Discover independent director jobs in India with complete details on vacancies across cities, salary ranges from ₹2L to ₹1Cr+, and step-by-step application strategies.

Table of Contents

Imagine a role where your experience, judgment, and reputation – not your 12 to 14-hour workdays – are the keys to success.

A position where you sit at the highest level of corporate decision-making, shaping billion-rupee strategies, influencing the direction of industries, and ensuring companies stay on the right side of the law and governance. And yes — you get paid handsomely for it.

Welcome to the world of Independent Directorship, one of the most prestigious and rewarding career paths in India’s corporate ecosystem today. And if you’re reading this in 2025, you’re entering the market at exactly the right time.

Consider the numbers. India now has over 28 lakh registered companies, nearly 18 lakh of which are active. More than 8,400 are listed on the BSE and NSE alone.

With each listed company typically requiring three to four independent directors, the demand stands at an estimated 20,000 board positions — a number that continues to grow. Moreover, a significant portion of existing board seats is about to open up.

The Companies Act, 2013 caps independent directorship at two consecutive five-year terms, meaning thousands of directors appointed between 2014 and 2016 are now completing their tenure.

The wave of IPOs and the startup boom further amplify this demand. India already boasts over 100 unicorns, and many startups are preparing to go public. Every IPO-bound company is legally required to restructure its board and appoint independent directors well before listing — creating a surge in opportunities.

This unprecedented demand is matched by attractive rewards.

As per the article published on Economic Times, the compensation for independent directors has more than doubled in the past five years, rising from ₹35.5 lakh in FY18 to ₹72 lakh in FY23.

For professionals with experience in law, finance, strategy, technology, ESG, or leadership, independent directorship offers an exceptional second career — one where your judgment and expertise, not long work hours, drive value. It is a chance to influence business at the highest level, guide companies through growth and transformation, and play a crucial role in shaping India’s corporate future.

In short, this is a once-in-a-generation opportunity.

As the governance landscape matures and boardrooms actively compete for qualified directors, those who position themselves now — with the right skills, credentials, and visibility — stand to build not just a lucrative career, but a lasting legacy in corporate India.

If you’re exploring board-level opportunities in India’s corporate landscape, independent director positions represent one of the most prestigious and rewarding career paths available today.

The demand for qualified independent directors has never been higher, driven by regulatory requirements, corporate governance reforms, and an unprecedented wave of companies going public.

Whether you are a chartered accountant, company secretary, legal professional, or seasoned executive looking to transition into board roles, understanding the current job market, compensation structures, and application processes is critical to positioning yourself for success.

In this comprehensive guide, I’ll walk you through everything you need to know about independent director jobs in India—from the exact number of vacancies available across major job portals to city-specific opportunities, detailed salary breakdowns across company types, and actionable strategies to secure your first board appointment.

Let’s dive into the rapidly evolving landscape of independent director opportunities in India.

Independent Director Job Market Overview in India

The independent director job market in India is experiencing transformative growth, creating unprecedented opportunities for qualified professionals seeking board-level positions. Understanding the current landscape and the forces driving this expansion will help you position yourself strategically in this competitive yet accessible market.

Current Market Demand and Growth Trends

India’s corporate governance landscape has fundamentally shifted over the past decade, and you’re entering this market at an optimal time.

According to recent data from from news article, there were over 625 vacancy for the role of independent director in Central Public Sector Understakinjs (PSU), while Indeed lists more than 300 vacancies (last visited in October 2025), for a broad Director position, across various industries and company sizes.

These numbers represent only the publicly advertised positions—the actual demand is significantly higher when you account for private searches conducted by executive recruitment firms and direct company outreach.

The growth trajectory is remarkable.

Between 2019 and 2024, the number of independent directors required across Indian companies has grown at a high rate, driven primarily by regulatory mandates and expanding corporate ecosystems.

The Companies Act 2013 requires listed companies to maintain at least one-third of their board composition as independent directors, while specific unlisted public companies must appoint a minimum of two independent directors.

What makes the current moment particularly significant is the confluence of multiple market forces.

As stated above, India currently has over 28 lakh registered companies, with approximately 18 lakh considered active, according to the news article published by Economic Times.

On the stock markets, as of June 2025, more than 5,800 companies are listed on the Bombay Stock Exchange (BSE), while the National Stock Exchange (NSE) features around 2,600 listed firms.

If we conservatively estimate that each listed company generally requires three to four independent directors, the total market need would be around 20,000 or more, qualified independent directors at any given time.

Why Is the Independent Director Jobs on a rise?

Several powerful factors are converging to create what I call the “independent director opportunity wave” in India, and understanding these dynamics will help you recognize where the best opportunities lie.

The 10-Year Tenure Expiry Wave: Perhaps the most significant driver is the impending expiry of ten-year maximum tenures for independent directors who were first appointed when the Companies Act 2013 came into effect.

Section 149(11) of the Companies Act stipulates that no individual can serve as an independent director for more than two consecutive terms of five years each. Since the majority of independent directors were appointed between 2014 and 2016 following the Act’s implementation, their first or second terms are now concluding.

This creates a massive replacement demand—thousands of board seats are becoming available as existing directors complete their maximum tenure or their first five-year term.

The IPO and Startup Ecosystem Boom: India’s startup ecosystem has exploded, with over 123 companies achieving unicorn status and many more preparing for public listings. Every company planning an IPO must restructure its board to include independent directors to meet SEBI’s LODR Regulations. The pre-IPO preparation phase alone creates substantial demand, and this doesn’t even account for the post-listing compliance requirements. Technology startups, fintech companies, and new-age businesses in sectors like e-commerce, edtech, and healthtech are particularly aggressive in recruiting independent directors with relevant domain expertise.

Stricter Governance and ESG Requirements: Regulatory bodies have significantly tightened corporate governance standards. SEBI’s continuous amendments to listing obligations have expanded the role and responsibilities of independent directors, particularly around audit committees, nomination and remuneration committees, and stakeholder relationship committees. Furthermore, the growing emphasis on Environmental, Social, and Governance (ESG) metrics has created demand for independent directors with sustainability expertise—a relatively new but rapidly growing specialization.

Increased Board Committee Requirements: Companies are now required to constitute multiple board committees, and independent directors must chair or participate in these committees. The audit committee, for instance, must have at least two-thirds independent directors. Similarly, nomination and remuneration committees require independent director participation. This multiplication effect means companies need more independent directors than the basic one-third board composition requirement suggests.

Government and PSU Reforms: Public Sector Undertakings (PSUs) are increasingly being directed to appoint independent directors to improve governance and operational efficiency. The Department of Public Enterprises has mandated independent director appointments across numerous PSUs, opening up a parallel job market that was previously non-existent.

The intersection of these factors creates what economists call a “structural demand increase”—not a temporary spike, but a fundamental expansion of the market. For you as a prospective independent director, this means that if you build the right qualifications and positioning, opportunities will continue to emerge throughout your career. The market isn’t just growing; it’s maturing and professionalizing, which means clearer pathways, better compensation, and more transparent hiring processes than ever before.

How to find Independent Director Jobs in India

One of the most common questions aspiring board members ask is: “Where can I find independent director vacancies?”

The honest answer is that you won’t find them listed like regular job openings. Independent directorships are rarely advertised publicly — instead, they’re filled through a mix of board nominations, search firms, the MCA’s Independent Directors Databank, and targeted outreach by companies themselves.

This means that while job portals and LinkedIn do show some openings, they represent only a fraction of the total opportunity landscape. Understanding where and how these appointments actually happen is far more valuable than browsing job listings — and that’s what we’ll explore below.

What is the total number of vacancies across major job portals?

While incomplete, job portal data still offers a window into visible demand:

- LinkedIn Jobs India lists around 50 director positions across industries. The platform’s search and filtering tools make it a key resource, particularly for companies targeting specific expertise (e.g., finance, legal, ESG).

- Indeed India shows over 300+ director job postings, with the caveat that some listings are for “Director” or “Non-Executive Director” that may also include independent director roles.

- Specialized platforms like Recruit.net show over 1,300+ postings, though these include a broader definition of “director” roles. The key insight here is that you shouldn’t rely on a single platform—successful candidates typically maintain active profiles and job alerts across four to six platforms simultaneously.

- Beyond job portals, the official Independent Directors Databank maintained by the Ministry of Corporate Affairs and Indian Institute of Corporate Affairs serves as a crucial resource. While it doesn’t function as a traditional job board, companies actively search this database when recruiting independent directors. Registration here is not optional but mandatory. As of 16th October 2025, over 38,000 professionals have registered on this platform, and companies can filter candidates by expertise, location, and availability.

Executive search firms and board advisory companies handle a significant portion of independent director recruitment, particularly for listed companies and large corporations. Firms like

- ABC Consultants,

- EMA Partners, and

- Korn Ferry maintain proprietary databases of board-ready candidates.

These positions rarely appear on public job boards, which is why networking and direct outreach to these firms is critical for accessing premium opportunities.

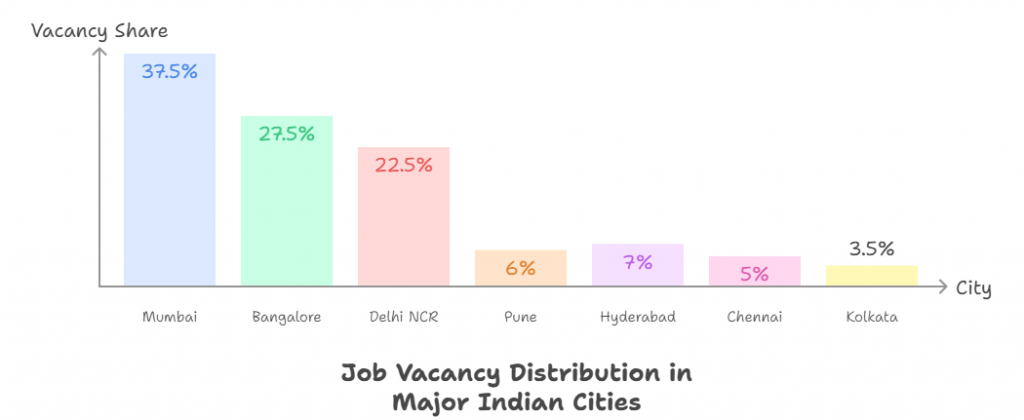

Which cities have the most board-level openings: Mumbai, Delhi NCR, or Bangalore?

Geographic concentration of opportunities varies significantly by city, and understanding these patterns will help you target your search effectively or even consider relocation if you’re serious about maximizing board opportunities.

Mumbai remains the undisputed leader in independent director job opportunities, accounting for approximately 35-40% of all board-level openings in India. Although, there isnt much publicaly availbale data to support the data. Nevertheless, this shouldn’t surprise you—as Mumbai hosts the headquarters of most major listed companies, financial institutions, and multinational corporations. The concentration of companies listed on BSE and NSE in Mumbai creates a density of board-level opportunities unmatched by any other Indian city. If you have expertise in banking, financial services, insurance, or capital markets, Mumbai is where you’ll find the highest concentration of relevant opportunities. The Bombay Stock Exchange and National Stock Exchange ecosystems create continuous demand as companies list, comply with governance requirements, and expand their boards.

Bangalore is the fastest-growing market for independent director positions, representing approximately 25-30% of total vacancies, based on my internal calculations. The city’s status as India’s technology capital means that if you have expertise in technology, digital transformation, cybersecurity, AI/ML, or startup operations, Bangalore offers the most relevant opportunities. The city is home to thousands of technology startups, many of which are in various stages of growth toward IPO.

Pre-IPO companies in Bangalore are particularly aggressive in recruiting independent directors because they need to demonstrate strong governance to investors and regulators. What makes Bangalore particularly attractive is the compensation premium—tech companies and well-funded startups often pay 20-30% more than traditional industries for independent directors with relevant technical expertise.

Delhi NCR (including Gurgaon and Noida) accounts for approximately remaining market for independent director openings. The presence of numerous corporate headquarters, particularly in sectors like real estate, infrastructure, automotive, and professional services, creates steady demand. Delhi NCR is also home to many family-owned businesses transitioning to professional management structures, which often involves adding independent directors to enhance governance credibility. If your background is in manufacturing, infrastructure, or traditional business sectors, Delhi NCR offers substantial opportunities.

What’s noteworthy is the distribution pattern: these three metros combined account for roughly over 80% of all independent director job opportunities in India. This concentration means that if you’re based in a smaller city, you’ll either need to be prepared for remote board participation (which has become more acceptable post-COVID) or consider the reality that most premium opportunities require physical presence in these metros at least for key board meetings.

Job opportunities in Tier-2 cities like Pune, Hyderabad, Kolkata and Chennai?

While metros dominate, Tier-2 cities are experiencing notable growth in independent director opportunities, and understanding these markets can give you a competitive advantage since they’re often overlooked by candidates focused solely on metros.

Pune has emerged as a significant secondary market, particularly in the automotive, manufacturing, and engineering sectors. The city hosts numerous manufacturing plants and mid-sized companies that are either listed or preparing for listings. Pune’s proximity to Mumbai also means that some companies prefer to register there for operational reasons while maintaining Mumbai connections. I estimate Pune accounts for approximately 5-7% of total independent director vacancies. The automotive and auto-component industry concentration in Pune creates specific demand for independent directors with manufacturing, supply chain, and quality management expertise.

Hyderabad represents approximately 6-8% (estimation) of the market, driven primarily by the pharmaceutical and biotechnology sectors. The city has become India’s pharmaceutical hub, with numerous mid-cap pharma companies requiring independent directors who understand regulatory compliance, FDA interactions, and drug development processes. If you have a background in life sciences, pharmaceuticals, or healthcare, Hyderabad offers niche opportunities that may face less competition than similar positions in metros. The growing IT/ITeS presence in Hyderabad also creates some technology-related board opportunities, though not at the scale of Bangalore.

Chennai accounts for roughly 4-6% (estimation) of vacancies, concentrated in automotive manufacturing, textiles, and engineering industries. Chennai’s strength lies in its established manufacturing base—companies like Ashok Leyland, TVS Group entities, and numerous auto component manufacturers maintain headquarters here. These are typically traditional industries with stable, mature companies seeking independent directors who understand operational efficiency, cost management, and international business development.

Kolkata represents approximately 3-4% of the market, with opportunities primarily in tea, jute, FMCG, and some traditional family businesses. The market here is smaller but less competitive, and companies often value local connections and understanding of regional business dynamics. If you have roots in Eastern India and relevant business experience, Kolkata offers opportunities where cultural fit and regional expertise provide competitive advantages.

The remote work revolution has fundamentally altered the dynamics of board participation. Many companies now accept that independent directors can participate in board meetings virtually, particularly for routine meetings, while expecting physical presence for key events like AGMs or strategic planning sessions. This means you don’t necessarily need to relocate to access opportunities in these cities—you can maintain a broader geographic search radius than was possible pre-2020.

Note: – The city-wise percentage figures are reasonable estimates based on industry experience and the concentration of relevant sectors in these cities, rather than officially published statistics.

Which Industries and Companies Are Hiring Independent Directors?

Are tech and fintech companies creating the most board roles?

The short answer is yes—technology and fintech sectors are currently the fastest-growing segments for independent director recruitment, and this trend will likely accelerate over the next 3-5 years. Let me explain why and what this means for you.

Technology startups and fintech companies face unique governance challenges that drive aggressive independent director recruitment. First, these companies are under intense regulatory scrutiny. The Reserve Bank of India has implemented stringent governance requirements for fintech companies, particularly those in payments, lending, and digital banking. Companies like Paytm, PhonePe, and numerous digital lending platforms must maintain boards with independent directors who understand both technology and financial regulations.

Second, the VC funding ecosystem demands strong governance. Venture capital firms and private equity investors increasingly require portfolio companies to appoint independent directors as a condition of investment. This happens much earlier in the company lifecycle than in traditional industries—you’ll find Series B and Series C startups recruiting independent directors, whereas in previous eras, only pre-IPO companies would consider board governance seriously.

Third, the IPO pipeline in technology is unprecedented.

Many technology and tech-enabled companies are in various stages of IPO preparation, and each must appoint independent directors well before listing. SEBI’s LODR Regulations require that at least half the board comprises independent directors if the chairperson is executive director, or one-third if the chairperson is non-executive. This creates immediate demand as companies prepare for public markets.

What does this mean practically for you?

If you have technology expertise—cybersecurity, data privacy, cloud architecture, AI/ML, digital transformation—you’re in exceptionally high demand.

Even if your primary career was in traditional industries but you’ve led digital transformation initiatives, you can position yourself as a technology-savvy independent director.

The compensation premium in tech is real: independent directors at well-funded tech startups or listed tech companies earn premium commissions more than peers in traditional industries.

How strong is the demand in BFSI, manufacturing, and ESG sectors?

While technology grabs headlines, the BFSI (Banking, Financial Services, and Insurance) sector remains the prominent employer of independent directors in India. This sector’s regulatory intensity means governance isn’t optional—it’s mandated and monitored continuously.

Banking and Financial Services: Every bank, NBFC, and financial services company must maintain boards with specific expertise. The Reserve Bank of India’s guidelines on corporate governance for banks specifically mandate that independent directors must constitute at least fifty percent of the board. Given India has thousands of NBFCs, hundreds of banks (public, private, and cooperative), and numerous asset management companies, the BFSI sector probably demands appointment of independent directors. If you’re a chartered accountant, have banking experience, or possess risk management expertise, this sector offers the most stable and consistent opportunities. The demand here isn’t driven by growth as much as by regulatory replacement and retirement cycles.

Manufacturing: Traditional manufacturing may seem less exciting than fintech, but it offers substantial opportunities, particularly for professionals with operational, engineering, or supply chain backgrounds. India’s manufacturing sector includes thousands of mid-cap companies in automotive components, industrial machinery, chemicals, and consumer goods. These companies often seek independent directors who understand shop floor operations, quality systems or ISO certifications, and cost optimization. The compensation in manufacturing is generally lower than BFSI or technology, but opportunities are plentiful and less competitive since fewer professionals actively target this sector.

ESG (Environmental, Social, and Governance): This is the emerging frontier, and if you re early in building your independent director career, developing ESG expertise could be your competitive differentiator. Regulatory requirements around ESG reporting, climate risk, and sustainability are accelerating rapidly. SEBI has mandated ESG reporting for top 1,000 listed companies, and this list will expand. Companies need independent directors who can guide ESG strategy, review sustainability reports, and engage with stakeholders on climate and social issues.

The demand for ESG-knowledgeable independent directors currently exceeds supply significantly, creating a niche where you can command premium compensation even without traditional board experience. If you have sustainability credentials, energy sector experience, or social impact backgrounds, this is a high-potential area to focus your board career.

Which types of Companies are recruiting Independent Director the most?

Understanding the company types actively recruiting independent directors will help you calibrate your expectations and target your efforts appropriately.

Listed Companies on NSE and BSE are the most active recruiters by regulation, not choice. Section 149(4) of the Companies Act 2013 mandates that every listed public company must have at least one-third of its board as independent directors.

With over 8,400 companies listed across NSE and BSE, and assuming an average board size of 8-10 directors, you’re looking at approximately 20,000 independent director positions in the listed space alone. Listed companies also tend to pay better, offer more prestige, and provide clearer role definitions than unlisted companies. However, they also demand more—expect 6-8 board meetings annually, extensive committee work, and higher liability exposure.

Pre-IPO Startups and Unicorns represent the growth opportunity. India currently has over 123 unicorns and several hundred companies in the $100 million to $1 billion valuation range, many of which plan IPOs within 3-5 years. These companies need to build governance structures early, meaning they are recruiting independent directors 12-24 months before listing.

Unlisted Public Companies Meeting Thresholds are required to appoint at least two independent directors if they meet any of the following criteria:

- paid-up share capital of ₹10 crore or more,

- turnover of ₹100 crore or more, or

- aggregate outstanding loans/debentures exceeding ₹50 crore.

There are thousands of such companies in India, and many are family-owned businesses professionalizing their governance. These opportunities can be excellent for building initial board experience, though compensation is typically lower than listed companies. The advantage is less competition and often more flexibility in time commitment.

PSUs and Government-Backed Enterprises are increasingly appointing independent directors following government directives to improve corporate governance. The compensation in PSUs is regulated and modest compared to private sector opportunities, but these positions offer stability, prestige, and lower liability risk. If you value reputation over high compensation, PSU independent directorships can be valuable additions to your portfolio, particularly if you’re building a multi-board career.

How to Position Yourself for an Independent Director Job?

The first and foremost requirement is to have an online and offline visibility.

Although, the appointment process for independent directors involves specific legal requirements under the Companies Act 2013 and SEBI regulations, but you need to combine some of the well established practical strategies to position yourself competitively in the market.

First, ensure you meet the basic eligibility criteria under Section 149(6) of the Companies Act 2013:

- you must be a person of integrity with relevant expertise and experience,

- cannot be a promoter or related to promoters/directors,

- must not hold more than 2% voting power in the company, and

- cannot have material business relationships that could compromise independence.

- Your relative should not hold any material interest in the company, among others.

Obtain a Director Identification Number (DIN) by filing Form DIR-3 with the Ministry of Corporate Affairs if you don’t already have one.

Register on the Independent Directors Databank maintained by the Indian Institute of Corporate Affairs. You can learn how to register on Independent Directors Databank by reading my another article on ‘How to become an independent Director’.

Complete your profile comprehensively—companies actively search this database when recruiting, so detailed information about your expertise, industry experience, and qualifications improves your visibility.

You must pass the online proficiency self-assessment test within two years of registration (50 questions, 75 minutes, 50% passing score) unless you qualify for exemptions. The test covers company law, securities regulations, corporate governance, and basic accounting—preparation resources are available on the IICA website. To know more about the Independent Director Exam, read my article on Complete Guide on Independent Exam.

Beyond regulatory compliance, actively build your professional visibility:

- optimize your LinkedIn profile to highlight board-ready experience,

- join professional bodies like the Institute of Directors or industry associations,

- attend corporate governance conferences and seminars,

- publish articles or speak on governance topics, and network with executive search firms specializing in board placements.

Many appointments happen through professional networks rather than job applications, so invest in relationship-building within corporate governance circles. When opportunities arise, prepare thoroughly—research the company’s financial performance, strategic challenges, and governance history, and articulate how your specific expertise addresses their board needs.

How Much Do Independent Directors Earn?

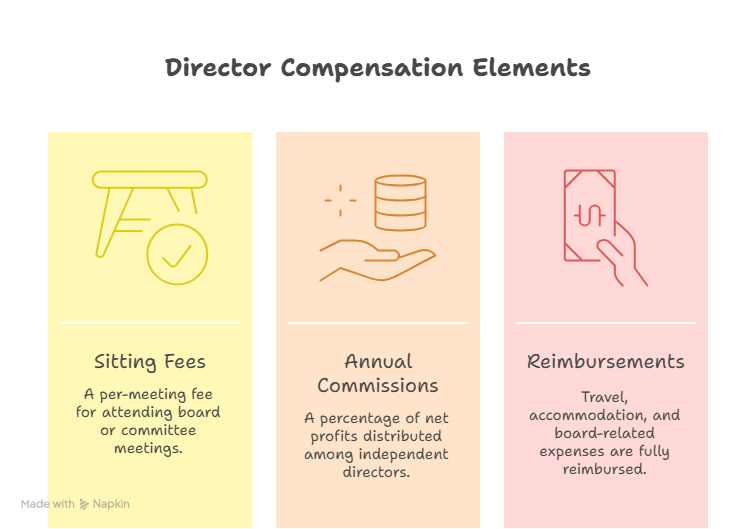

How Is an Independent Director’s Compensation Structured?

Independent director compensation in India has evolved rapidly in recent years, reflecting the rising expectations placed on boards and the growing strategic importance of governance. According to a 2024 Economic Times analysis of Nifty 50 companies, median compensation for independent directors has more than doubled in five years — from ₹35.5 lakh in FY18 to ₹72 lakh in FY23 — with the 75th percentile now around ₹1.04 crore.

Compensation is typically a combination of fixed payments and performance-linked incentives:

- Sitting Fees: This is the most straightforward element of compensation — a per-meeting fee for attending board or committee meetings. Under Rule 4 of the Companies (Appointment and Remuneration of Managerial Personnel) Rules, 2014, companies can pay up to ₹1 lakh per meeting. Smaller companies often pay ₹20,000–₹40,000, while mid-caps range between ₹50,000–₹75,000, and large-cap or blue-chip companies consistently pay at the ₹1 lakh ceiling.

- Annual Commissions: This is where the bulk of earnings often comes from. Under Section 197 of the Companies Act 2013, boards can allocate a percentage of net profits to be distributed among independent directors. For example, a company might set aside 0.5% of net profit, distributing ₹10–35 lakh per director depending on committee roles and performance. According to Business Standard’s FY24 remuneration study, Nifty 50 companies paid a median total compensation of ₹87.4 lakh, up 106% since FY19 — driven largely by increased commission payouts.

- Reimbursements: Travel, accommodation, and board-related expenses are fully reimbursed and do not count toward compensation limits. In some Nifty 50 companies, reimbursements alone can total ₹2–4 lakh annually.

- Equity (for unlisted companies): SEBI’s LODR Regulations prohibit listed companies from issuing stock options to independent directors.

The compensation model is thus highly variable, shaped by company size, profitability, and the director’s individual contribution.

How Do Earnings Differ by Company Size?

Earnings grow substantially as companies scale — and the gap between entry-level and top-tier board roles can be tenfold. Here’s how compensation typically breaks down:

- Small-Cap and Early-Stage Companies (₹2–8 lakh/year): Most first-time directors start here. These positions are often treated as compliance requirements rather than strategic roles, with compensation limited to ₹20,000–₹40,000 per meeting and minimal or no commission. The focus is on building boardroom experience.

- Mid-Cap Listed Companies (₹12–25 lakh/year): With turnover between ₹100–500 crore or market capitalisation between ₹5,000–₹20,000 crore, these boards offer higher meeting fees (₹50,000–₹75,000), profit-based commissions (₹5–12 lakh), and opportunities to serve on key committees.

- Large-Cap Companies (₹25–60 lakh/year): Boards of companies with ₹20,000 crore+ market capitalisation or substantial revenue offer significantly higher commissions — often ₹15–45 lakh annually — and expect deeper strategic involvement. Responsibilities here include regulatory engagement, investor relations, and oversight of high-stakes strategic decisions.

- Nifty-50 and Blue-Chip Boards (₹50 lakh – ₹1.11 crore+/year): At the top end, independent directors in India’s largest companies can earn well over ₹1 crore. According to BoardStewardship.com, 151 directors earned more than ₹1 crore in FY23, and the highest-paid, Om Prakash Bhatt (former SBI Chairman), earned ₹6.74 crore across multiple boards (TCS, Tata Motors, Tata Steel, Hindustan Unilever).

This steep earnings trajectory reflects the growing strategic value and liability associated with independent directorships. While ₹2–5 lakh per year is standard for newcomers, senior directors — especially those with niche expertise in technology, ESG, or risk governance — regularly command ₹50 lakh to ₹1 crore or more annually. Committee chair roles, particularly on audit committees, often add ₹8–10 lakh to total pay.

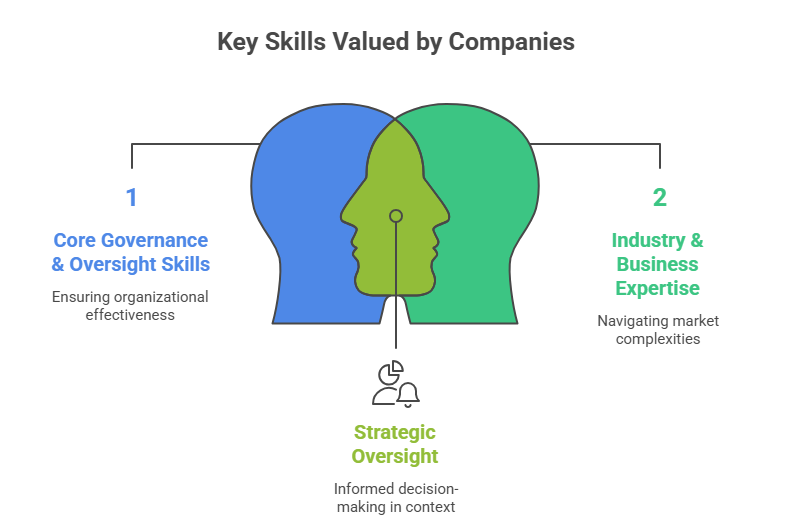

What Skills Are Most Valued by Companies Hiring Independent Directors?

When companies look to appoint an independent director, they are not searching for a figurehead to simply occupy a board seat. They want someone who can elevate strategic conversations, provide informed oversight, and guide the organisation through complex market, regulatory, and operational challenges. The most sought-after directors combine strategic foresight, governance literacy, financial intelligence, and sector-specific insight — along with the judgment to balance competing stakeholder interests.

Core Governance & Oversight Skills

What Strategic Decision-Making and Boardroom Leadership Skills Do Companies Expect from Independent Directors?

You as an Independent directors will be expected to bring a “balcony-view” of the business — the ability to rise above day-to-day decision-making and guide the company toward long-term value creation. This means not just participating in board discussions but shaping them.

For example, in a manufacturing company, directors are often asked to challenge capital expenditure decisions, assess whether automation investments align with future cost structures, or explore strategic partnerships to improve supply chain resilience.

Similarly in a technology firm, they may need to interrogate the product roadmap, test assumptions around scalability, and evaluate the competitive positioning of new innovations. And in healthcare company, strategic input often centres on evaluating R&D priorities, clinical partnerships, or product launch.

In every case, companies expect their independent directors to ask the hard questions, challenge conventional thinking, and ensure that strategic decisions are rooted in long-term value rather than short-term gains.

What Level of Corporate Governance and Regulatory Literacy Do Boards Look for in Independent Directors?

A strong grasp of corporate governance frameworks is a fundamental expectation — but companies want directors who can apply that knowledge in real-world, sector-specific contexts.

Governance risks look very different in a listed entity, where securities regulations, disclosure norms, and shareholder activism dominate board discussions, compared to a family-owned business, where related-party transactions, succession planning, and board independence are more pressing issues.

A banking or fintech company needs directors who understand prudential norms, data governance requirements, and customer protection laws, while a pharma or healthcare board looks for expertise in clinical trial compliance, patient safety, and regulatory approvals.

Boards want directors who don’t just “know the law” but can anticipate regulatory challenges before they become risks — and shape governance structures that align with both legal obligations and evolving stakeholder expectations.

What Financial Acumen and Risk Oversight Capabilities Make Independent Directors Stand Out?

Independent directors must be fluent in the language of finance and risk. That means being able to interpret complex financial statements, challenge management on capital allocation, and ensure the company’s risk appetite aligns with its strategic ambitions. The specifics, however, differ widely by industry.

Industry & Business Expertise

Why Is Deep Sector Knowledge and Market Understanding a Critical Skill for Independent Directors?

One of the most valuable traits an independent director can bring is a deep understanding of the company’s operating environment — including its competitive landscape, customer base, supply chain dynamics, and regulatory pressures.

A former logistics executive, for instance, can offer a manufacturing board fresh perspectives on supply-chain diversification or resilience planning.

Directors with backgrounds in payments or banking can advise fintech boards on navigating licensing regimes or partnering with traditional financial institutions. And those with healthcare or pharmaceutical expertise can help companies make informed decisions about regulatory pathways, market access strategies, or product portfolio diversification. This sector fluency ensures that board discussions are grounded in real-world dynamics, not just theoretical considerations.

How Can Strategic Growth and M&A Expertise Enhance an Independent Director’s Value?

Beyond operational oversight, companies increasingly expect independent directors to shape the organisation’s growth trajectory. This might involve assessing whether an acquisition makes strategic sense, evaluating potential joint ventures, or advising on market-entry decisions. The ability to think beyond “business as usual” and push management toward sustainable, scalable growth is a defining trait of a high-value independent director.

Compliance, Ethics & Stakeholder Protection

What Role Do Independent Directors Play in Strengthening Legal and Regulatory Compliance?

Compliance today is no longer a back-office function — it’s a boardroom priority. Independent directors are expected to anticipate regulatory change, ensure robust compliance frameworks, and oversee risk mitigation.

In a banking or fintech environment, this might involve scrutinising KYC/AML processes or ensuring adherence to RBI guidelines. In healthcare, it could mean overseeing ethical clinical practices and ensuring regulatory filings are robust. And in manufacturing or heavy industry, compliance often extends to environmental and safety standards, labour laws, and ESG reporting obligations. Boards seek directors who can connect these dots — ensuring compliance is not just a legal requirement but a strategic enabler of trust and long-term sustainability.

Why Are Ethical Leadership and Stakeholder Balancing Considered Essential Skills for Independent Directors?

Independence is as much about mindset as it is about status.

Companies value directors who can act as an impartial check on management decisions, even when doing so is uncomfortable. They want individuals who will call out conflicts of interest, insist on transparency, and advocate for decisions that balance shareholder returns with broader stakeholder interests.

For example, a technology company might need a director who questions the ethical implications of data monetisation strategies; a pharma board might rely on independent directors to weigh shareholder demands against patient safety; and a manufacturing company may need someone who ensures that cost-cutting measures don’t come at the expense of worker welfare or environmental obligations.

The most respected directors are those who can hold the tension between profitability, compliance, and purpose — and guide the company toward decisions that stand the test of public scrutiny.

To sum up, the most valued and skilled independent directors are those who combine broad boardroom competencies with deep, contextual understanding of the industries they serve. This rare blend of strategic foresight and sector-specific judgment is what transforms an independent director from a statutory necessity into a strategic asset.

Career Growth and Portfolio Building

How to Build a Portfolio of Board Positions?

Building a portfolio of multiple independent director positions is the optimal strategy for maximizing both income and impact while diversifying risk across companies and industries. Here’s how to approach portfolio construction strategically.

Start by establishing realistic targets based on your career stage and available time. You cannot be a director in more than 20 companies at a time, with a sub-limit of 10 public companies.

However, for independent directors specifically, a more restrictive limit applies:

Each board typically requires 10-20 days annually for meeting preparation, attendance, committee work, and strategic engagement, meaning 3-5 boards consume 30-100 days per year—feasible while maintaining other professional commitments.

When building your portfolio, prioritize diversity across multiple dimensions.

First, diversify by company size: include one large-cap or established company for prestige and stable income, one or two mid-cap companies for growth exposure and substantive engagement, and potentially one small-cap or pre-IPO company for higher upside through equity participation. This mix balances stable compensation with growth potential while preventing overexposure to any single market segment.

Second, diversify by industry sector: serving on boards across different industries (e.g., one technology company, one manufacturing company, one financial services company) reduces sector-specific risk and broadens your expertise, making you more valuable to future board opportunities. It also prevents calendar conflicts—industry-specific events like annual general meetings often cluster around similar times within sectors but vary across sectors.

Third, diversify by geography if feasible through virtual participation: companies in different regions face different regulatory environments, market dynamics, and growth trajectories. A portfolio spanning Mumbai-based financial services, Bangalore-based technology, and Pune-based manufacturing provides geographic diversification of both risk and income sources.

Timing your portfolio expansion matters significantly. Don’t try to join multiple boards simultaneously when you’re starting out—you’ll overwhelm yourself and underperform at all of them. Instead, follow a staged approach: spend 12-18 months on your first board learning governance processes, board dynamics, and regulatory requirements. Add your second board position once you’re fully comfortable with the first. After 2-3 years with two boards, consider adding a third if time permits. This measured approach ensures quality contributions to each board and builds your reputation as an effective independent director.

Balance income predictability with upside potential in your portfolio. Include at least one position at a profitable, stable company that provides reliable commission income regardless of market conditions. This base income supports you financially while you take calculated risks on higher-potential but less certain opportunities like pre-IPO startups. Many successful independent directors maintain a 60/40 split—60% of their portfolio in established companies providing stable income, 40% in growth-stage companies offering upside through equity or higher growth potential.

Manage conflicts of interest proactively as your portfolio grows. Companies generally prohibit independent directors from serving on competitor boards simultaneously—you can’t sit on boards of two banks, two pharmaceutical companies in the same therapeutic area, or two technology companies in identical markets. When building your portfolio, ensure each new opportunity doesn’t create conflicts with existing positions. Always disclose all your directorships during appointment discussions so companies can assess potential conflicts before appointing you.

Leverage your existing portfolio to attract new opportunities. Once you serve on 2-3 boards successfully, executive search firms and companies will approach you proactively rather than you needing to apply to job postings. Your existing board positions demonstrate your governance capabilities and industry knowledge, making you a lower-risk candidate for additional positions. Maintain a public record of your board positions on LinkedIn and in professional directories to maximize this visibility effect.

What Is the Career Progression Path?

The independent director career follows a generally predictable progression, though timing varies based on your starting credentials, networking effectiveness, and market conditions. Understanding this pathway will help you set realistic expectations and make strategic decisions at each stage. Nevertheless, you should not forget that the path to independent director normally starts after attaining atleast 10 years of work experience.

Stage 1: Entry and Credentialing (Year 0): Your career begins with qualification development—obtaining your DIN, registering on the Independent Directors Databank, passing the proficiency test, and building foundational knowledge of corporate governance frameworks. If you’re coming from executive roles, this stage involves repositioning yourself from operator to governance advisor, which requires psychological and skillset shifts. Many aspiring independent directors in this stage pursue certifications in corporate governance, attend board effectiveness programs, or complete courses offered by institutes like IICA or IOD India to formalize their governance knowledge.

Stage 2: First Board Appointment (Year 1-3): Securing your first appointment typically takes 6-18 months of active effort—networking, applying to positions, engaging with executive search firms, and building visibility. Your first position will likely be at a small to mid-sized company paying ₹3-8 lakh annually. Accept this as a learning opportunity rather than focusing on compensation. Your goals in this stage are to learn board processes, understand governance dynamics, develop relationships with other directors and management, and most importantly, demonstrate value so you can leverage this experience for future opportunities.

Stage 3: Building Experience and Portfolio (Year 3-7): Once you’ve served successfully on one board for 2-3 years, opportunities accelerate. You can now add a second board position, and the combination of two boards typically increases your annual compensation from ₹3-8 lakh (single board) to ₹15-30 lakh (two boards combined). During this stage, focus on building diverse experience across industries or company sizes, developing recognized expertise in specific governance areas (audit oversight, risk management, ESG), and cultivating relationships with executive search firms who handle mid-to-upper tier placements.

Stage 4: Established Independent Director (Year 7-12): By this stage, you’ve served on multiple boards, navigated complete business cycles, and developed strong references from chairmen, CEOs, and fellow directors. You can now target large-cap companies and premium positions. Your portfolio might include 3-4 boards generating ₹40-80 lakh total annual compensation. You’re approached proactively for opportunities rather than needing to apply actively. In this stage, focus on quality over quantity—pursue positions where you can make meaningful strategic contributions rather than simply collecting additional board seats for incremental income.

Stage 5: Senior Independent Director (Year 12+): The top tier of independent directors serves on blue-chip and Nifty-50 boards, chairs key committees, potentially serves on regulatory bodies or government advisory panels, and earns ₹80 lakh to ₹2+ crore annually across a portfolio of 3-5 premium positions. You’ve built a public reputation in corporate governance, might publish thought leadership or speak at major conferences, and are considered an industry expert in specific domains. Reaching this tier requires both excellence in governance contributions and strategic personal branding to build visibility beyond the companies you serve.

Alternative Progression—The Specialist Track: Instead of following the generalist path above, some independent directors build careers as recognized specialists in specific domains.

For example, you might position yourself as the leading independent director in cybersecurity, ESG, or fintech regulation. Specialists can sometimes accelerate to higher-paying positions faster than generalists because supply-demand imbalances in specialized areas create premium pricing. If you have deep expertise in a high-demand area, consider explicitly branding yourself as a specialist rather than pursuing diverse industry experience.

The realistic timeline from beginning your independent director journey to achieving ₹50+ lakh annual income from board positions is typically 8-12 years for professionals with strong executive backgrounds. This isn’t a path to quick wealth, but it is a path to substantial second-career income, meaningful governance work, and continued professional relevance beyond traditional retirement age—many successful independent directors remain active well into their 70s because the role doesn’t require the energy demands of executive positions while still utilizing their accumulated wisdom and judgment.

Conclusion

Boardrooms are evolving and so is the definition of leadership.

In a world where companies are judged not just by profits but by governance, ethics, and impact, independent directors stand at the centre of corporate credibility. This is not just a seat at the table but a seat where decisions shape industries, safeguard shareholder trust, and influence the future of business itself.

The window of opportunity is wide open, but it won’t remain so forever.

The professionals who act now by building their credentials, expanding their networks, and stepping into boardrooms will not only accelerate their own careers but also shape the trajectory of India’s corporate landscape for decades to come.

If you’ve ever aspired to make your experience matter beyond your job title, to guide rather than be guided, to lead from the top rather than follow from below — then now is the time. The boardroom is calling.

The question is: will you answer?

Frequently Asked Questions

What is the minimum age to apply for Independent Director jobs?

Under the Companies Act 2013, any individual who is at least 18 years old can be appointed as a director, including an independent director.

However, SEBI regulations impose stricter requirements for listed companies. The minimum age is 21 years as per Regulation 16, and the maximum age is 75 years as per Regulation 17 of the (Listing Obligation and Disclosure Requirement). If you are above 75 years old, your appointment requires approval by a special resolution from shareholders, along with an explanatory statement justifying why your age shouldn’t disqualify you.

How much do Independent Directors earn per board meeting in India?

Independent directors can earn up to ₹1 lakh per board meeting as sitting fees under Rule 4 of the Companies (Appointment and Remuneration of Managerial Personnel) Rules, 2014. In practice, small companies pay ₹20,000-₹40,000 per meeting, mid-cap companies pay ₹50,000-₹75,000, and large-cap or Nifty-50 companies typically pay the maximum ₹1 lakh. Additional committee meeting fees apply separately.

Where can I find Independent Director job vacancies?

You can find independent director vacancies on LinkedIn Jobs India , Indeed India Naukri.com, and specialized platforms like the Independent Directors Databank. Additionally, executive search firms like ABC Consultants, Korn Ferry, and EMA Partners handle premium board placements.

Is the proficiency test mandatory for all Independent Director applicants?

As per Rule 6(4), you don’t need to take the proficiency test if you meet any of the following criteria:

- You’ve practiced as a chartered accountant, cost accountant, company secretary, or advocate for at least 10 years.

- You have 3+ years of experience (from the date of registering on the databank) as a director or key managerial personnel in any of these:

- A listed public company

- An unlisted public company with ₹10 crore+ paid-up capital

- A foreign body corporate with $2 million+ paid-up capital

- A body corporate listed on any stock exchange

- A statutory corporation established in India

- You are or were a government official at the level of Director or above in ministries related to commerce, corporate affairs, finance, industry, or public enterprises.

- You are or were a Chief General Manager (or above) at SEBI, RBI, IRDAI, or PFRDA, with experience in corporate, securities, or economic laws.

Can Chartered Accountants apply for Independent Director positions?

Yes, chartered accountants are highly sought after for independent director positions, particularly for audit committee roles where financial expertise is essential. CAs with 10+ years of practice experience are exempt from the proficiency test requirement and can directly register on the Independent Directors Databank and apply for positions.

How long does it take to get hired as an Independent Director?

It depends on what stage of career you are on. For somebody with 10+ years of experience but no board experience can take up to 6 to 18 months. Candidates with 20+ years of experience in top leadership can get appointed in 6 to 12 months.

Do Independent Directors work full-time or part-time?

Independent directors work part-time, typically committing 10-20 days annually per board position for meeting preparation, attending 6-10 board meetings, serving on 2-3 committees, and engaging in strategic discussions. This allows professionals to serve on multiple boards simultaneously—most successful independent directors maintain portfolios of 3-5 board positions.

What is the demand for Independent Directors in startups?

Demand for independent directors in startups is surging, particularly among VC-backed companies and those preparing for IPO. Pre-IPO companies must establish strong governance structures 12-24 months before listing, creating substantial opportunities. Startups often offer ESOP compensation alongside cash, providing potential upside if the company successfully lists, though base cash compensation may be lower than established companies.

Can I apply for Independent Director jobs in multiple cities?

Yes, you can apply for and serve on boards across multiple cities.

What industries pay the highest salaries to Independent Directors?

As per my estimation, Technology and fintech companies pay the highest independent director salaries, typically 20-40% above other sectors, with compensation ranging from ₹25-35 lakh for senior positions at well-funded unicorns. Banking and financial services (BFSI) also pay premium rates due to regulatory complexity, while traditional manufacturing generally pays at the lower end of the spectrum.

How many companies can I serve as an Independent Director?

You cannot be an independent director in more than 7 listed companies simultaneously in terms of Regulation 17A of SEBI (LODR).

If you are already a whole-time director in any listed company, your independent directorship limit drops to 3 listed companies. These restrictions ensure you have sufficient time and attention to devote to each directorship, preventing overextension that could compromise your effectiveness.

Are there Independent Director jobs for freshers or early-career professionals?

Independent director roles are not suitable for freshers or early-career professionals. Companies seek candidates with substantial professional experience—typically 10 – 15 years minimum—who bring deep domain expertise, strategic judgment, and industry credibility. The role is designed as a second-career opportunity for senior professionals transitioning from executive positions.

What is the typical tenure for Independent Director positions?

Independent directors serve initial terms of up to 5 consecutive years under Section 149(10) of the Companies Act 2013. They can be reappointed for a second 5-year term via special resolution by shareholders, but cannot serve more than two consecutive terms (10 years maximum). After completing two terms, a mandatory 3-year cooling-off period applies before potential reappointment.

Do women Independent Directors receive equal salary as men?

Yes, legally mandated. The Companies Act specifies that sitting fees for independent directors and women directors must be equal to or higher than sitting fees paid to other directors, ensuring no gender-based compensation discrimination. Market data shows women independent directors at comparable companies earn equivalent compensation to male peers at similar experience levels.

How competitive is the Independent Director job market?

The independent director market is moderately competitive but significantly less saturated than executive job markets. With 25,000-30,000 estimated positions across India and continuous turnover due to tenure limits, qualified professionals with strong credentials and strategic networking face reasonable odds of securing positions. Competition intensifies significantly for Nifty-50 and premium blue-chip positions but remains manageable for mid-cap and growth companies.

Allow notifications

Allow notifications