Complete Enrolled Agent course guide: Compare Gleim, Becker, Surgent EA reviews. Fees ₹40k-80k. Salary ₹4-25L+. Pass rates, curriculum & career paths explained.

Table of Contents

How to become an Enrolled Agent?

Enrolled Agent Credential Overview

The Enrolled Agent (EA) credential represents the highest credential awarded by the Internal Revenue Service (IRS) and authorizes professionals to represent taxpayers before the IRS. Unlike CPAs, who are state-licensed, EAs hold a federal license that’s valid across all 50 states without geographical restrictions. This makes the EA designation particularly valuable for tax professionals who want to practice nationwide or work remotely.

To earn the EA credential, candidates must pass a three-part Special Enrollment Examination (SEE) covering individual taxation, business taxation, and representation practices. The exam is comprehensive and tests both theoretical knowledge and practical application of US tax law. Once certified, EAs must complete 72 hours of continuing education every three years to maintain their credential.

The EA credential has seen substantial global growth in recent years. As of September 2024, there were approximately 66,794 active Enrolled Agents, up from about 64,489 a year earlier, a growth of roughly 3.6%. In India specifically, the number of EAs is 2,683 as of September 2024, representing a nearly 19% jump in just one year. This expansion reflects rising demand from US tax preparation and advisory firms that are increasingly outsourcing to India.

The EA designation has gained significant traction internationally, particularly in India, where thousands of accounting professionals are pursuing this credential. The ability to work remotely for US clients while being based in India has transformed the EA into one of the most sought-after international accounting certifications. For Indian professionals, the EA offers a direct pathway into the lucrative US tax preparation industry without requiring relocation.

Why EA Course Training Matters

While the IRS allows candidates to prepare for the EA exam using free publications and self-study materials, professional EA courses dramatically improve your chances of passing. These structured programs condense thousands of pages of IRS circulars, tax code, and regulations into organized, digestible content that’s specifically aligned with the exam format. Without proper guidance, navigating the complex US tax system can be overwhelming and time-consuming.

Professional EA courses typically include adaptive learning technology that identifies your weak areas and adjusts study plans accordingly. This personalized approach ensures you’re not wasting time on topics you’ve already mastered while giving extra attention to challenging concepts. Most courses also provide thousands of practice questions that mirror the actual Prometric exam format, helping you build test-taking confidence and speed.

The support structure that comes with EA courses is equally valuable. Access to experienced instructors who can clarify complex tax scenarios, personal study counselors who keep you on track, and peer communities for motivation can make the difference between passing and failing. For Indian students unfamiliar with US taxation, this guidance becomes even more critical since the tax system differs fundamentally from Indian tax law.

The investment in a quality course often pays for itself through reduced exam retake fees and faster credential completion. When you consider that passing all three parts on the first attempt saves approximately $300-500 in retake fees alone, the value proposition becomes clear.

Who Should Take an EA Course?

Indian commerce graduates (B.Com, M.Com) represent one of the largest groups pursuing EA courses, particularly those looking to transition into US taxation without earning additional degrees. If you have a foundational understanding of accounting principles but no US tax background, an EA course provides the structured pathway you need. The curriculum starts from the basics and builds systematically, making it accessible even if you’ve never filed a US tax return.

Practicing accountants and tax professionals in India who want to expand their service offerings internationally find tremendous value in EA training. Many Indian CA firms and accounting practices are now serving US-based NRI clients, and the EA credential provides the legal authority to represent these clients before the IRS. An EA course helps you transition your existing tax knowledge to the US context while learning the specific representation and ethics requirements.

Finance professionals working in KPO/BPO sectors handling US taxation work benefit immensely from formal EA training. While many have on-the-job exposure to US tax returns, the EA credential validates your expertise and can significantly boost your career progression and salary. The course fills knowledge gaps and provides the comprehensive understanding needed to advance from processing roles to analytical or advisory positions.

Fresh graduates who want to enter the international accounting field directly can use EA courses as a launching pad for their careers. Unlike the CPA, which requires 150 credit hours and work experience, the EA has no educational prerequisites beyond a high school diploma. This accessibility makes it ideal for young professionals who want to establish themselves in US taxation early in their careers and potentially pursue remote work opportunities.

Major Enrolled Agent Course Providers: Complete Comparison

US-Based EA Course Providers

Gleim EA Review: Largest Question Bank

Gleim EA Review has established itself as the gold standard for EA exam preparation, primarily due to its massive question bank. This extensive practice material is significantly larger than any competitor’s and covers every conceivable topic that might appear on the actual exam. The questions are continuously updated to reflect the latest tax law changes and IRS procedural updates.

The course uses a proven study system that emphasizes repetition and mastery through multiple learning formats. Each study unit includes reading materials, instructional videos, practice questions, and simulations that reinforce concepts from different angles. Gleim’s methodology is straightforward: exposure to a high volume of quality questions builds both knowledge and exam confidence simultaneously.

What sets Gleim apart is its comprehensive coverage approach rather than trying to predict exam content. The philosophy is that thorough preparation across all topics ensures you’re ready for any question variation the exam throws at you. This approach has produced consistently high pass rates for decades and made Gleim the preferred choice for many tax professionals.

Course Features and Pricing

Gleim offers two main packages: Premium Review ($800) and Mega Test Bank ($500). The Premium package includes access to all study materials, video lectures, practice questions, simulations, and unlimited support through 12 months of access. The Mega Test Bank is more budget-friendly and focuses primarily on the question bank with basic study outlines, ideal for those who prefer learning through practice.

Both packages include mobile app access, allowing you to study on the go with downloadable content for offline use. The platform tracks your performance metrics, showing strengths and weaknesses across different topics. Gleim also provides printed books if you prefer physical study materials, though digital is the default format.

SmartAdapt Technology

Gleim’s SmartAdapt technology represents their recent innovation in personalized learning, though it’s not as advanced as Surgent’s adaptive system. SmartAdapt analyzes your quiz and test performance to recommend specific study units where you need improvement. The system creates customized quiz sessions that focus on your weak areas while periodically reviewing strong topics to maintain retention.

The technology adjusts question difficulty based on your performance, gradually increasing complexity as you demonstrate mastery. This prevents the frustration of constantly facing questions that are too difficult or the boredom of repetitive, easy questions. While not fully automated like some competitors, SmartAdapt provides enough guidance to keep your study sessions productive and focused.

Becker EA Review: AI-Powered Learning

Becker brings its CPA review expertise to the EA market with a premium course that emphasizes quality over quantity. They offer a question bank with 3000+ questions. Becker focuses on expert-written content that closely mimics actual exam questions. The materials are developed by practicing EAs and tax attorneys who understand exactly what the IRS tests and how questions are framed.

The course structure is highly organized with clear learning objectives for each chapter, making it easy to track your progress and know exactly what you need to master. Becker’s video lectures are professionally produced with experienced instructors who explain complex tax concepts in digestible segments. The platform is intuitive and user-friendly, particularly appreciated by first-time professional exam takers.

Becker’s reputation in the accounting certification industry gives its EA course immediate credibility. Many Indian professionals who used Becker for CPA or other certifications naturally gravitate toward their EA offering for consistency. The integration with Becker’s broader product ecosystem means you can potentially bundle EA with other certifications at discounted rates.

Premium vs. Essentials Package

Becker’s Premium package ($800) includes all study materials, unlimited practice questions, simulations, a final review course, and access to their Newt AI assistant, while the Essentials package ($500) provides core materials and limited AI interactions with shorter access periods.

Newt AI Study Assistant

Newt AI is Becker’s innovative artificial intelligence study assistant that answers your tax questions in real-time, provides additional examples when concepts are unclear, and can even quiz you conversationally on topics, offering a personalized tutoring experience that’s available 24/7.

Surgent EA Review: Adaptive Learning Leader

Surgent EA Review has revolutionized EA exam preparation with A.S.A.P. Technology (Advanced Adaptive Learning), the most sophisticated adaptive learning system in the EA prep market. The platform continuously analyzes your performance across thousands of data points to create a truly personalized study path. Unlike static courses where everyone follows the same sequence, Surgent adjusts in real-time based on your individual strengths and weaknesses.

The system’s intelligence goes beyond simple right/wrong tracking. It considers factors like time spent on questions, confidence levels, topic relationships, and even patterns in your mistake types. This multi-dimensional analysis allows Surgent to predict with remarkable accuracy which topics you’re likely to struggle with and which areas need reinforcement, even if you’re answering correctly.

Surgent’s efficiency claim is backed by data showing students can complete their preparation in significantly less time than traditional courses. By eliminating redundant study time on topics you’ve already mastered, the system focuses your limited study hours where they’ll have maximum impact. This makes Surgent particularly attractive for working professionals who need to prepare quickly without sacrificing pass probability.

61 Study Hours Average

Surgent claims their average student passes using just 61 hours of study time per exam part, which is dramatically lower than the industry standard of 70-100 hours, achieved through their adaptive technology that eliminates wasted study time on already-mastered material.

99% Pass Rate Claim

Surgent advertises a 99% pass rate for students who complete their recommended study plan, though this statistic requires context: it specifically refers to students who achieve “Exam Ready” status in the platform’s readiness assessment, not all enrolled students.

India-Based EA Course Providers

LawSikho: NSDC-Recognised Certificate Program

LawSikho offers a 6-month Certificate Program in Tax Advisory and Representation for Enrolled Agent Preparation, designed around the official three-part Special Enrollment Examination (SEE). The program follows a structured curriculum covering Part 1 (Individuals), Part 2 (Businesses), and Part 3 (Representation, Practices & Procedures), with detailed modules that mirror the SEE domain structure. Students are expected to commit around 6–8 hours per week, and the course is priced at ₹75,000. The curriculum is delivered through online classes, reading modules, and assessments aligned with IRS-prescribed question domains. The program is also recognised by the National Skill Development Corporation (NSDC), and students receive a Skill India–backed certificate upon successful completion.

While the primary focus of the LawSikho course is exam preparation, the platform also provides general career guidance and mentorship support as part of its broader learning ecosystem. The course page emphasises structured learning, syllabus clarity, and a guided preparation framework suitable for Indian learners targeting the EA qualification. For students who want a SEE-aligned, NSDC-recognised program with a clear weekly structure and institutional certification, LawSikho offers a credible and organised preparation pathway.

Simandhar Education: Becker’s Official India Partner

Simandhar Education serves as Becker’s authorized partner in India, offering the complete Becker EA course with added Indian context including rupee pricing (₹85,000 – ₹1,10,000), local payment options including EMI, faculty support in Indian time zones, and regular classroom/live online sessions conducted by Indian instructors familiar with both US and Indian taxation.

The Wall Street School (TWSS): Comprehensive Training

The Wall Street School provides end-to-end EA training with emphasis on placement assistance, offering recorded lectures, live doubt-clearing sessions, Gleim study materials, mock exams, and a structured curriculum designed specifically for Indian students with pricing around ₹50,000-80,000 and claims of strong placement records with US tax firms.

Hi-Educare: Gleim Partner in India

Hi-Educare is Gleim’s official Indian partner, providing access to Gleim’s extensive question bank, local faculty support, weekend batch options for working professionals, and additional India-specific career counseling sessions focusing on remote work opportunities with US firms.

ASAP Kerala: Government-Backed Program

ASAP (Additional Skill Acquisition Programme) Kerala offers EA training as part of Kerala government’s employment enhancement initiatives with heavily subsidized fees (₹60,000-80,000), eligibility limited to Kerala residents, partnership with established EA course providers for content, and strong emphasis on placement within Kerala’s growing finance sector.

Enrolled Agent Course Fees and Complete Cost Breakdown

How Much Do EA Courses Cost in India?

US Provider Pricing ($400 – $1,000)

Direct purchase from US providers like Gleim, Becke, and Surgent costs approximately ₹50,000-1,20,000 at current exchange rates, with payment requiring international credit cards or PayPal, but offering the advantage of direct access to the latest course updates and US-based support teams available 24/7.

Indian Provider Pricing (₹40,000 – ₹1,10,000)

Indian EA course providers offer more affordable options ranging from ₹40,000 (ASAP Kerala, subsidized) to ₹1,10,000 (Simandhar with Becker), with advantages including rupee pricing that avoids forex volatility, flexible payment plans and EMI options through Indian banks, local faculty support in convenient Indian time zones, and additional career counseling specifically for Indian job markets.

Many Indian providers offer package deals that include course materials, mock exams, doubt-clearing sessions, and even placement assistance. While the upfront cost might seem higher than self-study, the structured support significantly reduces the risk of expensive retakes. Consider that two retakes can cost more than the difference between a premium and basic course package.

For working professionals, the time value of money also matters. A more expensive course with adaptive learning that helps you pass faster means you can start earning EA-level salaries sooner. If a premium course helps you complete certification three months earlier, the additional salary (approximately ₹50,000-100,000 over three months at EA rates) far exceeds the extra course cost. This ROI calculation makes premium courses particularly attractive for those already employed in accounting.

Indian providers offering EMI options typically charge a small interest premium (12-15% annual) but make EA training accessible without large upfront payments. For recent graduates or those transitioning careers, spreading ₹60,000 over 6-12 months (₹5,000-10,000 monthly) is far more manageable than paying the lump sum. Always compare the total EMI cost with lump-sum discounts that some providers offer.

Enrolled Agent Course: How to Choose the Right Course

Factors to Consider When Selecting an EA Course

What’s Your Educational Background?

Your academic foundation significantly influences which EA course style will work best for you. If you’re a commerce graduate (B.Com, M.Com) with solid accounting fundamentals, you can handle courses that move quickly through basic concepts and dive deeper into US-specific taxation rules. Courses like Becker or Surgent that assume accounting literacy will feel appropriately paced without seeming remedial or overwhelming.

For those without formal accounting education, perhaps you’re transitioning from engineering, science, or liberal arts backgrounds, you’ll benefit from courses that include accounting basics and don’t assume prior knowledge. Indian providers like TWSS and Simandhar often include preliminary modules covering fundamental accounting concepts before jumping into US taxation. These foundational sections are invaluable if terms like depreciation, basis, or capital gains feel unfamiliar.

CA/CPA candidates or qualified professionals need courses that respect your advanced knowledge and don’t waste time on concepts you already understand thoroughly. Gleim’s comprehensive approach works well here because you can skip familiar topics and focus on US-specific nuances. The large question bank lets you identify exactly where US tax law differs from Indian taxation and concentrate your study time there.

If you have US taxation experience from working in KPO/BPO roles but lack formal credentials, you’re in a unique position. You might understand practical return preparation, but need structured knowledge of the theory and regulations behind the work. Courses with strong simulation components and real-world scenario practice will resonate with your hands-on experience while filling theoretical gaps.

What’s Your Study Style Preference?

Visual learners who retain information best through watching and observing should prioritize courses with extensive video content and graphical representations. If you find yourself rewinding videos repeatedly or taking screenshots for later reference, invest in a course with high-quality video production.

Reading-oriented learners who prefer working through written material at their own pace will appreciate If you typically learn from books rather than lectures, Gleim’s traditional study materials paired with their massive question bank provide the depth you need.

Hands-on learners who master concepts through practice and repetition should focus on question bank size and quality. If you typically struggle with pure theory but excel when working through examples and problems, prioritize courses that offer thousands of practice questions across varying difficulty levels.

Analytical learners who want to understand the “why” behind every rule need courses that explain rationale and policy reasoning, not just memorization. If you’re frustrated by “just memorize this” approaches and need logical frameworks to retain information, these courses provide that intellectual depth.

What’s Your Career Goal After EA?

If your goal is remote work with US tax firms while living in India, you need courses that emphasize practical return preparation and software proficiency alongside exam success. Indian providers often include training on actual tax software that US firms use, which pure exam-prep courses may not cover. This additional training makes you job-ready, not just exam-ready.

Aspiring to join Big 4 or major accounting firms in India requires understanding that these employers often value brand-name credentials. Becker’s reputation in the professional services world carries weight, and having “Becker EA Review” on your resume signals serious preparation. The premium price becomes worthwhile when targeting prestigious employers who recognize and respect established course providers.

Planning to start your own tax practice serving NRIs or US clients requires comprehensive knowledge beyond minimum passing scores. The investment in thorough preparation pays dividends when clients present unique scenarios that require deep tax knowledge.

Career pivoters who want EA as a stepping stone to other US credentials (CPA, CMA) should consider course providers offering bundled packages or progression pathways.

How Much Time Can You Dedicate?

Full-time students or those taking career breaks can dedicate 4-6 hours daily to EA preparation, making comprehensive courses ideal. With this time investment, you can complete all three parts in 3-4 months following a structured daily schedule. The extensive study material doesn’t feel overwhelming when you have time to work through it systematically, and the thoroughness ensures a strong foundational understanding.

Working professionals managing only 1-2 hours daily on weeknights and weekends need efficiency-focused courses with adaptive learning. When time is scarce, you cannot afford to waste it on topics you’ve already mastered or inefficient study methods.

Those preparing while handling demanding jobs (50+ hour work weeks) should consider extended access periods and self-paced options. Look for courses offering 18-24 months of access rather than standard 12 months, giving you flexibility to pause during busy seasons and resume when work eases. Indian providers often show more flexibility in extending access compared to US providers with strict time limits.

If you’re preparing for multiple parts simultaneously rather than sequentially, ensure your course supports concurrent study. Some platforms make it difficult to toggle between parts or require separate purchases for each section. Gleim and Becker both allow studying multiple parts during the same access period, which is essential if you want to maintain momentum across all three exams.

EA Course Curriculum and Learning Structure

What Does an EA Course Cover?

Part 1 – Individuals: Course Content

Part 1 focuses on individual taxation, which represents approximately 35% of the entire EA exam and typically requires the most study time. The curriculum covers filing requirements, income types (wages, self-employment, business, rental, investment), above-the-line deductions, itemized deductions, tax credits (Child Tax Credit, Earned Income Credit, education credits), and special situations like foreign income, expatriate taxation, and retirement distributions.

The individual taxation section requires understanding not just what’s taxable but also the nuances of how different income types are calculated and reported.

Most EA courses dedicate 40-50 hours of content to Part 1 because it’s the foundation for understanding the US tax system.

Courses include extensive practice with real-life scenarios: married filing jointly vs. separately optimization, head of household qualification, dependency tests for children and relatives, and phase-out calculations for various benefits. The simulations present multi-step problems requiring you to gather information, apply rules correctly, calculate amounts, and determine proper reporting, exactly what the actual exam tests.

Part 2 – Businesses: Course Content

Part 2 covers business entity taxation across partnerships, corporations (C-Corp and S-Corp), LLCs, and sole proprietorships. The curriculum includes formation and basis, income and deductions specific to each entity type, distributions and liquidations, special business credits and incentives, employment taxes, retirement plans, and exempt organizations.

Entity selection and the different tax treatments of various business forms represent a critical component. You need to understand why a business might choose S-Corp over sole proprietorship, how partnership income flows through to partners, and the double taxation inherent in C-Corporations. This comparative analysis appears frequently on the exam, testing your ability to advise clients on optimal structure.

The self-employment tax calculations, partnership basis adjustments, and S-Corp stock basis can be mathematically intensive. Quality courses break these calculations into step-by-step processes with practice problems progressing from simple to complex scenarios.

Employment tax and payroll considerations receive significant coverage since this is where many businesses face IRS problems. Courses with a strong practical orientation include real payroll scenarios that mirror actual business situations.

Part 3 – Representation: Course Content

Part 3 focuses on representation, practice, and procedures before the IRS. The curriculum covers Circular 230 (regulations governing practice before IRS), tax practitioner penalties and sanctions, IRS organizational structure and procedures, audit and examination procedures, collection processes, appeals and litigation, and innocent spouse relief and other taxpayer rights.

This section is conceptually different from Parts 1 and 2 because it’s less calculation-heavy and more focused on procedures, ethics, and representation protocols. You need to know what you can and cannot do as an EA, proper conduct in representing clients, and how to navigate various IRS processes. The exam tests situational judgment—given a scenario, what’s the appropriate action?

The representation procedures section covers everything from responding to IRS notices through collection alternatives and Tax Court proceedings. Courses teach the timeline and process for offers in compromise, installment agreements, currently not collectible status, and penalty abatement requests. Strong courses include actual IRS forms and notices in their materials, so you recognize them in practice, not just on the exam.

How Much Can You Earn in India After Taking the EA Course

What Salary Can You Expect in India After EA?

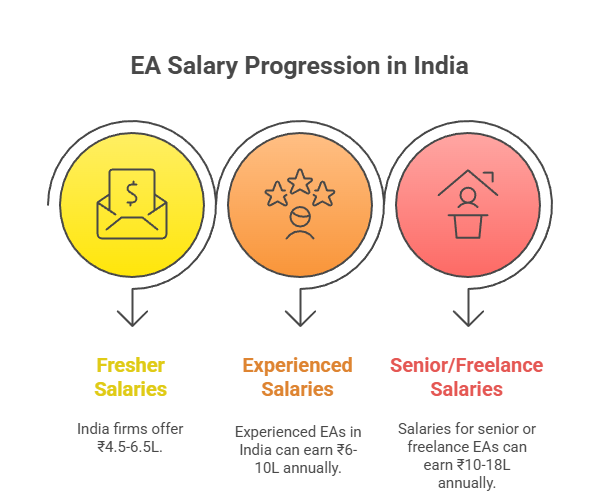

Fresher Salaries: ₹4-6 Lakhs Per Annum

Freshly certified EAs without prior US taxation experience typically start at ₹4.5 – 6.5 lakhs annually in KPO/BPO firms handling US tax returns, while those with strong interview performance and English communication skills can command more.

The geographic location within India significantly impacts fresher salaries. Bangalore, Hyderabad, and Pune, ities with concentrated US tax operations, offer the highest compensation. Smaller cities may start at ₹3.5-4.5 lakhs but often have lower living costs, making the effective purchasing power comparable.

Freshers should view the first year as an investment in practical experience that dramatically increases earning potential. The gap between EA exam knowledge and actual return preparation proficiency is substantial, and that first year bridges it. Those who progress quickly, demonstrate accuracy, and handle complex returns can expect 30-40% salary jumps within 12-18 months.

Landing that first EA job requires more than just passing exams. Employers seek candidates who can communicate clearly in English (written and verbal), demonstrate attention to detail, show familiarity with US tax software, and interview well on practical scenarios. Indian EA course providers offering placement assistance provide resume building, interview preparation, and sometimes direct introductions to hiring firms.

Experienced EA Salaries: ₹6-10 Lakhs

EAs with 2-4 years of experience in US taxation typically earn ₹6-10 lakhs in India, depending on the complexity of returns handled and employer type. Those specializing in business returns, partnerships, or multi-state taxation command the higher end of this range. At this career stage, you’re handling complex individual situations, business entity returns, and possibly supervising junior preparers or reviewing their work.

The jump from fresher to experienced EA salary levels reflects the significant expertise gained through seasons of actual return preparation. You’ve encountered thousands of unique tax situations, know how to research complex issues using IRS publications, can identify red flags that trigger audits, and work efficiently without constant supervision. This practical knowledge is far more valuable than exam passing ability alone.

Career progression at this stage branches into specializations. Some focus on high-net-worth individuals with complex investment portfolios, others specialize in expatriate taxation, and some move into business entity taxation exclusively. Specialization typically commands a 20-30% premium over generalist EAs because firms can bill specialist services at higher rates and clients specifically seek specialized expertise.

Senior Level and Freelance: ₹10-18 Lakhs

Senior EAs with5+ years of experience managing teams, handling extremely complex cases, or running successful freelance practices can earn ₹10-18 lakhs or significantly more. At this level, you’re likely in managerial roles (Manager, Senior Manager, Associate Director) in large firms, running your own practice serving NRIs and US clients, or working as a highly-paid consultant/contractor for US firms during tax season..

The freelance path requires entrepreneurial skills beyond tax knowledge. You need to market services, manage client relationships, handle your own business administration, maintain professional insurance and bonds, and navigate the challenges of seasonal income variability.

Partnership or ownership stakes in accounting firms represent another senior-level path. As firms recognize the growing market for US taxation services in India, experienced EAs who can build and lead US tax divisions command equity positions.

Evaluating EA Course Quality: What to Look For

How Do You Assess Course Credibility?

Provider Experience and Track Record

When evaluating EA course providers, prioritize those with substantial history in professional exam preparation rather than general education companies that added EA as an afterthought. Established providers have seen thousands of exam iterations, understand what the IRS consistently tests, and know which topics deserve more emphasis.

Look for providers who publicly share their student outcomes and aren’t shy about their results. Reputable course providers display testimonials with real names and sometimes even video interviews from successful candidates. Be wary of providers making extraordinary claims without verification, if someone boasts “100% pass rate” without caveats or supporting data, that’s likely marketing exaggeration rather than reality.

The provider’s involvement in the tax and accounting community signals credibility. Do their instructors actively practice as EAs or CPAs? Do they participate in industry conferences, write for tax publications, or maintain professional certifications? Courses taught by practitioners who deal with real clients daily bring practical insights that purely academic instructors cannot replicate.

For Indian providers, additional credibility markers include official partnerships with US providers, affiliation with professional bodies, and a track record of placing students in reputable firms. Ask for placement statistics, ideally with firm names where graduates work, and independently verify these claims through LinkedIn research or professional networks.

Pass Rate Claims: What’s Realistic?

Pass rate statistics require careful interpretation because providers calculate and present them in ways that make their courses look most favorable. When a provider claims “99% pass rate,” investigate the fine print. Is that 99% of all enrolled students, or 99% of students who completed the course, or 99% of those who achieved a certain readiness threshold? The differences are enormous and completely change the statistic’s meaning.

More honest providers present pass rate data alongside completion rates. If 90% of students pass but only 50% complete the course, the effective pass rate is really 45% of enrolled students. This transparency helps you understand that success requires full engagement with the material, not just registration. Providers confident in their courses share both statistics because they know committed students succeed.

Don’t make course selection based solely on claimed pass rates. A provider with an 85% pass rate and excellent support, engaging content, and adaptive technology might serve you better than one with 95% claimed pass rate but outdated materials. Your individual pass probability depends more on your effort, study approach, and match between learning style and course methodology than on aggregated statistics.

Student Testimonials and Reviews

Authentic student reviews provide invaluable insights into course reality beyond marketing claims. Look for reviews on independent platforms (Reddit, Quora, accounting forums) rather than just testimonials on the provider’s website. Provider-hosted testimonials are curated to show only positive experiences, while independent platforms include frustrated students who struggled with customer service, outdated content, or ineffective teaching methods.

When reading reviews, pay attention to specific criticisms rather than vague praise. A review saying “This course is amazing, highly recommend!” tells you nothing useful. But a review explaining “The video lectures were clear, but the mobile app constantly crashed, and customer support took 3-4 days to respond” gives actionable information about potential frustrations you might face.

Look for patterns in reviews rather than isolated complaints. Every course will have some dissatisfied customers, people who didn’t study enough, had learning style mismatches, or faced personal circumstances affecting their exam performance. But if multiple independent reviews consistently mention the same issue (outdated content, poor customer service, confusing interface), that pattern signals a genuine problem worth considering.

For Indian providers, seek reviews from students with similar backgrounds to yours. An NRI student with US work experience will have different needs than a fresh B.Com graduate in India. Find reviewers who mention their starting knowledge level and career goals matching yours, then evaluate if the course served them well. LinkedIn and WhatsApp groups for EA aspirants in India often provide candid, culturally relevant feedback.

What Technology Features Matter Most?

Adaptive Learning Systems

Adaptive learning technology represents the most significant innovation in professional exam preparation, using algorithms to personalize your study path based on performance data.

The efficiency gains from adaptive learning are substantial. Traditional courses require everyone to study every topic at the same depth, meaning you waste time on concepts you quickly grasp while potentially under-preparing for topics that challenge you.

However, not all “adaptive” systems are equally sophisticated. Some simply recommend topics based on quiz performance, essentially glorified progress tracking. True adaptive learning uses complex algorithms analyzing multiple variables: question difficulty you’re getting right/wrong, time spent per question, confidence levels, forgetting curves, and inter-topic relationships. This multi-dimensional analysis requires significant technological investment.

Mobile App Access and Flexibility

Quality mobile apps transform otherwise wasted time into productive study sessions, commutes, lunch breaks, waiting rooms, and early mornings become opportunities for progress. The best EA course apps offer full functionality, including video streaming, question banks, performance tracking, and note-taking, not just limited “preview” features that require desktop access for real work.

Offline capability is crucial for Indian users, where internet connectivity can be inconsistent. Apps that allow downloading video lectures, practice questions, and study materials for offline use ensure uninterrupted study regardless of data availability. Gleim and Becker both offer robust offline modes that sync progress once you reconnect, maintaining continuity without requiring constant internet access.

The course should automatically sync your progress, bookmarks, notes, and performance data across all devices so you can seamlessly transition between them without manually tracking where you left off.

Realistic Prometric Exam Simulation

Prometric test center simulations within your EA course familiarize you with the actual exam interface, reducing test-day anxiety and preventing time-wasting confusion about basic functionality. The EA exam uses specific Prometric software with particular navigation, calculator, and flagging features. Practicing with simulations that mirror this exact interface means you walk into the exam already comfortable with every button and feature.

The best simulations replicate not just the interface but also question formatting, time pressure, and overall exam experience. They use the same two-column format for tax exhibits, provide the same authorization literature access, and time questions appropriately. Surgent and Becker have particularly strong simulation modes that feel nearly identical to actual Prometric exams based on student feedback.

Simulation practice reveals test-taking strategy issues before they cost you exam fees. You discover whether you work too slowly and risk not finishing, whether you struggle with multi-part task-based simulations, or whether time pressure affects your accuracy. These insights during practice allow adjustments to pacing strategies, bathroom break timing, and energy management that directly improve exam performance.

What Support Should Your EA Course Provide?

Personal Counselors and Mentors

Personal study counselors who check in regularly, adjust your study plan based on progress, and provide motivation during difficult periods dramatically increase completion rates. These counselors don’t just answer technical tax questions, they help with time management, study strategy, exam anxiety, and the psychological challenges of multi-month preparation. This human element differentiates premium courses from basic question-bank-only options.

The counselor-student relationship works best when counselors have EA credentials themselves and understand the exact challenges you face. They’ve experienced the difficulty of Part 2 business entity taxation, know which topics most commonly trip up students, and can share strategies that helped them succeed. This experiential knowledge cannot be replicated by general academic advisors without EA backgrounds.

Group support through study groups, online forums, or WhatsApp communities provides peer motivation alongside formal counseling. Connecting with other EA candidates creates accountability, allows problem-sharing, and reduces the isolation of independent study. Indian providers often facilitate India-specific groups where students discuss timezone-appropriate study schedules, share local exam center experiences, and celebrate successes together.

Accounting Expert Access

Direct access to practicing EAs or tax professionals who can clarify complex scenarios beyond standard course explanations distinguishes premium courses from basic packages. Sometimes you encounter a tax situation in practice problems that the automated explanation doesn’t adequately resolve. The ability to submit that specific question to an expert and receive a detailed, personalized explanation is invaluable for deep understanding.

Expert instructors bring real-world context that makes abstract tax code tangible and memorable. When explaining the partnership basis, a practicing EA might share actual client situations illustrating why basis tracking matters and what disasters occur when it’s wrong. These war stories create mental anchors that help you remember concepts better than dry regulatory citations.

For Indian students, time zone compatibility matters for live expert sessions. If all instructor office hours occur at 10 PM – 2 AM Indian time, that “expert access” becomes practically useless for most working professionals. Indian providers offering local expert access during reasonable hours provide better practical support despite possibly less prestigious instructor credentials.

Technical Support Availability

Robust technical support ensuring platform functionality problems don’t derail your study progress is essential, but often overlooked until problems arise. When videos won’t stream, practice quizzes won’t submit, or your account shows incorrect progress tracking, you need fast technical resolution. Days-long waits for technical support to respond can completely destroy study momentum during crucial preparation periods.

The best technical support includes multiple contact channels (email, chat, phone) with clear escalation processes for urgent issues. During peak exam seasons when thousands of students are simultaneously using the platform, response times can slow dramatically unless the provider has scaled support capacity appropriately. Check reviews specifically mentioning technical support experiences during busy periods..

EA Course: Self-Study vs Coaching

Structured Learning vs. IRS Publications Alone

Self-study using free IRS publications and circulars is technically possible, but dramatically increases failure risk and preparation time. The IRS provides all necessary information through Publication 17 (individual taxation), Publication 334 (business taxation), Circular 230 (practice rules), and hundreds of supporting documents, but this material totals thousands of pages written in dense regulatory language designed for reference, not learning.

Structured EA courses organize this overwhelming information into logical learning sequences, building complexity progressively. They identify what’s actually tested versus what’s merely referenced, explain concepts in plain English before showing regulatory citations, and provide the connective tissue between topics that IRS publications assume you’ll figure out independently.

Pass Rate Advantages with Professional Courses

Industry data consistently shows that structured course students achieve points higher pass rates than pure self-study candidates.

The pass rate advantage comes from multiple factors: identifying knowledge gaps before the exam through diagnostic testing, providing practice questions that mirror actual exam difficulty, teaching test-taking strategies specific to EA exams, and maintaining motivation through structured milestones that self-study candidates often abandon when progress feels unclear.

Time Investment Comparison

Self-study candidates typically require 150-200 hours per exam part versus 60-100 hours for structured course students covering the same material. The efficiency difference stems from courses pre-organizing information, highlighting high-yield topics, and eliminating research time spent figuring out what to study. For working professionals where study time is precious, this 50-100% time saving justifies the course investment.

Additionally, self-study often involves false starts, studying topics that aren’t heavily tested, missing critical concepts that are heavily tested, or using outdated tax code that’s since changed. Structured courses eliminate these wasteful detours, ensuring every study hour contributes directly to exam readiness rather than wandering through the vast maze of tax code, hoping you’ll eventually cover everything important.

Conclusion

The decision to invest in an Enrolled Agent course represents a strategic career move that can transform your professional trajectory and earning potential. While self-study remains technically possible, the efficiency gains, structured guidance, and significantly higher pass rates associated with quality EA courses make them worthwhile investments for serious candidates. Whether you choose US providers like Gleim, Becker, or Surgent, or Indian partners offering localized support, selecting a course that matches your learning style and career goals is crucial.

Remember that the course cost should be evaluated against the total credential value, not just the upfront price. Prioritize course quality, support systems, and proven outcomes over minor price differences that won’t matter once you’re earning EA salaries.

To know more about the EA Course, please visit our iPleaders blog on Enrolled Agent Course: Providers, Fees, and Career Opportunities

Frequently Asked Questions About Enrolled Agent Courses

Which is the best Enrolled Agent course for Indian students?

Lawsikho, Simandhar Education (Becker partner), and Hi-Educare (Gleim partner) are top choices offering US-quality content with Indian pricing, local support, EMI options, and placement assistance specifically for Indian students.

How much does an EA course cost in total, including exam fees?

Total cost ranges ₹40,000-1,00,000+: Course fees ₹40,000-1,10,000 plus IRS exam fees ₹51,000 ($618 for three parts), not including potential retake fees or study materials.

Can I take the EA course online from India?

Yes, all major EA courses (Gleim, Becker, Surgent, and Indian providers) offer completely online programs accessible from India with video lectures, practice questions, and support.

Do I need coaching, or can I self-study for the EA exam?

While self-study is possible using free IRS publications, coached students have higher first-attempt pass rates and study 50-100 hours less per part.

What is the duration of an Enrolled Agent course?

EA courses typically provide 12-18 months access and average 100-150 total study hours across three parts, completable in 3-6 months depending on dedication.

Can B.Com graduates take EA courses without US taxation background?

Absolutely—EA courses assume no prior US tax knowledge and start from fundamentals, making them accessible to all commerce graduates regardless of specialization.

Are there EMI or installment options for EA course fees?

Indian providers typically offer 6-12 month EMI plans at 12-15% annual interest; US providers generally require lump-sum payment upfront.

Can I work as EA from India after completing the course?

Yes, many Indian EAs work remotely for US firms earning ₹12-42 lakhs annually, though building a client base or securing remote positions requires networking

Do EA courses include Prometric mock exams?

Yes, quality courses like Surgent, Becker, and Gleim include Prometric-simulation exams replicating actual test center interface, timing, and question format.

Allow notifications

Allow notifications