Complete guide to enrolled agents: IRS-authorized tax experts with federal representation rights. Learn EA vs CPA differences, exam requirements, career paths, and remote opportunities from India.

Table of Contents

If you’re looking to break into the US tax profession or seeking expert help with IRS matters, understanding enrolled agents is essential. Enrolled agents represent a unique credential in the American tax landscape. These are federally authorized practitioners who specialize exclusively in taxation. Unlike other professionals who dabble in tax matters alongside broader responsibilities, enrolled agents dedicate their entire practice to navigating the complexities of the US tax code and representing taxpayers before the IRS.

What makes enrolled agents particularly interesting for Indian accounting professionals is the accessibility of this credential combined with its powerful authority. You don’t need a US degree. You can take the exam internationally, and once certified, you can serve US clients remotely from anywhere in the world, including India.

What is an Enrolled Agent?

Who Are Enrolled Agents and What Do They Do?

An enrolled agent (EA) is a federally licensed tax practitioner authorized by the United States Department of the Treasury to represent taxpayers before the Internal Revenue Service. Think of them as America’s tax experts. The professionals who have earned the privilege to stand between you and the IRS on any tax matter. The credential dates back to 1884, when Congress established the position to help citizens navigate complex post-Civil War claims, and today’s enrolled agents carry forward that same advocacy mission in the modern tax system.

When you work with an EA, you’re working with someone whose entire professional identity centers on understanding and applying the US tax code. This specialization matters because the tax code contains over 3.8 million words and changes constantly, requiring dedicated expertise to navigate effectively.

Enrolled Agent Definition, Role, and IRS Authority

The “enrolled” designation means these practitioners are officially enrolled to practice before the IRS. They’ve been vetted, tested, and authorized by the federal government itself. This federal authorization is crucial because it grants enrolled agents unlimited practice rights across all 50 states without additional state-level licensing. Whether you’re dealing with a simple tax return question or facing a complex IRS audit, an enrolled agent has the legal authority to represent you at any IRS office, for any tax matter, without restriction.

Enrolled agents must meet rigorous standards to earn and maintain their credentials. They pass a comprehensive three-part examination covering individual taxation, business taxation, and representation procedures, or they qualify through at least five years of technical IRS employment. Once certified, they must complete 72 hours of continuing education every three years to stay current with constantly evolving tax laws. The IRS describes enrolled agent status as the highest credential the agency awards.

Enrolled Agent Responsibilities and Role in Tax Representation

At the core of every enrolled agent’s practice is tax preparation and planning. EAs prepare millions of tax returns annually for individuals, partnerships, corporations, estates, trusts, and any entity with tax reporting requirements. But their work extends far beyond filling out forms.

They develop tax strategies to minimize liabilities legally, identify credits and deductions clients might miss, and plan transactions to achieve optimal tax outcomes. When tax season arrives each January, enrolled agents are often working 60-80-hour weeks, ensuring their clients file accurate, complete returns that satisfy IRS requirements while paying no more tax than legally required.

The representation function is where enrolled agents truly shine and differentiate themselves from unlicensed tax preparers. When the IRS sends that dreaded audit notice, when collection letters arrive for unpaid taxes, or when you need to appeal an IRS decision, your enrolled agent steps into the gap.

They can attend IRS meetings in your place, negotiate with revenue agents on your behalf, submit documentation and arguments supporting your position, and work toward resolutions that protect your interests. This representation authority, backed by deep knowledge of IRS procedures outlined in Treasury Department Circular 230, gives enrolled agents the power to resolve tax problems that would overwhelm most taxpayers trying to navigate the system alone.

Enrolled Agent vs. CPA vs. Tax Attorney

Key Differences Between Enrolled Agent, CPA, and Tax Attorney

Education, Licensing, and Scope of Practice

The educational path to becoming an enrolled agent is remarkably accessible compared to other tax credentials. You don’t need any specific college degree. In fact, you don’t need a college degree at all. The IRS allows anyone to sit for the Special Enrollment Examination (SEE) regardless of educational background, making this credential available to career changers, international candidates, and professionals from diverse backgrounds. You simply need the knowledge to pass the comprehensive tax exam, which you can acquire through self-study, online courses, or structured exam prep programs.

Contrast this with becoming a CPA or tax attorney. CPAs must complete 150 semester hours of college education (typically a bachelor’s degree plus 30 additional credits), pass a four-part Uniform CPA Examination covering auditing, financial accounting, regulation, and business concepts, and meet state-specific experience requirements that often include 1-2 years working under a licensed CPA.

Tax attorneys follow an even longer path: four years of undergraduate education, three years of law school to earn a Juris Doctor degree, passing the state bar examination, and typically specializing in tax law through coursework and practice. We’re looking at 5-8 years minimum for CPA licensure and 7-10+ years for attorney credentials, compared to potentially 3-12 months for an enrolled agent who focuses intensively on exam preparation.

The scope of practice differs significantly across these three credentials. Enrolled agents practice tax exclusively. They prepare tax returns, provide tax planning advice, and represent clients before the IRS on tax matters. That’s their world, and they master it completely. CPAs hold broader authority. They can prepare tax returns and represent IRS clients like EAs, but they also audit financial statements, provide attestation services, sign off on SEC filings, and offer general accounting and business advisory services. Tax attorneys bring legal expertise.

They handle everything EAs do, plus they can represent clients in the US Tax Court when disputes escalate beyond IRS administrative levels, defend against criminal tax fraud charges, and provide legal counsel on complex transactions where tax intersects with contract law, corporate structure, or estate planning. For Indian professionals seeking US market access specifically for tax services, the EA path offers the fastest, most focused route to credible practice authority.

IRS Representation Rights Comparison

Enrolled Agent IRS Representation Rights

Enrolled agents possess unlimited practice rights before the Internal Revenue Service, the most expansive representation authority granted by the IRS. “Unlimited” means exactly what it sounds like. An EA can represent any taxpayer (individuals, corporations, partnerships, estates, trusts, exempt organizations) on any tax matter (income tax, payroll tax, estate and gift tax, excise tax, penalties, collections) before any IRS office or division (Examination, Collection, Appeals), without geographic restrictions. This isn’t state-specific, like CPA licenses. Your federal EA credential is valid in all 50 states, US territories, and for matters involving US taxpayers abroad.

What makes this particularly powerful is that enrolled agents don’t need to have prepared the original tax return to represent the taxpayer. If you receive an audit notice for a return someone else prepared years ago, an EA can step in and represent you going forward. They can attend IRS meetings in your place (you don’t even need to be present), negotiate installment payment agreements, submit Offers in Compromise to settle tax debts for less than owed, request penalty abatements, and handle Collection Due Process hearings. The only representation boundary for enrolled agents is US Tax Court litigation. That requires an attorney, unless the EA passes the separate non-attorney practitioner examination, which only a small number pursue.

CPA IRS Representation Rights

Certified Public Accountants hold identical unlimited IRS representation rights to enrolled agents when it comes to federal tax matters. A CPA can represent any client before any IRS division on any tax issue, just like an EA. This equivalence stems from Treasury Department Circular 230, which grants the same practice privileges to attorneys, CPAs, and enrolled agents before the IRS. So if you’re wondering whether CPAs are “better” representatives than EAs for IRS matters, they’re not. The representation authority is exactly the same.

However, there’s an important geographic limitation with CPAs that doesn’t apply to enrolled agents. CPA licenses are issued by individual state boards, not the federal government. A CPA licensed in California can represent IRS clients nationwide for federal tax matters, but if that same CPA wants to provide accounting services, audits, or state tax work in New York, they need to either obtain New York licensure or meet interstate practice requirements. Some states have reciprocity agreements that ease this, but the state-by-state nature of CPA licensing creates complexity that the federal EA credential avoids entirely. For someone in India wanting to serve clients across all US states remotely, the EA’s federal license offers cleaner, simpler authority.

Tax Attorney IRS Representation Rights

Tax attorneys hold unlimited IRS representation rights identical to enrolled agents and CPAs for all administrative matters, such as audits, collections, appeals, and everything at the IRS level. Where attorneys uniquely excel is in US Tax Court representation. When disputes with the IRS can’t be resolved administratively and the taxpayer wants to litigate, only attorneys (and the rare EA or CPA who passes the non-attorney exam) can represent clients in Tax Court. This courtroom authority matters most for high-stakes disputes involving hundreds of thousands of dollars or complex legal interpretations of tax law.

Attorneys also bring attorney-client privilege, which means communications between you and your lawyer generally can’t be compelled as evidence. Enrolled agents and CPAs have a more limited privilege under IRC Section 7525 that covers tax advice but doesn’t extend as broadly as the attorney-client relationship. For most tax situations, like filing returns, handling audits, negotiating payment plans, and resolving penalties, this privilege distinction rarely matters practically. But for cases involving potential criminal tax fraud or large contested liabilities that might end up in court, an attorney’s full privilege protection and litigation authority provide advantages that EAs and CPAs can’t match. That said, attorneys typically charge $300-500+ per hour compared to $100-250 for EAs, so you’re paying substantially more for capabilities you may never need.

How to Become an Enrolled Agent

Requirements and Pathways to EA Certification

Basic Requirements to Become an Enrolled Agent

Before you can become an enrolled agent, you must obtain a Preparer Tax Identification Number (PTIN) from the IRS. This eight-digit number serves as your credential to prepare federal tax returns for compensation. Think of it as your registration with the IRS as a paid tax professional. The PTIN application process is straightforward. You complete an online application through the IRS website, pay the annual fee ($19.75 as of 2025), and typically receive your PTIN within 24-48 hours.

You’ll need to provide your Social Security number (for US citizens/residents) or Individual Taxpayer Identification Number (for international applicants), pass a suitability check reviewing your tax compliance history, and consent to IRS oversight of your practice. This PTIN isn’t just for enrolled agents. Any paid tax preparer needs one, but it’s your first step toward EA certification.

The IRS conducts a comprehensive background check before granting enrolled agent status, and this suitability review has real teeth. They examine your personal tax compliance thoroughly to check that you have filed all required tax returns for the past several years. Do you have any outstanding tax liabilities or unfiled returns? The IRS won’t enroll someone to represent taxpayers who can’t manage their own tax obligations properly.

They also check for criminal convictions related to dishonesty or breach of trust, such as felony convictions for fraud, embezzlement, or financial crimes within the past 10 years, which typically disqualify applicants. This isn’t arbitrary gatekeeping. The IRS is granting you authority to represent taxpayers in adversarial proceedings against the government, so they need assurance of your ethical character and tax compliance track record.

Beyond PTIN and the background check, there are no educational prerequisites to become an enrolled agent. You don’t need a high school diploma, a bachelor’s degree, or any specific coursework in accounting or tax. This remarkable accessibility means career changers, international candidates, and professionals from non-traditional backgrounds can pursue the credential based solely on demonstrated tax knowledge. Of course, having an accounting education, whether that’s a BCom degree in India, an accounting bachelor’s in the US, or CA studies, gives you a foundation that makes exam preparation easier. But the IRS doesn’t require it. What they require is that you demonstrate comprehensive knowledge of the US tax code either through passing their rigorous examination or through qualifying work experience.

Two Pathways to Becoming an Enrolled Agent

SEE Exam

The primary pathway to enrolled agent certification is passing the Special Enrollment Examination (SEE), a comprehensive three-part test covering all aspects of US federal taxation. This exam is your proof to the IRS that you possess the technical knowledge needed to prepare returns and represent taxpayers competently. The SEE tests your mastery of individual taxation (Form 1040 and related schedules), business taxation (corporations, partnerships, payroll), and representation procedures (Circular 230 ethics, IRS practice and procedures). You must pass all three parts to qualify for enrollment, but you can take them in any order and spread them out over time. You have two years from the date you pass your first part to pass the remaining sections.

What makes the exam pathway attractive is its accessibility to anyone worldwide. Prometric testing centers administer the SEE not just across the United States but at international locations, including major cities in India like Mumbai, Delhi, Bangalore, Chennai, Hyderabad, and others. You don’t need to travel to America to take the exam. Testing windows run from May 1 through the end of February each year, with a blackout period during tax season (March-April) when the IRS doesn’t offer the exam. Each part costs $267 to register (as of 2025), so budget roughly $800 total for all three parts. The exam is computer-based with 100 multiple-choice questions per part, and you get 3.5 hours per section. You receive your score immediately upon completing each part, with no waiting weeks for results, and you can retake any failed section up to four times within the testing window after waiting just 24 hours between attempts.

IRS Experience

The alternative pathway requires at least five consecutive years of employment with the Internal Revenue Service in a position that regularly involved interpreting and applying the Internal Revenue Code. This isn’t just any IRS job. You need to have worked in a technical role dealing directly with tax law application, such as a revenue agent conducting examinations, a tax specialist reviewing returns, or an appeals officer resolving disputes. Administrative, clerical, or support positions don’t qualify. The IRS looks for experience specifically interpreting income, estate, gift, employment, or excise tax provisions as part of your regular duties.

If you qualify through the experience pathway, you can apply for enrollment without taking the SEE. Your IRS employment serves as proof of tax knowledge. However, you must apply within three years of leaving IRS employment, so this pathway has a time limit. You’ll still need your PTIN, and you’ll still undergo the background and tax compliance check. The experience pathway makes sense primarily for former IRS employees transitioning to private practice; for most aspiring enrolled agents, especially international candidates, the exam route is the practical choice.

Enrolled Agent Exam (SEE)

Three-Part Exam Structure

Individual

Part 1 of the Special Enrollment Examination focuses entirely on individual taxation, which is everything related to Form 1040 and the personal tax situations of US taxpayers. You’ll face questions covering filing status determinations (single, married filing jointly, head of household), income recognition from various sources (wages, interest, dividends, capital gains, rental income, business income), deductions both standard and itemized (Schedule A medical expenses, state taxes, mortgage interest, charitable contributions), tax credits (Child Tax Credit, Earned Income Credit, education credits, energy credits), and special situations like retirement distributions, Social Security benefits taxation, and Alternative Minimum Tax.

The exam doesn’t just test memorization. You’ll encounter scenarios requiring you to calculate correct tax liability, determine proper filing requirements, and identify which forms and schedules apply to different situations, mirroring the real-world analysis you’ll perform as a practicing enrolled agent.

Business

Part 2 shifts focus to business entity taxation and employment taxes in the complex world of corporations, partnerships, and employer tax obligations. You’ll be tested on C corporation taxation (Form 1120), S corporation rules and limitations (Form 1120-S), partnership taxation including basis calculations and distributive shares (Form 1065), and business income and expenses for all entity types. Payroll taxes constitute a significant portion of this section: Federal Insurance Contributions Act (FICA), Federal Unemployment Tax Act (FUTA), income tax withholding, and quarterly payroll reporting on Forms 941 and 940.

You’ll also encounter questions on business depreciation methods (MACRS, Section 179 expensing, bonus depreciation), self-employment tax calculations for Schedule C sole proprietors, and employee benefit plans. This part separates candidates with surface-level knowledge from those who truly understand how business taxation works in practice.

Representation

Part 3 tests your mastery of representation, practices, and procedures. Essentially, how to represent taxpayers before the IRS in full compliance with federal regulations. The foundation of this section is Treasury Department Circular 230, which governs the conduct of enrolled agents, CPAs, and attorneys who practice before the IRS. It outlines duties to clients, obligations to the IRS, due diligence standards, rules against conflicts of interest, restrictions on contingent fees, and sanctions for violations.

You’ll also be tested on the Office of Professional Responsibility (OPR). It is the body that enforces Circular 230 and the disciplinary actions it can take for unethical conduct. Beyond ethics, this section dives into IRS procedures: how examinations (audits) are initiated and resolved, how collections work (including notices, liens, levies, installment agreements, and Offers in Compromise), and how the appeals process functions when taxpayers challenge IRS determinations.

Expect questions on power of attorney (Form 2848) and tax information authorization (Form 8821) procedures, taxpayer rights, penalty structures for both taxpayers and preparers, and confidentiality obligations under IRC §7216. You’ll also encounter items on recordkeeping and document retention, electronic filing requirements, and due diligence obligations for preparers claiming refundable credits such as the Earned Income Credit.

Enrolled Agent Exam (SEE) Scoring, Costs, and Registration

The SEE uses scaled scoring from 40 to 130, with 105 as the passing score for each part. Your raw score (the number of correct answers) is converted to a scaled score through a formula that accounts for question difficulty. This means passing isn’t tied to a fixed percentage but to demonstrating sufficient competency across the tested material. When you complete each section, you’ll receive your result immediately. If you pass, your report shows proficiency levels, namely Below Proficient, Marginally Proficient, or Proficient, for each content area. If you fail, your scaled score (40–104) appears along with diagnostics to guide your study plan.

Each part costs $267 to schedule through Prometric, totaling $801 if you pass all three parts on your first attempt. Fees are non-refundable and non-transferable except in limited approved cases. You can take multiple parts in one day or spread them across the annual testing window (May through February).

Exam prep costs vary. IRS resources like Publication 947, Circular 230, and form instructions are free. Paid review courses from providers such as Gleim, Surgent, or Fast Forward Academy typically cost $500–$1,500, depending on features. Add the annual PTIN fee ($19.75) and the initial enrollment application fee ($140) after passing, and your total investment runs about $1,000–$2,500, which is still far less than earning CPA or attorney credentials.

Enrolled Agent Responsibilities and Authority

IRS Enrolled Agent Representation Rights and Powers

Unlimited Practice Rights Explained

The description of “unlimited practice rights” is accurate with minor clarifications. Under Treasury Department Circular 230 (§10.3), enrolled agents have full authority to represent taxpayers in all administrative matters before the IRS, including audits, collections, and appeals, without restriction by taxpayer type, issue, or geography. Their federally issued credential allows practice across all U.S. states and territories, unlike state-bound CPA licenses. To exercise these rights, enrolled agents must obtain written authorization (Form 2848, Power of Attorney) from clients, after which the IRS communicates directly with them, grants access to confidential tax records via the IRS e-Services portal, and permits representation in meetings or conferences without the client present. This authority ends at the U.S. Tax Court level, where only attorneys or non-attorney practitioners admitted under Rule 200 can appear.

Unlimited Practice Rights and Core EA Services

Tax Prep

Enrolled agents (EAs) are federally authorized tax practitioners whose core work centers on preparing federal income tax returns for individuals (Form 1040), corporations (Forms 1120 and 1120-S), partnerships (Form 1065), estates and trusts (Form 1041), and tax-exempt organizations (Form 990).

They may also prepare specialized IRS filings such as Form 5471 and Form 8938 for taxpayers with foreign assets, though FBAR (FinCEN Form 114) is filed separately with the U.S. Treasury’s Financial Crimes Enforcement Network. Beyond compliance work, EAs provide year-round tax planning by advising clients on timing income, structuring transactions, and maximizing deductions to legally minimize liabilities. Their federal credential, recognized across all states, distinguishes them from unenrolled preparers and affirms their qualification to represent taxpayers before the IRS.

Audit Rep

When clients receive IRS examination notices, enrolled agents step into the most valuable representation role: audit defense. You respond to correspondence audits where the IRS questions specific items by mail, requiring you to submit substantiating documentation and written explanations. You attend office audits at IRS facilities, presenting your client’s case to examining agents reviewing multiple issues on their return.

You handle field audits where revenue agents visit business locations to examine books and records comprehensively. In all these scenarios, you’re protecting your client’s interests by making arguments for why their positions are correct, negotiating which items the IRS adjusts, determining whether to agree to changes or appeal, and ensuring the IRS follows proper procedures. Many clients never attend their own audits; you handle everything from initial response through final resolution.

Collections

Collection representation might be the most stressful tax problem enrolled agents solve for clients. When taxpayers can’t pay what they owe, the IRS initiates collection actions: sending increasingly urgent notices, filing federal tax liens that damage credit and cloud property titles, and eventually issuing levies that seize bank accounts or garnish wages. As an enrolled agent, you intervene on your client’s behalf to negotiate reasonable payment arrangements. You submit Offers in Compromise proposing to settle debts for less than the full amount based on the taxpayer’s inability to pay.

You negotiate Installment Agreements, spreading payments over time (up to 72 months). You request Currently Not Collectible status when clients genuinely cannot afford any payment. You challenge liens and levy actions through Collection Due Process hearings. These interventions stop IRS collection machinery and provide breathing room while you work toward sustainable resolutions.

Appeals

When audits result in proposed adjustments you believe are wrong, or when the IRS denies collection relief you requested, enrolled agents exercise representation rights at the IRS Independent Office of Appeals, an administrative review process separate from the examination and collection divisions. You prepare protest letters explaining why the IRS determination is incorrect, citing relevant tax code provisions, regulations, court cases, and IRS guidance supporting your client’s position.

You attend appeals conferences (by phone or in person) where you negotiate with appeals officers who have authority to settle cases based on the “hazards of litigation,” or whether the IRS would likely win if the case went to Tax Court. Appeals representation requires not just tax knowledge but also legal argumentation skills and negotiation acumen. Many disputes that look lost after examination get resolved favorably at appeals because an experienced enrolled agent built a compelling case for why the IRS position won’t hold up under scrutiny.

Career Opportunities for Enrolled Agents

Employment Settings, IRS Enrolled Agent Roles, and Income Potential

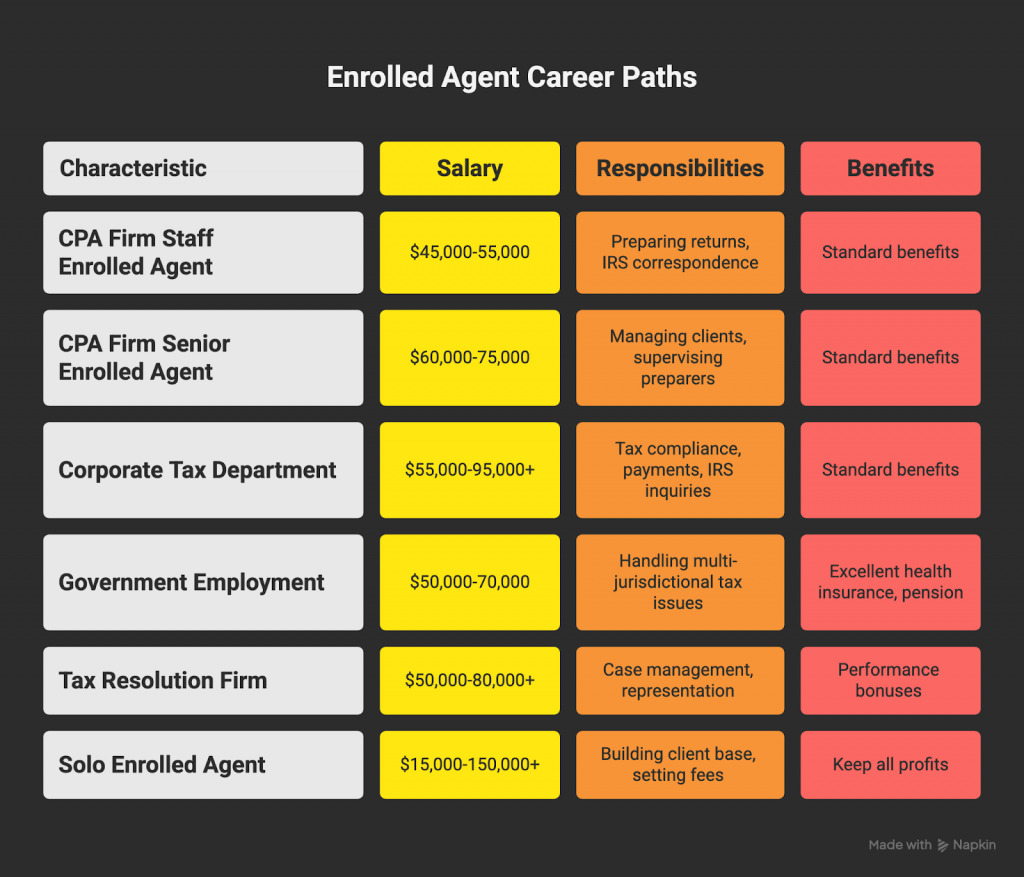

Enrolled agents work across diverse employment settings, each offering different work environments, income potential, and career development paths. Public accounting firms, particularly small and mid-sized CPA firms, employ enrolled agents to handle the firm’s tax preparation and representation workload. These firms often have more tax clients than their CPAs can handle (since CPAs split time between audit, accounting, and tax), creating opportunities for EAs to specialize in what they do best.

You might start as a staff enrolled agent earning $45,000-55,000 annually, preparing individual and small business returns during tax season and handling correspondence with the IRS year-round. As you gain experience and build expertise, you advance to senior enrolled agent roles ($60,000-75,000), managing complex client engagements, supervising junior preparers, and taking lead responsibility for audit representations.

Corporate tax departments in banks, investment firms, insurance companies, and larger businesses need enrolled agents on staff to ensure tax compliance, manage quarterly estimated payments, handle payroll tax deposits, and respond to IRS inquiries. These corporate positions typically offer $55,000-75,000 for mid-level EAs, with senior tax specialists earning $80,000-95,000 or more. Government employment is another path.

The IRS itself employs enrolled agents in various capacities (though most IRS employees become EAs after leaving to enter private practice), and state revenue departments value the federal credential for handling multi-jurisdictional tax issues. Government positions trade somewhat lower salaries ($50,000-70,000 typically) for superior benefits like excellent health insurance, defined benefit pensions, job security, and generous vacation time.

Tax resolution firms specializing in helping taxpayers with serious IRS problems, such as large unpaid tax debts, unfiled returns, and criminal tax investigations, employ enrolled agents as case managers and representation specialists. These firms often operate on contingency or flat-fee arrangements, and EA compensation reflects the high-stakes nature of the work, like a $50,000-80,000 base salary, often with performance bonuses based on cases successfully resolved. Seasonal employment with tax preparation chains like H&R Block, Jackson Hewitt, or Liberty Tax offers part-time income during tax season ($15-25 per hour plus seasonal bonuses based on returns completed), ideal for enrolled agents building independent practices who want guaranteed income during their busiest months.

Independent practice, working for yourself as a solo enrolled agent or in partnership with other tax professionals, offers the highest income potential but requires entrepreneurial skills beyond tax knowledge. Solo EAs build their own client bases, set their own fees, and keep all profits. Your income depends entirely on how many clients you serve and what you charge: a part-time practice with 50 individual return clients at $300 each generates $15,000 during tax season.

A full-time practice with 200 returns plus year-round bookkeeping and representation can produce $75,000-150,000+ annually. Freelance platforms like Upwork and Freelancer enable enrolled agents, including those based in India, to find US clients remotely, typically earning $25-50 per hour depending on experience and specialization. Specialized niches command premium rates: expat tax services ($75-150/hour), cryptocurrency tax specialists ($60-100/hour), and e-commerce business specialists ($50-80/hour) all leverage EA credentials to serve clients with complex needs who will pay for proven expertise.

Frequently Asked Questions

What is an enrolled agent?

An enrolled agent is a federally licensed tax practitioner authorized by the US Department of the Treasury to represent taxpayers before the Internal Revenue Service on any tax matter. Enrolled agents specialize exclusively in taxation and hold unlimited rights to represent any taxpayer, on any tax issue, in any IRS office across all 50 states.

How do enrolled agents differ from CPAs?

Enrolled agents specialize only in tax matters and receive federal licensing from the IRS, while CPAs are state-licensed accountants with a broader scope covering auditing, financial reporting, and business advisory services in addition to tax. EAs don’t need a college degree to qualify, but just need to pass the three-part SEE exam, whereas CPAs must complete 150 semester hours of education and meet state-specific requirements.

Do I need a degree to become an enrolled agent?

No, the IRS does not require any specific educational degree to become an enrolled agent.

How long does it take to become an enrolled agent?

The timeline varies based on your study intensity and schedule. With focused preparation, you can become an enrolled agent in as little as 3-6 months by dedicating 10-15 hours weekly to exam study, passing all three parts of the SEE, and completing the enrollment application. Working professionals studying part-time typically take 6-12 months. You have two years from passing your first exam part to pass the remaining sections, so you can spread preparation across multiple testing windows if needed.

What does the Enrolled Agent exam cover?

The Special Enrollment Examination (SEE) consists of three parts with 100 multiple-choice questions each. Part 1 covers individual taxation, including Form 1040, income, deductions, credits, and filing requirements. Part 2 tests business entity taxation (corporations, partnerships, and sole proprietors) and employment taxes. Part 3 focuses on representation practices, ethics under Circular 230, and IRS procedures for audits, collections, and appeals.

How much do enrolled agents earn?

Enrolled agent income varies significantly by employment setting and experience level. Entry-level EAs in firms or corporate positions typically earn $45,000-55,000 annually. Mid-level EAs with 3-5 years of experience earn $60,000-75,000, while senior EAs can make $80,000-95,000 or more. Independent enrolled agents running their own practices earn anywhere from $50,000 for part-time work to $150,000+ for specialized full-time practices. Freelance EAs working remotely typically charge $25-50 per hour, depending on expertise and specialization.

Can I work as an enrolled agent from India?

Yes, you can absolutely work as an enrolled agent from India, serving US clients remotely. The EA credential is federally issued and doesn’t require US residency or physical presence.

What is Circular 230?

Treasury Department Circular 230 is the set of federal regulations governing practice before the Internal Revenue Service. It establishes the rules, duties, and standards that enrolled agents (as well as CPAs and attorneys) must follow when representing taxpayers. Circular 230 covers ethical requirements, duties to clients and the IRS, standards for tax return preparation and advice, continuing education requirements (72 hours every three years for EAs), and disciplinary procedures for violations.

Allow notifications

Allow notifications