Discover Enrolled Agent salary in India: ₹5-25 LPA in traditional roles, ₹30-50+ LPA for remote work. Complete guide with Big 4, BPO, and freelance salary data for Indian EAs.

Table of Contents

What is the Average Enrolled Agent Salary Range in India?

If you’re considering becoming an Enrolled Agent in India, the first question on your mind is probably, “How much will I actually earn?” Let me give you a clear, data-backed answer that cuts through the confusion you’ll find online.

The Enrolled Agent salary in India varies significantly based on your experience, employer, and work arrangement. According to multiple authoritative sources, Indian EAs earn anywhere from ₹3.5 lakhs per annum as absolute beginners to over ₹25 lakhs per annum for senior professionals in top firms. Your actual earning potential depends on strategic choices you make about specialization, employer type, and whether you pursue traditional employment or remote opportunities.

The EA certification is gaining serious traction in India because of one powerful reality: U.S. companies are increasingly outsourcing tax work to Indian professionals who understand U.S. tax laws. This creates a unique income arbitrage opportunity. You can access higher compensation levels than traditional Indian accounting roles while living in India with its lower cost of living.

Your EA credential gives you IRS authorization to represent taxpayers before the Internal Revenue Service. This specialized expertise commands premium compensation, especially when you work directly with U.S.-based clients or tax firms.

Current Enrolled Agent Salary Market Data from Multiple Sources (Glassdoor India, Indeed India, LinkedIn Jobs)

Let me walk you through what different salary aggregators are reporting so you can get a realistic picture of current EA compensation in India. I’ve cross-referenced data from Glassdoor, Indeed India, and PayScale India to give you the most accurate market snapshot.

Glassdoor India reports an average Enrolled Agent salary of ₹5.5 lakhs per annum based on salary submissions from Indian EAs. The range they show is ₹5 lakhs (25th percentile) to ₹6 lakhs (75th percentile), which translates to approximately ₹45,833 per month or ₹264 per hour. This data comes from only a handful of sources, so it likely represents entry-level positions at smaller firms rather than the full earning spectrum.

Indeed India shows a notably higher average at ₹9.55 lakhs per annum for Enrolled Agents working in India. This figure aligns more closely with what I see mid-level EAs earning, especially those working for established outsourcing firms or Big 4 companies. The Indeed data appears to capture a broader range of experience levels, which explains why their average is significantly higher than Glassdoor’s entry-level-heavy sample.

PayScale India reports that entry-level Enrolled Agents with less than 1 year of experience earn an average total compensation of ₹4.88 lakhs based on 13 salaries, while early career EAs (1-4 years experience) earn ₹4.66 lakhs based on 18 salaries. Their certification data shows a much wider range of ₹2.48 lakhs to ₹20 lakhs, reflecting the enormous salary variance based on employer type and work arrangement.

LinkedIn Jobs data for EA positions in India shows advertised salary ranges typically between ₹6 lakhs and ₹12 lakhs for most postings, with senior roles at Big 4 firms and specialized tax companies offering ₹15-20 lakhs. What’s interesting about LinkedIn data is that it captures what employers are willing to pay rather than what employees report earning, giving you insight into current market demand.

Here’s my synthesis of all these sources: If you’re just starting out, expect realistic offers in the ₹5-8 lakh range from reputable firms. Mid-career EAs with 3-5 years of experience typically earn ₹10-15 lakhs, while senior EAs with specialized expertise command ₹18-25 lakhs or more. The wide variance you see across sources reflects the huge difference between working for a small outsourcing firm versus a Big 4 company, and between traditional employment versus high-paying remote freelance work.

One critical insight these aggregate salary sites miss: they don’t capture the growing number of Indian EAs earning in dollars by working directly with U.S. clients remotely. These professionals often earn $20-40 per hour (₹15-30 lakhs annually), which dramatically exceeds the traditional employment figures you’ll find on salary databases. I’ll dive deeper into this remote work premium in the sections ahead.

Enrolled Agent Salary by Experience Level in India

Understanding how your EA salary evolves with experience is crucial for planning your career trajectory. Let me break down what you can realistically expect to earn at each stage of your EA career in India, based on current market data and hiring patterns I’m seeing.

What is the Entry-Level Enrolled Agent Salary in India?

When you first clear all three parts of the Special Enrollment Examination and receive your EA credential, you’re entering the job market as a federally authorized tax professional but you’re still building practical experience. Here’s what you can expect in terms of compensation during your first 1-2 years.

Entry-level Enrolled Agents in India typically earn between ₹3.5 lakhs and ₹8 lakhs per annum, with the wide range reflecting significant differences in employer type and job location. If you join a mid-sized business process outsourcing firm or a regional tax consultancy, you’ll likely start at the lower end around ₹3.5-5 lakhs. However, if you secure a position at a Big 4 accounting firm like Deloitte, PwC, KPMG or EY, your starting salary jumps to ₹7-10 lakhs per annum.

The most common entry-level salary you’ll see advertised is around ₹5-6 lakhs per annum in cities like Bangalore, Hyderabad, or Mumbai. This typically comes with standard benefits like health insurance, paid time off, and often support for Continuing Professional Education (CPE) credits you’ll need to maintain your EA credential. At this stage, you’re primarily working on individual tax return preparation, basic business returns, and learning the practical workflows that your training didn’t cover.

Here’s what I want you to understand about entry-level EA compensation: your first salary matters less than your first employer’s reputation and the experience you’ll gain. A ₹6 lakh position at a company handling complex U.S. tax work will set you up for faster salary growth than a ₹7 lakh position doing repetitive data entry at a low-quality outsourcing firm. I’ve seen countless EAs who took the highest initial offer regret it two years later when they realized they weren’t building valuable specialized skills.

The job search phase can be challenging, especially if you’re a BCom or MCom graduate without prior U.S. tax experience. Many entry-level EAs spend 2-4 months finding their first position, during which they’re earning nothing. This is why I always recommend having 6 months of living expenses saved before you commit to the EA certification path. The investment pays off. Just be realistic about the timeline from passing your exams to receiving your first paycheck.

What is the Mid-Career Enrolled Agent Salary in India?

Once you’ve built 3-5 years of solid U.S. tax experience as an Enrolled Agent, your earning potential increases substantially. This is where your career choices and specialization decisions really start to impact your compensation.

Mid-career Enrolled Agents in India typically earn between ₹10 lakhs and ₹15 lakhs per annum in traditional employment. The progression from entry-level to mid-career isn’t automatic. It requires you to develop expertise beyond basic tax preparation. At this stage, you’re expected to handle complex individual returns, business taxation (partnerships, S-corporations, C-corporations), and potentially represent clients in IRS correspondence audits.

What drives you toward the higher end of this range? Specialization is the biggest factor. If you’ve developed niche expertise in areas like international taxation, expatriate tax services, or specific industries like real estate or e-commerce, you can command ₹12-15 lakhs at established firms. EAs who remain generalists typically plateau around ₹8-10 lakhs even with 5 years of experience.

Here’s a realistic progression timeline: In your third year as an EA, you should be earning ₹8-9 lakhs if you started at ₹5-6 lakhs. By year four, with one specialization developed and perhaps a certification like ADIT (Advanced Diploma in International Taxation) added to your credentials, you can reach ₹10-12 lakhs. By year five, if you’ve moved to a senior tax preparer or team lead role, ₹12-15 lakhs becomes achievable.

The mid-career phase is also when many EAs start exploring remote freelance opportunities with U.S. clients directly. I’ve seen EAs earning ₹10 lakhs in traditional employment transition to remote work and immediately jump to ₹15-18 lakhs by working directly with U.S. tax firms or individual clients at $20-25 per hour. This is when the geo-arbitrage advantage of the EA credential really becomes apparent. You can earn significantly more than local Indian accounting roles while still living in India.

Geographic location still matters significantly at this experience level. An EA with 4 years of experience in Bangalore or Mumbai will typically earn ₹2-4 lakhs more annually than someone with identical experience working in tier-2 cities like Pune, Chandigarh, or Jaipur. The concentration of multinational firms and Big 4 offices in metro cities drives this premium.

One critical decision you’ll face in mid-career: should you pursue management track positions (team lead, manager) or technical specialist roles? Management positions often show higher base salaries (₹13-15 lakhs) but involve less hands-on tax work and more people management. Technical specialist roles might cap slightly lower (₹11-13 lakhs) but offer better long-term prospects if you eventually want to freelance or start your own practice, since you’re continuously building deeper tax expertise rather than management skills.

What is the Senior Enrolled Agent Salary in India?

Senior Enrolled Agents with 6+ years of experience and established expertise represent the top tier of EA compensation in India’s traditional employment market. At this level, you’re typically managing teams, handling the most complex tax matters, or serving as the subject matter expert for specialized tax areas.

Senior EA salaries in India range from ₹15 lakhs to ₹25+ lakhs per annum in corporate employment. The absolute top end, ₹22-25 lakhs, is typically reserved for EAs working at Big 4 firms in senior manager or director-level positions, often with additional certifications like U.S. CPA. At companies like KPMG India or EY, a senior EA with 8-10 years of experience managing a U.S. tax practice can indeed command these premium salaries.

What distinguishes senior EAs earning ₹25 lakhs from those earning ₹15 lakhs? Three factors: scope of responsibility, specialized expertise, and client management capabilities. If you’re managing a team of 10-15 tax professionals, handling multi-million dollar client accounts, and serving as the primary point of contact for complex tax issues, you’re in the ₹20-25 lakh range. If you’re a senior individual contributor working on complex returns but without management responsibilities, you’re more likely in the ₹15-18 lakh range.

Here’s an important reality about senior EA compensation: there’s an income ceiling in traditional employment that many ambitious EAs find frustrating. Even at prestigious Big 4 firms, salaries rarely exceed ₹25-28 lakhs for EA roles unless you move into broader leadership positions that don’t primarily leverage your EA credential. This is why many senior EAs transition to independent consulting, advisory roles, or full-time remote work with U.S. clients, where earning potential can reach ₹35-50+ lakhs annually.

The career trajectory to senior EA positions typically takes 6-8 years minimum from when you first pass your EA exams. You can’t shortcut this timeline dramatically because employers need to see sustained excellence across multiple tax seasons, proven ability to handle complex situations, and evidence that you can train and mentor junior staff.

One often-overlooked aspect of senior EA compensation: total compensation includes more than just base salary. At this level, you’re likely receiving performance bonuses (15-25% of base), comprehensive health benefits, retirement contributions, stock options (if working for listed companies), and substantial CPE support. When evaluating senior EA offers, look at total compensation packages rather than just base salary numbers.

For senior EAs considering their next move, the biggest question becomes: continue climbing the traditional employment ladder toward ₹25-30 lakhs, or leverage your expertise and reputation to build an independent practice or remote consulting business where you can potentially earn ₹40-60 lakhs but with more income variability and business development responsibilities? There’s no universally right answer. It depends on your risk tolerance, entrepreneurial skills, and long-term career vision.

How Does Enrolled Agent Salary in India Compare to the US

When I talk to Indian professionals considering the EA certification, one of their biggest questions is, “How much do Enrolled Agents actually earn in the United States?” Understanding this comparison is crucial because it reveals both the opportunity and the limitations of working as an EA from India. Let me give you the realistic picture based on current U.S. market data.

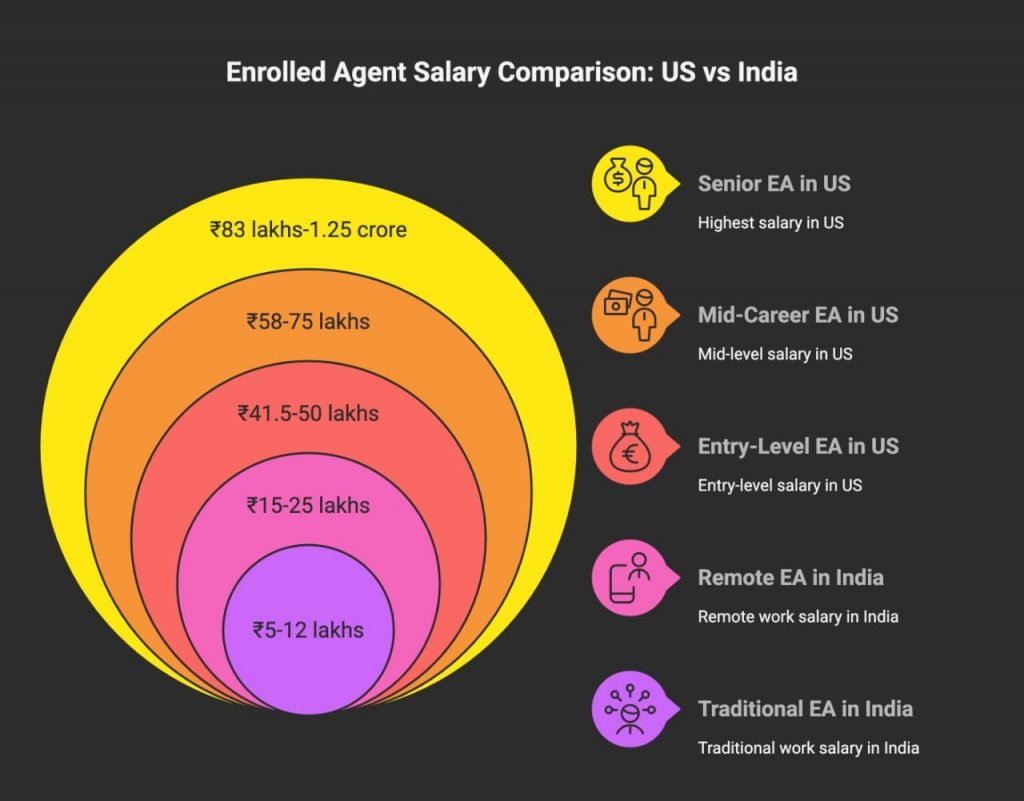

Enrolled Agents working in the United States earn significantly more than their Indian counterparts in absolute dollar terms. Entry-level EAs in the U.S. earn approximately $50,000-$60,000 per year, mid-career professionals make $70,000-$90,000 annually, and senior EAs can earn $100,000-$150,000 or more, particularly those running their own practices or serving high-net-worth clients. When you convert these figures to Indian rupees (at approximately ₹83 per dollar as of 2025), that’s ₹41.5-50 lakhs for entry-level, ₹58-75 lakhs for mid-career, and ₹83 lakhs-1.25 crore for senior positions which is dramatically higher than Indian EA salaries.

However, here’s what you need to understand about these seemingly astronomical figures: U.S. EAs face a much higher cost of living that consumes a large portion of that income. An entry-level EA earning $55,000 in the U.S. might pay $1,500-2,000 per month in rent, $300-500 for health insurance, $400-600 for groceries, and substantial amounts for transportation, utilities, and taxes. After expenses, their disposable income might be equivalent to an Indian EA earning ₹10-12 lakhs living in Bangalore or Hyderabad. The raw salary numbers look impressive until you factor in that a one-bedroom apartment in a U.S. city costs what a spacious three-bedroom apartment costs in an Indian metro.

The real opportunity for Indian EAs isn’t physically relocating to the U.S. to earn those salaries (which requires work visa sponsorship that’s increasingly difficult to obtain). Instead, the opportunity lies in geo-arbitrage, which involves earning a portion of U.S. rates while living in India with its lower cost structure. I’m seeing Indian EAs successfully charge $20-35 per hour for remote work with U.S. clients, which translates to ₹15-25 lakhs annually for full-time work. You’re not matching full U.S. salaries, but you’re earning 2-4 times what traditional Indian employment offers while enjoying a significantly lower cost of living. That’s the genuine value proposition the EA credential provides for Indian professionals.

Enrolled Agent Salary in India by Employer Type: Where Indian EAs Work

The type of employer you choose has a massive impact on your EA salary in India. Potentially more than experience level or location. Let me walk you through what different employer categories actually pay so you can make informed decisions about where to apply and what to negotiate for.

How Much Do Big 4 Firms Pay in Enrolled Agent Salary in India?

The Big 4 accounting firms, namely, Deloitte, PwC, EY, and KPMG, represent the gold standard of EA employment in India. These firms handle complex international tax work, offer structured career progression, and typically pay premium salaries compared to other employer types. However, they’re also highly competitive to get into and demand long hours, especially during tax season.

Deloitte

Deloitte Tax India typically offers entry-level Enrolled Agents ₹8-10 lakhs per annum, with mid-career EAs (3-5 years) earning ₹12-16 lakhs, and senior EAs commanding ₹20-24 lakhs. Deloitte has a strong U.S. tax outsourcing practice in India, particularly in their Hyderabad and Bangalore offices, which creates consistent demand for EA-certified professionals who can handle U.S. individual and business tax returns. The compensation includes performance bonuses that can add 15-20% to base salary, comprehensive health insurance, and support for CPE credits.

PwC

PwC’s Indian offices offer Enrolled Agents slightly lower starting salaries at ₹7.5-9.5 lakhs for entry-level positions, but their mid-career compensation is competitive at ₹11-15 lakhs, and senior EAs earn ₹18-23 lakhs. PwC India has a particularly strong expatriate tax services practice, so EAs with international tax expertise or interest in working with U.S. citizens living abroad can find excellent opportunities here. They’re known for strong training programs and clear promotion tracks, though work-life balance during tax season (January-April) can be challenging.

EY

Ernst & Young’s Indian practice offers entry-level EA salaries of ₹8-11 lakhs, mid-career compensation of ₹13-17 lakhs, and senior EA salaries reaching ₹21-26 lakhs. EY India has invested heavily in their Global Delivery Services centers in India, creating substantial opportunities for EAs who can handle both individual and corporate tax matters. According to PayScale data, EY shows some of the highest EA salaries in India at ₹18 lakhs average, likely reflecting their strong U.S. corporate tax practice.

KPMG

KPMG India’s EA salary ranges are ₹7.5-10 lakhs for entry-level, ₹12-15 lakhs for mid-career, and ₹19-24 lakhs for senior positions. KPMG has a particularly robust transfer pricing and international tax practice that values EA credentials highly when combined with international taxation expertise. PayScale data shows KPMG offering approximately ₹10.25 lakhs average for EA-certified professionals, positioning them competitively within the Big 4 range.

What Do BPO and Outsourcing Firms Pay to an Enrolled Agent in India?

Business process outsourcing firms and specialized tax outsourcing companies represent the largest volume employer of Enrolled Agents in India. These companies handle routine U.S. tax preparation work for American accounting firms and directly for U.S. taxpayers, offering good entry points for new EAs but generally lower compensation than Big 4 firms.

WNS, Genpact, and Wipro Salary Ranges

Large BPO companies like WNS, Genpact, and Wipro typically pay entry-level Enrolled Agents ₹5-7.5 lakhs per annum, with mid-career progression to ₹8-11 lakhs and senior roles reaching ₹13-17 lakhs. These firms offer stable employment, reasonable work-life balance outside tax season, and good training on U.S. tax software platforms like ProSeries and Lacerte. The main trade-off is that much of the work involves higher-volume, routine tax return preparation rather than complex tax planning or advisory work. This can limit your long-term skill development if you stay too long without seeking challenging assignments.

The advantage of starting your EA career at a large BPO is accessibility. They hire in larger numbers than Big 4 firms and are more willing to train freshers without prior U.S. tax experience. Many EAs use BPO positions as stepping stones: work there for 2-3 years to build solid U.S. tax preparation experience at ₹6-9 lakhs, then lateral to Big 4 firms or specialized boutiques at ₹10-13 lakhs. This strategy works well if you’re deliberate about seeking complex work assignments and building specialized skills even while at the BPO.

Specialized Tax Outsourcing Firms (QX Global, SurePrep, Initor)

Specialized tax outsourcing firms like QX Global, SurePrep, and Initor occupy a middle ground between large BPOs and Big 4 firms in terms of both work quality and compensation. These companies focus exclusively on U.S. tax work and typically pay ₹6-9 lakhs for entry-level EAs, ₹10-13 lakhs for mid-career professionals, and ₹15-19 lakhs for senior EAs.

What makes these specialized firms attractive is the quality of work. You’re handling more diverse tax situations and often have more direct interaction with U.S. CPAs and EAs who own the client relationships. SurePrep, for example, has a reputation for excellent training and exposure to sophisticated tax automation software. The compensation sits between BPO rates and Big 4 rates, but the work experience is often closer to Big 4 quality, making these firms are excellent options if you’re not ready for Big 4 intensity but want to avoid repetitive BPO work.

The career progression at specialized tax outsourcing firms can be excellent. Many senior EAs at these companies eventually get opportunities to work directly with U.S. partner firms, potentially leading to remote employment at near-U.S. rates. I’ve seen EAs start at ₹7 lakhs at companies like Initor, build strong relationships with their U.S. clients over 3-4 years while progressing to ₹12-14 lakhs, and then transition to direct remote employment with those U.S. firms at $25-35 per hour (₹18-25 lakhs).

What Do Mid-Sized and Boutique Firms Offer in Enrolled Agent Salary in India?

Beyond the Big 4 and large outsourcing companies, India has a growing ecosystem of mid-sized accounting firms and boutique tax practices that value EA credentials. These firms offer different trade-offs in terms of salary, work variety, and career growth.

CA Firms with US Tax Practice

Many established Chartered Accountant firms in India have developed U.S. tax service lines to serve NRI (Non-Resident Indian) clients, U.S. citizens living in India, and Indian companies with U.S. operations. These CA firms typically pay Enrolled Agents ₹4.5-7 lakhs at entry level, ₹7-10 lakhs for mid-career, and ₹12-16 lakhs for senior positions.

The salary is generally lower than at the Big 4 or specialized outsourcing firms, but CA firms with U.S. practices offer some unique advantages: broader exposure to both Indian and U.S. tax issues, closer mentorship from senior partners, and often more flexibility in work arrangements. If you’re interested in eventually serving NRI clients or Indian businesses with cross-border tax needs, starting at a CA firm can provide valuable exposure to both tax systems. The work is less assembly-line than BPOs, with more variety and client interaction, though the trade-off is lower initial compensation.

Independent Tax Consulting Firms

Smaller independent tax consulting firms and boutique practices represent another employment option for Enrolled Agents in India. These typically consist of U.S. CPAs or EAs who’ve established India-based operations to serve U.S. clients remotely. Compensation varies widely, anywhere from ₹5-8 lakhs for entry roles to ₹15-20 lakhs for senior positions, depending entirely on the firm’s client base and business model.

The advantage of boutique firms is often the direct client exposure and potential to learn the business side of tax practice, not just technical skills. You might work directly with the founding EA/CPA, handling client communications, learning pricing strategies, and understanding how to build a tax practice. This experience becomes invaluable if you eventually want to freelance or start your own remote tax practice. The downside is less stability, small firms may have revenue fluctuations and fewer formal benefits, and sometimes lower initial salaries than corporate employers.

How Much Can You Earn as a Remote or Freelance Enrolled Agent?

Here’s where Enrolled Agent compensation in India gets really interesting. The potential to earn significantly more than traditional employment by working remotely with U.S. clients. This is the geo-arbitrage opportunity that makes EA certification particularly valuable for Indian professionals seeking income growth without relocating abroad.

USD vs. INR Pay Rates (Geo-Arbitrage Reality)

The fundamental economic reality driving remote EA opportunities is simple: U.S. accounting firms and tax professionals need qualified help, especially during tax season, and they’re willing to pay rates significantly above Indian employment salaries but below what they’d pay U.S.-based EAs. This creates a “sweet spot” where Indian EAs can earn multiples of local salaries while U.S. firms save on labor costs.

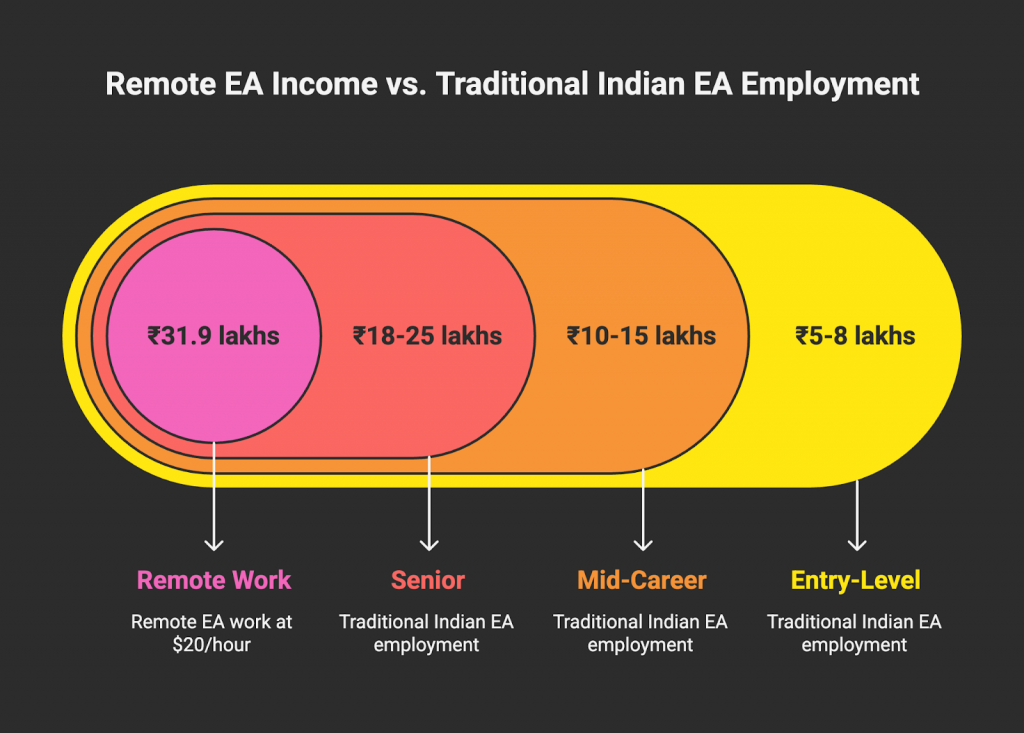

Remote Enrolled Agents working directly with U.S. clients typically earn $20-40 per hour, depending on experience and specialization. Let me break down what this means in practical terms: At $20 per hour working 40 hours per week for 48 weeks (allowing 4 weeks for holidays and breaks), you’re earning $38,400 annually, which translates to approximately ₹31.9 lakhs at current exchange rates. At $30 per hour with the same schedule, you’re at $57,600 annually or ₹47.8 lakhs. At $40 per hour for highly specialized work, you reach $76,800 or ₹63.7 lakhs.

Compare these remote work figures to traditional Indian EA employment: entry-level at ₹5-8 lakhs, mid-career at ₹10-15 lakhs, and senior at ₹18-25 lakhs. Even at the modest rate of $20 per hour, you’re earning more than most senior EA positions in Indian firms. This is geoarbitrage at work. You’re accessing a portion of U.S. market rates while living in India where your cost of living is 60-70% lower than the U.S.

However, I need to be honest about the realities of remote freelance work: you won’t immediately command $40 per hour as a new EA without U.S. tax experience. Most Indian EAs starting remote work begin at $15-20 per hour on platforms like Upwork or through subcontracting with U.S. firms. As you build your reputation, client base, and specialized expertise, you can progressively increase rates to $25-30 per hour over 2-3 years and eventually reach $35-45 per hour if you develop true niche expertise in areas like international taxation, complex business returns, or IRS representation.

The other critical reality: remote freelance income isn’t a guaranteed monthly salary like traditional employment. You’ll have income variability based on client demand, which peaks dramatically during U.S. tax season (January-April) and can be significantly slower during summer months. You’re also responsible for your own health insurance, retirement savings, and professional development costs that employers typically cover. When comparing a ₹15 lakh corporate job to $20/hour freelance work, remember to factor in benefits worth approximately 20-25% of salary that you’ll need to self-fund as a freelancer.

Part-Time, Full-Time, and Seasonal Income Models

The beauty of remote EA work is flexibility. You can structure it as a full-time career, part-time side income, or seasonal engagement depending on your goals and current situation. Let me show you how each model works financially.

Full-time remote EA work (35-40 hours per week year-round) at $25 per hour generates approximately $48,000-52,000 annually (₹39.8-43 lakhs). This income level exceeds what all but the most senior EAs earn in traditional Indian employment, while offering work-from-home flexibility and direct exposure to U.S. tax practices. The challenge is building a steady client pipeline that provides consistent work throughout the year, since U.S. tax demand fluctuates seasonally. Successful full-time remote EAs typically work with 5-8 recurring clients or partner with 2-3 U.S. accounting firms that provide steady overflow work.

Part-time remote work (15-20 hours per week) provides excellent supplemental income alongside traditional employment. At $20-25 per hour for 20 hours weekly, you’re earning an additional $20,000-26,000 annually (₹16.6-21.6 lakhs) beyond your primary salary. I know several EAs working full-time at Big 4 firms earning ₹12-15 lakhs who’ve added part-time U.S. client work on evenings and weekends, boosting their total income to ₹28-35 lakhs. This hybrid approach provides income security from employment while building your remote client base and skills for a potential future transition to full-time freelancing.

Why Enrolled Agent Salaries in India Differ from U.S. Levels

Understanding why Indian EA salaries don’t match U.S. levels is important for setting realistic expectations. The disparity isn’t about competence, Indian EAs are handling the exact same tax work as U.S. EAs, but it’s about market economics and structural factors.

The primary reason is cost arbitrage that benefits both parties. U.S. accounting firms can hire skilled Indian EAs at $20-30 per hour instead of paying U.S. EAs $40-75 per hour, reducing their labor costs by 50-60%. Meanwhile, Indian EAs earning $25 per hour (₹18-20 lakhs annually) are making 2-4 times what comparable traditional Indian accounting roles pay. Both parties benefit from the arrangement, which is why the U.S. tax outsourcing industry to India has grown substantially over the past decade.

Another factor is the cost of living differential that allows Indian professionals to maintain a higher quality of life at lower absolute income. An EA earning ₹20 lakhs in Bangalore can afford comfortable housing, household help, good schools for children, and regular savings. A lifestyle that would require $80,000-100,000 in a comparable U.S. city. From a purchasing power perspective, ₹20 lakhs in India provides a similar or better quality of life than $60,000 in the U.S., even though the conversion rate makes them appear drastically different.

Market maturity also plays a role. The Indian EA market is still developing. Most U.S. firms aren’t yet aware they can hire qualified remote Indian EAs, and most Indian accounting graduates don’t yet know about EA certification as a career path. As awareness grows on both sides, I expect Indian EA compensation to continue increasing, particularly for specialized expertise in areas like international tax, multi-state taxation, and IRS representation where supply is limited.

What Factors Influence Enrolled Agent Salary in India?

Now that you understand the salary ranges across different experience levels and employer types, let’s examine the specific factors that determine where you fall within those ranges. These variables are often more important than years of experience alone in determining your earning potential.

How Does Experience Impact Your Enrolled Agent Salary in India?

Experience drives EA salary growth in India, but not just in years. It’s in the complexity of work you’ve handled.

In your first 0–2 years, you earn ₹5–8 lakhs, building foundations in U.S. tax prep, mastering tools like ProSeries or Lacerte, and learning to apply tax law under supervision. Your value grows with repetition and accuracy.

By years 3–5, salaries climb to ₹10–15 lakhs as you take on complex individual and business returns, work independently, and guide juniors. This is the fastest growth phase, and specialization starts to shape long-term earnings.

With 6+ years’ experience, senior EAs earn ₹18–25+ lakhs, commanding higher pay for judgment, client management, and expertise in advanced tax planning and representation. This level isn’t about time served. It’s about accumulated insight from solving hundreds of complex cases.

Which Locations Pay the Highest EA Salaries?

Geographic location significantly impacts Enrolled Agent salaries in India, though the rise of remote work is gradually reducing these differentials. Metro cities like Mumbai, Bangalore, and Hyderabad consistently pay 20-30% more than tier-2 cities for equivalent EA roles, primarily because they host the concentration of Big 4 firms, multinational corporations, and specialized tax outsourcing companies that pay premium salaries. An entry-level EA earning ₹8 lakhs in Bangalore might receive only ₹6-6.5 lakhs for the same role in Pune, Chandigarh, or Jaipur. The metro premium reflects both higher cost of living and greater competition for talent in cities with many employers clustered together. However, remote work opportunities are changing this calculus. If you can secure remote employment with a Bangalore-based firm or U.S. client while living in a tier-2 city, you can earn metro-level income with tier-2 living costs, providing the best of both worlds.

How Do Specializations Affect Your Enrolled Agent Salary in India?

Specialization is perhaps the most powerful lever for increasing your EA salary beyond generic experience progression. Let me walk you through the specializations that command the highest premiums in the Indian market.

International Tax Specialization: +25-40% Premium

International tax expertise is the highest-value specialization for Indian Enrolled Agents, typically adding 25-40% to your base compensation. This includes areas like FATCA (Foreign Account Tax Compliance Act) reporting, FBAR (Foreign Bank Account Report) filings, foreign tax credit calculations, and taxation of U.S. citizens living abroad. If you’re earning ₹10 lakhs as a general EA, adding strong international tax expertise can push you to ₹13-15 lakhs. The premium exists because international tax is genuinely complex, constantly evolving, and high-stakes for clients. Mistakes can result in significant penalties. Developing this expertise typically requires 2-3 years of focused work on international returns plus additional study of IRS publications specific to international taxation.

Corporate Tax and Business Advisory

Expertise in corporate, partnership, and S-corporation taxation adds approximately 20-30% to EA salaries compared to individual-only practitioners. Corporate tax requires understanding entity taxation rules, consolidated returns, tax provision work, and business advisory services. An EA earning ₹12 lakhs handling individual returns might earn ₹15-16 lakhs with strong corporate tax capabilities. The demand for this specialization is particularly high in Big 4 firms and among EAs working directly with U.S. small business clients who need ongoing tax planning guidance throughout the year, not just annual return preparation.

IRS Representation and Audit Defense

IRS representation and audit defense expertise commands a 30-50% premium because of the specialized skills required and relatively few EAs who develop this competency. Representing clients in IRS audits, appeals, or collection matters requires deep procedural knowledge, strong communication skills, and comfort with adversarial situations. An EA who can competently handle audit representation might earn ₹16-18 lakhs compared to ₹12 lakhs for a general practitioner with similar experience. This specialization is particularly valuable for building a freelance practice, as audit representation services command premium hourly rates ($100-200 per hour) compared to routine tax preparation.

Estate Planning and High-Net-Worth Clients

Estate and gift tax expertise serving high-net-worth individuals is a niche specialization that can add 25-35% to EA compensation, though opportunities in India are more limited since you’re primarily serving U.S.-based wealthy clients rather than Indian clients. This specialization involves trust and estate tax returns (Forms 1041, 706, and 709), estate planning strategies, and often coordination with attorneys and financial advisors. The complexity and high stakes of estate work command premium rates. EAs with this expertise can earn ₹15-18 lakhs compared to ₹12 lakhs for generalists. Building estate tax expertise typically requires working at firms that serve high-net-worth clients and a willingness to invest significant study time in this specialized area.

What Additional Skills Command a Higher Enrolled Agent Salary in India?

Beyond your core EA knowledge and any tax specializations, certain adjacent skills significantly boost your market value and earning potential. Let me explain which skills provide the best return on your learning investment.

Tax Software Proficiency (ProSeries, Lacerte, UltraTax)

Mastery of professional tax software platforms used by U.S. firms can add ₹1-3 lakhs to your annual compensation. Most Indian EA positions require basic familiarity with tax software, but true proficiency, understanding advanced features, integration capabilities, troubleshooting, and efficiency optimization make you dramatically more valuable. U.S. firms particularly value EAs experienced with Intuit ProSeries, Lacerte, or UltraTax CS because these are the dominant platforms used by U.S. accounting firms. If you can train others on these platforms or optimize workflows for efficiency, your value increases further.

The reason software proficiency commands premium compensation is productivity. An EA highly proficient in Lacerte might prepare returns 40-50% faster than someone with basic skills, directly impacting firm profitability. When interviewing for positions or setting freelance rates, explicitly highlighting your software expertise and efficiency metrics (returns per hour, accuracy rates) can justify significantly higher compensation than EAs without this proficiency.

US Client Communication and Cultural Fit

Exceptional English communication skills and understanding of U.S. business culture can add 15-25% to EA compensation, particularly for roles involving direct client interaction rather than just back-office preparation work. This includes writing clear, professional emails, conducting video calls with U.S. clients, explaining complex tax concepts in accessible language, and understanding U.S. business norms around responsiveness, deadline management, and client service expectations. Indian EAs who can seamlessly communicate with U.S. clients are particularly valuable for remote work opportunities and client-facing roles at Indian firms serving U.S. clients.

The communication premium reflects the reality that technical tax knowledge alone isn’t sufficient. You need to build client trust, manage expectations, and represent your firm professionally. EAs who’ve developed strong communication skills often transition into client relationship management or business development roles where compensation can reach ₹18-25 lakhs because they’re generating revenue, not just preparing returns. Investing in communication skills through courses, Toastmasters, or simply practicing written and verbal communication provides an excellent return on effort.

Complementary Certifications (CPA, ADIT, CMA)

Adding complementary certifications to your EA credential can boost compensation by 30-60%, though this requires significant additional investment in exam preparation and fees. The U.S. CPA certification is the most valuable complement to EA, typically adding 40-60% to compensation because it opens opportunities beyond tax into audit, advisory, and CFO roles. An EA earning ₹12 lakhs might earn ₹18-20 lakhs with CPA added.

The Advanced Diploma in International Taxation (ADIT) specifically boosts international tax credibility, adding approximately 25-35% to EA salaries when combined with practical international tax experience. This is particularly valuable if you want to specialize in cross-border taxation serving NRI clients or multinational corporations. The U.S. CMA certification adds about a 20-30% premium by opening management accounting and financial planning opportunities beyond pure tax work. The decision to pursue additional certifications should be strategic. Only invest the time and money if you’re targeting roles or specializations where the credential provides clear ROI through higher compensation or better opportunities.

Conclusion

The Enrolled Agent salary landscape in India offers compelling opportunities for accounting professionals seeking to access the U.S. market without relocating abroad. You’ve seen that compensation ranges from ₹5-8 lakhs for entry-level positions to ₹18-25 lakhs for senior roles in traditional employment, with remote work and freelancing potentially pushing earnings to ₹30-50+ lakhs for experienced professionals with specialized expertise. The key insight is that your earning potential depends less on years elapsed and more on strategic choices about employer type, specialization development, and willingness to pursue remote opportunities.

What makes the EA credential particularly valuable in the Indian context is the geo-arbitrage advantage it creates. You can earn multiples of traditional Indian accounting salaries by accessing U.S. market rates while maintaining India’s lower cost of living. Whether you choose the stability of Big 4 employment, the accessibility of BPO firms, or the higher income potential of remote freelancing, the EA certification opens doors to compensation levels that competing certifications focused solely on the Indian market simply can’t match. Your success ultimately depends on continuous skill development, building specialized expertise, and strategically navigating from entry positions toward higher-value roles over your career arc.

Frequently Asked Questions

What is the starting salary for an Enrolled Agent in India?

Entry-level Enrolled Agents in India typically earn ₹5-8 lakhs per annum, with the range depending on employer type and location. Big 4 firms pay ₹7-10 lakhs, while BPO and mid-sized firms offer ₹5-7 lakhs.

How much can an experienced EA earn in India?

Experienced Enrolled Agents with 6+ years of expertise earn ₹18-25 lakhs per annum in traditional employment at Big 4 firms or specialized tax companies. Those working remotely with U.S. clients or running independent practices can earn ₹30-50+ lakhs annually by charging $25-40 per hour. The highest earners typically have specialized expertise in areas like international tax, IRS representation, or corporate taxation combined with strong client management capabilities.

Do Enrolled Agents earn more than CA/CPA in India?

Enrolled Agents typically earn comparable or slightly less than CPAs in India but significantly more than CAs working in purely domestic roles. The EA certification specifically targets U.S. tax work, which commands premium compensation due to dollar-based earning potential. CPAs with both U.S. and Indian credentials often earn the most (₹20-30+ lakhs), while CAs focused on Indian taxation typically earn ₹8-18 lakhs. The EA credential provides the best return on investment for professionals specifically targeting U.S. tax opportunities.

Can I earn in dollars as an Enrolled Agent from India?

Yes, many Indian Enrolled Agents earn in U.S. dollars by working remotely for American clients through freelance platforms like Upwork, direct client relationships, or subcontracting with U.S. accounting firms. Typical rates range from $20-40 per hour depending on experience and specialization.

Which companies in India pay the highest EA salaries?

Big 4 accounting firms (Deloitte, PwC, EY, and KPMG) consistently pay the highest Enrolled Agent salaries in India, with senior EAs earning ₹20-25 lakhs or more. Among these, EY and Deloitte’s Indian practices show particularly strong compensation, with average salaries around ₹18 lakhs, according to PayScale data. Specialized tax outsourcing firms like QX Global, SurePrep, and Initor pay ₹15-19 lakhs for senior EAs, which is less than Big 4 but more than general BPOs like WNS or Genpact.

How long does it take to reach ₹15 LPA as an EA?

Most Enrolled Agents reach ₹15 lakhs per annum within 4-6 years of earning their EA credential, though this timeline varies significantly based on employer type and career choices. At Big 4 firms with consistent progression, you might reach ₹15 lakhs in 4-5 years. In BPO or mid-sized firms, it typically takes 6-7 years. However, EAs who develop specialized expertise and transition to remote work with U.S. clients can reach ₹15 lakhs, equivalent to $20+ per hour, in just 2-3 years.

Is freelance or full-time employment more lucrative for EAs?

Freelance remote work offers higher income potential (₹25-50+ lakhs) compared to traditional full-time employment (₹18-25 lakhs maximum), but it comes with less stability and requires you to manage your own business development, client relationships, and benefits. Full-time employment provides consistent income, benefits, and career structure but caps at lower earning levels. Many EAs use a hybrid approach by maintaining full-time employment for stability while building part-time freelance income, then transitioning to full-time freelancing once they’ve established a steady client base.

What is the best specialization for high EA salary?

International tax specialization commands the highest premium, adding 25-40% to base EA salaries due to the complexity and limited supply of qualified professionals. IRS representation and audit defense is second-best, adding a 30-50% premium and particularly valuable for freelance practice. Corporate tax and business advisory adds 20-30% and provides steady year-round work. Estate and trust taxation serves high-net-worth clients at premium rates but has more limited opportunities in India since you’re primarily serving U.S.-based wealthy individuals.

Do I need additional certifications to earn well as an EA?

No, you can earn excellent income with EA certification alone, particularly if you develop specialized expertise and pursue remote work opportunities. However, adding complementary certifications significantly boosts earning potential. A U.S. CPA adds 40-60% to compensation, ADIT adds 25-35% for international tax roles, and CMA adds approximately 20-30% for management accounting positions.

How much can I earn during US tax season as a part-time EA?

Part-time Enrolled Agents working during peak U.S. tax season (January-April) can earn ₹1.5-3 lakhs in those four months by working 15-20 hours weekly at $20-25 per hour. If you can work full-time hours (35-40 hours weekly) during tax season while taking leave from your regular job, you could earn ₹3-6 lakhs in just four months. Many EAs use tax season work as supplemental income alongside traditional employment, effectively boosting annual earnings by 25-40% with intense four-month effort.

What is the salary difference between Bangalore and Mumbai for EAs?

Salary differences between major metro cities are relatively modest, around typically 5-10% variation. Mumbai EAs might earn ₹8.5-9 lakhs entry-level, whereas Bangalore EAs earn ₹8-8.5 lakhs for identical roles. The more significant differential is between metro cities (Mumbai, Bangalore, Hyderabad) and tier-2 cities (Pune, Chandigarh, Jaipur), where metro salaries are 20-30% higher. However, remote work opportunities are eliminating geographic salary differences.

Can freshers without experience get EA jobs in India?

Yes, freshers can secure entry-level EA positions, though you’ll likely start at the lower end of the salary range (₹5-6 lakhs) and may need to target BPO firms or mid-sized companies rather than Big 4 firms that prefer 1-2 years of accounting experience. The challenge is that EA certification alone without practical tax experience makes you less competitive. The strongest strategy is to gain 1-2 years of work experience at an Indian accounting firm while studying for your EA exams, then pursue EA-specific positions once certified.

How does remote work affect EA salary in India?

Remote work dramatically increases earning potential for Indian Enrolled Agents by providing access to U.S. market rates. While traditional Indian employment caps at ₹18-25 lakhs for senior positions, remote work with U.S. clients at $25-35 per hour translates to ₹35-50+ lakhs annually. Remote work also eliminates geographic salary differentials. You can earn the same rates living in a tier-2 city as you would in Mumbai or Bangalore.

What platforms pay the best rates for freelance EAs?

Direct client relationships and subcontracting with U.S. accounting firms generally pay the highest rates ($30-50/hour), followed by Upwork, where experienced EAs with strong profiles command $25-40/hour. LinkedIn is effective for finding direct remote employment with U.S. firms. TaxDome and similar tax-specific platforms connect EAs with firms seeking specialized expertise at premium rates. Avoid general freelance platforms like Fiverr, where rates are heavily commoditized at $10-20/hour and clients expect rock-bottom pricing.

How do Big 4 salaries compare to mid-sized firms for EAs?

Big 4 firms typically pay 30-50% more than mid-sized firms for equivalent EA roles. Entry-level Big 4 positions offer ₹8-10 lakhs versus ₹5-7 lakhs at mid-sized firms, and senior Big 4 EAs earn ₹20-25 lakhs compared to ₹13-17 lakhs at mid-sized companies. The Big 4 premium reflects more complex work, longer hours, and the prestige value of their brand on your resume. However, mid-sized firms often provide better work-life balance, closer mentorship from partners, and broader exposure to different client types, making them attractive despite lower compensation.

Allow notifications

Allow notifications