Compare Enrolled Agent course fees across Gleim, Surgent, Becker, and Indian providers. Learn about budget, mid-tier, and premium EA prep options with total certification costs.

Table of Contents

Why Should You Invest in an Enrolled Agent Prep Course?

The Special Enrollment Examination (SEE) has a 60-70% pass rate across all three parts, meaning nearly one-third of candidates fail at least one section on their first attempt. Investing in a quality EA prep course significantly improves your odds of passing all three parts on the first try, saving you both time and the $267 retake fee per failed section. While self-study using free IRS materials is technically possible, structured courses provide organized content, practice questions, and adaptive learning technology that mirror actual exam conditions.

What Are the Risks of Studying Without a Professional Course?

Self-studying for the EA exam without structured guidance carries significant financial and time risks that often outweigh the initial cost savings. The IRS provides free publications and sample questions, but these materials lack the organization, practice depth, and exam strategies that professional courses offer. Most successful self-study candidates already have extensive US tax experience or have previously attempted the exam with coaching.

Special Enrollment Examination Difficulty

The SEE tests comprehensive knowledge across individual taxation (Part 1), business taxation (Part 2), and representation procedures (Part 3), with 100 multiple-choice questions per part in 3.5-hour testing windows. Part 1 historically has the lowest pass rate at approximately 61%, while Part 3 achieves around 85%, according to data from major review providers. The exam doesn’t just test tax code memorization. It requires application of concepts to complex scenarios, understanding of IRS procedures, and the ability to advise clients on compliance strategies.

Benefits of an EA Course

Professional EA courses provide organized study paths that sequence topics logically, starting with foundational concepts before progressing to complex applications. Most quality courses include 2,000 to 3,500 practice questions with detailed explanations that teach you not just the correct answer but why other options are wrong. Adaptive learning technology tracks your performance and identifies weak areas, ensuring you spend study time where you need it most rather than reviewing material you’ve already mastered.

Live or recorded video lectures break down complex tax concepts into digestible segments, with instructors highlighting exam-relevant points and common pitfalls. Mock exams simulate actual testing conditions with timed 100-question tests, helping you develop pacing strategies and build stamina for 3.5-hour sessions. Many courses also provide access to instructor support or study communities where you can ask questions and get clarification on confusing topics, resources unavailable to pure self-study candidates.

Cost of Not Investing in Quality Preparation

Failing even one EA exam part costs you $267 minimum in retake fees, plus the opportunity cost of delayed certification and continued studying. If you fail two parts, you’ve spent $534 in additional fees, likely more than the cost of a mid-tier review course that could have prevented those failures. Beyond direct retake costs, failed attempts delay your ability to start earning as an EA, potentially costing thousands in lost income if you’re waiting to transition to higher-paying EA roles.

Poor preparation wastes the most valuable resource you have: time. Spending 300 hours studying with inadequate materials is far less effective than 200 hours with a structured course that focuses your efforts on high-yield topics and proven test strategies.

What Are the Different Price Ranges for Enrolled Agent Course Fees?

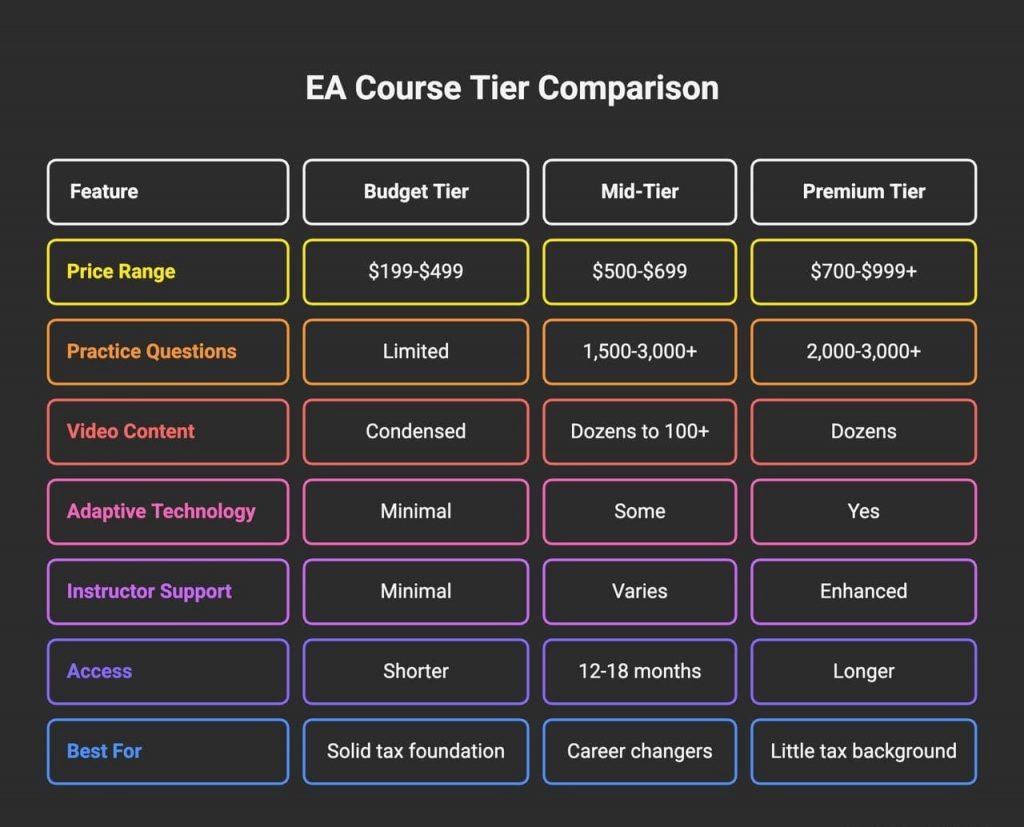

EA review courses span from budget options under $300 to premium packages exceeding $1,000, with pricing primarily reflecting practice question quantity, video content hours, adaptive technology sophistication, and instructor support levels. The market segments into three clear tiers: budget courses ($199-$499) offering basic study materials and limited questions, mid-tier options ($500-$699) providing comprehensive content with good question banks, and premium courses ($700-$999+) featuring extensive practice, advanced technology, and robust support.

What are the Enrolled Agent Course Fees Across Different Tiers?

Budget courses focus on delivering essential study materials at minimal cost, mid-tier offerings balance comprehensive content with reasonable pricing, while premium packages provide maximum resources for candidates wanting every possible advantage. Your choice should align with your tax knowledge background, available study time, learning style preferences, and budget realities.

Budget Tier Courses

Budget EA offerings include stripped-down test banks, condensed digital manuals, or basic “Essentials” packages. Expect fewer interactive features, fewer practice questions, minimal adaptive tech, and shorter access windows than premium packages. Major brands’ “Essentials” offerings differ. Becker lists 3,000+ practice questions and 12-month access at its Essentials level, while Surgent sells test banks and Essentials/Premier/Ultimate passes at different prices and access terms, so read the provider pages before assuming features based on price alone. These packages suit reviewers with a solid tax/accounting foundation who primarily need practice and a concise syllabus rather than full instruction.

Mid-Tier Courses

Mid-tier EA review courses commonly sit in the $500–$699 band and offer the best value for many candidates. Expect substantial question banks (typically 1,500+ questions and in many cases 2,000–3,000+), dozens to over 100 short video lectures, downloadable study guides or printed book options, and realistic, timed practice exams. Many mid-tier products include some adaptive or performance-tracking tools (Surgent, Fast Forward, and Gleim all advertise adaptive features), and access terms vary by vendor. Some tiers offer 12–18 months, while others provide updates and access until you pass. These packages suit career changers and working professionals who need full instruction plus ample practice without paying for one-on-one coaching.

Premium Tier Courses

Premium EA review packages occupy the top end of the pricing spectrum (often ~$700-$1,000+ or more) and aim to deliver the most comprehensive resources. Features you’ll typically see include large test banks (often 2,000+ questions, with some vendors exceeding 3,000), dozens of video lectures, adaptive learning technology (tracking performance, custom study paths), longer or until-you-pass access, and enhanced support (personal counselor, live webinars, coaching).

Examples include Gleim’s Premium EA Review System and Surgent’s higher-tier passes. These options serve candidates who have little tax background, have tried before and struggled, or want maximum preparation confidence. The trade-off: you pay more, so you’d only pick this level if you truly need the full suite of support and resources.

Premium Enrolled Agent Course Fees and Contents

Premium EA courses sit at the top of the market and often cost several hundred dollars more than mid-tier options. Leading providers (Gleim, Surgent, and Becker) offer higher-end packages that typically include larger test banks (many offer 2,000+ questions; some exceed 3,000), adaptive learning engines (SmartAdapt, ReadySCORE, and AI-driven study guidance), dozens of lecture videos or hundreds of short video segments, and elevated support (personal counselors, scheduled live webinars, and pass guarantees in certain packages).

Pricing and feature sets vary by vendor and by package; some “premium” passes are $699–$799, while others can approach or exceed $800–$900, so read product pages carefully. These packages are best for candidates who need full instruction from basics to advanced topics, those retaking parts, or professionals who value faster certification despite a higher upfront cost. Premium resources reduce resource-related risk but do not guarantee success; study discipline and time remain decisive.

What is the Gleim Enrolled Agent Review Course Fee?

Gleim EA Review offers two primary packages, Traditional ($599-$699) and Premium ($799-$899), with pricing varying based on whether you purchase all three parts together or individually. The Traditional package positions at the mid-tier/premium boundary, while Premium firmly occupies the premium space with enhanced features, justifying the higher investment. Gleim emphasizes its massive question bank (the industry’s largest) and SmartAdapt adaptive technology that personalizes your study path based on performance data.

Package Options and Costs

Gleim offers two primary Enrolled Agent (EA) Review packages: Traditional and Premium.

- Traditional EA Review costs $699 for all three parts, with discounts available through academic partnerships. It includes Gleim’s digital textbooks, 3,500+ practice questions, basic SmartAdapt adaptive technology, and email support from EA-certified counselors. Access continues until you pass each part, so candidates can study at their own pace without worrying about time limits.

- Premium EA Review costs $799 for all three parts, also with academic discounts available. In addition to the Traditional features, Premium provides audio lectures for mobile study, video lectures with expert instructors, enhanced SmartAdapt Pro with advanced performance tracking, and access to EA experts for technical support. It also includes 72 hours of Continuing Education (CE) credits, which fulfill part of the CE requirements needed post-certification. Based on typical CE course pricing, these credits have an estimated value of $576–$864, adding significant long-term value.

Both packages offer the Access Until You Pass® guarantee for bundle purchases, and Gleim occasionally provides promotional discounts of 10–20% during Black Friday, tax season, or back-to-school periods. Military members, students, and NAEA members may also qualify for special discounts ranging from $50 to $100.

What Each Package Includes

Gleim’s EA Review packages are designed to give candidates a structured, comprehensive approach to passing all three parts of the Enrolled Agent exam. Both the Traditional and Premium packages share the foundation of 3,800+ practice questions, the largest EA question bank available, covering every exam topic with detailed explanations that show not only the correct answers but also why alternatives are wrong.

Gleim’s SmartAdapt™ technology tracks your performance, identifies areas that need extra attention, and tailors your study path so you can focus on topics that matter most rather than spending time on material you’ve already mastered. The included digital textbooks provide in-depth coverage of all tested tax concepts and are organized to align closely with the exam’s structure and emphasis.

The Traditional package delivers these core resources in digital format and comes with email support from EA-certified counselors who monitor your progress and offer guidance. Full-length practice exams replicate the actual test experience, helping you build stamina and pacing skills, while the performance dashboard provides clear insight into your readiness and progress across all topics. Access continues until you pass each exam part, giving you the flexibility to study at your own pace.

The Premium package builds on these features by adding audio lectures for mobile study and over 30 hours of video instruction led by expert instructors, offering visual explanations of complex topics such as depreciation methods, business entity taxation, and Circular 230 regulations. Premium also includes the enhanced SmartAdapt Pro, which provides more detailed performance analysis and gives direct access to EA subject-matter experts for technical questions.

In addition, the three-part Premium bundle comes with 72 hours of Continuing Education credits, helping candidates meet post-certification CE requirements. Like the Traditional package, Premium comes with the Access Until You Pass® guarantee, ensuring you can continue using the materials until you successfully complete all exam parts.

Together, these packages provide candidates with a complete, flexible study solution, combining extensive practice, structured instruction, adaptive guidance, and expert support to cover all learning preferences and study needs.

Value Analysis for Gleim Pricing

The choice between Gleim’s Traditional and Premium EA Review packages often comes down to whether the extra $200 for Premium is worth it. The Traditional bundle costs $699 for all three parts and provides access to 3,800+ practice questions, digital textbooks, basic SmartAdapt technology, and email support from EA-certified counselors. Access continues until you pass, giving slower-paced or working professionals the flexibility to study at their own speed.

The Premium bundle costs $899 for all three parts and adds several features that justify the $200 investment for many candidates. Premium includes audio lectures for mobile study, over 30 hours of video instruction, enhanced SmartAdapt Pro technology with more detailed performance analysis, and direct access to EA subject-matter experts for technical questions.

In addition, the three-part Premium bundle includes 72 Continuing Education (CE) hours, which are required for your first three-year EA renewal cycle. If you were to purchase these CE hours separately, they could cost roughly $576–$864, meaning the Premium package’s incremental cost over Traditional is effectively reduced, sometimes even offset entirely.

The value of Premium depends on your circumstances:

- Worth it for Premium: Candidates with limited tax experience, those who learn better through video or audio instruction, or professionals planning a long-term EA career who need CE hours will find the additional resources justify the $200. Access to experts and enhanced adaptive technology can also save study time and provide confidence for first-attempt success.

- Traditional may suffice: Experienced tax professionals, self-directed learners, or candidates confident in self-study may find that the Traditional package offers all the essential resources they need without paying extra.

In essence, the $200 difference is not just a price increase. It represents added convenience, learning efficiency, expert guidance, and CE credit value. For many candidates, particularly those planning a career as an EA, Premium is an investment that pays for itself.

What Are Surgent and Becker Premium Enrolled Agent Course Fees?

Surgent and Becker both compete in the premium EA course market with three-tier pricing structures, offering budget, standard, and premium options ranging from $499 to $899. Both emphasize adaptive learning technology that customizes your study experience, though they implement this differently. Surgent with A.S.A.P. Technology and Becker with its proprietary learning management system. These providers suit candidates who prefer more modern, streamlined interfaces compared to Gleim’s comprehensive but traditional approach.

Surgent EA Review Three-Tier Pricing

Surgent offers three EA Review packages designed to meet different learning needs and budgets: Essentials ($299), Pass ($499), and Premier Pass ($699).

Essentials ($299) serves as the budget option, providing 1,800+ practice questions, 18 months of access, digital textbooks, and A.S.A.P.® Technology, which creates personalized study paths by identifying knowledge gaps and adjusting your study plan accordingly. This package is ideal for experienced tax professionals who primarily need focused review rather than comprehensive instruction. Less-experienced candidates may find the limited question count and access period insufficient for full exam preparation.

Pass ($499) builds on Essentials, offering unlimited course access, full A.S.A.P.® Technology, ReadySCORE™ predictive analytics, and live webinars with instructor guidance. ReadySCORE™ analyzes your practice performance to indicate when you are likely ready to take the exam, helping you study efficiently. This package represents solid value at the mid-tier/premium boundary, suitable for most candidates seeking a balance between cost and comprehensive features.

Premier Pass ($699) adds physical textbooks and flashcards, enhanced instructor support with faster response times, and the full suite of A.S.A.P.® Technology features. It also includes Surgent’s “Pass or Don’t Pay” guarantee, offering a money-back option if you follow the recommended study path and fail, subject to documenting study activity and meeting benchmark requirements. Premier Pass is ideal for candidates who want the most comprehensive combination of digital and physical materials, personalized study guidance, and adaptive technology support.

Becker EA Review Pricing Structure

Becker offers two main Enrolled Agent (EA) Exam Review packages: Essentials ($499) and Pro ($679–$799). These packages bring Becker’s established CPA exam prep expertise to the EA market, combining comprehensive content, adaptive learning technology, and robust student support.

Essentials ($499) provides a strong foundation for EA candidates. It includes 3,000+ multiple-choice questions, digital textbooks, video lectures, 700+ digital flashcards, and 12 months of course access. The package also offers unlimited academic and technical support and access to Becker’s private Facebook EA community, giving candidates guidance and peer interaction during exam preparation. Essentials is well-suited for candidates who want complete coverage in a fully digital format without additional features like physical textbooks or CE courses.

Pro ($679–$799) expands on Essentials by adding unlimited course access, printed textbooks, a free CE ethics course, and Newt™ AI, Becker’s AI-powered study assistant that personalizes your study plan based on your progress and performance. The Pro package also includes the Adapt2U Technology, unlimited practice tests, simulated exams, a customizable study planner, and hundreds of video tutorials covering concepts, tax forms, and SkillBuilder solutions.

Academic support remains unlimited, helping students troubleshoot difficult concepts and optimize their study strategy. The Pro package is ideal for candidates seeking maximum flexibility, adaptive learning, and a mix of digital and physical materials.

Becker emphasizes comprehensive coverage and adaptive learning, ensuring candidates can track their strengths and weaknesses and focus on areas needing improvement. Both packages include access to the Becker Learning Management System (LMS) and mobile access, so study sessions can be managed anytime, anywhere. The Pass Guarantee offered with the Pro package provides additional confidence, returning part of the cost if candidates meet study requirements but do not pass the exam.

What are the Mid-Tier Enrolled Agent Course Fees and Their Contents?

Mid-tier EA courses ($500-$699) deliver the best value for most candidates by balancing comprehensive content, adequate practice questions, and reasonable support at prices accessible to working professionals and career changers. These courses provide sufficient resources for first-attempt success while avoiding premium pricing for features like unlimited access or one-on-one tutoring that most candidates don’t utilize. Understanding mid-tier offerings helps you determine if stepping up from budget or down from premium makes strategic sense.

What is the Fast Forward Academy Enrolled Agent Course Fee?

Three Package Tiers and Costs

Fast Forward Academy offers three EA Review packages, allowing candidates to select the level of support and resources that best fits their study style and schedule:

EA Online Course – $549 ($494.10 with current discount)

Designed for independent learners, this self-study package provides 3,000+ practice questions, 155+ audio lectures, digital flashcards, unlimited practice exams, and access to academic support. It is ideal for candidates who can structure their own study plan and prefer a fully digital learning experience.

EA Smart Bundle – $649 ($584.10 with current discount)

This package adds a study guide eBook to the Online Course features, offering a more structured approach for candidates who want a guided study path without instructor-led webinars. All other resources, like practice questions, lectures, flashcards, practice exams, and academic support, remain included.

EA Smart Bundle + Bootcamp – $699 ($629.10 with current discount)

The top mid-tier package includes everything in the Smart Bundle plus on-demand bootcamp webinars led by instructors. These webinars provide additional guidance through key topics and practice questions, delivering a near-classroom experience with flexible self-paced access.

All packages include desktop, mobile, and tablet compatibility, integrated IRS publications, access and updates until you pass, and entry into FFA’s private EA community for peer support. Including the current discounts, candidates can select the right balance of features and price, ensuring comprehensive exam preparation without paying for unnecessary premium extras.

Enrolled Agent Course Fees Comparison and Best Value

For most candidates, Fast Forward Plus ($599) delivers optimal value by including physical textbooks that significantly enhance studying effectiveness compared to digital-only and community access that provides the motivational and clarification benefits of instructor support through peer interaction. The performance analytics help you identify weak areas needing extra focus, and 24-month access accommodates most study timelines, including working professionals studying 10-15 hours weekly.

Fast Forward Ultimate ($699) adds one-on-one coaching sessions, priority support with 24-hour response times, and access until you pass rather than time-limited access. The coaching sessions are particularly valuable if you’ve previously failed EA exams or have a very limited tax background, as personalized guidance ensures you’re studying effectively and understanding concepts correctly. However, many candidates succeed with the Plus package resources, making Ultimate’s extra $100 unnecessary unless you specifically need human coaching accountability.

Comparing Fast Forward to competitors, the 2,500+ questions in Basic ($539) exceed Becker Advantage’s 1,500 questions ($649-$699), while matching Surgent Pass’s quantity at a lower cost. The video content is more extensive and engaging than most competitors’, with instructors using examples and analogies that make complex tax concepts accessible. The main trade-off versus premium options is less sophisticated adaptive technology and no personal counselor tracking your overall progress, but the community forum partially compensates through peer support.

Why Fast Forward Offers Competitive Enrolled agent Course Fee?

Fast Forward keeps mid-tier pricing while offering premium-level question banks by focusing on digital delivery and community-driven support, reducing costs from physical books and one-on-one staffing. High-production video lectures are recorded once and delivered to all students, providing engaging instruction without premium pricing.

By emphasizing what students actually use, like comprehensive practice questions, clear videos, and peer forums, FFA delivers effective EA exam prep for $100–200 below premium alternatives, appealing to self-directed learners who don’t require personal counselors.

What are the Best Budget Options with Enrolled Agent Course Fee Under $500?

Budget EA courses under $500 attract cost-conscious candidates, experienced tax professionals needing focused review rather than comprehensive instruction, or students supplementing free resources with limited paid content. These options require careful evaluation. Some provide legitimate value for appropriate candidates, while others sacrifice critical features that increase failure risk. Understanding what you give up at budget pricing helps you decide if the savings justify reduced pass probability or if mid-tier investment offers better risk-adjusted value.

Which Budget Courses Offer the Best Value?

The best budget EA courses provide essential features, adequate practice questions, core content coverage, and reasonable access periods, without premium amenities like extensive video libraries, sophisticated adaptive technology, or intensive instructor support. Becker EA Review Essentials ($499) represents the upper end of the budget tier, while Surgent Essentials ($299) occupies the lower end. Both can support success for candidates with a strong accounting background, though lower-priced options may require supplementation with free resources or additional study aids to ensure full exam preparation.

Surgent Essentials

Surgent Essentials delivers 1,800 practice questions, digital textbooks, basic A.S.A.P. adaptive technology, and 18-month access for $299. This package works well for candidates with accounting degrees or tax experience who understand foundational concepts and primarily need exam-focused practice and review. The 1,800 questions provide sufficient volume to master most topics if you’re starting from a solid knowledge base rather than learning from scratch.

The A.S.A.P. Technology, even in basic form, offers valuable study path customization that identifies your weak areas and recommends focus topics. This helps you maximize limited study time by avoiding unnecessary review of concepts you’ve already mastered. The digital textbooks cover all exam topics adequately for review purposes, though they’re more condensed than premium offerings and assume reasonable baseline knowledge.

The 18-month access limitation is the main constraint. If life circumstances force study breaks or you’re a slow-paced learner preferring gradual preparation over 12-18 months, you risk losing access before testing. For most focused candidates studying 10-15 hours weekly, 18 months provides ample time to complete all three parts. If you fail parts requiring retakes, you’ll need to repurchase access or upgrade to unlimited-access packages.

Becker Essentials

Becker Essentials is priced at $499 and includes 3,000+ practice questions, 155+ audio/video lectures, digital textbooks, and 12-month access. This package works well for candidates who prefer visual instruction, as the professional-quality video lectures clearly explain concepts, though they are shorter and less detailed than Becker’s Pro package.

The large question bank ensures candidates can practice extensively across all exam topics, making Essentials suitable even for those without prior experience, though the condensed digital textbooks provide less depth and fewer examples than premium offerings. Academic support is included, giving students access to guidance when needed, though there is no personal coaching.

Essentials is an attractive option for visual learners or Becker brand loyalists who want comprehensive EA exam practice at a budget-friendly price. Candidates needing more extensive guidance, physical textbooks, or extended access may consider upgrading to Becker Pro.

What Budget Options Sacrifice

Budget courses under $500 typically sacrifice practice question quantity (limiting you to 800-1,800 vs 2,500-3,600 in premium courses) and have reduced or eliminated video content, forcing text-heavy learning, and limited support relegated to email-only with slower response times. These limitations create a higher failure risk, particularly for candidates without strong tax backgrounds who need comprehensive instruction and extensive practice to master new concepts.

The shorter access periods (18 months vs unlimited) create pressure to complete all parts quickly, which is problematic for working professionals or those facing life disruptions. If you need to pause studying for 2-3 months due to work demands or family situations, 18-month windows shrink dangerously close to expiration. Budget packages also exclude advanced features like sophisticated adaptive technology, personal counselors, or performance analytics that guide your studying and flag weaknesses before they become exam-day surprises.

Perhaps most critically, budget options often lack the practice depth necessary to encounter all possible exam question types and scenarios. With only 800-1,000 questions, you might face test questions on topics you barely practiced, whereas premium packages’ 3,000+ questions virtually guarantee you’ve seen every concept application the exam might present. This coverage gap directly impacts pass probability. The $200 saved on budget courses can easily be lost to a single $267 retake fee.

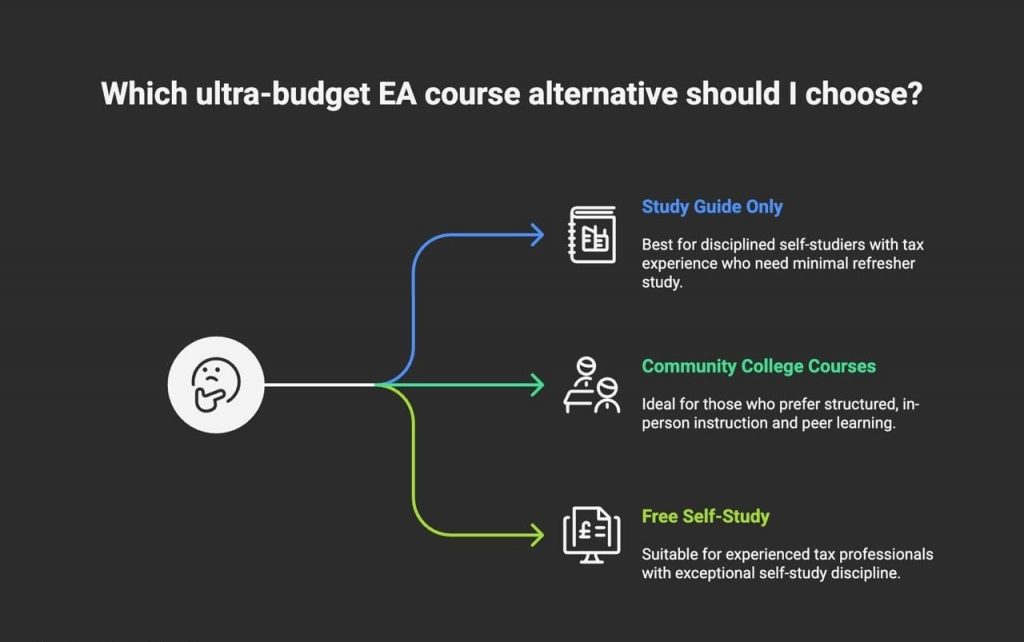

What are the Cheapest Enrollment Agent Courses?

Ultra-budget alternatives under $300 exist but require realistic expectations about limitations and likely need supplementation with free resources for complete preparation. These options suit very experienced tax professionals needing minimal refresher study, candidates with severe budget constraints accepting higher failure risk, or students using paid materials to supplement extensive self-study from free IRS resources. Understanding what ultra-budget options provide prevents mismatched expectations and strategic mistakes.

Study Guide Only Packages

Several publishers offer EA study guides as standalone purchases for $199-$275, providing comprehensive content coverage in textbook form without questions, videos, or online access. PassKey EA Review ($199 for all three parts) and Springer Publishing’s EA Review ($249) exemplify this category. These serve as reference texts for self-studiers who will source practice questions elsewhere and don’t need video instruction.

Study guide packages work for highly disciplined candidates who can create their own study plans, seek out free practice questions from the IRS and other sources, and learn effectively from reading without video or live instruction. Tax attorneys, CPAs, or experienced tax preparers can often succeed with guide-only preparation since they’re primarily reviewing concepts they already know rather than learning from scratch. The massive cost savings ($199 vs $500-900 for complete courses) appeal to professionals confident in their self-study abilities.

However, standalone guides fail most candidates because reading alone doesn’t provide the application practice that drives exam success. You can read about depreciation methods, but without working dozens of practice questions requiring depreciation calculations in various scenarios, you won’t develop the automatic recognition and execution speed needed under timed exam conditions. If you choose this route, plan to invest significant time finding free question sources and self-grading your practice, labor that paid courses eliminate through integrated platforms.

Community College Courses

Some community colleges and continuing education programs offer EA exam prep courses for $275-$400, typically meeting weekly for 8-12 weeks per exam part with instructor-led classroom sessions. Cuyahoga Community College (Ohio) charges approximately $220 per part, Tri-C offers similar pricing, and various California community colleges charge $300-400 per part. These programs suit local students who prefer structured class schedules and in-person instruction.

Community college courses provide live instructor interaction, peer learning with classmates, and scheduled accountability that helps procrastination-prone students stay on track. However, they require geographic proximity to participating colleges, fixed schedules that may conflict with work obligations, and longer course durations than self-paced online options. The quality varies significantly based on instructor experience. Some courses are taught by practicing EAs with decades of experience, while others use adjunct faculty with limited practical tax backgrounds.

The main limitation is restricted question practice, classroom time focuses on content instruction, leaving students to self-study practice questions outside of class using whatever resources they source independently. Most community college courses don’t include proprietary question banks, meaning you’ll need to supplement with purchased or free questions. If you value live instruction and scheduled structure, community college courses offer reasonable value; fully online learners should stick with self-paced digital courses offering more flexibility and often better resources.

Free Self-Study Options

The IRS provides completely free EA study materials, including Publication 5279 (Enrolled Agent Exam Guide), sample test questions for all three parts, and comprehensive tax publications covering every exam topic. Additionally, the IRS video portal includes free tax training webinars, YouTube features dozens of EA exam prep channels with free video content, and EA study communities on Reddit and Facebook offer peer support and question-sharing.

Free resources can legitimately prepare experienced tax professionals for EA certification if they’re disciplined about creating study plans, sourcing adequate practice questions, and self-assessing readiness. However, free materials lack organization. You must sequence topics yourself, find practice questions from multiple sources, and determine when you’ve studied sufficiently. This approach works for maybe 10-15% of candidates who have both tax expertise and exceptional self-study discipline.

For most candidates, attempting free-only preparation is a false economy. You might save $500-900 in course fees but dramatically increase failure probability, potentially costing $267-534 in retake fees plus months of additional studying. Free resources work best as supplements to paid courses, like using IRS publications to clarify specific topics, watching YouTube videos to reinforce concepts explained in your paid course, or joining study communities for motivation while following your course’s structured study plan.

Indian Enrolled Agent Course Fees

Regional EA course providers cater to specific geographic markets or student populations with pricing reflecting local economic conditions and specialized delivery methods. India-based providers like Simandhar, Miles, and TWSS offer substantially lower pricing (₹40,000-80,000 / $480-965) than US counterparts while including placement assistance and India-specific support features valuable for international candidates. Specialized US programs like UCLA Extension or Lambers command premium pricing ($900-2,355) by targeting specific student segments with enhanced services or brand prestige.

What are the India-Based Enrolled Agent Course Fees?

India-based EA coaching institutes price courses at ₹35,000 to ₹80,000, significantly undercutting US providers while adding valuable local features like placement assistance with Indian KPOs servicing US tax clients, time-zone-friendly live classes, and faculty understanding of Indian accounting backgrounds. These courses specifically target Indian BCom/MCom graduates and CA students seeking US market access without relocating. The pricing reflects India’s lower operating costs, while course quality has improved substantially as the EA credential gains popularity among Indian professionals.

Simandhar Education Enrollment Agent Course Fee

Simandhar Education, one of India’s most established EA coaching providers, prices its comprehensive program at approximately ₹45,000-55,000 for all three parts with live interactive classes, recorded lectures for revision, and a partnership with Fast Forward Academy for study materials. This pricing includes 120+ hours of instructor-led training per part (360+ hours total), access to 3,500+ practice questions through the Fast Forward partnership, unlimited mock exams, and placement assistance connecting graduates with Big 4 firms and tax KPOs.

Simandhar emphasizes live online classes taught by Sripal Jain (CA, US CPA) and experienced faculty, appealing to students who prefer structured instruction over pure self-study. The India-specific advantage includes classes scheduled for IST time zones, faculty familiar with transitioning from Indian tax concepts to US taxation, and placement support specifically for US tax roles in Indian offices of global firms or US-focused KPOs. The coaching-to-placement pipeline makes Simandhar attractive for career changers or fresh graduates seeking not just certification but actual job placement.

The pricing bundles comprehensive support rarely found in US courses at comparable prices, such as personal faculty guidance, doubt resolution sessions, study plan customization based on your background, and even post-certification career advisory. However, the India-based approach assumes you’ll dedicate significant time to live class participation; working professionals with unpredictable schedules might struggle with fixed class timings despite recorded backup options.

Miles Education Enrollment Agent Course Fee

Miles Education offers an Enrolled Agent (EA) program in India, priced between ₹35,000 and ₹50,000. This program includes live instructor-led classes, recorded lectures for revision, and access to Fast Forward Academy’s study materials, which provide over 3,500 practice questions and unlimited mock exams. The course is designed for professionals aiming to transition into U.S. taxation roles, particularly within multinational corporations or U.S.-focused knowledge process outsourcing (KPO) firms.

The program’s structure emphasizes live online classes conducted in the Indian Standard Time (IST) zone, accommodating students in India. Instructors, such as Sripal Jain (CA, US CPA), bring practical experience to the curriculum, facilitating the understanding of U.S. tax concepts in the context of Indian taxation. Additionally, Miles Education provides placement assistance, connecting graduates with opportunities in Big 4 firms and other multinational corporations.

While the program offers comprehensive support, including personalized study plans and doubt resolution sessions, prospective students should consider their ability to commit to live class schedules. Professionals with unpredictable work commitments may find the fixed class timings challenging, despite the availability of recorded sessions for revision.

Overall, Miles Education’s EA program is tailored for individuals seeking structured guidance and career placement in U.S. tax roles, offering a blend of live instruction and comprehensive study materials.

The Wall Street School Pricing Enrollment Agent Course Fee

The Wall Street School (TWSS) currently lists its Financial Modeling program at ₹50,000 + GST, with an additional ₹75,000 success-based placement fee. While TWSS is known for live training, mock tests, and placement support across its programs, recent information does not confirm 120+ hours per EA part or 9 total mock tests. The “100% placement assistance” applies generally across TWSS programs, contingent on successful placement and acceptance.

TWSS follows a success-based placement fee model that lowers upfront risk for students. The training fee is ₹50,000 + GST, and an additional ₹75,000 is payable only if the student accepts a job secured through TWSS’s placement support, thereby aligning the school’s incentives with student success. The Financial Modeling & Valuations bundle, priced around ₹47,500, includes complementary programs such as CFA Level I and Stock Market courses. It’s aimed at students seeking broader finance skills beyond tax and features instructor-led, case-based training from industry professionals.

TWSS’s Financial Modeling course offers about 240 hours of live training in the full-time batch (or 170 hours part-time), providing structured, hands-on instruction that suits beginners and career changers seeking guided learning. The program targets working professionals and graduates looking to transition into finance, focusing on practical skills through tools like Excel, Power BI, and Python.

TWSS’s placement network includes KPOs, Big 4 firms, international banks, and Fortune 500 companies’ Indian offices, with past recruiters such as Deutsche Bank, WNS, and Duff & Phelps. While the training quality and job-ready focus are strong draws, reviews suggest mixed experiences. Some praise the practical exposure, while others cite high placement fees and variable faculty quality.

What Are US-Based Specialized Enrolled Agent Course Fees?

Specialized US EA programs charge $900-$2,355 premium pricing by targeting specific student segments: university extension programs adding academic credibility, CPA firm training programs emphasizing professional development, or comprehensive programs including business development training beyond just exam prep. These programs suit candidates valuing brand recognition, seeking academic credit, or wanting extensive career support, justifying premium investment over standard commercial courses.

UCLA Extension Enrollment Agent Course Fees

Specialized US EA programs typically charge $900–$1,800 depending on the provider and package. University extension programs, like UCLA Extension, charge around $1,800 for all three parts, covering tuition, materials, and application fees. These programs target candidates who value academic credibility, structured instruction, and access to experienced faculty, and often include resources or support beyond basic exam prep, such as guidance on practical tax application. Candidates willing to invest in these programs are typically seeking reliable curriculum, professional development, and a recognized credential rather than the cheapest path to passing the EA exams.

Lambers CPA Review Premium Pricing

Lambers CPA Review offers an EA exam prep bundle priced at $399 for all three parts, making it one of the more affordable full-package options on the market. The program includes 60+ hours of video lectures, over 2,100 practice questions, 450+ flashcards, live review sessions, and fast instructor support from Eva Rosenberg (TaxMama).

The course focuses strictly on exam preparation rather than post-certification business-building. It’s designed for candidates who want structured content, guided practice, and instructor access to maximize their chance of passing all three EA exams. Unlike higher-priced courses claiming business-development guidance, Lambers emphasizes efficient study with comprehensive resources at a budget-friendly price.

This makes Lambers suitable for exam-focused candidates seeking value without paying a premium for additional services they may not need.

What Is the Total First-Year Cost for EA Certification?

Your complete first-year EA investment ranges from the $1,060 minimum budget path to the $1,940-2,240 recommended path, encompassing course fees, mandatory IRS fees, and a realistic contingency for potential retakes. The minimum path ($1,060) assumes a budget course, passing all parts on the first attempt, and no optional costs are achievable for experienced tax professionals but risky for most candidates. The recommended path ($1,940-2,240) includes a quality mid-tier or premium course, mandatory fees, and retake contingency, reflecting realistic costs for typical candidates prioritizing first-attempt success.

Minimum vs Recommended EA Certification Costs

The cost to become an Enrolled Agent varies widely depending on your study approach and goals.

Minimum Budget Path

For experienced tax professionals confident in their knowledge, the absolute minimum path costs roughly $1,160–1,460. This includes a low-cost study guide or Essentials package ($199–499), PTIN registration ($19.75), SEE exam fees ($203 per part, $609 total), and IRS enrollment ($140). This path assumes first-attempt success, no optional materials, and zero retakes. Risks are high: fewer practice questions, limited support, and minimal video content increase the chance of failure. A failed part adds $267, potentially erasing course savings.

Recommended Investment Path

For most candidates, a mid-tier or entry-premium course ($550–850) plus fees, one retake contingency ($267), and optional costs ($200–300 for CE or membership) brings total investment to roughly $1,980–2,180. This level provides 1,500–3,500 practice questions, 30–60+ hours of video, adaptive tools, sufficient access periods, and reliable support. It maximizes first-attempt pass probability while offering a clear, worry-free study experience.

ROI Considerations

The EA credential pays for itself quickly. Entry-level positions in the US start at $40k–50k, while experienced EAs earn $50k–70k+. Independent practitioners can bill $50–150/hour. Even modest increases of $5,000/year recover the $2,000 investment in under five months. Over a 30-year career, the credential can generate $150,000+ in additional earnings, far outweighing upfront costs.

How to Save Money on Enrolled Agent Course Fees?

Smart timing, strategic discounts, and avoiding hidden costs can significantly reduce your EA course expenses. Major providers offer seasonal sales, membership perks, and bundle deals that can save you $200–$500.

What Discounts Are Available for Enrolled Agent Course Fees?

EA course providers offer multiple discount types, reducing costs by $50-500, depending on discount magnitude and course price tier. Seasonal sales provide the largest absolute savings ($200-500 off premium courses), while membership discounts deliver more modest $50-100 reductions requiring association dues. Bundle savings reward purchasing all three parts together versus separately, typically saving $100-300 and ensuring material consistency across parts. Understanding discount availability and restrictions helps you time purchases optimally and maximize savings without sacrificing course quality.

Seasonal Sales

The largest EA course discounts occur during predictable annual sales cycles, with providers offering 15-30% off regular prices during peak periods. Black Friday/Cyber Monday (late November) represents the year’s best savings opportunity, with virtually all major providers running aggressive promotions. Gleim, Surgent, Becker, and Fast Forward typically offer 20-30% discounts, saving $120-270 on mid-tier courses or $160-300 on premium packages. These sales last only 4-7 days, requiring purchase readiness to capitalize.

New Year sales (January) provide second-best discount opportunities as providers target candidates making resolution-based career investments. Expect 15-25% discounts during the first two weeks of January, saving $90-225 depending on course tier. Tax season end sales (late April through May) clear inventory and capture post-tax-season professionals planning EA pursuit, typically offering 10-20% discounts, saving $60-180. Summer sales (July-August) offer modest 10-15% discounts as providers compete for back-to-school adult learners.

To maximize seasonal savings, monitor provider email lists starting 2-3 weeks before major sale periods, as early-bird or pre-sale discounts sometimes offer an additional 5% off posted sale prices. Stack seasonal discounts with membership discounts when possible. Some providers allow combining a 20% Black Friday discount with a 5% NAEA member discount for 25% total savings. However, read the terms carefully, as many sales explicitly prohibit discount stacking. The key strategic move is delaying purchase until optimal sale timing if you’re planning 3-6 months ahead.

Student and Member Discounts

Professional association memberships unlock year-round discounts independent of seasonal sales. National Association of Enrolled Agents (NAEA) membership ($325-375 annually) provides 5-15% discounts at major EA course providers, saving $30-135 on courses. The discount roughly breaks even on course purchase alone, with membership’s real value coming from professional resources, networking, and advocacy. If you’re committed to an EA career, purchasing NAEA membership before the course purchase makes financial sense and provides long-term professional benefits.

Student discounts require a valid .edu email or enrollment verification, offering 10-20% savings ($60-180) at some providers, including Fast Forward Academy and smaller courses. However, major providers (Gleim, Surgent, Becker) rarely offer student discounts since their pricing already assumes a professional/student audience. Military discounts (10-15% off) are more widely available, with most major providers honoring military service through verification services like ID.me or SheerID, saving $60-135.

Some providers offer group discounts for 3+ students purchasing together, typically 10-15% off per student when enrolled simultaneously. This suits study groups, classmates, or coworkers pursuing EA together. The savings ($60-135 per person), combined with built-in study accountability, make group purchases attractive when feasible. Contact provider sales teams directly for group pricing quotes, as these discounts often aren’t advertised publicly.

Bundle Savings

Purchasing all three EA exam parts together consistently saves $100-300 versus buying parts separately, plus ensures material consistency and usually includes “access until you pass” provisions not offered on individual purchases. Gleim saves approximately $99-100 on three-part bundles ($699 vs $798 for separate parts), Surgent saves $100-150 depending on tier, and Fast Forward saves around $80-120 on bundles. The savings alone justify bundle purchases even if you’re uncertain about completing all parts.

Beyond direct savings, bundles provide strategic advantages: material consistency ensures all three parts use the same publisher’s materials, question formats, and explanation styles rather than adapting to different providers; unified access means one login, one progress tracker, and one support channel rather than managing multiple accounts; and “pass guarantees” typically apply only to bundles, offering extended access or money-back provisions if you complete study plans but fail. These soft benefits add value beyond stated dollar savings.

The bundle-versus-separate decision depends on commitment certainty. If you’re 100% committed to completing all three parts, bundles clearly win through savings and consistency. If you’re testing EA interest with one part before deciding whether to continue, buying Part 1 separately makes sense despite costing more long-term. Most advisors recommend bundles for anyone serious about EA certification rather than casual exploration. The career value of EA comes from complete certification, not partial progress.

When Is the Best Time to Buy an EA Course?

The optimal EA course purchase timing balances discount availability, study readiness, and exam scheduling to minimize costs while maximizing preparation effectiveness. Black Friday (late November) offers the deepest discounts but requires planning an EA pursuit 6-12 months ahead, while January sales accommodate New Year resolution timing and capture post-holiday budget availability. Understanding purchase timing strategy helps you save $100-300 without compromising study effectiveness through excessive delay between purchase and beginning study.

Best Times to Buy

Black Friday/Cyber Monday (late November) provides the year’s deepest discounts (20-30% off) but is optimal only if you’re ready to begin studying within 1-3 months. Purchasing in November and delaying study until March-April wastes motivational momentum and risks never starting despite the course investment. The ideal scenario is purchasing during Black Friday for a January study start, maximizing both discount savings and study discipline through a reasonable timeframe between purchase and action.

New Year sales (early January) balance good discounts (15-25% off) with natural resolution-based motivation to start studying immediately. A January purchase for a February study start provides minimal delay between commitment and action while capturing strong sale pricing. This timing also aligns well with annual bonus or tax refund receipts (January-April), providing cash flow for course investment. For many candidates, January represents optimal purchase timing, combining motivation, funding, and savings.

Tax season end (April-May) suits tax professionals completing busy season who want to immediately invest in EA advancement while work is fresh in their minds. The 10-20% discounts aren’t maximum, but the timing capitalizes on peak motivation following a 3-4 month intensive tax preparation period. Tax professionals often have the clearest conviction about EA value immediately post-season, making April-May purchases more likely to convert to actual study completion versus November purchases that cool off over the holidays.

Financing Options

Most major EA course providers offer payment plans through Affirm, Klarna, or similar buy-now-pay-later services, splitting course costs across 3-12 monthly payments. The financing typically includes 0% APR for 3-6 month terms on courses over $500, avoiding interest charges while spreading costs. However, 9-12 month plans often carry 10-15% APR, potentially adding $50-100 in interest costs that eliminate any discount savings you captured.

The optimal financing strategy uses 0% APR short-term plans (3-6 months) to manage cash flow without paying an interest premium. A $700 course financed over 6 months at 0% APR costs $116.67 monthly with zero additional cost versus an upfront payment. This suits students or career changers with tight monthly budgets who can comfortably afford $120 monthly but struggle with a $700 lump sum. However, if you can pay upfront, doing so eliminates financing logistics and the psychological burden of monthly payments.

Some credit cards offer 0% APR introductory periods (12-18 months), making course purchases on these cards equivalent to interest-free financing if paid off during the intro period. This strategy requires discipline to actually pay off the balance before the regular APR kicks in (typically 18-25%), or you’ll pay far more in credit card interest than you saved on course discounts. If using this approach, set up automatic monthly payments, ensuring complete payoff before the promotional period expires.

Hidden Cost Avoidance

The most impactful savings strategy is avoiding hidden costs that inflate total EA investment: Pass the first attempt, avoiding $267-801 in retake fees by investing in quality courses and adequate study time, schedule exams carefully to avoid $35 rescheduling fees or $267 no-show forfeitures, complete certification within the course access period to avoid $150-500 repurchase costs when access expires, and use free resources strategically to minimize supplemental material purchases.

Purchase courses with “access until you pass” or unlimited access provisions rather than fixed-term access, particularly if you’re a part-time student or working professional with an unpredictable schedule. The $50-100 premium for unlimited access is far cheaper than $300-500 to repurchase an expired course. Similarly, invest adequately in courses to maximize first-attempt passage. Saving $400 on a budget course but failing two parts costs a net $134 more than a mid-tier course ($400 saved – $534 retake fees = -$134).

Time your initial PTIN application strategically to minimize renewals during the exam window. Applying in January and completing all three parts by December avoids any PTIN renewal costs before certification. Applying in November and testing through the following June requires a $30.75 renewal mid-process. While $30.75 isn’t huge, strategic timing eliminates unnecessary expenses. Finally, avoid international transaction fees by using no-foreign-transaction-fee credit cards for USD course purchases, saving 2-3% ($12-27 on $600-900 courses).

Which Price Point Should You Choose for Your EA Course?

Your optimal EA course price point depends on your tax background, available study time, learning style, and budget constraints, with most candidates best served by mid-tier options ($500-699), balancing comprehensive resources with reasonable pricing. Budget courses under $500 suit experienced tax professionals needing focused review rather than full instruction, while premium courses ($700-999) benefit candidates with limited backgrounds or previous failed attempts requiring maximum resources. Understanding which price tier matches your situation prevents both under-investing (risking failure) and over-investing (paying for unused features).

How Do You Choose Based on Your Budget?

Budget-first decision-making risks selecting inadequate courses to save money, but legitimate financial constraints sometimes necessitate budget options. The key is matching a limited budget to an appropriate background. Experienced professionals can succeed with budget materials, while career changers need mid-tier investment for a reasonable success probability. If the budget forces choosing between an inadequate course now and a better course later, delaying certification while saving for the appropriate course tier beats purchasing cheap materials and failing, which wastes the limited budget.

Under $500: Who Should Choose This

Budget courses under $500 ($199-499) suit only narrow candidate profiles: experienced tax professionals (5+ years of US tax preparation) needing exam-specific review of already-known concepts, candidates with CPAs or law degrees providing a strong tax law foundation, or students with severe budget constraints accepting a higher failure risk. If you’re explaining complex tax scenarios daily in your current role, budget courses probably suffice since you’re reviewing rather than learning.

$500 to $700: Best for Most Students

This tier suits the broadest candidate range: career changers from non-tax backgrounds needing complete instruction, accounting or finance professionals adding EA to existing credentials, working professionals requiring part-time study flexibility, students with limited budgets who still need comprehensive resources, and candidates seeking optimal value without premium price sensitivity. The mid-tier provides everything necessary for first-attempt success, including ample practice, clear instruction, and adequate support.

$700 to $1000: Premium Investment

Premium courses $700-1000 (typically $799-899 for Gleim Premium or Surgent Premier) justify their cost for specific situations: candidates with very limited tax backgrounds needing maximum instruction and practice, students who previously failed exam parts and want comprehensive resources for next attempts, working professionals with disposable income preferring premium confidence from maximum resources, or candidates valuing personal counseling and intensive support beyond self-directed study.

Conclusion: Recap of Enrolled Agent Course Fees

The EA credential typically delivers 2-6 month payback periods through increased earning potential of $5,000-10,000 annually ($4,800-14,400 in India or $40,000-70,000+ in US markets), making even premium course investments trivial relative to lifetime career value. Rather than obsessing over $200-400 course price differences, focus on selecting resources matching your needs and committing adequate study time. The difference between $600 and $800 courses is minor compared to the $267-$801 cost of exam retakes from inadequate preparation. Invest appropriately in quality courses, study diligently, pass on the first attempt, and begin earning EA income quickly to maximize return on your certification investment.

Frequently Asked Questions About EA Course Fees

How much does an Enrolled Agent course cost in 2025?

EA courses range from $199 for basic study guides to $999+ for premium packages, with most candidates choosing mid-tier options ($500-699) that provide comprehensive question banks (1,500-2,500 questions) and adequate video content.

What is the cheapest EA review course available?

The cheapest legitimate EA courses are Surgent Essentials and Becker Essentials at $499, including 1,000-1,800 practice questions, digital textbooks, and 18-month access. Study guide-only packages cost $199-275 but lack practice questions and online access, working only for experienced tax professionals who supplement with free IRS resources.

Is Gleim or Surgent better for EA exam preparation?

Gleim offers the largest question bank (3,600+ questions), ideal for candidates who learn through repetition, while Surgent emphasizes adaptive A.S.A.P. technology (1,800 questions) that reduces study time by 20-40%. Choose Gleim for maximum practice volume and value per question ($0.19/question), or Surgent for sophisticated technology and predictive ReadySCORE analytics showing your projected exam score.

How much are the IRS fees for becoming an Enrolled Agent?

The IRS requires a few core fees for EA certification: the PTIN application or renewal fee is $19.75 (for 2025). Each of the three exam parts costs $267, so taking all three in one cycle totals $801. After passing the exams you apply for enrollment before the IRS, paying $140 for Form 23. So the “hard” IRS fees add up to about $960.75.

What is the total cost to become an Enrolled Agent?

The base IRS fees for EA certification are about $860 ($19.75 PTIN + $267×3 exams + $140 enrollment). Review-course costs add up significantly. Most candidates should plan on $1,600–$2,200 total for review materials, fees, and realistic contingencies.

Are there any free Enrolled Agent study materials?

The IRS provides free official EA exam resources, such as the Candidate Information Bulletin and sample test questions, you can access online. However, these materials are limited in scope compared to full review courses. They generally lack large question banks, structured study plans, videos, and full-practice simulations. Free-only preparation may be viable if you already have deep tax experience and strong self-study habits, but most candidates will likely benefit from a paid review course with comprehensive resources.

How much does it cost to retake the EA exam?

Retaking a failed exam part costs $267 per part with no discounts or fee reductions, potentially adding $267-801 to certification costs if multiple parts require retakes. Indirect costs like extended course access and the opportunity cost of delayed certification also get added.

When is the best time to buy an EA review course?

The biggest discounts usually drop during major sales events, especially Black Friday/Cyber Monday (late November), when providers like Gleim advertise “up to 50%” off EA prep. If you’re ready to start studying within a few months, that’s the best entry point. New Year (early January) can offer strong, though less reliable, discount opportunities, which is good if you’ll begin studying quickly.

Do EA course providers offer student discounts?

Some do. NAEA members can get 5–15% off courses like Surgent. Fast Forward Academy occasionally runs 10–15% promo codes. Group discounts (for 3+ buyers) are possible only by direct request.

Allow notifications

Allow notifications