Complete IRS Enrolled Agent Exam guide: 3-part structure, syllabus, Prometric registration, preparation tips & India remote work (₹4.5-25L). Pass all three parts!

Table of Contents

The IRS Enrolled Agent exam represents one of the most accessible pathways to a federally authorized US tax career, especially for Indian commerce graduates and accounting professionals.

Unlike credentials like the CPA that demand 150 credit hours and US work experience, the EA exam welcomes candidates from any educational background. This comprehensive guide walks you through everything from exam structure and syllabus to Prometric registration and remote work opportunities with US tax firms.

Let me break down exactly what you need to know to pass the Enrolled Agent Exam and launch your career as an enrolled agent, whether you’re a B.Com graduate, CA dropout, or working professional targeting dollar-earning opportunities from India. If you want the complete roadmap from India to becoming an EA, see this detailed guide: How to Become a US Enrolled Agent from India.

What is the IRS Enrolled Agent Exam?

The IRS Enrolled Agent Exam, officially known as the Special Enrollment Examination (SEE), is a comprehensive three-part test administered by the Internal Revenue Service through Prometric testing centers.

This exam is your gateway to becoming a federally authorized tax practitioner with unlimited rights to represent taxpayers before the IRS.

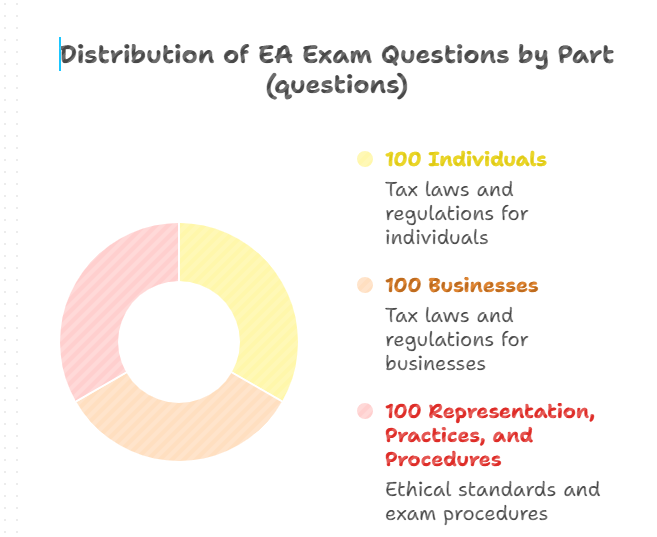

The exam covers

- individual taxation,

- business taxation, and

- representation practices and procedures, with each part containing 100 multiple-choice questions.

What makes the EA exam unique is its open enrollment policy.

You don’t need a specific degree, accounting background, or years of experience to sit for this exam.

To become an enrolled agent, you simply need to obtain a Preparer Tax Identification Number (PTIN), pass all three parts of the SEE, apply for enrollment, and pass a suitability check. This accessibility is particularly advantageous for Indian professionals looking to enter the US tax market without the barriers typically associated with other credentials.

The Special Enrollment Examination tests your knowledge of US federal tax law as it applies to individuals, businesses, and IRS representation procedures.

Each part of the exam is 3.5 hours long, with actual seat time of 4 hours to allow for a tutorial, survey, and one scheduled 15-minute break. The exam uses scaled scoring, and you need to achieve a score of 105 out of 130 to pass each part.

For Indian candidates, this exam opens doors to remote work opportunities with US accounting firms, Big 4 companies, and tax outsourcing firms.

The credential is recognized across all 50 US states and internationally, making it valuable for professionals who want to work from India while serving US clients. The earning potential ranges from ₹4.5 lakhs to ₹25+ lakhs annually depending on experience, significantly higher than many domestic accounting roles. For a deeper breakdown of role-wise and experience-wise pay, you can read our full guide on Enrolled Agent Salary in India.

Why should you take the Enrolled Agent Exam?

Unlimited IRS representation rights

As an enrolled agent, you gain unlimited practice rights before the IRS—a privilege shared only with CPAs and attorneys. Enrolled Agents are tax professionals who have demonstrated special competence in tax matters and are granted unlimited rights to practice before the IRS as the agents or legal representatives of taxpayers. This means you can represent any taxpayer on any tax matter before any IRS office, regardless of whether you prepared their return.

The representation rights extend to complex matters including audit representation, collection issues, appeals, penalty abatement, and innocent spouse relief. You can submit offers in compromise, negotiate installment agreements, and advocate for your clients in situations where their financial well-being depends on expert IRS representation. This scope of practice makes EAs invaluable to both individuals and businesses dealing with tax challenges.

Career advantages for Indian professionals

The enrolled agent credential offers extraordinary career advantages for Indian professionals, particularly those with commerce or accounting backgrounds. The US tax outsourcing industry actively recruits Indian EAs to work remotely, taking advantage of time zone differences and cost efficiencies. You can work night shifts from India during US business hours, earning dollar-denominated salaries while enjoying the lower cost of living in Indian cities.

Big 4 firms like Deloitte, PwC, EY, and KPMG maintain significant operations in Bangalore, Hyderabad, and Mumbai specifically to serve US tax clients. These firms hire enrolled agents for roles in tax preparation, compliance, and advisory services. Entry-level positions typically start at ₹4.5-8 lakhs annually, but with 3-5 years of experience, you can command ₹10-15 lakhs, and senior EAs working for multinational clients earn ₹15-25+ lakhs per year.

Beyond traditional employment, the EA credential enables freelance opportunities on platforms like Upwork, where US clients actively seek tax professionals. You can build your own practice serving US expatriates, small businesses, or individuals with straightforward tax situations. The credential’s recognition by the IRS adds credibility that clients value, especially when dealing with sensitive financial matters. For commerce graduates frustrated by limited domestic opportunities or CA students seeking alternatives, the EA path offers clear progression and international exposure.

Open enrollment advantage – no degree required

One of the most compelling aspects of the enrolled agent exam is its complete lack of educational prerequisites. There are no education or experience requirements you need to meet in order to take the EA exam. Whether you’re a B.Com graduate, engineering graduate, MBA, or even someone without a degree, you can sit for the exam as long as you have a valid PTIN.

This stands in stark contrast to the CPA exam, which requires 150 semester hours of education (typically a bachelor’s degree plus 30 additional credits) and often demands specific accounting course credits. The CA qualification in India requires years of articleship and passing multiple levels of exams. The EA path cuts through all that complexity—if you can learn US tax law and pass three exams, you’re qualified.

For CA dropouts, this is particularly liberating.

Many students invest years in CA preparation but don’t complete the qualification for various reasons. The EA credential offers a shorter, more focused path to a valuable professional designation. Similarly, commerce graduates who didn’t pursue CA or CMA can directly target the EA without feeling they’re starting from behind.

The open enrollment philosophy recognizes that tax expertise comes from study and practice, not necessarily from formal degrees.

Who is eligible for the Enrolled Agent Exam?

What are the basic eligibility rules for EA candidates?

PTIN Requirement – your first step

Before you can schedule any part of the enrolled agent exam, you must obtain a Preparer Tax Identification Number (PTIN) from the IRS.

You need to obtain a Preparer Tax Identification Number and apply to take the Special Enrollment Examination. The PTIN is free and serves as your unique identifier with the IRS for all tax preparation and representation activities.

Getting your PTIN is straightforward through the IRS website at irs.gov/ptin.

You’ll need to create an account, provide personal information including your Social Security Number or Individual Taxpayer Identification Number, and answer questions about your tax compliance. The process typically takes 15-20 minutes, and your PTIN is issued immediately online. Even if you’re applying from India and don’t have a US Social Security Number, you can still obtain a PTIN using alternative identification methods.

You can check the PTIN application checklist here and also the supplementary form application for foreign applicants here.

Educational background requirements (none required)

The enrolled agent exam has zero educational requirements.

You don’t need a degree in accounting, finance, or any related field. You don’t need to have completed specific coursework in taxation. You don’t need a bachelor’s degree at all. There are no education or experience requirements you need to meet in order to take the EA exam. This makes the EA credential uniquely accessible compared to virtually every other professional accounting designation.

This doesn’t mean preparation is unnecessary.

You’ll absolutely need to study US tax law thoroughly. But the barrier to entry is knowledge, not credentials. You can acquire that knowledge through self-study with review courses, without spending years in formal education programs. For working professionals in India, this flexibility means you can prepare for the EA exam while maintaining your current job, studying during evenings and weekends.

Can commerce graduates and CA dropouts become Enrolled Agents?

Absolutely yes.

Commerce graduates—whether B.Com, M.Com, or BBA Finance—are perfectly positioned to pursue the enrolled agent credential.

Your foundational knowledge of accounting principles, financial statements, and basic taxation provides a helpful starting point, even though the EA exam specifically tests US tax law rather than Indian taxation. The analytical thinking and numerical aptitude you’ve developed in commerce studies translate well to understanding US tax code provisions.

CA dropouts represent another ideal candidate pool for the EA exam.

If you’ve completed CA Foundation, Intermediate, or even partially completed Final but decided not to continue, you’ve already demonstrated strong accounting fundamentals and the discipline to study complex material.

The EA exam requires less time investment than completing CA—typically 3-6 months of focused preparation compared to years for CA—and leads to international opportunities that may be difficult to access with incomplete CA credentials.

What matters isn’t your educational background but your commitment to learning US federal tax law. The exam will test you on concepts that may be entirely new—US-specific provisions like head of household filing status, earned income credit, qualified business income deductions, and S corporation taxation.

Your commerce background helps with the underlying accounting concepts, but you’ll need to study the US tax system specifically. Many successful Indian EAs started as commerce graduates or CA students and found the EA path more aligned with their career goals.

What factors can disqualify you from becoming an EA?

While the exam itself has minimal eligibility requirements, the IRS enrollment process after you pass includes a suitability check that can disqualify candidates.

You must pass a suitability check, which will include tax compliance to ensure that you have filed all necessary tax returns and there are no outstanding tax liabilities, and criminal background. Let me explain what might prevent you from receiving your EA credential even after passing all three exam parts.

Tax compliance is the first area the IRS examines.

In general, any overdue tax return that has not been filed or any unpaid taxes unless acceptable payment arrangements have been established. If you have US tax filing obligations—perhaps you’ve worked in the US previously or have US-source income—you must be current on all returns and any tax due must either be paid or under an approved payment plan. Outstanding IRS debts without payment arrangements will disqualify you.

Criminal background considerations matter too.

In general, any criminal offense resulting in a felony conviction under federal tax laws or a felony conviction related to dishonesty or a breach of trust, that is less than ten years old. Tax-related felonies or crimes involving dishonesty will prevent enrollment. This includes offenses like tax evasion, filing false returns, embezzlement, fraud, or similar violations. Misdemeanors typically don’t disqualify you, and even felonies more than ten years old may be acceptable depending on circumstances.

For most Indian candidates applying for the first time with no US tax history, the suitability check is straightforward and shouldn’t present issues. The IRS simply verifies you don’t have outstanding US tax obligations and haven’t been convicted of relevant crimes.

The background check takes 60-90 days to complete after you submit your enrollment application. If you’re uncertain about anything in your background, it’s wise to consult with an EA or attorney before investing time in exam preparation.

How is the Enrolled Agent Exam structured?

What are the three parts of the EA exam?

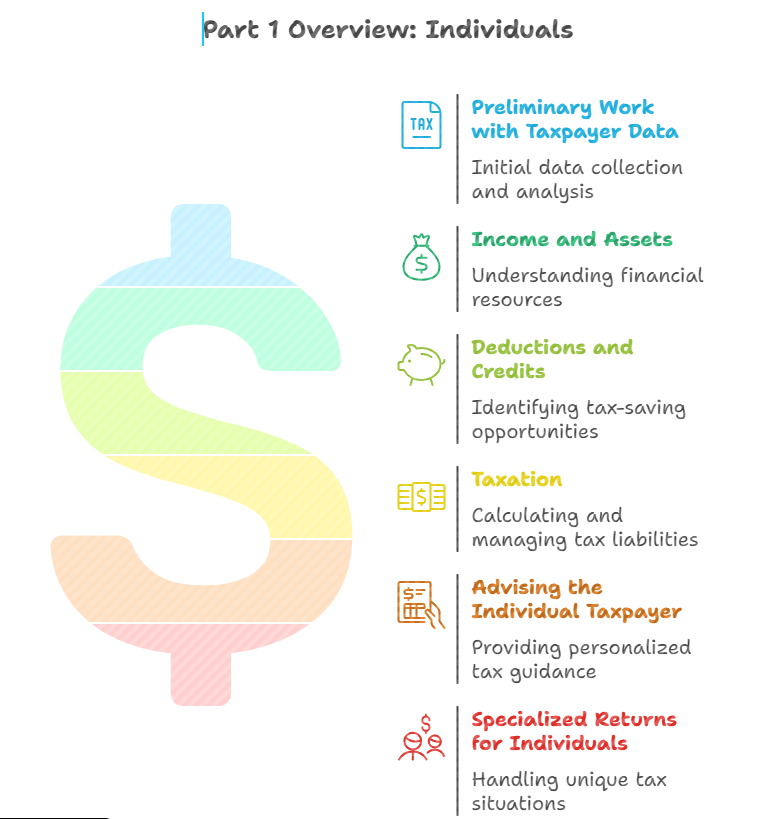

Part 1 – Individuals (100 Questions, 3.5 Hours)

Part 1 of the enrolled agent exam focuses entirely on individual taxation.

EA exam Part 1 covers individual taxation.

As a result, this part covers income from various sources, deductions and credits, and specialized items such as estate and gift tax. This part tests your knowledge of how individuals file their federal income tax returns, report various types of income, claim deductions and credits, and handle specialized situations like estate and gift tax filing.

The exam contains 100 multiple-choice questions, but only 85 are scored. The 100 multiple-choice questions that make up each exam include 15 experimental questions. The topics of the experimental questions cannot be known, so this breakdown accounts for the remaining 85 questions. The other 15 are experimental questions the IRS uses to test new content for future exams. Since you won’t know which questions are experimental, you must answer all 100 to the best of your ability.

The testing time is 3.5 hours (210 minutes) for the full exam.

After answering the first 50 questions, you’ll receive a mandatory 15-minute break option. You can choose to take this break or continue testing, but once you complete the first section and proceed, you cannot return to those questions. The break stops your exam timer, allowing you to use the restroom, access snacks from your locker, or simply rest your mind before tackling the second half.

Part 1 is often where candidates start because individual taxation feels more relatable—most people have filed personal tax returns and understand basic concepts like W-2 income and standard deductions. However, the exam goes much deeper, testing complex areas like basis calculations for property sales, passive activity loss limitations, alternative minimum tax, and international reporting requirements. The pass rate for Part 1 has dropped to around 58% in recent testing windows, partly because many candidates underestimate its difficulty.

Part 2 – Businesses (100 Questions, 3.5 Hours)

Part 2 shifts focus to business taxation and is often considered the most challenging part of the EA exam.

EA exam Part 2 covers business taxation.

Additionally, Part 2 tests three domains:

- Business Entities and Considerations (33%),

- Business Tax Preparation (46%),

- Specialized Returns and Taxpayers (21%).

This part examines your understanding of how partnerships, corporations, S corporations, and other business entities report income and pay taxes.

Like Part 1, this exam contains 100 questions (85 scored, 15 experimental) and allows 3.5 hours for completion with a 15-minute break after the first 50 questions. However, the content is more complex because business taxation involves multiple layers—the entity level and owner level—and requires understanding how business structure choices affect tax outcomes. You’ll face questions about partnership basis calculations, S corporation distributions, corporate tax rates, and depreciation methods.

The Part 2 syllabus also covers specialized topics like tax-exempt organizations, trusts and estates from the business perspective, retirement plans, and rental property taxation. If you have an accounting background, the financial statement analysis questions may feel familiar, but the tax treatment of transactions requires specific US tax knowledge. For example, understanding how businesses account for depreciation differs from knowing the Modified Accelerated Cost Recovery System (MACRS) rules the IRS requires.

Interestingly, Part 2 has a higher pass rate than Part 1 in recent years—around 71% compared to 58% for Part 1.

This might seem counterintuitive given Part 2’s reputation for difficulty.

The likely explanation is selection bias: most candidates who reach Part 2 have already passed Part 1, meaning they’ve proven they can pass EA exams and have learned effective study strategies. Additionally, fewer candidates attempt Part 2 compared to Part 1, filtering out those who gave up after failing Part 1.

Part 3 – Representation, Practices, and Procedures (100 Questions, 3.5 Hours)

Part 3 stands apart from the first two parts because it focuses on how enrolled agents practice before the IRS rather than on tax calculation.

Part 3 specializes in requirements for enrolled agents, the specific types of representation before the IRS, and the filing process. You’ll need to know Treasury Department Circular 230, which governs practice before the IRS, as well as IRS procedures for audits, appeals, collections, and penalties.

This part also contains 100 questions (85 scored, 15 experimental) with the same 3.5-hour time limit and break structure. The questions test your knowledge of topics like power of attorney procedures, taxpayer rights, IRS examination processes, collection alternatives like offers in compromise, penalties and their abatement, ethical standards for tax practitioners, and the structure of IRS administrative appeals.

Many candidates find Part 3 more manageable than Parts 1 and 2 because it’s less calculation-intensive and more conceptual.

Understanding the proper procedures and ethical requirements doesn’t require complex math—it requires careful reading and memorization of rules. The Part 3 pass rate has hovered between 83-86% in the last 3 years. After all, most candidates find the Part 3 EA subjects to be the easiest to master. Though note that recent data shows the pass rate closer to 70%, still higher than Part 1 but lower than the historical 83-86% range.

That said, don’t underestimate Part 3. While it may be more straightforward conceptually, it covers extensive ground including the entire Circular 230 document, multiple IRS procedures, and detailed rules about documentation requirements, statute of limitations, and taxpayer penalties. The questions often present scenarios where you must identify the correct procedure or determine whether a practitioner’s action violates ethical standards.

What question formats appear on the EA exam?

Direct questions

Direct questions are the most straightforward format you’ll encounter on the enrolled agent exam.

Direct questions: As the name suggests, you’re asked a clear question and must choose the correct answer from the choices provided. These questions simply ask something and present four answer options, one of which is correct. For example: “Which of the following entities are required to file Form 709, United States Gift Tax Return?” followed by four choices, including individuals, estates/trusts, corporations, or all of the above.

The key to direct questions is reading carefully and understanding exactly what’s being asked. Sometimes the question includes specific dollar amounts, dates, or other details that matter for selecting the right answer. Other times, the question tests whether you know a general rule or exception. Don’t rush through these even though they seem simple—careless reading errors cost points just as surely as knowledge gaps.

When you encounter direct questions during practice, pay attention to the answer explanations even when you answer correctly. Sometimes you might select the right answer for the wrong reason, or the explanation might reveal nuances that help you understand related concepts more deeply. Building strong foundational knowledge through direct questions prepares you for the more complex question formats.

Incomplete sentence questions

Incomplete sentence questions provide context in one or more sentences, then present an incomplete statement that you must finish by selecting the correct option. Incomplete sentence: You’re asked a question in which the choices complete the provided statement. For example: “Supplemental wages are compensation paid in addition to an employee’s regular wages. They do NOT include payments for:” followed by four completion options.

These questions test whether you can identify exceptions, distinguish between similar concepts, or recognize specific categories within broader topics. The incomplete sentence format often appears in areas where memorization of lists matters—what’s included versus excluded, what qualifies versus doesn’t qualify, or which forms apply to which situations. You need to read the setup carefully to understand what type of answer the question seeks.

The challenge with incomplete sentence questions is that all four answer options might seem plausible at first glance.

You’re essentially completing a sentence, so grammatically, all options probably work. The difference is technical accuracy—only one completion makes the statement factually correct according to US tax law. This format rewards candidates who’ve studied thoroughly and can distinguish subtle differences between similar provisions.

“All of the Following Except” Questions

“All of the following except” questions flip the typical approach by asking you to identify the incorrect statement rather than the correct one. All of the following except: You’re asked a question in which all the provided responses are correct except one, and you must choose the incorrect choice. For example: “There are five tests which must be met for a child to be a qualifying child. Which of the following is NOT a requirement?” followed by four tests, three of which are actual requirements and one that isn’t.

This question format can be tricky because you must identify what doesn’t belong rather than what does. It’s easy to miss the word “EXCEPT” or “NOT” if you’re reading quickly, which causes you to select the wrong answer even though you know the material. The IRS intentionally uses this format to test careful reading in addition to tax knowledge. Always mark or highlight the word “except” or “not” when you see it so you keep that focus throughout the question.

When answering these questions, use process of elimination strategically. If you can identify three options that are definitely correct, the remaining option must be your answer even if you’re not entirely sure why it’s wrong. Conversely, if you spot one option that’s clearly incorrect, you can select it confidently. Practice recognizing common variations of this format like “all are true except,” “which is not required,” or “which would not qualify.”

What is the passing score for the Enrolled Agent Exam?

Understanding the scaled scoring system (40-130)

The enrolled agent exam uses a scaled scoring system rather than reporting your raw score (the actual number of questions you answered correctly). Scaled scores are determined by calculating the number of questions answered correctly and converting it to a scale that ranges from 40 to 130. This system allows the IRS to maintain consistent passing standards across different exam versions, even when question difficulty varies slightly between test administrations.

Here’s how it works: When you complete the exam, the Prometric computer counts how many of the 85 scored questions you answered correctly. (Remember, 15 questions are experimental and don’t count toward your score.) That raw score then gets converted to a scaled score between 40 and 130 using a statistical formula. The conversion accounts for the relative difficulty of the specific questions on your exam version, ensuring fairness across different test takers.

This scaled scoring means you can’t calculate your passing percentage in the traditional sense. You don’t need to answer a specific percentage of questions correctly because the conversion varies. One candidate might answer 60 questions correctly and receive a scaled score of 105, while another answers 62 correctly on a slightly easier exam version and also receives 105. The scaling maintains equivalency.

If you fail, your score report will show your scaled score (somewhere from 40 to 104) plus diagnostic information indicating which domains were weak, marginal, or strong. Candidates that receive a scaled score of 104 are very close to passing. Candidates with a scaled score of 45 are far from being successful. This feedback helps you target your restudying efforts. If you pass, your report simply says “PASS” without showing a specific score—all that matters is you met the threshold.

What does a score of 105 mean?

A scaled score of 105 is the passing threshold for each part of the enrolled agent exam.

The IRS has set the scaled passing score at 105. You must achieve 105 or higher on Part 1, Part 2, and Part 3 independently—passing one part doesn’t carry over to help with others. Each exam is scored separately, and you need to reach 105 on all three to become eligible for EA enrollment.

What does 105 represent in practical terms?

The scoring methodology was determined by the IRS following a scoring study. A panel of subject matter experts composed of Enrolled Agents and IRS representatives, established a passing score for a candidate who meets the minimum qualifications to be an Enrolled Agent.

Essentially, the IRS determined that 105 represents the competency level needed to practice effectively as an enrolled agent. It’s not just a random cutoff—it reflects what expert practitioners believe is necessary for safe, competent tax practice.

Interestingly, 105 on the 40-130 scale doesn’t correspond to a specific percentage of questions answered correctly. Due to the scaling process, the number of correct answers needed varies slightly by exam version. However, as a rough estimate, you typically need to answer 60-65% of the scored questions correctly to achieve 105. This means you can miss 30-35 questions and still pass, which provides some breathing room for difficult or unfamiliar topics.

Your goal should be to exceed 105 comfortably rather than barely scraping by. When you’re scoring 110-120 on practice exams, you have a buffer for exam day nervousness, unexpected difficult questions, or topics you didn’t study as thoroughly. Candidates who consistently score 105-108 on practice tests sometimes fail the real exam when a few tough questions appear, while those scoring 115+ on practice tests usually pass even if the exam is harder than expected.

What is the EA Exam syllabus for 2025–2026?

What topics are covered in Part 1 – Individuals?

Preliminary work with taxpayer data (14 Questions)

This domain covers the foundational work you must complete before preparing a tax return. The Part 1 topics include: Preliminary Work with Taxpayer Data (16%).

You’ll face approximately 14 questions about gathering client information, determining filing status, understanding filing requirements, and identifying who qualifies as a dependent. These are critical basics that affect every calculation throughout the return.

Key topics include the five filing statuses (single, married filing jointly, married filing separately, head of household, qualifying surviving spouse) and the requirements for each. You need to know the dependency tests—qualifying child versus qualifying relative—including the relationship, age, residency, support, and joint return tests. Questions might present family scenarios where you must determine whether someone qualifies as a dependent or which filing status provides the most favorable tax outcome.

This domain also covers preliminary issues like when a taxpayer must file a return (income thresholds by filing status and age), who can use different tax forms (1040, 1040-SR), and basic tax year concepts. While this material seems straightforward, the questions can be tricky.

For example, determining head of household status requires understanding “maintaining a household” and “qualifying person” rules, which have specific technical definitions that differ from common usage.

Income and assets (17 Questions)

Income and assets represent the largest scoring area in Part 1, with approximately 17 questions. The domain breakdown includes Income and Assets (20%).

This domain tests your knowledge of how different types of income are taxed, how basis is calculated for assets, and how to report various income sources. Understanding what’s taxable versus excludable is fundamental to individual taxation.

You’ll encounter questions about wages and salaries, interest and dividend income, capital gains and losses, retirement distributions, Social Security benefits, alimony, unemployment compensation, business income, and rental income.

Each category has unique rules—for example, qualified dividends and long-term capital gains receive preferential tax rates, while ordinary income faces regular rates. Some Social Security benefits are taxable depending on other income, while certain types of interest like municipal bonds may be tax-exempt.

The asset portion covers basis calculations, which determine gain or loss when property is sold. You need to understand original basis, adjusted basis, basis of inherited property (stepped-up to fair market value at death), basis of gifted property (generally carryover basis), and how improvements and depreciation affect basis.

Questions might ask you to calculate gain on a home sale after applying the $250,000/$500,000 exclusion, or determine the basis of stock sold when shares were purchased at different times.

Deductions and credits (17 Questions)

Deductions and credits also account for approximately 17 questions in Part 1.

Topics include Deductions and Credits (20%). This domain covers both above-the-line deductions (adjustments to income) and below-the-line deductions (itemized deductions), as well as various tax credits. Understanding which items reduce adjusted gross income versus which reduce taxable income matters because it affects other calculations.

Above-the-line deductions include contributions to traditional IRAs and Health Savings Accounts, student loan interest deduction, self-employment tax deduction, and self-employed health insurance premiums.

These deductions are valuable because they reduce adjusted gross income, which affects eligibility for other tax benefits. Below-the-line itemized deductions include medical expenses (above 7.5% of AGI), state and local taxes (capped at $10,000), mortgage interest, and charitable contributions.

The 2025-2026 syllabus specifically mentions several areas, including qualified business income (QBI) deductions, limitations for charitable contributions, itemized deductions for vision and long-term care expenses, and energy credits.

Tax credits are powerful because they reduce tax dollar-for-dollar rather than just reducing taxable income. You will need to know the child tax credit, earned income credit, education credits (American Opportunity and Lifetime Learning), retirement savings contributions credit, and dependent care credit, along with their phaseout ranges and qualification requirements.

Taxation (15 Questions)

The taxation domain covers approximately 15 questions and deals with the actual calculation of tax liability.

The Part 1 syllabus includes Taxation (17%).

This includes understanding the progressive tax rate structure, how different types of income are taxed at different rates, self-employment tax, alternative minimum tax, and various penalties and additional taxes.

You need to know the tax brackets for different filing statuses and how to apply them.

For example, understanding that qualified dividends and long-term capital gains face 0%, 15%, or 20% rates depending on income level, while ordinary income faces the regular bracket rates (10%, 12%, 22%, 32%, 35%, 37%). The preferential rates for capital gains mean the order of operations matters when calculating total tax.

Self-employment tax is a major component of this domain—self-employed individuals pay both the employer and employee portions of Social Security and Medicare taxes.

You will face questions about calculating net self-employment earnings, applying the 15.3% rate (though only on 92.35% of net earnings), and understanding the cap on the Social Security portion.

The alternative minimum tax (AMT) adds another layer—you must calculate regular tax and AMT, then pay the higher amount. Understanding AMT adjustments and preferences is essential.

Additional topics include penalties for early retirement plan distributions (10% penalty with various exceptions), estimated tax requirements, and the net investment income tax (3.8% surtax on investment income for high earners).

Advising the individual taxpayer (11 Questions)

This domain tests your ability to provide practical advice to individual taxpayers, not just prepare returns. Part 1 includes Advising the Individual Taxpayer (13%).

You will face approximately 11 questions about situations where you must recommend the best tax strategy, explain the consequences of actions, or help clients make informed decisions about tax-related choices.

Topics include advising on retirement plan contributions, comparing Roth versus traditional IRA benefits, explaining tax implications of different investments, discussing the marriage penalty or bonus, advising on timing of income and deductions, and explaining estimated tax payment requirements to avoid penalties.

You might see questions about whether a client should itemize or take the standard deduction, how to minimize self-employment tax, or when to file an amended return.

The 2025 syllabus additions include mid-year estimated tax planning, joint and several liability implications for married couples, conditions for filing claims for refunds, and special tax provisions for military members. This domain requires understanding not just the mechanical rules but their practical application. For example, you might need to advise a client on whether taking a distribution from a retirement account early makes sense given the penalties, or whether they should convert a traditional IRA to a Roth given their current and expected future tax brackets.

Specialized returns for individuals (12 Questions)

The final domain in Part 1 covers specialized tax situations with approximately 12 questions. Part 1 ends with Specialized Returns for Individuals (14%).

This includes estate and gift tax, trusts and estates (from the individual beneficiary perspective), foreign income reporting, and other less common situations that still appear regularly enough to warrant testing.

Estate tax questions focus on Form 706, which must be filed when someone’s gross estate exceeds the exemption amount (currently over $13 million for 2025).

You’ll need to know what’s included in the gross estate, what deductions are available (debts, administrative expenses, charitable bequests, marital deduction), and filing deadlines. The 2025 syllabus specifically mentions estate filing requirements and due dates for Forms 706 and 1041.

Gift tax covers Form 709, which reports gifts exceeding the annual exclusion amount ($18,000 per recipient for 2024, likely adjusted for 2025). Understanding the annual exclusion, lifetime exemption, and gift splitting for married couples is essential. The syllabus update specifically includes filing requirements for Form 709 regarding gift tax.

Foreign income reporting has become increasingly important with global mobility.

Topics include Form 1116 for the foreign tax credit, which allows taxpayers to offset US tax with foreign taxes paid on foreign-source income. You’ll also encounter questions about reporting foreign bank accounts (FBAR) and foreign financial assets (Form 8938). Life insurance proceeds, alimony treatment, and property sales for antiques and collectibles are additional specialized topics that may appear in this domain.

Part 2 Syllabus – Businesses

Business entities and considerations (30 Questions)

Part 2 begins with the largest domain, business entities, accounting for approximately 30 questions. EA exam Part 2 covers business taxation with Business Entities and Considerations (33%).

This domain tests your understanding of different business structures—sole proprietorships, partnerships, limited liability companies, C corporations, and S corporations—and the tax implications of choosing each structure.

You need to know how partnerships operate from a tax perspective, including how profits and losses flow through to partners, how partnership basis is calculated and adjusted, what distributions are taxable versus nontaxable, and how the partnership makes tax elections. Partnership taxation is complex because partners are taxed on their share of partnership income whether or not distributed, and basis calculations affect whether distributions or losses are currently allowed.

C corporation taxation involves understanding corporate tax rates (flat 21% currently), how corporations report income and deductions, what dividends-received deductions are available, accumulated earnings tax, and personal holding company tax. S corporations combine elements of partnerships and corporations—income flows through to shareholders, but strict eligibility requirements apply (domestic corporation, one class of stock, limited number and types of shareholders). Understanding S corporation basis, built-in gains tax, and reasonable compensation requirements is critical.

The 2025 syllabus updates include partnership cancellation of debt, partnership-level audit and opt-out provisions, and SSTB calculations for qualified business income. You’ll also face questions about forming corporations, recognizing gain on property contributions, the basis of assets contributed, and how different entity structures affect owners’ self-employment tax obligations.

Business tax preparation (37 Questions)

Business tax preparation represents the largest single domain in the EA exam, with approximately 37 questions. Business Tax Preparation accounts for 46% of Part 2. This domain covers the day-to-day tax compliance work for businesses—calculating gross income, determining allowable deductions, understanding depreciation, and preparing accurate tax returns.

Business income questions cover gross receipts, cost of goods sold, inventory accounting methods, and business income from various sources. Deductions include ordinary and necessary business expenses like employee wages, rent, utilities, advertising, insurance, and professional fees. You need to know limitations—meals are 50% deductible, entertainment is not deductible, hobby loss rules prevent losses on activities not engaged in for profit, and home office deductions have specific requirements.

Depreciation is a massive topic within this domain.

You’ll need to understand Modified Accelerated Cost Recovery System (MACRS), Section 179 immediate expensing (up to $1,220,000 for 2024 with phase-out beginning at $3,050,000), bonus depreciation, asset classifications (3-year, 5-year, 7-year, etc.), and recapture rules when depreciated property is sold. Recent updates include disposition of assets and the balance sheet relationship to income statement and depreciation.

Special topics include the qualified business income (QBI) deduction under Section 199A, which allows pass-through business owners to deduct up to 20% of qualified income subject to limitations. Understanding specified service trade or business (SSTB) rules, W-2 wage limitations, and the unadjusted basis of qualified property is essential. The 2025 syllabus specifically emphasizes SSTB calculations, phase-outs, and UBIA for qualified business income. You’ll also see questions about vehicle use and expenses (actual vs. standard mileage), proper treatment of excise taxes, and start-up or organizational costs.

Specialized returns and taxpayers (18 Questions)

The final Part 2 domain covers specialized business tax situations with approximately 18 questions. Specialized Returns and Taxpayers comprises 21% of Part 2.

This includes tax-exempt organizations, trusts and estates from the fiduciary perspective, retirement plans, farmers, and rental property—all areas that require specialized knowledge beyond typical business taxation.

Tax-exempt organizations under Section 501(c)(3) and other 501(c) categories face unique requirements. You need to know what activities qualify for exemption, what unrelated business income tax (UBIT) applies to, Form 990 filing requirements, and potential loss of exempt status. Employee benefit plans, including qualified retirement plans (401(k), profit sharing, defined benefit), have contribution limits, distribution rules, and reporting requirements.

Trust and estate taxation from the fiduciary perspective involves Form 1041, understanding distributable net income (DNI), how deductions are allocated between the fiduciary and beneficiaries, and the income distribution deduction. This differs from the individual beneficiary perspective covered in Part 1—here you’re preparing the trust or estate return itself.

Farmers receive special tax treatment, including income averaging, crop insurance proceeds, the Farm Optional Method for self-employment tax, and specific depreciation rules for farm property and livestock. Rental property taxation is a major component—understanding passive activity loss limitations, real estate professional qualifications, distinguishing commercial rentals from residential units, handling mixed-use properties and vacation homes, rental income and expense reporting, and depreciation of rental property.

The 2025 syllabus specifically adds disaster-area provisions for drought, flood, and weather-related conditions affecting businesses.

Part 3 Syllabus – Representation, Practices, and Procedures

Practices and procedures (26 Questions)

Part 3 begins with practices and procedures, the largest domain with approximately 26 questions. Part 3 covers Practices and Procedures (31%). This domain focuses on Treasury Department Circular 230, which governs practice before the IRS, including who can practice, ethical standards, practitioner duties, and sanctionable acts.

You need to thoroughly understand what constitutes “practice before the IRS”—preparing returns, representing clients in examinations and appeals, corresponding with the IRS on behalf of clients, and appearing before IRS offices.

Different categories of practitioners have different practice rights: enrolled agents have unlimited rights, CPAs and attorneys have unlimited rights, enrolled retirement plan agents have limited rights to retirement plans, and registered tax return preparers (if the program is reinstated) have limited rights to taxpayers whose returns they prepared.

Circular 230 requirements for enrolled agents include

- competence,

- diligence,

- proper communication with clients and the IRS,

- conflicts of interest rules,

- fee arrangements (contingent fees are prohibited except in specific situations),

- rules about former IRS employees,

- advertising and solicitation standards, and

- return of client records.

You must know due diligence requirements including verifying information clients provide, making reasonable inquiries when information seems incorrect, and not relying on obviously erroneous information.

Sanctionable acts that can result in disciplinary action include incompetence or disreputable conduct, willfully failing to file your own tax returns, misappropriating client funds, giving false or misleading information to the IRS, delaying or obstructing federal tax matters, and violating Circular 230 regulations.

Representation before the IRS (25 Questions)

This domain covers approximately 25 questions about the practical aspects of representing taxpayers before the IRS.

Representation before the IRS accounts for 29% of Part 3.

You’ll need to know how to properly authorize representation, build a taxpayer’s case, understand their financial situation, gather supporting documentation, and apply relevant legal authority.

Power of attorney procedures are fundamental—Form 2848 authorizes you to represent a client before the IRS for specified tax matters and years. You must understand who can sign the power of attorney, what authority it grants, when it expires, how to revoke it, and differences from Form 8821 (Tax Information Authorization), which only allows you to inspect and receive tax information but not represent the client. Questions might test whether you have proper authority for specific actions in various scenarios.

Building a taxpayer’s case involves understanding their factual situation, identifying applicable tax law, researching relevant authority (Internal Revenue Code, Treasury Regulations, Revenue Rulings, court cases), and organizing information persuasively. Supporting documentation is critical—you need to know what evidence substantiates different types of income, deductions, and credits.

Related issues include understanding taxpayer rights under the Taxpayer Bill of Rights, knowing when to escalate matters to supervisors or the Taxpayer Advocate Service, understanding statute of limitations for assessments and refunds (generally 3 years but extended in certain situations), and taxpayer burden of proof considerations.

Specific areas of representation (20 Questions)

This domain tests specialized representation situations with approximately 20 questions. Specific Areas of Representation comprises 24% of Part 3.

Rather than general representation principles, these questions focus on particular IRS procedures—collections, examinations (audits), appeals, and penalty/interest abatement.

Collection representation involves helping taxpayers who owe taxes and cannot pay in full.

You need to know collection alternatives, including installment agreements (Form 9465), offers in compromise (Form 656), currently not collectible status, and innocent spouse relief (Form 8857).

Understanding when to propose which alternative, what financial documentation the IRS requires (Form 433-A for individuals, Form 433-B for businesses), and how the IRS evaluates reasonable collection potential is essential.

Examination (audit) representation covers different types of audits—correspondence audits, office audits, and field audits—and your role in each.

You’ll need to know what documentation to provide, how to respond to Information Document Requests (IDRs), when to request additional time, and how to advocate for your client’s position. Understanding examination procedures, including the 30-day letter and 90-day statutory notice of deficiency, matters because these trigger important deadlines for appealing.

Appeals representation involves understanding how the IRS Office of Appeals operates independently from exam divisions, what issues qualify for appeals consideration, how to prepare a protest letter, what happens at appeals conferences, and settlement options.

Penalty and interest abatement questions test your knowledge of reasonable cause arguments for penalty relief, first-time abatement policies, and interest abatement in limited circumstances. The domain also covers when taxpayers can pursue litigation in Tax Court, District Court, or Court of Federal Claims.

Filing process (14 Questions)

The final Part 3 domain covers filing procedures with approximately 14 questions.

Filing Process accounts for 16% of Part 3.

This domain focuses on accuracy requirements, recordkeeping obligations, and electronic filing procedures—the administrative side of tax practice.

Accuracy requirements include preparer due diligence for certain credits (earned income credit, child tax credit, American opportunity credit, head of household), penalties for understating tax liability, signature and PTIN requirements for paid preparers, and disclosure of tax return positions. You must understand when more stringent standards apply, such as positions contrary to regulations requiring disclosure to avoid penalties.

Record maintenance covers how long clients should retain tax records (generally 3 years from filing, but 6 years if substantial income underreporting, indefinitely for unfiled returns), what documentation substantiates different types of items, and special rules for substantiating charitable contributions, business expenses, and vehicle use. Electronic filing questions test knowledge of Form 8879 (IRS e-file Signature Authorization), practitioner responsibilities when e-filing, and electronic filing options.

Additional topics include amended return procedures (Form 1040-X for individuals, superseding returns versus amended returns), filing extensions (Form 4868 for individuals extends filing but not payment deadlines), and various reporting forms that practitioners must file or advise clients about. Understanding these procedural requirements ensures you maintain compliance while representing clients.

For the full official syllabus and exam policies, refer to the IRS SEE 2025 Candidate Information Bulletin.

How to register for the Enrolled Agent Exam on prometric?

Step-by-Step prometric registration process

Creating your Prometric account

Your journey to scheduling the enrolled agent exam begins at Prometric’s website.

You can schedule an examination appointment at any time online at Prometric, by calling 1800-306-3926 (toll-free) or +1 443-751-4193 (toll), Monday through Friday between 8 a.m. and 9 p.m. (Eastern time). The online process is straightforward and allows you to review available dates and times at your convenience before committing to an appointment.

Navigate to prometric.com/test-takers/search/irs and click on “Special Enrollment Examination (SEE)” to begin.

You will need to create a user profile if you’re a first-time tester.

Have your PTIN ready—you’ll need it to link your account properly. The registration form asks for personal information including your legal name (exactly as it appears on your government-issued photo ID), email address, phone number, and mailing address.

Make sure your name matches your identification document precisely. Any discrepancy between your Prometric registration and your ID will prevent you from testing, and you’ll forfeit your exam fee.

If your name contains special characters, hyphens, or multiple middle names, enter them exactly as they appear on your ID. Once you create your account, you’ll receive a confirmation email with login credentials. Keep this information secure as you’ll use it to schedule all three exam parts and access your score reports.

Linking your PTIN to Prometric

After creating your Prometric account, you must link your PTIN to authorize exam scheduling.

Your PTIN serves as proof that you’ve met the basic requirement to sit for the enrolled agent exam. Without a valid, active PTIN properly linked to your Prometric account, you cannot schedule any exam parts. This connection ensures the IRS can track your exam progress and verify completion of all three parts when you apply for enrollment.

During account creation or when scheduling your first exam, Prometric will prompt you to enter your PTIN. Type it carefully—a single digit error will prevent the system from verifying your eligibility. If you’ve recently obtained your PTIN, allow 24-48 hours for it to propagate through IRS systems before attempting to schedule your exam. Scheduling immediately after PTIN issuance sometimes causes verification failures.

If you encounter errors linking your PTIN, verify that it’s active and not expired. PTINs require annual renewal, and an expired PTIN won’t validate. Also confirm you entered your legal name in Prometric exactly as it appears in your PTIN account. Mismatches trigger verification failures. If problems persist after checking these details, contact Prometric’s Special Enrollment Examination support line at the phone numbers provided above. They can troubleshoot linking issues and manually verify your eligibility if necessary.

Selecting your testing center (India Locations: Bangalore, Hyderabad, New Delhi)

Once your account is active and your PTIN linked, you can search for available testing centers. International testing for the Special Enrollment Exam (SEE) is available for dates and locations including Bangalore, India, Hyderabad, India, and New Delhi, India. These three Indian locations serve candidates throughout the country, so you’ll want to choose the center most convenient to your location or travel plans.

When you begin scheduling an exam part, Prometric displays a map and list of testing centers. Use the location search function to find centers near your city.

Each center listing shows the address, available testing dates, and typically some indication of appointment availability. Click on a specific center to see the full calendar of open time slots. Testing centers generally offer morning and afternoon appointments on weekdays, with some centers also providing weekend testing.

Consider logistics when choosing your center.

How easy is it to reach?

Will you need to book a hotel if it’s in a different city?

What’s the traffic situation—should you arrive earlier to ensure on-time check-in?

Prometric requires arrival 30 minutes before your scheduled exam time, so factor in travel time accordingly.

If you’re planning to take multiple exam parts, you can use the same testing center for consistency or choose different centers if that better suits your schedule. Just remember that rescheduling to a different center may involve fees if done close to your exam date.

Scheduling your exam date

With your testing center selected, you’ll choose your specific exam date and time.

The test is offered from May 1 to the end of Feb. of the following year.

The test is not offered during the annual blackout period in March and April. This testing window runs for 10 months annually, with March and April reserved for exam updates incorporating the previous year’s tax law changes.

The calendar displays available dates with open appointments highlighted.

Click on a date to see specific time slots available that day.

Consider your personal schedule and preparation timeline—are you ready to test soon, or do you need additional study time? Many candidates schedule their exam 4-6 weeks out, providing motivation to stay on schedule while allowing time to complete their preparation.

After selecting your date and time, you’ll proceed to payment.

There is a $267 fee per part paid at the time of appointment scheduling. The test fee is non-refundable and non-transferable.

Prometric accepts MasterCard, Visa, and American Express. Once payment processes, you’ll receive an email confirmation containing your exam date, time, location, confirmation number, and important reminders about identification requirements and testing center rules. Save this email and note your confirmation number—you’ll need it to reschedule or cancel if necessary, and it’s helpful for accessing your score report after testing.

How much does the EA Exam cost?

Exam fee breakdown ($267 per Part)

The cost structure for the enrolled agent exam is straightforward: $267 per part paid directly to Prometric when you schedule each exam.

The fee to take each part of the SEE is $267. Since you must pass all three parts to become an enrolled agent, the total exam cost is $801 if you pass each part on your first attempt ($267 × 3 = $801).

This fee covers the computerized testing, immediate score reporting, and Prometric’s administration of the exam on behalf of the IRS.

Unlike some professional exams where you pay an application fee, then separate exam fees, then licensing fees to multiple organizations, the EA exam consolidates costs.

The $267 goes entirely to Prometric for test administration—there’s no separate fee to the IRS just to apply for exam eligibility. This transparent pricing helps you budget accurately for the exam investment.

Payment is required at the time of scheduling each part.

You cannot schedule an exam without paying, and you must pay separately for each part. If you plan to take all three parts, you’ll make three separate $267 payments, either all at once when scheduling three appointments or spread out as you schedule each part after passing the previous one.

Prometric does not offer payment plans or deferred payment—full payment is required to secure your appointment.

One cost consideration: if you fail an exam part, you must pay another $267 to retake it.

Each exam part may be taken 4 times per testing window, which runs from May 1 to the end of February.

If you fail Part 1 twice before passing, your total exam costs become $1,068 instead of $801 ($267 × 4 total attempts at Part 1, plus $267 each for Parts 2 and 3). This reality emphasizes the value of thorough preparation—the most cost-effective path is passing each part on your first try, which saves you both money and time.

Total investment for international candidates

For Indian candidates, the enrolled agent journey involves several costs beyond just exam fees.

Here’s a comprehensive breakdown of your total investment.

First, the exam fees total $801 for three parts ($267 each), assuming first-time passes.

Add study materials—EA review courses from providers like Gleim, Surgent, or Becker typically range from ₹35,000 to ₹50,000, depending on the package and features included. Some candidates supplement with additional practice questions or books, adding another ₹5,000-₹10,000.

After passing all three parts, you’ll pay the IRS enrollment fee.

You may electronically apply for enrollment and make a secure payment of the $140 enrollment fee at Pay.gov.

This $140 covers the IRS processing your application, conducting the suitability check (tax compliance and background check), and issuing your enrollment card upon approval.

Convert to rupees, and the enrollment fee is approximately ₹11,500-₹12,000, depending on exchange rates.

If you’re taking the exam in an Indian city different from where you live, factor in travel costs—flight or train tickets, hotel accommodation if overnight stays are needed, local transportation to the testing center, and meals.

For someone in a smaller city traveling to Bangalore, Hyderabad, or New Delhi three times (once per part), these logistics might add ₹20,000-₹40,000 to your total investment. Local candidates can simply take transport to and from their nearest center, minimizing these costs.

Total investment summary for an Indian candidate:

- exam fees (~₹66,000 for $801),

- study materials (₹35,000-₹50,000),

- IRS enrollment fee (~₹11,500), and

- potentially travel costs (₹0-₹40,000).

The total brings your complete EA investment to approximately ₹1,12,500 to ₹1,67,500 ($1,400-$2,100).

Compare this with CPA costs (often $3,000-$5,000 just in exam and licensing fees before educational requirements), CA costs (multiple years of opportunity cost plus course fees), and the EA represents excellent value for a US-recognized credential. The ROI is strong—entry-level remote EAs earn ₹4.5-8 lakhs, recovering your investment in the first year of practice.

What is the rescheduling and cancellation policy?

Rescheduling fees and deadlines

Life happens, and sometimes you need to change your exam appointment.

You can reschedule your appointment online or by phone using your confirmation number. Prometric allows rescheduling, but fees apply depending on how far in advance you make the change. Understanding these fees helps you avoid unnecessary costs while maintaining flexibility.

The rescheduling fee structure operates on a sliding scale.

No fee if you reschedule at least 30 calendar days prior to your appointment date, $35 fee if you reschedule 5 to 29 calendar days before your appointment date, and you will be required to pay another full examination fee if you reschedule less than five calendar days before your appointment date.

This policy encourages early rescheduling while acknowledging that last-minute changes prevent Prometric from filling your time slot.

If you realize three months before your exam that you need more preparation time, reschedule immediately at no cost.

The 30-day buffer gives you plenty of time to adjust plans without financial penalty. Waiting until you’re within the 29-day window costs you $35—not devastating, but unnecessary if you knew earlier. Rescheduling within five days of your exam essentially means forfeiting the entire $267 and paying again for a new appointment, making last-minute changes extremely expensive.

To reschedule, log into your Prometric account, locate your scheduled appointment, and select the reschedule option. You’ll see available dates at the same testing center, or you can choose a different center. Pay any applicable rescheduling fee, and you’ll receive a new confirmation email with your updated details.

Alternatively, call Prometric at +1800-306-3926 or +1443-751-4193 to reschedule by phone, which is helpful if you’re having technical issues with the website or need assistance finding availability.

What happens if you miss your appointment?

Missing your scheduled exam appointment without proper rescheduling has serious consequences. Your entire fee will be forfeited if you miss your appointment or arrive late by 30 minutes or more.

There are no refunds for no-shows, and you cannot transfer the fee to a future appointment. You simply lose the $267 completely and must pay again to schedule a new exam date.

Even arriving late by 30 minutes or more results in forfeiture. Prometric requires arrival 30 minutes before your scheduled time for check-in procedures.

If your exam is scheduled for 2:00 PM and you arrive at 1:45 PM, you’re cutting it close but may still be admitted at the test center’s discretion. Arrive at 2:30 PM or later, and you will not be allowed to test—the appointment is considered missed, your fee is lost, and you must reschedule and pay again.

This strict policy exists because computerized testing requires precise scheduling. Your time slot holds a testing station, and once you miss it, that capacity is wasted. The test center cannot accommodate walk-ins or significantly delayed candidates without disrupting the schedule for everyone else. Prometric and the IRS enforce the policy uniformly—there are no exceptions for traffic, family emergencies, or other reasons unless you reschedule in advance.

To protect your investment, plan carefully for exam day. Know the exact location of your testing center and have tested your route beforehand if it’s unfamiliar. Set multiple alarms to ensure you wake up with plenty of margin. Consider staying near the testing center the night before if you have a morning appointment and live far away.

Arrive at least 45-60 minutes early (not just the required 30) to create a buffer for unexpected delays. These precautions ensure you don’t forfeit $267 plus the opportunity to test on your prepared date, which could delay your EA timeline by weeks if appointments are limited.

Part-wise Enrolled Agent Exam preparation strategy

How long should you study for the Enrolled Agent Exam?

The time you need to prepare for the enrolled agent exam depends on your starting knowledge, how many hours you can dedicate weekly, and your learning style. These are the basic steps: study for each part separately, with recommended hours of

- Part 1: 70-90 hours,

- Part 2: 80-100 hours,

- Part 3: 60-80 hours.

This suggests a total preparation time of roughly 210-270 hours across all three parts if you have minimal prior US tax knowledge.

For candidates with US tax preparation experience or strong accounting backgrounds, you might need less time—perhaps 50-70 hours for Part 1, 60-80 for Part 2, and 40-60 for Part 3.

Conversely, if you’re completely new to US taxation or English isn’t your primary language, add 20-30% more time to account for learning both content and terminology.

Indian commerce graduates typically fall somewhere in the middle—you understand accounting concepts, but US tax specifics are new.

Converting hours to months depends on your weekly availability.

If you can study 10 hours per week consistently, Part 1 takes 7-9 weeks, Part 2 takes 8-10 weeks, and Part 3 takes 6-8 weeks—roughly 6 months total for all three parts with some breathing room. Study 20 hours weekly, and you can complete everything in 3-4 months. Working professionals typically aim for 8-12 hours weekly, targeting a 6-9 month timeline from start to finish.

Most successful candidates follow one of two approaches: the marathon method (study for and pass all three parts within one year) or the sprint method (focus intensively on one part at a time, testing every 4-6 weeks).

The marathon method keeps tax law fresh since you’re studying the same tax year for all parts. The sprint method provides quicker wins—passing Part 1 motivates you to tackle Part 2, creating momentum. Choose based on your schedule and motivation style.

How to prepare for Part 1 – Individuals

Start your Part 1 preparation by reading through the entire syllabus to understand what topics you’ll encounter. Focus first on high-weight domains: Income and Assets (20%), Deductions and Credits (20%), and Taxation (17%) collectively represent 57% of your scored questions. Master these areas thoroughly before moving to smaller domains.

Within each domain, identify the most commonly tested topics—for Income and Assets, that’s basis calculations and capital gains treatment; for Deductions and Credits, it’s above-the-line adjustments and major credits like child tax credit and earned income credit.

Use a quality review course (Gleim, Surgent, Becker, or PassKey) that provides structured lessons, examples, and practice questions for each topic. Work through lessons systematically rather than jumping around. After completing each section’s lesson, immediately do practice questions on that topic. This reinforcement helps cement concepts while they’re fresh.

Don’t just check if you got answers right—read explanations for both correct and incorrect answers to understand why each option works or doesn’t.

As you progress, take mini-practice exams covering domains you’ve completed. This helps identify weak areas before you’ve finished studying everything. If you’re struggling with retirement distributions or self-employment tax, you can revisit those sections while the material is relatively fresh rather than discovering gaps during final review. Aim to complete your first full-length 100-question Part 1 practice exam when you’re about 70% through the material. This gives you a baseline score and helps you gauge pacing.

In your final 2-3 weeks before the exam, shift focus to practice exams and review. Take at least 3-4 full-length timed tests under realistic conditions—quiet environment, no notes, strict 3.5-hour time limit.

Your goal is to score consistently 110+ on practice exams, giving you a buffer for exam day stress. Review missed questions carefully, not just reading the explanation but understanding the underlying concept. Create flashcards or summary sheets for items you repeatedly miss—these become your focused review materials in the final days before testing.

How to prepare for Part 2 – Businesses

Part 2 requires more extensive preparation than Part 1 for most candidates because business taxation is inherently more complex. Corporate taxation, in particular, is more complex than individual taxation.

Consequently, among the parts of the EA exam, candidates usually consider Part 2 to be more difficult than Part 1.

If you lack accounting background, consider reviewing basic financial accounting concepts—balance sheets, income statements, debits and credits—before diving into tax-specific material. This foundation makes business tax preparation topics more comprehensible.

Prioritize Business Tax Preparation (46% of questions, approximately 37 questions) since it’s the single largest domain in the entire EA exam.

Focus heavily on depreciation rules (MACRS, Section 179, bonus depreciation), qualified business income deductions with all their limitations, business income and expense rules, and inventory accounting. These topics appear repeatedly and require detailed understanding. Partnership and S corporation taxation (part of Business Entities domain at 33%) also demands significant attention—basis calculations, distributions, special allocations, and flow-through mechanics.

Many candidates find it helpful to create comparison charts for Part 2.

Build a table comparing partnerships, S corporations, and C corporations on key attributes: entity-level taxation (yes for C corp, no for pass-through entities), self-employment tax treatment, basis calculations, distribution rules, and ownership restrictions. Visual comparison helps prevent confusion during the exam when questions test subtle differences between entity types. Similarly, create charts for depreciation lives of common assets or comparison of different inventory methods.

Practice calculations extensively for Part 2—more so than Part 1.

You will face questions requiring you to calculate corporate taxable income, partnership basis adjustments, depreciation deductions, and QBI deductions.

Develop systematic approaches to these calculations so you work efficiently under time pressure. For example, when calculating partnership basis, always follow the same order: starting basis, plus income/gains, minus distributions, minus losses/deductions. Consistent methodology reduces errors and saves time.

How to prepare for Part 3 – Representation

Part 3 differs fundamentally from Parts 1 and 2 because it’s less calculation-intensive and more procedural. Many candidates find Part 3 more manageable than Parts 1 and 2 because it’s less calculation-intensive and more conceptual. Your preparation should emphasize memorization and understanding of rules rather than mathematical problem-solving. The two key documents to master are Treasury Department Circular 230 (governs practice before the IRS) and IRS Publication 1 (Your Rights as a Taxpayer).

Begin by reading Circular 230 in its entirety—it’s available free from the IRS website. Don’t just skim it; read carefully and take notes on key provisions about who can practice, standards of practice, sanctions, and specific duties. Circular 230 comprises a substantial portion of the Practices and Procedures domain (26 questions). After reading, work practice questions that test the Circular 230 application. These questions often present scenarios where you must identify whether a practitioner’s conduct violates ethical standards.

For IRS procedures (collections, examinations, appeals), understand the flow of events. When does the IRS send a 30-day letter versus a 90-day notice?

What collection alternatives exist and when is each appropriate?

What happens at different stages of an examination?

Creating flowcharts or timelines helps visualize these processes.

For example, chart the collection process: notice and demand → collection alternatives (payment plan, OIC, CNC) → if no resolution → collection actions (levy, lien) → appeals rights at each stage.

Part 3 has historically had the highest pass rate (70-86% depending on the year), which means two things:

- First, it’s genuinely more approachable for most candidates.

- Second, there’s no excuse for not passing it if you prepare adequately.

Don’t underestimate Part 3 just because it’s less mathematical.

The volume of procedural rules and ethical standards still requires dedicated study time. Allocate 60-80 hours, use that time efficiently to memorize rules and procedures, practice scenario-based questions that test application of rules, and you should pass confidently.

Which study materials should you use?

Top EA review courses (Gleim, Surgent, LawSikho Becker, PassKey)

Choosing a quality EA review course significantly increases your pass probability. The five leading providers—Gleim, Surgent, Becker, PassKey, and Skillarbitrage—each offer comprehensive courses with slightly different approaches.

Gleim is the most established and widely used, featuring detailed textbooks, extensive question banks (thousands of practice questions), audio lectures, and a reputation for thoroughness. Many candidates appreciate Gleim’s structured approach, though some find the material dense. Surgent differentiates itself with adaptive learning technology; its platform assesses your performance on practice questions and adapts your study plan to focus on weak areas, potentially reducing total study time. Surgent also offers unlimited practice exams and personalized coaching. Becker brings its CPA review expertise to the EA market, providing video lectures, digital textbooks, and practice questions with strong production quality. PassKey offers excellent value with lower pricing than competitors while maintaining quality content and comprehensive coverage.

Skillarbitrage, which provides an India-focused EA preparation program, offers structured training aligned with the SEE syllabus, video lessons, live doubt-clearing, mock tests, and step-by-step support for PTIN and enrollment processes. It also appeals to Indian candidates through locally priced courses and career-oriented guidance for roles in U.S. tax outsourcing firms.

Consider these factors when choosing:

budget—PassKey costs less; Gleim and Becker are premium-priced; Surgent and Skillarbitrage fall in the middle.

Learning style—if you prefer detailed reading, choose Gleim; if you learn better through video, consider Becker; if you want technology-driven efficiency, try Surgent; if you prefer India-based support and placement-oriented training, consider Skillarbitrage.

Pass guarantees—most providers offer guarantees allowing you to re-access materials if you don’t pass. Update frequency—ensure your course covers the current testing window (May 2025–February 2026 as of this writing).

Don’t skip investing in a proper review course to save money.

Yes, you could theoretically study from free IRS publications alone, but review courses organise material logically, explain concepts clearly, provide tested practice questions, and save you dozens of hours you’d spend trying to parse IRS documents yourself.

The $400–800 cost (approximately ₹33,000–₹66,000) for a quality course is worthwhile insurance for your $801 exam fee investment. Many Indian candidates successfully use these courses, and most providers offer customer support if you encounter difficulty understanding the material.

IRS publications for free preparation

While a review course is recommended, you can supplement with free IRS publications or, if your budget is extremely tight, build your preparation primarily around IRS materials.

When studying for the examination, you may wish to refer to the Internal Revenue Code, Treasury Department Circular 230, IRS publications, and IRS tax forms and their accompanying instructions.

These publications are freely available at IRS.gov and contain official information directly from the source.

For Part 1, start with Publication 17 (Your Federal Income Tax), which provides comprehensive individual tax information.

It’s lengthy (over 200 pages) but covers most Part 1 topics.

Supplement with Publication 501 (Dependents, Standard Deduction, and Filing Information), Publication 550 (Investment Income and Expenses), and Publication 544 (Sales and Other Dispositions of Assets).

Study the instructions for Form 1040 and related schedules (Schedule A for itemized deductions, Schedule C for self-employment, Schedule D for capital gains).

For Part 2, review Publication 535 (Business Expenses), Publication 946 (How to Depreciate Property), Publication 541 (Partnerships), Publication 542 (Corporations), and Publication 589 (Tax Information on S Corporations).

The instructions for Forms 1065 (partnership return), 1120 (corporate return), and 1120-S (S corporation return) contain valuable technical details. Publication 334 (Tax Guide for Small Business) provides a good overview material.

For Part 3, Circular 230 is absolutely essential—read it multiple times. Publication 1 (Your Rights as a Taxpayer) covers taxpayer rights. Publication 556 (Examination of Returns, Appeal Rights, and Claims for Refund) explains procedures.

While these free resources can work, recognize the challenge: IRS publications aren’t designed as study guides. They’re reference materials. You’ll need discipline to work through them systematically and create your own practice questions since IRS publications don’t include practice tests. The few sample questions on the IRS website aren’t sufficient in volume for adequate practice.

Practice exams and question banks

Practice questions and full-length exams are arguably the most critical component of EA preparation. You should take at least 3-4 full-length timed tests under realistic conditions. Working thousands of practice questions exposes you to different question formats, reinforces concepts through repetition, helps you identify weak areas, and builds speed and confidence for exam day.

Start with topic-specific practice questions as you complete each section.

If you just finished studying capital gains taxation, immediately work 20-30 capital gains questions. This immediate reinforcement helps cement the material while it’s fresh.