Compare the best Enrolled Agent Exam prep courses for 2025-2026: Gleim, Surgent, Becker, Fast Forward Academy & PassKey. Detailed pricing, features, and India-specific recommendations.

Table of Contents

Choosing the right study materials for the Enrolled Agent exam can make the difference between passing on your first attempt and spending months retaking exam parts.

With the EA exam fee now at $267 per part, failed attempts quickly become expensive not just in money but in time that delays your career in US taxation. If you’re an Indian professional targeting remote work with US tax firms, selecting the optimal preparation resources becomes even more critical since you’re investing in dollar-denominated courses while earning in rupees.

I’ve analyzed every major EA exam prep provider from Gleim’s massive question bank to Surgent’s adaptive technology to the budget-friendly PassKey textbooks to help you make an informed decision.

This guide compares Gleim, Surgent, Becker, Fast Forward Academy, PassKey/HOCK International, and free IRS resources based on features, pricing, learning styles, and value for Indian candidates. Whether you’re a commerce graduate exploring US tax careers or an accounting professional adding the EA credential, you’ll find specific recommendations matched to your situation.

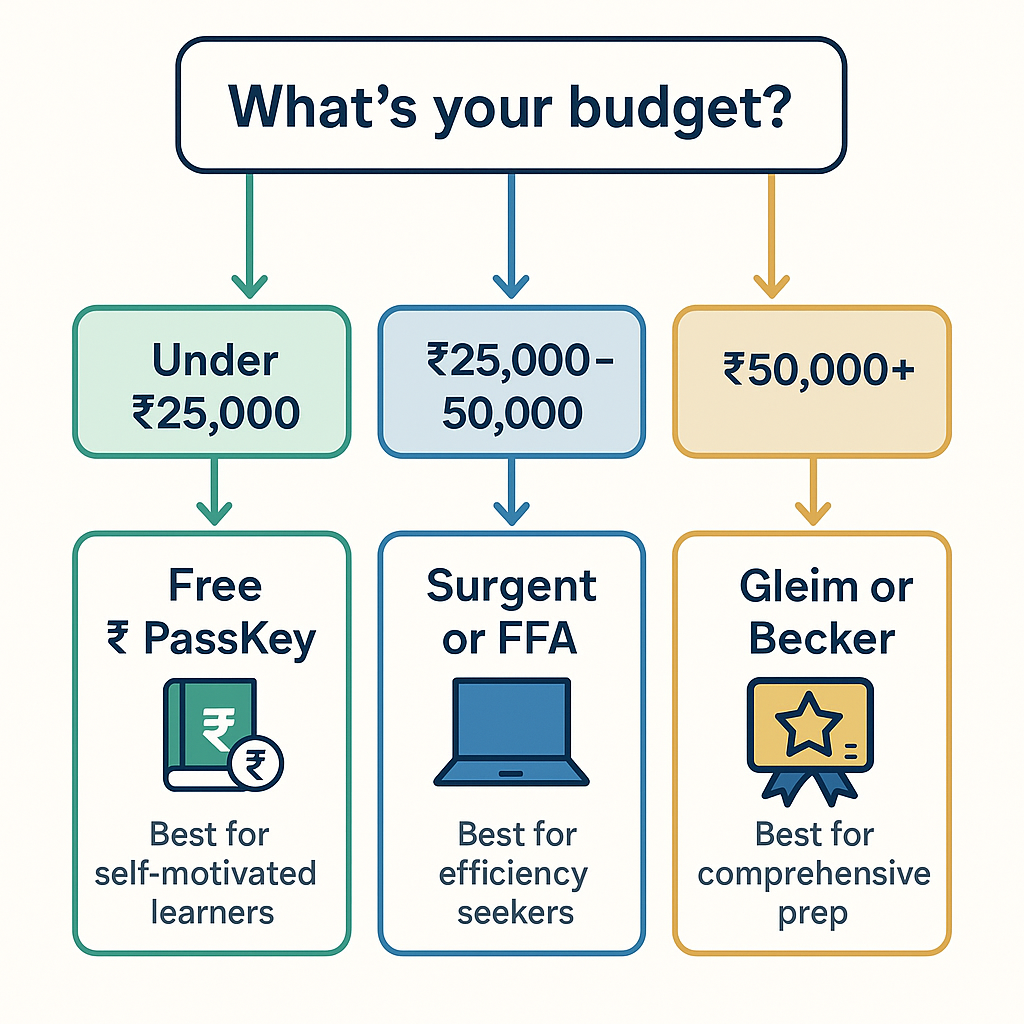

What sets this guide apart is the focus on practical decision-making for Indian professionals. I’ll show you exactly which course works best for each budget tier (in rupees), which platforms perform well for international users, and how to strategically combine free IRS resources with paid courses.

By the end, you’ll have a clear action plan for preparing for all three parts of the EA exam Part 1 (Individuals), Part 2 (Businesses), and Part 3 (Representation) with materials matched to your learning style and financial constraints.

How to choose the right enrolled agent exam study materials?

what factors should you consider when selecting enrolled agent prep materials?

Learning style and study habits

Your learning style fundamentally determines which EA prep course will work best for you. Visual learners thrive with video-heavy courses like Becker or Fast Forward Academy, where instructors walk through tax concepts and form explanations on screen. Auditory learners benefit from Gleim’s downloadable audio lectures that allow studying during commutes or exercise.

If you learn by doing, practice-focused courses with large question banks Gleim’s 3,500+ MCQs or Fast Forward’s 3,063 questions will serve you better than lecture-heavy alternatives.

Consider how you’ve succeeded in past exams when making this decision. If you passed your B.Com or CA Foundation exams by solving hundreds of practice problems, you’ll likely excel with Gleim or Surgent’s question-centric approach. If you learned accounting concepts best from classroom lectures, Becker’s expert-led video content will feel more natural. There’s no single “best” course only the best course for how your brain processes and retains tax law information.

Budget, time availability & course access limits

EA prep courses range dramatically in price, from free IRS resources to Becker’s premium packages at $799.

For Indian candidates, currency exchange significantly impacts value a $600 course translates to approximately ₹50,000, which represents a substantial investment. Before selecting a course, honestly assess your budget and consider whether payment plans (offered by Surgent and Becker through Affirm) might make premium courses accessible.

Time availability affects your course choice as much as budget does. If you’re working full-time while preparing, adaptive courses like Surgent that claim to reduce study time by 40% offer genuine value. Access periods matter too Becker limits access to 12 months, while Gleim and Surgent offer “access until you pass” guarantees.

If you’re planning to take all three parts over 18-24 months, ensure your chosen course won’t expire mid-preparation.

Importance of updated IRS-aligned content

The EA exam tests tax law as of December 31 of the prior year, meaning the 2025-2026 testing cycle (May 1, 2025 through February 28, 2026) covers 2024 tax law. Studying outdated materials isn’t just inefficient it’s actively harmful. SECURE Act 2.0 provisions, Inflation Reduction Act changes, and annual inflation adjustments all appear on current exams but weren’t in older editions.

Reputable providers update their materials annually during the March-April blackout period when Prometric doesn’t offer EA exams. Verify that any course or textbook you purchase explicitly states coverage for your testing cycle. PassKey books, for instance, clearly label their edition as “May 1, 2025 – February 28, 2026 Testing Cycle.” Avoid generic “2025 EA prep” products that don’t specify the testing window they may contain outdated content that costs you points on exam day.

Why does the right study material matter for enrolled agent exam success?

Pass-Rate differences across exam parts

EA exam pass rates vary significantly by part, and understanding these differences helps you allocate study resources strategically. According to data compiled by Gleim, Part 1 (Individuals) has approximately a 61% pass rate, Part 2 (Businesses) hovers around 60%, and Part 3 (Representation) enjoys the highest rate at roughly 85%. This means you should invest more heavily in business taxation resources if Part 2 concerns you, while Part 3 may require less intensive preparation.

Risks of low-quality or outdated resources

Using subpar study materials creates false confidence that shatters on exam day. Low-quality courses with inaccurate answer explanations teach you wrong concepts that cost points across multiple questions. Outdated resources miss recent tax law changes imagine studying pre-SECURE Act retirement plan rules when the exam tests current contribution limits and RMD ages. The $267 per part retake fee plus months of additional study time makes investing in quality materials upfront the financially smart choice.

All courses are updated for the 2025-2026 IRS testing cycle (May 1, 2025–Feb 28, 2026). However, it is recommended to always check official sites for current promos. If you’re choosing, consider your style e.g., Gleim/Becker for depth, Fast Forward/PassKey for affordability.

To understand the structure, scoring, and official requirements of the credential, you may also refer to the IRS Enrolled Agent Exam guide for a complete overview of the testing process.

Which enrolled agent review course is best for your needs (Gleim, Surgent, Becker, FFA, PassKey)?

Is Gleim EA review the best comprehensive course?

SmartAdapt technology & adaptive learning

Gleim’s SmartAdapt technology represents the core differentiator of their EA review platform. As you answer practice questions, the system analyzes your performance patterns to identify specific content weaknesses. Rather than forcing you through every topic sequentially, SmartAdapt directs your study time toward areas where you need improvement. This personalized approach eliminates the frustration of reviewing concepts you’ve already mastered.

The adaptive system integrates all Gleim learning tools textbooks, practice questions, video lectures, and flashcards into a cohesive study experience. Your dashboard shows exactly where you stand in each content domain and tells you when you’re ready to take the exam. For self-disciplined learners who want structure without rigid scheduling, SmartAdapt provides the guidance of a personal tutor at a fraction of the cost.

Question bank depth & explanations

Gleim EA Review boasts the largest test bank in the industry with over 3,500 multiple-choice questions across all three exam parts. More importantly, every question includes detailed answer explanations for both correct and incorrect choices. Understanding why wrong answers fail helps you recognize similar traps on exam day a critical skill given that the IRS writes questions designed to test nuanced understanding rather than surface-level memorization.

The questions closely mirror actual EA exam difficulty and format, recreating the Prometric testing environment. Gleim’s “Exam Rehearsal” mode simulates real exam conditions with 100 questions and a 3.5-hour time limit, building the stamina and time management skills you’ll need. Many candidates report that Gleim questions feel slightly harder than the actual exam intentional overpreprepration that makes test day feel manageable.

Pricing & value for Indian candidates

Gleim offers three pricing tiers: Test Bank only at $379, Traditional course at $503, and Premium at $598. For Indian candidates, the Premium tier at roughly ₹50,000 provides the best long-term value because it includes video lectures, audio reviews, access to accounting experts, and the “Access Until You Pass” guarantee. If currency exchange makes Premium prohibitive, the Traditional tier at approximately ₹42,000 still includes SmartAdapt technology and comprehensive study materials.

Consider Gleim’s value proposition through pass rate economics. If the Premium course helps you pass all three parts on your first attempt, you’ve spent ₹50,000 plus ₹66,000 in exam fees (₹22,000 × 3 parts at current exchange rates). Failing even one part with a cheaper course adds ₹22,000 plus months of additional study time. Gleim’s comprehensive approach and “until you pass” guarantee minimize this retake risk, making the upfront investment financially rational.

Pros and cons

Strengths: Gleim delivers the most comprehensive EA preparation available. The 3,500+ question test bank exceeds competitors by 50-100%, and the detailed answer explanations transform practice sessions into genuine learning opportunities. SmartAdapt technology personalizes your study path, while the Personal Counselor support provides human guidance when you’re stuck or discouraged.

Limitations: Gleim’s comprehensiveness can overwhelm some candidates. The sheer volume of material multiple textbooks, thousands of questions, hours of lectures requires disciplined self-management. Some users report the textbooks feel dense and technical, reading more like tax code explanations than engaging educational content. If you prefer streamlined, efficiency-focused preparation, Gleim’s depth may feel excessive.

Bottom Line: Gleim represents the gold standard for candidates who want thorough preparation and plan to take all three exam parts. If you’re the type who feels more confident with extra preparation rather than minimum-viable studying, Gleim’s comprehensive approach will serve you well. The higher price point pays off through superior pass rates and the security of unlimited access.

Is Surgent EA review the fastest way to prepare for the exam?

ASAP adaptive system & ReadySCORE

Surgent’s A.S.A.P. (Adaptive Study and Preparation) technology takes a fundamentally different approach than traditional courses. Instead of working through content sequentially, you begin with diagnostic assessments that establish your current knowledge baseline. The system then creates a customized study plan targeting only the content areas where you need work, claiming to reduce total study time by up to 40% compared to conventional preparation.

The ReadySCORE feature predicts your actual exam score based on your practice performance with remarkable accuracy users report it’s within 3-4 percentage points of their real results. This metric updates continuously as you study, showing you a concrete number that represents your exam readiness. When your ReadySCORE reaches passing threshold, you know you’re genuinely prepared rather than hoping you’ve studied enough.

Personalized study plans

Surgent generates truly personalized study plans by analyzing your diagnostic results and working backward from your target exam date. The system calculates exactly how many study hours you need, which topics require attention, and what pace you must maintain. This removes the guesswork from preparation you simply follow the plan and trust the algorithm.

The personalization extends to daily study sessions. Surgent’s software serves you questions weighted toward your weak areas, automatically adjusting as your proficiency improves. If you master partnership taxation but struggle with S-corporation rules, the system increases S-corp question frequency until your performance equalizes. This targeted approach ensures no study minute is wasted on content you’ve already mastered.

Pricing & pass guarantee

Surgent offers multiple pricing tiers, with the Premier Pass (approximately $799) including the pass guarantee. The Ultimate Pass at $999 adds physical textbooks and flashcards. Surgent’s guarantee provides a refund if you don’t pass after using their course as directed a meaningful safety net that reflects their confidence in the adaptive approach.

Pros and cons

Strengths: Surgent excels at efficient preparation for candidates who value time optimization. The A.S.A.P. technology genuinely reduces study hours by eliminating redundant content review. ReadySCORE provides objective exam readiness metrics that remove anxiety about whether you’ve prepared enough. The bilingual support (English and Spanish) expands accessibility.

Limitations: Surgent’s test bank contains approximately 1,800 questions substantial but significantly smaller than Gleim’s 3,500+. Some users find the textbook functions more as a reference dictionary than a teaching tool, lacking the detailed explanations that help concepts stick. The lack of a peer learning community means you’re studying in isolation without fellow candidates to discuss challenging topics.

Bottom line: Surgent is ideal for experienced tax professionals who already understand fundamental concepts and need efficient exam preparation rather than ground-up learning. If you’re coming from a CA background or have years of accounting experience, Surgent’s adaptive approach maximizes your existing knowledge while filling specific gaps. For candidates learning US taxation from scratch, the efficiency focus may feel rushed.

Is Becker EA review worth the premium pricing?

Adapt2U technology & competency tracking

Becker’s Adapt2U technology tracks every interaction you have with study materials questions answered, videos watched, time spent per topic to build a comprehensive picture of your competency levels. Unlike simple “percent correct” metrics, Adapt2U assesses whether you truly understand concepts rather than just memorized answers. This distinction matters because the EA exam tests application, not recall.

The competency tracker visualizes your progress across all content domains, showing which areas you’ve mastered and which need work. This dashboard-driven approach helps self-directed learners stay on track without external accountability. When you see concrete progress bars moving toward “exam ready” status, motivation increases and study sessions feel purposeful rather than aimless.

Video lectures & expert instruction

Becker’s video lectures feature actual Enrolled Agents and tax professionals with decades of combined experience. Instructors like Angelle Cascio (former KPMG), Mike Potenza (CPA, attorney, engineer), and Ricardo Buenrostro bring real-world context to abstract tax concepts. Rather than reading tax code provisions verbatim, they explain why rules exist and how they apply in practice.

The lecture library includes concept videos explaining principles, tax form videos walking through actual IRS forms, and SkillBuilder videos demonstrating problem-solving approaches. This variety accommodates different learning moments deep conceptual work versus quick practical review. The production quality exceeds typical accounting education, with clear audio, professional graphics, and engaging presentation styles.

Pricing & access limitations

Becker offers two packages: Essentials at approximately $599 and Pro at $799.

The Pro package includes physical textbooks, a free ethics course for continuing education, and a $100 back guarantee if you don’t pass. Payment plans through Affirm make the investment more manageable, spreading costs over monthly installments.

The significant limitation is Becker’s 12-month access period. Unlike Gleim and Surgent’s “until you pass” guarantees, your Becker access expires after one year regardless of exam status. If life interruptions delay your preparation or you need multiple attempts at difficult parts, you may face extension fees. Plan your timeline carefully before committing to Becker’s structured program.

Pros and cons

Strengths: Becker delivers premium production quality across all materials. The 3,000+ practice questions with answer explanations provide ample preparation, and the Newt AI assistant offers instant clarification when concepts don’t click. The brand reputation from CPA exam prep carries meaningful weight, and the Facebook study community connects you with fellow candidates.

Limitations: The 12-month access limitation creates pressure that some candidates find stressful rather than motivating. Becker lacks 1-on-1 coaching that competitors Gleim and Surgent offer. As a relatively new entrant to EA prep (launched 2024), long-term pass rate data isn’t yet available to validate effectiveness. The premium pricing may not justify the benefits for budget-conscious candidates.

Bottom Line: Becker suits candidates who value polished, professional learning experiences and can commit to completing preparation within 12 months. If you’ve used Becker for CPA prep and loved their approach, the EA course provides familiar quality. For candidates uncertain about their timeline or preferring unlimited access security, the expiration policy represents a meaningful drawback.

Is Fast Forward Academy best for community-driven learning?

Peer learning and online community

Fast Forward Academy distinguishes itself through a built-in community of fellow EA candidates accessible directly from your course dashboard. When you encounter a confusing concept or ambiguous question, you can post to the community and receive responses from both peers and instructors. This collaborative environment recreates the study group experience that many candidates miss in self-paced online courses.

The community extends beyond academic questions to motivation and accountability. Seeing other candidates’ progress, celebrating their pass announcements, and commiserating over difficult topics creates connection that sustains momentum through months of preparation. For candidates who struggle with isolation during solo study, FFA’s community features may justify the investment even if other providers offer more practice questions.

FastFocus tracking system

Fast Forward Academy’s FastFocus system takes a unique approach to performance tracking. Rather than simple percentage-correct metrics, FastFocus creates a “bullseye” visualization where your goal is moving all topics toward the center. The system tracks not just whether you answered correctly but whether you answered confidently lucky guesses don’t earn full credit toward readiness.

After completing chapter content, FastFocus helps you identify questions that will most impact your exam score if you improve. This prioritization ensures your limited study time targets high-value areas rather than diminishing returns on already-strong topics. The visual dashboard makes abstract progress feel concrete and achievable.

Pricing options & bundle value

Fast Forward Academy offers three tiers: EA Study Guide (textbook only) at $199, EA Online Course at $449-549, and EA Smart Bundle with bootcamp webinars at $699. The Smart Bundle includes 23 bootcamp sessions covering all three exam parts intensive review sessions that compress key concepts into focused presentations.

For pure value calculation, the $549 Online Course provides access to 3,063 practice questions, unlimited practice exams, digital flashcards, and the community features until you pass. Adding physical flashcards costs an additional $120. FFA frequently offers 15% discounts, reducing effective costs and making mid-tier options more competitive with budget alternatives.

Pros and Cons

Strengths: FFA’s community features genuinely differentiate it from isolated self-study alternatives. The FastFocus system provides actionable intelligence about where to focus remaining study time. Digital flashcards integrate with the textbook for seamless study sessions, and the “smart textbook” allows note-taking, highlighting, and quiz-taking within the content itself.

Limitations: Video content remains FFA’s weakest area the library includes approximately 10 hours of lectures, significantly less than competitors. The videos were originally created for CPA prep and adapted for EA, meaning they’re not specifically designed for Enrolled Agent candidates. Without the community engagement, FFA’s core materials don’t stand out against similarly-priced competitors.

Bottom Line: Fast Forward Academy is ideal for candidates who thrive in collaborative learning environments and value peer support during preparation. If isolation derails your study motivation or you learn best by discussing concepts with others, FFA’s community may outweigh its video content limitations. Solo learners comfortable with independent study may find better value elsewhere.

Is PassKey + HOCK International the best budget enrolled agent prep option?

Textbook-based learning approach

PassKey EA Review represents the traditional textbook approach to exam preparation comprehensive written content with practice questions rather than adaptive technology or video lectures. The PassKey books with HOCK International use simple language and concrete examples to demystify complex tax law, making them accessible to candidates without extensive US tax background.

Each part’s textbook runs approximately 300-400 pages covering all exam topics in logical sequence. The writing style differs from technical tax references PassKey aims to teach rather than merely document. For candidates who learn best by reading deeply and taking handwritten notes, the textbook approach provides focused study without digital distractions.

HOCK online platform integration

PassKey partnered with HOCK International to offer an online learning platform alongside the traditional textbooks. The platform includes video lectures, a question bank, and timed practice tests with interface similar to Prometric testing centers. Weekly live study sessions connect candidates with instructors for real-time questions and explanations.

The PassMap learning system tracks progress and identifies weak areas, providing adaptive-style benefits within the textbook framework. This hybrid approach physical textbooks for deep learning, online platform for practice and assessment accommodates candidates who want both traditional and digital study methods.

Pricing & subscription model

PassKey offers remarkable affordability. Individual textbooks cost approximately $40-60 per part on Amazon, with workbooks containing mock exams adding another $30-40 each. A complete set of all three textbooks plus workbooks totals roughly $300 a fraction of comprehensive course pricing.

HOCK’s online platform uses a subscription model: Standard at $29.95/month and Premium at $44.95/month. This pay-as-you-go approach lets you control costs based on study duration. If you prepare for one part per month, three months of Premium subscription ($135) plus textbooks ($300) totals approximately $435 for complete preparation competitive with entry-level tiers from premium providers.

Pros and cons

Strengths: PassKey delivers exceptional value for budget-conscious candidates. The textbooks are Amazon’s #1 bestselling tax law study guides with positive reviews from successful EA candidates. The HOCK partnership adds online capabilities without abandoning PassKey’s textbook strength. For Indian candidates, the lower USD investment significantly reduces currency exchange impact.

Limitations: PassKey’s practice question volume falls short of comprehensive courses approximately 900 mock exam questions across all workbooks versus Gleim’s 3,500+. Without the online platform, you lack simulated testing environment practice, which matters since the EA exam is entirely computer-based. Customer support is minimal compared to providers with dedicated counselors.

Bottom Line: PassKey suits self-motivated candidates comfortable with independent study who want quality materials at budget pricing. If you have strong US tax fundamentals and need structured review rather than ground-up learning, PassKey textbooks supplemented with free IRS resources provide sufficient preparation. Candidates needing extensive support, adaptive technology, or large question banks should consider premium alternatives.

How do enrolled agent study materials compare by learning style, budget & exam strategy?

Which enrolled agent courses work best for visual learners?

Video lecture quality comparison

Video quality varies dramatically across EA prep providers. Becker leads with professionally produced lectures featuring experienced instructors, clear graphics, and engaging presentation styles. The concept videos, tax form walkthroughs, and SkillBuilder problem-solving demonstrations provide diverse visual learning opportunities. Production values match what you’d expect from a premium education brand.

Gleim’s video library includes over 450 lectures led by university professors and tax professionals. The content is comprehensive but presentation style tends toward traditional lecture format rather than dynamic engagement. Fast Forward Academy offers approximately 10 hours of video content adequate but limited compared to competitors. Surgent and PassKey/HOCK provide video content but don’t emphasize it as a primary learning method.

Top recommendations

For pure visual learners, Becker EA Review represents the strongest choice with its emphasis on quality video instruction and visual progress tracking through the Adapt2U competency dashboard. The investment is higher, but visual learners extract maximum value from Becker’s production quality.

If Becker’s pricing exceeds your budget, Fast Forward Academy provides sufficient video content at lower cost, supplemented by the smart textbook’s visual note-taking and highlighting features. Gleim offers extensive video content in its Premium tier but visual learning isn’t its primary strength choose Gleim if you want comprehensive coverage that happens to include videos rather than video-first learning.

Which enrolled agent courses are best for practice-focused learners?

Question bank depth comparison

Practice-focused learners should prioritize question bank size and explanation quality. Gleim dominates with 3,500+ questions roughly twice the competition. Fast Forward Academy follows with 3,063 questions, then Becker with 3,000+, and Surgent with 1,800+. PassKey’s workbooks contain approximately 900 mock exam questions, suitable for testing readiness but insufficient for primary learning.

Question quality matters as much as quantity. Gleim provides detailed explanations for every answer choice correct and incorrect helping you understand why distractors fail. Surgent links questions directly to textbook sections for deeper exploration. Becker’s SkillBuilder videos demonstrate problem-solving approaches for difficult question types.

Mock exam & simulation tools

Exam simulation prepares you for the pressure and format of actual test day. Gleim’s “Exam Rehearsal” mode replicates Prometric conditions with 100-question, 3.5-hour timed tests. Fast Forward Academy offers unlimited practice exams that are “timed, weighted, and scored” like the real thing. Becker’s simulated exams use Adapt2U technology to match difficulty to your demonstrated competency.

For practice-focused learners, Gleim represents the clear winner with unmatched question volume, quality explanations, and authentic exam simulation.

The SmartAdapt technology ensures you’re not just answering questions but learning from every attempt. Surgent’s smaller question bank is offset by highly targeted adaptive delivery each question serves a specific purpose in your personalized study plan.

What are the best enrolled agent study materials for each budget tier?

Under ₹25,000 Free IRS + PassKey

For candidates with limited budgets, combine free IRS resources (sample questions, Publication 17, Circular 230, Candidate Information Bulletin) with PassKey textbooks and workbooks. Total investment: approximately ₹15,000-20,000 for complete materials covering all three parts, with rigorous self-discipline replacing adaptive technology’s guidance.

₹25,000–₹50,000 Surgent or FFA

Mid-budget candidates should choose between Surgent’s time-efficiency focus or Fast Forward Academy’s community features. Surgent’s adaptive technology maximizes learning per study hour ideal if you’re working full-time while preparing. FFA suits candidates who value peer support and collaborative learning environments. Both provide comprehensive coverage at reasonable investment.

₹50,000+ Gleim or Becker

Premium budgets enable access to the most comprehensive preparation available. Gleim Premium provides the largest question bank, unlimited access guarantee, and Personal Counselor support. Becker offers superior video content and polished learning experience with the caveat of 12-month access limits. Your choice depends on prioritizing question volume (Gleim) versus video quality (Becker).

Which enrolled agent review courses are best for indian candidates?

USD pricing & currency-exchange considerations

Currency exchange dramatically impacts EA prep costs for Indian candidates.

A $599 Becker Essentials course translates to approximately ₹50,000 at current rates substantial when average starting salaries for Indian EAs working remotely range from ₹6-10 lakhs annually. This calculation should factor into your ROI analysis: how many months of remote EA work will recoup your preparation investment?

PassKey’s affordability shines in this context. Complete textbook and workbook sets at $300 (approximately ₹25,000) provide quality preparation at manageable cost. Surgent and FFA’s mid-tier pricing balances features against affordability. Premium courses from Gleim and Becker require viewing as career investments rather than simple expenses justifiable if they improve pass rates and reduce retake costs.

Consider timing your purchase around exchange rate fluctuations and provider discount periods. Black Friday, tax season (January-April), and testing cycle transitions often trigger promotional pricing. A 15% discount on a $600 course saves $90 approximately ₹7,500 meaningful money that could fund supplementary materials.

Best platforms for international users

Platform accessibility matters when studying from India. All major providers Gleim, Surgent, Becker, Fast Forward Academy offer fully online courses accessible globally. Internet speed requirements are modest for text-based study but matter for video streaming. Download options for offline study help candidates with inconsistent connectivity.

Time zone considerations favor self-paced courses over scheduled live sessions. Surgent and Gleim’s asynchronous adaptive platforms accommodate any study schedule. Becker’s webcasts and FFA’s bootcamp sessions may occur at inconvenient India hours, though recordings are typically available. PassKey/HOCK’s weekly live study sessions explicitly accommodate international participants.

For Indian candidates specifically, Surgent and Gleim represent the strongest choices based on platform reliability, flexible scheduling, and comprehensive support accessible across time zones. PassKey offers best budget value for self-disciplined candidates comfortable with independent study.

How can you use free IRS resources to prepare for the enrolled agent exam?

What free IRS study resources are most useful?

Official sample questions

The IRS provides free sample questions for all three exam parts through the SEE Questions and Official Answers page. These questions were written specifically to demonstrate the types of items appearing on actual exams. While limited in quantity (approximately 20 questions per part), they offer authentic insight into IRS question-writing style and difficulty level.

Use sample questions strategically rather than as primary study material. Review them early in your preparation to calibrate expectations, then revisit before exam day to verify your readiness. The official answers include explanations that reveal how the IRS wants you to think through problems invaluable insight regardless of which prep course you ultimately choose.

Candidate bulletin & content outlines

The Candidate Information Bulletin serves as your official exam handbook. It details registration procedures, testing center policies, score reporting timelines, and critically content outlines for each exam part. These outlines specify exactly what topics appear on each exam and their approximate weighting.

Treat the content outlines as your preparation roadmap. Every topic listed requires coverage; topics not listed won’t appear. The outlines are detailed enough to identify specific sub-areas (e.g., “Itemized deductions” under Part 1) but not so specific that you can predict exact questions. Use them to verify your prep course covers all required content and to identify gaps in your knowledge.

Key IRS Publications (Pub 17 & Circular 230)

IRS Publication 17 covers individual income tax and serves as foundational reading for Part 1. At over 200 pages, it’s comprehensive but dense more reference material than teaching text. However, exam questions often test concepts exactly as explained in Publication 17, making familiarity with its language and examples valuable.

Treasury Circular 230 governs practice before the IRS and is essential reading for Part 3 (Representation). This document defines Enrolled Agent ethics, client responsibilities, and practice standards. Unlike Publication 17’s encyclopedic scope, Circular 230 is compact enough to read multiple times. Questions about practitioner penalties, due diligence requirements, and representation procedures derive directly from Circular 230 provisions.

For a clearer breakdown of all topics tested in each part, you can also consult an Enrolled Agent Syllabus Guide that organizes the exam content into structured sections.

How do you build an EA study plan using only free resources?

Strengths & limitations of free-only prep

Free resources provide authentic IRS content at zero cost significant value for budget-constrained candidates. The sample questions demonstrate real exam style, publications contain substantive tax law, and content outlines define scope precisely. Motivated self-learners with existing tax knowledge can potentially pass using only free materials supplemented by careful study.

Limitations are significant, however. Free resources lack adaptive technology to identify weak areas, question banks for extensive practice, simulated exam environments, and customer support when you’re stuck. You’ll spend hours finding and organizing materials that paid courses present systematically. The efficiency cost in time may exceed the financial cost of budget prep courses.

When to supplement with paid materials

Consider supplementing free resources when you need structured learning rather than reference materials, when your practice question accuracy plateaus below passing threshold, or when motivation wanes without progress tracking and external accountability. The hybrid approach free IRS publications for content, paid course for practice questions and simulation often provides optimal value.

Specifically, purchasing a test bank (Gleim offers theirs separately at $379) while using free materials for content learning reduces costs while maintaining practice volume. PassKey textbooks at $40-60 per part provide organized teaching at minimal cost, supplemented by free IRS publications for depth and sample questions for calibration.

Free trials and demos from major providers

Gleim free demo and practice questions

Gleim provides a free course demo with unlimited access to one complete study unit. This isn’t a superficial preview you experience SmartAdapt technology, see actual practice questions with explanations, and understand the platform before committing. The demo requires account creation but no payment information.

Additionally, Gleim offers 40 free practice questions per exam part without registration. These questions include the same detailed answer explanations found in paid courses, helping you assess Gleim’s teaching approach. The free resources section also includes webinars on exam hot topics and study strategies valuable regardless of which course you ultimately purchase.

Becker 14-day free trial

Becker offers a comprehensive 14-day free trial including access to video lectures, digital textbooks, practice questions, and the Newt AI assistant. This trial provides enough time to meaningfully explore the platform watch several video lectures, answer practice questions, and assess whether Becker’s approach matches your learning style.

The trial requires registration but no payment until you decide to continue. Use the full 14 days strategically: explore Part 1 materials the first week, Part 2 or Part 3 the second week, and evaluate whether Becker’s strengths (video quality, production values, AI assistance) justify the premium pricing for your learning style.

Surgent free trial access

Surgent offers a free trial demonstrating the A.S.A.P. adaptive technology and ReadySCORE prediction. The trial includes enough questions to generate preliminary weakness assessments, showing how the personalized study plan would direct your preparation. No credit card is required for basic trial access.

The Surgent trial is particularly valuable for candidates uncertain about adaptive learning approaches. Experience how the system targets weak areas and predicts exam readiness. If the technology resonates with your learning style, Surgent’s efficiency claims become more credible. If you prefer more control over your study sequence, other providers may suit you better.

Part-specific study material recommendations

Best materials for EA exam part 1 (Individuals)

Topic coverage requirements

Part 1 covers individual taxation including filing requirements, income types (wages, investments, retirement distributions), deductions (standard vs. itemized), credits (child tax credit, education credits, earned income credit), and basic tax calculations. The exam tests both conceptual understanding and practical application you must know how provisions work and when they apply to specific taxpayer situations.

Recommended course combinations

For Part 1, Gleim provides the most comprehensive coverage with extensive individual tax content and practice questions targeting every exam topic. Budget-conscious candidates should combine IRS Publication 17 (free) with PassKey Part 1 textbook for organized learning. Surgent’s adaptive approach works well for Part 1 since individual taxation concepts often interconnect mastering one area frequently helps with related topics.

Best materials for EA exam part 2 (Businesses)

Why part 2 has the lowest pass rate (~60%)

Part 2 covers business entities sole proprietorships, partnerships, S-corporations, C-corporations, trusts, estates, and tax-exempt organizations. The breadth of entity types combined with complex rules for each creates the exam’s steepest learning curve. Many candidates entering from individual tax backgrounds struggle with partnership allocation rules, S-corp basis calculations, and corporate formation/liquidation provisions.

Which courses provide strongest business tax coverage

For Part 2’s complexity, invest in comprehensive courses with extensive business content. Gleim’s business taxation textbook and question bank provide the depth needed for this challenging section. Becker’s video lectures excel at explaining partnership and corporate concepts visually. Budget candidates should not skimp on Part 2 the 60% pass rate reflects genuine difficulty that requires quality preparation.

Best materials for EA exam part 3 (Representation)

Circular 230 and ethics content requirements

Part 3 tests knowledge of IRS practice and procedure representation rights, preparer responsibilities, penalties, audit and appeals processes, and collection procedures. Circular 230 forms the core of ethics content, defining standards of practice for Enrolled Agents and consequences for violations.

Efficient study strategies for part 3

Part 3’s ~85% pass rate reflects narrower scope and more memorization-friendly content compared to Parts 1 and 2. Consider using PassKey textbooks or free Circular 230 as primary materials, supplementing with practice questions from any provider. The content is less conceptually complex if you understand Circular 230 provisions and IRS procedural rules, you’ll likely pass. Invest your premium course budget in Parts 1 and 2 where difficulty justifies the expense.

If you are also evaluating whether you qualify to sit for the SEE, reviewing the Enrolled Agent Eligibility criteria will help you confirm your status before choosing a prep course.

Conclusion

Selecting the right EA exam study materials requires honest assessment of your learning style, budget constraints, and timeline. For comprehensive preparation with the largest question bank and adaptive technology, Gleim represents the gold standard especially for candidates planning to tackle all three parts seriously. Surgent offers the most time-efficient approach for experienced professionals who need targeted review rather than ground-up learning. Becker delivers premium video content and production quality for visual learners willing to invest at higher price points.

Budget-conscious Indian candidates should seriously consider PassKey textbooks supplemented with free IRS resources and provider demos. The combination delivers quality preparation at approximately ₹25,000 a fraction of premium course pricing. Remember that passing all three parts on your first attempt saves ₹66,000 in retake fees plus months of additional study time. Whatever course you choose, commit fully to the preparation process. Your EA credential opens doors to remote US tax careers earning ₹6-25+ lakhs annually an investment return that justifies quality study materials.

Frequently Asked Questions

What Is the Best EA Exam Prep Course for 2025-2026?

Gleim EA Review is the most widely used and comprehensive course, with the largest question bank (3,500+ MCQs), SmartAdapt adaptive technology, and “Access Until You Pass” guarantee. Surgent offers the best time-efficient alternative with A.S.A.P. adaptive learning.

How Much Do EA Exam Study Materials Cost?

EA prep courses range from $200-$999. PassKey textbooks cost approximately $300 for all parts. Gleim ranges from $379 (test bank) to $598 (Premium). Surgent and Becker premium packages run $799-999. Free IRS resources cost nothing but require self-directed study.

Can I Pass the EA Exam Using Only Free Resources?

Passing with only free IRS resources is possible but challenging. Free materials lack practice questions, adaptive technology, and simulated exams. Most successful candidates supplement free resources with at least a question bank or budget textbooks like PassKey.

Which EA Course Has the Most Practice Questions?

Gleim leads with 3,500+ multiple-choice questions. Fast Forward Academy offers 3,063 questions, Becker provides 3,000+, and Surgent includes 1,800+. PassKey workbooks contain approximately 900 mock exam questions across all parts.

Is Gleim or Surgent Better for EA Exam Preparation?

Gleim is better for comprehensive coverage and candidates who learn through extensive practice. Surgent is better for time efficiency and candidates who already have tax knowledge and need targeted review. Both use adaptive technology but approach preparation differently.

How Long Should I Study for Each Part of the EA Exam?

Most candidates need 40-100 hours per part, depending on tax background and course efficiency. Plan 3-4 months for all three parts studying 1-2 hours daily. Part 2 (Businesses) typically requires the most time due to complexity.

Do EA Prep Courses Offer Money-Back Guarantees?

Gleim offers “Access Until You Pass” (free course extensions). Surgent offers a conditional money-back guarantee with requirements. Becker Pro includes $100 back if you don’t pass. Fast Forward Academy provides access until you pass without explicit refund.

Which EA Course Is Best for Indian Candidates?

Gleim and Surgent work best for Indian candidates due to global platform accessibility, flexible scheduling, and “until you pass” guarantees that accommodate longer preparation timelines. PassKey offers best budget value at approximately ₹25,000 for complete materials.

H2: What Are the Best Free EA Exam Study Materials?

Best free resources include IRS sample questions, Publication 17 (Part 1), Circular 230 (Part 3), and the Candidate Information Bulletin. Gleim, Becker, and Surgent offer free trials/demos that provide additional practice questions and platform experience.

Should I Buy PassKey Books or a Full Online Course?

Choose PassKey if you’re budget-conscious, self-disciplined, and comfortable with textbook learning. Choose a full online course if you need adaptive technology, extensive practice questions, video content, or structured accountability. Many candidates combine PassKey books with online question banks.

Which EA Course Has the Best Video Lectures?

Becker offers the highest quality video lectures with professional production and experienced instructors. Gleim provides 450+ videos in the Premium tier. Fast Forward Academy includes 10+ hours of video content. Surgent focuses on adaptive technology over video learning.

How Do I Know When I’m Ready to Take the EA Exam?

Surgent’s ReadySCORE predicts your actual exam score with ~95% accuracy. Gleim’s SmartAdapt indicates readiness when you’ve mastered all content domains. Generally, consistent scores of 75%+ on simulated full-length practice exams indicate readiness. The passing score is 105 out of 130 scaled points.

Allow notifications

Allow notifications