Complete guide to independent director salary in India: statutory limits, sitting fees, commission calculation, market benchmarks, tax implications & negotiation tips.

Table of Contents

Independent directors in India don’t receive a traditional monthly salary like executive directors. Instead, their compensation structure is fundamentally different, consisting primarily of meeting-based sitting fees and profit-linked commission.

This distinction exists because independent directors aren’t employees but rather board members providing oversight, strategic guidance, and governance expertise to companies.

The remuneration framework for independent directors is carefully regulated under the Companies Act 2013 and SEBI LODR Regulations to preserve their independence.

Unlike executive directors who draw fixed salaries for managing daily operations, independent directors are compensated through specific statutory mechanisms—sitting fees for attending board and committee meetings, commission linked to company profits (subject to shareholder approval), and in certain cases, minimum guaranteed remuneration when companies face losses or inadequate profits under Schedule V provisions.

Understanding this compensation structure is essential whether you’re considering an independent director role or evaluating your current remuneration package. Learn the full eligibility, qualification, and appointment roadmap in our guide on how to become an independent director.

The framework balances fair compensation for valuable board contributions with maintaining the independence that makes these directors effective governance watchdogs. Furthermore, this structure involves statutory caps, calculation methods, tax implications, and market benchmarks that determine what you can actually earn—ranging from ₹4 lakhs annually at smaller companies to ₹6+ crores for top independent directors at India’s largest corporations.

What are the statutory limits on independent director salary under Companies Act?

Section 149(9): permissible forms of compensation

Section 149(9) of the Companies Act 2013 specifically defines what independent directors can receive as remuneration.

Independent directors are entitled to sitting fees under Section 197(5), reimbursement of expenses for participating in board and committee meetings, and profit-related commission subject to approval by members through ordinary or special resolution. Critically, this section explicitly prohibits independent directors from receiving stock options or employee stock ownership plans (ESOPs), a restriction designed to preserve their independence and prevent conflicts of interest that equity-based compensation might create.

Section 197: overall remuneration limits

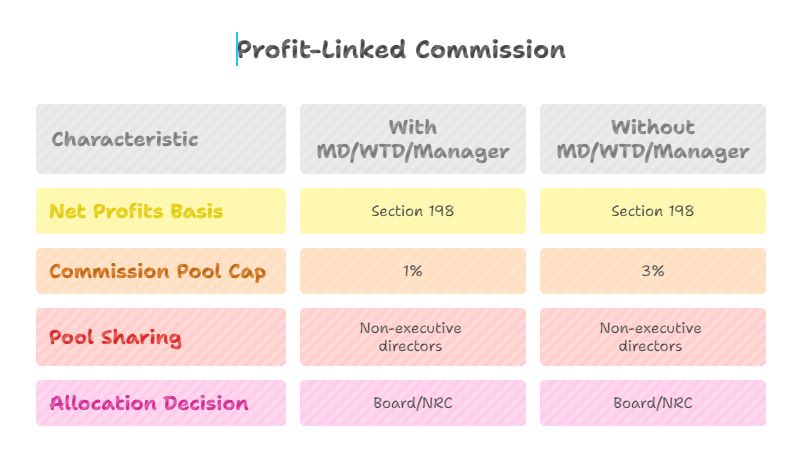

Section 197 establishes the overall ceiling for director remuneration linked to company profits. For companies with a managing director, whole-time director, or manager, the total managerial remuneration (including payments to all directors) cannot exceed 11% of net profits in a financial year. Within this overall limit, non-executive directors including independent directors can receive up to 1% of net profits if the company has a managing director, whole-time director, or manager, or up to 3% of net profits if no such managerial personnel exist.

The sitting fees component is separately governed under Section 197(5), which states that directors may receive fees for attending board or committee meetings or for any other purpose as decided by the board.

Rule 4 of the Companies (Appointment and Remuneration of Managerial Personnel) Rules 2014 caps sitting fees at ₹1 lakh per meeting. Companies can pay remuneration beyond the statutory limits mentioned in Section 197(1) by obtaining shareholder approval through special resolution, provided there are no defaults to secured creditors or financial institutions.

Schedule V: Minimum remuneration in loss-making companies

Schedule V became applicable to independent directors through the Companies (Amendment) Act 2020, which amended Sections 149(9) and 197(3) to address the remuneration gap for independent directors in companies with no profits or inadequate profits.

Prior to this amendment, independent directors in loss-making companies could only receive sitting fees, creating a significant compensation disadvantage compared to executive directors who could draw minimum remuneration. The 2020 amendment allows companies to pay minimum guaranteed remuneration to independent directors based on the company’s effective capital, even when profits are absent or insufficient.

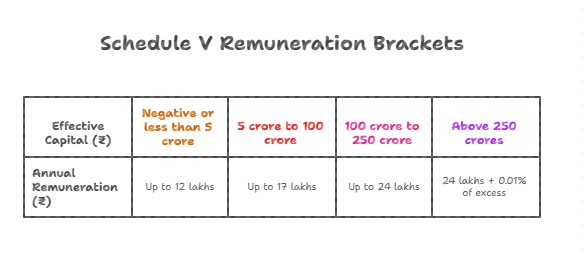

Schedule V prescribes specific remuneration brackets tied to effective capital ranges.

- Companies with negative or less than ₹5 crore effective capital can pay up to ₹12 lakhs annually to independent directors;

- those with ₹5 crore to ₹100 crore can pay up to ₹17 lakhs;

- companies with ₹100 crore to ₹250 crore effective capital can pay up to ₹24 lakhs; and

- for companies with effective capital above ₹250 crores, the limit is ₹24 lakhs plus 0.01% of effective capital exceeding ₹250 crores.

The above profit linked fees is exclusive of sitting fee.

These limits can be exceeded with shareholder approval through special resolution, and companies approved under IBC resolution plans can pay any amount for five years post-NCLT approval. For a full explanation of who qualifies as an independent director under the Companies Act 2013, see our detailed legal analysis here.

What are the key components of independent director salary and compensation?

Sitting fees – the primary cash component

What is the maximum sitting fee per meeting?

The statutory maximum for sitting fees is ₹1 lakh per meeting for attending board meetings or committee meetings, as prescribed under Rule 4 of the Companies (Appointment and Remuneration of Managerial Personnel) Rules 2014.

Companies have discretion to set sitting fees at any amount up to this cap, and the board of directors or the Nomination and Remuneration Committee typically determines the actual fee structure. Based on personal experience, most Nifty-50 companies pay between ₹50,000 and ₹1 lakh per meeting, while mid-cap companies typically range from ₹30,000 to ₹60,000, and smaller companies or startups often pay ₹10,000 to ₹30,000 per meeting depending on their financial capacity and governance maturity.

Board meeting vs Committee meeting sitting fees

Companies often differentiate sitting fees between board meetings and committee meetings, and some further distinguish between different committees based on their importance and workload.

For instance, critical committees like Audit Committee, Nomination and Remuneration Committee, or Risk Management Committee might carry higher sitting fees (often at or near the ₹1 lakh statutory maximum) compared to other committees.

This differentiation recognizes that committee work, particularly for audit and risk committees, requires substantial preparation, specialized expertise, and greater time commitment beyond the meeting itself.

The sitting fee structure may also distinguish between committee chairs and committee members, with chairs receiving additional compensation for their leadership responsibilities and increased workload.

Furthermore, the sitting fee paid to independent directors must not be less than the sitting fee paid to other non-executive directors for similar roles, ensuring parity and preventing discrimination. Some companies have adopted global practices by distinguishing sitting fees not just by committee type but also by appointing a lead independent director who receives separate compensation for coordinating independent director activities and serving as a liaison between independent directors and the chairman.

Retainer fees vs Per-meeting payments

While per-meeting sitting fees remain the dominant compensation model in India, an emerging practice involves paying fixed retainer fees to independent directors. Under the retainer model, independent directors receive a predetermined annual fee regardless of the number of meetings attended, with the amount reflecting expected time commitment and responsibilities.

This approach, more common globally, shifts focus from attendance-driven compensation to recognizing the director’s overall contribution, preparation time, and availability for consultation beyond formal meetings, though it’s still relatively uncommon in the Indian market compared to the traditional per-meeting payment structure.

Profit-linked commission for independent directors

How is commission calculated?

Profit-linked commission is calculated as a percentage of the company’s net profits as defined under Section 198 of the Companies Act 2013.

The net profit calculation starts with the profit shown in the profit and loss account for the financial year, then applies specific additions and deductions as prescribed—including adding back items like director remuneration, bonus or commission paid to employees, and certain provisions, while making only those deductions permitted under Section 198 — past losses are generally not deductible unless they fall under specific allowable categories. Once net profits are determined, the company can distribute commission to independent directors within the statutory limits of 1% or 3% of net profits (depending on whether the company has a managing director or not).

The actual commission allocation among independent directors is typically determined by the Nomination and Remuneration Committee or the board, considering factors like individual director contributions, committee memberships and chairmanships, meeting attendance, expertise provided, and tenure.

Many companies distribute commission equally among all independent directors, while others adopt differentiated approaches based on roles, committee chair positions, or specific contributions during the year.

1% vs 3% commission limits?

The applicable commission limit depends on your company’s managerial structure. If your company has a managing director, whole-time director, or manager (as defined under the Companies Act), then non-executive directors including independent directors collectively can receive up to 1% of net profits as commission. This lower limit applies because managerial personnel already consume a significant portion of the overall 11% managerial remuneration cap under Section 197(1), leaving less room for non-executive director compensation.

However, if your company has no managing director, whole-time director, or manager, then non-executive directors including independent directors can collectively receive up to 3% of net profits as commission.

This higher limit recognizes that in companies without full-time managerial personnel, non-executive directors often shoulder greater governance responsibilities and may need to dedicate more time and expertise to compensate for the absence of executive leadership.

The “collectively” aspect is important—the 1% or 3% limit applies to all non-executive directors combined, not per director, so the total commission pool must be distributed among all eligible directors.

Shareholder approval requirements for commission

Payment of commission to independent directors requires prior approval from shareholders through a resolution passed at a general meeting, as mandated by Section 197 of the Companies Act and Regulation 17(6)(a) of SEBI LODR Regulations 2015. The resolution should specify the amount or percentage of net profits that will be paid as commission and typically covers a defined period (often one to three years).

Once shareholder approval is obtained, the board or the Nomination and Remuneration Committee can determine the actual distribution of commission among individual independent directors based on their contributions, subject to the overall approved limit.

Minimum guaranteed remuneration under schedule V

When does schedule V apply?

Schedule V applies when a company has no profits or inadequate profits in a financial year, as determined under Section 198 calculations. In such situations, companies cannot pay profit-linked commission to independent directors since commission by definition requires net profits.

Before the 2020 amendment, this meant independent directors in loss-making companies received only sitting fees, which could be grossly inadequate for the responsibilities they shouldered. Schedule V now provides a safety net, allowing companies to pay minimum guaranteed remuneration to independent directors based on their effective capital, ensuring reasonable compensation even during financially challenging periods.

Effective capital calculation method

Effective capital is calculated by taking the aggregate of paid-up share capital (excluding share application money or advances against shares), amounts standing in the share premium account, reserves and surplus (excluding revaluation reserves), and long-term loans and deposits repayable after one year (excluding working capital loans, overdrafts, interest due on loans unless funded, and bank guarantees). From this aggregate, you subtract investments (except for investment companies whose principal business involves acquisition of securities), accumulated losses, and preliminary expenses not written off.

The effective capital calculation uses figures from the audited balance sheet of the immediately preceding financial year in which the independent director is appointed or whose remuneration is being determined.

For example, if an independent director is appointed in November 2024, the effective capital calculation would use the balance sheet as of March 31, 2024 (for companies following April-March financial year). This method ensures that remuneration is linked to the company’s actual capital base and financial scale, providing a rational benchmark for determining minimum compensation even when profit-based commission isn’t feasible.

Remuneration brackets based on company size

Schedule V establishes four remuneration brackets:

- companies with negative or less than ₹5 crore effective capital can pay up to ₹12 lakhs annually (exclusive of sitting fees);

- those with ₹5 crore to ₹100 crore can pay up to ₹17 lakhs;

- companies with ₹100 crore to ₹250 crore can pay up to ₹24 lakhs; and

- companies with effective capital above ₹250 crores can pay ₹24 lakhs plus 0.01% of the effective capital exceeding ₹250 crores.

These limits represent the maximum annual remuneration payable under Schedule V provisions and are in addition to sitting fees, meaning an independent director in a loss-making company could receive both Schedule V remuneration and sitting fees for meetings attended.

What independent directors cannot receive as compensation?

Why are stock options prohibited for Independent Directors

Section 149(9) explicitly prohibits independent directors from receiving stock options or ESOPs, a restriction introduced in the Companies Act 2013 to preserve the fundamental independence these directors must maintain.

The legislative rationale is that equity-based compensation creates a direct financial stake in the company’s stock price performance, potentially compromising the independent director’s ability to make objective decisions about management, strategy, and risk that might negatively impact short-term stock prices but serve long-term stakeholder interests. This differs markedly from non-executive directors who aren’t designated as “independent” and can receive stock options.

The prohibition has been debated extensively, with some arguing that it makes independent director positions less attractive compared to executive roles or non-independent directorships, particularly in high-growth startups where equity compensation is standard.

SEBI floated a consultation paper in March 2021 exploring the possibility of allowing ESOPs to independent directors with longer vesting periods (five years) in lieu of profit-linked commission, recognizing that the current framework might discourage top talent from accepting independent director roles. However, as of now, the prohibition remains absolute—independent directors cannot receive any form of stock options, restricted stock units, or equity-based compensation under Indian law.

Restrictions on monthly salary payments

Independent directors cannot receive regular monthly salaries in the manner that executive directors or employees do, because they aren’t involved in the day-to-day operations or management of the company. While Section 197(6) technically allows directors to be paid remuneration “either by way of monthly payment or at a specified percentage of net profits,” this provision in practice applies primarily to executive directors, and the regulatory framework’s emphasis on sitting fees and commission for independent directors makes monthly salary structures inappropriate and uncommon.

Companies like Bajaj Consumer, Sterling Tools, and VST Industries have passed resolutions for monthly remuneration to non-executive non-independent directors, but such arrangements remain extremely rare for independent directors specifically, whose compensation is intentionally structured around meeting attendance and profit-based commission to maintain the advisory rather than operational nature of their role.

What non-monetary benefits do independent directors receive?

D&O insurance

Directors and Officers (D&O) insurance provides liability coverage protecting independent directors from personal financial loss arising from claims, lawsuits, or regulatory actions related to their board duties. Companies typically purchase D&O insurance policies covering all directors, with premiums ranging from a few lakhs to several crores depending on company size, industry risk profile, and coverage limits. The insurance premium paid by the company for D&O coverage isn’t counted as remuneration to the director under the Companies Act, providing valuable protection without impacting statutory compensation limits.

This coverage is particularly crucial for independent directors who face significant legal and regulatory scrutiny under sections like

- Section 166 (duties of directors),

- Section 177 (audit committee responsibilities),

- Section 178 (nomination and remuneration committee), and

- Schedule IV (code for independent directors), along with SEBI regulations for listed companies.

Expense reimbursement

Companies reimburse independent directors for reasonable out-of-pocket expenses incurred while performing their duties, including travel (airfare, rail, road transport), accommodation, meals, and communication expenses for attending board meetings, committee meetings, annual general meetings, or site visits.

These reimbursements aren’t considered remuneration under Section 149(9) and don’t count toward statutory compensation limits, allowing independent directors to perform their duties without bearing personal costs.

Some companies provide travel in business class or provide company-arranged accommodation for outstation directors, while others reimburse actual expenses based on bills submitted.

Additionally, companies may reimburse costs for professional development activities like director training programs, governance seminars, or industry conferences that enhance the director’s ability to contribute effectively to the board.

Indirect benefits

Independent directors gain substantial non-monetary benefits that aren’t reflected in direct compensation but add significant value to their professional profile.

These include access to senior management networks across industries through board interactions and committee work, enhanced reputation and credibility from association with respected companies (particularly important for directors on boards of blue-chip firms like Tata Group, Infosys, or Reliance), valuable learning experiences about different business models and industries, and opportunities to influence corporate strategy and governance at the highest levels.

Furthermore, successful independent director tenures often lead to additional board opportunities—directors who demonstrate strong governance expertise, industry knowledge, and effective board contribution find themselves sought after for multiple directorships, which can significantly amplify total compensation through the cumulative effect of serving on several boards simultaneously.

How is the total of independent director’s salary and remuneration calculated?

Calculation of remuneration in profitable companies

Scenario 1 – Large cap company with MD

Consider a large-cap Nifty-50 company with effective capital of ₹5,000 crores, net profits of ₹2,000 crores, and a managing director.

The company has four independent directors, conducts 8 board meetings and 10 committee meetings annually, and pays sitting fees of ₹1 lakh for board meetings and ₹75,000 for committee meetings. Each independent director would earn sitting fees of approximately ₹15.5 lakhs annually (8 board meetings × ₹1 lakh + 10 committee meetings × ₹75,000), assuming regular attendance at meetings.

For commission, since the company has a managing director, the maximum commission payable to all non-executive directors (including independent directors) is 1% of net profits = ₹20 crores.

If the company, for instance, decides to distribute 80% of this available commission pool among the four independent directors equally, each would receive ₹4 crores as commission. Therefore, total annual remuneration per independent director would be approximately ₹4.15 crores (₹15.5 lakhs sitting fees + ₹4 crores commission).

This calculation demonstrates why top independent directors at India’s largest companies can earn ₹3-6 crores annually—their compensation comes primarily from profit-linked commission at profitable large-cap companies rather than sitting fees.

Scenario 2 – Mid-Cap company without MD

Consider a mid-cap listed company with effective capital of ₹400 crores, net profits of ₹50 crores, and no managing director (run by executive directors who aren’t designated as MD).

The company has three independent directors, conducts 6 board meetings and 12 committee meetings annually, and pays sitting fees of ₹50,000 for board meetings and ₹40,000 for committee meetings. Each independent director would earn sitting fees of approximately ₹7.8 lakhs annually (6 board meetings × ₹50,000 + 12 committee meetings × ₹40,000).

Since this company has no managing director, the maximum commission payable to all non-executive directors is 3% of net profits = ₹1.5 crores. If the company allocates 70% of available commission to the three independent directors equally, each would receive approximately ₹35 lakhs as commission.

Therefore, total annual remuneration per independent director would be approximately ₹42.8 lakhs (₹7.8 lakhs sitting fees + ₹35 lakhs commission).

This scenario illustrates that independent directors at mid-cap companies typically earn significantly less than their large-cap counterparts, with total compensation generally ranging from ₹25-45 lakhs depending on company profitability and commission distribution policies.

Calculation of remuneration in loss-making companies

Using schedule V effective capital method

For loss-making companies, independent directors cannot receive profit-linked commission since there are no net profits to distribute. However, Schedule V provisions allow payment of minimum guaranteed remuneration based on effective capital brackets.

The effective capital calculation follows the method described earlier: paid-up share capital + share premium + reserves (excluding revaluation reserves) + long-term loans – investments – accumulated losses – preliminary expenses. Once effective capital is determined, the applicable Schedule V bracket determines maximum permissible remuneration.

For example, a loss-making company with ₹150 crore effective capital falls in the ₹100-250 crore bracket, allowing maximum remuneration of ₹24 lakhs annually per independent director under Schedule V (in addition to sitting fees).

If this company conducts 6 board meetings and 10 committee meetings annually, with sitting fees of ₹30,000 per board meeting and ₹25,000 per committee meeting, each independent director attending all meetings would receive ₹4.3 lakhs in sitting fees (6 × ₹30,000 + 10 committee meetings × ₹25,000).

Adding Schedule V remuneration of ₹24 lakhs, the total annual compensation would be ₹28.3 lakhs—providing reasonable compensation despite the company’s loss-making status.

Scenario 3 – Startup with negative effective capital

Consider a technology startup that has raised venture capital funding but operates at a loss, with accumulated losses exceeding its paid-up capital and reserves, resulting in negative effective capital of ₹(-20) crores.

This startup has two independent directors, conducts 8 board meetings and 8 committee meetings annually, and pays sitting fees of ₹25,000 for board meetings and ₹20,000 for committee meetings.

Each independent director would earn sitting fees of approximately ₹3.6 lakhs annually (8 board meetings × ₹25,000 + 8 committee meetings × ₹20,000).

Under Schedule V, companies with negative or less than ₹5 crore effective capital can pay up to ₹12 lakhs annually as minimum remuneration to each independent director.

If the startup pays the full Schedule V amount, total annual compensation per independent director would be ₹15.6 lakhs (₹3.6 lakhs sitting fees + ₹12 lakhs Schedule V remuneration). This scenario demonstrates that even startups and loss-making ventures can provide reasonable compensation to attract quality independent directors, thanks to the 2020 amendment—though many startups, particularly early-stage ventures, may pay below the maximum Schedule V limits due to cash constraints and may negotiate lower remuneration with directors who join for strategic or networking reasons beyond pure compensation.

What are the benchmark salary ranges across company categories?

Salary range based on company size

Nifty-50 Companies

Independent directors at Nifty-50 companies represent the top tier of board compensation in India. According to Exec-Rem Advisors’ analysis published on Economic Times, the median total compensation for independent directors at Nifty-50 companies reached ₹87.4 lakhs in FY24, up from ₹42.3 lakhs in FY19—a 106% increase over five years. The 75th percentile earns approximately ₹1.11 crores, while the 25th percentile receives around ₹48.8 lakhs, indicating significant variation even within this elite category based on company profitability, industry sector, and individual director roles (committee chairmanships command premiums).

Mid-Cap listed companies

Independent directors at mid-cap listed companies (typically those ranked 51-500 in market capitalization) earn substantially less than Nifty-50 counterparts but still receive respectable compensation.

The typical range falls between ₹25 lakhs and ₹45 lakhs annually, with median compensation around ₹32-35 lakhs. Companies in the ₹500 crore to ₹5,000 crore market cap range generally offer sitting fees between ₹30,000-60,000 per meeting and distribute modest commission pools when profitable, though commission as a percentage of total compensation tends to be lower than at large-cap companies due to smaller absolute profit figures.

Unlisted and private companies

Unlisted and private companies that appoint independent directors (often because they exceed the thresholds requiring IDs, or voluntarily for governance purposes, or due to investor requirements in PE/VC-funded companies) typically offer the most modest compensation packages. The range generally spans ₹12 lakhs to ₹28 lakhs annually, often relying heavily or exclusively on sitting fees plus Schedule V minimum remuneration since many such companies operate with thin or negative profit margins. Family-owned businesses transitioning to professional management may offer ₹15-25 lakhs, while PE/VC-backed startups might pay ₹12-20 lakhs, with compensation often negotiated based on the director’s brand value and strategic contribution potential rather than pure market rates.

Industry-specific compensation variations

IT and technology sector

The IT and technology sector typically offers above-average compensation to independent directors, with companies like TCS, Infosys, Wipro, and Tech Mahindra among the highest payers.

Top independent directors in this sector earned ₹2.5-4 crores at leading IT firms in FY23, driven by high profit margins (often 18-25% net margins) that generate substantial commission pools and the sector’s emphasis on strong governance and global board expertise.

Technology companies particularly value independent directors with international experience, digital transformation expertise, cybersecurity knowledge, or backgrounds in scaling global operations, often resulting in premium compensation for directors possessing these specialized skill sets.

Financial services and banking

The financial services and banking sector presents a bifurcated compensation picture—private sector banks and NBFCs often pay competitively (₹60 lakhs to ₹1.5 crores for independent directors), while public sector banks and insurance companies regulated by RBI and IRDAI operate under government-prescribed pay scales that tend to be lower.

Private financial institutions like HDFC Bank, ICICI Bank, and Kotak Mahindra Bank value independent directors with financial expertise, risk management backgrounds, or regulatory experience, compensating accordingly.

However, the sector’s heavy regulatory oversight means independent directors face heightened scrutiny and potential liability, which compensation packages must account for to attract qualified candidates.

Manufacturing and industrial

Based on personal experience, manufacturing and industrial companies typically offer moderate compensation packages ranging from ₹30 lakhs to ₹80 lakhs for independent directors, depending on company size and profitability. This sector includes diverse subsectors—automobiles (Tata Motors, Mahindra & Mahindra), chemicals (UPL, Aarti Industries), cement (UltraTech, Ambuja), and engineering goods—with compensation varying significantly based on profit margins, capital intensity, and governance maturity. Established manufacturing conglomerates with strong profitability approach Nifty-50 compensation levels, while mid-sized manufacturers with 8-12% profit margins typically pay ₹25-45 lakhs, and capital-intensive sectors with thin margins (steel, commodities) may offer lower compensation despite large revenues.

Top-earning independent directors in india

Who are the crore club members?

The “crore club” of independent directors earning over ₹1 crore annually has expanded significantly from 67 members in FY18 to 151 in FY23, according to data from primeinfobase.com. The top 10 highest-paid independent directors in FY23 included Om Prakash Bhatt (former SBI Chairman) at ₹6.74 crores—earned through directorships at TCS, Tata Steel, Tata Motors, and Hindustan Unilever—followed by Adil Zainulbhai at ₹3.91 crores and Shikha Sharma (former Axis Bank CEO) at ₹3.8 crores.

Other top earners included Kosaraju Veerayya Chowdary (₹3.71 crores), Hanne Birgitte Breinbjerg Sorensen (₹3.65 crores), Pallavi Shardul Shroff (₹3.61 crores), Haigreve Khaitan (₹3.32 crores), Deepak Kapoor (₹3.31 crores), Damodarannair Sundaram (₹3.24 crores), and Kiran Mazumdar Shaw (₹3.21 crores).

Multiple directorships and total earnings

Top-earning independent directors achieve high compensation primarily through holding multiple directorships simultaneously rather than extracting maximum compensation from a single board.

For instance, OP Bhatt’s ₹6.74 crore total came from serving on four major boards—TCS (₹2.81 crores), Tata Steel (₹2.48 crores), Hindustan Unilever, and Tata Motors—demonstrating how serving on 3-5 boards of large profitable companies can generate ₹4-7 crores annually. The Companies Act doesn’t limit the number of independent directorships one person can hold (though it caps total directorships at 20, with listed company directorships capped at 10), allowing experienced directors to multiply their earnings, though practical constraints of time commitment typically limit most directors to 3-6 active board positions maximum.

How can independent directors negotiate their salary and compensation effectively?

When to discuss remuneration in the appointment process?

Remuneration discussions should occur after initial conversations establish mutual interest but before formal board approval and shareholder resolution for appointment.

The ideal timing is during discussions with the Nomination and Remuneration Committee or the company chairman, typically after you’ve reviewed the company’s background, understood the role expectations, assessed committee memberships, and determined the time commitment required.

Raising compensation too early can appear mercenary and damage relationship-building, while waiting until after appointment creates an awkward dynamic since remuneration structures typically require board and shareholder approvals that are easier to secure during the appointment process rather than retroactively.

Frame the compensation conversation professionally by asking about the company’s remuneration policy for independent directors rather than demanding specific amounts. Inquire about sitting fees (board vs. committee), whether the company pays commission on profits (and the distribution methodology), and whether Schedule V remuneration applies if the company faces losses.

Understanding the company’s remuneration philosophy helps you assess whether the opportunity aligns with your expectations and market benchmarks for your profile, while positioning you as a knowledgeable professional who understands governance frameworks rather than someone purely motivated by compensation.

What factors influence independent director salary offers?

Your experience and expertise

Companies pay premium compensation for independent directors with specialized expertise, industry experience, or accomplished professional backgrounds that directly add value to the board. Former CEOs of major corporations, ex-regulators, senior legal professionals, chartered accountants with Big Four backgrounds, technology leaders, or academics with recognized subject matter expertise command higher sitting fees and larger commission allocations compared to first-time independent directors. Your negotiating leverage increases significantly if you bring specific capabilities the board lacks—for instance, cybersecurity expertise for a digital company, international expansion experience for a company going global, or regulatory navigation skills for a heavily regulated industry. If you’re preparing for board roles, here is a complete guide to the Independent Director Exam and IICA proficiency requirements.

Company size and financial health

Larger companies with higher effective capital and profitability naturally offer better compensation due to statutory framework (higher Schedule V limits, larger commission pools) and ability to pay competitive rates to attract top talent.

A Nifty-50 company with ₹10,000 crore market cap will typically offer 3-5x the compensation of a ₹500 crore mid-cap company, while a loss-making startup may offer Schedule V minimum (₹12-17 lakhs) compared to ₹50-80 lakhs at profitable mid-caps. Assess the company’s profit trajectory—consistently profitable companies with 15-20% margins offer more predictable commission-based compensation compared to cyclical businesses with volatile earnings.

Committee roles and responsibilities

Committee memberships significantly impact workload and compensation, with audit committee and risk committee positions typically commanding the highest sitting fees (often at the ₹1 lakh statutory maximum) due to detailed financial review requirements and greater liability exposure. Chairing a committee usually carries additional compensation—a 20-50% premium over member fees is common practice.

If you’re being considered for multiple committee memberships, particularly as chair of the audit or nomination committee, this strengthens your negotiating position for overall compensation given the substantially increased time commitment (committee meetings, pre-meeting document review, regulatory compliance oversight) beyond basic board participation.

Time commitment and meeting frequency

Companies that conduct more frequent board and committee meetings (some companies meet 8-12 times annually while others meet 4-6 times) naturally generate higher sitting fee compensation even if per-meeting rates are similar. Additionally, some boards require significant preparation time, site visits, strategy session attendance, or availability for ad-hoc consultations beyond scheduled meetings.

If the role demands substantial time investment—say 150-200 hours annually including preparation, travel, and meetings compared to a minimal 50-60 hours for a less demanding board—you have legitimate grounds to negotiate for higher compensation, particularly if this limits your ability to accept other directorships due to bandwidth constraints.

How can independent directors benchmark their salary?

Public disclosures

Listed companies must disclose director remuneration in their annual reports under Section 197 of the Companies Act and SEBI LODR Regulation requirements, providing a transparent benchmark for market compensation.

You can access annual reports of companies similar to your target company (same industry, similar size/profitability) through their websites, BSE/NSE filings, or the MCA website. Look specifically for the Board’s Report section, which includes a statement showing details of remuneration paid to directors including sitting fees, commission, and total compensation—this data helps you understand market rates for comparable roles and strengthens your negotiating position with evidence-based benchmarks.

Annual reports

Annual reports provide more granular detail than simple remuneration disclosures, often including the company’s remuneration policy, criteria for determining director compensation, and comparative data showing remuneration paid to different categories of directors. Review the related party transactions note in financial statements, which discloses director remuneration details, and examine the Nomination and Remuneration Committee’s report explaining the compensation philosophy. By analyzing annual reports of 5-7 comparable companies, you can identify patterns—for instance, whether companies in your target sector typically distribute commission equally among IDs or weight it based on tenure/contribution, whether they pay retainer fees, and what sitting fee ranges are standard for board vs. committee meetings.

Red flags in compensation offers

Below-market offers – Warning signs

If a company with ₹500+ crore effective capital and healthy profitability offers sitting fees of ₹10,000-15,000 per meeting (far below the ₹30,000-60,000 mid-cap standard) or refuses to discuss commission despite consistent profits, this signals either financial stress the company hasn’t disclosed, poor governance practices around director compensation, or lack of commitment to attracting quality independent directors. Similarly, profitable large-cap companies offering total compensation below ₹40-50 lakhs annually when comparable companies pay ₹70-90 lakhs suggest the company either doesn’t value independent director contributions or faces undisclosed challenges constraining their ability to pay market rates.

Unclear commission calculation methods

Red flags emerge when companies cannot clearly explain how they calculate commission distribution among independent directors, refuse to share the methodology (equal distribution vs. contribution-based vs. committee-weighted), or indicate that commission payments are discretionary without transparent criteria. Ask specifically: “What percentage of available commission pool (1% or 3% of profits) do you typically distribute to independent directors?” and “How is this allocated among individual IDs?” Vague answers like “we’ll decide based on performance” without defined metrics, or responses suggesting commission is irregular despite consistent profitability, indicate potential compensation disputes or arbitrary decision-making that could leave you undercompensated.

Delayed payment terms

Standard practice involves paying sitting fees within 30-45 days of meetings and commission within 90-120 days of financial year-end following shareholder approval.

Red flags include payment terms extending beyond 90 days for sitting fees, companies delaying commission payments 6-9 months after year-end without justification, or patterns of requiring repeated follow-ups for payment.

During due diligence, discreetly inquire (through professional networks) whether the company has a history of delayed director payments—chronic payment delays signal cash flow problems, governance issues, or disrespect for director contributions, any of which should make you carefully reconsider the opportunity regardless of stated compensation levels.

Tax implications of independent director remuneration

TDS on sitting fees and commission

Independent director remuneration attracts Tax Deducted at Source (TDS) under Section 194J of the Income Tax Act, which applies to professional or technical services, at a rate of 10% (plus applicable surcharge and cess).

This applies specifically to sitting fees and commission payments, as these are considered fees for professional services rather than salary.

The company paying the remuneration is responsible for deducting TDS before payment and depositing it with the government, then issuing Form 16A to the director.

GST applicability on director remuneration

Goods and Services Tax (GST) at 18% applies to independent director remuneration under the Reverse Charge Mechanism (RCM), where the company receiving the services (not the director providing them) is liable to pay GST. This was clarified by a circular issued by Central Board of Indirect Taxes & Customs (CBIC) on 10th June 2020.

This means the company must account for GST on director remuneration and pay it to the government, even though they’re the recipient of services—a unique feature of RCM.

Net take-home calculation

To calculate net take-home from independent director remuneration, start with gross compensation (sitting fees + commission) and deduct TDS, which is typically 10% under Section 194J.

Some companies also add surcharge and cess at the TDS stage depending on the director’s projected income, though surcharge is normally adjusted during return filing.

For example, if you earn ₹50 lakhs gross (₹5 lakhs sitting fees + ₹45 lakhs commission), a TDS of around ₹5 lakhs (or approximately ₹5.6 lakhs where surcharge and cess are applied) may be deducted, resulting in a net receipt of ₹44–45 lakhs. This is not your final tax liability—independent director remuneration is added to your total income and taxed at slab rates (up to 30% plus surcharge and cess).

You may therefore need to pay additional tax or may receive a refund, depending on the total tax due. A tax professional can help you claim allowable deductions, optimize structure, and ensure compliance with income tax and GST requirements.

Conclusion

Independent director compensation in India reflects a carefully calibrated balance between fair remuneration for valuable governance contributions and maintaining the independence essential to effective board oversight.

The statutory framework under the Companies Act 2013—encompassing sitting fees capped at ₹1 lakh per meeting, profit-linked commission within 1-3% limits, and Schedule V minimum remuneration for loss-making companies—provides multiple compensation mechanisms that can generate anywhere from ₹12 lakhs annually at smaller companies to ₹6+ crores for top directors at India’s largest corporations serving on multiple boards. Understanding these components, calculation methods, and statutory limits is fundamental whether you’re evaluating your first independent director opportunity or optimizing compensation across multiple directorships.

Beyond the numbers, successful independent directors recognize that compensation negotiations, tax optimization, and market benchmarking are essential professional skills that require the same strategic thinking you bring to board decisions.

The expanding compensation trend—with median Nifty-50 ID remuneration growing 106% from FY19 to FY24 and the crore club expanding from 67 to 151 members—signals that Indian companies increasingly value strong independent directors who bring specialized expertise, dedicate substantial time to governance, and enhance board effectiveness.

By mastering the statutory framework, staying current with market benchmarks, negotiating thoughtfully, and ensuring your compensation reflects your contribution and expertise, you position yourself not just as a well-compensated independent director but as a governance professional who understands the business of boardroom service as thoroughly as the governance responsibilities it entails.

Frequently Asked Questions

What is the average salary of an independent director in India?

Independent directors at Nifty-50 companies earn a median of ₹87.4 lakhs annually, while mid-cap companies typically pay ₹25-45 lakhs, and smaller/unlisted companies offer ₹12-28 lakhs.

How much sitting fee can an independent director receive per meeting?

The statutory maximum is ₹1 lakh per meeting for board or committee meetings, with most companies paying ₹20,000-₹1 lakh depending on company size and meeting type.

Can independent directors receive stock options?

No, Section 149(9) explicitly prohibits independent directors from receiving stock options or ESOPs to preserve their independence and prevent conflicts of interest.

Is commission mandatory for independent directors?

No, commission is discretionary and requires shareholder approval; it’s only payable when companies have net profits and choose to distribute commission to IDs.

How is independent director commission calculated?

Commission is calculated as a percentage of net profits (up to 1% if company has MD, or 3% without MD), distributed among IDs per board-approved allocation.

What is Schedule V remuneration for independent directors?

Schedule V allows loss-making companies to pay minimum guaranteed remuneration (₹12-24+ lakhs annually) based on effective capital brackets, in addition to sitting fees.

Can independent directors receive monthly salary?

No, independent directors typically cannot receive regular monthly salaries as they’re not employees; their compensation comprises sitting fees, commission, and Schedule V payments.

What taxes apply to independent director remuneration?

TDS at 10% under Section 194J applies to sitting fees and commission, plus 18% GST under Reverse Charge Mechanism paid by the company.

How do I negotiate independent director compensation?

Research comparable company disclosures, discuss during NRC conversations before formal appointment, emphasize your specialized expertise, and understand statutory limits and market benchmarks for leverage.

What is the highest independent director salary in India?

OP Bhatt earned ₹6.74 crores in FY23 through multiple directorships at TCS, Tata Steel, Tata Motors, and HUL—the highest disclosed ID compensation.

Do independent directors in loss-making companies get paid?

Yes, through sitting fees (always payable) and Schedule V minimum remuneration (₹12-24+ lakhs annually) based on effective capital, even without profits.

What is the difference between sitting fees and commission?

Sitting fees are per-meeting payments (max ₹1 lakh) paid regardless of profits; commission is profit-linked annual payment (1-3% of net profits) requiring shareholder approval.

How many board meetings determine sitting fee earnings?

Most companies conduct 4-8 board meetings annually, generating ₹2-8 lakhs in board sitting fees, plus additional committee meeting fees depending on memberships.

Can independent directors hold multiple directorships?

Yes, with total directorship limit of 20 companies (maximum 10 listed companies), allowing directors to serve on 3-6 boards simultaneously and multiply earnings.

What is D&O insurance for independent directors?

Directors and Officers insurance provides liability coverage protecting IDs from personal financial loss in lawsuits/claims related to board duties; premiums paid by company.

Allow notifications

Allow notifications