Complete Enrolled Agent Exam guide for Indians: exam structure, registration in India, PTIN process, pass rates, costs, and US remote job opportunities. Start your US tax career.

Table of Contents

Why Indian Professionals Should Consider Enrolled Agent Exam

If you’re a BCom, MCom, CA, or CS in India, the domestic accounting market can feel a bit limiting. Entry-level salaries hover around ₹15-25k a month, promotions are slow, and competition is fierce. But what if I told you there’s a way to instantly step into the U.S. tax market without leaving India and earn $15-75 an hour for work you can do remotely? That’s exactly what the Enrolled Agent (EA) exam unlocks. It’s an IRS license that lets you represent clients before the IRS, handle audits, appeals, and collections, and work with U.S. firms or clients from anywhere in the world.

The opportunity is real and growing. As of 2023, India had over 2,200 EAs, just a small slice of the global total. U.S. accounting firms are increasingly outsourcing tax work to India, creating a surge in demand for professionals who understand U.S. tax law. That means roles at multinational corporations, Big Four firms, or boutique tax outsourcing companies that pay anywhere from ₹3.5 lakh for entry-level positions to ₹50 lakh+ for experienced specialists.

For Indian professionals, the EA isn’t just another certification. It’s a ticket to higher pay, international exposure, and career flexibility. You can start part-time with U.S. clients while keeping your current job or eventually transition fully if it’s more lucrative. If you’re tired of the slow grind at home and want a career that actually rewards your effort, the EA is your shortcut.

Enrolled Agent Exam Age Limit and Eligibility Criteria

To become an Enrolled Agent (EA), the IRS requires you to meet a few specific conditions, but age is rarely a barrier.

Minimum Age:

You must be at least 18 years old to qualify for enrollment under IRS Circular 230 (31 CFR §10.4). This minimum age applies to official enrollment, not just taking the Special Enrollment Examination (SEE).

Maximum Age:

There is no upper age limit specified in IRS regulations. The IRS does not restrict older applicants from taking the SEE or applying for enrollment. Any claims about a maximum age are informal or based on private employer preferences, not official policy.

Educational and Work Background:

The IRS does not mandate any specific educational qualification or work experience to sit for the SEE. Statements like “EA course is for BCom or MBA graduates” are marketing positions used by Indian training institutes, not regulatory criteria.

Suitability Check:

After passing all three parts of the SEE (or qualifying through IRS experience), candidates must pass a suitability check conducted by the IRS. This involves verifying tax compliance, reviewing for any history of tax-related violations, and ensuring there are no recent (within 10 years) felony convictions involving dishonesty or breach of trust.

Indian Market Note (Non-Regulatory):

In India, some employers informally prefer younger candidates (often below 30) for entry-level tax roles. However, the remote U.S. tax preparation market generally values competence over age, and no evidence suggests formal age discrimination in freelance or client-facing roles.

Complete Enrolled Agent Exam Structure and Format

IRS Enrolled Agent Exam Parts and Syllabus Breakdown

The Special Enrollment Examination (SEE) consists of three distinct parts that can be taken in any order you choose. Each exam part has 100 multiple-choice questions, divided into two blocks of 50 questions each. According to the official Candidate Information Bulletin, you’ll have the option to take a short 15-minute break after the first 50 questions. Out of the 100 questions, only 85 are scored, while 15 are experimental and do not count toward your score. Since you won’t know which questions are experimental, you must answer all 100 carefully. Each part allows 3.5 hours of testing time, excluding the optional break.

Each EA exam part tests the tax law of the previous year. While there is no official IRS bulletin specifying exact date ranges, most review providers note that exams from May through February generally cover the tax law in effect as of the previous December 31. The exam is unavailable during the March–April update period, when content is revised for the next testing cycle. This timing pattern means if you study across multiple years, you should ensure your materials reflect the latest tax law updates.

Each exam part covers major topics called “domains,” and the IRS releases Exam Content Outlines detailing the percentage weight of each domain. These outlines help you see which areas carry more marks and plan your preparation accordingly. For example, if a domain accounts for 30% of the exam, it deserves proportionately more study time than one worth 13%.

You’re allowed three years to pass all three parts of the SEE, as per the current IRS rule. This three-year carryover period starts from the date you pass your first part. (Earlier sources may mention two years, which was the previous policy.) If you don’t complete all three parts within that time, you’ll need to retake any expired sections.

From a practical standpoint, it’s advisable, not required, to aim to pass all three parts within one year while your study momentum and tax law knowledge are fresh. This is a strategic choice, not an IRS mandate. Strategic planning matters: don’t let your Part 1 credit expire while you’re still preparing for Part 3.

Enrolled Agent Exam Part 1 Questions and Topics – Individuals

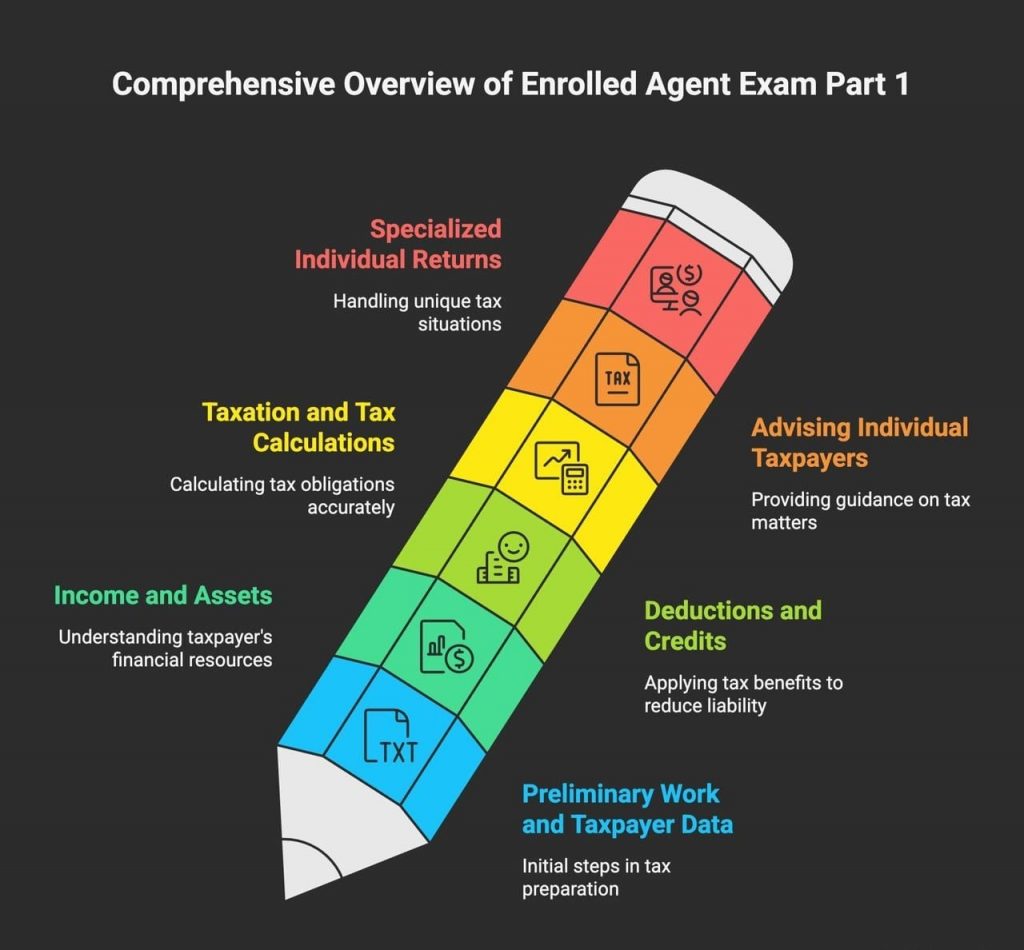

Part 1 focuses entirely on individual taxation. Preparing Form 1040 returns and understanding all the complexities of personal income tax. Part 1 covers Preliminary Work with Taxpayer Data, Income and Assets, Deductions and Credits, Taxation, Advising the Individual Taxpayer, and Specialized Returns for Individuals. This is typically the part Indian candidates take first because individual taxation concepts are more familiar from the Indian Income Tax Act experience. Think of this as the foundation, mastering 1040 returns before moving to business taxation.

Preliminary Work and Taxpayer Data

This domain covers everything you need to do before actually preparing a tax return. You’ll learn about filing status determination (single, married filing jointly, married filing separately, head of household, or qualifying widow/widower), dependency rules (who qualifies as a dependent and the tests that must be met), and the critical preliminary steps of gathering taxpayer information. Questions test your ability to determine which filing status provides the best tax outcome and how to properly identify qualifying dependents under IRS rules.

Income and Assets

This is a high-weighted domain in Part 1, covering all types of income that individuals must report. You’ll study wages and salaries (Form W-2), self-employment income (Schedule C), business income and losses, interest and dividend income, capital gains and losses, rental income (Schedule E), retirement distributions, Social Security benefits, alimony, and other income types. The key challenge here is understanding what’s taxable versus non-taxable, how different income types are reported on Form 1040, and the special rules for each income category.

Deductions and Credits

This domain focuses on how taxpayers reduce their tax liability. You’ll learn the difference between standard deduction and itemized deductions (Schedule A), which expenses qualify for itemization (mortgage interest, state and local taxes, charitable contributions, medical expenses), above-the-line deductions that reduce adjusted gross income, and the complex world of tax credits. Credits include the child tax credit, the earned income tax credit, the education credits, the retirement savings contributions credit, and the dependent care credit. Understanding credits versus deductions is crucial. Credits provide dollar-for-dollar tax reduction, while deductions only reduce taxable income.

Taxation and Tax Calculations

This domain tests your ability to actually compute the tax liability. You’ll work with tax tables and tax rate schedules, understand how progressive tax brackets function, calculate alternative minimum tax (AMT), compute self-employment tax, understand additional Medicare tax, and work through the complete Form 1040 calculation from gross income to final tax due or refund. This is where your mathematical skills and attention to detail matter most. Calculation errors here mean wrong answers.

Advising Individual Taxpayers

Here you move beyond mechanical tax preparation into advisory work. Questions test your knowledge of estimated tax payments (when they’re required and how to calculate them), tax withholding strategies, retirement account contributions and distributions, tax planning techniques, and how to advise clients on making tax-efficient decisions. This domain assumes you understand the previous domains well enough to provide guidance, not just prepare returns.

Specialized Individual Returns

The final domain covers less common but important return types. You’ll study estate and trust taxation (Form 1041), gift tax returns (Form 709), decedent’s final returns, and foreign income reporting requirements (FBAR, FATCA). For Indian EAs, the foreign income reporting sections are particularly relevant since you’ll likely have NRI clients with US tax obligations. Understanding how to report foreign bank accounts, foreign income, and foreign tax credits is valuable knowledge.

Enrolled Agent Exam Part 2 – Business Questions and Topics

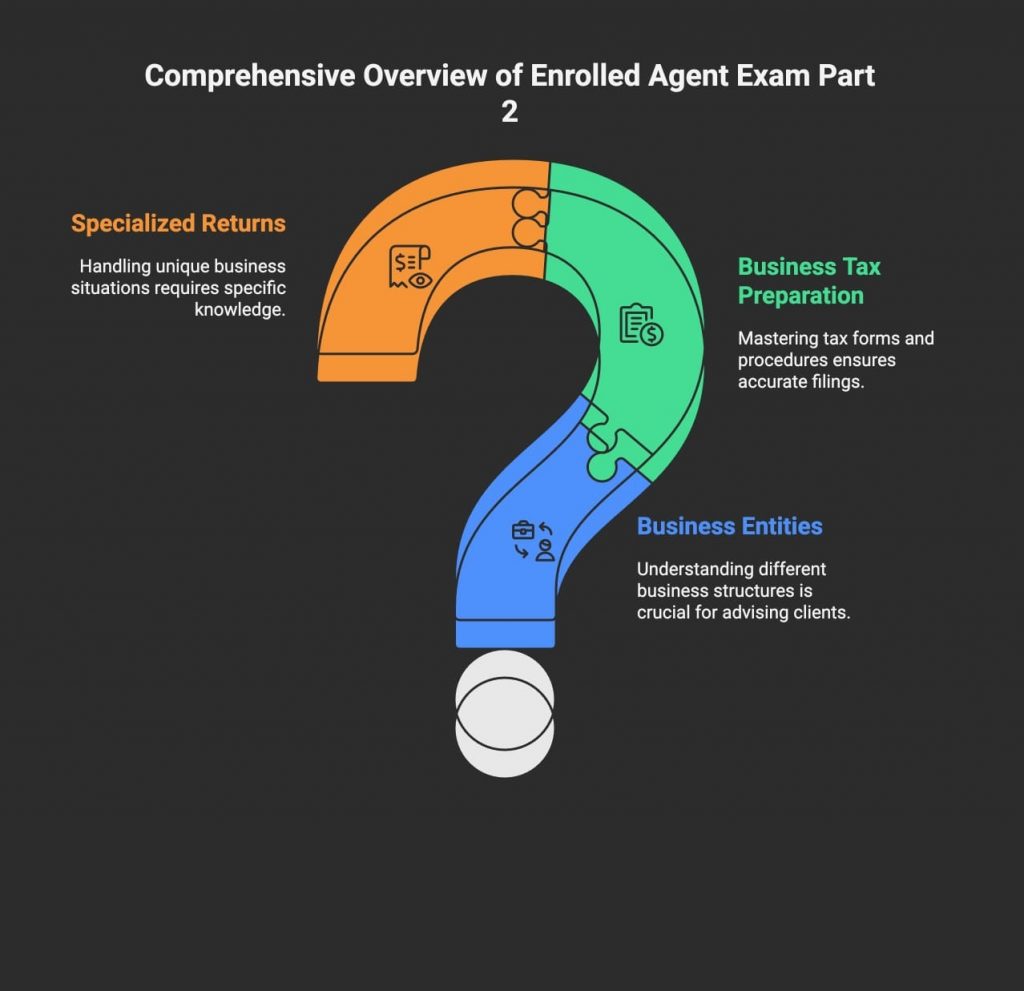

Part 2 shifts focus to business taxation. Corporations, partnerships, S-corporations, LLCs, and self-employed individuals operating businesses. Part 2 covers Business Entities and Considerations, Business Tax Preparation, and Specialized Returns and Taxpayers. This part typically requires more study time than Part 1 because US business entity structures differ significantly from Indian company structures, and the tax treatments are complex.

Business Entities and Considerations

This massive 30% domain requires a deep understanding of how different business entities are formed, operated, and taxed. You’ll study sole proprietorships (Schedule C on individual returns), partnerships (Form 1065), C-corporations (Form 1120), S-corporations (Form 1120-S), and LLCs (which can be taxed in multiple ways). The critical concept here is pass-through versus corporate taxation. Understanding entity structuring, formation requirements, and the tax implications of choosing one entity type over another is essential. You’ll also learn about basis (partner basis in partnerships, shareholder basis in S-corporations), distributions, liquidations, and entity conversions.

Business Tax Preparation

The heaviest-weighted domain in the entire EA exam covers actual business return preparation. You’ll work extensively with business income and expense classifications, depreciation methods (MACRS, Section 179 expensing, bonus depreciation), business deductions, cost of goods sold calculations, payroll taxes (Form 941, Form 940), employment taxes, business credits, and the qualified business income deduction under Section 199A. This domain is dense and detailed. You’re learning to prepare complete business returns from scratch. For Indian candidates, the payroll tax component is entirely new since India doesn’t have equivalent quarterly payroll tax filings.

Specialized Business Returns

This domain covers less common business scenarios. You’ll study exempt organizations (nonprofits), estate and trust business income, farming income (Schedule F), and specialized industries with unique tax rules. You’ll also learn about foreign business operations, controlled foreign corporations, and international business taxation basics. The complexity here isn’t necessarily in volume but in the specialized knowledge required for each return type.

Enrolled Agent Exam Part 3 Questions and Topics – Representation, Practices, and Procedures

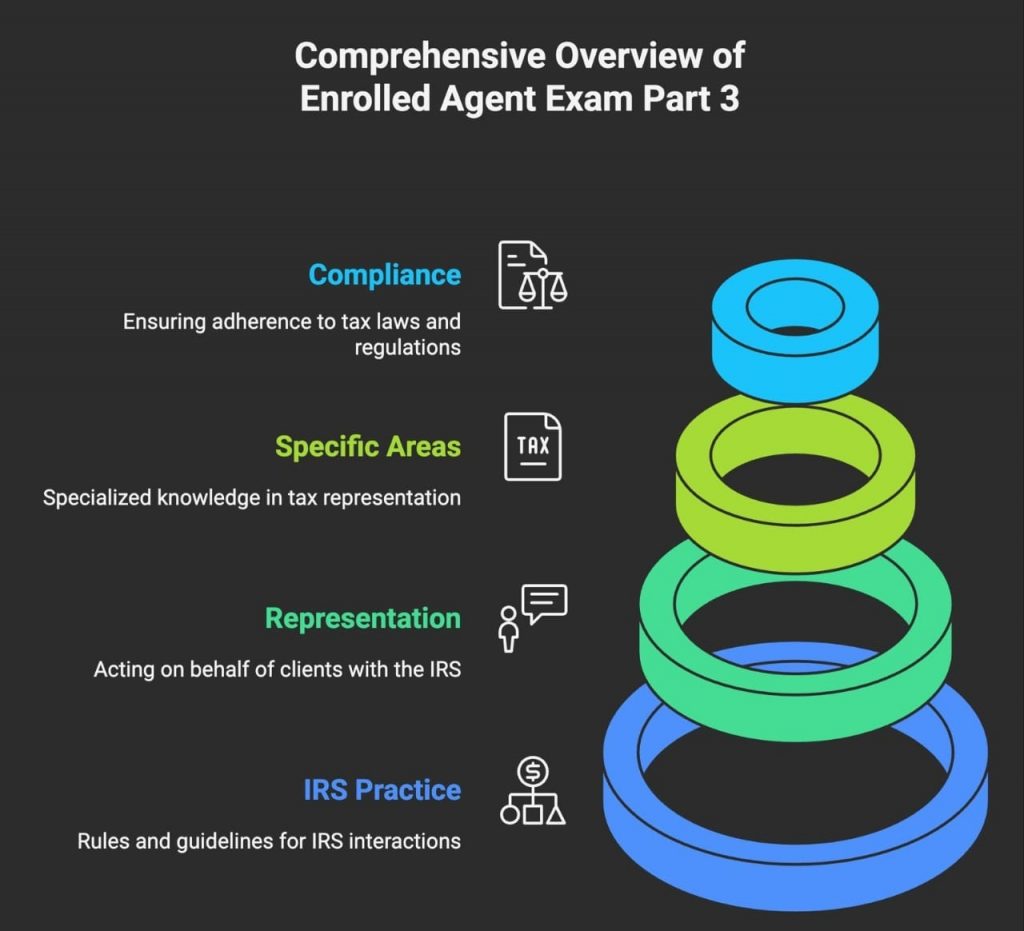

Part 3 is fundamentally different from Parts 1 and 2. Instead of tax preparation, it focuses on how to represent clients before the IRS and the ethical rules governing tax practice. Part 3 covers Practices and Procedures, Representation before the IRS, Specific Areas of Representation, and Filing Process. Many candidates find this the most challenging part conceptually because it’s entirely procedural and IRS-specific, with no equivalent in Indian tax administration.

IRS Practice and Procedures (Coverage Throughout)

This isn’t a separate domain but a theme running throughout Part 3. You’ll master Treasury Department Circular 230, which is the set of regulations governing practice before the IRS. This covers who can represent taxpayers, what enrolled agents can and cannot do, ethical obligations, conflicts of interest, best practices for tax return preparation, due diligence requirements, and the sanctions that can be imposed for violations. Think of Circular 230 as your professional code of conduct. Violating these rules can cost you your EA credential.

Representation Before the IRS (Coverage Throughout)

You’ll learn the complete process of representing clients in various IRS proceedings. This includes audit procedures (correspondence audits, office audits, and field audits), examination techniques, documentation requirements, and how to communicate effectively with IRS agents. You’ll study the Power of Attorney (Form 2848) process, which authorizes you to represent clients. Understanding the different levels of IRS authority (from revenue agents to appeals officers) and how to navigate each level is crucial.

Specific Areas of Representation (Coverage Throughout)

This covers specialized representation scenarios. You’ll study collection procedures (liens, levies, wage garnishment), offer in compromise (settling tax debt for less than owed), installment agreements, penalty abatement, currently not collectible status, innocent spouse relief, and audit reconsideration. For Indian EAs working with US clients, collection representation can be particularly lucrative. Taxpayers with IRS debt problems are willing to pay well for competent help. You’ll also learn about the appeals process when clients disagree with IRS determinations.

Filing Process and Compliance (Coverage Throughout)

The final area covers the administrative side of tax practice. You’ll learn about PTIN requirements, e-filing procedures (enrolled agents must understand Electronic Filing Identification Numbers), recordkeeping obligations, confidentiality rules (protecting client information), disclosure requirements, and the consequences of filing false returns. You’ll also study taxpayer rights (the Taxpayer Bill of Rights) and the procedural requirements for different types of tax submissions. This domain ensures you understand the compliance side of running a tax practice.

Enrolled Agent Exam Format

Enrolled Agent Exam Questions: Direct, Incomplete Sentence, and Exception Questions

There are three types of multiple-choice questions that you will see on the EA Exam: direct questions, incomplete sentence questions, and “all of the following except” questions. Understanding these question formats helps you develop the right answering strategies for each type.

Direct questions are straightforward. You’re asked a clear question and must choose the correct answer from four choices. Example: ‘Which of the following entities are required to file Form 709, United States gift tax return? a) An individual b) An estate or trust c) A corporation d) All of the above.’ The correct answer is (a) – individuals file gift tax returns, though certain estates or trusts may also be required to file in limited circumstances.

Incomplete sentence questions present a statement with the last portion missing, and you select the choice that correctly completes it. Example: “Supplemental wages are compensation paid in addition to an employee’s regular wages. They do NOT include payments for: a) Accumulated sick leave, b) Moving expenses (non-military), c) Vacation pay, d) Travel reimbursements paid at Federal Government per diem rate.” The correct answer is (d) – per diem travel reimbursements aren’t supplemental wages. This format requires you to read carefully and understand what the question is asking (what is NOT included versus what IS included).

“All of the following except” questions are often considered the trickiest. You’re asked a question in which all the provided responses are correct except one, and you must choose the incorrect one. Example: “There are five tests that must be met for a child to be a qualifying child. Which of the following is NOT a requirement? a) Residency test b) Relationship test c) Disability test d) Joint Return test.” The correct answer is (c) – disability is not one of the five tests. These questions require you to know the topic thoroughly because you’re identifying what doesn’t belong rather than what does. Many candidates miss these by selecting a correct statement instead of the exception.

The strategy for all three formats: read every question twice before answering. I’ve seen countless candidates rush and miss simple questions because they didn’t notice the word “NOT” or “EXCEPT.” Take your time, understand what’s being asked, eliminate obviously wrong answers, and then choose from the remaining options. The exam isn’t testing your reading speed. It’s testing your tax knowledge and careful analysis.

Enrolled Agent Exam Questions: Scored vs Experimental Questions Explained

Enrolled Agent Exam Questions: Scored vs Experimental Questions Explained

Here’s something that frustrates many candidates: each exam part has 100 questions, but only 85 are scored, while the remaining 15 are experimental questions that don’t count toward your score. The IRS uses these experimental questions to test new questions for future exams. They’re gathering data on question difficulty and performance before officially including them in scored portions of later exams.

The catch? You have absolutely no way to know which questions are experimental and which are scored. They’re not marked, they’re not grouped separately, and they’re randomly distributed throughout both 50-question sections. This means you must treat all 100 questions with equal seriousness and answer every single one to the best of your ability. You can’t afford to think, “Maybe this oddly worded question is experimental,” and give it less effort. It might be worth points.

Some candidates theorize that unusually difficult questions or questions on very obscure topics might be experimental, but this is pure speculation. The IRS doesn’t confirm this, and I’ve seen straightforward questions turn out to be experimental and complex questions that definitely scored. The safest approach: forget about trying to identify experimental questions and simply do your best on every question you see.

The silver lining of this system is that 15 questions won’t count against you if you get them wrong. You only need to correctly answer enough of the 85 scored questions to achieve the passing score of 105 (the exact number of correct answers needed isn’t published because of scaled scoring). This means you have some margin for error. You don’t need perfect performance to pass. But again, since you don’t know which questions are experimental, approach every question as if your score depends on it.

Enrolled Agent Exam Time Limits and Break Policies

You have three and a half hours (210 minutes) to complete both exam sections, which is a total of 100 questions. This works out to roughly 1.8 minutes per question, though you’ll want to move faster on easier questions to bank time for harder ones. The exam is divided into two sections of 50 questions each, and after completing the first section, you’re prompted to take an optional 15-minute break.

Here’s how the break system works: after completing the first section of 50 questions, you can choose to take a 15-minute break, and if you take this break, your exam timer will stop. You’ll be able to leave the testing room, access your locker for water or snacks, use the restroom, and take a mental break. However, once you start the second section, you cannot return to review or change answers from the first section. It’s locked and submitted.

You are allowed to take additional unscheduled breaks; however, the exam clock will continue to count down during any unscheduled break. So if you desperately need a restroom break during a section, you can leave, but you’re burning testing time. For this reason, most candidates stick to the scheduled 15-minute break and try to avoid unscheduled breaks by using the restroom before starting and during the scheduled break.

Time management strategy: aim to complete each 50-question section in about 90 minutes, leaving you 15-20 minutes per section for review. Mark questions you’re unsure about for later review (the testing software allows flagging), answer them with your best guess, and move on. If you finish both sections with time remaining, use it to review flagged questions. One of Becker’s tips to pass the SEE Exam is learning to spend no longer than about 1.8 minutes answering each question, which will give you enough time to complete all 100 questions with 30 minutes extra to review your answers.

For Indian candidates testing at Prometric centers in India, be aware that the actual seat time is 4 hours to allow for the tutorial at the beginning and a brief survey at the end, in addition to the 3.5-hour exam and optional break. Plan your testing day accordingly. You’ll be at the center for about 4-4.5 hours total, including check-in and check-out procedures.

Enrolled Agent Exam Scoring System

Understanding Scaled Scoring in Enrolled Agent Exam (40-130 Range)

The EA exam doesn’t use simple percentage scoring. Instead, it employs a scaled scoring system that ranges from 40 to 130 points. Exam results are scaled by calculating the number of questions answered correctly from the total number of questions asked and converting to a scale that ranges from 40 to 130. Understanding this system helps you interpret your results if you don’t pass and need to retake.

Here’s how it works: the IRS takes your raw score (the number of scored questions you answered correctly out of 85) and converts it using psychometric scaling to the 40–130 scale. This system accounts for slight variations in difficulty between different versions of the exam. If your particular exam version happens to be slightly harder, the scaling adjusts to ensure fairness.

The scoring methodology was determined by the IRS following a scoring study, and a panel of subject matter experts composed of Enrolled Agents and IRS representatives established a passing score for a candidate who meets the minimum qualifications to be an Enrolled Agent. This means the passing score of 105 was determined by experts identifying what level of knowledge represents minimum competence for EA practice. It’s not an arbitrary cutoff. It’s based on professional judgment about readiness to represent taxpayers.

The practical implication: you don’t need to answer 100% or even 90% of questions correctly to pass. Prometric calculates your SEE results based on how many multiple-choice questions you answered correctly in each exam section, using psychometric scaling that turns the number of questions answered correctly into a scaled score, requiring at least 105 to pass. Most estimates suggest you need to correctly answer approximately 70–75 of the 85 scored questions (roughly 82–88% accuracy) to achieve a scaled score of 105. This gives you room for 10–15 mistakes and still pass.

Enrolled Agent Exam Passing Score

The IRS sets a scaled passing score at 105 out of the available 130 points. This is your target for every exam part. You must achieve 105 or higher on all three parts to qualify for EA enrollment. Unlike some certifications that average your scores across sections, EA requires passing each part independently. A 120 on Part 1 doesn’t compensate for a 95 on Part 2.

When you pass an exam part with a score of 105 or higher, test results are available immediately following the exam, and candidates who pass are not told their score, simply that they passed. You’ll see “PASS” on your screen, but the system won’t reveal whether you scored 105, 115, or 130. The IRS takes the position that passing is passing. Once you’ve demonstrated minimum competence, your exact score doesn’t matter for credentialing purposes.

However, if you don’t pass, the system provides detailed diagnostic information. Candidates who fail will be told their score, as well as diagnostic information to help prepare for re-examination. You’ll receive your scaled score (somewhere from 40 to 104) and a breakdown showing your performance in each domain. If you do not pass a section, you will receive a numerical scaled score ranging from 40-104 to provide some insight into how close you came to passing, along with proficiency rankings.

The diagnostic feedback uses a three-level system for each domain. Level 1 means “Weak,” which means focus strongly on this area as you prepare to retake; Level 2 means “Marginal,” which means you need further work in this area; Level 3 means “Strong,” which means your knowledge of this domain was almost good enough to pass. This feedback is invaluable for targeted study. If you scored 100 and had “Weak” in two domains but “Strong” in the others, you know exactly where to focus your retake preparation.

One more important detail: the passing score of 105 is consistent across all three parts and remains the same year after year. The IRS doesn’t adjust the passing threshold based on overall performance or make the exam harder to pass over time. The standard is stable, which means preparation resources and advice from those who’ve recently passed remain relevant.

Enrolled Agent Exam Pass Rates Comparison Across the Three Parts

Understanding current pass rates helps you set realistic expectations and plan your approach. These are the EA Exam 2024-2025 pass rates: Part 1 Individuals has a 58% pass rate, Part 2 Business has a 71% pass rate, and Part 3 Representation, Practices, and Procedures has a 70% pass rate. These rates represent the percentage of candidates who passed each part during the testing window.

Part 1’s 58% pass rate being the lowest might surprise you since individual taxation seems more intuitive than business taxation. The explanation is simple: the number of candidates who take Part 1 is nearly twice the number of those taking Part 2 and Part 3. Many more candidates attempt Part 1, including some who aren’t fully prepared or are testing the waters. The self-selection effect means Parts 2 and 3 test pools include more serious, committed candidates who’ve already proven they can pass one part. Additionally, candidates often take Part 1 first when their study habits and exam strategies aren’t yet optimized.

Part 2’s 71% pass rate and Part 3’s 70% pass rate are considerably higher. This doesn’t necessarily mean these parts are easier. It means the candidates taking them are better prepared. By the time you’re sitting for Part 2 or 3, you understand what EA exam questions look like, you’ve refined your study approach, and you’re likely more motivated, having already invested effort in passing previous parts. The higher pass rates reflect this experienced candidate pool.

Compared to other professional exams, these EA pass rates are quite favorable. The IRS Enrolled Agent exam pass rate fluctuates from 70% to 74% on average, which is a high pass rate compared to other professional accounting exams, like the CPA, which has an average pass rate of 45-50%. The CPA exam’s lower pass rates reflect both greater breadth (covering audit, financial accounting, and tax) and more stringent requirements. The EA’s tax-only focus and more accessible format contribute to higher pass rates.

For Indian candidates specifically, I’ve noticed that those with CA or strong commerce backgrounds often pass Part 1 and Part 2 on their first attempt but sometimes need a second attempt on Part 3 due to unfamiliarity with IRS procedures. The procedural nature of Part 3 requires different preparation than the calculation-heavy Parts 1 and 2. My advice: don’t underestimate Part 3 just because it has a high pass rate. Take it as seriously as the other parts.

Enrolled Agent Exam Registration in India

How to Get Your PTIN Before Taking the Enrolled Agent Exam

PTIN Application Process for Indian Residents

Your PTIN journey begins on the IRS PTIN application website, where you’ll create an account and complete the online application. As an Indian resident, you’ll need to provide your full name exactly as it appears on your passport, your complete Indian address, your date of birth, and your passport number. The system requires a valid passport because that’s your primary identification document as a non-U.S. resident.

If you submit a paper Form W-12 instead of applying online, you must include a notarized color copy of your passport. The notarization must be done by a notary public in India who verifies that the passport copy is authentic and matches your original document.

For online applications, you do not need to submit a notarized copy. The IRS accepts the information entered in the application, along with uploaded supporting documentation if requested.

Required Documents and Notarization Requirements

For notarization, the notary must notarize each page of your passport showing your photograph and personal details. Not just the bio page, but any pages with stamps or visas if the IRS requests complete passport copies. Most candidates get their passport’s bio page and the last page (with address) notarized. The notarization should be fresh. Ideally, within three months of your PTIN application. Visit a registered notary public in your city, carry your original passport, and request notarized color photocopies. The notary will attest that they’ve verified the copies against your original passport. Cost varies but typically ranges from ₹50-200 per page depending on your location.

PTIN Processing Timeline and Costs

The PTIN application fee is approximately $50-60 USD (around ₹4,000-5,000) and must be paid via credit card during the online application process. The PTIN must be renewed annually. Once you submit your application with all required documents, processing typically takes 4-6 weeks for international applicants. The IRS will email your PTIN once approved, or they’ll contact you if additional documentation is needed. The candidate can apply for the Special Enrollment Examination only if they possess a valid PTIN, though the PTIN application process may be carried out while the batch is in progress, so candidates need not wait till the PTIN is generated to attend classes. Start your PTIN application 2-3 months before you plan to schedule your first exam to ensure it’s approved in time.

Enrolled Agent Exam Registration Through Prometric

Creating Your Prometric Account: Step-by-Step

Once your PTIN is issued, you’re ready to register for the exam through Prometric’s Special Enrollment Examination portal. All first-time users must create a new Prometric account with step-by-step instructions on how to create an account and establish a new user ID and password. Click “Create Account,” and you’ll provide your full name (matching your passport), email address, phone number with the India country code (+91), and your PTIN. The system will ask you to create a username and password. Write these down because you’ll need them to schedule exams and check results.

During account creation, carefully enter your personal information exactly as it appears on your government-issued ID. Any mismatch between your Prometric registration and your passport can cause issues on exam day when the test center verifies your identity. Double-check spelling, especially if your name has uncommon characters or multiple spellings. The Prometric system will send a confirmation email once your account is created. Verify you received it before proceeding.

Scheduling Your Enrolled Agent Exam Appointments Through Prometric

After creating your account, log in and select “Schedule New Exam.” You’ll choose your exam part (Part 1, Part 2, or Part 3), select your preferred testing location from available Prometric centers in India, choose your exam date and time, and pay your exam fee. This completes the scheduling process. The system shows real-time availability, so you can see which dates and times have open slots at your preferred location.

You can schedule all three parts at once if you’re confident in your timeline or schedule them one at a time as you complete your preparation. Candidates may schedule each part of the exam at their convenience, in any order, and it is not required to take all parts in one sitting. Many candidates prefer scheduling one part, passing it, then scheduling the next. This approach ensures you’re not locked into dates you might not be ready for.

Important: after scheduling your exam, review your appointment confirmation email to ensure that you have the correct exam, date, time, and testing location. Mistakes happen. Candidates sometimes accidentally select the wrong part or wrong date. Verify immediately while you can still make changes. If you need to reschedule, Prometric allows changes for a fee if done at least 2-3 business days before your exam date. Last-minute cancellations or no-shows usually mean forfeiting your exam fee entirely.

Enrolled Agent Exam Fees in India and Payment Options

As of March 1, 2025, the IRS increased the fee to $267 per part of the Special Enrollment Examination (SEE). The fee discrepancy exists because different sources may reflect different time periods or special pricing. As of 2025, the budget is approximately $267 per part, which equals roughly ₹22,000-23,000 per part at current exchange rates. For all three parts, you’re looking at approximately ₹66,000-70,000 in exam fees alone.

Payment must be made via credit card (Visa, MasterCard, or American Express) at the time of scheduling. Prometric collects payment when you schedule your exam sections, and you must pay using a Visa, Mastercard, or American Express credit card. Make sure your credit card has international transaction capability and a sufficient credit limit. Some Indian banks block international transactions by default. You may need to call your bank and request temporary authorization for Prometric charges.

Testing fees are generally not refundable or transferable, and in very limited situations, such as the death of the candidate or accidentally signing up for the examination twice for the same date and time, refunds will be considered. This non-refundable policy means you should only schedule exams when you’re genuinely ready to sit for them. Don’t schedule optimistically, hoping you’ll be prepared. Make sure your preparation is solid before committing your money.

Enrolled Agent Exam Centers in India

Prometric Testing Centers Across Indian Cities

In India, candidates can take the SEE at Prometric testing centers in Mumbai, Chennai, Kolkata, Bangalore, Hyderabad, and New Delhi (or Gurgaon). Prometric maintains approximately 300 test sites throughout the US and internationally. The availability of testing centers across India means most candidates can find a location within their own city or a nearby major city, avoiding the need for expensive domestic travel.

When selecting your testing center during scheduling, Prometric shows you available locations sorted by distance (if you’ve provided your address) or by city. Each center listing includes the complete address, available dates and times, and sometimes candidate reviews. I recommend choosing a center you can easily reach without traffic stress. Arriving frazzled from a difficult commute isn’t how you want to start your exam. If possible, visit the testing center location a few days before your exam to know exactly where it is and how long travel takes.

These centers follow strict guidelines and offer a secure and comfortable environment to take your exam. Prometric testing centers are professional facilities specifically designed for computer-based testing. You’ll have a dedicated workstation with a computer, desk, chair, and often noise-canceling headphones available. The testing rooms are climate-controlled and monitored by proctors and security cameras to ensure exam integrity.

What to Expect on Exam Day at Testing Centers

Arrive at your chosen Prometric center at least 30 minutes before your scheduled exam time. To enter the testing facility, you must present a valid, government-issued identification card containing both your signature and picture. For Indian candidates, this means your passport. Carry the original, not a photocopy. Your passport must match the name on your Prometric registration exactly. Any name mismatch, even a middle name difference, can result in being turned away.

When you arrive, you’ll present your identification, store your belongings in an assigned locker, and then pass through a metal detector to enter the testing room. The locker holds your phone, wallet, bags, study materials, and any personal items. You cannot bring anything into the testing room except your ID. No watches, no jewelry, no paper, no calculators (the exam software provides an on-screen calculator for Part 2 business calculations). You’re not allowed to bring any notes or study materials with you to the exam, and phones and electronic devices are also prohibited, even during breaks.

The check-in process includes palm vein scanning or fingerprint scanning for biometric verification, and the proctor may take your photograph. This isn’t invasive. It’s standard security to prevent proxy test-taking. You’ll be escorted to your assigned workstation, where you’ll find your computer ready with the exam tutorial. Take your time with the tutorial. It explains how to navigate the software, mark questions for review, use the on-screen calculator, and access the break. The tutorial time doesn’t count against your exam time.

Each exam session is monitored and conducted under strict examination protocols. Proctors watch via cameras and may enter the testing room periodically. If you need to raise your hand for any reason (technical issue, need an unscheduled break), a proctor will assist you. The room is typically quiet except for keyboard typing sounds from other test-takers. The noise-canceling headphones help if you’re sensitive to background sounds.

Enrolled Agent Exam Dates

Enrolled Agent Exam Window: May 1 to February 28

Exams are offered May 1 through February 28, with no testing in March or April. This testing window structure has important implications for your preparation planning. The intervening months, March and April, are used to update the Enrolled Agent exam content with the latest tax law changes. The blackout exists because the IRS needs time to incorporate new tax legislation, update questions based on the previous year’s performance data, and prepare the exam for the upcoming testing year.

Let’s talk strategy around this window. If you’re starting preparation in January or February, you face a decision: take exams immediately before the window closes or wait until May when the new window opens. Taking exams in February means testing on the previous year’s tax law before the update. If you’re confident in your preparation, this can be advantageous. You take the exam before any question changes. However, if you fail and need to retake in May or later, you’ll be tested on updated content.

Alternatively, starting preparation after tax season (April-May) means you’re studying when US tax season has just concluded and the updated exam content reflects the most recent tax year. It’s beneficial to study for the EA exam after tax season when the most recent tax law is fresh. This is particularly relevant for candidates working in tax roles. The practical experience during tax season reinforces exam concepts.

For Indian working professionals, consider your own work calendar. If you’re in an accounting role with a busy season (typically January-March for many firms), scheduling exams during that period adds stress. Many Indian EA candidates prefer scheduling exams from May to December when work pressures are lower and they can dedicate focused evening/weekend study time. The flexibility of the 10-month testing window allows you to work around your personal schedule.

One critical deadline to remember: candidates have a two-year window from the time they pass the first part to pass the other two parts of the exam, extended to three years by the IRS for added flexibility. If you pass Part 1 in June 2025, you have until June 2028 to pass Parts 2 and 3. However, don’t let this three-year window lull you into complacency. The longer you stretch out your exam timeline, the more you forget from previous parts, and the more tax law changes you need to relearn. Aim to complete all three parts within 12-18 months for optimal results.

Enrolled Agent Exam Pass Rates

The national average pass rate for the EA exam during the 2023–2024 period was approximately 66%, based on a weighted estimate across all three parts, with Part 1 generally having a lower pass rate that improves with each subsequent part. These overall pass rates represent a composite across all three parts and all candidate attempts. The rate reflects first-time test-takers, repeat attempts, fully prepared candidates, and those testing prematurely. This is a high pass rate compared to other professional accounting exams, like the CPA, which has an average pass rate of 45–50%. The EA’s higher pass rates indicate that with proper preparation, passing is highly achievable. This isn’t an insurmountable exam designed to fail most candidates.

What Happens When You Pass an Enrolled Agent Exam Part?

Enrolled Agent Exam Immediate Results and Score Reports

You will receive your results immediately on-screen after completing the test. Once you finish your 100th question, the computer displays either “PASS” or your scaled numerical score if you did not pass. The scaled score ranges from 40 to 130, with 105 being the minimum required to pass. If you pass, only the “PASS” designation appears. No numerical score is shown, since all scores above 105 indicate qualification. This immediate feedback is both a blessing and a source of anxiety. You know instantly whether you’ve succeeded, unlike some other professional exams that require weeks for results. After the exam, you can enter your full exam confirmation number (16 digits with leading zeros) and last name on the IRS score validation website to officially confirm and print your score report. Prometric also emails a copy of your score report for your records.

Enrolled Agent Exam Two-Year Carryover Period

Once you pass an exam part, that credit is valid for a two-year carryover period, extended to three years by the IRS to provide added flexibility. This means if you pass Part 1 on June 15, 2025, that passing score remains valid until June 15, 2028. You must pass Parts 2 and 3 by that date or your Part 1 credit expires and you’ll need to retake it. The three-year window is generous, but strategic candidates aim for much faster completion to maintain momentum and minimize the amount of relearning required as tax laws change year to year.

Enrolled Agent Exam Multiple Part Completion Management

Managing multiple part completions requires tracking your credit expiration dates carefully. If you pass Part 1 in June 2025 and Part 2 in December 2025 and then delay Part 3, you need to know that Part 1 expires in June 2028, while Part 2 doesn’t expire until December 2028. If you don’t pass Part 3 before June 2028, your Part 1 credit disappears even though Part 2 remains valid. You’d then need to retake Part 1 and pass it before your Part 2 credit expires. This cascading expiration risk is why completing all parts within 12-18 months is strongly recommended.

What if You Fail an Enrolled Agent Exam Part?

If you don’t pass an Enrolled Agent exam part, you’ll receive diagnostic feedback showing your performance in each domain as Level 1 (Weak), Level 2 (Marginal), or Level 3 (Strong). This feedback highlights exactly where you need to focus, so you can double down on weak areas while lightly reviewing domains where you performed well. Candidates can retake a failed part, but must wait at least 24 hours before scheduling the same part again.

Each part can be attempted up to four times within a testing window (May 1 through February 28); failing four times requires waiting until the next testing window to retake the exam. Each retake requires full payment, so careful preparation is essential. Use the waiting period to review diagnostic feedback and create a targeted study plan, focusing on specific weaknesses rather than simply “studying harder.”

Enrolled Agent Exam Difficulty

EA vs CPA Exam Difficulty Comparison

The EA exam and CPA exam target different scopes. Because the EA focuses specifically on tax subjects rather than covering broader accounting topics like the CPA Exam does, most find it much more accessible. The CPA covers four sections: Auditing and Attestation (AUD), Financial Accounting and Reporting (FAR), Regulation (REG, which includes tax plus business law), and Business Environment and Concepts (BEC). Only one of the four CPA sections is tax-focused, while all three EA parts are exclusively tax.

For Indian candidates specifically, EA tends to be more achievable because you can focus entirely on mastering US tax law without needing to learn US auditing standards, US GAAP financial accounting, or US business law. If your goal is tax preparation and representation work, EA gives you exactly the credential you need without requiring you to study unrelated accounting domains. That focused scope makes preparation more efficient.

The math also matters: Each EA exam part requires approximately 70-90 hours of study for Part 1, 80-100 hours for Part 2, and 60-80 hours for Part 3. Total study time for all three parts: roughly 210-270 hours. The CPA exam requires an estimated 300-400 hours total across all four sections. The time investment for EA is substantial but more manageable, especially for working professionals who must study alongside full-time jobs.

Is the Enrolled Agent Exam Worth It for Indian Professionals?

For BCom/MCom Graduates Seeking Remote Work

If you’re a BCom or MCom graduate and you’re reading this, you’re probably tired of the limited options in the Indian job market, which are around ₹15,000-25,000 monthly starting salaries for basic accounting roles, limited growth, and overwhelming competition. The EA credential fundamentally changes your position.

Within 6-12 months of focused study, you can be certified to work with US clients and command $15-25 per hour even as a beginner. Let’s do the math: at $20/hour working 40 hours per week, that’s $3,200 per month or approximately ₹2.7 lakhs monthly at current exchange rates. That’s ₹32+ lakhs annually, more than many mid-level professionals earn in India-based accounting roles.

Even if you start part-time while keeping your India-based job, working 20 hours per week at $20/hour gives you $1,600 monthly (roughly ₹1.35 lakhs) as supplementary income. This extra income dwarfs your primary salary and gives you financial freedom to eventually transition fully to US client work if you choose. For fresh graduates with no job yet, EA certification makes you immediately employable by India-based US tax outsourcing firms at ₹3.5-6 lakh annual packages, which is significantly better than generic BCom graduate starting salaries.

The investment-to-return ratio is compelling. Total costs: ₹66,000 exam fees + ₹20,000-40,000 study materials (self-study route) + ₹5,000 PTIN/application = roughly ₹90,000-1.1 lakhs total. If you land a US client paying $20/hour, you recover your entire investment in about 55-60 hours of billable work, which is essentially one month of part-time work or two weeks of full-time work. Few other professional certifications offer such a quick ROI for Indian graduates.

For CA/CS Professionals Wanting US Market Access

If you’re a CA or CS, you’ve already invested enormous effort into your qualification. The EA isn’t a replacement for your Indian credential. It’s an expansion pack. Your CA qualification carries immense value in India but limited recognition internationally. The EA gives you IRS-recognized credentials that US clients and employers immediately understand and respect. You’re essentially becoming bilingual in taxation, fluent in both the Indian and US tax systems.

The career flexibility this provides is remarkable. You can continue practicing as a CA in India while building a US tax practice on the side during US tax season (January-April). Many CAs work in the US tax preparation industry in India, with some working in the US tax outsourcing field for over a decade after taking this path. The US tax season doesn’t heavily overlap with Indian tax filing deadlines (July for companies, September for individuals), so you can serve both markets with good time management.

Income-wise, CAs with EA credentials command premium rates. In India-based US tax roles at Big 4 or multinational KPOs, EA certification can add ₹3-5 lakhs to your annual package. In freelance work, US clients readily pay $40-60/hour to CAs with EA credentials because they’re getting dual expertise in Indian accounting proficiency plus US tax certification. After years in this industry, completing EA certification has already led to opportunities for client consultations and representing taxpayers before the IRS, with potential promotion to manager positions enabling signing authority on tax returns.

The time investment is also reasonable for CAs. It’s comparatively easier for CAs to clear the exams in 6-12 months, as the fundamentals of tax are the same. You’re not starting from zero. Your CA knowledge of taxation principles, accounting standards, and professional ethics transfers substantially to the EA exam content. You’re mainly learning US-specific applications rather than foundational concepts. For the caliber of professional you already are, the EA exam represents an achievable 6-9 month project that significantly expands your career options.

For Working Accountants Seeking Income Diversification

If you’re currently working in an accounting or finance role in India, EA certification offers income diversification without requiring you to quit your job. This is particularly valuable in uncertain economic times. Having a secondary income stream from US clients provides financial security that single-source income cannot match. Many working professionals pursue EA specifically as a risk management strategy: if their India-based job becomes unstable, they have an alternative income source ready to scale up.

The typical path: continue your full-time job while studying for EA during evenings and weekends (6-12 months timeline). Once certified, start taking on 1-2 US clients during weekends and evenings. Many professionals work 2-3 hours daily, five days a week for one to two months per exam part while maintaining their regular jobs. As your US client base grows and income increases, you have options: continue both (maximizing total income), reduce the India job to part-time while expanding US work, or eventually transition fully to US client work if it becomes more lucrative.

The flexibility of US tax work makes this feasible. Most US small business clients don’t need daily interaction. They need quarterly bookkeeping catch-up, quarterly tax estimates, and annual return preparation. You can schedule this work during your personal time without disrupting your regular job. During US tax season (January-April), you’ll be busier and might need to take some leave from your India job, but it’s temporary. The off-season (May-December) is much lighter, allowing you to maintain a work-life balance.

For accountants in their 30s or 40s who feel stuck in their current roles, EA provides a pathway to career transition without the risk of unemployment. You’re building a safety net and testing whether US client work suits you before making any drastic employment changes. If it works well, great, scale up and transition. If it doesn’t fit your life, you still have your primary job and you’ve only invested study time and exam fees. The optionality is valuable.

Conclusion

The Enrolled Agent exam represents a legitimate pathway for Indian accounting professionals to access the lucrative US tax market without relocating or spending years on additional education. With no degree requirements, testing available in major Indian cities through Prometric centers, and a three-year window to complete all three parts, the EA credential is accessible to anyone willing to invest focused study time. The exam’s 66-70% overall pass rate indicates this is a challenging but passable certification for well-prepared candidates, which is not an insurmountable barrier.

Your decision to pursue EA should weigh the costs (₹66,000 in exam fees plus study materials) against the realistic income potential. India-based EA roles offer ₹3.5-12+ lakhs annually, depending on experience, while US remote client work can generate $15-75/hour based on your skill level and specialization. For most Indian professionals, the ROI timeline is measured in months, not years. Whether you’re a fresh graduate seeking better opportunities than generic BCom roles, a CA/CS wanting international market access, or a working professional building income diversification, the EA credential offers tangible career benefits worth the investment of 210-270 study hours spread across 6-18 months.

Frequently Asked Questions

Can I take the EA exam from India without visiting the US?

Yes, you can take the EA exam entirely from India without visiting the US. All steps, PTIN application, exam registration, testing, and enrollment, can be completed from India. Prometric SEE centers are available in Mumbai, Chennai, Kolkata, Bangalore, and New Delhi/Gurgaon.

Do I need any prior tax experience to take the EA exam?

No prior tax experience is required to sit for the EA exam. There are no education or experience requirements you need to meet to take the EA exam. The only prerequisite is obtaining your PTIN before registering.

How long does it take to complete all three EA exam parts?

It only takes most people between three months to a year to pass the EA exam and become fully credentialed. The timeline depends on your starting knowledge, available study time, and whether you’re a full-time student or working professional. With a commerce background and 10-15 hours of weekly study, you can realistically complete all three parts in 6-9 months. Without an accounting background, budget 12-18 months. Full-time students studying 25-30 hours weekly can finish in 3-4 months. CAs can clear in 6-12 months due to foundational knowledge transfer.

What happens if I don’t pass all three parts within the two-year window?

If you don’t pass all parts within the two-year carryover period (extended to three years for flexibility), the credits for passed parts expire, and you must retake those parts. For example, if you pass Part 1 in June 2025 but don’t pass Parts 2 and 3 by June 2028, your Part 1 credit expires. You’d need to retake and pass Part 1 again. Each part’s three-year clock starts from the date you passed it, so different parts may have different expiration dates if you spread them out. This cascading expiration risk is why completing all three parts within 12-18 months is recommended.

Can I work as an EA from India and serve US clients remotely?

Yes, this is increasingly common. Once you’re an enrolled agent, you have unlimited representation rights before the IRS regardless of where you’re physically located. Many Indian EAs successfully build practices serving US individuals and small businesses remotely.

How much does the entire EA certification process cost for Indian candidates?

Total costs include PTIN application (~₹5,000), exam fees for three parts (~₹66,000-70,000 at $267 per part), study materials (₹20,000-40,000 for self-study books and question banks, or ₹60,000-1.5 lakhs for coaching programs), enrollment application fee (~₹2,000), and incidental costs like notarization. The minimum total investment is approximately ₹90,000-1 lakh for a budget-conscious self-study approach, up to ₹2-2.5 lakhs if using premium review courses.

Is EA easier than CA or CPA for Indian commerce graduates?

EA is generally considered more accessible than both CA and CPA, but “easier” is relative. CA requires 4-5 years of articles plus extremely difficult exams with low pass rates. CPA requires specific educational credits and covers broader accounting topics beyond tax. EA focuses exclusively on US taxation, has no education prerequisites, features higher pass rates (66-70% vs. CPA’s 45-50%), and can be completed in 6-18 months. For CAs specifically, the EA is comparatively easier to clear in 6-12 months, as tax fundamentals are the same.

Do US employers recognize EA credentials earned by Indian professionals?

Yes, EA is a federally issued credential by the IRS, so it carries equal weight regardless of where you took the exams. Enrolled agents have unlimited IRS representation rights and are recognized nationally, with the IRS describing EA certification as the highest professional credential the agency awards. US employers hiring remotely, US CPA firms with offshore teams, and US clients seeking tax preparers all recognize and respect the EA credential equally whether you earned it in Chicago or Chennai. Your credential is listed in the IRS Directory of Federal Tax Return Preparers, providing legitimacy to potential clients and employers.

Can I get a job in India after becoming an Enrolled Agent?

Absolutely. India has a growing US tax outsourcing industry with opportunities at Big 4 firms (EY, Deloitte, PwC, KPMG), mid-tier accounting firms, specialized US tax KPOs, and multinational companies with US operations. EA-certified professionals can pursue careers in US-based MNCs, Indian companies with US presence, public accounting firms, and corporate accounting departments, with India-based salaries ranging from ₹3.5-6 lakhs for entry-level to ₹12-15+ lakhs for experienced EAs.

What’s the average salary for Enrolled Agents working from India?

Salaries vary significantly based on employment type and experience. India-based jobs: ₹3.5-6 lakhs annually with one part cleared, ₹7.5 lakhs with all parts and one year experience, ₹12 lakhs per annum with three parts and experience. US remote client work: Beginner EAs charge $15-25/hour (₹13-21 lakhs annually full-time), intermediate EAs $30-45/hour (₹26-39 lakhs annually), and expert EAs with specializations $50-75/hour (₹43-65 lakhs annually). Part-time freelancers working 20 hours weekly at $25/hour earn approximately ₹18 lakhs annually as supplementary income. Senior EAs with their own practices can exceed ₹50 lakhs annually.

How do I find my first US client as a new EA from India?

Start with freelance platforms like Upwork and Freelancer where US individuals and small businesses post tax preparation projects. Create a professional profile highlighting your EA credential, commerce education, and any relevant experience. Initially, bid competitively ($15-20/hour) to build reviews and portfolio. Join Facebook groups and LinkedIn communities for US tax professionals where job opportunities are posted. Network with established Indian EAs working in the US tax industry who can provide referrals or subcontracting opportunities. Consider approaching US CPA firms that outsource work to India, offering your services as a contract preparer. Build a simple website showcasing your credentials and services.

Is the EA exam entirely multiple choice, or are there essays?

The EA exam is 100% multiple-choice questions with no essays, written responses, or simulations. Each of the three parts contains 100 multiple-choice questions with four answer choices per question. Question types include direct questions, incomplete sentences where you select the correct completion, and “all of the following except,” where you identify the incorrect statement. This format means you can prepare using question banks and practice tests that closely mirror the actual exam experience. Unlike CPA’s task-based simulations or CA’s descriptive answers, the EA tests your knowledge through a standardized multiple-choice format exclusively.

Can I use a calculator during the EA exam?

Yes, but with restrictions. You cannot bring a personal calculator into the testing room, but the exam software provides an on-screen calculator. This built-in calculator handles basic functions (addition, subtraction, multiplication, division, percentages, and square root) sufficient for all tax calculations required on the exam. You’ll see a calculator icon on your screen that you can click to open the calculator window.

How often does the EA exam content change?

The exam content is updated annually during the March-April blackout period when testing is unavailable. Each testing window (May through February) tests the tax law of the previous calendar year. The IRS updates questions to reflect new tax legislation, removes questions that performed poorly based on statistical analysis, and adds new questions covering recent law changes. Major tax law changes (like the Tax Cuts and Jobs Act) result in significant exam updates, while years with minor law changes see smaller updates. The IRS publishes updated Exam Content Outlines showing the domains and topic weights, which remain relatively stable even as specific questions change.

Do I need to renew my PTIN every year even after becoming an EA?

Yes. Your PTIN must be renewed annually regardless of your EA status. The PTIN and EA enrollment are separate requirements. PTIN renewal opens each October for the following calendar year and must be completed by December 31st.

Allow notifications

Allow notifications