Complete Enrolled Agent exam guide for Indians: three-part structure, Prometric registration, ₹67K fees, 66% pass rates, India testing centres. Your pathway to US tax career.

Table of Contents

If you’re a commerce graduate, CA dropout, or accounting professional in India looking to break into the US tax market without relocating, the Enrolled Agent exam is your gateway.

This IRS-administered credential lets you represent US taxpayers before the Internal Revenue Service from anywhere in the world, including from your home in India. Unlike the CPA, which requires 150 credit hours and US work experience, the EA has no educational prerequisites and can be taken entirely from Indian cities through Prometric testing centers.

The opportunity is substantial. Indian EAs working remotely for US clients earning are high depending on experience.

The EA credential has seen substantial global growth in recent years. As of September 2024, there were approximately 66,794 active Enrolled Agents, up from about 64,489 a year earlier, a growth of roughly 3.6%. In India specifically, the number of EAs is 2,683 as of September 2024, representing a nearly 19% jump in just one year. That indicates two things:

- first, demand for qualified EA-credentialed professionals is clearly expanding outside the U.S.; and

- second, more Indian accounting graduates and professionals are successfully obtaining EA status — widening the pool of remote, globally oriented tax experts.

This expansion reflects rising demand from US tax preparation and advisory firms that are increasingly outsourcing to India.

This guide covers everything you need to know about the Enrolled Agent exam: eligibility requirements, three-part structure with detailed syllabus breakdown, Prometric registration from India, testing logistics, scoring methodology, and what happens after you pass. Whether you’re deciding if EA is right for you or ready to start your preparation, here’s what you need to know.

Introduction to the Enrolled Agent Exam

The Enrolled Agent exam is how the IRS certifies tax professionals who haven’t worked for the agency. If you want to become an enrolled agent through examination rather than IRS employment, you’ll take this three-part test covering US individual taxation, business taxation, and representation procedures. Let me walk you through what this exam actually is and why it matters.

What is the Special Enrollment Examination (SEE)?

The Special Enrollment Examination (SEE) is the official name for the Enrolled Agent exam administered by the IRS. This computerized test evaluates your knowledge of the US tax code, IRS procedures, and professional ethics required to represent taxpayers before the IRS. The exam consists of three separate parts that you can take in any order, with each part containing 100 multiple-choice questions testing different aspects of tax practice.

What makes the SEE unique is its accessibility. There are no educational prerequisites; you don’t need a college degree, an accounting background, or prior tax experience to sit for the exam. This open enrollment policy means anyone can attempt to become an enrolled agent purely by demonstrating tax knowledge through the examination. The exam tests content from the Internal Revenue Code, IRS forms and publications, and Treasury Department Circular 230 as they existed on December 31st of the previous year.

The IRS designed this exam to ensure enrolled agents have the competence to handle any tax matter for any type of taxpayer. Unlike tax preparers without credentials who can only represent clients whose returns they prepared, passing the SEE grants you unlimited representation rights. You’ll be able to represent individuals, businesses, estates, trusts any taxpayer with any tax issue before any IRS office.

Who Administers the Enrolled Agent Exam?

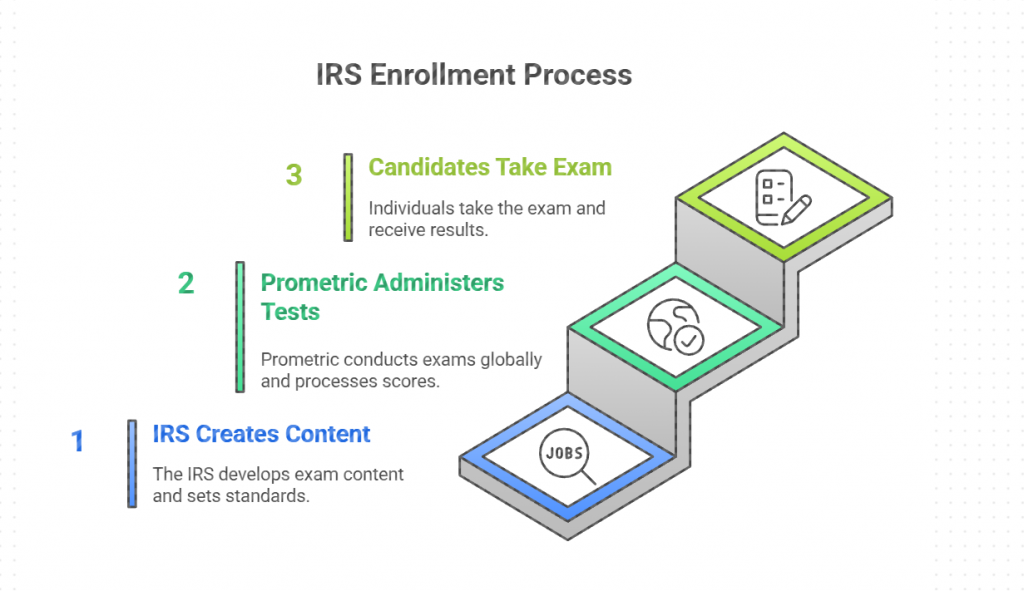

The IRS creates and owns the Enrolled Agent exam content, but Prometric administers the actual testing. Prometric is a global testing company that operates testing centers throughout the United States and internationally. This partnership means you take your exam at a Prometric testing center, not at an IRS office.

The IRS establishes what content appears on each exam part, determines the passing score, and reviews exam performance data to maintain quality standards. A panel of subject matter experts composed of enrolled agents and IRS representatives periodically reviews the exam to ensure it accurately tests the knowledge needed for competent EA practice. When tax laws change significantly, the IRS updates exam content during the annual March-April blackout period.

Prometric handles the logistics: maintaining testing centers, scheduling appointments, processing payments, delivering the computer-based exam, and providing immediate score reports. For international candidates, Prometric coordinates with the IRS to offer testing at select locations outside the US, including three cities in India—Bangalore, Hyderabad, and New Delhi.

What are the Three Parts of the EA Exam?

The Enrolled Agent exam is divided into three separate parts that you take independently.

- Part 1 focuses on individual taxation,

- Part 2 covers business taxation, and

- Part 3 addresses representation, practices, and procedures.

Each part is a standalone exam with 100 questions and 3.5 hours of testing time, and you must pass all three to qualify for EA enrollment.

You can take these parts in any sequence that suits your preparation strategy and comfort level. There’s no requirement to pass Part 1 before attempting Part 2 or Part 3. Many candidates choose to take Part 1 or Part 2 first because Part 3 builds on concepts tested in the earlier parts, but this sequencing is entirely your choice. You could even schedule all three parts in the same week if you’re exceptionally well-prepared, though most candidates space them out over several months.

Each part operates independently for scheduling, payment, and scoring. You pay $267 per part separately when you schedule each appointment. If you pass Part 1 and Part 2 but fail Part 3, you don’t need to retake the passed parts; you simply prepare more for Part 3 and retake only that section. Your passing scores remain valid for three years from the date you passed each part, giving you flexibility to complete the full exam series at your own pace.

The three-part structure serves a practical purpose. Individual taxation (Part 1) represents the foundation most tax professionals start with. Business taxation (Part 2) adds complexity with different entity types and more intricate rules. Representation procedures (Part 3) teaches you how to actually practice before the IRS, including ethical obligations and procedural requirements. Together, these three parts ensure you can handle any tax matter competently.

Enrolled Agent Exam: Eligibility and Requirements

Let’s address the eligibility question directly, because this is where EA differs dramatically from credentials like the CPA. The enrollment examination pathway has remarkably few barriers to entry, which is precisely why it’s attractive for Indian commerce graduates and accounting professionals looking to access the US tax market.

What are the Eligibility Criteria for the EA Exam?

The eligibility criteria for the Enrolled Agent exam are minimal. You must be at least 18 years old and obtain a Preparer Tax Identification Number (PTIN) from the IRS before you can register for the exam through Prometric. That’s essentially it for taking the exam itself. There are no citizenship requirements, no residency requirements, no educational qualifications, and no work experience mandates.

The age requirement of 18 years comes from IRS Circular 230, which governs practice before the IRS. This is the minimum age for official enrollment, not just for taking the exam, though practically speaking, you need to be 18 to obtain a PTIN as well. There is no maximum age limit—the IRS doesn’t restrict older candidates from taking the exam or applying for enrollment.

The PTIN requirement is straightforward. You apply online at the IRS website, pay approximately $18.75 (₹1,600). It takes about 15 minutes to sign up online and receive your PTIN. If you opt to use the paper application, Form W-12 IRS Paid Preparer Tax Identification Number (PTIN) Application, it will take 4-6 weeks to process. For Indian residents, you’ll need your passport information and Indian address. The PTIN serves as your professional identifier with the IRS and must be renewed annually.

The suitability check happens after you pass all three parts, when you apply for actual enrollment. The IRS reviews your tax compliance to ensure you’ve filed all required returns and have no outstanding tax liabilities, and conducts a criminal background check focusing on felony convictions involving dishonesty or breach of trust within the past 10 years. But these requirements don’t affect your eligibility to take the exam—they only impact whether you can become enrolled after passing.

Do You Need a Degree to Take the EA Exam?

No, you do not need a college degree to take the Enrolled Agent exam. The IRS explicitly states there are no education or experience requirements to sit for the SEE. This is one of the EA credentials’ most significant advantages over the CPA, which typically requires 150 college credit hours, including specific accounting and business courses.

You can take the EA exam as a current student, a recent graduate, or someone who never attended college. Your BCom, MCom, CA, CS, or MBA degree certainly helps with preparation because you’ll have foundational knowledge of accounting and taxation concepts, but it’s not a prerequisite. Engineers, science graduates, and liberal arts graduates have all successfully passed the EA exam and become enrolled agents.

The absence of degree requirements makes EA particularly attractive for Indian commerce graduates who face limited domestic opportunities and fierce competition. Rather than spending years pursuing CA or CPA qualifications with stringent educational prerequisites, you can focus entirely on mastering US tax law and take the exam whenever you’re ready. Your credibility as an enrolled agent comes from passing the comprehensive IRS examination, not from your educational pedigree.

What you do need is knowledge. The exam tests a detailed understanding of the Internal Revenue Code, tax forms, IRS procedures, and professional ethics. Most successful candidates study for 200-300 hours total across all three parts using commercial review courses or self-study materials. Your commerce or accounting background makes this preparation more efficient because you already understand concepts like income, deductions, credits, and entity structures—you’re just learning the US application of these principles.

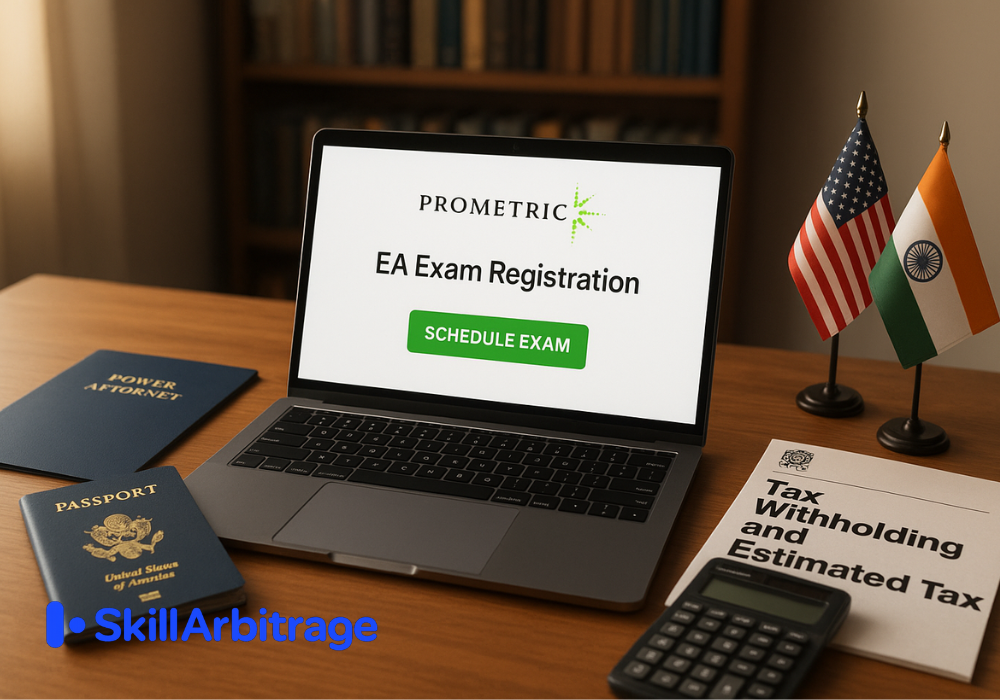

Can You Take the EA Exam from India?

Yes, you can take the EA exam entirely from India without visiting the United States. Prometric operates testing centers in three Indian cities—Bangalore, Hyderabad, and New Delhi—where you can schedule and sit for all three exam parts. The exam content, format, difficulty, and scoring are identical whether you test in Mumbai or Manhattan.

Here’s the practical process for Indian candidates: First, obtain your PTIN from the IRS by providing your passport information and Indian address. Once you have your PTIN, create a Prometric account and schedule your exam appointments at your preferred Indian city. You’ll pay $267 per part at the time of scheduling. On exam day, arrive at the Prometric center with your original passport; this is your required identification as a non-US citizen.

The testing experience at Indian Prometric centers follows the same protocols as US centers. The 3.5-hour time limit, 100 multiple-choice questions, optional 15-minute break, and immediate score report are identical to the US testing experience.

One important consideration: while you can take the exam from India, you’ll eventually need to complete IRS enrollment procedures after passing all three parts. This enrollment application can be done entirely online or by mail; you don’t need to visit the US for this either. The IRS processes international enrollment applications and conducts suitability checks for candidates worldwide.

Enrolled Agent Exam: Structure and Syllabus

The three parts of the Enrolled Agent exam each test distinct areas of tax knowledge. Let me break down what each part covers so you understand exactly what you’re preparing for.

EA Exam Part 1 – Individuals: Topics and Domains

Part 1 of the Enrolled Agent exam covers individual taxation, focusing on preparing Form 1040 returns and understanding personal income tax complexities. This part tests six major domains:

- Preliminary Work with Taxpayer Data,

- Income and Assets,

- Deductions and Credits,

- Taxation, Advising the Individual Taxpayer, and

- Specialized Returns for Individuals.

Preliminary Work with Taxpayer Data – This covers filing status determination (single, married filing jointly, married filing separately, head of household, qualifying surviving spouse) and dependency rules

Income and Assets – You’ll face questions on wages and salaries, self-employment income, business income and losses, interest and dividend income, capital gains and losses, rental income, retirement distributions, Social Security benefits, alimony, and numerous other income types.

Deductions and Credits – You must understand that credits provide dollar-for-dollar tax reduction while deductions only reduce taxable income. Questions test which expenses qualify for itemization and the limitations that apply.

The Taxation domain – This covers the actual computation of tax liability. Mathematical accuracy matters here—calculation errors mean wrong answers. These questions test whether you can actually compute what a taxpayer owes.

Advising Individual Taxpayers – This moves beyond mechanical preparation into advisory work. This domain assumes you understand the previous domains well enough to provide guidance.

Specialized Individual Returns – This covers less common but important return types, including estate and trust taxation, gift tax returns, decedent’s final returns, and foreign income reporting requirements.

EA Exam Part 2 – Businesses: Topics and Domains

Part 2 shifts focus to business taxation, covering corporations, partnerships, S-corporations, LLCs, and self-employed individuals operating businesses. This part tests three major domains:

- Business Entities and Considerations,

- Business Tax Preparation, and

- Specialized Returns and Taxpayers.

Part 2 typically requires more study hours than Part 1 because US business entity structures differ significantly from Indian company structures.

Business Entities and Considerations – This requires a deep understanding of how different business entities are formed, operated, and taxed. The critical concept is pass-through versus corporate taxation—understanding which entities pay tax at the entity level and which pass income through to owners.

Business Tax Preparation – This is the heaviest-weighted domain in the entire EA exam of Part 2. This is dense, detailed material testing whether you can prepare complete business returns from scratch.

Payroll taxes form a significant component of this domain. You’re learning both the substantive tax rules and the procedural compliance requirements. Business credits add another layer of complexity. These credits can significantly reduce business tax liability, so competent EAs need to identify opportunities for clients.

Specialized Returns and Taxpayers – This covers less common business scenarios. The complexity here isn’t necessarily in volume but in the specialized knowledge required for each return type.

EA Exam Part 3 – Representation: Topics and Domains

Part 3 is fundamentally different from Parts 1 and 2. Instead of tax preparation, it focuses on how to represent clients before the IRS and the ethical rules governing tax practice.

Part 3 covers four major domains:

- Practices and Procedures,

- Representation before the IRS,

- Specific Areas of Representation, and

- Filing Process.

Many candidates find this the most challenging part conceptually because it’s entirely procedural and IRS-specific.

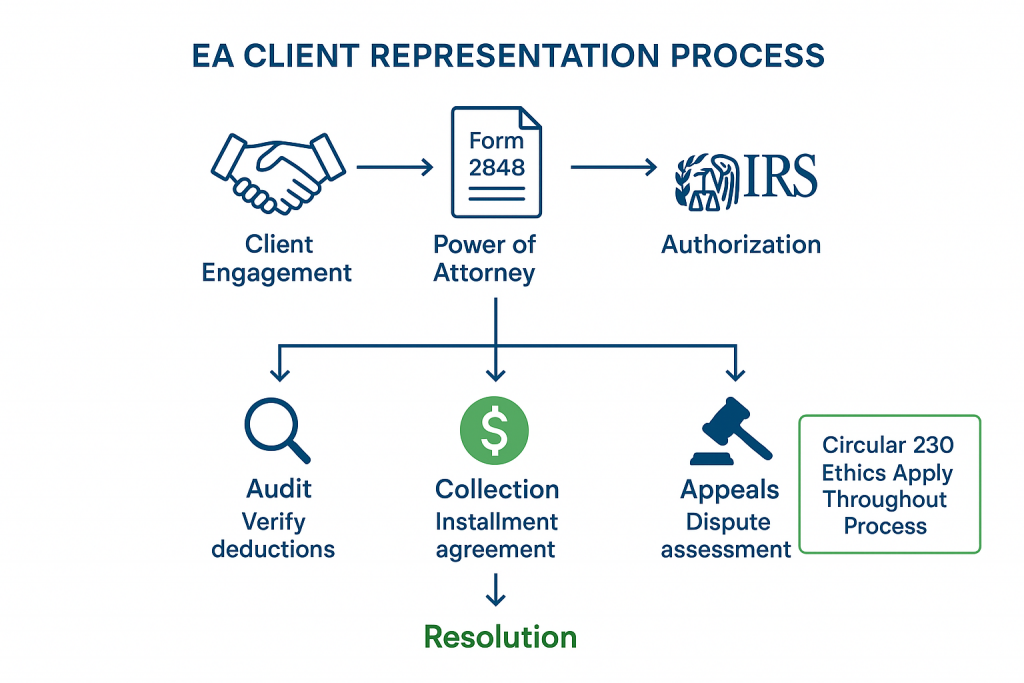

Practices and Procedures – This centers on Treasury Department Circular 230, the set of regulations governing practice before the IRS. Think of Circular 230 as your professional code of conduct—violating these rules can cost you your EA credential.

Questions test scenarios where you must identify proper versus improper practitioner conduct. You need to know fee rules (contingent fees are generally prohibited except in specific circumstances), advertising restrictions, requirements for informing the IRS of errors you discover, and rules about employing or accepting assistance from former IRS employees or disbarred persons. The IRS expects enrolled agents to maintain high ethical standards.

Representation before the IRS – This covers the complete process of representing clients in various IRS proceedings. This includes audit procedures (correspondence audits, office audits, field audits), examination techniques, documentation requirements, and how to communicate effectively with IRS agents.

You need to know the proper procedural response, documentation to gather, and how to communicate with the IRS. This isn’t about calculating taxes—it’s about navigating IRS systems competently.

Specific Areas of Representation- This covers specialized representation scenarios. You need to understand not just what these procedures are, but when each is appropriate and how to navigate them.

Filing Process and Compliance covers the administrative side of tax practice. You’ll learn about PTIN requirements, e-filing procedures (enrolled agents must understand Electronic Filing Identification Numbers), recordkeeping obligations, confidentiality rules protecting client information, disclosure requirements, and the consequences of filing false returns. You’ll study taxpayer rights under the Taxpayer Bill of Rights and the procedural requirements for different types of tax submissions.

Enrolled Agent Exam Registration and Fees

Now, let’s cover the practical logistics of actually registering for the exam and what it costs. This is where the process becomes concrete.

How to Register for the EA Exam Through Prometric?

You register for the Enrolled Agent exam through Prometric’s website after obtaining your PTIN from the IRS. The registration process is entirely online and can be completed from India using the same system that US candidates use. Here’s the step-by-step process you’ll follow.

First, ensure you have your PTIN. You cannot create a Prometric account or register for the exam without this number. Once your PTIN is issued, visit the Prometric website and navigate to the IRS Special Enrollment Examination section.

During account creation, carefully enter your personal information exactly matching your government-issued ID. Any mismatch between your Prometric registration and your passport can cause problems on exam day when the test center verifies your identity. Double-check spelling, especially if your name has uncommon characters or multiple possible spellings. The system will send a confirmation email once your account is created—verify you received it before proceeding.

After creating your account, log in and select “Schedule New Exam.” You’ll choose your exam part (Part 1, Part 2, or Part 3), select your preferred testing location from available Prometric centers, choose your exam date and time from available slots, and pay your exam fee using an international credit card. This completes the scheduling process.

The Prometric system shows real-time availability, displaying which dates and times have open slots at your selected location. You can schedule all three parts at once if you’re planning ahead, or schedule them one at a time as you complete preparation. Many candidates prefer scheduling one part, passing it, then scheduling the next—this prevents you from being locked into dates you might not be ready for.

Important: after scheduling, immediately review your appointment confirmation email. Verify you selected the correct exam part, the correct date and time, and the correct testing location. Mistakes happen; candidates sometimes accidentally select Part 2 when they meant Part 1, or choose the wrong date. If you catch an error immediately, you can make changes. Prometric allows rescheduling for a fee ($35 if done 5-29 days before your appointment, or full fee if less than 5 days), but your entire fee is forfeited if you miss your appointment or arrive more than 30 minutes late.

What is the EA Exam Fee?

The Enrolled Agent exam fee is $267 per part as of March 2025. You pay this fee separately when you schedule each part, so completing all three parts costs approximately $801 (around ₹67,000-68,000 at current exchange rates).

You pay at the time you schedule your exam appointment through Prometric’s online system. If you need to reschedule your appointment, additional fees apply: no fee if you reschedule at least 30 calendar days before your appointment, $35 fee if you reschedule 5-29 calendar days before, or a full $267 fee if you reschedule less than 5 days before.

Where are the EA Exam Centers Located in India?

EA exam centers in India are located in three cities: Bangalore, Hyderabad, and New Delhi. Prometric operates these testing centers specifically for international candidates taking the IRS Special Enrollment Examination..

When you schedule your exam through Prometric, you select your preferred testing center during the registration process. The system shows you the complete address for each center, available dates and times, and sometimes candidate reviews. You should choose a center you can reach easily without traffic stress.

On exam day, arrive at least 30 minutes early. The exam software provides an on-screen calculator for Part 2 business calculations. You’re not allowed to bring notes or study materials, and phones and electronic devices are prohibited even during breaks.

Enrolled Agent Exam Dates and Schedule

Understanding when you can take the exam and how long you have to complete all parts is crucial for planning your preparation timeline.

What is the EA Exam Testing Window?

The EA exam testing window opens May 1 and closes February 28 of the following year, giving you a 10-month period to schedule and take exams. Testing is unavailable during March and April—this two-month blackout exists because the IRS and Prometric update exam content with the latest tax law changes, revise questions based on performance data, and prepare for the next testing cycle.

The intervening months of March and April are used specifically to update the Enrolled Agent exam content to reflect the Internal Revenue Code, forms, and publications as amended through December 31 of the previous year.

This timing structure has strategic implications for your preparation. If you’re starting preparation in January or February, you face a decision: take exams immediately before the window closes, or wait until May when the new window opens. Taking exams in February means testing on the previous year’s tax law before updates. If you’re well-prepared, this can be advantageous—you take the exam before any question changes. However, if you fail and need to retake in May or later, you’ll be tested on updated content.

Alternatively, starting preparation after tax season (April-May) means studying when the US tax season has just concluded, and the updated exam content reflects the most recent tax year. During the testing window, you have the flexibility to schedule exams at your convenience.

How Long Do You Have to Pass All Three Parts?

You have three years from the date you pass your first part to pass the remaining two parts. This three-year carryover period is how long each passing score remains valid. If you don’t complete all three parts within this timeframe, the credits for your passed parts expire, and you must retake those parts. Each part’s three-year clock starts from the date you passed it, so different parts may have different expiration dates.

This cascading expiration risk is why strategic planning matters. While the three-year window seems generous, the longer you stretch out your exam timeline, the more you forget from earlier parts, the more tax law changes you need to relearn, and the higher your risk of credits expiring.

However, don’t let this extended timeline lull you into complacency. Tax laws change frequently, and exam content updates annually. If you pass Part 1 in 2025 but don’t take Part 3 until 2028, you’re dealing with three years of tax law evolution, and you might need to relearn material.

Enrolled Agent Exam Scoring and Results

Understanding how the exam is scored and what happens when you receive your results helps you interpret your performance and plan next steps.

What is the EA Exam Passing Score?

The Enrolled Agent exam passing score is 105 on a scaled score range of 40 to 130 points. You must achieve a scaled score of 105 or higher on each of the three parts independently to qualify for EA enrollment. The IRS sets this passing threshold consistently across all three parts—Part 1, Part 2, and Part 3 all require 105 to pass.

Most estimates suggest you need to correctly answer approximately 60-65 of the 85 scored questions (roughly 70-76% accuracy) to achieve a scaled score of 105, though the exact number varies slightly based on the difficulty of your specific exam version. This gives you room for 20-25 mistakes and still pass. The scaled scoring system means candidates facing a harder exam version need fewer correct answers to reach 105, while those with an easier version need slightly more correct answers—the goal is equivalent passing standards regardless of version difficulty.

What are the EA Exam Pass Rates?

According to the testing window 2022-23 for the Enrolled Agent exam, the passing rates for Part 1, Part 2, and Part 3 are respectively 60%, 69%, and 70%.

These rates represent the percentage of all candidates who passed each part during that testing period.

Part 1’s 60% pass rate being the lowest might surprise you since individual taxation seems more intuitive than business taxation. The explanation lies in candidate composition—the number of candidates who take Part 1 is nearly twice the number of those taking Part 2 and Part 3. Many more people attempt Part 1, including some who aren’t fully prepared or are testing the waters to see what the exam is like. This broader, less selective candidate pool brings down the pass rate.

Additionally, candidates often take Part 1 first when their study habits and exam strategies aren’t yet optimized. By the time these same candidates sit for Part 2 or Part 3, they understand what EA exam questions look like, they’ve refined their approach, and they’re more motivated, having already invested effort in passing previous parts. This self-selection effect partly explains why Parts 2 and 3 have higher pass rates.

How are EA Exam Results Delivered?

EA exam results are delivered immediately on-screen after you complete the exam. If you pass with a score of 105 or higher, the screen shows “PASS” with no numerical score. The IRS provides no additional details about your exact performance level. You simply know you met the minimum standard. Along with the pass indication, you’ll receive proficiency level feedback for each domain, showing whether you demonstrated weak, acceptable, or strong performance in different content areas. This feedback helps you identify areas where you might want continuing education even though you passed.

If you don’t pass, the screen displays your scaled score ranging from 40 to 104, providing insight into how close you came to passing. A score of 104 means you were extremely close—just one point below the passing threshold—while a score of 45 indicates you were far from passing. Along with your numerical score, you receive detailed diagnostic information showing your performance in each content domain.

After receiving your on-screen results, Prometric emails you a score report within a day or two. You can also log into the Prometric score report website, enter your 16-digit exam confirmation number and last name, and print your official score report at any time. This official score report serves as your documentation that you passed. Keep these score reports for all three parts because you’ll need to demonstrate that you passed when you apply for IRS enrollment.

Conclusion

The Enrolled Agent exam offers Indian accounting professionals a clear pathway into the US tax market without the barriers associated with traditional credentials like the CPA. With no degree requirements, testing available in Bangalore, Hyderabad, and New Delhi, and a three-year window to complete all parts, the EA credential is remarkably accessible. The three-part structure systematically tests individual taxation, business taxation, and IRS representation procedures, ensuring you have comprehensive knowledge to practice before the IRS.

Your investment—approximately ₹1-2.5 lakhs total for PTIN, exam fees, enrollment, and study materials—positions you for remote work earnings between ₹3.5 lakhs and ₹50+ lakhs annually, depending on experience. Most candidates complete all three parts within 6-18 months, studying 200-300 hours total.

The key to success is understanding exactly what each part tests and preparing systematically. Part 1 focuses on Form 1040 and individual taxation concepts familiar to commerce graduates. Part 2 introduces US business entity structures that require learning new concepts but build on your accounting foundation. Part 3 tests IRS procedures and ethics that have no equivalent in other jurisdictions, requiring focused study of Circular 230 and representation scenarios. Strategic candidates take parts in order of comfort, use official IRS materials alongside commercial review courses, and complete practice questions until they consistently score 70-75% before scheduling.

Once you pass all three parts, you’ll apply for IRS enrollment, undergo a suitability check, and receive your enrolled agent credential—positioning you to represent any taxpayer on any tax matter before any IRS office from anywhere in the world, including from your home in India.

For more insights on this topic please visit our iPleaders blog by clicking here.

Frequently Asked Questions

How Many Hours Should I Study for the Enrolled Agent Exam in Total?

Most candidates study 200-280 hours total across all three parts: Part 1 requires 70-90 hours, Part 2 requires 80-100 hours, and Part 3 requires 60-80 hours. Candidates with accounting backgrounds need fewer hours, while those new to taxation may need 300+ hours total.

Can I Pass the EA Exam Without a Review Course?

Yes, you can pass the EA exam using only IRS publications, sample questions, and self-study books. However, commercial review courses provide structured content, practice questions, and study plans that improve efficiency and success rates, especially for Part 2 business taxation.

Which EA Exam Part is the Hardest to Pass?

Part 1 has the lowest pass rate, though this reflects broader candidate composition rather than inherent difficulty. Many candidates find Part 2 hardest due to complex business entity rules, while Part 3 is conceptually different from both, focusing on procedures rather than calculations.

How Do I Know When I Am Ready to Take the EA Exam?

You’re ready when you consistently score 70-75% or higher on practice tests under timed conditions. Take at least two full-length practice exams for each part before scheduling, and ensure you understand why you got questions wrong, not just the correct answers.

What Score Do I Need to Pass Each Part of the EA Exam?

You need a scaled score of 105 out of 130 to pass each EA exam part. This typically requires correctly answering approximately 60-65 of the 85 scored questions (70-76% accuracy), though the exact number varies based on exam difficulty due to psychometric scaling.

Can I Take All Three EA Exam Parts in One Week?

Yes, you can schedule all three EA exam parts within one week if you’re prepared. However, most candidates space parts out over 2-6 months to allow adequate preparation time for each section and to avoid burnout from attempting multiple exams rapidly.

How Long After Failing Can I Retake an EA Exam Part?

You must wait at least 24 hours before scheduling another appointment for the same part you failed. You can take each part up to four times within a testing window (May 1 – February 28), after which you must wait until the next window opens.

What Should I Do If I Keep Failing the Same EA Exam Part?

Review your diagnostic feedback to identify weak domains, focus study exclusively on those areas, use different study resources, consider a commercial review course with instructor support, and take more practice tests to identify specific question types causing difficulty before reattempting.

How Do I Study for the EA Exam If I Have No Tax Background?

Start with IRS Publication 17 to learn basic individual tax concepts, use a comprehensive review course with foundational content like Gleim or Surgent, allocate extra study time (300-350 hours total), and focus on understanding concepts rather than memorizing, beginning with Part 1 Individuals.

What Happens to My Passed Parts If I Don’t Complete All Three in Time?

Passed parts expire three years from the date you passed them. If you pass Part 1 on November 15, 2025, but don’t complete all parts by November 15, 2028, your Part 1 credit expires, and you must retake it even if other parts remain valid.

Can Indian Candidates Use the Same Study Materials as US Candidates?

Yes, Indian candidates use identical study materials as US candidates including Gleim, Surgent, Becker, and PassKey review courses, IRS publications, and practice question banks. The exam content and difficulty are the same regardless of where you test, so preparation materials are universal.

Allow notifications

Allow notifications