000 | AICPA/State | Post-exam | Required for most states |

| TOTAL RANGE | $4,900-7,900 | ₹4,16,500-6,71,500 | – | 12-24 months | First attempt, no retakes |

Source: Official fee schedules from NASBA, AICPA, state boards, and review providers as of December 2025. Verify current rates before applying.

Cost Components for CPA Exam

The credential evaluation is your first expense, and choosing between agencies depends on your state’s acceptance and processing time needs. NIES evaluations feed directly into NASBA’s system, streamlining subsequent steps, while WESoffers faster processing but may require additional steps for some state boards.

The biggest expense for Indian candidates is exam fees. According to NASBA’s 2025 fee schedule, the base examination fee is $390.76 per section. Indian candidates testing at Prometric centers in India pay an additional international administration fee of $390 per section. As reported by EduMont’s fee analysis, this international fee increased by $120 per section in 2025, adding approximately ₹40,800 to the total cost compared to previous years.

The review course investment varies significantly based on your choice. Premium options like Becker offer comprehensive materials, adaptive learning technology, and strong track records, but cost nearly ₹3 lakh when purchased directly. Indian coaching institutes like Miles Education and Simandhar Education bundle Becker materials with local live classes, mentoring, and application support at prices ranging from ₹1.4 to 2.5 lakh.

The true cost impact of failing a section cannot be overstated. Each retake in India costs approximately ₹66,000 in exam fees alone, plus additional study time. Investing in quality preparation that maximizes your first-attempt pass probability often costs less than budget preparation plus retakes. According to AICPA candidate statistics, only about 20% of candidates pass all four sections on their first attempt, making preparation quality a critical investment decision.

Which US State Should Indian Candidates Choose for CPA Licensure?

Selecting the right state is one of the most important decisions in your CPA journey. Each of the 55 US jurisdictions has different requirements, and choosing wisely can make your path significantly smoother. The NASBA State Board Directory provides detailed requirements for each jurisdiction.

Factors That Matter for State Selection

Several key factors should influence your state choice. The most critical for Indian candidates are Social Security Number requirements, residency requirements, credit hour thresholds, and experience verification provisions.

Social Security Number Requirements

This is crucial for international candidates. According to NASBA’s international candidate resources, some states require a Social Security Number for exam application or licensure, which most Indian candidates don’t have. States like Montana, Colorado, Alaska, Washington, Delaware, and Guam are popular among Indian candidates specifically because they don’t require an SSN. Without an SSN requirement, you can complete the entire process from exam to licensure while remaining in India.

Credit Hours and Education Requirements

States vary in their credit hour requirements for both exam eligibility and licensure. According to the AICPA’s state requirements database, Montana requires 120 credits for the exam and 150 for licensure, with 24 accounting credits minimum. Colorado requires 120 for the exam but 150 for licensure, with 27 accounting credits. Washington similarly requires 120 for the exam and 150 for licensure with 24 accounting credits. These states allow you to start your exams earlier while completing additional credits before licensure.

Work Experience and Verification Requirements

Licensing requirements for work experience vary from zero to two years, depending on the state. According to state board information compiled by NASBA, Montana requires one year of experience that can be verified by a licensed CPA or equivalent, and importantly, accepts verification from international supervisors, including Indian CAs. Colorado similarly requires one year with flexible verification options. Washington requires one year under a licensed CPA’s supervision.

Some states, like Alaska, require two years of experience, which may extend your timeline to licensure. States that accept international supervisor verification are particularly valuable for Indian candidates working in India, as finding a US-licensed CPA supervisor locally can be challenging.

Best States for Indian CPA Candidates

Based on the factors above, Montana, Washington, and Guam consistently emerge as favorable choices for Indian candidates. Montana has become particularly popular because it offers no SSN requirement, no residency requirement, accepts international supervisors for experience verification, and has straightforward application processing, typically completed in 2 to 4 weeks.

Colorado offers similar benefits with a slightly larger CPA community and more established processes, though application processing may take 3 to 5 weeks. Washington provides a good balance of accessible requirements and reasonable fees. Guam, as a US territory, follows US CPA requirements but has historically been accommodating to international candidates, though processing times can vary.

The key is matching your specific situation to the state’s requirements. If you have 150 credits and strong accounting course coverage, almost any flexible state works well. If you have exactly 120 credits and plan to complete additional education while testing, choose a state that allows exam eligibility at 120 credits with licensure at 150.

Can You Change States After Passing the Exam?

Yes, but with caveats. According to NASBA’s score transfer information, most states accept exam scores through a process called score transfer or interstate exchange. However, you’ll need to meet the new state’s education and experience requirements for licensure. Some candidates strategically choose a state with easy exam eligibility, then transfer to their target licensing state after passing. This can work, but requires careful planning to ensure your target state accepts transferred scores and to understand what additional requirements you’ll need to meet.

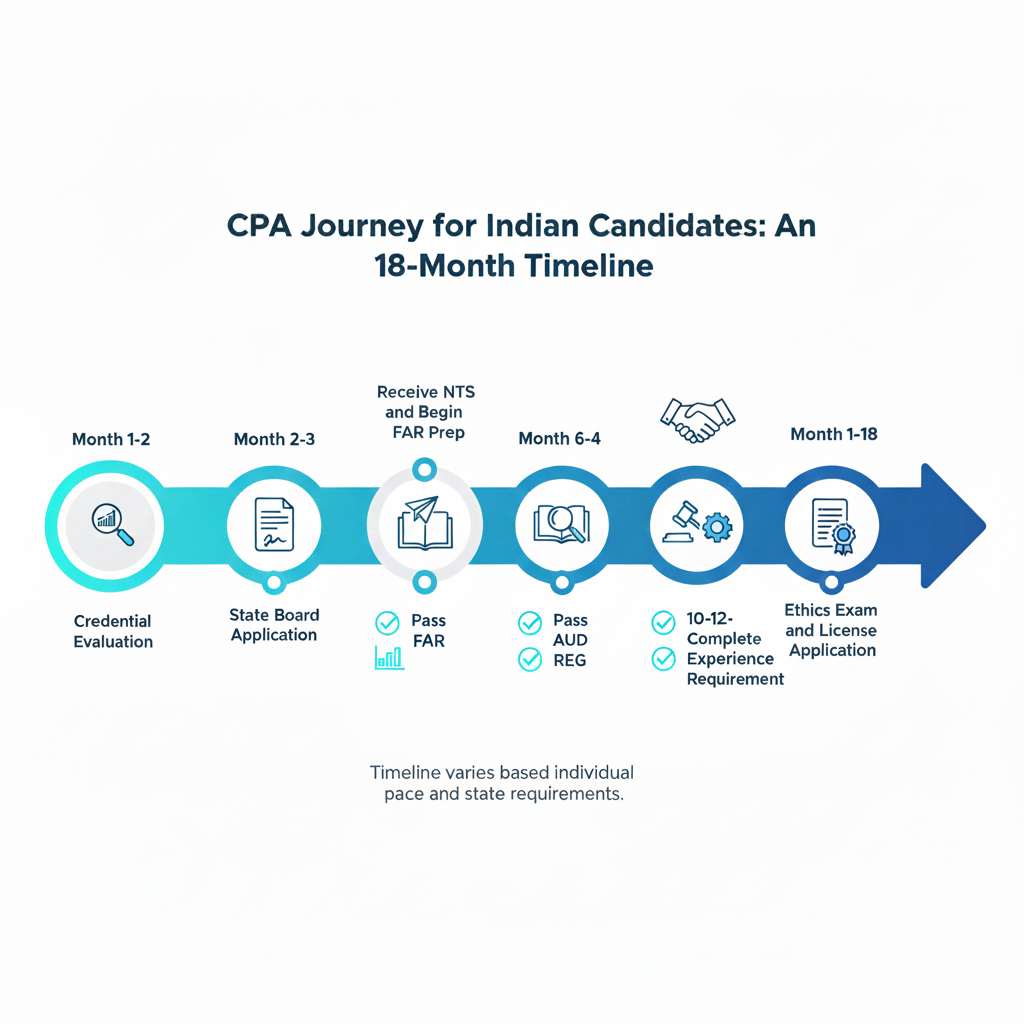

Step-by-Step CPA Exam Application Process for Indians

The application process involves multiple steps across different organizations. Understanding the sequence helps you avoid delays and plan your timeline effectively. Here’s exactly how to go from deciding to pursue the CPA to sitting for your first exam section.

Getting Your Credentials Evaluated

Your first official step is getting your Indian education credentials evaluated by a recognized agency. According to NIES, the evaluation process typically takes 6 to 8 weeks for standard processing or 2 to 3 weeks for rush processing. WES offers faster turnaround of about 7 business days after receiving all documents, but may require additional processing steps for some state boards.

You’ll need sealed official transcripts from all universities you attended, your degree certificates, and course syllabi or detailed mark sheets showing subjects studied. Some agencies require documents to be sent directly from your university, while others accept sealed envelopes delivered by you. Start gathering documents as soon as you decide to pursue the CPA, as Indian universities can be slow with document requests, and missing or incorrect documents cause delays.

Applying to Your Chosen State Board

Once your evaluation is complete, you’ll apply to your chosen state board for exam eligibility determination. According to NASBA, most states use NASBA’s CPA Central portal for exam applications. Create your account and complete the application form, providing details about your education, evaluation results, and personal information. You’ll upload identification documents and pay the application fee through this portal.

Processing times vary by state, ranging from 2 weeks to several months during busy periods. Track your application status through the CPA Central portal and respond promptly if your state board requests additional information.

Receiving Your Notice to Schedule (NTS)

The NTS is your authorization to schedule and take the exam. According to NASBA’s NTS information, your NTS is valid for a specific period, typically six to nine months, depending on your state. During this window, you must schedule and take all sections listed on your NTS. If you don’t complete a section within the validity period, you forfeit the exam fees for that section.

Many candidates make the mistake of requesting all four sections on one NTS, then struggling to prepare and schedule them all within the validity window. Consider requesting one or two sections at a time, even if it means paying additional registration fees. The flexibility is often worth the extra cost.

Scheduling Your Exam at Prometric India

With your NTS in hand, you’re ready to schedule your exam at a Prometric testing center. According to NASBA’s international testing page, the CPA Exam is available at Prometric centers in eight Indian cities: Ahmedabad, Bangalore, Kolkata (Calcutta), Chennai, Hyderabad, Mumbai, New Delhi, and Trivandrum.

Popular time slots at major centers like Bangalore and Mumbai fill up quickly, especially during peak testing periods. Book your appointment as soon as you feel confident about your preparation level. On exam day, arrive at least 30 minutes early with your NTS and two forms of identification, including your passport. The center provides scratch paper and calculators; you cannot bring your own materials.

Starting in 2025, Core sections (AUD, FAR, REG) offer continuous testing throughout the year, meaning you can schedule these sections anytime a testing center is open. Discipline sections (BAR, ISC, TCP) are offered during specific quarterly windows, so plan your exam sequence around these schedules.

How to Prepare for the CPA Exam While Working in India

Most Indian CPA candidates are working professionals juggling exam preparation with demanding jobs and personal responsibilities. According to AICPA candidate surveys, working candidates typically take 18 to 24 months to complete all sections. Effective preparation requires smart planning, not just hard work.

Creating a Realistic Study Timeline

A realistic timeline accounts for your actual availability, not an idealized version of your schedule. Working professionals typically need 12 to 18 months to complete all four CPA Exam sections, assuming 15 to 20 hours of study per week. Some highly motivated candidates complete everything in 9 to 12 months, while others with heavier work commitments take up to 24 months.

According to study hour recommendations from Becker and Surgent, you should plan for 300 to 400 total study hours across all four sections. FAR typically requires the most time at 120 to 150 hours, due to its content volume. AUD and REG each need approximately 80 to 110 hours, while your Discipline section requires 50 to 90 hours, depending on your existing knowledge.

Map out your year, considering work busy seasons, holidays, and personal commitments. Avoid scheduling exams during your organization’s year-end close or audit season if you’re in a finance role. Build in buffer time for unexpected work demands or the possibility of needing to retake a section.

Choosing the Right Review Course

Your review course is a crucial investment that significantly impacts your success probability. According to Gleim’s CPA exam analysis, candidates using structured review courses pass at significantly higher rates than self-study candidates.

- Skillarbitrage offers The CPA Prep & Global Finance Career Acceleration Program offered on SkillArbitra.ge is a structured 6-month online certification course designed to help learners prepare for the U.S. CPA (Certified Public Accountant) exam and build a global finance career, with an expected commitment of about 8–10 hours per week. The curriculum covers comprehensive modules including CPA exam orientation and registration, study planning for working professionals, deep dives into the four CPA exam sections (FAR, REG, AUD, BEC), question-type strategies, mock practice and test-taking techniques, licensing and ethics, as well as practical finance tools like Excel and AI applications for reporting and automation. The program also includes mentoring on freelancing, networking, client proposals, and job‐readiness skills, and on successful completion students receive a certificate co-branded by NSDC and Skill India. It features live online classes, practical assignments, instructor feedback, and support through an LMS, with a waitlist for enrollment.

- Becker offers the most comprehensive materials with their Adapt2U adaptive learning technology, extensive video lectures exceeding 190 hours, and a question bank of over 9,000 MCQs. The premium pricing of approximately ₹3 lakh reflects this positioning.

- UWorld Roger CPA Review provides excellent video instruction with engaging lectures from Roger Philipp and Peter Olinto, plus their SmartPath technology for adaptive learning. At around ₹2.5 lakh with unlimited access, they offer strong value.

- Surgent differentiates with their A.S.A.P. (Adaptive Study And Predict) technology that claims to reduce study time by identifying and focusing on your weak areas. Their ReadySCORE feature predicts your exam score based on your preparation progress. At approximately ₹1.9 lakh with unlimited access, Surgent offers compelling technology at a mid-range price.

- Gleim provides the largest test bank with over 10,000 practice questions and detailed explanations. At around ₹1.7 lakh, they’re the most affordable major provider while still offering comprehensive coverage.

- Indian coaching institutes like Miles Education and Simandhar Education add value through live classes, local mentoring, and application support. They typically bundle Becker materials with their own instruction and support systems. This hand-holding can be valuable for candidates unfamiliar with the US system or preferring structured classroom environments.

Section Order Strategy for Indian Candidates

The order in which you take sections can significantly impact your momentum and success rate. Most candidates benefit from starting with FAR because it’s the most content-heavy section, and tackling it first means you’re taking it when your motivation is highest and before study fatigue sets in. FAR content also overlaps with AUD and BAR, creating useful synergies for subsequent sections.

According to analysis from UWorld Roger, a common successful sequence is FAR first (building foundational knowledge), then AUD (leveraging FAR concepts), followed by REG (fresh subject requiring dedicated focus), and finally your Discipline section. If you choose BAR as your discipline, taking it immediately after FAR while that content is fresh makes sense. If you choose TCP, sequencing it after REG capitalizes on the content overlap.

Some candidates prefer starting with their strongest subject to build confidence with an early pass. If you have strong tax knowledge from your CA background or work experience, beginning with REG might work well. The key is having a deliberate strategy rather than randomly selecting your first section.

Balancing Work, Study, and Personal Life

Sustainable preparation requires maintaining your health and relationships alongside your career and exam goals. Consistency matters more than marathon study sessions. According to learning science research cited by Surgent, three hours of daily study is more effective than cramming 15 hours on weekends because your brain retains information better with regular reinforcement.

Set boundaries with your employer if possible. Many Indian professionals hesitate to discuss their CPA plans with managers, but supportive employers may offer flexibility during your exam period. Even small accommodations like avoiding travel during your final preparation weeks can make a meaningful difference. Don’t neglect exercise, sleep, and relationships. Burned-out candidates don’t perform well on exams.

Career Opportunities After Passing the CPA Exam in India

The CPA credential opens doors to career opportunities that might otherwise remain closed. Understanding these opportunities helps you appreciate the value of your investment and make informed career decisions.

Job Roles Open to CPA-Qualified Professionals

The Big 4 accounting firms (Deloitte, PwC, EY, and KPMG) actively recruit CPAs for their India offices, particularly for roles serving US clients or handling US GAAP reporting. According to job market analysis, CPAs often move into these firms at higher levels than non-credentialed peers, with faster promotion trajectories. Roles include US GAAP reporting specialists, SOX compliance professionals, international tax advisors, and transaction advisory positions.

Multinational corporations with US parent companies also value the CPA credential highly. Companies like Amazon, Google, Microsoft, Accenture, and major banks have significant finance operations in India that employ CPAs. Roles in shared services centers, global finance teams, and internal audit frequently prefer or require CPA qualification. The credential signals that you understand US accounting standards and can work effectively with US headquarters.

For those interested in international mobility, the CPA license provides a pathway to US employment. Many Indian CPAs eventually relocate to the US for senior finance roles, bringing both their technical expertise and international experience. Even without relocating, CPAs can work remotely for US companies or consulting firms from India, capturing opportunities that geographic boundaries once blocked.

Salary Expectations for CPAs in India

While salary varies based on location, employer, and experience, CPAs generally command premium compensation compared to non-credentialed professionals. According to salary surveys from recruitment firms and job portals, entry-level CPAs in India typically earn between ₹7 and ₹9 lakh per annum.

Mid-career CPAs with 5 to 8 years of experience often reach ₹15 to ₹25 lakh annually, while those with 10+ years command ₹25 to ₹30 lakh. Senior leadership positions like Finance Director, VP Finance, or Controller can command more, particularly in MNCs and companies with significant US operations. The CPA premium is most visible when comparing peers at similar experience levels; the credential effectively accelerates your earning potential by several years.

CPA License Maintenance and CPE Requirements

Passing the exam is just the beginning; maintaining your license requires ongoing commitment. According to AICPA’s CPE requirements, most states require CPAs to complete 40 hours of Continuing Professional Education annually or 80 hours over two years. These requirements ensure that CPAs stay current with evolving standards and regulations.

CPE courses are available online and in-person from providers including AICPA, state CPA societies, and commercial providers. Costs range from free for some basic courses to several hundred dollars for specialized topics. You’ll also need to renew your license periodically, typically every one to three years depending on your state. Renewal involves paying a fee and certifying that you’ve met CPE requirements.

Conclusion

The CPA Exam represents a significant but worthwhile investment for Indian accounting and finance professionals. With careful planning, realistic expectations, and sustained effort, you can join the thousands of Indians who have earned this prestigious credential and transformed their careers.

The path forward is clear. Start by confirming your eligibility through a credential evaluation and choosing the right state for your situation. Budget appropriately for the ₹4.5 to ₹6 lakh investment, understanding that this pays dividends throughout your career. Select quality study materials that match your learning style, and create a preparation timeline that balances ambition with sustainability.

Remember that you’re not alone on this journey. Connect with CPA communities, reach out to CPAs who’ve walked this path, and don’t hesitate to seek support when you need it. The CPA community is generally welcoming to newcomers, and the shared experience of exam preparation creates lasting professional bonds.

Your CPA journey starts with a single step. Whether that’s requesting a credential evaluation, researching state requirements, or purchasing your first review course, take that step today. Your future self will thank you for the opportunities this credential creates.

FAQs

Can I pursue CPA with a 3-year Indian B.Com degree?

Yes, you can pursue the CPA with a 3-year B.Com degree, but you’ll need additional credits to meet eligibility requirements. According to NIES evaluation guidelines, most B.Com degrees provide approximately 90 credit hours when evaluated, while the minimum requirement for exam eligibility is typically 120 credits. You can bridge this gap through a master’s degree, bridge courses from providers like Miles Education or Simandhar, or additional coursework from accredited institutions.

Is CPA harder than the Indian CA exam?

The CPA and CA exams are different rather than directly comparable in difficulty. CA involves multiple levels over several years with historically low pass rates around 10-15% at the Final level, while CPA has four sections typically completed in 12 to 18 months with section pass rates ranging from 40% to 80%. CPA focuses on US accounting standards, while CA covers Indian standards. According to AICPA pass rate data, many CAs find CPA preparation manageable because of their strong accounting foundation.

How long does it take to complete the CPA Exam from India?

Most Indian candidates complete all four CPA Exam sections within 12 to 18 months while working full-time, according to AICPA candidate surveys. This timeline assumes consistent study of 15 to 20 hours per week. Some candidates finish faster with more intensive preparation, while others take up to 24 months depending on work commitments and personal circumstances.

What is the total cost of CPA in Indian Rupees for 2025?

The total investment for Indian candidates typically ranges from ₹4,16,500 to ₹6,71,500 according to current fee schedules from NASBA and review course providers. This includes credential evaluation (₹22,000-35,000), state board fees (₹12,000-47,000), exam fees for all four sections in India (₹2,65,000-2,70,000), review courses (₹1,10,000-3,00,000), and licensing fees (₹21,000-52,000).

Do I need to travel to the US to take the CPA Exam?

No, you can take the entire CPA Exam in India. According to NASBA, Prometric test centers in eight Indian cities (Ahmedabad, Bangalore, Kolkata, Chennai, Hyderabad, Mumbai, New Delhi, and Trivandrum) offer all CPA Exam sections throughout the year. You’ll pay an additional international administration fee of approximately $390 per section, but travel to the US is not required.

Which CPA Exam section should I take first?

According to analysis from UWorld Roger and other review providers, most candidates benefit from starting with FAR (Financial Accounting and Reporting) because it’s the most content-heavy section and provides foundational knowledge useful for other sections. However, some candidates prefer starting with their strongest subject to build confidence. Choose based on your background and have a deliberate strategy.

Can Indian CAs get any exemptions in the CPA Exam?

No, Indian CAs do not receive any exemptions from CPA Exam sections. According to the AICPA, all candidates must pass all four sections regardless of prior qualifications. However, CAs typically meet the 150-credit requirement easily and have strong accounting foundations that often accelerate their preparation.

What happens if I fail a CPA Exam section?

If you fail a section, you can retake it after waiting for the next testing window for Discipline sections or immediately for Core sections under continuous testing. According to NASBA, you’ll need to pay the exam fees again (approximately ₹66,000 per section in India) for the retake. There’s no limit on retake attempts, but remember that passed sections are only valid for 30 to 36 months depending on your state.

How long is my CPA Exam credit valid after passing a section?

According to NASBA’s credit expiration rules, once you pass a CPA Exam section, that credit is valid for 30 to 36 months depending on your state’s rules. Within this window, you must pass all remaining sections. If you don’t complete all sections within the validity period, your earliest passed section expires, and you must retake it.

Is CPA recognized by Indian employers?

Yes, the CPA is increasingly recognized and valued by Indian employers, particularly Big 4 firms (Deloitte, PwC, EY, KPMG), multinational corporations, and companies with US operations. While the CPA doesn’t grant practicing rights in India the way the CA does, it signals expertise in US accounting standards and enhances career opportunities in international finance roles.

Which US state is best for Indian CPA candidates?

According to requirements compiled by NASBA, states like Montana, Colorado, Washington, and Delaware are popular among Indian candidates because they don’t require a Social Security Number or US residency, have reasonable experience requirements, and accept international supervisor verification. The best state depends on your specific qualifications and career plans.

Can I work in the US with a CPA license obtained from India?

The CPA license itself doesn’t grant work authorization in the US, but it significantly enhances your employability for US positions. Many Indian CPAs successfully obtain US work visas (H-1B, L-1) with employer sponsorship. The credential demonstrates your understanding of US standards, making you attractive to US employers seeking international talent.

What is the CPA Exam passing score?

According to the AICPA, the passing score for each CPA Exam section is 75 on a scale of 0 to 99. This score isn’t a percentage of questions answered correctly; it’s a scaled score that accounts for question difficulty. You must achieve 75 or higher on all four sections to pass the exam.

How often can I retake a failed CPA Exam section?

According to NASBA testing rules, you can retake a failed Core section continuously under the new 2025 testing model, or during the next quarterly window for Discipline sections. There’s no lifetime limit on retake attempts. However, each retake requires paying the full exam fees again, making first-attempt passes financially beneficial.

What is the difference between CPA Evolution Core and Discipline sections?

According to the AICPA’s CPA Evolution overview, Core sections (AUD, FAR, REG) cover foundational knowledge all CPAs need and are required for every candidate. Discipline sections (BAR, ISC, TCP) allow specialization based on career interests. You must pass all three Core sections plus one Discipline section of your choice to complete the exam.

Allow notifications

Allow notifications