Learn what is an independent director – under the Companies Act 2013 – definition, qualification criteria, appointment process, IICA registration, roles, tenure limits, and key responsibilities in corporate governance.

Table of Contents

An independent director is a non-executive member of a company’s board who maintains complete independence from management and has no material or pecuniary relationship with the company, its promoters, or related parties.

Under Section 149(6) of the Companies Act 2013, an independent director must be a person of integrity with relevant expertise and experience, who is neither a managing director, whole-time director, nor nominee director, and who brings objective judgment to board deliberations.

Regulation 16 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, further reinforces this definition for listed entities, mandating that independent directors must not have any material relationship with the company that could interfere with their independent judgment.

Both regulatory frameworks emphasize that independence extends beyond just the absence of employment to include freedom from financial, familial, and business relationships that might compromise objectivity in corporate governance.

How are independent directors different from other types of directors?

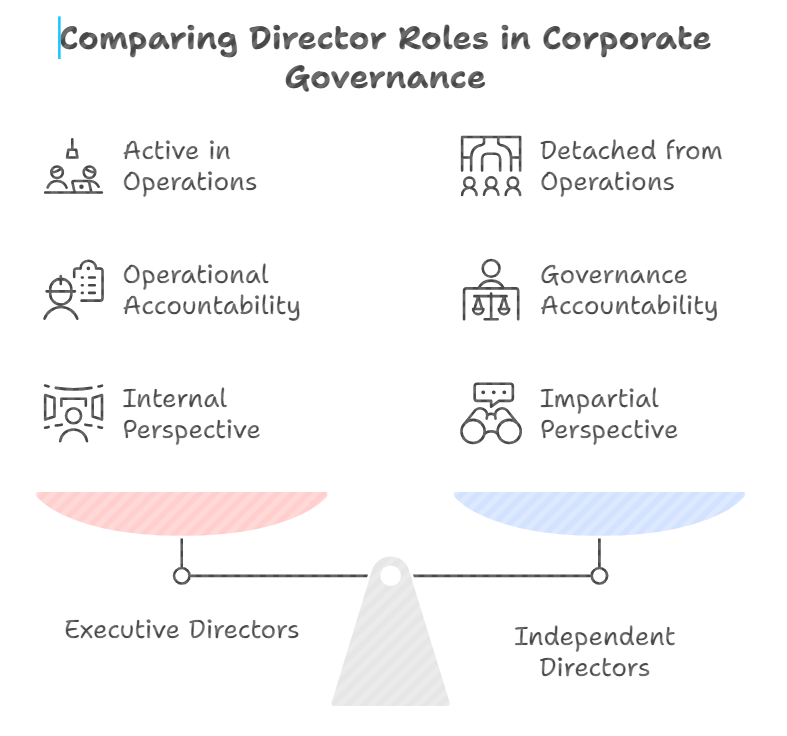

Executive director vs independent director

Executive directors are individuals employed by the company in a managerial capacity who participate actively in day-to-day operations and strategic execution. They typically hold positions like Chief Financial Officer, Chief Operating Officer, or other C-suite roles, drawing regular salaries and being deeply involved in operational decision-making. Their primary responsibility is to implement board decisions and manage the company’s business activities.

Independent directors, in contrast, remain completely detached from daily operations and executive functions. They attend board meetings periodically to provide oversight, strategic guidance, and objective assessment of management performance without being part of the executive team. Unlike executive directors who have operational accountability, independent directors focus exclusively on governance, risk oversight, and protecting stakeholder interests through their impartial perspective.

Non-executive director vs Independent director

Non-executive directors are board members who don’t participate in daily management but may have material relationships with the company, such as being substantial shareholders, promoter representatives, or having business dealings with the organization. While they’re not employees, they might have financial interests or connections that influence their decision-making. Their appointment doesn’t require the same stringent independence criteria as independent directors.

Independent directors represent a specialized subset of non-executive directors with an additional layer of regulatory protection.

They must meet strict independence criteria under Section 149(6), including prohibitions on promoter relationships, pecuniary ties exceeding 10% of their income, and family member restrictions on shareholding and indebtedness. Essentially, all independent directors are non-executive directors, but not all non-executive directors qualify as independent directors due to these stringent eligibility requirements.

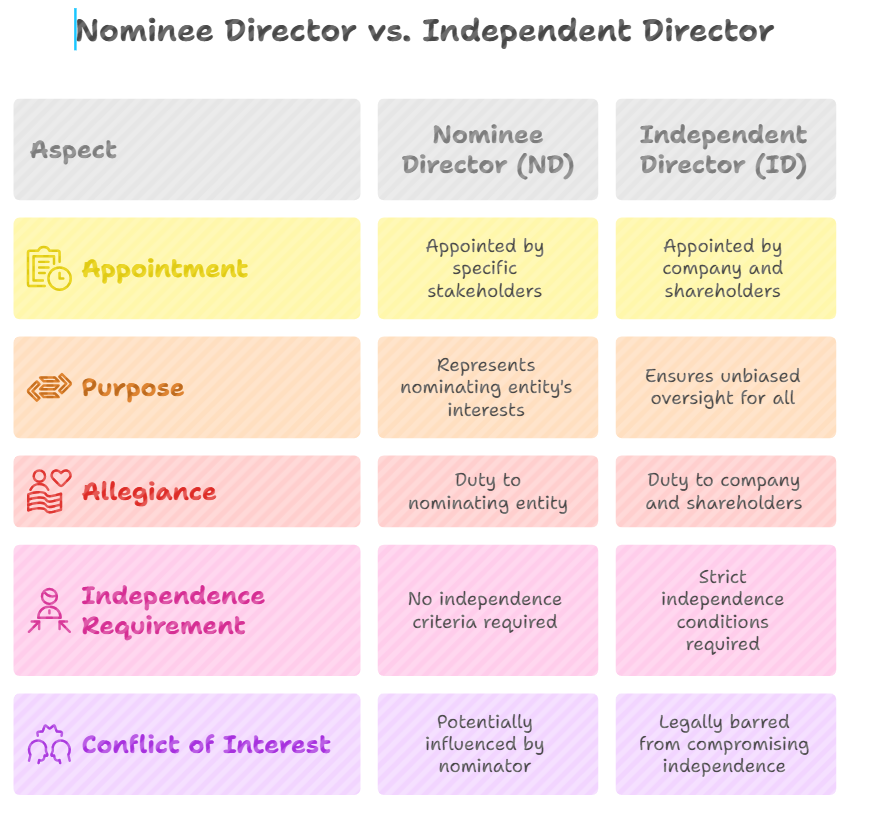

Nominee director vs Independent director

Nominee directors are appointed by specific stakeholders such as financial institutions, lenders, venture capitalists, or government bodies to represent their particular interests on the board. Banks nominating directors on borrower company boards or government nominees on public sector undertaking boards exemplify this category. Their primary allegiance is to the entity that nominated them, and they’re expected to safeguard those specific stakeholder interests.

Independent directors, by statutory design, cannot be nominee directors and must remain free from any stakeholder allegiance or obligation. Under the Companies Act 2013, independent directors are explicitly prohibited from being nominees and must exercise judgment solely in the company’s best interest, balancing all stakeholder concerns rather than favoring any particular group. This fundamental difference ensures that independent directors provide truly objective oversight without being beholden to lenders, investors, or any other party.

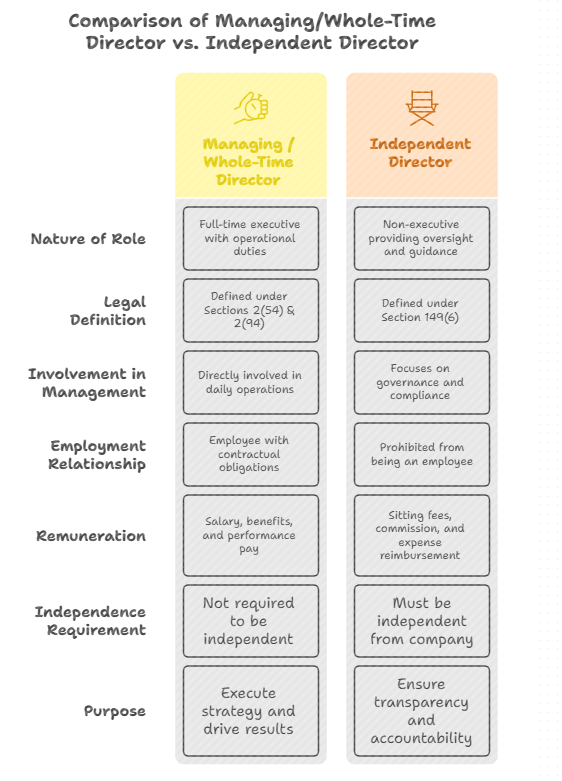

Managing / whole-time director vs Independent director

Managing directors and whole-time directors are executive appointments involving full-time employment with the company, comprehensive operational authority, and responsibility for day-to-day business management. As defined under Section 2(54) and Section 2(94) of the Companies Act 2013, these directors receive substantial remuneration, including salary, perquisites, and performance-based compensation, and they’re deeply embedded in the company’s management structure with signing authority and executive powers.

Independent directors are statutorily barred from holding any managerial position or having employment relationships with the company. Section 149(6) explicitly states that a person cannot be an independent director if they or their relatives held any key managerial personnel position or were employees during the three immediately preceding financial years. This prohibition ensures that independent directors maintain the arm’s length relationship necessary for objective oversight and governance.

Why are Independent Directors Important?

Role in ensuring board accountability and transparency

Independent directors serve as crucial guardians of corporate governance by bringing objective scrutiny to board decisions and management actions.

They ensure that board deliberations remain focused on long-term value creation rather than short-term gains that might benefit controlling shareholders at the expense of minority investors.

By questioning management proposals, examining financial statements, and challenging assumptions during board meetings, independent directors create a culture of accountability where decisions must be justified on merit rather than authority.

Protection of minority and stakeholder interests

Minority shareholders often lack the voting power to influence company decisions or challenge actions that may be detrimental to their interests. Independent directors bridge this gap by acting as fiduciary representatives who safeguard the rights of all stakeholders, particularly those without board representation.

As mandated under Schedule IV of the Companies Act 2013, they must balance conflicting stakeholder interests and ensure that related-party transactions, dividend policies, and capital allocation decisions don’t unfairly favor promoters or majority shareholders over minority investors.

Balancing ownership and management power

In companies where promoters or founding families retain significant ownership while professional managers handle operations, the potential for conflicts between ownership and management objectives exists. Independent directors provide a neutral perspective that prevents either group from dominating board decisions to the detriment of the company’s overall health. They act as a bridge between controlling shareholders and professional management, ensuring that strategic decisions reflect the company’s best interests rather than serving personal agendas of either promoters or executives.

Which companies must appoint independent directors in India?

Listed companies

Every listed public company, regardless of its size, paid-up capital, or turnover, must mandatorily appoint independent directors constituting at least one-third of the total board strength as per Section 149(4) of the Companies Act 2013. This requirement applies to all companies whose shares are listed on any stock exchange in India, whether on BSE, NSE, or regional exchanges. For instance, if a listed company has a board of nine directors, at least three must be independent directors, and any fraction in the one-third calculation should be rounded up to the next whole number.

Unlisted public companies

Unlisted public companies must appoint at least two independent directors if they meet any of the following thresholds as per Rule 4 of the Companies (Appointment and Qualification of Directors) Rules, 2014:

(a) paid-up share capital of ₹10 crore or more,

(b) turnover of ₹100 crore or more, or

(c) aggregate outstanding loans, debentures, and deposits exceeding ₹50 crore, based on the latest audited financial statements.

However, unlisted public companies that are joint ventures, wholly-owned subsidiaries, or dormant companies are exempt from this requirement even if they cross these thresholds.

What is an Independent Director: Qualification criteria

To be eligible for appointment as an independent director under Section 149(6) of the Companies Act 2013, a person must possess integrity and relevant expertise as determined by the board.

They cannot be a promoter of the company or its holding, subsidiary, or associate companies, nor can they be related to promoters or directors. The candidate must not have or have had any pecuniary relationship with the company, its holding, subsidiary, or associate companies during the two immediately preceding financial years, except remuneration as a director or transactions not exceeding 10% of their total income.

Several relatives related disqualifications apply to protect independence.

None of the candidate’s relatives should have or have had any pecuniary relationship with the company during the current or two immediately preceding financial years. Additionally, relatives cannot hold securities or interests exceeding ₹50 lakhs or 2% of paid-up capital, be indebted to the company, or have provided guarantees or security for third-party indebtedness. The candidate or their relatives must not have held any key managerial personnel position or been employed by the company during the three immediately preceding financial years.

Professional service relationships create disqualification, too.

The candidate or their relatives cannot have been, during the three immediately preceding financial years, an employee, proprietor, or partner in firms providing audit, company secretarial, cost audit, or legal services to the company where such services constitute 10% or more of the firm’s gross turnover.

The candidate must not hold two percent or more voting power in the company along with relatives, and cannot be a chief executive or director of any non-profit organization that receives 25% or more of its receipts from the company or holds 2% or more of the company’s total voting power.

The candidate must also not have been a partner or executive of the company’s statutory auditors, internal auditors, or legal or consulting firms during the three years immediately preceding their proposed appointment.

Any person who fails to meet these independence criteria or who has been disqualified under Section 164 of the Companies Act 2013 cannot be appointed as an independent director. These stringent qualifications ensure that independent directors maintain genuine objectivity and freedom from conflicts of interest.

What is the appointment and tenure framework for independent directors?

Mandatory registration with the IICA and proficiency test process

The Indian Institute of Corporate Affairs (IICA) maintains a databank of independent directors under Section 150 of the Companies Act 2013, and every person intending to be appointed as an independent director must register with this databank.

Registration requires a valid Director Identification Number (DIN) and payment of fees: ₹5,900 (including GST) for one year, ₹17,700 for five years, or ₹29,500 for lifetime registration.

Once registered at independentdirectorsdatabank.in, individuals must pass an online proficiency self-assessment test within two years of databank inclusion.

The proficiency test, as per Rule 6(4) of the Companies (Appointment and Qualification of Directors) Rules, 2014, consists of 50 questions covering Companies Act provisions, SEBI regulations, corporate governance, and basic accounting principles, requiring a 50% score to pass. Exemptions apply to individuals who have served for at least three years as directors or key managerial personnel in listed companies or unlisted companies with ₹10 crore paid-up capital, or professionals like chartered accountants, company secretaries, cost accountants, or advocates with 10+ years of practice. Those failing to pass within two years will have their names removed from the databank. Read my article here to know in detail about the Independent Director Exam.

Appointment procedure and board approval requirements

The appointment process begins with the board of directors or nomination committee identifying suitable candidates from the IICA databank or through other means, ensuring they meet the eligibility criteria under Section 149(6).

The proposed independent director must provide written consent through Form DIR-2 as per Section 152(5). The board then passes a resolution recommending the appointment to shareholders.

Shareholder approval is mandatory through a resolution in a general meeting, with the notice containing an explanatory statement justifying the appointment and confirming that the board believes the person meets independence criteria as required under Section 149(6) and Schedule IV of the Companies Act 2013.

For listed companies, an appointment requires a special resolution if not already included in the articles of association. After shareholder approval, the company must issue a formal appointment letter outlining tenure, expectations, fiduciary duties, remuneration, and other Schedule IV requirements, and file Form DIR-12 with the MCA along with publishing the appointment terms on the company website.

To learn in detail the appointment process, read my article on How to Appoint an Independent Director.

Term of office and reappointment conditions

Independent directors can be appointed for a maximum term of five consecutive years as per Section 149(10) of the Companies Act 2013, and they’re eligible for reappointment for another term of up to five consecutive years. Reappointment for the second term requires approval through a special resolution passed by shareholders in a general meeting. However, an independent director cannot hold office for more than two consecutive terms, meaning the maximum continuous tenure is 10 years.

After serving two consecutive terms totaling 10 years, an independent director must observe a cooling-off period of three years before being eligible for reappointment in the same company as per Section 149(11). Unlike other directors, independent directors do not retire by rotation under Section 149(13), ensuring continuity in their oversight role. Any vacancy arising from the office of an independent director must be filled by the board at the next board meeting or within three months from the date of vacancy, whichever is later.

Resignation, removal, and cooling-off period provisions

An independent director may resign by submitting a written notice to the company, specifying the reasons for resignation. The Board of Directors must take note of the resignation at its next meeting and file Form DIR-12 with the Registrar of Companies within 30 days of receiving the notice.

A director resigning from the company can also file Form DIR-11 for record-keeping and to limit future liability.

In the case of a listed company, the resignation and its detailed reasons must be promptly disclosed to the stock exchange and reported in the Board’s Report presented at the next annual general meeting.

Independent directors can be removed before their term expires through an ordinary resolution passed by shareholders, but only after giving them a reasonable opportunity to be heard as per Section 169 of the Companies Act 2013.

The company must give special notice of the resolution to remove the director, and the concerned director is entitled to make representations and request that those representations be circulated to shareholders.

Compensation and sitting fee limits

Independent directors are prohibited from receiving stock options under Section 149(9) of the Companies Act 2013, ensuring their compensation doesn’t create incentives that might compromise independence.

They can receive remuneration in the form of sitting fees for attending board and committee meetings, with the amount per meeting not exceeding ₹1 lakh as determined by the board. Additionally, they’re entitled to reimbursement of expenses incurred in performing their duties, such as travel, accommodation, and other meeting-related costs.

Independent directors may also receive profit-related commission if approved by shareholders through a resolution, though this is subject to the overall limits on managerial remuneration under Section 197 of the Companies Act 2013. The remuneration policy must be disclosed on the company’s website and in the board’s report. For listed companies, the SEBI LODR Regulations, 2015 mandate disclosure of remuneration paid to independent directors in the annual report, ensuring transparency in compensation practices.

What is an independent director: key roles and responsibilities

Providing strategic guidance and independent judgment

Independent directors bring an external, objective perspective to board deliberations on strategy, performance, risk management, resources, key appointments, and standards of conduct as mandated under Schedule IV of the Companies Act 2013. They challenge management assumptions, ask probing questions about strategic initiatives, and ensure that board decisions are made after thorough analysis rather than rushed approvals. By drawing on their diverse industry experience and expertise from other boards, they provide valuable insights that internal directors might miss due to organizational proximity.

Independent directors must exercise their independent judgment without allowing undue influence from management, controlling shareholders, or personal relationships to interfere with their fiduciary duties. They’re expected to devote sufficient time to understanding the company’s business, industry dynamics, competitive landscape, and regulatory environment to make informed decisions. During board meetings, they should constructively dissent when they disagree with proposed actions, ensuring their concerns are recorded in minutes, and they must act in good faith to promote the company’s best interests while balancing stakeholder expectations.

Evaluating board and management performance

Independent directors play a crucial role in objectively assessing the performance of the board as a whole, individual directors including the chairman, and the company’s executive management team. As required under Schedule IV, they must scrutinize management’s performance in meeting agreed goals and objectives and monitor the reporting of performance metrics. This evaluation extends to examining whether management is executing board-approved strategies effectively and achieving key performance indicators.

Independent directors must hold at least one separate meeting annually without the presence of non-independent directors and management to review the board’s performance, assess the chairman’s leadership, and evaluate the quality and flow of information between management and the board. This exclusive forum allows candid discussions about board effectiveness, management capability, and any concerns about corporate governance without potential conflicts of interest. Based on performance evaluations, independent directors can recommend changes in management, board composition, or governance processes to enhance organizational effectiveness.

Overseeing financial reporting and risk management

Independent directors must satisfy themselves on the integrity of financial information and ensure that financial controls and systems of risk management are robust and defensible, as mandated under Schedule IV of the Companies Act 2013.

This responsibility involves reviewing quarterly and annual financial statements, understanding significant accounting policies and judgments, and questioning management about unusual transactions or accounting treatments. They must ensure that the company’s financial reporting complies with applicable accounting standards and provides a true and fair view of the company’s financial position.

Risk oversight requires independent directors to understand the company’s risk appetite, evaluate the effectiveness of risk management frameworks, and ensure adequate systems exist to identify, assess, and mitigate material risks including operational, financial, regulatory, and reputational risks.

Through the audit committee, they must regularly review risk assessment reports, internal audit findings, and management’s responses to identified risks. They should ensure that the company has appropriate insurance coverage, disaster recovery plans, and cybersecurity measures, and that emerging risks are promptly brought to the board’s attention.

Ensuring ethical conduct and whistleblower protection

Independent directors must ascertain and ensure that the company has an adequate and functional vigil mechanism (whistleblower policy) and protect the interests of persons who use such mechanisms from victimization as required under Schedule IV. They’re responsible for reporting concerns about unethical behavior, actual or suspected fraud, or violations of the company’s code of conduct and ethics policy to the board. When credible allegations of misconduct arise, independent directors must ensure thorough investigations are conducted impartially and appropriate actions are taken against wrongdoers.

The audit committee, typically chaired by an independent director, oversees the vigil mechanism and reviews complaints received through the whistleblower channel, ensuring confidentiality and protection for complainants.

Independent directors must create a culture where employees feel safe reporting concerns without fear of retaliation, and they should periodically assess the effectiveness of the ethics program through employee surveys, training completion rates, and incident reporting statistics. They must also ensure that the company’s code of conduct applies uniformly across all levels, including senior management and promoters.

Succession planning and board appointments

Independent directors fulfill a vital role in succession planning for the CEO, managing director, and other key management personnel, ensuring business continuity and smooth leadership transitions. They must identify potential internal candidates for senior positions, assess their readiness through performance reviews and development programs, and maintain emergency succession plans for unexpected departures. Through the nomination and remuneration committee, independent directors should regularly review the leadership pipeline and recommend investments in talent development.

In board appointments, independent directors ensure that the nomination committee maintains appropriate board composition with the right mix of skills, experience, diversity, and independence to meet the company’s strategic needs. They evaluate potential director candidates against competency frameworks, conduct reference checks, and assess cultural fit before recommending appointments to shareholders. Independent directors must also facilitate board refreshment by recommending retirement or non-renewal of underperforming directors and identifying gaps in board expertise that need to be filled through new appointments.

Committee roles – audit, nomination, and remuneration committees

Independent directors form the majority of the audit committee under Section 177 of the Companies Act 2013, with at least one member having accounting or financial management expertise. The audit committee oversees financial reporting, recommends appointment of statutory and internal auditors, reviews audit findings, monitors internal controls, approves related-party transactions, and examines reasons for material defaults in payments to creditors and debenture holders. Independent directors in this committee act as gatekeepers of financial integrity and ensure that auditors remain independent and effective.

The nomination and remuneration committee must comprise at least three non-executive directors with at least half being independent directors, and the chairman must be an independent director as per Section 178. This committee formulates criteria for board appointments, recommends director remuneration policies, evaluates director performance, and ensures that executive compensation aligns with company performance and industry benchmarks. Independent directors in the corporate social responsibility committee (at least one required under Section 135) formulate and monitor CSR policies and ensure that the company fulfills its social obligations effectively. To know in detail about the roles and responsibilities of an Independent Director, click on the link.

Conclusion

Independent directors represent a cornerstone of modern corporate governance in India, serving as impartial guardians who bridge the interests of management, controlling shareholders, and minority stakeholders. Through their statutory mandate under the Companies Act 2013 and SEBI LODR Regulations, they bring objective oversight, strategic guidance, and ethical accountability to boardrooms across listed and large unlisted companies. The rigorous qualification criteria, mandatory IICA databank registration, and proficiency testing ensure that only individuals with genuine independence and relevant expertise occupy these critical positions.

As India’s corporate landscape continues to evolve with increasing regulatory expectations and stakeholder awareness, the role of independent directors will only grow in significance. Their effectiveness depends not just on statutory compliance but on their willingness to ask difficult questions, challenge management assumptions, and stand firm on governance principles even when faced with pressure from controlling interests.

For aspiring independent directors, understanding the comprehensive framework governing their appointment, tenure, responsibilities, and compensation is essential to fulfilling this vital fiduciary role with competence and integrity. For further elaboration, you may refer to the guidance note here.

Frequently Asked Questions on What is an Independent Director

What is an Independent Director and who can be appointed to this role?

An independent director is a non-executive board member who has no material or pecuniary relationship with the company, its promoters, or management, ensuring objective oversight of corporate governance.

To qualify for appointment, a person must meet the stringent criteria under Section 149(6) of the Companies Act 2013, including being a person of integrity with relevant expertise, not being a promoter or related to promoters, having no pecuniary relationship exceeding 10% of their income in the preceding two years, not having been an employee or key managerial personnel in the last three years, and not being associated with the company’s auditors, legal advisors, or consultants.

The candidate must also register with the IICA databank and pass the online proficiency self-assessment test unless exempted based on experience or professional qualifications.

Can a practicing company secretary be appointed as an independent director?

Yes, a practicing company secretary can be appointed as an independent director in a company where they don’t provide professional services. Since independent directors are non-executive by definition, there’s no conflict between practicing as a company secretary and serving as an independent director in unrelated companies. However, under Section 149(6), the practicing company secretary cannot be appointed as an independent director in any company where they or their firm has provided company secretarial services during the three immediately preceding financial years, or where such services constitute 10% or more of their firm’s gross turnover.

The prohibition ensures that professional service relationships don’t compromise the independence required for the director role.

Can a company secretary working in a company be appointed as an independent director in the same company?

No, a company secretary employed by a company cannot be appointed as an independent director in the same company. Section 149(6) of the Companies Act 2013 explicitly disqualifies any person who has held a key managerial personnel position (which includes company secretary under Section 2(51)) during the three immediately preceding financial years from being appointed as an independent director. This prohibition exists to prevent conflicts of interest and ensure that independent directors maintain the arm’s length relationship necessary for objective oversight. However, the company secretary could be appointed as an independent director in any other company where they’re not employed, subject to meeting all other eligibility criteria.

What is the minimum age to be appointed as an independent director?

The Companies Act 2013 does not prescribe any minimum age requirement for appointment as an independent director. According to Section 149, any person who has attained the age of 18 years can be appointed as a director, including as an independent director, provided they meet all the qualification criteria specified under Section 149(6). However, for listed companies, Regulation 17 of SEBI LODR Regulations, 2015 mandates that independent directors must be at least 21 years of age and not more than 75 years of age at the time of appointment, though the age limit can be extended with shareholder approval through a special resolution.

Is an independent director liable for non-compliance under the Companies Act 2013?

An independent director can be held liable for non-compliance with provisions of the Companies Act 2013, but with important qualifications. Under Section 149(12), an independent director is liable only in respect of acts of omission or commission by the company that occurred with their knowledge, attributable through board processes, and with their consent or connivance, or where they have not acted diligently. This provision provides a safe harbor for independent directors who attend board meetings, ask appropriate questions, express dissent when warranted, and act in good faith based on information provided by management. However, if an independent director is aware of non-compliance and fails to take reasonable steps to prevent it or voice objections in board minutes, they can face penalties, disqualification, and even prosecution for serious offenses under the Act.

Do I need to register with the IICA databank to be appointed as an independent director?

Yes, registration with the IICA (Indian Institute of Corporate Affairs) databank is mandatory for anyone intending to be appointed as an independent director in India. Under Section 150 of the Companies Act 2013 read with the Companies (Appointment and Qualification of Directors) Rules, 2014, both existing independent directors and individuals aspiring to become independent directors must include their names in the databank maintained by IICA at independentdirectorsdatabank.in. Registration requires payment of prescribed fees (₹5,900 for one year, ₹17,700 for five years, or ₹29,400 for lifetime) and submission of required information including DIN, qualifications, experience, and other details. Companies can select independent directors from this databank, though they’re not restricted to databank members if they conduct proper due diligence on candidates.

What happens if I fail the IICA proficiency test?

If you fail the IICA online proficiency self-assessment test, there are no immediate penalties, and you can retake the test multiple times without any limit on the number of attempts as per Rule 6(4) of the Companies (Appointment and Qualification of Directors) Rules, 2014. However, you must maintain a gap of at least one day between consecutive test attempts. The critical deadline is that you must pass the test (achieving at least 50% marks) within two years from the date of inclusion of your name in the IICA databank. If you fail to pass the proficiency test within this two-year period, your name will be removed from the databank, and you’ll need to re-register and pay the registration fees again to continue as or become an independent director. During the period before passing the test, you can still serve as an independent director if already appointed, but new appointments may be contingent on test completion.

What is the tenure of appointment for independent directors?

Independent directors can be appointed for a maximum term of five consecutive years as per Section 149(10) of the Companies Act 2013. After completing the first five-year term, they’re eligible for reappointment for one more term of up to five consecutive years, subject to approval by shareholders through a special resolution in a general meeting. The total maximum continuous tenure is capped at two consecutive terms totaling 10 years, after which a mandatory cooling-off period of three years applies under Section 149(11) before the same person can be reappointed as an independent director in the same company. Unlike other directors, independent directors are not subject to retirement by rotation, providing stability and continuity in their oversight role throughout their tenure.

Can I serve as an independent director in multiple companies simultaneously?

Yes, you can serve as an independent director in multiple companies simultaneously, subject to certain limits prescribed under the Companies Act 2013. According to Section 165, a person can be a director in a maximum of 20 companies at a time, with a sub-limit of 10 public companies. More specifically, as per Regulation 17A for independent directorships, you cannot serve as an independent director in more than seven listed companies at a time. Additionally, if you are serving as a whole-time director in any listed company, you can be an independent director in a maximum of three other listed companies. These limits ensure that independent directors can devote adequate time and attention to each company where they serve and maintain the quality of oversight expected from the role.

How much can independent directors earn as sitting fees?

Independent directors can receive sitting fees for attending board meetings and committee meetings, with the amount per meeting not exceeding ₹1 lakh as determined by the board of directors under Section 149(9) of the Companies Act 2013. There’s no statutory limit on the total annual sitting fees, so if an independent director attends, for example, six board meetings and ten committee meetings in a year, they could potentially earn ₹16 lakhs in sitting fees alone. In addition to sitting fees, independent directors are entitled to reimbursement of expenses for travel, accommodation, and other costs incurred in performing their duties. They may also receive profit-related commission if approved by shareholders through a resolution, subject to the overall ceiling on managerial remuneration under Section 197, though this is less common in practice.

Can independent directors receive stock options?

No, independent directors are explicitly prohibited from receiving stock options under Section 149(9) of the Companies Act 2013. This prohibition exists to ensure that independent directors’ compensation doesn’t create financial incentives that might compromise their independence and objectivity in board decision-making. If independent directors held stock options, they might be tempted to support decisions that boost short-term share prices at the expense of long-term value creation or might hesitate to challenge management actions that could negatively impact stock performance. Their remuneration is therefore limited to sitting fees, expense reimbursements, and potentially profit-related commission approved by shareholders, ensuring their financial interests remain aligned with overall company performance rather than short-term stock price movements.

What is the difference between an independent director and a non-executive director?

A non-executive director is any director who doesn’t participate in day-to-day management and isn’t an employee of the company, but they may have material relationships such as being promoters, substantial shareholders, or having business dealings with the organization. Independent directors form a specialized subset of non-executive directors who must meet additional stringent independence criteria under Section 149(6) of the Companies Act 2013, including prohibitions on promoter relationships, pecuniary ties exceeding 10% of income, family member shareholding limits, and past employment or professional service relationships. All independent directors are non-executive directors, but not all non-executive directors qualify as independent directors due to these strict eligibility requirements designed to ensure complete objectivity and freedom from conflicts of interest in corporate governance.

Do independent directors need to attend every board meeting?

While not strictly mandatory to attend every single board meeting, independent directors are expected to attend board meetings regularly and exercise due diligence in their duties under Schedule IV of the Companies Act 2013. They must strive to attend all board meetings and meetings of board committees where they’re members or chairpersons. For listed companies, Regulation 17 of SEBI LODR Regulations, 2015 requires independent directors to attend at least one meeting held without management participation and mandates disclosure of attendance records in annual reports. If an independent director’s attendance falls below prescribed limits (typically absent for three consecutive meetings or all meetings in a year), they risk vacation of office, and poor attendance reflects negatively on their commitment to fulfilling fiduciary duties.

Can independent directors be removed before their term ends?

Yes, independent directors can be removed before their term expires through an ordinary resolution passed by shareholders in a general meeting as per Section 169 of the Companies Act 2013. However, the company must follow proper procedure by giving special notice of the resolution to remove the director at least 14 days before the meeting. The concerned independent director must be given a reasonable opportunity to be heard and can make representations in writing, which the company must circulate to shareholders if requested. The director or their representative can also speak at the meeting before the vote. This procedural safeguard prevents arbitrary removal and protects independent directors who may face pressure for taking unpopular but correct governance positions. Upon removal, the company must file Form DIR-12 with the Registrar of Companies within 30 days.

What is the cooling-off period after serving two terms as an independent director?

After serving two consecutive terms totaling 10 years (two five-year terms) as an independent director in a company, a person must observe a mandatory cooling-off period of three years before being eligible for reappointment in the same company as per Section 149(11) of the Companies Act 2013. During this three-year cooling-off period, the individual cannot be appointed as an independent director in that specific company, though they remain eligible to serve as an independent director in other companies where they haven’t exhausted the two-term limit. This cooling-off requirement ensures board refreshment, prevents independent directors from becoming too close to management over extended tenures, and brings fresh perspectives to governance. After completing the cooling-off period, the same person can be reappointed as an independent director in the company for new consecutive terms subject to meeting all eligibility criteria and shareholder approval.

Are wholly-owned subsidiaries required to appoint independent directors?

No, wholly-owned subsidiaries are specifically exempt from the requirement to appoint independent directors even if they meet the threshold criteria of paid-up capital, turnover, or outstanding loans and deposits. According to Rule 4 of the Companies (Appointment and Qualification of Directors) Rules, 2014, the following categories of unlisted public companies are exempt: (a) wholly-owned subsidiaries (companies where 100% shares are held by another company), (b) joint ventures, and (c) dormant companies as defined under Section 455 of the Companies Act 2013. This exemption recognizes that wholly-owned subsidiaries are essentially operational extensions of their parent companies, and governance oversight is exercised at the parent company level where independent directors serve on the holding company’s board.

Allow notifications

Allow notifications