Complete guide to CPA exam sections for Indian candidates. Learn about AUD, FAR, REG, and Discipline sections BAR, ISC, TCP with pass rates, costs in INR, and strategic advice.

Table of Contents

If you’re an Indian professional considering the US CPA credential, you’ve probably heard that the exam changed dramatically in January 2024. The old four-section format that tested everyone on the same content is gone. In its place, AICPA and NASBA introduced something called the Core + Discipline model, and understanding how it works is essential before you begin your CPA journey. Whether you’re a Chartered Accountant looking to add global credentials, a B.Com graduate exploring international opportunities, or an M.Com holder seeking career advancement, this new structure offers both flexibility and strategic choices you’ll need to navigate carefully.

This guide breaks down everything you need to know about all six CPA exam sections. You’ll learn exactly what each section tests, how the exam is structured, which sections tend to be the hardest, and most importantly, how to choose the right discipline based on your background and career aspirations. We’ve included current pass rates from AICPA data, cost breakdowns in Indian rupees, and strategic advice specifically tailored for Indian professionals taking this exam from India or planning to test at international Prometric centers.

What makes this guide different from generic CPA resources is our focus on your specific situation as an Indian candidate. We’ll discuss how your CA, CMA, or B.Com background might give you advantages in certain sections, which disciplines align with Big 4 India GCC opportunities, and how to plan your exam sequence for maximum success. By the end, you’ll have a clear roadmap for tackling the CPA exam with confidence.

What is the CPA Exam Structure Under CPA Evolution

Understanding the Core and Discipline Model

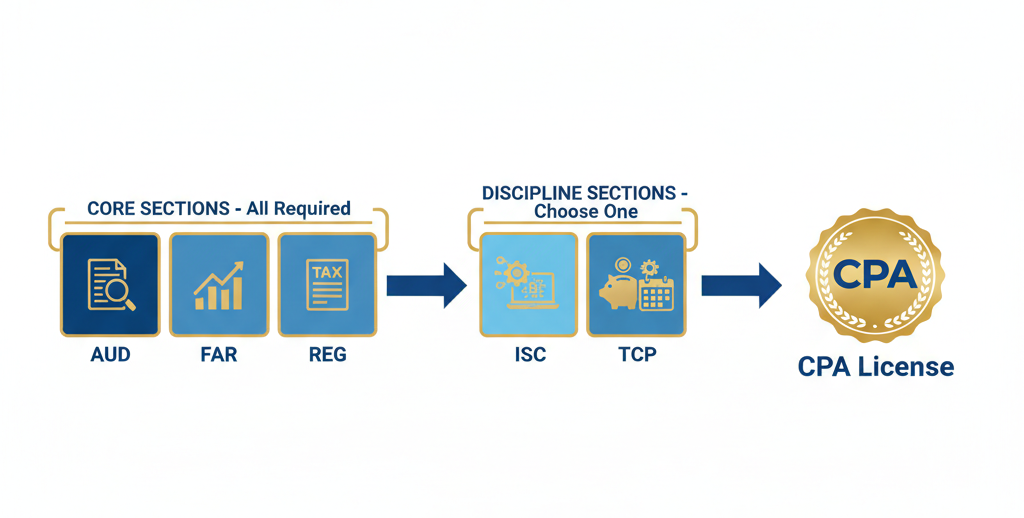

The CPA Evolution initiative fundamentally transformed how candidates earn their CPA license. Instead of the previous structure where everyone took the same four sections, the new model recognizes that newly licensed CPAs need both foundational knowledge and specialized expertise. This change reflects the reality of modern accounting practice, where professionals often develop deep skills in specific areas while maintaining broad competency across the field.

Under this new framework, you must pass three mandatory Core sections that every CPA candidate takes, plus one Discipline section that you choose based on your interests and career goals. Think of the Core sections as the foundation that proves you understand essential accounting, auditing, and tax concepts. The Discipline section, on the other hand, allows you to demonstrate deeper knowledge in a specialized area. According to NASBA’s official guidance, this model ensures all CPAs share a common knowledge base while also developing expertise relevant to their intended career path.

The Three Mandatory Core Sections of CPA Exam

Every CPA candidate, regardless of background or career goals, must pass three Core sections:

- Auditing and Attestation (AUD),

- Financial Accounting and Reporting (FAR), and

- Taxation and Regulation (REG).

These sections test the foundational knowledge and skills that all CPAs need to protect the public interest, regardless of which specific area they eventually practice in.

The Core sections assess universal CPA competencies that apply across all practice areas. AUD ensures you understand how to conduct audits and attestation engagements ethically and effectively. FAR tests your ability to prepare and analyze financial statements under US GAAP. REG confirms you can navigate federal tax compliance and business law. Together, these three sections create the baseline competency expected of every licensed CPA in the United States.

What’s important to understand is that passing all three Core sections is non-negotiable. You cannot substitute one for another or skip any section. The AICPA’s CPA Exam Blueprints clearly outline the specific content areas and skills tested in each Core section, and these blueprints should be your primary reference when preparing for any section.

The Three Discipline Options under CPA Exam

The Discipline sections represent the biggest change from the old CPA exam. Previously, everyone took a section called Business Environment and Concepts (BEC), which covered a broad mix of topics. Under CPA Evolution, BEC was eliminated and replaced with three specialized Discipline options:

- Business Analysis and Reporting (BAR),

- Information Systems and Controls (ISC), and

- Tax Compliance and Planning (TCP).

You only need to pass one Discipline section, and you get to choose which one. Each Discipline builds on concepts from one of the Core sections, allowing you to deepen your expertise in a related area. BAR extends FAR’s financial reporting focus into advanced accounting and analysis. ISC builds on AUD’s assurance concepts with IT audit and controls expertise. TCP expands REG’s tax foundation into complex compliance and planning scenarios.

The discipline you choose does not limit your future practice areas. Once you’re licensed, your CPA credential looks the same regardless of which Discipline you passed. You’ll have the full rights and privileges of any CPA, including the ability to sign audit reports and practice in any area. The Discipline simply represents a path you took during licensure, not a permanent career constraint.

AUD Section – Auditing and Attestation Explained

What Topics Are Covered in the AUD Section?

The AUD section tests your understanding of audit engagements, attestation services, and the professional responsibilities that come with assurance work. If you’ve completed CA articleship or worked in audit roles, you’ll find some concepts familiar, though the specific standards and frameworks tested are distinctly American. The section focuses on how newly licensed CPAs approach audit planning, risk assessment, evidence gathering, and reporting.

Content Area Breakdown and Weightings

The AUD section covers four major content areas, each with specific weightings that tell you how much of the exam focuses on that topic.

- Area I – Ethics, Professional Responsibilities, and General Principles accounts for 15-25% of the exam and covers the AICPA Code of Professional Conduct, independence requirements, and professional skepticism.

- Area II – Assessing Risk and Developing a Planned Response makes up the largest portion at 25-35%, testing your ability to understand an entity’s environment and design appropriate audit procedures.

- Area III – Performing Further Procedures and Obtaining Evidence represents 30-40% of the exam, focusing on substantive procedures, tests of controls, and audit sampling.

- Area IV – Finally, Forming Conclusions and Reporting covers 10-20%, testing your knowledge of audit reports, modifications, and communication requirements. According to the official AICPA blueprints, AUD is unique among all sections because it tests the Evaluation skill level, which requires you to make judgments and draw conclusions based on evidence.

Key Concepts Indian Candidates Should Focus On

For Indian candidates, AUD presents an interesting mix of familiar and unfamiliar territory. The fundamental concepts of audit planning, risk assessment, and evidence gathering translate well from Indian auditing standards. However, you’ll need to learn the specific requirements of AICPA standards, PCAOB standards for public company audits, and government auditing standards under GAO guidelines. The COSO Internal Control framework is heavily tested and may differ from internal control frameworks you’ve studied.

Pay particular attention to the differences between AICPA and Indian auditing standards regarding materiality, sampling, and reporting formats. The US system places significant emphasis on internal controls, especially for public companies under the Sarbanes-Oxley Act. You’ll also need to understand attestation engagements beyond traditional audits, including review engagements, agreed-upon procedures, and compliance attestation that may not have direct equivalents in Indian practice.

AUD Exam: Format and Question Types

Testlet Structure and Time Management

The AUD section gives you four hours to complete five testlets containing a total of 78 multiple-choice questions (MCQs) and 7 task-based simulations (TBSs). The first two testlets contain 39 MCQs each, while the remaining three testlets contain your TBSs distributed as 2, 3, and 2 simulations, respectively. You’ll receive an optional 15-minute break after the third testlet, which doesn’t count against your exam time.

Your score comes equally from MCQs and TBSs, with each component worth 50% of your total score. This means you cannot afford to neglect either question type. The MCQs test your knowledge across all four content areas and skill levels, while the TBSs present realistic scenarios requiring you to apply multiple concepts. For time management, plan to spend roughly 90 minutes on MCQs and 120 minutes on simulations, leaving a buffer for review. Many Indian candidates find the TBSs challenging because they require not just knowledge but also familiarity with the exam interface and research functions.

FAR Section – Financial Accounting and Reporting Deep Dive

What Makes FAR the Most Challenging CPA Section?

FAR consistently has the lowest pass rates among all CPA exam sections, and there are good reasons for this reputation. The section covers an enormous breadth of financial accounting and reporting topics under US GAAP, requiring you to understand everything from basic transaction recording to complex financial statement preparation. For Indian candidates, the challenge is compounded by needing to learn US GAAP standards that differ significantly from Indian Accounting Standards in several key areas.

Content Area Breakdown and Weightings

FAR divides its content into three major areas with relatively balanced weightings.

- Area I – Financial Reporting accounts for 30-40% of the exam, covering financial statement preparation, presentation requirements, and disclosure rules for various entity types, including for-profit businesses, not-for-profit organizations, and government entities.

- Area II – Select Balance Sheet Accounts makes up another 30-40%, testing your knowledge of specific asset and liability accounts like receivables, inventory, fixed assets, and various liabilities.

- Area III – Select Transactions rounds out the section at 25-35%, focusing on how to account for specific types of transactions such as revenue recognition, leases, and equity transactions. Under CPA Evolution, several advanced topics moved from FAR to the BAR Discipline section, including business combinations, consolidated financial statements, derivatives, and government accounting. This shift made FAR more focused but didn’t necessarily make it easier, as the remaining content is tested more deeply.

US GAAP Focus and Why It Matters

The entire FAR section is built around US GAAP as codified by the Financial Accounting Standards Board (FASB). If your background is in Indian Accounting Standards or even IFRS, you’ll need to pay close attention to the differences. While convergence efforts have aligned some standards, significant variations remain in areas like revenue recognition timing, lease classification, and inventory valuation methods.

Critical topics where US GAAP differs from Indian standards include the treatment of development costs (generally expensed under US GAAP), specific lease accounting rules under ASC 842, and the requirements for segment reporting. The good news is that if you’ve studied Ind AS, which is largely converged with IFRS, you’ll find many concepts translatable. However, you cannot assume knowledge transfers directly. Using materials specifically designed for CPA exam preparation, rather than relying on your existing accounting knowledge, is essential for FAR success.

FAR Exam: Format and Strategic Preparation

Testlet Structure and Scoring

FAR presents 50 MCQs across two testlets (25 questions each) and 7 TBSs across three testlets. Like AUD, your score splits evenly between MCQs and TBSs at 50% each. The smaller number of MCQs compared to other sections means each question carries more weight, so accuracy matters significantly. The TBSs in FAR often involve journal entries, financial statement preparation, and account reconciliations that test your ability to apply GAAP to realistic scenarios.

Time Investment Required for FAR

Most CPA review providers recommend 150-200 hours of study time for FAR, making it the most time-intensive section. For Indian working professionals balancing jobs and study, this translates to roughly 10-15 hours per week over 12-16 weeks. The key is consistent daily study rather than weekend cramming, as the volume of material requires continuous reinforcement. Many successful Indian candidates report that FAR requires starting from scratch regardless of background, treating it as an entirely new subject rather than a refresher of existing knowledge.

REG Section – Taxation and Regulation Explained

What Topics Are Covered in the REG Section?

REG tests your understanding of US federal taxation for individuals and business entities, along with business law and professional ethics related to tax practice. For most Indian candidates, this section presents the steepest learning curve because the US tax system has virtually no overlap with Indian tax law. Everything from tax brackets to deduction rules to entity classification is specific to the US federal tax code.

Content Area Breakdown and Weightings

The REG section spans five content areas with varying emphasis.

- Area I – Ethics, Professional Responsibilities, and Federal Tax Procedures covers 10-20%, testing your knowledge of Circular 230 regulations and practitioner responsibilities before the IRS.

- Area II – Business Law accounts for 15-25%, including contracts, agency relationships, business structures, and debtor-creditor relationships.

- Area III – Federal Taxation of Property Transactions makes up 5-15%, focusing on basis calculations, gains and losses, and like-kind exchanges.

- Area IV – Federal Taxation of Individuals is heavily weighted at 22-32%, covering everything from gross income to deductions to credits for individual taxpayers.

- Area V – Finally, Federal Taxation of Entities at 23-33% tests your knowledge of C corporations, S corporations, partnerships, and other business entity taxation. According to the AICPA’s REG blueprint, the section focuses on routine and recurring tax compliance tasks that newly licensed CPAs commonly perform.

US Tax System Fundamentals for Indian Candidates

The US federal tax system operates completely differently from Indian taxation. You’ll need to learn concepts like the distinction between above-the-line and below-the-line deductions, the alternative minimum tax, and how different entity types (C-Corp, S-Corp, Partnership, LLC) are taxed. The tax treatment of individuals, including filing statuses, standard versus itemized deductions, and various credits, requires building knowledge from the ground up.

Entity taxation is particularly complex, with pass-through entities like S corporations and partnerships requiring you to understand how income flows to owners’ personal returns. Business law topics may feel more familiar if you’ve studied Indian commercial law, but specific US concepts like the Uniform Commercial Code and bankruptcy rules need dedicated attention. The good news is that REG has consistently higher pass rates than FAR, suggesting that candidates who invest time in learning the material systematically tend to succeed.

REG Exam: Format and Preparation Strategy

Testlet Structure and Scoring

REG contains 72 MCQs across two testlets (36 questions each) and 8 TBSs across three testlets, giving it more simulation questions than AUD or FAR. The scoring remains 50% MCQs and 50% TBSs. The additional TBS means simulations in REG often involve tax return preparation, basis calculations, and multi-step problems requiring you to trace transactions through their tax consequences.

Why REG Requires Fresh Learning for Most Indian Candidates

Unlike AUD and FAR, where some concepts transfer from Indian education, REG essentially requires learning an entirely new tax system. Indian CAs and B.Com graduates have no prior exposure to the US Internal Revenue Code sections, IRS procedures, or federal tax forms. This isn’t a disadvantage; it simply means everyone starts at the same place regardless of background. Many Indian candidates actually find REG manageable because they approach it with fresh eyes, methodically learning each concept without assumptions from prior knowledge.

The key to REG success is treating it like learning a new language. Start with fundamental concepts, build vocabulary around tax terminology, and practice extensively with tax scenarios. Unlike FAR, where you might be tempted to skim familiar topics, REG demands thorough coverage of all material since nothing will feel familiar initially.

CPA Exam Discipline Sections – BAR, ISC, and TCP Explained

Business Analysis and Reporting (BAR) Section

Content Areas and Weightings

The BAR tests advanced accounting and financial analysis skills that build on FAR’s foundation. The section covers three main content areas:

- Area I – Business Analysis at 40-50%,

- Area II – Technical Accounting and Reporting at 35-45%, and

- Area III – State and Local Governments at 10-20%.

Business Analysis includes financial statement analysis, budgeting, forecasting, and performance measurement. Technical Accounting covers complex topics that moved from the old FAR section, including business combinations, consolidated statements, derivatives, and stock compensation.

The government accounting portion covers GASB standards for state and local entities, which were previously tested in FAR but now fall under BAR. This section requires strong analytical skills and the ability to interpret financial data rather than just prepare it. According to Becker’s guide to CPA exam sections, BAR assesses your ability to compare historical results to budgets, derive impacts of transactions on performance measures, and evaluate investment alternatives.

Who Should Choose BAR?

BAR is ideal for candidates interested in corporate finance, financial planning and analysis (FP&A), advisory services, or management accounting roles. If you see yourself analyzing financial statements, preparing forecasts, or advising on business decisions rather than conducting audits or preparing tax returns, BAR aligns well with your career trajectory. The section also suits candidates who enjoyed FAR and want to deepen that knowledge.

For Indian candidates eyeing roles in Big 4 consulting divisions, corporate treasury, or CFO tracks at multinational companies, BAR provides relevant specialized knowledge. However, be aware that BAR consistently has lower pass rates than the other disciplines, hovering around 34-41%. This reflects the volume and complexity of technical accounting topics tested, rather than poor candidate preparation.

Information Systems and Controls (ISC) Section

Content Areas and Weightings

ISC focuses on technology, data management, and IT audit skills that are increasingly critical in modern accounting.

Area I – The section covers Information Systems and Data Management at 35-45%,

Area II – Security, Confidentiality, and Privacy at 35-45%, and

Area III – Considerations for SOC Engagements at 15-25%.

This Discipline builds directly on AUD’s assurance concepts but applies them to IT environments, data governance, and system controls.

Topics include IT general controls, application controls, data lifecycle management, cybersecurity frameworks, and the planning and execution of System and Organization Controls (SOC) engagements. The section reflects the accounting profession’s growing involvement in IT audit and technology advisory services.

Who Should Choose ISC?

ISC suits candidates drawn to IT audit, cybersecurity assurance, data analytics, or technology advisory roles. If you’re interested in how information systems work, enjoy evaluating controls in technology environments, or want to specialize in SOC engagements, ISC provides directly relevant expertise. The section is particularly valuable for candidates targeting Big 4 technology risk or IT audit practices.

For Indian candidates, ISC opens doors to the rapidly growing GCC (Global Capability Center) operations, where Big 4 firms handle IT audit and technology assurance for global clients. Roles in internal audit with a technology focus, risk advisory, and data governance also align well with ISC knowledge. The pass rate for ISC falls in the middle range at 56-59%, suggesting it’s challenging but achievable with proper preparation.

ISC’s Unique Exam Format

ISC differs from other sections in its question distribution and scoring. The section contains 82 MCQs (the highest of any section) and only 6 TBSs (the lowest). More significantly, ISC’s scoring weight is 60% MCQs and 40% TBSs, unlike all other sections, which are split 50-50. This means your multiple-choice performance matters more in ISC than anywhere else.

The skill levels tested also differ, with ISC emphasizing Remembering and Understanding at 55-65%, higher than other sections. This means more questions test your recall of concepts rather than complex application or analysis. For candidates who perform better on knowledge-based questions than complex simulations, ISC’s format may offer an advantage.

Tax Compliance and Planning (TCP) Section

Content Areas and Weightings

TCP extends REG’s tax foundation into more complex compliance scenarios and tax planning strategies.

- Area I – The section covers Tax Compliance and Planning for Individuals and Personal Financial Planning at 30-40%.

- Area II – Entity Tax Compliance at 30-40%,

- Area III – Entity Tax Planning at 10-20%, and

- Area IV – Property Transactions at 10-20%.

Topics include advanced individual tax situations, complex entity taxation, tax planning strategies, and personal financial planning.

Content that moved from REG to TCP includes consolidated corporate returns, international tax issues, and advanced property transactions. TCP essentially takes where REG leaves off, diving deeper into the complexities that tax specialists regularly encounter. The section also uniquely incorporates personal financial planning concepts, including retirement planning and estate considerations.

Who Should Choose TCP?

TCP is the natural choice for candidates pursuing tax careers, whether in public accounting tax practices, corporate tax departments, or personal financial planning. If you enjoyed REG and want to specialize in taxation, TCP builds directly on that foundation. The section also appeals to candidates interested in wealth management or financial advisory roles where tax planning is central.

For Indian candidates, TCP knowledge is valuable for Big 4 US tax practices with India delivery centers, international tax compliance roles, and positions supporting US-India cross-border transactions. Notably, TCP consistently has the highest pass rate among all disciplines, ranging from 72-78%. This makes it an attractive option for candidates seeking a strategically advantageous path, though you should still choose based on genuine interest rather than pass rates alone.

How Should Indian Candidates Choose Their CPA Discipline?

Factors to Consider When Selecting Your Discipline

Choosing your Discipline isn’t a decision to take lightly, even though it doesn’t permanently lock you into a career path. The section you choose affects your study time, exam experience, and the specialized knowledge you’ll demonstrate as a newly licensed CPA. For Indian candidates, the decision should factor in both your existing strengths and your intended career direction.

Your Educational Background and Strengths

Your educational background influences which Discipline might come more naturally to you. Indian Chartered Accountants often have strong foundations in financial reporting and auditing, potentially making FAR and AUD more comfortable. If you excelled in your CA final’s financial reporting or audit papers, BAR (which extends FAR) might align well with your existing knowledge base.

Similarly, if your background includes information systems coursework or you’ve worked with IT controls and data management, ISC could leverage existing familiarity. Candidates from commerce backgrounds without CA who’ve focused heavily on taxation might find TCP’s extension of REG content more accessible. The goal is to play to your strengths while still choosing a discipline that genuinely interests you, since motivation matters during the intensive study period.

Your Career Goals in India and Abroad

Your career aspirations should significantly influence your Discipline choice. Big 4 firms in India have different practice areas with varying demand for specialized CPA knowledge. If you’re targeting assurance or audit roles, either BAR (for financial reporting depth) or ISC (for IT audit specialization) makes sense. Tax practice roles clearly align with TCP, while advisory and consulting positions might value BAR’s analytical focus.

For candidates planning US careers, consider which specializations are in the highest demand. Tax specialists with TCP knowledge find opportunities in US tax practices serving both domestic and international clients. IT audit and SOC engagement expertise from ISC addresses growing demand for technology assurance professionals. BAR’s corporate finance focus suits FP&A and management accounting roles in US corporations. Understanding the job market you’re targeting helps ensure your Discipline choice opens the right doors.

Discipline Selection Framework for Indian Professionals

Choose BAR If You Want Corporate Finance or FP&A Roles

BAR prepares you for roles requiring deep financial analysis and reporting expertise. If you see yourself in corporate treasury, financial planning and analysis, or management accounting positions, BAR’s content directly supports these functions. The section covers performance metrics, forecasting techniques, and complex accounting treatments you’ll encounter in corporate finance environments.

Analytical roles at multinational companies, financial advisory positions, and corporate controller tracks all benefit from BAR knowledge. The section also supports consulting roles where you’d advise clients on financial reporting issues, business valuations, or transaction accounting. Despite its lower pass rate, candidates genuinely interested in these areas should not be deterred, as the additional challenge reflects content complexity rather than unfair difficulty.

Choose ISC If You’re Interested in IT Audit or Advisory

ISC positions you for the intersection of accounting and technology, an area experiencing tremendous growth. IT audit roles, SOC engagement teams, cybersecurity assurance positions, and data governance functions all value ISC expertise. The section’s focus on information systems controls and data management reflects skills increasingly demanded across the profession.

Big 4 India GCCs heavily invest in technology risk and IT audit capabilities, creating significant opportunities for CPAs with ISC backgrounds. Internal audit departments at technology companies, fintech firms, and traditional companies undergoing digital transformation also seek professionals combining accounting credentials with IT assurance knowledge. If technology excites you and you enjoy evaluating systems and controls, ISC offers a differentiated specialization.

Choose TCP If Tax and Compliance Excite You

TCP is the straightforward choice for aspiring tax professionals. If you found REG engaging and want to specialize in taxation, TCP deepens that expertise into areas like consolidated returns, international tax provisions, and personal financial planning. Tax advisory careers, whether in public accounting or corporate tax departments, directly utilize TCP knowledge.

The section also opens doors to personal financial planning and wealth management roles where tax planning is central to client service. For Indian candidates, TCP knowledge supports positions in US tax compliance centers, international tax teams handling US-India matters, and advisory roles helping clients optimize their tax positions. The consistently high pass rate (72-78%) is an added benefit, though genuine interest in tax should drive your decision rather than exam statistics alone.

Does Your Discipline Choice Limit Your Career?

Understanding Full CPA License Rights

Here’s something important that surprises many candidates: your CPA license won’t indicate which Discipline you passed. Once licensed, you’re simply a CPA with full rights and privileges, including the ability to sign audit reports, prepare tax returns, and practice in any area of accounting. The Discipline choice affects your exam journey, not your licensed capabilities.

This means you shouldn’t choose a Discipline solely based on short-term pass rate considerations if your genuine interest lies elsewhere. A CPA who passed TCP can absolutely work in audit or advisory. A CPA who passed the bar can take on tax clients. Your ongoing career development, continuing education, and work experience will shape your expertise far more than which Discipline section you cleared. Choose based on genuine interest and career alignment, knowing the choice doesn’t create permanent boundaries around your practice.

Strategic Exam Order and Section Pairing for Success

Which CPA Section Should You Take First?

The order in which you tackle CPA exam sections can significantly impact your success. While there’s no single correct sequence, certain approaches have proven effective for Indian candidates balancing work, study, and the unique challenges of preparing for US content from India.

Starting with FAR: The Traditional Approach

Many candidates choose to tackle FAR first, and there’s solid reasoning behind this approach. FAR covers foundational accounting concepts that support understanding in other sections, particularly BAR and portions of AUD. By conquering the most content-heavy section early, you build confidence and establish strong study habits that carry through subsequent sections.

Starting with FAR also means getting the lowest-pass-rate section out of the way when your motivation is highest. The beginning of your CPA journey typically brings the most enthusiasm and discipline, which you’ll need for FAR’s demanding content volume. If you pass FAR first, you’ve cleared the biggest hurdle and can approach the remaining sections knowing the hardest technical challenge is behind you.

Starting with Your Strongest Subject

An alternative strategy is to begin with whichever section aligns best with your recent experience or education. If you’ve just completed extensive tax coursework or work heavily in tax, starting with REG while that knowledge is fresh makes sense. Similarly, if your job involves financial statement audits, AUD might be your strongest entry point.

The psychological benefit of passing your first section cannot be overstated. An early pass builds confidence, validates your study approach, and creates momentum for subsequent sections. Starting with a section where you have natural advantages increases your chances of that crucial first victory. Just ensure you don’t wait too long before tackling less familiar sections, as the 30-month clock starts ticking once you pass your first section.

Optimal Core-Discipline Pairing Strategies

FAR + BAR: The Financial Reporting Track

If you choose BAR as your Discipline, scheduling it immediately after FAR offers significant advantages. Both sections deal heavily with financial accounting and reporting under FASB standards. Topics like revenue recognition, lease accounting, and financial statement analysis appear in both, with BAR testing these concepts at higher complexity levels.

By taking BAR while the FAR material is fresh, you leverage momentum and avoid relearning foundational concepts. Many BAR topics were previously part of FAR before CPA Evolution, so the content connection is direct and intentional. Candidates pursuing this track should consider studying for both simultaneously during the later stages of FAR preparation, allowing a seamless transition to BAR studies after passing FAR.

AUD + ISC: The Assurance and IT Track

The AUD and ISC pairing makes sense for candidates interested in assurance services with a technology focus. ISC builds directly on AUD’s foundation, especially regarding internal controls, risk assessment, and attestation concepts. SOC engagements tested in ISC are essentially specialized attestation services governed by AICPA standards you’ll learn in AUD.

Taking ISC shortly after AUD means concepts like the COSO framework, control testing, and professional standards remain fresh in your mind. The transition from general audit concepts to IT-specific controls feels natural when the foundational knowledge is recent. This pairing particularly suits candidates targeting IT audit or technology risk careers.

REG + TCP: The Taxation Track

The REG and TCP combination offers perhaps the most synergistic pairing of any Core-Discipline track. TCP explicitly extends REG content into more complex scenarios, using the same tax code, IRS procedures, and entity structures you learned in REG. Candidates who enjoy REG typically find TCP’s content engaging rather than overwhelming.

This pairing also offers strategic advantages from a pass rate perspective. REG averages 60-64% pass rates, and TCP leads all Disciplines at 72-78%. Sequencing these together creates positive momentum and efficient knowledge building. For candidates with a limited tax background, learning US taxation comprehensively through this track creates genuine expertise in an area with strong career demand.

CPA Exam Pass Rates: What Indian Candidates Should Know

Current Pass Rates by Section (2024-2025 Data)

Understanding pass rates helps you set realistic expectations and allocate study time appropriately. The AICPA publishes quarterly pass rate data that shows how candidates perform across all sections. These statistics come from all test-takers, not just Indian candidates, but they provide valuable benchmarks for your planning.

Core Section Pass Rates

Among the Core sections, REG consistently shows the highest pass rates, averaging 60-64% through 2024 and into 2025. This may seem counterintuitive since US tax content is completely foreign to Indian candidates, but it reflects the focused nature of tax material and the effectiveness of structured study approaches. Candidates who methodically learn tax concepts tend to succeed.

AUD pass rates hover around 46-48%, placing it in the middle range. The section’s emphasis on judgment and evaluation skills rather than pure knowledge recall creates variability in candidate performance. FAR remains the most challenging Core section with pass rates of 40-43%, reflecting its vast content scope and technical depth. These rates have remained relatively stable since CPA Evolution launched, suggesting the exam difficulty is consistent.

Discipline Section Pass Rates

Discipline pass rates show more dramatic variation. TCP leads significantly at 72-78%, making it the highest-pass-rate section across the entire exam. This partly reflects that candidates choosing TCP often have tax backgrounds or recent REG knowledge, but it also suggests the content scope is more manageable than other Disciplines.

ISC falls in the middle at 65-69%, reasonable for a technology-focused section that many candidates find unfamiliar. BAR presents the biggest challenge among Disciplines, with pass rates of 39-42%, often lower than even FAR. The combination of advanced accounting topics, government accounting, and analytical requirements creates a demanding section that requires substantial preparation.

What Pass Rates Tell You About Section Difficulty

Why FAR and BAR Have the Lowest Pass Rates

FAR and BAR share something important: they test extensive technical accounting content requiring deep understanding rather than surface knowledge. FAR covers financial reporting across multiple entity types with numerous standards to master. BAR adds complexity through advanced topics, government accounting, and analytical applications.

Both sections also weigh Application and Analysis skill levels heavily, meaning you must not just know concepts but apply them to realistic scenarios. The volume of material combined with higher-order testing creates the challenging profile reflected in pass rates. Candidates should budget extra study time for these sections and ensure their review materials provide extensive practice with application-based questions.

Why TCP Has Consistently High Pass Rates

TCP’s strong pass rates reflect several factors working together. First, the section builds directly on REG, so candidates arrive with foundational tax knowledge already established. Second, TCP’s content scope, while complex, is more focused than BAR’s diverse requirements. Third, many TCP candidates have a genuine interest in taxation, bringing motivation that supports effective study.

The pass rates don’t mean TCP is easy; it means well-prepared candidates tend to succeed. If you approach TCP with the same diligence you’d apply to lower-pass-rate sections, you’re likely to perform well. However, choosing TCP solely for pass rate advantages without genuine interest may backfire, as unmotivated study rarely produces strong results in any section.

CPA Exam Section Costs for Indian Candidates

Fee Breakdown by Section in INR

Understanding CPA exam costs in Indian rupees helps you budget realistically for your certification journey. Fees vary by state and testing location, with international candidates paying additional amounts for testing outside the United States. As of late 2025, NASBA’s fee schedule and state board requirements determine what you’ll pay.

Per-Section Exam Fees

Each CPA exam section involves multiple fee components. The examination fee set by NASBA is approximately $262.64 per section for domestic US testing. However, candidates testing at international locations, including all Prometric centers in India, pay an additional international surcharge. As of recent NASBA updates, the per-section cost for international testing is $510 per section.

For Indian candidates testing in India, expect to pay roughly $510 per section (approximately ₹42,000-43,000 at current exchange rates). This covers the NASBA examination fee plus the international testing surcharge. Additionally, most states charge application and registration fees ranging from $50-100 per section. Total per-section costs for Indian candidates testing in India typically range from ₹47,000-55,000, depending on your chosen state board.

Additional Costs to Consider

Beyond basic exam fees, several additional costs can arise during your CPA journey. If your Notice to Schedule (NTS) expires before you test, you’ll need to reapply and pay fees again. NTS extension requests, where permitted, carry their own fees. Rescheduling your Prometric testing appointment less than 30 days before your exam date typically incurs rescheduling charges of $35 or more.

Failed sections require full repayment of exam fees for retakes, making first-attempt passes significantly more economical. Some states require background checks, adding $30-50 to your costs. If you need to change your testing state or transfer scores between jurisdictions, additional administrative fees apply. Building a 20-30% buffer into your budget for unexpected costs is wise financial planning.

Budgeting Your CPA Exam Journey Section by Section

Cost Planning Strategy for Indian Professionals

Rather than paying for all four sections upfront, many Indian candidates spread costs across their testing timeline. This approach preserves cash flow and avoids losing fees if study delays cause NTS expiration. Plan to pay for one or two sections at a time, scheduling payments to align with your realistic preparation timeline.

Total CPA exam costs for Indian candidates typically range from ₹1,80,000-2,50,000 for exam fees alone across all four sections. Adding review course costs (₹80,000-1,80,000 depending on provider), credential evaluation fees (₹15,000-30,000), and miscellaneous expenses, the complete investment often reaches ₹3,50,000-5,50,000. Many Indian coaching providers like Miles Education and Simandhar Education offer EMI options that spread this investment over 12-24 months, making the financial burden more manageable for working professionals.

Conclusion

The CPA exam’s Core + Discipline structure offers Indian candidates both a clear pathway to licensure and meaningful choices about their specialization. You now understand that success requires passing three Core sections (AUD, FAR, and REG) that establish your foundational competency, plus one Discipline section (BAR, ISC, or TCP) that allows you to demonstrate deeper expertise in your chosen area.

For Indian professionals, the key strategic decisions involve selecting the right Discipline based on your career goals and sequencing your exams for maximum efficiency. Whether you’re drawn to the financial analysis focus of BAR, the technology and controls emphasis of ISC, or the tax specialization of TCP, your choice should reflect genuine interest aligned with your intended career path. Remember that your Discipline doesn’t limit your future practice; once licensed, you’re a fully credentialed CPA with opportunities across all areas of the profession.

Your next steps should include evaluating your eligibility through your chosen state board, selecting a CPA review course that fits your learning style and budget, and creating a realistic study timeline that accounts for your work commitments. The investment in time, money, and effort is substantial, but the career advancement opportunities that come with CPA licensure make it worthwhile for motivated Indian professionals. Start by downloading the official AICPA CPA Exam Blueprints to understand exactly what each section tests, then build your study plan around conquering these sections one by one.

Frequently Asked Questions

How many sections are there in the CPA exam?

The CPA exam consists of four sections that you must pass: three Core sections (AUD, FAR, REG) that all candidates take, plus one Discipline section (BAR, ISC, or TCP) that you choose. While there are six possible sections in total, you only take four since you select just one Discipline.

What are the three Core sections of the CPA exam?

The three Core sections are Auditing and Attestation (AUD), Financial Accounting and Reporting (FAR), and Taxation and Regulation (REG). Every CPA candidate must pass all three Core sections regardless of their chosen career specialization or Discipline selection.

What are the three Discipline sections of the CPA exam?

The three Discipline sections are Business Analysis and Reporting (BAR), Information Systems and Controls (ISC), and Tax Compliance and Planning (TCP). You choose and pass only one Discipline section based on your career interests and strengths.

Do I have to pass all Core sections before taking a Discipline section?

No, you can take CPA exam sections in any order you prefer. Many candidates take their chosen Discipline immediately after the related Core section (FAR then BAR, AUD then ISC, or REG then TCP) to leverage fresh knowledge, but there’s no required sequence.

Can I change my Discipline choice if I fail?

Yes, if you fail a Discipline section, you can choose a different Discipline when you retake. You’re not locked into your original choice. However, if you pass a Discipline, you cannot take a different one since you only need one passing Discipline for licensure.

Which CPA section is the hardest for Indian candidates?

FAR is generally considered the hardest section due to its vast content covering US GAAP across multiple entity types. For Indian candidates specifically, REG’s US tax content represents the steepest learning curve since it has no overlap with Indian taxation.

Which CPA Discipline has the highest pass rate?

TCP (Tax Compliance and Planning) consistently has the highest pass rate among all CPA exam sections, averaging 72-78%. This reflects the focused content scope and strong foundation that candidates build from the REG Core section.

How long do I have to pass all four CPA sections?

Most states follow NASBA’s recommendation of a 30-month testing window, meaning you must pass all four sections within 30 months of passing your first section. Some states still use 18-month windows, so verify with your specific state board.

How many questions are in each CPA section?

Question counts vary by section: AUD has 78 MCQs and 7 TBSs, FAR has 50 MCQs and 7 TBSs, REG has 72 MCQs and 8 TBSs, BAR has 50 MCQs and 7 TBSs, ISC has 82 MCQs and 6 TBSs, and TCP has 68 MCQs and 7 TBSs.

Is the CPA exam the same difficulty at all Prometric centers in India?

Yes, the CPA exam content and difficulty are identical regardless of where you test. Whether you take the exam in Hyderabad, Mumbai, Bangalore, or any other Prometric location globally, you receive the same standardized exam administered under uniform conditions.

Can Indian CAs skip any CPA sections?

No, Indian Chartered Accountants cannot skip any CPA exam sections. Regardless of your Indian qualifications, you must pass all three Core sections plus one Discipline. Your CA background may help you understand certain concepts faster, but no exemptions exist.

How much does each CPA section cost in Indian rupees?

For Indian candidates testing in India, each section costs approximately ₹47,000-55,000, including NASBA examination fees, international surcharge, and state registration fees. Total costs for all four sections typically range from ₹1,80,000-2,20,000.

What happens if my CPA section credit expires?

If a passed section’s credit expires before you complete all four sections, you must retake that section and pay full fees again. Credits expire based on your state’s testing window (typically 30 months from your first passed section), making timely completion important.

Allow notifications

Allow notifications