Complete guide to independent director exam eligibility in India: age requirements, exemption categories for CA/CS/professionals, disqualifications, foreign national rules & required documents.

Table of Contents

Understanding independent director exam eligibility can feel like navigating a maze of regulations, exemptions, and documentation requirements.

If you are considering a board position in India’s corporate landscape, you need clarity on whether you must take the proficiency test or qualify for exemption.

The eligibility framework combines provisions from the Companies Act 2013, SEBI regulations, and multiple MCA amendments, creating confusion about who needs the exam and who doesn’t.

This comprehensive guide breaks down every aspect of independent director exam eligibility in India.

I’ll walk you through the general requirements, detailed exemption categories with calculation examples, disqualification criteria that prevent registration, special rules for foreign nationals and government employees, and the complete documentation process. Whether you’re a practicing professional wondering if your experience qualifies for exemption, a foreign national exploring board opportunities, or someone with past disqualifications checking current eligibility, you’ll find definitive answers here.

My goal is simple: by the end of this article, you’ll know exactly where you stand on exam eligibility and what steps you need to take next.

What should you know about independent director exam eligibility requirements in India?

Understanding independent director exam eligibility is the first step for anyone aiming to serve on corporate boards in India.

While the basic process begins with registering on the IICA databank, the rules also allow specific candidates to skip the exam entirely if they meet defined professional or experience-based exemptions.

Independent director exam eligibility only makes sense once you understand the statutory concept of an independent director itself — including how Section 149 defines independence, the role expected under corporate governance principles, and the safeguards built into the Companies Act. A helpful primer that explains these fundamentals in plain language is available here.

Nevertheless, before diving into detailed criteria, it helps to have clarity on how the eligibility framework works and who actually needs to take the test.

What makes someone eligible for the independent director exam

The independent director exam follows a two-tier eligibility system in India.

First, you must register with the Independent Directors Databank maintained by IICA (Indian Institute of Corporate Affairs) under Section 150 of the Companies Act 2013. Registration itself has minimal barriers—any individual meeting basic criteria can apply to be included in the databank. Once your name appears in the databank, you become eligible to attempt the online proficiency self-assessment test.

However, eligibility doesn’t mean mandatory.

The system creates three pathways:

- professionals with 10+ years of practice in specified fields are exempt from the exam,

- individuals with 3+ years of experience as directors or key managerial personnel in qualifying entities are exempt, and

- everyone else must pass the exam within two years of databank registration.

Understanding which pathway applies to you determines whether you need to prepare for the test or can proceed directly to seeking board appointments with your exemption status.

To understand the format, syllabus, passing criteria and preparation tips, read our full breakdown of the Independent Director Exam.

Relationship between databank registration and exam eligibility

Databank registration and exam eligibility are sequential, not simultaneous.

You cannot take the proficiency test without first being included in the Independent Directors Databank. Think of registration as the gate that opens exam access—your databank inclusion date starts the critical two-year clock within which you must pass the test if you don’t qualify for exemption. Rule 6(4) of the Companies (Appointment and Qualification of Directors) Rules 2014 explicitly states that individuals must pass the exam within two years from the databank inclusion date.

If you fail to pass within this two-year window, your name gets removed from the databank automatically.

This removal affects your eligibility for independent director appointments since companies can only appoint individuals whose names appear in the databank. You can apply for restoration by paying ₹1,000 + GST and passing the exam within one year of restoration, but prevention is better—understanding your exemption status before registration helps you avoid this situation entirely.

Who is required to take the independent director exam?

Like I said before, not everyone listed in the IICA databank is automatically required to take the independent director exam.

The obligation depends on whether an individual qualifies for any of the statutory exemptions based on professional practice or board-level experience. This section explains who must sit for the exam, how first-time applicants are treated, and the circumstances in which the test becomes mandatory.

Independent director exam eligibility for first-time applicants

First-time applicants face the most straightforward eligibility assessment.

If you’ve never served as a director or key managerial personnel in any company, and you don’t hold professional qualifications like CA/CS/CMA with 10+ years of practice, you must take the exam.

The Companies (Appointment and Qualification of Directors) Rules make no exceptions for education level, industry experience, or management credentials—the exam requirement applies universally to those outside exemption categories.

Your first step is an honest self-assessment against the exemption criteria covered in the later part of this guide. If you don’t meet any exemption category, accept that the exam is mandatory and start preparing.

The good news: the proficiency test isn’t exceptionally difficult for well-prepared candidates, and you get unlimited attempts within your two-year window with only a one-day gap required between attempts. First-time applicants often find the exam manageable with 30-60 days of focused preparation covering Companies Act provisions, SEBI regulations, basic accounting, and corporate governance fundamentals.

DIN and IICA registration prerequisites

You don’t need a Director Identification Number (DIN) to register with the IICA databank or take the proficiency exam. DIN becomes mandatory only when a company formally appoints you as an independent director, not during the eligibility and examination phase. Many candidates obtain DIN parallel to databank registration so their documentation is complete when board opportunities arise, but it’s not a prerequisite for exam eligibility.

IICA databank registration, however, is absolutely mandatory before attempting the exam. You cannot book an exam slot without an active databank profile.

The registration process requires basic identity documents (PAN or passport for foreign nationals), address proof, educational certificates, and payment of ₹5,000 + GST for one year, ₹15,000 + GST for five years, or ₹25,000 + GST for a lifetime subscription.

Once registered, your exam eligibility activates immediately, though you should review the exemption criteria carefully before booking your first test slot.

What are the minimum eligibility requirements for taking the exam?

Once you understand who needs to take the exam, the next question is what minimum criteria must be met before registering for it.

Unlike many professional certifications, the independent director exam does not impose strict educational or nationality-based barriers—but there are still a few foundational conditions every applicant must satisfy. This section breaks down those basic requirements so you know the threshold before preparing for or scheduling the test.

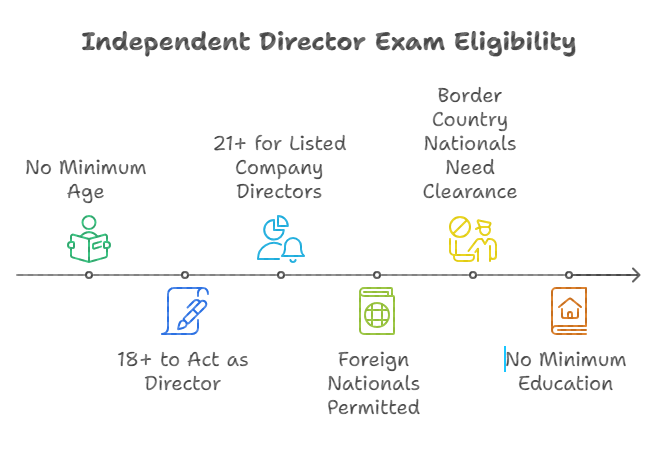

What is the minimum age for independent director exam eligibility?

The Companies Act 2013 imposes no minimum age restriction for independent director exam eligibility. Section 149, which governs independent director appointments, doesn’t specify any age requirement for taking the proficiency test or being included in the databank. Theoretically, even individuals below 21 years could register and attempt the exam, though practical appointment opportunities would be limited by their youth and lack of business experience that companies typically seek.

Although SEBI mandates a minimum age of 21 years only for independent directors of listed companies under Regulation 16 of the SEBI (LODR) Regulations 2015, there is no minimum age to enrol in the IICA databank or to appear for the proficiency test.

However, to legally give consent to act as a director in any company—listed or unlisted—an individual must be at least 18 years old, because a director’s consent is a valid contract and the Indian Contract Act, 1872 requires a person to be a major to enter into a legally enforceable agreement.

Accordingly:

- You may take the exam at any age.

- You may be appointed as an independent director of an unlisted public company once you are 18 (since no separate statutory age bar exists).

- For listed companies, you must satisfy both thresholds: minimum 18 years under contract law and minimum 21 years under SEBI LODR.

Do applicants need to be Indian citizens or residents?

Indian citizenship is not mandatory for independent director exam eligibility. Foreign nationals can register with the IICA databank, take the proficiency test, and serve as independent directors in Indian companies subject to regulatory compliance. Section 149(6) of the Companies Act 2013 defines independence criteria without imposing nationality restrictions. The databank registration system accommodates foreign nationals by allowing passport-based registration for those without Indian PAN cards.

However, foreign nationals from countries sharing land borders with India face additional scrutiny. An MCA notification dated June 1, 2022, mandates security clearance from the Ministry of Home Affairs for nationals of land-border countries seeking independent director appointments. This requirement affects citizens of Pakistan, China, Afghanistan, Bangladesh, Myanmar, Nepal, and Bhutan. While they remain eligible to take the exam, their appointment process involves security verification that doesn’t apply to other foreign nationals or Indian citizens.

I’ll cover the detailed foreign national eligibility process in the later part of this guide.

What educational qualifications are required?

No specific educational qualification is mandatory for independent director exam eligibility under the Companies Act 2013 or Companies (Appointment and Qualification of Directors) Rules 2014.

Rule 5 of these Rules states that independent directors should possess “appropriate skills, experience and knowledge” in relevant fields, but this assessment happens at the board level during appointment, not as an exam eligibility criterion. You could theoretically register for the databank and take the exam with just a high school education.

That said, practical success requires business acumen and legal understanding. The exam tests knowledge of company law, securities regulations, basic accounting, and corporate governance—areas where formal education provides substantial advantages. Legal professionals understand the Companies Act provisions naturally, commerce graduates grasp financial statements easily, and even engineers or scientists can succeed with systematic preparation. Your educational background affects exam preparation difficulty but doesn’t determine eligibility. Focus on building the knowledge required to pass rather than worrying about degree requirements that don’t exist.

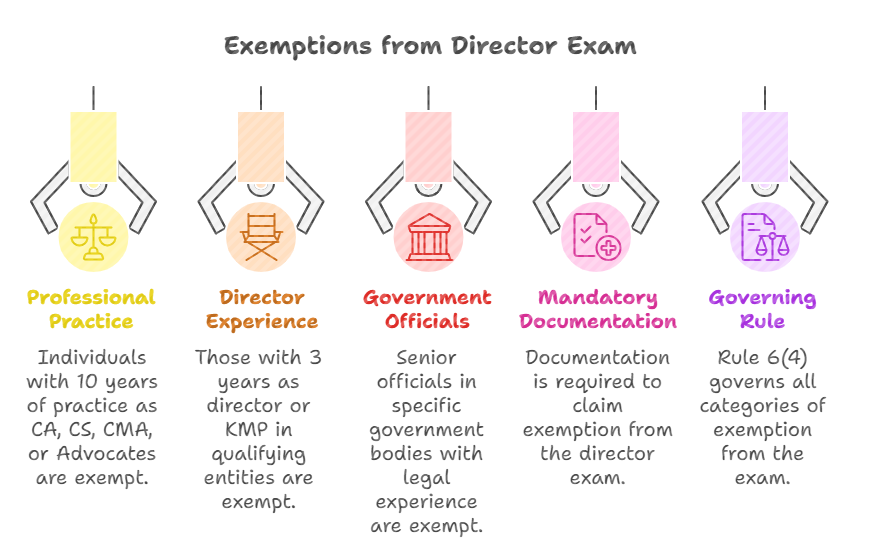

Who is exempt from passing the independent director exam?

While many candidates will have to pass the exam to remain in the databank, the law deliberately carves out exemptions for those who are already considered sufficiently experienced.

These exemptions recognize long-term professional practice, prior board-level roles, and certain senior government or regulatory positions. Before preparing for the test, it’s important to understand whether you already qualify to bypass it altogether—and what proof is needed to claim that benefit.

How does the 10-year professional practice exemption work?

The 10-year professional practice exemption applies to four categories:

- chartered accountants,

- company secretaries,

- cost accountants, and

- advocates who have practiced for at least 10 years as of their databank registration date.

Rule 6(4) of the Companies (Appointment and Qualification of Directors) Rules 2014 explicitly exempts these professionals from the proficiency test requirement. The rationale is simple—a decade of practice in these fields demonstrates sufficient knowledge of corporate governance, legal compliance, and financial matters that the exam is redundant.

The 10-year period must be continuous professional practice, not just holding the qualification.

For advocates, this means practicing before a High Court or higher courts for at least 10 years. For CAs, CSs, and CMAs, it means active practice with a certificate of practice issued by the respective institute. If you obtained your CA qualification 15 years ago but practiced for only 8 years before joining corporate employment, you don’t qualify for exemption—the practice period, not qualification vintage, determines eligibility.

When registering for the databank, you’ll need to provide practice certificates from ICAI/ICSI/ICMAI or Bar Council showing your continuous 10-year practice period.

Who qualifies under the 3-year director or KMP exemption?

The 3-year exemption applies to individuals who have served as directors or key managerial personnel (KMP) for at least 3 years as of their databank registration date in specified entities.

These qualifying entities include:

- listed public companies,

- unlisted public companies with paid-up share capital of ₹10 crore or more,

- body corporates listed on any stock exchange,

- foreign body corporates with paid-up capital of $2 million or more, and

- statutory corporations established under central or state acts carrying on commercial activities.

Here’s the critical calculation rule that many miss: if you served as director or KMP in multiple qualifying entities simultaneously, that concurrent period counts only once toward your 3-year requirement. For example, if you were KMP in two listed companies from 2020-2023, you have 3 years of qualifying experience—not 6 years. The proviso to Rule 6(4) explicitly states that concurrent service is counted only once. This prevents people from artificially inflating experience through simultaneous positions. You’ll need experience letters from all companies where you served, showing your designation (director/KMP), tenure with specific dates, and the company’s qualifying status (listed/unlisted with capital details/statutory corporation nature).

Are government and regulatory officials exempt from the exam?

Government officials with specific seniority levels and experience qualify for exam exemption under Rule 6(4). Two categories exist: first, officials in the pay scale of Director or equivalent or above in the Ministry of Corporate Affairs, Ministry of Finance, Ministry of Commerce and Industry, or Ministry of Heavy Industries and Public Enterprises, with experience handling matters relating to corporate laws, securities laws, or economic laws. Second, officials in the pay scale of Chief General Manager or above at SEBI, RBI, IRDAI, or PFRDA, with similar relevant experience.

The experience requirement is critical—merely holding the pay scale isn’t sufficient. You must have at least 3 years of experience as of databank registration date in the specified pay scale while handling corporate/securities/economic law matters. A Chief General Manager at RBI who worked exclusively on monetary policy without any corporate governance exposure wouldn’t qualify for exemption despite meeting the pay scale criterion. When claiming this exemption, you’ll need an official certificate from your department confirming your pay scale, tenure in that scale, and specific experience in relevant areas of corporate governance or securities regulation.

How do you calculate eligibility and experience periods?

All eligibility and exemption calculations use your databank registration date as the reference point.

If you register on March 15, 2025, your 10-year professional practice must span March 15, 2015, to March 15, 2025; your 3-year director/KMP experience must cover March 15, 2022 to March 15, 2025, and any government service must meet the 3-year threshold by March 15, 2025. Partial years matter—2 years 11 months doesn’t satisfy a 3-year requirement even though you’re one month short.

For concurrent positions, count calendar time only once.

If you were a director in Company A (Jan 2020-Dec 2022) and Company B (Jan 2021-Dec 2023), your total qualifying period is 4 years (Jan 2020-Dec 2023), not 6 years added sequentially.

For professional practice calculation, gaps matter significantly. If you practiced as a CA from 2010-2015, then joined a company as CFO from 2015-2020, then resumed practice in 2020, you cannot count the corporate employment period toward the 10-year practice requirement. Only periods with an active certificate of practice issued by ICAI count. Maintain clear documentation showing continuous periods without gaps when claiming exemptions—IICA may request verification during databank review.

What factors can disqualify you from taking the exam?

Before getting into statutory disqualifications, it’s important to understand that eligibility isn’t just about meeting age, qualification, or experience thresholds—your legal standing also matters. Even highly qualified professionals can be barred from the process if they fall within specific statutory exclusions.

This is where Section 164 comes into play, because certain corporate or personal defaults can block you from taking the exam altogether, regardless of your credentials.

Section 164 disqualifications that affect Independent Director Exam Eligibility

Section 164 of the Companies Act 2013 lists specific disqualifications that prevent someone from being appointed as a director. While technically these disqualifications apply to appointments rather than exam eligibility, IICA’s databank inclusion process screens for Section 164 violations. If you’re currently disqualified under Section 164, your databank registration may be rejected, effectively preventing exam eligibility. The rationale is straightforward—there’s no point allowing someone to take the exam when they cannot legally accept independent director appointments even after passing.

Section 164 disqualifications include: conviction by a court involving moral turpitude with sentence of at least 6 months (disqualification lasts 5 years from conviction), being an undischarged insolvent, being ordered by NCLT to not hold directorships due to fraud, misfeasance or persistent default (variable periods), and failure to file financial statements or annual returns for 3 consecutive years in any company where you were director (applies until the pending documents are filed). If any of these apply to you currently, resolve the underlying issue before attempting databank registration. For conviction-based disqualifications, wait until the 5-year period expires. For filing defaults, complete all pending filings in companies where you were a director.

Do criminal convictions or court orders stop exam registration?

Not all criminal convictions trigger disqualification—any offence for which the individual is sentenced to imprisonment for at least six months — whether involving moral turpitude or otherwise — results in 5 years of disqualification after expiry of sentence.

Moral turpitude typically includes fraud, forgery, embezzlement, theft, and similar dishonest conduct, but traffic violations or minor regulatory offenses generally don’t qualify. The disqualification lasts 5 years from the date of conviction. During this period, you cannot register with the databank or take the exam even if you’ve served your sentence and been released.

Court orders specifically barring you from holding directorships create absolute disqualification until the order is vacated. SEBI can impose director disqualifications through consent orders or adjudication proceedings for securities law violations. The National Company Law Tribunal can order director disqualifications for fraud, misfeasance, or gross negligence. If you’re subject to any such order, you must first approach the relevant authority for vacation or modification of the order before becoming eligible for databank registration. The order duration varies—some specify fixed periods like 3 or 5 years, while others may be indefinite until specific conditions are met.

Can you take the exam if your disqualification is still under appeal?

Section 164 disqualifications apply immediately from the date of conviction or order, regardless of pending appeals. Even if you’ve appealed your conviction to a higher court or challenged a SEBI/NCLT order, the disqualification remains operative until the appellate authority grants a stay or sets aside the original decision. Merely filing an appeal doesn’t suspend your disqualification or restore exam eligibility—you need an express stay order from the appellate forum.

If you obtain a stay on your disqualification from a competent court or tribunal, preserve that order carefully as you’ll need to submit it during databank registration. IICA will verify the stay order’s validity before processing your application. However, stay orders are often conditional and time-bound. If your stay expires or gets vacated before you complete the exam and receive appointments, your eligibility vanishes retroactively. The safest approach: if possible, resolve the underlying disqualification completely through appeal success rather than relying on temporary stays. Once the appellate authority sets aside your conviction or disqualification order, you become cleanly eligible without ongoing litigation risks.

Are there special eligibility rules for foreign nationals and government employees?

Before examining the specific rules that apply to foreign nationals and government employees, it helps to step back and see why these categories are treated differently. Independent director roles involve access to sensitive financial and governance information, potential conflicts of interest, and regulatory oversight concerns.

As a result, the law builds in additional safeguards—not to restrict these candidates unfairly, but to ensure that appointments in these categories comply with national security, procedural, and public service integrity requirements.

Can foreign nationals register without a PAN?

Yes, foreign nationals can register with the IICA databank using their passport details instead of a PAN card. Rule 4(2)(a) of the Companies (Creation and Maintenance of Databank of Independent Directors) Rules 2019 specifically accommodates foreign nationals by allowing passport-based registration. When you access the databank registration portal, you’ll see options to register using DIN, PAN, or passport—select passport and provide your passport number, nationality, and other required details.

The registration process for foreign nationals is otherwise identical to Indian citizens:

- upload identity proof (passport serves this purpose),

- address proof from your home country,

- educational certificates, and

- professional qualification documents if claiming exemption.

You’ll pay the same databank registration fee (₹5,000 + GST minimum). After successful registration, you can book exam slots just like Indian applicants.

The only limitation: you cannot obtain a DIN without a PAN, so you’ll need to apply for a PAN from the Income Tax Department before companies can formally appoint you post-exam, since a DIN requires a PAN as a prerequisite.

What security clearances are required for land-border country nationals?

The MCA notification dated June 1, 2022, introduced mandatory security clearance from the Ministry of Home Affairs for nationals of countries sharing land borders with India. This requirement affects citizens of Pakistan, China, Afghanistan, Bangladesh, Myanmar, Nepal, and Bhutan who seek appointment as independent directors.

Importantly, the security clearance requirement applies to appointments, not to exam eligibility or databank registration—you can register and take the exam without security clearance.

However, a practical strategy suggests obtaining security clearance before investing time in the exam if you’re from an affected country.

The clearance process can take several months, and there’s no guarantee of approval, especially for Pakistani and Chinese nationals, where geopolitical considerations may influence decisions. Apply for security clearance through the Ministry of Home Affairs, following their prescribed format and procedures. Once obtained, the clearance enables companies to appoint you as an independent director. Without clearance, you might pass the exam but face appointment barriers.

The security clearance requirement depends on current citizenship, not OCI status. If an individual is still a citizen of a land-border country, they must obtain MHA clearance even if they hold OCI status. Only if the individual holds citizenship of a non-land-border country does the clearance requirement not apply.

Do government employees need departmental permission?

Government employees don’t need departmental permission to register with the IICA databank or take the proficiency exam. These are personal capacity activities—you’re building eligibility for potential future roles, not accepting actual appointments. However, accepting an independent director appointment while in government service absolutely requires departmental permission under conduct rules applicable to central and state government employees.

Most government departments have specific policies on outside directorships.

Some permit directorships in government companies or PSUs without restriction, some allow limited private sector directorships with prior approval, and some prohibit all outside commercial activities during service. Before investing time in the exam, clarify your department’s policy on director positions.

If you’re planning to serve as an independent director while continuing government employment, obtain written permission from your competent authority.

The safer approach for government employees: register for the databank and take the exam while in service (no permission needed), but only accept board appointments after retirement or with explicit departmental approval citing the specific conduct rule that permits such activity.

Should you take the exam if you are close to qualifying for an exemption?

If you’re within 6-12 months of qualifying for an exemption, strategic timing can save you exam preparation effort.

For example, if you have 9 years 6 months of CA practice and will complete 10 years in 6 months, waiting makes sense—you can register for the databank after completing 10 years and claim exemption immediately. Similarly, if you’re serving as KMP in a listed company and will complete 3 years in 8 months, delaying registration avoids the exam requirement.

However, if you’re more than a year away from exemption qualification, take the exam rather than waiting. The two-year window after registration provides ample time for exam completion, and passing early maximizes your board opportunity timeline. Moreover, circumstances can change—you might leave your KMP position before completing 3 years, or your practice might be interrupted by personal circumstances.

Once you’ve passed the exam, your qualification is permanent regardless of subsequent career changes. The exam isn’t exceptionally difficult for prepared candidates, so “waiting for exemption” when you’re 1-2 years away often just delays your board career without material benefit. Make a pragmatic decision: if exemption is imminent (under 6 months), wait; if it’s distant (over 12 months), take the exam now.

What documents do you need to prove eligibility or claim an exemption?

Before gathering documents, it’s worth understanding why the paperwork matters so much. The databank isn’t just a registration system—it acts as a compliance filter to ensure only genuinely eligible individuals move forward.

Because exemption claims and eligibility checks rely entirely on what you submit, the documentation stage becomes the real test of credibility.

Properly organised and correctly formatted records can make the process seamless, while incomplete or inconsistent paperwork is the most common reason for rejection.

Accepted identity and address proofs

For identity verification, IICA accepts government-issued photo identity documents, including Aadhaar card, PAN card, passport, voter ID card, or driving license. The name on your identity document must match exactly with your databank registration details—even minor spelling variations can cause rejection. If you’re an Indian citizen, a PAN card serves a dual purpose as both an identity proof and a tax identification. Foreign nationals should use their passport as a primary identity document since they won’t have an Indian PAN initially.

Address proof requires documents showing your current residential address:

- Aadhaar card (most preferred),

- passport,

- driving license,

- voter ID,

- bank account statements from the last 3 months, or utility bills (electricity, water, gas, telephone) in your name from the last 3 months.

If you’re residing at a rented accommodation where utilities aren’t in your name, use your rental agreement along with owner’s property documents.

Foreign nationals can submit address proof from their home country—a government-issued ID showing residential address, utility bills, or bank statements in their home country are acceptable. Ensure address documents are current (not more than 3 months old for bills/statements) and clearly legible when scanned.

Required academic and qualification documents

Upload scanned copies of your highest educational qualification certificate—bachelor’s degree, master’s degree, or professional qualification certificates.

The educational documents serve two purposes: they verify your claimed qualifications on the databank profile, and they help companies assess your suitability for board positions requiring specific expertise. If you hold professional qualifications like CA/CS/CMA/Advocate that form the basis of exemption claims, those certificates become mandatory.

Ensure your academic documents are complete:

- degree certificate showing qualification awarded,

- year of completion, and

- university seal.

Mark sheets alone without degree certificates are generally insufficient. If your original degree is in a language other than English or Hindi, provide certified English translations along with originals.

For professional qualifications, upload membership certificates from ICAI/ICSI/ICMAI or Bar Council enrollment certificates showing your membership number and enrollment date. These membership documents help calculate whether you meet the 10-year practice exemption threshold. Keep all educational documents in PDF format under 2 MB file size for smooth upload during registration.

Required certificates for exemption claims

For the 10-year professional practice exemption, you need a certificate of practice (COP) from ICAI for CAs, ICSI for CSs, ICMAI for CMAs, or Bar Council enrollment certificate for advocates. The certificate must show continuous practice for at least 10 years as of your databank registration date.

Additionally, obtain a statement from your professional institute or Bar Council confirming your practice period—ICAI provides “Practice Period Certificate” upon request, ICSI similarly issues practice confirmation letters. These documents prove you weren’t just a qualified professional but actively practiced for the requisite decade.

For the 3-year director/KMP exemption, collect experience letters from every company where you served as director or KMP during the qualifying 3-year period.

Each letter must specify: your designation (Independent Director/Managing Director/Whole-time Director/KMP specifying position), exact tenure with joining and leaving dates, the company’s qualifying status (listed company, unlisted with ₹10 crore paid-up capital, statutory corporation under which Act, foreign body corporate with capital), and company letterhead with authorized signatory signature and seal.

If you were the director, attach copies of your appointment resolutions from board meetings. If companies you previously served have been wound up or are untraceable, obtain your director records from the MCA portal showing your directorship history—this serves as alternative proof when experience letters are unavailable.

What to do if IICA rejects your eligibility documentation

IICA rejection typically occurs for specific document deficiencies:

- name mismatches between documents,

- unclear/illegible scans,

- documents in unsupported formats,

- incomplete exemption claim documentation, or documents not meeting specified criteria (expired address proofs, incomplete experience letters, insufficient practice period proof).

Your rejection notification will specify the deficiency reason.

Carefully read the rejection communication to understand exactly what’s missing or incorrect.

Rectify the identified deficiency and resubmit. For name mismatches, if your name has changed due to marriage or a legal name change, submit a name change gazette notification or marriage certificate along with both old and new name documents. For illegible scans, rescan documents at a higher resolution, ensuring all text is clearly readable.

For incomplete exemption claims, obtain the specific missing certificates—if your practice certificate doesn’t show 10-year continuity, get a detailed practice period statement from your institute.

If initial rejection was due to substantive eligibility issues (you genuinely don’t meet criteria), you cannot appeal—either wait until you meet the criteria or accept that you must take the exam. IICA’s eligibility assessment follows statutory rules without discretionary exceptions.

Conclusion

Independent director exam eligibility in India follows a structured framework balancing accessibility with quality standards. While basic eligibility criteria are minimal—any individual can register for the IICA databank regardless of age, nationality, or educational background—the system recognizes professional expertise through well-defined exemptions.

If you’ve practiced as a CA/CS/CMA/Advocate for 10+ years or served as director/KMP in qualifying entities for 3+ years, you’re exempt from the exam. Everyone else must pass the proficiency test within two years of databank registration.

Your next steps depend on your exemption status. If you qualify for exemption, gather the required practice certificates or experience letters and proceed directly to databank registration, claiming exemption during the process.

If you don’t qualify for exemption, register for the databank and schedule your exam preparation timeline to ensure you pass within the two-year window. If you’re currently disqualified under Section 164, resolve the underlying issue—complete pending filings, wait for conviction disqualification periods to expire, or obtain appellate stays—before attempting registration.

The independent director ecosystem in India is growing rapidly with increasing demand for qualified, ethical board members.

By understanding your eligibility status clearly and completing the necessary documentation systematically, you position yourself to participate in this expanding governance landscape.

Nevertheless, eligibility for the exam is just one part of the larger journey toward board readiness. For those who are still exploring the full pathway from qualification to appointment, including required skills, onboarding and compliance, we’ve covered the entire process in a separate guide on how to become an independent director.

Frequently Asked Questions

Can I take the exam if I’m under 21 years old?

Yes, the Companies Act imposes no minimum age for exam eligibility. However, SEBI Regulation 16 requires 21+ years for listed company independent director appointments.

Do I need to pass the exam if I have 15 years of CA practice?

No, you’re exempt from the exam if you have 10+ years of practice as a chartered accountant with a valid certificate of practice.

What if I served as a director in a private company for 5 years?

Private company directorships don’t qualify for the 3-year exemption unless the company meets the ₹10 crore paid-up capital threshold for unlisted public companies.

Can foreign nationals from Pakistan or China take the exam?

Yes, they can register and take the exam, but they need the Ministry of Home Affairs security clearance before accepting independent director appointments.

Does my Section 164 disqualification from 8 years ago still affect eligibility?

No, most Section 164 disqualifications last 5 years from conviction. After 8 years, your disqualification has expired and you’re eligible for registration.

Can I register for the exam before obtaining my DIN?

Yes, DIN is not required for databank registration or taking the exam—it becomes mandatory only when companies formally appoint you as independent director.

How do I prove 3 years of KMP experience spanning multiple companies?

Obtain experience letters from each company showing your KMP designation, tenure dates, and company’s qualifying status—concurrent periods count only once toward 3 years.

What happens if I don’t pass the exam within 2 years of registration?

Your name gets removed from the databank. You can apply for restoration by paying ₹1,000 + GST and passing within one year of restoration.

Can government employees on deputation claim exemption?

Yes, if your deputation position meets the pay scale criteria (Director-equivalent or Chief General Manager-equivalent) with 3+ years relevant experience in specified ministries/regulators.

Is there any age upper limit for taking the exam?

No, there’s no maximum age restriction for exam eligibility or independent director appointments under the Companies Act or SEBI regulations.

Do I need to take the exam again if my databank registration expires?

No, your exam qualification has lifetime validity—you only need to renew your databank registration, not retake the exam.

Can I take the exam if I have a pending criminal case?

Yes, pending cases don’t disqualify you—only actual convictions involving moral turpitude with 6+ month sentences trigger a 5-year disqualification from the conviction date.

How is the 10-year practice period calculated for advocates?

Practice period means active practice before High Courts or higher, calculated from Bar Council enrollment to databank registration—gaps and non-practice periods are excluded.

What if I’m eligible under multiple exemption categories?

You only need to claim one exemption category during registration—choose whichever you can most easily document with certificates and experience letters.

Can retired directors claim the 3-year experience exemption?

Yes, the 3-year experience is calculated as of your databank registration date—past service counts even if you’re currently retired from directorship positions.

Allow notifications

Allow notifications