Complete guide to CPA exam eligibility for Indian B.Com graduates. Learn credit requirements, 4 eligibility pathways, best US states, evaluation process, and costs in INR.

Table of Contents

If you are a B.Com graduate wondering whether you can pursue the US CPA certification, you are not alone. Every year, thousands of Indian commerce graduates find themselves confused about credit requirements, state board rules, and eligibility pathways. The good news is that CPA eligibility for Indian B.Com graduates is absolutely achievable once you understand how the system works.

The challenge most candidates face is not a lack of qualifications but a lack of clarity. The US CPA system operates on a credit-based framework that differs significantly from the Indian education structure. Without understanding how your B.Com degree translates into US credits, you might either assume you are ineligible when you are not, or waste time and money applying to the wrong state board.

According to official guidance from the National Association of State Boards of Accountancy (NASBA), nearly all U.S. jurisdictions require 120 credit-hours of post-secondary education to sit for the US Certified Public Accountant (CPA) exam, and 150 credit-hours for full CPA licensure.

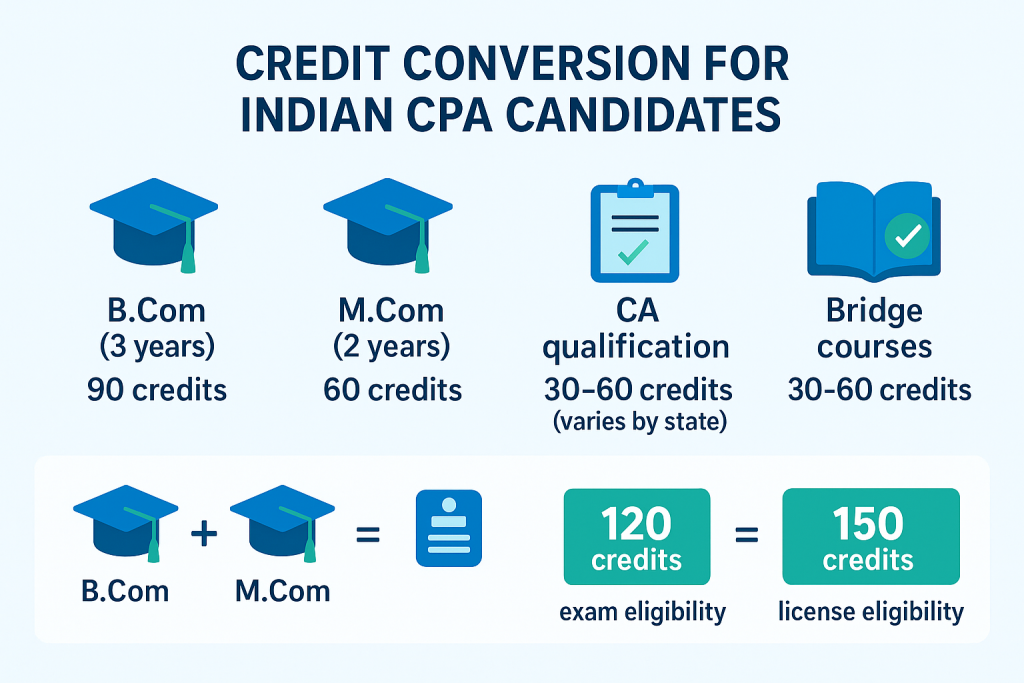

In the Indian context, a typical three-year Bachelor of Commerce (B.Com) is generally mapped as 90 credits (30 credits per year) under US equivalency norms. As a result, a plain B.Com often falls short of eligibility for the exam under most state-board rules, unless supplemented with additional education, typically a master’s (like M.Com or MBA) or a recognized professional qualification (such as Chartered Accountant, Cost & Works Accountant, or Company Secretary), which helps reach the 150-credit threshold.

Recent data shows a rapidly growing interest among Indian students in the US CPA pathway. India has become the second-largest market for US-CPA among international candidates as enrollment rose by about 60% after the exam became widely accessible in India, with thousands of Indian applicants every year. This surge is driven by demand from global firms: as U.S. accounting graduates dwindle and many accountants in the U.S. workforce near retirement, American firms are increasingly turning to Indian finance professionals to fill the gap

This guide will walk you through everything you need to know about CPA exam eligibility for Indian B.Com graduates. We will cover credit calculations, the four main eligibility pathways, state selection strategies, credential evaluation processes, application steps, and complete cost breakdowns. By the end, you will have a clear roadmap to start your CPA journey with confidence.

US CPA: Why Should Indian B.Com Graduates Consider It?

The Certified Public Accountant credential has become one of the most sought-after qualifications for Indian accounting and finance professionals. Before diving into eligibility requirements, let us understand what makes this credential valuable and why B.Com graduates are particularly well-positioned to pursue it.

Understanding the CPA Credential and Its Global Recognition

The CPA is not just another certification. It is a professional license that opens doors to global career opportunities and commands respect across industries worldwide.

What Does CPA Stand For and Who Awards This Credential?

CPA stands for Certified Public Accountant, and it is the highest standard of competence in the accounting profession in the United States. The credential is awarded by individual State Boards of Accountancy across the 55 US jurisdictions, while the exam itself is administered by the American Institute of Certified Public Accountants (AICPA) in partnership with the National Association of State Boards of Accountancy (NASBA).

Unlike the Indian CA qualification, which is awarded by a single body (ICAI), the CPA license comes from individual state boards. This means eligibility requirements can vary from state to state, which actually works in favor of international candidates. You can choose a state with requirements that best match your educational background, giving you flexibility that does not exist in most other professional certifications.

The CPA exam consists of four sections that must be completed within a rolling 30-month window. Three core sections cover:

- Auditing and Attestation (AUD),

- Financial Accounting and Reporting (FAR), and

- Taxation and Regulation (REG).

Additionally, candidates choose one discipline section from:

- Business Analysis and Reporting (BAR),

- Information Systems and Controls (ISC), or

- Tax Compliance and Planning (TCP).

This structure, introduced through CPA Evolution in 2024, reflects the modern demands of the accounting profession.

Career Benefits of CPA for Indian Commerce Graduates

The decision to pursue CPA should be driven by clear career objectives. For Indian B.Com graduates, the credential offers tangible benefits that can transform your professional trajectory.

Job Opportunities in India After CPA (Big 4, MNCs, GCCs)

CPA holders in India find opportunities across Big 4 accounting firms (Deloitte, PwC, EY, KPMG), multinational corporations, and the rapidly growing Global Capability Centers (GCCs). Roles include financial analyst, audit manager, tax consultant, and advisory positions that require expertise in US GAAP, IFRS, and international taxation.

Salary Expectations for CPA Holders in India

Entry-level CPA professionals in India can expect salaries ranging from INR 6-9 lakhs per annum, while experienced professionals often earn INR 20 lakhs or more. The salary premium over non-certified professionals makes the CPA investment worthwhile for long-term career growth.

Why B.Com Graduates Have a Unique Advantage in Pursuing CPA

Here is something that might surprise you: B.Com graduates actually have several advantages when pursuing a CPA compared to candidates from other backgrounds. Your commerce foundation means you already understand accounting principles, financial statements, and business concepts that form the core of CPA exam content.

The B.Com curriculum in India covers subjects like financial accounting, cost accounting, auditing, taxation, and business law. These topics align directly with CPA exam content areas, reducing your learning curve during preparation. While you will certainly encounter new concepts like US GAAP and federal taxation, your foundational knowledge gives you a significant head start.

Additionally, B.Com graduates often have more flexibility in choosing their CPA pathway. Unlike CA students who may be locked into a specific professional track, B.Com graduates can combine their degree with various additional qualifications or bridge courses to meet CPA eligibility requirements. This flexibility allows you to choose the most efficient and cost-effective route based on your personal circumstances.

How Does the US Credit System Work for CPA Eligibility?

Understanding the credit system is the foundation of everything else in your CPA journey. Many Indian candidates get confused at this stage because the US education system measures academic achievement differently from the Indian system.

Understanding Credit Hours and Their Importance

The entire CPA eligibility framework revolves around credit hours. Let us break down exactly what this means and how it applies to your Indian qualifications.

What are Semester Credit Hours in the US Education System?

In the United States, academic progress is measured in semester credit hours rather than years of study. A typical full-time student earns approximately 30 credit hours per academic year. Each course carries a certain number of credits based on classroom contact hours and expected study time. For example, a course meeting three hours per week for a semester typically awards 3 credit hours.

This credit-based system allows for precise measurement of educational achievement. When US state boards set eligibility requirements, they specify exact credit counts rather than degree types, which is why understanding credit conversion is essential for international candidates.

How Indian Degrees Convert to US Credits

The standard conversion rate for Indian education is 30 semester credits per year of university study. This means your 3-year B.Com degree typically converts to 90 semester credits (3 years × 30 credits = 90 credits). A 2-year postgraduate degree like M.Com adds another 60 credits (2 years × 30 credits = 60 credits).

However, the actual credit count you receive depends on the credential evaluation agency’s assessment of your specific transcripts. Factors like course content, contact hours, and university accreditation can affect your final credit count. This is why getting a professional credential evaluation is a critical early step in your CPA journey.

The 120 Credit Rule for CPA Exam Eligibility

The 120 credit threshold is your first major milestone. Understanding this requirement helps you determine whether you can sit for the CPA exam and what additional steps you might need to take.

Minimum Credits Required to Sit for the CPA Exam

Most US state boards require a minimum of 120 semester credits to be eligible to sit for the CPA exam. This is equivalent to a 4-year bachelor’s degree in the United States. Since a standard 3-year Indian B.Com provides only 90 credits, there is typically a 30-credit gap that needs to be bridged.

Accounting Credits vs Business Credits vs General Education Credits

Beyond the total credit count, most states have specific requirements for how those credits are distributed. Typically, you need a minimum of 24 credits in accounting subjects and 24 credits in business-related subjects. The remaining credits can come from general education courses.

Accounting credits must come from courses like financial accounting, cost accounting, auditing, taxation, and management accounting. Business credits include subjects like business law, economics, finance, management, and marketing. Your B.Com degree likely covers many of these requirements, but the exact distribution will be determined during your credential evaluation.

Understanding this breakdown is important because some candidates have enough total credits but fall short in specific categories. In such cases, you may need to take additional courses in accounting or business subjects rather than just any courses to reach your target numbers.

The 150 Credit Rule for CPA License

Here is where many candidates get confused: meeting the 120 credit requirement allows you to sit for the exam, but you need 150 credits to actually obtain your CPA license. Let us clarify this important distinction.

Why are 150 Credits Required for Licensure

The 150-credit requirement for licensure reflects the profession’s commitment to ensuring CPAs have a comprehensive education. This requirement was established to raise professional standards and ensure that licensed CPAs possess both breadth and depth of knowledge. While you can begin taking exam sections with 120 credits in most states, you must complete 150 credits before your license is issued.

For Indian B.Com graduates, this means planning for education beyond your bachelor’s degree. The 150-credit requirement is equivalent to approximately 5 years of higher education in US terms. This is typically achieved through a combination of your undergraduate degree plus a master’s degree or additional coursework.

How to Bridge the Gap Between 120 and 150 Credits

If you have a B.Com (90 credits) plus M.Com (60 credits), you already meet the 150-credit requirement. If you are short of 150 credits, you have several options to bridge the gap. You can pursue additional academic coursework from accredited universities, complete bridge courses offered by CPA training providers, or pursue professional qualifications that may count toward your credit total.

The key is to plan your education pathway strategically. If you are still deciding between M.Com, MBA, or professional qualifications like CA, consider how each option contributes to your CPA eligibility. Some candidates find it efficient to complete bridge courses specifically designed to meet CPA requirements, while others prefer the broader benefits of a full master’s degree.

CPA Exam Eligibility for Indian B.Com Graduates: The 4 Pathways

Now that you understand the credit system, let us explore the specific pathways available to Indian B.Com graduates. Each pathway has its advantages, and the right choice depends on your current qualifications, career timeline, and budget.

CPA Exam Eligibility for Indian B.Com Graduates: Pathway 1 – B.Com (3 Years) with NAAC A+ First Division

This pathway is particularly relevant for recent graduates from top-tier Indian universities. Under certain conditions, your B.Com degree alone might be sufficient to meet the 120-credit requirement.

How the First Division from NAAC A Accredited Universities Adds 30 Bonus Credits

Some US state boards recognize academic excellence from accredited Indian institutions by awarding additional credits. If you have completed your B.Com in first division from a NAAC A or A+ accredited university, certain states treat your 3-year degree as equivalent to a 4-year US degree. This effectively awards you 30 bonus credits, bringing your total from 90 to 120 credits.

This recognition is based on the reasoning that first division performance from a top-tier institution indicates academic rigor comparable to an additional year of study. The extra 30 credits represent the gap between a 3-year and 4-year bachelor’s program, which is waived for high-performing students from quality institutions.

However, this advantage is not universal. Not all states recognize the NAAC A+ first division bonus, and even those that do may have specific documentation requirements. You must verify whether your target state accepts this provision before relying on it for your eligibility strategy.

Which States Recognize the NAAC A+ First Division Advantage?

States that have historically been more flexible with international credentials include Guam, Montana, and certain other jurisdictions that work closely with NASBA International Evaluation Services. However, state board policies can change, and what was accepted last year may not apply today.

The safest approach is to use NASBA’s advisory evaluation service before committing to a specific state. This pre-evaluation will tell you exactly how your credentials are assessed and whether you qualify for any bonus credits based on your academic performance and institution type.

Documentation Required to Claim Bonus Credits

To claim the NAAC A+ first division advantage, you will typically need to provide your official transcripts showing first division marks, a letter confirming your university’s NAAC accreditation status at the time of your graduation, and any other documentation the evaluation agency requests. Some agencies may also ask for course syllabi to verify the content and rigor of your coursework.

Keep in mind that documentation requirements can be stringent. Universities must send transcripts directly to the evaluation agency in sealed envelopes, and all documents not in English must be accompanied by certified translations. Starting this documentation process early gives you time to address any complications that arise.

CPA Exam Eligibility for Indian B.Com Graduates: Pathway 2 – B.Com Plus Postgraduate Qualification (M.Com or MBA)

This is the most straightforward pathway for most Indian B.Com graduates. Adding a postgraduate degree to your B.Com creates a clear path to meeting both the 120-credit and 150-credit requirements.

How M.Com Adds 60 Credits to Your Profile

A 2-year M.Com degree from an Indian university typically adds 60 semester credits to your profile. Combined with your B.Com (90 credits), this gives you a total of 150 credits, meeting both the exam eligibility and licensure requirements in one go.

The M.Com pathway is particularly advantageous because the curriculum often overlaps significantly with CPA exam content. Subjects like advanced accounting, taxation, auditing, and financial management in your M.Com program prepare you for the CPA exam while simultaneously meeting your credit requirements. This dual benefit makes M.Com a popular choice among serious CPA aspirants.

Additionally, pursuing M.Com while preparing for CPA allows you to reinforce your understanding of key concepts. Many candidates find that their M.Com coursework complements their CPA study materials, creating a synergistic learning experience.

Does an MBA Count Toward CPA Eligibility?

Yes, an MBA also adds approximately 60 credits to your profile, similar to an M.Com. However, there is an important consideration: the distribution of credits between accounting and business subjects. While MBA programs provide strong business credits, they may not include enough accounting coursework to meet the specific accounting credit requirements of certain state boards.

If you have a B.Com plus MBA, you likely meet the total credit requirement, but you may need to verify that you have sufficient accounting credits. Some candidates with non-accounting master’s degrees need to take additional accounting courses to meet the 24-credit accounting requirement. A credential evaluation will clarify whether you need supplementary coursework.

CPA Exam Eligibility for Indian B.Com Graduates: Pathway 3 – B.Com Plus Professional Qualification (CA, CS, CMA)

Indian professional qualifications can contribute significantly to your CPA eligibility. If you have pursued CA, CS, or CMA alongside or after your B.Com, you may already have more credits than you realize.

How CA Qualification Contributes to CPA Credits

The Chartered Accountancy qualification from ICAI is recognized by many US state boards as an educational credential that can contribute to CPA eligibility. Depending on the state and evaluation agency, CA can add 30-60 credits to your profile. Some states have historically treated CA as equivalent to 2 years of additional education (60 credits), while others are more conservative.

It is important to understand that CA is now primarily recognized as an educational qualification rather than a substitute for academic degrees. In the past, some states accepted CA as an automatic qualification for the CPA exam. Those provisions have largely been eliminated, and CA now contributes credits that are counted alongside your academic qualifications.

If you are a B.Com graduate who has also completed CA, your combined credentials likely exceed the 150-credit requirement. This pathway offers the advantage of having both Indian and US accounting credentials, making you highly marketable for roles involving cross-border accounting and compliance.

CS and CMA Recognition by US State Boards

Company Secretary (CS) and Cost and Management Accountant (CMA) qualifications from India can also contribute credits toward CPA eligibility, though recognition varies significantly by state. Generally, these qualifications are valued for their specialized knowledge but may not receive as many credits as CA.

If you hold CS or CMA alongside your B.Com, include these credentials in your evaluation application. The evaluation agency will assess how many credits they contribute based on the coursework and examination requirements. Even if the credit contribution is modest, every credit helps you get closer to the eligibility threshold.

Pathway 4: B.Com Plus Bridge Courses

Bridge courses offer a targeted solution for B.Com graduates who need to fill specific credit gaps without committing to a full postgraduate degree. This pathway is often the fastest and most cost-effective route to CPA eligibility.

What are CPA Bridge Courses and How Do They Work?

Bridge courses are supplementary academic programs specifically designed to help international candidates meet CPA eligibility requirements. These courses are typically offered by accredited universities or in partnership with CPA training providers. They focus on subjects that count toward accounting and business credit requirements.

The beauty of bridge courses is their efficiency. Unlike a full M.Com program that takes 2 years, bridge courses can be completed in a few months. They are designed to provide exactly the credits you need without requiring you to study subjects irrelevant to your CPA goals. Most bridge courses are available online, allowing you to study at your own pace while continuing your work or other commitments.

Bridge courses typically cover subjects like advanced accounting, US taxation, business law, and ethics. Upon completion, you receive academic credits from the partnering university that count toward your CPA eligibility. The credits are recognized by state boards because they come from accredited US institutions or their approved partners.

Popular Bridge Course Providers in India

Several established providers offer bridge courses for Indian CPA aspirants. Miles Education offers a 30-credit bridge program in partnership with Jain University (NAAC A++ accredited) that is integrated with their CPA coaching. Simandhar Education provides bridge courses through its partnership with Becker Professional Education. Other providers like Zell Education and EduPristine also offer bridge course options.

When choosing a bridge course provider, consider factors like accreditation of the partnering university, recognition by your target state board, course duration and flexibility, cost, and integration with CPA exam preparation. Some providers offer bundled packages that include both bridge courses and CPA review materials, which can be more economical than purchasing these separately.

Which US States are Best for Indian B.Com Graduates to Apply to?

State selection is one of the most strategic decisions in your CPA journey. The right state can make the difference between straightforward eligibility and a complicated process filled with additional requirements.

Understanding Why State Selection Matters

Unlike professional qualifications in India that are awarded by a single national body, the CPA license is issued by individual state boards. Each state has its own rules, and understanding these differences is crucial for international candidates.

How CPA Requirements Vary by State

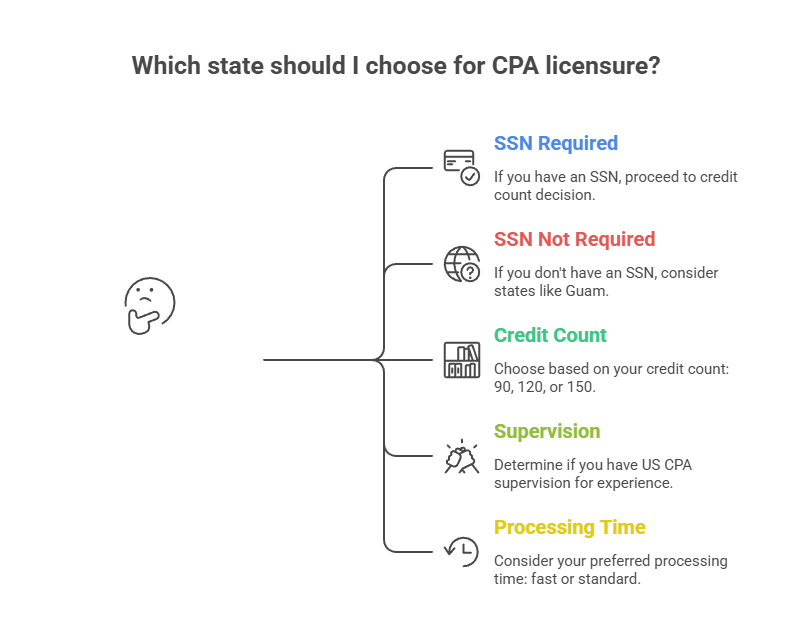

Different states have different requirements for education, examination, and experience. Some states allow you to sit for the exam with 120 credits, while others require the full 150 credits up front. Some states require US residency or Social Security Numbers, while others are open to international candidates. Experience verification requirements also vary, with some states requiring supervision by a US CPA and others accepting verification from equivalent international professionals.

Factors to Consider When Choosing a State Board

When selecting a state, consider your current credit count and how close you are to meeting that state’s requirements. Evaluate whether the state requires an SSN, as many Indian candidates do not have one. Check the experience verification requirements and whether your Indian work experience can be verified appropriately.

Also consider processing times, as some states are faster than others in reviewing applications. Finally, think about whether you plan to eventually transfer your license to another state, as most states have reciprocity agreements that allow license transfers after initial licensure.

Top 5 Recommended States for Indian B.Com Candidates

Based on their international-friendly policies and flexible requirements, these five states consistently emerge as top choices for Indian candidates:

Guam stands out as the most popular choice for international candidates. This US territory does not require an SSN, accepts international work experience for verification through NASBA’s Experience Verification Service, allows candidates to sit with 120 credits, and has no residency requirements. The only consideration is that Guam is a US territory rather than a state, but your license is still fully valid and can be transferred to other states later.

Washington offers flexibility in experience verification and accepts international candidates without requiring US residency. The state has reduced processing times recently, making it faster to get your application approved. Washington allows 120 credits for exam eligibility and is known for being accommodating to international credentials.

Montana is another excellent option that does not require an SSN and participates in NASBA’s experience verification service. This is particularly valuable if you are working in India and cannot find a US CPA to directly supervise and verify your experience. Montana’s requirements are straightforward, and the state has a reputation for efficient processing.

Illinois offers unique advantages, particularly its flexibility regarding experience verification. Your supervisor (who may or may not be a CPA) can verify your experience, which is helpful for candidates working in Indian companies without US CPA supervision. Illinois does not require an SSN and has clear, well-documented requirements.

Alaska accepts international work experience and does not require candidates to be US residents. The state is relatively flexible with international credentials and offers a straightforward application process for overseas candidates.

States to Avoid as an Indian B.Com Graduate

Not all states are equally welcoming to international candidates. Some states have requirements that make it impractical or impossible for Indian B.Com graduates.

States with a Strict 150 Credit Requirement for the Exam

Certain states, like North Dakota and South Dakota, require the full 150 credits before you can even sit for the exam. This means you cannot begin taking exam sections until you have completed all your educational requirements. For candidates who want to start the exam while completing additional coursework, these states create unnecessary delays.

States Requiring SSN or US Residency

Some states require a Social Security Number for exam registration or licensure. States like Alabama require proof of lawful presence in the US. If you do not have an SSN or a US immigration status, these states are not viable options. Always verify SSN requirements before beginning your application to avoid wasted time and fees.

You can compare the CPA requirements between the states here.

How to Get Your Indian Credentials Evaluated for CPA?

Credential evaluation is a mandatory step for all international CPA candidates. This process translates your Indian qualifications into US-equivalent terms and determines your official credit count.

Why Credential Evaluation is Mandatory for International Candidates

US state boards need a standardized way to assess international education. Since they cannot directly interpret Indian transcripts and degree structures, they rely on professional evaluation agencies to provide an objective assessment.

What Evaluation Agencies Look for in Your Transcripts

Evaluation agencies examine your course titles, credit hours (or contact hours), grades, and the accreditation status of your institution. They compare your coursework against US educational standards to determine equivalency. The agency assesses both the quantity (how many credits) and quality (what subjects) of your education.

How Evaluation Reports Determine Your Credit Count

The evaluation report provides a course-by-course breakdown showing how each of your Indian courses translates to US credits. This report determines whether you meet the total credit requirement and whether you have sufficient accounting and business credits. State boards rely on this report to make eligibility decisions, so its accuracy is crucial.

NIES vs WES: Which Evaluation Agency Should You Choose?

Two agencies dominate the CPA credential evaluation space: NASBA International Evaluation Services (NIES) and World Education Services (WES). Understanding their differences helps you make an informed choice.

NASBA International Evaluation Services (NIES) Overview

NIES is operated by NASBA and is specifically designed for CPA exam candidates. Many state boards prefer or require NIES evaluations because NIES understands CPA-specific requirements. If you are unsure which agency to use, NIES is generally the safer choice as it is accepted by virtually all state boards.

World Education Services (WES) Overview

WES is a more general credential evaluation service used for various purposes, including immigration, employment, and professional licensing. While WES is well-respected and accepted by many state boards, some states specifically require NIES. Check your target state’s requirements before choosing WES.

Cost and Processing Time Comparison

NIES evaluation costs approximately $225-$300, depending on the type of evaluation requested. WES evaluations are similarly priced. Processing times vary from 4-8 weeks for standard service, with express options available for additional fees. Both agencies have experienced increased demand, so starting early is advisable.

Document Preparation for Credential Evaluation

Proper document preparation can prevent delays and rejections. Understanding what is required helps you gather everything efficiently.

How to Obtain Sealed Transcripts from Indian Universities

Your transcripts must be sent directly from your university to the evaluation agency in sealed envelopes. Contact your university’s examination or records department to request this service. Most universities charge a nominal fee for issuing sealed transcripts and courier services. Allow several weeks for processing, especially during busy periods like graduation seasons.

Some universities have online transcript request systems, while others require in-person applications. If you graduated several years ago, your records may be archived, which can add processing time. Starting this process early prevents last-minute stress.

Attestation Requirements and Procedures

Depending on your state and evaluation agency, you may need certain documents attested or notarized. Attestation typically involves getting your documents verified by appropriate authorities, which may include your university registrar, notary public, or even the Ministry of External Affairs for apostille certification in some cases.

Requirements vary, so check with your evaluation agency before getting documents attested. Unnecessary attestation adds cost and time without benefit, while missing required attestation causes application rejection.

Handling Semester vs Annual System Transcripts

Indian universities use either semester systems or annual examination systems, and transcripts look different depending on which system your university follows. Semester system transcripts typically show credits per course, while annual system transcripts show marks for year-end examinations.

Evaluation agencies are familiar with both formats and can interpret them appropriately. However, if your transcript format is unusual or lacks certain information, the agency may request additional documentation, like course syllabi or credit hour certifications from your university.

What to Do if Your University Has Closed or Merged

If your university has closed, merged with another institution, or changed names, obtaining transcripts can be complicated. In such cases, contact the successor institution or the relevant state education department to locate your records. The University Grants Commission (UGC) may be able to direct you to the appropriate authority.

Evaluation agencies understand that institutional changes happen and have processes for handling such situations. You may need to provide additional documentation proving the connection between your original institution and the current record-holder. Be prepared for longer processing times when dealing with institutional complications.

What is the Complete CPA Application Process for B.Com Graduates?

With your credentials evaluated and state selected, you are ready to begin the formal application process. Here is a step-by-step guide to navigating the CPA application.

Step 1: Check Your Eligibility and Choose a State

Before submitting your full application, confirm that you meet all requirements for your chosen state. This verification step can save you significant time and money.

Using NASBA’s Advisory Evaluation Service

NASBA offers an advisory evaluation service that assesses your credentials and recommends suitable states based on your qualifications. This preliminary evaluation costs less than a full evaluation and provides guidance before you commit to a specific state. Consider using this service if you are uncertain about your eligibility.

Confirming Your Credit Count Before Applying

Review your credential evaluation report carefully to confirm your total credits and the breakdown between accounting and business subjects. If you are short in any category, address the gap before applying. Applying with insufficient credits results in rejection and loss of application fees.

Step 2: Submit Your Application and Documents

Once you have confirmed your eligibility, it is time to submit your formal application. This process can be completed online through NASBA or directly through your state board.

Online Application Through NASBA or State Board

Most states allow applications through the NASBA CPA Examination Services portal. Some states require direct application to the state board. Follow the specific instructions for your chosen state and ensure all required documents are uploaded or mailed as specified.

Application Fees and Payment Methods

Application fees typically range from $100-$200, depending on the state. These fees are separate from exam section fees, which you pay when scheduling your actual exam. International credit cards are accepted, and payment is usually required at the time of application submission.

Step 3: Receive Your Notice to Schedule (NTS)

After your application is approved, you will receive a Notice to Schedule (NTS) that authorizes you to register for exam sections.

What is an NTS, and How Long is it Valid?

The NTS contains your authorization to schedule exam sections and includes important identification information used during testing. NTS validity periods vary by state, typically ranging from 6 to 9 months. You must schedule and take your exam sections before the NTS expires, or you will need to reapply and pay fees again.

What to Do if Your Application is Rejected

If your application is rejected, you will receive a notification explaining the reason. Common rejection reasons include insufficient credits, missing documents, or issues with credential evaluation. Address the specific issue cited, whether that means obtaining additional coursework, submitting missing documents, or getting a revised evaluation report.

Step 4: Schedule Your Exam at Prometric Centers in India

With your NTS in hand, you can schedule your exam at any Prometric testing center worldwide, including centers in India.

Prometric Test Centers in India (8 Cities)

CPA exams are available at Prometric centers in eight Indian cities: Ahmedabad, Bangalore, Kolkata (Calcutta), Chennai, Hyderabad, Mumbai, New Delhi, and Trivandrum. This extensive network means most candidates can find a testing center within a reasonable travel distance.

How to Book Your Exam Slot

Schedule your exam through the Prometric website using your NTS information. Popular testing slots fill up quickly, especially during peak periods, so book as early as possible. You can reschedule if needed, though fees may apply depending on how close to the exam date you request the change.

How Much Does the CPA Journey Cost for Indian B.Com Graduates?

Understanding the complete cost picture helps you budget appropriately and avoid surprises. Let us break down all the expenses involved in obtaining your CPA certification.

Complete Cost Breakdown in Indian Rupees

The total investment for CPA includes multiple components spread across evaluation, application, examination, preparation, and licensing phases.

Evaluation Fees

Credential evaluation through NIES or WES costs approximately INR 18,000-25,000 ($225-$300). This is a one-time fee that covers the assessment of all your educational credentials. Express processing options are available at additional cost if you need faster turnaround.

Application and Exam Fees

Initial application fees range from INR 8,000-16,000 ($100-$200) depending on the state. Exam section fees are approximately INR 20,000-25,000 ($250-$300) per section, totaling INR 80,000-100,000 for all four sections.

International Testing Surcharge

Since you are taking the exam outside the United States, an international testing surcharge applies. The CPA International Testing Surcharge is an additional fee for candidates taking the exam outside the U.S. As of June 1, 2025, the surcharge is $510 (INR 42,000) per section, an increase from the previous $390. This surcharge covers the additional infrastructure costs of international test administration.

Review Course Costs

CPA review courses from providers like Becker, Wiley, Surgent, or Gleim range from INR 80,000-200,000, depending on the package and provider. Indian coaching institutes that partner with these providers may offer more competitive pricing bundled with additional support services.

Bridge Course Costs (If Required)

If you need bridge courses to meet credit requirements, expect to invest INR 50,000-150,000, depending on the provider and the number of credits needed. Some providers bundle bridge courses with review materials for better value.

Licensing Fees

After passing all exam sections and meeting experience requirements, licensing fees range from INR 8,000-20,000 ($100-$250) depending on the state. Annual license renewal fees apply thereafter, typically INR 8,000-15,000 per year.

Total Investment and ROI Analysis

Adding up all components gives you a realistic picture of the total investment required for CPA certification.

Estimated Total Cost for Different Pathways

For a B.Com graduate with M.Com who does not need bridge courses, the total investment ranges from INR 3.5-6 lakhs, including evaluation, application, exams, international testing fees, review course, and licensing. If bridge courses are needed, add INR 50,000-150,000 to this estimate.

The total cost varies significantly based on factors like review course choice, number of exam retakes (hopefully none), and whether you need bridge courses. Budget conservatively and plan for contingencies.

Is the CPA Investment Worth It? ROI Calculation

With CPA salaries starting at INR 8-12 lakhs and reaching INR 20-40 lakhs with experience, the investment typically pays for itself within 1-2 years through salary premiums. Beyond financial returns, the credential provides career flexibility, global mobility, and professional prestige that enhance your long-term earning potential.

Consider also the non-monetary returns: expanded job opportunities, professional network access, and the satisfaction of achieving a globally recognized credential. For most serious accounting professionals, the ROI strongly favors pursuing CPA certification.

Conclusion

The path to CPA certification for Indian B.Com graduates is clearer than many candidates initially believe. While the US credit system and state board variations can seem confusing at first, a systematic approach makes the journey manageable and achievable.

Your 3-year B.Com degree provides 90 credits as a foundation. From there, you have multiple pathways to reach the 120 credits needed for exam eligibility and 150 credits needed for licensure. Whether you choose to add an M.Com, leverage professional qualifications like CA, or complete targeted bridge courses, the path exists for you to qualify.

Starting your credential evaluation early gives you clarity about your exact credit count and any gaps you need to address. The evaluation process takes time, and knowing your position allows you to plan your preparation and application timeline effectively.

The total investment for CPA certification ranges from INR 3.5-6.5 lakhs, depending on your pathway, but the returns in terms of salary premiums, career opportunities, and professional growth make this one of the best investments you can make in your accounting career. With proper planning, focused preparation, and systematic execution, your B.Com foundation can take you to the pinnacle of the global accounting profession.

Take the first step today by getting your credentials evaluated and understanding exactly where you stand. Your CPA journey starts with that clarity.

Frequently Asked Questions

Can I do CPA directly after completing my 3-year B.Com degree?

In most cases, a standalone 3-year B.Com provides only 90 credits, which is below the 120-credit threshold for exam eligibility. However, if you have a first division from an NAAC A-accredited university, some states may award bonus credits, bringing you to 120. Otherwise, you will need additional qualifications or bridge courses.

How many credits does a B.Com degree from India give me?

A standard 3-year B.Com degree from India typically converts to 90 semester credits under US educational standards. This calculation follows the general rule of 30 credits per year of university education.

What is the NAAC A first division advantage for CPA eligibility?

Some US state boards recognize first division academic performance from NAAC A or A+ accredited universities by awarding additional credits. This can effectively treat your 3-year degree as equivalent to a 4-year US degree, adding 30 bonus credits to reach the 120-credit threshold.

Do I need to complete M.Com before applying for CPA?

M.Com is not mandatory, but it is one of the most straightforward pathways to meet credit requirements. A 2-year M.Com adds 60 credits, bringing your total to 150 credits. Alternative pathways include professional qualifications (CA, CS, CMA) or bridge courses.

Can I do CPA if I have failed or dropped out of CA?

Absolutely. CPA eligibility is based on your completed educational qualifications, not on CA exam results. Many candidates who did not complete CA successfully have gone on to become CPAs. Your B.Com degree plus any additional qualifications you have completed will be evaluated for credit purposes.

Which is the best state for Indian candidates to register for the CPA?

Guam is the most popular choice due to its international-friendly policies: no SSN requirement, acceptance of NASBA experience verification, and 120 credits for exam eligibility. Other excellent options include Washington, Montana, Illinois, and Alaska.

How long does the credential evaluation process take?

Standard credential evaluation takes 4-8 weeks, though processing times can vary based on agency workload and document completeness. Express processing options are available for additional fees. Allow extra time during peak periods and for any document complications.

What is the difference between 120 credits and 150 credits for CPA?

You need 120 credits to be eligible to sit for the CPA exam in most states. However, you need 150 credits to obtain your actual CPA license after passing all exam sections. Many candidates begin the exam with 120 credits while completing additional coursework toward the 150-credit licensure requirement.

Can I take the CPA exam in India?

Yes, CPA exams are available at Prometric testing centers in eight Indian cities: Ahmedabad, Bangalore, Kolkata, Chennai, Hyderabad, Mumbai, New Delhi, and Trivandrum. You can schedule and take all four exam sections in India.

Do I need work experience to sit for the CPA exam?

No, work experience is not required to sit for the CPA exam. Experience requirements apply only for licensure, which comes after passing all exam sections. Most states require 1-2 years of relevant work experience verified by a licensed CPA or equivalent.

What are bridge courses, and do I need them?

Bridge courses are supplementary academic programs designed to help candidates meet CPA credit requirements. You need them if your existing qualifications do not provide sufficient credits for exam eligibility (120) or licensure (150). Bridge courses typically provide 30-60 credits through targeted coursework.

How much does it cost to become a CPA from India?

The total investment ranges from INR 3.5-6.5 lakhs, depending on your pathway. This includes evaluation fees, application and exam fees, international testing surcharges, review course costs, bridge courses if needed, and licensing fees.

Can I work in the US after getting my CPA license?

A CPA license alone does not grant work authorization in the US. However, CPA certification significantly enhances your profile for US job opportunities and visa sponsorship. Many Indian CPAs work for US companies either in India-based roles or after obtaining appropriate work visas.

Is CPA valid in India?

Yes, CPA is recognized and valued by employers in India, particularly Big 4 accounting firms, multinational corporations, and Global Capability Centers. While you cannot sign statutory audits in India with a CPA license alone, the credential opens doors to international finance, US GAAP reporting, and cross-border advisory roles.

How long does it take to complete a CPA from India?

Most dedicated candidates complete all four CPA exam sections within 12-18 months of starting preparation. The entire journey from initial evaluation to license typically takes 18-24 months, depending on factors like your preparation pace, exam scheduling, and experience fulfillment.

Allow notifications

Allow notifications