How to find independent director jobs in India. Complete guide covering job markets, salary ranges (₹5L-₹1Cr+), IICA databank, executive search firms, networking strategies, and realistic timelines from certification to appointment.

Table of Contents

Independent director jobs in India refer to non-executive board positions where professionals provide independent oversight and strategic guidance to companies without being involved in day-to-day operations.

Unlike executive directors who manage company operations full-time, independent directors attend board meetings (typically 4-8 times annually), participate in committee work, and offer unbiased perspectives on corporate governance, strategy, risk management, and compliance matters.

These are statutory appointments under the Companies Act, 2013, carrying significant legal responsibilities and fiduciary duties toward shareholders and stakeholders.

The role demands a substantial time commitment beyond just attending meetings. You’ll spend hours reviewing board papers, analysing financial statements, monitoring regulatory compliance, evaluating management proposals, and staying updated on industry developments and legal changes. Independent directors serve as the conscience of the board, protecting minority shareholder interests, questioning management decisions constructively, and ensuring the company operates ethically and transparently while pursuing growth objectives.

The duties and roles of independent directors, including oversight, protection of minority shareholders, and strategic guidance, arise from Schedule IV (Code for Independent Directors) read with Section 149(8). You can also explore the complete legal framework in my analysis of Independent Director under the Companies Act for a deeper understanding of statutory obligations.

What makes independent director jobs unique is the balance between authority and accountability. You wield considerable influence over major corporate decisions—approving strategies, overseeing CEO performance, sanctioning large transactions, and guiding crisis management—yet you maintain independence from management and promoters. This dual role as both advisor and watchdog requires deep business acumen, industry expertise, ethical integrity, and the courage to voice dissenting opinions when necessary, making it one of the most challenging yet rewarding professional opportunities for senior executives and domain experts.

Independent director jobs market in India

The independent director job market in India is substantial and growing rapidly.

Currently, approximately 5,300 companies are listed on the Bombay Stock Exchange (BSE) and around 2,100 companies on the National Stock Exchange (NSE). Listed public companies must appoint at least one-third of their board as independent directors under Section 149(4) of the Companies Act, 2013, creating demand for approx imately 20,000 – 25,000 independent director positions across listed companies alone.

Additionally, certain unlisted public companies meeting specific thresholds (paid-up capital of ₹10 crore or more, turnover of ₹100 crore or more, or outstanding deposits/debentures of ₹50 crore or more) must appoint at least two independent directors, expanding the opportunity universe significantly.

Beyond mandatory appointments, hundreds of unlisted companies, growth-stage startups, and foreign companies’ Indian subsidiaries voluntarily appoint independent directors to strengthen governance and attract investors.

Recent data from the Indian Institute of Corporate Affairs (IICA) shows over 38,900+ (as on Nov 2025) professionals have registered on the Independent Directors Databank, but market demand continues to outpace supply, particularly for professionals with specialized expertise in fintech, technology, ESG (Environmental, Social, Governance), cybersecurity, and emerging sectors.

The significant gap between registered professionals and actual appointments stems from companies seeking very specific domain expertise and experience profiles rather than general business knowledge.

Which types of companies appoint independent directors?

Listed public companies form the largest segment requiring independent directors, with Nifty-50, mid-cap, and small-cap companies on BSE and NSE collectively creating thousands of board positions.

These companies face mandatory requirements under both the Companies Act, 2013 and SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, which stipulate that at least one-third (or half, for certain promoter-driven companies) of board members must be independent directors.

This regulatory framework ensures strong demand from banking, financial services, insurance, manufacturing, IT, pharma, and infrastructure companies listed on stock exchanges.

Unlisted public companies meeting specific financial thresholds must also appoint independent directors, though with less stringent requirements (minimum two IDs). This category includes private equity-backed companies, family-owned business groups transitioning to professional management, and companies preparing for IPOs.

Additionally, startups that have raised funding often voluntarily appoint independent directors to satisfy investor requirements, access specialised expertise, and build credibility for future fundraising.

Public sector undertakings, government companies, and statutory corporations also appoint independent directors, though selection processes may involve government nominations. Foreign multinational companies operating Indian subsidiaries increasingly appoint local independent directors to navigate regulatory complexity and understand the Indian business environment effectively.

Current market trends driving independent director demand

The independent director job market is experiencing a significant surge driven by multiple converging factors.

First, a massive wave of tenure completions occurred in 2024, as thousands of independent directors appointed in 2014 (when the Companies Act, 2013 rules came into force) completed their maximum permissible two consecutive five-year terms.

Simultaneously, India’s economic growth is fueling an IPO boom, with hundreds of unlisted companies preparing to list and thus requiring independent directors for the first time.

Regulatory emphasis on corporate governance has intensified following several high-profile corporate scandals and governance failures.

SEBI has strengthened disclosure requirements, enhanced independent director responsibilities, and empowered shareholders, making companies more careful about appointing truly independent, qualified professionals rather than token appointments.

Additionally, there’s growing demand for specialised expertise in emerging areas—fintech regulations, data privacy, ESG compliance, cybersecurity, and sustainability reporting—creating opportunities for professionals with niche domain knowledge. Companies are also seeking diverse boards, with increasing focus on appointing women independent directors and professionals from non-traditional backgrounds (technology, healthcare, academia) rather than only retired bankers or civil servants, broadening the talent pool and opportunity landscape considerably.

Where to find independent director job opportunities

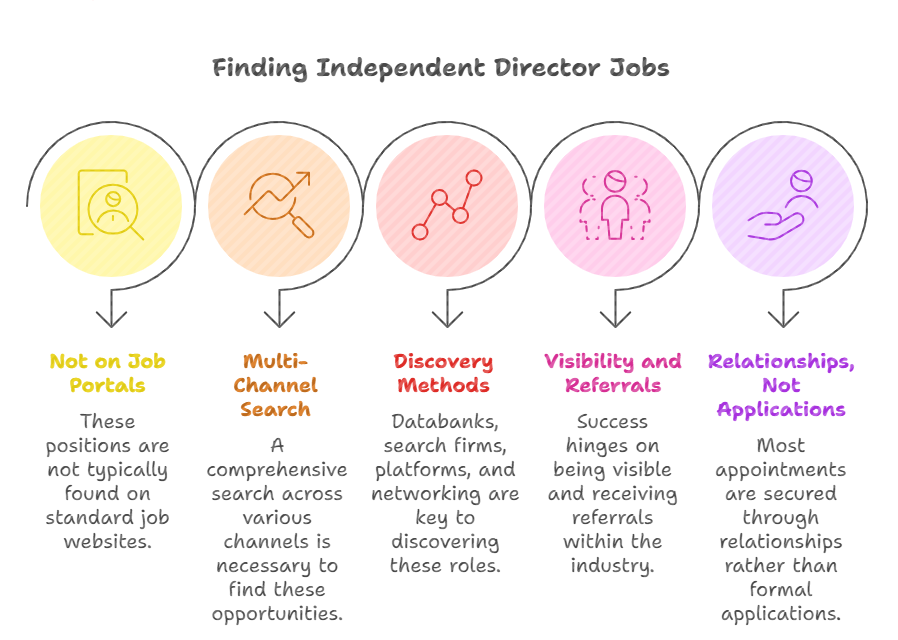

Finding independent director opportunities requires a strategic, multi-channel approach rather than passive job search methods.

Unlike traditional employment, where job portals dominate, independent director positions rarely appear on general job websites, and when they do, listings are often misleading (showing executive “Director” management roles instead of non-executive board positions).

The primary discovery channels include:

- official databanks maintained by the government and professional bodies,

- executive search firms specialising in board placements,

- private placement platforms,

- professional networking within industry associations, and

- direct outreach to companies in target sectors where your expertise adds value.

Success in finding independent director jobs depends heavily on active networking and building visibility in your domain.

Most board appointments happen through professional referrals, industry reputation, and existing relationships rather than formal applications. Companies typically seek independent directors through their existing board members’ networks, recommendations from major shareholders or investors, executive search firm databases, and increasingly through online professional platforms like LinkedIn, where thought leadership and domain expertise are visible. Understanding this informal, relationship-driven appointment ecosystem is crucial for positioning yourself effectively.

The timeline from starting your job search to securing your first appointment typically ranges from 6 to 18 months, depending on your experience level, network strength, and target company segment.

First-time independent directors without prior board experience or extensive CXO backgrounds may need longer to build credibility and connections, while professionals with strong industry reputations, relevant certifications, and active networks may receive opportunities within 3-6 months.

The key is maintaining persistent, strategic outreach across multiple channels while continuously enhancing your profile visibility and domain expertise to stand out among the 38,900+ registered professionals competing for limited board seats.

Official databanks for independent director jobs

IICA Independent Directors Databank

The IICA Independent Directors Databank is the official government-mandated platform established under Section 150 of the Companies Act, 2013, and maintained by the Indian Institute of Corporate Affairs under the Ministry of Corporate Affairs.

Registration on this databank is mandatory for professionals who wish to be considered for independent director appointments at companies. The platform serves as a comprehensive repository containing profiles of over 38,900+ professionals who have either passed the online proficiency self-assessment test or qualified for exemptions based on their professional credentials and experience. For a complete breakdown of eligibility, syllabus, exemptions, and passing strategy, refer to my in-depth article on the Independent Director Exam.

To register on the IICA databank, you must first obtain a Director Identification Number (DIN) through the MCA portal, complete the online proficiency self-assessment test (unless you qualify for exemptions as a CA, CS, or advocate with 10+ years practice, or as a director/KMP with 3+ years experience in qualifying companies), and then create your detailed profile on the databank portal.

Your profile should include comprehensive information about educational qualifications, professional experience, domain expertise, past directorships, committee memberships, and any specialised certifications in areas like ESG, cybersecurity, or financial literacy that distinguish you from other candidates.

IOD directors databank – How it differs from IICA

The IOD Directors DataBank is a private sector initiative by the Institute of Directors (India) that operates alongside the government’s IICA platform.

Unlike IICA’s focus exclusively on statutory independent directors, IOD’s databank covers a broader spectrum—executive directors, non-executive directors, advisory board members, and independent directors for both listed and unlisted companies.

IOD DataBank operates on a subscription model (unlike the free IICA platform) and offers additional services, including networking events, director training programs, governance workshops, and facilitated introductions to companies seeking board members.

How companies actually use databanks to search for candidates

Companies access the IICA through corporate registration, which allows them to search candidate profiles using multiple filters—industry expertise, functional specialisation (finance, legal, technology, operations), educational qualifications, prior board experience, geographic location, and specific skill sets like ESG knowledge or international exposure.

Search functionality works similarly to professional recruitment platforms, enabling companies to shortlist candidates whose profiles match specific board requirements. For instance, a fintech company seeking an independent director might filter for candidates with backgrounds in banking regulation, technology, and financial services combined with prior board experience in listed companies.

However, the reality is that databank searches rarely result in direct appointments without additional validation.

Companies typically use databanks as one of several sourcing channels, often complementing databank searches with referrals from existing board members, recommendations from major shareholders, and executive search firm proposals.

When companies identify interesting profiles on databanks, they usually conduct extensive background checks, seek references from mutual professional contacts, and evaluate the candidate’s industry reputation before extending interview invitations. This means merely having a profile on the databank is necessary but insufficient—you must actively network, build industry visibility, and ensure your profile stands out with unique expertise that companies specifically need rather than generic business experience.

Are there executive search firms specializing in independent director placements?

IICA-partnered executive search firms

In November 2024, the IICA signed Memoranda of Understanding with six prominent executive search firms to provide them access to the Independent Directors Databank for board placement services. These firms are Korn Ferry, ABC Consultants, EMA Partners, DHR Global, Sheffield Haworth, and Vahura. This official partnership represents a significant development in the independent director job market, as these firms now have privileged access to the database of 38,900+ registered professionals and can facilitate matches between companies and qualified candidates more efficiently than either party searching independently.

These executive search firms typically work on retained search mandates from companies, meaning they’re hired and paid by companies to identify, evaluate, and recommend suitable independent director candidates for specific board vacancies.

Their role extends beyond simple database matching—they conduct thorough assessments of candidates’ expertise, interview shortlisted professionals, reference-check with industry contacts, and present detailed recommendations to company boards.

Major firms like Korn Ferry and DHR Global have global networks and sophisticated assessment methodologies, while India-focused firms like ABC Consultants and Vahura bring deep local market knowledge and extensive databases of senior professionals built over decades of executive search work in the Indian market.

How to approach executive search firms as an aspiring independent director?

Approaching executive search firms requires professionalism and strategic positioning rather than cold outreach.

The most effective approach is to register your detailed profile on their candidate databases through their official websites—most firms have specific sections for board-level candidates where you can upload comprehensive CVs highlighting board-relevant experience, domain expertise, and notable achievements.

When creating your profile, emphasize unique specializations (ESG, cybersecurity, fintech regulations, international markets) rather than generic business experience, as search firms need to differentiate you from hundreds of other senior professionals in their databases.

Building relationships with specific consultants who specialize in board placements within these firms significantly improves your visibility.

Attend industry conferences, governance forums, and director training programs where search consultants often participate as speakers or attendees. Request informational meetings (not job requests) with board practice leaders at target firms to introduce yourself, understand what companies are seeking, and receive feedback on how to strengthen your profile.

Follow search consultants on LinkedIn, engage thoughtfully with their content about board trends, and share your own thought leadership to stay visible. When you do connect, clearly articulate your unique value proposition—what specific problems your expertise solves for companies, which sectors you’re targeting, and why you’re particularly qualified to serve on boards in those industries.

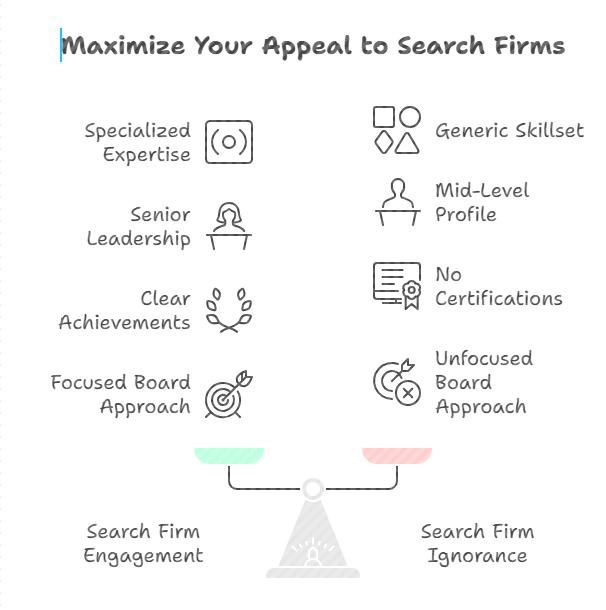

When search firms consider your profile vs. ignore it?

Executive search firms prioritize candidates who bring specialized, hard-to-find expertise that companies specifically request rather than general business management experience that thousands of professionals possess. They actively seek professionals with domain mastery in high-demand areas—fintech regulations, cybersecurity frameworks, ESG reporting standards, international market expansion, digital transformation, or sector-specific technical knowledge (pharma R&D, semiconductor manufacturing, renewable energy technology).

If your profile showcases such differentiated expertise combined with senior leadership credentials (CXO roles, P&L responsibility, major transaction experience), search firms will proactively engage you for relevant mandates.

Conversely, search firms typically ignore profiles that appear generic, lack specificity about achievements and expertise, show no prior board experience or governance training, or seem too junior for board-level responsibilities.

Candidates who have only mid-level management experience, haven’t completed any director certification programs, lack visibility in their industries, or present themselves as available for “any board opportunity” across unrelated sectors signal desperation rather than strategic board career planning. Search firms also avoid candidates with reputational issues, frequent job changes suggesting instability, or those who appear difficult to work with based on their professional interactions.

To stay on search firms’ active consideration lists, maintain an updated profile, periodically inform them of significant career developments, complete advanced director certifications, publish thought leadership, and demonstrate genuine commitment to board service rather than treating it as a post-retirement pastime.

Are private board placement platforms worth paying for to get a job as an independent director?

MentorMyBoard, PrimeDirectors, and other specialized platforms

MentorMyBoard positions itself as a comprehensive governance tech platform offering subscription-based services including board placement opportunities, director training programs, governance advisory, and a digital community of board professionals. The platform claims to facilitate matches between companies seeking directors and qualified professionals through a curated marketplace approach.

Similarly, PrimeDirectors operates as a dedicated platform for connecting companies with independent director candidates, using a searchable database model where companies can filter candidates by experience, expertise, and qualifications.

Other emerging platforms include BoardEx (focused on board intelligence and networking), Boardsi (an international board placement platform with an India presence), and various LinkedIn-based director networks and groups.

These platforms typically offer tiered subscription models—basic free profiles with limited visibility, premium paid subscriptions promising enhanced profile placement, featured listings, direct company access, and additional services like profile review, governance training, and networking events. The value proposition centres on access to a curated network of companies actively seeking board members, rather than relying solely on the large, undifferentiated government databanks where your profile may get lost among 38,900+ registered professionals.

Should you pay for premium placement services?

The decision to invest in premium board placement services depends on your current network strength, career stage, and financial capacity.

If you’re a first-time independent director candidate with limited connections in corporate circles, no prior board experience, and difficulty accessing decision-makers at target companies, paid platforms may offer valuable structured pathways to opportunities that would otherwise remain invisible to you.

Premium services typically include profile optimization assistance, targeted company introductions, preparation for board interviews, and access to governance training that strengthens your credentials—benefits that could justify costs if they accelerate your appointment timeline significantly.

However, exercise caution and skepticism about platforms making unrealistic promises of guaranteed board appointments or implying that paid subscriptions automatically result in interviews.

No legitimate placement service can guarantee board positions, as appointment decisions ultimately rest with company boards based on specific needs, chemistry, and often existing relationships.

Before paying for premium services, research the platform’s track record thoroughly—request verifiable placement statistics, speak with members who secured appointments through the platform, understand refund policies, and compare offerings against free alternatives.

Many successful independent directors have built board portfolios entirely through professional networking, LinkedIn visibility, industry associations, and the free IICA databank without ever paying for placement services, suggesting that paid platforms should be viewed as potential accelerators rather than necessary investments.

Evaluating platform effectiveness – what actually works

Evaluating board placement platform effectiveness requires looking beyond marketing claims to assess actual appointment outcomes. Request specific data: How many active companies regularly post board opportunities on the platform? What percentage of registered candidates received board appointments in the past year? How long did successful candidates take from registration to appointment? What types of companies use the platform—primarily startups, SMEs, or established listed companies? Platforms reluctant to share concrete success metrics should raise red flags about their actual effectiveness compared to their promotional messaging.

The most effective platforms combine multiple value elements rather than just passive profile hosting. Look for platforms offering active learning communities where you can network with sitting independent directors, regular webinars on governance trends, access to governance experts for profile feedback, and structured programs that prepare candidates for board roles. Platforms that facilitate real networking—through virtual meetups, in-person governance conferences, director mentorship programs, and industry-specific director forums—provide compounding value beyond simple job board functionality.

Additionally, assess whether the platform has genuine corporate credibility by checking if reputable companies publicly acknowledge using it for board searches, and whether it has partnerships with recognized institutions like IICA, IOD, or major business chambers, as such affiliations signal legitimacy and likely lead to higher-quality board opportunities rather than token advisory roles with minimal compensation or responsibility.

How can networking and direct outreach help you secure independent director jobs?

Which industry associations help independent director job seekers?

The Institute of Directors (India) stands as the premier professional association for directors in India, offering director training programs, governance workshops, networking forums, and advocacy for director interests. IOD membership provides access to a community of thousands of serving directors, regular events where you can build relationships with board professionals and company promoters, and visibility through their publications and platforms. Additionally, the Institute of Company Secretaries of India (ICSI) and Institute of Chartered Accountants of India (ICAI) offer specialized programs on corporate governance and director responsibilities, providing networking opportunities with professionals who often transition into independent director roles.

Industry-specific associations offer particularly valuable networking for securing relevant board positions. For example, professionals targeting fintech boards benefit from membership in Digital Lenders Association of India or Payments Council of India, while those interested in technology company boards should engage with NASSCOM and participate in their governance forums. Similarly, CII (Confederation of Indian Industry), FICCI (Federation of Indian Chambers of Commerce & Industry), and ASSOCHAM host board effectiveness and corporate governance programs where company promoters, CEOs, and sitting directors congregate—perfect environments for making connections that lead to board opportunities.

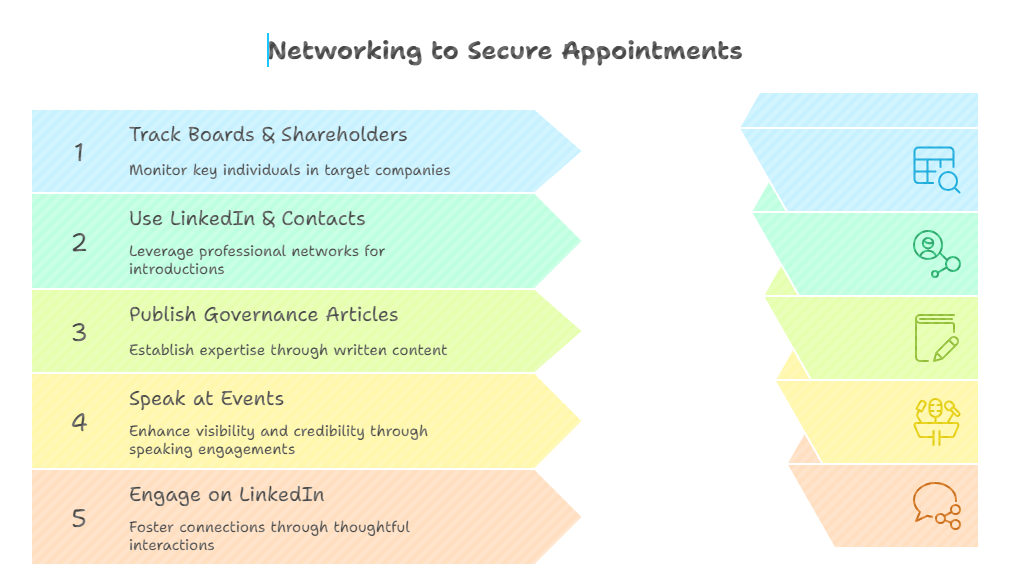

Networking strategies that lead to board appointments

Effective board networking focuses on building genuine professional relationships and demonstrating expertise rather than explicitly asking for board positions.

Start by identifying 5-10 companies in sectors where your expertise adds significant value, then map their existing board members, major shareholders, senior executives, and advisors through public disclosures available on company websites and BSE or NSE announcements. Look for second-degree connections through LinkedIn and mutual professional contacts, then seek warm introductions to have informational conversations about industry trends, governance challenges, and how your expertise might address specific problems these companies face.

Thought leadership significantly accelerates board-level visibility and networking effectiveness. Publish articles on relevant topics across platforms like LinkedIn, personal blogs, Board Stewardship magazines, corporate governance newsletters, ICSI publications, ICAI journals, The Directors’ Institute, Institute of Directors (IOD) publications, and business media outlets such as Economic Times, Mint, and Business Standard (Opinion/Expert Columns).

Speak at conferences, webinars, and industry forums on governance, boardroom practices, ESG, audit and risk oversight, or emerging regulatory challenges. You can also contribute to podcasts, YouTube panels, corporate governance masterclasses, professional associations (CII, FICCI, ASSOCHAM), academic institutions, and community platforms like Harvard Corporate Governance Forum, NACD Directorship, Lexology, and Mondaq to further expand your visibility and credibility as a prospective Independent Director.

Contribute to LinkedIn discussions thoughtfully, sharing insights rather than self-promotion. When decision-makers repeatedly encounter your name associated with valuable expertise, they naturally think of you when board vacancies arise.

Additionally, cultivate relationships with sitting independent directors in your network—they’re often asked to recommend candidates for board positions at other companies and can provide invaluable referrals, insider information about unadvertised opportunities, and coaching on navigating board selection processes effectively.

Building visibility in your target industry sector

Building visibility requires a consistent, strategic presence in forums where your target companies’ decision-makers congregate. Attend and actively participate in industry conferences, regulatory roundtables, and sector-specific governance workshops—not as passive attendees but as engaged participants asking insightful questions, contributing to panel discussions, and connecting with speakers and fellow attendees during networking sessions.

Volunteer to serve on industry association committees, working groups on governance or regulatory matters, or advisory panels that address sector challenges, as such involvement demonstrates commitment and expertise while expanding your professional network organically.

Digital visibility through LinkedIn has become increasingly important for independent director positioning.

Optimize your LinkedIn profile with a professional headline clearly stating your board interests and expertise areas (e.g., “Fintech Executive | Board Advisor | Expert in Digital Payments & Regulatory Compliance”), create a compelling summary highlighting unique value you bring to boards, and regularly share content demonstrating thought leadership in your domain.

Write LinkedIn articles on governance topics, comment thoughtfully on regulatory developments affecting your target sectors, and engage with content from company executives and sitting directors. Join relevant LinkedIn groups focused on corporate governance, independent directors, and your industry sector, where you can participate in discussions and build relationships with fellow professionals. Remember that visibility building is a long-term strategy—most board appointments result from sustained reputation-building over 12-24 months rather than short-term networking sprints.

How do you actually get appointed as an independent director?

Getting appointed as an independent director involves a multi-stage process that begins long before companies formally search for candidates. Most appointments result from professional reputation, sector expertise, and personal networks rather than formal applications.

Companies typically identify potential independent director candidates through referrals from existing board members, recommendations from major investors or institutional shareholders, suggestions from executive search firms they’ve retained, profiles discovered on the IICA databank that match specific requirements, or increasingly through LinkedIn searches for professionals with specialised expertise in areas where the board lacks strength.

Once your profile catches attention, companies conduct extensive preliminary due diligence—reviewing your professional background, checking for any regulatory violations or reputational issues, seeking informal references from mutual contacts, assessing your public visibility and thought leadership, and evaluating whether your expertise genuinely addresses specific board needs.

If preliminary assessments are positive, you will typically receive an exploratory phone call or meeting with the company secretary, HR head, or a sitting director to gauge mutual fit, discuss the company’s governance philosophy, understand time commitments and expectations, and assess cultural compatibility before formal interview processes begin with the full board or nominations committee.

Note: If you’re looking for a step-by-step roadmap to build eligibility and position yourself for board roles, you may find my detailed guide on How to Become an Independent Director helpful.

Why databank registration alone does not get you appointed?

The reality – 38,900+ registered professionals competing for limited seats

The IICA Independent Directors Databank contains profiles of over 38,900+ registered professionals, yet only a small fraction receive board appointments in any given year. This creates intense competition where simply having a registered profile provides almost no competitive advantage. Companies searching the databank can apply multiple filters simultaneously—seeking professionals with specific industry expertise, prior board experience in listed companies, advanced certifications in ESG or financial literacy, particular educational backgrounds, and geographic proximity to company headquarters—often narrowing results to 50-100 candidates who then compete on reputation, network connections, and interpersonal chemistry rather than credentials alone.

What triggers company’s interest in your profile

Company interest gets triggered by differentiated expertise that solves specific board problems rather than generic business experience.

If a fintech company faces regulatory scrutiny, they’ll prioritize candidates with deep knowledge of RBI regulations and prior experience navigating regulatory challenges. When a manufacturing company plans international expansion, they seek directors with demonstrated success in relevant foreign markets.

Your profile stands out when it showcases unique combinations—technology expertise plus listed company board experience, CA qualification plus startup scaling knowledge, international exposure plus India market mastery—that few other candidates possess, making you the obvious choice for companies facing particular strategic or governance challenges.

How long does it take to get your first independent director appointment?

Typical timeline from certification to first board seat

For most professionals, the timeline from IICA certification to first independent director appointment ranges from 6 to 18 months of active job search effort. Professionals with extensive CXO experience, strong industry networks, and recognized domain expertise may secure appointments in 3-6 months, while first-time candidates without prior board experience typically need 12-18 months to build relationships, enhance visibility, and convince companies to take a chance on an untested director.

Factors that accelerate your appointment

Several factors significantly accelerate independent director appointments.

Prior board experience (even advisory boards or non-profit boards) demonstrates you understand board dynamics and governance. Active networking that builds relationships with sitting directors, company promoters, and executive search consultants creates channels for opportunities.

A strong LinkedIn presence with thought leadership establishes credibility. Specialised certifications in high-demand areas (ESG from IICA, cybersecurity governance, and financial literacy for board members) differentiate your profile. Most importantly, having a clear target focus—specific industries where your expertise adds obvious value—allows concentrated networking efforts rather than scattered “any board” approaches that signal desperation.

Why do some professionals wait 18+ months for their first opportunity?

Extended timelines typically result from several common mistakes. Professionals without clear expertise differentiation get lost among thousands of similar profiles. Those who rely solely on databank registration without active networking never build the relationships that drive most appointments.

Candidates targeting the wrong company segments (aspiring for Nifty-50 boards without commensurate experience) face inevitable rejections. Additionally, professionals who completed certification but haven’t maintained current knowledge of regulatory changes, governance trends, or industry developments appear outdated to companies seeking forward-looking board members.

What factors determine who gets appointed and who doesn’t?

Does domain expertise matter more than general business knowledge?

Domain expertise decisively outweighs general business knowledge in independent director appointments. Companies already have generalist business managers in executive roles—they seek independent directors who bring specialized knowledge the management team lacks. A technology company values a director who understands cybersecurity frameworks, data privacy regulations, and emerging tech trends over someone with generic P&L management experience. Similarly, a healthcare company prioritizes candidates with deep pharma regulatory knowledge, clinical trial expertise, or hospital operations experience over general business consultants.

The demand for specialized expertise has intensified as business complexity increases. Companies facing digital transformation seek directors who’ve successfully led technology implementations.

Those navigating ESG pressures want directors with demonstrated ESG strategy expertise. Organizations expanding internationally need directors with specific geographic market knowledge. Your appointment chances increase exponentially when you can point to tangible achievements in the exact areas where target companies face strategic or operational challenges, rather than claiming broad competence across multiple unrelated domains.

The importance of prior CXO or senior leadership experience

Prior CXO or senior leadership experience significantly influences independent director appointments, though it’s not always mandatory. Companies value candidates who’ve held P&L responsibility, led large teams, reported to boards, navigated crises, and made consequential business decisions under pressure.

This experience signals you understand business realities, can evaluate management proposals critically, and won’t be overwhelmed by the complexity and pace of board deliberations. Former CEOs, CFOs, COOs, and CXOs bring credibility and practical wisdom that theoretical knowledge alone cannot provide.

However, some pathways exist for non-CXOs with highly specialised expertise. Renowned domain experts—technology innovators, regulatory specialists, academic researchers, sector-specific consultants—can secure appointments based on unique knowledge despite never holding CXO titles.

The key is demonstrating that your expertise is sufficiently differentiated and valuable that it compensates for a lack of general management experience. For instance, a cybersecurity expert who’s never been a CXO but advises governments on national cyber policy might be highly sought after by companies in banking or technology sectors facing sophisticated cyber threats.

How sector-specific credentials influence appointment decisions

Sector-specific credentials like Chartered Accountant certification for financial services boards, engineering degrees for manufacturing or infrastructure companies, medical qualifications for healthcare boards, or technology certifications for IT companies significantly enhance appointment prospects. These credentials signal a deep understanding of sector nuances, technical complexities, and regulatory frameworks that generalists cannot match, making you particularly valuable for boards in those industries.

Geographic proximity and other practical considerations

Geographic proximity matters more than many candidates realize, as board meetings require physical attendance at company headquarters 4-8 times annually. Companies prefer directors based in the same city or willing to travel regularly without scheduling complications. Additionally, practical factors like bandwidth availability (board service requires 20-30 hours monthly), conflict of interest checks (not serving on competing company boards), and regulatory clearances (no criminal proceedings or disqualifications) influence appointment decisions significantly.

Should you target listed companies, unlisted companies, or startups first?

Pros & Cons of Listed Boards

Listed company boards offer significant advantages including higher compensation (₹50 lakh to ₹1 crore+ annually for Nifty-50 companies), strong regulatory frameworks providing role clarity, prestigious brand association enhancing your board portfolio, and well-established governance processes making your role clearer. However, they also bring intense scrutiny from regulators, media, and shareholders, higher legal liability exposure, stringent time commitments with frequent committee meetings, and fierce competition for positions as hundreds of qualified candidates compete for each opening.

Why unlisted companies may be better for first-timers?

Unlisted public companies and large private companies often provide better entry points for first-time independent directors. Appointment processes are less competitive than listed companies, allowing candidates without extensive board portfolios to gain consideration. Compensation, while lower than listed giants (₹10-25 lakhs annually), remains meaningful, and the experience builds credibility for future listed company boards. You’ll encounter real governance challenges—advising on strategy, overseeing risk, guiding management—providing authentic board learning without the intense regulatory and media spotlight that characterises listed company directorships.

Startup/scale-up board roles

Startup and scale-up board positions (particularly companies that have raised Series B/C funding or beyond) offer unique opportunities for professionals willing to accept equity compensation alongside cash fees.

These boards value practical, hands-on guidance rather than only governance oversight, allowing you to contribute actively to strategy, operations, fundraising, and talent acquisition.

However, startup boards carry a higher failure risk, often lack structured governance processes requiring you to build frameworks yourself, and may demand more time commitment than established company boards.

They work best as portfolio additions alongside more established board positions rather than as standalone opportunities, particularly if you bring specialised expertise in areas critical to startup success like fundraising, scaling operations, or navigating regulatory challenges.

How much do independent directors earn in India?

Independent director compensation in India varies dramatically based on company size, profitability, industry sector, and individual director experience. At the top end, independent directors at Nifty-50 companies earn a median compensation of ₹87.4 lakh annually, according to Business Standard reports, with 151 directors earning ₹1 crore or more annually. Mid-cap and small-cap listed companies typically pay ₹30-50 lakh annually, while unlisted public companies and SMEs pay ₹10-25 lakh annually for independent directors. First-time directors without extensive board portfolios generally start at lower compensation levels (₹5-15 lakh annually) until they build track records and can command premium rates.

Compensation structures combine multiple elements rather than fixed salaries.

Sitting fees are currently capped at ₹1 lakh per board/committee meeting under Rule 4 of Companies (Appointment and Remuneration of Managerial Personnel) Rules 2014 form the base, with independent directors attending 4-8 board meetings and various committee meetings annually, generating ₹5-12 lakh just from meeting attendance.

The larger component comes from profit-linked commission, where companies can distribute up to 1% or 3% (if there are no MD/WTD/Manager) of net profits to all non-executive directors collectively under Section 197 of the Companies Act, 2013, with this pool divided among independent directors based on board decisions. Additionally, directors receive reimbursement of expenses (travel, accommodation for meetings) and sometimes benefits like Directors & Officers (D&O) liability insurance coverage worth significant amounts.

How are independent directors paid?

Sitting fees

Sitting fees represent payment for attending each board meeting and committee meeting, currently capped at ₹1 lakh per meeting under SEBI regulations. Most Nifty-100 companies now pay ₹1 lakh per meeting (29 companies in FY24 according to Business Standards), while smaller companies pay ₹25,000-50,000 per meeting. With 4-8 board meetings annually plus committee meetings (audit, nomination, risk, CSR), sitting fees typically generate ₹4-12 lakh annually, depending on company practices and meeting frequency.

Commission structures

Commission forms the largest compensation component, calculated as a percentage of company profits. Companies can distribute up to 1% or 3% (if there are no MD/WTD/Manager) of net profits to all non-executive directors collectively, though most use only 0.3-0.6% according to corporate governance surveys.

This pool gets divided among independent directors based on committee memberships, meeting attendance, and board contribution. For profitable companies, commission can range from ₹20-80 lakh annually for individual independent directors, explaining why total compensation at profitable companies far exceeds sitting fees alone.

Additional perks

Beyond sitting fees and commission, independent directors receive travel reimbursements for board meetings (flights, hotels, local conveyance), professional liability insurance (D&O insurance policies covering personal liability), and access to company resources for discharging board duties. Some companies provide additional benefits like annual health checkups, professional development allowances for governance training, or technology allowances for board portal access, though these vary significantly by company policy and industry practice.

What can you realistically expect to earn as an independent director?

Nifty 50 & Large Listed Companies

Independent directors at Nifty-50 and large listed companies earn a median annual compensation of ₹87.4 lakh (FY24 data), with the top quartile earning ₹1 crore or more. Companies like Reliance Industries, TCS, HDFC Bank, and other blue-chip corporates pay premium compensation reflecting board member caliber, time commitment, and reputational value. However, securing such positions requires exceptional credentials—typically prior CXO experience at major corporations, existing board portfolio at listed companies, or unique expertise in critical domains with national/international recognition.

Mid-Cap, Small-Cap & Unlisted Companies

Mid-cap listed companies (market cap ₹5,000-20,000 crore) typically pay ₹30-50 lakh annually, while small-cap listed companies (market cap below ₹5,000 crore) pay ₹15-30 lakh annually.

Unlisted public companies meeting independent director appointment thresholds generally pay ₹10-20 lakh annually, though compensation varies significantly based on company profitability and promoter philosophy. Well-funded startups and growth companies may pay ₹8-15 lakh cash plus meaningful equity grants that could deliver substantial value if companies succeed in IPOs or acquisitions.

First-Time Director vs Experienced Director Earnings

First-time independent directors without prior board experience typically start at lower compensation levels—₹5-12 lakh annually at smaller unlisted companies or startups—building credentials before commanding premium rates. Experienced directors with 3-5 years board service, multiple board memberships, and demonstrated value creation can negotiate ₹20-40 lakh at mid-sized companies. Highly sought-after directors with extensive board portfolios, domain expertise in high-demand areas, and strong track records of guiding companies through major transitions or crises can command ₹50 lakh-₹1 crore+ annually at top-tier companies.

Note: Some of the figures are based on the personal experience of the author.

What are the latest compensation trends in independent director jobs?

Why has independent director compensation doubled since 2019

Independent director compensation has surged 106% from FY19 to FY24, according to Exec-Rem Advisors analysis, driven primarily by strong profit growth at Indian companies enabling higher commission payouts.

Additionally, responsibilities have intensified with stricter regulatory requirements, enhanced disclosure obligations, increased committee workloads, and greater legal liability exposure, making companies recognize they must pay competitively to attract qualified professionals willing to assume these burdens. The trend toward specialization—seeking directors with ESG expertise, cybersecurity knowledge, or international market experience—has further increased compensation as scarce specialized talent commands premium rates.

How many independent directors earn ₹1 crore or more annually?

According to Economic Times, 151 independent directors across Indian companies earned ₹1 crore or more annually in FY24, up from approximately 100 directors in this compensation band just three years earlier.

This “crore club” comprises primarily directors at Nifty-50 companies, though some prominent independent directors serve on multiple mid-cap company boards, with combined compensation exceeding ₹1 crore from their entire board portfolio. The growth of this elite compensation segment reflects both rising corporate profitability and increasing recognition of independent director value in governance and strategic guidance.

Conclusion

Independent director jobs in India represent a significant professional opportunity for senior executives, domain experts, and accomplished professionals seeking meaningful board-level engagement beyond traditional employment.

The market offers thousands of positions across listed companies, unlisted public companies, and growth-stage startups, with compensation ranging from ₹5-15 lakh annually for first-time directors at smaller companies to ₹50 lakh-₹1 crore+ for experienced directors at blue-chip corporations. However, success requires strategic, persistent effort across multiple channels—official databanks, executive search firms, private platforms, professional networking, and thought leadership—rather than passive registration and waiting.

The path from certification to appointment typically takes 6-18 months of active job search, with success depending heavily on differentiated expertise, active networking, and clear targeting of companies where your skills address specific board needs. Focus on building genuine professional relationships, establishing thought leadership in your domain, and continuously enhancing your governance knowledge rather than mass-applying to random opportunities. Remember that most appointments result from reputation, referrals, and demonstrated expertise rather than formal applications, making visibility building and network cultivation essential long-term strategies for developing a successful independent director career.

Frequently Asked Questions

How do companies find independent directors in India?

Companies find independent directors primarily through professional networks and referrals from existing board members, followed by executive search firm recommendations, IICA databank searches, investor suggestions, and increasingly LinkedIn professional searches.

What is the difference between executive director jobs and independent director positions?

Executive director jobs are full-time management positions with operational responsibilities and regular salaries, while independent director positions are non-executive board seats providing oversight and governance with compensation through sitting fees and commission.

How long does it take to get appointed as an independent director after certification?

Typical timeline from IICA certification to first appointment ranges from 6-18 months depending on experience, network strength, domain expertise, and active job search intensity across multiple channels.

Can I apply directly to companies for independent director positions?

Yes, though direct applications rarely succeed without existing relationships; targeted outreach to companies where your expertise addresses specific needs works better than mass applications.

Do I need to register on both IICA and IOD databanks?

IICA registration is mandatory for certain statutory appointments; IOD registration broadens opportunities to include unlisted companies and advisory roles, so maintaining both profiles maximizes visibility.

How much do independent directors earn in India?

Compensation ranges from ₹5-15 lakh annually for first-time directors at smaller companies to ₹50 lakh-₹1 crore+ at Nifty-50 companies, with median compensation of ₹87.4 lakh at large listed companies.

Which executive search firms specialize in independent director placements?

Korn Ferry, ABC Consultants, EMA Partners, DHR Global, Sheffield Haworth, and Vahura have official IICA partnerships for independent director placements, while other firms like Heidrick & Struggles also handle board searches.

What are the chances of getting appointed from the IICA databank?

Very low without additional efforts, as 38,900+ registered professionals compete for limited positions; success requires combining databank registration with networking, thought leadership, and specialized expertise differentiation.

Should I target listed or unlisted companies for my first independent director role?

Unlisted public companies and well-funded startups typically offer better entry points for first-time directors, with less competition and more willingness to consider candidates without extensive board portfolios.

Can I work as an independent director while having a full-time job?

Yes, independent director roles are non-executive positions requiring 20-30 hours monthly for meetings and preparation, making them compatible with full-time employment subject to employer approval and no conflicts of interest.

How many independent director positions can I hold simultaneously?

You can hold independent directorships in up to 7 listed companies or 20 companies total (including private companies) under Companies Act provisions, subject to availability and effective time management.

What qualifications do companies look for beyond the IICA proficiency test?

Companies prioritize domain expertise in relevant sectors, prior CXO or senior leadership experience, specialized certifications (ESG, cybersecurity, financial literacy), demonstrated governance knowledge, and strong professional reputation over basic certification.

Are there independent director opportunities for first-time directors without CXO experience?

Yes, though fewer; candidates with deep specialized expertise (technology, regulatory, sector-specific) can secure appointments based on unique knowledge despite lacking traditional CXO credentials, particularly at smaller companies.

How do I optimize my profile on the IICA databank to increase visibility?

Highlight unique specialized expertise, complete all profile sections comprehensively, showcase relevant certifications and achievements, update regularly with current activities, and use keywords matching what companies search for in your domain.

What networking strategies work best for finding independent director jobs?

Join industry associations (IOD, sector-specific bodies), attend governance forums and conferences, build relationships with sitting directors, establish thought leadership through speaking and writing, and leverage LinkedIn strategically for visibility.

Allow notifications

Allow notifications